UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09815

THE ARBITRAGE FUNDS

(exact name of registrant as specified in charter)

41 Madison Avenue, 42nd Floor, New York, NY 10010

(Address of principal executive offices) (Zip code)

John S. Orrico

Water Island Capital, LLC

41 Madison Avenue

42nd Floor

New York, NY 10010

(Name and address of agent for service)

Registrant’s telephone number, including area code: 212-584-2366

Date of fiscal year end: May 31

Date of reporting period: June 1, 2014 – May 31, 2015

Item 1. Reports to Stockholders.

| Shareholder Letter | | 1 |

| The Arbitrage Fund | | |

| Manager Commentary | | 3 |

| Portfolio Information | | 6 |

| Portfolio of Investments | | 8 |

| The Arbitrage Event-Driven Fund | | |

| Manager Commentary | | 20 |

| Portfolio Information | | 23 |

| Portfolio of Investments | | 25 |

| The Arbitrage Credit Opportunities Fund | | |

| Mana ger Commentary | | 47 |

| Portfolio Information | | 50 |

| Portfolio of Investments | | 52 |

| The Arbitrage Tactical Equity Fund | | |

| Mana ger Commentary | | 65 |

| Portfolio Information | | 67 |

| Portfolio of Investments | | 69 |

| Statement of Assets and Liabilities | | |

| The Arbitrage Fund | | 81 |

| The Arbitrage Event-Driven Fund | | 83 |

| The Arbitrage Credit Opportunities Fund | | 85 |

| The Arbitrage Tactical Equity Fund | | 87 |

| Statement of Operations | | |

| The Arbitrage Fund | | 89 |

| The Arbitrage Event-Driven Fund | | 90 |

| The Arbitrage Credit Opportunities Fund | | 92 |

| The Arbitrage Tactical Equity Fund | | 94 |

| Statements of Changes in Net Assets | | |

| The Arbitrage Fund | | 96 |

| The Arbitrage Event-Driven Fund | | 98 |

| The Arbitrage Credit Opportunities Fund | | 100 |

| The Arbitrage Tactical Equity Fund | | 102 |

| Financial Highlights | | |

| The Arbitrage Fund - Class R | | 104 |

| The Arbitrage Fund - Class I | | 106 |

| The Arbitrage Fund - Class C | | 108 |

| The Arbitrage Fund - Class A | | 110 |

| The Arbitrage Event-Driven Fund - Class R | | 112 |

| The Arbitrage Event-Driven Fund - Class I | | 114 |

| The Arbitrage Event-Driven Fund - Class C | | 116 |

| The Arbitrage Event-Driven Fund - Class A | | 118 |

| The Arbitrage Credit Opportunities Fund - Class R | | 120 |

| The Arbitrage Credit Opportunities Fund - Class I | | 122 |

| The Arbitrage Credit Opportunities Fund - Class C | | 124 |

| The Arbitrage Credit Opportunities Fund - Class A | | 126 |

| The Arbitrage Tactical Equity Fund - Class R | | 128 |

| The Arbitrage Tactical Equity Fund - Class I | | 129 |

| The Arbitrage Tactical Equity Fund - Class C | | 130 |

| The Arbitrage Tactical Equity Fund - Class A | | 131 |

| Notes to Financial Statements | | 132 |

| Report of Independent Registered Public Accounting Firm | | 164 |

| Disclosure of Fund Expenses | | 165 |

| Additional Information | | 168 |

| Trustees’ Approval of Advisory Agreement | | 169 |

| Trustees & Officers | | 173 |

| The Arbitrage Fund | Shareholder Letter |

| | May 31, 2015 |

Dear Fellow Shareholders,

For event-driven investors, 2014 was a challenging year – but not for want of opportunities. A slow-growth global economy, attractive financing terms, cash-rich balance sheets, and rich acquisition currency reignited efforts to unlock shareholder value, whether through spin-offs, restructurings, refinancings, acquisitions or other corporate actions. Amidst the positive trends, macroeconomic uncertainties – from falling energy prices to geopolitical uncertainties in Europe and Asia – elongated many corporate event timelines and made it difficult for event-driven managers to recognize positive returns for investors in the near-term.

Yet much of the opportunity set we saw ahead of us a year ago remains intact today. Both shareholder activism and mergers and acquisitions (M&A) activity are reaching record levels in 2015. Corporate management teams, increasingly turning to M&A as an avenue for growth, have driven global M&A volume in the first half of calendar year 2015 to $2.3 trillion. This is the second-highest volume for a six-month period in history, behind only the first half of 2007, according to Dealogic. Much of this deal flow is in the large cap space, with transactions greater than $10 billion reaching an all-time high.

More importantly, amidst the increasing deal flow, we’re witnessing a broadening of activity throughout sectors and market caps. While certain sectors such as health care, telecom and technology continue to lead the charge, deal flow is increasing across the board. In addition, whereas last year we saw acquisition activity concentrated amongst larger, well-established players, we are now beginning to see more acquisitions sourced from the lower end of the market cap spectrum, as well as a pickup in activity in Europe. This, finally, is the healthy environment for M&A we’ve been waiting for. On top of it all, we are still seeing elevated deal spreads relative to what we witnessed in the period leading up to the Shire/AbbVie deal break in October 2014. That terminated transaction reverberated throughout the merger arbitrage space, causing a re-pricing of risk that remains today. With a healthy amount of deal flow in front of us and a more optimal spread environment than we’ve seen in years, we feel confident our merger arbitrage team will be able to focus on constructing a portfolio that avoids deals at the riskiest end of the spectrum yet still offers favorable rates of return.

On the equity special situations side, M&A is delivering both pre-arbitrage situations as well as post-deal re-rating situations. Combined with a flood of shareholder activism and spin-off activity, we see ample opportunity in the equity markets. While a number of our equity special situations trades have experienced elevated levels of volatility relative to our other strategies – which is to be expected – we have high conviction in these names, we believe our theses are sound, and we feel patience is warranted as we wait for these situations to play out.

For our credit opportunities team, the fiscal year began with wide-open credit markets. Fears of imminent increases in interest rates failed to materialize – and likely won’t until September 2015 at the earliest. The severe decline in oil prices in the second half of 2014, however, caused a more significant disruption that rippled throughout the high yield markets – particularly in companies associated with the energy sector. While energy failed to stage a substantial recovery, credit markets nonetheless stabilized and moved higher in a fairly orderly fashion.

| | |

| Annual Report | May 31, 2015 | 1 |

| The Arbitrage Fund | Shareholder Letter (continued) |

| | May 31, 2015 |

Following the dislocation in oil prices, we foresee a large universe of opportunities looming in the energy and commodities space. While these situations are highly dependent on the direction of commodity prices such as oil, iron ore, and coal, capital structures for many companies in these sectors have been severely weakened. At the other end of the spectrum, we anticipate the increase in M&A activity will translate into more merger-related debt opportunities for us. We also expect that activist pressure on corporate managements and boards will translate into more spin-offs and asset sales, which, in turn, can lead to more refinancing and deleveraging activity from which to choose. We are particularly fond of these types of investments as their firmer catalysts and shorter durations can help produce lower correlated and less volatile returns.

While the timeline for rising interest rates continues to be extended, it is not a pipe dream – eventually, rates will rise. Investors are keenly aware of what could occur to the credit markets once the Federal Reserve finally begins to ratchet rates upward, and we continue to take steps to reduce potential liquidity risks in our portfolios, particularly by focusing on the aforementioned firmer, shorter-dated catalysts; increasing the number of short credit ideas we implement; tempering the pace at which we build positions in bonds with high exchange-traded fund (ETF) ownership; maintaining higher cash levels; and increasing our opportunistic hedging programs.

Amidst these factors, our investment teams remain anchored to our discipline of capitalizing on corporate catalysts by understanding the rationale and underlying complexities of each event, sharing insights between our teams, using hedging to mitigate market influence, and building well-diversified portfolios. As always, we maintain a focus on risk management, with a keen eye toward downside protection. We believe through this approach, the Arbitrage Funds family can generate attractive long-term results with lower volatility and lower correlation to the broader equity and credit markets.

We are grateful for your continued trust and support.

Sincerely,

The Investment Team at Water Island Capital

The statements and opinions expressed are those of the author as of the date of this report. All information is historical and not indicative of future results and subject to change. This information is not a recommendation to buy or sell any security.

Definitions

A spread, or deal spread, is the difference between the price at which a target company’s shares currently trade, and the price an acquiring company has agreed to pay.

Deal flow refers to the volume of announced mergers and acquisitions activity.

Taper Tantrum refers to the period during the summer of 2013 when investor fear caused market volatility and Treasury yields to spike in response to the Federal Reserve publicly discussing plans to potentially taper its quantitative easing program, a bond buying program designed to stimulate the economy.

The Bank of America Merrill Lynch U.S. High Yield Master II Index measures the broad U.S. high yield market, and is commonly used as a benchmark for high yield corporate bonds.

| | |

| 2 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Manager Commentary (continued) |

| | May 31, 2015 (Unaudited) |

The Arbitrage Fund | Tickers: ARBNX, ARBFX, ARBCX, ARGAX

The Fund’s Goal and Main Investments Merger arbitrage is a sub‐set of a broader event‐driven investment strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically merger arbitrage is a low volatility strategy pursued by absolute‐return‐minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets. |

Investment Strategy

The Fund seeks to achieve capital growth by engaging in merger arbitrage. The strategy’s focus is to capture returns from corporate events, generate market neutral capital growth, preservation of capital, consistent and positive returns, and achieve low correlation, and low volatility. The Fund’s general investment approach can be best described as risk averse, and many systems, policies, and procedures are in place to facilitate this low‐risk approach. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly‐announced mergers, takeovers, tender offers, leveraged buyouts, spin‐offs, liquidations, and other corporate reorganizations. The Fund’s investment advisor uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition’s completion. That difference, or “spread,” is the primary driver of returns for this strategy. There is no limit to the number of stocks the Fund can hold; however, the Fund typically invests in 40 to 80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock‐for‐stock deal) and, in many cases, associated derivative positions for hedging purposes.

Commentary

Last year began with hostile offers, topping bids, and auction processes peppering the M&A landscape, including 2014’s largest proposed transaction: Pfizer’s unsolicited $118 billion bid for AstraZeneca. This benign environment of moderate deal flow and few deal disruptions was upended by the return of volatility to the merger arbitrage space in the second half of 2014, leading to spreads widening in long-dated deals and the re-pricing of risk on newly announced deals. This turmoil created the most attractive entry points for arbitrageurs in nearly four years.

The fallout was brought on by a recent trend in acquiring companies engaging in transactions predicated on tax inversions, whereby a corporation domiciled in a high-tax jurisdictions (primarily the U.S.) will purchase a company in an area with lower corporate taxes, such as the U.K. or Netherlands, and then re-domicile the combined entity in the lesser-tax jurisdiction. This peculiarity of M&A activity ground to a screeching halt in October, when the board of Shire recommended that shareholders vote against an agreed-to takeover by AbbVie. Prior to this, tax inversions were popular in the pharmaceutical industry, where nearly half of $650 billion in deals in the sector – including Medtronic’s $46 billion bid for Covidien; Valeant Pharmaceutical’s $47 billion hostile offer for Allergan (which in November agreed to a $65 billion deal with Actavis, fresh off its acquisition of Forest Laboratories); and of course AbbVie’s $55 billion offer for Shire – were contingent on this maneuver. But in late September 2014, the U.S. Treasury proposed new rules designed to curtail the financial benefits of tax inversions, hoping to curb the flow of tax dollars overseas. Spreads on these deals widened as the prospect of further government intervention gave investors pause.

| | |

| Annual Report | May 31, 2015 | 3 |

| The Arbitrage Fund | Manager Commentary (continued) |

| | May 31, 2015 (Unaudited) |

These fears were justified when AbbVie withdrew its offer for Shire in October, just weeks after Treasury’s announcement, citing the proposed new rules as a reason. The demise of this popular trade reverberated widely, ushering the return of volatility and a re-pricing of risk in the merger arbitrage space. Speculators and arbitrageurs with outsized, unhedged exposure to this transaction were forced to reduce portfolio risk by selling positions in complicated, long-dated deals, and crowded into transactions with a perceived high degree of certainty of closing. As a result, new deals started to be attractively priced. The net effect was that average deal spreads widened to levels not seen since 2011. To date, though they have narrowed somewhat from the immediate aftermath, spreads have remained at elevated levels. When combined with record-breaking amounts of deal flow announced in the opening months of calendar year 2015, we foresee a promising environment for the strategy.

Fiscal Year Highlights

In fiscal 2015, the Arbitrage Fund (ARBNX) returned 3.51%. The results were predominantly derived from companies residing in the Americas. In terms of sectors, consumer staples and health care companies were the top contributors, while energy and utilities sectors added the least to results.

One of the best performing investments of the year was the acquisition of Allergan by Actavis for $65 billion. In April 2014, Valeant and Pershing Square Capital, Allergan’s largest shareholder, combined efforts for a $47 billion hostile offer to purchase Allergan. Allergan sports a robust portfolio of medical aesthetic drugs and products, the most well known being Botox. Despite Valeant increasing its bid in late May, another company, Actavis, entered with a topping bid in November and Valeant walked away a few days later. The deal closed in March and the Fund profited by holding a core position in Allergan.

Our participation in the bidding war for Hillshire Brands was also a strong contributor to results. We recognized Hillshire Brands, a maker of well‐known processed meats and foods, to be a scarce asset and a takeover target in the fast‐consolidating food processing industry. When Hillshire announced its acquisition of Pinnacle Foods, we believed it could be the start of something much bigger – something that could ultimately include bids for Hillshire itself – and we positioned the Fund accordingly. After a bidding contest, Tyson Foods’ $8 billion bid (which was nearly 40% above the initial offer from competitor Pilgrim’s Pride) ultimately won out.

We also profited from another health care deal which resulted from Valeant’s spurned bid for Allergan. After losing the battle for Allergan in November 2014, Valeant began searching for its next acquisition target, eventually settling on Salix Pharmaceuticals. Soon after Valeant announced their acquisition intentions in late February, Endo International emerged with a topping bid. The bidding war ended in Valeant’s favor, along with an added condition that the deal close quickly. The Fund benefited from the quick deal turnaround (the deal closed April 1) as well as the topping bid.

| | |

| 4 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Manager Commentary (continued) |

| | May 31, 2015 (Unaudited) |

The aforementioned derailed acquisition of Shire by AbbVie, was the Fund’s biggest drag on performance. In June 2014, U.S.-based pharmaceutical company AbbVie made an unsolicited offer to acquire Shire, a U.K.-based pharmaceutical company. AbbVie intended to utilize a tax inversion strategy to re-domicile in the U.K. upon completing the transaction. This deal was terminated during the fourth quarter of 2014 when efforts by the U.S. government to stem the tide of tax inversions led AbbVie’s board to recommend that shareholders vote against the deal, causing AbbVie to walk away from the transaction.

Another deal that weighed on performance during the period was our position in Steris’ proposal to acquire Synergy Health. In May 2015, the U.S. Department of Justice (DOJ) sued to block this transaction, citing competition concerns. While Steris is currently litigating the decision, and we expect the company to come to an agreement with the DOJ, given that the timeline on this transaction has now been significantly extended we have reduced our exposure.

Outlook

As acquisitions continue to replace share buybacks, dividend increases, and cost-cutting efforts – particularly in slow growth, global industries – deal volume should remain elevated. The momentum from large- and mega-cap transaction activity usually cascades to other capitalization levels, which would give us a broader opportunity set, and we have started to witness the early innings of this trend occurring.

The return of volatility to the merger arbitrage space has led to spreads widening in long-dated deals and the re-pricing of risk on newly announced deals. We believe this marks the beginning of a more normalized spread environment, whereby investors begin to price risk appropriately. Furthermore, while the specter of rising interest rates – which have historically provided a tailwind for merger arbitrage returns – has loomed on the horizon for some time now, even if short-term rates remain at historically low levels, as long as volatility persists we believe our approach to investing in definitive, announced merger deals should yield attractive risk-adjusted returns.

Sincerely,

The Investment Team at Water Island Capital

| | |

| Annual Report | May 31, 2015 | 5 |

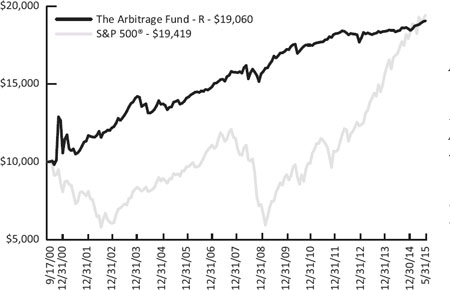

Performance (annualized returns as of May 31, 2015)

| | One

Year | Five

Year | Ten

Year | Since

Inception* |

| Arbitrage Fund, Class R | 3.35% | 2.35% | 3.50% | 4.49% |

| Arbitrage Fund, Class I | 3.51% | 2.60% | 3.73% | 3.25% |

| Arbitrage Fund, Class C ** | 1.52% | N/A | N/A | 0.87% |

| Arbitrage Fund, Class A*** | 0.71% | N/A | N/A | 0.93% |

| HFRI Event Driven: Merger Arbitrage Index | 4.63% | 3.74% | 5.09% | 4.73% |

S&P 500® Index | 11.81% | 16.54% | 8.12% | 4.62% |

| Barclays Capital U.S. Aggregate Bond Index | 3.03% | 3.90% | 4.61% | 5.44% |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R inception: 9/17/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A

inception: 6/1/13.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 2.50% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 0.50% on purchases of $250,000 or more purchased without a front-end sales load and redeemed within 12 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.17%, 1.92%, 2.92% and 2.17%, respectively.

The HFRI Event Driven: Merger Arbitrage Index is an index consisting of merger arbitrage strategies which employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre-, post-date or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits.

The S&P 500® Index is an unmanaged index consisting of 500 stocks.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| 6 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio Information (continued) |

| | May 31, 2015 (Unaudited) |

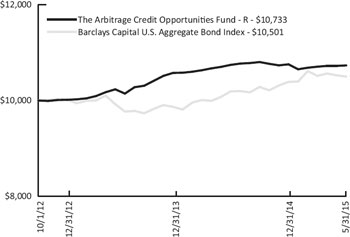

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

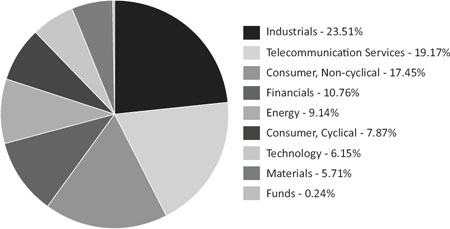

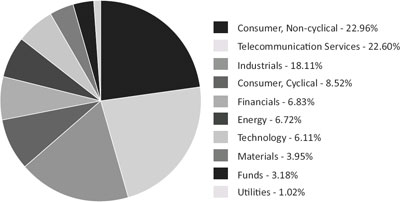

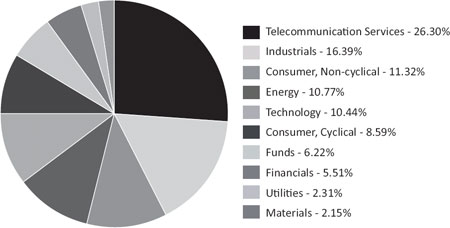

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Fund’s investments in common stock and limited partnerships as of the report date.

| | |

| Annual Report | May 31, 2015 | 7 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.64% | |

| Banks - 3.60% | |

Bank of Kentucky Financial Corp.(a) | | | 256,265 | | | $ | 12,636,427 | |

| City National Corp. | | | 408,652 | | | | 37,669,541 | |

Hudson Valley Holding Corp.(a) | | | 361,039 | | | | 9,329,248 | |

Susquehanna Bancshares, Inc.(a) | | | 1,058,556 | | | | 14,703,343 | |

| | | | | | | | 74,338,559 | |

| | | | | | | | | |

| Biotechnology - 0.48% | |

Synageva BioPharma Corp.(b)(c) | | | 46,895 | | | | 10,007,862 | |

| | | | | | | | | |

| Chemicals - 4.15% | |

Sigma-Aldrich Corp.(a) | | | 592,279 | | | | 82,504,465 | |

| Zep, Inc. | | | 157,436 | | | | 3,142,422 | |

| | | | | | | | 85,646,887 | |

| | | | | | | | | |

| Computers - 0.25% | |

IGATE Corp.(b) | | | 108,000 | | | | 5,131,080 | |

| | | | | | | | | |

| Food - 0.23% | |

Kraft Foods Group, Inc.(c) | | | 56,752 | | | | 4,792,706 | |

| | | | | | | | | |

| Forest Products & Paper - 7.87% | |

MeadWestvaco Corp.(a) | | | 3,218,711 | | | | 162,673,654 | |

| | | | | | | | | |

| Healthcare - Products - 1.20% | |

| Synergy Health Plc | | | 888,814 | | | | 24,764,786 | |

| | | | | | | | | |

| Insurance - 3.04% | |

PartnerRe Ltd.(a)(c) | | | 478,716 | | | | 62,917,644 | |

| | | | | | | | | |

| Internet - 0.80% | |

AOL, Inc.(b)(c) | | | 116,131 | | | | 5,807,711 | |

ClickSoftware Technologies Ltd.(b) | | | 846,318 | | | | 10,646,681 | |

| | | | | | | | 16,454,392 | |

| | | | | | | | | |

| Leisure Time - 4.60% | |

Life Time Fitness, Inc.(a)(b) | | | 1,321,874 | | | | 95,042,741 | |

| | | | | | | | | |

| Media - 8.34% | |

DIRECTV(a)(b) | | | 1,893,567 | | | | 172,390,340 | |

| | | | | | | | | |

| Metal Fabricate & Hardware - 2.74% | |

RTI International Metals, Inc.(a)(b) | | | 1,604,054 | | | | 56,574,985 | |

| | | | | | | | | |

| See Notes to Financial Statements. | |

| 8 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.64% (Continued) | |

| Mining - 0.01% | |

Yancoal Australia Ltd.(b) | | | 1,491,115 | | | $ | 171,005 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 5.13% | |

Pall Corp.(a)(c) | | | 417,870 | | | | 51,999,743 | |

Polypore International, Inc.(a)(b) | | | 900,663 | | | | 53,958,720 | |

| | | | | | | | 105,958,463 | |

| | | | | | | | | |

| Oil & Gas - 2.22% | |

Rosetta Resources, Inc.(b) | | | 1,962,345 | | | | 45,840,379 | |

| | | | | | | | | |

| Pharmaceuticals - 14.37% | |

| AbbVie, Inc. | | | 566,947 | | | | 37,753,001 | |

Catamaran Corp.(a)(b)(c) | | | 1,544,087 | | | | 92,413,607 | |

Hospira, Inc.(a)(b)(c) | | | 1,359,737 | | | | 120,227,945 | |

Omnicare, Inc.(c) | | | 487,079 | | | | 46,413,758 | |

| | | | | | | | 296,808,311 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 3.04% | |

Associated Estates Realty Corp.(a) | | | 1,295,583 | | | | 37,040,718 | |

| Excel Trust, Inc. | | | 1,615,769 | | | | 25,674,569 | |

| | | | | | | | 62,715,287 | |

| | | | | | | | | |

| Retail - 3.61% | |

ANN, Inc.(b) | | | 1,294,803 | | | | 60,532,040 | |

World Duty Free SpA(b) | | | 1,263,329 | | | | 13,986,144 | |

| | | | | | | | 74,518,184 | |

| | | | | | | | | |

| Semiconductors - 2.03% | |

| Broadcom Corp., Class A | | | 407,598 | | | | 23,171,946 | |

| CSR Plc | | | 152,433 | | | | 2,057,201 | |

| Micrel, Inc. | | | 1,196,366 | | | | 16,653,415 | |

| | | | | | | | 41,882,562 | |

| | | | | | | | | |

| Software - 4.03% | |

Informatica Corp.(a)(b) | | | 1,524,318 | | | | 73,776,991 | |

Rally Software Development Corp.(b) | | | 483,314 | | | | 9,385,958 | |

| | | | | | | | 83,162,949 | |

| | | | | | | | | |

| Telecommunications - 5.15% | |

| Harris Corp. | | | 312,045 | | | | 24,720,185 | |

Jazztel Plc(b) | | | 5,090,899 | | | | 72,491,654 | |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 9 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.64% (Continued) | |

| Telecommunications - 5.15% (Continued) | |

Procera Networks, Inc.(b) | | | 806,331 | | | $ | 9,272,806 | |

| | | | | | | | 106,484,645 | |

| | | | | | | | | |

| Transportation - 2.75% | |

| Ansaldo STS SpA | | | 3,066,265 | | | | 31,639,344 | |

| Norbert Dentressangle SA | | | 33,911 | | | | 8,178,882 | |

| TNT Express N.V. | | | 2,007,410 | | | | 16,932,392 | |

| | | | | | | | 56,750,618 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $1,643,238,950) | | | | | | | 1,645,028,039 | |

| | | | | | | | | |

| LIMITED PARTNERSHIPS - 2.97% | |

| Pipelines - 2.97% | |

Williams Partners LP(a) | | | 1,099,296 | | | | 61,428,660 | |

| | | | | | | | | |

| TOTAL LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $63,122,705) | | | | | | | 61,428,660 | |

| | | | | | | | | |

| RIGHTS - 0.52% | |

ArthroCare Corp., CVR(b)(d)(e) | | | 3,215,721 | | | | 1,085,627 | |

Casa Ley, CVR(b)(d)(e) | | | 6,223,326 | | | | 2,249,732 | |

Chelsea Therapeutics, CVR(b)(d)(e) | | | 2,389,273 | | | | 194,726 | |

Cubist Pharmaceuticals, Inc., CPR(b)(d)(e) | | | 119,343 | | | | 0 | |

Leap Wireless International, CVR(b)(d)(e) | | | 1,783,190 | | | | 6,865,282 | |

PDC, CVR(b)(d)(e) | | | 6,223,326 | | | | 140,025 | |

Trius Therapeutics, CVR(b)(d)(e) | | | 1,034,403 | | | | 175,745 | |

| | | | | | | | | |

| TOTAL RIGHTS | | | | | | | | |

| (Cost $12,345,884) | | | | | | | 10,711,137 | |

| | | | | | | | | |

| | | Expiration

Date | | | Exercise

Price | | | Contracts | | | Value | |

PURCHASED OPTIONS(b)- 0.15% | |

| Call Options Purchased - 0.08% | |

| AT&T, Inc. | | | 06/2015 | | | $ | 35.00 | | | | 39,416 | | | $ | 1,458,392 | |

| Catamaran Corp. | | | 10/2015 | | | | 62.50 | | | | 418 | | | | 2,090 | |

| Kraft Foods Group, Inc. | | | 09/2015 | | | | 90.00 | | | | 383 | | | | 24,895 | |

| Noble Energy, Inc.: | | | | | | | | | | | | | | | | |

| | | | 06/2015 | | | | 47.50 | | | | 2,086 | | | | 41,720 | |

| | | | 08/2015 | | | | 50.00 | | | | 1,321 | | | | 69,353 | |

| See Notes to Financial Statements. | |

| 10 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Expiration

Date | | | Exercise

Price | | | Contracts | | | Value | |

PURCHASED OPTIONS(b)- 0.15% (Continued) | |

| Call Options Purchased - 0.08% (Continued) | |

| Omnicare, Inc. | | | 09/2015 | | | $ | 100.00 | | | | 128 | | | $ | 960 | |

| | | | | | | | | | | | | | | | | |

| TOTAL CALL OPTIONS PURCHASED | | | | | | | | | | | | | |

| (Cost $2,247,234) | | | | | | | | | | | | | | | 1,597,410 | |

| | | | | | | | | | | | | | | | | |

| Put Options Purchased - 0.07% | |

| Alcoa, Inc. | | | 06/2015 | | | | 12.00 | | | | 16,226 | | | | 186,599 | |

| Avago Technologies Ltd.: | | | | | | | | | | | | | | | | |

| | | | 06/2015 | | | | 135.00 | | | | 57 | | | | 4,275 | |

| | | | 06/2015 | | | | 140.00 | | | | 57 | | | | 9,120 | |

| Axis Capital Holdings Ltd. | | | 09/2015 | | | | 50.00 | | | | 1,243 | | | | 71,473 | |

| Catamaran Corp. | | | 10/2015 | | | | 57.50 | | | | 153 | | | | 14,535 | |

| Dresser-Rand Group, Inc. | | | 06/2015 | | | | 75.00 | | | | 146 | | | | 730 | |

| Family Dollar Stores, Inc. | | | 07/2015 | | | | 72.50 | | | | 2,860 | | | | 107,250 | |

| Hospira, Inc. | | | 08/2015 | | | | 70.00 | | | | 2 | | | | 5 | |

| Kraft Foods Group, Inc. | | | 09/2015 | | | | 82.50 | | | | 2,139 | | | | 454,537 | |

| Microchip Technology, Inc. | | | 10/2015 | | | | 46.00 | | | | 72 | | | | 11,880 | |

| Orbitz Worldwide, Inc.: | | | | | | | | | | | | | | | | |

| | | | 08/2015 | | | | 10.00 | | | | 6,554 | | | | 81,925 | |

| | | | 01/2016 | | | | 10.00 | | | | 1,156 | | | | 28,900 | |

| Synageva BioPharma Corp.: | | | | | | | | | | | | | | | | |

| | | | 07/2015 | | | | 165.00 | | | | 480 | | | | 280,800 | |

| | | | 07/2015 | | | | 170.00 | | | | 287 | | | | 185,115 | |

| ZF TRW Automotive Holdings Corp. | | | 07/2015 | | | | 95.00 | | | | 923 | | | | 0 | |

| | | | | | | | | | | | | | | | | |

| TOTAL PUT OPTIONS PURCHASED | | | | | | | | | | | | | |

| (Cost $1,451,659) | | | | | | | | | | | | | | | 1,437,144 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| TOTAL PURCHASED OPTIONS | | | | | | | | | | | | | |

| (Cost $3,698,893) | | | | | | | | | | | | | | | 3,034,554 | |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 11 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Yield | | | Shares | | | Value | |

| SHORT-TERM INVESTMENTS - 17.05% | |

| Money Market Fund | |

| State Street Institutional Liquid Reserves Fund | | | 0.100 | %(f) | | | 352,115,204 | | | $ | 352,115,204 | |

| | | | | | | | | | | | | |

| TOTAL SHORT-TERM INVESTMENTS | | | | | | | | | | | | |

| (Cost $352,115,204) | | | | | | | | | | | 352,115,204 | |

| | | | | | | | | | | | | |

Total Investments - 100.33% (Cost $2,074,521,636) | | | | | | | | | | | 2,072,317,594 | |

| | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.33%) | | | | | | | | | | | (6,776,045 | )(g) |

| | | | | | | | | | | | | |

| NET ASSETS - 100.00% | | | | | | | | | | $ | 2,065,541,549 | |

| (a) | Security, or a portion of security, is being held as collateral for short sales or written option contracts. At period end, the aggregate market value of those securities was $485,877,750, representing 23.52% of net assets. |

| (b) | Non-income-producing security. |

| (c) | Underlying security for a written/purchased call/put option. |

| (d) | Security considered illiquid. On May 31, 2015, the total market value of these securities was $10,711,137, representing 0.52% of net assets. |

| (e) | Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2015, the total market value of these securities was $10,711,137, representing 0.52% of net assets. |

| (f) | Rate shown is the 7-day effective yield as of May 31, 2015. |

| (g) | Includes cash which is being held as collateral for short sales and written option contracts. |

Securities are determined to be illiquid under the procedures approved by the Funds’ Board of Trustees. Information related to the illiquid securities is as follows:

| Date of Purchase | Security | | Cost | | | Market Value | | | % of Net Assets | |

| 05/30/2014 | ArthroCare Corp., CVR | | $ | 1,125,502 | | | $ | 1,085,627 | | | | 0.05 | % |

| 01/30/2015 | Casa Ley, CVR | | | 6,316,054 | | | | 2,249,732 | | | | 0.11 | |

| 06/24/2014 | Chelsea Therapeutics, CVR | | | 0 | | | | 194,726 | | | | 0.01 | |

| 12/12/2011 | Cubist Pharmaceuticals, Inc., CPR | | | 0 | | | | 0 | | | | 0.00 | |

| 03/14/2014 | Leap Wireless International, CVR | | | 4,600,630 | | | | 6,865,282 | | | | 0.33 | |

| 01/30/2015 | PDC, CVR | | | 303,698 | | | | 140,025 | | | | 0.01 | |

| 09/12/2013 | Trius Therapeutics, CVR | | | 0 | | | | 175,745 | | | | 0.01 | |

| | | | | | | | $ | 10,711,137 | | | | 0.52 | % |

| See Notes to Financial Statements. | |

| 12 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| COMMON STOCKS - (29.42%) | |

| Banks - (1.95%) | |

| BB&T Corp. | | | (526,985 | ) | | $ | (20,800,098 | ) |

| Royal Bank of Canada | | | (305,981 | ) | | | (19,469,571 | ) |

| | | | | | | | (40,269,669 | ) |

| | | | | | | | | |

| Biotechnology - (0.24%) | |

| Alexion Pharmaceuticals, Inc. | | | (30,864 | ) | | | (5,056,758 | ) |

| | | | | | | | | |

| Healthcare - Products - (1.24%) | |

| STERIS Corp. | | | (382,876 | ) | | | (25,587,603 | ) |

| | | | | | | | | |

| Mining - (2.26%) | |

| Alcoa, Inc. | | | (3,730,572 | ) | | | (46,632,150 | ) |

| | | | | | | | | |

| Oil & Gas - (2.04%) | |

| Noble Energy, Inc. | | | (963,429 | ) | | | (42,178,921 | ) |

| | | | | | | | | |

| Packaging & Containers - (7.92%) | |

| Rock-Tenn Co., Class A | | | (2,509,826 | ) | | | (163,490,066 | ) |

| | | | | | | | | |

| Pharmaceuticals - (1.83%) | |

| AbbVie, Inc. | | | (566,947 | ) | | | (37,753,001 | ) |

| | | | | | | | | |

| Pipelines - (3.03%) | |

| Williams Companies, Inc. | | | (1,225,688 | ) | | | (62,632,657 | ) |

| | | | | | | | | |

| Retail - (0.63%) | |

| Ascena Retail Group, Inc. | | | (880,337 | ) | | | (13,011,381 | ) |

| | | | | | | | | |

| Savings & Loans - (0.45%) | |

| Sterling Bancorp | | | (693,093 | ) | | | (9,363,686 | ) |

| | | | | | | | | |

| Semiconductors - (0.60%) | |

| Avago Technologies Ltd. | | | (83,490 | ) | | | (12,362,364 | ) |

| | | | | | | | | |

| Telecommunications - (7.23%) | |

| AT&T, Inc. | | | (3,607,318 | ) | | | (124,596,764 | ) |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 13 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | | Value | |

| COMMON STOCKS - (29.42%)(Continued) | |

| Telecommunications - (7.23%) (Continued) | |

| Harris Corp. | | | (312,052 | ) | | $ | (24,720,759 | ) |

| | | | | | | | (149,317,523 | ) |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Proceeds $613,737,060) | | | | | | | (607,655,779 | ) |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS - (0.27%) | |

| Equity Funds - (0.27%) | |

SPDR® S&P 500® ETF Trust | | | (26,087 | ) | | | (5,507,748 | ) |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED FUNDS | | | | | | | | |

| (Proceeds $5,342,119) | | | | | | | (5,507,748 | ) |

| | | | | | | | | |

RIGHTS - (0.00%)(a) | |

| Chelsea Therapeutics, CVR | | | (1,100 | ) | | | (90 | ) |

| | | | | | | | | |

| TOTAL RIGHTS | | | | | | | | |

| (Proceeds $0) | | | | | | | (90 | ) |

| | | | | | | | | |

| TOTAL SECURITIES SOLD SHORT - (29.69%) | | | | | |

| (Proceeds $619,079,179) | | | | | | $ | (613,163,617 | ) |

(a) | Less than (0.005%) of net assets. |

SCHEDULE OF

WRITTEN OPTIONS | | Expiration

Date | | | Exercise Price | | | Contracts | | | Value | |

| Written Call Options | |

| Alcoa, Inc. | | | 06/2015 | | | $ | 13.00 | | | | (8,113 | ) | | $ | (85,186 | ) |

| AOL, Inc.: | | | | | | | | | | | | | | | | |

| | | | 06/2015 | | | | 50.00 | | | | (144 | ) | | | (1,440 | ) |

| | | | 07/2015 | | | | 50.00 | | | | (1,161 | ) | | | (17,415 | ) |

| Avago Technologies Ltd. | | | 06/2015 | | | | 145.00 | | | | (57 | ) | | | (33,060 | ) |

| Catamaran Corp. | | | 07/2015 | | | | 65.00 | | | | (153 | ) | | | (383 | ) |

| Hospira, Inc. | | | 08/2015 | | | | 90.00 | | | | (350 | ) | | | (1,750 | ) |

| Kraft Foods Group, Inc.: | | | | | | | | | | | | | | | | |

| | | | 06/2015 | | | | 85.00 | | | | (164 | ) | | | (13,940 | ) |

| | | | 09/2015 | | | | 85.00 | | | | (356 | ) | | | (80,100 | ) |

| Microchip Technology, Inc. | | | 10/2015 | | | | 50.00 | | | | (72 | ) | | | (16,560 | ) |

| Noble Energy, Inc. | | | 06/2015 | | | | 45.00 | | | | (384 | ) | | | (31,680 | ) |

| Pall Corp. | | | 06/2015 | | | | 125.00 | | | | (380 | ) | | | (2,850 | ) |

| See Notes to Financial Statements. | |

| 14 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

SCHEDULE OF

WRITTEN OPTIONS | | Expiration

Date | | | Exercise Price | | | Contracts | | | Value | |

| Written Call Options (Continued) | |

| ZF TRW Automotive Holdings Corp. | | | 07/2015 | | | $ | 105.00 | | | | (321 | ) | | $ | 0 | |

| | | | | | | | | | | | | | | | | |

| TOTAL WRITTEN CALL OPTIONS | | | | | | | | | | | | | |

| (Premiums received $993,663) | | | | (284,364 | ) |

| Written Put Options | |

| Alcoa, Inc. | | | 06/2015 | | | | 13.00 | | | | (8,113 | ) | | | (478,667 | ) |

| Avago Technologies Ltd. | | | 06/2015 | | | | 145.00 | | | | (269 | ) | | | (75,320 | ) |

| Catamaran Corp. | | | 07/2015 | | | | 57.50 | | | | (153 | ) | | | (4,973 | ) |

| Kraft Foods Group, Inc.: | | | | | | | | | | | | | | | | |

| | | | 06/2015 | | | | 82.50 | | | | (66 | ) | | | (3,135 | ) |

| | | | 06/2015 | | | | 83.50 | | | | (40 | ) | | | (3,000 | ) |

| | | | 06/2015 | | | | 85.00 | | | | (306 | ) | | | (42,840 | ) |

| | | | 09/2015 | | | | 87.50 | | | | (399 | ) | | | (191,520 | ) |

| Noble Energy, Inc. | | | 06/2015 | | | | 42.50 | | | | (1,461 | ) | | | (105,922 | ) |

| Omnicare, Inc. | | | 06/2015 | | | | 95.00 | | | | (135 | ) | | | (6,075 | ) |

| Pall Corp. | | | 06/2015 | | | | 120.00 | | | | (362 | ) | | | (2,715 | ) |

| PartnerRe Ltd. | | | 08/2015 | | | | 130.00 | | | | (202 | ) | | | (62,115 | ) |

| | | | | | | | | | | | | | | | | |

| TOTAL WRITTEN PUT OPTIONS | | | | | | | | | | | | | |

| (Premiums received $656,452) | | | | (976,282 | ) |

| | | | | | | | | | | | | | | | | |

| TOTAL WRITTEN OPTIONS | | | | | | | | | | | | | |

| (Premiums received $1,650,115) | | | $ | (1,260,646 | ) |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 15 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

EQUITY SWAP CONTRACTS

| Swap Counterparty | Reference

Obligation | Rate

Paid/Received

by the Fund | Termination

Dates | | Notional

Amount | | | Unrealized

Appreciation | |

| Goldman, Sachs & Co. | Brit Plc | 1 Month-LIBOR

plus 0.45 bps | 04/12/2016 | | $ | 18,131,985 | | | $ | 73,938 | |

| Morgan Stanley | Brit Plc | 1 Day-SONIA

minus 0.90 bps | 02/17/2017 | | | 12,048,241 | | | | 38,851 | |

| Goldman, Sachs & Co. | Domino Printing Sciences Plc | 1 Month-LIBOR

plus 0.45 bps | 05/31/2016 | | | 39,986 | | | | 77 | |

| | | | | | $ | 30,220,212 | | | $ | 112,866 | |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Contract

Description | | Contracts to

Deliver/Receive | | Purchase/Sale

Contract | Expiration

Date | | Current Value | | | Unrealized

Appreciation | |

| AUD | | | 85,509,113 | | Sale | 06/15/2015 | | $ | 65,316,959 | | | $ | 77,029 | |

| CAD | | | 2,035,616 | | Purchase | 06/15/2015 | | | 1,636,415 | | | | 45,701 | |

| EUR | | | 93,602,600 | | Purchase | 06/15/2015 | | | 102,826,651 | | | | 2,726,705 | |

| NOK | | | 53,047,200 | | Purchase | 06/15/2015 | | | 6,822,825 | | | | 142,808 | |

| SEK | | | 255,742,400 | | Purchase | 06/15/2015 | | | 30,003,512 | | | | 742,442 | |

| SGD | | | 2,609,200 | | Purchase | 06/15/2015 | | | 1,934,741 | | | | 51,205 | |

| | | | | | | | | | | | | $ | 3,785,890 | |

Contract

Description | | Contracts to

Deliver/Receive | | Purchase/Sale

Contract | Expiration

Date | | Current Value | | | Unrealized

Depreciation | |

| AUD | | | 85,285,400 | | Purchase | 06/15/2015 | | $ | 65,146,073 | | | $ | (326,711 | ) |

| CAD | | | 2,035,616 | | Sale | 06/15/2015 | | | 1,636,415 | | | | (37,122 | ) |

| EUR | | | 225,317,398 | | Sale | 06/15/2015 | | | 247,521,260 | | | | (5,238,611 | ) |

| GBP | | | 5,310,400 | | Sale | 06/15/2015 | | | 8,115,424 | | | | (2,429,875 | ) |

| NOK | | | 56,524,500 | | Sale | 06/15/2015 | | | 7,270,068 | | | | (375,894 | ) |

| SEK | | | 255,742,400 | | Sale | 06/15/2015 | | | 30,003,512 | | | | (308,783 | ) |

| SGD | | | 2,609,200 | | Sale | 06/15/2015 | | | 1,934,741 | | | | (61,776 | ) |

| | | | | | | | | | | | | $ | (8,778,772 | ) |

| See Notes to Financial Statements. | |

| 16 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

The following is a summary of investments classified by foreign country exposure:

| Country | | % of Net Assets(a) | |

| Great Britain | | | 4.71 | % |

| Bermuda | | | 3.05 | % |

| Italy | | | 2.21 | % |

| Netherlands | | | 0.82 | % |

| Israel | | | 0.51 | % |

| France | | | 0.40 | % |

| United Kingdom | | | 0.10 | % |

| Australia | | | 0.01 | % |

| United States | | | 88.52 | % |

| Liabilities in Excess of Other Assets | | | (0.33 | )% |

| | | | 100.00 | % |

(a) | These percentages represent long positions only and are not net of short positions. |

| Abbreviations: |

| |

| AUD - Australian Dollar |

| bps - Basis Points |

| CAD - Canadian Dollar |

| CPR - Conditional Prepayment Rate |

| CVR - Contingent Value Rights |

| ETF - Exchange-Traded Fund |

| EUR - Euro |

| GBP - British Pound |

| LIBOR - London Interbank Offered Rate |

| LP - Limited Partnership |

| Ltd. - Limited |

| NOK - Norwegian Kronor |

| N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation |

| Plc - Public Limited Company |

| SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company |

| SEK - Swedish Kronor |

| SGD - Singapore Dollar |

| SONIA - Sterling OverNight Index Average |

| S&P - Standard & Poor’s |

| SpA - Societa per Azione |

| SPDR - Standard & Poor’s Depositary Receipt |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 17 |

| The Arbitrage Fund | |

| | May 31, 2015 |

The following table summarizes the Arbitrage Fund’s investments and derivative financial instruments categorized in the disclosure hierarchy as of May 31, 2015:

| | | | | | | | | | | | | |

Investments in Securities at Value* | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | |

Common Stocks** | | $ | 1,645,028,039 | | | $ | – | | | $ | – | | | $ | 1,645,028,039 | |

| Limited Partnerships | | | 61,428,660 | | | | – | | | | – | | | | 61,428,660 | |

| Rights | | | – | | | | – | | | | 10,711,137 | | | | 10,711,137 | |

| Purchased Options | | | 3,034,554 | | | | 0 | | | | – | | | | 3,034,554 | |

| Short-Term Investments | | | 352,115,204 | | | | – | | | | – | | | | 352,115,204 | |

| TOTAL | | $ | 2,061,606,457 | | | $ | 0 | | | $ | 10,711,137 | | | $ | 2,072,317,594 | |

| | | | | | | | | | | | | | | | | |

Other Financial Instruments*** | | | | | | | | | | | | | | | | |

| Assets | | | | | | | | | | | | | | | | |

| Equity Swap Contracts | | $ | 112,866 | | | $ | – | | | $ | – | | | $ | 112,866 | |

| Forward Foreign Currency Exchange Contracts | | | – | | | | 3,785,890 | | | | – | | | | 3,785,890 | |

| Liabilities | | | | | | | | | | | | | | | | |

Common Stocks** | | | (607,655,779 | ) | | | – | | | | – | | | | (607,655,779 | ) |

| Exchange-Traded Funds | | | (5,507,748 | ) | | | – | | | | – | | | | (5,507,748 | ) |

| Rights | | | – | | | | – | | | | (90 | ) | | | (90 | ) |

| Written Options | | | (1,260,646 | ) | | | 0 | | | | – | | | | (1,260,646 | ) |

| Forward Foreign Currency Exchange Contracts | | | – | | | | (8,778,772 | ) | | | – | | | | (8,778,772 | ) |

| TOTAL | | $ | (614,311,307 | ) | | $ | (4,992,882 | ) | | $ | (90 | ) | | $ | (619,304,279 | ) |

| * | Refer to footnote 2 where leveling hierarchy is defined. |

| ** | Refer to Portfolio of Investments for sector information. |

| *** | Other financial instruments are instruments such as securities sold short, written options, equity swap contracts, and forward foreign currency contracts. |

| See Notes to Financial Statements. | |

| 18 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Fund | |

| | May 31, 2015 |

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund’s assets and liabilities during the year ended May 31, 2015:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Investments

in Securities | | Balance as

of May 31, 2014 | | | Realized

Gain | | | Change in

Unrealized

Depreciation | | | Purchases | | | Sales

Proceeds | | | Transfer

into

Level 3 | | | Transfer out of Level 3 | | | Balance as

of May 31,

2015 | | | Net change in

unrealized

depreciation

included in the

Statements of

Operations

attributable to

Level 3

investments

held at

May 31, 2015 | |

| Common Stocks | | $ | 21,230 | | | $ | 19,478 | | | $ | (876 | ) | | $ | – | | | $ | (39,832 | ) | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| Rights | | | 7,414,115 | | | | 948,995 | | | | (2,167,292 | ) | | | 6,619,752 | | | | (2,104,433 | ) | | | – | | | | – | | | | 10,711,137 | | | | (1,765,662 | ) |

| Total | | $ | 7,435,345 | | | $ | 968,473 | | | $ | (2,168,168 | ) | | $ | 6,619,752 | | | $ | (2,144,265 | ) | | $ | – $– | | | $ | 10,711,137 | | | $ | (1,765,662 | ) | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Other

Financial

Instruments | | Balance as

of May 31,

2014 | | | Realized

Gain | | | Change in

Unrealized

Depreciation | | | Purchases | | | Sales

Proceeds | | | Transfer

into

Level 3 | | | Transfer out of

Level 3 | | | Balance as

of May 31,

2015 | | | Net change in

unrealized

depreciation

included in the

Statements of

Operations

attributable to

Level 3

investments

held at

May 31, 2015 | |

| Rights | | $ | – | | | $ | – | | | $ | (90 | ) | | $ | – | | | $ | – | | | $ | – $– | | | $ | (90 | ) | | $ | (90 | ) | | | | |

| Total | | $ | – | | | $ | – | | | $ | (90 | ) | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | (90 | ) | | $ | (90 | ) |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 19 |

| The Arbitrage Event-Driven Fund | Manager Commentary |

| | May 31, 2015 |

The Arbitrage Event‐Driven Fund | Tickers: AEDNX, AEDFX, AEFCX, AGEAX

The Fund’s Goal and Main Investments The Fund seeks to provide capital growth by investing in credit and equity securities involved in specific corporate events, with a focus on low volatility and low correlation relative to the broader capital markets. |

Investment Strategy

The Fund’s investment process follows a disciplined, fundamental approach that values downside protection while identifying compelling risk/reward opportunities available to us as we screen catalyst‐driven corporate events, such as mergers and acquisitions, restructurings, refinancings, recapitalizations, spin‐offs, litigation, regulatory changes, bankruptcy, and more. We analyze these events through three core approaches: merger arbitrage, equity special situations, and credit opportunities. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark, and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event‐driven strategy. This process and approach has been an integral part of the culture at Water Island Capital since the firm’s inception.

Commentary

For event-driven investors, 2014 was a challenging year – but not for want of opportunities. A slow-growth global economy, attractive financing terms, cash-rich balance sheets, and rich acquisition currency reignited efforts to unlock shareholder value, whether through spin-offs, restructurings, refinancings, acquisitions or other corporate actions. We witnessed the return of hostile offers, topping bids, and acquirers becoming targets. Activist investors agitated boards into complicated corporate restructuring maneuvers fueled by insatiable demand for high yield paper and leveraged loans. Amidst these positive trends, macroeconomic uncertainties – from falling energy prices, to geopolitical uncertainties in Europe and Asia – elongated many corporate event timelines and made it difficult for event-driven managers to recognize positive returns for investors in the near term.

Fiscal Year Highlights

In fiscal 2015, the Arbitrage Event‐Driven Fund (AEDNX) returned -2.96%. This result was predominantly derived from companies residing in the Americas. In terms of sectors, health care and consumer staples were the largest contributors, while energy and financials were the largest detractors. Of our three sub-strategies – merger arbitrage, equity special situations, and credit opportunities – merger arbitrage provided a positive contribution over the period, while credit opportunities and equity special situations detracted from returns.

Our largest contributor during the fiscal year was our equity special situations investment in Mylan. We initially became involved with Mylan in calendar year 2014 on our view that the company would either successfully lower taxes through an inversion via its acquisition of Abbot Laboratories’ generic pharmaceuticals business, or fail to invert and become a take-out target itself. We believed either scenario would cause the stock to re-rate to a higher valuation. While our analysis of the Treasury notice on inversions concluded that Mylan would not be affected due to its unique transaction structure, the market was happy to short this perennial sector underperformer as an ‘inversion hedge’ to investments in other inversion-related positions. In October, the company publicly re-committed to the inversion transaction and increased their earnings forecast, causing investors to take a less favorable view to shorting the stock. We subsequently sold out of the position on the move higher, but continued to monitor in anticipation of another catalyst occurring.

| | |

| 20 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Event-Driven Fund | Manager Commentary (continued) |

| | May 31, 2015 (Unaudited) |

That new catalyst occurred in April when Mylan initiated an unsolicited bid for Perrigo Company, an Ireland-based over-the-counter pharmaceutical maker. The deal would be accretive for Mylan, yet to date, Perrigo has rebuffed Mylan’s offer. In turn, Mylan has received its own unsolicited acquisition offer, from Teva Pharmaceuticals of Israel. We see potential upside for Mylan in either situation and have re-initiated a position in the stock.

Actavis’ $65 billion acquisition of Allergan was also one of the largest contributors for the period. In April 2014, Valeant and Pershing Square Capital, Allergan’s largest shareholder, combined efforts for a $47 billion hostile offer to purchase Allergan. Allergan sports a robust portfolio of medical aesthetic drugs and products, the most well-known being Botox. Despite Valeant increasing its bid in late May, another company, Actavis, entered with a topping bid in November and Valeant walked away a few days later. The deal closed in March and the Fund profited by holding a core position in Allergan.

Another positive contributor was our investment in T-Mobile. Positive sentiment thanks to increasing subscriber growth and rumors that Deutsche Telekom AG, the largest shareholder of T-Mobile, was looking to sell its stake contributed to a rise in T-Mobile’s share price over the period. DISH has been rumored as the most likely bidder for the company, and the Fund continues to hold a position on the belief that a merger could come to fruition sometime in the near future.

The largest drag on performance during the past year was our position in Genworth. Following a disappointing earnings release in the summer of 2014, shares of Genworth, a life insurance and mortgage insurance company, fell by 35%. Despite our view that Genworth’s mortgage insurance division would be the key driver of shareholder value over the years ahead, we were disappointed by the struggling long-term care results and we believed the overhang would remove the positive momentum from the mortgage insurance business for the foreseeable future. While we believe there is a clear case for shareholders to agitate for a break-up into two separate public companies – one owning the mortgage insurance division and the other holding the life insurance and long-term care units – we believe that scenario is unlikely to occur until the long-term care business is self-sustainable and thus have exited the position.

Our investment in the Sabine-Forest Oil merger also detracted from performance over the period. Our thesis for this investment was that Sabine would refinance their 2017 9.75% bonds to extend the runway for the post-merger company from their planned acquisition of Forest Oil. While the deal closed in December, due to lower oil prices and a lack of attractive financing terms, the 9.75% bonds remained outstanding. Consequently, we were subject to the high yield market’s lack of liquidity and widening price action for this position.

| | |

| Annual Report | May 31, 2015 | 21 |

| The Arbitrage Event-Driven Fund | Manager Commentary (continued) |

| | May 31, 2015 (Unaudited) |

Outlook

As acquisitions continue to replace share buybacks, dividend increases, and cost-cutting efforts – particularly in slow growth, global industries – M&A deal volume should remain elevated. The momentum from large- and mega-cap transaction activity usually cascades to other capitalization levels, which would give us a broader opportunity set in our merger arbitrage sleeve of the Fund, and we have started to witness the early innings of this trend occurring. The return of volatility to the merger arbitrage space has led to spreads widening in long-dated deals and the re-pricing of risk on newly announced deals. We believe this marks the beginning of a more normalized spread environment, whereby investors begin to price risk appropriately. Furthermore, while the specter of rising interest rates – which have historically provided a tailwind for merger arbitrage returns – has loomed on the horizon for some time now, and even if short-term rates remain at historically low levels, as long as volatility persists we believe our approach to investing in definitive, announced merger deals should yield attractive risk-adjusted returns.

In our equity special situations sleeve, we feel we are in the middle innings of a number of our investment opportunities. Following the dislocation in equity markets caused in part by the Shire/AbbVie deal break and the collapse in oil prices in October of 2014, we had the opportunity to build positions in distressed energy names at favorable entry points. We felt consolidation in the space would be a necessary outcome of the steep decline in commodity prices. While these names have seen increased volatility as of late, these positions remain some of our highest conviction ideas as we feel their shares will see significant upside once their particular catalysts are realized. As markets began to rebound in Q1 2015, we felt the pendulum of investor sentiment had perhaps swung too far in the opposite direction, providing an opportunity to capitalize on what we saw as investor complacency. We initiated a number of short positions on the catalyst-driven ideas we believed had become overvalued. These weren’t necessarily events we believed would not create value for the companies involved, but rather situations where we felt the markets had priced in too much of the value of the catalyst too soon. Many of these situations are still pending, but some have already begun to pay off. These situations, in addition to a number of catalysts predicated on record amounts of shareholder activism and a lack of organic growth options for many corporations, are providing ample opportunity for our equity special situations team.

In the credit opportunities sleeve of the Fund, we anticipate increased mergers and acquisitions activity will translate into more merger-related debt opportunities for us. We also expect that activist pressure on corporate managements and boards will translate into more spin-offs and asset sales, which, in turn, can lead to more refinancing and deleveraging activity from which to choose. We are particularly fond of these types of investments as their firmer catalysts and shorter durations can help produce lower correlated and less volatile returns for the portfolio.

As we embark on fiscal year 2016, we will stay true to our discipline of capitalizing on corporate events by understanding the rationale and underlying complexities of each situation, sharing insights between our teams, using hedges to mitigate market influence, and building well-diversified portfolios. We believe through this approach, the Arbitrage Event-Driven Fund can generate attractive long-term results with lower volatility and correlation to broader markets.

Sincerely,

The Investment Team at Water Island Capital

| | |

| 22 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Event-Driven Fund | Portfolio Information |

| | May 31, 2015 (Unaudited) |

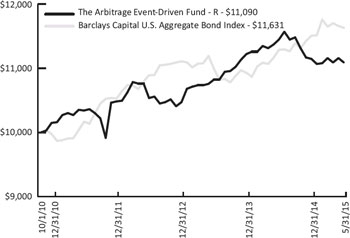

Performance (annualized returns as of May 31, 2015)

| | One Year | Since Inception* |

| Arbitrage Event-Driven Fund, Class R | -3.12% | 2.24% |

| Arbitrage Event-Driven Fund, Class I | -2.96% | 2.48% |

| Arbitrage Event-Driven Fund, Class C** | -4.89% | 1.07% |

| Arbitrage Event-Driven Fund, Class A*** | -6.40% | -0.45% |

| HFRI Event Driven Index | 1.99% | 5.87% |

| Barclays Capital U.S. Aggregate Bond Index | 3.03% | 3.29% |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain

performance data current to the most recent month end by calling 1-800-295-4485 or going

to www.arbitragefunds.com.

| * | Class R and Class I inception: 10/1/10; Class C inception: 6/1/12; Class A inception: 6/1/13. |

| ** | Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase. |

| *** | Class A shares are subject to a maximum front-end sales load of 3.25% on purchases up to $500,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $500,000 or more purchased without a front-end sales load and redeemed within 18 months of purchase. |

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.36%, 2.11%, 3.11% and 2.36%, respectively. The Advisor has agreed to waive fees in excess of 1.69%, 1.44%, 2.44% and 1.69% for Class R, Class I, Class C and Class A, respectively, until at least August 31, 2016.

The HFRI Event Driven Index is an index of companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated and frequently involve additional derivative securities. Event-Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company-specific developments.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

| | |

| Annual Report | May 31, 2015 | 23 |

| The Arbitrage Event-Driven Fund | Portfolio Information (continued) |

| | May 31, 2015 (Unaudited) |

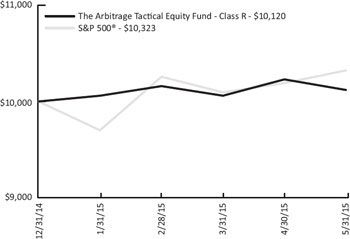

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

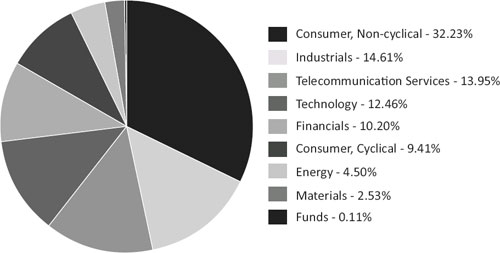

Sector Weighting

The following chart shows the sector weightings of the Arbitrage Event-Driven Fund’s investments in common stock, corporate bonds, convertible corporate bonds and exchange-traded funds as of the report date.

| | |

| 24 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Event-Driven Fund | Portfolio of Investments |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.85% | | | | | | |

| Aerospace & Defense - 2.65% | | | | | | |

B/E Aerospace, Inc.(a)(b) | | | 166,940 | | | $ | 9,572,340 | |

KLX, Inc.(b)(c) | | | 142,322 | | | | 6,239,396 | |

| | | | | | | | 15,811,736 | |

| | | | | | | | | |

| Auto Parts & Equipment - 0.56% | | | | | | | | |

Visteon Corp.(c) | | | 30,701 | | | | 3,362,374 | |

| | | | | | | | | |

| Banks - 0.17% | | | | | | | | |

Hudson Valley Holding Corp.(a) | | | 39,673 | | | | 1,025,150 | |

| | | | | | | | | |

| Beverages - 0.70% | | | | | | | | |

Molson Coors Brewing Co., Class B(b) | | | 56,532 | | | | 4,148,318 | |

| | | | | | | | | |

| Biotechnology - 1.97% | | | | | | | | |

Synageva BioPharma Corp.(b)(c) | | | 55,040 | | | | 11,746,086 | |

| | | | | | | | | |

| Chemicals - 2.53% | | | | | | | | |

Axalta Coating Systems Ltd.(a)(b)(c) | | | 218,959 | | | | 7,499,346 | |

| Sigma-Aldrich Corp. | | | 43,268 | | | | 6,027,232 | |

| Zep, Inc. | | | 75,886 | | | | 1,514,685 | |

| | | | | | | | 15,041,263 | |

| | | | | | | | | |

| Coal - 1.90% | | | | | | | | |

Cloud Peak Energy, Inc.(a)(b)(c) | | | 162,049 | | | | 935,023 | |

CONSOL Energy, Inc.(a)(b) | | | 346,684 | | | | 9,651,682 | |

Peabody Energy Corp.(a)(b) | | | 217,474 | | | | 735,062 | |

| | | | | | | | 11,321,767 | |

| | | | | | | | | |

| Computers - 1.63% | | | | | | | | |

EMC Corp.(a)(b) | | | 369,708 | | | | 9,738,109 | |

| | | | | | | | | |

| Computers & Computer Services - 1.61% | | | | | | | | |

Hewlett-Packard Co.(a)(b) | | | 286,504 | | | | 9,569,234 | |

| | | | | | | | | |

| Cosmetics & Personal Care - 0.14% | | | | | | | | |

| Coty, Inc., Class A | | | 32,629 | | | | 813,441 | |

| | | | | | | | | |

| Electric - 1.36% | | | | | | | | |

Dynegy, Inc.(a)(b)(c) | | | 251,103 | | | | 8,120,671 | |

| | | | | | | | | |

| Food - 0.07% | | | | | | | | |

Kraft Foods Group, Inc.(b) | | | 4,963 | | | | 419,125 | |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 25 |

| The Arbitrage Event-Driven Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.85% (Continued) | | | | | | |

| Healthcare - Products - 1.09% | | | | | | |

| Synergy Health Plc | | | 232,215 | | | $ | 6,470,144 | |

| | | | | | | | | |

| Home Furnishings - 0.04% | | | | | | | | |

| Ethan Allen Interiors, Inc. | | | 10,357 | | | | 259,961 | |

| | | | | | | | | |

| Insurance - 1.49% | | | | | | | | |

PartnerRe Ltd.(b) | | | 67,313 | | | | 8,846,948 | |

| | | | | | | | | |

| Internet - 2.06% | | | | | | | | |

Borderfree, Inc.(c) | | | 110,452 | | | | 1,545,223 | |

ClickSoftware Technologies Ltd.(c) | | | 17,241 | | | | 216,892 | |

Yahoo!, Inc.(a)(c) | | | 244,252 | | | | 10,486,960 | |

| | | | | | | | 12,249,075 | |

| | | | | | | | | |

| Leisure Time - 1.74% | | | | | | | | |

Life Time Fitness, Inc.(c) | | | 144,305 | | | | 10,375,529 | |

| | | | | | | | | |

| Lodging - 3.30% | | | | | | | | |

MGM Resorts International(b)(c) | | | 541,042 | | | | 10,847,892 | |

Starwood Hotels & Resorts Worldwide, Inc.(b) | | | 106,189 | | | | 8,788,202 | |

| | | | | | | | 19,636,094 | |

| | | | | | | | | |

| Media - 10.04% | | | | | | | | |

Charter Communications, Inc., Class A(b)(c) | | | 40,002 | | | | 7,161,158 | |

DIRECTV(a)(c) | | | 328,617 | | | | 29,917,292 | |

DISH Network Corp., Class A(b)(c) | | | 138,203 | | | | 9,783,390 | |

Media General, Inc.(b)(c) | | | 339,889 | | | | 5,628,562 | |

Viacom, Inc., Class B(b) | | | 108,819 | | | | 7,277,815 | |

| | | | | | | | 59,768,217 | |

| | | | | | | | | |

| Metal Fabricate & Hardware - 2.04% | | | | | | | | |

RTI International Metals, Inc.(c) | | | 343,687 | | | | 12,121,840 | |

| | | | | | | | | |

Mining - 0.00% (d) | | | | | | | | |

Nevada Copper Corp.(c) | | | 6,725 | | | | 10,166 | |

Yancoal Australia Ltd.(c) | | | 198,487 | | | | 22,763 | |

| | | | | | | | 32,929 | |

| | | | | | | | | |

| Miscellaneous Manufacturing - 8.16% | | | | | | | | |

Pall Corp.(b) | | | 158,700 | | | | 19,748,628 | |

Polypore International, Inc.(a)(c) | | | 291,995 | | | | 17,493,420 | |

| See Notes to Financial Statements. | |

| 26 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Event-Driven Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.85% (Continued) | | | | | | |

| Miscellaneous Manufacturing - 8.16% (Continued) | | | | |

| SPX Corp.(b) | | | 152,793 | | | $ | 11,354,048 | |

| | | | | | | | 48,596,096 | |

| | | | | | | | | |

| Oil & Gas - 0.06% | | | | | | | | |

| Cobalt International Energy, Inc.(b)(c) | | | 36,255 | | | | 368,351 | |

| | | | | | | | | |

| Oil & Gas Services - 1.58% | | | | | | | | |

| Exterran Holdings, Inc.(a)(b) | | | 191,407 | | | | 6,327,915 | |

| Weatherford International Plc(a)(b)(c) | | | 221,757 | | | | 3,064,682 | |

| | | | | | | | 9,392,597 | |

| | | | | | | | | |

| Packaging & Containers - 3.45% | | | | | | | | |

| Ball Corp.(b) | | | 165,570 | | | | 11,753,815 | |

| Berry Plastics Group, Inc.(a)(b)(c) | | | 262,192 | | | | 8,775,566 | |

| | | | | | | | 20,529,381 | |

| | | | | | | | | |

| Pharmaceuticals - 14.82% | | | | | | | | |

| AbbVie, Inc. | | | 239,289 | | | | 15,934,254 | |

| Actavis Plc(b)(c) | | | 32,043 | | | | 9,831,113 | |

| Catamaran Corp.(b)(c) | | | 126,396 | | | | 7,564,801 | |

| Hospira, Inc.(a)(b)(c) | | | 255,085 | | | | 22,554,616 | |

| Mylan N.V.(b)(c) | | | 36,829 | | | | 2,674,890 | |

| Omnicare, Inc.(b) | | | 124,287 | | | | 11,843,308 | |

| Perrigo Co., Plc(b) | | | 30,282 | | | | 5,762,665 | |

Teva Pharmaceutical Industries Ltd., Sponsored ADR(a)(b) | | | 201,074 | | | | 12,084,547 | |

| | | | | | | | 88,250,194 | |

| | | | | | | | | |

| Real Estate - 1.53% | | | | | | | | |

| Forest City Enterprises, Inc., Class A(c) | | | 395,487 | | | | 9,119,930 | |

| | | | | | | | | |

| Real Estate Investment Trusts - 1.64% | | | | | | | | |

| InfraREIT, Inc. | | | 36,371 | | | | 1,102,042 | |

| Macerich Co. | | | 105,830 | | | | 8,689,701 | |

| | | | | | | | 9,791,743 | |

| | | | | | | | | |

| Retail - 2.87% | | | | | | | | |

| ANN, Inc.(c) | | | 155,278 | | | | 7,259,246 | |

| Bob Evans Farms, Inc.(a)(b) | | | 90,730 | | | | 4,167,229 | |

| Staples, Inc.(b) | | | 342,567 | | | | 5,640,366 | |

| | | | | | | | 17,066,841 | |

| See Notes to Financial Statements. | |

| Annual Report | May 31, 2015 | 27 |

| The Arbitrage Event-Driven Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| COMMON STOCKS - 79.85% (Continued) | | | | | | |

| Semiconductors - 1.13% | | | | | | |

| Broadcom Corp., Class A | | | 118,381 | | | $ | 6,729,960 | |

| | | | | | | | | |

| Software - 1.21% | | | | | | | | |

Informatica Corp.(a)(c) | | | 67,346 | | | | 3,259,547 | |

Salesforce.com, Inc.(b)(c) | | | 54,131 | | | | 3,938,030 | |

| | | | | | | | 7,197,577 | |

| | | | | | | | | |

| Telecommunications - 4.82% | | | | | | | | |

Cyan, Inc.(c) | | | 613,319 | | | | 3,244,458 | |

| Frontier Communications Corp. | | | 1,002,601 | | | | 5,163,395 | |

Harris Corp.(b) | | | 136,064 | | | | 10,779,024 | |

HC2 Holdings, Inc.(c) | | | 316,259 | | | | 3,532,613 | |

T-Mobile US, Inc.(a)(b)(c) | | | 154,165 | | | | 5,993,935 | |

| | | | | | | | 28,713,425 | |

| | | | | | | | | |

| Transportation - 1.49% | | | | | | | | |

| Ansaldo STS SpA | | | 272,086 | | | | 2,807,527 | |

| TNT Express N.V. | | | 133,039 | | | | 1,122,176 | |

XPO Logistics, Inc.(b)(c) | | | 100,604 | | | | 4,945,693 | |

| | | | | | | | 8,875,396 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (Cost $471,744,306) | | | | | | | 475,509,502 | |

| | | | | | | | | |

| LIMITED PARTNERSHIPS - 0.75% | | | | | | | | |

| Pipelines - 0.75% | | | | | | | | |

| Williams Partners LP | | | 79,779 | | | | 4,458,051 | |

| | | | | | | | | |

| TOTAL LIMITED PARTNERSHIPS | | | | | | | | |

| (Cost $4,522,285) | | | | | | | 4,458,051 | |

| | | | | | | | | |

| EXCHANGE-TRADED NOTES - 0.04% | | | | | | | | |

| Specialty Funds - 0.04% | | | | | | | | |

iPath® S&P 500® VIX Short-Term Futures™ ETN(c) | | | 14,471 | | | | 274,949 | |

| | | | | | | | | |

| TOTAL EXCHANGE-TRADED NOTES | | | | | | | | |

| (Cost $344,848) | | | | | | | 274,949 | |

| | | | | | | | | |

| RIGHTS - 0.12% | | | | | | | | |

ArthroCare Corp., CVR(c)(e)(f) | | | 157,791 | | | | 53,270 | |

Casa Ley, CVR(c)(e)(f) | | | 891,084 | | | | 322,127 | |

Chelsea Therapeutics, CVR(c)(e)(f) | | | 434,520 | | | | 35,413 | |

| See Notes to Financial Statements. | |

| 28 | www.arbitragefunds.com | 1-800-295-4485 |

| The Arbitrage Event-Driven Fund | Portfolio of Investments (continued) |

| | May 31, 2015 |

| | | Shares | | | Value | |

| RIGHTS - 0.12% (Continued) | | | | | | |

Cubist Pharmaceuticals, Inc., CPR(c)(e)(f) | | | 34,500 | | | $ | 0 | |

Leap Wireless International, CVR(c)(e)(f) | | | 64,802 | | | | 249,488 | |

PDC, CVR(c)(e)(f) | | | 891,084 | | | | 20,049 | |

Trius Therapeutics, CVR(c)(e)(f) | | | 103,378 | | | | 17,564 | |

| | | | | | | | | |

| TOTAL RIGHTS | | | | | | | | |

| (Cost $1,170,262) | | | | | | | 697,911 | |

| | | | Maturity Date | | Rate(g) | | | Principal Amount | | | Value | |

| BANK LOANS - 2.21% | | | | | | | | | | | | |

| FairPoint Communications, Inc. | | | 02/14/2019 | | | 7.500 | % | | $ | 2,659,296 | | | $ | 2,687,565 | |

| OSG Bulk Ships, Inc. | | | 07/22/2019 | | | 5.250 | % | | | 5,309,875 | | | | 5,343,061 | |

| Station Casinos | | | 03/01/2020 | | | 4.250 | % | | | 2,381,187 | | | | 2,390,867 | |

| Zayo Bandwidth LLC | | | 05/06/2021 | | | 4.000 | % | | | 2,728,065 | | | | 2,728,679 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| TOTAL BANK LOANS | | | | | | | | | | | | | | | |

| (Cost $13,175,402) | | | | | | | | | | | | | | 13,150,172 | |

| | | | | | | | | | | | | | | | |

| CORPORATE BONDS - 20.12% | | | | | | | | | | | | | | | |

| Auto Parts & Equipment - 0.70% | | | | | | | | | | | | | | | |

| TRW Automotive, Inc.(h) | | | 03/01/2021 | | | 4.500 | % | | | 4,121,000 | | | | 4,172,513 | |

| | | | | | | | | | | | | | | | |

| Banks - 0.30% | | | | | | | | | | | | | | | |

| Wells Fargo Capital X | | | 12/15/2036 | | | 5.950 | % | | | 1,768,000 | | | | 1,798,940 | |

| | | | | | | | | | | | | | | | |

| Chemicals - 0.39% | | | | | | | | | | | | | | | |

| Ashland, Inc. | | | 04/15/2018 | | | 3.875 | % | | | 2,275,000 | | | | 2,343,705 | |

| | | | | | | | | | | | | | | | |

| Diversified Financial Services - 1.26% | | | | | | | | | | | | | | | |