| OMB APPROVAL |

OMB Number: 3235-0570 Expires: August 31, 2011 Estimated average burden hours per response: 18.9 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number ___811-09911________________________

Hussman Investment Trust

(Exact name of registrant as specified in charter)

| 5136 Dorsey Hall Drive Ellicott City, Maryland | 21042 |

| (Address of principal executive offices) | (Zip code) |

John F. Splain

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: June 30, 2010

Date of reporting period: December 31, 2009

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

HUSSMAN INVESTMENT TRUST

Hussman Strategic Growth Fund

Hussman Strategic Total Return Fund

SEMI-ANNUAL REPORT

DECEMBER 31, 2009

(UNAUDITED)

STRATEGIC GROWTH FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Growth Fund

versus the Standard & Poor's 500 Index and the Russell 2000 Index(a)

| Average Annual Total Returns(b) |

| For Periods Ended December 31, 2009 |

| | 1 Year | 3 Years | 5 Years | Since Inception(c) |

Hussman Strategic Growth Fund(d) | 4.63% | (0.28%) | 1.65% | 8.19% |

| S&P 500 Index | 26.46% | (5.63%) | 0.42% | (1.04%) |

| Russell 2000 Index | 27.17% | (6.07%) | 0.51% | 3.46% |

| (a) | Hussman Strategic Growth Fund invests in stocks listed on the New York, American, and NASDAQ exchanges, and does not specifically restrict its holdings to a particular market capitalization. The S&P 500 and Russell 2000 are indices of large and small capitalization stocks, respectively. ���HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, but excluding the impact of hedging transactions. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their peformance is presented solely for purposes of comparison and performance attribution. |

| (b) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (c) | The Fund commenced operations on July 24, 2000. |

| (d) | The Fund’s annualized expense ratio was 1.05% during the six months ended December 31, 2009. The expense ratio as disclosed in the November 1, 2009 prospectus was 1.09% |

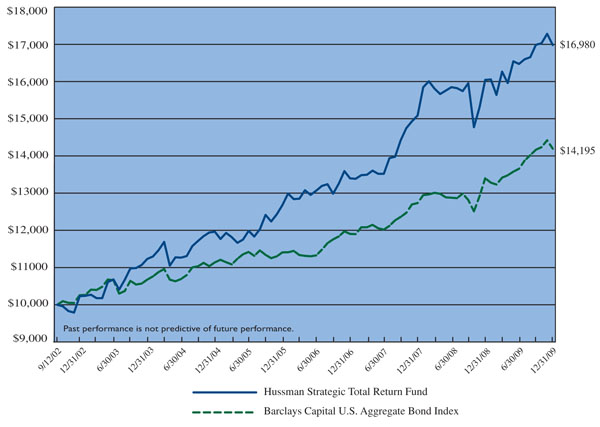

STRATEGIC TOTAL RETURN FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total

Return Fund versus the Barclays Capital U.S. Aggregate Bond Index

| Average Annual Total Returns(a) |

| For Periods Ended December 31, 2009 |

| | 1 Year | 3 Years | 5 Years | Since Inception(b) |

Hussman Strategic Total Return Fund(c) | 5.84% | 8.22% | 7.26% | 7.52% |

Barclays Capital U.S. Aggregate Bond Index(d) | 5.93% | 6.04% | 4.97% | 4.91% |

| (a) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (b) | The Fund commenced operations on September 12, 2002. |

| (c) | The Fund’s annualized expense ratio was 0.68% during the six months ended December 31, 2009. The expense ratio as disclosed in the November 1, 2009 prospectus was 0.79%. |

| (d) | The Barclays Capital U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. |

The Hussman Funds | |

| Letter to Shareholders | February 19, 2010 |

Dear Shareholder,

The Hussman Funds ended 2009 with moderate positive returns, reflecting a continued defensive investment stance and enduring concerns about economic fundamentals and credit risks. Both Funds have substantially outperformed their respective benchmarks since inception, while maintaining contained volatility.

For the year ended December 31, 2009, Strategic Growth Fund achieved a total return of 4.63%, compared with a total return of 26.46% in the S&P 500 Index. Since the inception of the Fund on July 24, 2000 to December 31, 2009, the Fund has achieved an average annual total return of 8.19%, compared with an average annual total return of -1.04% for the S&P 500 Index over the same period. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $21,029, as compared with $9,063 if the same investment had been made in the S&P 500 Index.

For the year ended December 31, 2009, Strategic Total Return Fund achieved a total return of 5.84%, compared with a total return of 5.93% in the Barclays Capital U.S. Aggregate Bond Index. Since the inception of the Fund on September 12, 2002, the Fund has achieved an average annual total return of 7.52%, compared with an average annual total return of 4.91% for the Barclays Capital U.S. Aggregate Bond Index over the same period. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $16,980, as compared with $14,195 if a similar investment had been made in the Barclays Capital U.S. Aggregate Bond Index.

The greatest challenge we have faced over the past year has been distinguishing two very different possible states of the world. One is a world in which our economic problems are largely solved, profits are on the mend, and things will soon be back to normal, except for a large number of unemployed people whose fate appears to be of remote concern to Wall Street. The other is a world that has enjoyed a brief intermission prior to a second wave of credit losses, and in which the range of policy choices will be more restricted because we have already issued an enormous volume of government liabilities, and will steeply debase our currency if we do it again. It is not at all clear that the recent data has removed any uncertainty as to which world we face.

Our defensive investment posture continues to be driven by concern that the present economic environment is more comparable to severe multi-year debt crises (which have periodically been observed throughout history) than it

The Hussman Funds | |

| Letter to Shareholders (continued) | |

is to previous run-of-the-mill post-war recessions. A number of specific concerns are detailed later in this letter. Major debt crises have rarely been resolved quickly, and while there is a clear tendency for the stock market to enjoy large recoveries from its initial losses, these advances also have typically been followed by abrupt and often steep failure. As of December 31, 2009, the S&P 500 Index would have to retreat by -17.26%, with Strategic Growth Fund unchanged, to eliminate the 2009 performance gap between the Fund and the S&P 500. Meanwhile, even with the recent market rebound, the Fund remains substantially ahead of the S&P 500 Index since the end of 2007.

The table below presents the total returns for Strategic Growth Fund and the S&P 500 Index since the inception of the Fund. In order to assist in attributing the effects of stock selection and hedging on the Fund, the table separately presents the returns of the stock positions and cash equivalents held by the Fund (after expenses), without the impact of hedging transactions. Notably, a portion of our hedge during 2009 was tied to the Russell 2000 Index and the NASDAQ 100 Index (as some investments owned by the Fund were best correlated with these indices). Both of these indices outperformed the S&P 500 Index in 2009, with particular strength in technology stocks. As a result, the total return of the S&P 500 during 2009 was smaller than the total return of the basket of market indices that we used to hedge the Fund’s security holdings.

| Year | HSGFX | Stocks Only | S&P 500 |

| 2000* | 16.40% | 4.86% | -9.37% |

| 2001 | 14.67% | 9.13% | -11.89% |

| 2002 | 14.02% | -10.03% | -22.10% |

| 2003 | 21.08% | 37.68% | 28.68% |

| 2004 | 5.16% | 12.81% | 10.88% |

| 2005 | 5.71% | 8.43% | 4.91% |

| 2006 | 3.51% | 13.88% | 15.79% |

| 2007 | 4.16% | 0.89% | 5.49% |

| 2008 | -9.02% | -33.97% | -37.00% |

| 2009 | 4.63% | 38.12% | 26.46% |

| Since Inception (Average Annual) | 8.19% | 6.53% | -1.04% |

| * | July 24, 2000 – December 31, 2000, not annualized |

The Hussman Funds | |

| Letter to Shareholders (continued) | |

The table below presents the returns for Strategic Total Return Fund and the Barclays Capital U.S. Aggregate Bond Index since the inception of the Fund.

| Year | HSTRX | Barclays Capital U.S. Aggregate Bond Index |

| 2002* | 2.30% | 2.56% |

| 2003 | 9.80% | 4.10% |

| 2004 | 6.50% | 4.34% |

| 2005 | 6.00% | 2.43% |

| 2006 | 5.66% | 4.33% |

| 2007 | 12.61% | 6.97% |

| 2008 | 6.34% | 5.24% |

| 2009 | 5.84% | 5.93% |

| Since Inception (Average Annual) | 7.52% | 4.91% |

| * | September 12, 2002 – December 31, 2002, not annualized |

The investment objectives of the Hussman Funds are distinctly long-term and “full cycle” in nature, placing very little weight on tracking the market over short periods of time. Because of our emphasis on risk management, the Funds’ returns will periodically behave differently than various market indices. The intent of our investment strategy is to outperform the major indices over the complete market cycle (bull and bear markets combined), with added emphasis on defending capital in unfavorable market conditions.

Strategic Growth Fund

For the calendar year ended December 31, 2009, Strategic Growth Fund achieved a total return of 4.63%. The Fund maintained a largely or fully-hedged investment stance during 2009, as the attractiveness of speculative “trend following” appeared insufficient in light of weak economic fundamentals, persistent structural credit risks, dull trading volume, strenuously overbought conditions, and ultimately overvaluation.

We entered 2009 well aware that historical credit crises have generally included sharp but temporary market recoveries after the initial crash (which are typically followed by fresh losses). In hindsight, I underestimated the extent to which Wall Street would respond to the ebb-and-flow in the economic data – particularly the predictable and temporary lull in the adjustable rate mortgage reset schedule between March and November 2009 – and drive

The Hussman Funds | |

| Letter to Shareholders (continued) | |

stocks to the point where they are now not only overvalued again, but strikingly dependent on a sustained economic recovery and the achievement and maintenance of record profit margins in the years ahead. Because our primary concern is to achieve long-term returns consistent with prudent risk management, there is no likelihood, even in hindsight, that I would have responded to purely speculative factors with more than a moderate exposure to market fluctuations last year. Still, there was clearly more room to speculate than I had expected, and our defensiveness during the later months of the year proved to be unnecessary, or at least too early.

From a stock-selection perspective, Strategic Growth Fund continues to emphasize companies and industries that exhibit strong stable revenue growth and profit margins, balance sheets generally having low levels of debt, and valuations that we view as favorable based on the long-term stream of cash flows that investors can expect to receive over time. The Fund’s primary sector holdings remain in consumer-related goods, technology, and health care, with a continued avoidance of sectors that rely on credit expansion, such as financials and homebuilders.

Strategic Total Return Fund

For the calendar year ended December 31, 2009, Strategic Total Return Fund achieved a total return of 5.84%, compared with a total return of 5.93% in the Barclays Capital U.S. Aggregate Bond Index. In an environment of low and generally rising yields, the Fund achieved much of its gains last year through opportunistic trading of Treasury securities, beginning the year with a very small exposure to interest rate fluctuations, and increasing its exposure after interest rates had advanced substantially by mid-year.

Strategic Total Return Fund has the ability to hold up to 30% of its assets in alternatives to U.S. fixed income securities, including foreign government bonds, utility stocks and precious metals shares. Given that Strategic Total Return Fund seeks to preserve and enhance long-term purchasing power against inflation, precious metals have been an effective component of our investment strategy. As the prices of precious metals shares advanced, the Fund gradually liquidated the bulk of its holdings in these securities by year-end. More recently, the Fund has reestablished modest positions in precious metals shares on the price weakness observed during the first several weeks of 2010.

The Hussman Funds | |

| Letter to Shareholders (continued) | |

Portfolio composition and performance drivers

As of December 31, 2009, Strategic Growth Fund had net assets of $5,448,326,267, and held 93 stocks in a wide variety of industries. The largest sector holdings as a percentage of net assets were in consumer discretionary (35.1%), information technology (31.7%), and health care (11.9%). The smallest sector weights were in materials (0.1%) and financials (0.5%).

The Fund’s holdings of individual stocks as of December 31, 2009 accounted for $4,909,240,920, or 90.1% of net assets. Against these stock positions, the Fund also held 33,500 option combinations (long put option, short call option) on the S&P 500 Index, 8,000 option combinations on the Russell 2000 Index and 3,000 option combinations on the NASDAQ 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 31, 2009, the S&P 500 Index closed at 1,115.10, while the Russell 2000 Index and the NASDAQ 100 Index closed at 625.39 and 1,860.31, respectively. The Fund’s total hedge therefore represented a short position of $4,793,990,000, thereby hedging 97.7% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following holdings achieved gains in excess of $50 million during the semi-annual period ended December 31, 2009: NetApp and Amazon.com. Holdings with losses in excess of $10 million during this same period were Synaptics and Research in Motion. For the full calendar year ended December 31, 2009, the Fund achieved gains in excess of $50 million in Amazon.com, Aeropostale, NetApp, Netflix, Starbucks, Research in Motion, Cisco Systems and Humana. The Fund experienced a loss greater than $10 million in General Electric, Sunpower, Citigroup, Martek Biosciences and Wal-Mart.

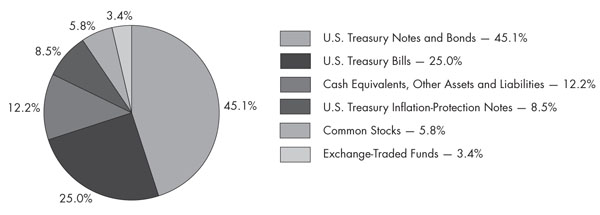

As of December 31, 2009, Strategic Total Return Fund had net assets of $1,396,177,064. Treasury Inflation Protected Securities accounted for 8.5% of the Fund’s net assets, with U.S. Treasury Bills, Notes and Bonds, representing an additional 70.1% of net assets. Exchange-traded funds, precious metals shares and utility shares accounted for 3.4%, 2.5% and 3.3% of net assets, respectively. The remaining 12.2% of net assets were in cash equivalents. The Fund carried a duration of approximately 4 years (meaning that a 1% change in interest rates would be expected to impact the Fund’s asset value by about 4% on the basis of bond price fluctuations).

The Hussman Funds | |

| Letter to Shareholders (continued) | |

In Strategic Total Return Fund, during the semi-annual period ended December 31, 2009, portfolio gains in excess of $2 million were achieved in Agnico-Eagle Mines, U.S. Treasury Inflation-Protected Note (2.625%, due 7/15/2017), U.S. Treasury Inflation-Protected Note (2.375%, due 1/15/2025), U.S. Treasury Inflation-Protected Note (2.00%, due 1/15/2016), DTE Energy, Barrick Gold and Cia De Minas Buena - ADR. Holdings with losses in excess of $2 million were U.S. Treasury Note (3.375%, due 11/15/2019) and U.S. Treasury Note (3.625%, due 8/15/2019). For the full calendar year ended December 31, 2009, the Fund achieved gains in excess of $3 million in U.S. Treasury Inflation-Protected Note (2.625%, due 7/15/2017), U.S. Treasury Inflation-Protected Note (2.00%, due 1/15/2016), U.S. Treasury Inflation-Protected Note (2.375%, due 1/15/2025), U.S. Treasury Inflation-Protected Note (2.375% due 4/15/2011), CurrencyShares British Pound Sterling Trust, Agnico-Eagle Mines, AngloGold Ashanti and U.S. Treasury Inflation-Protected Note (2.00%, due 7/15/2014). Holdings with losses in excess of $2 million during this same period were U.S. Treasury Note (3.375%, due 11/15/2019), U.S. Treasury Note (2.75%, due 2/15/2019) and U.S. Treasury Note (3.625%, due 8/15/2019).

Present conditions

As we enter 2010, the most important headwinds facing the U.S. stock market are rich valuation and continuing credit risks. Market valuations are certainly better than they were at the market peak in 2000. However, the S&P 500 Index ended 2009 at valuations which are characteristic of those found at prior market peaks including 1972 and 1987. From such valuations, durable market returns have typically not emerged, so whatever merit there might be in accepting market risk is decidedly speculative and short-term.

While near term market returns are extremely difficult to project, it is possible to calculate fairly reliable projections of long-term total returns for the S&P 500, because over the long-term, stock prices track “smooth” fundamental measures such as revenues, cash flows, and normalized (cyclically-adjusted) earnings. For example, over the past century, S&P 500 earnings have fluctuated widely due to economic expansions and recessions, yet they have followed a very well-behaved growth trend when measured from peak-to-peak across economic cycles. One historically reliable method of projecting long-term market returns is to apply a reasonable range of price/earnings multiples to those future “normalized” earnings.

The Hussman Funds | |

| Letter to Shareholders (continued) | |

Even assuming that the long-term trend of S&P 500 earnings will remain intact despite deleveraging pressures and a continuing collapse in bank lending, we estimate that the S&P 500 is currently priced to deliver annual total returns averaging just 6.1% over the coming decade. This is certainly better than the similar calculation in 2000, which correctly projected a negative total return. Unfortunately, it is also the lowest projected return that has historically been observed outside of the late-1990’s stock market bubble and a handful of previous market peaks such as 1987. This is not an argument that stocks must decline in the near-term, but it presents a difficult obstacle to risk-taking, because it suggests that further market advances may not be durable.

Meanwhile, the U.S. currently faces a predictable wave of resets on Alt-A and Option-ARM mortgages, of approximately the same size as the wave of sub-prime resets that ended in early 2009. These Alt-A and Option-ARM structures were specifically designed as “teasers” with low interest rates and temporarily optional principal payments – allowing loans to be made without documentation of creditworthiness, in return for post-reset interest terms that were generally higher than a documented lender would have paid. This “yield spread premium” tends to be particularly obnoxious at the point of reset if the mortgage itself is underwater (loan amount in excess of home value). Given that these mortgages were written during the last stages of the housing boom, at the highest prices, it is reasonable to assume that they now sport very high loan-to-value ratios. From our perspective, the combination of deeply underwater mortgages, tepid employment conditions, and a heavy mortgage reset schedule creates a large threat of further credit losses.

The loose-handed government bailout of financial institutions in early 2009 had the result of driving up the values of a wide variety of risky investments, driving the the yields of junk bonds and other low-grade debt to levels that existed in 2008, prior to the onset of major difficulties. While it might be considered natural for investors to bid up risky assets when they feel confident that the government will bail them out if they are incorrect, investors have now placed themselves in a position of relying on such bailouts, while at the same time earning low returns as compensation for the probable volatility.

Stagnant personal income and depressed corporate cash flows appear no more capable of servicing record amounts of debt today than they were at the beginning of this crisis. As a result, consumer credit and bank lending have continued to collapse, despite widespread perceptions of a fresh economic recovery. The depth of this collapse in credit is unprecedented in post-war

The Hussman Funds | |

| Letter to Shareholders (continued) | |

data. Historically, sustained economic expansions have commenced with rapid growth in debt-financed classes of spending such as housing, automobiles, durable goods, and capital spending. Recent economic growth has instead been driven primarily by temporary government stimulus, which has offset the erosion in private lending in recent quarters.

In the credit markets, the past two years have seen an enormous issuance of new government liabilities. The amount of U.S. Treasury debt held by the public (outside of agencies such as the Social Security Administration and the Federal Reserve) has already surged by more than 50%, from $5.05 trillion to $7.55 trillion, and record fiscal deficits continue to mount. Meanwhile, the Federal Reserve has expanded the U.S. monetary base from $850 billion to $2.02 trillion, fueled by aggressive purchases of Fannie Mae and Freddie Mac’s mortgage-backed securities. As Fannie Mae and Freddie Mac have deeply insolvent balance sheets, their securities can be gradually made whole only with bailout funds obtained by issuing more U.S. Treasury debt.

It is in this context that we should consider inflation risks over the coming decade. At present, inflation risks are hardly considered to be problematic by Wall Street. From the standpoint of the next few years, that complacency is probably well founded, as fresh credit concerns are likely to create additional “safe haven” demand for default-free government liabilities. From a longer-term perspective, however, I believe that inflation will be a major event in the latter part of the coming decade, with the consumer price index roughly doubling over the next ten years.

While the near-term case for inflation hedges appears fairly weak, I expect that we will gradually accept greater exposure to commodities and inflation-protected securities in Strategic Total Return Fund in the coming years, particularly in response to occasional price weakness. Historically, inflation has been much better correlated with the growth of government spending than with the growth of the monetary base itself. This is particularly true over horizons of four years and beyond. Ultimately, a massive expansion in government liabilities can do little but undermine the value of the U.S. dollar relative to real goods and services.

Our willingness to accept market risk is essentially proportional to the expected return that we anticipate as compensation. Accordingly, we look to adopt a greater exposure to market risk when the expected return from accepting risk increases, or when the expected range of outcomes becomes

The Hussman Funds | |

Letter to Shareholders (continued) | |

narrower. The past decade has been challenging in that the S&P 500 has delivered a great deal of volatility, but no net return at all. That environment has made it difficult to accept substantial market risk for any extended period of time. Presently, two things would improve this situation. One is clarity, the other is better valuation.

First and foremost, over the next few quarters, we are likely to discover the extent to which “second wave” credit risks materialize. It is not necessary for the nation to work through all of its economic problems in order for us to accept a constructive position. However, the most hostile market declines have often been associated with problems (overvaluation, credit strains) that were developing for some time but whose risks were dismissed or underestimated.

Presently, what we need most is for several latent problems to become more observable, so that we can have greater clarity about their extent. Among these are the likelihood of surging delinquencies tied to Alt-A and Option-ARM loans, the requirement beginning in January that banks and other financials bring “off balance sheet” entities onto their books, and clarity about the disposition of a mountain of mortgages that are already seriously delinquent, but where foreclosure has been temporarily delayed.

Improved valuations, combined with better clarity, can be expected to move us to a more constructive investment stance. I expect that we will resolve the “two states of the world” issue during the coming quarters, which itself will narrow the range of possible outcomes and – especially if prices retreat – allow us to accept greater amounts of risk in response to improvements in valuations and market action. I look forward to greater optimism as we move through 2010. In any event, I remain focused on our goal of outperforming the major indices over the complete (bull-bear) market cycle, while reducing the impact of periodic market losses. We continue to achieve our objective in that regard.

As always, I am grateful for your investment in the Funds, and for your trust.

Best wishes,

John P. Hussman, Ph.D.

The Hussman Funds | |

Letter to Shareholders (continued) | |

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund Portfolio Information | |

December 31, 2009 (Unaudited) | |

Sector Allocation (% of Net Assets)

Hussman Strategic Total Return Fund Portfolio Information | |

December 31, 2009 (Unaudited) | |

Asset Allocation (% of Net Assets)

Hussman Strategic Growth Fund Schedule of Investments | |

| December 31, 2009 (Unaudited) | |

| COMMON STOCKS — 90.1% | | Shares | | | Value | |

| Consumer Discretionary — 35.1% | | | | | | |

| Hotels, Restaurants & Leisure — 9.7% | | | | | | |

| Brinker International, Inc. | | | 350,000 | | | $ | 5,222,000 | |

Cheesecake Factory, Inc. (The) (a) | | | 2,500,000 | | | | 53,975,000 | |

Chipotle Mexican Grill, Inc. - Class A (a) | | | 776,000 | | | | 68,412,160 | |

| Darden Restaurants, Inc. | | | 2,600,000 | | | | 91,182,000 | |

Panera Bread Co. - Class A (a) | | | 2,140,000 | | | | 143,315,800 | |

PF Chang’s China Bistro, Inc. (a) | | | 400,000 | | | | 15,164,000 | |

Royal Caribbean Cruises Ltd. (a) | | | 1,382,000 | | | | 34,936,960 | |

Starbucks Corp. (a) | | | 5,000,000 | | | | 115,300,000 | |

| | | | | | | | 527,507,920 | |

| Household Durables — 0.7% | | | | | | | | |

| Whirlpool Corp. | | | 460,000 | | | | 37,103,600 | |

| | | | | | | | | |

| Internet & Catalog Retail — 4.1% | | | | | | | | |

Amazon.com, Inc. (a) | | | 500,000 | | | | 67,260,000 | |

Netflix, Inc. (a) | | | 2,800,000 | | | | 154,392,000 | |

| | | | | | | | 221,652,000 | |

| Leisure Equipment & Products — 0.1% | | | | | | | | |

| Mattel, Inc. | | | 380,000 | | | | 7,592,400 | |

| | | | | | | | | |

| Media — 0.3% | | | | | | | | |

| Comcast Corp. - Class A | | | 1,050,000 | | | | 17,703,000 | |

| | | | | | | | | |

| Multiline Retail — 4.9% | | | | | | | | |

Dollar Tree, Inc. (a) | | | 1,000,000 | | | | 48,300,000 | |

Kohl’s Corp. (a) | | | 2,750,000 | | | | 148,307,500 | |

| Nordstrom, Inc. | | | 650,000 | | | | 24,427,000 | |

| Target Corp. | | | 1,000,000 | | | | 48,370,000 | |

| | | | | | | | 269,404,500 | |

| Specialty Retail — 13.0% | | | | | | | | |

AÈropostale, Inc. (a) | | | 4,500,000 | | | | 153,225,000 | |

| American Eagle Outfitters, Inc. | | | 2,000,000 | | | | 33,960,000 | |

Bed Bath & Beyond, Inc. (a) | | | 3,750,000 | | | | 144,862,500 | |

| Best Buy Co., Inc. | | | 3,750,000 | | | | 147,975,000 | |

GameStop Corp. - Class A (a) | | | 2,394,000 | | | | 52,524,360 | |

| Limited Brands, Inc. | | | 2,000,000 | | | | 38,480,000 | |

| PetSmart, Inc. | | | 750,000 | | | | 20,017,500 | |

| Ross Stores, Inc. | | | 1,500,000 | | | | 64,065,000 | |

| TJX Cos., Inc. (The) | | | 1,500,000 | | | | 54,825,000 | |

| | | | | | | | 709,934,360 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) | |

| December 31, 2009 (Unaudited) | |

| COMMON STOCKS — 90.1% (continued) | | Shares | | | Value | |

| Consumer Discretionary — 35.1% (continued) | | | | | | |

| Textiles, Apparel & Luxury Goods — 2.3% | | | | | | |

| Coach, Inc. | | | 1,290,000 | | | $ | 47,123,700 | |

| NIKE, Inc. - Class B | | | 755,000 | | | | 49,882,850 | |

Under Armour, Inc. - Class A (a) | | | 955,000 | | | | 26,042,850 | |

| | | | | | | | 123,049,400 | |

| Consumer Staples — 3.9% | | | | | | | | |

| Beverages — 1.6% | | | | | | | | |

| Coca-Cola Co. (The) | | | 1,500,000 | | | | 85,500,000 | |

| | | | | | | | | |

| Food & Staples Retailing — 2.3% | | | | | | | | |

| Walgreen Co. | | | 3,500,000 | | | | 128,520,000 | |

| | | | | | | | | |

| Energy — 5.0% | | | | | | | | |

| Energy Equipment & Services — 3.4% | | | | | | | | |

| Diamond Offshore Drilling, Inc. | | | 600,000 | | | | 59,052,000 | |

Dresser-Rand Group, Inc. (a) | | | 1,090,000 | | | | 34,454,900 | |

| Noble Corp. | | | 297,000 | | | | 12,087,900 | |

Transocean Ltd. (a) | | | 943,000 | | | | 78,080,400 | |

| | | | | | | | 183,675,200 | |

| Oil, Gas & Consumable Fuels — 1.6% | | | | | | | | |

| Chevron Corp. | | | 142,000 | | | | 10,932,580 | |

| Exxon Mobil Corp. | | | 1,000,000 | | | | 68,190,000 | |

| Marathon Oil Corp. | | | 214,000 | | | | 6,681,080 | |

| | | | | | | | 85,803,660 | |

| Financials — 0.5% | | | | | | | | |

| Insurance — 0.5% | | | | | | | | |

Berkshire Hathaway, Inc. - Class A (a) | | | 250 | | | | 24,800,000 | |

| | | | | | | | | |

| Health Care — 11.9% | | | | | | | | |

| Biotechnology — 1.2% | | | | | | | | |

Amgen, Inc. (a) | | | 1,000,000 | | | | 56,570,000 | |

Martek Biosciences Corp. (a) | | | 530,000 | | | | 10,038,200 | |

| | | | | | | | 66,608,200 | |

| Health Care Equipment & Supplies — 1.4% | | | | | | | | |

Align Technology, Inc. (a) | | | 1,500,000 | | | | 26,730,000 | |

ArthroCare Corp. (a) | | | 1,060,000 | | | | 25,122,000 | |

IDEXX Laboratories, Inc. (a) | | | 500,000 | | | | 26,720,000 | |

| | | | | | | | 78,572,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) | |

| December 31, 2009 (Unaudited) | |

| COMMON STOCKS — 90.1% (continued) | | Shares | | | Value | |

| Health Care — 11.9% (continued) | | | | | | |

| Health Care Providers & Services — 2.1% | | | | | | |

Humana, Inc. (a) | | | 2,150,000 | | | $ | 94,363,500 | |

LifePoint Hospitals, Inc. (a) | | | 470,000 | | | | 15,279,700 | |

| McKesson Corp. | | | 48,000 | | | | 3,000,000 | |

| | | | | | | | 112,643,200 | |

| Life Sciences Tools & Services — 2.3% | | | | | | | | |

Life Technologies Corp. (a) | | | 1,062,000 | | | | 55,468,260 | |

Waters Corp. (a) | | | 1,162,000 | | | | 71,997,520 | |

| | | | | | | | 127,465,780 | |

| Pharmaceuticals — 4.9% | | | | | | | | |

| AstraZeneca plc - ADR | | | 2,600,000 | | | | 122,044,000 | |

| Biovail Corp. | | | 1,578,000 | | | | 22,028,880 | |

Endo Pharmaceuticals Holdings, Inc. (a) | | | 390,000 | | | | 7,998,900 | |

Forest Laboratories, Inc. (a) | | | 150,000 | | | | 4,816,500 | |

| Johnson & Johnson | | | 1,000,000 | | | | 64,410,000 | |

| Pfizer, Inc. | | | 1,750,000 | | | | 31,832,500 | |

| Shire plc - ADR | | | 183,000 | | | | 10,742,100 | |

| | | | | | | | 263,872,880 | |

| Industrials — 1.9% | | | | | | | | |

| Commercial Services & Supplies — 0.1% | | | | | | | | |

| Cintas Corp. | | | 225,000 | | | | 5,861,250 | |

| | | | | | | | | |

| Electrical Equipment — 1.2% | | | | | | | | |

| Cooper Industries Ltd. - Class A | | | 670,000 | | | | 28,568,800 | |

SunPower Corp. - Class A (a) | | | 1,400,000 | | | | 33,152,000 | |

Thomas & Betts Corp. (a) | | | 125,000 | | | | 4,473,750 | |

| | | | | | | | 66,194,550 | |

| Machinery — 0.6% | | | | | | | | |

| Timken Co. | | | 1,420,000 | | | | 33,668,200 | |

| | | | | | | | | |

| Information Technology — 31.7% | | | | | | | | |

| Communications Equipment — 6.1% | | | | | | | | |

| ADTRAN, Inc. | | | 2,500,000 | | | | 56,375,000 | |

Cisco Systems, Inc. (a) | | | 6,000,000 | | | | 143,640,000 | |

EchoStar Corp. - Class A (a) | | | 180,000 | | | | 3,625,200 | |

Motorola, Inc. (a) | | | 3,500,000 | | | | 27,160,000 | |

Research In Motion Ltd. (a) | | | 1,500,000 | | | | 101,310,000 | |

| | | | | | | | 332,110,200 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) | |

| December 31, 2009 (Unaudited) | |

| COMMON STOCKS — 90.1% (continued) | | Shares | | | Value | |

| Information Technology — 31.7% (continued) | | | | | | |

| Computers & Peripherals — 6.2% | | | | | | |

Dell, Inc. (a) | | | 1,756,000 | | | $ | 25,216,160 | |

| International Business Machines Corp. | | | 250,000 | | | | 32,725,000 | |

NetApp, Inc. (a) | | | 3,925,000 | | | | 134,980,750 | |

QLogic Corp. (a) | | | 3,320,000 | | | | 62,648,400 | |

Synaptics, Inc. (a) | | | 1,744,000 | | | | 53,453,600 | |

Western Digital Corp. (a) | | | 650,000 | | | | 28,697,500 | |

| | | | | | | | 337,721,410 | |

| Electronic Equipment, Instruments & Components — 1.8% | | | | | | | | |

| Corning, Inc. | | | 5,000,000 | | | | 96,550,000 | |

| FUJIFILM Holdings Corp. - ADR | | | 49,400 | | | | 1,491,880 | |

| | | | | | | | 98,041,880 | |

| Internet Software & Services — 2.3% | | | | | | | | |

eBay, Inc. (a) | | | 4,500,000 | | | | 105,930,000 | |

Vistaprint N.V. (a) | | | 303,000 | | | | 17,167,980 | |

| | | | | | | | 123,097,980 | |

| IT Services — 2.5% | | | | | | | | |

Amdocs Ltd. (a) | | | 988,000 | | | | 28,187,640 | |

Computer Sciences Corp. (a) | | | 1,820,000 | | | | 104,704,600 | |

Sapient Corp. (a) | | | 700,000 | | | | 5,789,000 | |

| | | | | | | | 138,681,240 | |

| Semiconductors & Semiconductor Equipment — 7.5% | | | | | | | | |

| Altera Corp. | | | 1,000,000 | | | | 22,630,000 | |

| Analog Devices, Inc. | | | 3,100,000 | | | | 97,898,000 | |

Broadcom Corp. - Class A (a) | | | 4,500,000 | | | | 141,525,000 | |

| Intel Corp. | | | 2,000,000 | | | | 40,800,000 | |

Semtech Corp. (a) | | | 1,935,000 | | | | 32,914,350 | |

| Xilinx, Inc. | | | 3,000,000 | | | | 75,180,000 | |

| | | | | | | | 410,947,350 | |

| Software — 5.3% | | | | | | | | |

Adobe Systems, Inc. (a) | | | 1,700,000 | | | | 62,526,000 | |

Autodesk, Inc. (a) | | | 290,000 | | | | 7,368,900 | |

Check Point Software Technologies Ltd. (a) | | | 916,000 | | | | 31,034,080 | |

| FactSet Research Systems, Inc. | | | 1,150,000 | | | | 75,750,500 | |

| Microsoft Corp. | | | 2,000,000 | | | | 60,980,000 | |

| Oracle Corp. | | | 2,000,000 | | | | 49,080,000 | |

| | | | | | | | 286,739,480 | |

| Materials — 0.1% | | | | | | | | |

| Chemicals — 0.1% | | | | | | | | |

| BASF SE - ADR | | | 76,800 | | | | 4,769,280 | |

| | | �� | | | | | | |

Total Common Stocks (Cost $4,034,549,815) | | | | | | $ | 4,909,240,920 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) | |

| December 31, 2009 (Unaudited) | |

| PUT OPTION CONTRACTS — 2.3% | | Contracts | | | Value | |

| Nasdaq 100 Index Option, 02/20/2010 at $1,800 | | | 2,750 | | | $ | 9,185,000 | |

| Nasdaq 100 Index Option, 03/20/2010 at $1,800 | | | 250 | | | | 1,257,500 | |

| Russell 2000 Index Option, 03/20/2010 at $450 | | | 8,000 | | | | 1,560,000 | |

| S&P 500 Index Option, 02/20/2010 at $1,120 | | | 12,500 | | | | 43,812,500 | |

| S&P 500 Index Option, 03/20/2010 at $1,080 | | | 15,000 | | | | 46,995,000 | |

| S&P 500 Index Option, 03/20/2010 at $1,100 | | | 6,000 | | | | 23,016,000 | |

Total Put Option Contracts (Cost $131,154,518) | | | | | | $ | 125,826,000 | |

| | | | | | | | | |

Total Investments at Value — 92.4% (Cost $4,165,704,333) | | | | | | $ | 5,035,066,920 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 19.0% | | Shares | | | Value | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.02% (b) | | | 707,887,267 | | | $ | 707,887,267 | |

First American Treasury Obligations Fund - Class Y, 0.00% (b) | | | 328,398,042 | | | | 328,398,042 | |

Total Money Market Funds (Cost $1,036,285,309) | | | | | | $ | 1,036,285,309 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 111.4% | | | | | | | | |

| (Cost $5,201,989,642) | | | | | | $ | 6,071,352,229 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (11.4%) | | | | | | | (623,025,962 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 5,448,326,267 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| | |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2009. |

See accompanying notes to financial statements.

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts | |

| December 31, 2009 (Unaudited) | |

| WRITTEN CALL OPTION CONTRACTS | | Contracts | | | Value of Options | | | Premiums Received | |

| Nasdaq 100 Index Option, 03/20/2010 at $1,600 | | | 3,000 | | | $ | 82,170,000 | | | $ | 69,556,788 | |

| Russell 2000 Index Option, 03/20/2010 at $450 | | | 8,000 | | | | 140,080,000 | | | | 101,588,768 | |

| S&P 500 Index Option, 02/20/2010 at $1,100 | | | 12,500 | | | | 47,812,500 | | | | 52,076,200 | |

| S&P 500 Index Option, 03/20/2010 at $900 | | | 6,000 | | | | 129,048,000 | | | | 129,591,576 | |

| S&P 500 Index Option, 03/20/2010 at $1,080 | | | 15,000 | | | | 91,665,000 | | | | 98,978,940 | |

| Total Written Call Option Contracts | | | | | | $ | 490,775,500 | | | $ | 451,792,272 | |

See accompanying notes to financial statements.

Hussman Strategic Total Return Fund Schedule of Investments | |

| December 31, 2009 (Unaudited) | |

| COMMON STOCKS — 5.8% | | Shares | | | Value | |

| Materials — 2.5% | | | | | | |

| Metals & Mining — 2.5% | | | | | | |

| Agnico-Eagle Mines Ltd. | | | 55,000 | | | $ | 2,970,000 | |

| AngloGold Ashanti Ltd. - ADR | | | 55,000 | | | | 2,209,900 | |

| Barrick Gold Corp. | | | 355,000 | | | | 13,979,900 | |

| Compania de Minas Buenaventura S.A. - ADR | | | 5,000 | | | | 167,350 | |

| Goldcorp, Inc. | | | 5,000 | | | | 196,700 | |

| Harmony Gold Mining Co. Ltd. - ADR | | | 10,000 | | | | 101,700 | |

| Newmont Mining Corp. | | | 305,000 | | | | 14,429,550 | |

| Randgold Resources Ltd. - ADR | | | 5,000 | | | | 395,600 | |

Stillwater Mining Co. (a) | | | 10,000 | | | | 94,800 | |

| | | | | | | | 34,545,500 | |

| Utilities — 3.3% | | | | | | | | |

| Electric Utilities — 1.5% | | | | | | | | |

| DPL, Inc. | | | 300,000 | | | | 8,280,000 | |

| Pepco Holdings, Inc. | | | 300,000 | | | | 5,055,000 | |

| Pinnacle West Capital Corp. | | | 200,000 | | | | 7,316,000 | |

| | | | | | | | 20,651,000 | |

| Multi-Utilities — 1.8% | | | | | | | | |

| Alliant Energy Corp. | | | 100,000 | | | | 3,026,000 | |

| Ameren Corp. | | | 200,000 | | | | 5,590,000 | |

| Consolidated Edison, Inc. | | | 65,000 | | | | 2,952,950 | |

| DTE Energy Co. | | | 200,000 | | | | 8,718,000 | |

| SCANA Corp. | | | 141,200 | | | | 5,320,416 | |

| | | | | | | | 25,607,366 | |

| | | | | | | | | |

Total Common Stocks (Cost $78,900,742) | | | | | | $ | 80,803,866 | |

| | | | | | | | | |

| U.S. TREASURY OBLIGATIONS — 78.6% | | Par Value | | | Value | |

| U.S. Treasury Bills — 25.0% | | | | | | | | |

0.16% (b), due 06/17/2010 | | $ | 100,000,000 | | | $ | 99,919,400 | |

0.19% (b), due 07/01/2010 | | | 250,000,000 | | | | 249,775,000 | |

| | | | | | | | 349,694,400 | |

| U.S. Treasury Bonds — 1.7% | | | | | | | | |

| 4.25%, due 05/15/2039 | | | 25,000,000 | | | | 23,460,950 | |

| | | | | | | | | |

| U.S. Treasury Inflation-Protection Notes — 8.5% | | | | | | | | |

| 2.00%, due 04/15/2012 | | | 26,632,250 | | | | 27,863,992 | |

| 2.00%, due 07/15/2014 | | | 28,670,250 | | | | 30,408,384 | |

| 2.375%, due 01/15/2027 | | | 16,078,950 | | | | 16,960,784 | |

| 2.50%, due 01/15/2029 | | | 40,274,000 | | | | 43,297,691 | |

| | | | | | | | 118,530,851 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) | |

| December 31, 2009 (Unaudited) | |

| U.S. TREASURY OBLIGATIONS — 78.6% (continued) | | Par Value | | | Value | |

| U.S. Treasury Notes — 43.4% | | | | | | |

| 2.625%, due 05/31/2010 | | $ | 50,000,000 | | | $ | 50,509,800 | |

| 3.00%, due 08/31/2016 | | | 75,000,000 | | | | 73,787,175 | |

| 2.75%, due 02/15/2019 | | | 50,000,000 | | | | 46,046,900 | |

| 3.125%, due 05/15/2019 | | | 50,000,000 | | | | 47,367,200 | |

| 3.625%, due 08/15/2019 | | | 200,000,000 | | | | 196,687,600 | |

| 3.375%, due 11/15/2019 | | | 200,000,000 | | | | 192,438,600 | |

| | | | | | | | 606,837,275 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $1,101,917,446) | | | | | | $ | 1,098,523,476 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 3.4% | | Shares | | | Value | |

| CurrencyShares British Pound Sterling Trust | | | 50,000 | | | $ | 8,056,500 | |

| CurrencyShares Euro Trust | | | 100,000 | | | | 14,291,000 | |

CurrencyShares Japanese Yen Trust (a) | | | 150,000 | | | | 15,991,500 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 160,000 | | | | 8,937,600 | |

Total Exchange-Traded Funds (Cost $46,217,940) | | | | | | $ | 47,276,600 | |

| | | | | | | | | |

Total Investments at Value — 87.8% (Cost $1,227,036,128) | | | | | | $ | 1,226,603,942 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 30.0% | | Shares | | | Value | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.02% (c) | | | 148,198,065 | | | $ | 148,198,065 | |

First American Treasury Obligations Fund - Class Y, 0.00% (c) | | | 270,163,315 | | | | 270,163,315 | |

Total Money Market Funds (Cost $418,361,380) | | | | | | $ | 418,361,380 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 117.8% | | | | | | | | |

| (Cost $1,645,397,508) | | | | | | $ | 1,644,965,322 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets(d) — (17.8%) | | | | | | | (248,788,258 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,396,177,064 | |

ADR - American Depositary Receipt.

| (a) | Non-income producing security. |

| | |

| (b) | Annualized yield at time of purchase, not a coupon rate. |

| | |

| (c) | The rate shown is the 7-day effective yield as of December 31, 2009. |

| | |

| (d) | Liabilities include primarily payables for unsettled security purchases which settled on 01/04/2010. See the Statement of Assets and Liabilities. |

See accompanying notes to financial statements.

Hussman Investment Trust Statements of Assets and Liabilities | |

| December 31, 2009 (Unaudited) | |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

| At acquisition cost | | $ | 4,165,704,333 | | | $ | 1,227,036,128 | |

| At value (Note 1) | | $ | 5,035,066,920 | | | $ | 1,226,603,942 | |

| Investments in money market funds | | | 1,036,285,309 | | | | 418,361,380 | |

| Cash | | | 500,000 | | | | — | |

| Dividends and interest receivable | | | 1,375,864 | | | | 6,616,595 | |

| Receivable for capital shares sold | | | 8,739,372 | | | | 5,123,739 | |

| Other assets | | | 274,518 | | | | 165,215 | |

| Total Assets | | | 6,082,241,983 | | | | 1,656,870,871 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

| Dividends payable | | | 1,799,687 | | | | 1,012,458 | |

| Written call options, at value (Notes 1 and 4) (premiums received $451,792,272) | | | 490,775,500 | | | | — | |

| Payable for investment securities purchased | | | 129,034,331 | | | | 257,420,565 | |

| Payable for capital shares redeemed | | | 7,296,919 | | | | 1,471,523 | |

| Accrued investment advisory fees (Note 3) | | | 4,232,986 | | | | 569,049 | |

| Payable to administrator (Note 3) | | | 360,150 | | | | 110,100 | |

| Payable to Trustees | | | 8,000 | | | | 8,000 | |

| Other accrued expenses and liabilities | | | 408,143 | | | | 102,112 | |

| Total Liabilities | | | 633,915,716 | | | | 260,693,807 | |

| | | | | | | | | |

| NET ASSETS | | $ | 5,448,326,267 | | | $ | 1,396,177,064 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

| Paid-in capital | | $ | 6,080,712,565 | | | $ | 1,361,133,740 | |

| Accumulated net investment income (loss) | | | (1,958,044 | ) | | | 1,899,816 | |

| Accumulated net realized gains (losses) from security transactions and option contracts | | | (1,460,807,613 | ) | | | 33,575,694 | |

| Net unrealized appreciation (depreciation) on investments and option contracts | | | 830,379,359 | | | | (432,186 | ) |

| | | | | | | | | |

| NET ASSETS | | $ | 5,448,326,267 | | | $ | 1,396,177,064 | |

| | | | | | | | | |

| Shares of beneficial interest outstanding (unlimited number of shares authorized, no par value) | | | 426,226,565 | | | | 116,655,617 | |

| | | | | | | | | |

Net asset value, offering price and redemption price per share(a) (Note 1) | | $ | 12.78 | | | $ | 11.97 | |

| (a) | Redemption price varies based on length of time shares are held. |

See accompanying notes to financial statements.

Hussman Investment Trust Statements of Operations | |

| For the Six Months Ended December 31, 2009 (Unaudited) | |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| INVESTMENT INCOME | | | | | | |

| Dividends | | $ | 26,234,770 | | | $ | 1,454,268 | |

| Foreign withholding taxes on dividends | | | (155,376 | ) | | | (3,032 | ) |

| Interest | | | — | | | | 15,259,959 | |

| Total Income | | | 26,079,394 | | | | 16,711,195 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

| Investment advisory fees (Note 3) | | | 24,470,819 | | | | 3,014,679 | |

| Transfer agent, account maintenance and shareholder services fees (Note 3) | | | 1,492,998 | | | | 365,687 | |

| Administration fees (Note 3) | | | 1,108,458 | | | | 369,629 | |

| Registration and filing fees | | | 227,501 | | | | 134,932 | |

| Custodian and bank service fees | | | 186,207 | | | | 54,817 | |

| Fund accounting fees (Note 3) | | | 161,082 | | | | 58,320 | |

| Trustees’ fees and expenses | | | 68,170 | | | | 68,170 | |

| Printing of shareholder reports | | | 85,005 | | | | 30,389 | |

| Professional fees | | | 54,987 | | | | 47,089 | |

| Compliance service fees (Note 3) | | | 44,502 | | | | 12,534 | |

| Insurance expense | | | 33,359 | | | | 7,157 | |

| Other expenses | | | 103,647 | | | | 16,917 | |

| Total Expenses | | | 28,036,735 | | | | 4,180,320 | |

| | | | | | | | | |

| NET INVESTMENT INCOME (LOSS) | | | (1,957,341 | ) | | | 12,530,875 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND OPTION CONTRACTS (Note 4) | | | | | | | | |

| Net realized gains (losses) from: | | | | | | | | |

| Security transactions | | | 322,747,686 | | | | 51,549,474 | |

| Option contracts | | | (1,208,758,214 | ) | | | — | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 770,104,636 | | | | (30,592,995 | ) |

| Option contracts | | | 35,536,402 | | | | — | |

| | | | | | | | | |

| NET REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS AND OPTION CONTRACTS | | | (80,369,490 | ) | | | 20,956,479 | |

| | | | | | | | | |

| NET INCREASE (DECREASE) IN NET ASSETS FROM OPERATIONS | | $ | (82,326,831 | ) | | $ | 33,487,354 | |

See accompanying notes to financial statements.

Hussman Strategic Growth Fund Statements of Changes in Net Assets | |

| | |

| | | Six Months Ended December 31, 2009 (Unaudited) | | | Year Ended June 30, 2009 | |

| FROM OPERATIONS | | | | | | |

| Net investment income (loss) | | $ | (1,957,341 | ) | | $ | 10,748,413 | |

| Net realized gains (losses) from: | | | | | | | | |

| Security transactions | | | 322,747,686 | | | | (688,494,870 | ) |

| Option contracts | | | (1,208,758,214 | ) | | | 330,850,635 | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

| Investments | | | 770,104,636 | | | | 429,851,097 | |

| Option contracts | | | 35,536,402 | | | | (250,709,448 | ) |

| Net decrease in net assets resulting from operations | | | (82,326,831 | ) | | | (167,754,173 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (7,151,672 | ) | | | (7,024,520 | ) |

| From net realized gains | | | — | | | | (442,790,095 | ) |

| Decrease in net assets from distributions to shareholders | | | (7,151,672 | ) | | | (449,814,615 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 1,568,150,706 | | | | 3,473,953,198 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 5,351,985 | | | | 362,131,353 | |

| Proceeds from redemption fees collected (Note 1) | | | 289,145 | | | | 1,924,023 | |

| Payments for shares redeemed | | | (1,011,799,167 | ) | | | (1,519,635,649 | ) |

| Net increase in net assets from capital share transactions | | | 561,992,669 | | | | 2,318,372,925 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 472,514,166 | | | | 1,700,804,137 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 4,975,812,101 | | | | 3,275,007,964 | |

| End of period | | $ | 5,448,326,267 | | | $ | 4,975,812,101 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME (LOSS) | | $ | (1,958,044 | ) | | $ | 7,150,969 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 120,726,310 | | | | 258,930,556 | |

| Shares reinvested | | | 418,778 | | | | 30,193,795 | |

| Shares redeemed | | | (78,079,953 | ) | | | (114,190,405 | ) |

| Net increase in shares outstanding | | | 43,065,135 | | | | 174,933,946 | |

| Shares outstanding at beginning of period | | | 383,161,430 | | | | 208,227,484 | |

| Shares outstanding at end of period | | | 426,226,565 | | | | 383,161,430 | |

See accompanying notes to financial statements.

Hussman Strategic Total Return Fund Statements of Changes in Net Assets | |

| | |

| | | Six Months Ended December 31, 2009 (Unaudited) | | | Year Ended June 30, 2009 | |

| FROM OPERATIONS | | | | | | |

| Net investment income | | $ | 12,530,875 | | | $ | 1,581,737 | |

| Net realized gains from security transactions | | | 51,549,474 | | | | 3,973,011 | |

| Net change in unrealized appreciation (depreciation) on investments | | | (30,592,995 | ) | | | 28,241,637 | |

| Net increase in net assets resulting from operations | | | 33,487,354 | | | | 33,796,385 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

| From net investment income | | | (10,672,306 | ) | | | (315,708 | ) |

| From net realized gains | | | (18,352,276 | ) | | | (21,886,570 | ) |

| Decrease in net assets from distributions to shareholders | | | (29,024,582 | ) | | | (22,202,278 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

| Proceeds from shares sold | | | 599,535,851 | | | | 906,369,367 | |

| Net asset value of shares issued in reinvestment of distributions to shareholders | | | 25,439,882 | | | | 19,366,504 | |

| Proceeds from redemption fees collected (Note 1) | | | 141,659 | | | | 687,046 | |

| Payments for shares redeemed | | | (256,994,274 | ) | | | (245,390,922 | ) |

| Net increase in net assets from capital share transactions | | | 368,123,118 | | | | 681,031,995 | |

| | | | | | | | | |

| TOTAL INCREASE IN NET ASSETS | | | 372,585,890 | | | | 692,626,102 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

| Beginning of period | | | 1,023,591,174 | | | | 330,965,072 | |

| End of period | | $ | 1,396,177,064 | | | $ | 1,023,591,174 | |

| | | | | | | | | |

| ACCUMULATED NET INVESTMENT INCOME | | $ | 1,899,816 | | | $ | 41,247 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

| Shares sold | | | 49,586,111 | | | | 78,248,845 | |

| Shares reinvested | | | 2,097,681 | | | | 1,792,403 | |

| Shares redeemed | | | (21,247,354 | ) | | | (21,430,538 | ) |

| Net increase in shares outstanding | | | 30,436,438 | | | | 58,610,710 | |

| Shares outstanding at beginning of period | | | 86,219,179 | | | | 27,608,469 | |

| Shares outstanding at end of period | | | 116,655,617 | | | | 86,219,179 | |

See accompanying notes to financial statements.

Hussman Strategic Growth Fund Financial Highlights | |

| Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended December 31, 2009 (Unaudited) | | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | | | Year Ended June 30, 2007 | | | Year Ended June 30, 2006 | | | Year Ended June 30, 2005 | |

| Net asset value at beginning of period | | $ | 12.99 | | | $ | 15.73 | | | $ | 15.85 | | | $ | 16.13 | | | $ | 15.90 | | | $ | 15.89 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.01 | ) | | | 0.03 | | | | 0.04 | | | | 0.14 | | | | 0.08 | | | | 0.06 | |

| Net realized and unrealized gains (losses) on investments and options | | | (0.18 | ) | | | (0.88 | ) | | | 0.55 | | | | 0.16 | | | | 0.69 | | | | 0.68 | |

| Total from investment operations | | | (0.19 | ) | | | (0.85 | ) | | | 0.59 | | | | 0.30 | | | | 0.77 | | | | 0.74 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.02 | ) | | | (0.03 | ) | | | (0.09 | ) | | | (0.13 | ) | | | (0.05 | ) | | | (0.03 | ) |

| Distributions from net realized gains | | | — | | | | (1.87 | ) | | | (0.63 | ) | | | (0.46 | ) | | | (0.50 | ) | | | (0.71 | ) |

| Total distributions | | | (0.02 | ) | | | (1.90 | ) | | | (0.72 | ) | | | (0.59 | ) | | | (0.55 | ) | | | (0.74 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected (Note 1) | | | 0.00 | (a) | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 12.78 | | | $ | 12.99 | | | $ | 15.73 | | | $ | 15.85 | | | $ | 16.13 | | | $ | 15.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | (1.49% | )(c) | | | (4.35% | ) | | | 3.84% | | | | 1.98% | | | | 5.05% | | | | 4.95% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 5,448,326 | | | $ | 4,975,812 | | | $ | 3,275,008 | | | $ | 2,718,324 | | | $ | 2,816,108 | | | $ | 1,835,514 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of expenses to average net assets | | | 1.05% | (d) | | | 1.09% | | | | 1.11% | | | | 1.11% | | | | 1.14% | | | | 1.24% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income (loss) to average net assets | | | (0.07% | )(d) | | | 0.28% | | | | 0.28% | | | | 0.91% | | | | 0.63% | | | | 0.44% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 39% | (c) | | | 69% | | | | 150% | | | | 106% | | | | 63% | | | | 81% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | Annualized. |

See accompanying notes to financial statements

Hussman Strategic Total Return Fund Financial Highlights | |

| Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period | |

| | | Six Months Ended December 31, 2009 (Unaudited) | | | Year Ended June 30, 2009 | | | Year Ended June 30, 2008 | | | Year Ended June 30, 2007 | | | Year Ended June 30, 2006 | | | Year Ended June 30, 2005 | |

| Net asset value at beginning of period | | $ | 11.87 | | | $ | 11.99 | | | $ | 10.92 | | | $ | 11.30 | | | $ | 10.94 | | | $ | 10.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.11 | | | | 0.05 | | | | 0.24 | | | | 0.32 | | | | 0.32 | | | | 0.24 | |

| Net realized and unrealized gains on investments and foreign currencies | | | 0.26 | | | | 0.35 | | | | 1.59 | | | | 0.06 | | | | 0.65 | | | | 0.42 | |

| Total from investment operations | | | 0.37 | | | | 0.40 | | | | 1.83 | | | | 0.38 | | | | 0.97 | | | | 0.66 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| Dividends from net investment income | | | (0.10 | ) | | | (0.01 | ) | | | (0.23 | ) | | | (0.33 | ) | | | (0.31 | ) | | | (0.24 | ) |

| Distributions from net realized gains | | | (0.17 | ) | | | (0.53 | ) | | | (0.54 | ) | | | (0.43 | ) | | | (0.30 | ) | | | (0.02 | ) |

| Total distributions | | | (0.27 | ) | | | (0.54 | ) | | | (0.77 | ) | | | (0.76 | ) | | | (0.61 | ) | | | (0.26 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Proceeds from redemption fees collected (Note 1) | | | 0.00 | (a) | | | 0.02 | | | | 0.01 | | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 11.97 | | | $ | 11.87 | | | $ | 11.99 | | | $ | 10.92 | | | $ | 11.30 | | | $ | 10.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | 3.08% | (c) | | | 3.94% | | | | 17.23% | | | | 3.46% | | | | 9.01% | | | | 6.40% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net assets at end of period (000’s) | | $ | 1,396,177 | | | $ | 1,023,591 | | | $ | 330,965 | | | $ | 174,480 | | | $ | 158,735 | | | $ | 128,156 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses to average net

assets(d) | | | 0.68% | (e) | | | 0.75% | | | | 0.90% | | | | 0.90% | | | | 0.90% | | | | 0.90% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratio of net investment income to average net assets | | | 2.04% | (e) | | | 0.26% | | | | 2.05% | | | | 2.86% | | | | 2.94% | | | | 2.25% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Portfolio turnover rate | | | 60% | (c) | | | 36% | | | | 212% | | | | 41% | | | | 55% | | | | 64% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | Absent investment advisory fee reductions and expense reimbursements by the Adviser, the ratios of expenses to average net assets would have been 0.92% and 1.01% for the years ended June 30, 2006 and 2005, respectively. |

| | |

| (e) | Annualized. |

See accompanying notes to financial statements.

Hussman Investment Trust Notes to Financial Statements | |

| December 31, 2009 (Unaudited) | |

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

Hussman Strategic Growth Fund and Hussman Strategic Total Return Fund (each, a “Fund”, and collectively, the “Funds”) are each a diversified series of Hussman Investment Trust (the “Trust”), which is registered under the Investment Company Act of 1940 as an open-end managment investment company. Each Fund is authorized to issue an unlimited number of shares. Hussman Strategic Growth Fund commenced operations on July 24, 2000. Hussman Strategic Total Return Fund commenced operations on September 12, 2002.

Hussman Strategic Growth Fund’s investment objective is to provide long-term capital appreciation, with added emphasis on protection of capital during unfavorable market conditions.

Hussman Strategic Total Return Fund’s investment objective is to provide long-term total return from income and capital appreciation, with added emphasis on protection of capital during unfavorable market conditions.

Securities and Options Valuation — The Funds’ portfolio securities are valued at market value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 Eastern time) on each business day the NYSE is open. Securities, other than options, listed on the NYSE or other exchanges are valued on the basis of their last sale prices on the exchanges on which they are primarily traded. However, if the last sale price on the NYSE is different than the last sale price on any other exchange, the NYSE price will be used. If there are no sales on that day, the securities are valued at the last bid price on the NYSE or other primary exchange for that day. Securities traded on a foreign stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. If there are no sales on that day, the securities are valued at the last bid price as reported by NASDAQ. Securities traded in over-the-counter markets, other than NASDAQ quoted securities, are valued at the last sales price, or if there are no sales on that day, at the mean of the closing bid and asked prices. Values of foreign securities are translated from the local currency into U.S. dollars using currency exchange rates supplied by a pricing quotation service.

Pursuant to valuation procedures approved by the Board of Trustees, options traded on a national securities exchange are valued at prices between the closing bid and ask prices determined by Hussman Econometrics Advisors,

Hussman Investment Trust Notes to Financial Statements (continued) | |

| December 31, 2009 (Unaudited) | |

Inc. (the “Adviser”) to most closely reflect market value as of the time of computation of net asset value. As of December 31, 2009, all options held by Hussman Strategic Growth Fund have been valued in this manner. Options not traded on a national securities exchange or board of trade, but for which over-the-counter market quotations are readily available, are valued at the mean of their closing bid and ask prices. Futures contracts and options thereon, which are traded on commodities exchanges, are valued at their daily settlement value as of the close of such commodities exchanges.

Fixed income securities not traded or dealt in upon any securities exchange but for which over-the-counter market quotations are readily available generally are valued at the mean of their closing bid and asked prices. Fixed income securities may also be valued on the basis of prices provided by an independent pricing service. The Board of Trustees will review and monitor the methods used by such services to assure itself that securities are appropriately valued. The fair value of securities with remaining maturities of 60 days or less may be determined in good faith by the Board of Trustees to be represented by amortized cost value, absent unusual circumstances.

In the event that market quotations are not readily available or are determined by the Adviser to not be reflective of fair market value due to market events or developments, securities and options are valued at fair value as determined by the Adviser in accordance with procedures adopted by the Board of Trustees. Such methods of fair valuation may include, but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurement.

Various inputs are used in determining the value of each of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | • | Level 1 – quoted prices in active markets for identical securities |

| | • | Level 2 – other significant observable inputs |

| | • | Level 3 – significant unobservable inputs |

Hussman Investment Trust Notes to Financial Statements (continued) | |

| December 31, 2009 (Unaudited) | |

For example, options contracts purchased and written by Hussman Strategic Growth Fund are classified as Level 2 since they are valued at prices between the closing bid and ask prices determined by the Adviser to most closely reflect market value, pursuant to procedures approved by the Board of Trustees. U.S. Government Agency and Treasury obligations held by Hussman Strategic Total Return Fund are classified as Level 2 since values are based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors. Shares of money market funds are classified as Level 2 because their shares are valued at amortized cost, which approximates fair value absent unusual circumstances. The inputs or methodology used for valuing securities are not necessarily an indication of the risks associated with investing in those securities.

The following is a summary of the inputs used to value each Fund’s investments and other financial instruments as of December 31, 2009 by security type:

Hussman Strategic Growth Fund

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 4,909,240,920 | | | $ | — | | | $ | — | | | $ | 4,909,240,920 | |

| Put Option Contracts | | | — | | | | 125,826,000 | | | | — | | | | 125,826,000 | |

| Money Market Funds | | | — | | | | 1,036,285,309 | | | | — | | | | 1,036,285,309 | |

| Written Call Option Contracts | | | — | | | | (490,775,500 | ) | | | — | | | | (490,775,500 | ) |

| Total | | $ | 4,909,240,920 | | | $ | 671,335,809 | | | $ | — | | | $ | 5,580,576,729 | |

Hussman Strategic Total Return Fund

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 80,803,866 | | | $ | — | | | $ | — | | | $ | 80,803,866 | |

| U.S. Treasury Obligations | | | — | | | | 1,098,523,476 | | | | — | | | | 1,098,523,476 | |

| Exchange-Traded Funds | | | 47,276,600 | | | | — | | | | — | | | | 47,276,600 | |

| Money Market Funds | | | — | | | | 418,361,380 | | | | — | | | | 418,361,380 | |

| Total | | $ | 128,080,466 | | | $ | 1,516,884,856 | | | $ | — | | | $ | 1,644,965,322 | |

Each Fund’s Schedule of Investments identifies the specific securities (by type of security and industry type) that comprise that Funds holdings within the Level 1 and Level 2 categories shown in the tables above.

Futures Contracts and Option Transactions — Hussman Strategic Growth Fund may purchase and write put and call options on broad-based stock indices. The Fund may also purchase and write call and put options on

Hussman Investment Trust Notes to Financial Statements (continued) | |

| December 31, 2009 (Unaudited) | |

individual securities. Hussman Strategic Total Return Fund may use financial futures contracts and related options to hedge against changes in the market value of its portfolio securities. The Fund may also purchase a foreign currency option to establish or modify the Fund’s exposure to foreign currencies, or an interest rate futures contract to protect against a decline in the value of its portfolio.

The Hussman Strategic Growth Fund may use futures and options contracts for the purpose of seeking to reduce the overall investment risk that would otherwise be associated with the securities in which it invests. For example, the Fund may sell a stock index futures contract in anticipation of a general market or market sector decline that might adversely affect prices of the Fund’s portfolio securities. To the extent there is a correlation between the Fund’s portfolio and a particular stock index, the sale of futures contracts on that index could reduce general market risk and permit the fund to retain its securities positions.

When a Fund writes an index option, an amount equal to the net premium (the premium less the commission) received by the Fund is recorded as a liability in the Fund’s Statement of Assets and Liabilities and is subsequently valued. If an index option expires unexercised on the stipulated expiration date or if the Fund enters into a closing purchase transaction, it will realize a gain (or a loss if the cost of a closing purchase transaction exceeds the net premium received when the option is sold) and the liability related to such option will be eliminated. If an index option is exercised, the Fund will be required to pay the difference between the closing index value and the exercise price of the option. In this event, the proceeds of the sale will be increased by the net premium originally received and the Fund will realize a gain or loss.

Repurchase Agreements — The Funds may enter into repurchase agreements with certain banks or non-bank dealers. The value of the underlying securities collateralizing these agreements is monitored on a daily basis to ensure that the value of the collateral during the term of the agreements equals or exceeds the repurchase price plus accrued interest. If the bank or dealer defaults realization of the collateral by the Fund may be delayed or limited, and the Funds may suffer a loss if the value of the collateral declines.

Foreign Currency Translation — Amounts denominated in or expected to settle in foreign currencies are translated into U.S. dollars based on exchange rates on the following basis:

Hussman Investment Trust Notes to Financial Statements (continued) | |

| December 31, 2009 (Unaudited) | |

A. The market values of investment securities and other assets and liabilities are translated at the closing rate on the London Stock Exchange each day.

B. Purchases and sales of investment securities and income and expenses are translated at the rate of exchange prevailing on the respective date of such transactions.

C. The Funds do not isolate that portion of the results of operations caused by changes in foreign exchange rates on investments from those caused by changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gains or losses on investments.

Reported net realized foreign exchange gains or losses arise from 1) purchases and sales of foreign currencies, 2) currency gains or losses realized between the trade and settlement dates on securities transactions and 3) the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books, and the U.S. dollar equivalent of the amounts actually received or paid. Reported net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities that result from changes in exchange rates.

Share Valuation and Redemption Fees — The net asset value per share of each Fund is calculated as of the close of regular trading on the NYSE (normally 4:00 p.m., Eastern time) on each day that the NYSE is open for business. The net asset value per share of each Fund is calculated by dividing the total value of the Fund’s assets, less its liabilities, by the number of its shares outstanding. The offering price and redemption price per share of each Fund is equal to the net asset value per share. However, shares of each Fund are generally subject to a redemption fee of 1.5%, payable to the applicable Fund, if redeemed within sixty days of the date of purchase. During the periods ended December 31, 2009 and June 30, 2009, proceeds from redemption fees totaled $289,145 and $1,924,023, respectively, for Hussman Strategic Growth Fund and $141,659 and $687,046, respectively, for Hussman Strategic Total Return Fund.

Investment Income — Interest income is accrued as earned. Dividend income is recorded on the ex-dividend date. Discounts and premiums on fixed income securities are amortized using the interest method.

Distributions to Shareholders — Dividends from net investment income, if any, are declared and paid annually to shareholders of Hussman

Hussman Investment Trust Notes to Financial Statements (continued) | |

| December 31, 2009 (Unaudited) | |