Exhibit (c) (5)

CONFIDENTIAL – PRELIMINARY DRAFT

Project Aurora

Special Committee Discussion Material

Strictly Private and Confidential Goldman Sachs (Asia) LLC

March 2013

CONFIDENTIAL – PRELIMINARY DRAFT

Disclaimer

Goldman Sachs (Asia) L.L.C. (“GS”) has prepared and provided these materials and GS’s related presentation (the “Confidential Information”) solely for the information and assistance of the Special Committee of the Board of Directors (the “Special Committee”) of Aurora (the “Company”) in connection with its consideration of the matters referred to herein. Without GS’s prior written consent, the Confidential Information may not be circulated or referred to publicly, disclosed to or relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without GS imposing any limitation of any kind. The Confidential Information, including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee thereof, on the one hand, and GS, on the other hand.

GS and its affiliates are engaged in investment banking, commercial banking and financial advisory services, securities trading, investment management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, GS and its affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, the Company, any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction for their own account and for the accounts of their customers.

The Confidential Information has been prepared and based on information obtained by GS from publicly available sources, the Company’s management and/or other sources. In preparing the Confidential Information, GS has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by GS, and GS does not assume any liability for any such information discussed with or reviewed by GS. GS has assumed that all forecasts provided to, discussed with or reviewed by GS have been reasonably prepared and reflect the best currently available estimates and judgments of the Company. GS does not provide accounting, tax, legal or regulatory advice. GS’s role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which

may be significantly more or less favorable than suggested by these analyses, and GS does not assume responsibility if future results are materially different from those forecast.

GS has not made an independent evaluation or appraisal of the assets and liabilities of the Company or any other person and has no obligation to evaluate the solvency of the Company or any person under any law. The analyses in the Confidential Information are not appraisals nor do they necessarily reflect the prices at which businesses or securities actually may be sold or purchased. The Confidential Information does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to GS as of, the date of such Confidential Information and GS assumes no responsibility for updating or revising the Confidential Information.

CONFIDENTIAL – PRELIMINARY DRAFT

Table of Contents

I. Aurora Situation Overview II. Financial Analysis

Appendix A: Illustrative Weighted Average Cost of Capital Calculation

CONFIDENTIAL – PRELIMINARY DRAFT

I. Aurora Situation Overview

CONFIDENTIAL – PRELIMINARY DRAFT

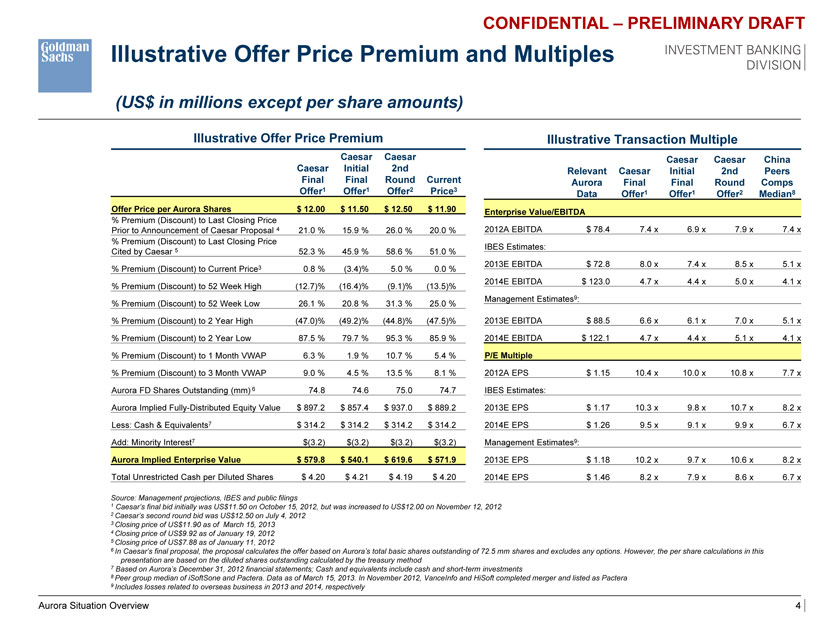

Illustrative Offer Price Premium and Multiples

(US$ in millions except per share amounts)

Illustrative Offer Price Premium Illustrative Transaction Multiple

Caesar Caesar Caesar Caesar China

Caesar Initial 2nd Relevant Caesar Initial 2nd Peers

Final Final Round Current Aurora Final Final Round Comps

Offer1 Offer1 Offer2 Price3 Data Offer1 Offer1 Offer2 Median8

Offer Price per Aurora Shares $ 12.00 $ 11.50 $ 12.50 $ 11.90 Enterprise Value/EBITDA

% Premium (Discount) to Last Closing Price

Prior to Announcement of Caesar Proposal 4 21.0 % 15.9 % 26.0 % 20.0 % 2012A EBITDA $ 78.4 7.4 x 6.9 x 7.9 x 7.4 x

% Premium (Discount) to Last Closing Price

IBES Estimates:

Cited by Caesar 5 52.3 % 45.9 % 58.6 % 51.0 %

2013E EBITDA $ 72.8 8.0 x 7.4 x 8.5 x 5.1 x

% Premium (Discount) to Current Price3 0.8 % (3.4)% 5.0 % 0.0 %

2014E EBITDA $ 123.0 4.7 x 4.4 x 5.0 x 4.1 x

% Premium (Discount) to 52 Week High (12.7)% (16.4)% (9.1)% (13.5)%

Management Estimates9:

% Premium (Discount) to 52 Week Low 26.1 % 20.8 % 31.3 % 25.0 %

% Premium (Discount) to 2 Year High (47.0)% (49.2)% (44.8)% (47.5)% 2013E EBITDA $ 88.5 6.6 x 6.1 x 7.0 x 5.1 x

% Premium (Discount) to 2 Year Low 87.5 % 79.7 % 95.3 % 85.9 % 2014E EBITDA $ 122.1 4.7 x 4.4 x 5.1 x 4.1 x

% Premium (Discount) to 1 Month VWAP 6.3 % 1.9 % 10.7 % 5.4 % P/E Multiple

% Premium (Discount) to 3 Month VWAP 9.0 % 4.5 % 13.5 % 8.1 % 2012A EPS $ 1.15 10.4 x 10.0 x 10.8 x 7.7 x

Aurora FD Shares Outstanding (mm) 6 74.8 74.6 75.0 74.7 IBES Estimates:

Aurora Implied Fully-Distributed Equity Value $ 897.2 $ 857.4 $ 937.0 $ 889.2 2013E EPS $ 1.17 10.3 x 9.8 x 10.7 x 8.2 x

Less: Cash & Equivalents7 $ 314.2 $ 314.2 $ 314.2 $ 314.2 2014E EPS $ 1.26 9.5 x 9.1 x 9.9 x 6.7 x

Add: Minority Interest7 $(3.2) $(3.2) $(3.2) $(3.2) Management Estimates9:

Aurora Implied Enterprise Value $ 579.8 $ 540.1 $ 619.6 $ 571.9 2013E EPS $ 1.18 10.2 x 9.7 x 10.6 x 8.2 x

Total Unrestricted Cash per Diluted Shares $ 4.20 $ 4.21 $ 4.19 $ 4.20 2014E EPS $ 1.46 8.2 x 7.9 x 8.6 x 6.7 x

Source: Management projections, IBES and public filings

1 | | Caesar’s final bid initially was US$11.50 on October 15, 2012, but was increased to US$12.00 on November 12, 2012 |

2 | | Caesar’s second round bid was US$12.50 on July 4, 2012 |

3 | | Closing price of US$11.90 as of March 15, 2013 |

4 | | Closing price of US$9.92 as of January 19, 2012 |

5 | | Closing price of US$7.88 as of January 11, 2012 |

6 In Caesar’s final proposal, the proposal calculates the offer based on Aurora’s total basic shares outstanding of 72.5 mm shares and excludes any options. However, the per share calculations in this

presentation are based on the diluted shares outstanding calculated by the treasury method

7 Based on Aurora’s December 31, 2012 financial statements; Cash and equivalents include cash and short-term investments

8 Peer group median of iSoftSone and Pactera. Data as of March 15, 2013. In November 2012, VanceInfo and HiSoft completed merger and listed as Pactera

9 Includes losses related to overseas business in 2013 and 2014, respectively

Aurora Situation Overview 4

CONFIDENTIAL – PRELIMINARY DRAFT

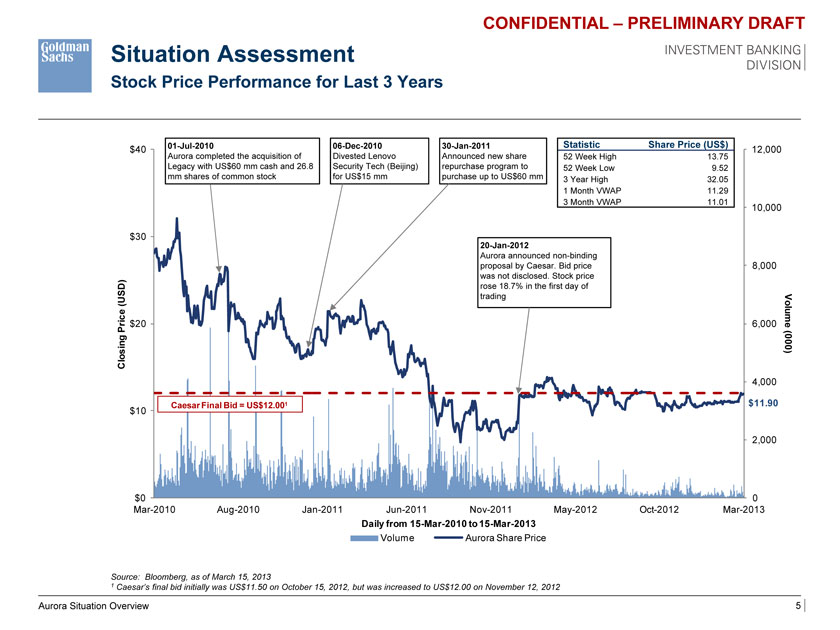

Situation Assessment

Stock Price Performance for Last 3 Years

01-Jul-2010 06-Dec-2010 30-Jan-2011 Statistic Share Price (US$)

$40 12,000

Aurora completed the acquisition of Divested Lenovo Announced new share 52 Week High 13.75 Legacy with US$60 mm cash and 26.8 Security Tech (Beijing) repurchase program to 52 Week Low 9.52 mm shares of common stock for US$15 mm purchase up to US$60 mm 3 Year High 32.05

10,000

$30

20-Jan-2012

Aurora announced non-binding proposal by Caesar. Bid price 8,000 was not disclosed. Stock price rose 18.7% in the first day of (USD) trading

$20 6,000 Volume Price ing (000 Clos )

4,000

$10 Caesar Final Bid = US$12.001 $11.90

2,000

$0 0 Mar-2010 Aug-2010 Jan-2011 Jun-2011 Nov-2011 May-2012 Oct-2012 Mar-2013

Daily from 15-Mar-2010 to 15-Mar-2013

Volume Aurora Share Price

Source: Bloomberg, as of March 15, 2013

1 | | Caesar’s final bid initially was US$11.50 on October 15, 2012, but was increased to US$12.00 on November 12, 2012 |

Aurora Situation Overview 5

CONFIDENTIAL – PRELIMINARY DRAFT

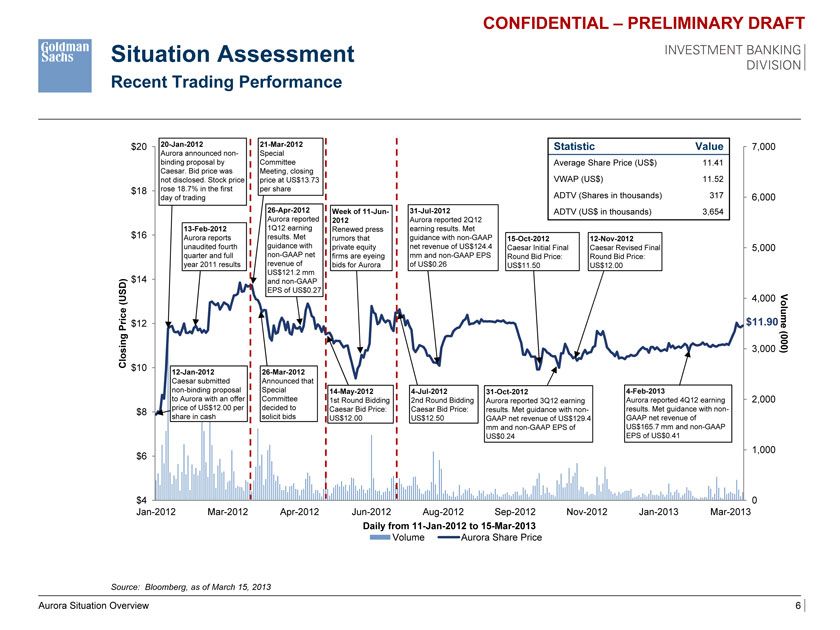

Situation Assessment

Recent Trading Performance

$20 20-Jan-2012 21-Mar-2012 Statistic Value 7,000

Aurora announced non—Special binding proposal by Committee Average Share Price (US$) 11.41

Caesar. Bid price was Meeting, closing not disclosed. Stock price price at US$13.73 VWAP (US$) 11.52 $18 rose 18.7% in the first per share day of trading ADTV (Shares in thousands) 317 6,000

26-Apr-2012 Week of 11-Jun—31-Jul-2012 ADTV (US$ in thousands) 3,654

Aurora reported 2012 Aurora reported 2Q12

13-Feb-2012 1Q12 earning Renewed press earning results. Met

$16 Aurora reports results. Met rumors that guidance with non-GAAP 15-Oct-2012 12-Nov-2012 unaudited fourth guidance with private equity net revenue of US$124.4 Caesar Initial Final Caesar Revised Final 5,000 quarter and full non-GAAP net firms are eyeing mm and non-GAAP EPS Round Bid Price: Round Bid Price: year 2011 results revenue of bids for Aurora of US$0.26 US$11.50 US$12.00 US$121.2 mm $14 and non-GAAP

(USD) EPS of US$0.27 4,000

Price $12 $11.90 Volume (000 sing 3,000 ) Clo $10

12-Jan-2012 26-Mar-2012

Caesar submitted Announced that non-binding proposal Special 14-May-2012 4-Jul-2012 31-Oct-2012 4-Feb-2013 to Aurora with an offer Committee 1st Round Bidding 2nd Round Bidding Aurora reported 3Q12 earning Aurora reported 4Q12 earning 2,000 $8 price of US$12.00 per decided to Caesar Bid Price: Caesar Bid Price: results. Met guidance with non—results. Met guidance with non-share in cash solicit bids US$12.00 US$12.50 GAAP net revenue of US$129.4 GAAP net revenue of mm and non-GAAP EPS of US$165.7 mm and non-GAAP

US$0.24 EPS of US$0.41

1,000 $6

$4 0 Jan-2012 Mar-2012 Apr-2012 Jun-2012 Aug-2012 Sep-2012 Nov-2012 Jan-2013 Mar-2013

Daily from 11-Jan-2012 to 15-Mar-2013

Volume Aurora Share Price

Source: Bloomberg, as of March 15, 2013

Aurora Situation Overview 6

CONFIDENTIAL – PRELIMINARY DRAFT

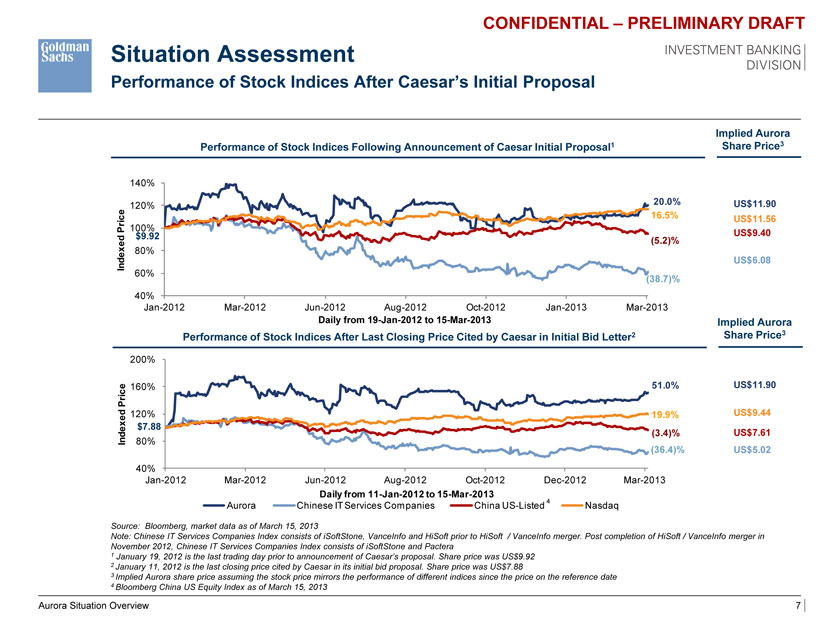

Situation Assessment

Performance of Stock Indices After Caesar’s Initial Proposal

Implied Aurora Performance of Stock Indices Following Announcement of Caesar Initial Proposal1 Share Price3

140%

120% 20.0% US$11.90

16.5% US$11.56 Price 100% $9.92 (5.2)% US$9.40

80%

Indexed US$6.08

60%

(38.7)%

40%

Jan-2012 Mar-2012 Jun-2012 Aug-2012 Oct-2012 Jan-2013 Mar-2013

Daily from 19-Jan-2012 to 15-Mar-2013 Implied Aurora Performance of Stock Indices After Last Closing Price Cited by Caesar in Initial Bid Letter2 Share Price3

200%

Price 160% 51.0% US$11.90 US$9.44 ed 120% 19.9% $7.88 Index 80% (3.4)% US$7.61 (36.4)% US$5.02

40%

Jan-2012 Mar-2012 Jun-2012 Aug-2012 Oct-2012 Dec-2012 Mar-2013

Daily from 11-Jan-2012 to 15-Mar-2013 4

Aurora Chinese IT Services Companies China US-Listed Nasdaq

Source: Bloomberg, market data as of March 15, 2013

Note: Chinese IT Services Companies Index consists of iSoftStone, VanceInfo and HiSoft prior to HiSoft / VanceInfo merger. Post completion of HiSoft / VanceInfo merger in November 2012, Chinese IT Services Companies Index consists of iSoftStone and Pactera

1 | | January 19, 2012 is the last trading day prior to announcement of Caesar’s proposal. Share price was US$9.92 |

2 | | January 11, 2012 is the last closing price cited by Caesar in its initial bid proposal. Share price was US$7.88 |

3 Implied Aurora share price assuming the stock price mirrors the performance of different indices since the price on the reference date

4 | | Bloomberg China US Equity Index as of March 15, 2013 |

Aurora Situation Overview 7

CONFIDENTIAL – PRELIMINARY DRAFT

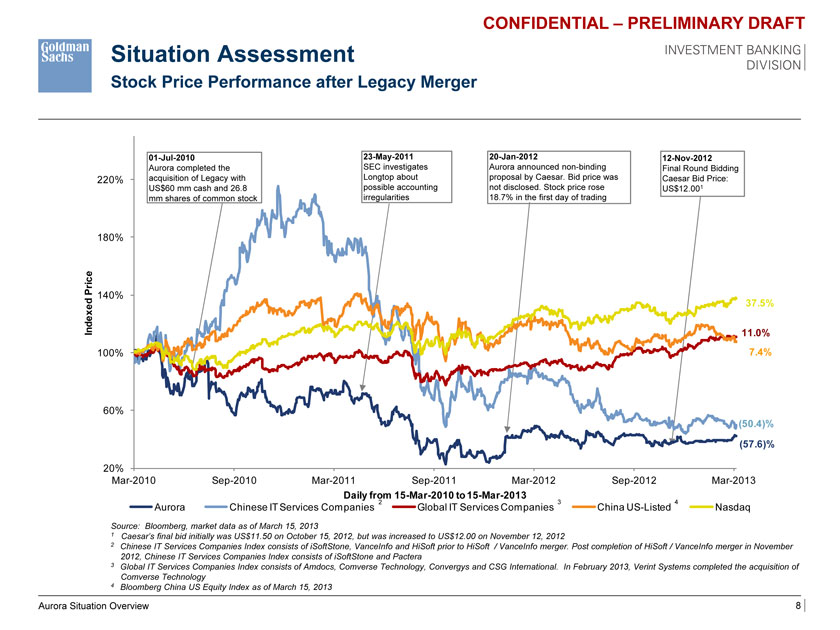

Situation Assessment

Stock Price Performance after Legacy Merger

01-Jul-2010 23-May-2011 20-Jan-2012 12-Nov-2012

Aurora completed the SEC investigates Aurora announced non-binding Final Round Bidding 220% acquisition of Legacy with Longtop about proposal by Caesar. Bid price was Caesar Bid Price: US$60 mm cash and 26.8 possible accounting not disclosed. Stock price rose US$12.001 mm shares of common stock irregularities 18.7% in the first day of trading

180%

Pric e 140%

Indexed 37.5%

11.0%

100% 7.4%

60%

(50.4)%

(57.6)%

20%

Mar-2010 Sep-2010 Mar-2011 Sep-2011 Mar-2012 Sep-2012 Mar-2013

Daily from 2 15-Mar-2010 to15 —Mar-2013 34

Aurora Chinese IT Services Companies Global IT Services Companies China US-Listed Nasdaq

Source: Bloomberg, market data as of March 15, 2013

1 | | Caesar’s final bid initially was US$11.50 on October 15, 2012, but was increased to US$12.00 on November 12, 2012 |

2 Chinese IT Services Companies Index consists of iSoftStone, VanceInfo and HiSoft prior to HiSoft / VanceInfo merger. Post completion of HiSoft / VanceInfo merger in November 2012, Chinese IT Services Companies Index consists of iSoftStone and Pactera

3 Global IT Services Companies Index consists of Amdocs, Comverse Technology, Convergys and CSG International. In February 2013, Verint Systems completed the acquisition of Comverse Technology

4 | | Bloomberg China US Equity Index as of March 15, 2013 |

Aurora Situation Overview 8

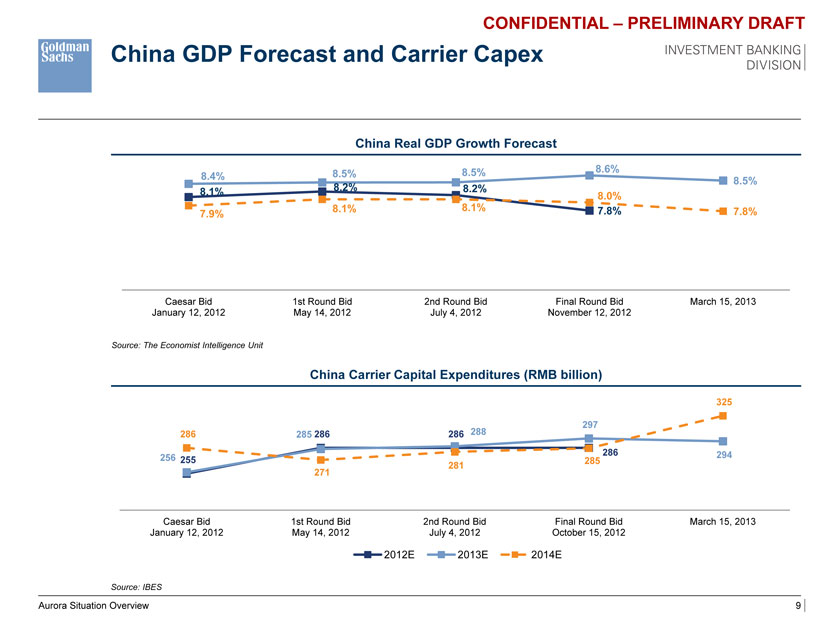

CONFIDENTIAL – PRELIMINARY DRAFT

China GDP Forecast and Carrier Capex

China Real GDP Growth Forecast

8.5% 8.5% 8.6%

8.4% 8.5% 8.1% 8.2% 8.2% 8.0% 8.1% 81% . 7.8% 7.8% 7.9%

Caesar Bid 1st Round Bid 2nd Round Bid Final Round Bid March 15, 2013 January 12, 2012 May 14, 2012 July 4, 2012 November 12, 2012

Source: The Economist Intelligence Unit

China Carrier Capital Expenditures (RMB billion)

325

297 286 285 286 286 288

286 294 256 255 285 281 271

Caesar Bid 1st Round Bid 2nd Round Bid Final Round Bid March 15, 2013 January 12, 2012 May 14, 2012 July 4, 2012 October 15, 2012

2012E 2013E 2014E

Source: IBES

Aurora Situation Overview 9

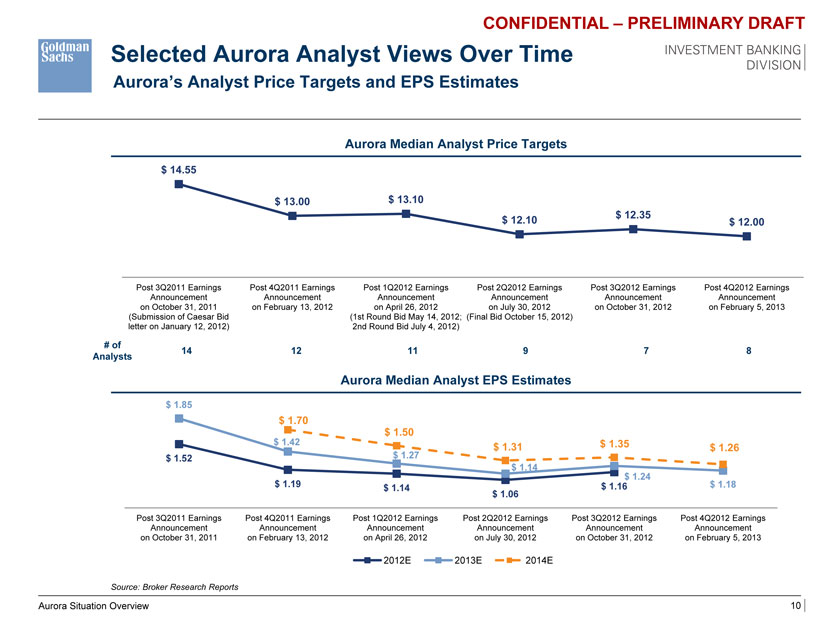

CONFIDENTIAL – PRELIMINARY DRAFT

Selected Aurora Analyst Views Over Time

Aurora’s Analyst Price Targets and EPS Estimates

Aurora Median Analyst Price Targets

$ 14.55

$ 13.00 $ 13.10

$ 12.35

$ 12.10 $ 12.00

Post 3Q2011 Earnings Post 4Q2011 Earnings Post 1Q2012 Earnings Post 2Q2012 Earnings Post 3Q2012 Earnings Post 4Q2012 Earnings Announcement Announcement Announcement Announcement Announcement Announcement on October 31, 2011 on February 13, 2012 on April 26, 2012 on July 30, 2012 on October 31, 2012 on February 5, 2013 (Submission of Caesar Bid (1st Round Bid May 14, 2012; (Final Bid October 15, 2012) letter on January 12, 2012) 2nd Round Bid July 4, 2012)

# of

14 12 11 9 7 8 Analysts

Aurora Median Analyst EPS Estimates

$ 1.85 $ 1.70 $ 1.50 $ 1.42 $ 1.31 $ 1.35 $ 1.26 $ 1.52 $ 1.27 $ 1.14 $ 1.24 $ 1.19 $ 1.14 $ 1.16 $ 1.18 $ 1.06

Post 3Q2011 Earnings Post 4Q2011 Earnings Post 1Q2012 Earnings Post 2Q2012 Earnings Post 3Q2012 Earnings Post 4Q2012 Earnings Announcement Announcement Announcement Announcement Announcement Announcement on October 31, 2011 on February 13, 2012 on April 26, 2012 on July 30, 2012 on October 31, 2012 on February 5, 2013

2012E 2013E 2014E

Source: Broker Research Reports

Aurora Situation Overview 10

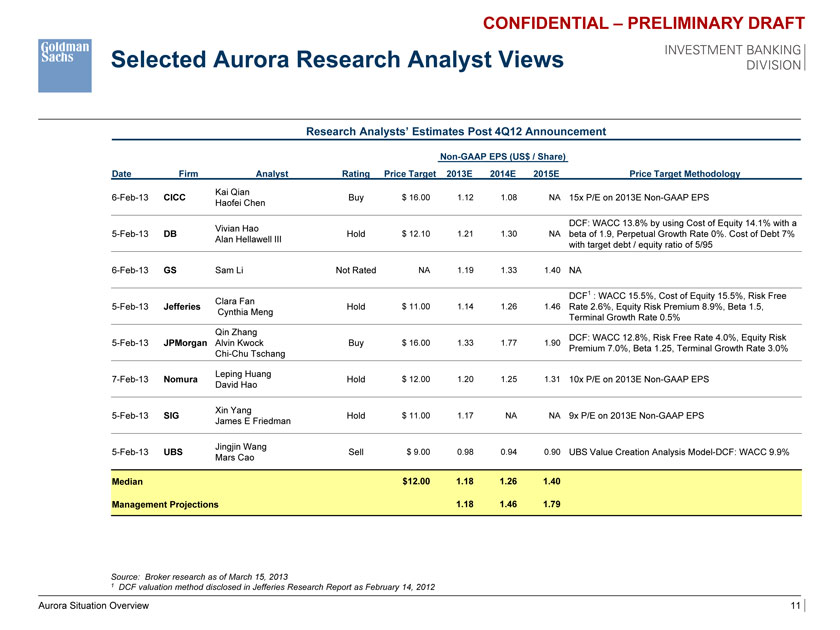

CONFIDENTIAL – PRELIMINARY DRAFT

Selected Aurora Research Analyst Views

Research Analysts’ Estimates Post 4Q12 Announcement

Non-GAAP EPS (US$ / Share)

Date Firm Analyst Rating Price Target 2013E 2014E 2015E Price Target Methodology

Kai Qian

6-Feb-13 CICC Buy $ 16.00 1.12 1.08 NA 15x P/E on 2013E Non-GAAP EPS

Haofei Chen

DCF: WACC 13.8% by using Cost of Equity 14.1% with a Vivian Hao

5-Feb-13 DB Hold $ 12.10 1.21 1.30 NA beta of 1.9, Perpetual Growth Rate 0%. Cost of Debt 7% Alan Hellawell III with target debt / equity ratio of 5/95

6-Feb-13 GS Sam Li Not Rated NA 1.19 1.33 1.40 NA

DCF1 : WACC 15.5%, Cost of Equity 15.5%, Risk Free Clara Fan

5-Feb-13 Jefferies Hold $ 11.00 1.14 1.26 1.46 Rate 2.6%, Equity Risk Premium 8.9%, Beta 1.5, Cynthia Meng Terminal Growth Rate 0.5% Qin Zhang DCF: WACC 12.8%, Risk Free Rate 4.0%, Equity Risk

5-Feb-13 JPMorgan Alvin Kwock Buy $ 16.00 1.33 1.77 1.90

Premium 7.0%, Beta 1.25, Terminal Growth Rate 3.0% Chi-Chu Tschang

Leping Huang

7-Feb-13 Nomura Hold $ 12.00 1.20 1.25 1.31 10x P/E on 2013E Non-GAAP EPS

David Hao

Xin Yang

5-Feb-13 SIG Hold $ 11.00 1.17 NA NA 9x P/E on 2013E Non-GAAP EPS

James E Friedman

Jingjin Wang

5-Feb-13 UBS Sell $ 9.00 0.98 0.94 0.90 UBS Value Creation Analysis Model-DCF: WACC 9.9% Mars Cao

Median $12.00 1.18 1.26 1.40

Management Projections 1.18 1.46 1.79

Source: Broker research as of March 15, 2013

1 | | DCF valuation method disclosed in Jefferies Research Report as February 14, 2012 |

Aurora Situation Overview 11

CONFIDENTIAL – PRELIMINARY DRAFT

II. Financial Analysis

CONFIDENTIAL – PRELIMINARY DRAFT

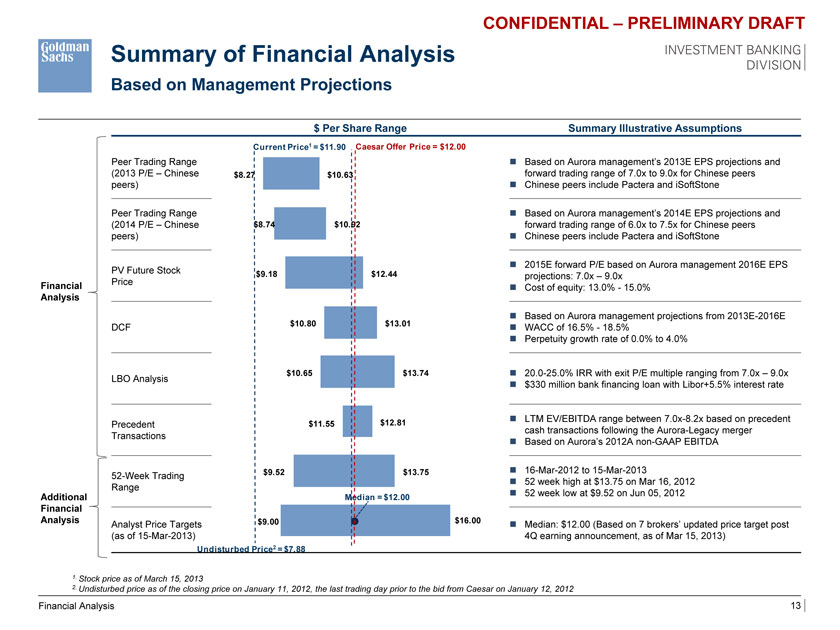

Summary of Financial Analysis

Based on Management Projections

$ Per Share Range Summary Illustrative Assumptions

Current Price1 = $11.90 Caesar Offer Price = $12.00

Peer Trading Range ? Based on Aurora management’s 2013E EPS projections and (2013 P/E – Chinese $8.27 $10.63 forward trading range of 7.0x to 9.0x for Chinese peers peers)? Chinese peers include Pactera and iSoftStone

Peer Trading Range ? Based on Aurora management’s 2014E EPS projections and (2014 P/E – Chinese $8.74 $10.92 forward trading range of 6.0x to 7.5x for Chinese peers peers)? Chinese peers include Pactera and iSoftStone

? 2015E forward P/E based on Aurora management 2016E EPS PV Future Stock $9.18 $12.44 projections: 7.0x – 9.0x

Financial Price

? Cost of equity: 13.0%—15.0%

Analysis

$10.80 $13.01? Based on Aurora management projections from 2013E-2016E

DCF? WACC of 16.5%—18.5%

? Perpetuity growth rate of 0.0% to 4.0%

$10.65 $13.74? 20.0-25.0% IRR with exit P/E multiple ranging from 7.0x – 9.0x LBO Analysis? $330 million bank financing loan with Libor+5.5% interest rate

$12.81? LTM EV/EBITDA range between 7.0x-8.2x based on precedent Precedent $11.55 cash transactions following the Aurora-Legacy merger Transactions? Based on Aurora’s 2012A non-GAAP EBITDA

$9.52 $13.75? 16-Mar-2012 to 15-Mar-2013

52-Week Trading

? 52 week high at $13.75 on Mar 16, 2012 Range? 52 week low at $9.52 on Jun 05, 2012

Additional Median = $12.00

Financial

Analysis $9.00 $16.00

Analyst Price Targets? Median: $12.00 (Based on 7 brokers’ updated price target post (as of 15-Mar-2013) 4Q earning announcement, as of Mar 15, 2013)

Undisturbed Price2 = $7.88

1. Stock price as of March 15, 2013

2. Undisturbed price as of the closing price on January 11, 2012, the last trading day prior to the bid from Caesar on January 12, 2012

Financial Analysis 13

CONFIDENTIAL – PRELIMINARY DRAFT

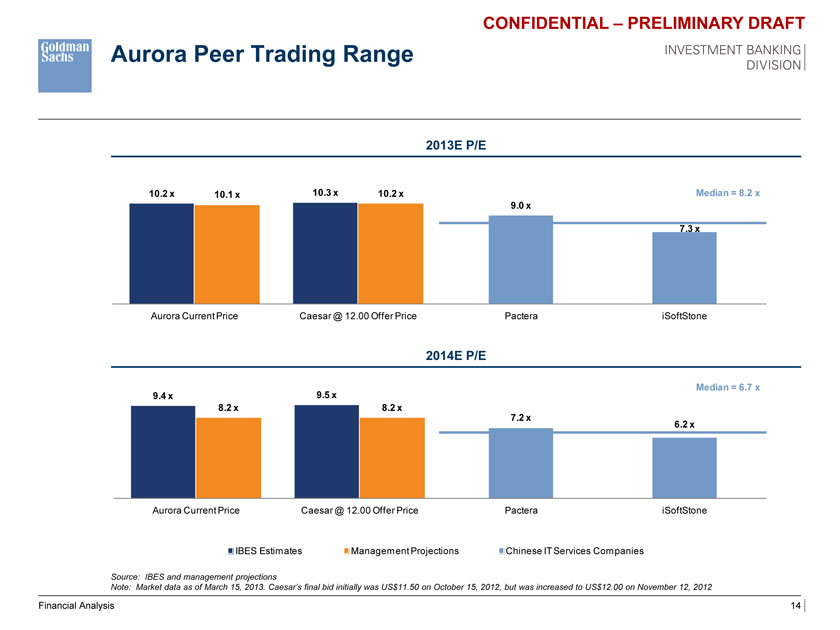

Aurora Peer Trading Range

2013E P/E

10.2 x 10.1 x 10.3 x 10.2 x Median = 8.2 x

9.0 x

7.3 x

Aurora Current Price Caesar @ 12.00 Offer Price Pactera iSoftStone

2014E P/E

Median = 6.7 x

9.4 x 9.5 x

8.2 x 8.2 x

7.2 x

6.2 x

Aurora Current Price Caesar @ 12.00 Offer Price Pactera iSoftStone

IBES Estimates Management Projections Chinese IT Services Companies

Source: IBES and management projections

Note: Market data as of March 15, 2013. Caesar’s final bid initially was US$11.50 on October 15, 2012, but was increased to US$12.00 on November 12, 2012

Financial Analysis 14

CONFIDENTIAL – PRELIMINARY DRAFT

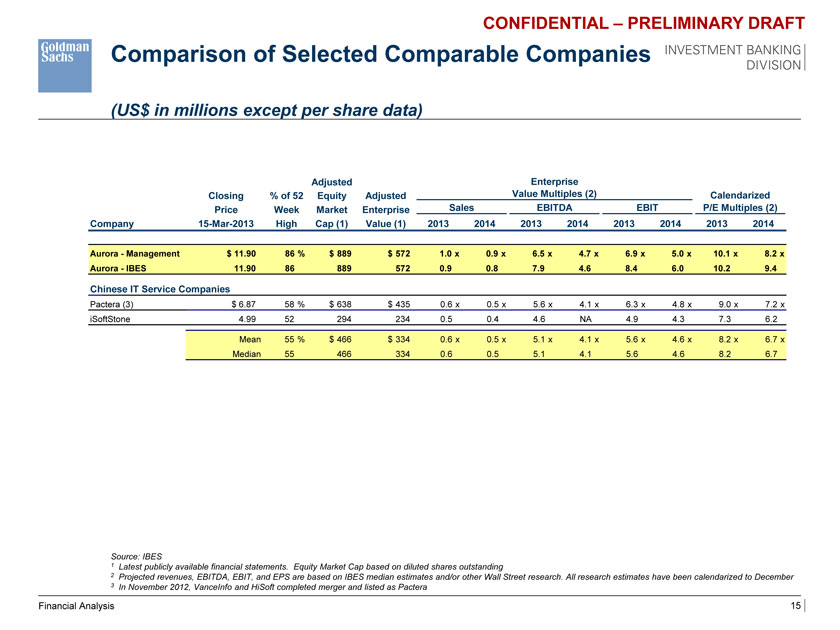

Comparison of Selected Comparable Companies

(US$ in millions except per share data)

Adjusted Enterprise

Closing % of 52 Equity Adjusted Value Multiples (2) Calendarized Price Week Market Enterprise Sales EBITDA EBIT P/E Multiples (2) Company 15-Mar-2013 High Cap (1) Value (1) 2013 2014 2013 2014 2013 2014 2013 2014

Aurora—Management $ 11.90 86 % $ 889 $ 572 1.0 x 0.9 x 6.5 x 4.7 x 6.9 x 5.0 x 10.1 x 8.2 x Aurora—IBES 11.90 86 889 572 0.9 0.8 7.9 4.6 8.4 6.0 10.2 9.4

Chinese IT Service Companies

Pactera (3) $ 6.87 58 % $ 638 $ 435 0.6 x 0.5 x 5.6 x 4.1 x 6.3 x 4.8 x 9.0 x 7.2 x iSoftStone 4.99 52 294 234 0.5 0.4 4.6 NA 4.9 4.3 7.3 6.2

Mean 55 % $ 466 $ 334 0.6 x 0.5 x 5.1 x 4.1 x 5.6 x 4.6 x 8.2 x 6.7 x Median 55 466 334 0.6 0.5 5.1 4.1 5.6 4.6 8.2 6.7

Source: IBES

1 | | Latest publicly available financial statements. Equity Market Cap based on diluted shares outstanding |

2 Projected revenues, EBITDA, EBIT, and EPS are based on IBES median estimates and/or other Wall Street research. All research estimates have been calendarized to December

3 | | In November 2012, VanceInfo and HiSoft completed merger and listed as Pactera |

Financial Analysis 15

CONFIDENTIAL – PRELIMINARY DRAFT

Comparable Trading Multiples

Historical 1-Year Forward Trading Multiples

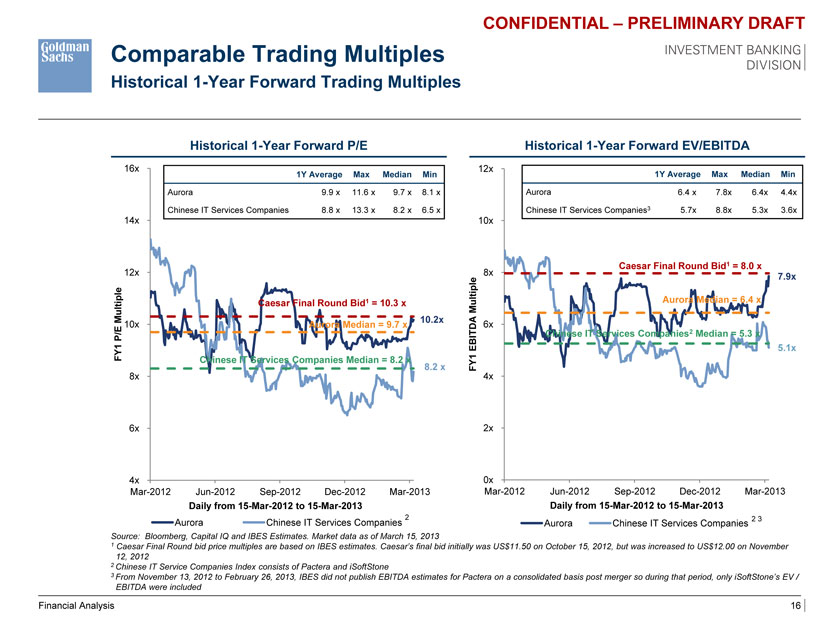

Historical 1-Year Forward P/E Historical 1-Year Forward EV/EBITDA

16x 12x

1Y Average Max Median Min 1Y Average Max Median Min

Aurora 9.9 x 11.6 x 9.7 x 8.1 x Aurora 6.4 x 7.8x 6.4x 4.4x

Chinese IT Services Companies 8.8 x 13.3 x 8.2 x 6.5 x Chinese IT Services Companies3 5.7x 8.8x 5.3x 3.6x

14x 10x

Caesar Final Round Bid1 = 8.0 x

12x 8x 7.9x Caesar Final Round Bid1 = 10.3 x Multiple Aurora Median = 6.4 x Multiple 10.2x 10x Aurora Median = 9.7 x 6x P/E Chinese IT Services Companies2 Median = 5.3 x

1 | | EBITDA 5.1x FY Chinese IT Services Companies Median = 8.2 x 8.2 x FY1 |

8x 4x

6x 2x

4x 0x

Mar-2012 Jun-2012 Sep-2012 Dec-2012 Mar-2013 Mar-2012 Jun-2012 Sep-2012 Dec-2012 Mar-2013

Daily from 15-Mar-2012 to 15-Mar-2013 Daily from 15-Mar-2012 to 15-Mar-2013

Aurora Chinese IT Services Companies Aurora Chinese IT Services Companies

Source: Bloomberg, Capital IQ and IBES Estimates. Market data as of March 15, 2013

1 Caesar Final Round bid price multiples are based on IBES estimates. Caesar’s final bid initially was US$11.50 on October 15, 2012, but was increased to US$12.00 on November 12, 2012

2 | | Chinese IT Service Companies Index consists of Pactera and iSoftStone |

3 From November 13, 2012 to February 26, 2013, IBES did not publish EBITDA estimates for Pactera on a consolidated basis post merger so during that period, only iSoftStone’s EV / EBITDA were included

Financial Analysis 16

CONFIDENTIAL – PRELIMINARY DRAFT

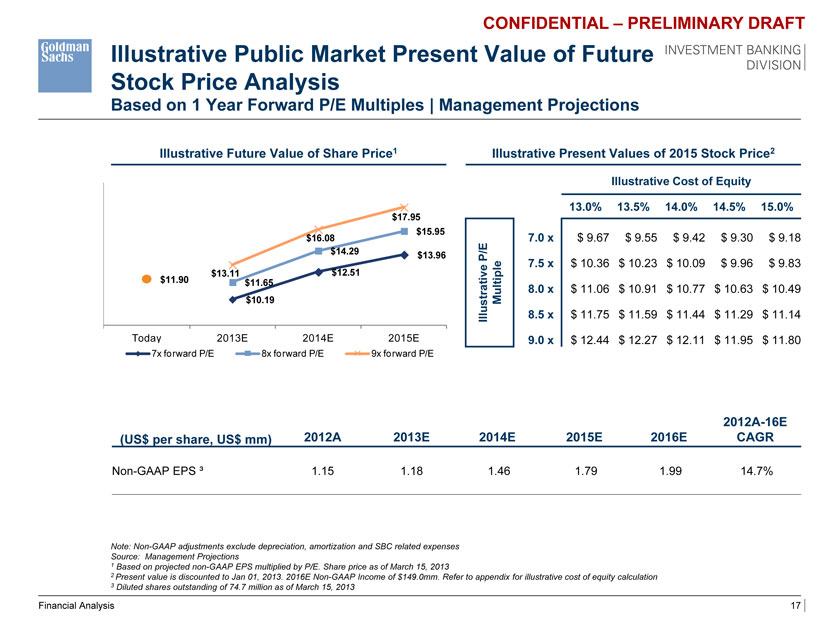

Illustrative Public Market Present Value of Future Stock Price Analysis

Based on 1 Year Forward P/E Multiples | Management Projections

Illustrative Future Value of Share Price1 Illustrative Present Values of 2015 Stock Price2

Illustrative Cost of Equity

13.0% 13.5% 14.0% 14.5% 15.0%

$17.95

$15.95

$16.08 7.0 x $ 9.67 $ 9.55 $ 9.42 $ 9.30 $ 9.18

$14.29 $13.96 P/E

7.5 x $ 10.36 $ 10.23 $ 10.09 $ 9.96 $ 9.83

$13.11 $12.51 ve ple

$11.90 $11.65

8.0 x $ 11.06 $ 10.91 $ 10.77 $ 10.63 $ 10.49

$10.19 Multi

Illustrati 8.5 x $ 11.75 $ 11.59 $ 11.44 $ 11.29 $ 11.14 Today 2013E 2014E 2015E 9.0 x $ 12.44 $ 12.27 $ 12.11 $ 11.95 $ 11.80

7x forward P/E 8x forward P/E 9x forward P/E

2012A-16E (US$ per share, US$ mm) 2012A 2013E 2014E 2015E 2016E CAGR

Non-GAAP EPS ³ 1.15 1.18 1.46 1.79 1.99 14.7%

Note: Non-GAAP adjustments exclude depreciation, amortization and SBC related expenses Source: Management Projections

1 | | Based on projected non GAAP EPS multiplied by P/E. Share price as of March 15, 2013 |

2 Present value is discounted to Jan 01, 2013. 2016E Non-GAAP Income of $149.0mm. Refer to appendix for illustrative cost of equity calculation

3 | | Diluted shares outstanding of 74.7 million as of March 15, 2013 |

Financial Analysis 17

CONFIDENTIAL – PRELIMINARY DRAFT

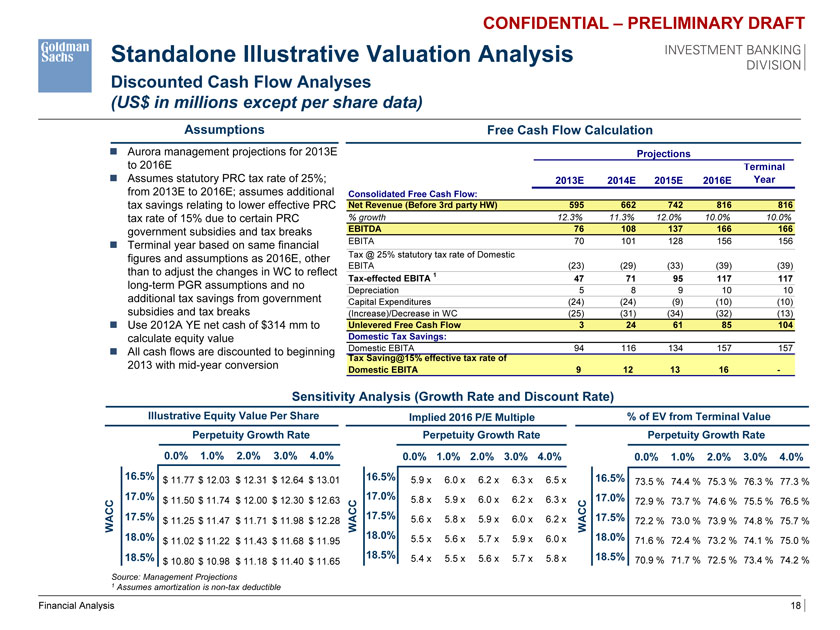

Standalone Illustrative Valuation Analysis

Discounted Cash Flow Analyses

(US$ in millions except per share data)

Assumptions Free Cash Flow Calculation

? Aurora management projections for 2013E Projections to 2016E Terminal ? Assumes statutory PRC tax rate of 25%; 2013E 2014E 2015E 2016E Year from 2013E to 2016E; assumes additional Consolidated Free Cash Flow:

tax savings relating to lower effective PRC Net Revenue (Before 3rd party HW) 595 662 742 816 816

tax rate of 15% due to certain PRC % growth 12.3% 11.3% 12.0% 10.0% 10.0% government subsidies and tax breaks EBITDA 76 108 137 166 166? Terminal year

based on same financial EBITA 70 101 128 156 156 figures and assumptions as 2016E, other Tax @ 25% statutory tax rate of Domestic

EBITA (23) (29) (33) (39) (39)

than to adjust the changes in WC to reflect 1

Tax-effected EBITA 47 71 95 117 117

long-term PGR assumptions and no

Depreciation 5 8 9 10 10

additional tax savings from government Capital Expenditures (24) (24) (9) (10) (10)

subsidies and tax breaks (Increase)/Decrease in WC (25) (31) (34) (32) (13)

? Use 2012A YE net cash of $314 mm to Unlevered Free Cash Flow 3 24 61 85 104 calculate equity value Domestic Tax Savings:? All cash flows are discounted to beginning Domestic EBITA 94 116 134 157 157

Tax Saving@15% effective tax rate of

2013 with mid-year conversion Domestic EBITA 9 12 13 16 —

Sensitivity Analysis (Growth Rate and Discount Rate)

Illustrative Equity Value Per Share Implied 2016 P/E Multiple % of EV from Terminal Value Perpetuity Growth Rate Perpetuity Growth Rate Perpetuity Growth Rate 0.0% 1.0% 2.0% 3.0% 4.0% 0.0% 1.0% 2.0% 3.0% 4.0% 0.0% 1.0% 2.0% 3.0% 4.0%

16.5% $ 11.77 $ 12.03 $ 12.31 $ 12.64 $ 13.01 16.5% 5.9 x 6.0 x 6.2 x 6.3 x 6.5 x 16.5%

73.5 % 74.4 % 75.3 % 76.3 % 77.3 %

17.0% $ 11.50 $ 11.74 $ 12.00 $ 12.30 $ 12.63 17.0% 5.8 x 5.9 x 6.0 x 6.2 x 6.3 x 17.0%

72.9 % 73.7 % 74.6 % 75.5 % 76.5 %

17.5% 17.5% 5.6 x 5.8 x 5.9 x 6.0 x 6.2 x 17.5%

WACC $ 11.25 $ 11.47 $ 11.71 $ 11.98 $ 12.28 WACC WACC 72.2 % 73.0 % 73.9 % 74.8 % 75.7 %

18.0% 18.0% 5.5 x 5.6 x 5.7 x 5.9 x 6.0 x 18.0%

$ 11.02 $ 11.22 $ 11.43 $ 11.68 $ 11.95 71.6 % 72.4 % 73.2 % 74.1 % 75.0 %

18.5% 18.5% 5.4 x 5.5 x 5.6 x 5.7 x 5.8 x 18.5%

$ 10.80 $ 10.98 $ 11.18 $ 11.40 $ 11.65 70.9 % 71.7 % 72.5 % 73.4 % 74.2 %

Source: Management Projections

1 | | Assumes amortization is non-tax deductible |

Financial Analysis 18

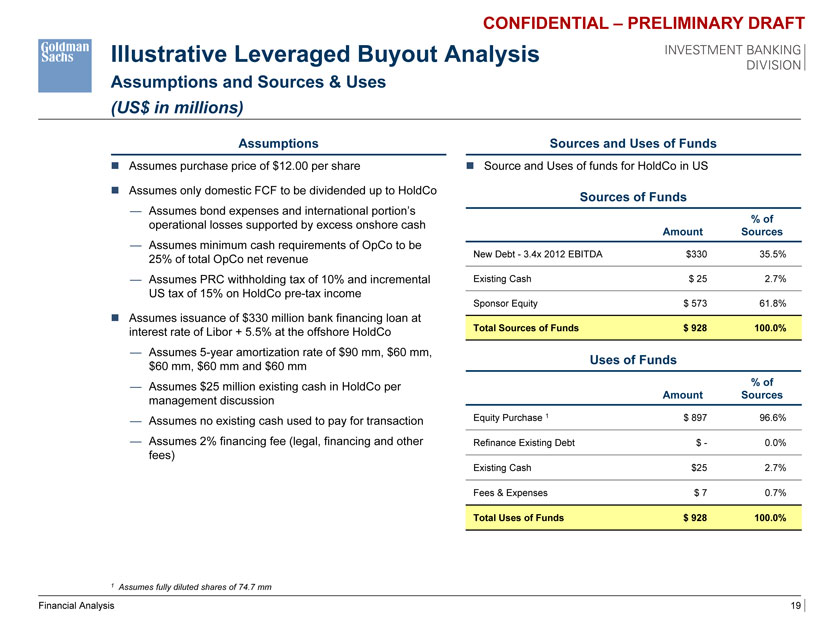

CONFIDENTIAL – PRELIMINARY DRAFT

Illustrative Leveraged Buyout Analysis

Assumptions and Sources & Uses

(US$ in millions)

Assumptions Sources and Uses of Funds

? Assumes purchase price of $12.00 per share? Source and Uses of funds for HoldCo in US

? Assumes only domestic FCF to be dividended up to HoldCo

Sources of Funds

— Assumes bond expenses and international portion’s

% of operational losses supported by excess onshore cash

Amount Sources

— Assumes minimum cash requirements of OpCo to be New Debt—3.4x 2012 EBITDA $330 35.5% 25% of total OpCo net revenue Assumes PRC withholding tax of 10% and incremental Existing Cash $ 25 2.7% US tax of 15% on HoldCo pre-tax income

Sponsor Equity $ 573 61.8%

? Assumes issuance of $330 million bank financing loan at interest rate of Libor + 5.5% at the offshore HoldCo Total Sources of Funds $ 928 100.0%

— Assumes 5-year amortization rate of $90 mm, $60 mm,

Uses of Funds $60 mm, $60 mm and $60 mm

— Assumes $25 million existing cash in HoldCo per % of

Amount Sources management discussion

— Assumes no existing cash used to pay for transaction Equity Purchase 1 $ 897 96.6%

— Assumes 2% financing fee (legal, financing and other Refinance Existing Debt $—0.0% fees)

Existing Cash $25 2.7%

Fees & Expenses $ 7 0.7%

Total Uses of Funds $ 928 100.0%

1 | | Assumes fully diluted shares of 74.7 mm |

Financial Analysis 19

CONFIDENTIAL – PRELIMINARY DRAFT

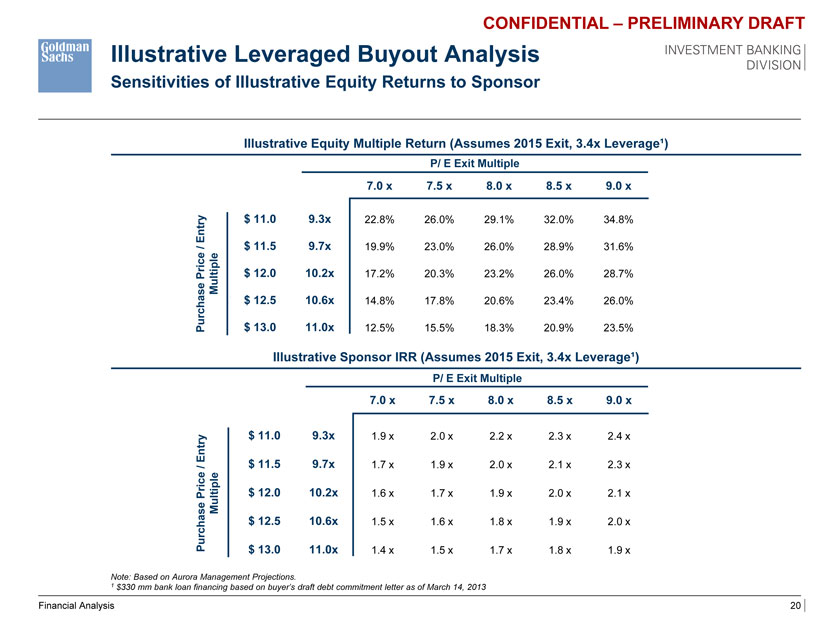

Illustrative Leveraged Buyout Analysis

Sensitivities of Illustrative Equity Returns to Sponsor

Illustrative Equity Multiple Return (Assumes 2015 Exit, 3.4x Leverage¹)

P/ E Exit Multiple

7.0 x 7.5 x 8.0 x 8.5 x 9.0 x

$ 11.0 9.3x

Entry 22.8% 26.0% 29.1% 32.0% 34.8%

/ $ 11.5 9.7x 19.9% 23.0% 26.0% 28.9% 31.6% Price ltiple $ 12.0 10.2x 17.2% 20.3% 23.2% 26.0% 28.7%

Mu

$ 12.5 10.6x 14.8% 17.8% 20.6% 23.4% 26.0% Purchase $ 13.0 11.0x 12.5% 15.5% 18.3% 20.9% 23.5%

Illustrative Sponsor IRR (Assumes 2015 Exit, 3.4x Leverage¹)

P/ E Exit Multiple

7.0 x 7.5 x 8.0 x 8.5 x 9.0 x

Entry $ 11.0 9.3x 1.9 x 2.0 x 2.2 x 2.3 x 2.4 x

/ $ 11.5 9.7x 1.7 x 1.9 x 2.0 x 2.1 x 2.3 x rice tiple P $ 12.0 10.2x 1.6 x 1.7 x 1.9 x 2.0 x 2.1 x

Mul

Purchase $ 12.5 10.6x 1.5 x 1.6 x 1.8 x 1.9 x 2.0 x

$ 13.0 11.0x 1.4 x 1.5 x 1.7 x 1.8 x 1.9 x

Note: Based on Aurora Management Projections.

1 | | $330 mm bank loan financing based on buyer’s draft debt commitment letter as of March 14, 2013 |

Financial Analysis 20

CONFIDENTIAL – PRELIMINARY DRAFT

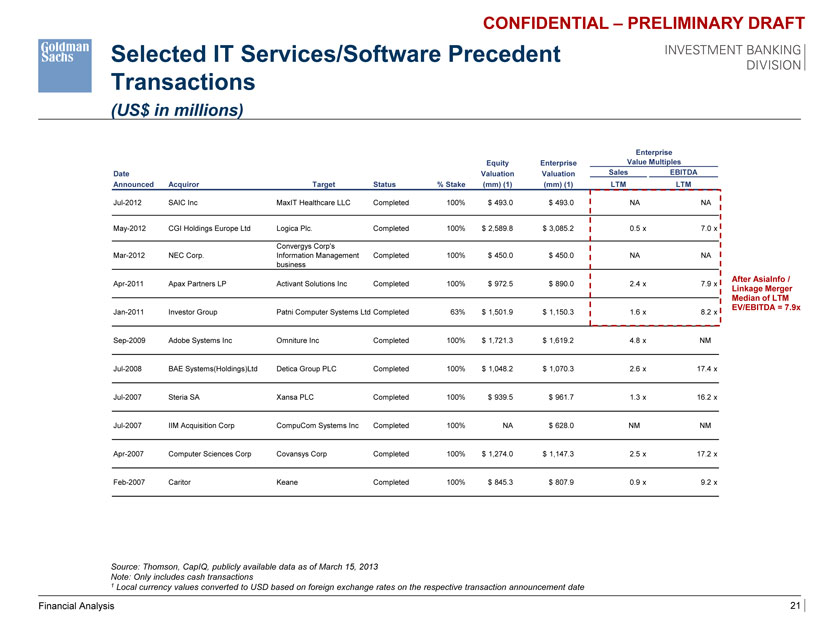

Selected IT Services/Software Precedent Transactions

(US$ in millions)

Enterprise Equity Enterprise Value Multiples Date Valuation Valuation Sales EBITDA Announced Acquiror Target Status % Stake (mm) (1) (mm) (1) LTM LTM

Jul-2012 SAIC Inc MaxIT Healthcare LLC Completed 100% $ 493.0 $ 493.0 NA NA

May-2012 CGI Holdings Europe Ltd Logica Plc. Completed 100% $ 2,589.8 $ 3,085.2 0.5 x 7.0 x

Convergys Corp’s

Mar-2012 NEC Corp. Information Management Completed 100% $ 450.0 $ 450.0 NA NA business

After AsiaInfo /

Apr-2011 Apax Partners LP Activant Solutions Inc Completed 100% $ 972.5 $ 890.0 2.4 x 7.9 x

Linkage Merger Median of LTM EV/EBITDA = 7.9x

Jan-2011 Investor Group Patni Computer Systems Ltd Completed 63% $ 1,501.9 $ 1,150.3 1.6 x 8.2 x Sep-2009 Adobe Systems Inc Omniture Inc Completed 100% $ 1,721.3 $ 1,619.2 4.8 x NM Jul-2008 BAE Systems(Holdings)Ltd Detica Group PLC Completed 100% $ 1,048.2 $ 1,070.3 2.6 x 17.4 x Jul-2007 Steria SA Xansa PLC Completed 100% $ 939.5 $ 961.7 1.3 x 16.2 x Jul-2007 IIM Acquisition Corp CompuCom Systems Inc Completed 100% NA $ 628.0 NM NM Apr-2007 Computer Sciences Corp Covansys Corp Completed 100% $ 1,274.0 $ 1,147.3 2.5 x 17.2 x Feb-2007 Caritor Keane Completed 100% $ 845.3 $ 807.9 0.9 x 9.2 x

Source: Thomson, CapIQ, publicly available data as of March 15, 2013 Note: Only includes cash transactions

1 Local currency values converted to USD based on foreign exchange rates on the respective transaction announcement date

Financial Analysis 21

CONFIDENTIAL – PRELIMINARY DRAFT

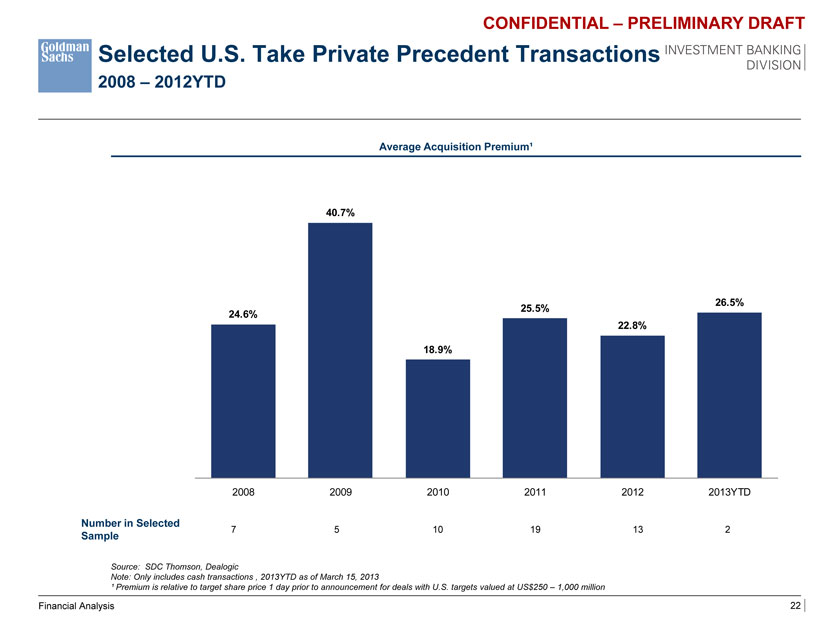

Selected U.S. Take Private Precedent Transactions

2008 – 2012YTD

Average Acquisition Premium¹

40.7%

26.5%

25.5%

24.6%

22.8%

18.9%

2008 2009 2010 2011 2012 2013YTD

Number in Selected

Sample

Source: SDC Thomson, Dealogic

Note: Only includes cash transactions , 2013YTD as of March 15, 2013

¹ Premium is relative to target share price 1 day prior to announcement for deals with U.S. targets valued at US$250 – 1,000 million

Financial Analysis 22

Appendix A: Illustrative Weighted Average Cost of Capital Calculation

CONFIDENTIAL – PRELIMINARY DRAFT

Aurora’s WACC Calculation

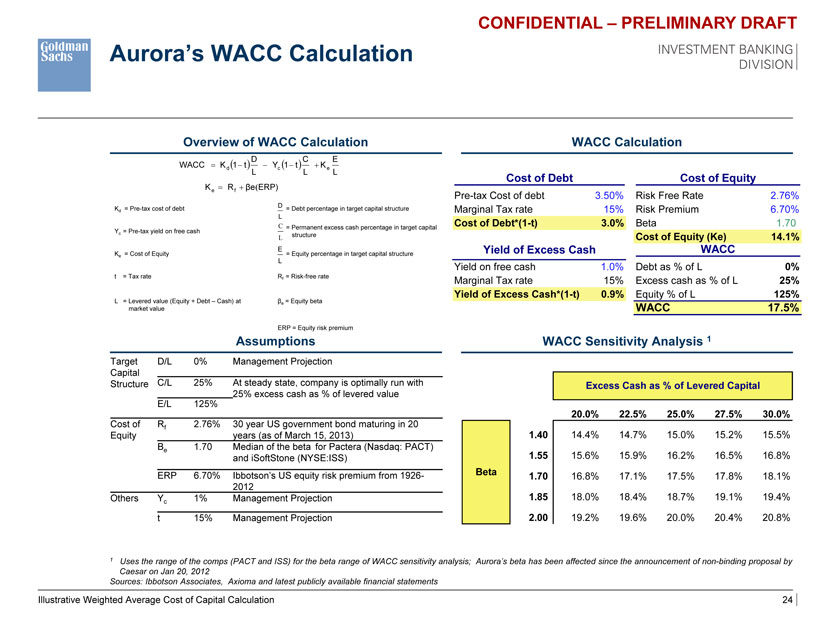

Overview of WACC Calculation WACC Calculation

D C E WACC? Kd? 1?t?L? Yc? 1?t?L?Ke L

K? R??e?ERP) Cost of Debt Cost of Equity

e f

Pre-tax Cost of debt 3.50% Risk Free Rate 2.76%

D

Kd = Pre-tax cost of debt = Debt percentage in target capital structure Marginal Tax rate 15% Risk Premium 6.70%

L

C Cost of Debt*(1-t) 3.0% Beta 1.70

= Permanent excess cash percentage in target capital Yc = Pre-tax yield on free cash

L structure Cost of Equity (Ke) 14.1%

E Yield of Excess Cash WACC

Ke = Cost of Equity = Equity percentage in target capital structure

L

Yield on free cash 1.0% Debt as % of L 0% t = Tax rate Rf = Risk-free rate Marginal Tax rate 15% Excess cash as % of L 25%

L = Levered value (Equity + Debt – Cash) at ? = Equity beta Yield of Excess Cash*(1-t) 0.9% Equity % of L 125% market value e WACC 17.5% ERP = Equity risk premium

Assumptions WACC Sensitivity Analysis 1

Target D/L 0% Management Projection Capital

Structure C/L 25% At steady state, company is optimally run with Excess Cash as % of Levered Capital 25% excess cash as % of levered value E/L 125%

0.17 20.0% 22.5% 25.0% 27.5% 30.0%

Cost of Rf 2.76% 30 year US government bond maturing in 20

Equity years (as of March 15, 2013) 1.40 14.4% 14.7% 15.0% 15.2% 15.5% ?e 1.70 Median of the beta for Pactera (Nasdaq: PACT) 1.55 15.6% 15.9% 16.2% 16.5% 16.8% and iSoftStone (NYSE:ISS) ERP 6.70% Ibbotson’s US equity risk premium from 1926—Beta 1.70 16.8% 17.1% 17.5% 17.8% 18.1% 2012 Others Y 1% Management Projection 1.85 18.0% 18.4% 18.7% 19.1% 19.4%

c

t 15% Management Projection 2.00 19.2% 19.6% 20.0% 20.4% 20.8%

1 Uses the range of the comps (PACT and ISS) for the beta range of WACC sensitivity analysis; Aurora’s beta has been affected since the announcement of non binding proposal by Caesar on Jan 20, 2012 Sources: Ibbotson Associates, Axioma and latest publicly available financial statements

Illustrative Weighted Average Cost of Capital Calculation 24

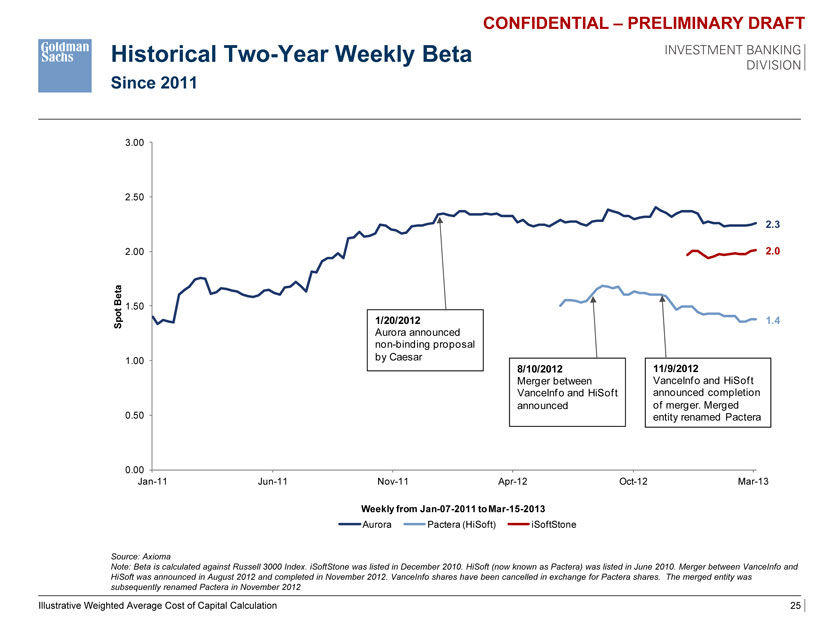

CONFIDENTIAL – PRELIMINARY DRAFT

Historical Two-Year Weekly Beta

Since 2011

3.00

2.50

2.3

2.00 2.0

Beta 1.50

Spot 1/20/2012 1.4

Aurora announced non-binding proposal

1.00 by Caesar

8/10/2012 11/9/2012

Merger between VanceInfo and HiSoft VanceInfo and HiSoft announced completion announced of merger. Merged

0.50 entity renamed Pactera

0.00

Jan-11 Jun-11 Nov-11 Apr-12 Oct-12 Mar-13

Weekly from Jan-07-2011 to Mar-15-2013

Aurora Pactera (HiSoft) iSoftStone

Source: Axioma

Note: Beta is calculated against Russell 3000 Index. iSoftStone was listed in December 2010. HiSoft (now known as Pactera) was listed in June 2010. Merger between VanceInfo and HiSoft was announced in August 2012 and completed in November 2012. VanceInfo shares have been cancelled in exchange for Pactera shares. The merged entity was subsequently renamed Pactera in November 2012

Illustrative Weighted Average Cost of Capital Calculation 25

CONFIDENTIAL – PRELIMINARY DRAFT

Project Aurora

Supplementary Special Committee Discussion Material

Strictly Private and Confidential Goldman Sachs (Asia) LLC

March 2013

CONFIDENTIAL – PRELIMINARY DRAFT

Disclaimer

Goldman Sach (Asia) L.L.C. (“GS”) has prepared and provided these materials and GS’s related presentation (the “Confidential Information”) solely for the information and assistance of the Special Committee of the Board of Directors (the “Special Committee”) of Aurora (the “Company”) in connection with its consideration of the matters referred to herein. Without GS’s prior written consent, the Confidential Information may not be circulated or referred to publicly, disclosed to or relied upon by any other person, or used or relied upon for any other purpose. Notwithstanding anything herein to the contrary, the Company may disclose to any person the US federal income and state income tax treatment and tax structure of any transaction described herein and all materials of any kind (including tax opinions and other tax analyses) that are provided to the Company relating to such tax treatment and tax structure, without GS imposing any limitation of

any kind. The Confidential Information, including this disclaimer, is subject to, and governed by, any written agreement between the Company, the Board and/or any committee thereof, on the one hand, and GS, on the other hand.

GS and its affiliates are engaged in investment banking, commercial banking and financial advisory services, securities trading, investment management, principal investment, financial planning, benefits counseling, risk management, hedging, financing, brokerage activities and other financial and non-financial activities and services for various persons and entities. In the ordinary course of these activities and services, GS and its affiliates may at any time make or hold long or short positions and investments, as well as actively trade or effect transactions, in the equity, debt and other securities (or related derivative securities) and financial instruments (including bank loans and other obligations) of third parties, the Company, any other party to any transaction and any of their respective affiliates or any currency or commodity that may be involved in any transaction for their own account and for the accounts of their customers.

The Confidential Information has been prepared and based on information obtained by GS from publicly available sources, the Company’s management and/or other sources. In preparing the Confidential Information, GS has relied upon and assumed, without assuming any responsibility for independent verification, the accuracy and completeness of all of the financial, legal, regulatory, tax, accounting and other information provided to, discussed with or reviewed by GS, and GS does not assume any liability for any such information discussed with or reviewed by GS. GS has assumed that all forecasts provided to, discussed with or reviewed by GS have been reasonably prepared and reflect the best currently available estimates and judgments of the Company. GS does not provide accounting, tax, legal or regulatory advice. GS’s role in any due diligence review is limited solely to performing such a review as it shall deem necessary to support its own advice and analysis and shall not be on behalf of the Company. Analyses based upon forecasts of future results are not necessarily indicative of actual future results, which may be significantly more or less favorable than suggested by these analyses, and GS does not assume responsibility if future results are materially different from those forecast.

GS has not made an independent evaluation or appraisal of the assets and liabilities of the Company or any other person and has no obligation to evaluate the solvency of the Company or any person under any law. The analyses in the Confidential Information are not appraisals nor do they necessarily reflect the prices at which businesses or securities actually may be sold or purchased. The Confidential Information does not address the underlying business decision of the Company to engage in any transaction, or the relative merits of any strategic alternative referred to herein as compared to any other alternative that may be available to the Company. The Confidential Information is necessarily based on economic, monetary, market and other conditions as in effect on, and the information made available to GS as of, the date of such Confidential Information and GS assumes no responsibility for updating or revising the Confidential Information.

CONFIDENTIAL – PRELIMINARY DRAFT

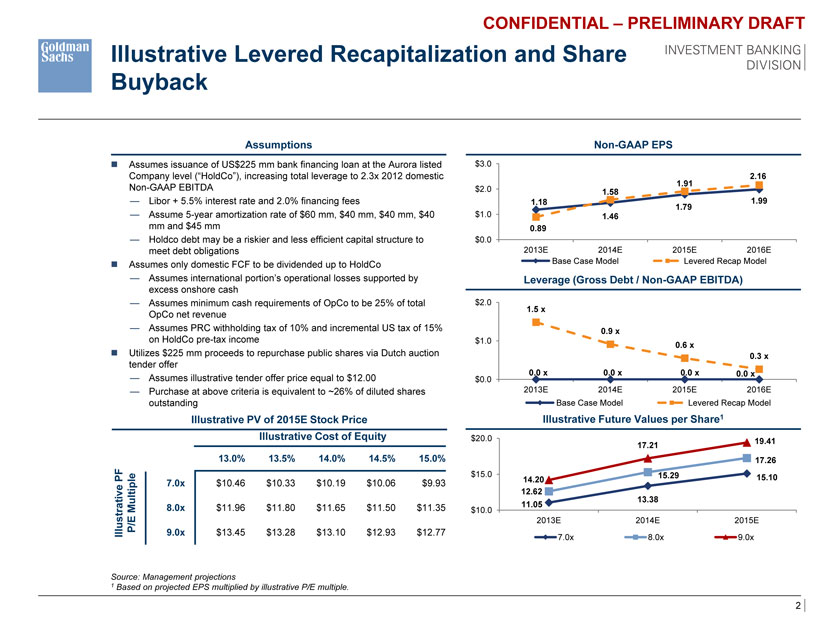

Illustrative Levered Recapitalization and Share Buyback

Assumptions Non-GAAP EPS

? Assumes issuance of US$225 mm bank financing loan at the Aurora listed $3.0

Company level (“HoldCo”), increasing total leverage to 2.3x 2012 domestic 1.91 2.16 Non-GAAP EBITDA $2.0

1.58

— Libor + 5.5% interest rate and 2.0% financing fees 1.18 1.99

$1.0 1.79

— Assume 5-year amortization rate of $60 mm, $40 mm, $40 mm, $40 1.46 mm and $45 mm 0.89

— Holdco debt may be a riskier and less efficient capital structure to $0.0 meet debt obligations 2013E 2014E 2015E 2016E

? Assumes only domestic FCF to be dividended up to HoldCo Base Case Model Levered Recap Model

— Assumes international portion’s operational losses supported by Leverage (Gross Debt / Non-GAAP EBITDA) excess onshore cash

— Assumes minimum cash requirements of OpCo to be 25% of total $2.0

1.5 x

OpCo net revenue

— Assumes PRC withholding tax of 10% and incremental US tax of 15% 0.9 x on HoldCo pre-tax income $1.0

? Utilizes $225 mm proceeds to repurchase public shares via Dutch auction 0.6 x tender offer 0.3 x 0.0 x 0.0 x 0.0 x 0.0 x

— Assumes illustrative tender offer price equal to $12.00 $0.0

— Purchase at above criteria is equivalent to ~26% of diluted shares 2013E 2014E 2015E 2016E outstanding Base Case Model Levered Recap Model

Illustrative PV of 2015E Stock Price Illustrative Future Values per Share1 Illustrative Cost of Equity $20.0

19.41

17.21

13.0% 13.5% 14.0% 14.5% 15.0% 17.26

PF $15.0 15.29 15.10

14.20

7.0x $10.46 $10.33 $10.19 $10.06 $9.93 ve tiple 12.62 13.38

Mul 8.0x $11.96 $11.80 $11.65 $11.50 $11.35 11.05

$10.0

P/E 2013E 2014E 2015E

Illustrati 9.0x $13.45 $13.28 $13.10 $12.93 $12.77

7.0x 8.0x 9.0x

Source: Management projections

1 | | Based on projected EPS multiplied by illustrative P/E multiple. |

CONFIDENTIAL – PRELIMINARY DRAFT

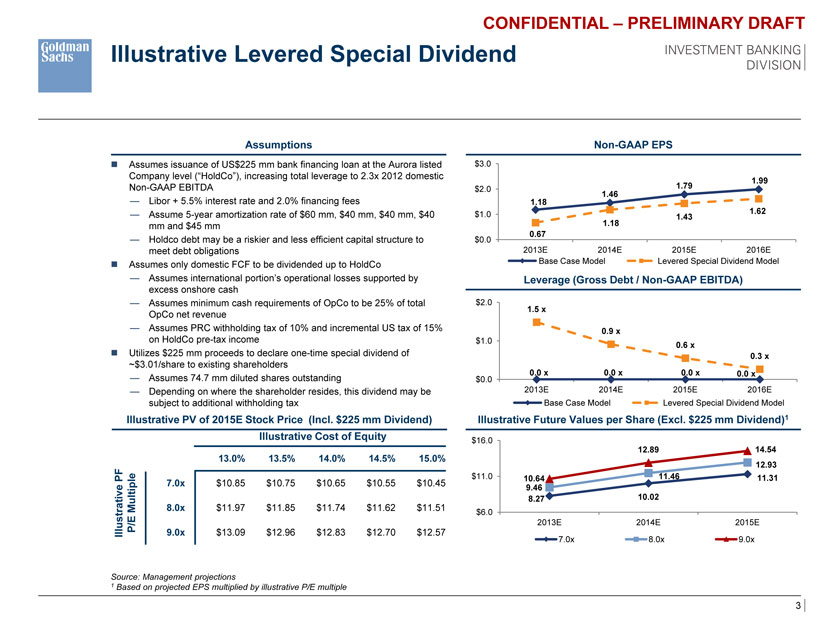

Illustrative Levered Special Dividend

Assumptions Non-GAAP EPS

? Assumes issuance of US$225 mm bank financing loan at the Aurora listed $3.0 Company level (“HoldCo”), increasing total leverage to 2.3x 2012 domestic

1.99

Non-GAAP EBITDA $2.0 1.79 1.46

— Libor + 5.5% interest rate and 2.0% financing fees 1.18

— Assume 5-year amortization rate of $60 mm, $40 mm, $40 mm, $40 $1.0 1.62 1.43 mm and $45 mm 1.18 0.67

— Holdco debt may be a riskier and less efficient capital structure to $0.0 meet debt obligations 2013E 2014E 2015E 2016E

? Assumes only domestic FCF to be dividended up to HoldCo Base Case Model Levered Special Dividend Model

— Assumes international portion’s operational losses supported by Leverage (Gross Debt / Non-GAAP EBITDA) excess onshore cash

— Assumes minimum cash requirements of OpCo to be 25% of total $2.0

1.5 x

OpCo net revenue

— Assumes PRC withholding tax of 10% and incremental US tax of 15% 0.9 x on HoldCo pre-tax income $1.0

? Utilizes $225 mm proceeds to declare one-time special dividend of 0.6 x

~$3.01/share to existing shareholders 0.3 x 0.0 x 0.0 x 0.0 x 0.0 x

— Assumes 74.7 mm diluted shares outstanding $0.0

— Depending on where the shareholder resides, this dividend may be 2013E 2014E 2015E 2016E subject to additional withholding tax Base Case Model Levered Special Dividend Model

Illustrative PV of 2015E Stock Price (Incl. $225 mm Dividend) Illustrative Future Values per Share (Excl. $225 mm Dividend)1 Illustrative Cost of Equity $16.0

12.89 14.54

13.0% 13.5% 14.0% 14.5% 15.0%

12.93 PF $11.0 10.64 11.46 11.31 ve tiple 7.0x $10.85 $10.75 $10.65 $10.55 $10.45 9.46 8.27 10.02

Mul 8.0x $11.97 $11.85 $11.74 $11.62 $11.51

$6.0

P/E 2013E 2014E 2015E

Illustrati 9.0x $13.09 $12.96 $12.83 $12.70 $12.57

7.0x 8.0x 9.0x

Source: Management projections

1 | | Based on projected EPS multiplied by illustrative P/E multiple |

CONFIDENTIAL – PRELIMINARY DRAFT

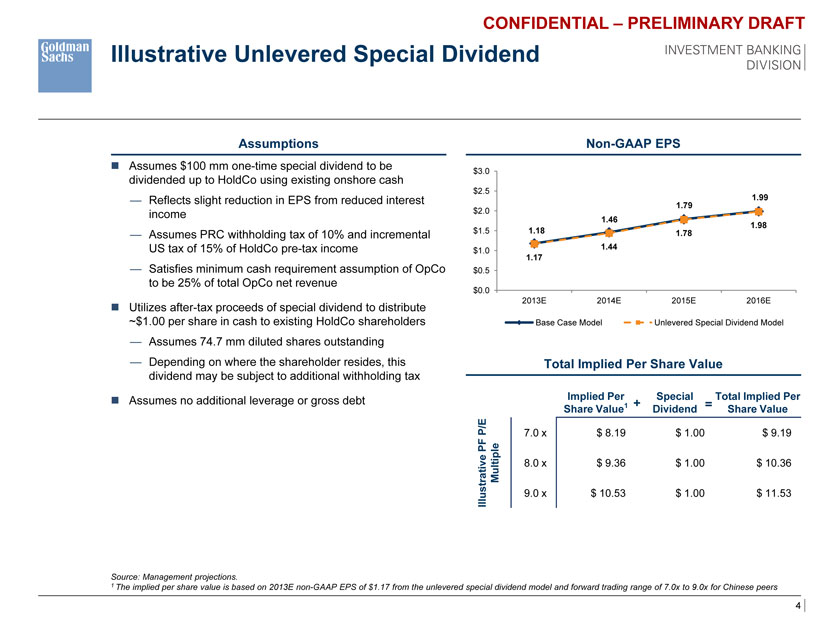

Illustrative Unlevered Special Dividend

Assumptions Non-GAAP EPS

? Assumes $100 mm one-time special dividend to be

$3.0

dividended up to HoldCo using existing onshore cash

$2.5

— Reflects slight reduction in EPS from reduced interest 1.79 1.99 income $2.0

1.46

1.98

— Assumes PRC withholding tax of 10% and incremental $1.5 1.18 1.78 US tax of 15% of HoldCo pre-tax income 1.44

$1.0

1.17

— Satisfies minimum cash requirement assumption of OpCo $0.5 to be 25% of total OpCo net revenue

$0.0

2013E 2014E 2015E 2016E

? Utilizes after-tax proceeds of special dividend to distribute

~$1.00 per share in cash to existing HoldCo shareholders Base Case Model Unlevered Special Dividend Model

— Assumes 74.7 mm diluted shares outstanding

— Depending on where the shareholder resides, this Total Implied Per Share Value dividend may be subject to additional withholding tax

? Assumes no additional leverage or gross debt Implied Per Special Total Implied Per

Share Value Dividend Share Value E

P/ 7.0 x $ 8.19 $ 1.00 $ 9.19

PF strative Multiple 8.0 x $ 9.36 $ 1.00 $ 10.36 9.0 x $ 10.53 $ 1.00 $ 11.53

Illu

Source: Management projections.

1 The implied per share value is based on 2013E non-GAAP EPS of $1.17 from the unlevered special dividend model and forward trading range of 7.0x to 9.0x for Chinese peers