UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

THE ARBITRAGE FUNDS

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-259-2655

Date of fiscal year end: May 31

Date of reporting period: June 1, 2012 – May 31, 2013

| Item 1. | Reports to Stockholders. |

| | |

| | TABLE OF CONTENTS |

| | |

| | |

The Arbitrage Funds | | Shareholder Letter |

| |

| | May 31, 2013 |

Dear Fellow Shareholders,

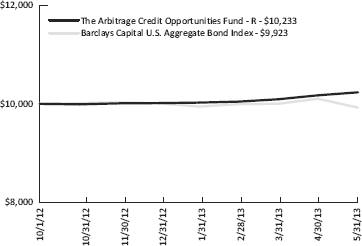

For the fiscal year ending May 31, 2013, The Arbitrage Fund returned 0.42% (Class R, ARBFX), The Arbitrage Event-Driven Fund returned 2.72% (Class R, AEDFX), and The Arbitrage Credit Opportunities Fund – newly launched on October 1, 2012 – returned 2.33% since inception (Class R, ARCFX). The HFRI Event Driven: Merger Arbitrage Index returned 3.64% and the HFRI Event Driven Index returned 13.78% for the twelve month period, and the Barclays Capital U.S. Aggregate Bond Index returned - 0.77% since 10/1/12. (See pages 5, 23, and 44 for standard performance).

The Arbitrage Fund

Low interest rates continued to keep merger arbitrage spreads in check for a third year in a row. This, in concert with a lackluster deal environment and volatility derived from a handful of terminated or delayed transactions, constrained The Arbitrage Fund’s performance. That said, the Fund’s volatility (as measured by annualized three-year standard deviation) reached an all-time low of 2.59% as of May 31, 2013. Moreover, the Fund’s correlations to the broader fixed income and equity markets (as measured by the Barclays Capital U.S. Aggregate Bond Index and the S&P 500 Index) are near all time lows as well, at 0.15 and 0.04, respectively. While equity markets have reached record highs as of late, the dislocation experienced shortly after fiscal year-end illustrates the value of maintaining an allocation to low volatility, low correlation, alternative strategies in one’s portfolio.

Investors have been looking for the mergers and acquisitions environment to improve for almost three years now, anticipating that the combination of low interest rates, cash-rich balance sheets, and rising stock prices would underpin an uptick in deal flow. But one ingredient (and an important one) had not yet made its way into the mix: confidence. Confidence on the part of corporate executives and board members to pull the trigger on mergers and acquisitions has been notably absent over this time frame. Given the uncertainties around the direction of interest rates, global macroeconomic conditions, and ever-changing fiscal and regulatory policy making, it’s no wonder that executives have hit the pause button ahead of moving forward on acquisition activity. Corporate acquirers have been playing it safe, focusing on smaller transactions that are less dependent on broader macroeconomic conditions to successfully integrate. In addition, staying independent often remains a stronger option for target companies in this ultra-low interest rate environment, where high investor demand for corporate debt opens the door for even the least creditworthy borrowers.

According to Dealogic, 510 deals with values totaling $377.3B were announced during the first five months of 2013: $195.2B in the Americas, $113.2B in Europe/Middle East/Africa (EMEA), and $68.9B in Asia-Pacific (APAC). While EMEA and APAC saw declines compared to the year-ago period (down 17% from $136.8B and down 15% from $81.1B, respectively), activity in the Americas region grew over 35% from the $144.5B announced in the first five months of 2012. This led to an overall increase in worldwide deal flow of 4% for the period.

Given these signs, have we turned a corner? We think yes, but we remain in the early stages of a move to more robust deal flow. Investors are beginning to witness the early signs of stabilization in Europe, and although most Asia-Pacific economies have shown signs of slowing, the continued modest growth in North America appears to be picking up the slack. Competitive bidding in the telecom space in the U.S. (Sprint, Clearwire, PCS), in the cable space in Europe (Virgin Media, Kabel Deutschland), and some acceleration of consolidation in the biotech/healthcare sector (Warner Chilcott PLC, Life Technologies, Onyx Pharm, etc.) bode well for our prediction.

| | |

| | | |

Annual Report | May 31, 2013 | | 1 |

| | |

The Arbitrage Funds | | Shareholder Letter (continued) |

| |

| | May 31, 2013 |

The Arbitrage Event-Driven Fund

The Arbitrage Event-Driven Fund, which combines optimized sleeves of our merger arbitrage and credit opportunities strategies with a third equity special situations strategy, returned 0.62% during the volatile final month of the fiscal year. The merger arbitrage and credit opportunities sleeves of this Fund take a more concentrated approach compared to their pure-play counterparts in The Arbitrage Fund and The Arbitrage Credit Opportunities Fund. For the Fund’s third sleeve, we focus on an expanded universe of corporate events in the equity markets – not strictly limited to mergers and acquisitions. In the current market environment, our equity special situations team sees corporations under pressure to maximize shareholder value, leading to activist scenarios, split-offs, and tax-efficient restructurings like Real Estate Investment Trust conversions, and in the near term we expect such events to be primary areas of opportunity.

The Arbitrage Credit Opportunities Fund

Short-term interest rates have historically been one of the building blocks of merger arbitrage returns, and while a return to more “normalized” interest rates may contribute positively to merger arbitrage spreads – and we saw how quickly such a reversion could occur at the tail end of the fiscal year – the associated disruption to the overall credit markets could be significant. Point of fact: as the yield on the 10-year U.S. Treasury increased from 1.67% on April 30, 2013 to 2.16% at fiscal year-end on May 31, the Barclays U.S. Aggregate Bond Index declined -1.78%, the Bank of America Merrill Lynch Corporate Master Index returned -2.28%, and the Bank of America Merrill Lynch High Yield Master II Index was down -0.53%.

For that same month of May, the newest member of The Arbitrage Funds Series Trust – The Arbitrage Credit Opportunities Fund (Class R) – returned 0.59%. In addition, the Fund, which launched on October 1, 2012, has returned 2.33% since inception, while the Barclays Capital U.S. Aggregate Bond Index has returned -0.77% for the same period. The recent dislocation in the credit markets has not changed our investment theses. We simply have different entry points due to the market correction. We have added groups of names mainly in the merger-related space and post reorganization refinancing space. In particular, the increase in merger deals over the last two months has increased our universe of merger-related credit opportunities, and we have added these positions at more attractive prices. These trades range from three to six months in duration, and we believe they will hold up well in a volatile market. For our positions that are longer in duration or with softer catalysts, we have increased our market hedges to help mitigate further downward moves in those specific names.

Outlook

We believe global equity and credit markets will remain volatile as the Federal Reserve transitions its policies to accommodate any changes in economic growth. Any stability in the U.S. Treasury market (particularly the 10-Year), would be influential in, and a sign of, lessening fear among global investors. More volatile markets typically provide us with attractive entry points in many of the deals and events we track around the globe. Rising interest rates, when they do materialize, should serve to buttress merger arbitrage returns, and if accompanied by strengthening macroeconomic conditions, will likely mean a more robust deal environment as well. Market action towards the end of the fiscal year gave us the opportunity to demonstrate how the drivers of returns in merger arbitrage are so uniquely distinct and counter to the behavior of other asset

| | |

| | | |

2 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Funds | | Shareholder Letter (continued) |

| |

| | May 31, 2013 |

classes. For our credit strategies, we remain focused on positions that we believe will hold up well in a volatile market. Our equity special situations team will focus on maintaining hedging strategies to mitigate market beta exposure. While these hedges may reduce potential gains in bull markets, they also serve to reduce volatility in down markets and adhere to the strategy’s fundamental market neutral core. We will continue to avoid those transactions for which our risk-taking is not well compensated, and remain focused on solid, strategic transactions underpinned by strong strategic rationales.

Sincerely,

The Investment Team

Water Island Capital

| | |

| | | |

Annual Report | May 31, 2013 | | 3 |

| | |

| The Arbitrage Fund | | Manager Commentary |

| |

| | May 31, 2013 (Unaudited) |

|

The Arbitrage Fund | NASDAQ Ticker Symbols | ARBNX, ARBFX, ARBCX, ARGAX The Fund’s Goal and Main Investments Merger arbitrage is a sub-set of a broader event-driven strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically merger arbitrage is a low volatility strategy pursued by absolute-return-minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets. |

Investment Strategy

The Fund seeks to achieve capital growth by engaging in merger arbitrage. The strategy’s focus is to capture returns from corporate events, generate market neutral capital growth, preservation of capital, consistent and positive returns, and achieve low correlation, and low volatility. The Fund’s general investment approach can be best described as risk averse, and many systems, policies, and procedures are in place to facilitate this low-risk approach. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations, and other corporate reorganizations. The Fund’s investment advisor uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition’s completion. That difference, or “spread,” is the primary driver of returns for this strategy. There is no limit to the number of stocks the Fund can hold, however, the Fund typically invests in 40-80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock-for-stock deal) and, in many cases, associated derivative positions for hedging purposes.

| | |

| | | |

4 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio Information |

| |

| | May 31, 2013 (Unaudited) |

Performance (annualized returns as of May 31, 2013)

| | | | | | | | |

| | | One

Year | | Five

Year | | Ten

Year | | Since

Inception* |

Arbitrage Fund, Class R | | 0.42% | | 2.40% | | 3.61% | | 4.85% |

Arbitrage Fund, Class I | | 0.67% | | 2.61% | | – | | 3.42% |

Arbitrage Fund, Class C** | | -1.24% | | – | | – | | -1.24% |

HFRI Event Driven: Merger Arbitrage Index | | 3.64% | | 3.16% | | 5.17% | | 4.80% |

S&P 500® Index | | 27.27% | | 5.43% | | 7.58% | | 2.92% |

Barclays Capital U.S. Aggregate Bond Index | | 0.91% | | 5.50% | | 4.66% | | 5.85% |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R inception: 9/17/00; Class I inception: 10/17/03; Class C inception: 6/1/12.

** Class C shares are also subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I and Class C are 2.25%, 2.00% and 3.00%, respectively.

The HFRI Event Driven: Merger Arbitrage Index is an index consisting of merger arbitrage strategies which employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre-, post-date or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits.

The S&P 500® Index is an unmanaged index consisting of 500 stocks.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| | | |

Annual Report | May 31, 2013 | | 5 |

| | |

The Arbitrage Fund | | Portfolio Information (continued) |

| |

| | May 31, 2013 (Unaudited)

|

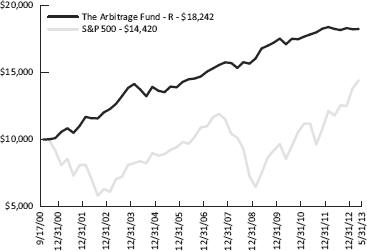

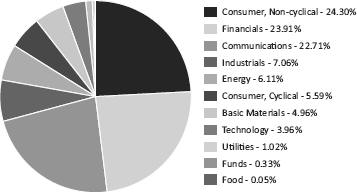

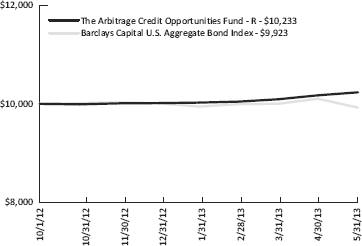

Growth of $10,000 Investment

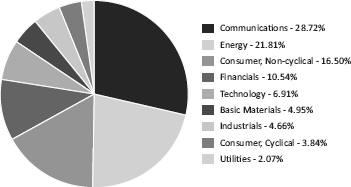

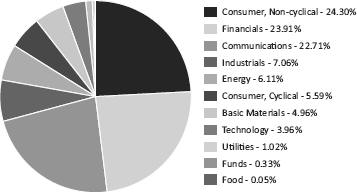

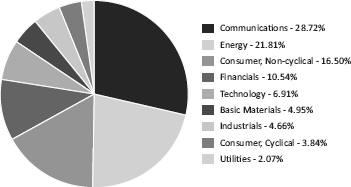

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Fund’s investments in common stock and exchange-traded funds as of the report date.

| | |

| | | |

6 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 97.08% | | | | | | | | |

Aerospace & Defense - 0.03% | | | | | | | | |

Allied Defense Group, Inc.(a)(b)(e) | | | 398,319 | | | $ | 796,638 | |

| | | | | | | | |

| | |

Agriculture - 2.19% | | | | | | | | |

GrainCorp Ltd., Class A | | | 5,185,361 | | | | 63,025,500 | |

| | | | | | | | |

| | |

Apparel - 1.29% | | | | | | | | |

True Religion Apparel, Inc.(c) | | | 1,163,461 | | | | 37,044,598 | |

| | | | | | | | |

| | |

Auto Parts & Equipment - 0.14% | | | | | | | | |

Nidec-Tosok Corp. | | | 476,900 | | | | 4,025,795 | |

| | | | | | | | |

| | |

Banks - 0.41% | | | | | | | | |

Sterling Bancorp | | | 977,267 | | | | 11,678,341 | |

| | | | | | | | |

| | |

Beverages - 5.32% | | | | | | | | |

DE Master Blenders 1753 N.V.(a) | | | 7,720,179 | | | | 121,465,033 | |

Grupo Modelo SAB de CV, Series C | | | 3,464,958 | | | | 31,281,087 | |

| | | | | | | | |

| | | | | | | 152,746,120 | |

| | | | | | | | |

| | |

Biotechnology - 4.43% | | | | | | | | |

Life Technologies Corp.(a)(c) | | | 1,717,369 | | | | 127,257,043 | |

| | | | | | | | |

| | |

Chemicals - 0.13% | | | | | | | | |

Ferro Corp.(a)(c) | | | 532,184 | | | | 3,650,782 | |

| | | | | | | | |

| | |

Coal - 0.18% | | | | | | | | |

Whitehaven Coal Ltd. | | | 2,324,408 | | | | 5,072,018 | |

| | | | | | | | |

| | |

Commercial Services - 3.19% | | | | | | | | |

Lender Processing Services, Inc. | | | 1,512,557 | | | | 50,050,511 | |

Stewart Enterprises, Inc., Class A | | | 3,207,395 | | | | 41,696,135 | |

| | | | | | | | |

| | | | | | | 91,746,646 | |

| | | | | | | | |

| | |

Computers - 0.46% | | | | | | | | |

Stonesoft OYJ(a) | | | 2,294,522 | | | | 13,301,058 | |

| | | | | | | | |

| | |

Diversified Financial Services - 9.52% | | | | | | | | |

Asset Acceptance Capital Corp.(a) | | | 1,307,277 | | | | 8,876,411 | |

National Financial Partners Corp.(a) | | | 1,535,920 | | | | 38,720,543 | |

Netspend Holdings, Inc.(a)(d) | | | 4,103,170 | | | | 65,691,752 | |

NYSE Euronext(d) | | | 3,980,752 | | | | 160,145,653 | |

| | | | | | | | |

| | | | | | | 273,434,359 | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 7 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 97.08% (Continued) | | | | | | | | |

Electric - 1.05% | | | | | | | | |

NV Energy, Inc. | | | 1,286,364 | | | $ | 30,152,372 | |

| | | | | | | | |

| | |

Electrical Components & Equipment - 1.82% | | | | | | | | |

Power-One, Inc.(a) | | | 8,275,799 | | | | 52,385,808 | |

| | | | | | | | |

| | |

Engineering & Construction - 0.65% | | | | | | | | |

Gemina SpA(a) | | | 9,835,216 | | | | 18,586,919 | |

| | | | | | | | |

| | |

Food - 5.79% | | | | | | | | |

Copeinca ASA | | | 1,409,751 | | | | 13,932,601 | |

H.J. Heinz Co.(c)(d) | | | 1,929,120 | | | | 139,591,123 | |

Smithfield Foods, Inc.(a) | | | 390,503 | | | | 12,863,169 | |

| | | | | | | | |

| | | | | | | 166,386,893 | |

| | | | | | | | |

| | |

Forest Products & Paper - 2.21% | | | | | | | | |

Buckeye Technologies, Inc. | | | 1,705,848 | | | | 63,576,955 | |

| | | | | | | | |

| | |

Healthcare - Products - 2.92% | | | | | | | | |

Conceptus, Inc.(a) | | | 2,247,192 | | | | 69,618,008 | |

Palomar Medical Technologies, Inc.(a) | | | 1,058,001 | | | | 14,314,754 | |

| | | | | | | | |

| | | | | | | 83,932,762 | |

| | | | | | | | |

| | |

Household Products & Wares - 0.37% | | | | | | | | |

American Greetings Corp., Class A | | | 572,861 | | | | 10,540,642 | |

| | | | | | | | |

| | |

Insurance - 1.80% | | | | | | | | |

Great-West Lifeco, Inc.(a) | | | 1,848,620 | | | | 51,727,481 | |

| | | | | | | | |

| | |

Internet - 1.74% | | | | | | | | |

Acquity Group Ltd., Sponsored ADR(a) | | | 354,604 | | | | 4,556,661 | |

Softchoice Corp. | | | 1,255,942 | | | | 24,167,874 | |

Websense, Inc.(a)(c) | | | 857,894 | | | | 21,318,666 | |

| | | | | | | | |

| | | | | | | 50,043,201 | |

| | | | | | | | |

| | |

Iron & Steel - 0.28% | | | | | | | | |

Sundance Resources Ltd.(a) | | | 89,795,434 | | | | 7,992,282 | |

| | | | | | | | |

| | |

Machinery - Diversified - 4.34% | | | | | | | | |

Gardner Denver, Inc.(d) | | | 1,653,325 | | | | 124,826,037 | |

| | | | | | | | |

| | |

Media - 4.62% | | | | | | | | |

Astral Media, Inc., Class A | | | 2,417,304 | | | | 113,316,590 | |

Fisher Communications, Inc. | | | 223,636 | | | | 9,193,676 | |

| | |

See Notes to Financial Statements. | | |

| |

8 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 97.08% (Continued) | | | | | | | | |

Media - 4.62% (Continued) | | | | | | | | |

Liberty Global, Inc., Class A(a)(c) | | | 138,712 | | | $ | 10,223,074 | |

| | | | | | | | |

| | | | | | | 132,733,340 | |

| | | | | | | | |

| | |

Metal Fabricate & Hardware - 0.27% | | | | | | | | |

Hoganas AB, Class B | | | 161,397 | | | | 7,870,825 | |

| | | | | | | | |

| | |

Mining - 3.53% | | | | | | | | |

Aurizon Mines Ltd.(a) | | | 10,506,222 | | | | 45,382,218 | |

Flinders Mines Ltd.(a) | | | 46,335,055 | | | | 1,906,829 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 1,497,223 | | | | 46,488,788 | |

Rainy River Resources Ltd.(a) | | | 2,046,985 | | | | 7,186,907 | |

Yancoal Australia Ltd.(a) | | | 25,903 | | | | 17,353 | |

Yancoal Australia Ltd., CVR(a) | | | 166,860 | | | | 431,171 | |

| | | | | | | | |

| | | | | | | 101,413,266 | |

| | | | | | | | |

| | |

Oil & Gas - 1.53% | | | | | | | | |

McMoRan Exploration Co.(a)(d) | | | 2,648,628 | | | | 44,046,684 | |

| | | | | | | | |

| | |

Oil & Gas Services - 4.58% | | | | | | | | |

Lufkin Industries, Inc.(c) | | | 1,491,116 | | | | 131,605,898 | |

| | | | | | | | |

| | |

Real Estate Investment Trusts - 1.09% | | | | | | | | |

CapLease, Inc. | | | 2,499,567 | | | | 21,546,268 | |

MPG Office Trust, Inc.(a) | | | 3,085,640 | | | | 9,658,053 | |

| | | | | | | | |

| | | | | | | 31,204,321 | |

| | | | | | | | |

| | |

Retail - 3.50% | | | | | | | | |

Hot Topic, Inc.(c) | | | 3,275,176 | | | | 45,819,712 | |

OfficeMax, Inc.(c) | | | 3,250,286 | | | | 42,351,227 | |

rue21, Inc.(a) | | | 295,399 | | | | 12,403,804 | |

| | | | | | | | |

| | | | | | | 100,574,743 | |

| | | | | | | | |

| | |

Savings & Loans - 4.11% | | | | | | | | |

Hudson City Bancorp, Inc.(d) | | | 13,890,099 | | | | 118,065,842 | |

| | | | | | | | |

| | |

Semiconductors - 6.98% | | | | | | | | |

ASML Holding N.V., New York Registered Shares | | | 2,467,630 | | | | 200,544,280 | |

| | | | | | | | |

| | |

Software - 3.61% | | | | | | | | |

BMC Software, Inc.(a)(c) | | | 1,932,981 | | | | 87,554,374 | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 9 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | |

| | | | | | | | Shares | | | Value | |

| |

COMMON STOCKS - 97.08% (Continued) | | | | | | | | | | | | | | |

Software - 3.61% (Continued) | | | | | | | | | | | | | | |

Market Leader, Inc.(a) | | | | | | | | | 1,509,044 | | | $ | 16,146,771 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 103,701,145 | |

| | | | | | | | | | | | | | |

| | | | |

Telecommunications - 13.00% | | | | | | | | | | | | | | |

Clearwire Corp., Class A(a)(c) | | | | | | | | | 8,786,698 | | | | 39,364,407 | |

Sprint Nextel Corp.(a)(c) | | | | | | | | | 14,368,540 | | | | 104,890,342 | |

Virgin Media, Inc.(d) | | | | | | | | | 4,613,361 | | | | 229,099,507 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | 373,354,256 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL COMMON STOCKS (Cost $2,774,491,115) | | | | | | | | | | | | | 2,789,044,850 | |

| | | | | | | | | | | | | | |

| | | | |

RIGHTS - 0.00% | | | | | | | | | | | | | | |

Cubist Pharmaceuticals, Inc.(a)(b)(e) | | | | | | | | | 119,343 | | | | 0 | |

Emergent Biosolutions, Inc.(a)(b)(e) | | | | | | | | | 595,405 | | | | 0 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL RIGHTS (Cost $173,313) | | | | | | | | | | | | | 0 | |

| | | | | | | | | | | | | | |

| | | | |

| | | Expiration Date | | Exercise Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS(a) - 0.14% | | | | | | | | | | | | | | |

Call Options Purchased - 0.02% | | | | | | | | | | | | | | |

Sprint Nextel Corp. | | 08/2013 | | | $7.00 | | | | 12,124 | | | $ | 691,068 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL CALL OPTIONS PURCHASED (Cost $580,572) | | | | | | | | | | | | | 691,068 | |

| | | | | | | | | | | | | | |

| | | | |

Put Options Purchased - 0.12% | | | | | | | | | | | | | | |

Liberty Global, Inc., Class A: | | | | | | | | | | | | | | |

| | 07/2013 | | | 80.00 | | | | 3,169 | | | | 2,249,990 | |

| | 07/2013 | | | 85.00 | | | | 786 | | | | 903,900 | |

| | |

See Notes to Financial Statements. | | |

| |

10 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | | | |

| | | Expiration Date | | | Exercise Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS (a)- 0.14% (Continued) | | | | | | | | | | | | | | | | |

Put Options Purchased - 0.12% (Continued) | | | | | | | | | | | | | | | | |

Sprint Nextel Corp. | | | 08/2013 | | | | $7.00 | | | | 4,061 | | | $ | 160,410 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL PUT OPTIONS PURCHASED (Cost $6,163,524) | | | | | | | | | | | | | | | 3,314,300 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED OPTIONS (Cost $6,744,096) | | | | | | | | | | | | | | | 4,005,368 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | | | | Yield | | | Shares | | | Value | |

| |

SHORT-TERM INVESTMENTS - 6.58% | | | | | | | | | | | | | | | | |

Money Market Fund | | | | | | | | | | | | | | | | |

State Street Institutional Liquid Reserves Fund(f) | | | | | | | 0.093% | | | | 124,059,643 | | | $ | 124,059,643 | |

| | | | | | | | | | | | | | | | |

| | | | |

Time Deposits | | | | | | | | | | | | | | | | |

Euro Time Deposit | | | | | | | 0.010% | | | | 64,885,408 | | | | 64,885,408 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $188,945,051) | | | | | | | | | | | | | | | 188,945,051 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments - 103.80% (Cost $2,970,353,575) | | | | | | | | | | | | | | | 2,981,995,269 | |

| | | | |

Liabilities in Excess of Other Assets - (3.80%) | | | | | | | | | | | | | | | (109,063,174) | |

| | | | | | | | | | | | | | | | |

| | | | |

NET ASSETS - 100.00% | | | | | | | | | | | | | | $ | 2,872,932,095 | |

| | | | | | | | | | | | | | | | |

| (a) | Non-income-producing security. |

| (b) | Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2013, the total market value of these securities was $796,638, representing 0.03% of net assets. |

| (c) | Underlying security for a written/purchased call/put option. |

| (d) | Security, or a portion of security, is being held as collateral for short sales, or written option contracts. At period end, the aggregate market value of those securities was $485,770,000, representing 16.91% of net assets. |

| (e) | Security considered illiquid. On May 31, 2013, the total market value of these securities was $796,638, representing 0.03% of net assets. |

| (f) | Rate shown is the 7-day effective yield as of May 31, 2013. |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 11 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

Securities determined to be illiquid under the procedures approved by the Funds’ Board of Trustees. Information related to the illiquid securities is as follows:

| | | | | | | | | | | | | | |

Date(s) of Purchase | | Security | | Cost | | | Market Value | | | % of Net

Assets | |

| |

05/20/2010 – 12/28/2010 | | Allied Defense Group, Inc. | | $ | 1,553,995 | | | $ | 796,638 | | | | 0.03% | |

12/12/2011 | | Cubist Pharmaceuticals, Inc. | | | 0 | | | | 0 | | | | 0.00 | |

08/13/2010 – 09/02/2010 | | Emergent Biosolutions, Inc. | | | 173,313 | | | | 0 | | | | 0.00 | |

| | | | | | | | | | |

| | | | | | | | $ | 796,638 | | | | 0.03% | |

| | | | | | | | | | |

| | | | | | | | |

SCHEDULE OF SECURITIES SOLD SHORT | | | Shares | | | | Value | |

| |

COMMON STOCKS | | | | | | | | |

Banks | | | | | | | | |

M&T Bank Corp. | | | (1,167,129) | | | | $ (122,431,832) | |

| | | | | | | | |

| | |

Commercial Services | | | | | | | | |

Atlantia SpA | | | (1,092,696) | | | | (18,690,217) | |

| | | | | | | | |

| | |

Diversified Financial Services | | | | | | | | |

Encore Capital Group, Inc. | | | (70,615) | | | | (2,518,837) | |

IntercontinentalExchange, Inc. | | | (677,934) | | | | (116,069,080) | |

| | | | | | | | |

| | | | | | | (118,587,917) | |

| | | | | | | | |

| | |

Electrical Components & Equipment | | | | | | | | |

Nidec Corp. | | | (58,900) | | | | (4,057,419) | |

| | | | | | | | |

| | |

Healthcare - Products | | | | | | | | |

Cynosure, Inc., Class A | | | (203,358) | | | | (5,065,648) | |

| | | | | | | | |

| | |

Insurance | | | | | | | | |

Fidelity National Financial, Inc. | | | (788,318) | | | | (20,740,647) | |

Great-West Lifeco, Inc. | | | (1,848,523) | | | | (51,671,277) | |

| | | | | | | | |

| | | | | | | (72,411,924) | |

| | | | | | | | |

| | |

Internet | | | | | | | | |

Trulia, Inc. | | | (169,009) | | | | (5,195,336) | |

| | | | | | | | |

| | |

Media | | | | | | | | |

Liberty Global, Inc., Class A | | | (1,160,451) | | | | (85,525,238) | |

Liberty Global, Inc., Series C | | | (663,520) | | | | (45,577,189) | |

| | | | | | | | |

| | | | | | | (131,102,427) | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

12 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| |

COMMON STOCKS (Continued) | | | | | | | | |

Mining | | | | | | | | |

Freeport-McMoRan Copper & Gold, Inc. | | | (1,449,446) | | | $ | (45,005,298) | |

Hecla Mining Co. | | | (3,084,644) | | | | (11,814,187) | |

New Gold, Inc. | | | (511,747) | | | | (3,479,929) | |

| | | | | | | | |

| | | | | | | (60,299,414) | |

| | | | | | | | |

| | |

Oil & Gas | | | | | | | | |

McMoRan Exploration Co. | | | (27,779) | | | | (45,413) | |

| | | | | | | | |

| | |

Retail | | | | | | | | |

Office Depot, Inc. | | | (5,351,100) | | | | (23,598,351) | |

OfficeMax, Inc. | | | (1,700) | | | | (22,151) | |

| | | | | | | | |

| | | | | | | (23,620,502) | |

| | | | | | | | |

| | |

Savings & Loans | | | | | | | | |

Provident New York Bancorp | | | (1,234,795) | | | | (11,360,114) | |

| | | | | | | | |

| | |

Semiconductors | | | | | | | | |

ASML Holding N.V., New York Registered Shares | | | (2,467,236) | | | | (200,512,270) | |

| | | | | | | | |

| | |

Telecommunications | | | | | | | | |

BCE, Inc. | | | (2,200) | | | | (98,865) | |

Clearwire Corp., Class A | | | (46,800) | | | | (209,664) | |

| | | | | | | | |

| | | | | | | (308,529) | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Proceeds $725,813,495) | | | | | | | (773,688,962) | |

| | | | | | | | |

| | |

EXCHANGE-TRADED FUNDS | | | | | | | | |

Equity Fund | | | | | | | | |

SPDR® S&P 500® ETF Trust | | | (59,541) | | | | (9,719,473) | |

| | | | | | | | |

| | |

TOTAL EXCHANGE-TRADED FUNDS (Proceeds $9,502,177) | | | | | | | (9,719,473) | |

| | | | | | | | |

| | |

TOTAL SECURITIES SOLD SHORT (Proceeds $735,315,672) | | | | | | | (783,408,435) | |

| | | | | | | | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 13 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | |

SCHEDULE OF WRITTEN OPTIONS | | Expiration Date | | Exercise Price | | | Contracts | | | Value | |

| |

Written Call Options | | | | | | | | | | | | | | |

BMC Software, Inc.: | | | | | | | | | | | | | | |

| | 06/2013 | | $ | 46.00 | | | | (223) | | | $ | (1,673) | |

| | 08/2013 | | | 46.00 | | | | (858) | | | | (15,015) | |

| | 08/2013 | | | 47.00 | | | | (430) | | | | (2,150) | |

Clearwire Corp., Class A: | | | | | | | | | | | | | | |

| | 06/2013 | | | 3.00 | | | | (9,767) | | | | (1,440,632) | |

| | 06/2013 | | | 3.50 | | | | (9,487) | | | | (924,982) | |

| | 06/2013 | | | 4.00 | | | | (455) | | | | (26,163) | |

| | 07/2013 | | | 3.50 | | | | (8,039) | | | | (783,803) | |

DISH Network Corp.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 41.00 | | | | (1,688) | | | | (88,620) | |

| | 06/2013 | | | 42.00 | | | | (1,684) | | | | (58,940) | |

Ferro Corp. | | 06/2013 | | | 7.50 | | | | (22) | | | | (110) | |

Fidelity National Financial, Inc. | | 07/2013 | | | 25.00 | | | | (1,821) | | | | (286,808) | |

H.J. Heinz Co.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 75.00 | | | | (3,862) | | | | (9,655) | |

| | 09/2013 | | | 75.00 | | | | (9,146) | | | | (22,865) | |

Hot Topic, Inc. | | 08/2013 | | | 14.00 | | | | (869) | | | | (2,172) | |

Life Technologies Corp.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 75.00 | | | | (980) | | | | (12,250) | |

| | 07/2013 | | | 75.00 | | | | (274) | | | | (6,165) | |

| | 08/2013 | | | 75.00 | | | | (228) | | | | (6,840) | |

Lufkin Industries, Inc. | | 06/2013 | | | 90.00 | | | | (1,230) | | | | (3,075) | |

Office Depot, Inc.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 3.50 | | | | (246) | | | | (22,755) | |

| | 06/2013 | | | 4.00 | | | | (6,354) | | | | (285,930) | |

| | 06/2013 | | | 4.50 | | | | (258) | | | | (2,580) | |

| | 07/2013 | | | 4.00 | | | | (256) | | | | (13,440) | |

| | 07/2013 | | | 4.50 | | | | (51) | | | | (1,147) | |

OfficeMax, Inc.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 11.00 | | | | (4,439) | | | | (887,800) | |

| | 06/2013 | | | 12.00 | | | | (6,903) | | | | (742,072) | |

| | 06/2013 | | | 13.00 | | | | (965) | | | | (36,188) | |

Sprint Nextel Corp.: | | | | | | | | | | | | | | |

| | 06/2013 | | | 7.50 | | | | (2,262) | | | | (16,965) | |

| | 08/2013 | | | 8.00 | | | | (19,839) | | | | (337,263) | |

True Religion Apparel, Inc. | | 07/2013 | | | 32.00 | | | | (303) | | | | (3,788) | |

Trulia, Inc. | | 06/2013 | | | 30.00 | | | | (436) | | | | (88,290) | |

Websense, Inc. | | 06/2013 | | | 25.00 | | | | (998) | | | | (12,475) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN CALL OPTIONS | | | | | | | | | | | | | | |

(Premiums received $2,466,604) | | | | | | | | | | | | | (6,142,611) | |

| | | | | | | | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

14 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | |

SCHEDULE OF WRITTEN OPTIONS | | Expiration Date | | Exercise Price | | | Contracts | | | Value | |

| |

| | | | |

Written Put Options | | | | | | | | | | | | | | |

H.J. Heinz Co.: | | | | | | | | | | | | | | |

| | 06/2013 | | $ | 70.00 | | | | (2,088) | | | $ | (15,660) | |

| | 06/2013 | | | 75.00 | | | | (241) | | | | (61,455) | |

Lufkin Industries, Inc. | | 06/2013 | | | 85.00 | | | | (164) | | | | (820) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN PUT OPTIONS | | | | | | | | | | | | | | |

(Premiums received $140,837) | | | | | | | | | | | | | (77,935) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN OPTIONS | | | | | | | | | | | | | | |

(Premiums received $2,607,441) | | | | | | | | | | | | | $ (6,220,546) | |

| | | | | | | | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 15 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

EQUITY SWAP CONTRACTS

| | | | | | | | | | | | | | |

Swap Counterparty | | Reference Obligation | | Rate Paid/Received by the Fund | | Termination

Dates | | Notional

Amount | | | Unrealized

Appreciation | |

| |

Goldman, Sachs & Co. | | Gardner Denver, Inc. | | 1 Month-LIBOR-BBA plus 0.50 bps | | 05/05/2014 | | $ | 21,791,739 | | | $ | 103,261 | |

Goldman, Sachs & Co. | | MAY Gurney Integrated Services Plc | | 1 Month-LIBOR-BBA plus 0.45 bps | | 05/14/2014 | | | 1,096,944 | | | | 28,535 | |

Goldman, Sachs & Co. | | Mikuni Coca-Cola Bottling Co. Ltd. | | LIBOR-BBA plus 0.50 bps | | 05/09/2014 -

06/05/2014 | | | 4,692,342 | | | | 189,680 | |

Goldman, Sachs & Co. | | Yancoal Australia Ltd. | | 1 Month-BBSW-REUTERS plus 0.50 bps | | 05/31/2014 | | | 3,877 | | | | 23 | |

Goldman, Sachs & Co. | | Yancoal Australia Rights Ltd. | | 1 Month-BBSW-REUTERS plus 0.50 bps | | 05/07/2014 | | | 8,300,050 | | | | 350,007 | |

Goldman, Sachs & Co. | | Yanzhou Coal

Mining Co. | | 1 Month-HIBOR-REUTERS minus 1.0 bps | | 05/30/2014 | | | (522,101) | | | | 27,306 | |

UBS | | Mikuni Coca-Cola Bottling Co. Ltd. | | 1 Month-LIBOR-BBA plus 0.40 bps | | Monthly Reset | | | 8,461,458 | | | | 555,588 | |

UBS | | Yancoal Australia Rights Ltd. | | 1 Month-BBSW-REUTERS plus 0.55 bps | | Monthly Reset | | | 16,473,946 | | | | 828,949 | |

UBS | | Yanzhou Coal

Mining Co. | | 1 Month-HIBOR-REUTERS plus 0.4 bps | | Monthly Reset | | | (20,105) | | | | 1,055 | |

| | | | | | | | | | |

| | | | | | | | $ | 60,278,150 | | | $ | 2,084,404 | |

| | | | | | | | | | |

| | | | | |

Swap Counterparty | | Reference Obligation | | Rate Paid/Received by the Fund | | Termination

Dates | | Notional

Amount | | | Unrealized

Depreciation | |

| |

Goldman, Sachs & Co. | | Coca-Cola Central Japan Co. Ltd. | | LIBOR-BBA minus 2.00 bps - 2.136 bps | | 05/09/2014 -

06/05/2014 | | $ | (7,076,958) | | | $ | (190,613) | |

Goldman, Sachs & Co. | | H.J. Heinz Co. | | 1 Month-LIBOR-BBA plus 0.50 bps | | 05/05/2014 | | | 98,825,193 | | | | (102,998) | |

Goldman, Sachs & Co. | | Kier Group Plc | | 1 Month-LIBOR-BBA minus 3.0 bps - 3.025 bps | | 05/14/2014 | | | (917,385) | | | | (31,232) | |

UBS | | Coca-Cola Central Japan Co. Ltd. | | 1 Month-LIBOR-BBA minus 0.40 bps | | Monthly Reset | | | (6,244,006) | | | | (280,748) | |

UBS | | Flinders Mines Ltd | | 1 Month-BBSW-REUTERS plus 0.55 bps | | Monthly Reset | | | 3,063,136 | | | | (319,077) | |

UBS | | H.J. Heinz Co. | | 1 Month-LIBOR-BBA plus 0.70 bps | | Monthly Reset | | | 7,178,003 | | | | (9,876) | |

UBS | | Yancoal Australia Ltd. | | 1 Month-BBSW-REUTERS plus 0.55 bps | | Monthly Reset | | | 4,581,583 | | | | (59,590) | |

| | | | | | | | | | |

| | | | | | | | $ | 99,409,566 | | | $ | (994,134) | |

| | | | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

16 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| | | | | | | | | | | | | | | | |

Contract Description | | Contracts to

Deliver/Receive | | | Purchase/ Sale Contract | | Expiration Date | | Current Value | | | Unrealized

Appreciation | |

| |

AUD | | | 86,495,613 | | | Sale | | 6/17/2013 | | | 82,675,508 | | | $ | 3,360,427 | |

CAD | | | 176,796,316 | | | Sale | | 6/17/2013 | | | 170,461,348 | | | | 3,984,778 | |

EUR | | | 230,000 | | | Sale | | 6/17/2013 | | | 298,971 | | | | 1,148 | |

JPY | | | 40,730,000 | | | Purchase | | 6/17/2013 | | | 405,483 | | | | 5,684 | |

NOK | | | 61,240,000 | | | Sale | | 6/17/2013 | | | 10,428,382 | | | | 78,034 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 7,430,071 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Contract Description | | Contracts to

Deliver/Receive | | | Purchase/ Sale Contract | | Expiration Date | | Current Value | | | Unrealized

Depreciation | |

| |

AUD | | | 4,660,000 | | | Purchase | | 6/17/2013 | | | 4,454,190 | | | $ | (97,703) | |

CAD | | | 1,590,000 | | | Purchase | | 6/17/2013 | | | 1,533,027 | | | | (9,927) | |

EUR | | | 103,068,197 | | | Sale | | 6/17/2013 | | | 133,975,495 | | | | (502,400) | |

JPY | | | 48,610,000 | | | Sale | | 6/17/2013 | | | 483,932 | | | | (5,817) | |

NOK | | | 1,780,000 | | | Purchase | | 6/17/2013 | | | 303,111 | | | | (1,675) | |

NOK | | | 22,280,000 | | | Sale | | 6/17/2013 | | | 3,793,997 | | | | (14,472) | |

SEK | | | 51,970,000 | | | Sale | | 6/17/2013 | | | 7,843,255 | | | | (57,528) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (689,522) | |

| | | | | | | | | | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 17 |

| | |

The Arbitrage Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | |

| Country | | % of Net Assets | |

| |

Netherlands | | | 11.21% | |

Canada | | | 8.42% | |

Australia | | | 2.73% | |

Mexico | | | 1.09% | |

Italy | | | 0.65% | |

Spain | | | 0.56% | |

Norway | | | 0.49% | |

Finland | | | 0.46% | |

Sweden | | | 0.27% | |

Hong Kong | | | 0.16% | |

Japan | | | 0.14% | |

United States | | | 77.62% | |

Liabilities in Excess of Other Assets | | | (3.80%) | |

| | | | |

| | | 100.00% | |

| | | | |

| | | | |

Abbreviations:

AB - Arktiebolag is the Swedish term for a limited company

ADR - American Depositary Receipt

ASA - Allmennaksjeselskap is the Norwegian term for a public limited company

AUD - Australian Dollar

BBA - British Bankers Association

BBSW - Australian Bank Bill Swap Reference Rate

bps - Basis Points

CAD - Canadian Dollar

CVR - Contingent Value Rights

ETF - Exchange Traded Fund

EUR - Euro

HIBOR - Hong Kong Interbank Offer Rate

JPY - Japanese Yen

LIBOR - London Interbank Offered Rate

Ltd. - Limited

NOK - Norwegian Krone

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation

OYJ - Osakeyhtio is the Finnish equivalent of a public limited company

Plc - Public Limited Liability

| SA - | Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company |

SAB de CV - A variable capital company

SEK - Swedish Krona

S&P - Standard & Poor’s

SpA - Societa per Azione

SPDR - Standard & Poor’s Depositary Receipt

| | |

See Notes to Financial Statements. | | |

| |

18 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | |

| |

| | May 31, 2013 |

The following is a summary of the inputs used as of May 31, 2013, in valuing the Arbitrage Fund’s investments carried at value:

Investments in Securities at Value

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Aerospace & Defense | | $ | – | | | $ | – | | | $ | 796,638 | | | $ | 796,638 | |

Agriculture | | | 63,025,500 | | | | – | | | | – | | | | 63,025,500 | |

Apparel | | | 37,044,598 | | | | – | | | | – | | | | 37,044,598 | |

Auto Parts & Equipment | | | 4,025,795 | | | | – | | | | – | | | | 4,025,795 | |

Banks | | | 11,678,341 | | | | – | | | | – | | | | 11,678,341 | |

Beverages | | | 152,746,120 | | | | – | | | | – | | | | 152,746,120 | |

Biotechnology | | | 127,257,043 | | | | – | | | | – | | | | 127,257,043 | |

Chemicals | | | 3,650,782 | | | | – | | | | – | | | | 3,650,782 | |

Coal | | | 5,072,018 | | | | – | | | | – | | | | 5,072,018 | |

Commercial Services | | | 91,746,646 | | | | – | | | | – | | | | 91,746,646 | |

Computers | | | 13,301,058 | | | | – | | | | – | | | | 13,301,058 | |

Diversified Financial Services | | | 273,434,359 | | | | – | | | | – | | | | 273,434,359 | |

Electric | | | 30,152,372 | | | | – | | | | – | | | | 30,152,372 | |

Electrical Components & Equipment | | | 52,385,808 | | | | – | | | | – | | | | 52,385,808 | |

Engineering & Construction | | | 18,586,919 | | | | – | | | | – | | | | 18,586,919 | |

Food | | | 166,386,893 | | | | – | | | | – | | | | 166,386,893 | |

Forest Products & Paper | | | 63,576,955 | | | | – | | | | – | | | | 63,576,955 | |

Healthcare - Products | | | 83,932,762 | | | | – | | | | – | | | | 83,932,762 | |

Household Products & Wares | | | 10,540,642 | | | | – | | | | – | | | | 10,540,642 | |

Insurance | | | 51,727,481 | | | | – | | | | – | | | | 51,727,481 | |

Internet | | | 50,043,201 | | | | – | | | | – | | | | 50,043,201 | |

Iron & Steel | | | 7,992,282 | | | | – | | | | – | | | | 7,992,282 | |

Machinery - Diversified | | | 124,826,037 | | | | – | | | | – | | | | 124,826,037 | |

Media | | | 132,733,340 | | | | – | | | | – | | | | 132,733,340 | |

Metal Fabricate & Hardware | | | 7,870,825 | | | | – | | | | – | | | | 7,870,825 | |

Mining | | | 56,031,048 | | | | 45,382,218 | | | | – | | | | 101,413,266 | |

Oil & Gas | | | 44,046,684 | | | | – | | | | – | | | | 44,046,684 | |

Oil & Gas Services | | | 131,605,898 | | | | – | | | | – | | | | 131,605,898 | |

Real Estate Investment Trusts | | | 31,204,321 | | | | – | | | | – | | | | 31,204,321 | |

Retail | | | 100,574,743 | | | | – | | | | – | | | | 100,574,743 | |

Savings & Loans | | | 118,065,842 | | | | – | | | | – | | | | 118,065,842 | |

Semiconductors | | | 200,544,280 | | | | – | | | | – | | | | 200,544,280 | |

Software | | | 103,701,145 | | | | – | | | | – | | | | 103,701,145 | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 19 |

| | |

The Arbitrage Fund | | |

| |

| | May 31, 2013 |

Investments in Securities at Value (Continued)

| | | | | | | | | | | | | | | | |

| | | | Level 1 | | | | Level 2 | | | | Level 3 | | | | Total | |

Telecommunications | | $ | 373,354,256 | | | $ | – | | | $ | – | | | $ | 373,354,256 | |

Rights | | | – | | | | – | | | | 0 | | | | 0 | |

Purchased Options | | | 4,005,368 | | | | – | | | | – | | | | 4,005,368 | |

Short-Term Investments | | | 188,945,051 | | | | – | | | | – | | | | 188,945,051 | |

TOTAL | | $ | 2,935,816,413 | | | $ | 45,382,218 | | | $ | 796,638 | | | $ | 2,981,995,269 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments* | | | | | | | | | | | | | | | | |

Assets | | | | | | | | | | | | | | | | |

Forward Foreign | | | | | | | | | | | | | | | | |

Currency Exchange | | | | | | | | | | | | | | | | |

Contracts | | $ | – | | | $ | 7,430,071 | | | | – | | | $ | 7,430,071 | |

Equity Swaps | | | 2,084,404 | | | | – | | | | – | | | | 2,084,404 | |

Liabilities | | | | | | | | | | | | | | | | |

Common Stocks** | | | (773,643,549) | | | | (45,413) | | | | – | | | | (773,688,962) | |

Exchange-Traded Funds | | | (9,719,473) | | | | – | | | | – | | | | (9,719,473) | |

Written Options | | | (6,220,546) | | | | – | | | | – | | | | (6,220,546) | |

Forward Foreign | | | | | | | | | | | | | | | | |

Currency Exchange | | | | | | | | | | | | | | | | |

Contracts | | | – | | | | (689,522) | | | | – | | | | (689,522) | |

Equity Swaps | | | (994,134) | | | | – | | | | – | | | | (994,134) | |

Total | | $ | (788,493,298) | | | $ | 6,695,136 | | | $ | – | | | $ | (781,798,162) | |

| | | | | | | | | | | | | | | | | |

| * | Other financial instruments are instruments such as written options, securities sold short, equity swaps and forward foreign currency exchange contracts. |

| ** | Refer to Portfolio of Investments for sector information. |

| | |

See Notes to Financial Statements. | | |

| |

20 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Fund | | |

| |

| | May 31, 2013 |

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund’s assets and liabilities during the year ended May 31, 2013:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in

Securities | | Balance as of

May 31, 2012* | | | Realized Gain | | | Change in

Unrealized

Depreciation | | | Purchases | | | Sale Proceeds | | | Transfer into

Level 3 | | | Transfer out

of Level 3 | | | Balance as of

May 31, 2013 | | | Net change in

unrealized

appreciation/

(depreciation)

included in the

Statements of

Operations

attributable to

Level 3

investments

still held at

May 31, 2013 | |

Common Stocks | | $ | 796,638 | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | 796,638 | | | $ | – | |

Rights | | | 0 | | | | – | | | | – | | | | – | | | | – | | | | – | | | | – | | | | 0 | | | | – | |

TOTAL | | $ | 796,638 | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | 796,638 | | | $ | – | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | Certain Investments, with a total value of $4,288,136, were reclassified from an investment to a receivable during the current year. |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 21 |

| | |

The Arbitrage Event-Driven Fund | | Manager Commentary |

| |

| | May 31, 2013 (Unaudited) |

|

| The Arbitrage Event-Driven Fund | NASDAQ Ticker Symbols | AEDNX, AEDFX, AEFCX, AGEAX |

|

The Fund’s Goal and Main Investments |

The Fund seeks capital growth with its highly specialized investment strategy designed to profit from the often predictable behaviors of equity and fixed income securities involved in the standard timelines of specific corporate events such as asset sales, corporate distress, mergers and acquisitions, recapitalization, restructuring, bankruptcy, litigation, proxy fights, refinancing, and spin-offs. The event-driven strategy invests in Water Island Capital’s best investment ideas across the event-driven universe, regardless of security type, event type, or geography (however, at the present time any publicly traded vehicles following this strategy will not have significant exposure to distressed/illiquid securities). The “best ideas” strategy is our most flexible and diversified approach to allocating capital and is a logical and natural extension of the style that has been our focus for more than a decade. |

Investment Strategy

The Fund’s investment process follows a disciplined, fundamental approach that values downside protection while identifying compelling risk/reward opportunities available to us as we screen catalyst-driven corporate events, such as mergers and acquisitions, restructuring, refinancing, recapitalization, spin-offs, litigation, regulatory changes, bankruptcy, and more. We approach these events through four core strategies: Equity Merger Arbitrage, Equity Special Situations, Credit Special Situations, and Merger-Related Credit. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark, and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event-driven strategy. This process and approach has been an integral part of the culture at Water Island Capital since the firm’s inception.

| | |

| | |

| |

22 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio Information |

| |

| | May 31, 2013 (Unaudited) |

Performance (annualized returns as of May 31, 2013)

| | | | | | |

| | | One Year | | | Since Inception* |

Arbitrage Event-Driven Fund, Class R | | | 2.72% | | | 3.02% |

Arbitrage Event-Driven Fund, Class I | | | 3.04% | | | 3.27% |

Arbitrage Event-Driven Fund, Class C** | | | 1.33% | | | 1.33% |

HFRI Event Driven Index | | | 13.78% | | | 6.32% |

Barclays Capital U.S. Aggregate Bond Index | | | 0.91% | | | 3.61% |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

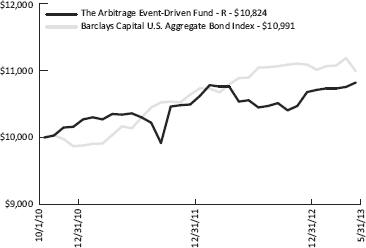

* Class R and Class I inception: 10/1/10; Class C inception: 6/1/12.

** Class C shares are also subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I and Class C are 2.67%, 2.42% and 3.42%, respectively. The Advisor has agreed to waive fees in excess of 1.69%, 1.44% and 2.44% for Class R, Class I and Class C, respectively, until at least August 31, 2015.

The HFRI Event Driven Index is an index of companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated and frequently involve additional derivative securities. Event-Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company-specific developments.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| | | |

Annual Report | May 31, 2013 | | 23 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio Information (continued) |

| |

| | May 31, 2013 (Unaudited) |

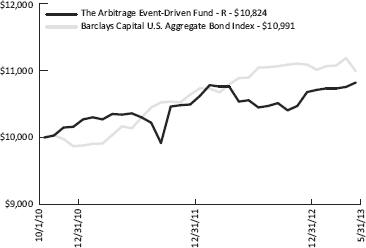

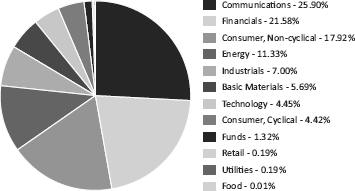

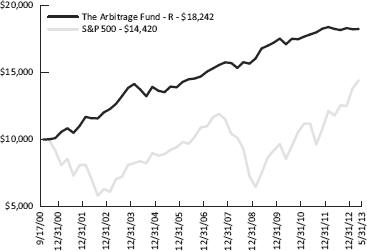

Growth of $10,000 Investment

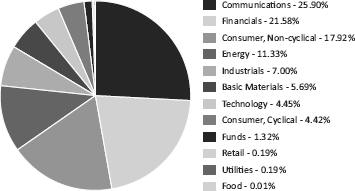

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Event-Driven Fund’s investments in common stock, corporate bonds, convertible corporate bonds and exchange-traded funds as of the report date.

| | |

| | | |

24 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 57.05% | | | | | | | | |

Aerospace & Defense - 1.49% | | | | | | | | |

Aerosonic Corp.(a) | | | 98,689 | | | $ | 764,840 | |

Allied Defense Group, Inc.(a)(b)(f) | | | 5,000 | | | | 10,000 | |

| | | | | | | | |

| | | | | | | 774,840 | |

| | | | | | | | |

| | |

Agriculture - 1.80% | | | | | | | | |

GrainCorp Ltd., Class A | | | 76,999 | | | | 935,885 | |

| | | | | | | | |

| | |

Beverages - 1.69% | | | | | | | | |

DE Master Blenders 1753 N.V.(a) | | | 55,594 | | | | 874,685 | |

| | | | | | | | |

| | |

Biotechnology - 1.67% | | | | | | | | |

Life Technologies Corp.(a)(c) | | | 10,229 | | | | 757,969 | |

PROLOR Biotech, Inc.(a) | | | 17,185 | | | | 108,265 | |

| | | | | | | | |

| | | | | | | 866,234 | |

| | | | | | | | |

| | |

Building Materials - 0.54% | | | | | | | | |

Vulcan Materials Co.(c) | | | 5,200 | | | | 278,616 | |

| | | | | | | | |

| | |

Chemicals - 0.22% | | | | | | | | |

Ferro Corp.(a) | | | 16,290 | | | | 111,749 | |

| | | | | | | | |

| | |

Coal - 0.30% | | | | | | | | |

Whitehaven Coal Ltd. | | | 72,502 | | | | 158,204 | |

| | | | | | | | |

| | |

Commercial Services - 1.02% | | | | | | | | |

Stewart Enterprises, Inc., Class A | | | 40,875 | | | | 531,375 | |

| | | | | | | | |

| | |

Computers - 0.51% | | | | | | | | |

Stonesoft OYJ(a) | | | 45,597 | | | | 264,320 | |

| | | | | | | | |

| | |

Diversified Financial Services - 6.02% | | | | | | | | |

Asset Acceptance Capital Corp.(a) | | | 112,188 | | | | 761,756 | |

NYSE Euronext(d) | | | 58,720 | | | | 2,362,306 | |

| | | | | | | | |

| | | | | | | 3,124,062 | |

| | | | | | | | |

| | |

Entertainment - 0.19% | | | | | | | | |

Club Mediterranee SA(a) | | | 4,188 | | | | 96,184 | |

| | | | | | | | |

| | |

Environmental Control - 0.93% | | | | | | | | |

Met-Pro Corp. | | | 36,072 | | | | 484,447 | |

| | | | | | | | |

| | |

Food - 3.55% | | | | | | | | |

Cermaq ASA | | | 6,462 | | | | 120,020 | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 25 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 57.05% (Continued) | | | | | | | | |

Food - 3.55% (Continued) | | | | | | | | |

Copeinca ASA | | | 20,853 | | | $ | 206,091 | |

H.J. Heinz Co.(c)(d) | | | 17,795 | | | | 1,287,646 | |

Smithfield Foods, Inc.(a) | | | 7,005 | | | | 230,745 | |

| | | | | | | | |

| | | | | | | 1,844,502 | |

| | | | | | | | |

| | |

Forest Products & Paper - 0.51% | | | | | | | | |

Buckeye Technologies, Inc. | | | 7,115 | | | | 265,176 | |

| | | | | | | | |

| | |

Healthcare - Products - 2.06% | | | | | | | | |

Conceptus, Inc.(a) | | | 28,684 | | | | 888,630 | |

Palomar Medical Technologies, Inc.(a) | | | 13,255 | | | | 179,340 | |

| | | | | | | | |

| | | | | | | 1,067,970 | |

| | | | | | | | |

| | |

Household Products & Wares - 0.97% | | | | | | | | |

American Greetings Corp., Class A | | | 27,400 | | | | 504,160 | |

| | | | | | | | |

| | |

Insurance - 0.92% | | | | | | | | |

Genworth Financial, Inc., Class A(a)(c) | | | 44,312 | | | | 479,013 | |

| | | | | | | | |

| | |

Iron & Steel - 0.17% | | | | | | | | |

Sundance Resources Ltd.(a) | | | 999,923 | | | | 88,999 | |

| | | | | | | | |

| | |

Machinery - Diversified - 1.43% | | | | | | | | |

Gardner Denver, Inc. | | | 9,136 | | | | 689,768 | |

MAN SE(a) | | | 471 | | | | 52,409 | |

| | | | | | | | |

| | | | | | | 742,177 | |

| | | | | | | | |

| | |

Media - 4.40% | | | | | | | | |

Astral Media, Inc., Class A | | | 40,364 | | | | 1,892,154 | |

Fisher Communications, Inc. | | | 6,300 | | | | 258,993 | |

Liberty Global, Inc., Class A(a)(c) | | | 1,800 | | | | 132,660 | |

| | | | | | | | |

| | | | | | | 2,283,807 | |

| | | | | | | | |

| | |

Metal Fabricate & Hardware - 0.25% | | | | | | | | |

Hoganas AB, Class B | | | 2,661 | | | | 129,769 | |

| | | | | | | | |

| | |

Mining - 2.39% | | | | | | | | |

Aurizon Mines Ltd.(a) | | | 171,033 | | | | 738,787 | |

Freeport-McMoRan Copper & Gold, Inc. | | | 15,638 | | | | 485,554 | |

Nevada Copper Corp.(a) | | | 6,725 | | | | 15,049 | |

| | | | | | | | |

| | | | | | | 1,239,390 | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

26 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 57.05% (Continued) | | | | | | | | |

Oil & Gas - 1.34% | | | | | | | | |

McMoRan Exploration Co.(a)(d) | | | 30,427 | | | $ | 506,001 | |

SandRidge Energy, Inc.(a)(c) | | | 20,200 | | | | 104,434 | |

TORC Oil & Gas Ltd.(a) | | | 65,779 | | | | 87,557 | |

| | | | | | | | |

| | | | | | | 697,992 | |

| | | | | | | | |

| | |

Oil & Gas Services - 1.16% | | | | | | | | |

Lufkin Industries, Inc. | | | 6,815 | | | | 601,492 | |

| | | | | | | | |

| | |

Pharmaceuticals - 1.89% | | | | | | | | |

Actavis, Inc.(a)(c) | | | 6,528 | | | | 804,837 | |

Valeant Pharmaceuticals International, Inc.(a)(c) | | | 1,920 | | | | 174,950 | |

| | | | | | | | |

| | | | | | | 979,787 | |

| | | | | | | | |

| | |

Retail - 2.61% | | | | | | | | |

Hot Topic, Inc. | | | 33,330 | | | | 466,287 | |

OfficeMax, Inc.(c)(d) | | | 59,789 | | | | 779,051 | |

Siam Makro Public Co. | | | 4,197 | | | | 107,576 | |

| | | | | | | | |

| | | | | | | 1,352,914 | |

| | | | | | | | |

| | |

Savings & Loans - 4.30% | | | | | | | | |

Hudson City Bancorp, Inc.(d) | | | 262,757 | | | | 2,233,434 | |

| | | | | | | | |

| | |

Semiconductors - 1.84% | | | | | | | | |

ASML Holding N.V., New York Registered Shares | | | 11,776 | | | | 957,036 | |

| | | | | | | | |

| | |

Software - 1.94% | | | | | | | | |

BMC Software, Inc.(a)(c)(d) | | | 22,200 | | | | 1,005,549 | |

| | | | | | | | |

| | |

Telecommunications - 8.94% | | | | | | | | |

Clearwire Corp., Class A(a)(c) | | | 147,165 | | | | 659,299 | |

Globalstar, Inc.(a) | | | 179,913 | | | | 96,254 | |

Sprint Nextel Corp.(a)(c) | | | 119,514 | | | | 872,452 | |

Telular Corp. | | | 82,946 | | | | 1,040,143 | |

Virgin Media, Inc.(d) | | | 39,715 | | | | 1,972,247 | |

| | | | | | | | |

| | | | | | | 4,640,395 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $29,283,648) | | | | | | | 29,614,163 | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 27 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| | | Shares | | | Value | |

| |

PREFERRED STOCKS - 1.19% | | | | | | | | |

Banks - 0.68% | | | | | | | | |

Citizens Funding Trust I, 7.500% | | | 1,213 | | | $ | 30,871 | |

GMAC Capital Trust I, 8.125%(e) | | | 12,067 | | | | 321,224 | |

| | | | | | | | |

| | | | | | | 352,095 | |

| | | | | | | | |

| | |

Financial Services - 0.51% | | | | | | | | |

Citigroup Capital IX, 6.000% | | | 10,617 | | | | 266,911 | |

| | | | | | | | |

| | |

TOTAL PREFERRED STOCKS (Cost $584,091) | | | | | | | 619,006 | |

| | | | | | | | |

| | |

RIGHTS - 0.00% | | | | | | | | |

Cubist Pharmaceuticals, Inc.(a)(b)(f) | | | 34,500 | | | | 0 | |

Emergent Biosolutions, Inc.(a)(b)(f) | | | 546 | | | | 0 | |

| | | | | | | | |

| | |

TOTAL RIGHTS (Cost $162) | | | | | | | 0 | |

| | | | | | | | |

| | |

See Notes to Financial Statements. | | |

| |

28 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | | | |

| | | Maturity Date | | | Rate | | | Principal

Amount | | | Value | |

| |

CORPORATE BONDS - 33.52% | | | | | | | | | | | | | | | | |

Alere, Inc. | | | 10/01/2018 | | | | 8.625 | % | | $ | 537,000 | | | $ | 581,302 | |

ARD Finance SA | | | 06/01/2018 | | | | 11.125 | % | | | 273,000 | | | | 298,935 | |

BMC Software, Inc. | | | 12/01/2022 | | | | 4.500 | % | | | 311,000 | | | | 317,970 | |

BMC Software, Inc. | | | 02/15/2022 | | | | 4.250 | % | | | 311,000 | | | | 315,090 | |

Bresnan Broadband Holdings LLC(g) | | | 12/15/2018 | | | | 8.000 | % | | | 290,000 | | | | 313,925 | |

Brown Shoe Co., Inc. | | | 05/15/2019 | | | | 7.125 | % | | | 252,000 | | | | 266,490 | |

Chaparral Energy, Inc. | | | 09/01/2021 | | | | 8.250 | % | | | 621,000 | | | | 686,205 | |

Cincinnati Bell, Inc. | | | 03/15/2018 | | | | 8.750 | % | | | 539,000 | | | | 552,475 | |

Clearwire Communications LLC / Clearwire Finance, Inc.(g) | | | 12/01/2015 | | | | 12.000 | % | | | 391,000 | | | | 417,901 | |

Coleman Cable, Inc. | | | 02/15/2018 | | | | 9.000 | % | | | 466,000 | | | | 502,115 | |

Copano Energy LLC / Copano Energy Finance Corp. | | | 04/01/2021 | | | | 7.125 | % | | | 824,000 | | | | 949,660 | |

Cricket Communications, Inc. | | | 10/15/2020 | | | | 7.750 | % | | | 447,000 | | | | 445,882 | |

Dean Foods Co. | | | 12/15/2018 | | | | 9.750 | % | | | 724,000 | | | | 834,410 | |

DynCorp International, Inc. | | | 07/01/2017 | | | | 10.375 | % | | | 271,000 | | | | 277,775 | |

Endeavour International Corp. | | | 03/01/2018 | | | | 12.000 | % | | | 411,000 | | | | 386,340 | |

Entercom Radio LLC | | | 12/01/2019 | | | | 10.500 | % | | | 411,000 | | | | 479,842 | |

Fifth Third Capital Trust IV(e) | | | 04/15/2037 | | | | 6.500 | % | | | 679,000 | | | | 680,697 | |

Icahn Enterprises LP / Icahn Enterprises Finance Corp. | | | 01/15/2016 | | | | 7.750 | % | | | 383,000 | | | | 396,405 | |

Intelsat Luxembourg SA(e) | | | 02/04/2017 | | | | 11.250 | % | | | 484,000 | | | | 512,072 | |

MacDermid, Inc.(g) | | | 04/15/2017 | | | | 9.500 | % | | | 750,000 | | | | 776,250 | |

Marina District Finance Co., Inc. | | | 08/15/2018 | | | | 9.875 | % | | | 245,000 | | | | 263,069 | |

McMoRan Exploration Co. | | | 11/15/2014 | | | | 11.875 | % | | | 744,000 | | | | 781,200 | |

Midwest Vanadium Pty Ltd.(g) | | | 02/15/2018 | | | | 11.500 | % | | | 135,000 | | | | 89,100 | |

Newfield Exploration Co. | | | 05/15/2018 | | | | 7.125 | % | | | 218,000 | | | | 224,540 | |

NII Capital Corp. | | | 04/01/2021 | | | | 7.625 | % | | | 684,000 | | | | 569,430 | |

Nortel Networks Ltd.(h) | | | 07/15/2016 | | | | 10.750 | % | | | 301,000 | | | | 339,377 | |

NOVA Chemicals Corp. | | | 11/01/2019 | | | | 8.625 | % | | | 385,000 | | | | 430,238 | |

NRG Energy, Inc. | | | 06/15/2019 | | | | 8.500 | % | | | 95,000 | | | | 103,787 | |

NXP BV / NXP Funding LLC(g) | | | 08/01/2018 | | | | 9.750 | % | | | 226,000 | | | | 255,380 | |

Offshore Group Investment Ltd. | | | 11/01/2019 | | | | 7.500 | % | | | 261,000 | | | | 281,880 | |

Packaging Dynamics Corp.(g) | | | 02/01/2016 | | | | 8.750 | % | | | 338,000 | | | | 353,633 | |

Quicksilver Resources, Inc. | | | 01/01/2016 | | | | 11.750 | % | | | 761,000 | | | | 806,660 | |

Spectrum Brands, Inc. | | | 06/15/2018 | | | | 9.500 | % | | | 212,000 | | | | 234,525 | |

The Reader’s Digest Association, Inc.(e)(h) | | | 02/15/2017 | | | | 9.500 | % | | | 274,000 | | | | 116,450 | |

United Rentals North America, Inc. | | | 09/15/2020 | | | | 8.375 | % | | | 407,000 | | | | 443,630 | |

Univision Communications, Inc.(g) | | | 05/15/2021 | | | | 8.500 | % | | | 208,000 | | | | 225,160 | |

Virgin Media Finance Plc | | | 02/15/2022 | | | | 4.875 | % | | | 488,000 | | | | 492,270 | |

Windstream Corp. | | | 03/15/2019 | | | | 7.000 | % | | | 657,000 | | | | 670,140 | |

| | |

See Notes to Financial Statements. | | |

| |

Annual Report | May 31, 2013 | | 29 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | | | |

| | | Maturity Date | | | Rate | | | Principal Amount | | | Value | |

| |

CORPORATE BONDS - 33.52% (Continued) | | | | | | | | | | | | | | | | |

YPG Financing, Inc.(g) | | | 11/30/2018 | | | | 9.250 | % | | $ | 734,255 | | | $ | 731,245 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CORPORATE BONDS (Cost $17,542,033) | | | | | | | | | | | | | | | 17,403,455 | |

| | | | | | | | | | | | | | | | |

| | | | |

CONVERTIBLE CORPORATE BONDS - 4.58% | | | | | | | | | | | | | | | | |

Clearwire Communications LLC / Clearwire Finance, Inc.(g) | | | 12/01/2040 | | | | 8.250 | % | | | 155,000 | | | | 171,178 | |

Globalstar, Inc., PIK | | | 04/01/2028 | | | | 8.000 | % | | | 324,062 | | | | 272,212 | |

McMoRan Exploration Co. | | | 10/06/2013 | | | | 5.250 | % | | | 394,000 | | | | 410,745 | |

Nortel Networks Corp.(h) | | | 04/15/2014 | | | | 2.125 | % | | | 316,000 | | | | 306,125 | |

RadioShack Corp.(g) | | | 08/01/2013 | | | | 2.500 | % | | | 422,000 | | | | 417,780 | |

Rambus, Inc. | | | 06/15/2014 | | | | 5.000 | % | | | 320,000 | | | | 330,400 | |

United States Steel Corp. | | | 05/15/2014 | | | | 4.000 | % | | | 440,000 | | | | 451,550 | |

YPG Financing, Inc. | | | 11/30/2022 | | | | 8.000 | % | | | 17,710 | | | | 15,547 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CONVERTIBLE CORPORATE BONDS (Cost $2,189,615) | | | | | | | | | | | | | | | 2,375,537 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | | Expiration Date | | | Exercise Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS (a)- 0.14% | | | | | | | | | | | | | | | | |

Call Options Purchased - 0.02% | | | | | | | | | | | | | | | | |

Martin Marietta Materials, Inc. | | | 06/2013 | | | $ | 110.00 | | | | 9 | | | $ | 1,935 | |

Sprint Nextel Corp. | | | 08/2013 | | | | 7.00 | | | | 114 | | | | 6,498 | |

| | | | | | | | | | | | | | | | |

| | | | |

TOTAL CALL OPTIONS PURCHASED (Cost $7,034) | | | | | | | | | | | | | | | 8,433 | |

| | | | | | | | | | | | | | | | |

| | | | |

Put Options Purchased - 0.12% | | | | | | | | | | | | | | | | |

Actavis, Inc.: | | | | | | | | | | | | | | | | |

| | | 08/2013 | | | | 115.00 | | | | 17 | | | | 5,313 | |

| | | 11/2013 | | | | 110.00 | | | | 15 | | | | 5,925 | |

Genworth Financial, Inc., Class A: | | | | | | | | | | | | | | | | |

| | | 06/2013 | | | | 8.00 | | | | 96 | | | | 336 | |

| | | 09/2013 | | | | 9.00 | | | | 104 | | | | 3,640 | |

Liberty Global, Inc., Class A: | | | | | | | | | | | | | | | | |

| | | 07/2013 | | | | 80.00 | | | | 22 | | | | 15,620 | |

| | | 07/2013 | | | | 85.00 | | | | 9 | | | | 10,350 | |

| | |

See Notes to Financial Statements. | | |

30 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | | | | | | | |

| | | Expiration Date | | Exercise Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS (a)- 0.14% (Continued) | | | | | | | | | | | | | | |

Put Options Purchased - 0.12% (Continued) | | | | | | | | | | | | | | |

SandRidge Energy, Inc. | | 06/2013 | | $ | 5.00 | | | | 202 | | | $ | 2,929 | |

Sprint Nextel Corp. | | 08/2013 | | | 7.00 | | | | 28 | | | | 1,106 | |

Valeant Pharmaceuticals International, Inc.: | | | | | | | | | | | | | | |

| | 08/2013 | | | 87.50 | | | | 16 | | | | 8,240 | |

| | 08/2013 | | | 90.00 | | | | 16 | | | | 10,000 | |

Vulcan Materials Co. | | 06/2013 | | | 50.00 | | | | 13 | | | | 520 | |

Warner Chilcott Plc | | 07/2013 | | | 17.00 | | | | 52 | | | | 1,430 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PUT OPTIONS PURCHASED (Cost $106,587) | | | | | | | | | | | | | 65,409 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED OPTIONS (Cost $113,621) | | | | | | | | | | | | | 73,842 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | Yield | | | Shares | | | Value | |

| |

SHORT-TERM INVESTMENTS - 2.13% | | | | | | | | | | | | | | |

Time Deposits | | | | | | | | | | | | | | |

Euro Time Deposit | | | | | 0.010% | | | | 1,108,410 | | | | 1,108,410 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $1,108,410) | | | | | | | | | | | | | 1,108,410 | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments - 98.61% (Cost $50,821,580) | | | | | | | | | | | | | 51,194,413 | |

| | | |

Other Assets in Excess of Liabilities - 1.39% | | | | | | | | | | | 720,377 | |

| | | | | | | | | | | | | | |

| | | | |

NET ASSETS - 100.00% | | | | | | | | | | | | $ | 51,914,790 | |

| | | | | | | | | | | | | | |

| (a) | Non-income-producing security. |

| (b) | Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2013, the total market value of these securities was $10,000, representing 0.02% of net assets. |

| (c) | Underlying security for a written/purchased call/put option. |

| (d) | Security, or a portion of security, is being held as collateral for short sales, or written option contracts. At period end, the aggregate market value of those securities was $8,602,650, representing 16.57% of net assets. |

| (e) | Interest rate will change at a future date. Interest rate shown reflects the rate in effect at May 31, 2013. |

| (f) | Security considered illiquid. On May 31, 2013, the total market value of these securities was $10,000, representing 0.02% of net assets. |

| | |

See Notes to Financial Statements. | | |

Annual Report | May 31, 2013 | | 31 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| (g) | Security exempt from registration under Rule 144A of the Securities Act of 1933. These may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2013, these securities had a total value of $3,751,552 or 7.23% of net assets. |

| (h) | Security in default on interest payments. |

Securities determined to be illiquid under the procedures approved by the Funds’ Board of Trustees. Information related to the illiquid securities is as follows:

| | | | | | | | | | | | |

Date(s) of Purchase | | Security | | Cost | | | Market Value | | | % of Net Assets |

|

12/31/2010 – 01/05/2011 | | Allied Defense Group, Inc. | | $ | 16,534 | | | $ | 10,000 | | | 0.02% |

12/12/2011 | | Cubist Pharmaceuticals, Inc. | | | 0 | | | | 0 | | | 0.00 |

10/04/2010 – 10/22/2010 | | Emergent Biosolutions, Inc. | | | 162 | | | | 0 | | | 0.00 |

| | | | | | | | | |

| | | | | | | | $ | 10,000 | | | 0.02% |

| | | | | | | | | |

| | |

| See Notes to Financial Statements. | | |

32 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

| |

| | May 31, 2013 |

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| |

COMMON STOCKS | | | | | | | | |

Banks | | | | | | | | |

M&T Bank Corp. | | | (22,080) | | | $ | (2,316,192) | |