UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

THE ARBITRAGE FUNDS

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-259-2655

Date of fiscal year end: May 31

Date of reporting period: June 1, 2013 – May 31, 2014

Item 1. Reports to Stockholders.

| | |

ANNUAL REPORT | MAY 31 . 2014 THE ARBITRAGE FUND THE ARBITRAGE EVENT-DRIVEN FUND THE ARBITRAGE CREDIT OPPORTUNITIES FUND | |  |

| | |

| | TABLE OF CONTENTS |

| | |

| | |

| The Arbitrage Funds | | Shareholder Letter |

May 31, 2014

Dear Fellow Shareholders,

For the fiscal year ending May 31, 2014, The Arbitrage Fund returned 1.10% (Class R, ARBFX), The Arbitrage Event-Driven Fund returned 5.75% (Class R, AEDFX), and The Arbitrage Credit Opportunities Fund returned 4.99% (Class R, ARCFX). The HFRI Merger Arbitrage Index returned 3.95%, HFRI Event-Driven Index returned 8.76%, and the Barclays Capital U.S. Aggregate Bond Index returned 2.71% over the same period. (See pages 7, 26, and 53 for standard performance).

A year ago, we would have been hard-pressed to predict the rollercoaster ride broad markets took investors on for much of the 12 months ending May 2014. As we looked out to the year ahead last summer, we expected an increase in volatility thanks largely to speculation over the end of the U.S Federal Reserve’s accommodative monetary policies. While markets became increasingly skittish in June 2013, any fears of the Fed’s policy changes related to Quantitative Easing soon evaporated. When the dust settled, the S&P 500 rose 18% and credit spreads tightened across the risk spectrum, for the 12-months through May 2014. The 10-Year Treasury yield, which went from 2.50 last summer to peaking at 3.03 at the start of 2014 to a low of 2.44 at the end of May, was seemingly as volatile as equity markets.

Meanwhile, the environment for mergers and acquisitions (M&A) became increasingly aggressive as 2014 unfolded. A number deals were characterized by hostile offers, bear hugs and topping bids. The credit markets continue to see spread compression as investors’ demand for income has pushed yields for Investment Grade and High Yield corporate credits to all-time lows. The associated credit spreads are well below historical median levels.

While we are always mindful of the performance of the equity and credit markets, our mandate is to find compelling corporate events capable of unlocking value and identifying the most promising part of the capital structure to realize our thesis. In that sense, there may be no better time to be event-driven investors. We have receptive markets ready to fund initial public offerings (IPOs), secondary offerings, private placements, lines of credit, high yield debt, and convertible securities, just to name a few, along with eager investors. We have numerous activists agitating for change and corporate managements becoming more receptive to their ideas for unlocking shareholder value.

That said, we also are aware that investors may not be well compensated for taking on the many potential pitfalls we face, including increased regulatory and political scrutiny on deals, geopolitical turmoil and an aging bull market.

Moreover, we would rather see this activity tied to fundamental analysis and strategic initiatives rather than fueled by the Fed’s cheap money and frothy capital markets. Wishful thinking aside, we do not believe that the forces that have reawakened animal spirits in the corporate world—relatively low financing costs, cash-rich companies, and the Fed’s money printing press—are going away anytime soon.

Thus, we will stay true to our discipline of capitalizing on corporate actions by understanding the rationale and underlying complexities of each event, sharing insights between our teams, using hedging to mitigate market influence, and building well-diversified portfolios. We believe through this approach, the Arbitrage Funds Family can generate attractive long-term results with lower volatility and correlation to broader markets.

| | |

| Annual Report | May 31, 2014 | | 1 |

| | |

| The Arbitrage Funds | | Shareholder Letter (continued) |

May 31, 2014

To that end, we’ve invested in our people, capabilities and infrastructure over the past year. We added two equity analysts and an experienced credit trader/analyst to help us source and research ideas. We also fortified our regulatory and compliance oversight with additional technologies and processes that put us on the forefront of the industry, all in an effort to serve you better.

As always, we are grateful for your continued trust and support.

Sincerely,

The Investment Team at Water Island Capital

High yield corporate credits are high paying bonds with a lower credit rating than investment-grade corporate bonds, Treasury bonds and municipal bonds. Because of the higher risk of default, these bonds pay a higher yield than investment grade bonds.

Investment grade is a rating that indicates that a municipal or corporate bond has a relatively low risk of default. Bond rating firms, such as Standard & Poor’s, use different designations consisting of upper- and lower-case letters ‘A’ and ‘B’ to identify a bond’s credit quality rating. ‘AAA’ and ‘AA’ (high credit quality) and ‘A’ and ‘BBB’ (medium credit quality) are considered investment grade. Credit ratings for bonds below these designations (‘BB’, ‘B’, ‘CCC’, etc.) are considered low credit quality, and are commonly referred to as “junk bonds.”

Quantitative easing is an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply. Quantitative easing increases the money supply by flooding financial institutions with capital in an effort to promote increased lending and liquidity. Quantitative easing is considered when short-term interest rates are at or approaching zero, and does not involve the printing of new banknotes.

The statements and opinions expressed are those of the author as of the date of this report. All information is historical and not indicative of future results and subject to change. This information is not a recommendation to buy or sell any security.

| | |

| 2 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Manager Commentary |

May 31, 2014 (Unaudited)

|

The Arbitrage Fund | NASDAQ | ARBNX, ARBFX, ARBCX, ARGAX The Fund’s Goal and Main Investments Merger arbitrage is a sub-set of a broader event-driven investment strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically merger arbitrage is a low volatility strategy pursued by absolute-return-minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets. |

Investment Strategy

The Fund seeks to achieve capital growth by engaging in merger arbitrage. The strategy’s focus is to capture returns from corporate events, generate market neutral capital growth, preservation of capital, consistent and positive returns, and achieve low correlation, and low volatility. The Fund’s general investment approach can be best described as risk averse, and many systems, policies, and procedures are in place to facilitate this low-risk approach. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly-announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations, and other corporate reorganizations. The Fund’s investment advisor uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition’s completion. That difference, or “spread,” is the primary driver of returns for this strategy. There is no limit to the number of stocks the Fund can hold; however, the Fund typically invests in 40 to 80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock-for-stock deal) and, in many cases, associated derivative positions for hedging purposes.

Commentary

We had muted expectations for a pick-up in merger and acquisition activity at the start of the Fund’s fiscal year last summer. While many of the factors for a surge in the number and value of deals were in place—relatively cheap financing, cash rich corporations and rising share prices—companies were sorely lacking in boardroom confidence.

As the efficacy of share buybacks and dividends on share prices started to wane, corporate boards and executives increasingly turned to M&A for growth during the third quarter of 2013. A number of well-recognized CEOs and companies openly talked about using M&A as a way to enter new regions and to boost core businesses, mainly in the pharmaceutical, media, and technology sectors. Private equity firms with record funding levels also started to put their cash balances to work.

Ultimately, the spark that ignited one of the most active periods for M&A since the private-equity-led frenzy of 2007 was a tactic known as tax inversions, which involves using M&A to re-domicile businesses in more favorable tax jurisdictions. This would lower the pro forma tax profile of the company, providing an earnings boost, and usually, a rerating of its price-earnings multiple.

| | |

| Annual Report | May 31, 2014 | | 3 |

| | |

| The Arbitrage Fund | | Manager Commentary (continued) |

May 31, 2014 (Unaudited)

Some of the biggest deals of the first half of 2014 were predicated on such tactics, including Pfizer-AstraZenaca’s $125 billion proposed merger, which was eventually scuttled due to vocal objections from lawmakers and regulators from both sides of the Atlantic. We believe the window of opportunity is closing on this strategy as it will certainly encounter resistance from lawmakers. However, we expect corporations that intend to use this ploy to accelerate the proposal of any such deals, which could make the usually quiet summer months much more active.

Finally, the return of hostile offers, bear hugs and topping bids was a trend from which we profited. According to Dealogic, in 2014 through May 31, 25 unsolicited offers worth $290 billion were made, the most since 2000. Most of them took place in slow growth industries where consolidation is driving mergers, such as pharmaceuticals, telecommunications and food processing. That said, the current aggressive merger and acquisition landscape also inserts uncertainty into definitively announced deals, which is our purview.

Fiscal Year Highlights

In fiscal 2014, the Arbitrage Fund returned 1.10%. The results were predominantly derived from companies residing in the Americas. In terms of sectors, consumer staples and health care companies were the top contributors, while energy and consumer discretionary sectors added the least to results.

One of the best performing investments of the year was the acquisition of Fidelity National Financial (FNF) of Lender Processing Services (LPS) nearly $4 billion. When FNF announced an agreement to acquire LPS, we viewed this as a very strategic deal. The combination brings together LPS’s mortgage transaction and data analytics with FNF’s title insurance business. The pro forma company would have significant opportunity to generate synergies to spur both revenues and profits. It would also benefit from an overall housing recovery. The complex nature of the deal created opportunity for dynamic trading around the position, which closed after minor divestitures led to regulatory approval.

Our participation in the bidding war for Hillshire Brands was a strong contributor to results. We recognized Hillshire Brands, a maker of well-known processed meats and foods, to be a scarce asset and a takeover target in the fast-consolidating food processing industry. When Hillshire announced its acquisition of Pinnacle Foods, we believed it was just the start of something bigger, which would include bids for Hillshire itself, and positioned the fund accordingly. After a bidding contest, Tyson Foods’ $8 billion bid, which was nearly 40% above the initial offer for Hillshire, ultimately won out.

We also profited from the tussle for Canadian gold miner Osisko. In January, Goldcorp announced a $2.9 billion hostile offer for Osisko, which was rebuffed as too low. Osisko also questioned Goldcorp’s motives and tactics while courting a friendly offer from Yamana Gold, which teamed with Agnico Eagle Mines to make the winning bid worth $3.5 billion in mid-April.

The derailed acquisition of Ohio-based Cooper Tire by Apollo Tyres of India, which would have created one of the largest global tire producers, was one of the biggest drags on performance. Given Apollo’s desire to enter the American tire market and the potential for competing bidders who also viewed Cooper as an attractive asset, we believed the deal made strategic sense and

| | |

| 4 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Manager Commentary (continued) |

May 31, 2014 (Unaudited)

posed an acceptable risk/reward profile. However, the transaction failed due to labor disputes at Cooper’s production facility in China and the inability of Apollo Tyres to obtain financing to close the deal.

Another deal that weighed on performance during the period was our position in Liberty Media’s (LMCA) January 3, 2014 proposal to acquire the 47% of Sirius XM (SIRI) it did not already own. The transaction would have allowed LMCA to capture 100% of the cash flow generated by SIRI. With a low initial offer, shareholder valuation complaints, and majority of the minority vote provisions, we believed LMCA would need to increase its offer in order to successfully acquire SIRI. However, on March 13, 2014, LMCA announced a plan to split LMCA into dual-trading stocks, rescinding its bid to acquire the portion of SIRI it did not already own.

While we were disappointed the deal fell through, we believed that the nearly 10% fall in SIRI’s stock was overdone. The shares have since rebounded and, as expected, SIRI announced plans for additional share buybacks totaling in excess of $2 billion. As of July, the Fund has recovered most of the losses experienced following the abandoned bid by Liberty.

Finally, the position we established following Cubist Pharmaceuticals’ acquisition of Optimer Pharma for $10.75 cash per share and 1 CVR (contingent value right) also weighed on the portfolio. The CVR payment could be worth up to $5 per share if it reached certain sales milestones on Optimer’s antibiotic drug DIFICID. After the deal closed, DIFICID missed sales targets and the CVR lost value in the marketplace for these instruments. We still hold the CVRs with the understanding that our time frame to realize their return potential has been extended. The portfolio incurred a small loss from this position.

Outlook

If we gleaned our insight solely from the newspapers and business news networks, we would be telling you about how the long-awaited resurgence of merger and acquisition (M&A) activity has finally arrived. The last nine months of our fiscal year were certainly active. For the first time since the private-equity-led merger frenzy of 2007, global announced deals topped $1 trillion in value during the second quarter and $1.83 trillion for the first half of 2014, according to Dealogic.

Yet all is not as a rosy as it seems. For one, the dollar value of deals withdrawn, or cancelled, is at $338 billion through the end of June, which is the highest level since first half of 2008, according to Dealogic. Additionally, buyers are paying more on average for their targets—13 times earnings before interest, taxes, depreciation, and amortization charges (EBITDA) versus 11.8 times EBITDA for the same period in 2013. Thanks to the market rally over the past year, the percentage of stock-only transactions is at a level not seen in nearly a decade. And while we are excited over several transformational transactions such as Time Warner Cable/Comcast, we have yet to see these types of strategically-driven deals reflected across all industries, geographies and market capitalization levels.

Historically, a hostile merger and acquisitions environment bolstered boardroom confidence enough to spur overall deal activity. We are hopeful that will be the case this time around, as an increase in the number of deals usually leads to a higher quality portfolio better diversified by geography, market capitalization size and sector.

| | |

| Annual Report | May 31, 2014 | | 5 |

| | |

| The Arbitrage Fund | | Manager Commentary (continued) |

May 31, 2014 (Unaudited)

However, more deals don’t necessarily alter our return targets, which are predicted on the level of short-term rates. For this to increase, we would still need to see the number of deals increase across the market capitalization spectrum and to occur in more diverse locales. We would also need to see interest rates at the short-end of the curve rise.

We plan to remain vigilant for opportunities, and to position the Fund for the resurgence of activity that usually begins in earnest in the second half of the calendar year.

Sincerely,

The Investment Team at Water Island Capital

| | |

| 6 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio Information |

May 31, 2014 (Unaudited)

Performance (annualized returns as of May 31, 2014)

| | | | | | | | | | | | | | | | |

| | | One Year | | | Five Year | | | Ten Year | | | Since Inception* | |

Arbitrage Fund, Class R | | | 1.10% | | | | 2.29% | | | | 3.05% | | | | 4.57% | |

Arbitrage Fund, Class I | | | 1.39% | | | | 2.55% | | | | 3.25% | | | | 3.22% | |

Arbitrage Fund, Class C** | | | -0.62% | | | | N/A | | | | N/A | | | | 0.05% | |

Arbitrage Fund, Class A*** | | | -1.35% | | | | N/A | | | | N/A | | | | -1.35% | |

HFRI Event Driven: Merger Arbitrage Index | | | 3.95% | | | | 4.16% | | | | 5.06% | | | | 4.73% | |

S&P 500® Index | | | 20.45% | | | | 18.40% | | | | 7.77% | | | | 4.11% | |

Barclays Capital U.S. Aggregate Bond Index | | | 2.71% | | | | 4.96% | | | | 4.99% | | | | 5.62% | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R inception: 9/17/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A inception: 6/1/13.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 2.50% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 0.50% on purchases of $250,000 or more purchased without a front-end sales load and redeemed within 12 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 1.99%, 1.74%, 2.74% and 1.99%, respectively.

The HFRI Event Driven: Merger Arbitrage Index is an index consisting of merger arbitrage strategies which employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre-, post-date or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits.

The S&P 500® Index is an unmanaged index consisting of 500 stocks.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| Annual Report | May 31, 2014 | | 7 |

| | |

| The Arbitrage Fund | | Portfolio Information (continued) |

May 31, 2014 (Unaudited)

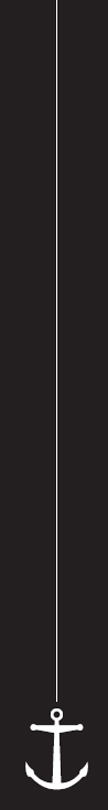

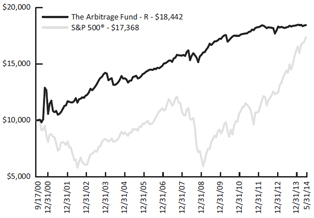

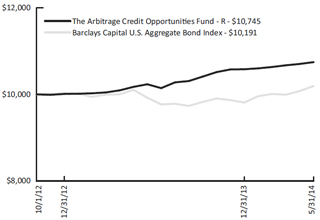

Growth of $10,000 Investment

| | | | |

| | The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | |

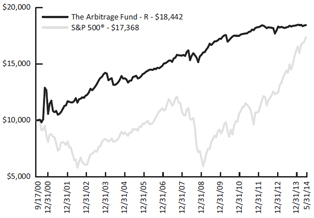

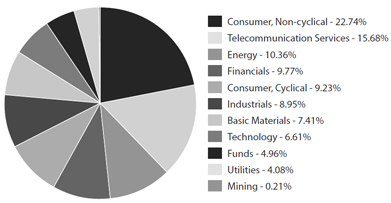

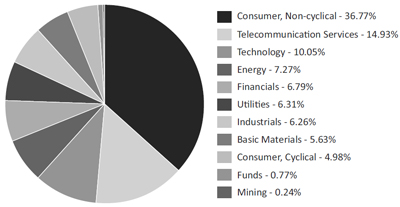

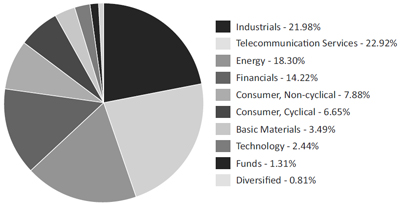

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Fund’s investments in common stock, exchange-traded funds and limited partnerships as of the report date.

| | |

| 8 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 87.88% | | | | | | | | |

Aerospace & Defense - 0.00%(a) | | | | | | | | |

Allied Defense Group, Inc.(b)(c)(d) | | | 398,319 | | | $ | 21,230 | |

| | | | | | | | |

| | |

Banks - 1.27% | | | | | | | | |

1st United Bancorp, Inc. | | | 1,350,921 | | | | 11,280,190 | |

OmniAmerican Bancorp, Inc. | | | 542,683 | | | | 13,062,380 | |

Wing Hang Bank Ltd. | | | 474,723 | | | | 7,580,432 | |

| | | | | | | | |

| | | | | | | 31,923,002 | |

| | | | | | | | |

| | |

Biotechnology - 0.62% | | | | | | | | |

Chelsea Therapeutics International Ltd.(b)(e) | | | 2,379,228 | | | | 15,536,359 | |

| | | | | | | | |

| | |

Building Materials - 1.00% | | | | | | | | |

Texas Industries, Inc.(b) | | | 293,668 | | | | 25,223,145 | |

| | | | | | | | |

| | |

Diversified Financial Services - 0.66% | | | | | | | | |

DFC Global Corp.(b) | | | 1,463,602 | | | | 13,713,951 | |

SFG Australia Ltd. | | | 788,912 | | | | 640,589 | |

SWS Group, Inc.(b) | | | 325,302 | | | | 2,335,668 | |

| | | | | | | | |

| | | | | | | 16,690,208 | |

| | | | | | | | |

| | |

Electric - 7.58% | | | | | | | | |

Pepco Holdings, Inc. | | | 2,360,197 | | | | 65,377,457 | |

UNS Energy Corp.(f) | | | 2,064,333 | | | | 125,036,650 | |

| | | | | | | | |

| | | | | | | 190,414,107 | |

| | | | | | | | |

| | |

Electronics - 0.61% | | | | | | | | |

Zygo Corp.(b) | | | 793,105 | | | | 15,243,478 | |

| | | | | | | | |

| | |

Engineering & Construction - 5.21% | | | | | | | | |

Foster Wheeler AG(f) | | | 3,866,552 | | | | 130,921,451 | |

| | | | | | | | |

| | |

Food - 10.66% | | | | | | | | |

Hillshire Brands Co.(e) | | | 1,414,000 | | | | 75,337,920 | |

Loblaw Cos. Ltd. | | | 1,600,090 | | | | 67,439,005 | |

Pinnacle Foods, Inc. | | | 23,545 | | | | 737,194 | |

Safeway, Inc.(f) | | | 3,621,345 | | | | 124,356,987 | |

| | | | | | | | |

| | | | | | | 267,871,106 | |

| | | | | | | | |

| | |

Gas - 0.33% | | | | | | | | |

Envestra Ltd. | | | 6,483,495 | | | | 8,236,208 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 9 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 87.88% (Continued) | | | | | | | | |

Healthcare - Products - 2.17% | | | | | | | | |

Nordion, Inc.(b)(f) | | | 4,552,875 | | | $ | 54,406,856 | |

| | | | | | | | |

| | |

Healthcare - Services - 4.86% | | | | | | | | |

Emeritus Corp.(b)(f) | | | 3,907,361 | | | | 122,222,252 | |

| | | | | | | | |

| | |

Home Builders - 0.19% | | | | | | | | |

BWG Homes ASA | | | 1,981,300 | | | | 4,855,559 | |

| | | | | | | | |

| | |

Internet - 1.21% | | | | | | | | |

Vocus, Inc.(b) | | | 1,697,026 | | | | 30,512,527 | |

| | | | | | | | |

| | |

Media - 8.00% | | | | | | | | |

DIRECTV(b) | | | 740,108 | | | | 61,014,504 | |

Sirius XM Holdings, Inc.(b)(e) | | | 8,914,700 | | | | 29,240,216 | |

Time Warner Cable, Inc.(f) | | | 784,281 | | | | 110,709,106 | |

| | | | | | | | |

| | | | | | | 200,963,826 | |

| | | | | | | | |

| | |

Mining - 4.39% | | | | | | | | |

Osisko Mining Corp.(b) | | | 14,643,981 | | | | 108,989,142 | |

Yancoal Australia Ltd.(b) | | | 5,778,676 | | | | 1,425,147 | |

| | | | | | | | |

| | | | | | | 110,414,289 | |

| | | | | | | | |

| | |

Oil & Gas - 5.72% | | | | | | | | |

Aurora Oil & Gas Ltd.(b) | | | 11,141,303 | | | | 43,548,256 | |

Caracal Energy, Inc.(b) | | | 3,198,622 | | | | 29,220,218 | |

EPL Oil & Gas, Inc.(b) | | | 1,157,816 | | | | 43,892,805 | |

Heritage Oil Plc(b) | | | 5,070,889 | | | | 27,012,329 | |

| | | | | | | | |

| | | | | | | 143,673,608 | |

| | | | | | | | |

| | |

Pharmaceuticals - 14.34% | | | | | | | | |

Actavis Plc(b)(e) | | | 4,100 | | | | 867,314 | |

Forest Laboratories, Inc.(b)(f) | | | 2,883,598 | | | | 273,307,418 | |

Furiex Pharmaceuticals, Inc.(b)(e) | | | 412,230 | | | | 42,608,093 | |

Questcor Pharmaceuticals, Inc.(e) | | | 483,786 | | | | 43,603,632 | |

| | | | | | | | |

| | | | | | | 360,386,457 | |

| | | | | | | | |

| | |

Retail - 6.04% | | | | | | | | |

David Jones Ltd. | | | 2,180,943 | | | | 8,199,950 | |

Jos. A. Bank Clothiers, Inc.(b)(e) | | | 2,209,673 | | | | 143,518,261 | |

| | | | | | | | |

| | | | | | | 151,718,211 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 10 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 87.88% (Continued) | | | | | | | | |

Savings & Loans - 2.82% | | | | | | | | |

Hudson City Bancorp, Inc.(f) | | | 7,259,231 | | | $ | 70,922,687 | |

| | | | | | | | |

| | |

Semiconductors - 8.15% | | | | | | | | |

Aeroflex Holding Corp.(b) | | | 2,292,961 | | | | 24,030,231 | |

Tokyo Electron Ltd., Unsponsored ADR | | | 5,548,050 | | | | 83,831,036 | |

TriQuint Semiconductor, Inc.(b)(f) | | | 6,238,631 | | | | 97,073,098 | |

| | | | | | | | |

| | | | | | | 204,934,365 | |

| | | | | | | | |

| | |

Software - 0.81% | | | | | | | | |

ReadSoft AB, Class B | | | 849,089 | | | | 5,062,560 | |

Schawk, Inc.(f) | | | 756,532 | | | | 15,357,600 | |

| | | | | | | | |

| | | | | | | 20,420,160 | |

| | | | | | | | |

| | |

Telecommunications - 1.22% | | | | | | | | |

Cbeyond, Inc.(b)(f) | | | 1,875,493 | | | | 18,511,116 | |

Ziggo N.V. | | | 255,362 | | | | 12,039,006 | |

| | | | | | | | |

| | | | | | | 30,550,122 | |

| | | | | | | | |

| | |

Trucking & Leasing - 0.02% | | | | | | | | |

Goodpack Ltd. | | | 237,657 | | | | 462,316 | |

| | | | | | | | |

| | |

TOTAL COMMON STOCKS (Cost $2,144,365,871) | | | | | | | 2,208,523,529 | |

| | | | | | | | |

| | |

LIMITED PARTNERSHIPS - 0.47% | | | | | | | | |

Chemicals - 0.23% | | | | | | | | |

PetroLogistics LP | | | 400,771 | | | | 5,775,110 | |

| | | | | | | | |

| | |

Media - 0.24% | | | | | | | | |

LIN Media LLC, Class A(b) | | | 244,209 | | | | 6,139,415 | |

| | | | | | | | |

| | |

TOTAL LIMITED PARTNERSHIPS (Cost $12,074,653) | | | | | | | 11,914,525 | |

| | | | | | | | |

| | |

RIGHTS - 0.31% | | | | | | | | |

ArthroCare Corp., CVR(b)(c)(d) | | | 3,215,721 | | | | 1,052,505 | |

BMC Software, Inc., CVR(b)(c)(d) | | | 4,637,757 | | | | 401,630 | |

Cubist Pharmaceuticals, Inc., CPR(b)(c)(d) | | | 119,343 | | | | 44,097 | |

Cubist Pharmaceuticals, Inc., CVR(b) | | | 2,200,925 | | | | 363,153 | |

Leap Wireless International, CVR(b)(c)(d) | | | 2,231,034 | | | | 5,756,068 | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 11 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | | | | | | | |

| | | | | | | | Shares | | | Value | |

| |

RIGHTS - 0.31% (Continued) | | | | | | | | | | | | | | |

Trius Therapeutics, CVR(b)(c)(d) | | | | | | | | | 1,034,403 | | | $ | 159,815 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL RIGHTS (Cost $11,773,126) | | | | | | | | | | | | | 7,777,268 | |

| | | | | | | | | | | | | | |

| | | | |

| | | Expiration

Date | | Exercise

Price | | | Contracts | | | Value | |

| |

PURCHASED OPTIONS(b)- 0.24% | | | | | | | | | | | | | | |

Put Options Purchased - 0.24% | | | | | | | | | | | | | | |

AT&T, Inc. | | 01/2015 | | $ | 35.00 | | | | 10,172 | | | $ | 2,253,098 | |

Questcor Pharmaceuticals, Inc.: | | | | | | | | | | | | | | |

| | 07/2014 | | | 80.00 | | | | 1,023 | | | | 654,720 | |

| | 07/2014 | | | 82.50 | | | | 490 | | | | 352,800 | |

| | 07/2014 | | | 85.00 | | | | 2,373 | | | | 1,874,670 | |

Sirius XM Holdings, Inc. | | 01/2015 | | | 3.00 | | | | 16,453 | | | | 320,834 | |

SPDR® S&P 500® ETF Trust: | | | | | | | | | | | | | | |

| | 06/2014 | | | 184.00 | | | | 770 | | | | 20,405 | |

| | 06/2014 | | | 185.00 | | | | 3,474 | | | | 114,642 | |

Valeant Pharmaceuticals International, Inc. | | 07/2014 | | | 125.00 | | | | 750 | | | | 318,750 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PUT OPTIONS PURCHASED (Cost $6,724,079) | | | | | | | | | | | | | 5,909,919 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL PURCHASED OPTIONS (Cost $6,724,079) | | | | | | | | | | | | | 5,909,919 | |

| | | | | | | | | | | | | | |

| | | | |

| | | | | Yield | | | Shares | | | Value | |

| |

SHORT-TERM INVESTMENTS - 9.78% | | | | | | | | | | | | | | |

Money Market Fund | | | | | | | | | | | | | | |

State Street Institutional Liquid Reserves Fund(g) | | | | | 0.069% | | | | 245,699,350 | | | | 245,699,350 | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL SHORT-TERM INVESTMENTS (Cost $245,699,350) | | | | | | | | | | | | | 245,699,350 | |

| | | | | | | | | | | | | | |

| | | | |

Total Investments - 98.68% (Cost $2,420,637,079) | | | | | | | | | | | | | 2,479,824,591 | |

| | | | |

Other Assets in Excess of Liabilities - 1.32% | | | | | | | | | | | | | 33,289,504 | |

| | | | | | | | | | | | | | |

| | | | |

NET ASSETS - 100.00% | | | | | | | | | | | | $ | 2,513,114,095 | |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

| 12 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| (a) | Less than 0.005% of Net Assets. |

| (b) | Non-income-producing security. |

| (c) | Security considered illiquid. On May 31, 2014, the total market value of these securities was $7,435,345, representing 0.30% of net assets. |

| (d) | Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2014, the total market value of these securities was $7,435,345, representing 0.30% of net assets. |

| (e) | Underlying security for a written/purchased call/put option. |

| (f) | Security, or a portion of security, is being held as collateral for short sales or written option contracts. At period end, the aggregate market value of these securities was $486,406,000, representing 19.35% of net assets. |

| (g) | Rate shown is the 7-day effective yield as of May 31, 2014. |

Securities are determined to be illiquid under the procedures approved by the Funds’ Board of Trustees. Information related to the illiquid securities is as follows:

| | | | | | | | | | | | | | |

Date(s) of Purchase | | Security | | Cost | | | Market Value | | | % of Net Assets | |

| |

05/20/2010-12/28/2010 | | Allied Defense Group, Inc. | | $ | 20,354 | | | $ | 21,230 | | | | 0.00% | |

05/30/2014 | | AnthroCare Corp., CVR | | | 1,125,502 | | | | 1,052,505 | | | | 0.04 | |

09/10/2013 | | BMC Software, Inc., CVR | | | 0 | | | | 401,630 | | | | 0.02 | |

12/12/11 | | Cubist Pharmaceuticals, Inc., CPR | | | 0 | | | | 44,097 | | | | 0.00 | |

03/14/2014 | | Leap Wireless International, CVR | | | 5,756,068 | | | | 5,756,068 | | | | 0.23 | |

09/12/2013 | | Trius Therapeutics, CVR | | | 0 | | | | 159,815 | | | | 0.01 | |

| | | | | | | | | | |

| | | | | | | | $ | 7,435,345 | | | | 0.30% | |

| | | | | | | | | | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 13 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| |

COMMON STOCKS - (35.89%) | | | | | | | | |

Banks - (3.66%) | | | | | | | | |

M&T Bank Corp. | | | (609,910) | | | $ | (74,024,777) | |

Southside Bancshares, Inc. | | | (242,048) | | | | (6,249,679) | |

Valley National Bancorp | | | (1,202,072) | | | | (11,648,078) | |

| | | | | | | | |

| | | | | | | (91,922,534) | |

| | | | | | | | |

| | |

Building Materials - (1.00%) | | | | | | | | |

Martin Marietta Materials, Inc. | | | (204,665) | | | | (25,132,862) | |

| | | | | | | | |

| | |

Commercial Services - (0.25%) | | | | | | | | |

Matthews International Corp., Class A | | | (155,583) | | | | (6,378,903) | |

| | | | | | | | |

| | |

Diversified Financial Services - (0.03%) | | | | | | | | |

IOOF Holdings Ltd. | | | (82,049) | | | | (648,286) | |

| | | | | | | | |

| | |

Healthcare - Services - (4.90%) | | | | | | | | |

Brookdale Senior Living, Inc. | | | (3,702,216) | | | | (123,135,704) | |

| | | | | | | | |

| | |

Insurance - (0.07%) | | | | | | | | |

Hilltop Holdings, Inc. | | | (81,220) | | | | (1,685,315) | |

| | | | | | | | |

| | |

Media - (3.98%) | | | | | | | | |

Comcast Corp., Class A | | | (1,688,173) | | | | (88,122,631) | |

Liberty Global, Inc. Plc, Class A | | | (58,275) | | | | (2,623,540) | |

Liberty Global, Inc. Plc, Series C | | | (143,767) | | | | (6,153,228) | |

Media General, Inc. | | | (177,958) | | | | (3,155,195) | |

| | | | | | | | |

| | | | | | | (100,054,594) | |

| | | | | | | | |

| | |

Mining - (2.72%) | | | | | | | | |

Agnico Eagle Mines Ltd. | | | (1,035,365) | | | | (31,501,145) | |

Agnico Eagle Mines Ltd. | | | (28,000) | | | | (846,720) | |

Osisko Spinco | | | (5,650,691) | | | | (7,400,148) | |

Yamana Gold, Inc. | | | (3,845,831) | | | | (28,693,879) | |

| | | | | | | | |

| | | | | | | (68,441,892) | |

| | | | | | | | |

| | |

Oil & Gas - (0.58%) | | | | | | | | |

Energy XXI Bermuda Ltd. | | | (676,003) | | | | (14,500,264) | |

| | | | | | | | |

| | |

Oil & Gas Services - (2.80%) | | | | | | | | |

AMEC Plc | | | (3,479,140) | | | | (70,447,060) | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 14 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| |

COMMON STOCKS - (35.89%)(Continued) | | | | | | | | |

Pharmaceuticals - (8.24%) | | | | | | | | |

Actavis Plc | | | (916,630) | | | $ | (193,903,910) | |

Mallinckrodt Plc | | | (170,824) | | | | (13,283,274) | |

| | | | | | | | |

| | | | | | | (207,187,184) | |

| | | | | | | | |

| | |

Semiconductors - (3.62%) | | | | | | | | |

Applied Materials, Inc. | | | (4,507,714) | | | | (91,010,746) | |

| | | | | | | | |

| | |

Telecommunications - (4.04%) | | | | | | | | |

AT&T, Inc. | | | (89,485) | | | | (3,174,033) | |

RF Micro Devices, Inc. | | | (10,441,224) | | | | (98,251,918) | |

| | | | | | | | |

| | | | | | | (101,425,951) | |

| | | | | | | | |

TOTAL COMMON STOCKS (Proceeds $861,321,290) | | | | | | | (901,971,295) | |

| | | | | | | | |

| | |

EXCHANGE-TRADED FUNDS - (0.96%) | | | | | | | | |

Equity Fund - (0.96%) | | | | | | | | |

SPDR® S&P 500® ETF Trust | | | (125,545) | | | | (24,183,733) | |

| | | | | | | | |

| | |

TOTAL EXCHANGE-TRADED FUNDS (Proceeds $22,447,844) | | | | | | | (24,183,733) | |

| | | | | | | | |

| | |

TOTAL SECURITIES SOLD SHORT (Proceeds $883,769,134) | | | | | | $ | (926,155,028) | |

| | | | | | | | |

| | | | | | | | | | | | | | |

SCHEDULE OF WRITTEN OPTIONS | | Expiration

Date | | Exercise Price | | | Contracts | | | Value | |

| |

Written Call Options | | | | | | | | | | | | | | |

Actavis Plc: | | | | | | | | | | | | | | |

| | 06/2014 | | $ | 195.00 | | | | (122) | | | $ | (211,670) | |

| | 06/2014 | | | 200.00 | | | | (122) | | | | (154,940) | |

| | 06/2014 | | | 205.00 | | | | (166) | | | | (141,930) | |

Chelsea Therapeutics International Ltd. | | 09/2014 | | | 6.00 | | | | (47) | | | | (2,820) | |

Furiex Pharmaceuticals, Inc.: | | | | | | | | | | | | | | |

| | 06/2014 | | | 105.00 | | | | (120) | | | | (8,100) | |

| | 07/2014 | | | 105.00 | | | | (264) | | | | (13,200) | |

Hillshire Brands Co. | | 06/2014 | | | 55.00 | | | | (722) | | | | (59,565) | |

Jos. A. Bank Clothiers, Inc. | | 07/2014 | | | 65.00 | | | | (719) | | | | (1,797) | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 15 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | | | | | | | |

SCHEDULE OF WRITTEN OPTIONS | | Expiration

Date | | Exercise Price | | | Contracts | | | Value | |

| |

Written Call Options (Continued) | | | | | | | | | | | | | | |

Mallinckrodt Plc: | | | | | | | | | | | | | | |

| | 06/2014 | | �� $ | 80.00 | | | | (85) | | | $ | (7,863) | |

| | 06/2014 | | | 81.00 | | | | (165) | | | | (14,850) | |

| | 06/2014 | | | 78.00 | | | | (47) | | | | (10,927) | |

| | 06/2014 | | | 79.00 | | | | (48) | | | | (8,400) | |

| | 06/2014 | | | 80.00 | | | | (47) | | | | (6,463) | |

| | 06/2014 | | | 82.00 | | | | (164) | | | | (27,470) | |

| | 06/2014 | | | 80.00 | | | | (1,154) | | | | (248,110) | |

Media General, Inc. | | 06/2014 | | | 17.50 | | | | (140) | | | | (11,550) | |

Sirius XM Holdings, Inc.: | | | | | | | | | | | | | | |

| | 06/2014 | | | 3.00 | | | | (774) | | | | (21,285) | |

| | 06/2014 | | | 4.50 | | | | (35) | | | | (35) | |

| | 01/2015 | | | 4.00 | | | | (16,453) | | | | (213,889) | |

Yamana Gold, Inc. | | 06/2014 | | | 7.00 | | | | (328) | | | | (15,252) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN CALL OPTIONS (Premiums received $1,569,952) | | | | | | | | | | | | | (1,180,116) | |

| | | | | | | | | | | | | | |

| | | | |

Written Put Options | | | | | | | | | | | | | | |

Hillshire Brands Co. | | 06/2014 | | | 50.00 | | | | (722) | | | | (32,490) | |

Valeant Pharmaceuticals International, Inc.: | | | | | | | | | | | | | | |

| | 06/2014 | | | 120.00 | | | | (50) | | | | (6,875) | |

| | 06/2014 | | | 125.00 | | | | (325) | | | | (69,875) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN PUT OPTIONS (Premiums received $108,251) | | | | | | | | | | | | | (109,240) | |

| | | | | | | | | | | | | | |

| | | | |

TOTAL WRITTEN OPTIONS (Premiums received $1,678,203) | | | | | | | | | | | | $ | (1,289,356) | |

| | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

| 16 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

EQUITY SWAP CONTRACTS

| | | | | | | | | | | | | | |

Swap Counterparty | | Reference Obligation | | Rate Paid/Received by the Fund | | Termination

Dates | | Notional

Amount | | | Unrealized

Appreciation | |

| |

Goldman, Sachs & Co. | | UNS Energy Corp. | | 1 Month-LIBOR-BBA plus 0.50 bps | | 04/14/2015 | | $ | 20,208,792 | | | $ | 71,680 | |

UBS | | Jos. A. Bank Clothiers, Inc. | | 1 Month-LIBOR-BBA plus 1.10 bps | | 12/02/2016 | | | 37,124,800 | | | | 221,450 | |

| | | | | | | | | | |

| | | | | | | | $ | 57,333,592 | | | $ | 293,130 | |

| | | | | | | | | | |

| | | | | |

Swap Counterparty | | Reference Obligation | | Rate Paid/Received by the Fund | | Termination

Dates | | Notional

Amount | | | Unrealized

Depreciation | |

| |

Goldman, Sachs & Co. | | Wolfson Microelectronics Plc | | 1 Month-LIBOR plus 0.45 bps | | 05/06/2015 | | $ | 3,252,694 | | | $ | (15,363) | |

| | | | | | | | | | |

| | | | | | | | $ | 3,252,694 | | | $ | (15,363) | |

| | | | | | | | | | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 17 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

| | | | | | | | | | | | | | | | |

Contract Description | | Contracts to

Deliver/Receive | | | Purchase/

Sale

Contract | | Expiration

Date | | Current Value | | | Unrealized

Appreciation | |

| |

AUD | | | 22,330,000 | | | Purchase | | 06/16/2014 | | | 20,756,961 | | | $ | 474,231 | |

AUD | | | 20,710,000 | | | Sale | | 06/16/2014 | | | 19,251,082 | | | | 103,175 | |

CAD | | | 52,840,000 | | | Purchase | | 06/16/2014 | | | 48,711,789 | | | | 574,234 | |

CAD | | | 2,200,000 | | | Sale | | 06/16/2014 | | | 2,028,121 | | | | 2,729 | |

EUR | | | 3,170,000 | | | Purchase | | 06/16/2014 | | | 4,321,081 | | | | 11,022 | |

EUR | | | 83,418,198 | | | Sale | | 06/16/2014 | | | 113,708,775 | | | | 1,967,761 | |

GBP | | | 17,513,700 | | | Purchase | | 06/16/2014 | | | 29,352,717 | | | | 320,859 | |

GBP | | | 27,516,000 | | | Sale | | 06/16/2014 | | | 46,116,433 | | | | 298,595 | |

NOK | | | 26,430,000 | | | Sale | | 06/16/2014 | | | 4,418,316 | | | | 28,680 | |

SEK | | | 206,564,000 | | | Sale | | 06/16/2014 | | | 30,857,480 | | | | 1,353,556 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | 5,134,842 | |

| | | | | | | | | | | | | | | | |

| | | | | |

Contract Description | | Contracts to

Deliver/Receive | | | Purchase/

Sale

Contract | | Expiration

Date | | Current Value | | | Unrealized

Depreciation | |

| |

AUD | | | 67,505,813 | | | Sale | | 06/16/2014 | | | 62,750,360 | | | $ | (1,566,115) | |

CAD | | | 1,700,000 | | | Purchase | | 06/16/2014 | | | 1,567,185 | | | | (375) | |

CAD | | | 170,284,316 | | | Sale | | 06/16/2014 | | | 156,980,579 | | | | (3,634,436) | |

EUR | | | 66,922,000 | | | Purchase | | 06/16/2014 | | | 91,222,525 | | | | (1,787,089) | |

GBP | | | 53,395,000 | | | Purchase | | 06/16/2014 | | | 89,489,277 | | | | (574,656) | |

GBP | | | 35,025,000 | | | Sale | | 06/16/2014 | | | 58,701,412 | | | | (444,434) | |

HKD | | | 252,190,000 | | | Purchase | | 06/16/2014 | | | 32,529,357 | | | | (8,370) | |

HKD | | | 310,960,000 | | | Sale | | 06/16/2014 | | | 40,109,952 | | | | (42,663) | |

SEK | | | 172,554,000 | | | Purchase | | 06/16/2014 | | | 25,776,909 | | | | (1,465,488) | |

SGD | | | 580,000 | | | Sale | | 06/16/2014 | | | 462,409 | | | | (33) | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | $ | (9,523,659) | |

| | | | | | | | | | | | | | | | |

See Notes to Financial Statements.

| | |

| 18 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | |

| Country | | % of Net Assets(a) | |

| |

Canada | | | 10.35% | |

Japan | | | 3.34% | |

Australia | | | 2.47% | |

Jersey | | | 1.08% | |

Netherlands | | | 0.48% | |

Hong Kong | | | 0.30% | |

Sweden | | | 0.20% | |

Norway | | | 0.19% | |

Singapore | | | 0.02% | |

United States | | | 80.25% | |

Other Assets in Excess of Liabilities | | | 1.32% | |

| | | | |

| | | 100.00% | |

| | | | |

| (a) | These percentages represent long positions only and are not net of short positions. |

Abbreviations:

AB - Arktiebolag is the Swedish term for a limited company

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders

ASA - Allmennaksjeselskap is the Norwegian term for public limited company

AUD - Australian Dollar

BBA - British Bankers Association

bps - Basis Points

CAD - Canadian Dollar

CPR - Conditional Prepayment Rate

CVR - Contingent Value Rights

ETF - Exchange-Traded Fund

EUR - Euro

GBP - British Pound

HKD - Hong Kong Dollar

LIBOR - London Interbank Offered Rate

LLC - Limited Liability Company

LP - Limited Partnership

Ltd. - Limited

NOK - Norwegian Kronor

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation

Plc - Public Limited Liability

SEK - Swedish Kronor

SGD - Singapore Dollar

S&P - Standard & Poor’s

SPDR - Standard & Poor’s Depositary Receipt

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 19 |

May 31, 2014

The following is a summary of the inputs used as of May 31, 2014, in valuing the Arbitrage Fund’s investments carried at value:

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

Assets | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Aerospace & Defense | | $ | – | | | $ | – | | | $ | 21,230 | | | $ | 21,230 | |

Banks | | | 31,923,002 | | | | – | | | | – | | | | 31,923,002 | |

Biotechnology | | | 15,536,359 | | | | – | | | | – | | | | 15,536,359 | |

Building Materials | | | 25,223,145 | | | | – | | | | – | | | | 25,223,145 | |

Diversified Financial Services | | | 16,690,208 | | | | – | | | | – | | | | 16,690,208 | |

Electric | | | 190,414,107 | | | | – | | | | – | | | | 190,414,107 | |

Electronics | | | 15,243,478 | | | | – | | | | – | | | | 15,243,478 | |

Engineering & Construction | | | 130,921,451 | | | | – | | | | – | | | | 130,921,451 | |

Food | | | 267,871,106 | | | | – | | | | – | | | | 267,871,106 | |

Gas | | | 8,236,208 | | | | – | | | | – | | | | 8,236,208 | |

Healthcare - Products | | | 54,406,856 | | | | – | | | | – | | | | 54,406,856 | |

Healthcare - Services | | | 122,222,252 | | | | – | | | | – | | | | 122,222,252 | |

Home Builders | | | 4,855,559 | | | | – | | | | – | | | | 4,855,559 | |

Internet | | | 30,512,527 | | | | – | | | | – | | | | 30,512,527 | |

Media | | | 200,963,826 | | | | – | | | | – | | | | 200,963,826 | |

Mining | | | 110,414,289 | | | | – | | | | – | | | | 110,414,289 | |

Oil & Gas | | | 100,125,352 | | | | 43,548,256 | | | | – | | | | 143,673,608 | |

Pharmaceuticals | | | 360,386,457 | | | | – | | | | – | | | | 360,386,457 | |

Retail | | | 151,718,211 | | | | – | | | | – | | | | 151,718,211 | |

Savings & Loans | | | 70,922,687 | | | | – | | | | – | | | | 70,922,687 | |

Semiconductors | | | 204,934,365 | | | | – | | | | – | | | | 204,934,365 | |

Software | | | 20,420,160 | | | | – | | | | – | | | | 20,420,160 | |

Telecommunications | | | 30,550,122 | | | | – | | | | – | | | | 30,550,122 | |

Trucking & Leasing | | | 462,316 | | | | – | | | | – | | | | 462,316 | |

Limited Partnerships | | | 11,914,525 | | | | – | | | | – | | | | 11,914,525 | |

Rights | | | 363,153 | | | | – | | | | 7,414,115 | | | | 7,777,268 | |

Purchased Options | | | 5,909,919 | | | | – | | | | – | | | | 5,909,919 | |

Short-Term Investments | | | 245,699,350 | | | | – | | | | – | | | | 245,699,350 | |

| |

TOTAL | | $ | 2,428,840,990 | | | $ | 43,548,256 | | | $ | 7,435,345 | | | $ | 2,479,824,591 | |

| |

| | | | | | | | | | | | | | | | |

| |

| Other Financial Instruments* | | | | | | | | | | | | |

| |

Assets | | | | | | | | | | | | | | | | |

Forward Foreign Currency Exchange Contracts | | $ | – | | | $ | 5,134,842 | | | $ | – | | | $ | 5,134,842 | |

Equity Swaps | | | 293,130 | | | | – | | | | – | | | | 293,130 | |

Liabilities | | | | | | | | | | | | | | | | |

Common Stocks** | | | (894,571,147) | | | | (7,400,148) | | | | – | | | | (901,971,295) | |

Exchange-Traded Funds | | | (24,183,733) | | | | – | | | | – | | | | (24,183,733) | |

See Notes to Financial Statements.

| | |

| 20 | | www.arbitragefunds.com | 1-800-295-4485 |

May 31, 2014

| | | | | | | | | | | | | | | | |

| Investments in Securities at Value (Continued) | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| |

Written Options | | $ | (1,289,356) | | | $ | – | | | $ | – | | | $ | (1,289,356) | |

Forward Foreign Currency Exchange Contracts | | | – | | | | (9,523,659) | | | | – | | | | (9,523,659) | |

Equity Swaps | | | (15,363) | | | | – | | | | – | | | | (15,363) | |

| |

TOTAL | | $ | (919,766,469) | | | $ | (11,788,965) | | | $ | – | | | $ | (931,555,434) | |

| |

| * | Other financial instruments are instruments such as written options, securities sold short, equity swaps and forward foreign currency exchange contracts. |

| ** | Refer to Portfolio of Investments for sector information. |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 21 |

May 31, 2014

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund’s assets and liabilities during the year ended May 31, 2014:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments in Securities | | Balance

as of

May 31, 2013 | | | Realized

Gain | | | Change in

Unrealized

Appreciation | | | Purchases | | | Sales

Proceeds | | | Transfer

into

Level 3 | | | Transfer

out of

Level 3 | | | Balance

as of

May 31, 2014 | | | Net change in

unrealized

appreciation

included in the

Statements of

Operations

attributable to

Level 3

investments

held at

May 31, 2014 | |

| |

Common Stocks | | $ | 796,638 | | | $ | 501,769 | | | $ | 758,233 | | | $ | – | | | $ | (2,035,410) | | | $ | – | | | $ | – | | | $ | 21,230 | | | $ | 758,233 | |

Rights | | | 0 | | | | – | | | | 532,545 | | | | 6,881,570 | | | | – | | | | – | | | | – | | | | 7,414,115 | | | | 532,545 | |

| |

Total | | $ | 796,638 | | | $ | 501,769 | | | $ | 1,290,778 | | | $ | 6,881,570 | | | $ | (2,035,410) | | | $ | – | | | $ | – | | | $ | 7,435,345 | | | $ | 1,290,778 | |

| |

See Notes to Financial Statements.

| | |

| 22 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Event-Driven Fund | | Manager Commentary |

May 31, 2014 (Unaudited)

|

The Arbitrage Event-Driven Fund | NASDAQ | AEDNX, AEDFX, AEFCX, AGEAX The Fund’s Goal and Main Investments The fund seeks to provide capital growth and absolute returns by investing in credit and equity securities involved in specific corporate events, with a focus on low volatility and low correlation relative to the broader capital markets. |

Investment Strategy

The Fund’s investment process follows a disciplined, fundamental approach that values downside protection while identifying compelling risk/reward opportunities available to us as we screen catalyst-driven corporate events, such as mergers and acquisitions, restructuring, refinancing, recapitalization, spin-offs, litigation, regulatory changes, bankruptcy, and more. We analyze these events through four core approaches: Equity Merger Arbitrage, Equity Special Situations, Credit Special Situations, and Merger-Related Credit. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark, and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event-driven strategy. This process and approach has been an integral part of the culture at Water Island Capital since the firm’s inception.

Commentary

When we surveyed the investment landscape at the start of our fiscal year, we were cautiously optimistic that corporate activity, be it mergers, spin-offs, restructurings or refinancings, to name a few, would pick up. After all, many companies had large cash balances earning paltry returns, and there were plenty of activist investors recommending ways corporate boards could unlock value. In addition, after years of cost cutting, companies needed to find other ways to boost the bottom line.

In 2014, we fully expected a significant pick up in corporate activity, as strong market performance generally emboldens boards and corporate management to take action. Yet, the first quarter proved to be a choppy backdrop for event-driven investing. On one hand, the environment was generally favorable for fixed income, particularly corporate credit. A decrease in underlying Treasury rates, a “good-enough-for credit” economic environment, and investors’ reach for yield generally supported demand for bonds. On the other, the equity markets, which were still digesting 2013’s run, had little to cheer about. Ongoing geopolitical risks in Ukraine, the Federal Reserve’s (Fed) unexpected hawkish language, and investors’ concerns that the bull market was starting to show signs of fatigue, unnerved equity investors.

But then in the Spring animal spirits returned to the markets with a vengeance. Boards became more receptive to suggestions from activist investors, and market participants approved by bidding up shares of those companies who demonstrated creative approaches to transformation, be it through divestitures, restructurings, refinancings, Real Estate Investment Trust conversions, or other corporate actions. Furthermore, hostile offers, bear hugs and topping bids, terms not frequently heard since 2007’s private-equity-led merger and acquisition frenzy, returned to the lexicon of investors. It seemed that almost any company in a slow-growth industry was potentially a target or acquirer. While this adds uncertainty in definitively announced deals, it is a terrific backdrop to deploy our analytical prowess to determine the best way to take advantage of this atmosphere.

| | |

| Annual Report | May 31, 2014 | | 23 |

| | |

| The Arbitrage Event-Driven Fund | | Manager Commentary (continued) |

May 31, 2014 (Unaudited)

Fiscal Year Highlights

In fiscal 2014, the Arbitrage Event-Driven Fund returned 5.75%. The results were predominantly derived from companies residing in the Americas. In terms of sectors, telecommunication services and financials led the way, contributing 45% of the returns, while consumer discretionary and utilities added the least to results. Our three substrategies—merger arbitrage, equity special situations and credit opportunities—generally contributed equally to performance, providing 28%, 35% and 37% of returns, respectively.

Our focus on idiosyncratic situations can be seen in our investment in Globalstar (GSAT), which provides mobile satellite services (MSS) including global voice and data communications. When we conducted our initial research on the company, GSAT had been in the process of restructuring its balance sheet due to a crucial near-term maturity for its convertible bonds. At the same time, however, GSAT was in the process of petitioning the Federal Communications Commission (FCC) to begin the approval process which would enable GSAT to convert a portion of its MSS spectrum in order to create a terrestrial network. The network that GSAT envisioned had the potential to free-up the nation’s WiFi “traffic jams” which implied significant revenue opportunities for the company.

After valuing corporate assets, understanding the motivations of management and creditors, assessing the likelihood of receiving FCC approval, and analyzing the value created by various bond restructuring scenarios, we purchased GSAT’s 5.75% Convertible Notes in February and March of 2013. In May, GSAT offered to exchange the Notes for a combination of cash, new 8% convertible senior notes, and common equity in the company. While the FCC has not formally approved GSAT’s request to convert spectrum, we are now at advanced stages of the FCC approval process, and believe the company will receive approval by the end of 2014. Thus far, our stock and bond holdings in GSAT have been strong contributors to performance.

Another highlight is Genworth Financial (GNW), which has been an investment since the end of 2012. The company provides insurance and investment products to U.S. retail and institutional customers, mortgage insurance in Canada, Australia, and Europe, and lifestyle protection products in Europe. Since our initial investment, GNW has effectively executed on several significant catalysts: the naming of a permanent CEO following the abrupt resignation of his predecessor; the successful divestment of non-core businesses, including its wealth management and alternative investments businesses; and the initial public offering of its Australian mortgage unit. A number of value-enhancing catalysts remain, including the potential for a return of capital to shareholders once GNW’s balance sheet is fully repaired. Thus, despite a sizeable appreciation since our initial investment in late 2012, we continue to see upside in the stock and retain a position in our portfolio.

Another top contributor during the year was our investment in the surplus notes of bond insurance companies Ambac Financial Group and Syncora Holdings. Prior to the financial crisis, bond insurance companies insured or “wrapped” pools of mortgages against the risk of default. As part of this securitization process, the mortgage originators provide guarantees, known as representations and warranties, that these mortgages meet an agreed-upon level of underwriting due diligence and credit-worthiness. As the financial crisis ensued and mortgage defaults skyrocketed, bond insurers came under serious financial stress because they were responsible for paying out claims to banks and investors for defaulted securities. However, the bond insurers claimed the originators failed to meet their representation and warranty obligations, and, as a result, the bond insurers had the right to “put back” impaired loans to the underwriting banks and mortgage originators.

| | |

| 24 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Event-Driven Fund | | Manager Commentary (continued) |

May 31, 2014 (Unaudited)

Through prior investments, we had analyzed, and were familiar with, monoline insurance company litigation against mortgage underwriters. We believed precedent court rulings and legal settlements supported the respective cases of Ambac and Syncora to receive close to 100% of damage claims against the banks in outstanding court cases. Our analysis concluded that proceeds from expected counterparty settlements would cover Ambac and Syncora surplus notes by 3.9 and 1.5 times, respectively. The notes were trading at significant discounts to their accreted value, and offered a compelling risk/reward profile. Consequently, we purchased the notes at attractive prices, and have since seen our positions rise in value as positive news flow has given investors higher conviction over future settlements.

The largest drag on performance during the past year, besides the market hedges we employ as portfolio insurance, was our relative-value position where we went long the shares of General Motors (GM) while simultaneously shorting the shares of rival Ford. GM’s well-publicized recall of 29 million of its vehicles overwhelmed the many catalysts and improving fundamentals we believed would narrow the valuation gap between the two automakers. We still hold this relative-value position. We believe once the recall is addressed, investors will return to focus on GM’s attractive attributes. Other detractors to the portfolio this fiscal year included the aforementioned positions in Sirus XM and Cooper Tires’ failed transaction with India’s Apollo Tyre (see Arbitrage Fund commentary for more details).

Outlook

We believe it is a terrific time to be event-driven investors. We have receptive markets ready to fund IPOs, secondary offerings, private placements, lines of credit, high yield debt and convertible securities, just to name a few, along with eager investors. We have numerous activists agitating for change and corporate managements becoming even more receptive to their ideas for unleashing shareholder value.

We also fully understand that at current valuations investors may not be well compensated for increased regulatory and political scrutiny on deals, geopolitical turmoil, an aging bull market or any extraordinary event that may shake confidence.

We will stay true to our discipline of capitalizing on corporate actions by understanding the rationale and underlying complexities of each event, sharing insights between our teams, using hedges to mitigate market influence, and building well-diversified portfolios. We believe through this approach, the Arbitrage Event-Driven Fund can generate attractive long-term results with lower volatility and correlation to broader markets.

Sincerely,

The Investment Team at Water Island Capital

| | |

| Annual Report | May 31, 2014 | | 25 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio Information |

May 31, 2014 (Unaudited)

Performance (annualized returns as of May 31, 2014)

| | | | |

| | | One Year | | Since Inception* |

Arbitrage Event-Driven Fund, Class R | | 5.75% | | 3.76% |

Arbitrage Event-Driven Fund, Class I | | 6.02% | | 4.01% |

Arbitrage Event-Driven Fund, Class C** | | 4.05% | | 3.68% |

Arbitrage Event-Driven Fund, Class A*** | | 2.40% | | 2.40% |

HFRI Event Driven Index | | 8.76% | | 6.98% |

Barclays Capital US Aggregate Bond Index | | 2.71% | | 3.36% |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R and Class I inception: 10/1/10; Class C inception: 6/1/12; Class A inception: 6/1/13.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 3.25% on purchases up to $500,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $500,000 or more purchased without a front-end sales load and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.55%, 2.30%, 3.30% and 2.55%, respectively. The Advisor has agreed to waive fees in excess of 1.69%, 1.44%, 2.44% and 1.69% for Class R, Class I, Class C and Class A, respectively, until at least August 31, 2016.

The HFRI Event Driven Index is an index of companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated and frequently involve additional derivative securities. Event-Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company-specific developments.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| 26 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio Information (continued) |

May 31, 2014 (Unaudited)

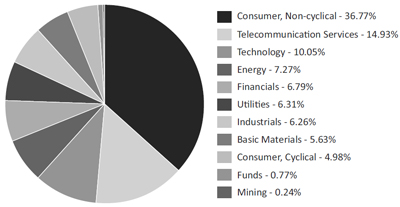

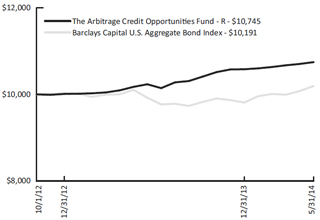

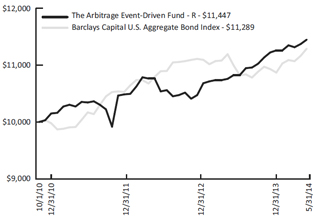

Growth of $10,000 Investment

| | | | |

| | The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. | | |

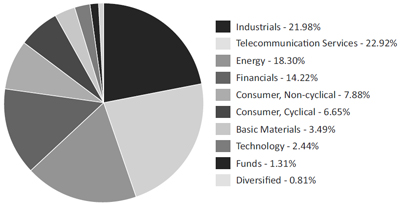

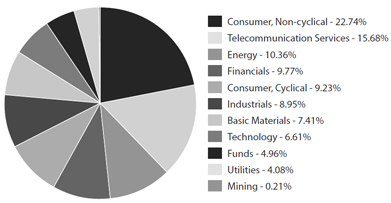

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Event-Driven Fund’s investments in common stock, preferred stock, corporate bonds, convertible corporate bonds, exchange-traded funds and limited partnerships as of the report date.

| | |

| Annual Report | May 31, 2014 | | 27 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio of Investments |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 56.34% | | | | | | | | |

Aerospace & Defense - 0.38% | | | | | | | | |

Allied Defense Group, Inc.(a)(b)(c) | | | 5,000 | | | $ | 266 | |

B/E Aerospace, Inc.(a) | | | 19,862 | | | | 1,921,649 | |

| | | | | | | | |

| | | | | | | 1,921,915 | |

| | | | | | | | |

| | |

Airlines - 1.25% | | | | | | | | |

American Airlines Group, Inc.(a)(d) | | | 156,903 | | | | 6,301,224 | |

| | | | | | | | |

| | |

Auto Manufacturers - 0.80% | | | | | | | | |

General Motors Co.(d)(e) | | | 116,996 | | | | 4,045,722 | |

| | | | | | | | |

| | |

Biotechnology - 0.56% | | | | | | | | |

Chelsea Therapeutics International Ltd.(a)(e) | | | 434,520 | | | | 2,837,416 | |

| | | | | | | | |

| | |

Building Materials - 0.35% | | | | | | | | |

Armstrong World Industries, Inc.(a) | | | 33,611 | | | | 1,783,736 | |

| | | | | | | | |

| | |

Coal - 1.71% | | | | | | | | |

Alpha Natural Resources, Inc.(a) | | | 4,600 | | | | 15,548 | |

CONSOL Energy, Inc.(d)(e) | | | 113,553 | | | | 5,015,636 | |

Peabody Energy Corp. | | | 220,317 | | | | 3,560,323 | |

| | | | | | | | |

| | | | | | | 8,591,507 | |

| | | | | | | | |

| | |

Commercial Services - 0.11% | | | | | | | | |

Civeo Corp.(a)(f) | | | 23,024 | | | | 530,933 | |

| | | | | | | | |

| | |

Diversified Financial Services - 0.65% | | | | | | | | |

DFC Global Corp.(a) | | | 150,088 | | | | 1,406,324 | |

Outerwall, Inc.(a) | | | 26,142 | | | | 1,849,024 | |

| | | | | | | | |

| | | | | | | 3,255,348 | |

| | | | | | | | |

| | |

Electric - 4.49% | | | | | | | | |

NRG Energy, Inc.(d)(e) | | | 35,400 | | | | 1,261,656 | |

Pepco Holdings, Inc. | | | 177,551 | | | | 4,918,163 | |

UNS Energy Corp.(d) | | | 270,709 | | | | 16,396,844 | |

| | | | | | | | |

| | | | | | | 22,576,663 | |

| | | | | | | | |

| | |

Electronics - 0.13% | | | | | | | | |

Zygo Corp.(a) | | | 34,767 | | | | 668,222 | |

| | | | | | | | |

| | |

Engineering & Construction - 0.53% | | | | | | | | |

Foster Wheeler AG | | | 79,050 | | | | 2,676,633 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 28 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 56.34% (Continued) | | | | | | | | |

Food - 5.15% | | | | | | | | |

Hillshire Brands Co.(e) | | | 231,461 | | | $ | 12,332,242 | |

Hormel Foods Corp. | | | 2,926 | | | | 143,988 | |

Loblaw Cos. Ltd. | | | 200,471 | | | | 8,449,253 | |

Pinnacle Foods, Inc. | | | 4,130 | | | | 129,310 | |

Safeway, Inc. | | | 117,478 | | | | 4,034,195 | |

Tyson Foods, Inc., Class A | | | 19,011 | | | | 807,207 | |

| | | | | | | | |

| | | | | | | 25,896,195 | |

| | | | | | | | |

| | |

Gas - 0.05% | | | | | | | | |

Envestra Ltd. | | | 181,583 | | | | 230,671 | |

| | | | | | | | |

| | |

Healthcare - Products - 0.48% | | | | | | | | |

CareFusion Corp.(a) | | | 51,338 | | | | 2,203,941 | |

Smith & Nephew Plc, Sponsored ADR | | | 2,651 | | | | 232,678 | |

| | | | | | | | |

| | | | | | | 2,436,619 | |

| | | | | | | | |

| | |

Healthcare - Services - 2.37% | | | | | | | | |

Emeritus Corp.(a) | | | 380,523 | | | | 11,902,759 | |

| | | | | | | | |

| | |

Home Builders - 0.04% | | | | | | | | |

BWG Homes ASA | | | 90,363 | | | | 221,452 | |

| | | | | | | | |

| | |

Insurance - 1.28% | | | | | | | | |

Assured Guaranty Ltd.(d)(e) | | | 135,591 | | | | 3,311,132 | |

Genworth Financial, Inc., Class A(a)(d)(e) | | | 184,638 | | | | 3,137,000 | |

| | | | | | | | |

| | | | | | | 6,448,132 | |

| | | | | | | | |

| | |

Internet - 0.89% | | | | | | | | |

Rackspace Hosting, Inc.(a) | | | 7,534 | | | | 274,916 | |

TIBCO Software, Inc.(a) | | | 47,755 | | | | 1,027,210 | |

Vocus, Inc.(a) | | | 176,698 | | | | 3,177,030 | |

| | | | | | | | |

| | | | | | | 4,479,156 | |

| | | | | | | | |

| | |

Machinery - Diversified - 1.05% | | | | | | | | |

MAN SE | | | 2,176 | | | | 271,796 | |

Manitowoc Co., Inc.(e) | | | 184,631 | | | | 4,994,269 | |

| | | | | | | | |

| | | | | | | 5,266,065 | |

| | | | | | | | |

| | |

Media - 4.96% | | | | | | | | |

Charter Communications, Inc., Class A(a)(e) | | | 18,292 | | | | 2,618,317 | |

DIRECTV(a) | | | 8,000 | | | | 659,520 | |

Media General, Inc.(a) | | | 111,527 | | | | 1,977,374 | |

Sirius XM Holdings, Inc.(a)(d)(e) | | | 2,183,273 | | | | 7,161,135 | |

See Notes to Financial Statements.

| | |

| Annual Report | May 31, 2014 | | 29 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 56.34% (Continued) | | | | | | | | |

Media - 4.96% (Continued) | | | | | | | | |

Time Warner Cable, Inc.(d) | | | 89,003 | | | $ | 12,563,663 | |

| | | | | | | | |

| | | | | | | 24,980,009 | |

| | | | | | | | |

| | |

Mining - 3.82% | | | | | | | | |

Augusta Resource Corp.(a) | | | 130,886 | | | | 360,923 | |

Nevada Copper Corp.(a) | | | 6,725 | | | | 12,776 | |

Osisko Mining Corp.(a) | | | 2,528,490 | | | | 18,818,514 | |

Yancoal Australia Ltd.(a) | | | 131,238 | | | | 32,366 | |

| | | | | | | | |

| | | | | | | 19,224,579 | |

| | | | | | | | |

| | |

Miscellaneous Manufacturing - 1.29% | | | | | | | | |

Ingersoll-Rand Plc(d)(e) | | | 108,396 | | | | 6,484,249 | |

| | | | | | | | |

| | |

Oil & Gas - 2.28% | | | | | | | | |

Aurora Oil & Gas Ltd.(a) | | | 611,479 | | | | 2,390,101 | |

Caracal Energy, Inc.(a) | | | 152,036 | | | | 1,388,887 | |

EPL Oil & Gas, Inc.(a) | | | 77,900 | | | | 2,953,189 | |

Heritage Oil Plc(a) | | | 111,490 | | | | 593,901 | |

Ithaca Energy, Inc.(a) | | | 140,915 | | | | 322,299 | |

Noble Corp. Plc(d)(e) | | | 65,395 | | | | 2,057,327 | |

Talisman Energy, Inc.(e) | | | 169,856 | | | | 1,752,914 | |

| | | | | | | | |

| | | | | | | 11,458,618 | |

| | | | | | | | |

| | |

Oil & Gas Services - 1.65% | | | | | | | | |

National Oilwell Varco, Inc. | | | 7,189 | | | | 588,563 | |

Oil States International, Inc.(a)(e) | | | 71,858 | | | | 7,730,484 | |

| | | | | | | | |

| | | | | | | 8,319,047 | |

| | | | | | | | |

| | |

Pharmaceuticals - 8.58% | | | | | | | | |

Actavis Plc(a)(d)(e) | | | 15,505 | | | | 3,279,928 | |

Allergan, Inc. | | | 4,993 | | | | 836,128 | |

AstraZeneca Plc, Sponsored ADR | | | 12,444 | | | | 898,457 | |

Celesio AG | | | 50,747 | | | | 1,804,808 | |

Forest Laboratories, Inc.(a)(d) | | | 201,165 | | | | 19,066,419 | |

Furiex Pharmaceuticals, Inc.(a)(e) | | | 44,912 | | | | 4,642,104 | |

Mylan, Inc.(a) | | | 94,900 | | | | 4,729,816 | |

Questcor Pharmaceuticals, Inc.(e) | | | 22,519 | | | | 2,029,637 | |

Shire Plc, ADR | | | 23,527 | | | | 4,079,347 | |

Valeant Pharmaceuticals International, Inc.(a) | | | 13,616 | | | | 1,786,555 | |

| | | | | | | | |

| | | | | | | 43,153,199 | |

| | | | | | | | |

See Notes to Financial Statements.

| | |

| 30 | | www.arbitragefunds.com | 1-800-295-4485 |

| | |

| The Arbitrage Event-Driven Fund | | Portfolio of Investments (continued) |

May 31, 2014

| | | | | | | | |

| | | Shares | | | Value | |

| |

COMMON STOCKS - 56.34% (Continued) | | | | | | | | |

Real Estate - 0.43% | | | | | | | | |

Deutsche Wohnen AG(a) | | | 100,692 | | | $ | 2,175,559 | |

| | | | | | | | |

| | |

Retail - 4.05% | | | | | | | | |

Jos. A. Bank Clothiers, Inc.(a)(e) | | | 313,466 | | | | 20,359,617 | |

| | | | | | | | |

| | |

Savings & Loans - 0.72% | | | | | | | | |

Hudson City Bancorp, Inc.(d) | | | 369,164 | | | | 3,606,732 | |

| | | | | | | | |

| | |

Semiconductors - 3.21% | | | | | | | | |

Entegris, Inc.(a) | | | 126,913 | | | | 1,455,692 | |

Tokyo Electron Ltd., Unsponsored ADR(d) | | | 971,136 | | | | 14,673,865 | |

| | | | | | | | |

| | | | | | | 16,129,557 | |

| | | | | | | | |

| | |

Software - 0.07% | | | | | | | | |

ReadSoft AB, Class B | | | 58,367 | | | | 348,004 | |

| | | | | | | | |

| | |

Telecommunications - 3.01% | | | | | | | | |

Cbeyond, Inc.(a) | | | 200,931 | | | | 1,983,189 | |

DigitalGlobe, Inc.(a)(d) | | | 139,367 | | | | 4,231,182 | |

HC2 Holdings, Inc. | | | 45,748 | | | | 185,279 | |

Juniper Networks, Inc.(a)(d) | | | 166,098 | | | | 4,062,757 | |

T-Mobile US, Inc.(a)(d) | | | 48,239 | | | | 1,656,045 | |

Verizon Communications, Inc.(d) | | | 45,136 | | | | 2,254,995 | |