| OMB APPROVAL |

OMB Number: 3235-0570 Expires: January 31, 2014 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-09911

Hussman Investment Trust

(Exact name of registrant as specified in charter)

| 5136 Dorsey Hall Drive Ellicott City, Maryland | 21042 |

| (Address of principal executive offices) | (Zip code) |

John F. Splain

U

ltimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: (513) 587-3400

Date of fiscal year end: June 30, 2014

Date of reporting period: December 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

HUSSMAN INVESTMENT TRUST

HUSSMAN STRATEGIC GROWTH FUND

HUSSMAN STRATEGIC TOTAL RETURN FUND

HUSSMAN STRATEGIC INTERNATIONAL FUND

HUSSMAN STRATEGIC DIVIDEND VALUE FUND

SEMI-ANNUAL REPORT

December 31, 2013

(Unaudited)

| Performance Information | |

| Hussman Strategic Growth Fund | 1 |

| Hussman Strategic Total Return Fund | 2 |

| Hussman Strategic International Fund | 3 |

| Hussman Strategic Dividend Value Fund | 4 |

| Letter to Shareholders | 5 |

| Portfolio Information | 18 |

| Schedules of Investments | |

| Hussman Strategic Growth Fund | 21 |

| Hussman Strategic Total Return Fund | 28 |

| Hussman Strategic International Fund | 31 |

| Hussman Strategic Dividend Value Fund | 39 |

| Statements of Assets and Liabilities | 45 |

| Statements of Operations | 47 |

| Statements of Changes in Net Assets | |

| Hussman Strategic Growth Fund | 49 |

| Hussman Strategic Total Return Fund | 50 |

| Hussman Strategic International Fund | 51 |

| Hussman Strategic Dividend Value Fund | 52 |

| Financial Highlights | |

| Hussman Strategic Growth Fund | 53 |

| Hussman Strategic Total Return Fund | 54 |

| Hussman Strategic International Fund | 55 |

| Hussman Strategic Dividend Value Fund | 56 |

| Notes to Financial Statements | 57 |

| About Your Funds’ Expenses | 84 |

| Other Information | 87 |

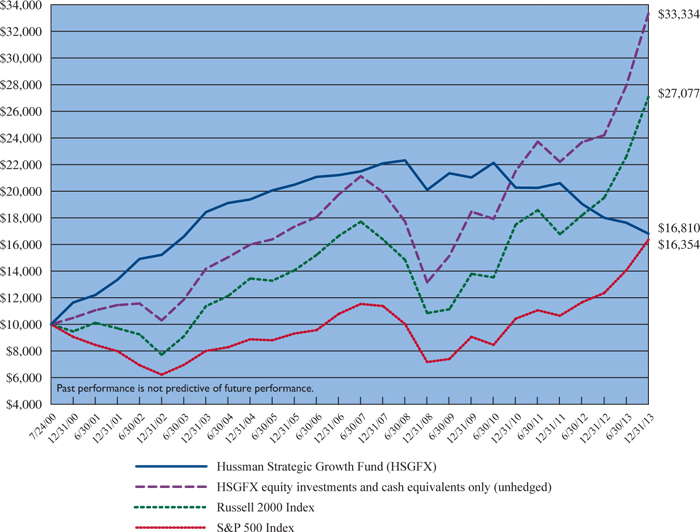

HUSSMAN STRATEGIC GROWTH FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Growth Fund

versus the Standard & Poor’s 500 Index and the Russell 2000 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2013 |

| | | | | | | |

Hussman Strategic Growth Fund(c)(d) | (6.62%) | (6.05%) | (3.51%) | (0.92%) | 3.94% | |

| S&P 500 Index | 32.39% | 16.18% | 17.94% | 7.41% | 3.73% | |

| Russell 2000 Index | 38.82% | 15.67% | 20.08% | 9.07% | 7.69% | |

| (a) | Hussman Strategic Growth Fund invests in stocks listed on the New York, American, and NASDAQ exchanges, and does not specifically restrict its holdings to a particular market capitalization. The S&P 500 and Russell 2000 are indices of large and small capitalization stocks, respectively. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, but excluding the impact of hedging transactions. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their peformance is presented solely for purposes of comparison and performance attribution. |

| (b) | The Fund commenced operations on July 24, 2000. |

| (c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The Adviser has contractually agreed to defer its investment advisory fees and/or absorb or reimburse Fund expenses until at least November 1, 2014 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.07% annually of the Fund’s average daily net assets. The gross expense ratio as disclosed in the November 1, 2013 prospectus was 1.14%. |

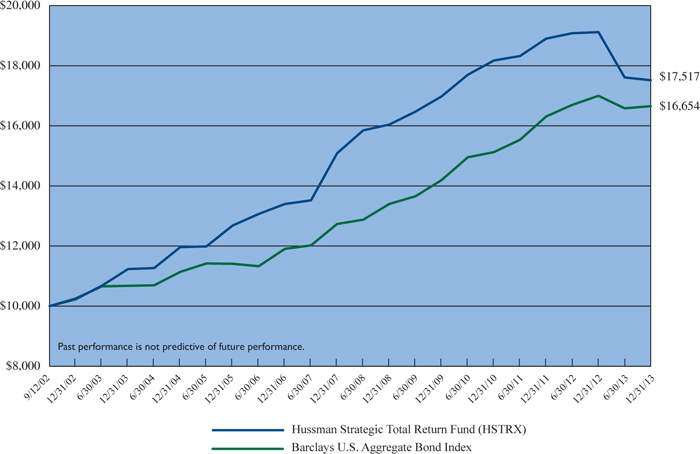

HUSSMAN STRATEGIC TOTAL RETURN FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Barclays U.S. Aggregate Bond Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2013 |

| | | | | | | |

Hussman Strategic Total Return Fund(c)(d) | (8.37%) | (1.22%) | 1.77% | 4.54% | 5.09% | |

| Barclays U.S. Aggregate Bond Index | (2.02%) | 3.26% | 4.44% | 4.55% | 4.62% | |

| (a) | The Barclays U.S.Aggregate Bond Index covers the U.S.investment grade fixed rate bond market, with index components for U.S.government, agency and corporate securities.The Fund does not invest solely in securities included in the Barclays U.S.Aggregate Bond Index and may invest in other types of bonds, as well as common stocks, exchange-traded funds and other securities. |

| (b) | The Fund commenced operations on September 12, 2002. |

| (c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The Adviser has contractually agreed to defer its investment advisory fees and/or absorb or reimburse Fund expenses until at least November 1, 2014 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 0.63% annually of the Fund’s average daily net assets.The gross expense ratio as disclosed in the November 1, 2013 prospectus was 0.68%. |

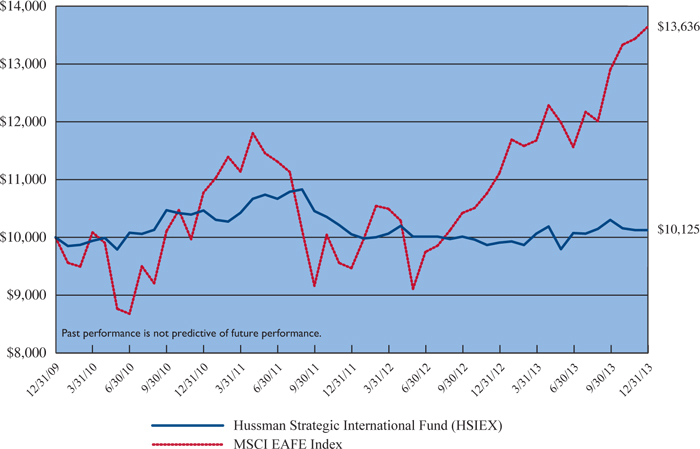

HUSSMAN STRATEGIC INTERNATIONAL FUND

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2013 |

| | | | | |

Hussman Strategic International Fund(c)(d) | 2.18% | (1.10%) | 0.31% | |

| MSCI EAFE Index | 22.78% | 8.17% | 8.06% | |

| (a) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float-adjusted weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2013, the MSCI EAFE Index consisted of the following 21 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund may not invest in all of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. |

| (b) | The Fund commenced operations on December 31, 2009. |

| (c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The Fund’s expense ratio was 1.54% for the six months ended December 31, 2013. The expense ratio as disclosed in the November 1, 2013 prospectus was 1.61%. |

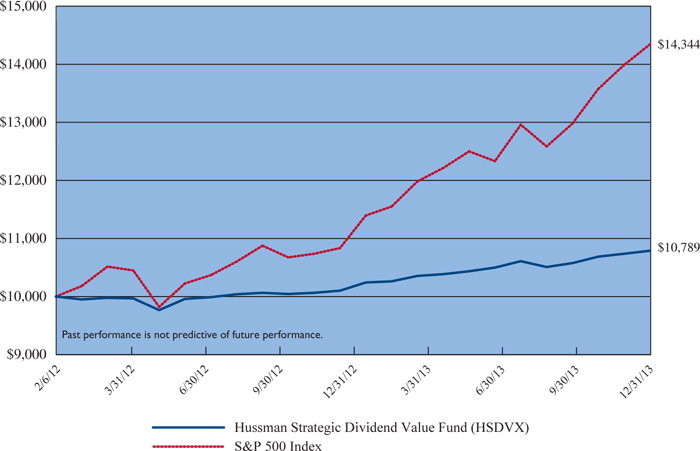

HUSSMAN STRATEGIC DIVIDEND VALUE FUND

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic Dividend Value Fund versus the Standard & Poor’s 500 Index(a) (Unaudited)

Average Annual Total Returns For Periods Ended December 31, 2013 |

| | | | |

Hussman Strategic Dividend Value Fund(c)(d) | 6.81% | 4.07% | |

| S&P 500 Index | 32.39% | 20.89% | |

| (a) | Hussman Strategic Dividend Value Fund invests primarily in securities of U.S. issuers but may invest in stocks of foreign companies. There are no restrictions as to the market capitalization of companies in which the Fund invests. The S&P 500 Index is believed to be the appropriate broad-based securities market index against which to compare the Fund’s long-term performance. However, the Fund may invest in securities that are not included in the S&P 500 Index, and may vary its exposure to market fluctuations depending on market conditions. |

| (b) | The Fund commenced operations on February 6, 2012. |

| (c) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| (d) | The Adviser has contractually agreed to defer its investment advisory fees and/or absorb or reimburse Fund expenses until at least February 1, 2015 to the extent necessary to limit the Fund’s annual ordinary operating expenses to an amount not exceeding 1.25% annually of the Fund’s average daily net assets. The gross expense ratio as disclosed in the November 1, 2013 prospectus was 2.77%. |

The Hussman Funds continue to pursue a disciplined, value-conscious, risk-managed and historically-informed investment approach focused on the complete market cycle. From the standpoint of a full-cycle discipline, it is essential to understand the position of the market within that cycle. In 2013, the stock market experienced what I view as the speculative crescendo of the third Fed-enabled equity bubble in 14 years. On the basis of valuation measures that are strongly correlated with subsequent total returns in stocks over the following 7-10 year period, the Standard and Poor’s 500 Index ended 2013 at fully twice its historical valuation norms prior to the late-1990’s valuation bubble. These fundamental measures include price/revenues, non-financial equity market capitalization/nominal GDP, market value/replacement cost (Tobin’s Q), and a variety of measures based on price to properly normalized earnings.

The word “normalized” is important here. Equities are a claim not to a single year of earnings, but to a very long-term stream of future cash flows that will be delivered into the hands of investors over time. Almost invariably, valuation measures that identify stocks as “reasonably” valued today are those that rely on a single year of earnings. However, profit margins remain about 70% above their historical norms. To rely on these measures is to assume that profit margins (which have historically reverted toward historical norms in nearly every economic cycle, including the two most recent ones) will remain at record highs not just for a year or two, but for several decades. The measures that we find most reliably correlated with actual subsequent market returns are those that normalize earnings by taking these wide swings in profit margins into account.

As I wrote in my weekly commentary on the Hussman Funds website in August 2007, just before a market plunge that wiped out the entire total return of the S&P 500 Index – over and above Treasury bill returns – all the way back to June 1995, “There is no evidence that historically reliable valuation measures have lost their validity. Speculators hoping for a ‘Bernanke put’ to save their assets are likely to discover - too late - that the strike price is way out of the money.”

I fully understand that investors would like to believe nearly 14 years after the 2000 bubble peak, it should be impossible that stocks could be in yet another valuation bubble. The S&P 500 Index was priced in 2000 to achieve what we estimated to be negative total returns over the following decade, and the market did exactly that. But today, a few years past that 10-year mark, the 3.17% annual total return of the S&P 500 Index from its peak on 3/24/2000 to its recent peak on 1/15/2014 has been achieved only by restoring historically severe valuations. Present valuations are certainly less severe than in 2000 for the S&P 500 Index as a whole, but are actually

|

Letter to Shareholders (continued) |

more severe for the median stock. In 2000, small capitalization stocks were much better valued than larger ones, though that didn’t prevent them from losing a large portion of their value in the bear market that followed. For investors who share a full-cycle investment discipline, we strongly encourage maintaining that discipline at present.

The perception that we maintain a permanently defensive outlook toward the equity market is largely an artifact of our response to the 2008-2009 credit crisis. While the Hussman Funds performed admirably in that period, the broader behavior of the financial markets and the economy was “out of sample” from the standpoint of the post-WWII data on which our return/risk estimates were based. I insisted on stress-testing our investment approach to increase its robustness to Depression-era outcomes, but that effort resulted in missed returns in the interim. Though investors in Strategic Growth Fund may recall that we quickly removed most of our hedges following the 2000-2002 bear market, my reputation as a “perma-bear” is a misconception born of that 2009-early 2010 stress-testing period (which I do not expect to be repeated in the future), compounded by the more recent Fed-induced speculative advance in the equity market (most or all of which I expect to be surrendered over the completion of the present market cycle).

I remain convinced that we will observe ample opportunities, over the completion of the present market cycle and beyond, to pursue investment returns at far lower levels of risk than investors presently face. Valuations, measures of market action, and a broad ensemble of other considerations have historically been effective in identifying these opportunities. Investors should not be surprised to observe the Funds establishing unhedged or aggressive investment positions at these points. Indeed, they should expect it.

For the year ended December 31, 2013, Strategic Growth Fund lost -6.62%, largely attributable to the cumulative decay in the time-value of index put options held by the Fund. Strategic Total Return Fund lost -8.37%, attributable to a general decline in the value of precious metals shares and U.S. Treasury securities. Strategic International Fund achieved a total return of 2.18%, reflecting a generally hedged investment stance in the international equity market. Strategic Dividend Value Fund achieved a total return of 6.81%, reflecting a partially hedged investment stance in dividend-paying stocks.

|

Letter to Shareholders (continued) |

From the inception of Strategic Growth Fund on July 24, 2000 through December 31, 2013, the Fund achieved an average annual total return of 3.94%, compared with an average annual total return of 3.73% for the S&P 500 Index. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $16,810, compared with $16,354 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -28.58%, compared with a maximum loss of -55.25% for the S&P 500 Index.

It is instructive that in order to lose -55.25% (as the S&P 500 Index did following steep overvaluation in 2007 much like the present), one must first lose -28.58%, and then lose an additional -37.34%. Conversely, simply recovering from a -55.25% loss to a -28.58% loss requires an advance of 59.60%. The focus of our risk-management is not the avoidance of small or moderate losses, which we view as a necessary aspect of long-term investing, but rather the avoidance of severe declines requiring heroic recovery.

From the inception of Strategic Total Return Fund on September 12, 2002 through December 31, 2013, the Fund achieved an average annual total return of 5.08%, compared with an average annual total return of 4.62% for the Barclays U.S. Aggregate Bond Index. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $17,517, compared with $16,654 for the same investment in the Barclays U.S. Aggregate Bond Index. The deepest loss experience by the Fund since inception was -11.52%, compared with a maximum loss of -5.09% for the Barclays U.S. Aggregate Bond Index.

From the inception of Strategic International Fund on December 31, 2009 through December 31, 2013, the Fund achieved an average annual total return of 0.31%, compared with an average annual total return of 8.06% for the MSCI EAFE Index. An initial $10,000 investment in the Fund on December 31, 2009 would have grown to $10,125, compared with $13,636 for the same investment in the MSCI EAFE Index. The maximum decline of the EAFE Index was -26.48%, compared with a maximum decline of -10.45% for Strategic International Fund.

From the inception of Strategic Dividend Value Fund on February 6, 2012 through December 31, 2013, the Fund achieved an average annual total return of 4.07%, compared with an average annual total return of 20.89% for the S&P 500 Index. An initial $10,000 investment in the Fund on February 6, 2012 would be valued at $10,789, compared with $14,344 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -2.82%, compared with a maximum loss of -9.58% for the S&P 500 Index.

|

Letter to Shareholders (continued) |

The stock selection approach of the Fund has outperformed the S&P 500 Index by 5.64% (564 basis points) annually since the inception of the Fund and in the most recent year ended December 31, 2013, the stock selection approach outperformed the S&P 500 Index by 5.35% (535 basis points). However, market conditions during the past year generally matched those that have historically been associated with strikingly negative return/risk profiles. In the face of rich valuations and strenuously extended market conditions, the Fund was fully hedged during this period, and index put options held by the Fund experienced a loss of time value. The hedging strategy of the Fund (which often offsets periodic losses in the Fund’s holdings and can contribute strongly to investment returns in unfavorable market conditions) accounted for the Fund’s -6.62% one year loss. In my view, the fact that negative market outcomes did not emerge during this period is more a reflection of uncertain timing and temporary monetary distortion than of any durable change in market structure.

Historically, the simultaneous emergence of overextended valuations, price trends and exuberant sentiment (which we generally refer to as an “overvalued, overbought, overbullish” syndrome) has created significant risk for the stock market. In the past year, this risk was not realized and the stock market instead moved to further extremes. We expect that the most reasonable opportunity to reduce hedges and establish a more constructive investment stance will emerge at the point that a material retreat in valuations is coupled with a firming of market action after such a retreat.

| Strategic Total Return Fund |

During the year ended December 31, 2013, Strategic Total Return Fund declined in value by -8.37%. The Fund held a relatively conservative position in bonds during this time, with a duration typically ranging between 2-6 years (meaning that a 100 basis point move in interest rates would be expected to affect Fund value by about 2-6% on the basis of bond price fluctuations). During 2013, the yield on 10-year U.S. Treasury bonds surged from 1.88% to 3.03%, producing negative returns for even a conservative position in bonds. An additional driver of fluctuations in the Fund during this period was its exposure to precious metals shares. While this exposure was generally modest, gold stocks as measured by the Philadelphia Gold and Silver Sector Index (XAU) plunged by -48.01% during the year.

|

Letter to Shareholders (continued) |

Since the inception of Strategic Total Return Fund, the Fund has benefited from its ability to vary its duration and exposure to precious metals shares, utility shares, and other asset classes in response to changes in valuations and yields. While the Fund was exposed to a modest portion of the significant losses in these markets, the improved valuations in precious metals shares and bonds is quite welcome, as opportunities to increase investment exposure and participate in long-term investment returns are grounded in such improvements.

| Strategic International Fund |

In the year ended December 31, 2013, Strategic International Fund gained 2.18%. The Fund remained fully hedged against the impact of general market fluctuations during this period. The Fund generally held a defensive portfolio focused on equities that we view as undervalued and having significant dividend yields. Despite a risk-seeking environment, these holdings performed generally in line with the performance of the indices used by the Fund to hedge. While value-oriented stocks tended to underperform more cyclically-sensitive securities, the Fund benefited from having about one fifth of the portfolio invested in Japanese stocks during the strong advance in the Nikkei index during the past year. The Fund has since pared this position to a slight underweight relative to the representation of Japanese stocks in the MSCI EAFE Index.

| Strategic Dividend Value Fund |

In the year ended December 31, 2013, Strategic Dividend Value Fund gained 6.81%. In the context of market conditions that have historically been hostile for equities, the Fund held a larger position in cash than we would anticipate under normal conditions. Meanwhile about 50% of the value of the Fund’s holdings have been hedged over the past year, using option combinations on the S&P 500 Index. We anticipate a significantly larger exposure to equities, coupled with a smaller hedge, as the combination of valuations and other market conditions improve over the course of the present market cycle.

As of December 31, 2013, Strategic Growth Fund had net assets of $1,269,366,224, and held 110 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were information technology (27.6%), health care (26.0%), consumer discretionary (19.0%), consumer staples (11.5%), energy (6.0%), financials (4.5%), and industrials (4.4%). The smallest sector weights were in utilities (1.5%), materials (0.5%), and telecommunication services (0.0%).

|

Letter to Shareholders (continued) |

Strategic Growth Fund’s holdings of individual stocks as of December 31, 2013 were valued at $1,282,245,965. Against these stock positions, the Fund also held 5,000 option combinations (long put option/short call option) on the S&P 500 Index, 1,500 option combinations on the Russell 2000 Index and 500 option combinations on the Nasdaq 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 30, 2013, the S&P 500 Index closed at 1,848.36, while the Russell 2000 Index and the Nasdaq 100 Index closed at 1,163.64 and 3,591.996, respectively. The Fund’s total hedge therefore represented a short position of $1,278,325,800, thereby hedging 99.7% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following holdings achieved gains in excess of $10 million during the six months ended December 31, 2013: United Therapeutics, Deckers Outdoor, and Safeway. Holdings with losses in excess of $2 million during this same period were Laboratory Corporation of America, Valueclick, Jabil Circuit, Cisco Systems, and Cooper Tire and Rubber.

As of December 31, 2013, Strategic Total Return Fund had net assets of $702,128,254. Treasury notes, Treasury bonds, Treasury Inflation-Protected Securities (TIPS) and money market funds represented 89.6% of the Fund’s net assets. Exchange-traded funds, precious metals shares and utility shares accounted for 1.8%, 6.0% and 3.3% of net assets, respectively.

In Strategic Total Return Fund, during the six months ended December 31, 2013, portfolio gains in excess of $2 million were achieved in Agnico-Eagle Mines, Barrick Gold, Randgold Resources ADR, and Barrick Gold. Holdings with losses in excess of $2 million during this same period were U.S. Treasury Note (2.75%, due 11/15/2023), U. S. Treasury Note (1.75%, due 5/15/2022), U.S. Treasury Note (1.625%, due 11/15/2022) and U.S. Treasury Note (1.75%, due 5/15/2023).

As of December 31, 2013, Strategic International Fund had net assets of $106,568,140 and held 88 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were in health care (10.9%), information technology (10.0%), consumer staples (8.2%), consumer discretionary (7.6%), utilities (6.3%), industrials (5.4%), and telecommunications (4.0%). The smallest sector weights were in financials (1.0%), energy (0.7%), and materials (0.5%). Exchange-traded funds (ETFs) and money market funds accounted for 8.2% and 35.7% of net assets, respectively. The total value of equities and exchange-traded funds held by the Fund was $66,952,868.

|

Letter to Shareholders (continued) |

In order to hedge the impact of general market fluctuations, as of December 31, 2013 Strategic International Fund held 85 option combinations (long put option/short call option) on the S&P 500 Index, and was short 800 futures on the Euro STOXX 50 Index and 150 futures on the FTSE 100 Index. The combined notional value of these hedges was $66,695,098, hedging 99.6% of the value of equity and ETF investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While Strategic International Fund is widely diversified and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through December 31, 2013. Individual equity holdings having portfolio gains in excess of $350,000 during the six months ended December 31, 2013 included Softbank, Wuxi Pharmatech, and iShares MSCI Germany Index Fund. Holdings with portfolio losses in excess of $50,000 during this same period included Yamada Denki, Heineken, and Ricoh.

As of December 31, 2013, Strategic Dividend Value Fund had net assets of $31,492,984, and held 67 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were information technology (19.3%), consumer discretionary (16.7%), consumer staples (14.4%), health care (10.7%), and energy (7.6%). The smallest sector weights were in materials (4.4%), utilities (1.6%), financials (1.0%), industrials (0.4%) and telecommunication services (0.0%).

Strategic Dividend Value Fund’s holdings of individual stocks as of December 31, 2013 were valued at $23,963,187. Against these stock positions, the Fund also held 63 option combinations (long put option/short call option) on the S&P 500 Index. The notional value of this hedge was $11,644,668, hedging 48.6% of the value of equity investments held by the Fund.

In Strategic Dividend Value Fund, during the six months ended December 31, 2013, portfolio gains in excess of $75,000 were achieved in Safeway, John Wiley and Sons – Class A, Microsoft, Valassis Communications, CA, and Astrazeneca PLC - ADR. There were no losses greater than $50,000 during this same period.

Supplementary information including quarterly returns and equity-only performance is available on the Hussman Funds website: www.hussmanfunds.com

|

Letter to Shareholders (continued) |

Part of a good investment discipline is, and must be, to constantly seek improvements and address challenges. We’ve done a great deal of that since 2009 as a response to stress-testing demands and Fed-induced speculation. I expect the benefits of this work to be fully evident as the present cycle is completed and the next one unfolds. Still, part of a good investment discipline is also to recognize those points where discomfort is an unpleasant necessity. A change in strategy that might ease discomfort by participating in an overvalued speculative advance, but that would have left investors vulnerable to the deepest market losses on record, is no improvement at all. We’ve tolerated the frustration of remaining defensive during this speculative advance because it shares hallmarks that were shortly followed by the most punishing market losses in history. The fact that a similar consequence has been deferred in this instance does not convince us that it has been avoided.

In any event, I doubt that we’ll have much to lament by the completion of the current market cycle. We can clearly observe the risks inherent in present market conditions, and we know very well how those risks have typically been resolved throughout history.

| Quantitative Easing: Perception, Misattribution and Superstition |

What seems different this time, enough to revive the conclusion that “this time is different,” is faith in the Federal Reserve’s policy of quantitative easing. The main impact of quantitative easing is to make low-risk assets psychologically uncomfortable to hold, forcing investors to reach for yield in more speculative assets. Still, this policy requires investors to be permanently averse to low-risk assets, and to be permanently indifferent to rich valuations. We doubt that an easy Fed can hold stock prices up in the next few years any more than it did in the 2000-2002 decline or the 2007-2009 decline – both periods of persistent and aggressive Fed easing. But QE is novel, and like the internet bubble, novelty feeds imagination. That novelty is wearing thin, and in our view, most of what investors believe about QE is indeed imaginative.

When we examine the 2008-2009 credit crisis in retrospect, the central concern at that time was that massive bank failures would trigger a “global financial meltdown.” The risk of widespread failures was driven by losses in mortgage-backed securities and related assets held by major banks, and by highly leveraged financial institutions like Bear Stearns and Lehman, representing the “shadow” banking system. At some of these institutions, “leverage ratios” were 30-to-1 or higher. Given 30 times leverage, it takes a decline of just over 3% in the value of assets to completely wipe out capital and leave the institution insolvent (as the remaining value of assets

|

Letter to Shareholders (continued) |

would be unable to pay off the existing obligations to customers and bondholders). In such an environment, a “run” on one institution could force asset sales, accelerating capital losses at other institutions and increase the likelihood of insolvency.

Under existing accounting rules, banks and other financial institutions were required to report the value of the securities they held, using prevailing market prices, a requirement known as “mark-to-market.” As asset values collapsed in 2008 and early-2009 because of mortgage losses, financial institutions across the globe found themselves rapidly approaching insolvency.

As the willingness of investors to buy mortgage securities seized up, and economic activity plunged, the Federal Reserve stepped into the financial markets and became the major purchaser of existing and new mortgage securities issued by Fannie Mae and Freddie Mac. This arguably helped to support continuing activity in the housing market, but it is not what ended the crisis.

Rather, the crisis ended – and in our view, ended precisely – on March 16, 2009, when the Financial Accounting Standards Board abandoned mark-to-market rules, in response to Congressional pressure by the House Committee on Financial Services on March 12, 2009. That change immediately removed the threat of widespread insolvency by giving banks “significant judgment” in the values that they assigned to their assets. My impression is that much of the market’s confidence and oversensitivity to quantitative easing stems from misattribution of the initial recovery to QE. This has created a nearly self-fulfilling superstition that links the level of stock prices directly to the size of the Fed's balance sheet, despite the absence of any reliable or historically demonstrable transmission mechanism that relates the two with any precision at all.

The misattribution of cause and effect in 2009 created the Grand Superstition of our time – the belief that Federal Reserve policy was responsible for ending the financial crisis and sending the stock market higher. By 2010, this narrative was so fully accepted that the Fed’s announcement of further “quantitative easing” was met by equally great enthusiasm by investors.

Complicating matters, the European Central Bank forestalled a currency crisis in Europe through massive purchases of debt from credit-strained member countries. While this action was interpreted as quantitative easing, it actually functioned as a funding operation to weaker countries that was much more akin to a fiscal subsidy from stronger countries like Germany. Still, the fact that it was executed by the central bank and eased the Euro crisis helped to contribute to a perception that central bank purchases of government securities – in and of themselves – are sufficient to support

|

Letter to Shareholders (continued) |

the stock markets indefinitely. Worse, perception creates its own reality in the financial markets. If enough investors imagine something to be true, the markets will behave the same as if it really were – at least for a while.

To be clear, quantitative easing has undoubtedly been the primary driver of stock prices since 2010. But one must evaluate the extent to which there is any reliable, mechanistic link between the cause and the effect. If there is not, investors may be resting their confidence on little more than perception and superstition. This is exactly what historical data indicates.

Probably the most challenging aspect of quantitative easing is that, particularly since late-2011, overvalued, overbought, overbullish conditions usually associated with severe market losses have instead been associated with even more extreme speculation. That has made the advancing portion of this unfinished half cycle difficult. Still, my expectation is that investors will ultimately look back at the present market exuberance in hindsight and ask “after watching the market collapse following nearly identical bubbles in 2000 and 2007, despite aggressive monetary easing, how did we actually refuse to consider major losses in the belief – yet again – that this time was different?”

| Speculation and Overvaluation |

The latest data from the NYSE shows equity margin debt at a new all-time high. Relative to GDP, the current 2.6% level was eclipsed only once – at the March 2000 market peak. The issuance of low-quality “covenant lite” debt has also eclipsed the level prior to the 2008-2009 credit crisis, as investors “reach for yield” in response to the Federal Reserve’s policy of quantitative easing. In the context of the most extreme bullish sentiment in decades, and reliable valuation metrics about double their historical norms prior to the late-1990’s bubble (price/revenue, market cap/GDP, Tobin’s Q, properly normalized price/forward operating earnings, price to cyclically-adjusted earnings), we view present market conditions as dangerously speculative.

There are certainly some popular valuation measures that suggest that stocks are reasonably valued. However, as I’ve detailed in research presented on the Hussman Funds website, these measures tend to be poor indicators of actual subsequent market returns, because they essentially value stocks as if they are a claim on a single year of earnings instead of a long-term stream of future cash flows. Put another way, investors are taking current earnings at face value, as if they are representative of long-term flows, at a time when current earnings are more unrepresentative of those flows than at any time in history. The problem is not simply that earnings are likely to retreat deeply over the next few years. Rather, the problem is that investors have embedded

|

Letter to Shareholders (continued) |

the assumption of permanently elevated profit margins into stock prices, leaving the market about twice the level that would provide investors with historically adequate long-term returns.

We presently estimate prospective 10-year S&P 500 nominal total returns averaging just 2.7% annually, with negative expected total returns on every horizon shorter than 7 years. Given a 2% dividend yield, we expect the S&P 500 Index to be no higher a decade from today than it is at present. Uniformly, and across fundamentals that have reliably correlated with actual subsequent market returns, we project weak S&P 500 total returns over the coming decade. Indeed, the median price/revenue ratio of stocks in the S&P 500 is actually above the 2000 peak.

These valuation measures are the same ones that led us to correctly anticipate a decade of negative total returns in 2000, and significant market weakness in 2007. In contrast, these measures were quite favorable toward equities in 2009 (our stress-testing concerns were not driven by valuations). We estimate that a passive, equally balanced portfolio of stocks, bonds, and cash can be expected to return about 2% annually over the coming decade. If this seems to be an untenable long-term rate of return, the security prices underlying those expected returns are equally untenable.

Valuations appear less extreme in the international equity markets, but the correlation between international equities and U.S. equities tends to increase sharply during periods of weakness in the U.S. markets. We expect much greater latitude to reduce hedging in international equities once the most severe aspects of U.S. conditions are resolved.

Investment strategies that are sensitive to the changing profile of valuation and risk may not be popular in an environment where extreme valuations seem inconsequential and speculative risks are rewarded. Still, I expect that these strategies will be essential to achieving strong returns and navigating acute risks in the coming decade.

Part of the ability to sustain our investment discipline comes from understanding the profile of returns from that discipline in complete market cycles (bull markets and bear markets combined) across history. For example, investors often become convinced late in a bull market that “the greatest risk is being out of the market.” The only antidote to that is an understanding of how critical those speculative moments are from the standpoint of full-cycle investment returns. Put simply, the majority of the outperformance from risk-managed investment approaches over time comes from

|

Letter to Shareholders (continued) |

the avoidance of severe initial losses following overvalued, overbought, overbullish conditions, and from the limitation of deep and extended losses as market action subsequently deteriorates.

Though the market has advanced in the face of persistently overvalued, overbought, overbullish conditions since about late-2011, I am convinced that the result is an even more extreme and hazardous financial precipice.

Investors who believe that history has lessons to teach should take our present concerns with significant weight, but should also recognize that tendencies that repeatedly prove reliable over complete market cycles are sometimes defied over portions of those cycles.

In the face of an unusually extended period of speculation as a result of faith in quantitative easing, I continue to believe that normal historical regularities will exert themselves with a vengeance over the completion of this market cycle. Importantly, the market recently re-established the most hostile overvalued, overbought, overbullish syndrome we identify. It is tempting to ignore these concerns because we observed similarly extreme conditions in February and May of 2013. Still, prior to the past year, we have observed similarly extreme conditions only at market peaks (1929, 1972, 1987, 2000 and 2007) that investors view in hindsight as reckless speculative carnivals.

The problem is always that historical outcomes are easy to observe in hindsight, but the outcome of the present instance is still unseen – even if the underlying conditions are the same. As we saw in 2000 and again in 2007, until unseen risks become observable reality in hindsight (and by then, it is too late), all of these concerns are quickly dismissed by investors. Quantitative easing has distorted not only financial markets, but financial memory. I doubt that the awakening will be gentle.

Still, the most important message that shareholders should take from this letter is that market cycles across history have invariably produced strong investment opportunities, typically at points where significantly reduced market valuations have been joined by fresh improvements in market action. We missed that opportunity in 2009-early 2010 as a result of our stress-testing response to the credit crisis. Being comfortable with the ability of our approach to navigate even Depression-era outcomes, I expect no such demands again.

Though we would still be refraining from the recent Fed-induced speculation, the period since 2009 would undoubtedly look far different without that stress-testing miss. For exactly that reason, I believe that our experience during the incomplete half-cycle since 2009 is an aberration that should not be expected in future market cycles. I often described the performance of our investment strategy prior to 2009 with the

|

Letter to Shareholders (continued) |

phrase “as intended.” I am very excited about the prospect of pursuing our discipline – simply as intended – in the coming market cycle and beyond. As always, I remain grateful for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

Estimates of prospective return and risk for equities, bonds, and other financial markets are forward-looking statements based the analysis and reasonable beliefs of Hussman Strategic Advisors. They are not a guarantee of future performance, and are not indicative of the prospective returns of any of the Hussman Funds. Actual returns may differ substantially from the estimates provided. Estimates of prospective long-term returns for the S&P 500 Index reflect valuation methods focusing on the relationship between current market prices and earnings, dividends and other fundamentals, adjusted for variability over the economic cycle.

This Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in this Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

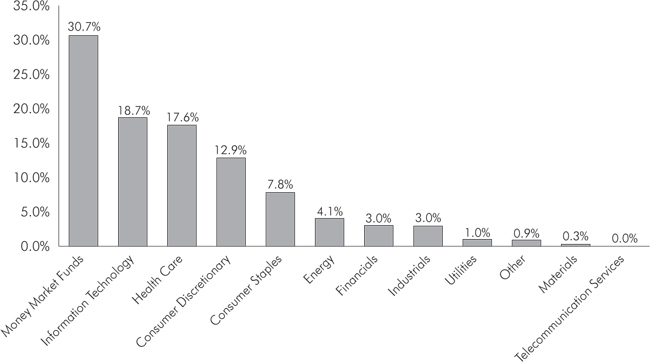

Hussman Strategic Growth Fund Portfolio Information |

December 31, 2013 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

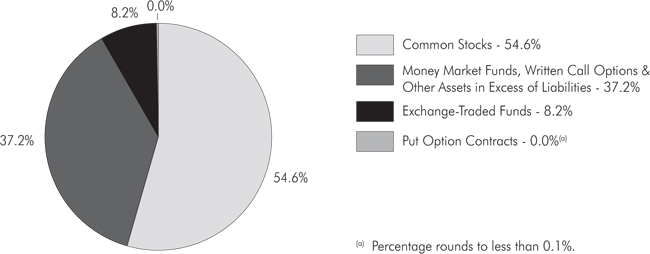

Hussman Strategic Total Return Fund Portfolio Information |

December 31, 2013 (Unaudited) |

| Asset Allocation (% of Net Assets) |

Hussman Strategic International Fund Portfolio Information |

December 31, 2013 (Unaudited) |

| Asset Allocation (% of Net Assets) |

| Country Allocation (% of Equity Holdings) |

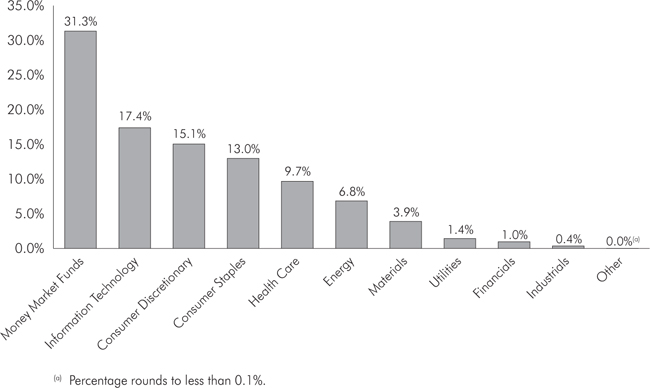

Hussman Strategic Dividend Value Fund Portfolio Information |

December 31, 2013 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

Hussman Strategic Growth Fund Schedule of Investments |

December 31, 2013 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 19.0% | | | | | | |

| Auto Components — 1.3% | | | | | | |

| Cooper Tire & Rubber Co. | | | 373,000 | | | $ | 8,966,920 | |

TRW Automotive Holdings Corp. (a) | | | 100,000 | | | | 7,439,000 | |

| | | | | | | | 16,405,920 | |

| Diversified Consumer Services — 3.0% | | | | | | | | |

| DeVry, Inc. | | | 208,000 | | | | 7,384,000 | |

Grand Canyon Education, Inc. (a) | | | 93,000 | | | | 4,054,800 | |

| Hillenbrand, Inc. | | | 426,000 | | | | 12,532,920 | |

Outerwall, Inc. (a) | | | 215,000 | | | | 14,463,050 | |

| | | | | | | | 38,434,770 | |

| Hotels, Restaurants & Leisure — 8.1% | | | | | | | | |

| Cheesecake Factory, Inc. (The) | | | 478,000 | | | | 23,073,060 | |

| International Game Technology | | | 500,000 | | | | 9,080,000 | |

Jack in the Box, Inc. (a) | | | 400,000 | | | | 20,008,000 | |

| McDonald's Corp. | | | 200,000 | | | | 19,406,000 | |

Panera Bread Co. - Class A (a) | | | 120,000 | | | | 21,202,800 | |

| Starbucks Corp. | | | 125,000 | | | | 9,798,750 | |

| | | | | | | | 102,568,610 | |

| Internet & Catalog Retail — 0.2% | | | | | | | | |

Shutterfly, Inc. (a) | | | 50,000 | | | | 2,546,500 | |

| | | | | | | | | |

| Leisure Equipment & Products — 0.8% | | | | | | | | |

| Hasbro, Inc. | | | 175,000 | | | | 9,626,750 | |

| | | | | | | | | |

| Media — 2.1% | | | | | | | | |

DISH Network Corp. - Class A (a) | | | 225,000 | | | | 13,032,000 | |

| Gannett Co., Inc. | | | 391,000 | | | | 11,565,780 | |

| Meredith Corp. | | | 34,000 | | | | 1,761,200 | |

| | | | | | | | 26,358,980 | |

| Multiline Retail — 0.5% | | | | | | | | |

| Target Corp. | | | 100,000 | | | | 6,327,000 | |

| | | | | | | | | |

| Specialty Retail — 2.0% | | | | | | | | |

| American Eagle Outfitters, Inc. | | | 42,000 | | | | 604,800 | |

Bed Bath & Beyond, Inc. (a) | | | 200,000 | | | | 16,060,000 | |

Murphy USA, Inc. (a) | | | 112,500 | | | | 4,675,500 | |

Urban Outfitters, Inc. (a) | | | 125,000 | | | | 4,637,500 | |

| | | | | | | | 25,977,800 | |

| Textiles, Apparel & Luxury Goods — 1.0% | | | | | | | | |

Deckers Outdoor Corp. (a) | | | 150,000 | | | | 12,669,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 101.0% (continued) | | | | | | |

| Consumer Staples — 11.5% | | | | | | |

| Beverages — 2.3% | | �� | | | | |

| Coca-Cola Co. (The) | | | 150,000 | | | $ | 6,196,500 | |

| PepsiCo, Inc. | | | 275,000 | | | | 22,808,500 | |

| | | | | | | | 29,005,000 | |

| Food & Staples Retailing — 3.3% | | | | | | | | |

Rite Aid Corp. (a) | | | 1,200,000 | | | | 6,072,000 | |

| Safeway, Inc. | | | 600,000 | | | | 19,542,000 | |

| Sysco Corp. | | | 225,000 | | | | 8,122,500 | |

| Walgreen Co. | | | 150,000 | | | | 8,616,000 | |

| | | | | | | | 42,352,500 | |

| Food Products — 4.8% | | | | | | | | |

| Archer-Daniels-Midland Co. | | | 276,000 | | | | 11,978,400 | |

| Fresh Del Monte Produce, Inc. | | | 40,000 | | | | 1,132,000 | |

| General Mills, Inc. | | | 400,000 | | | | 19,964,000 | |

Green Mountain Coffee Roasters, Inc. (a) | | | 250,000 | | | | 18,895,000 | |

| Kellogg Co. | | | 150,000 | | | | 9,160,500 | |

| | | | | | | | 61,129,900 | |

| Household Products — 1.1% | | | | | | | | |

| Clorox Co. (The) | | | 150,000 | | | | 13,914,000 | |

| | | | | | | | | |

| Energy — 6.0% | | | | | | | | |

| Energy Equipment & Services — 2.6% | | | | | | | | |

| Halliburton Co. | | | 300,000 | | | | 15,225,000 | |

| Helmerich & Payne, Inc. | | | 216,000 | | | | 18,161,280 | |

| | | | | | | | 33,386,280 | |

| Oil, Gas & Consumable Fuels — 3.4% | | | | | | | | |

| Chevron Corp. | | | 171,000 | | | | 21,359,610 | |

| Exxon Mobil Corp. | | | 50,000 | | | | 5,060,000 | |

| HollyFrontier Corp. | | | 200,000 | | | | 9,938,000 | |

| Murphy Oil Corp. | | | 100,000 | | | | 6,488,000 | |

| | | | | | | | 42,845,610 | |

| Financials — 4.5% | | | | | | | | |

| Commercial Banks — 0.7% | | | | | | | | |

| Fifth Third Bancorp | | | 400,000 | | | | 8,412,000 | |

| | | | | | | | | |

| Consumer Finance — 1.5% | | | | | | | | |

| American Express Co. | | | 50,000 | | | | 4,536,500 | |

World Acceptance Corp. (a) | | | 174,000 | | | | 15,230,220 | |

| | | | | | | | 19,766,720 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 101.0% (continued) | | | | | | |

| Financials — 4.5% (continued) | | | | | | |

| Insurance — 2.3% | | | | | | |

| Assurant, Inc. | | | 232,000 | | | $ | 15,397,840 | |

| Protective Life Corp. | | | 131,000 | | | | 6,636,460 | |

| Reinsurance Group of America, Inc. | | | 88,000 | | | | 6,812,080 | |

| | | | | | | | 28,846,380 | |

| Health Care — 26.0% | | | | | | | | |

| Biotechnology — 3.5% | | | | | | | | |

| Amgen, Inc. | | | 175,000 | | | | 19,978,000 | |

Harvard Apparatus Regenerative Technology, Inc. (a) | | | 232,500 | | | | 1,104,375 | |

| PDL BioPharma, Inc. | | | 1,052,000 | | | | 8,878,880 | |

United Therapeutics Corp. (a) | | | 134,000 | | | | 15,152,720 | |

| | | | | | | | 45,113,975 | |

| Health Care Equipment & Supplies — 7.2% | | | | | | | | |

| Baxter International, Inc. | | | 100,000 | | | | 6,955,000 | |

| Becton, Dickinson and Co. | | | 125,000 | | | | 13,811,250 | |

Cyberonics, Inc. (a) | | | 355,000 | | | | 23,256,050 | |

| Medtronic, Inc. | | | 250,000 | | | | 14,347,500 | |

| ResMed, Inc. | | | 235,000 | | | | 11,063,800 | |

| St. Jude Medical, Inc. | | | 350,000 | | | | 21,682,500 | |

| | | | | | | | 91,116,100 | |

| Health Care Providers & Services — 5.9% | | | | | | | | |

| Aetna, Inc. | | | 270,000 | | | | 18,519,300 | |

| Chemed Corp. | | | 61,000 | | | | 4,673,820 | |

| Humana, Inc. | | | 100,000 | | | | 10,322,000 | |

Laboratory Corp. of America Holdings (a) | | | 200,000 | | | | 18,274,000 | |

| UnitedHealth Group, Inc. | | | 100,000 | | | | 7,530,000 | |

WellCare Health Plans, Inc. (a) | | | 26,000 | | | | 1,830,920 | |

| WellPoint, Inc. | | | 150,000 | | | | 13,858,500 | |

| | | | | | | | 75,008,540 | |

| Life Sciences Tools & Services — 2.8% | | | | | | | | |

| Agilent Technologies, Inc. | | | 313,000 | | | | 17,900,470 | |

Harvard Bioscience, Inc. (a) | | | 930,000 | | | | 4,371,000 | |

Waters Corp. (a) | | | 135,000 | | | | 13,500,000 | |

| | | | | | | | 35,771,470 | |

| Pharmaceuticals — 6.6% | | | | | | | | |

| AbbVie, Inc. | | | 300,000 | | | | 15,843,000 | |

| GlaxoSmithKline plc - ADR | | | 400,000 | | | | 21,356,000 | |

| Johnson & Johnson | | | 100,000 | | | | 9,159,000 | |

Medicines Co. (The) (a) | | | 104,000 | | | | 4,016,480 | |

Mylan, Inc. (a) | | | 200,000 | | | | 8,680,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 101.0% (continued) | | | | | | |

| Health Care — 26.0% (continued) | | | | | | |

| Pharmaceuticals — 6.6% (continued) | | | | | | |

| Novartis AG - ADR | | | 200,000 | | | $ | 16,076,000 | |

| Questcor Pharmaceuticals, Inc. | | | 150,000 | | | | 8,167,500 | |

| | | | | | | | 83,297,980 | |

| Industrials — 4.4% | | | | | | | | |

| Commercial Services & Supplies — 1.0% | | | | | | | | |

| Cintas Corp. | | | 225,000 | | | | 13,407,750 | |

| | | | | | | | | |

| Industrial Conglomerates — 1.7% | | | | | | | | |

| 3M Co. | | | 150,000 | | | | 21,037,500 | |

| | | | | | | | | |

| Machinery — 1.2% | | | | | | | | |

| Illinois Tool Works, Inc. | | | 175,000 | | | | 14,714,000 | |

| | | | | | | | | |

| Professional Services — 0.5% | | | | | | | | |

| Robert Half International, Inc. | | | 150,000 | | | | 6,298,500 | |

| | | | | | | | | |

| Information Technology — 27.6% | | | | | | | | |

| Communications Equipment — 3.1% | | | | | | | | |

| Cisco Systems, Inc. | | | 850,000 | | | | 19,082,500 | |

| Harris Corp. | | | 300,000 | | | | 20,943,000 | |

| | | | | | | | 40,025,500 | |

| Computers & Peripherals — 4.0% | | | | | | | | |

| NetApp, Inc. | | | 250,000 | | | | 10,285,000 | |

| Seagate Technology plc | | | 250,000 | | | | 14,040,000 | |

Synaptics, Inc. (a) | | | 275,000 | | | | 14,247,750 | |

| Western Digital Corp. | | | 150,000 | | | | 12,585,000 | |

| | | | | | | | 51,157,750 | |

| Electronic Equipment, Instruments & Components — 3.5% | | | | | | | | |

| Avnet, Inc. | | | 385,000 | | | | 16,982,350 | |

| FLIR Systems, Inc. | | | 650,000 | | | | 19,565,000 | |

Plexus Corp. (a) | | | 100,000 | | | | 4,329,000 | |

Sanmina Corp. (a) | | | 200,000 | | | | 3,340,000 | |

| | | | | | | | 44,216,350 | |

| Internet Software & Services — 2.3% | | | | | | | | |

| j2 Global, Inc. | | | 374,000 | | | | 18,703,740 | |

VistaPrint N.V. (a) | | | 177,000 | | | | 10,062,450 | |

| | | | | | | | 28,766,190 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 101.0% (continued) | | | | | | |

| Information Technology — 27.6% (continued) | | | | | | |

| IT Services — 3.0% | | | | | | |

| Amdocs Ltd. | | | 144,000 | | | $ | 5,938,560 | |

| International Business Machines Corp. | | | 60,000 | | | | 11,254,200 | |

Sapient Corp. (a) | | | 453,000 | | | | 7,864,080 | |

| Western Union Co. (The) | | | 750,000 | | | | 12,937,500 | |

| | | | | | | | 37,994,340 | |

| Office Electronics — 0.3% | | | | | | | | |

Zebra Technologies Corp. - Class A (a) | | | 75,000 | | | | 4,056,000 | |

| | | | | | | | | |

| Semiconductors & Semiconductor Equipment — 6.2% | | | | | | | | |

| Avago Technologies Ltd. | | | 250,000 | | | | 13,222,500 | |

First Solar, Inc. (a) | | | 250,000 | | | | 13,660,000 | |

| Intel Corp. | | | 750,000 | | | | 19,470,000 | |

| NVIDIA Corp. | | | 500,000 | | | | 8,010,000 | |

SunEdison, Inc. (a) | | | 1,000,000 | | | | 13,050,000 | |

SunPower Corp. (a) | | | 400,000 | | | | 11,924,000 | |

| | | | | | | | 79,336,500 | |

| Software — 5.2% | | | | | | | | |

Adobe Systems, Inc. (a) | | | 225,000 | | | | 13,473,000 | |

| CA, Inc. | | | 476,000 | | | | 16,017,400 | |

| Microsoft Corp. | | | 550,000 | | | | 20,586,500 | |

| Open Text Corp. | | | 90,000 | | | | 8,276,400 | |

| Symantec Corp. | | | 300,000 | | | | 7,074,000 | |

| | | | | | | | 65,427,300 | |

| Materials — 0.5% | | | | | | | | |

| Metals & Mining — 0.5% | | | | | | | | |

| Barrick Gold Corp. | | | 200,000 | | | | 3,526,000 | |

| Newmont Mining Corp. | | | 100,000 | | | | 2,303,000 | |

| | | | | | | | 5,829,000 | |

| Utilities — 1.5% | | | | | | | | |

| Electric Utilities — 1.5% | | | | | | | | |

| Edison International | | | 250,000 | | | | 11,575,000 | |

| PPL Corp. | | | 250,000 | | | | 7,522,500 | |

| | | | | | | | 19,097,500 | |

| | | | | | | | | |

Total Common Stocks (Cost $1,091,739,090) | | | | | | $ | 1,282,245,965 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

PUT OPTION CONTRACTS — 1.0% | | | | | | |

| Nasdaq 100 Index Option, 03/22/2014 at $3,300 | | | 500 | | | $ | 1,253,000 | |

| Russell 2000 Index Option, 03/22/2014 at $1,100 | | | 1,500 | | | | 2,704,500 | |

| S&P 500 Index Option, 02/22/2014 at $1,800 | | | 5,000 | | | | 9,500,000 | |

Total Put Option Contracts (Cost $13,123,572) | | | | | | $ | 13,457,500 | |

CALL OPTION CONTRACTS — 0.3% | | | | | | |

| S&P 500 Index Option, 01/18/2014 at $1,870 (Cost $2,480,677) | | | 5,000 | | | $ | 3,700,000 | |

| | | | | | | | | |

Total Investments at Value — 102.3% (Cost $1,107,343,339) | | | | | | $ | 1,299,403,465 | |

MONEY MARKET FUNDS — 45.3% | | | | | | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.00% (b) | | | 173,083,447 | | | $ | 173,083,447 | |

First American Treasury Obligations Fund - Class Y, 0.00% (b) | | | 401,447,973 | | | | 401,447,973 | |

Total Money Market Funds (Cost $574,531,420) | | | | | | $ | 574,531,420 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 147.6% | | | | | | | | |

| (Cost $1,681,874,759) | | | | | | $ | 1,873,934,885 | |

| | | | | | | | | |

| Written Call Option Contracts — (46.8%) | | | | | | | (594,119,500 | ) |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.8%) | | | | | | | (10,449,161 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 1,269,366,224 | |

| ADR - American Depositary Receipt. |

| (a) | Non-income producing security. |

| (b) | The rate shown is the 7-day effective yield as of December 31, 2013. |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts |

December 31, 2013 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| Nasdaq 100 Index Option, | | | | | | | | | |

| 03/22/2014 at $1,800 | | | 500 | | | $ | 89,173,000 | | | $ | 83,299,332 | |

| Russell 2000 Index Option, | | | | | | | | | | | | |

| 03/22/2014 at $620 | | | 1,500 | | | | 81,046,500 | | | | 75,065,497 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

| 01/18/2014 at $1,000 | | | 5,000 | | | | 423,900,000 | | | | 401,243,324 | |

| Total Written Call Option Contracts | | | | | | $ | 594,119,500 | | | $ | 559,608,153 | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Schedule of Investments |

December 31, 2013 (Unaudited) |

| | | | | | |

Energy — 0.0% (a) | | | | | | |

Oil, Gas & Consumable Fuels — 0.0% (a) | | | | | | |

| NuStar Energy L.P. | | | 1,000 | | | $ | 50,990 | |

| ONEOK Partners L.P. | | | 1,000 | | | | 52,650 | |

| Williams Partners L.P. | | | 1,000 | | | | 50,860 | |

| | | | | | | | 154,500 | |

| Materials — 6.0% | | | | | | | | |

| Metals & Mining — 6.0% | | | | | | | | |

| Agnico-Eagle Mines Ltd. | | | 300,000 | | | | 7,914,000 | |

| AngloGold Ashanti Ltd. - ADR | | | 500,000 | | | | 5,860,000 | |

| Barrick Gold Corp. | | | 600,000 | | | | 10,578,000 | |

| Compañía de Minas Buenaventura S.A. - ADR | | | 100,000 | | | | 1,122,000 | |

| Gold Fields Ltd. - ADR | | | 250,000 | | | | 800,000 | |

| Goldcorp, Inc. | | | 25,000 | | | | 541,750 | |

| Harmony Gold Mining Co. Ltd. - ADR | | | 500,000 | | | | 1,265,000 | |

| Newmont Mining Corp. | | | 400,000 | | | | 9,212,000 | |

| Randgold Resources Ltd. - ADR | | | 60,000 | | | | 3,768,600 | |

| Sibanye Gold Ltd. - ADR | | | 119,000 | | | | 572,390 | |

Stillwater Mining Co. (b) | | | 10,000 | | | | 123,400 | |

| | | | | | | | 41,757,140 | |

| Utilities — 3.3% | | | | | | | | |

| Electric Utilities — 2.5% | | | | | | | | |

| American Electric Power Co., Inc. | | | 50,000 | | | | 2,337,000 | |

| Duke Energy Corp. | | | 333 | | | | 22,981 | |

| Edison International | | | 1,000 | | | | 46,300 | |

| Entergy Corp. | | | 75,000 | | | | 4,745,250 | |

| Exelon Corp. | | | 150,000 | | | | 4,108,500 | |

| FirstEnergy Corp. | | | 1,000 | | | | 32,980 | |

| NextEra Energy, Inc. | | | 1,000 | | | | 85,620 | |

| Pepco Holdings, Inc. | | | 1,000 | | | | 19,130 | |

| Pinnacle West Capital Corp. | | | 1,000 | | | | 52,920 | |

| PPL Corp. | | | 200,000 | | | | 6,018,000 | |

| UNS Energy Corp. | | | 1,000 | | | | 59,850 | |

| | | | | | | | 17,528,531 | |

| Multi-Utilities — 0.8% | | | | | | | | |

| Ameren Corp. | | | 1,000 | | | | 36,160 | |

| Dominion Resources, Inc. | | | 1,000 | | | | 64,690 | |

| DTE Energy Co. | | | 1,000 | | | | 66,390 | |

| PG&E Corp. | | | 50,000 | | | | 2,014,000 | |

| Public Service Enterprise Group, Inc. | | | 100,000 | | | | 3,204,000 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 9.3% (continued) | | | | | | |

| Utilities — 3.3% (continued) | | | | | | |

| Multi-Utilities — 0.8% (continued) | | | | | | |

| SCANA Corp. | | | 1,000 | | | $ | 46,930 | |

| TECO Energy, Inc. | | | 1,000 | | | | 17,240 | |

| | | | | | | | 5,449,410 | |

| | | | | | | | | |

Total Common Stocks (Cost $67,458,988) | | | | | | $ | 64,889,581 | |

U.S. TREASURY OBLIGATIONS — 79.9% | | | | | | |

| U.S. Treasury Inflation-Protected Notes — 6.3% | | | | | | |

| 2.00%, due 07/15/2014 | | $ | 30,977,500 | | | $ | 31,679,326 | |

| 2.50%, due 01/15/2029 | | | 10,878,700 | | | | 12,801,173 | |

| | | | | | | | 44,480,499 | |

| U.S. Treasury Notes — 73.6% | | | | | | | | |

| 1.75%, due 05/15/2022 | | | 100,000,000 | | | | 92,484,400 | |

| 1.625%, due 11/15/2022 | | | 200,000,000 | | | | 180,554,600 | |

| 2.50%, due 08/15/2023 | | | 50,000,000 | | | | 48,021,500 | |

| 2.75%, due 11/15/2023 | | | 200,000,000 | | | | 195,671,800 | |

| | | | | | | | 516,732,300 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $586,947,101) | | | | | | $ | 561,212,799 | |

EXCHANGE-TRADED FUNDS — 1.8% | | | | | | |

iShares Gold Trust (b) | | | 150,000 | | | $ | 1,752,000 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 160,000 | | | | 9,352,000 | |

SPDR Gold Trust (b) | | | 15,000 | | | | 1,742,550 | |

Total Exchange-Traded Funds (Cost $10,884,365) | | | | | | $ | 12,846,550 | |

| | | | | | | | | |

Total Investments at Value — 91.0% (Cost $665,290,454) | | | | | | $ | 638,948,930 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

MONEY MARKET FUNDS — 9.7% | | | | | | |

Federated U.S. Treasury Cash Reserves Fund - Institutional Shares, 0.00% (c) | | | 20,348,896 | | | $ | 20,348,896 | |

First American Treasury Obligations Fund - Class Y, 0.00% (c) | | | 47,480,754 | | | | 47,480,754 | |

Total Money Market Funds (Cost $67,829,650) | | | | | | $ | 67,829,650 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 100.7% | | | | | | | | |

| (Cost $733,120,104) | | | | | | $ | 706,778,580 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (0.7%) | | | | | | | (4,650,326 | ) |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 702,128,254 | |

| ADR - American Depositary Receipt. |

| (a) | Percentage rounds to less than 0.1%. |

| (b) | Non-income producing security. |

| (c) | The rate shown is the 7-day effective yield as of December 31, 2013. |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Investments |

December 31, 2013 (Unaudited) |

| | | | | | |

| Australia — 1.7% | | | | | | |

Cochlear Ltd. (a) | | | 3,000 | | | $ | 158,075 | |

Seven West Media Ltd. (a) | | | 325,000 | | | | 684,893 | |

Sonic Healthcare Ltd. (a) | | | 63,000 | | | | 935,030 | |

| | | | | | | | 1,777,998 | |

| Austria — 0.7% | | | | | | | | |

| OMV AG | | | 15,000 | | | | 717,961 | |

| | | | | | | | | |

| Belgium — 0.6% | | | | | | | | |

Colruyt S.A. (a) | | | 12,000 | | | | 670,529 | |

| | | | | | | | | |

| Canada — 4.0% | | | | | | | | |

| Gildan Activewear, Inc. | | | 22,000 | | | | 1,172,436 | |

| MacDonald, Dettwiler and Associates Ltd. | | | 10,000 | | | | 774,770 | |

| Pizza Pizza Royalty Corp. | | | 10,000 | | | | 125,206 | |

| Shaw Communications, Inc. - Class B | | | 48,000 | | | | 1,168,087 | |

| Transcontinental, Inc. - Class A | | | 15,000 | | | | 206,449 | |

| WestJet Airlines Ltd. | | | 30,000 | | | | 786,538 | |

| | | | | | | | 4,233,486 | |

| China — 1.7% | | | | | | | | |

| Mindray Medical International Ltd. - ADR | | | 22,500 | | | | 818,100 | |

| NetEase.com, Inc. - ADR | | | 8,000 | | | | 628,800 | |

WuXi PharmaTech (Cayman), Inc. - ADR (b) | | | 10,000 | | | | 383,800 | |

| | | | | | | | 1,830,700 | |

| Finland — 1.4% | | | | | | | | |

| Atria plc | | | 16,860 | | | | 179,305 | |

Lassila & Tikanoja Oyj (a) (b) | | | 45,000 | | | | 942,339 | |

Tieto Oyj (a) | | | 15,000 | | | | 339,750 | |

| | | | | | | | 1,461,394 | |

| France — 6.1% | | | | | | | | |

Albioma S.A. (a) | | | 12,090 | | | | 280,404 | |

Alten (a) | | | 25,000 | | | | 1,135,132 | |

Bouygues S.A. (a) | | | 15,000 | | | | 567,278 | |

Casino Guichard-Perrachon S.A. (a) | | | 7,500 | | | | 865,458 | |

Électricité de France S.A. (a) | | | 15,000 | | | | 530,696 | |

| Infotel S.A. | | | 3,066 | | | | 297,594 | |

Metropole Television S.A. (a) | | | 12,500 | | | | 286,295 | |

Neopost S.A. (a) | | | 14,000 | | | | 1,080,424 | |

| Norbert Dentressangle S.A. | | | 2,000 | | | | 257,274 | |

| Sanofi - ADR | | | 22,100 | | | | 1,185,223 | |

| | | | | | | | 6,485,778 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 54.6% (continued) | | | | | | |

| Germany — 1.6% | | | | | | |

Deutsche Telekom AG (a) | | | 60,000 | | | $ | 1,033,887 | |

Wincor Nixdorf AG (a) | | | 10,000 | | | | 694,191 | |

| | | | | | | | 1,728,078 | |

| India — 0.4% | | | | | | | | |

| Wipro Ltd. - ADR | | | 30,718 | | | | 386,740 | |

| | | | | | | | | |

| Italy — 1.3% | | | | | | | | |

Atlantia S.P.A. (a) | | | 35,000 | | | | 784,052 | |

Società Iniziative Autostradali e Servizi S.P.A. (a) | | | 60,000 | | | | 596,865 | |

| | | | | | | | 1,380,917 | |

| Japan — 11.4% | | | | | | | | |

ABC-MART, Inc. (a) | | | 20,000 | | | | 873,893 | |

Central Japan Railway Co. (a) | | | 3,500 | | | | 412,541 | |

DISCO Corp. (a) | | | 10,000 | | | | 663,825 | |

KDDI Corp. (a) | | | 19,000 | | | | 1,170,857 | |

K's Holdings Corp. (a) | | | 14,000 | | | | 404,633 | |

Mochida Pharmaceutical Co. Ltd. (a) | | | 10,000 | | | | 594,557 | |

Nitori Holdings Co. Ltd. (a) | | | 2,000 | | | | 189,381 | |

Nomura Research Institute Ltd. (a) | | | 20,000 | | | | 632,147 | |

Ricoh Co. Ltd. (a) | | | 50,000 | | | | 531,817 | |

Shionogi & Co. Ltd. (a) | | | 40,000 | | | | 868,511 | |

SoftBank Corp. (a) | | | 10,000 | | | | 877,633 | |

Sogo Medical Co. Ltd. (a) | | | 15,000 | | | | 571,323 | |

Sugi Holdings Co. Ltd. (a) | | | 23,000 | | | | 934,504 | |

Sundrug Co. Ltd. (a) | | | 25,000 | | | | 1,116,867 | |

Takeda Pharmaceutical Co. Ltd. (a) | | | 10,500 | | | | 481,652 | |

Toppan Forms Co. Ltd. (a) | | | 66,900 | | | | 613,843 | |

Trend Micro, Inc. (a) | | | 15,000 | | | | 525,722 | |

Yamada Denki Co. Ltd. (a) | | | 100,000 | | | | 327,144 | |

YAOKO Co. Ltd. (a) | | | 8,600 | | | | 338,571 | |

| | | | | | | | 12,129,421 | |

| Netherlands — 1.0% | | | | | | | | |

| Reed Elsevier N.V. - ADR | | | 15,100 | | | | 644,317 | |

Ziggo N.V. (a) | | | 10,000 | | | | 457,314 | |

| | | | | | | | 1,101,631 | |

| New Zealand — 0.9% | | | | | | | | |

| Telecom Corp. of New Zealand Ltd. - ADR | | | 92,500 | | | | 876,530 | |

Warehouse Group Ltd. (The) (a) | | | 13,442 | | | | 41,387 | |

| | | | | | | | 917,917 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 54.6% (continued) | | | | | | |

| Norway — 0.9% | | | | | | |

| Ekornes ASA | | | 5,000 | | | $ | 67,811 | |

| Tomra Systems ASA | | | 95,000 | | | | 885,045 | |

| | | | | | | | 952,856 | |

| Portugal — 0.5% | | | | | | | | |

EDP Energias de Portugal S.A. (a) | | | 150,000 | | | | 551,004 | |

| | | | | | | | | |

| Spain — 4.7% | | | | | | | | |

EDP Renovàveis S.A. (a) | | | 125,000 | | | | 664,013 | |

Enagas S.A. (a) | | | 40,000 | | | | 1,044,950 | |

Iberdrola S.A. (a) | | | 175,000 | | | | 1,116,889 | |

Indra Sistemas S.A. (a) | | | 70,000 | | | | 1,171,875 | |

Red Electrica Corp. S.A. (a) | | | 15,000 | | | | 1,001,468 | |

| | | | | | | | 4,999,195 | |

| Sweden — 0.8% | | | | | | | | |

| Axfood AB | | | 6,500 | | | | 326,144 | |

Clas Ohlson AB - B Shares (a) | | | 30,000 | | | | 562,996 | |

| | | | | | | | 889,140 | |

| Switzerland — 2.1% | | | | | | | | |

Lonza Group AG (a) (b) | | | 12,000 | | | | 1,140,347 | |

| Novartis AG - ADR | | | 14,000 | | | | 1,125,320 | |

| | | | | | | | 2,265,667 | |

| Taiwan — 0.9% | | | | | | | | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 55,000 | | | | 959,200 | |

| | | | | | | | | |

| United Kingdom — 11.9% | | | | | | | | |

Admiral Group plc (a) | | | 48,000 | | | | 1,043,443 | |

| AstraZeneca plc - ADR | | | 21,500 | | | | 1,276,455 | |

| British Sky Broadcasting Group plc | | | 70,000 | | | | 978,389 | |

| GlaxoSmithKline plc - ADR | | | 23,500 | | | | 1,254,665 | |

Inmarsat plc (a) | | | 60,000 | | | | 752,337 | |

J Sainsbury plc (a) | | | 180,000 | | | | 1,089,460 | |

| J.D. Wetherspoon plc | | | 26,849 | | | | 338,586 | |

Marks & Spencer Group plc (a) | | | 40,000 | | | | 287,251 | |

| National Grid plc - ADR | | | 10,500 | | | | 685,860 | |

| Reckitt Benckiser Group plc - ADR | | | 75,000 | | | | 1,206,750 | |

| Smith & Nephew plc - ADR | | | 19,500 | | | | 1,398,930 | |

SSE plc (a) | | | 35,000 | | | | 795,391 | |

Tesco plc (a) | | | 190,000 | | | | 1,055,192 | |

William Morrison Supermarkets plc (a) | | | 80,000 | | | | 346,324 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

COMMON STOCKS — 54.6% (continued) | | | | | | |

| United Kingdom — 11.9% (continued) | | | | | | |

WS Atkins plc (a) | | | 10,000 | | | $ | 234,904 | |

| | | | | | | | 12,743,937 | |

| | | | | | | | | |

Total Common Stocks (Cost $47,988,844) | | | | | | $ | 58,183,549 | |

EXCHANGE-TRADED FUNDS — 8.2% | | | | | | |

| iShares MSCI Belgium Index Fund | | | 107,000 | | | $ | 1,753,719 | |

| iShares MSCI Germany Index Fund | | | 55,000 | | | | 1,746,800 | |

| iShares MSCI Netherlands Index Fund | | | 68,000 | | | | 1,763,240 | |

| iShares MSCI Sweden Index Fund | | | 49,500 | | | | 1,773,585 | |

| iShares MSCI Switzerland Index Fund | | | 52,500 | | | | 1,731,975 | |

Total Exchange-Traded Funds (Cost $7,927,293) | | | | | | $ | 8,769,319 | |

PUT OPTION CONTRACTS — 0.0% (c) | | | | | | |

| S&P 500 Index Option, 03/22/2014 at $1,150 (Cost $4,864) | | | 85 | | | $ | 6,800 | |

| | | | | | | | | |

Total Investments at Value — 62.8% (Cost $55,921,001) | | | | | | $ | 66,959,668 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2013 (Unaudited) |

MONEY MARKET FUNDS — 35.7% | | | | | | |

Northern Institutional Treasury Portfolio, 0.01% (d)

(Cost $38,001,332) | | | 38,001,332 | | | $ | 38,001,332 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 98.5% | | | | | | | | |

| (Cost $93,922,333) | | | | | | $ | 104,961,000 | |

| | | | | | | | | |

| Written Call Options — (5.5%) | | | | | | | (5,887,100 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 7.0% | | | | | | | 7,494,240 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 106,568,140 | |

| ADR - American Depositary Receipt. |

| (a) | Fair value priced (Note 1). Fair valued securities totaled $37,071,264 at December 31, 2013, representing 34.8% of net assets. |

| (b) | Non-income producing security. |

| (c) | Percentage rounds to less than 0.1%. |

| (d) | The rate shown is the 7-day effective yield as of December 31, 2013. |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Summary of Common Stocks by Sector and Industry |

December 31, 2013 (Unaudited) |

| |

| Consumer Discretionary — 7.6% | | |

| Hotels, Restaurants & Leisure | 0.4% |

| Household Durables | 0.1% |

| Media | 3.5% |

| Multiline Retail | 0.3% |

| Specialty Retail | 2.2% |

| Textiles, Apparel & Luxury Goods | 1.1% |

| Consumer Staples — 8.2% | | |

| Food & Staples Retailing | 6.9% |

| Food Products | 0.2% |

| Household Products | 1.1% |

| Energy — 0.7% | | |

| Oil, Gas & Consumable Fuels | 0.7% |

| Financials — 1.0% | | |

| Insurance | 1.0% |

| Health Care — 10.9% | | |

| Health Care Equipment & Supplies | 2.2% |

| Health Care Providers & Services | 0.9% |

| Life Sciences Tools & Services | 1.4% |

| Pharmaceuticals | 6.4% |

| Industrials — 5.4% | | |

| Air Freight & Logistics | 0.3% |

| Airlines | 0.7% |

| Commercial Services & Supplies | 2.5% |

| Professional Services | 0.2% |

| Road & Rail | 0.4% |

| Transportation Infrastructure | 1.3% |

| Information Technology — 10.0% | | |

| Computers & Peripherals | 0.7% |

| Internet Software & Services | 1.4% |

| IT Services | 2.8% |

| Office Electronics | 1.5% |

| Semiconductors & Semiconductor Equipment | 1.5% |

| Software | 2.1% |

| Materials — 0.5% | | |

| Construction Materials | 0.5% |

| Telecommunication Services — 4.0% | | |

| Diversified Telecommunication Services | 2.9% |

| Wireless Telecommunication Services | 1.1% |

| Utilities — 6.3% | | |

| Electric Utilities | 3.8% |

| Gas Utilities | 1.0% |

| Independent Power Producers & Energy Traders | 0.9% |

| Multi-Utilities | |

| | | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts |

December 31, 2013 (Unaudited) |

| | | | | | Aggregate Market Value of Contracts | | | | |

| Dollar Index Future | 03/17/2014 | | | 150 | | | $ | 12,042,750 | | | $ | (77,375 | ) |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Open Written Option Contracts |

December 31, 2013 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| S&P 500 Index Option, | | | | | | | | | |

| 03/22/2014 at $1,150 | | | 85 | | | $ | 5,887,100 | | | $ | 5,414,562 | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts Sold Short |

December 31, 2013 (Unaudited) |

FUTURES CONTRACTS SOLD SHORT | | | | | | Aggregate Market Value of Contracts | | | | |

| Euro STOXX 50 Index Future | 03/21/2014 | | | 800 | | | $ | 34,207,883 | | | $ | (1,721,176 | ) |

| FTSE 100 Index Future | 03/21/2014 | | | 150 | | | | 16,636,996 | | | | (599,404 | ) |

Total Futures Contracts Sold Short | | | | | | �� | $ | 50,844,879 | | | $ | (2,320,580 | ) |

| See accompanying notes to financial statements. |

Hussman Strategic Dividend Value Fund Schedule of Investments |

December 31, 2013 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 16.7% | | | | | | |

| Hotels, Restaurants & Leisure — 3.5% | | | | | | |

| Carnival Corp. | | | 8,000 | | | $ | 321,360 | |

| Darden Restaurants, Inc. | | | 5,500 | | | | 299,035 | |

| McDonald's Corp. | | | 5,000 | | | | 485,150 | |

| | | | | | | | 1,105,545 | |

| Household Durables — 0.2% | | | | | | | | |

| Koss Corp. | | | 15,000 | | | | 76,875 | |

| | | | | | | | | |