Washington, D.C. 20549

John F. Splain

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

HUSSMAN STRATEGIC INTERNATIONAL FUND

HUSSMAN STRATEGIC DIVIDEND VALUE FUND

SEMI-ANNUAL REPORT

December 31, 2012

(Unaudited)

| Performance Information | |

| Hussman Strategic Growth Fund | 1 |

| Hussman Strategic Total Return Fund | 2 |

| Hussman Strategic International Fund | 3 |

| Hussman Strategic Dividend Value Fund | 4 |

| Letter to Shareholders | 5 |

| Portfolio Information | 16 |

| Schedules of Investments | |

| Hussman Strategic Growth Fund | 19 |

| Hussman Strategic Total Return Fund | 26 |

| Hussman Strategic International Fund | 29 |

| Hussman Strategic Dividend Value Fund | 37 |

| Statements of Assets and Liabilities | 43 |

| Statements of Operations | 45 |

| Statements of Changes in Net Assets | |

| Hussman Strategic Growth Fund | 47 |

| Hussman Strategic Total Return Fund | 48 |

| Hussman Strategic International Fund | 49 |

| Hussman Strategic Dividend Value Fund | 50 |

| Financial Highlights | |

| Hussman Strategic Growth Fund | 51 |

| Hussman Strategic Total Return Fund | 52 |

| Hussman Strategic International Fund | 53 |

| Hussman Strategic Dividend Value Fund | 54 |

| Notes to Financial Statements | 55 |

| About Your Fund’s Expenses | 78 |

| Other Information | 81 |

HUSSMAN STRATEGIC GROWTH FUND

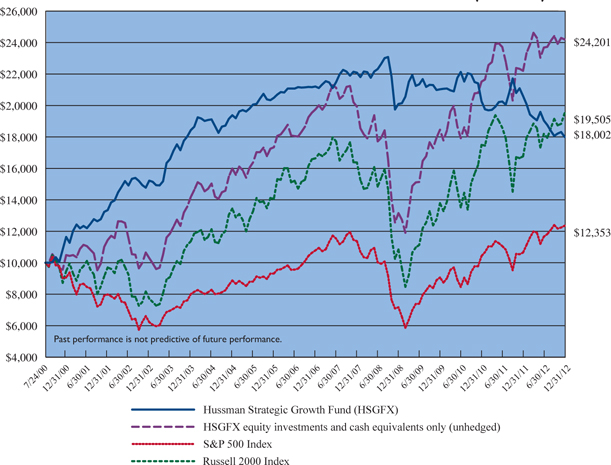

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Growth Fund

versus the Standard & Poor’s 500 Index and the Russell 2000 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2012 |

| | | | | | | |

Hussman Strategic Growth Fund(b)(d) | (12.62%) | (5.05%) | (4.01%) | 1.69% | 4.84% | |

| S&P 500 Index | 16.00% | 10.87% | 1.66% | 7.10% | 1.71% | |

| Russell 2000 Index | 16.35% | 12.25% | 3.56% | 9.72% | 5.52% | |

| (a) | Hussman Strategic Growth Fund invests in stocks listed on the New York, American, and NASDAQ exchanges, and does not specifically restrict its holdings to a particular market capitalization. The S&P 500 and Russell 2000 are indices of large and small capitalization stocks, respectively. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, but excluding the impact of hedging transactions. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their performance is presented solely for purposes of comparison and performance attribution. |

| | |

| (b) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | The Fund commenced operations on July 24, 2000. |

| | |

| (d) | The Fund’s expense ratio was 1.08% for the six months ended December 31, 2012. The expense ratio as disclosed in the November 1, 2012 prospectus was 1.07% for the year ended June 30, 2012, including acquired fund fees and expenses. |

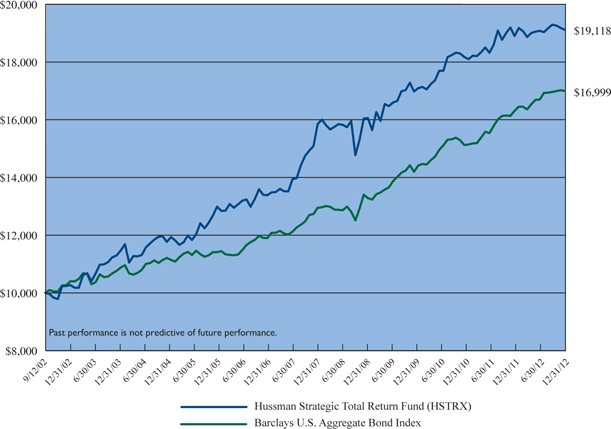

HUSSMAN STRATEGIC TOTAL RETURN FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Barclays U.S. Aggregate Bond Index (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2012 |

| | | | | | |

Hussman Strategic Total Return Fund(a)(c) | 1.14% | 4.03% | 4.85% | 6.45% | 6.49% |

Barclays U.S. Aggregate Bond Index(d) | 4.22% | 6.19% | 5.95% | 5.18% | 5.28% |

| (a) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | The Fund commenced operations on September 12, 2002. |

| | |

| (c) | The Fund’s expense ratio was 0.64% for the six months ended December 31, 2012. The expense ratio as disclosed in the November 1, 2012 prospectus was 0.66% for the year ended June 30, 2012, including acquired fund fees and expenses. |

| | |

| (d) | The Barclays U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Barclays U.S. Aggregate Bond Index and may invest in other types of bonds, common stocks, etc. |

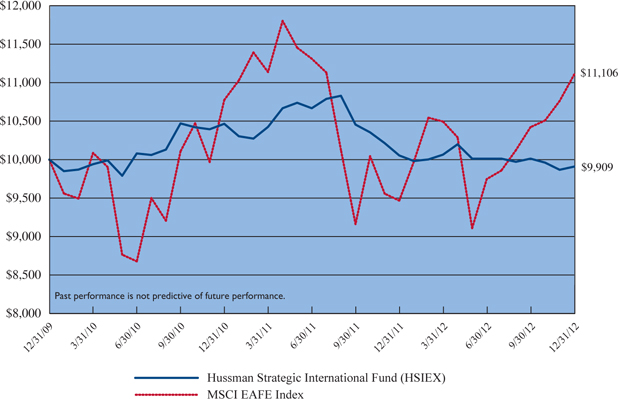

HUSSMAN STRATEGIC INTERNATIONAL FUND

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2012 |

| | | | |

Hussman Strategic International Fund(a)(c) | (1.44%) | (0.30%) | (0.30%) |

MSCI EAFE Index(d) | 17.32% | 3.56% | 3.56% |

| (a) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | The Fund commenced operations on December 31, 2009. |

| | |

| (c) | The Fund’s expense ratio was 1.64% for the six months ended December 31, 2012. The expense ratio as disclosed in the November 1, 2012 prospectus was 1.79% for the year ended June 30, 2012, including acquired fund fees and expenses. |

| | |

| (d) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float-adjusted market weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2012, the MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund may not invest in all of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. |

HUSSMAN STRATEGIC DIVIDEND VALUE FUND

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Dividend Value Fund versus the Standard & Poor’s 500 Index(a) (Unaudited)

Total Return For Period Ended December 31, 2012 |

| | | |

Hussman Strategic Dividend Value Fund(b)(d) | | 1.01% |

| S&P 500 Index | | 8.34% |

| (a) | Hussman Strategic Dividend Value Fund invests primarily in securities of U.S. issuers but may invest in stocks of foreign companies. There are no restrictions as to the market capitalization of companies. The S&P 500 Index is believed to be the most appropriate broad-based securities market index against which to compare the Fund’s long-term performance. However, the Fund invests in securities that are not included in the S&P 500 Index, and may vary its exposure to market fluctuations depending on market conditions. |

| | |

| (b) | The Fund’s return does not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | The Fund commenced operations on February 6, 2012. |

| | |

| (d) | The Adviser has contractually agreed to defer its fee and/or to absorb or reimburse a portion of the Fund’s expenses until at least February 1, 2015 to the extent necessary to limit the Fund’s ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. The gross expense ratio as disclosed in the November 1, 2012 prospectus was 4.25%. |

For the year ended December 31, 2012, Strategic Growth Fund lost -12.62%, Strategic Total Return Fund achieved a total return of 1.14%, and Strategic International Fund lost -1.44%. From its inception on February 6, 2012 through December 31, 2012, Strategic Dividend Value achieved a total return of 1.01%. Notably, the decline in Strategic Growth Fund was primarily driven by a 7% shortfall between the performance of the Fund’s stock holdings and the performance of the S&P 500 Index – the primary index used in the Fund to hedge market risk. While the Fund’s stock selection approach has significantly outperformed the S&P 500 Index over time, a brief but similar performance lag in the Fund’s stock holdings was also observed during the advance toward the 2007 stock market peak.

The period since 2009 has been challenging, particularly for Strategic Growth Fund. By the market low of March 9, 2009, a $10,000 investment in the Fund at its inception on July 24, 2000 would have grown to $20,557, compared with a decline in value to $5,401 for a similar investment in the S&P 500 Index. The period since then has comprised a trough-to-peak bull market advance in the S&P 500, without the corresponding bear market decline that typically completes a full market cycle.

As detailed in the June 30, 2012 Hussman Funds Annual Report, we missed a substantial rebound in the stock market in 2009-early 2010 period. That “miss” did not result from applying our present methods, but resulted from the need to address a “two data sets” problem in a world where Depression-era outcomes had become possible. As economic conditions worsened beyond anything observed in the post-war period, I insisted in 2009 that our investment approach should perform well even in the most extreme conditions, including Depression-era data – despite the strong performance of our existing methods until that time. The two resulting enhancements to our approach are described in the 2012 Annual Report. It is not entirely clear whether future market cycles will invite Depression-like outcomes, rapid inflation, or unforeseen fiscal strains. What I do believe is that our approach to estimating prospective market return/risk will be able to engage those uncertainties – if they emerge – without further changes.

Unfortunately, what I saw as a necessary stress-testing response in 2009 ended up injuring not only my record, but my reputation, and the patience of those who rely on my work. I continue to believe that it was necessary, and that it made us far stronger, but time will tell, and I do not expect that we will require a great deal of it. The period since 2009 comprises what is now a mature bull market advance to rich valuations and historically overextended conditions, and the completion of the present cycle remains ahead. As detailed below, the U.S. stock market recently

|

Letter to Shareholders (continued) |

established a syndrome of hostile conditions that have been observed previously at only a handful of dates in market history, including the market peaks of 1972, 1987, 2000, and 2007.

The recent bull market advance has at least temporarily narrowed the performance gap between Strategic Growth Fund and the S&P 500 Index. Still, Strategic Growth Fund remains ahead of its benchmark since inception. The Fund has achieved an average annual total return of 4.84% from its inception on July 24, 2000 through December 31, 2012, compared with an average annual return of 1.71% for the S&P 500 Index over the same period. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $18,002, compared with $12,353 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -23.93%, compared with a maximum loss of -55.25% for the S&P 500 Index.

Nearly every investment discipline has its own “bear markets” when a given strategy can be difficult to pursue, yet when continued discipline can be pivotal to the long-term performance of that strategy. For a passive buy-and-hold strategy in the S&P 500 Index, the most recent bear markets comprised losses of -47.41% (including dividends) in the 2000-2002 decline, and -55.25% in the 2007-2009 decline. Gains and losses in Strategic Growth Fund are often unrelated to general market fluctuations, and the recent decline in Fund value might be viewed as our own “bear market.” Still, that decline is a fraction of those experienced by the S&P 500 Index in recent cycles, and I believe that it remains essential to maintain our full-cycle investment perspective, despite the appearance that the recent market advance will never be interrupted. Our investment strategy does not require the stock market to suffer vast losses in order for us to justify a constructive investment position. But we do require a withdrawal from presently overvalued, overbought, overbullish, rising-interest rate conditions, which have historically been followed by very negative market outcomes, on average.

Strategic Total Return Fund has achieved an average annual total return of 6.49% from its inception on September 12, 2002 through December 31, 2012, compared with an average annual total return of 5.28% for the Barclays U.S. Aggregate Bond Index for that period. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $19,118, compared with $16,999 for the same investment in the Barclays U.S. Aggregate Bond Index. The deepest loss experienced by the Fund since inception was -11.52%, compared with a maximum loss of -5.08% for the Barclays U.S. Aggregate Bond Index.

|

Letter to Shareholders (continued) |

Strategic International Fund has achieved an average annual total return of -0.30% from its inception on December 31, 2009 through December 31, 2012, compared with an average annual total return of 3.56% for the MSCI EAFE Index for that period. An initial $10,000 investment in the Fund on December 31, 2009 would be valued at $9,909 on December 31, 2012, compared with $11,106 for the same investment in the MSCI EAFE Index. The deepest loss experienced by the Fund since inception was -9.59%, compared with a maximum loss of -26.48% for the MSCI EAFE Index.

From the inception of Strategic Dividend Value Fund on February 6, 2012 through December 31, 2012, the Fund achieved a cumulative total return of 1.01%, compared with a cumulative total return of 8.34% for the S&P 500 Index. An initial $10,000 investment in the Fund on February 6, 2012 would have grown to $10,101, compared with $10,834 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -2.82%, compared with a maximum loss of -9.58% for the S&P 500 Index.

Many financial markets exhibited historically depressed yields in 2012, as promises of “unlimited” monetary easing from both the Federal Reserve and the European Central Bank encouraged investors to stretch for yield despite already elevated security prices. The yield on the 10-year U.S. Treasury bond plunged to a record low of 1.45% before rebounding slightly by year-end. Likewise, the yield on the Dow Jones Corporate Bond Index set a record low of 2.61% in November. The “Shiller P/E” of the S&P 500 – the ratio of the S&P 500 Index to the 10-year average of inflation-adjusted earnings – ended the year at 21, a level observed in less than 10% of history prior to the late-1990’s market bubble. Similarly, our estimate of likely annual total returns for the S&P 500 over the coming decade fell to 4.5% (nominal) by year-end, a level that with the exception of 1929 was never observed until the late-1990’s, and has predictably been followed by weak long-term returns for investors.

As investment yields fall, prices generally rise. Unfortunately, this process can make past investment returns seem most impressive at exactly the point where prospective future returns are most dismal. A low yield, pressed slightly lower, still produces a positive total return. Pushed to its limits, the short-term desire to stretch for yield in a low-yield environment is how investors are enticed into stocks and bonds at valuations that ultimately deliver terrible long-term outcomes. While this environment has been intentionally encouraged by the Federal Reserve, my impression is that it is likely to end no less badly than if it had emerged unintentionally.

|

Letter to Shareholders (continued) |

The compression of investment yields in 2012 was generally most beneficial to those securities associated with the greatest amount of risk and economic sensitivity. Junk-rated corporate debt, cyclical industries, and financial stocks performed particularly well. Conversely, the avoidance of these sectors resulted in lower returns, as was evident by the performance lag in the stocks held by Strategic Growth Fund, relative to the S&P 500 Index, despite a long record of the Fund’s stock selections outperforming the Index in prior years. The relative avoidance of financial, cyclical, and materials shares in Strategic Dividend Value Fund and Strategic International Fund had a similar effect on the performance of these Funds in the year ended December 31, 2012. Likewise, the avoidance of credit risk and long maturity debt muted the returns of Strategic Total Return Fund relative to the Barclays U.S. Aggregate Bond Index.

While it is clear that the intent of monetary policy is to force investors to speculate in securities with high risk and high economic sensitivity, I expect that far better opportunities to pursue higher returns at lower risk will emerge over the completion of the present market cycle. Keep in mind that a typical bear market decline in stocks erases more than half of the preceding bull market advance. The portion of surrendered gains has been even greater, on average, in bear market periods that started from valuations comparable to those we observe at present.

In my view, exposure to market risk is most appropriately taken when a decline to moderate or depressed valuations is followed by an improvement in broad measures of market action. We were comfortable to act on that opportunity in 2003, despite still-rich market valuations. In 2009, we admittedly missed that opportunity because the crisis raised stress-testing concerns (despite anticipating and avoiding most of that downturn). In contrast, as investors discovered in 2000 and again in 2007, exposure to market risk is most dangerous when an exuberant advance to multi-year highs is coupled with disproportionately optimistic sentiment among market participants, particularly when long-term interest rates are advancing. Countless investment strategies may be willing to accept market risk here, though my impression is that they are generally strategies that suffered profoundly during 2000-2002 and 2007-2009. I am convinced that stretching for yield in a low-yield environment is not intelligent investment strategy, but rather is unsound capitulation.

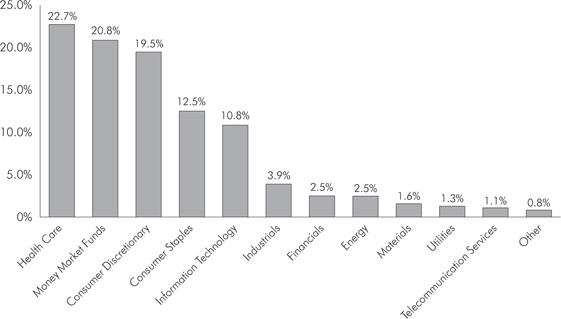

As of December 31, 2012, Strategic Growth Fund had net assets of $3,279,460,713, and held approximately 110 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were health care (29.4%),

|

Letter to Shareholders (continued) |

consumer discretionary (25.2%), consumer staples (16.2%), and information technology (14.0%). The smallest sector weights relative to the S&P 500 Index were in industrials (5.0%), energy (3.2%), financials (3.2%), materials (2.0%), utilities (1.7%) and telecommunications (1.4%). The portion of the Fund’s net assets invested in a particular sector is affected by valuation considerations and other investment characteristics of that sector. As a result, the Fund’s investments in various business sectors generally will change over time, and a significant allocation to any particular sector does not represent a fixed investment policy or strategy to invest in that sector.

The Fund’s holdings of individual stocks as of December 31, 2012 accounted for $3,322,901,792, or 101.3% of net assets (the Fund made an income distribution to shareholders on December 31, 2012, much of which was immediately reinvested in the Fund). Against these stock positions, the Fund also held 18,000 option combinations (long put option/short call option) on the S&P 500 Index, 5,000 option combinations on the Russell 2000 Index and 1,000 option combinations on the Nasdaq 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 31, 2012, the S&P 500 Index closed at 1,426.19, while the Russell 2000 Index and the Nasdaq 100 Index closed at 849.35 and 2,660.93, respectively. The Fund’s total hedge therefore represented a short position of $3,257,910,100, thereby hedging 98.0% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following holdings achieved gains in excess of $10 million during the semi-annual period ended December 31, 2012: Walgreen, Panera Bread, Amgen, DISH Network, eBay, Eli Lilly, Procter and Gamble, Lowe’s, and Illumina. Holdings with losses in excess of $10 million during this same period were Coinstar, Humana, Aeropostale, and Intel.

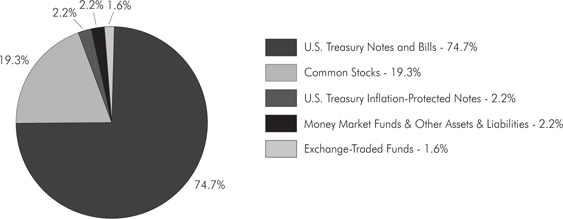

As of December 31, 2012, Strategic Total Return Fund had net assets of $2,181,511,637. Treasury bills, Treasury notes, Treasury Inflation-Protected Securities (TIPS) and shares of money market funds represented 79.1% of the Fund’s net assets. Precious metals shares, utility and energy shares, and exchange-traded funds (ETFs) accounted for 15.2%, 3.4%, 0.7% and 1.6% of net assets, respectively. The Fund carried a duration of approximately 3 years (meaning that a 1% change in interest rates would be expected to impact the Fund’s asset value by about 3% on the basis of bond price fluctuations).

|

Letter to Shareholders (continued) |

In Strategic Total Return Fund, during the semi-annual period ended December 31, 2012, portfolio gains in excess of $1 million were achieved in Agnico-Eagle Mines and U.S. Treasury Note (1.625%, due 8/15/2022). Holdings with losses in excess of $1 million during this same period were AngloGold Ashanti ADR,Goldcorp and Nustar Energy.

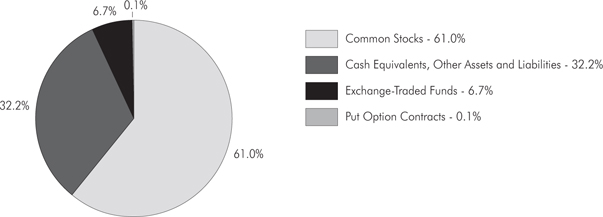

As of December 31, 2012, Strategic International Fund had net assets of $93,290,275 and held approximately 100 stocks in a wide variety of industries. The largest sectors as a percent of net assets were in consumer staples (11.5%), health care (11.0%), information technology (9.0%), consumer discretionary (8.7%), telecommunications (8.6%), and industrials (4.6%). The smallest sector weights were in energy (3.3%), utilities (3.0%), materials (0.8%) and financials (0.5%). Shares of exchange-traded funds and money market funds accounted for 6.7% and 28.7% of net assets, respectively. The total value of equities and ETF shares held by the Fund was $63,228,685.

In order to hedge the impact of general market fluctuations, as of December 31, 2012, Strategic International Fund held 150 option combinations (long put option/short call option) on the S&P 500 Index, and was short 750 futures on the Euro STOXX 50 Index and 150 futures on the FTSE 100 Index. The combined notional value of these hedges was $61,855,834, hedging 97.8% of the value of equity and ETF investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While Strategic International Fund holds a diversified portfolio of stocks and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through December 31, 2012. Individual equity holdings having portfolio gains in excess of $200,000 during the semi-annual period ended December 31, 2012 included SAP AG – ADR, Sanofi - ADR, and Telstra Corp. Holdings with portfolio losses in excess of $100,000 during this same period included Logitech International, Yamada Denki, NetEase.com - ADR, and H. Lundbeck A/S.

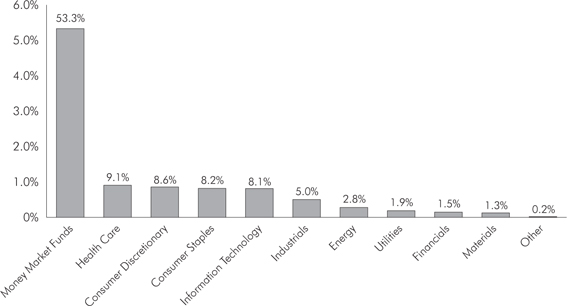

As of December 31, 2012, Strategic Dividend Value Fund had net assets of $13,825,955, and held approximately 80 stocks in a wide variety of industries. The largest sector holdings as a percentage of net assets were in health care (9.3%), consumer discretionary (8.8%), consumer staples (8.4%), and information technology (8.3%). The smallest sector weights were in industrials (5.1%), energy (2.9%), utilities (1.9%), financials (1.5%), and materials (1.3%).

|

Letter to Shareholders (continued) |

Strategic Dividend Value Fund’s holdings of individual stocks as of December 31, 2012 were valued at $6,571,318. Against these stock positions, the Fund also held 22 option combinations (long put option/short call option) on the S&P 500 Index. The combined notional value of these hedges was $3,137,618, an amount equal to 47.7% of the value of equity investments held by the Fund.

In Strategic Dividend Value Fund, during the semi-annual period ended December 31, 2012, a portfolio gain in excess of $25,000 was achieved in BASF AG - ADR. The Fund did not have any holdings with losses in excess of $25,000 during this same period.

With respect to Strategic International Fund and Strategic Dividend Value Fund, the cash positions in these funds would be expected to decline in the event of more favorable risk and return prospects.

Supplementary information including quarterly returns and equity-only performance is available on the Hussman Funds website at www.hussmanfunds.com.

Present Conditions

The U.S. economy appears suspended at the boundary between tepid growth and recession, requiring a trillion-dollar federal deficit and unprecedented monetary easing simply to maintain that position. The Federal Reserve continues a well-known and fully-announced policy of quantitative easing, on course to push the monetary base (currency and bank reserves) to 27 cents per dollar of nominal GDP. The last time the monetary base reached even 17 cents per dollar of nominal GDP was in the early 1940’s. This was not unwound by subsequent monetary tightening, but instead by a near-doubling in the consumer price index by 1952. Based on the strong relationship between the monetary base and short-term interest rates, even a normalization of short-term interest rates to 2% would tolerate no more than about 9 cents of base money per dollar of nominal GDP without inflation. As a result, an eventual normalization of Fed policy would require either a 50% contraction in the monetary base, a doubling of the consumer price index, or about 14 years of economic growth at a 5% nominal rate. It is doubtful that the Federal Reserve will be able to extricate itself smoothly from its current policy stance by any of these means.

While a few better-than-expected economic reports have encouraged the view that bond yields have nowhere to go but higher, there remain substantial risks to the U.S. economy and to global economic stability (particularly relating to European banks and Japanese fiscal conditions). It is tempting to believe that there is a one-to-one correlation between Treasury bond yields and prospective stock market

|

Letter to Shareholders (continued) |

returns, but that correlation is actually quite weak historically. The belief in a one-to-one relationship between bond yields and stock yields is largely an artifact of the disinflationary period from 1982-1998.

Federal Reserve policy is quite capable of suppressing short-term yields, and by extension, long-term yields that reflect their expected course. As a result, it appears likely that bond yields may remain reasonably well-behaved until inflationary pressures accelerate. Despite an increase in 10-year inflation expectations beyond 2.5% (based on the difference between nominal and inflation-protected Treasury yields), my impression is that significant inflationary pressures are most likely to emerge in the second half of the coming decade, and that a descent toward global recession is a more immediate concern.

I expect that U.S. Treasury securities will tend to benefit from periodic economic uncertainty and credit strains, at least until the U.S. debt burden becomes substantially larger or the Federal Reserve is forced to reverse monetary policy. In contrast, the whole-hearted embrace of the Federal Reserve’s policy of quantitative easing has resulted in a suppression of risk premiums in securities that have little to do with the course of risk-free interest rates and much more to do with credit and economic risk. These securities include corporate debt, junk-rated debt, and a wide range of equities. In these securities, there is little reason to expect risk premiums to be closely tied to the level of short-term interest rates, particularly in the event of unforeseen economic shocks. With yields on many asset classes at record-low levels, I don’t believe that this vulnerability can be overstated.

With regard to the equity market, only a handful of historical instances have featured the same hostile syndrome of overvalued, overbought, overbullish, rising yield conditions that we observe today. This syndrome has generally emerged near the most significant market peaks – and preceded the most severe market declines – in history:

| | 1. | S&P 500 Index overvalued, with the Shiller P/E (S&P 500 divided by the 10-year average of inflation-adjusted earnings) greater than 18. |

| | 2. | S&P 500 Index overbought, with the index more than 7% above its 52-week average, at least 50% above its 4-year low, and within 2% of its upper Bollinger bands (2 standard deviations above the 20-period average) at weekly and monthly resolutions. |

| | 3. | Investor sentiment overbullish, with the 2-week average of advisory bulls greater than 52% and bearishness below 28%. |

|

Letter to Shareholders (continued) |

| | 4. | Yields rising, with the 10-year Treasury yield higher than 6 months earlier. |

The exhaustive list of these instances in recent decades includes the following: November 1972 (followed by a market plunge in excess of 50%), August 1987 (followed by a market crash in excess of 30%), March 2000 (followed by a market plunge in excess of 50%), May 2007 (followed by a market plunge in excess of 50%), January 2011 (followed by a market decline limited to just under 20% as a result of central bank intervention), and today. Based on the relationship between investment advisory sentiment and prior market movements, we can impute sentiment figures for dates when this data was not yet available. On this basis, August 1929 (followed by the 85% market decline of the Great Depression) also joins the list of instances that match present conditions on the foregoing criteria.

It is important that we allow for the possibility that the present instance will be resolved differently than previous ones, but it strikes me as dangerous to rely on the expectation that this time will be different. Our own approach to this uncertainty is straightforward: we generally align our investment stance in proportion to the expected return/risk profile that we estimate in various financial markets. We do not rely on the market’s outcome in any specific instance, but instead rely on the average outcome that is associated with prevailing conditions. We tolerate moderate losses and periods where our returns do not track our benchmarks at all, but we also do everything possible to avoid major losses. We pursue our discipline instance after instance, with the confidence that deviations from our expectations in any particular instance will, on average, be corrected over the course of the full market cycle.

While the exceptional stress-testing challenges of the recent market cycle have been addressed, I expect that nearly every market cycle will present the more typical challenge of moving to a defensive stance against an enthusiastic bullish consensus, once conditions become overvalued and overextended. These are conditions that we have faced, with increasing intensity, since March 2012. The discomfort we have experienced since then is something that we would expect, at least for a time, in any market where conditions become as strenuously extended as they are at present. One can hardly admire our avoidance of separate market losses of close to 50% in 2000-2002 and 2007-2009, and yet reject our defensiveness today, because each was born of the same considerations. Fortunately, market conditions will change, and I have no doubt that much more favorable conditions will emerge over the completion of the present market cycle.

Meanwhile, keep in mind how market returns are distributed over time. We presently estimate a likely nominal total return for the S&P 500 over the coming decade of about 3.8% annually, but it is unlikely that the market’s return will be

|

Letter to Shareholders (continued) |

achieved smoothly. Instead, based on present conditions and typical market cycle norms, a reasonable 3.8% annual course over a decade might unfold like this: a 40% bear market decline, followed by an 80% bull market advance, followed by a 33% bear market loss, followed by a 100% bull market recovery by the 10-year mark. There are nearly infinite alternatives, but a smooth path with the absence of deep interim losses is among the least likely. Very large cyclical fluctuations are not implausible – they are actually the norm, and it is unlikely that the Fed can permanently eliminate those cycles. That is a very good thing, because while it implies greater risks than investors presently assume, it also implies a far wider range of opportunities in the coming years than investors presently imagine.

During the period from 2000-2009, I often noted in our Annual Reports that our investment performance was “as intended” – neither extraordinary nor disappointing relative to our expectations. Our investment approach admirably navigated the period until 2009, but despite that strong performance, I insisted that our methods should perform well even in the event of Depression-era outcomes. We solved that “two data sets” problem, but we missed a major advance in the interim. It is not enough that the resulting methods might have enabled us to successfully navigate the Depression-era, the post-war era, and even the most recent cycle. What may be more than enough, however, is also what I expect – performance that is again “as intended.” Nearly all of my own investments are, and remain, in the Hussman Funds. Despite the challenging journey behind us, I have frankly never been more confident in our investment discipline.

I remain grateful for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

|

Letter to Shareholders (continued) |

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

The Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund Portfolio Information |

December 31, 2012 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

Hussman Strategic Total Return Fund Portfolio Information |

December 31, 2012 (Unaudited) |

| Asset Allocation (% of Net Assets) |

Hussman Strategic International Fund Portfolio Information |

December 31, 2012 (Unaudited) |

| Asset Allocation (% of Net Assets) |

| Country Allocation (% of Equity Holdings) |

Hussman Strategic Dividend Value Fund Portfolio Information |

December 31, 2012 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

Hussman Strategic Growth Fund Schedule of Investments |

December 31, 2012 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 25.2% | | | | | | |

| Diversified Consumer Services — 0.5% | | | | | | |

H&R Block, Inc. | | | 1,000,000 | | | $ | 18,570,000 | |

| | | | | | | | | |

| Hotels, Restaurants & Leisure — 6.7% | | | | | | | | |

Brinker International, Inc. | | | 250,000 | | | | 7,747,500 | |

Cheesecake Factory, Inc. (The) | | | 1,000,000 | | | | 32,720,000 | |

Darden Restaurants, Inc. | | | 1,186,000 | | | | 53,453,020 | |

Jack in the Box, Inc. (a) | | | 1,673,000 | | | | 47,847,800 | |

Panera Bread Co. - Class A (a) | | | 484,000 | | | | 76,873,720 | |

| | | | | | | | 218,642,040 | |

| Internet & Catalog Retail — 0.6% | | | | | | | | |

Amazon.com, Inc. (a) | | | 75,000 | | | | 18,835,500 | |

| | | | | | | | | |

| Leisure Equipment & Products — 1.2% | | | | | | | | |

Mattel, Inc. | | | 1,100,000 | | | | 40,282,000 | |

| | | | | | | | | |

| Media — 5.2% | | | | | | | | |

Comcast Corp. - Class A | | | 1,050,000 | | | | 39,249,000 | |

DIRECTV (a) | | | 250,000 | | | | 12,540,000 | |

DISH Network Corp. - Class A | | | 1,700,000 | | | | 61,880,000 | |

McClatchy Co. (The) - Class A (a) | | | 143,000 | | | | 467,610 | |

McGraw-Hill Cos., Inc. (The) | | | 500,000 | | | | 27,335,000 | |

Scripps Networks Interactive, Inc. - Class A | | | 500,000 | | | | 28,960,000 | |

| | | | | | | | 170,431,610 | |

| Multiline Retail — 3.4% | | | | | | | | |

Family Dollar Stores, Inc. | | | 480,000 | | | | 30,436,800 | |

Kohl's Corp. | | | 500,000 | | | | 21,490,000 | |

Target Corp. | | | 1,000,000 | | | | 59,170,000 | |

| | | | | | | | 111,096,800 | |

| Specialty Retail — 6.5% | | | | | | | | |

Aéropostale, Inc. (a) | | | 3,000,000 | | | | 39,030,000 | |

American Eagle Outfitters, Inc. | | | 750,000 | | | | 15,382,500 | |

AutoZone, Inc. (a) | | | 100,000 | | | | 35,443,000 | |

Bed Bath & Beyond, Inc. (a) | | | 950,000 | | | | 53,114,500 | |

Gap, Inc. (The) | | | 1,000,000 | | | | 31,040,000 | |

Lowe's Cos., Inc. | | | 250,000 | | | | 8,880,000 | |

RadioShack Corp. | | | 850,000 | | | | 1,802,000 | |

Staples, Inc. | | | 1,500,000 | | | | 17,100,000 | |

TJX Cos., Inc. (The) | | | 250,000 | | | | 10,612,500 | |

| | | | | | | | 212,404,500 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 101.3% (continued) | | | | | | |

| Consumer Discretionary — 25.2% (continued) | | | | | | |

| Textiles, Apparel & Luxury Goods — 1.1% | | | | | | |

NIKE, Inc. - Class B | | | 400,000 | | | $ | 20,640,000 | |

Under Armour, Inc. - Class A (a) | | | 300,000 | | | | 14,559,000 | |

| | | | | | | | 35,199,000 | |

| Consumer Staples — 16.2% | | | | | | | | |

| Beverages — 4.3% | | | | | | | | |

Coca-Cola Co. (The) | | | 2,000,000 | | | | 72,500,000 | |

PepsiCo, Inc. | | | 1,000,000 | | | | 68,430,000 | |

| | | | | | | | 140,930,000 | |

| Food & Staples Retailing — 5.7% | | | | | | | | |

CVS Caremark Corp. | | | 250,000 | | | | 12,087,500 | |

Kroger Co. (The) | | | 1,000,000 | | | | 26,020,000 | |

Sysco Corp. | | | 700,000 | | | | 22,162,000 | |

Walgreen Co. | | | 1,750,000 | | | | 64,767,500 | |

Wal-Mart Stores, Inc. | | | 900,000 | | | | 61,407,000 | |

| | | | | | | | 186,444,000 | |

| Food Products — 0.9% | | | | | | | | |

Campbell Soup Co. | | | 500,000 | | | | 17,445,000 | |

General Mills, Inc. | | | 300,000 | | | | 12,123,000 | |

| | | | | | | | 29,568,000 | |

| Household Products — 5.3% | | | | | | | | |

Clorox Co. (The) | | | 650,000 | | | | 47,593,000 | |

Colgate-Palmolive Co. | | | 650,000 | | | | 67,951,000 | |

Kimberly-Clark Corp. | | | 364,000 | | | | 30,732,520 | |

Procter & Gamble Co. (The) | | | 400,000 | | | | 27,156,000 | |

| | | | | | | | 173,432,520 | |

| Energy — 3.2% | | | | | | | | |

| Oil, Gas & Consumable Fuels — 3.2% | | | | | | | | |

Chevron Corp. | | | 250,000 | | | | 27,035,000 | |

Exxon Mobil Corp. | | | 900,000 | | | | 77,895,000 | |

| | | | | | | | 104,930,000 | |

| Financials — 3.2% | | | | | | | | |

| Commercial Banks — 0.8% | | | | | | | | |

Wells Fargo & Co. | | | 750,000 | | | | 25,635,000 | |

| | | | | | | | | |

| Consumer Finance — 1.0% | | | | | | | | |

Capital One Financial Corp. | | | 350,000 | | | | 20,275,500 | |

World Acceptance Corp. (a) | | | 190,000 | | | | 14,166,400 | |

| | | | | | | | 34,441,900 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 101.3% (continued) | | | | | | |

| Financials — 3.2% (continued) | | | | | | |

| Insurance — 1.4% | | | | | | |

Progressive Corp. (The) | | | 1,500,000 | | | $ | 31,650,000 | |

Protective Life Corp. | | | 500,000 | | | | 14,290,000 | |

| | | | | | | | 45,940,000 | |

| Health Care — 29.4% | | | | | | | | |

| Biotechnology — 8.7% | | | | | | | | |

Amgen, Inc. | | | 900,000 | | | | 77,688,000 | |

Biogen Idec, Inc. (a) | | | 500,000 | | | | 73,335,000 | |

Celgene Corp. (a) | | | 400,000 | | | | 31,488,000 | |

Cubist Pharmaceuticals, Inc. (a) | | | 674,000 | | | | 28,348,440 | |

Gilead Sciences, Inc. (a) | | | 350,000 | | | | 25,707,500 | |

PDL BioPharma, Inc. | | | 3,000,000 | | | | 21,150,000 | |

United Therapeutics Corp. (a) | | | 500,000 | | | | 26,710,000 | |

| | | | | | | | 284,426,940 | |

| Health Care Equipment & Supplies — 7.0% | | | | | | | | |

Align Technology, Inc. (a) | | | 640,000 | | | | 17,760,000 | |

Cyberonics, Inc. (a) | | | 997,000 | | | | 52,372,410 | |

Medtronic, Inc. | | | 1,650,000 | | | | 67,683,000 | |

ResMed, Inc. | | | 300,000 | | | | 12,471,000 | |

St. Jude Medical, Inc. | | | 1,042,000 | | | | 37,657,880 | |

Varian Medical Systems, Inc. (a) | | | 133,000 | | | | 9,341,920 | |

Zimmer Holdings, Inc. | | | 500,000 | | | | 33,330,000 | |

| | | | | | | | 230,616,210 | |

| Health Care Providers & Services — 2.1% | | | | | | | | |

Laboratory Corp. of America Holdings (a) | | | 184,000 | | | | 15,938,080 | |

UnitedHealth Group, Inc. | | | 607,000 | | | | 32,923,680 | |

WellPoint, Inc. | | | 339,000 | | | | 20,651,880 | |

| | | | | | | | 69,513,640 | |

| Life Sciences Tools & Services — 1.8% | | | | | | | | |

Harvard Bioscience, Inc. (a) | | | 1,000,000 | | | | 4,380,000 | |

Illumina, Inc. (a) | | | 1,000,000 | | | | 55,590,000 | |

| | | | | | | | 59,970,000 | |

| Pharmaceuticals — 9.8% | | | | | | | | |

Abbott Laboratories | | | 400,000 | | | | 26,200,000 | |

AstraZeneca plc - ADR | | | 1,500,000 | | | | 70,905,000 | |

Bristol-Myers Squibb Co. | | | 750,000 | | | | 24,442,500 | |

Eli Lilly & Co. | | | 1,400,000 | | | | 69,048,000 | |

Endo Health Solutions, Inc. (a) | | | 1,040,000 | | | | 27,320,800 | |

GlaxoSmithKline plc - ADR | | | 500,000 | | | | 21,735,000 | |

Johnson & Johnson | | | 500,000 | | | | 35,050,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 101.3% (continued) | | | | | | |

| Health Care — 29.4% (continued) | | | | | | |

| Pharmaceuticals — 9.8% (continued) | | | | | | |

Medicines Co. (The) (a) | | | 696,000 | | | $ | 16,683,120 | |

Novartis AG - ADR | | | 465,000 | | | | 29,434,500 | |

| | | | | | | | 320,818,920 | |

| Industrials — 5.0% | | | | | | | | |

| Air Freight & Logistics — 0.7% | | | | | | | | |

FedEx Corp. | | | 250,000 | | | | 22,930,000 | |

| | | | | | | | | |

| Airlines — 0.6% | | | | | | | | |

Copa Holdings S.A. - Class A | | | 35,000 | | | | 3,480,750 | |

Southwest Airlines Co. | | | 1,500,000 | | | | 15,360,000 | |

| | | | | | | | 18,840,750 | |

| Commercial Services & Supplies — 1.5% | | | | | | | | |

Cintas Corp. | | | 1,000,000 | | | | 40,900,000 | |

Tetra Tech, Inc. (a) | | | 350,000 | | | | 9,257,500 | |

| | | | | | | | 50,157,500 | |

| Electrical Equipment — 0.5% | | | | | | | | |

Generac Holdings, Inc. | | | 449,000 | | | | 15,405,190 | |

| | | | | | | | | |

| Industrial Conglomerates — 1.1% | | | | | | | | |

3M Co. | | | 400,000 | | | | 37,140,000 | |

| | | | | | | | | |

| Machinery — 0.6% | | | | | | | | |

Illinois Tool Works, Inc. | | | 300,000 | | | | 18,243,000 | |

| | | | | | | | | |

Road & Rail — 0.0%(b) | | | | | | | | |

Landstar System, Inc. | | | 34,000 | | | | 1,783,640 | |

| | | | | | | | | |

| Information Technology — 14.0% | | | | | | | | |

| Communications Equipment — 1.0% | | | | | | | | |

Cisco Systems, Inc. | | | 1,750,000 | | | | 34,387,500 | |

| | | | | | | | | |

| Computers & Peripherals — 2.5% | | | | | | | | |

Synaptics, Inc. (a) | | | 1,730,000 | | | | 51,848,100 | |

Western Digital Corp. | | | 680,000 | | | | 28,893,200 | |

| | | | | | | | 80,741,300 | |

| Electronic Equipment, Instruments & Components — 0.4% | | | | | | | | |

Dolby Laboratories, Inc. - Class A | | | 400,000 | | | | 11,732,000 | |

FUJIFILM Holdings Corp. - ADR | | | 49,400 | | | | 989,482 | |

| | | | | | | | 12,721,482 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 101.3% (continued) | | | | | | |

| Information Technology — 14.0% (continued) | | | | | | |

| Internet Software & Services — 2.7% | | | | | | |

Akamai Technologies, Inc. (a) | | | 500,000 | | | $ | 20,455,000 | |

eBay, Inc. (a) | | | 1,250,000 | | | | 63,775,000 | |

j2 Global, Inc. | | | 91,000 | | | | 2,782,780 | |

| | | | | | | | 87,012,780 | |

| IT Services — 0.1% | | | | | | | | |

Syntel, Inc. | | | 85,000 | | | | 4,555,150 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 3.2% | | | | | | | | |

Intel Corp. | | | 3,250,000 | | | | 67,047,500 | |

OmniVision Technologies, Inc. (a) | | | 500,000 | | | | 7,040,000 | |

Skyworks Solutions, Inc. (a) | | | 750,000 | | | | 15,225,000 | |

SunPower Corp. (a) | | | 786,000 | | | | 4,417,320 | |

Ultratech, Inc. (a) | | | 57,000 | | | | 2,126,100 | |

Xilinx, Inc. | | | 250,000 | | | | 8,975,000 | |

| | | | | | | | 104,830,920 | |

| Software — 4.1% | | | | | | | | |

Adobe Systems, Inc. (a) | | | 850,000 | | | | 32,028,000 | |

BMC Software, Inc. (a) | | | 1,250,000 | | | | 49,575,000 | |

Microsoft Corp. | | | 2,000,000 | | | | 53,460,000 | |

| | | | | | | | 135,063,000 | |

| Materials — 2.0% | | | | | | | | |

| Chemicals — 1.6% | | | | | | | | |

Agrium, Inc. | | | 250,000 | | | | 24,977,500 | |

BASF SE - ADR | | | 76,800 | | | | 7,296,000 | |

CF Industries Holdings, Inc. | | | 100,000 | | | | 20,316,000 | |

| | | | | | | | 52,589,500 | |

| Paper & Forest Products — 0.4% | | | | | | | | |

International Paper Co. | | | 350,000 | | | | 13,944,000 | |

| | | | | | | | | |

| Telecommunication Services — 1.4% | | | | | | | | |

| Diversified Telecommunication Services — 0.5% | | | | | | | | |

AT&T, Inc. | | | 500,000 | | | | 16,855,000 | |

| | | | | | | | | |

| Wireless Telecommunication Services — 0.9% | | | | | | | | |

China Mobile Ltd. - ADR | | | 500,000 | | | | 29,360,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 101.3% (continued) | | | | | | |

| Utilities — 1.7% | | | | | | |

| Electric Utilities — 1.7% | | | | | | |

Duke Energy Corp. | | | 500,000 | | | $ | 31,900,000 | |

Entergy Corp. | | | 350,000 | | | | 22,312,500 | |

| | | | | | | | 54,212,500 | |

| | | | | | | | | |

Total Common Stocks (Cost $3,010,840,305) | | | | | | $ | 3,322,901,792 | |

PUT OPTION CONTRACTS — 1.0% | | | | | | |

| Nasdaq 100 Index Option, 01/19/2013 at $2,550 | | | 1,000 | | | $ | 1,463,000 | |

| Russell 2000 Index Option, 03/16/2013 at $620 | | | 5,000 | | | | 495,000 | |

S&P 500 Index Option, 01/19/2013 at $980 | | | 6,500 | | | | 32,500 | |

| S&P 500 Index Option, 03/16/2013 at $1,380 | | | 11,500 | | | | 32,775,000 | |

Total Put Option Contracts (Cost $53,649,315) | | | | | | $ | 34,765,500 | |

| | | | | | | | | |

Total Investments at Value — 102.3% (Cost $3,064,489,620) | | | | | | $ | 3,357,667,292 | |

MONEY MARKET FUNDS — 27.0% | | | | | | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.00% (c) | | | 270,870,090 | | | $ | 270,870,090 | |

First American Treasury Obligations Fund - Class Y, 0.00% (c) | | | 613,399,081 | | | | 613,399,081 | |

Total Money Market Funds (Cost $884,269,171) | | | | | | $ | 884,269,171 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 129.3% | | | | | | | | |

(Cost $3,948,758,791) | | | | | | $ | 4,241,936,463 | |

| | | | | | | | | |

Written Call Options — (30.5%) | | | | | | | (1,000,921,000 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 1.2% | | | | | | | 38,445,250 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 3,279,460,713 | |

| ADR - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | Percentage rounds to less than 0.1%. |

| (c) | The rate shown is the 7-day effective yield as of December 31, 2012. |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts |

December 31, 2012 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| Nasdaq 100 Index Option, | | | | | | | | | |

01/19/2013 at $1,800 | | | 1,000 | | | $ | 85,906,000 | | | $ | 83,998,669 | |

| Russell 2000 Index Option, | | | | | | | | | | | | |

03/16/2013 at $620 | | | 5,000 | | | | 113,295,000 | | | | 99,993,344 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

01/19/2013 at $980 | | | 18,000 | | | | 801,720,000 | | | | 781,081,038 | |

Total Written Option Contracts | | | | | | $ | 1,000,921,000 | | | $ | 965,073,051 | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Schedule of Investments |

December 31, 2012 (Unaudited) |

| | | | | | |

| Energy — 0.7% | | | | | | |

| Oil, Gas & Consumable Fuels — 0.7% | | | | | | |

NuStar Energy L.P. | | | 89,000 | | | $ | 3,780,720 | |

ONEOK Partners L.P. | | | 144,000 | | | | 7,774,560 | |

Williams Partners L.P. | | | 85,000 | | | | 4,136,100 | |

| | | | | | | | 15,691,380 | |

| Materials — 15.2% | | | | | | | | |

| Metals & Mining — 15.2% | | | | | | | | |

Agnico-Eagle Mines Ltd. | | | 950,000 | | | | 49,837,000 | |

AngloGold Ashanti Ltd. - ADR | | | 1,200,000 | | | | 37,644,000 | |

Barrick Gold Corp. | | | 1,900,000 | | | | 66,519,000 | |

| Compañía de Minas Buenaventura S.A. - ADR | | | 563,000 | | | | 20,239,850 | |

Goldcorp, Inc. | | | 1,000,000 | | | | 36,700,000 | |

Gold Fields Ltd. | | | 1,250,000 | | | | 15,612,500 | |

Harmony Gold Mining Co. Ltd. - ADR | | | 1,000,000 | | | | 8,960,000 | |

Newmont Mining Corp. | | | 1,450,000 | | | | 67,338,000 | |

Randgold Resources Ltd. - ADR | | | 275,000 | | | | 27,293,750 | |

Stillwater Mining Co. (a) | | | 10,000 | | | | 127,800 | |

| | | | | | | | 330,271,900 | |

| Utilities — 3.4% | | | | | | | | |

| Electric Utilities — 1.6% | | | | | | | | |

American Electric Power Co., Inc. | | | 151,000 | | | | 6,444,680 | |

Duke Energy Corp. | | | 333 | | | | 21,245 | |

Edison International | | | 1,000 | | | | 45,190 | |

Entergy Corp. | | | 101,000 | | | | 6,438,750 | |

Exelon Corp. | | | 400,000 | | | | 11,896,000 | |

FirstEnergy Corp. | | | 83,000 | | | | 3,466,080 | |

NextEra Energy, Inc. | | | 1,000 | | | | 69,190 | |

Pepco Holdings, Inc. | | | 55,000 | | | | 1,078,550 | |

Pinnacle West Capital Corp. | | | 23,000 | | | | 1,172,540 | |

PPL Corp. | | | 100,000 | | | | 2,863,000 | |

UNS Energy Corp. | | | 56,000 | | | | 2,375,520 | |

| | | | | | | | 35,870,745 | |

| Multi-Utilities — 1.8% | | | | | | | | |

Ameren Corp. | | | 148,000 | | | | 4,546,560 | |

Dominion Resources, Inc. | | | 16,000 | | | | 828,800 | |

DTE Energy Co. | | | 67,000 | | | | 4,023,350 | |

PG&E Corp. | | | 350,000 | | | | 14,063,000 | |

Public Service Enterprise Group, Inc. | | | 400,000 | | | | 12,240,000 | |

SCANA Corp. | | | 37,000 | | | | 1,688,680 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 19.3% (continued) | | | | | | |

| Utilities — 3.4% (continued) | | | | | | |

| Multi-Utilities — 1.8% (continued) | | | | | | |

TECO Energy, Inc. | | | 91,000 | | | $ | 1,525,160 | |

| | | | | | | | 38,915,550 | |

| | | | | | | | | |

Total Common Stocks (Cost $428,692,991) | | | | | | $ | 420,749,575 | |

U.S. TREASURY OBLIGATIONS — 76.9% | | | | | | |

U.S. Treasury Bills (b) — 11.4% | | | | | | |

0.13%, due 06/06/2013 | | $ | 250,000,000 | | | $ | 249,892,500 | |

| | | | | | | | | |

| U.S. Treasury Inflation-Protected Notes — 2.2% | | | | | | | | |

2.00%, due 07/15/2014 | | | 30,679,500 | | | | 32,388,440 | |

2.50%, due 01/15/2029 | | | 10,774,100 | | | | 15,393,496 | |

| | | | | | | | 47,781,936 | |

| U.S. Treasury Notes — 63.3% | | | | | | | | |

0.75%, due 06/15/2014 | | | 300,000,000 | | | | 302,379,000 | |

2.25%, due 03/31/2016 | | | 200,000,000 | | | | 211,953,200 | |

2.00%, due 04/30/2016 | | | 150,000,000 | | | | 157,839,900 | |

1.75%, due 05/31/2016 | | | 100,000,000 | | | | 104,476,600 | |

3.00%, due 08/31/2016 | | | 75,000,000 | | | | 81,855,450 | |

1.75%, due 05/15/2022 | | | 100,000,000 | | | | 100,882,800 | |

1.625%, due 08/15/2022 | | | 250,000,000 | | | | 248,398,500 | |

1.625%, due 11/15/2022 | | | 175,000,000 | | | | 173,113,325 | |

| | | | | | | | 1,380,898,775 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $1,640,739,614) | | | | | | $ | 1,678,573,211 | |

EXCHANGE-TRADED FUNDS — 1.6% | | | | | | |

iShares Gold Trust (a) | | | 1,500,000 | | | $ | 24,405,000 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 160,000 | | | | 10,166,400 | |

Total Exchange-Traded Funds (Cost $32,479,295) | | | | | | $ | 34,571,400 | |

| | | | | | | | | |

Total Investments at Value — 97.8% (Cost $2,101,911,900) | | | | | | $ | 2,133,894,186 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

MONEY MARKET FUNDS — 2.2% | | | | | | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.00% (c) | | | 14,231,211 | | | $ | 14,231,211 | |

First American Treasury Obligations Fund - Class Y, 0.00% (c) | | | 34,170,301 | | | | 34,170,301 | |

Total Money Market Funds (Cost $48,401,512) | | | | | | $ | 48,401,512 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 100.0% | | | | | |

(Cost $2,150,313,412) | | | | | | $ | 2,182,295,698 | |

| | | | | | | | | |

Liabilities in Excess of Other Assets — (0.0%) (d) | | | | | | | (784,061 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 2,181,511,637 | |

| ADR - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | Rate shown is the annualized yield at time of purchase, not a coupon rate. |

| (c) | The rate shown is the 7-day effective yield as of December 31, 2012. |

| (d) | Percentage rounds to greater than (0.1%). |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Investments |

December 31, 2012 (Unaudited) |

| | | | | | |

| Argentina — 0.3% | | | | | | |

Telecom Argentina S.A. - ADR | | | 28,000 | | | $ | 318,640 | |

| | | | | | | | | |

| Australia — 2.3% | | | | | | | | |

Cochlear Ltd. (a) | | | 3,000 | | | | 249,015 | |

Sonic Healthcare Ltd. (a) | | | 63,000 | | | | 880,513 | |

Telstra Corp. Ltd. - ADR | | | 46,000 | | | | 1,046,500 | |

| | | | | | | | 2,176,028 | |

| Austria — 0.6% | | | | | | | | |

OMV AG (a) | | | 15,000 | | | | 543,364 | |

| | | | | | | | | |

| Belgium — 0.2% | | | | | | | | |

Mobistar S.A. (a) | | | 8,000 | | | | 205,573 | |

| | | | | | | | | |

| Brazil — 0.6% | | | | | | | | |

Telefônica Brasil S.A. - ADR | | | 23,000 | | | | 553,380 | |

| | | | | | | | | |

| Canada — 0.7% | | | | | | | | |

Shoppers Drug Mart Corp. | | | 15,000 | | | | 646,767 | |

| | | | | | | | | |

| Chile — 0.2% | | | | | | | | |

Enersis S.A. - ADR | | | 8,000 | | | | 145,760 | |

| | | | | | | | | |

| China — 1.4% | | | | | | | | |

Mindray Medical International Ltd. - ADR | | | 22,500 | | | | 735,750 | |

NetEase.com, Inc. - ADR (b) | | | 8,000 | | | | 340,400 | |

Yue Yuen Industrial (Holdings) Ltd. - ADR | | | 12,000 | | | | 202,320 | |

| | | | | | | | 1,278,470 | |

| Denmark — 1.5% | | | | | | | | |

H. Lundbeck A/S | | | 45,000 | | | | 659,830 | |

William Demant Holding A/S (a) (b) | | | 8,000 | | | | 687,118 | |

| | | | | | | | 1,346,948 | |

| Finland — 1.3% | | | | | | | | |

Elisa Oyj (a) | | | 20,000 | | | | 443,250 | |

Tieto Oyj (a) | | | 40,000 | | | | 790,069 | |

| | | | | | | | 1,233,319 | |

| France — 7.9% | | | | | | | | |

Alten | | | 12,000 | | | | 414,066 | |

Casino Guichard-Perrachon S.A. (a) | | | 7,750 | | | | 742,073 | |

Cegid Group | | | 5,000 | | | | 100,944 | |

Christian Dior S.A. (a) | | | 4,000 | | | | 681,595 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 61.0% (continued) | | | | | | |

| France — 7.9% (continued) | | | | | | |

Danone S.A. | | | 13,000 | | | $ | 856,060 | |

Fromageries Bel S.A. | | | 90 | | | | 21,507 | |

Iliad S.A. | | | 5,500 | | | | 943,821 | |

Infotel S.A. | | | 3,066 | | | | 224,129 | |

L'Oréal S.A. (a) | | | 3,600 | | | | 500,751 | |

Metropole Television S.A. (a) | | | 17,500 | | | | 275,012 | |

Norbert Dentressangle S.A. | | | 9,427 | | | | 727,068 | |

Sanofi - ADR | | | 22,100 | | | | 1,047,098 | |

Total S.A. - ADR | | | 16,500 | | | | 858,165 | |

| | | | | | | | 7,392,289 | |

| Germany — 3.2% | | | | | | | | |

Axel Springer AG (a) | | | 6,000 | | | | 256,776 | |

Deutsche Telekom AG (a) | | | 60,000 | | | | 682,753 | |

SAP AG - ADR | | | 13,100 | | | | 1,052,978 | |

United Internet AG (a) | | | 45,000 | | | | 972,819 | |

| | | | | | | | 2,965,326 | |

| India — 0.9% | | | | | | | | |

Wipro Ltd. - ADR | | | 100,000 | | | | 876,000 | |

| | | | | | | | | |

| Italy — 1.5% | | | | | | | | |

Enel S.P.A. (a) | | | 125,000 | | | | 519,766 | |

Eni S.P.A. - ADR | | | 10,000 | | | | 491,400 | |

Luxottica Group S.P.A. (a) | | | 10,000 | | | | 412,615 | |

| | | | | | | | 1,423,781 | |

| Japan — 9.7% | | | | | | | | |

ABC-MART, Inc. (a) | | | 13,000 | | | | 565,243 | |

AEON Co. Ltd. (a) | | | 40,000 | | | | 456,561 | |

Central Japan Railway Co. (a) | | | 3,500 | | | | 283,698 | |

Don Quijote Co. Ltd. (a) | | | 20,000 | | | | 734,784 | |

KDDI Corp. (a) | | | 9,500 | | | | 670,773 | |

Komeri Co. Ltd. (a) | | | 20,000 | | | | 504,615 | |

K's Holdings Corp. (a) | | | 14,000 | | | | 355,928 | |

Mochida Pharmaceutical Co. Ltd. (a) | | | 50,000 | | | | 613,402 | |

NAFCO Co. Ltd. (a) | | | 1,700 | | | | 25,317 | |

| Nippon Telegraph and Telephone Corp. - ADR | | | 20,000 | | | | 420,600 | |

Nitori Holdings Co. Ltd. (a) | | | 2,000 | | | | 146,347 | |

Nomura Research Institute Ltd. (a) | | | 20,000 | | | | 416,086 | |

Ryohin Keikaku Co. Ltd. (a) | | | 13,000 | | | | 726,140 | |

Sundrug Co. Ltd. (a) | | | 25,000 | | | | 854,027 | |

Takeda Pharmaceutical Co. Ltd. (a) | | | 10,500 | | | | 468,702 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 61.0% (continued) | | | | | | |

| Japan — 9.7% (continued) | | | | | | |

Trend Micro, Inc. (a) | | | 15,000 | | | $ | 452,652 | |

United Arrows Ltd. (a) | | | 25,000 | | | | 574,985 | |

Yamada Denki Co. Ltd. (a) | | | 10,000 | | | | 386,020 | |

YAOKO Co., Ltd. (a) | | | 10,000 | | | | 369,988 | |

| | | | | | | | 9,025,868 | |

| Mexico — 1.0% | | | | | | | | |

| América Móvil S.A.B. de C.V. - Series A - ADR | | | 24,700 | | | | 571,805 | |

Gruma S.A.B. de C.V. - ADR (b) | | | 32,400 | | | | 394,308 | |

| | | | | | | | 966,113 | |

| Netherlands (The) — 2.1% | | | | | | | | |

ASML Holding N.V. | | | 5,630 | | | | 362,628 | |

Royal Dutch Shell plc - Class A - ADR | | | 8,000 | | | | 551,600 | |

Unilever N.V. - ADR | | | 27,000 | | | | 1,034,100 | |

| | | | | | | | 1,948,328 | |

| New Zealand — 1.1% | | | | | | | | |

Chorus Ltd. - ADR | | | 16,000 | | | | 195,200 | |

Telecom Corp. of New Zealand Ltd. - ADR | | | 92,500 | | | | 856,550 | |

| | | | | | | | 1,051,750 | |

| Norway — 2.3% | | | | | | | | |

Statoil ASA (a) | | | 20,000 | | | | 503,938 | |

Tomra Systems ASA (a) | | | 95,000 | | | | 864,166 | |

Yara International ASA (a) | | | 15,000 | | | | 747,651 | |

| | | | | | | | 2,115,755 | |

| Spain — 1.3% | | | | | | | | |

Industria de Diseño Textil S.A. (Inditex) (a) | | | 3,500 | | | | 491,613 | |

Red Electrica Corp. S.A. (a) | | | 15,000 | | | | 740,698 | |

| | | | | | | | 1,232,311 | |

| Sweden — 2.5% | | | | | | | | |

Axfood AB (a) | | | 13,000 | | | | 491,804 | |

Clas Ohlson AB - B Shares (a) | | | 55,000 | | | | 731,864 | |

Hennes & Mauritz AB - B Shares (a) | | | 14,100 | | | | 488,806 | |

NIBE Industrier AB - B Shares (a) | | | 30,000 | | | | 434,346 | |

Securitas AB - B Shares (a) | | | 25,000 | | | | 219,231 | |

| | | | | | | | 2,366,051 | |

| Switzerland — 3.4% | | | | | | | | |

Logitech International S.A. (b) | | | 61,000 | | | | 459,940 | |

Nestlé S.A. - ADR | | | 8,800 | | | | 573,496 | |

Novartis AG - ADR | | | 14,000 | | | | 886,200 | |

Roche Holding Ltd. - ADR | | | 19,000 | | | | 959,500 | |

Swisscom AG - ADR | | | 6,000 | | | | 259,500 | |

| | | | | | | | 3,138,636 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 61.0% (continued) | | | | | | |

| Taiwan — 1.0% | | | | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 55,000 | | | $ | 943,800 | |

| | | | | | | | | |

| United Kingdom (The) — 14.0% | | | | | | | | |

AstraZeneca plc - ADR | | | 21,500 | | | | 1,016,305 | |

BT Group plc - ADR | | | 10,000 | | | | 380,300 | |

Dairy Crest Group plc (a) | | | 70,000 | | | | 443,665 | |

Ensco plc - Class A | | | 2,500 | | | | 148,200 | |

GlaxoSmithKline plc - ADR | | | 23,500 | | | | 1,021,545 | |

Greggs plc (a) | | | 90,000 | | | | 671,642 | |

Interserve plc (a) | | | 64,000 | | | | 408,428 | |

J Sainsbury plc (a) | | | 180,000 | | | | 1,018,778 | |

London Stock Exchange Group plc (a) | | | 25,000 | | | | 446,129 | |

Marks & Spencer Group plc (a) | | | 40,000 | | | | 251,364 | |

Mitie Group plc (a) | | | 175,000 | | | | 752,573 | |

N Brown Group plc (a) | | | 50,000 | | | | 301,914 | |

National Grid plc - ADR | | | 10,500 | | | | 603,120 | |

Reckitt Benckiser Group plc - ADR | | | 75,000 | | | | 961,500 | |

Sage Group plc (The) (a) | | | 200,000 | | | | 962,080 | |

SSE plc (a) | | | 35,000 | | | | 814,566 | |

Smith & Nephew plc - ADR | | | 19,500 | | | | 1,080,300 | |

Vodafone Group plc - ADR | | | 19,000 | | | | 478,610 | |

William Morrison Supermarkets plc (a) | | | 160,000 | | | | 687,257 | |

WS Atkins plc (a) | | | 45,000 | | | | 560,982 | |

| | | | | | | | 13,009,258 | |

| | | | | | | | | |

Total Common Stocks (Cost $53,887,674) | | | | | | $ | 56,903,515 | |

EXCHANGE-TRADED FUNDS — 6.7% | | | | | | |

iShares MSCI Australia Index Fund | | | 53,000 | | | $ | 1,332,420 | |

iShares MSCI Canada Index Fund | | | 45,000 | | | | 1,278,000 | |

iShares MSCI Netherlands Index Fund | | | 65,000 | | | | 1,333,150 | |

iShares MSCI Singapore Index Fund | | | 80,000 | | | | 1,095,200 | |

iShares MSCI Switzerland Index Fund | | | 48,000 | | | | 1,286,400 | |

Total Exchange-Traded Funds (Cost $5,912,571) | | | | | | $ | 6,325,170 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

PUT OPTION CONTRACTS — 0.1% | | | | | | |

| S&P 500 Index Option, 03/16/2013 at $1,150 (Cost $56,450) | | | 150 | | | $ | 54,000 | |

| | | | | | | | | |

Total Investments at Value — 67.8% (Cost $59,856,695) | | | | | | $ | 63,282,685 | |

MONEY MARKET FUNDS — 28.7% | | | | | | |

Northern Institutional Treasury Portfolio, 0.01% (c) (Cost $26,784,536) | | | 26,784,536 | | | $ | 26,784,536 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 96.5% | | | | | |

(Cost $86,641,231) | | | | | | $ | 90,067,221 | |

| | | | | | | | | |

Written Call Options — (4.4%) | | | | | | | (4,110,000 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 7.9% | | | | | | | 7,333,054 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 93,290,275 | |

| ADR - American Depositary Receipt. |

| (a) | Fair value priced (Note 1). Fair valued securities totaled $30,481,825 at December 31, 2012, representing 32.7% of net assets. |

| (b) | Non-income producing security. |

| (c) | The rate shown is the 7-day effective yield as of December 31, 2012. |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Summary of Common Stocks by Sector and Industry |

December 31, 2012 (Unaudited) |

| | |

| Consumer Discretionary — 8.7% | | |

| | Internet & Catalog Retail | 0.3% |

| | Media | 0.6% |

| | Multiline Retail | 2.0% |

| | Specialty Retail | 4.6% |

| | Textiles, Apparel & Luxury Goods | 1.2% |

| Consumer Staples — 11.5% | | |

| | Food & Staples Retailing | 5.7% |

| | Food Products | 4.3% |

| | Household Products | 1.0% |

| | Personal Products | 0.5% |

| Energy — 3.3% | | |

| | Energy Equipment & Services | 0.1% |

| | Oil, Gas & Consumable Fuels | 3.2% |

| Financials — 0.5% | | |

| | Diversified Financial Services | 0.5% |

| Health Care — 11.0% | | |

| | Health Care Equipment & Supplies | 3.0% |

| | Health Care Providers & Services | 0.9% |

| | Pharmaceuticals | 7.1% |

| Industrials — 4.6% | | |

| | Air Freight & Logistics | 0.8% |

| | Building Products | 0.5% |

| | Commercial Services & Supplies | 2.0% |

| | Construction & Engineering | 0.4% |

| | Professional Services | 0.6% |

| | Road & Rail | 0.3% |

| Information Technology — 9.0% | | |

| | Computers & Peripherals | 0.5% |

| | Internet Software & Services | 1.4% |

| | IT Services | 2.2% |

| | Semiconductors & Semiconductor Equipment | 1.4% |

| | Software | 3.5% |

| Materials — 0.8% | | |

| | Chemicals | 0.8% |

| Telecommunication Services — 8.6% | | |

| | Diversified Telecommunication Services | 6.5% |

| | Wireless Telecommunication Services | 2.1% |

| Utilities — 3.0% | | |

| | Electric Utilities | 2.4% |

| | Multi-Utilities | |

| | | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts |

December 31, 2012 (Unaudited) |

| | | | | | Aggregate Market Value of Contracts | | | | |

Dollar Index Future | 03/18/2013 | | | 150 | | | $ | 11,979,000 | | | $ | (87,325 | ) |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Open Written Option Contracts |

December 31, 2012 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| S&P 500 Index Option, | | | | | | | | | |

03/16/2013 at $1,150 | | | 150 | | | $ | 4,110,000 | | | $ | 3,929,800 | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts Sold Short |

December 31, 2012 (Unaudited) |

FUTURES CONTRACTS SOLD SHORT | | | | | | Aggregate Market Value of Contracts | | | Unrealized Appreciation (Depreciation) | |

Euro Stoxx 50 Index Future | 03/15/2013 | | | 750 | | | $ | 25,879,132 | | | $ | (32,240 | ) |

FTSE 100 Index Future | 03/15/2013 | | | 150 | | | | 14,255,302 | | | | 92,350 | |

Total Futures Contracts Sold Short | | | | | | | $ | 40,134,434 | | | $ | 60,110 | |

| See accompanying notes to financial statements. |

Hussman Strategic Dividend Value Fund Schedule of Investments |

December 31, 2012 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 8.8% | | | | | | |

| Auto Components — 0.5% | | | | | | |

Autoliv, Inc. | | | 1,100 | | | $ | 74,129 | |

| | | | | | | | | |

| Diversified Consumer Services — 1.0% | | | | | | | | |

H&R Block, Inc. | | | 4,000 | | | | 74,280 | |

Strayer Education, Inc. | | | 1,000 | | | | 56,170 | |

| | | | | | | | 130,450 | |

| Hotels, Restaurants & Leisure — 1.5% | | | | | | | | |

Carnival Corp. | | | 1,500 | | | | 55,155 | |

Darden Restaurants, Inc. | | | 1,500 | | | | 67,605 | |

McDonald's Corp. | | | 1,000 | | | | 88,210 | |

| | | | | | | | 210,970 | |

| Household Durables — 1.1% | | | | | | | | |

Garmin Ltd. | | | 2,800 | | | | 114,296 | |

Koss Corp. | | | 9,000 | | | | 43,290 | |

| | | | | | | | 157,586 | |

| Internet & Catalog Retail — 0.4% | | | | | | | | |

Nutrisystem, Inc. | | | 6,000 | | | | 49,140 | |

| | | | | | | | | |

| Leisure Equipment & Products — 0.7% | | | | | | | | |

Hasbro, Inc. | | | 2,625 | | | | 94,238 | |

| | | | | | | | | |

| Media — 1.7% | | | | | | | | |

Harte-Hanks, Inc. | | | 14,000 | | | | 82,600 | |

Meredith Corp. | | | 3,000 | | | | 103,350 | |

Omnicom Group, Inc. | | | 1,100 | | | | 54,956 | |

| | | | | | | | 240,906 | |

| Multiline Retail — 1.0% | | | | | | | | |

Kohl's Corp. | | | 2,000 | | | | 85,960 | |

Target Corp. | | | 900 | | | | 53,253 | |

| | | | | | | | 139,213 | |

| Specialty Retail — 0.9% | | | | | | | | |

Best Buy Co., Inc. | | | 2,250 | | | | 26,662 | |

Staples, Inc. | | | 8,000 | | | | 91,200 | |

| | | | | | | | 117,862 | |

| Consumer Staples — 8.4% | | | | | | | | |

| Beverages — 1.1% | | | | | | | | |

Coca-Cola Co. (The) | | | 2,250 | | | | 81,562 | |

PepsiCo, Inc. | | | 1,125 | | | | 76,984 | |

| | | | | | | | 158,546 | |

Hussman Strategic Dividend Value Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 47.5% (continued) | | | | | | |

| Consumer Staples — 8.4% (continued) | | | | | | |

| Food & Staples Retailing — 2.5% | | | | | | |

Kroger Co. (The) | | | 3,000 | | | $ | 78,060 | |

Safeway, Inc. | | | 3,000 | | | | 54,270 | |

Sysco Corp. | | | 1,500 | | | | 47,490 | |

Walgreen Co. | | | 3,000 | | | | 111,030 | |

Wal-Mart Stores, Inc. | | | 900 | | | | 61,407 | |

| | | | | | | | 352,257 | |

| Food Products — 2.7% | | | | | | | | |

Archer-Daniels-Midland Co. | | | 2,400 | | | | 65,736 | |

Campbell Soup Co. | | | 3,500 | | | | 122,115 | |

ConAgra Foods, Inc. | | | 2,000 | | | | 59,000 | |

General Mills, Inc. | | | 1,125 | | | | 45,461 | |

Kellogg Co. | | | 1,500 | | | | 83,775 | |

| | | | | | | | 376,087 | |

| Household Products — 1.9% | | | | | | | | |

Clorox Co. (The) | | | 1,000 | | | | 73,220 | |

Colgate-Palmolive Co. | | | 800 | | | | 83,632 | |

Procter & Gamble Co. (The) | | | 1,500 | | | | 101,835 | |

| | | | | | | | 258,687 | |

| Personal Products — 0.2% | | | | | | | | |

Avon Products, Inc. | | | 1,500 | | | | 21,540 | |

| | | | | | | | | |

| Energy — 2.9% | | | | | | | | |

| Oil, Gas & Consumable Fuels — 2.9% | | | | | | | | |

BP plc - ADR | | | 2,600 | | | | 108,264 | |

ConocoPhillips | | | 1,500 | | | | 86,985 | |

Exxon Mobil Corp. | | | 500 | | | | 43,275 | |

Murphy Oil Corp. | | | 2,100 | | | | 125,055 | |

Phillips 66 | | | 575 | | | | 30,533 | |

| | | | | | | | 394,112 | |

| Financials — 1.5% | | | | | | | | |

| Diversified Financial Services — 0.7% | | | | | | | | |

CME Group, Inc. | | | 1,900 | | | | 96,349 | |

| | | | | | | | | |

| Insurance — 0.8% | | | | | | | | |

Aflac, Inc. | | | 2,100 | | | | 111,552 | |

| | | | | | | | | |

| Health Care — 9.3% | | | | | | | | |

| Biotechnology — 0.6% | | | | | | | | |

PDL BioPharma, Inc. | | | 12,000 | | | | 84,600 | |

Hussman Strategic Dividend Value Fund Schedule of Investments (continued) |

December 31, 2012 (Unaudited) |

COMMON STOCKS — 47.5% (continued) | | | | | | |

| Health Care — 9.3% (continued) | | | | | | |

| Health Care Equipment & Supplies — 2.9% | | | | | | |

Baxter International, Inc. | | | 1,750 | | | $ | 116,655 | |

Becton, Dickinson and Co. | | | 1,125 | | | | 87,964 | |

Medtronic, Inc. | | | 2,400 | | | | 98,448 | |

St. Jude Medical, Inc. | | | 2,800 | | | | 101,192 | |

| | | | | | | | 404,259 | |

| Health Care Providers & Services — 1.1% | | | | | | | | |

Cardinal Health, Inc. | | | 2,400 | | | | 98,832 | |

Owens & Minor, Inc. | | | 2,000 | | | | 57,020 | |

| | | | | | | | 155,852 | |

| Health Care Technology — 0.4% | | | | | | | | |

Quality Systems, Inc. | | | 3,000 | | | | 52,080 | |

| | | | | | | | | |

| Pharmaceuticals — 4.3% | | | | | | | | |

Abbott Laboratories | | | 1,750 | | | | 114,625 | |

AstraZeneca plc - ADR | | | 1,500 | | | | 70,905 | |

Eli Lilly & Co. | | | 1,000 | | | | 49,320 | |

Johnson & Johnson | | | 1,750 | | | | 122,675 | |

Merck & Co., Inc. | | | 2,625 | | | | 107,467 | |

Novartis AG - ADR | | | 1,900 | | | | 120,270 | |

| | | | | | | | 585,262 | |

| Industrials — 5.1% | | | | | | | | |

| Aerospace & Defense — 0.6% | | | | | | | | |

United Technologies Corp. | | | 1,000 | | | | 82,010 | |

| | | | | | | | | |

| Air Freight & Logistics — 1.2% | | | | | | | | |

C.H. Robinson Worldwide, Inc. | | | 975 | | | | 61,640 | |