UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-09869

__Franklin Floating Rate Master Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_650 312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/17

Item 1. Reports to Stockholders.

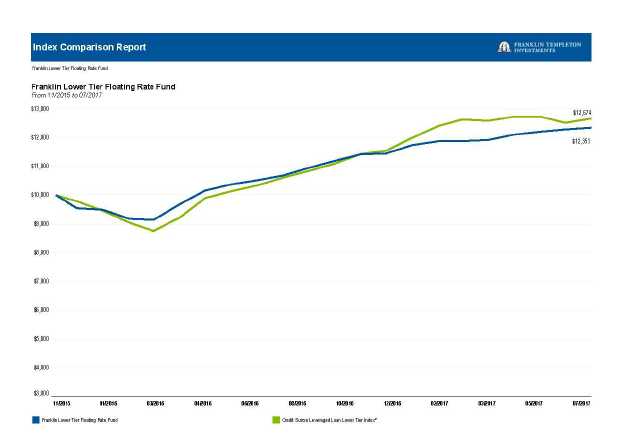

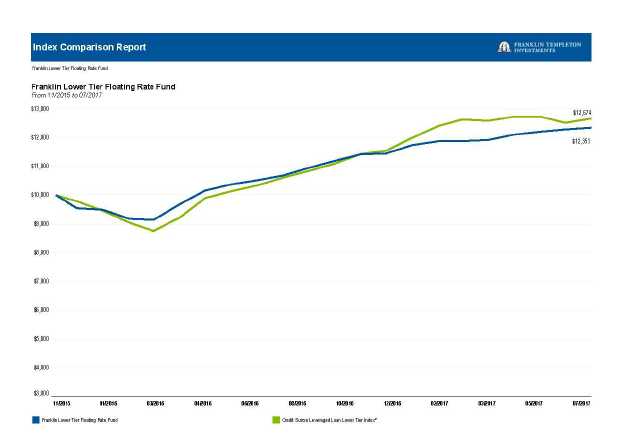

Franklin Lower Tier Floating Rate Fund Annual Report

Manager’s Discussion

During the period under review, the Franklin Lower Tier Floating Rate Fund delivered a +15.55% cumulative total return. In comparison, the Fund’s benchmark, the Credit Suisse Leveraged Loan (CS LL) Lower Tier Index (LTI), which is designed to mirror the lower tier (comprising companies with lower range revenues within the markets in which they operate) portion of the U.S. dollar-denominated leveraged loan market, generated a +19.40% total return for the same period.1 The Fund’s relative return benefited from its loan selection in the transportation and metals and mining industries, while the food and tobacco industry detracted from relative results. Over the period in review, the CS LL Upper Tier Index, which includes loans rated BB or above, returned +4.22%; the CS LL Middle Tier Index, which includes loans rated split BB, B and split B, returned +6.90%; and the CS LL LTI, which includes loans rated CCC or lower, returned +19.40%.1

Prior to this one-year period, the extended period of depressed and declining commodity prices negatively impacted valuations, which translated into lower trade levels as defaults in energy-related sectors increased and the outlook dimmed. However, at the start of the period under review, many energy-related commodity companies rebounded significantly from trough levels. The defaulted outstanding term debt of Peabody Energy jumped higher in price following a run-up in metallurgic coal spot price levels. The positive outlook for metallurgic coal pricing resulted in the loan becoming a top contributor to total return over the period. The higher market prices for metallurgic coal fully covered the first-lien term debt, which supported the higher trade levels for the loan. We used the stabilized commodity environment and the stronger market as an opportunity to reduce our exposure to Peabody and eventually exited the position. Also in the metals and mining sector, the term debt of Foresight Energy, an Illinois-Basin coal miner, traded higher following management's release of good financial results covering the fourth quarter in 2016 that significantly improved the company’s liquidity profile. The borrower approached the primary market with a new transaction that we used to eliminate our holdings. In the transportation sector, FRAM GROUP Holdings, an aftermarket supplier of car care products and an overweight position in the Fund, achieved new financing in the primary market and retired at par the outstanding short maturity first- and second-lien term loans the Fund held.

The term loan of CSM Bakery Supplies, a leading producer of bakery goods and finished products, stumbled following a new third-party technology initiative that led to inventory tracking errors and ultimately to several canceled contracts. The company believed the temporary disruption would not persist and the lost customer contracts could be re-signed. However, during this period, the company failed to win back select lost customer contracts and the expectation of deteriorating results continued to negatively impact trading levels. In general, the loan market experienced consecutive periods of positive performance generated from material cash inflows into prime funds and the newly formed collateralized debt obligations. In addition, the limited supply of net-new loans through primary market transactions created a technical imbalance pushing loan prices in the secondary market higher and above their call

protection in some cases. As a result, the portfolio held very few loans that detracted from relative results.

During the period, we focused on purchasing discounted short-maturity loans as several discounted short-maturity positions refinanced or amended their credit agreements to extend their maturities. The term debt of Jack Ohio Finance, an operator of three Ohio based casinos, rebranded the Ohio properties including a full renovation of the Thistledown site, which grew revenues sequentially. During the period, the term loan paid down in full shortly after our discounted purchases. In addition, Cannery Casino completed its final sale to Boyd Gaming, and Alfred Fueling, a manufacturer of fuel dispensing systems, also paid down their debt in full during the period. Overall, the majority of changes to the portfolio stemmed from large paydowns as a result of take-out loans (long-term loans that replace short-term loans) and refinancings of riskier borrowers, which ultimately positively impacted the credit quality of the portfolio. In the secondary market, we added FGI Operating Company, a firearm manufacturer, as well as Sungard Availability Services Capital, a provider of disaster recovery and colocation services, both of which were priced at a discount to par and near-term maturity with zero debt maturity in front of our loan tranches. In addition, we added to several new borrowers, including two borrowers in the telecommunications sector. We purchased the second-lien tranches of Global Tel*Link and Securus Technologies, which provide prisons with telecommunications systems and payment processing, at a modest discount to par. Overall, we decreased the number of borrowers in the portfolio from 26 issuers at the beginning of the period to 23 issuers by period-end. The loan assets that paid down in full, in addition to positions actively reduced toward an exit, increased the portfolio’s credit quality. Over the same period, the loan portfolio’s weighted average rating factor modestly decreased, another indication of increased credit quality.

Notes:

1. Source: Credit Suisse Group.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees,

expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s

portfolio.

See www.franklintempletondatasources.com for additional data provider information.

| | |

| Portfolio Breakdown | % of Total Net Assets | |

| 7/31/17 | | |

| |

| Senior Floating Rate Interests | 91.5 | % |

| Other Net Assets | 8.5 | % |

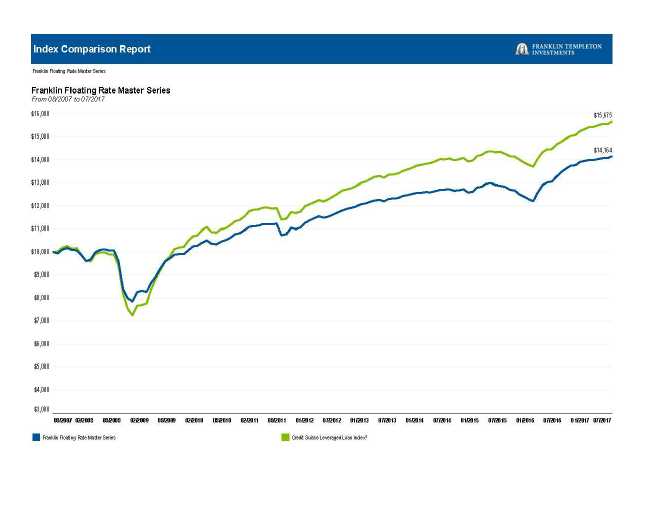

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

| | |

| Average Annual Total Return3 | |

| 7/31/17 | | |

| 1-Year | +15.55 | % |

| Since Inception 11/6/15 | +12.96 | % |

1. The Fund has an expense reduction contractually guaranteed through 11/30/17. Fund investment results reflect

the expense reduction; without this reduction, the results would have been lower.

2. Source: Credit Suisse Group. The CS LL LTI is designed to mirror the lower tier (comprising companies with

lower range revenues within the markets in which they operate) portion of the U.S. dollar-denominated leveraged

loan market. Loans must be below investment grade and rated no higher than Baa1/BB+ or Ba1/BBB+ by

Moody’s/Standard and Poor’s® (S&P).

3. Average annual total return represents the average annual change in value of an investment over the period

indicated. Return for less than one year, if any, has not been annualized.

See www.franklintempletondatasources.com for additional data provider information.

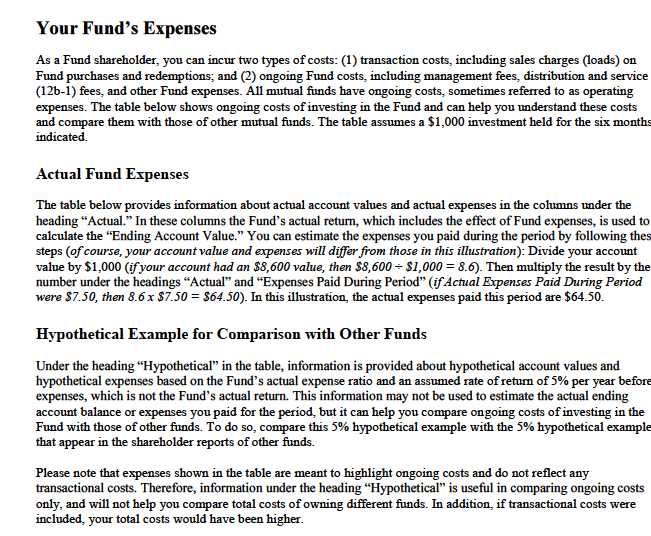

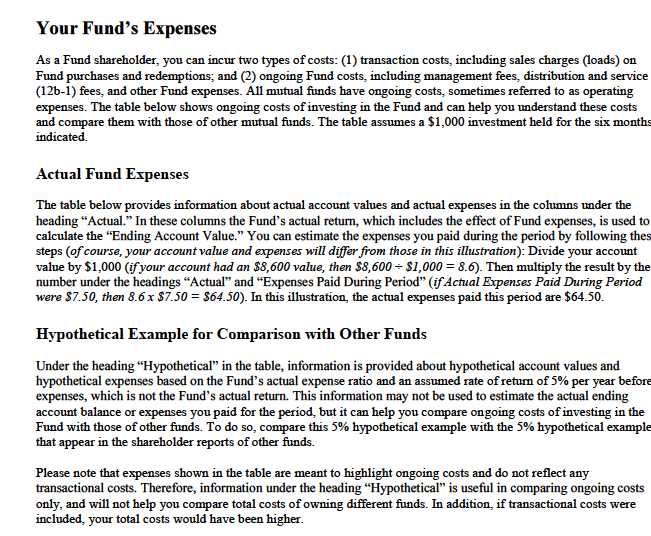

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical | | |

| | (actual return after expenses) | | (5% annual return before expenses) | |

| |

| | | | | | Expenses | | | | Expenses | | |

| | Beginning | | Ending | | Paid During | | Ending | | Paid During | | |

| | Account | | Account | | Period | | Account | | Period | Net Annualized | |

| | Value 2/1/17 | | Value 7/31/17 | | 2/1/17–7/31/171,2 | | Value 7/31/17 | | 2/1/17–7/31/171,2 | Expense Ratio2 | |

| |

| $ | 1,000 | $ | 1,039.60 | $ | 3.03 | $ | 1,021.82 | $ | 3.01 | 0.60 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—

multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year

period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

.

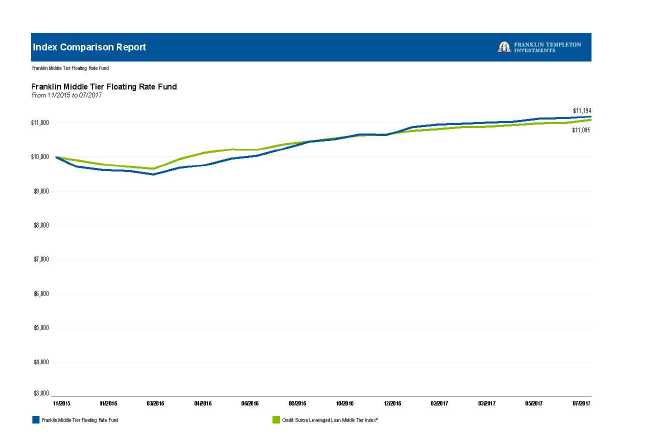

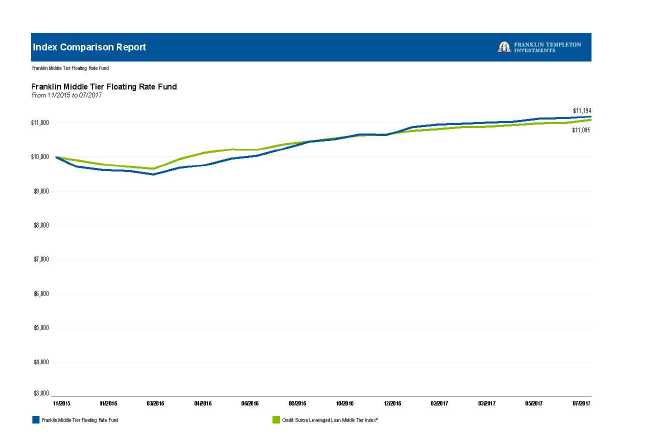

Franklin Middle Tier Floating Rate Fund Annual Report

Manager’s Discussion

During the period under review, the Franklin Middle Tier Floating Rate Fund delivered a +9.25% cumulative total return.1 In comparison, the Fund’s benchmark, the Credit Suisse Leveraged Loan (CS LL) Middle Tier Index (MTI), which is designed to mirror the middle tier (comprising companies with mid-range revenues within the markets in which they operate) portion of the U.S. dollar-denominated leveraged loan market, generated a +6.90% total return for the same period.1 The Fund’s relative return benefited from its loan selection in the energy, consumer durables and retail sectors, but was hampered by its loan selection in the services sector. Over the period in review, the CS LL Upper Tier Index, which includes loans rated BB or above, returned +4.22%; the CS LL Middle Tier Index, which includes loans rated split BB, B and split B, returned +6.90%; and the CS LL LTI, which includes loans rated CCC or lower, returned +19.40%.1

The Fund’s top contributors primarily consisted of those loans that had traded at a discount to par at the beginning of the period but traded higher following stabilized financial results. The term loan of 99 Cents Only Stores, one of the top performing loan assets over the period, benefited from management’s guidance by further reducing shrinkage and scrap losses, improving store operations and procurement of goods, which translated into increased revenue and a much-improved leverage and liquidity profile. We purchased the term loan at a material discount to par. Another loan asset, Freedom Group, a manufacturer of firearms, appreciated in the period as the company delivered on new product introductions and finally completed a planned operations consolidation. Meanwhile, the company was able to decrease total leverage over the period through increased profit margins and lower fixed costs. Lastly, in the energy sector, the term debt of Fieldwood Energy Group traded higher following a more constructive commodity price environment and well-timed new hedges that kept the company’s free cash flow positive. The company’s improved liquidity and increased value of its oil reserves provided adequate coverage of the first-lien debt facility and supported higher trading prices over the period.

The service sector detracted from relative results, which included the term debt of Onsite Rental Group that gradually declined following mixed financial results that continued to highlight a tight liquidity condition. Overall, the borrower refrained from additional capital expenditures to preserve liquidity and failed to win a new, important contract due to liquidity constraints. In general, the loan market experienced consecutive periods of positive performance generated from material cash inflows into prime funds and newly formed collateralized debt obligations. In addition, the limited supply of net-new loans through primary market transactions created a technical imbalance pushing loan prices in the secondary market higher and above their call protection in some cases. As a result, the portfolio held very few loans that detracted from relative results.

During the period, we actively managed the Fund’s exposures and purchased new positions to help diversify our holdings and reduce individual loan assets concentrations. Mainly, we targeted discounted high-quality loan assets with short-dated maturities that require the borrower to

address the capital structure in the near term. We purchased an upper tier-rated borrower, General Nutrition Centers, which encompassed all of our desired metrics and we added to the discounted position throughout the period. In the telecommunications sector, we purchased Global Tel*Link and Securus Technologies that provide prisons with telecommunication systems and payment processing, at a slight discount to par. We reduced the term debt of Carestream Health following further pressure on the loan as a result of deteriorating fundamentals. Carestream received bids from a buyout firm to acquire the dental business unit at an attractive multiple. The news pushed the term loan price higher and we actively reduced the large exposure toward an eventual exit of the first-lien debt at prices near par. A majority of the transactions that impacted the portfolio’s composition stemmed from capital market transactions that, in most cases, retired the outstanding debt obligations of the loan asset. Over the period, Alinta Energy Finance Pty, Cannery Casino Resorts and Sensus USA exited the loan market through transactions that retired the near-term outstanding loans. Overall, we increased the number of borrowers in the portfolio by five, from 27 issuers at the beginning of the period to 32 by period-end, which improved the portfolio’s diversification. Over the same period, the loan portfolio’s weighted average rating factor increased, indicating a modest decrease in credit quality.

Notes:

1. Source: Credit Suisse Group.

The indexes are unmanaged and include reinvestment of any income or distributions. They do not reflect any fees,

expenses or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s

portfolio.

See www.franklintempletondatasources.com for additional data provider information.

| | |

| Portfolio Breakdown | % of Total Net Assets | |

| 7/31/17 | | |

| |

| Senior Floating Rate Interests | 95.2 | % |

| Other Net Assets | 4.8 | % |

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

| | |

| Average Annual Total Return3 | |

| 7/31/17 | | |

| 1-Year | +9.25 | % |

| Since Inception 11/6/15 | +6.72 | % |

1. The Fund has an expense reduction contractually guaranteed through 11/30/17. Fund investment results reflect the

expense reduction; without this reduction, the results would have been lower.

2. Source: Credit Suisse Group. The CS LL MTI is designed to mirror the middle tier (comprising companies with

mid-range revenues within the markets in which they operate) portion of the U.S. dollar-denominated leveraged loan

market. Loans must be below investment grade and rated no higher than Baa1/BB+ or Ba1/BBB+ by

Moody’s/Standard and Poor’s® (S&P).

3. Average annual total return represents the average annual change in value of an investment over the period

indicated. Return for less than one year, if any, has not been annualized.

See www.franklintempletondatasources.com for additional data provider information.

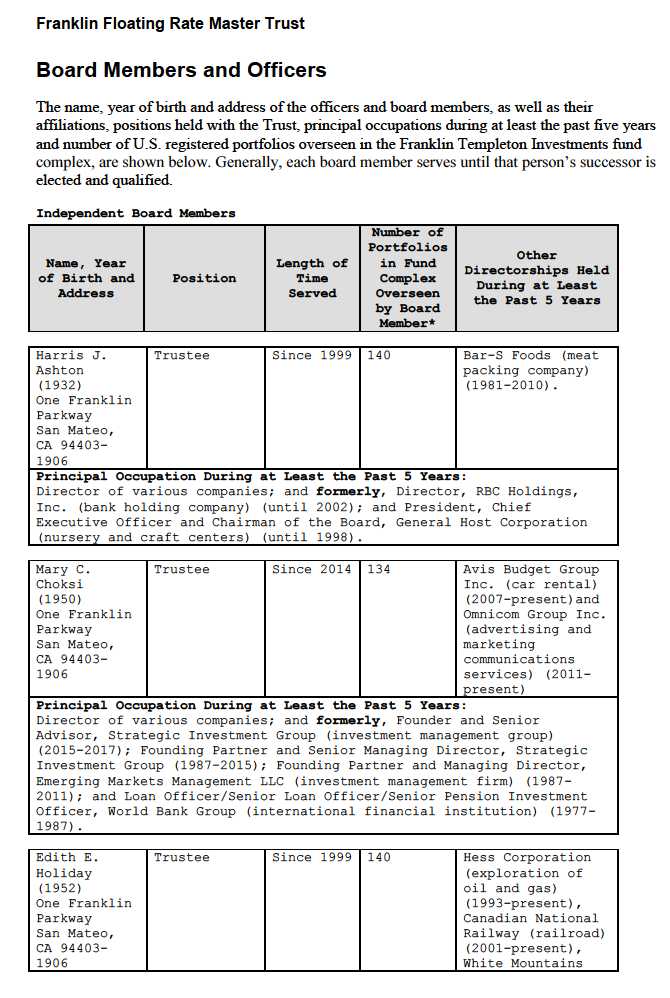

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | | |

| | | | Actual | | | | | | Hypothetical | | |

| | (actual return after expenses) | | (5% annual return before expenses) | |

| |

| | | | | | Expenses | | | | Expenses | | |

| | Beginning | | Ending | | Paid During | | Ending | | Paid During | | |

| | Account | | Account | | Period | | Account | | Period | Net Annualized | |

| | Value 2/1/17 | | Value 7/31/17 | | 2/1/17–7/31/171,2 | | Value 7/31/17 | | 2/1/17–7/31/171,2 | Expense Ratio2 | |

| |

| $ | 1,000 | $ | 1,021.20 | $ | 3.01 | $ | 1,021.82 | $ | 3.01 | 0.60 | % |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—

multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year

period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

| | | | | | |

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T | | | | | | |

| |

| |

| Financial Highlights | | | | | | |

| Franklin Lower Tier Floating Rate Fund | | | | | | |

| | | Year Ended July 31, | |

| | | 2017 | | | 2016 | a |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $ | 9.99 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income | | 0.962 | | | 0.658 | |

| Net realized and unrealized gains (losses) | | 0.530 | | | (0.017 | ) |

| Total from investment operations | | 1.492 | | | 0.641 | |

| Less distributions from net investment income | | (0.982 | ) | | (0.651 | ) |

| Net asset value, end of year. | $ | 10.50 | | $ | 9.99 | |

| |

| Total returnc | | 15.55 | % | | 6.90 | % |

| |

| Ratios to average net assetsd | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.70 | % | | 0.70 | % |

| Expenses net of waiver and payments by affiliatese | | 0.60 | % | | 0.60 | % |

| Net investment income | | 9.31 | % | | 9.47 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $ | 341,611 | | $ | 436,180 | |

| Portfolio turnover rate | | 54.26 | % | | 26.40 | %f |

aFor the period November 6, 2015 (commencement of operations) to July 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

eBenefit of expense reduction rounds to less than 0.01%.

fExcludes the value of portfolio securities received from purchase in-kind. See Note 3(f).

| 13 | Annual Report | The accompanying notes are an integral part of these financial statements. |

| | | | | |

| F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T |

| |

| |

| |

| Statement of Investments, July 31, 2017 | | | | | |

| Franklin Lower Tier Floating Rate Fund | | | | | |

| | | | Principal | | |

| | Country | | Amount* | | Value |

| a,b Senior Floating Rate Interests 91.5% | | | | | |

| Aerospace & Defense 4.7% | | | | | |

| Doncasters U.S. Finance LLC, Second Lien Term Loan, 9.546%, 10/09/20 | United States | $ | 16,536,432 | $ | 16,040,339 |

| Agricultural Products 0.3% | | | | | |

| Allflex Holdings III Inc., Second Lien Initial Term Loan, 8.307%, 7/16/21. | United States | | 981,132 | | 988,338 |

| Apparel Retail 1.8% | | | | | |

| Ascena Retail Group Inc., Tranche B Term Loan, 5.75%, 8/21/22 | United States | | 7,201,876 | | 6,013,566 |

| Coal & Consumable Fuels 1.5% | | | | | |

| Bowie Resource Holdings LLC, First Lien Initial Term Loan, 6.984%, 8/14/20 | United States | | 179,744 | | 174,052 |

| Westmoreland Coal Co., Term Loan, 7.796%, 12/16/20 | United States | | 5,746,625 | | 5,107,313 |

| | | | | | 5,281,365 |

| Commodity Chemicals 4.4% | | | | | |

| Cyanco Intermediate Corp., Initial Term Loan, 5.734%, 5/01/20. | United States | | 14,954,088 | | 15,078,700 |

| Diversified Chemicals 1.6% | | | | | |

| OCI Beaumont LLC, Term B-3 Loan, 7.929%, 8/20/19 | United States | | 5,355,159 | | 5,395,323 |

| Forest Products 4.0% | | | | | |

| Appvion Inc., Term Loan, 7.75% - 7.79%, 6/28/19 | United States | | 13,882,250 | | 13,529,405 |

| General Merchandise Stores 20.0% | | | | | |

| 99 Cents Only Stores, Tranche B-2 Loan, 4.702% - 4.796%, 1/11/19 | United States | | 35,850,718 | | 34,715,433 |

| Evergreen AcqCo. 1 LP (Savers), Term Loan, 5.011% - 5.064%, 7/09/19 | United States | | 35,423,379 | | 33,475,093 |

| | | | | | 68,190,526 |

| Industrial Machinery 3.3% | | | | | |

| Onsite Rental Group Operations Pty. Ltd., Term B Loan, 5.732%, 7/31/21 | Australia | | 14,923,274 | | 11,192,455 |

| Integrated Telecommunication Services 7.1% | | | | | |

| Global Tel*Link Corp., Second Lien Term Loan, 9.046%, 11/20/20. | United States | | 5,095,856 | | 5,092,672 |

| Securus Technologies Holdings Inc., | | | | | |

| Second Lien Term Loan, 9.00%, 4/17/21 | United States | | 9,556,000 | | 9,625,682 |

| c Second Lien Term Loan, 11.50%, 6/30/25 | United States | | 9,556,000 | | 9,625,682 |

| | | | | | 24,344,036 |

| IT Consulting & Other Services 5.2% | | | | | |

| Sungard Availability Services Capital Inc., 2019 Tranche B Term Loan, 6.234%, 3/29/19 . | United States | | 18,169,110 | | 17,964,707 |

| Movies & Entertainment 1.1% | | | | | |

| c Global Eagle Entertainment Inc., Initial Term Loans, 8.456%, 1/06/23 | United States | | 3,840,000 | | 3,746,400 |

| Oil & Gas Exploration & Production 18.4% | | | | | |

| Fieldwood Energy LLC, Loans, 4.171%, 10/01/18 | United States | | 22,149,764 | | 21,332,992 |

| UTEX Industries Inc., | | | | | |

| First Lien Initial Term Loan, 5.234%, 5/21/21 | United States | | 44,468,096 | | 40,049,079 |

| Second Lien Initial Term Loan, 8.484%, 5/20/22 | United States | | 1,500,000 | | 1,336,875 |

| | | | | | 62,718,946 |

| Oil & Gas Storage & Transportation 0.7% | | | | | |

| International Seaways Inc., Initial Term Loans, 6.79%, 6/22/22 | United States | | 2,500,000 | | 2,484,375 |

| Packaged Foods & Meats 4.4% | | | | | |

| CSM Bakery Supplies LLC, Second Lien Term Loan, 9.05%, 7/03/21 | United States | | 16,927,258 | | 14,938,305 |

| Paper Packaging 4.2% | | | | | |

| Caraustar Industries Inc., Refinancing Term Loans, 6.796%, 3/14/22 | United States | | 14,236,568 | | 14,352,240 |

| Personal Products 2.0% | | | | | |

| FGI Operating Co. LLC (Freedom Group), Term B Loans, 5.50%, 4/19/19 | United States | | 7,570,216 | | 7,033,995 |

Annual Report

14

| | | | | |

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T | | | | | |

| S T A T E M E N T OF IN V E S T M E N T S | | | | | |

| |

| |

| |

| |

| Franklin Lower Tier Floating Rate Fund (continued) | | | | | |

| | | | Principal | | |

| | Country | | Amount* | | Value |

| a,b Senior Floating Rate Interests (continued) | | | | | |

| Specialty Chemicals 4.6% | | | | | |

| Oxbow Carbon LLC, Second Lien Initial Term Loan, 8.234%, 1/17/20 | United States | $ | 15,510,000 | $ | 15,606,938 |

| Specialty Stores 2.2% | | | | | |

| PetSmart Inc., Tranche B-2 Loans, 4.23%, 3/11/22 | United States | | 7,897,063 | | 7,507,596 |

| Total Senior Floating Rate Interests | | | | | |

| (Cost $300,596,766) | | | | | 312,407,555 |

| Other Assets, less Liabilities 8.5% | | | | | 29,203,769 |

| Net Assets 100.0% | | | | $ | 341,611,324 |

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aThe coupon rate shown represents the rate at period end.

bSee Note 1(c) regarding senior floating rate interests.

cSecurity purchased on a delayed delivery basis. See Note 1(b).

| 15 | Annual Report | The accompanying notes are an integral part of these financial statements. |

| | | | | | |

| | | F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T | |

| |

| |

| Financial Highlights | | | | | | |

| Franklin Middle Tier Floating Rate Fund | | | | | | |

| | | Year Ended July 31, | |

| | | 2017 | | | 2016 | a |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $ | 9.83 | | $ | 10.00 | |

| Income from investment operationsb: | | | | | | |

| Net investment income | | 0.686 | | | 0.403 | |

| Net realized and unrealized gains (losses) | | 0.214 | | | (0.174 | ) |

| Total from investment operations | | 0.900 | | | 0.229 | |

| Less distributions from net investment income | | (0.690 | ) | | (0.399 | ) |

| Net asset value, end of year. | $ | 10.04 | | $ | 9.83 | |

| |

| Total returnc | | 9.25 | % | | 2.46 | % |

| |

| Ratios to average net assetsd | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.69 | % | | 0.71 | % |

| Expenses net of waiver and payments by affiliatese | | 0.60 | % | | 0.60 | % |

| Net investment income | | 6.82 | % | | 5.76 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $ | 303,689 | | $ | 348,682 | |

| Portfolio turnover rate | | 62.11 | % | | 42.49 | %f |

aFor the period November 6, 2015 (commencement of operations) to July 31, 2016.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cTotal return is not annualized for periods less than one year.

dRatios are annualized for periods less than one year, except for non-recurring expenses, if any.

eBenefit of expense reduction rounds to less than 0.01%.

fExcludes the value of portfolio securities received from purchase in-kind. See Note 3(f).

The accompanying notes are an integral part of these financial statements. | Annual Report 16

| | | | | | |

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T | | | | | |

| |

| |

| |

| Statement of Investments, July 31, 2017 | | | | | |

| Franklin Middle Tier Floating Rate Fund | | | | | |

| | | | | Principal | | |

| | | Country | | Amount* | | Value |

| a,b Senior Floating Rate Interests 95.2% | | | | | |

| Aerospace & Defense 6.5% | | | | | |

| Doncasters U.S. Finance LLC, | | | | | |

| | Second Lien Term Loan, 9.546%, 10/09/20 | United States | $ | 5,623,654 | $ | 5,454,944 |

| | Term B Loans, 4.796%, 4/09/20 | United States | | 14,810,641 | | 14,181,189 |

| | | | | | | 19,636,133 |

| Air Freight & Logistics 0.1% | | | | | |

| XPO Logistics Inc., Loans, 3.554%, 11/01/21 | United States | | 394,536 | | 396,651 |

| Apparel Retail 2.0% | | | | | |

| Ascena Retail Group Inc., Tranche B Term Loan, 5.75%, 8/21/22 | United States | | 7,394,300 | | 6,174,241 |

| Auto Parts & Equipment 0.2% | | | | | |

| TI Group Automotive Systems LLC, Initial US Term Loan, 3.984%, 6/30/22 | United States | | 611,424 | | 614,099 |

| Casinos & Gaming 0.6% | | | | | |

| c Caesars Entertainment Operating Co. LLC, Term B Loans, 5.75%, 8/31/24 | United States | | 389,276 | | 390,979 |

| Kingpin Intermediate Holdings LLC., Initial Term Loans, 5.48%, 7/03/24. | United States | | 1,376,000 | | 1,394,044 |

| | | | | | | 1,785,023 |

| Commodity Chemicals 4.6% | | | | | |

| Cyanco Intermediate Corp., Initial Term Loan, 5.734%, 5/01/20. | United States | | 13,752,651 | | 13,867,251 |

| Diversified Chemicals 1.6% | | | | | |

| OCI Beaumont LLC, Term B-3 Loan, 7.929%, 8/20/19 | United States | | 4,819,570 | | 4,855,716 |

| Electric Utilities 0.2% | | | | | |

| EFS Cogen Holdings I LLC (Linden), Term B Advance, 4.80%, 6/28/23 | United States | | 695,434 | | 702,823 |

| Food Retail 1.6% | | | | | |

| Smart & Final LLC, First Lien Term Loan, 4.734% - 4.796%, 11/15/22 | United States | | 4,999,217 | | 4,895,068 |

| General Merchandise Stores 10.4% | | | | | |

| 99 Cents Only Stores, Tranche B-2 Loan, 4.702% - 4.796%, 1/11/19 | United States | | 32,651,414 | | 31,617,442 |

| Health Care Services 1.1% | | | | | |

| c U.S. Renal Care Inc., Initial Term Loan, 5.546%, 12/31/22 | United States | | 3,291,646 | | 3,241,757 |

| Household Products 0.1% | | | | | |

| Spectrum Brands Inc., USD Term Loans, 3.179% - 3.314%, 6/23/22 | United States | | 154,217 | | 155,220 |

| Industrial Machinery 9.0% | | | | | |

| Navistar Inc., Tranche B Term Loans, 5.23%, 8/07/20 | United States | | 13,864,686 | | 14,029,329 |

| Onsite Rental Group Operations Pty. Ltd., Term B Loan, 5.732%, 7/31/21 | Australia | | 17,683,181 | | 13,262,386 |

| | | | | | | 27,291,715 |

| Integrated Telecommunication Services 10.6% | | | | | |

| Consolidated Communications Inc., Initial Term Loan, 4.24%, 10/05/23 | United States | | 1,017,267 | | 1,020,319 |

| c Global Tel*Link Corp., Term Loan, 5.296%, 5/23/20 | United States | | 15,156,078 | | 15,276,857 |

| Securus Technologies Holdings Inc., | | | | | |

| | Initial Term Loan, 4.694%, 4/30/20 | United States | | 7,760,828 | | 7,848,137 |

| | c Second Lien Term Loan, 11.50%, 6/30/25 | United States | | 136,615 | | 137,611 |

| | c Term Loan B, 7.50%, 6/30/24 | United States | | 7,760,828 | | 7,848,137 |

| | | | | | | 32,131,061 |

| IT Consulting & Other Services 2.5% | | | | | |

| c Sungard Availability Services Capital Inc., 2019 Tranche B Term Loan, 6.234%, 3/29/19 . | United States | | 7,592,444 | | 7,507,029 |

| Leisure Facilities 3.8% | | | | | |

| 24 Hour Fitness Worldwide Inc., Term Loan, 5.046%, 5/28/21. | United States | | 11,683,959 | | 11,672,860 |

| Marine 2.9% | | | | | |

| Navios Maritime Partners LP, Initial Term Loan, 6.25%, 9/14/20. | Greece | | 8,887,500 | | 8,909,719 |

| |

| |

| 17 | Annual Report | | | | | |

|

| F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T |

| S T A T E M E N T O F I N V E S T M E N T S |

| | | | | |

| Franklin Middle Tier Floating Rate Fund (continued) | | | | | |

| | | | Principal | | |

| | Country | | Amount* | | Value |

| a,b Senior Floating Rate Interests (continued) | | | | | |

| Movies & Entertainment 0.3% | | | | | |

| c Global Eagle Entertainment Inc., Initial Term Loans, 8.456%, 1/06/23 | United States | $ | 960,000 | $ | 936,600 |

| Oil & Gas Exploration & Production 11.1% | | | | | |

| Fieldwood Energy LLC, Loans, 4.171%, 10/01/18 | United States | | 21,656,525 | | 20,857,940 |

| UTEX Industries Inc., First Lien Initial Term Loan, 5.234%, 5/21/21 | United States | | 14,317,579 | | 12,894,770 |

| | | | | | 33,752,710 |

| Packaged Foods & Meats 4.7% | | | | | |

| CSM Bakery Supplies LLC, | | | | | |

| Second Lien Term Loan, 9.05%, 7/03/21 | United States | | 2,000,000 | | 1,765,000 |

| Term Loans, 5.30%, 7/03/20. | United States | | 12,999,049 | | 12,614,498 |

| | | | | | 14,379,498 |

| Personal Products 10.2% | | | | | |

| FGI Operating Co. LLC (Freedom Group), Term B Loans, 5.50%, 4/19/19 | United States | | 33,327,663 | | 30,966,965 |

| Semiconductors 0.4% | | | | | |

| MACOM Technology Solutions Holdings Inc., Initial Term Loans, 3.478%, 5/07/24 | United States | | 1,069,699 | | 1,069,699 |

| Specialized Consumer Services 0.1% | | | | | |

| NVA Holdings Inc., Second Lien Term Loan, 8.296%, 8/14/22. | United States | | 333,824 | | 337,996 |

| Specialty Chemicals 2.8% | | | | | |

| Oxbow Carbon LLC, Second Lien Initial Term Loan, 8.234%, 1/17/20 | United States | | 8,517,180 | | 8,570,412 |

| Specialty Stores 7.8% | | | | | |

| General Nutrition Centers Inc., Tranche B Term Loans, 3.74%, 3/04/19 | United States | | 6,249,902 | | 6,051,987 |

| c Jo-Ann Stores Inc., Initial Loans, 8.25%, 10/21/23 | United States | | 3,778,963 | | 3,782,901 |

| c PetSmart Inc., Tranche B-2 Loans, 4.23%, 3/11/22 | United States | | 14,543,610 | | 13,826,348 |

| | | | | | 23,661,236 |

| Total Senior Floating Rate Interests | | | | | |

| (Cost $285,858,306) | | | | | 289,128,924 |

| Other Assets, less Liabilities 4.8% | | | | | 14,559,844 |

| Net Assets 100.0% | | | | $ | 303,688,768 |

See Abbreviations on page 29.

*The principal amount is stated in U.S. dollars unless otherwise indicated.

aThe coupon rate shown represents the rate at period end.

bSee Note 1(c) regarding senior floating rate interests.

cA portion or all of the security purchased on a delayed delivery basis. See Note 1(b).

The accompanying notes are an integral part of these financial statements. | Annual Report 18

| | | | | | |

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T | | | | | | |

| |

| Financial Statements | | | | | | |

| |

| Statements of Assets and Liabilities | | | | | | |

| July 31, 2017 | | | | | | |

| |

| | | Franklin | | | Franklin | |

| | | Lower Tier | | | Middle Tier | |

| | | Floating | | | Floating | |

| | | Rate Fund | | | Rate Fund | |

| Assets: | | | | | | |

| Investments in securities: | | | | | | |

| Cost - Unaffiliated issuers | $ | 300,596,766 | | $ | 285,858,306 | |

| Value - Unaffiliated issuers | $ | 312,407,555 | | $ | 289,128,924 | |

| Cash. | | 27,336,275 | | | 41,333,350 | |

| Receivables: | | | | | | |

| Investment securities sold | | 16,860,175 | | | — | |

| Interest | | 1,042,830 | | | 819,927 | |

| Other assets | | 222 | | | 171 | |

| Total assets | | 357,647,057 | | | 331,282,372 | |

| Liabilities: | | | | | | |

| Payables: | | | | | | |

| Investment securities purchased | | 13,166,840 | | | 25,771,732 | |

| Management fees | | 212,705 | | | 153,156 | |

| Distributions to shareholders | | 2,646,912 | | | 1,657,243 | |

| Accrued expenses and other liabilities. | | 9,276 | | | 11,473 | |

| Total liabilities | | 16,035,733 | | | 27,593,604 | |

| Net assets, at value | $ | 341,611,324 | | $ | 303,688,768 | |

| Net assets consist of: | | | | | | |

| Paid-in capital | $ | 319,942,505 | | $ | 301,079,797 | |

| Undistributed net investment income. | | — | | | 73,673 | |

| Distributions in excess of net investment income | | (363,490 | ) | | — | |

| Net unrealized appreciation (depreciation) | | 11,810,789 | | | 3,270,618 | |

| Accumulated net realized gain (loss) | | 10,221,520 | | | (735,320 | ) |

| Net assets, at value | $ | 341,611,324 | | $ | 303,688,768 | |

| Shares outstanding. | | 32,528,928 | | | 30,236,980 | |

| Net asset value per share | $ | 10.50 | | $ | 10.04 | |

| 19 | Annual Report | The accompanying notes are an integral part of these financial statements. |

| | | | | | |

| | | F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T | |

| | | F I N A N C I A L S T A T E M E N T S | |

| |

| Statements of Operations | | | | | | |

| for the year ended July 31, 2017 | | | | | | |

| | | Franklin | | | Franklin | |

| | | Lower Tier | | | Middle Tier | |

| | | Floating | | | Floating | |

| | | Rate Fund | | | Rate Fund | |

| Investment income: | | | | | | |

| Interest. | $ | 38,799,964 | | $ | 23,454,623 | |

| Expenses: | | | | | | |

| Management fees (Note 3a) | | 2,547,386 | | | 2,056,183 | |

| Custodian fees (Note 4) | | 4,629 | | | 3,270 | |

| Reports to shareholders | | 4,463 | | | 4,219 | |

| Registration and filing fees | | 219 | | | 219 | |

| Professional fees | | 131,340 | | | 66,916 | |

| Trustees’ fees and expenses | | 15,801 | | | 12,496 | |

| Amortization of offering costs | | 18,414 | | | 19,085 | |

| Other | | 11,630 | | | 12,024 | |

| Total expenses | | 2,733,882 | | | 2,174,412 | |

| Expense reductions (Note 4) | | (2,779 | ) | | (2,190 | ) |

| Expenses waived/paid by affiliates (Note 3d) | | (383,584 | ) | | (275,356 | ) |

| Net expenses | | 2,347,519 | | | 1,896,866 | |

| Net investment income | | 36,452,445 | | | 21,557,757 | |

| Realized and unrealized gains (losses): | | | | | | |

| Net realized gain (loss) from investments | | 14,294,484 | | | 1,493,949 | |

| Net change in unrealized appreciation (depreciation) on investments | | 7,702,837 | | | 6,209,380 | |

| Net realized and unrealized gain (loss) | | 21,997,321 | | | 7,703,329 | |

| Net increase (decrease) in net assets resulting from operations | $ | 58,449,766 | | $ | 29,261,086 | |

The accompanying notes are an integral part of these financial statements. | Annual Report 20

| | | | | | | | | | | | | | |

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T | | | | | | | | | | | | | | |

| F I N A N C I A L S T A T E M E N T S | | | | | | | | | | | | | | |

| |

| |

| Statements of Changes in Net Assets | | | | | | | | | | | | | | |

| |

| | | Franklin Lower Tier | | | Franklin Middle Tier | |

| | | Floating Rate Fund | | | Floating Rate Fund | |

| | | Year Ended July 31, | | | Year Ended July 31, | |

| | | 2017 | | | | 2016 | * | | 2017 | | | | 2016 | * |

| Increase (decrease) in net assets: | | | | | | | | | | | | | | |

| Operations: | | | | | | | | | | | | | | |

| Net investment income | $ | 36,452,445 | | $ | 28,938,210 | | $ | 21,557,757 | | $ | 14,484,239 | |

| Net realized gain (loss) | | 14,294,484 | | | | (2,418,238 | ) | | 1,493,949 | | | | (2,238,129 | ) |

| Net change in unrealized appreciation (depreciation) | | 7,702,837 | | | | 4,107,952 | | | 6,209,380 | | | | (2,938,762 | ) |

| Net increase (decrease) in net assets resulting from | | | | | | | | | | | | | | |

| operations | | 58,449,766 | | | 30,627,924 | | | 29,261,086 | | | | 9,307,348 | |

| Distributions to shareholders from net investment income | | (37,193,892 | ) | | (28,634,343 | ) | | (21,691,391 | ) | | | (14,340,632 | ) |

| Capital share transactions (Note 2) | | (115,824,771 | ) | | 434,186,640 | | | (52,562,680 | ) | | 353,715,037 | |

| Net increase (decrease) in net assets | | (94,568,897 | ) | | 436,180,221 | | | (44,992,985 | ) | | 348,681,753 | |

| Net assets: | | | | | | | | | | | | | | |

| Beginning of year | | 436,180,221 | | | | — | | | 348,681,753 | | | | — | |

| End of year | $ | 341,611,324 | | $ | 436,180,221 | | $ | 303,688,768 | | $ | 348,681,753 | |

| Undistributed net investment income included in net assets: | | | | | | | | | | | | | | |

| End of year | $ | — | | | $ | 359,660 | | $ | 73,673 | | | $ | 178,650 | |

| Distributions in excess of net investment income included in net | | | | | | | | | | | | | | |

| assets: | | | | | | | | | | | �� | | | |

| End of year | $ | (363,490 | ) | | $ | — | | $ | — | | | $ | — | |

| * | For the period November 6, 2015 (commencement of operations) to July 31, 2016. |

| 21 | Annual Report | The accompanying notes are an integral part of these financial statements. |

FRANKLIN FLOATING RATE MASTER TRUST

Notes to Financial Statements

1. Organization and Significant Accounting Policies

Franklin Floating Rate Master Trust (Trust) is registered under the Investment Company Act of 1940 (1940 Act) as an open-end management investment company, consisting of three separate funds, two of which are included in this report (Funds) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The shares are issued in private placements and exempt from registration under the Securities Act of 1933.

The following summarizes the Funds’ significant accounting policies.

a. Financial Instrument Valuation

The Funds’ investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Funds calculate the net asset value (NAV) per share as of 4 p.m. Eastern time each day the New York Stock Exchange (NYSE) is open for trading. Under compliance policies and procedures approved by the Trust’s Board of Trustees (the Board), the Funds’ administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation Committee (VC). The VC provides administration and oversight of the Funds’ valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Funds to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Funds’ pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

The Funds have procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Securities Purchased on a Delayed Delivery Basis

Certain or all Funds purchase securities on a delayed delivery basis, with payment and delivery scheduled for a future date. These transactions are subject to market fluctuations and are subject to the risk that the value at delivery may be more or less than the trade date purchase price. Although the Funds will generally purchase these securities with the intention of holding the securities, they may sell the securities before the settlement date. Sufficient assets have been segregated for these securities.

c. Senior Floating Rate Interests

Certain or all Funds invest in senior secured corporate loans that pay interest at rates which are periodically reset by reference to a base lending rate plus a spread. These base lending rates are generally the prime rate offered by a designated U.S. bank or the London InterBank Offered Rate (LIBOR). Senior secured corporate loans often require prepayment of principal from excess cash flows or at the discretion of the borrower. As a result, actual maturity may be substantially less than the stated

Annual Report

22

|

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

1. Organization and Significant Accounting

Policies (continued)

c. Senior Floating Rate Interests (continued)

maturity. Senior secured corporate loans in which the Funds invest are generally readily marketable, but may be subject to certain restrictions on resale.

d. Income Taxes

It is each Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. Each Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

Each Fund may recognize an income tax liability related to its uncertain tax positions under U.S. GAAP when the uncertain tax position has a less than 50% probability that it will be sustained upon examination by the tax authorities based on its technical merits. As of July 31, 2017, each Fund has determined that no tax liability is required in its financial statements related to uncertain tax positions for any open tax years (or expected to be taken in future tax years). Open tax years are those that remain subject to examination and are based on the statute of limitations in each jurisdiction in which the Fund invests.

e. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Facility fees are recognized as income over the expected term of the loan. Dividends from net investment income are normally declared daily; these dividends may be reinvested or paid monthly to shareholders. Distributions from realized capital gains and other distributions, if any, are recorded on the ex-dividend date. Distributable earnings are determined according to income tax regulations (tax basis) and may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Common expenses incurred by the Trust are allocated among the Funds based on the ratio of net assets of each Fund to the combined net assets of the Trust. Fund specific expenses are charged directly to the Fund that incurred the expense.

f. Offering Costs

Offering costs are amortized on a straight line basis over twelve months.

g. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

h. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Funds, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

|

| F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

| | | | | | | | | | |

| 2. Shares of Beneficial Interest | | | | | | | | | | |

| |

| At July 31, 2017, there were an unlimited number of shares authorized (without par value). Transactions in the Funds’ shares were | |

| as follows: | | | | | | | | | | |

| |

| | Franklin Lower Tier | | Franklin Middle Tier | |

| | Floating Rate Fund | | Floating Rate Fund | |

| | Shares | | | Amount | | Shares | | | Amount | |

| Year ended July 31, 2017 | | | | | | | | | | |

| Shares sold | 1,895,423 | | $ | 20,008,980 | | 1,989,000 | | $ | 20,007,330 | |

| Shares issued in reinvestment of distributions | 26,801 | | | 279,449 | | 7,316 | | | 73,590 | |

| Shares redeemed. | (13,034,522 | ) | | (136,113,200 | ) | (7,237,066 | ) | | (72,643,600 | ) |

| Net increase (decrease) | (11,112,298 | ) | $ | (115,824,771 | ) | (5,240,750 | ) | $ | (52,562,680 | ) |

| Year ended July 31, 2016a | | | | | | | | | | |

| Shares sold in-kind (Note 3f) | 43,615,926 | | $ | 434,631,279 | | 36,016,253 | | $ | 358,899,279 | |

| Shares issued in reinvestment of distributions | 1,076,227 | | | 9,864,962 | | 538,477 | | | 5,111,878 | |

| Shares redeemed. | (1,050,927 | ) | | (10,309,601 | ) | (1,077,000 | ) | | (10,296,120 | ) |

| Net increase (decrease) | 43,641,226 | | $ | 434,186,640 | | 35,477,730 | | $ | 353,715,037 | |

|

| aFor the period November 6, 2015 (commencement of operations) to July 31, 2016. |

| 3. Transactions with Affiliates |

| Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton |

| Investments. Certain officers and trustees of the Trust are also officers, and/or directors of the following subsidiaries: |

| |

| Subsidiary | Affiliation |

| Franklin Advisers, Inc. (Advisers) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

a. Management Fees

The Funds pay an investment management fee to Advisers based on the average daily net assets of the Funds as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.650 | % | Up to and including $500 million |

| 0.550 | % | Over $500 million, up to and including $1 billion |

| 0.500 | % | Over $1 billion, up to and including $1.5 billion |

| 0.450 | % | Over $1.5 billion, up to and including $6.5 billion |

| 0.425 | % | Over $6.5 billion, up to and including $11.5 billion |

| 0.400 | % | Over $11.5 billion, up to and including $16.5 billion |

| 0.390 | % | Over $16.5 billion, up to and including $19 billion |

| 0.380 | % | Over $19 billion, up to and including $21.5 billion |

| 0.370 | % | In excess of $21.5 billion |

Annual Report

24

|

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

3. Transactions with Affiliates (continued)

a. Management Fees (continued)

For the year ended July 31, 2017, each Fund’s effective investment management fee rate based on average daily net assets was as follows:

| | | |

| Franklin | | Franklin | |

| Lower Tier | | Middle Tier | |

| Floating | | Floating | |

| Rate Fund | | Rate Fund | |

| |

| 0.650 | % | 0.650 | % |

b. Administrative Fees

Under an agreement with Advisers, FT Services provides administrative services to the Funds. The fee is paid by Advisers based on each of the Fund’s average daily net assets, and is not an additional expense of the Funds.

c. Transfer Agent Fees

Investor Services, under terms of an agreement, performs shareholder servicing for the Funds and is not paid by the Funds for the services.

d. Waiver and Expense Reimbursements

Advisers has contractually agreed in advance to waive or limit its fees and to assume as its own expense certain expenses otherwise payable by the Funds so that the expenses (excluding acquired fund fees and expenses) for each Fund do not exceed 0.60% based on each Fund’s average net assets (other than certain non-routine expenses or costs, including those relating to litigation, indemnification, reorganizations, and liquidations) until November 30, 2017. Total expenses waived or paid are not subject to recapture subsequent to each Fund’s fiscal year end.

e. Other Affiliated Transactions

At July 31, 2017, the shares of the Funds were owned by the following investment companies:

| | | |

| | | Percentage of | |

| | | Outstanding | |

| Franklin Lower Tier Floating Rate Fund | Shares | Shares | |

| Franklin Floating Rate Daily Access Fund | 1,895,423 | 5.8 | % |

| Franklin Low Duration Total Return Fund | 1,893,663 | 5.8 | % |

| Franklin Real Return Fund | 299,273 | 0.9 | % |

| Franklin Strategic Income Fund | 25,361,119 | 78.0 | %a |

| Franklin Strategic Income VIP Fund | 2,081,861 | 6.4 | % |

| Franklin Total Return Fund. | 997,589 | 3.1 | % |

| Total | 32,528,928 | 100.0 | % |

|

| F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

| | | | | | | |

| | | | | | | Percentage of | |

| | | | | | | Outstanding | |

| Franklin Middle Tier Floating Rate Fund | | | | Shares | | Shares | |

| Franklin Floating Rate Daily Access Fund | | | | 1,989,000 | | 6.6 | % |

| Franklin Low Duration Total Return Fund | | | | 2,389,308 | | 7.9 | % |

| Franklin Real Return Fund | | | | 110,724 | | 0.4 | % |

| Franklin Strategic Income Fund | | | | 21,833,687 | | 72.2 | %a |

| Franklin Strategic Income VIP Fund | | | | 2,024,951 | | 6.7 | % |

| Franklin Total Return Fund. | | | | 1,889,310 | | 6.2 | % |

| Total | | | | 30,236,980 | | 100.0 | % |

| aInvestment activities of this shareholder could have a material impact on the Fund. | | | | | |

| |

| f. Purchase In-Kind | | | | | | | |

| During the period ended July 31, 2016, shares of the Funds were sold to affiliated management investment companies through | |

| in-kind transfers of securities as follows: | | | | | | | |

| |

| Franklin Lower Tier Floating Rate Fund | | | | Market Value of Securities Transferred | |

| Franklin Low Duration Total Return Fund | | | | | $ | 17,742,918 | |

| Franklin Real Return Fund | | | | | | 2,519,518 | |

| Franklin Strategic Income Fund | | | | | | 374,291,707 | |

| Franklin Strategic Income VIP Fund | | | | | | 30,730,099 | |

| Franklin Total Return Fund | | | | | | 9,347,037 | |

| Total | | | | | $ | 434,631,279 | |

| |

| Franklin Middle Tier Floating Rate Fund | | | | Market Value of Securities Transferred | |

| Franklin Low Duration Total Return Fund | | | | | $ | 22,984,002 | |

| Franklin Real Return Fund | | | | | | 983,344 | |

| Franklin Strategic Income Fund | | | | | | 290,085,114 | |

| Franklin Strategic Income VIP Fund | | | | | | 26,672,554 | |

| Franklin Total Return Fund | | | | | | 18,174,265 | |

| Total | | | | | $ | 358,899,279 | |

| |

| g. Interfund Transactions | | | | | | | |

| Certain or all Funds engaged in purchases and sales of investments with funds or other accounts that have common investment | |

| managers (or affiliated investment managers), directors, trustees or officers. These purchases and sales for the year ended July 31, | |

| 2017, were as follows: | | | | | | | |

| |

| | | Franklin | | Franklin | | | |

| | | Lower Tier | | Middle Tier | | | |

| | | Floating | | Floating | | | |

| | | Rate Fund | | Rate Fund | | | |

| Purchases | $ | 26,970,014 | $ | 16,692,887 | | | |

| Sales. | $ | 16,692,887 | $ | 55,466,740 | | | |

| |

| |

| 4. Expense Offset Arrangement | | | | | | | |

| |

| The Funds have entered into an arrangement with their custodian whereby credits realized as a result of uninvested cash balances | |

| are used to reduce a portion of the Funds’ custodian expenses. During the year ended July 31, 2017, the custodian fees were reduced | |

| as noted in the Statements of Operations. | | | | | | | |

Annual Report

26

|

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

| | | | | | | | | | | | | | |

| 5. Income Taxes | | | | | | | | | | | | | | |

| For tax purposes, capital losses may be carried over to offset future capital gains, if any. At July 31, 2017, the capital loss |

| carryforwards were as follows: | | | | | | | | | | | | | | |

| | | Franklin Middle Tier | | | | | | | | | | | | |

| | | Floating Rate Fund | | | | | | | | | | | | |

| Capital loss carryforwards not subject to | | | | | | | | | | | | | | |

| expiration – short-term | $ | 729,517 | | | | | | | | | | | | |

| During the year ended July 31, 2017, the Funds utilized capital loss carryforwards as follows: | | | | | |

| | | Franklin | | | | | Franklin | | | | | |

| | | Lower Tier | | | Middle Tier | | | | | |

| | | Floating | | | | | Floating | | | | | |

| | | Rate Fund | | | | | Rate Fund | | | | | |

| | $ | 2,422,438 | | | | $ | 792,610 | | | | | |

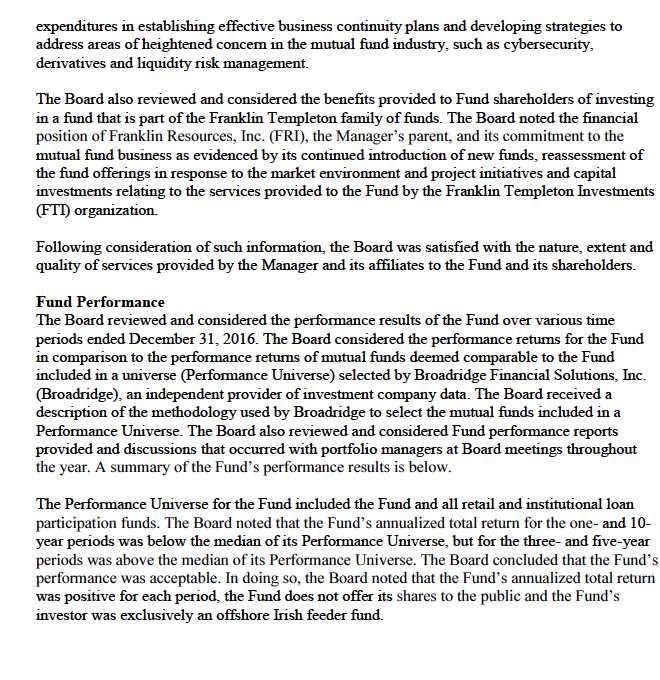

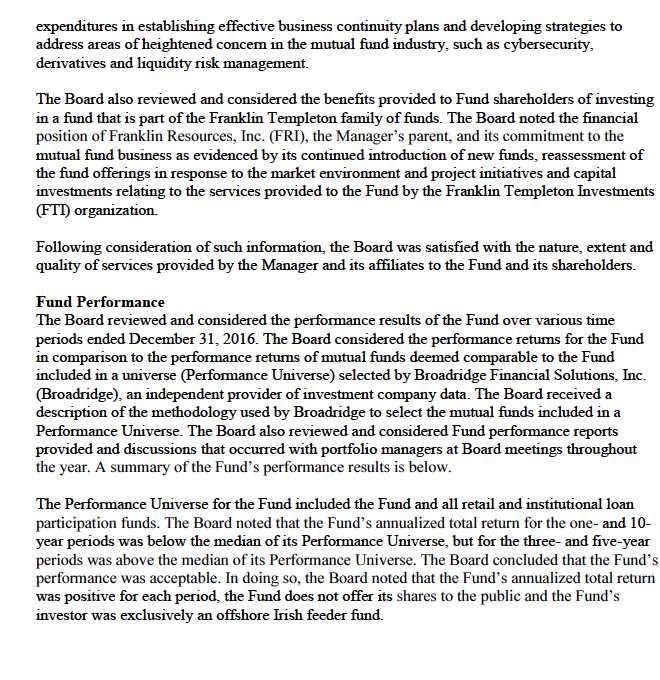

| The tax character of distributions paid during the years ended July 31, 2017 and 2016, was as follows: | | | | | |

| | | | | | Franklin Lower Tier | | | Franklin Middle Tier |

| | | | | | Floating Rate Fund | | | Floating Rate Fund |

| | | | | | 2017 | | 2016 | | | 2017 | | 2016 |

| Distributions paid from ordinary income. | | | | $ | 37,193,892 | $ | 28,634,343 | | $ | 21,691,391 | $ | 14,340,632 |

| |

| At July 31, 2017, the cost of investments, net unrealized appreciation (depreciation), undistributed ordinary income and | | |

| undistributed long term capital gains for income tax purposes were as follows: | | | | | | | |

| | | Franklin | | | | | Franklin | | | | | |

| | | Lower Tier | | | | | Middle Tier | | | | | |

| | | Floating | | | | | Floating | | | | | |

| | | Rate Fund | | | | | Rate Fund | | | | | |

| Cost of investments | $ | 300,611,589 | | $ | 285,863,044 | | | | | |

| |

| Unrealized appreciation | $ | 13,977,435 | | | $ | | 8,414,980 | | | | | |

| Unrealized depreciation | | (2,181,469 | ) | | | | (5,149,100 | ) | | | | |

| Net unrealized appreciation (depreciation) | $ | 11,795,966 | | | $ | | 3,265,880 | | | | | |

| |

| Undistributed ordinary income | $ | 4,599,290 | | | $ | | 1,729,849 | | | | | |

| Undistributed long term capital gains | | 7,920,479 | | | | | | | — | | | | | |

| Distributable earnings. | $ | 12,519,769 | | | $ | | 1,729,849 | | | | | |

| |

| Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing |

| treatments of offering costs and wash sales. | | | | | | | | | | | | | | |

|

| F R A N K L I N F L O A T I N G R A T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the year ended July 31, 2017, were as follows:

| | | | |

| | | Franklin | | Franklin |

| | | Lower Tier | | Middle Tier |

| | | Floating | | Floating |

| | | Rate Fund | | Rate Fund |

| |

| Purchases | $ | 188,195,743 | $ | 180,889,913 |

| Sales | $ | 334,336,886 | $ | 230,908,413 |

7. Credit Risk

At July 31, 2017, the Funds had 100% of their portfolios invested in senior secured floating rate notes rated below investment grade. These securities may be more sensitive to economic conditions causing greater price volatility and are potentially subject to a greater risk of loss due to default than higher rated securities.

8. Credit Facility

The Funds, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which matures on February 9, 2018. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Funds shall, in addition to interest charged on any borrowings made by the Funds and other costs incurred by the Funds, pay their share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon their relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.15% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statements of Operations. During the year ended July 31, 2017, the Funds did not use the Global Credit Facility.

9. Fair Value Measurements

The Funds follow a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Funds’ own market assumptions (unobservable inputs). These inputs are used in determining the value of the Funds’ financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Funds’ own assumptions in determining the fair value of financial instruments)

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

For movements between the levels within the fair value hierarchy, the Funds have adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At July 31, 2017, all of the Funds’ investments in financial instruments carried at fair value were valued using Level 2 inputs.

Annual Report

28

|

| F R A N K L I N F L O A T I N G RA T E MA S T E R T R U S T |

| N O T E S T O F I N A N C I A L S T A T E M E N T S |

10. New Accounting Pronouncements

In March 2017, the Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2017-08, Receivables—Nonrefundable Fees and Other Costs (Subtopic 310-20): Premium Amortization on Purchased Callable Debt Securities. The amendments in the ASU shorten the amortization period for certain callable debt securities acquired at a premium, to be amortized to the earliest call date. The ASU does not require an accounting change for securities acquired at a discount, which continues to be amortized to maturity. The ASU is effective for fiscal years and interim periods within those fiscal years beginning after December 15, 2018. Management is currently evaluating the impact, if any, of applying this provision.

11. Investment Company Reporting Modernization

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, final rules) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosures about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management has reviewed the requirements and believes the adoption of the amendments to Regulation S-X will not have a material impact on the Funds’ financial statements and related disclosures.

12. Subsequent Events

The Funds have evaluated subsequent events through the issuance of the financial statements and determined that no events have

occurred that require disclosure.

Abbreviations

Selected Portfolio

USD United States Dollar

FRANKLIN FLOATING RATE MASTER TRUST

Report of Independent Registered Public Accounting Firm

To the Board of Trustees of Franklin Floating Rate Master Trust and Shareholders of the Franklin Lower Tier Floating Rate Fund and Franklin Middle Tier Floating Rate Fund:

In our opinion, the accompanying statements of assets and liabilities, including the statements of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of the Franklin Lower Tier Floating Rate Fund and Franklin Middle Tier Floating Rate Fund (the "Funds") as of July 31, 2017, the results of each of their operations, the changes in each of their net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as "financial statements") are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities as of July 31, 2017 by correspondence with the custodian and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

September 15, 2017

Annual Report

30

FRANKLIN FLOATING RATE MASTER TRUST

Tax Information

Under Section 852(b)(3)(C) of the Internal Revenue Code, the Funds hereby report the maximum amount allowable but no less than the following amounts as long term capital gain dividends for the fiscal year ended July 31, 2017:

Franklin

Lower Tier

Floating

Rate Fund

$1,650,643

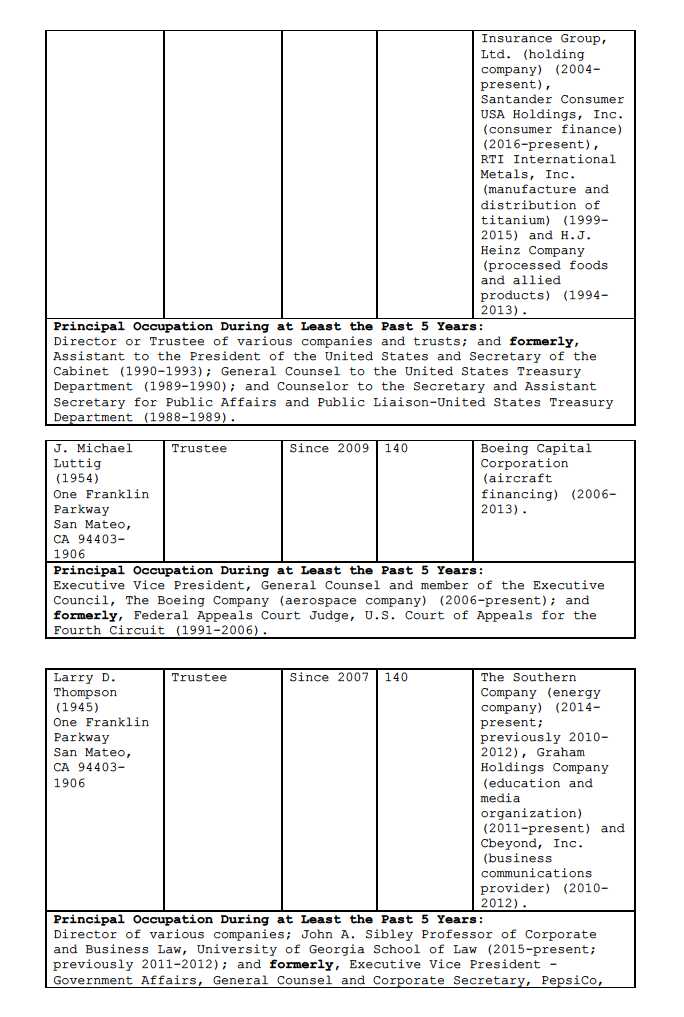

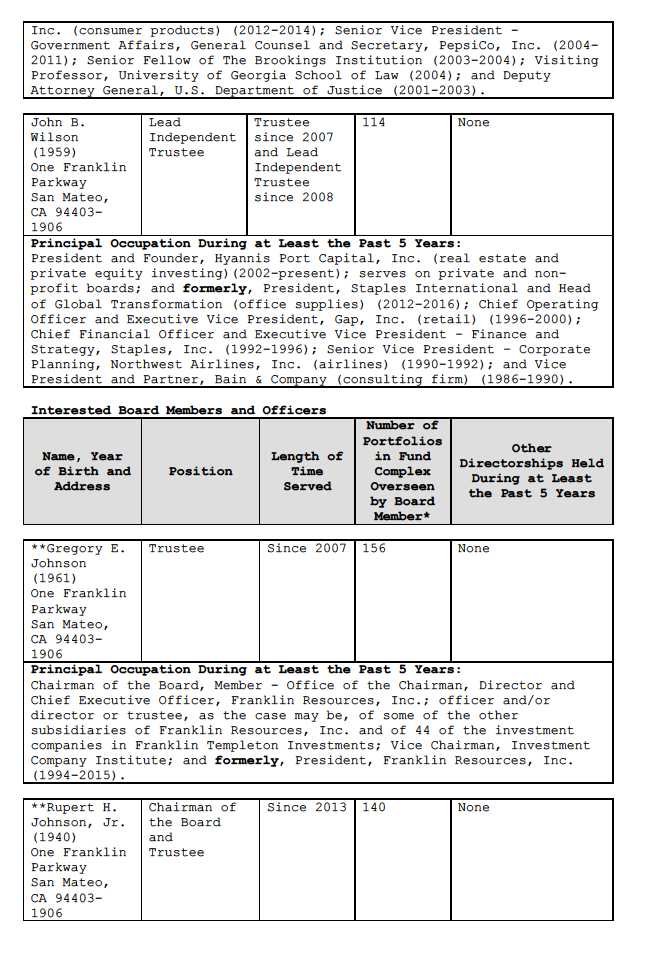

Franklin Floating Rate Master Trust

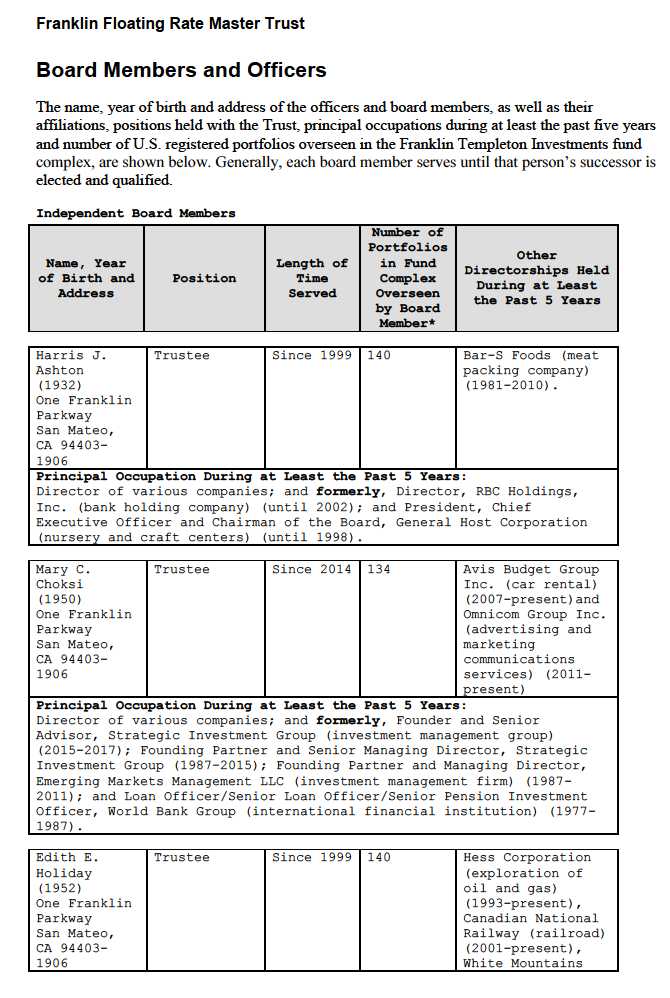

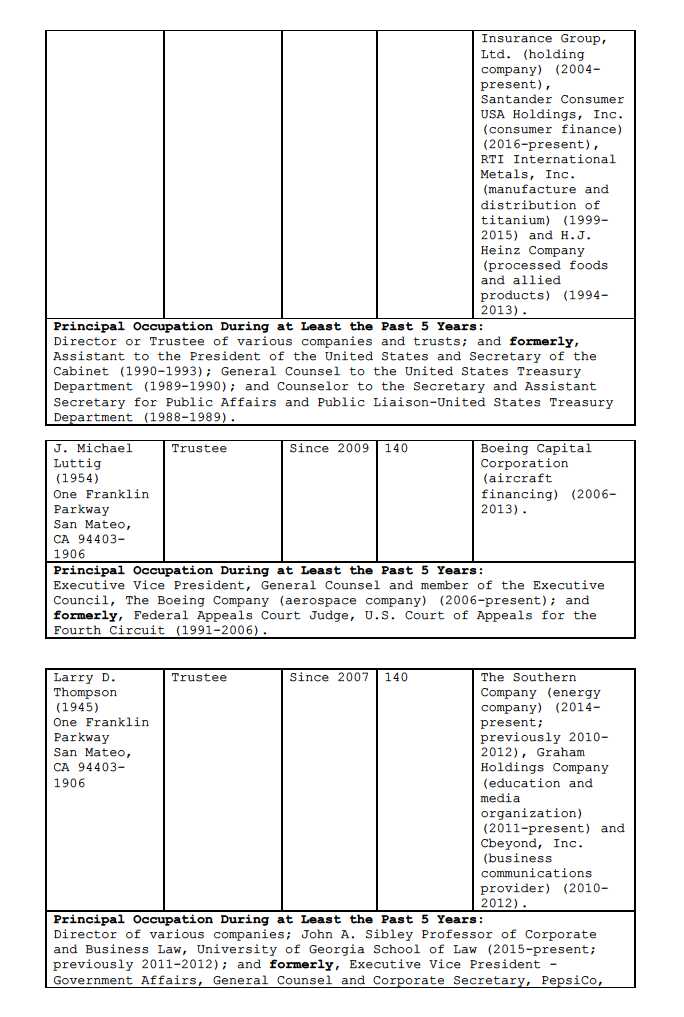

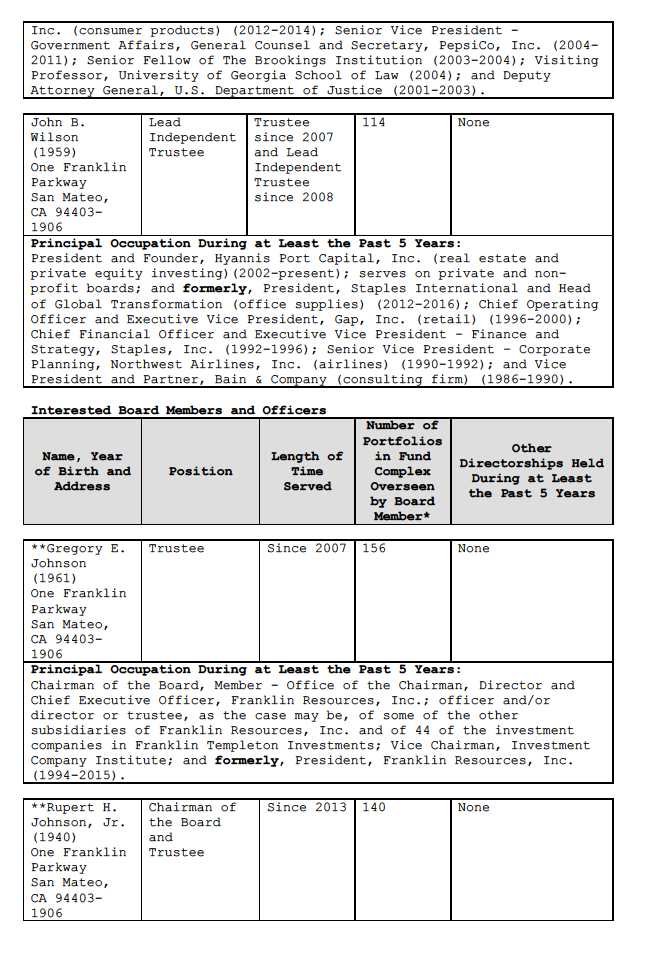

Board Members and Officers

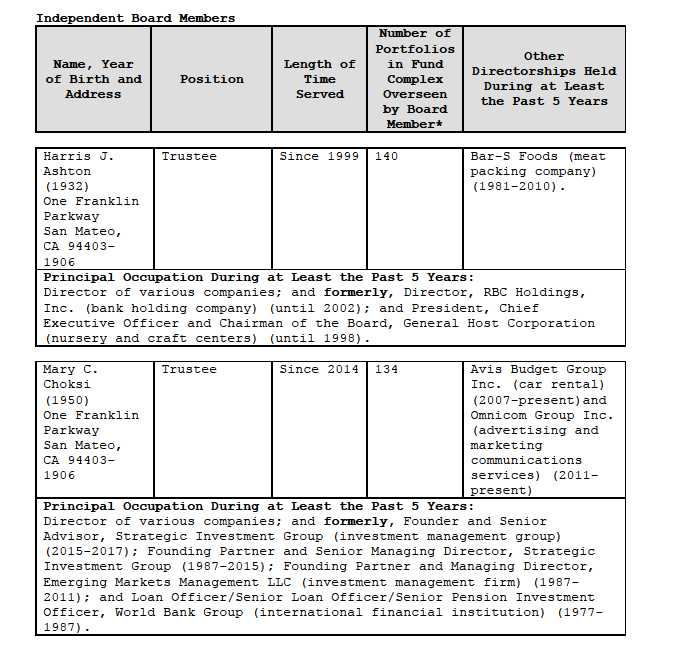

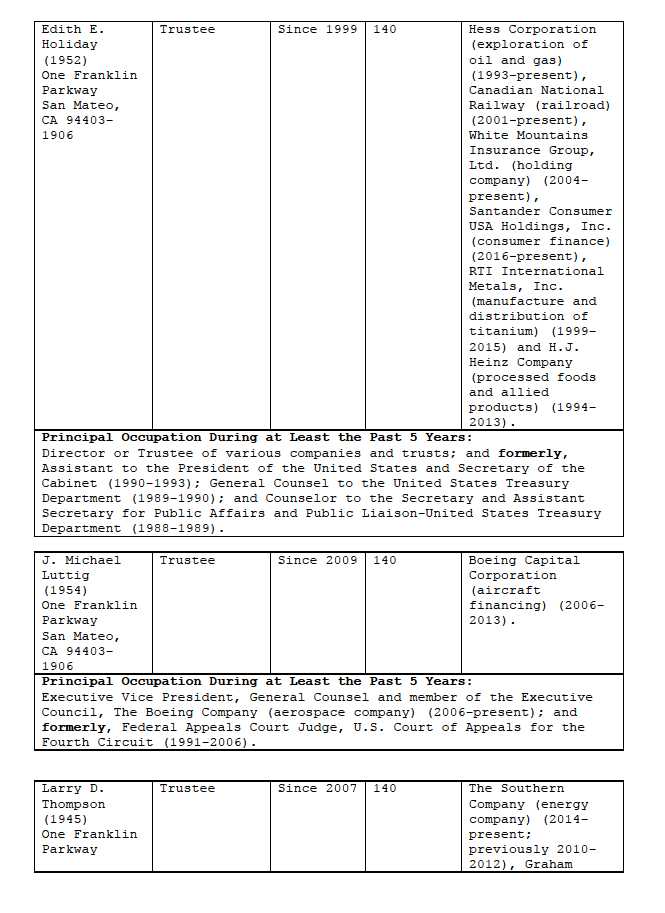

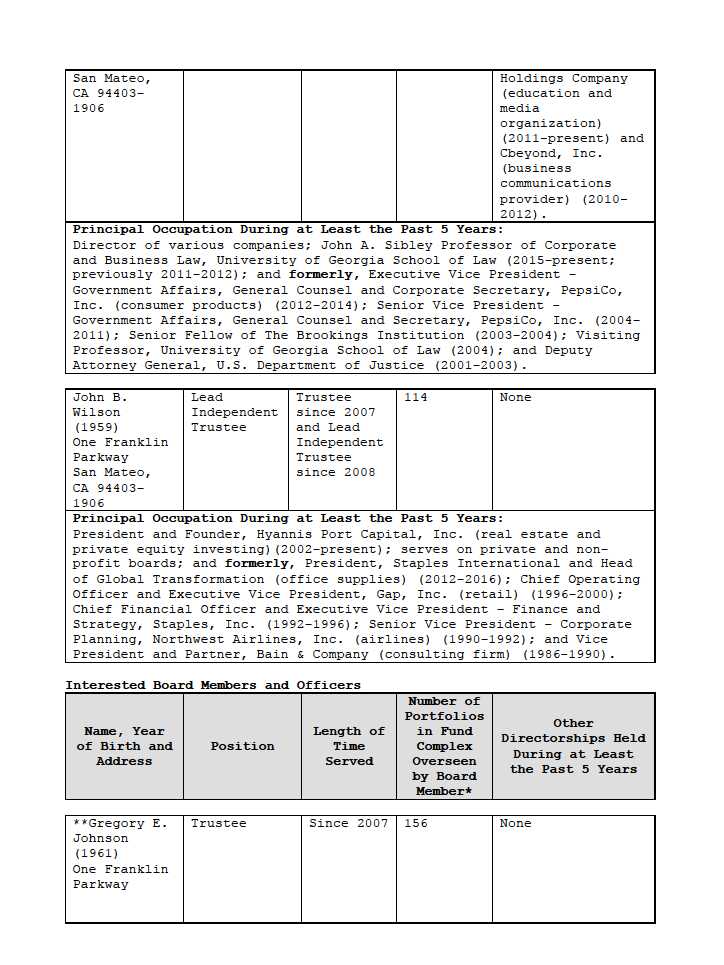

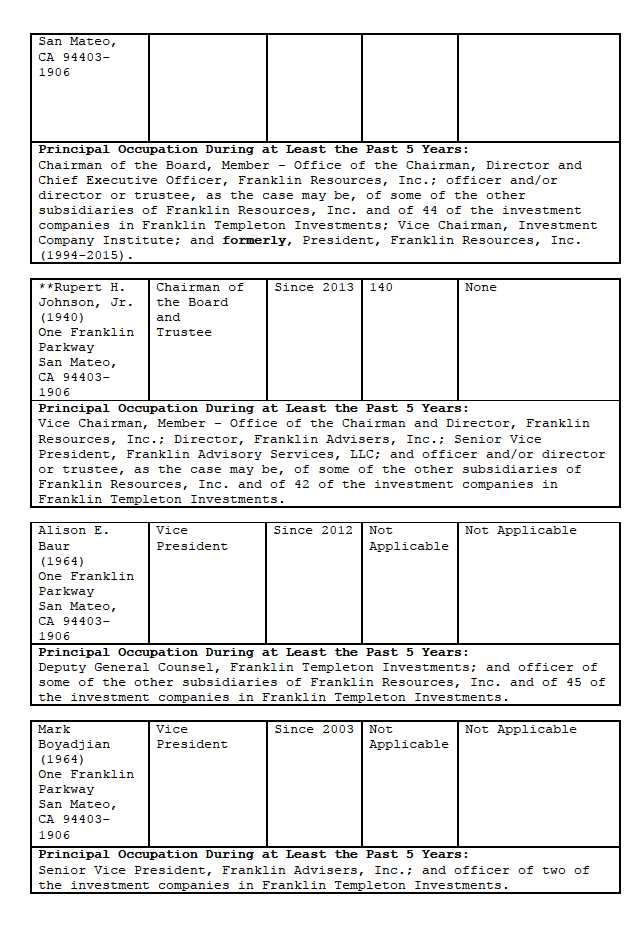

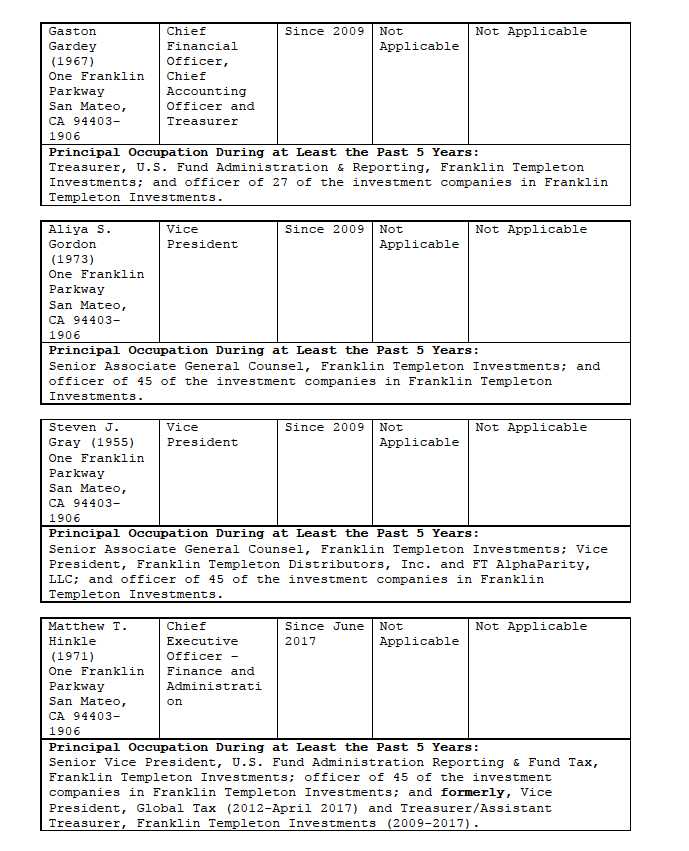

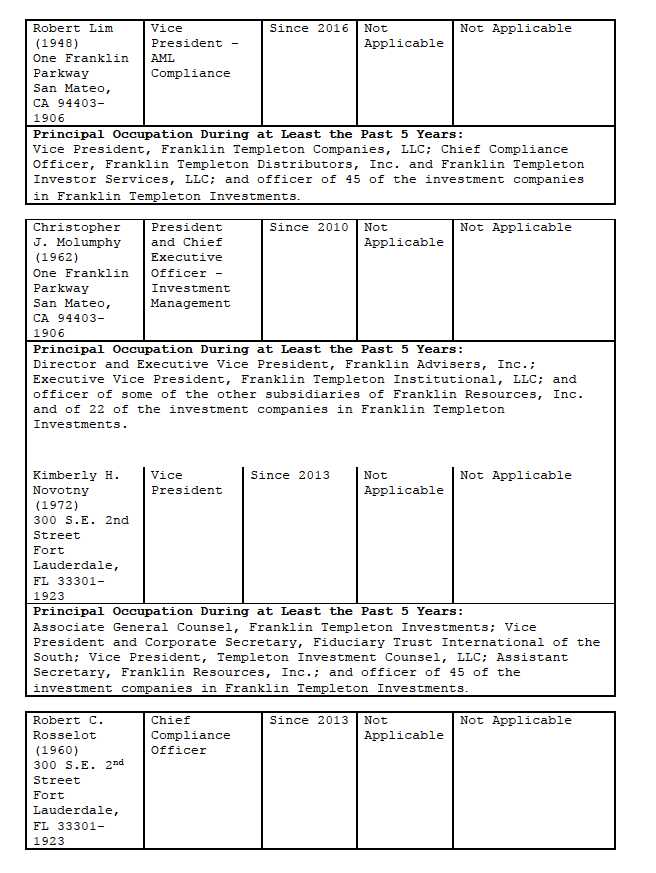

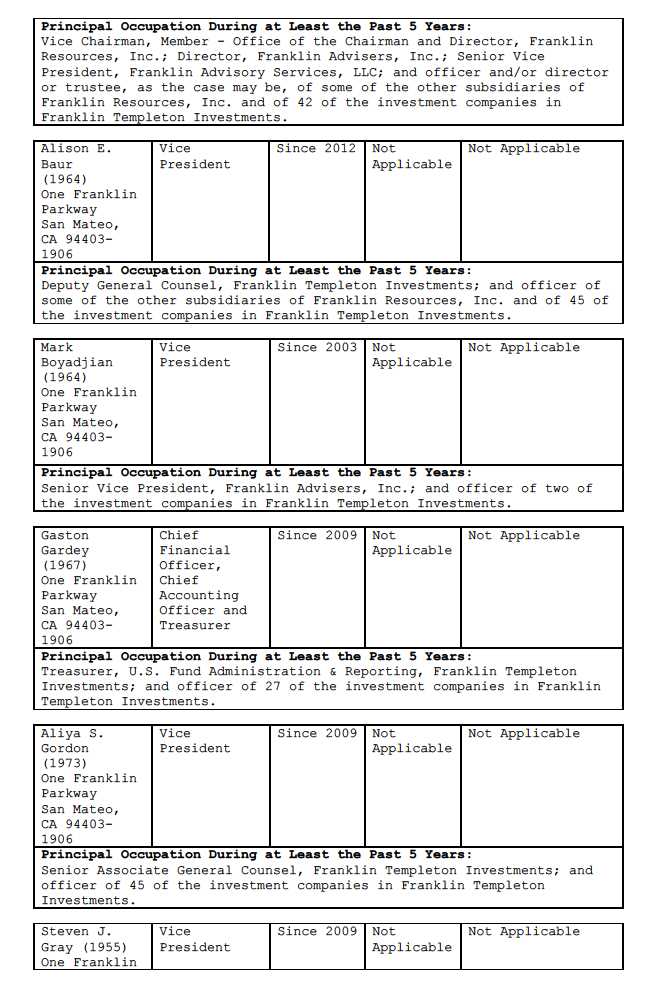

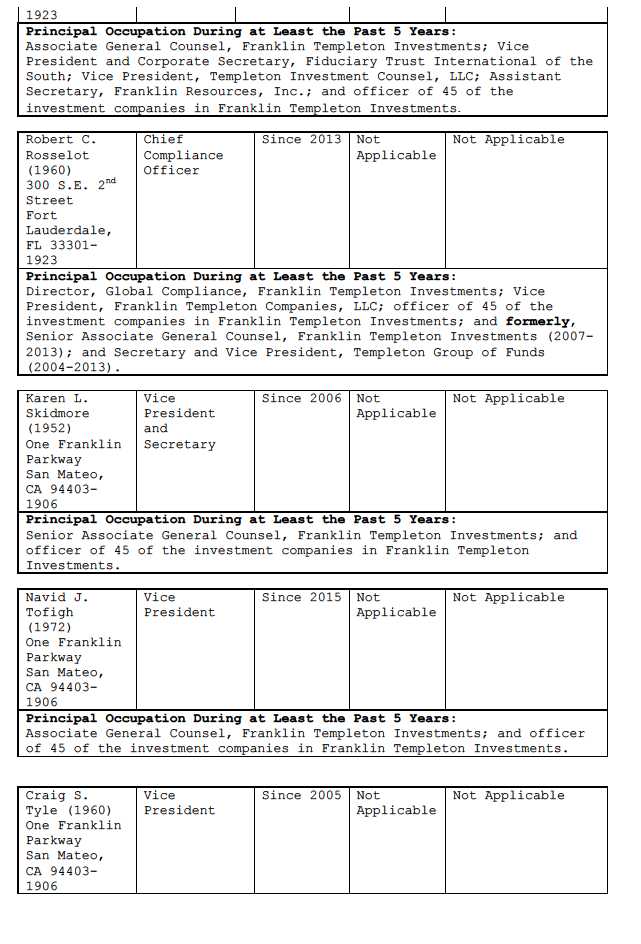

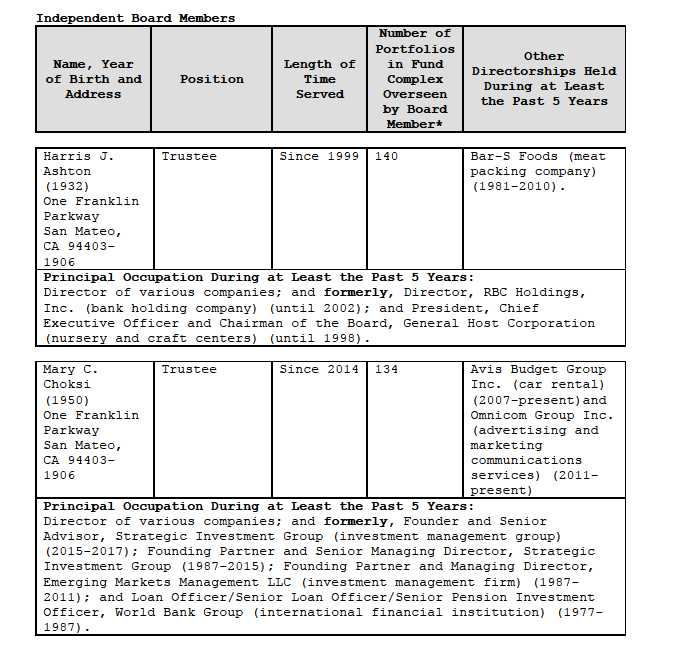

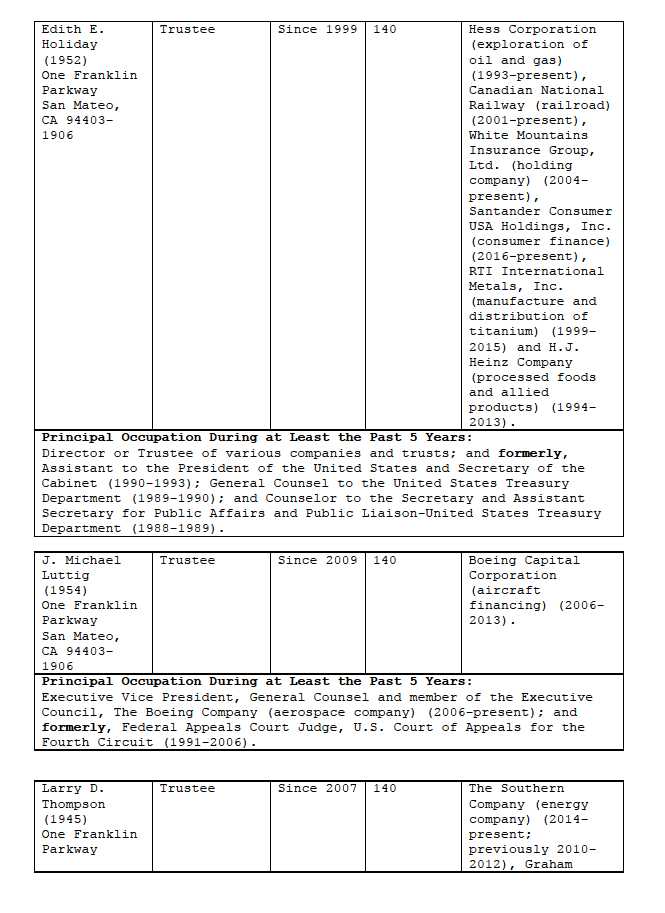

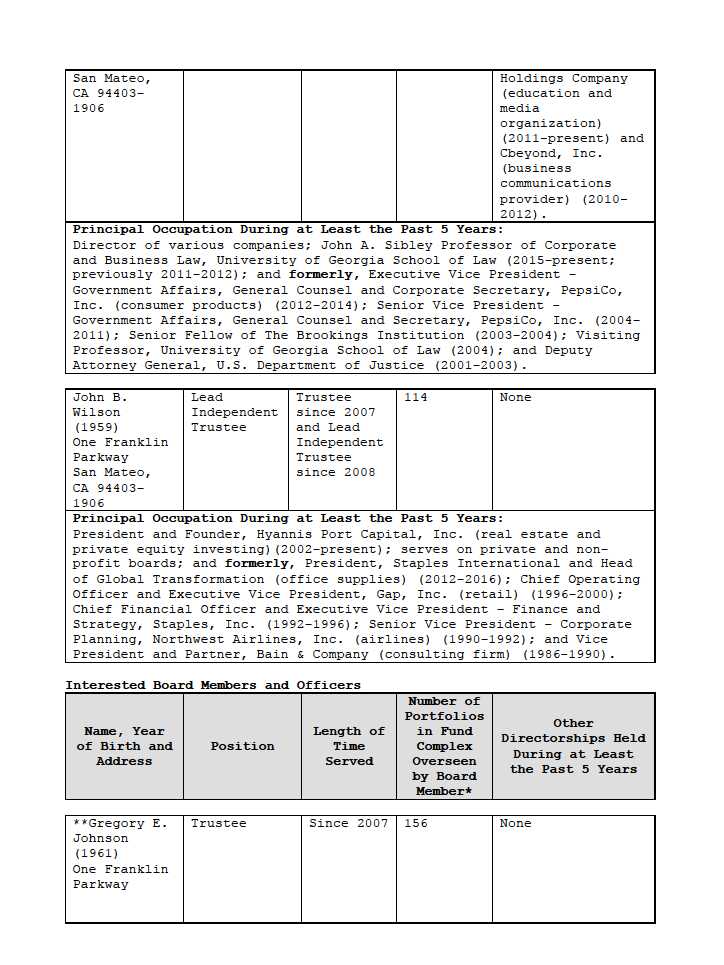

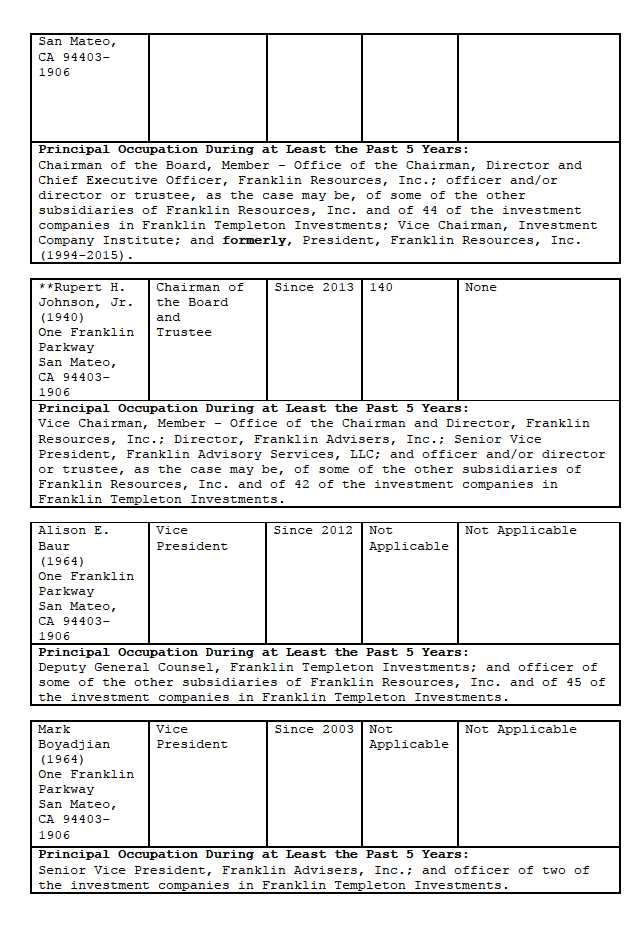

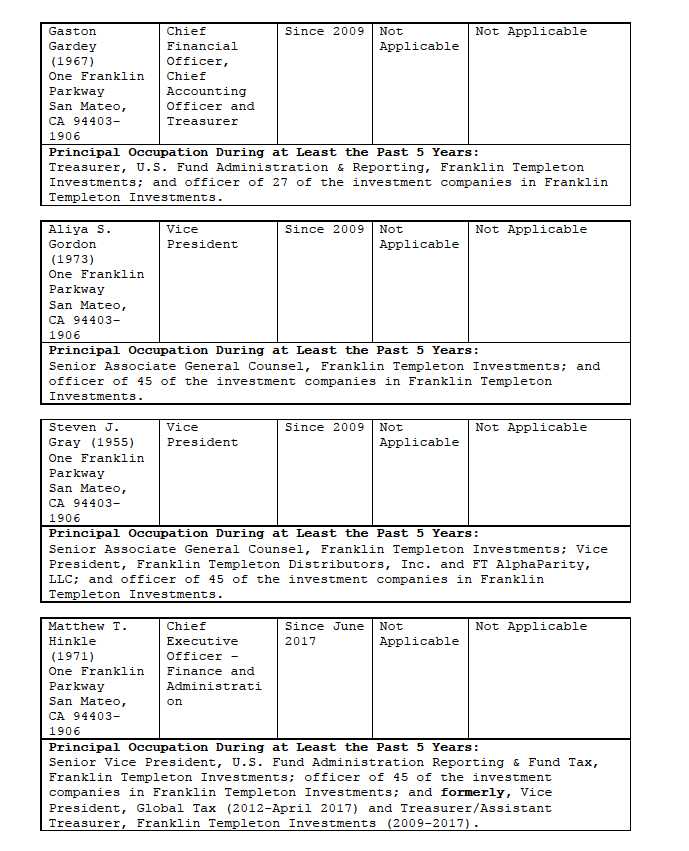

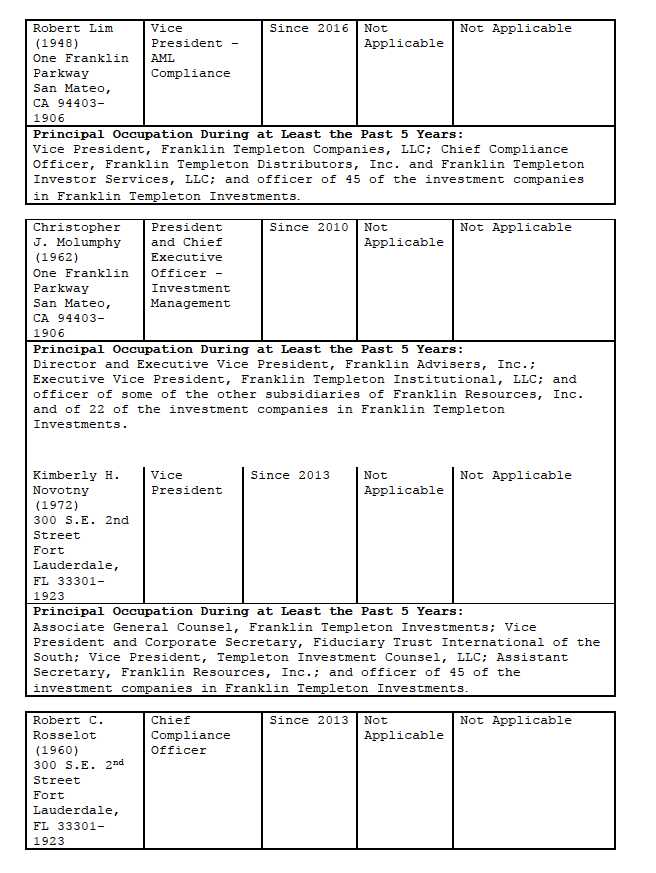

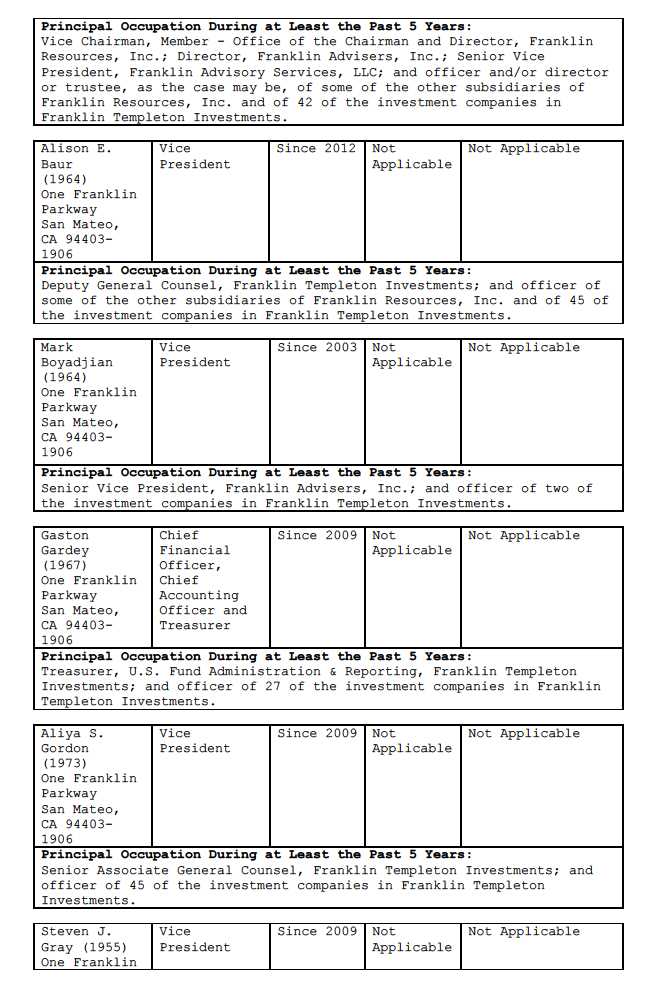

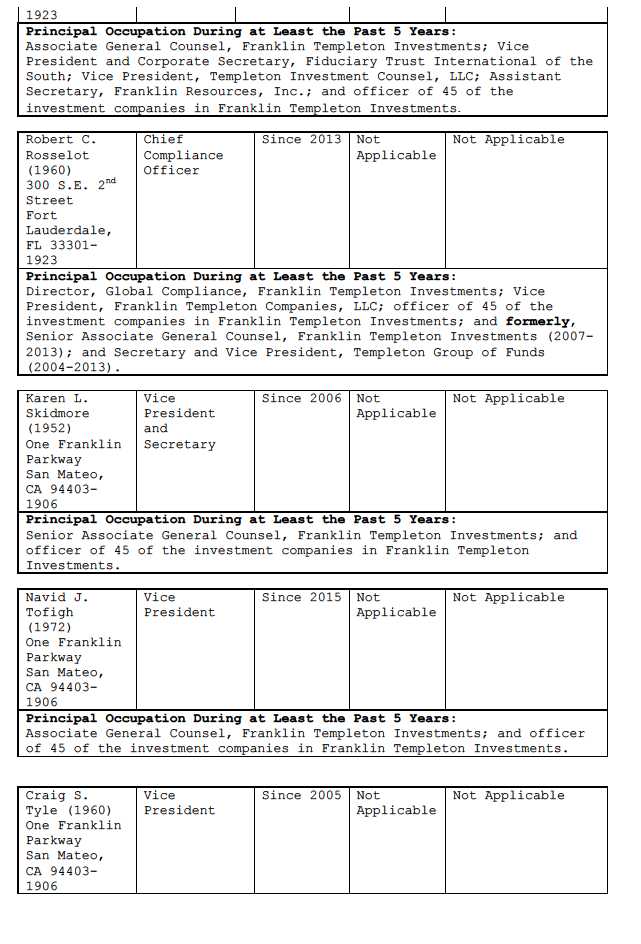

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, principal occupations during at least the past five years and number of U.S. registered portfolios overseen in the Franklin Templeton Investments fund complex, are shown below. Generally, each board member serves until that person’s successor is elected and qualified.

|

| Principal Occupation During at Least the Past 5 Years: |

| Senior Associate General Counsel, Franklin Templeton Investments; |

| Assistant Secretary, Franklin Resources, Inc.; Vice President and |

| Secretary, Templeton Investment Counsel, LLC; and officer of 45 of the |

| investment companies in Franklin Templeton Investments. |

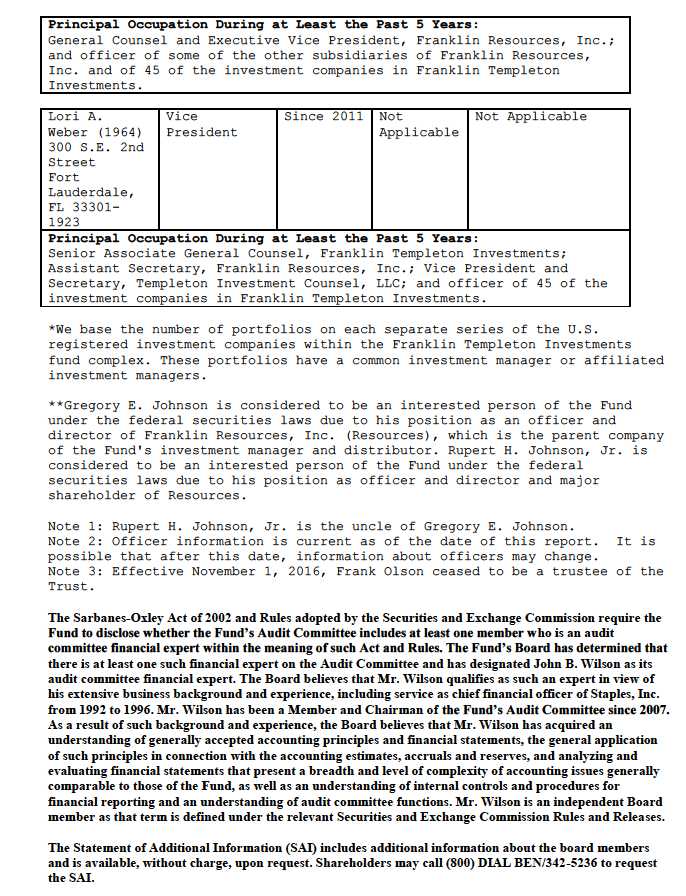

*We base the number of portfolios on each separate series of the U.S.

registered investment companies within the Franklin Templeton Investments

fund complex. These portfolios have a common investment manager or affiliated

investment managers.

**Gregory E. Johnson is considered to be an interested person of the Fund

under the federal securities laws due to his position as an officer and

director of Franklin Resources, Inc. (Resources), which is the parent company

of the Fund's investment manager and distributor. Rupert H. Johnson, Jr. is

considered to be an interested person of the Fund under the federal

securities laws due to his position as officer and director and major

shareholder of Resources.

Note 1: Rupert H. Johnson, Jr. is the uncle of Gregory E. Johnson.

Note 2: Officer information is current as of the date of this report. It is

possible that after this date, information about officers may change.

Note 3: Effective November 1, 2016, Frank Olson ceased to be a trustee of the

Trust.

The Sarbanes-Oxley Act of 2002 and Rules adopted by the Securities and Exchange Commission require the

Fund to disclose whether the Fund’s Audit Committee includes at least one member who is an audit

committee financial expert within the meaning of such Act and Rules. The Fund’s Board has determined that

there is at least one such financial expert on the Audit Committee and has designated John B. Wilson as its

audit committee financial expert. The Board believes that Mr. Wilson qualifies as such an expert in view of

his extensive business background and experience, including service as chief financial officer of Staples, Inc.

from 1992 to 1996. Mr. Wilson has been a Member and Chairman of the Fund’s Audit Committee since 2007.

As a result of such background and experience, the Board believes that Mr. Wilson has acquired an

understanding of generally accepted accounting principles and financial statements, the general application

of such principles in connection with the accounting estimates, accruals and reserves, and analyzing and

evaluating financial statements that present a breadth and level of complexity of accounting issues generally

comparable to those of the Fund, as well as an understanding of internal controls and procedures for

financial reporting and an understanding of audit committee functions. Mr. Wilson is an independent Board

member as that term is defined under the relevant Securities and Exchange Commission Rules and Releases.

The Statement of Additional Information (SAI) includes additional information about the board members

and is available, without charge, upon request. Shareholders may call (800) DIAL BEN/342-5236 to request

the SAI.

Franklin Floating Rate Master Trust Franklin Lower Tier Floating Rate Fund

Shareholder Information

Board Approval of Investment Management Agreements

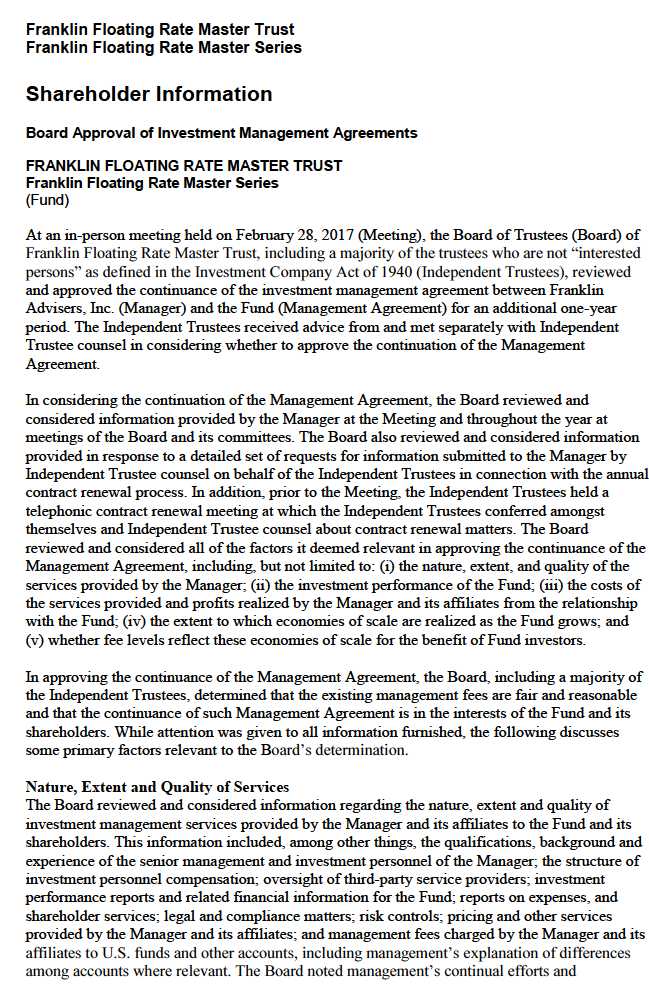

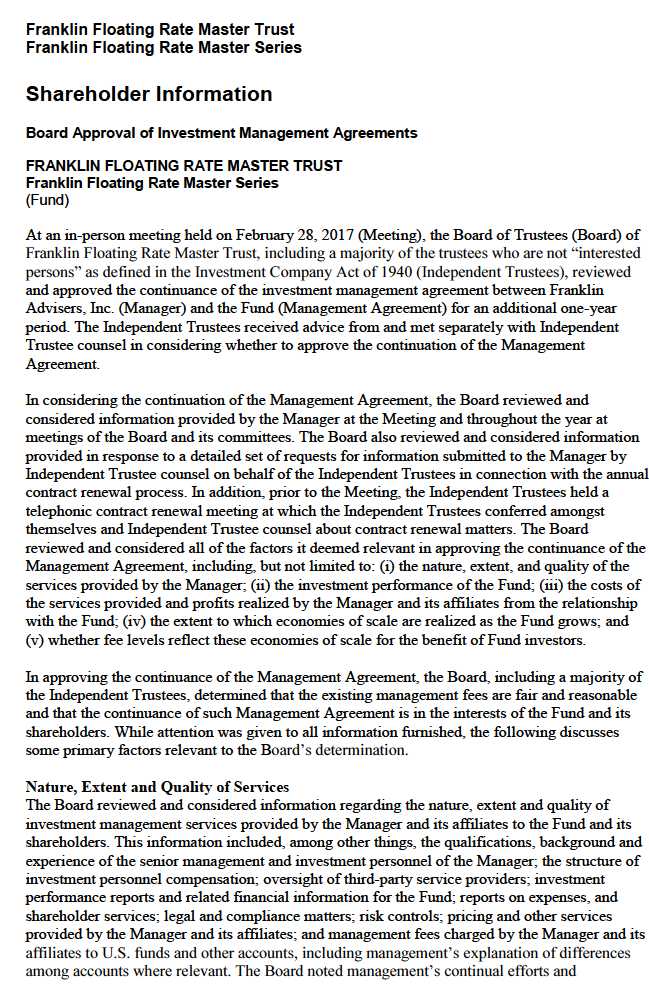

FRANKLIN FLOATING RATE MASTER TRUST Franklin Lower Tier Floating Rate Fund

(Fund)

At an in-person meeting held on February 28, 2017 (Meeting), the Board of Trustees (Board) of Franklin Floating Rate Master Trust, including a majority of the trustees who are not “interested persons” as defined in the Investment Company Act of 1940 (Independent Trustees), reviewed and approved the continuance of the investment management agreement between Franklin Advisers, Inc. (Manager) and the Fund (Management Agreement) for an additional one-year period. The Independent Trustees received advice from and met separately with Independent Trustee counsel in considering whether to approve the continuation of the Management Agreement.