UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-09815 |

|

THE ARBITRAGE FUNDS |

(Exact name of registrant as specified in charter) |

|

41 Madison Avenue, 42nd Floor, New York, NY | | 10010 |

(Address of principal executive offices) | | (Zip code) |

|

John S. Orrico Water Island Capital, LLC 41 Madison Avenue 42nd Floor New York, NY 10010 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 917-475-9252 | |

|

Date of fiscal year end: | May 31 | |

|

Date of reporting period: | May 31, 2016 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

Annual Report

May 31, 2016

The Arbitrage Fund

The Arbitrage Event-Driven Fund

The Arbitrage Credit Opportunities Fund

The Arbitrage Tactical Equity Fund

TABLE OF CONTENTS

Shareholder Letter | | | 1 | | |

The Arbitrage Fund | |

Manager Commentary | | | 3 | | |

Portfolio Information | | | 5 | | |

Portfolio of Investments | | | 7 | | |

The Arbitrage Event-Driven Fund | |

Manager Commentary | | | 19 | | |

Portfolio Information | | | 21 | | |

Portfolio of Investments | | | 23 | | |

The Arbitrage Credit Opportunities Fund | |

Manager Commentary | | | 39 | | |

Portfolio Information | | | 41 | | |

Portfolio of Investments | | | 43 | | |

The Arbitrage Tactical Equity Fund | |

Manager Commentary | | | 52 | | |

Portfolio Information | | | 54 | | |

Portfolio of Investments | | | 57 | | |

Statements of Assets and Liabilities | | | 66 | | |

Statements of Operations | | | 70 | | |

Statements of Changes in Net Assets | | | 72 | | |

Financial Highlights | |

The Arbitrage Fund - Class R | | | 76 | | |

The Arbitrage Fund - Class I | | | 78 | | |

The Arbitrage Fund - Class C | | | 80 | | |

The Arbitrage Fund - Class A | | | 82 | | |

The Arbitrage Event-Driven Fund - Class R | | | 84 | | |

The Arbitrage Event-Driven Fund - Class I | | | 86 | | |

The Arbitrage Event-Driven Fund - Class C | | | 88 | | |

The Arbitrage Event-Driven Fund - Class A | | | 90 | | |

The Arbitrage Credit Opportunities Fund - Class R | | | 92 | | |

The Arbitrage Credit Opportunities Fund - Class I | | | 94 | | |

The Arbitrage Credit Opportunities Fund - Class C | | | 96 | | |

The Arbitrage Credit Opportunities Fund - Class A | | | 98 | | |

The Arbitrage Tactical Equity Fund - Class R | | | 100 | | |

The Arbitrage Tactical Equity Fund - Class I | | | 102 | | |

The Arbitrage Tactical Equity Fund - Class C | | | 104 | | |

The Arbitrage Tactical Equity Fund - Class A | | | 106 | | |

Notes to Financial Statements | | | 108 | | |

Report of Independent Registered Public Accounting Firm | | | 137 | | |

Disclosure of Fund Expenses | | | 138 | | |

Additional Information | | | 141 | | |

Results of Shareholder Meeting | | | 142 | | |

Trustees' Approval of Advisory Agreement | | | 143 | | |

Trustees & Officers | | | 147 | | |

The Arbitrage Funds Shareholder Letter

Dear Fellow Shareholders,

The fiscal year ended May 31, 2016 encompassed one of the most volatile market environments in recent memory. The CBOE Volatility Index (VIX), a measure of implied volatility in the domestic equity markets, closed above its historical average of 20 on nearly 30% of the trading days over the trailing 12-month period. By way of comparison, that was four times greater than the prior year, and the 2016 period contained almost twice as many days above 20 as the prior three years combined.

This shouldn't necessarily come as a surprise. Investors have had plenty of reason for worry, whether it be concerns over stagnant global economic growth, precipitous declines in oil prices, GREXIT, BREXIT, "will they or won't they?" debates over the likelihood of Federal Reserve interest rate hikes, or worries over the devaluation of China's currency. Tepid corporate earnings and diverging central bank policies around the world serve only to fuel the fire.

And yet, somehow, credit and equity markets continue to march toward new highs. While the S&P 500 Index and the BAML High Yield Index had fallen -10.3% and -5.1%, respectively, for the calendar year-to-date period through February 11, 2016, a combination of actions led to a sudden reversal that pushed markets into positive territory by the end of the first quarter. From mid-February, the European Central Bank provided a larger-than-expected expansion of monetary policy; Chinese officials at the G20 Meeting calmed worries around growth and currency policy; the world's major oil-producing countries hinted at production cuts and cooperation; US recession fears faded; and the Federal Reserve's tone turned considerably more dovish toward expected rate increases.

The second quarter of 2016 saw a strong continuation of the rally that began in mid-February. Credit products experienced dual tailwinds, aided by declines both in the 10-Year US Treasury yield and in high yield credit spreads. And while central bank support, under-investment, and significant cash balances conspired to provide ample stimulus for the markets, the environment has been punctuated by bouts of significant short-term volatility. Market sentiment seems to veer from risk-on to risk-off on a daily basis. Shortly after the end of the period, for example – in reaction to the UK Referendum to leave the EU – investors drove the S&P 500 Index down 5.3% in the four days after the vote, only to see it whipsaw back 5.0% over the following three days.

For event-driven investors like ourselves, recent years have admittedly presented a difficult environment. Yet while the first six months of the fiscal year showed little evidence of halting the trend, the period evolved into a tale of two halves. For the first half of the fiscal year, our Arbitrage, Arbitrage Event-Driven, Arbitrage Credit Opportunities, and Arbitrage Tactical Equity funds generated Sharpe ratios of -1.1, -3.5, -2.1, and -3.0, respectively. For the final six months, however, they generated Sharpe ratios of +4.9, +3.8, +1.6, and +0.8, respectively. This compares favorably to the second-half Sharpe ratios of the S&P 500 Index (+0.3) and the BAML High Yield Index (+1.1). Within the context of credit and equity markets rife with uncertainty, which nonetheless continue to climb, each of our strategies weathered the volatility admirably and provided downside protection in line with expectations. In markets such as these, we are truly able to exhibit the benefits of the non-correlated nature of our event-driven portfolios.

While the buoyancy in the markets indicates that investors have once again embraced the efforts of supportive central banks, our largest concern continues to be that this support is the result of

Annual Report | May 31, 2016

1

The Arbitrage Funds Shareholder Letter (continued)

deep worries of a deflationary trap and anemic growth. Central banks continue to subsidize risky assets while investors ignore underlying causes. We also find it curious that as recently as the first quarter of 2016, investors had begun to question the continued efficacy of zero and negative interest rate policies – the results of which may resurface again. While market participants and economists will continue to debate these issues, we will continue to seek investments that we believe to be more correlated to the outcomes of specific catalysts rather than to market direction. Across all our strategies, we have focused our portfolios on the investment opportunities that lay at the shorter end of the duration spectrum and at the more definitive end of the catalyst spectrum. We are also looking to maintain more balance in our credit opportunities and tactical equity portfolios by including both long and short alpha investments. This portfolio construction approach served us well in the second half of the fiscal year, and is a reflection of our expectations for continued bouts of volatility throughout 2016. We would be the first to admit that the current environment, with both equity and credit market indices hitting new highs, is perplexing. There is no precedent for what we are witnessing today, and as such, we'll remain cautious and opportunistic during the remainder of the year.

Sincerely,

The Investment Team Water Island Capital

The statements and opinions expressed are those of the author as of the date of this report. All information is historical and not indicative of future results and subject to change. This information is not a recommendation to buy or sell any security.

Definitions

S&P 500 Index: An index of US equities meant to reflect the risk/return characteristics of the large cap universe, and one of the most commonly used benchmarks for the overall US stock market.

BAML High Yield Index: A measure of the broad high yield market, commonly used as a benchmark for high yield corporate bonds.

G20 Meeting: A meeting of the G20, an international forum for the governments and central bank governors from 20 major economies. It was founded in 1999 with the aim of studying, reviewing, and promoting high-level discussion of policy issues pertaining to the promotion of international financial stability, and seeks to address issues that go beyond the responsibilities of any one organization.

Sharpe Ratio: A measure of risk-adjusted performance, calculated by subtracting the risk-free rate from the rate of return for a portfolio, and dividing the result by the standard deviation of the portfolio returns.

www.arbitragefunds.com | 1-800-295-4485

2

The Arbitrage Fund Manager Commentary

The Arbitrage Fund | Tickers: ARBFX, ARBNX, ARBCX, ARGAX

The Fund's Goal and Main Investments

Merger arbitrage is a sub-set of a broader event-driven investment strategy, which seeks to profit from investing in securities that are involved in corporate events such as mergers and acquisitions. Typically merger arbitrage is a low volatility strategy pursued by absolute-return-minded investors. At Water Island Capital, our goal is to capture a return stream with a low correlation to the overall markets.

Investment Strategy

The Fund seeks to achieve capital growth by engaging in merger arbitrage. The strategy's focus is to capture returns from corporate events, generate market neutral capital growth, preservation of capital, consistent and positive returns, and achieve low correlation, and low volatility. The Fund's general investment approach can be best described as risk averse, and many systems, policies, and procedures are in place to facilitate this low-risk approach. The Fund generally engages in active and frequent trading of portfolio securities to achieve its principal investment objective. In attempting to achieve its investment strategy, the Fund plans to invest at least 80% of its net assets in equity securities of companies (both U.S. and foreign) that are involved in publicly-announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations, and other corporate reorganizations. The Fund's investment adviser uses investment strategies designed to minimize market exposure, including short selling along with purchasing and selling options. The most common merger arbitrage activity, and the approach generally used by the Fund, involves purchasing the shares of an announced acquisition target company at a discount to their expected value upon the acquisition's completion. That difference, or "spread," is the primary driver of returns for this strategy. There is no limit to the number of stocks the Fund can hold; however, the Fund typically invests in 40 to 80 deals at any given time. Each deal will have one, or perhaps two, equity positions (a long and short position in a stock-for-stock deal) and, in many cases, associated derivative positions for hedging purposes.

Fiscal Year Highlights

The Arbitrage Fund (Class I shares: ARBNX) returned 1.16% for fiscal year 2016. Performance was equally driven by deals in the Americas and deals in the European region. Financials and consumer discretionary, each led by deals with competitive bidding scenarios, were the top performing sectors for the period. Conversely, the energy sector was the largest detractor due to the fallout from a terminated deal.

The Fund's top performing deal of the year was Exor's $6.4 billion acquisition of international multi-line reinsurer PartnerRe (PRE). PartnerRe had long favored a proposed deal with Axis Capital, despite multiple higher offers from Exor. When Exor bumped its bid one last time, offering its best and final proposal, a number of advisory services and a large PRE shareholder recommended that shareholders vote down the Axis deal. Investors heeded their advice, and PRE agreed to terms with Exor in August 2015. The deal closed successfully in March 2016, wrapping up this protracted bidding war.

The Fund's second highest contributor for the period was yet another topping bid situation. Anbang Insurance Group of China made an offer to acquire Starwood Hotels & Resorts Worldwide, disrupting Marriot International's bid for the company. Anbang bowed out at the end of Q1 2016, after Marriott raised its offer multiple times and agreed to a $14.9 billion deal with Starwood.

Annual Report | May 31, 2016

3

The Arbitrage Fund Manager Commentary (continued)

The Fund initiated a position in the deal early and profited nicely as the situation unfolded. We still hold the position in anticipation of a Q3 2016 close.

Competitive bidding scenarios are often the yin to a terminated transaction's yang, and just as the Fund's two best performing deals resulted from topping bids, the largest detractors for the period resulted from the only two broken deals the Fund experienced over the fiscal year: Pfizer's abandoned acquisition of Allergan, and the Williams Companies saga.

In June 2015, Williams Companies' roll-up of its master limited partnership (MLP) subsidiary, Williams Partners, was interrupted when Energy Transfer entered with a bid for the acquirer. Williams Companies rejected the Energy Transfer bid and subsequently entered into an official auction process. Energy Transfer participated in the auction process and eventually won out with its cash-and-stock bid; however, amidst the decline in oil prices from $60/barrel in June to $45/barrel at the end of September, what was once a deal valuing Williams at $64/share was now only worth $43.50/share. The Fund exited the position during the first quarter of 2016.

In November 2015, Pfizer entered into a definitive agreement to acquire fellow drugmaker Allergan (AGN), with the intention of redomiciling as an Irish company in order to realize significant corporate tax benefits (a strategy known as a tax inversion). The stock-for-stock transaction was worth $160 billion – the largest inversion on record. While the acquisition of AGN was clearly a high profile/high risk deal given the potential for US tax reform, the initial impression from the street was that any future actions by the U.S. Treasury Department (Treasury) would be unlikely to stop the deal. However, in April 2016 Treasury released new guidelines on inversions which would have eliminated the tax benefits Pfizer hoped to gain from the transaction. As a result, the two companies decided to abandon the merger.

www.arbitragefunds.com | 1-800-295-4485

4

The Arbitrage Fund Portfolio Information

Performance (annualized returns as of May 31, 2016)

| | One

Year | | Five

Year | | Ten

Year | | Since

Inception* | |

Arbitrage Fund, Class R | | | 0.87 | % | | | 1.65 | % | | | 2.88 | % | | | 4.25 | % | |

Arbitrage Fund, Class I | | | 1.16 | % | | | 1.89 | % | | | 3.12 | % | | | 3.08 | % | |

Arbitrage Fund, Class C** | | | 0.18 | % | | | N/A | | | | N/A | | | | 0.69 | % | |

Arbitrage Fund, Class A*** | | | 0.95 | % | | | N/A | | | | N/A | | | | 1.79 | % | |

S&P 500® Index | | | 1.72 | % | | | 11.67 | % | | | 7.41 | % | | | 4.33 | % | |

HFRI Event Driven: Merger Arbitrage Index | | | 0.11 | % | | | 2.43 | % | | | 3.76 | % | | | 4.31 | % | |

Barclays Capital U.S. Aggregate Bond Index | | | 2.99 | % | | | 3.33 | % | | | 4.97 | % | | | 5.28 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R inception: 9/18/00; Class I inception: 10/17/03; Class C inception: 6/1/12; Class A inception: 6/1/13.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 2.50% on purchases up to $250,000. The shares are also subject to a deferred sales charge of up to 0.50% on purchases of $250,000 or more purchased without a front-end sales load and redeemed within 12 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.31%, 2.06%, 3.06% and 2.31%, respectively. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The S&P 500® Index is an unmanaged index consisting of 500 stocks.

The HFRI Event Driven: Merger Arbitrage Index is an index consisting of merger arbitrage strategies which employ an investment process primarily focused on opportunities in equity and equity related instruments of companies which are currently engaged in a corporate transaction. Merger Arbitrage involves primarily announced transactions, typically with limited or no exposure to situations which pre-, post-date or situations in which no formal announcement is expected to occur. Opportunities are frequently presented in cross border, collared and international transactions which incorporate multiple geographic regulatory institutions, with typically involve minimal exposure to corporate credits.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

An investor may not invest directly in an index.

Annual Report | May 31, 2016

5

The Arbitrage Fund Portfolio Information (continued)

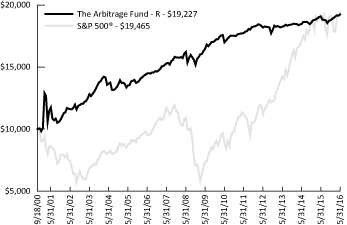

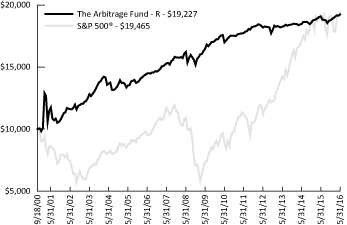

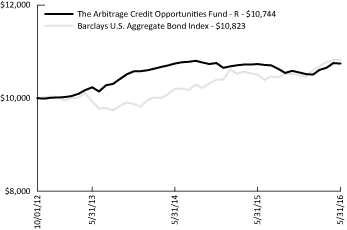

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

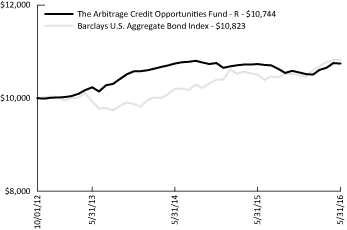

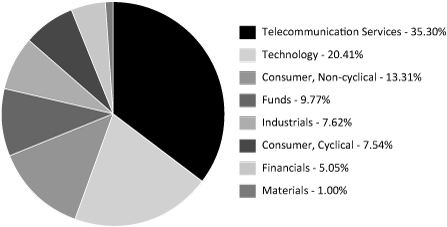

Sector Weighting

The following chart shows the sector weightings of The Arbitrage Fund's investments in common stock as of the report date.

www.arbitragefunds.com | 1-800-295-4485

6

The Arbitrage Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 70.16% | |

Banks - 1.82% | |

FirstMerit Corp.(a) | | | 1,499,765 | | | $ | 34,014,670 | | |

Beverages - 2.63% | |

SABMiller Plc | | | 788,698 | | | | 49,056,524 | | |

Biotechnology - 0.49% | |

Celator Pharmaceuticals, Inc.(b)(c) | | | 305,347 | | | | 9,184,838 | | |

Chemicals - 2.69% | |

Syngenta AG, ADR | | | 186,833 | | | | 14,739,255 | | |

Valspar Corp.(a)(b) | | | 328,452 | | | | 35,577,921 | | |

| | | | 50,317,176 | | |

Commercial Services - 2.91% | |

Electro Rent Corp. | | | 193,600 | | | | 2,536,160 | | |

ExamWorks Group, Inc.(c) | | | 369,020 | | | | 12,882,488 | | |

USG People N.V.(c) | | | 2,006,429 | | | | 39,000,968 | | |

| | | | 54,419,616 | | |

Computers & Computer Services - 0.38% | |

Brocade Communications Systems, Inc. | | | 784,617 | | | | 7,108,630 | | |

Construction Materials - 0.13% | |

Italcementi SpA(c) | | | 200,000 | | | | 2,332,115 | | |

Electric - 7.34% | |

Empire District Electric Co. | | | 116,061 | | | | 3,888,044 | | |

ITC Holdings Corp.(a) | | | 1,234,522 | | | | 54,960,919 | | |

NextEra Energy, Inc. | | | 58,205 | | | | 6,991,585 | | |

TECO Energy, Inc. | | | 2,322,771 | | | | 63,969,113 | | |

Westar Energy, Inc. | | | 130,987 | | | | 7,378,498 | | |

| | | | 137,188,159 | | |

Electrical Components & Equipment - 0.35% | |

Saft Groupe SA | | | 158,243 | | | | 6,452,933 | | |

Electronics - 1.90% | |

FEI Co. | | | 154,358 | | | | 16,585,767 | | |

Rofin-Sinar Technologies, Inc.(b)(c) | | | 302,462 | | | | 9,663,661 | | |

Tyco International Plc | | | 218,579 | | | | 9,315,837 | | |

| | | | 35,565,265 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

7

The Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 70.16% (Continued) | |

Entertainment - 0.75% | |

DreamWorks Animation SKG, Inc., Class A(c) | | | 349,666 | | | $ | 14,070,560 | | |

Environmental Control - 1.60% | |

Progressive Waste Solutions Ltd.(a)(d) | | | 948,690 | | | | 29,906,314 | | |

Gas - 8.70% | |

AGL Resources, Inc.(a) | | | 913,411 | | | | 60,102,444 | | |

Piedmont Natural Gas Co., Inc.(a) | | | 613,668 | | | | 36,856,900 | | |

Questar Corp.(a) | | | 2,604,018 | | | | 65,647,294 | | |

| | | | 162,606,638 | | |

Healthcare - Products - 1.32% | |

Affymetrix, Inc.(c)(d)(e) | | | 679,125 | | | | 9,507,750 | | |

St Jude Medical, Inc. | | | 192,521 | | | | 15,085,945 | | |

| | | | 24,593,695 | | |

Home Furnishings - 1.44% | |

TiVo, Inc.(c) | | | 2,696,773 | | | | 26,832,891 | | |

Household Products/Wares - 1.26% | |

Tumi Holdings, Inc.(c) | | | 874,402 | | | | 23,460,206 | | |

Internet - 1.05% | |

Marketo, Inc.(c) | | | 394,336 | | | | 13,892,457 | | |

Textura Corp.(c) | | | 216,044 | | | | 5,617,144 | | |

| | | | 19,509,601 | | |

Leisure Time - 0.06% | |

Kuoni Reisen Holding AG(c) | | | 3,226 | | | | 1,195,957 | | |

Lodging - 4.67% | |

Interval Leisure Group, Inc. | | | 609,075 | | | | 8,746,317 | | |

Starwood Hotels & Resorts Worldwide, Inc.(a) | | | 1,069,823 | | | | 78,557,103 | | |

| | | | 87,303,420 | | |

Media - 7.21% | |

Cablevision Systems Corp., Class A(a) | | | 1,578,517 | | | | 54,742,970 | | |

Charter Communications, Inc., Class A(b)(c) | | | 287,328 | | | | 62,907,592 | | |

Media General, Inc.(c) | | | 951,044 | | | | 16,966,625 | | |

| | | | 134,617,187 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

8

The Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 70.16% (Continued) | |

Mining - 0.25% | |

Kaminak Gold Corp., Class A(c) | | | 2,563,000 | | | $ | 4,671,194 | | |

Packaging & Containers - 1.65% | |

Rexam Plc | | | 3,391,111 | | | | 30,868,869 | | |

Pharmaceuticals - 6.03% | |

Allergan Plc(c) | | | 62,000 | | | | 14,616,500 | | |

Anacor Pharmaceuticals, Inc.(b)(c) | | | 141,348 | | | | 14,035,856 | | |

Baxalta, Inc.(a) | | | 1,612,408 | | | | 72,929,214 | | |

Shire Plc, ADR | | | 20,200 | | | | 3,760,432 | | |

XenoPort, Inc.(c) | | | 1,041,063 | | | | 7,381,137 | | |

| | | | 112,723,139 | | |

Pipelines - 3.71% | |

Columbia Pipeline Group, Inc.(a)(b) | | | 1,166,559 | | | | 29,793,917 | | |

TransCanada Corp. | | | 960,000 | | | | 39,524,459 | | |

| | | | 69,318,376 | | |

Real Estate Investment Trusts - 0.54% | |

Hatteras Financial Corp. | | | 337,004 | | | | 5,422,394 | | |

Rouse Properties, Inc. | | | 257,454 | | | | 4,698,537 | | |

| | | | 10,120,931 | | |

Retail - 0.30% | |

Krispy Kreme Doughnuts, Inc.(b)(c) | | | 262,227 | | | | 5,606,413 | | |

Savings & Loans - 0.97% | |

Astoria Financial Corp. | | | 737,465 | | | | 11,784,691 | | |

First Niagara Financial Group, Inc. | | | 579,047 | | | | 6,323,193 | | |

| | | | 18,107,884 | | |

Semiconductors - 2.13% | |

Fairchild Semiconductor International, Inc.(c) | | | 247,800 | | | | 4,923,786 | | |

KLA-Tencor Corp.(a) | | | 479,164 | | | | 34,945,430 | | |

| | | | 39,869,216 | | |

Software - 5.63% | |

Cegid Group SA | | | 72,147 | | | | 4,956,943 | | |

Cvent, Inc.(b)(c) | | | 1,647,651 | | | | 59,002,382 | | |

inContact, Inc.(c) | | | 479,017 | | | | 6,648,756 | | |

OPOWER, Inc.(c) | | | 1,014,538 | | | | 10,439,596 | | |

SciQuest, Inc.(c) | | | 520,000 | | | | 9,172,800 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

9

The Arbitrage Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 70.16% (Continued) | |

Software - 5.63% (Continued) | |

Xura, Inc.(c) | | | 602,928 | | | $ | 14,964,673 | | |

| | | | 105,185,150 | | |

Telecommunications - 0.25% | |

Alliance Fiber Optic Products, Inc.(c) | | | 250,000 | | | | 4,630,000 | | |

TOTAL COMMON STOCKS

(Cost $1,263,142,049) | | | 1,310,837,567 | | |

RIGHTS - 0.51% | |

ArthroCare Corp. CVR, No expiration(c)(d)(e) | | | 2,685,721 | | | | 1,130,420 | | |

Casa Ley CVR, Expires 01/30/2018(c)(d)(e) | | | 6,223,326 | | | | 2,475,639 | | |

Chelsea Therapeutics CVR, Expires 03/31/2018(c)(d)(e) | | | 2,389,273 | | | | 137,861 | | |

Cubist Pharmaceuticals, Inc. CPR, Expires 07/01/2019(c)(d)(e) | | | 119,343 | | | | — | | |

Leap Wireless International CVR, Expires 03/13/2017(c)(e) | | | 1,783,190 | | | | 5,617,049 | | |

PDC CVR, Expires 12/31/2016(c)(d)(e) | | | 6,223,326 | | | | 143,759 | | |

Trius Therapeutics CVR, Expires 02/15/2017(c)(d)(e) | | | 1,034,403 | | | | 96,717 | | |

TOTAL RIGHTS

(Cost $12,160,385) | | | 9,601,445 | | |

Expiration

Date | | Exercise

Price | | Contracts | | Value | |

PURCHASED OPTIONS(c) - 0.15% | |

Call Options Purchased - 0.03% | |

Anacor Pharmaceuticals, Inc.: | |

| 08/2016 | | $ | 105.00 | | | | 1,332 | | | $ | 39,960 | | |

| 08/2016 | | | 110.00 | | | | 2,384 | | | | 41,720 | | |

Great Plains Energy, Inc.: | |

| | | 09/2016 | | | 30.00 | | | | 258 | | | | 22,575 | | |

| | | 12/2016 | | | 30.00 | | | | 193 | | | | 24,125 | | |

Huntington Bancshares, Inc. | | 07/2016 | | | 12.00 | | | | 24,349 | | | | 73,047 | | |

Krispy Kreme Doughnuts, Inc. | | 08/2016 | | | 22.00 | | | | 99 | | | | 1,485 | | |

Mylan N.V. | | 07/2016 | | | 50.00 | | | | 111 | | | | 3,108 | | |

Rovi Corp. | | 07/2016 | | | 17.50 | | | | 2,350 | | | | 217,375 | | |

Waste Connections, Inc. | | 06/2016 | | | 75.00 | | | | 691 | | | | 107,105 | | |

Xura, Inc. | | 07/2016 | | | 25.00 | | | | 512 | | | | 10,240 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $764,041) | | | 540,740 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

10

The Arbitrage Fund Portfolio of Investments (continued)

| | | Expiration

Date | | Exercise

Price | | Contracts | | Value | |

PURCHASED OPTIONS(c) - 0.15% (Continued) | |

Put Options Purchased - 0.12% | |

Anacor Pharmaceuticals, Inc.: | |

| | | 08/2016 | | $ | 85.00 | | | | 1,148 | | | $ | 40,180 | | |

| | | 08/2016 | | | 90.00 | | | | 958 | | | | 45,505 | | |

Celator Pharmaceuticals, Inc.: | |

| | | 07/2016 | | | 24.00 | | | | 233 | | | | 1,747 | | |

| | | 10/2016 | | | 19.00 | | | | 218 | | | | 2,725 | | |

| | | 10/2016 | | | 20.00 | | | | 16 | | | | 200 | | |

| | | 10/2016 | | | 21.00 | | | | 115 | | | | 1,438 | | |

Charter Communications, Inc.,

Class A | | 06/2016 | | | 250.00 | | | | 344 | | | | 1,800,840 | | |

Columbia Pipeline Group, Inc. | | 10/2016 | | | 22.50 | | | | 4,512 | | | | 22,560 | | |

Cvent, Inc. | | 10/2016 | | | 30.00 | | | | 76 | | | | 1,520 | | |

Rofin-Sinar Technologies, Inc.: | |

| | | 09/2016 | | | 25.00 | | | | 761 | | | | 15,220 | | |

| | | 09/2016 | | | 30.00 | | | | 791 | | | | 61,302 | | |

Rovi Corp. | | 07/2016 | | | 15.00 | | | | 4,010 | | | | 230,575 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $2,271,043) | | | 2,223,812 | | |

TOTAL PURCHASED OPTIONS

(Cost $3,035,084) | | | 2,764,552 | | |

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 33.91% | |

Money Market Fund | |

State Street Institutional Liquid Reserves

Fund | | | 0.455 | %(f) | | | 633,462,131 | | | $ | 633,462,131 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $633,462,131) | | | 633,462,131 | | |

Total Investments - 104.73%

(Cost $1,911,799,649) | | | 1,956,665,695 | | |

Liabilities in Excess of Other Assets - (4.73)%(g) | | | (88,316,684 | ) | |

NET ASSETS - 100.00% | | $ | 1,868,349,011 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

11

The Arbitrage Fund Portfolio of Investments (continued)

Portfolio Footnotes

(a) Security, or a portion of security, is being held as collateral for short sales or written option contracts. At May 31, 2016, the aggregate market value of those securities was $234,167,000, representing 12.53% of net assets.

(b) Underlying security for a written/purchased call/put option.

(c) Non-income-producing security.

(d) Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2016, the total market value of these securities was $43,398,460, representing 2.32% of net assets.

(e) Security considered illiquid. On May 31, 2016, the total market value of these securities was $19,109,195, representing 1.02% of net assets.

(f) Rate shown is the 7-day effective yield as of May 31, 2016.

(g) Includes cash which is being held as collateral for short sales and written option contracts.

Securities are determined to be illiquid under the procedures approved by the Funds' Board of Trustees. Information related to the Fund's illiquid securities as of May 31, 2016 is as follows:

Date of

Purchase | | Security | | Cost | | Value | | % of Net Assets | |

01/01/2016 | | Affymetrix, Inc. | | $ | 9,338,481 | | | $ | 9,507,750 | | | | 0.51 | % | |

05/30/2014 | | ArthroCare Corp. CVR | | | 940,003 | | | | 1,130,420 | | | | 0.05 | | |

01/30/2015 | | Casa Ley CVR | | | 6,316,054 | | | | 2,475,639 | | | | 0.13 | | |

06/24/2014 | | Chelsea Therapeutics CVR | | | — | | | | 137,861 | | | | 0.01 | | |

12/12/2011 | | Cubist Pharmaceuticals, Inc. CPR | | | — | | | | — | | | | 0.00 | | |

03/14/2014 | | Leap Wireless International CVR | | | 4,600,630 | | | | 5,617,049 | | | | 0.30 | | |

01/30/2015 | | PDC CVR | | | 303,698 | | | | 143,759 | | | | 0.01 | | |

09/12/2013 | | Trius Therapeutics CVR | | | — | | | | 96,717 | | | | 0.01 | | |

| | | | | | | $ | 19,109,195 | | | | 1.02 | % | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

12

The Arbitrage Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (22.05%) | |

Auto Parts & Equipment - (0.59%) | |

Johnson Controls, Inc. | | | (251,177 | ) | | $ | (11,089,464 | ) | |

Banks - (1.71%) | |

Huntington Bancshares, Inc. | | | (2,577,139 | ) | | | (26,931,102 | ) | |

KeyCorp | | | (393,751 | ) | | | (5,047,888 | ) | |

| | | | (31,978,990 | ) | |

Chemicals - (0.01%) | |

Valspar Corp. | | | (1,400 | ) | | | (151,648 | ) | |

Computers & Computer Services - (0.38%) | |

Brocade Communications Systems, Inc. | | | (784,617 | ) | | | (7,108,630 | ) | |

Electric - (1.97%) | |

Fortis, Inc. | | | (925,025 | ) | | | (28,935,468 | ) | |

Great Plains Energy, Inc. | | | (364 | ) | | | (10,622 | ) | |

Hawaiian Electric Industries, Inc. | | | (241,215 | ) | | | (7,919,088 | ) | |

| | | | (36,865,178 | ) | |

Environmental Control - (1.60%) | |

Waste Connections, Inc. | | | (456,716 | ) | | | (29,901,196 | ) | |

Healthcare - Products - (0.36%) | |

Abbott Laboratories | | | (167,654 | ) | | | (6,644,128 | ) | |

Lodging - (3.57%) | |

Interval Leisure Group, Inc. | | | (608,971 | ) | | | (8,744,824 | ) | |

Marriott International, Inc., Class A | | | (809,225 | ) | | | (53,441,219 | ) | |

Starwood Hotels & Resorts Worldwide, Inc. | | | (62,000 | ) | | | (4,552,660 | ) | |

| | | | (66,738,703 | ) | |

Media - (3.34%) | |

Charter Communications, Inc., Class A | | | (256,229 | ) | | | (56,098,777 | ) | |

Nexstar Broadcasting Group, Inc., Class A | | | (118,993 | ) | | | (6,332,808 | ) | |

| | | | (62,431,585 | ) | |

Mining - (0.25%) | |

Goldcorp, Inc. | | | (278,436 | ) | | | (4,681,827 | ) | |

Packaging & Containers - (0.60%) | |

Ball Corp. | | | (154,893 | ) | | | (11,198,764 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

13

The Arbitrage Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (22.05%) (Continued) | |

Pharmaceuticals - (3.53%) | |

Allergan Plc | | | (62,000 | ) | | $ | (14,616,500 | ) | |

Baxalta, Inc. | | | (170,000 | ) | | | (7,689,100 | ) | |

Shire Plc, ADR | | | (234,051 | ) | | | (43,570,934 | ) | |

| | | | (65,876,534 | ) | |

Pipelines - (2.13%) | |

TransCanada Corp. | | | (960,000 | ) | | | (39,780,684 | ) | |

Real Estate Investment Trusts - (0.19%) | |

Annaly Capital Management, Inc. | | | (333,377 | ) | | | (3,527,129 | ) | |

Retail - (0.08%) | |

Rite Aid Corp. | | | (195,400 | ) | | | (1,504,580 | ) | |

Savings & Loans - (0.62%) | |

New York Community Bancorp, Inc. | | | (737,322 | ) | | | (11,605,448 | ) | |

Semiconductors - (1.12%) | |

Lam Research Corp. | | | (239,582 | ) | | | (19,839,785 | ) | |

Rovi Corp. | | | (60,855 | ) | | | (1,022,973 | ) | |

| | | | (20,862,758 | ) | |

TOTAL COMMON STOCKS

(Proceeds $396,672,194) | | | (411,947,246 | ) | |

RIGHTS - (0.00%)(a) | |

Chelsea Therapeutics CVR, Expires 03/31/2018 | | | (1,100 | ) | | | (65 | ) | |

TOTAL RIGHTS

(Proceeds $(1)) | | | (65 | ) | |

TOTAL SECURITIES SOLD SHORT

(Proceeds $396,672,195) | | $ | (411,947,311 | ) | |

(a) Less than 0.005% of net assets.

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

14

The Arbitrage Fund Portfolio of Investments (continued)

WRITTEN OPTIONS | | Expiration

Date | | Exercise

Price | | Contracts | | Value | |

Written Call Options | |

Charter Communications, Inc.,

Class A | | 06/2016 | | $ | 250.00 | | | | (344 | ) | | $ | (75,680 | ) | |

Krispy Kreme Doughnuts, Inc. | | 08/2016 | | | 21.00 | | | | (392 | ) | | | (19,600 | ) | |

Microchip Technology, Inc. | | 08/2016 | | | 9.00 | | | | (60 | ) | | | (750 | ) | |

Valspar Corp. | | 07/2016 | | | 105.00 | | | | (490 | ) | | | (127,400 | ) | |

TOTAL WRITTEN CALL OPTIONS

(Premiums received $171,350) | | | (223,430 | ) | |

Written Put Options | |

Anacor Pharmaceuticals, Inc. | | 06/2016 | | | 95.00 | | | | (217 | ) | | | (2,713 | ) | |

Krispy Kreme Doughnuts, Inc. | | 06/2016 | | | 21.00 | | | | (392 | ) | | | (980 | ) | |

Rovi Corp.: | |

| | | 06/2016 | | | 15.00 | | | | (883 | ) | | | (17,660 | ) | |

| | | 07/2016 | | | 15.00 | | | | (52 | ) | | | (2,990 | ) | |

TOTAL WRITTEN PUT OPTIONS

(Premiums received $82,843) | | | (24,343 | ) | |

TOTAL WRITTEN OPTIONS

(Premiums received $254,193) | | $ | (247,773 | ) | |

OUTSTANDING FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS

Contract

Description | | Counterparty | | Contracts to

Deliver/Receive | | Purchase/Sale

Contract | | Expiration

Date | | Current Value | | Unrealized

Appreciation | |

AUD | | | | Goldman Sachs | | | 8,950,200 | | | Sale | | 06/15/2016 | | $ | 6,465,584 | | | $ | 179,800 | | |

CAD | | | | Goldman Sachs | | | 5,642,100 | | | Sale | | 06/15/2016 | | | 4,302,389 | | | | 49,760 | | |

CHF | | | | Goldman Sachs | | | 53,088,100 | | | Sale | | 06/15/2016 | | | 53,438,741 | | | | 1,497,161 | | |

EUR | | | | Goldman Sachs | | | 156,772,898 | | | Sale | | 06/15/2016 | | | 174,508,995 | | | | 1,839,655 | | |

GBP | | | | Goldman Sachs | | | 400,000 | | | Purchase | | 06/15/2016 | | | 579,385 | | | | 1,443 | | |

GBP | | | | Goldman Sachs | | | 3,101,100 | | | Sale | | 06/15/2016 | | | 4,491,823 | | | | 28,830 | | |

| | | $ | 3,596,649 | | |

Contract

Description | | Counterparty | | Contracts to

Deliver/Receive | | Purchase/Sale

Contract | | Expiration

Date | | Current Value | | Unrealized

Depreciation | |

AUD | Gol | dman Sachs | | 8,950,200 | | Purchase | | 06/15/2016 | | $6,465,584 | | $(386,896) | |

CAD | Gol | dman Sachs | | 49,150,300 | | Purchase | | 06/15/2016 | | 37,479,619 | | (400,068) | |

CAD | Gol | dman Sachs | | 43,312,600 | | Sale | | 06/15/2016 | | 33,028,073 | | (524,277) | |

CHF | Gol | dman Sachs | | 52,661,000 | | Purchase | | 06/15/2016 | | 53,008,819 | | (299,128) | |

EUR | Gol | dman Sachs | | 112,748,600 | | Purchase | | 06/15/2016 | | 125,504,121 | | (770,617) | |

EUR | Gol | dman Sachs | | 1,411,800 | | Sale | | 06/15/2016 | | 1,571,520 | | (553) | |

GBP | Gol | dman Sachs | | 45,298,600 | | Sale | | 06/15/2016 | | 65,613,266 | | (801,958) | |

| | | $ | (3,183,497 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

15

The Arbitrage Fund Portfolio of Investments (continued)

The following is a summary of investments classified by country exposure:

Country | | % of Net Assets(a) | |

United Kingdom | | | 4.28 | % | |

Canada | | | 3.97 | % | |

Netherlands | | | 2.09 | % | |

Switzerland | | | 0.85 | % | |

France | | | 0.61 | % | |

Italy | | | 0.13 | % | |

United States | | | 92.80 | % | |

Liabilities in Excess of Other Assets | | | (4.73 | )% | |

| | | | 100.00 | % | |

(a) These percentages represent long positions only and are not net of short positions.

Abbreviations:

ADR - American Depositary Receipt

AG - Aktiengesellschaft is a German term that refers to a corporation that is limited by shares, i.e., owned by shareholders.

AUD - Australian dollar

CAD - Canadian dollar

CHF - Swiss franc

CPR - Conditional Prepayment Rate

CVR - Contingent Value Rights

EUR - Euro

GBP - British pound

Ltd. - Limited

N.V. - Naamloze Vennootschap is the Dutch term for a public limited liability corporation.

Plc - Public Limited Company

SA - Generally designates corporations in various countries, mostly those employing civil law. This translates literally in all languages mentioned as anonymous company.

SpA - Societa per Azione

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

16

The Arbitrage Fund Portfolio of Investments (continued)

The following table summarizes The Arbitrage Fund's investments and derivative financial instruments categorized in the disclosure hierarchy as of May 31, 2016:

Investments in Securities at Value* | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Common Stocks | |

Banks | | $ | 34,014,670 | | | $ | — | | | $ | — | | | $ | 34,014,670 | | |

Beverages | | | 49,056,524 | | | | — | | | | — | | | | 49,056,524 | | |

Biotechnology | | | 9,184,838 | | | | — | | | | — | | | | 9,184,838 | | |

Chemicals | | | 50,317,176 | | | | — | | | | — | | | | 50,317,176 | | |

Commercial Services | | | 54,419,616 | | | | — | | | | — | | | | 54,419,616 | | |

Computers & Computer

Services | | | 7,108,630 | | | | — | | | | — | | | | 7,108,630 | | |

Construction Materials | | | 2,332,115 | | | | — | | | | — | | | | 2,332,115 | | |

Electric | | | 137,188,159 | | | | — | | | | — | | | | 137,188,159 | | |

Electrical Components &

Equipment | | | 6,452,933 | | | | — | | | | — | | | | 6,452,933 | | |

Electronics | | | 35,565,265 | | | | — | | | | — | | | | 35,565,265 | | |

Entertainment | | | 14,070,560 | | | | — | | | | — | | | | 14,070,560 | | |

Environmental Control | | | — | | | | 29,906,314 | | | | — | | | | 29,906,314 | | |

Gas | | | 162,606,638 | | | | — | | | | — | | | | 162,606,638 | | |

Healthcare – Products | | | 15,085,945 | | | | 9,507,750 | | | | — | | | | 24,593,695 | | |

Home Furnishings | | | 26,832,891 | | | | — | | | | — | | | | 26,832,891 | | |

Household Products/Wares | | | 23,460,206 | | | | — | | | | — | | | | 23,460,206 | | |

Internet | | | 19,509,601 | | | | — | | | | — | | | | 19,509,601 | | |

Leisure Time | | | 1,195,957 | | | | — | | | | — | | | | 1,195,957 | | |

Lodging | | | 87,303,420 | | | | — | | | | — | | | | 87,303,420 | | |

Media | | | 134,617,187 | | | | — | | | | — | | | | 134,617,187 | | |

Mining | | | 4,671,194 | | | | — | | | | — | | | | 4,671,194 | | |

Packaging & Containers | | | 30,868,869 | | | | — | | | | — | | | | 30,868,869 | | |

Pharmaceuticals | | | 112,723,139 | | | | — | | | | — | | | | 112,723,139 | | |

Pipelines | | | 69,318,376 | | | | — | | | | — | | | | 69,318,376 | | |

Real Estate Investment Trusts | | | 10,120,931 | | | | — | | | | — | | | | 10,120,931 | | |

Retail | | | 5,606,413 | | | | — | | | | — | | | | 5,606,413 | | |

Savings & Loans | | | 18,107,884 | | | | — | | | | — | | | | 18,107,884 | | |

Semiconductors | | | 39,869,216 | | | | — | | | | — | | | | 39,869,216 | | |

Software | | | 105,185,150 | | | | — | | | | — | | | | 105,185,150 | | |

Telecommunications | | | 4,630,000 | | | | — | | | | — | | | | 4,630,000 | | |

Rights | | | — | | | | 6,747,469 | | | | 2,853,976 | | | | 9,601,445 | | |

Purchased Options | | | 2,764,552 | | | | — | | | | — | | | | 2,764,552 | | |

Short-Term Investments | | | 633,462,131 | | | | — | | | | — | | | | 633,462,131 | | |

TOTAL | | $ | 1,907,650,186 | | | $ | 46,161,533 | | | $ | 2,853,976 | | | $ | 1,956,665,695 | | |

* Refer to footnote 2 where leveling hierarchy is defined.

See Notes to Financial Statements.

Annual Report | May 31, 2016

17

The Arbitrage Fund Portfolio of Investments (continued)

Other Financial Instruments*** | | Level 1 | | Level 2 | | Level 3 | | Total | |

Assets | |

Forward Foreign Currency

Exchange Contracts | | $ | — | | | $ | 3,596,649 | | | $ | — | | | $ | 3,596,649 | | |

Liabilities | |

Common Stocks** | | | (411,947,246 | ) | | | — | | | | — | | | | (411,947,246 | ) | |

Rights | | | — | | | | — | | | | (65 | ) | | | (65 | ) | |

Written Options | | | (247,773 | ) | | | — | | | | — | | | | (247,773 | ) | |

Forward Foreign Currency

Exchange Contracts | | | — | | | | (3,183,497 | ) | | | — | | | | (3,183,497 | ) | |

TOTAL | | $ | (412,195,019 | ) | | $ | 413,152 | | | $ | (65 | ) | | $ | (411,781,932 | ) | |

** Refer to Portfolio of Investments for sector information.

*** Other financial instruments are instruments such as written options, securities sold short, equity swaps and forward foreign currency exchange contracts.

The following is a reconciliation of the fair valuations using significant unobservable inputs (Level 3) for the Fund's assets and liabilities during the year ended May 31, 2016:

Investments

in Securities | | Balance as of

May 31, 2015 | | Realized

Gain/(Loss) | | Change in

Unrealized

Appreciation/

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance as of

May 31, 2016 | | Net change in

Unrealized

Appreciation/

(Depreciation)

included in the

Statement of

Operations

attributable to

Level 3

investments

held at

May 31, 2016 | |

Rights | | $ | 10,711,137 | | | $ | – | | | $ | 93,748 | | | $ | – | | | $ | – | | | $ | – | | | $ | (7,950,909 | ) | | $ | 2,853,976 | | | $ | 93,748 | | |

Total | | $ | 10,711,137 | | | $ | – | | | $ | 93,748 | | | $ | – | | | $ | – | | | $ | – | | | $ | (7,950,909 | ) | | $ | 2,853,976 | | | $ | 93,748 | | |

Other

Financial

Instruments | | Balance as of

May 31, 2015 | | Realized

Gain/(Loss) | | Change in

Unrealized

Appreciation/

(Depreciation) | | Purchases | | Sales

Proceeds | | Transfers

into

Level 3 | | Transfers

out of

Level 3 | | Balance as of

May 31, 2016 | | Net change in

Unrealized

Appreciation/

(Depreciation)

included in the

Statement of

Operations

attributable to

Level 3

investments

held at

May 31, 2016 | |

Rights | | $ | (90 | ) | | $ | – | | | $ | 25 | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | (65 | ) | | $ | 25 | | |

Total | | $ | (90 | ) | | $ | – | | | $ | 25 | | | $ | – | | | $ | – | | | $ | – | | | $ | – | | | $ | (65 | ) | | $ | 25 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

18

The Arbitrage Event-Driven Fund Manager Commentary

The Arbitrage Event-Driven Fund | Tickers: AEDFX, AEDNX, AEFCX, AGEAX

The Fund's Goal and Main Investments

The Fund seeks to provide capital growth by investing in credit and equity securities involved in specific corporate events, with a focus on low volatility and low correlation relative to the broader capital markets.

Investment Strategy

The Fund's investment process follows a disciplined, fundamental approach that values downside protection while identifying compelling risk/reward opportunities available to us as we screen catalyst-driven corporate events, such as mergers and acquisitions, restructurings, refinancings, recapitalizations, spin-offs, litigation, regulatory changes, and bankruptcy. We analyze these events through three core approaches: merger arbitrage, equity special situations, and credit opportunities. We seek to generate investment returns that have low volatility and low correlation compared to the broader capital markets. We do not manage against any particular benchmark, and believe that capital preservation in difficult markets is as important as generating positive returns within our low correlated, low volatility event-driven strategy. This process and approach has been an integral part of the culture at Water Island Capital since the firm's inception.

Fiscal Year Highlights

The Arbitrage Event-Driven Fund (Class I shares: AEDNX) returned -5.27% for fiscal year 2016. The merger arbitrage sleeve of the fund contributed to returns overall, while the equity special situations and credit opportunities sleeves were detractors. While the Fund experienced losses primarily in the Americas, the European region was a contributor overall. The Fund's top-performing sector was consumer discretionary. Conversely, the energy sector detracted the most from returns, which was impacted by both a terminated transaction in the merger arbitrage sleeve as well as a number of equity special situations investments that experienced deteriorating fundamentals amidst last year's severe decline in oil prices.

The Fund's top performing investment for the year was our equity special situations position in Media General (MEG). Our involvement in MEG began when the company completed its acquisition of LIN Media in December 2014. We continued to own the stock as we believed MEG could benefit from the synergies resulting from the LIN acquisition. However, after earnings misses over the course of the year, and following their announcement in August 2015 that they would pursue an acquisition of Meredith (a move viewed unfavorably by their shareholders) MEG's stock price plummeted. We held onto the position on the belief that the decrease in share price would either lead to shareholder activism or an acquisition offer. In September 2015, our thesis was confirmed as Nexstar made an offer for MEG contingent on them abandoning their Meredith acquisition. The Fund profited from this position as Nexstar made increasingly larger bids during Q4 2015 in an effort to lock down a definitive agreement (which it did in January 2016).

The next highest contributor for the Fund was Charter Communications' deal to purchase rival Time Warner Cable for $87.4 billion. In May 2015, Charter entered into a definitive agreement to acquire Time Warner, which had been the target of an attempted acquisition by Comcast that was blocked due to competition concerns a year prior. Charter, on the other hand, received all required regulatory approvals in a straightforward and timely fashion, and the deal closed successfully in May 2016.

Annual Report | May 31, 2016

19

The Arbitrage Event-Driven Fund Manager Commentary (continued)

The Fund's largest detractor for the year was our credit opportunities investment in NII Holdings (NIHD). NIHD is a wireless telecommunications service provider with a focus on markets in Brazil and Argentina, which filed for bankruptcy protection in September 2014. We established a position in NIHD's debt in early 2015 after a group of its largest creditors agreed on a reorganization plan that we believed offered NIHD creditors attractive risk-adjusted returns upon emergence from Chapter 11. Following its exit from bankruptcy during Q2 2015, where holders received cash and equity in the company, a combination of events, including weakness for Brazilian assets, motivated bond holders seeking to quickly exit the equity that they received as part of the reorganization process, and a poor earnings release shortly following exit from Chapter 11, all conspired to pressure prices of NIHD equity. As conditions in Brazil and the wireless sector rapidly deteriorated into late 2015, we sold our position in the Fund as we saw diminishing prospects for a clear or near-dated catalyst.

The Fund was also impacted by a broken deal in the merger arbitrage sleeve, the saga of Williams Companies. In June 2015, Williams Companies' roll-up of its master limited partnership (MLP) subsidiary, Williams Partners, was interrupted when Energy Transfer entered with a bid for the acquirer. Williams Companies rejected the Energy Transfer bid and subsequently entered into an official auction process. Energy Transfer participated in the auction process and eventually won out with its cash-and-stock bid; however, amidst the decline in oil prices from $60/barrel in June to $45/barrel at the end of September, what was once a deal valuing Williams at $64/share was now only worth $43.50/share. The Fund exited the position during the first quarter of 2016.

The Fund's worst performer in the equity special situations sleeve was our investment in Dynegy, an electric utility company operating both coal-fired and natural gas-fired power stations across the US. While, historically, a majority of Dynegy's exposure was to coal-fired plants, after emerging from bankruptcy in 2012, the company began an aggressive acquisition of natural gas-fired plants and now has a 50-50 split of coal and gas utility/exposure. The Fund experienced losses in this position during Q3 2015 as Franklin Resources, a bond income fund which owned Dynegy in bankruptcy and was a large shareholder of the company's equity, filed a 13D looking to potentially sell their position. The market reacted to this news with a sell-off as the prevailing belief was that because Franklin Resources was under duress (the company previously had significant exposure to distressed energy names as energy prices plummeted in the latter half of the year), they would sell their equity holdings at depressed levels in order to raise funds and that Dynegy's stock price would be negatively impacted. While we believe Dynegy was attractively valued, we chose to exit our position in the Q4 2015 as we believed the duration associated with a change in sentiment around Dynegy's fundamentals was no longer appropriate.

Definitions

13D: An SEC filing that must be submitted to the US Securities and Exchange Commission within 10 days, by anyone who acquires beneficial ownership of more than 5% of any class of publicly traded securities in a public company.

www.arbitragefunds.com | 1-800-295-4485

20

The Arbitrage Event-Driven Fund Portfolio Information

Performance (annualized returns as of May 31, 2016)

| | | One

Year | | Five

Year | | Since

Inception* | |

Arbitrage Event-Driven Fund, Class R | | | -5.55 | % | | | 0.25 | % | | | 0.82 | % | |

Arbitrage Event-Driven Fund, Class I | | | -5.27 | % | | | 0.50 | % | | | 1.06 | % | |

Arbitrage Event-Driven Fund, Class C** | | | -6.14 | % | | | N/A | | | | -0.78 | % | |

Arbitrage Event-Driven Fund, Class A*** | | | -5.54 | % | | | N/A | | | | -1.09 | % | |

Barclays Capital U.S. Aggregate Bond Index | | | 2.99 | % | | | 3.33 | % | | | 3.24 | % | |

HFRI Event Driven Index | | | -4.71 | % | | | 2.60 | % | | | 3.90 | % | |

Current performance may be higher or lower than performance quoted above. Any performance data quoted represents past performance, and the investment return and principal value of an investment in the Fund will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance is no guarantee of future results. Returns do not reflect a 2% redemption fee for shares that are redeemed from the fund within 30 days of purchase, which, if reflected, would reduce the performance quoted. Returns shown above include the reinvestment of all dividends and capital gains. Contractual fee waivers are currently in effect. Without such fee waivers, performance numbers would be reduced. You can obtain performance data current to the most recent month end by calling 1-800-295-4485 or going to www.arbitragefunds.com.

* Class R and Class I inception: 10/1/10; Class C inception: 6/1/12; Class A inception: 6/1/13.

** Class C shares are subject to a 1.00% contingent deferred sales charge on all purchases redeemed in 12 months of purchase.

*** Class A shares are subject to a maximum front-end sales load of 3.25% on purchases up to $500,000. The shares are also subject to a deferred sales charge of up to 1.00% on purchases of $500,000 or more purchased without a front-end sales load and redeemed within 18 months of purchase.

The Total Annual Fund Operating Expenses for Class R, Class I, Class C and Class A are 2.52%, 2.27%, 3.27% and 2.52%, respectively. The Advisor has agreed to waive fees (not including the effects of interest, dividends on short positions, brokerage commissions, acquired fund fees and expenses, taxes, or other extraordinary expenses) in excess of 1.69%, 1.44%, 2.44% and 1.69% for Class R, Class I, Class C and Class A, respectively, until at least September 30, 2017. These expense ratios are as stated in the current prospectus and may differ from the expense ratios disclosed in the financial highlights in this report.

The Barclays Capital U.S. Aggregate Bond Index is a market value-weighted index of investment-grade fixed-rated debt issues, including government, corporate, asset-backed and mortgage-backed securities with a maturity of one year or more.

The HFRI Event Driven Index is an index of companies currently or prospectively involved in corporate transactions of a wide variety including but not limited to mergers, restructurings, financial distress, lender offers, shareholder buybacks, debt exchanges, security issuance or other capital structure adjustments. Security types can range from most senior in the capital structure to most junior or subordinated and frequently involve additional derivative securities. Event-Driven exposure includes a combination of sensitivities to equity markets, credit markets and idiosyncratic, company-specific developments.

An investor may not invest directly in an index.

Annual Report | May 31, 2016

21

The Arbitrage Event-Driven Fund Portfolio Information (continued)

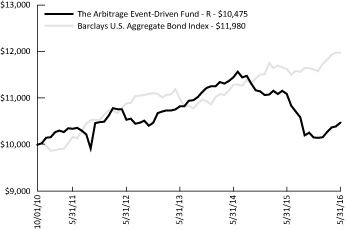

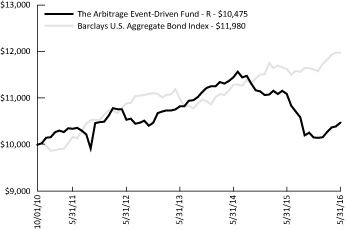

Growth of $10,000 Investment

The chart represents historical performance of a hypothetical investment of $10,000 in the Class R shares of the Fund since inception. Past performance does not guarantee future results. This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

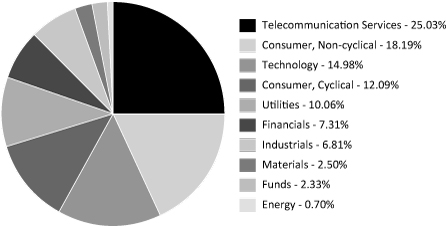

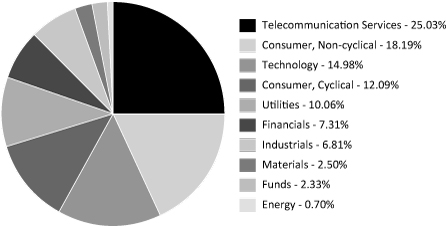

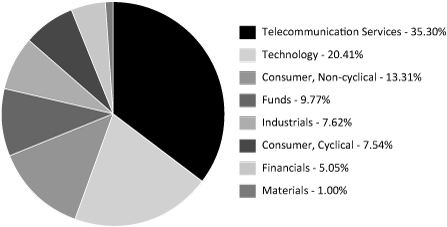

Sector Weighting

The following chart shows the sector weightings of The Arbitrage Event-Driven Fund's investments in common stock, preferred stock, exchange-traded funds, corporate bonds and convertible corporate bonds as of the report date.

www.arbitragefunds.com | 1-800-295-4485

22

The Arbitrage Event-Driven Fund Portfolio of Investments

| | | Shares | | Value | |

COMMON STOCKS - 59.60% | |

Auto Parts & Equipment - 0.27% | |

Tower International, Inc. | | | 22,609 | | | $ | 489,937 | | |

Banks - 3.27% | |

FirstMerit Corp.(a) | | | 259,313 | | | | 5,881,219 | | |

Beverages - 2.64% | |

SABMiller Plc | | | 76,350 | | | | 4,748,923 | | |

Biotechnology - 0.49% | |

Celator Pharmaceuticals, Inc.(b)(c) | | | 29,417 | | | | 884,863 | | |

Chemicals - 2.69% | |

Syngenta AG, ADR | | | 17,968 | | | | 1,417,496 | | |

Valspar Corp.(a)(b) | | | 31,620 | | | | 3,425,078 | | |

| | | | 4,842,574 | | |

Commercial Services - 2.93% | |

ExamWorks Group, Inc.(c) | | | 35,698 | | | | 1,246,217 | | |

USG People N.V.(c) | | | 207,262 | | | | 4,028,759 | | |

| | | | 5,274,976 | | |

Computers & Computer Services - 2.29% | |

Accenture Plc, Class A | | | 1,885 | | | | 224,259 | | |

Brocade Communications Systems, Inc. | | | 72,323 | | | | 655,242 | | |

CGI Group, Inc., Class A(c) | | | 10,240 | | | | 479,027 | | |

Cognizant Technology Solutions Corp., Class A(c) | | | 3,568 | | | | 219,218 | | |

Electronics For Imaging, Inc.(c) | | | 19,746 | | | | 865,467 | | |

Genpact Ltd.(c) | | | 9,168 | | | | 258,446 | | |

Hewlett Packard Enterprise Co. | | | 76,341 | | | | 1,410,018 | | |

| | | | 4,111,677 | | |

Electric - 3.19% | |

ITC Holdings Corp.(a) | | | 113,057 | | | | 5,033,298 | | |

Westar Energy, Inc. | | | 12,620 | | | | 710,884 | | |

| | | | 5,744,182 | | |

Electrical Components & Equipment - 0.35% | |

Saft Groupe SA | | | 15,294 | | | | 623,668 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

23

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 59.60% (Continued) | |

Electronics - 1.89% | |

FEI Co. | | | 14,871 | | | $ | 1,597,889 | | |

Rofin-Sinar Technologies, Inc.(b)(c) | | | 28,081 | | | | 897,188 | | |

Tyco International Plc | | | 21,143 | | | | 901,115 | | |

| | | | 3,396,192 | | |

Food - 0.67% | |

Illovo Sugar Ltd. | | | 165,800 | | | | 259,520 | | |

Nomad Foods Ltd.(c) | | | 98,036 | | | | 952,910 | | |

| | | | 1,212,430 | | |

Gas - 3.09% | |

AGL Resources, Inc. | | | 84,346 | | | | 5,549,967 | | |

Healthcare - Products - 1.27% | |

Affymetrix, Inc.(c)(d)(e) | | | 64,469 | | | | 902,566 | | |

St Jude Medical, Inc. | | | 17,714 | | | | 1,388,069 | | |

| | | | 2,290,635 | | |

Home Furnishings - 1.38% | |

TiVo, Inc.(c) | | | 249,053 | | | | 2,478,077 | | |

Household Products/Wares - 1.26% | |

Tumi Holdings, Inc.(c) | | | 84,794 | | | | 2,275,023 | | |

Internet - 3.43% | |

F5 Networks, Inc.(c) | | | 1,968 | | | | 216,874 | | |

Marketo, Inc.(c) | | | 38,220 | | | | 1,346,491 | | |

Yahoo!, Inc.(a)(c) | | | 121,640 | | | | 4,615,021 | | |

| | | | 6,178,386 | | |

Lodging - 4.11% | |

Interval Leisure Group, Inc. | | | 39,983 | | | | 574,156 | | |

Starwood Hotels & Resorts Worldwide, Inc.(a) | | | 92,780 | | | | 6,812,835 | | |

| | | | 7,386,991 | | |

Media - 7.37% | |

Cablevision Systems Corp., Class A(a) | | | 152,756 | | | | 5,297,578 | | |

Charter Communications, Inc., Class A(b)(c) | | | 29,047 | | | | 6,359,550 | | |

Nexstar Broadcasting Group, Inc., Class A(a)(b) | | | 30,172 | | | | 1,605,754 | | |

| | | | 13,262,882 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

24

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

COMMON STOCKS - 59.60% (Continued) | |

Mining - 0.00%(f) | |

Nevada Copper Corp.(c)(e) | | | 6,725 | | | $ | 3,333 | | |

Office/Business Equip - 0.48% | |

Canon, Inc., Sponsored ADR | | | 29,618 | | | | 854,479 | | |

Packaging & Containers - 1.67% | |

Rexam Plc | | | 329,607 | | | | 3,000,372 | | |

Pharmaceuticals - 5.73% | |

Allergan Plc(c) | | | 5,800 | | | | 1,367,350 | | |

Anacor Pharmaceuticals, Inc.(b)(c) | | | 13,618 | | | | 1,352,267 | | |

Baxalta, Inc. | | | 146,521 | | | | 6,627,145 | | |

Shire Plc, ADR | | | 1,300 | | | | 242,008 | | |

XenoPort, Inc.(c) | | | 100,738 | | | | 714,233 | | |

| | | | 10,303,003 | | |

Retail - 1.71% | |

Cabela's, Inc.(c) | | | 41,625 | | | | 2,021,310 | | |

Krispy Kreme Doughnuts, Inc.(b)(c) | | | 25,418 | | | | 543,437 | | |

Office Depot, Inc.(c) | | | 140,275 | | | | 502,184 | | |

| | | | 3,066,931 | | |

Semiconductors - 2.16% | |

KLA-Tencor Corp.(a) | | | 53,264 | | | | 3,884,544 | | |

Software - 5.18% | |

Cvent, Inc.(a)(b)(c) | | | 161,427 | | | | 5,780,701 | | |

inContact, Inc.(c) | | | 46,158 | | | | 640,673 | | |

Qlik Technologies, Inc.(c) | | | 30,003 | | | | 861,086 | | |

VMware, Inc., Class A(c) | | | 9,588 | | | | 580,649 | | |

Xura, Inc.(b)(c) | | | 58,308 | | | | 1,447,205 | | |

| | | | 9,310,314 | | |

Telecommunications - 0.08% | |

LogMeIn, Inc.(c) | | | 2,465 | | | | 151,031 | | |

TOTAL COMMON STOCKS

(Cost $103,052,963) | | | 107,206,609 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

25

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Shares | | Value | |

EXCHANGE-TRADED FUNDS - 1.89% | |

Equity Funds - 1.89% | |

Consumer Staples Select Sector SPDR® Fund | | | 20,970 | | | $ | 1,105,539 | | |

SPDR® S&P® Homebuilders ETF | | | 29,145 | | | | 996,176 | | |

Industrial Select Sector SPDR® Fund | | | 14,067 | | | | 786,767 | | |

Technology Select Sector SPDR® Fund | | | 11,352 | | | | 501,872 | | |

| | | | 3,390,354 | | |

TOTAL EXCHANGE-TRADED FUNDS

(Cost $3,264,327) | | | 3,390,354 | | |

RIGHTS - 0.38% | |

ArthroCare Corp. CVR, No expiration(c)(d)(e) | | | 157,791 | | | | 66,414 | | |

Casa Ley CVR, Expires 01/30/2018(c)(d)(e) | | | 891,084 | | | | 354,473 | | |

Chelsea Therapeutics CVR, Expires 03/31/2018(c)(d)(e) | | | 434,520 | | | | 25,072 | | |

Cubist Pharmaceuticals, Inc. CPR, Expires 07/01/2019(c)(d)(e) | | | 34,500 | | | | — | | |

Leap Wireless International CVR, Expires 03/13/2017(c)(e) | | | 64,802 | | | | 204,126 | | |

PDC CVR, Expires 12/31/2016(c)(d)(e) | | | 891,084 | | | | 20,584 | | |

Trius Therapeutics CVR, Expires 02/15/2017(c)(d)(e) | | | 103,378 | | | | 9,666 | | |

TOTAL RIGHTS

(Cost $1,170,262) | | | 680,335 | | |

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CORPORATE BONDS - 11.98% | |

Computers & Computer Services - 1.00% | |

Western Digital Corp.(g) | |

| | | 04/01/2023 | | | 7.375 | % | | $ | 1,127,000 | | | $ | 1,174,898 | | |

| | | 04/01/2024 | | | 10.500 | % | | | 607,000 | | | | 628,245 | | |

| | | | 1,803,143 | | |

Electric - 1.45% | |

Energy Future Intermediate

Holding Co. LLC /

EFIH Finance, Inc.(g)(h) | | 03/01/2022 | | | 11.750 | % | | | 2,264,438 | | | | 2,609,764 | | |

Entertainment - 0.02% | |

Pinnacle Entertainment, Inc.(g) | | 05/01/2024 | | | 5.625 | % | | | 37,000 | | | | 36,168 | | |

Insurance - 1.78% | |

Ambac Assurance Corp.(g) | | 06/07/2020 | | | 5.100 | % | | | 2,837,988 | | | | 3,210,474 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

26

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Maturity

Date | | Rate | | Principal

Amount | | Value | |

CORPORATE BONDS - 11.98% (Continued) | |

Media - 3.03% | |

LIN Television Corp.(a) | | 01/15/2021 | | | 6.375 | % | | $ | 1,926,000 | | | $ | 2,007,855 | | |

Neptune Finco Corp.(g) | | 10/15/2025 | | | 10.875 | % | | | 3,021,000 | | | | 3,436,387 | | |

| | | | 5,444,242 | | |

Miscellaneous Manufacturing - 1.69% | |

LSB Industries, Inc. | | 08/01/2019 | | | 7.750 | % | | | 2,974,000 | | | | 3,031,907 | | |

Telecommunications - 3.01% | |

Frontier Communications

Corp.(g) | | 09/15/2025 | | | 11.000 | % | | | 1,879,000 | | | | 1,911,882 | | |

Sprint Communications, Inc. | |

| | | 12/01/2016 | | | 6.000 | % | | | 2,780,000 | | | | 2,811,275 | | |

| | | 03/01/2017 | | | 9.125 | % | | | 669,000 | | | | 691,084 | | |

| | | | 5,414,241 | | |

TOTAL CORPORATE BONDS & NOTES

(Cost $20,799,109) | | | 21,549,939 | | |

CONVERTIBLE CORPORATE BONDS - 1.64% | |

Electric - 0.47% | |

Emera, Inc. | | 09/29/2025 | | | 4.000 | % | | | 2,565,000 | | | | 841,080 | | |

Home Furnishings - 1.17% | |

TiVo, Inc. | | 10/01/2021 | | | 2.000 | % | | | 2,146,000 | | | | 2,107,104 | | |

TOTAL CONVERTIBLE CORPORATE BONDS

(Cost $3,001,891) | | | 2,948,184 | | |

| | | Shares | | Value | |

PREFERRED STOCKS - 0.30% | |

Retail - 0.30% | |

RONA, Inc. | | | 34,344 | | | $ | 539,510 | | |

TOTAL PREFERRED STOCKS

(Cost $496,364) | | | 539,510 | | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

27

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Expiration

Date | | Exercise

Price | | Contracts | | Value | |

PURCHASED OPTIONS(c) - 0.17% | |

Call Options Purchased - 0.04% | |

Anacor Pharmaceuticals, Inc.: | |

| | | 08/2016 | | $ | 105.00 | | | | 128 | | | $ | 3,840 | | |

| | | 08/2016 | | | 110.00 | | | | 230 | | | | 4,025 | | |

Great Plains Energy, Inc.: | |

| | | 09/2016 | | | 30.00 | | | | 25 | | | | 2,188 | | |

| | | 12/2016 | | | 30.00 | | | | 19 | | | | 2,375 | | |

Huntington Bancshares, Inc. | | 07/2016 | | | 12.00 | | | | 4,477 | | | | 13,431 | | |

Krispy Kreme Doughnuts, Inc. | | 08/2016 | | | 22.00 | | | | 10 | | | | 150 | | |

LSB Industries, Inc.: | |

| | | 06/2016 | | | 10.00 | | | | 46 | | | | 15,180 | | |

| | | 06/2016 | | | 12.50 | | | | 46 | | | | 6,325 | | |

Mylan N.V. | | 07/2016 | | | 50.00 | | | | 11 | | | | 308 | | |

Rovi Corp. | | 07/2016 | | | 17.50 | | | | 223 | | | | 20,627 | | |

Xura, Inc. | | 07/2016 | | | 25.00 | | | | 50 | | | | 1,000 | | |

TOTAL CALL OPTIONS PURCHASED

(Cost $111,577) | | | 69,449 | | |

Put Options Purchased - 0.13% | |

Anacor Pharmaceuticals, Inc.: | |

| | | 08/2016 | | | 85.00 | | | | 111 | | | | 3,885 | | |

| | | 08/2016 | | | 90.00 | | | | 92 | | | | 4,370 | | |

Celator Pharmaceuticals, Inc.: | |

| | | 07/2016 | | | 24.00 | | | | 22 | | | | 165 | | |

| | | 10/2016 | | | 19.00 | | | | 21 | | | | 263 | | |

| | | 10/2016 | | | 20.00 | | | | 2 | | | | 25 | | |

| | | 10/2016 | | | 21.00 | | | | 11 | | | | 138 | | |

Charter Communications, Inc.,

Class A | | 06/2016 | | | 250.00 | | | | 38 | | | | 198,930 | | |

Cvent, Inc. | | 10/2016 | | | 30.00 | | | | 7 | | | | 140 | | |

Rofin-Sinar Technologies, Inc.: | |

| | | 09/2016 | | | 25.00 | | | | 74 | | | | 1,480 | | |

| | | 09/2016 | | | 30.00 | | | | 124 | | | | 9,610 | | |

Rovi Corp. | | 07/2016 | | | 15.00 | | | | 367 | | | | 21,102 | | |

TOTAL PUT OPTIONS PURCHASED

(Cost $228,570) | | | 240,108 | | |

TOTAL PURCHASED OPTIONS

(Cost $340,147) | | | 309,557 | | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

28

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

| | | Yield | | Shares | | Value | |

SHORT-TERM INVESTMENTS - 30.02% | |

Money Market Fund | |

State Street Institutional Liquid Reserves

Fund | | | 0.455 | %(i) | | | 53,994,504 | | | $ | 53,994,504 | | |

TOTAL SHORT-TERM INVESTMENTS

(Cost $53,994,504) | | | 53,994,504 | | |

Total Investments - 105.98%

(Cost $186,119,567) | | | 190,618,992 | | |

Liabilities in Excess of Other Assets - (5.98)%(j) | | | (10,750,378 | ) | |

NET ASSETS - 100.00% | | $ | 179,868,614 | | |

Portfolio Footnotes

(a) Security, or a portion of security, is being held as collateral for short sales or written option contracts. At May 31, 2016, the aggregate market value of those securities was $23,795,350, representing 13.23% of net assets.

(b) Underlying security for a written/purchased call/put option.

(c) Non-income-producing security.

(d) Security fair valued using methods determined in good faith by the Pricing Committee. As of May 31, 2016, the total market value of these securities was $1,378,775, representing 0.77% of net assets.

(e) Security considered illiquid. On May 31, 2016, the total market value of these securities was $1,586,234, representing 0.88% of net assets.

(f) Less than 0.005% of net assets.

(g) Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of May 31, 2016, these securities had a total value of $13,007,818 or 7.23% of net assets.

(h) Security in default on interest payments.

(i) Rate shown is the 7-day effective yield as of May 31, 2016.

(j) Includes cash which is being held as collateral for short sales and written option contracts.

See Notes to Financial Statements.

Annual Report | May 31, 2016

29

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

Securities are determined to be illiquid under the procedures approved by the Funds' Board of Trustees. Information related to the Fund's illiquid securities as of May 31, 2016 is as follows:

Date of

Purchase | | Security | | Cost | | Value | | % of Net Assets | |

01/01/2016 | | Affymetrix, Inc. | | $ | 886,419 | | | $ | 902,566 | | | | 0.50 | % | |

05/30/2014 | | ArthroCare Corp. CVR | | | 55,227 | | | | 66,414 | | | | 0.04 | | |

01/30/2015 | | Casa Ley CVR | | | 904,361 | | | | 354,473 | | | | 0.20 | | |

06/24/2014 | | Chelsea Therapeutics CVR | | | — | | | | 25,072 | | | | 0.01 | | |

12/12/2011 | | Cubist Pharmaceuticals, Inc. CPR | | | — | | | | — | | | | 0.00 | | |

03/17/2014 | | Leap Wireless International CVR | | | 167,189 | | | | 204,126 | | | | 0.11 | | |

07/07/2011 | | Nevada Copper Corp. | | | 37,891 | | | | 3,333 | | | | 0.00 | | |

01/30/2015 | | PDC CVR | | | 43,485 | | | | 20,584 | | | | 0.01 | | |

09/12/2013 | | Trius Therapeutics CVR | | | — | | | | 9,666 | | | | 0.01 | | |

| | | | | | | $ | 1,586,234 | | | | 0.88 | % | |

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (29.37%) | |

Auto Parts & Equipment - (0.89%) | |

Autoliv, Inc. | | | (1,282 | ) | | $ | (157,186 | ) | |

BorgWarner, Inc. | | | (5,394 | ) | | | (183,558 | ) | |

Dana Holding Corp. | | | (5,096 | ) | | | (61,254 | ) | |

Johnson Controls, Inc. | | | (24,297 | ) | | | (1,072,712 | ) | |

Magna International, Inc. | | | (3,209 | ) | | | (130,061 | ) | |

| | | | (1,604,771 | ) | |

Banks - (2.60%) | |

Huntington Bancshares, Inc. | | | (447,658 | ) | | | (4,678,026 | ) | |

Beverages - (1.08%) | |

Molson Coors Brewing Co., Class B | | | (19,659 | ) | | | (1,949,780 | ) | |

Chemicals - (0.01%) | |

Valspar Corp. | | | (100 | ) | | | (10,832 | ) | |

Computers & Computer Services - (1.24%) | |

Brocade Communications Systems, Inc. | | | (72,322 | ) | | | (655,237 | ) | |

Computer Sciences Corp. | | | (24,958 | ) | | | (1,227,934 | ) | |

International Business Machines Corp. | | | (2,313 | ) | | | (355,601 | ) | |

| | | | (2,238,772 | ) | |

Construction Materials - (0.58%) | |

Armstrong World Industries, Inc. | | | (25,196 | ) | | | (1,041,855 | ) | |

See Notes to Financial Statements.

www.arbitragefunds.com | 1-800-295-4485

30

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (29.37%) (Continued) | |

Electric - (2.67%) | |

Emera, Inc. | | | (61,015 | ) | | $ | (2,150,077 | ) | |

Fortis, Inc. | | | (84,748 | ) | | | (2,650,980 | ) | |

Great Plains Energy, Inc. | | | (35 | ) | | | (1,021 | ) | |

| | | | (4,802,078 | ) | |

Healthcare - Products - (0.34%) | |

Abbott Laboratories | | | (15,426 | ) | | | (611,332 | ) | |

Internet - (2.24%) | |

Alibaba Group Holding Ltd., Sponsored ADR | | | (49,227 | ) | | | (4,036,614 | ) | |

Lodging - (3.12%) | |

Interval Leisure Group, Inc. | | | (39,974 | ) | | | (574,027 | ) | |

Marriott International, Inc., Class A | | | (69,935 | ) | | | (4,618,507 | ) | |

Starwood Hotels & Resorts Worldwide, Inc. | | | (5,700 | ) | | | (418,551 | ) | |

| | | | (5,611,085 | ) | |

Machinery - Diversified - (0.52%) | |

Manitowoc Foodservice, Inc. | | | (56,653 | ) | | | (933,075 | ) | |

Media - (5.08%) | |

Cable One, Inc. | | | (3,318 | ) | | | (1,625,787 | ) | |

Cablevision Systems Corp., Class A | | | (22,378 | ) | | | (776,069 | ) | |

Charter Communications, Inc., Class A | | | (25,612 | ) | | | (5,607,491 | ) | |

Gray Television, Inc. | | | (27,698 | ) | | | (327,390 | ) | |

Sinclair Broadcast Group, Inc., Class A | | | (13,157 | ) | | | (416,156 | ) | |

TEGNA, Inc. | | | (16,465 | ) | | | (378,037 | ) | |

| | | | (9,130,930 | ) | |

Mining - (0.00%)(a) | |

Nevada Copper Corp. | | | (6,725 | ) | | | (3,333 | ) | |

Miscellaneous Manufacturing - (0.07%) | |

LSB Industries, Inc. | | | (9,200 | ) | | | (120,980 | ) | |

Office/Business Equip - (0.98%) | |

Xerox Corp. | | | (176,298 | ) | | | (1,757,691 | ) | |

Packaging & Containers - (0.61%) | |

Ball Corp. | | | (15,056 | ) | | | (1,088,549 | ) | |

Pharmaceuticals - (3.21%) | |

Allergan Plc | | | (5,800 | ) | | | (1,367,350 | ) | |

See Notes to Financial Statements.

Annual Report | May 31, 2016

31

The Arbitrage Event-Driven Fund Portfolio of Investments (continued)

SCHEDULE OF SECURITIES SOLD SHORT | | Shares | | Value | |

COMMON STOCKS - (29.37%) (Continued) | |

Pharmaceuticals - (3.21%) (Continued) | |

Baxalta, Inc. | | | (7,000 | ) | | $ | (316,610 | ) | |

Shire Plc, ADR | | | (21,981 | ) | | | (4,091,983 | ) | |

| | | | (5,775,943 | ) | |

Real Estate Investment Trusts - (0.24%) | |

InnVest Real Estate Investment Trust | | | (85,872 | ) | | | (434,811 | ) | |

Retail - (0.10%) | |

Office Depot, Inc. | | | (47,900 | ) | | | (171,482 | ) | |

Semiconductors - (1.48%) | |

Intel Corp. | | | (11,054 | ) | | | (349,196 | ) | |

Lam Research Corp. | | | (26,632 | ) | | | (2,205,396 | ) | |

Rovi Corp. | | | (6,631 | ) | | | (111,467 | ) | |

| | | | (2,666,059 | ) | |

Software - (0.98%) | |

Citrix Systems, Inc. | | | (20,799 | ) | | | (1,766,251 | ) | |

Telecommunications - (1.33%) | |

Cisco Systems, Inc. | | | (12,062 | ) | | | (350,401 | ) | |

Frontier Communications Corp. | | | (28,561 | ) | | | (147,661 | ) | |

T-Mobile US, Inc. | | | (44,270 | ) | | | (1,892,985 | ) | |

| | | | (2,391,047 | ) | |

TOTAL COMMON STOCKS

(Proceeds $51,588,716) | | | (52,825,296 | ) | |

EXCHANGE-TRADED FUNDS - (0.63%) | |

Equity Funds - (0.63%) | |

Consumer Staples Select Sector SPDR® Fund | | | (12,641 | ) | | | (666,434 | ) | |

SPDR® S&P® Retail ETF | | | (10,966 | ) | | | (463,971 | ) | |

| | | | (1,130,405 | ) | |

TOTAL EXCHANGE-TRADED FUNDS

(Proceeds $1,096,068) | | | (1,130,405 | ) | |

RIGHTS - (0.00%)(a) | |

Chelsea Therapeutics CVR, Expires 03/31/2018 | | | (200 | ) | | | (12 | ) | |

TOTAL RIGHTS

(Proceeds $0) | | | (12 | ) | |

(a) Less than 0.005% of net assets.

See Notes to Financial Statements.