UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number_811-09869

__Franklin Floating Rate Master Trust

(Exact name of registrant as specified in charter)

One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code:_650 312-2000

Date of fiscal year end: 7/31

Date of reporting period: 7/31/18

Item 1. Reports to Stockholders.

Annual Report

Franklin Floating Rate Master Series

| | |

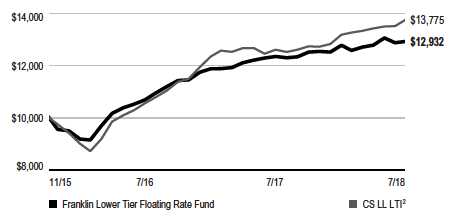

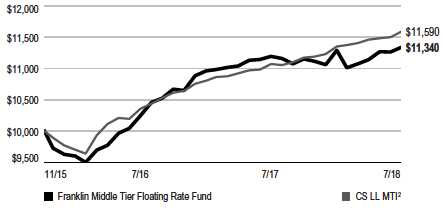

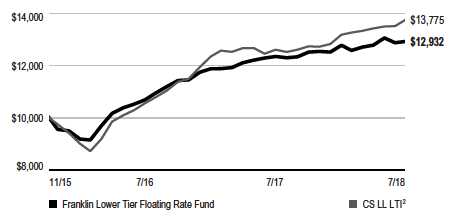

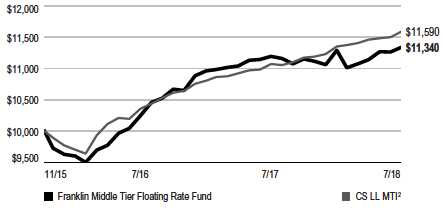

This annual report for Franklin Floating Rate Master Series covers the fiscal year ended July 31, 2018. Manager’s Discussion During the 12 months ended July 31, 2018, the Fund delivered a +2.73% cumulative total return. In comparison, its benchmark, the Credit Suisse Leveraged Loan Index (CS LLI), generated a +4.72% total return.1 The Fund maintained an overweighting in the upper tier of the index throughout the period, which detracted from performance as upper tier loans in the index returned +3.90%, middle tier loans returned +4.68%, and lower tier loans returned +9.24%. The top contributors to performance included issuers in which we had built relatively large positions, and through proactive engagement, we were able to execute transactions that contributed to returns. The term loan of a provider of oil and gas traded higher after the company completed a restructuring plan and the exit term loan also increased spread. The term loan of a specialty retailer with multiple core brands traded higher after the company reported better-than-expected earnings and the loan attracted demand from collateralized loan obligations (CLOs) due to its relatively higher spread and credit ratings. However, our term loan position in a manufacturer of firearms and ammunition detracted from performance after the company filed for bankruptcy due to weaker sales. Another term loan position, in a paper products manufacturer, similarly detracted from performance as the company also filed for bankruptcy, and the company faced price declines in its products due to competition and higher costs for a key raw material. | | rated CLO tranches. Other positions included two open-end funds, Franklin Middle Tier Floating Rate Fund and Franklin Lower Tier Floating Rate Fund, and an exchange-traded fund, Franklin Liberty Senior Loan ETF. The investments allowed the Fund to have further credit exposure, while providing additional liquidity. The Fund also held a position in a high yield credit default swap index to protect against volatility in the credit markets. |

| |

| Portfolio Composition | % of Total |

| 7/31/18 | Net Assets |

| |

| Senior Floating Rate Interests | 70.60% |

| Other Long-Term Investments* | 19.57% |

| Short-Term Investments & Other Net Assets | 9.83% |

*Common stocks and other equity interests, management investment companies, corporate bonds and asset-backed securities.

In addition to maintaining a significant overweighting in higher-rated loans, the Fund was also invested in AAA to A

1. Source: Credit Suisse Group.

The index is unmanaged and includes reinvestment of any income or distributions. It does not reflect any fees, expense or sales charges. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

See www.franklintempletondatasources.com for additional data provider information.

Annual Report | 1

FRANKLIN FLOATING RATE MASTER SERIES

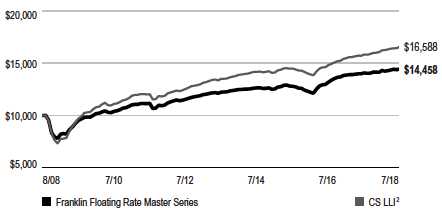

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

8/1/08–7/31/18

Performance as of 7/31/181

| |

| | Average |

| | Annual |

| | Total Return3 |

| 1-Year | +2.73% |

| 5-Year | +3.40% |

| 10-Year | +3.76% |

1. The Fund has a voluntary expense reduction, which can be discontinued at any time upon notification to the Fund’s board. Fund investment results reflect the expense reduction; without this reduction, the results would have been lower.

2. Source: Credit Suisse Group. The CS LLI is designed to mirror the investable universe of the US dollar-denominated leveraged loan market. Loans must be below investment grade and rated no higher than Baa1/BB+ or Ba1/BBB+ by Moody’s or Standard & Poor’s® (S&P).

3. Average annual total return represents the average annual change in value of an investment over the period indicated. Return for less than one year, if any, has not been annualized.

See www.franklintempletondatasources.com for additional data provider information.

2 | Annual Report

FRANKLIN FLOATING RATE MASTER SERIES

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs: (1) transaction costs, including sales charges (loads) on Fund purchases and redemptions; and (2) ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses. The table below shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The table below provides information about actual account values and actual expenses in the columns under the heading “Actual.” In these columns the Fund’s actual return, which includes the effect of Fund expenses, is used to calculate the “Ending Account Value.” You can estimate the expenses you paid during the period by following these steps (of course, your account value and expenses will differ from those in this illustration): Divide your account value by $1,000 (if your account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6). Then multiply the result by the number in the row for your class of shares under the headings “Actual” and “Expenses Paid During Period” (if Actual Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50). In this illustration, the actual expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Under the heading “Hypothetical” in the table, information is provided about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. This information may not be used to estimate the actual ending account balance or expenses you paid for the period, but it can help you compare ongoing costs of investing in the Fund with those of other funds. To do so, compare this 5% hypothetical example for the class of shares you hold with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transactional costs. Therefore, information under the heading “Hypothetical” is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transactional costs were included, your total costs would have been higher.

| | | | | | | | | | |

| | | | Actual | | Hypothetical | |

| | | | (actual return after expenses) | | (5% annual return before expenses) | |

| |

| | | | | | | | | | | Net |

| | Beginning | | Ending | | Paid During | | Ending | | Paid During | Annualized |

| | Account | | Account | | Period | | Account | | Period | Expense |

| | Value 2/1/18 | | Value 7/31/18 | | 2/1/18–7/31/181,2 | | Value 7/31/18 | | 2/1/18–7/31/181,2 | Ratio2 |

| |

| $ 1,000 | | $ 1,010.20 | | $ 2.64 | | $ 1,022.17 | | $ 2.66 | 0.53% |

1. Expenses are equal to the annualized expense ratio for the six-month period as indicated above—in the far right column—multiplied by the simple average account value over the period indicated, and then multiplied by 181/365 to reflect the one-half year period.

2. Reflects expenses after fee waivers and expense reimbursements. Does not include acquired fund fees and expenses.

Annual Report | 3

FRANKLIN FLOATING RATE MASTER TRUST

| | | | |

| Board Members and Officers | | |

| |

| |

| The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, |

| principal occupations during at least the past five years and number of US registered portfolios overseen in the Franklin Templeton |

| Investments fund complex, are shown below. Generally, each board member serves until that person’s successor is elected and |

| qualified. | | | | |

| |

| |

| Independent Board Members | | | |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Harris J. Ashton (1932) | Trustee | Since 1999 | 136 | Bar-S Foods (meat packing company) |

| One Franklin Parkway | | | | (1981-2010). |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive |

| Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998). | |

| |

| Terrence J. Checki (1945) | Trustee | Since March 2018 | 112 | Hess Corporation (exploration of oil |

| One Franklin Parkway | | | | and gas) (2014-present). |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Member of the Council on Foreign Relations (1996-present); Member of the National Committee on U.S.-China Relations (1999-present); |

| member of the Board of Trustees of the Economic Club of New York (2013-present); member of the Board of Trustees of the Foreign Policy |

| Association (2005-present) and member of various other boards of trustees and advisory boards; and formerly, Executive Vice President of |

| the Federal Reserve Bank of New York and Head of its Emerging Markets and Internal Affairs Group and Member of Management Committee |

| (1995-2014); and Visiting Fellow at the Council on Foreign Relations (2014). | |

| |

| Mary C. Choksi (1950) | Trustee | Since 2014 | 136 | Avis Budget Group Inc. (car rental) |

| One Franklin Parkway | | | | (2007-present), Omnicom Group Inc. |

| San Mateo, CA 94403-1906 | | | | (advertising and marketing |

| | | | | communications services) |

| | | | | (2011-present) and White Mountains |

| | | | | Insurance Group, Ltd. (holding |

| | | | | company) (2017-present). |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director of various companies; and formerly, Founder and Senior Advisor, Strategic Investment Group (investment management group) |

| (2015-2017); Founding Partner and Senior Managing Director, Strategic Investment Group (1987-2015); Founding Partner and Managing |

| Director, Emerging Markets Management LLC (investment management firm) (1987-2011); and Loan Officer/Senior Loan Officer/Senior |

| Pension Investment Officer, World Bank Group (international financial institution) (1977-1987). | |

| |

| Edith E. Holiday (1952) | Trustee | Since 1999 | 136 | Hess Corporation (exploration of oil |

| One Franklin Parkway | | | | and gas) (1993-present), Canadian |

| San Mateo, CA 94403-1906 | | | | National Railway (railroad) |

| | | | | (2001-present), White Mountains |

| | | | | Insurance Group, Ltd. (holding |

| | | | | company) (2004-present), Santander |

| | | | | Consumer USA Holdings, Inc. |

| | | | | (consumer finance) (2016-present), |

| | | | | RTI International Metals, Inc. |

| | | | | (manufacture and distribution of |

| | | | | titanium) (1999-2015) and H.J. Heinz |

| | | | | Company (processed foods and allied |

| | | | | products) (1994-2013). |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the |

| Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant |

| Secretary for Public Affairs and Public Liaison-United States Treasury Department (1988-1989). | |

| |

| J. Michael Luttig (1954) | Trustee | Since 2009 | 136 | Boeing Capital Corporation (aircraft |

| One Franklin Parkway | | | | financing) (2006-2013). |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Executive Vice President, General Counsel and member of the Executive Council, The Boeing Company (aerospace company) (2006-present); |

| and formerly, Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006). | |

4 | Annual Report

FRANKLIN FLOATING RATE MASTER TRUST

| | | | |

| Independent Board Members (continued) | | |

| |

| |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Larry D. Thompson | Trustee | Since 2007 | 136 | The Southern Company (energy |

| One Franklin Parkway | | | | company) (2014-present; previously |

| San Mateo, CA 94403-1906 | | | | 2010-2012), Graham Holdings |

| | | | | Company (education and media |

| | | | | organization) (2011-present) and |

| | | | | Cbeyond, Inc. (business |

| | | | | communications provider) |

| | | | | (2010-2012). |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director of various companies; Counsel, Finch McCranie, LLP (law firm) (2015-present); Independent Compliance Monitor and Auditor, |

| Volkswagen AG (manufacturer of automobiles and commercial vehicles) (2017 – present); John A. Sibley Professor of Corporate and Business |

| Law, University of Georgia School of Law (2015-present; previously 2011-2012); and formerly, Executive Vice President - Government Affairs, |

| General Counsel and Corporate Secretary, PepsiCo, Inc. (consumer products) (2012-2014); Senior Vice President - Government Affairs, |

| General Counsel and Secretary, PepsiCo, Inc. (2004-2011); Senior Fellow of The Brookings Institution (2003-2004); Visiting Professor, |

| University of Georgia School of Law (2004); and Deputy Attorney General, U.S. Department of Justice (2001-2003). |

| |

| John B. Wilson (1959) | Lead | Trustee | 112 | None |

| One Franklin Parkway | Independent | since 2007 | | |

| San Mateo, CA 94403-1906 | Trustee | and Lead | | |

| | | Independent | | |

| | | Trustee | | |

| | | since 2008 | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| President and Founder, Hyannis Port Capital, Inc. (real estate and private equity investing) (2002-present); Senior Advisor, McKinsey & Co. |

| (consulting) (2017-present); serves on private and non-profit boards; and formerly, President, Staples International and Head of Global |

| Transformation (office supplies) (2012-2016); Chief Operating Officer and Executive Vice President, Gap, Inc. (retail) (1996-2000); Chief |

| Financial Officer and Executive Vice President – Finance and Strategy, Staples, Inc. (1992-1996); Senior Vice President – Corporate Planning, |

| Northwest Airlines, Inc. (airlines) (1990-1992); and Vice President and Partner, Bain & Company (consulting firm) (1986-1990). |

| |

| |

| Interested Board Members and Officers | | |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| **Gregory E. Johnson (1961) | Trustee | Since 2007 | 150 | None |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Chairman of the Board, Member - Office of the Chairman, Director and Chief Executive Officer, Franklin Resources, Inc.; officer and/or director |

| or trustee, as the case may be, of some of the other subsidiaries of Franklin Resources, Inc. and of 42 of the investment companies in Franklin |

| Templeton Investments; Vice Chairman, Investment Company Institute; and formerly, President, Franklin Resources, Inc. (1994-2015). |

| |

| **Rupert H. Johnson, Jr. (1940) | Chairman of | Since 2013 | 136 | None |

| One Franklin Parkway | the Board | | | |

| San Mateo, CA 94403-1906 | and Trustee | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Vice Chairman, Member - Office of the Chairman and Director, Franklin Resources, Inc.; Director, Franklin Advisers, Inc.; Senior Vice |

| President, Franklin Advisory Services, LLC; and officer and/or director or trustee, as the case may be, of some of the other subsidiaries of |

| Franklin Resources, Inc. and of 40 of the investment companies in Franklin Templeton Investments. | |

| |

| Alison E. Baur (1964) | Vice President | Since 2012 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Deputy General Counsel, Franklin Templeton Investments; and officer of some of the other subsidiaries of Franklin Resources, Inc. and of 44 |

| of the investment companies in Franklin Templeton Investments. | | |

Annual Report | 5

FRANKLIN FLOATING RATE MASTER TRUST

| | | | |

| Interested Board Members and Officers (continued) | |

| |

| |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Mark Boyadjian (1964) | Vice President | Since 2003 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Vice President, Franklin Advisers, Inc.; and officer of two of the investment companies in Franklin Templeton Investments. |

| |

| Gaston Gardey (1967) | Chief Financial | Since 2009 | Not Applicable | Not Applicable |

| One Franklin Parkway | Officer, | | | |

| San Mateo, CA 94403-1906 | Chief | | | |

| | Accounting | | | |

| | Officer and | | | |

| | Treasurer | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Treasurer, U.S. Fund Administration & Reporting, Franklin Templeton Investments; and officer of 28 of the investment companies in Franklin |

| Templeton Investments. | | | | |

| |

| Aliya S. Gordon (1973) | Vice President | Since 2009 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Associate General Counsel, Franklin Templeton Investments; and officer of 44 of the investment companies in Franklin Templeton |

| Investments. | | | | |

| |

| Steven J. Gray (1955) | Vice President | Since 2009 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Associate General Counsel, Franklin Templeton Investments; Vice President, Franklin Templeton Distributors, Inc. and FASA, LLC; and |

| officer of 44 of the investment companies in Franklin Templeton Investments. | |

| |

| Matthew T. Hinkle (1971) | Chief | Since 2017 | Not Applicable | Not Applicable |

| One Franklin Parkway | Executive | | | |

| San Mateo, CA 94403-1906 | Officer – | | | |

| | Finance and | | | |

| | Administration | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Vice President, Franklin Templeton Services, LLC; officer of 44 of the investment companies in Franklin Templeton Investments; and |

| formerly, Vice President, Global Tax (2012-April 2017) and Treasurer/Assistant Treasurer, Franklin Templeton Investments (2009-2017). |

| |

| Robert Lim (1948) | Vice President | Since 2016 | Not Applicable | Not Applicable |

| One Franklin Parkway | – AML | | | |

| San Mateo, CA 94403-1906 | Compliance | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Vice President, Franklin Templeton Companies, LLC; Chief Compliance Officer, Franklin Templeton Distributors, Inc. and Franklin Templeton |

| Investor Services, LLC; and officer of 44 of the investment companies in Franklin Templeton Investments. |

| |

| Christopher J. Molumphy | President and | Since 2010 | Not Applicable | Not Applicable |

| One Franklin Parkway | Chief Executive | | | |

| San Mateo, CA 94403-1906 | Officer - | | | |

| | Investment | | | |

| | Management | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director and Executive Vice President, Franklin Advisers, Inc.; Executive Vice President, Franklin Templeton Institutional, LLC; and officer of |

| some of the other subsidiaries of Franklin Resources, Inc. and of 21 of the investment companies in Franklin Templeton Investments. |

6 | Annual Report

FRANKLIN FLOATING RATE MASTER TRUST

| | | | |

| Interested Board Members and Officers (continued) | |

| |

| |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Kimberly H. Novotny (1972) | Vice President | Since 2013 | Not Applicable | Not Applicable |

| 300 S.E. 2nd Street | | | | |

| Fort Lauderdale, FL 33301-1923 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Associate General Counsel, Franklin Templeton Investments; Vice President and Corporate Secretary, Fiduciary Trust International of the |

| South; Vice President, Templeton Investment Counsel, LLC; Assistant Secretary, Franklin Resources, Inc.; and officer of 44 of the investment |

| companies in Franklin Templeton Investments. | | | |

| |

| Robert C. Rosselot (1960) | Chief | Since 2013 | Not Applicable | Not Applicable |

| 300 S.E. 2nd Street | Compliance | | | |

| Fort Lauderdale, FL 33301-1923 | Officer | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director, Global Compliance, Franklin Templeton Investments; Vice President, Franklin Templeton Companies, LLC; officer of 44 of the |

| investment companies in Franklin Templeton Investments; and formerly, Senior Associate General Counsel, Franklin Templeton Investments |

| (2007-2013); and Secretary and Vice President, Templeton Group of Funds (2004-2013). | |

| |

| Karen L. Skidmore (1952) | Vice President | Since 2006 | Not Applicable | Not Applicable |

| One Franklin Parkway | and Secretary | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Associate General Counsel, Franklin Templeton Investments; and officer of 44 of the investment companies in Franklin Templeton |

| Investments. | | | | |

| |

| Navid J. Tofigh (1972) | Vice President | Since 2015 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Associate General Counsel, Franklin Templeton Investments; and officer of 44 of the investment companies in Franklin Templeton Investments. |

| |

| Craig S. Tyle (1960) | Vice President | Since 2005 | Not Applicable | Not Applicable |

| One Franklin Parkway | | | | |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| General Counsel and Executive Vice President, Franklin Resources, Inc.; and officer of some of the other subsidiaries of Franklin Resources, |

| Inc. and of 44 of the investment companies in Franklin Templeton Investments. | |

| |

| Lori A. Weber (1964) | Vice President | Since 2011 | Not Applicable | Not Applicable |

| 300 S.E. 2nd Street | | | | |

| Fort Lauderdale, FL 33301-1923 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Senior Associate General Counsel, Franklin Templeton Investments; Assistant Secretary, Franklin Resources, Inc.; Vice President and |

| Secretary, Templeton Investment Counsel, LLC; and officer of 44 of the investment companies in Franklin Templeton Investments. |

Annual Report | 7

FRANKLIN FLOATING RATE MASTER TRUST

*We base the number of portfolios on each separate series of the US registered investment companies within the Franklin Templeton Investments fund complex. These portfolios have a common investment manager or affiliated investment managers.

**Gregory E. Johnson is considered to be an interested person of the Fund under the federal securities laws due to his position as an officer and director of Franklin Resources, Inc. (Resources), which is the parent company of the Fund’s investment manager and distributor. Rupert H. Johnson, Jr. is considered to be an interested person of the Fund under the federal securities laws due to his position as an officer and director and major shareholder of Resources.

Note 1: Rupert H. Johnson, Jr. is the uncle of Gregory E. Johnson.

Note 2: Officer information is current as of the date of this report. It is possible that after this date, information about officers may change.

The Sarbanes-Oxley Act of 2002 and Rules adopted by the Securities and Exchange Commission require the Fund to disclose whether the Fund’s Audit Committee includes at least one member who is an audit committee financial expert within the meaning of such Act and Rules. The Fund’s Board has determined that there is at least one such financial expert on the Audit Committee and has designated John B. Wilson as its audit committee financial expert. The Board believes that Mr. Wilson qualifies as such an expert in view of his extensive business background and experience, including service as chief financial officer of Staples, Inc. from 1992 to 1996. Mr. Wilson has been a Member and Chairman of the Fund’s Audit Committee since 2007. As a result of such background and experience, the Board believes that Mr. Wilson has acquired an understanding of generally accepted accounting principles and financial statements, the general application of such principles in connection with the accounting estimates, accruals and reserves, and analyzing and evaluating financial statements that present a breadth and level of complexity of accounting issues generally comparable to those of the Fund, as well as an understanding of internal controls and procedures for financial reporting and an understanding of audit committee functions. Mr. Wilson is an independent Board member as that term is defined under the relevant Securities and Exchange Commission Rules and Releases.

The Statement of Additional Information (SAI) includes additional information about the board members and is available, without charge, upon request.

Shareholders may call (800) DIAL BEN/342-5236 to request the SAI.

8 | Annual Report

FRANKLIN FLOATING RATE MASTER TRUST

FRANKLIN FLOATING RATE MASTER SERIES

| | |

Shareholder Information Board Approval of Investment Management Agreements FRANKLIN FLOATING RATE MASTER TRUST Franklin Floating Rate Master Series (Fund) At an in-person meeting held on February 27, 2018 (Meeting), the Board of Trustees (Board) of Franklin Floating Rate Master Trust (Trust), including a majority of the trustees who are not “interested persons” as defined in the Investment Company Act of 1940 (Independent Trustees), reviewed and approved the continuance of the investment management agreement between Franklin Advisers, Inc. (Manager) and the Trust, on behalf of the Fund (Management Agreement) for an additional one-year period. The Independent Trustees received advice from and met separately with Independent Trustee counsel in considering whether to approve the continuation of the Management Agreement. In considering the continuation of the Management Agreement, the Board reviewed and considered information provided by the Manager at the Meeting and throughout the year at meetings of the Board and its committees. The Board also reviewed and considered information provided in response to a detailed set of requests for information submitted to the Manager by Independent Trustee counsel on behalf of the Independent Trustees in connection with the annual contract renewal process. In addition, prior to the Meeting, the Independent Trustees held a telephonic contract renewal meeting at which the Independent Trustees conferred amongst themselves and Independent Trustee counsel about contract renewal matters. The Board reviewed and considered all of the factors it deemed relevant in approving the continuance of the Management Agreement, including, but not limited to: (i) the nature, extent and quality of the services provided by the Manager; (ii) the investment performance of the Fund; (iii) the costs of the services provided and profits realized by the Manager and its affiliates from the relationship with the Fund; (iv) the extent to which economies of scale are realized as the Fund grows; and (v) whether fee levels reflect these economies of scale for the benefit of Fund investors. In approving the continuance of the Management Agreement, the Board, including a majority of the Independent Trustees, determined that the terms of the Management Agreement are fair and reasonable and that the continuance of such Management Agreement is in the interests of the Fund and its shareholders. While attention was given to all information | | furnished, the following discusses some primary factors relevant to the Board’s determination. Nature, Extent and Quality of Services The Board reviewed and considered information regarding the nature, extent and quality of investment management services provided by the Manager and its affiliates to the Fund and its shareholders. This information included, among other things, the qualifications, background and experience of the senior management and investment personnel of the Manager; the structure of investment personnel compensation; oversight of third-party service providers; investment performance reports and related financial information for the Fund; reports on expenses, and shareholder services; legal and compliance matters; risk controls; pricing and other services provided by the Manager and its affiliates; and management fees charged by the Manager and its affiliates to U.S. funds and other accounts, including management’s explanation of differences among accounts where relevant. The Board also reviewed and considered an annual report on payments made by Franklin Templeton Investments (FTI) or the Fund to financial intermediaries, as well as a memorandum relating to third-party servicing arrangements in response to a guidance update in 2016 from the U.S. Securities and Exchange Commission (SEC) relating to mutual fund distribution and sub-accounting fees. The Board noted management’s continuing efforts and expenditures in establishing effective business continuity plans and developing strategies to address areas of heightened concern in the mutual fund industry, such as cybersecurity and liquidity risk management. The Board also recognized management’s commitment to facilitating Board oversight of particular areas, including derivatives and payments to intermediaries, by enhanced reporting. The Board also reviewed and considered the benefits provided to Fund shareholders of investing in a fund that is part of the Franklin Templeton family of funds. The Board noted the financial position of Franklin Resources, Inc. (FRI), the Manager’s parent, and its commitment to the mutual fund business as evidenced by its continued introduction of new funds, reassessment of the fund offerings in response to the market environment and project initiatives and capital investments relating to the services provided to the Fund by the FTI organization. Following consideration of such information, the Board was satisfied with the nature, extent and quality of services provided by the Manager and its affiliates to the Fund and its shareholders. |

Annual Report | 9

FRANKLIN FLOATING RATE MASTER TRUST

FRANKLIN FLOATING RATE MASTER SERIES

SHAREHOLDER INFORMATION

| | |

Fund Performance The Board reviewed and considered the performance results of the Fund over various time periods ended December 31, 2017. The Board considered the performance returns for the Fund in comparison to the performance returns of mutual funds deemed comparable to the Fund included in a universe (Performance Universe) selected by Broadridge Financial Solutions, Inc. (Broadridge), an independent provider of investment company data. The Board received a description of the methodology used by Broadridge to select the mutual funds included in a Performance Universe. The Board also reviewed and considered Fund performance reports provided and discussions that occurred with portfolio managers at Board meetings throughout the year. A summary of the Fund’s performance results is below. The Performance Universe for the Fund included the Fund and all retail and institutional loan participation funds. The Board noted that the Fund’s annualized total return for the one- and 10-year periods was below the median of its Performance Universe, but for the three- and five-year periods was above the median of its Performance Universe. The Board concluded that the Fund’s performance was acceptable. In doing so, the Board noted that the Fund’s annualized total return was positive for each period, the Fund does not offer its shares to the public and the Fund’s investor was exclusively an offshore Irish feeder fund. Comparative Fees and Expenses The Board reviewed and considered information regarding the Fund’s actual total expense ratio and its various components, including, as applicable, management fees; transfer agent expenses; underlying fund expenses; Rule 12b-1 and non-Rule 12b-1 service fees; and other non-management fees. The Board considered the actual total expense ratio and, separately, the contractual management fee rate, without the effect of fee waivers (Management Rate), if any, of the Fund in comparison to the median expense ratio and median Management Rate, respectively, of other mutual funds deemed comparable to and with a similar expense structure as the Fund selected by Broadridge (Expense Group). Broadridge fee and expense data is based upon information taken from each fund’s most recent annual report, which reflects historical asset levels that may be quite different from those currently existing, particularly in a period of market volatility. While recognizing such inherent limitation and the fact that expense ratios and Management Rates generally increase as assets decline and decrease as assets grow, the Board believed the independent analysis conducted by Broadridge to be an appropriate measure | | of comparative fees and expenses. The Broadridge Management Rate includes administrative charges, and the actual total expense ratio, for comparative consistency, was shown for Class A shares for funds with multiple classes of shares. The Board received a description of the methodology used by Broadridge to select the mutual funds included in an Expense Group. The Expense Group for the Fund included the Fund and 13 other loan participation funds. The Board noted that the Management Rate and actual total expense ratio for the Fund were below the medians of its Expense Group. The Board concluded that the Management Rate charged to the Fund is reasonable. In doing so, the Board noted that the Fund’s actual total expense ratio reflected a fee waiver from management. Profitability The Board reviewed and considered information regarding the profits realized by the Manager and its affiliates in connection with the operation of the Fund. In this respect, the Board considered the Fund profitability analysis provided by the Manager that addresses the overall profitability of FTI’s U.S. fund business, as well as its profits in providing investment management and other services to each of the individual funds during the 12-month period ended September 30, 2017, being the most recent fiscal year-end for FRI. The Board noted that although management continually makes refinements to its methodologies used in calculating profitability in response to organizational and product related changes, the overall methodology has remained consistent with that used in the Fund’s profitability report presentations from prior years. Additionally, PricewaterhouseCoopers LLP, auditor to Franklin Resources, Inc. and certain Franklin Templeton funds, has been engaged by the Manager to periodically review and assess the allocation methodologies to be used solely by the Fund’s Board with respect to the profitability analysis. The Board noted management’s belief that costs incurred in establishing the infrastructure necessary for the type of mutual fund operations conducted by the Manager and its affiliates may not be fully reflected in the expenses allocated to the Fund in determining its profitability, as well as the fact that the level of profits, to a certain extent, reflected operational cost savings and efficiencies initiated by management. The Board also noted management’s expenditures in improving shareholder services provided to the Fund, as well as the need to implement systems and meet additional regulatory and compliance requirements resulting from recent SEC and other regulatory requirements. |

10 | Annual Report

FRANKLIN FLOATING RATE MASTER TRUST

FRANKLIN FLOATING RATE MASTER SERIES

SHAREHOLDER INFORMATION

The Board also considered the extent to which the Manager and its affiliates might derive ancillary benefits from fund operations, including revenues generated from transfer agent services, potential benefits resulting from personnel and systems enhancements necessitated by fund growth, as well as increased leverage with service providers and counterparties. Based upon its consideration of all these factors, the Board concluded that the level of profits realized by the Manager and its affiliates from providing services to the Fund was not excessive in view of the nature, extent and quality of services provided to the Fund. Economies of Scale The Board reviewed and considered the extent to which the Manager may realize economies of scale, if any, as the Fund grows larger and whether the Fund’s management fee structure reflects any economies of scale for the benefit of shareholders. With respect to possible economies of scale, the Board noted the existence of management fee breakpoints, which operate generally to share any economies of scale with a Fund’s shareholders by reducing the Fund’s effective management fees as the Fund grows in size. The Board considered the Manager’s view that any analyses of potential economies of scale in managing a particular fund are inherently limited in light of the joint and common costs and investments the Manager incurs across the Franklin Templeton family of funds as a whole. The Board concluded that to the extent economies of scale may be realized by the Manager and its affiliates, the Fund’s management fee structure provided a sharing of benefits with the Fund and its shareholders as the Fund grows. Conclusion Based on its review, consideration and evaluation of all factors it believed relevant, including the above-described factors and conclusions, the Board unanimously approved the continuation of the Management Agreement for an additional one-year period. Proxy Voting Policies and Procedures The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online | | at franklintempleton.com and posted on the US Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30. Quarterly Consolidated Statement of Investments The Trust, on behalf of the Fund, files a complete consolidated statement of investments with the US Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330. |

Annual Report | 11

FRANKLIN FLOATING RATE MASTER TRUST

Financial Highlights

Franklin Floating Rate Master Series

| | | | | | | | | | | | | | | | | |

| | | | | | Year Ended July 31, | | | | | |

| | | 2018 | | | 2017 | | | | 2016 | | | | 2015 | | | 2014 | |

| Per share operating performance | | | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 8.69 | | $ | 8.47 | | | $ | 8.65 | | | $ | 8.92 | | $ | 8.93 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | | | |

| Net investment income | | 0.398 | | | 0.332 | | | | 0.419 | | | | 0.391 | | | 0.299 | |

| Net realized and unrealized gains (losses) | | (0.156 | ) | | 0.221 | | | | (0.184 | ) | | | (0.270 | ) | | (0.010 | ) |

| Total from investment operations | | 0.242 | | | 0.553 | | | | 0.235 | | | | 0.121 | | | 0.289 | |

| Less distributions from net investment income | | (0.392 | ) | | (0.333 | ) | | | (0.415 | ) | | | (0.391 | ) | | (0.299 | ) |

| Net asset value, end of year. | $ | 8.54 | | $ | 8.69 | | | $ | 8.47 | | | $ | 8.65 | | $ | 8.92 | |

| |

| Total return | | 2.73 | % | | 6.71 | % | | | 3.07 | % | | | 1.30 | % | | 3.28 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.55 | % | | 0.55 | % | | | 0.55 | % | | | 0.77 | % | | 0.92 | % |

| Expenses net of waiver and payments by affiliatesb | | 0.53 | % | | 0.53 | % | | | 0.53 | % | | | 0.67 | % | | 0.80 | % |

| Net investment income | | 4.60 | % | | 3.78 | % | | | 5.03 | % | | | 4.43 | % | | 3.36 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 1,760,544 | | $ | 2,090,626 | | | $ 1,363,955 | | | $ 1,959,681 | | $ | 2,260,151 | |

| Portfolio turnover rate | | 49.97 | % | | 67.00 | % | | 28.94 | % | | 62.43 | % | | 70.55 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBenefit of expense reduction rounds to less than 0.01%.

12 | Annual Report | The accompanying notes are an integral part of these financial statements.

FRANKLIN FLOATING RATE MASTER TRUST

| | | | | | |

| Statement of Investments, July 31, 2018 | | | | | | |

| |

| Franklin Floating Rate Master Series | | | | | | |

| | | | Shares/ | | | % of Net |

| | Country | | Units | | Value | Assets |

| Common Stocks and Other Equity Interests | | | | | | |

| Oil & Gas Exploration & Production | | | | | | |

| Samson Resources II LLC | United States | | 155,501 | $ | 3,732,024 | 0.21 |

| Diversified Support Services | | | | | | |

| a,b,c Remington Outdoor Co. Inc | United States | | 870,865 | | 15,038,779 | 0.86 |

| a,b,c Remington Outdoor Co. Inc., Litigation Units | United States | | 81,987 | | — | 0.00 |

| | | | | | 15,038,779 | 0.86 |

| Forest Products | | | | | | |

| a,b,c Appvion Inc | United States | | 519,107 | | 5,140,480 | 0.29 |

| Total Common Stocks and Other Equity Interests | | | | | | |

| (Cost $49,304,337) | | | | | 23,911,283 | 1.36 |

| |

| Management Investment Companies | | | | | | |

| Other Diversified Financial Services | | | | | | |

| d Franklin Liberty Senior Loan ETF | United States | | 248,000 | | 6,238,787 | 0.35 |

| d Franklin Lower Tier Floating Rate Fund | United States | | 3,405,364 | | 33,304,460 | 1.89 |

| d Franklin Middle Tier Floating Rate Fund | United States | | 3,457,562 | | 32,673,956 | 1.86 |

| Total Management Investment Companies | | | | | | |

| (Cost $75,457,450) | | | | | 72,217,203 | 4.10 |

| |

| | | | Principal | | | |

| | | | Amount* | | | |

| Corporate Bonds (Cost $8,692,485) | | | | | | |

| Industrial Machinery | | | | | | |

| e Onsite Rental Group Operations Pty. Ltd., secured note, PIK, 6.10%, | | | | | | |

| 10/26/23 | Australia | $ | 10,100,685 | | 7,828,031 | 0.45 |

| |

| f,g Senior Floating Rate Interests | | | | | | |

| Aerospace & Defense | | | | | | |

| Delos Finance S.A.R.L. (AerCap), New Loans, 4.084%, (3-month | | | | | | |

| USD LIBOR + 1.75%), 10/06/23 | Luxembourg | | 32,284,435 | | 32,392,039 | 1.84 |

| Doncasters U.S. Finance LLC, | | | | | | |

| Second Lien Term Loan, 10.584%, (3-month USD LIBOR + | | | | | | |

| 8.25%), 10/09/20 | United States | | 6,096,324 | | 5,171,714 | 0.29 |

| Term B Loans, 5.834%, (3-month USD LIBOR + 3.50%), | | | | | | |

| 4/09/20 | United States | | 14,887,914 | | 13,957,419 | 0.79 |

| Flying Fortress Holdings LLC (ILFC), New Loan, 4.084%, (3-month | | | | | | |

| USD LIBOR + 1.75%), 10/30/22 | United States | | 18,210,912 | | 18,298,179 | 1.04 |

| Leidos Innovations Corp., Term Loan B, 3.875%, (1-month USD | | | | | | |

| LIBOR + 1.75%), 8/16/23 | United States | | 1,559,615 | | 1,570,825 | 0.09 |

| | | | | | 71,390,176 | 4.05 |

| Agricultural Products | | | | | | |

| Allflex Holdings III Inc., Second Lien Initial Term Loan, 9.347%, | | | | | | |

| (3-month USD LIBOR + 7.00%), 7/19/21 | United States | | 1,591,815 | | 1,601,100 | 0.09 |

| Airlines | | | | | | |

| Air Canada, Term Loan, 4.072%, (1-month USD LIBOR + 2.00%), | | | | | | |

| 10/06/23 | Canada | | 16,944,482 | | 17,022,139 | 0.97 |

| American Airlines Inc., 2018 Replacement Term Loans, 3.827%, | | | | | | |

| (1-month USD LIBOR + 1.75%), 6/27/25 | United States | | 7,941,691 | | 7,833,111 | 0.44 |

| | | | | | 24,855,250 | 1.41 |

| Apparel Retail | | | | | | |

| Ascena Retail Group Inc., Tranche B Term Loan, 6.625%, (1-month | | | | | | |

| USD LIBOR + 4.50%), 8/21/22 | United States | | 44,797,160 | | 41,129,393 | 2.34 |

13

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | |

| | | | Principal | | | % of Net |

| | Country | | Amount* | | Value | Assets |

| f,g Senior Floating Rate Interests (continued) | | | | | | |

| Auto Parts & Equipment | | | | | | |

| Allison Transmission Inc., New Term Loans, 3.84%, (1-month USD | | | | | | |

| LIBOR + 1.75%), 9/23/22 | United States | $ | 14,528,482 | $ | 14,626,854 | 0.83 |

| American Axle and Manufacturing Inc., Tranche B Term Loan, | | | | | | |

| 4.32%, (1-month USD LIBOR + 2.25%), 4/06/24 | United States | | 1,949,682 | | 1,946,432 | 0.11 |

| TI Group Automotive Systems LLC, Initial US Term Loan, 4.577%, | | | | | | |

| (1-month USD LIBOR + 2.50%), 6/30/22 | United States | | 16,310,481 | | 16,344,456 | 0.93 |

| | | | | | 32,917,742 | 1.87 |

| Broadcasting | | | | | | |

| Gray Television Inc., Term B-2 Loan, 4.34%, (1-month USD LIBOR + | | | | | | |

| 2.25%), 2/07/24. | United States | | 15,704,652 | | 15,735,732 | 0.89 |

| Mission Broadcasting Inc., Term Loan B-2, 4.592%, (1-month USD | | | | | | |

| LIBOR + 2.50%), 1/17/24 | United States | | 552,963 | | 554,345 | 0.03 |

| Nexstar Broadcasting Inc., | | | | | | |

| Term A-2 Loan, 4.092%, (1-month USD LIBOR + 2.00%), | | | | | | |

| 7/19/22 | United States | | 7,190,617 | | 7,190,617 | 0.41 |

| Term Loan B-2, 4.592%, (1-month USD LIBOR + 2.50%), | | | | | | |

| 1/17/24 | United States | | 4,147,913 | | 4,158,283 | 0.24 |

| Sinclair Television Group Inc., | | | | | | |

| Tranche B Term Loans, 4.33%, (1-month USD LIBOR + 2.25%), | | | | | | |

| 1/03/24 | United States | | 17,436,393 | | 17,447,291 | 0.99 |

| h,i Tranche B-1 Term Loans, TBD, 1/31/25 | United States | | 5,700,000 | | 5,702,109 | 0.33 |

| WXXA-TV LLC and WLAJ-TV LLC, Term Loan A-2, 4.092%, | | | | | | |

| (1-month USD LIBOR + 2.00%), 7/19/22 | United States | | 242,944 | | 242,944 | 0.01 |

| | | | | | 51,031,321 | 2.90 |

| Cable & Satellite | | | | | | |

| Charter Communications Operating LLC, Term B Loan, 4.08%, | | | | | | |

| (1-month USD LIBOR + 2.00%), 4/30/25 | United States | | 18,952,381 | | 18,984,695 | 1.08 |

| CSC Holdings LLC, March 2017 Incremental Term Loans, 4.322%, | | | | | | |

| (1-month USD LIBOR + 2.25%), 7/17/25 | United States | | 18,724,379 | | 18,655,885 | 1.06 |

| Mediacom Illinois LLC, Tranche N Term Loan, 3.70%, (1-week USD | | | | | | |

| LIBOR + 1.75%), 2/15/24 | United States | | 4,764,852 | | 4,776,764 | 0.27 |

| | | | | | 42,417,344 | 2.41 |

| Casinos & Gaming | | | | | | |

| h Aristocrat Technologies Inc., Term B-3 Loans, 4.098%, (3-month | | | | | | |

| USD LIBOR + 1.75%), 10/19/24 | United States | | 9,098,989 | | 9,101,310 | 0.52 |

| Boyd Gaming Corp., | | | | | | |

| Refinancing Term B Loans, 4.45%, (1-week USD LIBOR + | | | | | | |

| 2.50%), 9/15/23 | United States | | 7,994,008 | | 8,044,970 | 0.46 |

| Term A Loan, 4.20%, (1-week USD LIBOR + 2.25%), 9/15/21 | United States | | 2,152,643 | | 2,155,334 | 0.12 |

| Caesars Resort Collection LLC/CRC Finco Inc., Term B Loans, | | | | | | |

| 4.827%, (1-month USD LIBOR + 2.75%), 12/22/24 | United States | | 6,334,085 | | 6,337,480 | 0.36 |

| CEOC LLC, Term B Loans, 4.077%, (1-month USD LIBOR + | | | | | | |

| 2.00%), 10/06/24 | United States | | 1,529,888 | | 1,529,888 | 0.09 |

14

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | | |

| | | | | Principal | | | % of Net |

| | | Country | | Amount* | | Value | Assets |

| f,g Senior Floating Rate Interests (continued) | | | | | | | |

| Casinos & Gaming (continued) | | | | | | | |

| Eldorado Resorts Inc., | | | | | | | |

| Initial Term Loan, 4.375%, (1-month USD LIBOR + 2.25%), | | | | | | | |

| 4/17/24 | | United States | $ | 3,614,072 | $ | 3,619,717 | 0.20 |

| Initial Term Loan, 4.438%, (2-month USD LIBOR + 2.25%), | | | | | | | |

| 4/17/24 | | United States | | 2,585,414 | | 2,589,452 | 0.15 |

| Greektown Holdings LLC, Initial Term Loan, 5.077%, (1-month USD | | | | | | | |

| LIBOR + 3.00%), 4/25/24 | | United States | | 8,367,671 | | 8,379,871 | 0.47 |

| Kingpin Intermediate Holdings LLC, Initial Term Loans, 5.58%, | | | | | | | |

| (1-month USD LIBOR + 3.50%), 7/03/24 | | United States | | 1,584,000 | | 1,600,830 | 0.09 |

| h Las Vegas Sands LLC, Term B Loans, 3.827%, (1-month USD | | | | | | | |

| LIBOR + 1.75%), 3/27/25 | | United States | | 7,568,585 | | 7,567,533 | 0.43 |

| | | | | | | 50,926,385 | 2.89 |

| Coal & Consumable Fuels | | | | | | | |

| Bowie Resource Holdings LLC, | | | | | | | |

| First Lien Initial Term Loan, 7.827%, (1-month USD LIBOR + | | | | | | | |

| 5.75%), 8/14/20 | | United States | | 18,177,382 | | 17,927,443 | 1.02 |

| Second Lien Initial Term Loan, 12.827%, (1-month USD LIBOR | | | | | | | |

| + 10.75%), 2/16/21 | | United States | | 2,232,389 | | 2,143,093 | 0.12 |

| Foresight Energy LLC, Term Loans, 7.827%, (1-month USD LIBOR | | | | | | | |

| + 5.75%), 3/28/22 | | United States | | 26,556,009 | | 26,506,216 | 1.51 |

| | | | | | | 46,576,752 | 2.65 |

| Commodity Chemicals | | | | | | | |

| Ineos U.S. Finance LLC, 2024 Dollar Term Loan, 4.169%, (2-month | | | | | | | |

| USD LIBOR + 2.00%), 3/31/24 | | United States | | 11,621,368 | | 11,617,336 | 0.66 |

| Communications Equipment | | | | | | | |

| Ciena Corp., Refinancing Term Loan, 4.586%, (1-month USD LIBOR | | | | | | | |

| + 2.50%), 1/28/22 | | United States | | 8,678,039 | | 8,726,853 | 0.50 |

| CommScope Inc., Tranche 5 Term Loans, 4.077%, (1-month USD | | | | | | | |

| LIBOR + 2.00%), 12/29/22 | | United States | | 4,898,659 | | 4,926,978 | 0.28 |

| | | | | | | 13,653,831 | 0.78 |

| Construction & Engineering | | | | | | | |

| AECOM, Term B Loans, 3.827%, (1-month USD LIBOR + 1.75%), | | | | | | | |

| 3/13/25 | . | United States | | 7,844,218 | | 7,869,986 | 0.45 |

| Data Processing & Outsourced Services | | | | | | | |

| First Data Corp., Term A Loan, 3.819%, (1-month USD LIBOR + | | | | | | | |

| 1.75%), 6/02/20. | | United States | | 16,373,668 | | 16,390,074 | 0.93 |

| Iron Mountain Information Management LLC, Term B Loan, 3.827%, | | | | | | | |

| (1-month USD LIBOR + 1.75%), 1/26/26 | | United States | | 4,612,920 | | 4,562,939 | 0.26 |

| Wex Inc., Term B-2 Loan, 4.327%, (1-month USD LIBOR + 2.25%), | | | | | | | |

| 7/01/23 | . | United States | | 9,802,242 | | 9,829,375 | 0.56 |

| | | | | | | 30,782,388 | 1.75 |

| Diversified Chemicals | | | | | | | |

| Chemours Co., Tranche B-2 US$ Term Loan, 3.83%, (1-month USD | | | | | | | |

| LIBOR + 1.75%), 4/03/25 | | United States | | 8,820,638 | | 8,798,587 | 0.50 |

| Diversified Support Services | | | | | | | |

| h Ventia Pty. Ltd., Term B Loans (USD), 5.834%, (3-month USD | | | | | | | |

| LIBOR + 3.50%), 5/21/22 | | Australia | | 4,913,144 | | 4,962,276 | 0.28 |

| Electric Utilities | | | | | | | |

| EFS Cogen Holdings I LLC (Linden), Term B Advance, 5.59%, | | | | | | | |

| (3-month USD LIBOR + 3.25%), 6/28/23 | | United States | | 4,159,778 | | 4,175,897 | 0.24 |

15

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | | | |

| | | | | Principal | | | % of Net | |

| | | Country | | Amount* | | Value | Assets | |

| f,g Senior Floating Rate Interests (continued) | | | | | | | | |

| Fertilizers & Agricultural Chemicals | | | | | | | | |

| Mosaic Co., Term Loan A, 3.572%, (1-month USD LIBOR + 1.50%), | | | | | | | | |

| 11/18/21 | | United States | $ | 871,925 | $ | 869,745 | 0.05 | |

| Food Distributors | | | | | | | | |

| Aramark Corp., U.S. Term B-3 Loan, 4.084%, (3-month USD LIBOR | | | | | | | | |

| + 1.75%), 3/11/25 | | United States | | 9,603,778 | | 9,636,796 | 0.55 | |

| Nutraceutical International Corp., Term Loan B, 5.327%, (1-month | | | | | | | | |

| USD LIBOR + 3.25%), 8/22/23 | | United States | | 2,904,212 | | 2,896,951 | 0.16 | |

| | | | | | | 12,533,747 | 0.71 | |

| Food Retail | | | | | | | | |

| BI-LO LLC (Southeastern Grocers), FILO Loan (ABL), 7.557%, | | | | | | | | |

| (3-month USD LIBOR + 5.25%), 5/31/22 | | United States | | 5,000,000 | | 4,925,000 | 0.28 | |

| Forest Products | | | | | | | | |

| Appvion Inc., Term Loan, 8.09%, (1-month USD LIBOR + 6.00%), | | | | | | | | |

| 6/15/26 | . | United States | | 9,539,138 | | 9,539,138 | 0.54 | |

| General Merchandise Stores | | | | | | | | |

| e 99 Cents Only Stores, First Lien Term Loan, PIK, 8.807% - 8.834%, | | | | | | | | |

| (3-month USD LIBOR + 6.50%), 1/13/22 | | United States | | 17,540,704 | | 16,619,905 | 0.95 | |

| Evergreen AcqCo. 1 LP (Savers), | | | | | | | | |

| Term Loan, 5.93%, (2-month USD LIBOR + 3.75%), 7/09/19 | | United States | | 64,188 | | 63,305 | 0.00 | † |

| Term Loan, 6.097%, (3-month USD LIBOR + 3.75%), 7/09/19 | | United States | | 24,134,791 | | 23,802,938 | 1.35 | |

| | | | | | | 40,486,148 | 2.30 | |

| Health Care Distributors | | | | | | | | |

| Mallinckrodt International Finance SA/CB LLC, Extended Term Loan | | | | | | | | |

| B, 5.203%, (6-month USD LIBOR + 2.75%), 9/24/24 | | Luxembourg | | 8,986,956 | | 8,865,884 | 0.50 | |

| Health Care Facilities | | | | | | | | |

| HCA Inc., | | | | | | | | |

| h,i Term Loan B10, TBD, 3/13/25 | | United States | | 4,472,368 | | 4,503,626 | 0.25 | |

| Term Loan B11, 3.827%, (1-month USD LIBOR + 1.75%), | | | | | | | | |

| 3/18/23 | | United States | | 2,573,550 | | 2,587,825 | 0.15 | |

| | | | | | | 7,091,451 | 0.40 | |

| Health Care Services | | | | | | | | |

| h Air Medical Group Holdings Inc., 2018 New Term Loans, 6.329%, | | | | | | | | |

| (1-month USD LIBOR + 4.25%), 3/14/25 | | United States | | 7,190,939 | | 7,114,535 | 0.41 | |

| DaVita Healthcare Partners Inc., | | | | | | | | |

| Tranche A Term Loan, 4.077%, (1-month USD LIBOR + 2.00%), | | | | | | | | |

| 6/24/19 | | United States | | 5,999,714 | | 6,018,463 | 0.34 | |

| h Tranche B Term Loan, 4.827%, (1-month USD LIBOR + 2.75%), | | | | | | | | |

| 6/24/21 | | United States | | 7,278,031 | | 7,330,345 | 0.42 | |

| Envision Healthcare Corp., Initial Term Loans, 5.08%, (1-month USD | | | | | | | | |

| LIBOR + 3.00%), 12/01/23 | | United States | | 4,794,685 | | 4,799,902 | 0.27 | |

| U.S. Renal Care Inc., Initial Term Loan, 6.584%, (3-month USD | | | | | | | | |

| LIBOR + 4.25%), 12/31/22 | | United States | | 8,935,936 | | 8,813,067 | 0.50 | |

| | | | | | | 34,076,312 | 1.94 | |

| Health Care Technology | | | | | | | | |

| IQVIA Inc., | | | | | | | | |

| h Term B-1 Dollar Loans, 4.334%, (3-month USD LIBOR + | | | | | | | | |

| 2.00%), 3/07/24 | | United States | | 5,681,250 | | 5,697,226 | 0.32 | |

| Term B-3 Dollar Loans, 4.084%, (3-month USD LIBOR + | | | | | | | | |

| 1.75%), 6/11/25 | | United States | | 3,000,000 | | 2,992,500 | 0.17 | |

| | | | | | | 8,689,726 | 0.49 | |

16

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | | |

| | | | Principal | | | % of Net | |

| | Country | | Amount* | | Value | Assets | |

| f,g Senior Floating Rate Interests (continued) | | | | | | | |

| Hotels, Resorts & Cruise Lines | | | | | | | |

| Hilton Worldwide Finance LLC, Series B-2 Term Loans, 3.814%, | | | | | | | |

| (1-month USD LIBOR + 1.75%), 10/25/23 | United States | $ | 8,628,356 | $ | 8,667,572 | 0.49 | |

| Household Products | | | | | | | |

| Spectrum Brands Inc., | | | | | | | |

| USD Term Loans, 4.17%, (2-month USD LIBOR + 2.00%), | | | | | | | |

| 6/23/22 | United States | | 32,491 | | 32,567 | 0.00 | † |

| USD Term Loans, 4.34% - 4.363%, (3-month USD LIBOR + | | | | | | | |

| 2.00%), 6/23/22 | United States | | 12,801,467 | | 12,831,474 | 0.73 | |

| | | | | | 12,864,041 | 0.73 | |

| Independent Power Producers & Energy Traders | | | | | | | |

| Helix Gen Funding LLC, Term Loan, 5.827%, (1-month USD LIBOR | | | | | | | |

| + 3.75%), 6/02/24 | United States | | 18,327,804 | | 18,491,289 | 1.05 | |

| NRG Energy Inc., Term Loan B, 4.084%, (3-month USD LIBOR + | | | | | | | |

| 1.75%), 6/30/23. | United States | | 32,134,296 | | 32,114,372 | 1.82 | |

| | | | | | 50,605,661 | 2.87 | |

| Industrial Machinery | | | | | | | |

| Harsco Corp., Term Loan B-2, 4.375%, (1-month USD LIBOR + | | | | | | | |

| 2.25%), 12/10/24 | United States | | 9,280,471 | | 9,340,405 | 0.53 | |

| Navistar Inc., Tranche B Term Loan, 5.60%, (1-month USD LIBOR + | | | | | | | |

| 3.50%), 11/06/24 | United States | | 33,168,430 | | 33,386,081 | 1.90 | |

| Onsite Rental Group Operations Property Ltd., Term Loan, 6.564%, | | | | | | | |

| (1-month USD LIBOR + 4.50%), 10/25/22 | Australia | | 7,387,773 | | 7,313,895 | 0.41 | |

| | | | | | 50,040,381 | 2.84 | |

| Integrated Telecommunication Services | | | | | | | |

| Consolidated Communications Inc., Initial Term Loan, 5.08%, | | | | | | | |

| (1-month USD LIBOR + 3.00%), 10/05/23 | United States | | 2,042,115 | | 2,022,204 | 0.12 | |

| Global Tel*Link Corp., | | | | | | | |

| Second Lien Term Loan, 10.584%, (3-month USD LIBOR + | | | | | | | |

| 8.25%), 11/23/20 | United States | | 3,374,143 | | 3,391,014 | 0.19 | |

| Term Loan, 6.334%, (3-month USD LIBOR + 4.00%), 5/23/20 | United States | | 4,900,539 | | 4,933,466 | 0.28 | |

| Securus Technologies Holdings Inc., Second Lien Initial Loan, | | | | | | | |

| 10.327%, (1-month USD LIBOR + 8.25%), 11/01/25 | United States | | 817,114 | | 820,859 | 0.05 | |

| Zayo Group LLC, 2017 Incremental Refinancing B-1 Term Loan, | | | | | | | |

| 4.077%, (1-month USD LIBOR + 2.00%), 1/19/21 | United States | | 16,703,429 | | 16,750,398 | 0.95 | |

| | | | | | 27,917,941 | 1.59 | |

| Internet Software & Services | | | | | | | |

| h Go Daddy Operating Co. LLC, Tranche B-1 Term Loans, 4.327%, | | | | | | | |

| (1-month USD LIBOR + 2.25%), 2/15/24 | United States | | 7,913,579 | | 7,940,288 | 0.45 | |

| Legalzoom.com Inc., Initial Term Loan, 6.331%, (1-month USD | | | | | | | |

| LIBOR + 4.25%), 11/21/24 | United States | | 802,179 | | 805,187 | 0.04 | |

| Rackspace Hosting Inc., Term B Loans, 5.363%, (3-month USD | | | | | | | |

| LIBOR + 3.00%), 11/03/23 | United States | | 5,080,897 | | 5,063,444 | 0.29 | |

| | | | | | 13,808,919 | 0.78 | |

| IT Consulting & Other Services | | | | | | | |

| Gartner Inc., Tranche A Term Loans, 4.077%, (1-month USD LIBOR | | | | | | | |

| + 2.00%), 3/20/22 | United States | | 1,509,272 | | 1,511,158 | 0.09 | |

| Leisure Facilities | | | | | | | |

| 24 Hour Fitness Worldwide Inc., Term Loan, 5.572%, (1-month USD | | | | | | | |

| LIBOR + 3.50%), 5/30/25 | United States | | 7,380,422 | | 7,421,937 | 0.42 | |

| h,i Equinox Holdings Inc., Term Loan B, TBD, 3/08/24 | United States | | 880,000 | | 884,400 | 0.05 | |

| | | | | | 8,306,337 | 0.47 | |

17

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | | |

| | | | | Principal | | | % of Net |

| | | Country | | Amount* | | Value | Assets |

| f,g Senior Floating Rate Interests (continued) | | | | | | | |

| Life Sciences Tools & Services | | | | | | | |

| Syneos Health Inc., Initial Term B Loans, 4.077%, (1-month USD | | | | | | | |

| LIBOR + 2.00%), 8/01/24 | | United States | $ | 8,278,132 | $ | 8,283,927 | 0.47 |

| Marine | | | | | | | |

| International Seaways Operating Corp., Initial Term Loans, 8.08%, | | | | | | | |

| (1-month USD LIBOR + 5.50%), 6/22/22 | | United States | | 3,127,209 | | 3,131,118 | 0.18 |

| Navios Maritime Partners LP, Initial Term Loan, 7.33%, (3-month | | | | | | | |

| USD LIBOR + 5.00%), 9/14/20 | | United States | | 8,297,396 | | 8,325,051 | 0.47 |

| | | | | | | 11,456,169 | 0.65 |

| Metal & Glass Containers | | | | | | | |

| h,i Berry Global Inc., Term Loan Q, TBD, 10/01/22 | | United States | | 1,408,801 | | 1,413,301 | 0.08 |

| Crown Americas LLC, Term B Loans, 4.077%, (1-month USD LIBOR | | | | | | | |

| + 2.00%), 4/03/25 | | United States | | 5,620,585 | | 5,645,175 | 0.32 |

| | | | | | | 7,058,476 | 0.40 |

| Movies & Entertainment | | | | | | | |

| AMC Entertainment Holdings Inc., | | | | | | | |

| 2016 Incremental Term Loans, 4.322%, (1-month USD LIBOR + | | | | | | | |

| 2.25%), 12/15/23 | | United States | | 1,601,945 | | 1,605,808 | 0.09 |

| Initial Term Loans, 4.322%, (1-month USD LIBOR + 2.25%), | | | | | | | |

| 12/15/22 | | United States | | 2,731,224 | | 2,737,809 | 0.16 |

| Lions Gate Capital Holdings LLC, Term A Loan, 3.814%, (1-month | | | | | | | |

| USD LIBOR + 1.75%), 3/22/23 | | Canada | | 12,095,329 | | 12,110,448 | 0.69 |

| Live Nation Entertainment Inc., Term B-3 Loans, 3.875%, (1-month | | | | | | | |

| USD LIBOR + 1.75%), 10/31/23 | | United States | | 5,808,699 | | 5,817,168 | 0.33 |

| | | | | | | 22,271,233 | 1.27 |

| Oil & Gas Exploration & Production | | | | | | | |

| Cantium LLC, Commitment, 8.34%, (3-month USD LIBOR + 6.00%), | | | | | | | |

| 6/13/20 | . | United States | | 4,635,416 | | 4,681,770 | 0.27 |

| Fieldwood Energy LLC, Closing Date Loans, 7.327%, (1-month USD | | | | | | | |

| LIBOR + 5.25%), 4/11/22 | | United States | | 69,684,139 | | 69,910,612 | 3.97 |

| UTEX Industries Inc., First Lien Initial Term Loan, 6.077%, (1-month | | | | | | | |

| USD LIBOR + 4.00%), 5/21/21 | | United States | | 16,641,446 | | 16,530,498 | 0.94 |

| | | | | | | 91,122,880 | 5.18 |

| Oil & Gas Storage & Transportation | | | | | | | |

| OSG Bulk Ships Inc., Initial Term Loan, 6.77%, (3-month USD | | | | | | | |

| LIBOR + 4.25%), 8/05/19 | | United States | | 9,950,458 | | 9,888,268 | 0.56 |

| Strike LLC, Term Loan, 10.453%, (6-month USD LIBOR + 8.00%), | | | | | | | |

| 11/30/22 | | United States | | 3,459,500 | | 3,511,392 | 0.20 |

| | | | | | | 13,399,660 | 0.76 |

| Other Diversified Financial Services | | | | | | | |

| Asurion LLC, | | | | | | | |

| h AM No.14 Replacement B-4 Term Loans, 5.077%, (1-month | | | | | | | |

| USD LIBOR + 3.00%), 8/04/22 | | United States | | 4,269,566 | | 4,274,903 | 0.24 |

| Replacement B-6 Term Loans, 5.077%, (1-month USD LIBOR + | | | | | | | |

| 3.00%), 11/03/23 | | United States | | 1,745,482 | | 1,746,261 | 0.10 |

| | | | | | | 6,021,164 | 0.34 |

18

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | |

| | | | Principal | | | % of Net |

| | Country | | Amount* | | Value | Assets |

| f,g Senior Floating Rate Interests (continued) | | | | | | |

| Packaged Foods & Meats | | | | | | |

| CSM Bakery Supplies LLC, | | | | | | |

| Second Lien Term Loan, 10.09%, (3-month USD LIBOR + | | | | | | |

| 7.75%), 7/03/21 | United States | $ | 7,271,086 | $ | 6,881,777 | 0.39 |

| Term Loans, 6.34%, (3-month USD LIBOR + 4.00%), 7/03/20 | United States | | 2,560,483 | | 2,499,671 | 0.14 |

| h JBS USA LUX SA, New Initial Term Loans, 4.834% - 4.835%, | | | | | | |

| (3-month USD LIBOR + 2.50%), 10/30/22 | United States | | 30,007,598 | | 30,015,640 | 1.71 |

| Pinnacle Foods Finance LLC, Initial B Term Loan, 3.84%, (1-month | | | | | | |

| USD LIBOR + 1.75%), 2/03/24 | United States | | 5,075,415 | | 5,084,932 | 0.29 |

| Post Holdings Inc., Series A Incremental Term Loans, 4.07%, | | | | | | |

| (1-month USD LIBOR + 2.00%), 5/24/24 | United States | | 17,127,786 | | 17,153,958 | 0.97 |

| | | | | | 61,635,978 | 3.50 |

| Paper Packaging | | | | | | |

| Caraustar Industries Inc., Refinancing Term Loans, 7.834%, | | | | | | |

| (3-month USD LIBOR + 5.50%), 3/14/22 | United States | | 12,669,501 | | 12,799,617 | 0.73 |

| h,i Reynolds Group Holdings Inc., Term B, TBD, 2/05/23 | United States | | 2,326,531 | | 2,336,709 | 0.13 |

| | | | | | 15,136,326 | 0.86 |

| Personal Products | | | | | | |

| b FGI Operating Co. LLC (Freedom Group), | | | | | | |

| Term Loan, 12.343%, (3-month USD LIBOR + 10.00%), | | | | | | |

| 5/15/22 | United States | | 8,563,000 | | 8,563,000 | 0.49 |

| Term Loan FILO, 8.843%, (3-month USD LIBOR + 6.50%), | | | | | | |

| 5/15/21 | United States | | 2,727,273 | | 2,618,182 | 0.15 |

| | | | | | 11,181,182 | 0.64 |

| Pharmaceuticals | | | | | | |

| Bausch Health Companies Inc., Initial Term Loans, 5.092%, | | | | | | |

| (1-month USD LIBOR + 3.00%), 6/02/25 | United States | | 6,339,820 | | 6,355,276 | 0.36 |

| Endo Luxembourg Finance Co. I S.A.R.L. and Endo LLC, Initial Term | | | | | | |

| Loans, 6.375%, (1-month USD LIBOR + 4.25%), 4/29/24 | United States | | 20,757,544 | | 20,812,676 | 1.18 |

| Grifols Worldwide Operations USA Inc., Tranche B Term Loan, | | | | | | |

| 4.20%, (1-week USD LIBOR + 2.25%), 1/31/25. | United States | | 11,507,650 | | 11,554,947 | 0.66 |

| Horizon Pharma Inc., Third Amendment Refinancing Term Loan, | | | | | | |

| 5.375%, (1-month USD LIBOR + 3.25%), 3/29/24 | United States | | 8,826,168 | | 8,844,094 | 0.50 |

| Innoviva Inc., Initial Term Loan, 6.831%, (3-month USD LIBOR + | | | | | | |

| 4.50%), 8/18/22. | United States | | 840,633 | | 844,836 | 0.05 |

| | | | | | 48,411,829 | 2.75 |

| Restaurants | | | | | | |

| KFC Holding Co./Pizza Hut Holdings LLC/Taco Bell of America LLC | | | | | | |

| (Yum Brands), Term Loan B, 3.829%, (1-month USD LIBOR + | | | | | | |

| 1.75%), 4/03/25. | United States | | 8,406,011 | | 8,417,174 | 0.48 |

| NPC International Inc., Second Lien Initial Term Loan, 9.577%, | | | | | | |

| (1-month USD LIBOR + 7.50%), 4/20/25 | United States | | 4,842,941 | | 4,915,585 | 0.28 |

| | | | | | 13,332,759 | 0.76 |

| Security & Alarm Services | | | | | | |

| h Prime Security Services Borrower LLC, Term B-1 Loans, 4.827%, | | | | | | |

| (1-month USD LIBOR + 2.75%), 5/02/22 | United States | | 4,491,184 | | 4,503,346 | 0.26 |

| Semiconductor Equipment | | | | | | |

| MKS Instruments Inc., Tranche B-4 Term Loan, 3.827%, (1-month | | | | | | |

| USD LIBOR + 1.75%), 4/29/23 | United States | | 742,028 | | 745,430 | 0.04 |

| Semiconductors | | | | | | |

| ON Semiconductor Corp., 2018 New Replacement Term B-3 Loans, | | | | | | |

| 3.827%, (1-month USD LIBOR + 1.75%), 3/31/23 | United States | | 14,139,597 | | 14,174,946 | 0.81 |

19

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | |

| | | | Principal | | | % of Net |

| | Country | | Amount* | | Value | Assets |

| f,g Senior Floating Rate Interests (continued) | | | | | | |

| Specialized Consumer Services | | | | | | |

| Avis Budget Car Rental LLC, Tranche B Term Loans, 4.34%, | | | | | | |

| (3-month USD LIBOR + 2.00%), 2/13/25 | United States | $ | 19,176,144 | $ | 19,230,125 | 1.09 |

| h NVA Holdings Inc., Term B-3 Loan, 4.827%, (1-month USD LIBOR + | | | | | | |

| 2.75%), 2/02/25. | United States | | 7,798,594 | | 7,786,413 | 0.44 |

| Sabre GLBL Inc., | | | | | | |

| 2017 Other Term A Loans, 4.077%, (1-month USD LIBOR + | | | | | | |

| 2.00%), 7/01/22 | United States | | 6,324,381 | | 6,340,192 | 0.36 |

| 2018 Other Term B Loans, 4.077%, (1-month USD LIBOR + | | | | | | |

| 2.00%), 2/22/24 | United States | | 1,542,460 | | 1,545,472 | 0.09 |

| | | | | | 34,902,202 | 1.98 |

| Specialized Finance | | | | | | |

| h,i Trans Union LLC, Term A-2 Facility, TBD, 8/09/22 | United States | | 6,752,226 | | 6,754,353 | 0.38 |

| Specialty Chemicals | | | | | | |

| h Ashland LLC, Term B Loan, 3.827% - 3.829%, (1-month USD LIBOR | | | | | | |

| + 1.75%), 5/17/24 | United States | | 9,579,020 | | 9,620,928 | 0.55 |

| Axalta Coating Systems U.S. Holdings Inc., Term B-3 Dollar Loan, | | | | | | |

| 4.084%, (3-month USD LIBOR + 1.75%), 6/01/24 | United States | | 15,782,953 | | 15,801,025 | 0.90 |

| KMG Chemicals Inc., Initial Term Loan, 4.827%, (1-month USD | | | | | | |

| LIBOR + 2.75%), 6/15/24 | United States | | 1,429,522 | | 1,438,456 | 0.08 |

| Oxbow Carbon LLC, | | | | | | |

| Second Lien Term Loan, 9.577%, (1-month USD LIBOR + | | | | | | |

| 7.50%), 1/04/24 | United States | | 7,556,614 | | 7,707,746 | 0.44 |

| Tranche A Term Loan, 4.327%, (1-month USD LIBOR + 2.50%), | | | | | | |

| 1/04/22 | United States | | 5,700,000 | | 5,721,375 | 0.32 |

| Tranche B Term Loan, 5.827%, (1-month USD LIBOR + 3.75%), | | | | | | |

| 1/04/23 | United States | | 4,797,000 | | 4,868,955 | 0.28 |

| WR Grace & Co., | | | | | | |

| Term B-1 Loans, 4.084%, (3-month USD LIBOR + 1.75%), | | | | | | |

| 4/03/25 | United States | | 1,847,640 | | 1,853,414 | 0.10 |

| Term B-2 Loans, 4.084%, (3-month USD LIBOR + 1.75%), | | | | | | |

| 4/03/25 | United States | | 3,167,384 | | 3,177,282 | 0.18 |

| | | | | | 50,189,181 | 2.85 |

| Specialty Stores | | | | | | |

| General Nutrition Centers Inc., | | | | | | |

| FILO Term Loan (ABL), 9.08%, (1-month USD LIBOR + 7.00%), | | | | | | |

| 12/31/22 | United States | | 12,691,811 | | 13,096,363 | 0.74 |

| Tranche B-2 Term Loans, 10.83%, (1-month USD LIBOR + | | | | | | |

| 8.75%), 3/04/21 | United States | | 27,104,979 | | 26,299,961 | 1.49 |

| Michaels Stores Inc., 2018 New Replacement Term B Loan, 4.572% | | | | | | |

| - 4.581%, (1-month USD LIBOR + 2.50%), 1/28/23 | United States | | 13,665,750 | | 13,675,999 | 0.78 |

| | | | | | 53,072,323 | 3.01 |

| Technology Hardware, Storage & Peripherals | | | | | | |

| Western Digital Corp., US Term B-4 Loan, 3.827%, (1-month USD | | | | | | |

| LIBOR + 1.75%), 4/29/23 | United States | | 2,992,500 | | 2,996,552 | 0.17 |

| Trucking | | | | | | |

| Hertz Corp., Tranche B-1 Term Loan, 4.83%, (1-month USD LIBOR | | | | | | |

| + 2.75%), 6/30/23 | United States | | 20,823,331 | | 20,808,692 | 1.18 |

| Total Senior Floating Rate Interests | | | | | | |

| (Cost $1,241,805,349) | | | | | 1,242,963,533 | 70.60 |

20

FRANKLIN FLOATING RATE MASTER TRUST

STATEMENT OF INVESTMENTS

| | | | | | |

| Franklin Floating Rate Master Series (continued) | | | | | | |

| | | | Principal | | | % of Net |

| | Country | | Amount* | | Value | Assets |

| |

| Asset-Backed Securities | | | | | | |

| Other Diversified Financial Services | | | | | | |

| j,k Alinea CLO Ltd., 2018-1A, C, 144A, FRN, 4.207%, (3-month USD | | | | | | |

| LIBOR + 1.90%), 7/20/31 | United States | $ | 2,600,000 | $ | 2,599,870 | 0.15 |

| j,k Annisa CLO Ltd., 2016-2A, CR, 144A, FRN, 4.348%, (3-month USD | | | | | | |

| LIBOR + 2.00%), 7/20/31 | United States | | 1,800,000 | | 1,799,604 | 0.10 |

| j,k Ares CLO Ltd., 2018-48A, C, 144A, FRN, 4.139%, (3-month USD | | | | | | |

| LIBOR + 1.80%), 7/20/30 | United States | | 3,135,000 | | 3,134,342 | 0.18 |

| j,l,m ARES XLIX CLO Ltd., 2018-49A, C, 144A, FRN, 4.293%, 7/22/30 | United States | | 3,100,000 | | 3,099,845 | 0.18 |

| j,k Ares XXXVII CLO Ltd., 2015-4A, BR, 144A, FRN, 4.139%, (3-month | | | | | | |

| USD LIBOR + 1.80%), 10/15/30 | United States | | 3,150,000 | | 3,145,086 | 0.18 |

| j,k Atrium XI, 2011A, CR, 144A, FRN, 4.497%, (3-month USD LIBOR + | | | | | | |

| 2.15%), 10/23/25 | United States | | 2,352,136 | | 2,358,393 | 0.13 |

| j,k Atrium XII, 2012A, CR, 144A, FRN, 3.997%, (3-month USD LIBOR + | | | | | | |

| 1.65%), 4/22/27. | United States | | 2,240,000 | | 2,222,909 | 0.13 |

| j,l,m Atrium XIV LLC, | | | | | | |

| 14A, B, 144A, FRN, 4.01%, 8/23/30 | United States | | 7,200,000 | | 7,200,144 | 0.41 |

| 14A, C, 144A, FRN, 4.26%, 8/23/30 | United States | | 4,000,000 | | 4,000,080 | 0.23 |

| j,k Betony CLO 2 Ltd., 2018-1A, B, 144A, FRN, 3.959%, (3-month USD | | | | | | |

| LIBOR + 1.85%), 4/30/31 | United States | | 2,400,000 | | 2,395,512 | 0.14 |

| j,k BlueMountain CLO Ltd., | | | | | | |

| 2012-2A, AR, 144A, FRN, 3.751%, (3-month USD LIBOR + | | | | | | |

| 1.42%), 11/20/28 | United States | | 10,790,000 | | 10,808,775 | 0.61 |

| 2012-2A, CR, 144A, FRN, 4.931%, (3-month USD LIBOR + | | | | | | |