Washington, D.C. 20549

John F. Splain

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

HUSSMAN INVESTMENT TRUST

Hussman Strategic Growth Fund

Hussman Strategic Total Return Fund

Hussman Strategic International Fund

SEMI-ANNUAL REPORT

December 31, 2011

(Unaudited)

STRATEGIC GROWTH FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Growth Fund

versus the Standard & Poor’s 500 Index and the Russell 2000 Index(a)

Average Annual Total Returns For Periods Ended December 31, 2011 |

| | | | | | |

Hussman Strategic Growth Fund(b)(d) | 1.64% | 0.83% | (0.58)% | 4.44% | 6.52% |

| S&P 500 Index | 2.11% | 14.11% | (0.25)% | 2.92% | 0.55% |

| Russell 2000 Index | (4.18)% | 15.63% | 0.15% | 5.62% | 4.62% |

| (a) | Hussman Strategic Growth Fund invests in stocks listed on the New York, American, and NASDAQ exchanges, and does not specifically restrict its holdings to a particular market capitalization. The S&P 500 and Russell 2000 are indices of large and small capitalization stocks, respectively. “HSGFX equity investments and cash equivalents only (unhedged)” reflects the performance of the Fund’s stock investments and modest day-to-day cash balances, after fees and expenses, but excluding the impact of hedging transactions. The Fund’s unhedged equity investments do not represent a separately available portfolio, and their peformance is presented solely for purposes of comparison and performance attribution. |

| | |

| (b) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | The Fund commenced operations on July 24, 2000. |

| | |

| (d) | The Fund’s annualized expense ratio was 1.04% during the six months ended December 31, 2011. The expense ratio as disclosed in the November 1, 2011 prospectus was 1.05% for the year ended June 30, 2011, including acquired fund fees. |

STRATEGIC TOTAL RETURN FUND

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Barclays Capital U.S. Aggregate Bond Index

Average Annual Total Returns For Periods Ended December 31, 2011 |

| | | | | |

Hussman Strategic Total Return Fund(a)(c) | 4.00% | 5.62% | 7.13% | 7.08% |

Barclays Capital U.S. Aggregate Bond Index(d) | 7.84% | 6.77% | 6.50% | 5.40% |

| (a) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | The Fund commenced operations on September 12, 2002. |

| | |

| (c) | The Fund’s annualized expense ratio was 0.63% during the six months ended December 31, 2011. The expense ratio as disclosed in the November 1, 2011 prospectus was 0.72% for the year ended June 30, 2011, including acquired fund fees. |

| | |

| (d) | The Barclays Capital U.S. Aggregate Bond Index covers the U.S. investment grade fixed rate bond market, with index components for U.S. government, agency and corporate securities. The Fund does not invest solely in securities included in the Barclays Capital U.S. Aggregate Bond Index and may invest in other types of bonds, common stocks and etc. |

STRATEGIC INTERNATIONAL FUND

Comparison of the Change in Value of a $10,000 Investment in

Hussman Strategic International Fund versus the MSCI EAFE Index

Average Annual Total Returns For Periods Ended December 31, 2011 |

| | | |

Hussman Strategic International Fund(a)(c) | (3.93)% | 0.27% |

MSCI EAFE Index(d) | (12.14)% | (2.70)% |

| (a) | Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (b) | The Fund commenced operations on December 31, 2009. |

| | |

| (c) | The Fund’s annualized expense ratio was 2.00% during the six months ended December 31, 2011. The expense ratio as disclosed in the November 1, 2011 prospectus was 2.08% for the year ended June 30, 2011, including acquired fund fees. |

| | |

| (d) | The MSCI EAFE (Europe, Australasia, and Far East) Index is a free float weighted capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada. As of December 31, 2011, the MSCI EAFE Index consisted of the following 22 developed market country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The Fund may not invest in all of the countries represented in the MSCI EAFE Index and may invest in securities that are not included in the MSCI EAFE Index. |

For the year ended December 31, 2011, Strategic Growth Fund achieved a total return of 1.64%, Strategic Total Return Fund achieved a total return of 4.00%, and Strategic International Fund lost -3.93%.

Strategic Growth Fund has achieved an average annual total return of 6.52% from its inception on July 24, 2000 through December 31, 2011, compared with an average annual return of 0.55% for the S&P 500 Index over the same period. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $20,601, compared with $10,649 for the same investment in the S&P 500 Index. The deepest loss experienced by the Fund since inception was -21.45%, compared with a maximum loss of -55.25% for the S&P 500 Index.

Strategic Total Return Fund has achieved an average annual total return of 7.08% from its inception on September 12, 2002 through December 31, 2011, compared with an average annual total return of 5.40% for the Barclays Capital U.S. Aggregate Bond Index for that period. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $18,902, compared with $16,310 for the same investment in the Barclays Capital U.S. Aggregate Bond Index. The deepest loss experienced by the Fund since inception was -11.52%, compared with a maximum loss of -5.08% for the Barclays Capital U.S. Aggregate Bond Index.

Strategic International Fund has achieved an average annual total return of 0.27% from its inception December 31, 2009 through December 31, 2011, compared with an average annual total return of -2.70% for the MSCI EAFE Index for that period. An initial $10,000 investment in the Fund on December 31, 2009 would have grown to $10,054, compared with $9,467 for the same investment in the MSCI EAFE Index. The deepest loss experienced by the Fund since inception was -7.92%, compared with a maximum loss of -26.93% for the MSCI EAFE Index.

Credit concerns remained a significant focus of the financial markets in 2011, with the modest 2.11% total return of the S&P 500 Index masking a great deal of volatility during the year. Meanwhile, the yield on 30-year U.S. Treasury securities plunged from 4.33% to 2.89% during the year, driven by strong “safe haven” demand for Treasury securities in the face of government debt strains affecting a number of European countries. As credit concerns mounted, the European Central Bank (ECB) introduced changes in the quality of collateral it would accept in return for 3-year loans. Notably, the list of acceptable collateral was revised to include new, unlisted

|

Letter to Shareholders (continued) |

debt issued by European banks - essentially allowing distressed banks to issue bonds to themselves and then pledge those bonds to the ECB as collateral for newly created Euros. While I believe that these actions are hostile to the long-term stability of the global financial system, they provided short-term relief for the distressed European banking system, and the global stock markets enjoyed a year-end advance from their mid-year lows.

Meanwhile, as leading economic measures broadly deteriorated, the retreat in credit concerns supported a burst of economic activity late in the year. This created a divergence between numerous historically reliable leading indicators, which remained unfavorable at the end of 2011, and widely followed coincident indicators (such as employment and various regional surveys), which enjoyed a rebound. It remains unclear whether the late-year increase in activity represented a temporary release of pent-up demand, or whether it reflects a more durable improvement in economic activity.

Over the past few quarters, Strategic Growth Fund has enjoyed muted volatility and positive returns during market declines, but also a moderately inverse relationship versus the S&P 500 Index during market advances. This behavior isn’t a general feature of our hedging approach, but rather the reflection of two factors that are currently in place. One is our significant “underweight” in financials, materials, cyclicals and other “risk on” sectors that we view as speculative, and where we find few candidates that satisfy the discounted cash flow criteria that we rely on in large part for stock selection. While our stock selection has significantly outperformed the S&P 500 Index over time, our continued avoidance of financials does introduce some inverse behavior in our hedged investment position during periods of “risk on” speculation.

The other related factor is that the past several quarters have been a constant cycle of “hot potato” between recession risk and what we identify as an “overvalued, overbought, overbullish” syndrome where market valuations, recent price trends, and investor sentiment are overextended at the same time. The result is that one or the other has generally kept us in a tightly hedged investment position. In our most defensive stance, we typically endure some decay in option value during market advances, because we raise the strike prices of our put options in order to defend against indiscriminate selling that often follows, as we saw during sharp market declines in 2010 and 2011. The overall result is that the Fund has typically enjoyed positive returns when the market plunges, but has experienced some erosion during speculative periods.

|

Letter to Shareholders (continued) |

During 2011, Strategic Growth Fund and Strategic International Fund remained largely hedged against the impact of market fluctuations. Strategic Total Return Fund generally held a conservative duration (a measure of interest-rate sensitivity and effective bond maturity) between 2-4 years during 2011, primarily in U.S. Treasury securities. The Fund also benefited from investments in precious metals and utility shares, which ranged from less than 2% of net assets early in the year, to slightly more than 20% of net assets by mid-year, followed by a gradual reduction in these holdings late in 2011.

| Risk Management and Stress Testing |

One of the main approaches we use to estimate return and risk prospects is to group current market conditions among historical instances that are most similar. Each point in history is defined by various “features” based on a broad range of key factors, including valuations, measures of market action, investor sentiment, economic factors, and so forth. In order to make the analysis less dependent on any particular historical period (e.g., post-war data, bubble-era data, Depression-era data), or any single set of indicators, we extend this analysis to a very large number of randomly selected sub-samples across history.

This sort of analysis is an example of an “ensemble method” of modeling which has several benefits, the two most important being on measures of “accuracy” and “robustness.” It is not difficult to fit a model to past data, but those models often break down quickly in new data. So to evaluate accuracy, we estimate return and risk on data that the model has not “seen” previously, and find that the ensemble approach generally performs better than alternative methods. Equally important, ensembles tend to be robust to very large changes in the underlying economic environment, because randomizing over numerous sub-samples of history reduces the likelihood that the model is “over-fitted” to a particular set of economic conditions.

Though I wrote numerous commentaries anticipating much of what actually occurred during the credit crisis, I certainly did not anticipate what I still consider to be terrible policy mistakes - particularly the absolute unwillingness to restructure bad debt, in preference for kicking the can down the road with public funds. It was a far cry from how U.S. regulators had responded to the S&L crisis, and how other international banking crises had been successfully addressed. (For example, in the early 1990’s, the Swedish banking crisis was durably resolved by the government taking receivership of a large portion of the banking industry, wiping out existing shareholders, writing down bad assets, and then taking the banks public to recapitalize them under new owners.)

|

Letter to Shareholders (continued) |

In response to the 2008-2009 crisis, I believed that it was the responsibility of portfolio managers to stress-test each aspect of their investment approach, though I am still not convinced that much of Wall Street has stress-tested anything at all. For us, stress-testing meant taking our models to Depression-era data, because it was clear that events of the time were largely “out of sample” from the standpoint of post-war data. At the time, we were basing our estimates of market risk and return on data since about 1950, which I had expected was sufficient to capture “modern” market behavior. Prior to 2008, it seemed unlikely that the U.S. would face Depression-like credit strains again.

While our existing hedging approach performed well in Depression-era data overall, the occasional losses were far deeper than I was willing to risk for our shareholders. The result was what I called a “two-data sets” problem, which demanded that our hedging methods perform well, out-of-sample, and with tolerable risk, in data drawn from both post-war and Depression-era periods. We reached a satisfactory solution in late 2010 with the introduction of our ensemble approach. For the full period, we avoided a significant portion of the market’s 2007-2009 downturn, but in hindsight, the need to alter our hedging methods in response to the credit crisis led us to miss a rebound in 2009 that we should not have missed, had our present approach been already in hand.

As always, the hedging strategies used by the Hussman Funds are intended to be applied over a complete market cycle - generally several years, but in any event comprising a complete bull and bear market. Our approach to managing risk may result in lagging performance during the overvalued, overextended portions of a given cycle, but it has repeatedly demonstrated value over complete bull-bear market cycles, both adding returns and defending against severe market losses (exceeding 50% on two separate occasions in the last decade alone).

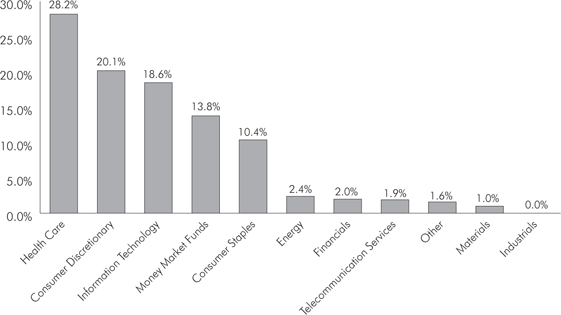

As of December 31, 2011, Strategic Growth Fund had net assets of $5,772,828,014, and held approximately 150 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were health care (33.5%), consumer discretionary (23.9%), information technology (22.0%), and consumer staples (12.4%). The smallest sector weights relative to the S&P 500 Index were in energy (2.8%), telecommunications (2.3%), financials (2.3%), materials (1.2%), and industrials (less than 0.1%). |

Letter to Shareholders (continued) |

The Fund’s holdings of individual stocks as of December 31, 2011 accounted for $5,792,612,946, or 100% of net assets. Against these stock positions, the Fund also held 37,000 option combinations (long put option/short call option) on the S&P 500 Index, 8,000 option combinations on the Russell 2000 Index and 2,000 option combinations on the Nasdaq 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 31, 2011, the S&P 500 Index closed at 1,257.60, while the Russell 2000 Index and the Nasdaq 100 Index closed at 740.92 and 2,277.83, respectively. The Fund’s total hedge therefore represented a short position of $5,701,422,000, thereby hedging 98.4% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following holdings achieved gains in excess of $10 million during the semi-annual period ended December 31, 2011: Panera Bread, Apple, Synaptics, AutoZone, Dollar Tree Stores, Humana, Ross Stores, Starbucks, MasterCard, Cisco Systems, and Amazon.com. Holdings with losses in excess of $25 million during this same period were First Solar, Illumina, SunPower, BMC Software, and Life Technologies.

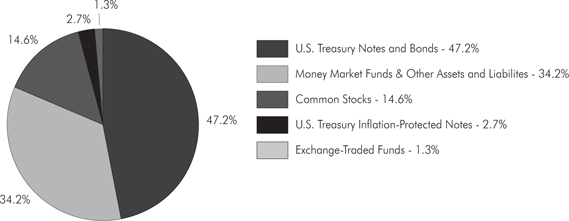

As of December 31, 2011, Strategic Total Return Fund had net assets of $2,728,550,834. Treasury notes, Treasury bonds, Treasury Inflation-Protected Securities (TIPS) and shares of money market funds represented 83.9% of the Fund’s net assets. Precious metals shares, utility and energy shares, and exchange-traded funds (ETFs) accounted for 13.2%, 1.4% and 1.3% of net assets, respectively. The Fund carried a duration of less than 4 years (meaning that a 1% change in interest rates would be expected to impact the Fund’s asset value by less than 4% on the basis of bond price fluctuations).

In Strategic Total Return Fund, during the semi-annual period ended December 31, 2011, portfolio gains in excess of $5 million were achieved in Newmont Mining, U.S. Treasury Note (1.75%, due 5/31/2016), U.S. Treasury Note (2.125%, due 8/15/2021), Randgold Resources-ADR, U.S. Treasury Bond (3.75%, due 8/15/2041), U.S. Treasury Note (2.25%, due 3/31/2016), U.S. Treasury Inflation-Protected Note (2.50%, due 1/15/2029), and U.S. Treasury Note (2.00%, due 4/30/2016). Holdings with losses in excess of $1 million during this same period were NuStar Energy, Freeport-McMoRan Copper & Gold, Harmony Gold Mining-ADR, Goldcorp, and Agnico-Eagle Mines.

|

Letter to Shareholders (continued) |

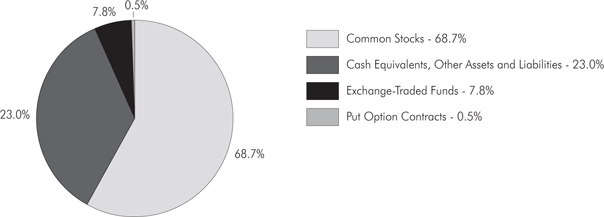

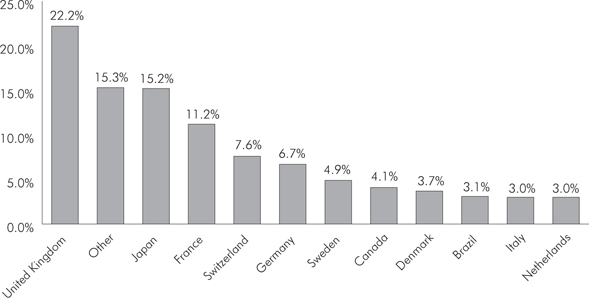

As of December 31, 2011, Strategic International Fund had net assets of $79,052,209 and held approximately 125 stocks in a wide variety of industries. The largest sectors as a percent of net assets were in health care (11.7%), consumer discretionary (11.2%), telecommunications (10.5%), consumer staples (9.4%), information technology (8.4%), and industrials (8.0%). The smallest sector weights were in utilities (5.5%), energy (3.0%), and materials (1.0%). Shares of exchange-traded funds and money market funds accounted for 7.8% and 13.6% of net assets, respectively. The total value of equities and ETF shares held by the Fund was $60,497,717.

In order to hedge the impact of general market fluctuations, as of December 31, 2011, Strategic International Fund held 185 option combinations (long put option/short call option) on the S&P 500 Index, and was short 750 futures on the Euro STOXX 50 Index and 150 futures on the FTSE 100 Index. The combined notional value of these hedges was $58,731,037, hedging 97.1% of the value of equity and ETF investments held by the Fund. When the Fund is in a hedged investment position, the primary driver of Fund returns is the difference in performance between the stocks owned by the Fund and the indices that are used to hedge.

While Strategic International Fund is widely diversified and its performance is affected by numerous investment positions, the hedging strategy of the Fund was primarily responsible for the reduced sensitivity of the Fund to market fluctuations from the Fund’s inception through December 31, 2011. Individual equity holdings having portfolio gains in excess of $75,000 during the semi-annual period ended December 31, 2011 included Bunzl, Royal Dutch Shell–ADR, William Morrison Supermarkets, and Next. Holdings with portfolio losses in excess of $200,000 during this same period included Norbert Dentressangle, Enel, H. Lundbeck, iShares MSCI Germany Index Fund, DeNA, Recordati, Telecom Argentina-ADR, and CENTROTEC Sustainable.

Supplementary information including quarterly returns and equity-only performance is available on the Hussman Funds website at www.hussmanfunds.com.

Recent quarters have been largely characterized by a fragile underlying global economy coupled with a persistently overvalued stock market (though to varying degrees). We have seen little during this period but the effect of a hot potato being repeatedly passed from speculative “overvalued, overbought, overbullish” market

|

Letter to Shareholders (continued) |

conditions fueled by massive central bank interventions, to renewed credit strains and emerging economic pressures that appear nearly the instant those interventions are even temporarily suspended. By turns, we’ve seen the repeated emergence of the same speculative conditions that have historically accompanied major and intermediate market peaks, followed by credit strains and economic pressures that reflect an unresolved overhang of global debt. The alternation is certainly not typical of market history. Nor is it typical of a complete market cycle or business cycle. As unsatisfactory as it may be, the market is presently in an extended game of “hot potato” which will be resolved by the market’s eventual departure from both environments.

The more extended period since 2000 has been generally characterized by unusually rich valuations, which is duly reflected in the annual average total return of 0.21%, including dividends, that the S&P 500 achieved from its 2000 peak through the end of 2011. That is not an accident, but instead approximates the total return that we projected for the S&P 500 more than a decade ago, based on our standard valuation methodology. Given this outcome, it should be clear that the generally defensive stance of Strategic Growth Fund during this period is no fixed aspect of investment strategy or personal temperament, but instead owes far more to the repeatedly and predictably disastrous overvaluation of the stock market since the late 1990’s.

Such a richly overvalued period is unique in U.S. stock market history, and as a direct result, 12-year periods of virtually zero returns are also rare. Only two periods come close. The stock market suffered negative returns in the 12 years after the 1929 peak, which started with the S&P 500 at about 22 times cyclically-adjusted earnings (the 10-year average of prior inflation-adjusted earnings). Stocks also achieved an average annual total return of just 3.7% in the 12 years between 1963 and 1975, owing to the unfortunate combination of a high starting valuation, with a starting price-earnings multiple of about 21, and a low ending valuation, with a multiple below 9. That depressed valuation in 1975 then set the groundwork for over two decades of excellent market returns.

As of February 2012, the S&P 500 is again at a multiple of over 22 times cyclically-adjusted earnings. Regardless of economic prospects, this is a strong headwind. As of February 2012, we estimate that the S&P 500 is likely to achieve an average annual total return of just 4.4% over the coming decade. However, this does not imply that strong investment opportunities will remain scarce for another decade. Projected long-term returns can rise quickly when the stock market declines significantly, which appears likely to occur within a far shorter period than a decade.

|

Letter to Shareholders (continued) |

Unfortunately, it is both dangerous to speculate, and utterly frustrating to remain defensive, in richly overvalued markets coupled with significant economic risks or strenuously overbought conditions. This is the environment we are presented with, and it is in no way typical of “standard” market conditions, despite its repetition in recent years.

Even so, it is notable that less than half of a bull market gain is typically retained by the end of the subsequent bear market. There is very little chance, in my view, that market gains from present levels will be retained by investors over the remainder of the current cycle. There appears equally little chance that investors who are willing to accept significant risk now will be prompted to reduce their risk later, until they encounter a market decline that is - by then - nearly impossible to act upon. The value of avoiding major losses is clear from the arithmetic of compounding: a 20% loss wipes out a 25% gain; a 30% loss wipes out a 43% gain; a 40% loss wipes out a 67% gain; and a 50% loss wipes out a 100% gain. Investors should not overlook the fact that the market has lost more than 50% of its value twice in the past decade, and remains overvalued on our measures (which correctly anticipated those losses).

We will certainly have periods where we appear remarkably out-of-step with the prevailing trend of the market, particularly in overvalued, overbought, overbullish periods of speculation. But defending against losses in these periods is essential to risk management, despite the tendency of bulls to declare victory at halftime. One of the reasons we so strongly discourage short-term investments in the Hussman Funds is that I hope - and also manage the Funds on the expectation - that shareholders will be with us through the completion of each bull-bear market cycle. For example, shareholders who initially invest in Strategic Growth Fund near major lows in the stock market are encouraged to set their investment horizon at least through the completion of the subsequent market cycle.

This period of overextended conditions and high recession uncertainty will end, and we will have opportunities to accept moderate or even significant amounts of market risk, with proportionately high expected returns. Whether the present gap between leading and coincident economic evidence closes in favor of recession or recovery, that gap will close. As investor sentiment and short-term price movement experience a normal ebb-and-flow, I expect that at least some opportunity to accept market risk will emerge even within the next few quarters. A major positive shift in our investment stance would most probably accompany a significant improvement in valuations, confirmed by improving market internals (a sequence that is characteristic |

Letter to Shareholders (continued) |

of early bull market advances). With the stock market characterized by an overvalued, overbought, overbullish syndrome of conditions, I do not believe that we are faced with such an opportunity here. This will change, and we will respond accordingly.

Always, I remain grateful for your trust.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted.

Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund Portfolio Information |

December 31, 2011 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

Hussman Strategic Total Return Fund Portfolio Information |

December 31, 2011 (Unaudited) |

| Asset Allocation (% of Net Assets) |

Hussman Strategic International Fund Portfolio Information |

December 31, 2011 (Unaudited) |

| Asset Allocation (% of Net Assets) |

| Country Allocation (% of Equity Holdings) |

Hussman Strategic Growth Fund Schedule of Investments |

December 31, 2011 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 23.9% | | | | | | |

| Diversified Consumer Services — 0.9% | | | | | | |

DeVry, Inc. | | | 300,000 | | | $ | 11,538,000 | |

H&R Block, Inc. | | | 1,500,000 | | | | 24,495,000 | |

ITT Educational Services, Inc. (a) | | | 250,000 | | | | 14,222,500 | |

| | | | | | | | 50,255,500 | |

| Hotels, Restaurants & Leisure — 5.9% | | | | | | | | |

Cheesecake Factory, Inc. (The) (a) | | | 2,292,000 | | | | 67,270,200 | |

Jack in the Box, Inc. (a) | | | 1,200,000 | | | | 25,080,000 | |

Panera Bread Co. - Class A (a) | | | 1,228,000 | | | | 173,700,600 | |

PF Chang's China Bistro, Inc. | | | 500,000 | | | | 15,455,000 | |

Starbucks Corp. | | | 1,250,000 | | | | 57,512,500 | |

| | | | | | | | 339,018,300 | |

| Household Durables — 0.2% | | | | | | | | |

Whirlpool Corp. | | | 216,000 | | | | 10,249,200 | |

| | | | | | | | | |

| Internet & Catalog Retail — 0.7% | | | | | | | | |

Amazon.com, Inc. (a) | | | 250,000 | | | | 43,275,000 | |

| | | | | | | | | |

| Leisure Equipment & Products — 1.3% | | | | | | | | |

Mattel, Inc. | | | 2,700,000 | | | | 74,952,000 | |

| | | | | | | | | |

| Media — 2.0% | | | | | | | | |

Comcast Corp. - Class A | | | 1,050,000 | | | | 24,895,500 | |

DIRECTV - Class A (a) | | | 550,000 | | | | 23,518,000 | |

DISH Network Corp. - Class A | | | 1,500,000 | | | | 42,720,000 | |

McClatchy Co. (The) - Class A (a) | | | 143,000 | | | | 341,770 | |

McGraw-Hill Cos., Inc. (The) | | | 500,000 | | | | 22,485,000 | |

New York Times Co. (The) - Class A (a) | | | 200,000 | | | | 1,546,000 | |

| | | | | | | | 115,506,270 | |

| Multiline Retail — 1.7% | | | | | | | | |

Family Dollar Stores, Inc. | | | 693,000 | | | | 39,958,380 | |

Kohl's Corp. | | | 1,250,000 | | | | 61,687,500 | |

| | | | | | | | 101,645,880 | |

| Specialty Retail — 9.3% | | | | | | | | |

Aéropostale, Inc. (a) | | | 4,551,000 | | | | 69,402,750 | |

American Eagle Outfitters, Inc. | | | 1,000,000 | | | | 15,290,000 | |

AutoZone, Inc. (a) | | | 195,000 | | | | 63,369,150 | |

Bed Bath & Beyond, Inc. (a) | | | 1,500,000 | | | | 86,955,000 | |

Best Buy Co., Inc. | | | 2,250,000 | | | | 52,582,500 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 100.4% (Continued) | | | | | | |

| Consumer Discretionary — 23.9% (Continued) | | | | | | |

| Specialty Retail — 9.3% (Continued) | | | | | | |

Buckle, Inc. (The) | | | 716,000 | | | $ | 29,262,920 | |

GameStop Corp. - Class A (a) | | | 1,112,000 | | | | 26,832,560 | |

Gap, Inc. (The) | | | 1,000,000 | | | | 18,550,000 | |

PetSmart, Inc. | | | 450,000 | | | | 23,080,500 | |

RadioShack Corp. | | | 1,000,000 | | | | 9,710,000 | |

Ross Stores, Inc. | | | 1,500,000 | | | | 71,295,000 | |

Staples, Inc. | | | 1,500,000 | | | | 20,835,000 | |

TJX Cos., Inc. (The) | | | 750,000 | | | | 48,412,500 | |

| | | | | | | | 535,577,880 | |

| Textiles, Apparel & Luxury Goods — 1.9% | | | | | | | | |

Coach, Inc. | | | 350,000 | | | | 21,364,000 | |

NIKE, Inc. - Class B | | | 300,000 | | | | 28,911,000 | |

Under Armour, Inc. - Class A (a) | | | 826,000 | | | | 59,298,540 | |

| | | | | | | | 109,573,540 | |

| Consumer Staples — 12.4% | | | | | | | | |

| Beverages — 3.3% | | | | | | | | |

Coca-Cola Co. (The) | | | 1,603,000 | | | | 112,161,910 | |

PepsiCo, Inc. | | | 1,177,000 | | | | 78,093,950 | |

| | | | | | | | 190,255,860 | |

| Food & Staples Retailing — 2.9% | | | | | | | | |

Kroger Co. (The) | | | 1,650,000 | | | | 39,963,000 | |

Sysco Corp. | | | 1,000,000 | | | | 29,330,000 | |

Walgreen Co. | | | 3,000,000 | | | | 99,180,000 | |

| | | | | | | | 168,473,000 | |

| Food Products — 1.4% | | | | | | | | |

Campbell Soup Co. | | | 1,055,000 | | | | 35,068,200 | |

ConAgra Foods, Inc. | | | 500,000 | | | | 13,200,000 | |

General Mills, Inc. | | | 400,000 | | | | 16,164,000 | |

Kellogg Co. | | | 250,000 | | | | 12,642,500 | |

| | | | | | | | 77,074,700 | |

| Household Products — 4.8% | | | | | | | | |

Clorox Co. (The) | | | 1,000,000 | | | | 66,560,000 | |

Colgate-Palmolive Co. | | | 1,000,000 | | | | 92,390,000 | |

Energizer Holdings, Inc. (a) | | | 250,000 | | | | 19,370,000 | |

Kimberly-Clark Corp. | | | 900,000 | | | | 66,204,000 | |

Procter & Gamble Co. (The) | | | 500,000 | | | | 33,355,000 | |

| | | | | | | | 277,879,000 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 100.4% (Continued) | | | | | | |

| Energy — 2.8% | | | | | | |

| Oil, Gas & Consumable Fuels — 2.8% | | | | | | |

Chevron Corp. | | | 250,000 | | | $ | 26,600,000 | |

Exxon Mobil Corp. | | | 1,250,000 | | | | 105,950,000 | |

Marathon Oil Corp. | | | 1,000,000 | | | | 29,270,000 | |

| | | | | | | | 161,820,000 | |

| Financials — 2.3% | | | | | | | | |

| Consumer Finance — 0.4% | | | | | | | | |

World Acceptance Corp. (a) | | | 345,000 | | | | 25,357,500 | |

| | | | | | | | | |

| Insurance — 1.9% | | | | | | | | |

ACE Ltd. | | | 450,000 | | | | 31,554,000 | |

Aflac, Inc. | | | 500,000 | | | | 21,630,000 | |

Berkshire Hathaway, Inc. - Class B (a) | | | 375,000 | | | | 28,612,500 | |

Chubb Corp. (The) | | | 400,000 | | | | 27,688,000 | |

| | | | | | | | 109,484,500 | |

| Health Care — 33.5% | | | | | | | | |

| Biotechnology — 6.0% | | | | | | | | |

Amgen, Inc. | | | 1,500,000 | | | | 96,315,000 | |

Biogen Idec, Inc. (a) | | | 1,163,000 | | | | 127,988,150 | |

Cubist Pharmaceuticals, Inc. (a) | | | 458,000 | | | | 18,145,960 | |

Gilead Sciences, Inc. (a) | | | 1,000,000 | | | | 40,930,000 | |

PDL BioPharma, Inc. | | | 905,000 | | | | 5,611,000 | |

Vertex Pharmaceuticals, Inc. (a) | | | 1,800,000 | | | | 59,778,000 | |

| | | | | | | | 348,768,110 | |

| Health Care Equipment & Supplies — 7.1% | | | | | | | | |

Align Technology, Inc. (a) | | | 1,500,000 | | | | 35,587,500 | |

Baxter International, Inc. | | | 400,000 | | | | 19,792,000 | |

Becton, Dickinson and Co. | | | 450,000 | | | | 33,624,000 | |

C.R. Bard, Inc. | | | 340,000 | | | | 29,070,000 | |

Covidien plc | | | 500,000 | | | | 22,505,000 | |

Cyberonics, Inc. (a) | | | 997,000 | | | | 33,399,500 | |

IDEXX Laboratories, Inc. (a) | | | 46,000 | | | | 3,540,160 | |

Medtronic, Inc. | | | 1,250,000 | | | | 47,812,500 | |

ResMed, Inc. (a) | | | 477,000 | | | | 12,115,800 | |

St. Jude Medical, Inc. | | | 1,500,000 | | | | 51,450,000 | |

Stryker Corp. | | | 750,000 | | | | 37,282,500 | |

Varian Medical Systems, Inc. (a) | | | 1,250,000 | | | | 83,912,500 | |

| | | | | | | | 410,091,460 | |

| Health Care Providers & Services — 7.4% | | | | | | | | |

Aetna, Inc. | | | 750,000 | | | | 31,642,500 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 100.4% (Continued) | | | | | | |

| Health Care — 33.5% (Continued) | | | | | | |

| Health Care Providers & Services — 7.4% (Continued) | | | | | | |

Amedisys, Inc. (a) | | | 146,000 | | | $ | 1,592,860 | |

Cardinal Health, Inc. | | | 250,000 | | | | 10,152,500 | |

CIGNA Corp. | | | 1,250,000 | | | | 52,500,000 | |

Humana, Inc. | | | 1,279,000 | | | | 112,053,190 | |

Laboratory Corp. of America Holdings (a) | | | 750,000 | | | | 64,477,500 | |

Patterson Cos., Inc. | | | 608,900 | | | | 17,974,728 | |

UnitedHealth Group, Inc. | | | 1,650,000 | | | | 83,622,000 | |

WellPoint, Inc. | | | 800,000 | | | | 53,000,000 | |

| | | | | | | | 427,015,278 | |

| Life Sciences Tools & Services — 3.2% | | | | | | | | |

Harvard Bioscience, Inc. (a) | | | 1,000,000 | | | | 3,870,000 | |

Illumina, Inc. (a) | | | 810,000 | | | | 24,688,800 | |

Life Technologies Corp. (a) | | | 1,953,000 | | | | 75,991,230 | |

Techne Corp. | | | 44,000 | | | | 3,003,440 | |

Waters Corp. (a) | | | 1,000,000 | | | | 74,050,000 | |

| | | | | | | | 181,603,470 | |

| Pharmaceuticals — 9.8% | | | | | | | | |

Abbott Laboratories | | | 750,000 | | | | 42,172,500 | |

AstraZeneca plc - ADR | | | 3,000,000 | | | | 138,870,000 | |

Bristol-Myers Squibb Co. | | | 1,000,000 | | | | 35,240,000 | |

Eli Lilly & Co. | | | 1,250,000 | | | | 51,950,000 | |

Endo Pharmaceuticals Holdings, Inc. (a) | | | 2,151,000 | | | | 74,274,030 | |

Forest Laboratories, Inc. (a) | | | 500,000 | | | | 15,130,000 | |

Impax Laboratories, Inc. (a) | | | 341,000 | | | | 6,877,970 | |

Johnson & Johnson | | | 1,250,000 | | | | 81,975,000 | |

Novartis AG - ADR | | | 650,000 | | | | 37,160,500 | |

Par Pharmaceutical Cos., Inc. (a) | | | 250,000 | | | | 8,182,500 | |

Pfizer, Inc. | | | 2,500,000 | | | | 54,100,000 | |

Shire plc - ADR | | | 183,000 | | | | 19,013,700 | |

| | | | | | | | 564,946,200 | |

| Industrials — 0.0% | | | | | | | | |

| Airlines — 0.0% | | | | | | | | |

Copa Holdings, S.A. - Class A | | | 1,000 | | | | 58,670 | |

| | | | | | | | | |

| Information Technology — 22.0% | | | | | | | | |

| Communications Equipment — 3.3% | | | | | | | | |

ADTRAN, Inc. | | | 1,000,000 | | | | 30,160,000 | |

Cisco Systems, Inc. | | | 4,500,000 | | | | 81,360,000 | |

InterDigital, Inc. | | | 608,000 | | | | 26,490,560 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 100.4% (Continued) | | | | | | |

| Information Technology — 22.0% (Continued) | | | | | | |

| Communications Equipment — 3.3% (Continued) | | | | | | |

QUALCOMM, Inc. | | | 650,000 | | | $ | 35,555,000 | |

Research In Motion Ltd. (a) | | | 1,000,000 | | | | 14,500,000 | |

| | | | | | | | 188,065,560 | |

| Computers & Peripherals — 4.1% | | | | | | | | |

Dell, Inc. (a) | | | 5,000,000 | | | | 73,150,000 | |

Hewlett-Packard Co. | | | 500,000 | | | | 12,880,000 | |

NetApp, Inc. (a) | | | 500,000 | | | | 18,135,000 | |

QLogic Corp. (a) | | | 1,650,000 | | | | 24,750,000 | |

Synaptics, Inc. (a) | | | 3,135,000 | | | | 94,520,250 | |

Western Digital Corp. (a) | | | 516,000 | | | | 15,970,200 | |

| | | | | | | | 239,405,450 | |

| Electronic Equipment & Instruments — 0.0% | | | | | | | | |

FUJIFILM Holdings Corp. - ADR | | | 49,400 | | | | 1,149,044 | |

| | | | | | | | | |

| Internet Software & Services — 2.6% | | | | | | | | |

eBay, Inc. (a) | | | 3,000,000 | | | | 90,990,000 | |

j2 Global, Inc. | | | 572,000 | | | | 16,096,080 | |

Open Text Corp. (a) | | | 330,000 | | | | 16,876,200 | |

Sohu.com, Inc. (a) | | | 361,000 | | | | 18,050,000 | |

VistaPrint N.V. (a) | | | 277,500 | | | | 8,491,500 | |

| | | | | | | | 150,503,780 | |

| IT Services — 2.3% | | | | | | | | |

Accenture plc - Class A | | | 300,000 | | | | 15,969,000 | |

CACI International, Inc. - Class A (a) | | | 250,000 | | | | 13,980,000 | |

Cognizant Technology Solutions Corp. - Class A (a) | | | 250,000 | | | | 16,077,500 | |

MasterCard, Inc. - Class A | | | 150,000 | | | | 55,923,000 | |

Syntel, Inc. | | | 334,000 | | | | 15,621,180 | |

Western Union Co. (The) | | | 900,000 | | | | 16,434,000 | |

| | | | | | | | 134,004,680 | |

| Semiconductors & Semiconductor Equipment — 6.4% | | | | | | | | |

Altera Corp. | | | 952,000 | | | | 35,319,200 | |

Broadcom Corp. - Class A (a) | | | 1,250,000 | | | | 36,700,000 | |

First Solar, Inc. (a) | | | 567,000 | | | | 19,141,920 | |

Intel Corp. | | | 5,000,000 | | | | 121,250,000 | |

Microchip Technology, Inc. | | | 264,000 | | | | 9,670,320 | |

SunPower Corp. (a) | | | 2,700,000 | | | | 16,821,000 | |

Teradyne, Inc. (a) | | | 1,000,000 | | | | 13,630,000 | |

Texas Instruments, Inc. | | | 1,250,000 | | | | 36,387,500 | |

TriQuint Semiconductor, Inc. (a) | | | 1,319,000 | | | | 6,423,530 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 100.4% (Continued) | | | | | | |

| Information Technology — 22.0% (Continued) | | | | | | |

| Semiconductors & Semiconductor Equipment — 6.4% (Continued) | | | | | | |

Xilinx, Inc. | | | 2,290,000 | | | $ | 73,417,400 | |

| | | | | | | | 368,760,870 | |

| Software — 3.3% | | | | | | | | |

Adobe Systems, Inc. (a) | | | 500,000 | | | | 14,135,000 | |

BMC Software, Inc. (a) | | | 1,354,000 | | | | 44,384,120 | |

Check Point Software Technologies Ltd. (a) | | | 309,000 | | | | 16,234,860 | |

Intuit, Inc. | | | 700,000 | | | | 36,813,000 | |

Microsoft Corp. | | | 2,000,000 | | | | 51,920,000 | |

Oracle Corp. | | | 1,000,000 | | | | 25,650,000 | |

| | | | | | | | 189,136,980 | |

| Materials — 1.2% | | | | | | | | |

| Chemicals — 0.1% | | | | | | | | |

BASF SE - ADR | | | 76,800 | | | | 5,355,264 | |

| | | | | | | | | |

| Metals & Mining — 1.1% | | | | | | | | |

Barrick Gold Corp. | | | 750,000 | | | | 33,937,500 | |

Newmont Mining Corp. | | | 500,000 | | | | 30,005,000 | |

| | | | | | | | 63,942,500 | |

| Telecommunication Services — 2.3% | | | | | | | | |

| Diversified Telecommunication Services — 1.6% | | | | | | | | |

AT&T, Inc. | | | 1,750,000 | | | | 52,920,000 | |

Verizon Communications, Inc. | | | 1,000,000 | | | | 40,120,000 | |

| | | | | | | | 93,040,000 | |

| Wireless Telecommunications Services — 0.7% | | | | | | | | |

China Mobile Ltd. - ADR | | | 750,000 | | | | 36,367,500 | |

| | | | | | | | | |

Total Common Stocks (Cost $5,431,973,411) | | | | | | $ | 5,792,612,946 | |

PUT OPTION CONTRACTS — 1.9% | | | | | | |

Nasdaq 100 Index Option, 03/17/2012 at $1,800 | | | 2,000 | | | $ | 2,126,000 | |

Russell 2000 Index Option, 03/17/2012 at $620 | | | 8,000 | | | | 9,144,000 | |

S&P 500 Index Option, 01/21/2012 at $1,260 | | | 20,000 | | | | 51,400,000 | |

S&P 500 Index Option, 02/18/2012 at $1,220 | | | 13,000 | | | | 37,362,000 | |

S&P 500 Index Option, 03/17/2012 at $1,160 | | | 4,000 | | | | 10,252,000 | |

Total Put Option Contracts (Cost $113,492,158) | | | | | | $ | 110,284,000 | |

| | | | | | | | | |

Total Investments at Value — 102.3% (Cost $5,545,465,569) | | | | | | $ | 5,902,896,946 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

MONEY MARKET FUNDS — 16.3% | | | | | | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.00% (b) | | | 548,887,654 | | | $ | 548,887,654 | |

First American Treasury Obligations Fund - Class Y, 0.00% (b) | | | 394,458,053 | | | | 394,458,053 | |

Total Money Market Funds (Cost $943,345,707) | | | | | | $ | 943,345,707 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 118.6% (Cost $6,488,811,276) | | | | | | $ | 6,846,242,653 | |

| | | | | | | | | |

Written Call Options — (20.7%) | | | | | | | (1,197,242,000 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 2.1% | | | | | | | 123,827,361 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 5,772,828,014 | |

| ADR - American Depositary Receipt. |

| | |

| (a) | Non-income producing security. |

| | |

| (b) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2011. |

| |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts |

December 31, 2011 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| Nasdaq 100 Index Option, | | | | | | | | | |

03/17/2012 at $1,800 | | | 2,000 | | | $ | 96,712,000 | | | $ | 100,397,355 | |

| Russell 2000 Index Option, | | | | | | | | | | | | |

03/17/2012 at $620 | | | 8,000 | | | | 103,792,000 | | | | 101,989,420 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

01/21/2012 at $950 | | | 13,000 | | | | 397,774,000 | | | | 380,882,808 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

01/21/2012 at $980 | | | 20,000 | | | | 552,000,000 | | | | 527,973,550 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

03/17/2012 at $1,160 | | | 4,000 | | | | 46,964,000 | | | | 46,559,710 | |

Total Written Option Contracts | | | | | | $ | 1,197,242,000 | | | $ | 1,157,802,843 | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Schedule of Investments |

December 31, 2011 (Unaudited) |

| | | | | | |

| Energy — 0.5% | | | | | | |

| Oil, Gas & Consumable Fuels — 0.5% | | | | | | |

NuStar Energy L.P. | | | 89,000 | | | $ | 5,042,740 | |

ONEOK Partners L.P. | | | 69,000 | | | | 3,984,060 | |

Williams Partners L.P. | | | 85,000 | | | | 5,099,150 | |

| | | | | | | | 14,125,950 | |

| Materials — 13.2% | | | | | | | | |

| Metals & Mining — 13.2% | | | | | | | | |

Agnico-Eagle Mines Ltd. | | | 500,000 | | | | 18,160,000 | |

AngloGold Ashanti Ltd. - ADR | | | 850,000 | | | | 36,082,500 | |

Barrick Gold Corp. | | | 1,500,000 | | | | 67,875,000 | |

| Compañía de Minas Buenaventura S.A. - ADR | | | 1,000,000 | | | | 38,340,000 | |

Goldcorp, Inc. | | | 1,095,000 | | | | 48,453,750 | |

Gold Fields Ltd. - ADR | | | 1,500,000 | | | | 22,875,000 | |

Harmony Gold Mining Co. Ltd. - ADR | | | 1,500,000 | | | | 17,460,000 | |

Newmont Mining Corp. | | | 1,100,000 | | | | 66,011,000 | |

Randgold Resources Ltd. - ADR | | | 450,000 | | | | 45,945,000 | |

Stillwater Mining Co. (a) | | | 10,000 | | | | 104,600 | |

| | | | | | | | 361,306,850 | |

| Utilities — 0.9% | | | | | | | | |

| Electric Utilities — 0.4% | | | | | | | | |

American Electric Power Co., Inc. | | | 1,000 | | | | 41,310 | |

Duke Energy Corp. | | | 1,000 | | | | 22,000 | |

Edison International | | | 1,000 | | | | 41,400 | |

Entergy Corp. | | | 14,000 | | | | 1,022,700 | |

Exelon Corp. | | | 1,000 | | | | 43,370 | |

FirstEnergy Corp. | | | 83,000 | | | | 3,676,900 | |

NextEra Energy, Inc. | | | 1,000 | | | | 60,880 | |

Pepco Holdings, Inc. | | | 55,000 | | | | 1,116,500 | |

Pinnacle West Capital Corp. | | | 23,000 | | | | 1,108,140 | |

PPL Corp. | | | 1,000 | | | | 29,420 | |

UniSource Energy Corp. | | | 56,000 | | | | 2,067,520 | |

| | | | | | | | 9,230,140 | |

| Multi-Utilities — 0.5% | | | | | | | | |

Ameren Corp. | | | 1,000 | | | | 33,130 | |

Dominion Resources, Inc. | | | 16,000 | | | | 849,280 | |

DTE Energy Co. | | | 67,000 | | | | 3,648,150 | |

Public Service Enterprise Group, Inc. | | | 250,000 | | | | 8,252,500 | |

SCANA Corp. | | | 37,000 | | | | 1,667,220 | |

| | | | | | | | 14,450,280 | |

| | | | | | | | | |

Total Common Stocks (Cost $411,409,788) | | | | | | $ | 399,113,220 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

U.S. TREASURY OBLIGATIONS — 49.9% | | | | | | |

| U.S. Treasury Bonds — 4.3% | | | | | | |

3.75%, due 08/15/2041 | | $ | 100,000,000 | | | $ | 117,625,000 | |

| | | | | | | | | |

| U.S. Treasury Inflation-Protected Notes — 2.7% | | | | | | | | |

2.00%, due 04/15/2012 | | | 27,897,000 | | | | 28,036,485 | |

2.00%, due 07/15/2014 | | | 30,031,750 | | | | 32,375,638 | |

2.50%, due 01/15/2029 | | | 10,546,600 | | | | 14,093,717 | |

| | | | | | | | 74,505,840 | |

| U.S. Treasury Notes — 42.9% | | | | | | | | |

0.75%, due 06/15/2014 | | | 300,000,000 | | | | 303,304,800 | |

2.25%, due 03/31/2016 | | | 200,000,000 | | | | 213,359,400 | |

2.00%, due 04/30/2016 | | | 150,000,000 | | | | 158,414,100 | |

1.75%, due 05/31/2016 | | | 100,000,000 | | | | 104,586,000 | |

3.00%, due 08/31/2016 | | | 75,000,000 | | | | 82,623,075 | |

2.125%, due 08/15/2021 | | | 300,000,000 | | | | 307,734,300 | |

| | | | | | | | 1,170,021,675 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $1,304,718,296) | | | | | | $ | 1,362,152,515 | |

EXCHANGE-TRADED FUNDS — 1.3% | | | | | | |

CurrencyShares British Pound Sterling Trust (a) (b) | | | 100,000 | | | $ | 15,413,000 | |

CurrencyShares Swiss Franc Trust (a) (b) | | | 100,000 | | | | 10,510,000 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 160,000 | | | | 9,081,600 | |

Total Exchange-Traded Funds (Cost $33,328,100) | | | | | | $ | 35,004,600 | |

| | | | | | | | | |

Total Investments at Value — 65.8% (Cost $1,749,456,184) | | | | | | $ | 1,796,270,335 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

MONEY MARKET FUNDS — 34.0% | | | | | | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.00% (c) | | | 267,739,340 | | | $ | 267,739,340 | |

First American Treasury Obligations Fund - Class Y, 0.00% (c) | | | 658,189,031 | | | | 658,189,031 | |

Total Money Market Funds (Cost $925,928,371) | | | | | | $ | 925,928,371 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 99.8% (Cost $2,675,384,555) | | | | | | $ | 2,722,198,706 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.2% | | | | | | | 6,352,128 | |

| | | | | | | | | |

| Net Assets — 100.0% | | | | | | $ | 2,728,550,834 | |

| ADR - American Depositary Receipt. |

| | |

| (a) | Non-income producing security. |

| | |

| (b) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (c) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2011. |

| |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Investments |

December 31, 2011 (Unaudited) |

| | | | | | |

| Argentina — 0.6% | | | | | | |

Telecom Argentina S.A. - ADR | | | 28,000 | | | $ | 500,640 | |

| | | | | | | | | |

| Australia — 1.2% | | | | | | | | |

Cochlear Ltd. (a) | | | 3,000 | | | | 190,545 | |

Telstra Corp. Ltd. - ADR | | | 44,000 | | | | 750,200 | |

| | | | | | | | 940,745 | |

| Belgium — 0.5% | | | | | | | | |

Mobistar S.A. (a) | | | 8,000 | | | | 417,572 | |

| | | | | | | | | |

| Brazil — 2.4% | | | | | | | | |

Companhia de Saneamento Básico do Estado de São Paulo - ADR (b) | | | 12,000 | | | | 667,800 | |

Companhia Energética de Minas Gerais - ADR | | | 25,000 | | | | 444,750 | |

| Companhia Paranaense de Energia - COPEL - ADR | | | 7,500 | | | | 157,350 | |

Telefônica Brasil S.A. - ADR | | | 23,000 | | | | 628,590 | |

| | | | | | | | 1,898,490 | |

| Canada — 1.6% | | | | | | | | |

Alimentation Couche-Tard, Inc. - Class B (b) | | | 20,000 | | | | 622,362 | |

Tim Hortons, Inc. - ADR | | | 14,000 | | | | 677,880 | |

| | | | | | | | 1,300,242 | |

| Chile — 0.5% | | | | | | | | |

Embotelladora Andina S.A. - Class B - ADR | | | 200 | | | | 5,206 | |

Empresa Nacional de Electricidad S.A. - ADR | | | 6,000 | | | | 266,100 | |

Enersis S.A. - ADR | | | 8,000 | | | | 141,040 | |

| | | | | | | | 412,346 | |

| China — 2.0% | | | | | | | | |

3SBio, Inc. - ADR (b) | | | 22,000 | | | | 224,840 | |

China Petroleum and Chemical Corp. - ADR | | | 5,500 | | | | 577,775 | |

JA Solar Holdings Co. Ltd. - ADR (b) | | | 20,000 | | | | 26,800 | |

Mindray Medical International Ltd. - ADR | | | 5,000 | | | | 128,200 | |

NetEase.com, Inc. - ADR (b) | | | 8,000 | | | | 358,800 | |

Trina Solar Ltd. - ADR (b) | | | 7,500 | | | | 50,100 | |

Yue Yuen Industrial (Holdings) Ltd. - ADR | | | 12,000 | | | | 187,680 | |

| | | | | | | | 1,554,195 | |

| Denmark — 2.8% | | | | | | | | |

H. Lundbeck A/S (a) | | | 52,000 | | | | 975,120 | |

Novo Nordisk A/S - ADR | | | 5,000 | | | | 576,300 | |

William Demant Holding A/S (a) (b) | | | 8,000 | | | | 663,495 | |

| | | | | | | | 2,214,915 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 68.7% (Continued) | | | | | | |

| France — 8.6% | | | | | | |

Alten (a) | | | 12,000 | | | $ | 281,530 | |

Casino Guichard-Perrachon S.A. (a) | | | 4,750 | | | | 399,374 | |

Cegid Group (a) | | | 10,000 | | | | 185,260 | |

Christian Dior S.A. (a) | | | 4,000 | | | | 472,089 | |

Danone S.A. (a) | | | 13,000 | | | | 815,674 | |

Dassault Systemes S.A. - ADR | | | 6,750 | | | | 542,767 | |

Iliad S.A. (a) | | | 5,500 | | | | 676,863 | |

Infotel S.A. | | | 3,900 | | | | 280,053 | |

L'Oréal S.A. (a) | | | 3,600 | | | | 374,890 | |

Metropole Television S.A. (a) | | | 17,500 | | | | 260,221 | |

Norbert Dentressangle S.A. (a) | | | 8,000 | | | | 558,243 | |

Sanofi-Aventis - ADR | | | 22,100 | | | | 807,534 | |

Somfy S.A. | | | 227 | | | | 44,622 | |

Total S.A. - ADR | | | 12,500 | | | | 638,875 | |

Zodiac Aerospace (a) | | | 5,000 | | | | 422,337 | |

| | | | | | | | 6,760,332 | |

| Germany — 3.6% | | | | | | | | |

Axel Springer AG (a) | | | 6,000 | | | | 257,444 | |

CENTROTEC Sustainable AG (a) | | | 22,500 | | | | 327,694 | |

Deutsche Telekom AG (a) | | | 60,000 | | | | 688,163 | |

SAP AG - ADR | | | 14,800 | | | | 783,660 | |

United Internet AG (a) | | | 45,000 | | | | 802,031 | |

| | | | | | | | 2,858,992 | |

| Hong Kong — 0.4% | | | | | | | | |

China Mobile Ltd. - ADR | | | 7,000 | | | | 339,430 | |

| | | | | | | | | |

| Italy — 2.3% | | | | | | | | |

Enel S.P.A. (a) | | | 125,000 | | | | 507,025 | |

Eni S.P.A. - ADR | | | 10,000 | | | | 412,700 | |

Luxottica Group S.P.A. (a) | | | 17,000 | | | | 475,295 | |

Recordati S.P.A. (a) | | | 60,000 | | | | 432,726 | |

| | | | | | | | 1,827,746 | |

| Japan — 11.6% | | | | | | | | |

ABC-MART, Inc. (a) | | | 13,000 | | | | 493,843 | |

AEON Co. Ltd. (a) | | | 40,000 | | | | 547,927 | |

Central Japan Railway Co. (a) | | | 35 | | | | 295,375 | |

DeNA Co. Ltd. (a) | | | 12,000 | | | | 359,477 | |

Don Quijote Co. Ltd. (a) | | | 20,000 | | | | 686,674 | |

KDDI Corp. (a) | | | 95 | | | | 610,119 | |

Komeri Co. Ltd. (a) | | | 20,000 | | | | 614,907 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 68.7% (Continued) | | | | | | |

| Japan — 11.6% (Continued) | | | | | | |

K's Holdings Corp. (a) | | | 14,000 | | | $ | 553,966 | |

Mochida Pharmaceutical Co. Ltd. (a) | | | 50,000 | | | | 560,281 | |

NAFCO Co. Ltd (a) | | | 1,700 | | | | 29,082 | |

Nintendo Co. Ltd. - ADR | | | 12,500 | | | | 211,750 | |

Nippon Telegraph and Telephone Corp. - ADR | | | 20,000 | | | | 506,600 | |

Nitori Holdings Co. Ltd. (a) | | | 2,000 | | | | 187,535 | |

NTT DOCOMO, Inc. (a) | | | 275 | | | | 504,905 | |

Ryohin Keikaku Co. Ltd. (a) | | | 13,000 | | | | 634,782 | |

Sundrug Co. Ltd. (a) | | | 25,000 | | | | 755,655 | |

Takeda Pharmaceutical Co. Ltd. (a) | | | 10,500 | | | | 461,218 | |

United Arrows Ltd. (a) | | | 25,000 | | | | 481,953 | |

Yamada Denki Co. Ltd. (a) | | | 10,000 | | | | 681,192 | |

| | | | | | | | 9,177,241 | |

| Mexico — 1.1% | | | | | | | | |

| América Móvil S.A.B. de C.V. - Series A - ADR | | | 30,000 | | | | 674,400 | |

Gruma S.A.B. de C.V. - ADR (b) | | | 22,400 | | | | 168,224 | |

| | | | | | | | 842,624 | |

| Netherlands — 2.3% | | | | | | | | |

ASML Holding N.V. | | | 10,000 | | | | 417,900 | |

Royal Dutch Shell plc - Class A - ADR | | | 8,000 | | | | 584,720 | |

Unilever N.V. - ADR | | | 23,000 | | | | 790,510 | |

| | | | | | | | 1,793,130 | |

| New Zealand — 1.1% | | | | | | | | |

Chorus Ltd. - ADR (b) | | | 16,000 | | | | 191,520 | |

Telecom Corp. of New Zealand Ltd. - ADR | | | 80,000 | | | | 639,200 | |

| | | | | | | | 830,720 | |

| Norway — 0.8% | | | | | | | | |

Tomra Systems ASA (a) | | | 95,000 | | | | 635,090 | |

| | | | | | | | | |

| Philippines — 0.1% | | | | | | | | |

| Philippine Long Distance Telephone Co. - ADR | | | 2,000 | | | | 115,240 | |

| | | | | | | | | |

| Spain — 2.1% | | | | | | | | |

Abengoa S.A. (a) | | | 25,000 | | | | 528,003 | |

Industria de Diseño Textil S.A. (Inditex) (a) | | | 3,000 | | | | 244,872 | |

Red Electrica Corp. S.A. (a) | | | 20,000 | | | | 853,934 | |

| | | | | | | | 1,626,809 | |

| Sweden — 2.1% | | | | | | | | |

Alfa Laval AB (a) | | | 25,000 | | | | 472,098 | |

Axfood AB (a) | | | 13,000 | | | | 478,413 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 68.7% (Continued) | | | | | | |

| Sweden — 2.1% (Continued) | | | | | | |

Hennes & Mauritz AB - B Shares (a) | | | 14,100 | | | $ | 452,291 | |

Securitas AB - Class B (a) | | | 25,000 | | | | 215,019 | |

Telefonaktiebolaget LM Ericsson - ADR | | | 6,000 | | | | 60,780 | |

| | | | | | | | 1,678,601 | |

| Switzerland — 4.2% | | | | | | | | |

Actelion Ltd. (a) | | | 9,000 | | | | 307,862 | |

Nestlé S.A. - ADR | | | 8,800 | | | | 507,848 | |

Novartis AG - ADR | | | 14,000 | | | | 800,380 | |

Roche Holding Ltd. - ADR | | | 15,000 | | | | 638,250 | |

SGS S.A. (a) | | | 250 | | | | 412,336 | |

Swisscom AG - ADR | | | 6,000 | | | | 227,520 | |

Synthes, Inc. (a) | | | 2,500 | | | | 418,449 | |

| | | | | | | | 3,312,645 | |

| Taiwan — 1.3% | | | | | | | | |

| Advanced Semiconductor Engineering, Inc. - ADR | | | 50,000 | | | | 217,000 | |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | | 65,000 | | | | 839,150 | |

| | | | | | | | 1,056,150 | |

| United Kingdom — 15.5% | | | | | | | | |

AstraZeneca plc - ADR | | | 16,000 | | | | 740,640 | |

BHP Billiton plc - ADR | | | 13,000 | | | | 759,070 | |

BT Group plc - ADR | | | 10,000 | | | | 296,400 | |

Bunzl plc (a) | | | 60,000 | | | | 823,375 | |

Dairy Crest Group plc (a) | | | 90,000 | | | | 469,635 | |

Ensco plc - ADR | | | 2,500 | | | | 117,300 | |

Fidessa Group plc (a) | | | 24,000 | | | | 564,181 | |

GlaxoSmithKline plc - ADR | | | 16,500 | | | | 752,895 | |

Greggs plc (a) | | | 70,000 | | | | 550,186 | |

Interserve plc (a) | | | 64,000 | | | | 318,867 | |

Marks & Spencer Group plc (a) | | | 74,000 | | | | 357,441 | |

Mitie Group plc (a) | | | 225,000 | | | | 848,585 | |

N Brown Group plc (a) | | | 110,000 | | | | 397,071 | |

National Grid plc - ADR | | | 13,000 | | | | 630,240 | |

Next plc (a) | | | 15,000 | | | | 636,428 | |

PayPoint plc | | | 335 | | | | 2,872 | |

Reckitt Benckiser Group plc - ADR | | | 12,500 | | | | 123,000 | |

Sage Group plc (The) (a) | | | 150,000 | | | | 685,474 | |

Scottish and Southern Energy plc (a) | | | 35,000 | | | | 700,676 | |

Smith & Nephew plc - ADR | | | 12,500 | | | | 601,875 | |

Ted Baker plc (a) | | | 10,000 | | | | 101,247 | |

Hussman Strategic International Fund Schedule of Investments (continued) |

December 31, 2011 (Unaudited) |

COMMON STOCKS — 68.7% (Continued) | | | | | | |

| United Kingdom — 15.5% (Continued) | | | | | | |

Vodafone Group plc - ADR | | | 19,000 | | | $ | 532,570 | |

William Morrison Supermarkets plc (a) | | | 160,000 | | | | 809,360 | |

WS Atkins plc (a) | | | 45,000 | | | | 432,864 | |

| | | | | | | | 12,252,252 | |

| | | | | | | | | |

Total Common Stocks (Cost $56,077,441) | | | | | | $ | 54,346,147 | |

EXCHANGE-TRADED FUNDS — 7.8% | | | | | | |

iShares MSCI Canada Index Fund | | | 45,000 | | | $ | 1,197,000 | |

iShares MSCI Germany Index Fund | | | 63,500 | | | | 1,220,470 | |

iShares MSCI Sweden Index Fund | | | 50,000 | | | | 1,257,000 | |

iShares MSCI Switzerland Index Fund | | | 57,000 | | | | 1,289,340 | |

iShares MSCI United Kingdom Index Fund | | | 73,500 | | | | 1,187,760 | |

Total Exchange-Traded Funds (Cost $6,510,336) | | | | | | $ | 6,151,570 | |

PUT OPTION CONTRACTS — 0.5% | | | | | | |

S&P 500 Index Option, 03/17/2012 at $1,080 | | | 85 | | | $ | 113,390 | |

S&P 500 Index Option, 03/17/2012 at $1,170 | | | 100 | | | | 277,400 | |

Total Put Option Contracts (Cost $600,644) | | | | | | $ | 390,790 | |

| | | | | | | | | |

Total Investments at Value — 77.0% (Cost $63,188,421) | | | | | | $ | 60,888,507 | |

MONEY MARKET FUNDS — 13.6% | | | | | | |

Northern Institutional Treasury Portfolio, 0.01% (c) (Cost $10,753,205) | | | 10,753,205 | | | $ | 10,753,205 | |

| | | | | | | | | |

Total Investments and Money Market Funds at Value — 90.6% (Cost $73,941,626) | | | | | | $ | 71,641,712 | |

| | | | | | | | | |

Written Call Options — (3.4%) | | | | | | | (2,668,720 | ) |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 12.8% | | | | | | | 10,079,217 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 79,052,209 | |

| ADR - American Depositary Receipt. |

| | |

| (a) | Fair value priced (Note 1). Fair valued securities totaled $31,356,239 at December 31, 2011, representing 39.7% of net assets. |

| | |

| (b) | Non-income producing security. |

| | |

| (c) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2011. |

| |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts |

December 31, 2011 (Unaudited) |

| | | | | | Aggregate Market Value of Contracts | | | | |

Dollar Index Future | 3/16/2012 | | | 150 | | | $ | 12,096,000 | | | $ | 59,419 | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Open Written Option Contracts |

December 31, 2011 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| S&P 500 Index Option, | | | | | | | | | |

03/17/2012 at $1,080 | | | 85 | | | $ | 1,573,520 | | | $ | 1,512,887 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

03/17/2012 at $1,170 | | | 100 | | | | 1,095,200 | | | | 1,069,868 | |

Total Written Option Contracts | | | | | | $ | 2,668,720 | | | $ | 2,582,755 | |

| See accompanying notes to financial statements. |

Hussman Strategic International Fund Schedule of Futures Contracts Sold Short |

December 31, 2011 (Unaudited) |

FUTURES CONTRACTS SOLD SHORT | | | | | | Aggregate Market Value of Contracts | | | | |

Euro STOXX 50 Index Future | 3/16/2012 | | | 750 | | | $ | 22,400,518 | | | $ | (553,666 | ) |

FTSE 100 Index Future | 3/16/2012 | | | 150 | | | | 12,897,414 | | | | (175,330 | ) |

Total Futures Contracts Sold Short | | | | | | | $ | 35,297,932 | | | $ | (728,996 | ) |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Assets and Liabilities |

December 31, 2011 (Unaudited) |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

At acquisition cost | | $ | 5,545,465,569 | | | $ | 1,749,456,184 | |

At value (Note 1) | | $ | 5,902,896,946 | | | $ | 1,796,270,335 | |

Investments in money market funds | | | 943,345,707 | | | | 925,928,371 | |

Cash | | | 500,000 | | | | — | |

Dividends and interest receivable | | | 4,388,996 | | | | 7,269,915 | |

Receivable for investment securities sold | | | 135,663,045 | | | | — | |

Receivable for capital shares sold | | | 8,466,484 | | | | 4,376,860 | |

Other assets | | | 161,741 | | | | 157,297 | |

Total Assets | | | 6,995,422,919 | | | | 2,734,002,778 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

Dividends payable | | | 10,067,778 | | | | 1,011,268 | |

Written call options, at value (Notes 1 and 4)

(premiums received $1,157,802,843) | | | 1,197,242,000 | | | | — | |

Payable for capital shares redeemed | | | 9,873,439 | | | | 2,844,677 | |

Accrued investment advisory fees (Note 3) | | | 4,444,314 | | | | 1,077,929 | |

Payable to administrator (Note 3) | | | 445,800 | | | | 204,200 | |

Other accrued expenses | | | 521,574 | | | | 313,870 | |

Total Liabilities | | | 1,222,594,905 | | | | 5,451,944 | |

| | | | | | | | | |

NET ASSETS | | $ | 5,772,828,014 | | | $ | 2,728,550,834 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 6,666,444,183 | | | $ | 2,673,536,481 | |

| Accumulated undistributed net investment income | | | 9,645 | | | | 211,924 | |

Accumulated net realized gains (losses) from security

transactions and option contracts | | | (1,211,618,034 | ) | | | 7,988,278 | |

| Net unrealized appreciation on investments and option contracts | | | 317,992,220 | | | | 46,814,151 | |

| | | | | | | | | |

NET ASSETS | | $ | 5,772,828,014 | | | $ | 2,728,550,834 | |

| | | | | | | | | |

Shares of beneficial interest outstanding

(unlimited number of shares authorized, no par value) | | | 464,570,576 | | | | 221,892,053 | |

| | | | | | | | | |

Net asset value, offering price and redemption

price per share(a) (Note 1) | | $ | 12.43 | | | $ | 12.30 | |

| (a) | Redemption fee may apply to redemptions of shares held for 60 days or less. |

| |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Assets and Liabilities (continued) |

December 31, 2011 (Unaudited) |

| | | Hussman Strategic International Fund | |

| ASSETS | | | |

| Investments in securities: | | | |

| At acquisition cost | | $ | 63,188,421 | |

| At value (Note 1) | | $ | 60,888,507 | |

| Investments in money market funds | | | 10,753,205 | |

| Dividends receivable | | | 157,166 | |

| Receivable for capital shares sold | | | 87,839 | |

| Variation margin receivable (Notes 1 and 4) | | | 4,139,134 | |

| Margin deposits for futures contracts (Notes 1 and 4) | | | 5,919,187 | |

| Other assets | | | 44,958 | |

| Total Assets | | | 81,989,996 | |

| | | | | |

| LIABILITIES | | | | |

| Dividends payable | | | 25,273 | |

| Written call options, at value (Notes 1 and 4) (premiums received $2,582,755) | | | 2,668,720 | |

| Payable for capital shares redeemed | | | 102,156 | |

| Accrued investment advisory fees (Note 3) | | | 77,104 | |

| Payable to administrator (Note 3) | | | 10,820 | |

| Other accrued expenses | | | 53,714 | |

| Total Liabilities | | | 2,937,787 | |

| | | | | |

| NET ASSETS | | $ | 79,052,209 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 84,410,977 | |

| Accumulated net investment loss | | | (511,263 | ) |

| Accumulated net realized losses from security transactions and option and futures contracts | | | (1,746,409 | ) |

| Net unrealized depreciation on: | | | | |

| Investment securities | | | (2,090,060 | ) |

| Option contracts | | | (295,819 | ) |

| Futures contracts | | | (669,577 | ) |

| Translation of assets and liabilities in foreign currencies | | | (45,640 | ) |

| | | | | |

| NET ASSETS | | $ | 79,052,209 | |

| | | | | |

Shares of beneficial interest outstanding (unlimited number

of shares authorized, no par value) | | | 8,130,314 | |

| | | | | |

Net asset value, offering price and redemption price per share (a) (Note 1) | | $ | 9.72 | |

| (a) | Redemption fee may apply to redemptions of shares held for 60 days or less. |

| |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Operations |

For the Six Months Ended December 31, 2011 (Unaudited) |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| INVESTMENT INCOME | | | | | | |

Dividends | | $ | 46,856,347 | | | $ | 5,069,780 | |

Foreign withholding taxes on dividends | | | (93,704 | ) | | | (149,766 | ) |

Interest | | | — | | | | 10,445,478 | |

Total Income | | | 46,762,643 | | | | 15,365,492 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

Investment advisory fees (Note 3) | | | 25,794,820 | | | | 6,084,312 | |

Transfer agent, account maintenance

and shareholder services fees (Note 3) | | | 2,203,760 | | | | 849,955 | |

Administration fees (Note 3) | | | 1,162,936 | | | | 685,320 | |

Custodian and bank service fees | | | 204,844 | | | | 86,582 | |

Fund accounting fees (Note 3) | | | 171,962 | | | | 92,756 | |

Registration and filing fees | | | 71,840 | | | | 142,885 | |

Postage and supplies | | | 130,704 | | | | 69,705 | |

Printing of shareholder reports | | | 71,600 | | | | 42,690 | |

Professional fees | | | 63,717 | | | | 37,411 | |

Trustees’ fees and expenses | | | 43,848 | | | | 43,848 | |

Compliance service fees (Note 3) | | | 45,474 | | | | 21,950 | |

Insurance expense | | | 40,530 | | | | 17,582 | |

Other expenses | | | 19,891 | | | | 16,114 | |

Total Expenses | | | 30,025,926 | | | | 8,191,110 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 16,736,717 | | | | 7,174,382 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON

INVESTMENTS AND OPTION CONTRACTS (Note 4) | | | | | | | | |

| Net realized gains from: | | | | | | | | |

Security transactions | | | 270,275,204 | | | | 31,169,444 | |

Option contracts | | | 141,702,077 | | | | — | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (472,579,655 | ) | | | 32,301,065 | |

Option contracts | | | 127,977,055 | | | | — | |

| | | | | | | | | |

NET REALIZED AND UNREALIZED GAINS

ON INVESTMENTS AND OPTION CONTRACTS | | | 67,374,681 | | | | 63,470,509 | |

| | | | | | | | | |

NET INCREASE IN NET ASSETS

RESULTING FROM OPERATIONS | | $ | 84,111,398 | | | $ | 70,644,891 | |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Operations (continued) |

For the Six Months Ended December 31, 2011 (Unaudited) |

| | | Hussman Strategic International Fund | |

| INVESTMENT INCOME | | | |

| Dividend income | | $ | 500,649 | |

| Foreign withholding taxes on dividends | | | (43,358 | ) |

| Total Income | | | 457,291 | |

| | | | | |

| EXPENSES | | | | |

| Investment advisory fees (Note 3) | | | 468,253 | (a) |

| Professional fees | | | 72,345 | |

| Registration and filing fees | | | 46,063 | |

| Trustees' fees and expenses | | | 43,848 | |

| Administration fees (Note 3) | | | 29,286 | |

| Custodian fees | | | 25,300 | |

| Transfer agent, account maintenance and shareholder services fees (Note 3) | | | 25,063 | |

| Fund accounting fees (Note 3) | | | 21,971 | |

| Printing of shareholder reports | | | 10,220 | |

| Postage and supplies | | | 4,304 | |

| Compliance service fees (Note 3) | | | 3,082 | |

| Insurance expense | | | 648 | |

| Other expenses | | | 30,621 | |

| Net Expenses | | | 781,004 | |

| | | | | |

| NET INVESTMENT LOSS | | | (323,713 | ) |

| | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON INVESTMENTS

AND OPTION AND FUTURES CONTRACTS (Note 4) | | | | |

| Net realized gains (losses) from: | | | | |

| Security transactions | | | (1,540,109 | ) |

| Option contracts | | | (679,997 | ) |

| Futures contracts | | | 2,637,804 | |

| Foreign currency transactions | | | (554,140 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | (4,320,579 | ) |

| Option contracts | | | (45,609 | ) |

| Futures contracts | | | (125,721 | ) |

| Foreign currency translation | | | (126,728 | ) |

| | | | | |

NET REALIZED AND UNREALIZED LOSSES ON INVESTMENTS

AND OPTION AND FUTURES CONTRACTS | | | (4,755,079 | ) |

| | | | | |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (5,078,792 | ) |

| (a) | Includes previously waived investment advisory fees of $77,975 recouped by the Adviser (Note 3). |

| |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Statements of Changes in Net Assets |

|

| | | Six Months Ended December 31, 2011 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | |

Net investment income | | $ | 16,736,717 | | | $ | 23,894,935 | |

| Net realized gains (losses) from: | | | | | | | | |

Security transactions | | | 270,275,204 | | | | 1,023,661,028 | |

Option contracts | | | 141,702,077 | | | | (2,038,117,631 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | (472,579,655 | ) | | | 789,181,664 | |

Option contracts | | | 127,977,055 | | | | (392,897,290 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 84,111,398 | | | | (594,277,294 | ) |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (28,671,281 | ) | | | (14,114,668 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 1,089,558,467 | | | | 2,590,660,391 | |

Net asset value of shares issued in reinvestment

of distributions to shareholders | | | 18,603,504 | | | | 10,023,895 | |

| Proceeds from redemption fees collected (Note 1) | | | 306,748 | | | | 546,677 | |

Payments for shares redeemed | | | (1,035,146,928 | ) | | | (2,534,114,790 | ) |

| Net increase in net assets from capital share transactions | | | 73,321,791 | | | | 67,116,173 | |

| | | | | | | | | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | | | 128,761,908 | | | | (541,275,789 | ) |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of period | | | 5,644,066,106 | | | | 6,185,341,895 | |

End of period | | $ | 5,772,828,014 | | | $ | 5,644,066,106 | |

| | | | | | | | | |

| ACCUMULATED UNDISTRIBUTED NET INVESTMENT INCOME | | $ | 9,645 | | | $ | 11,944,209 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 85,815,404 | | | | 203,808,819 | |

Shares reinvested | | | 1,496,661 | | | | 815,614 | |

Shares redeemed | | | (82,385,843 | ) | | | (204,778,368 | ) |

Net increase (decrease) in shares outstanding | | | 4,926,222 | | | | (153,935 | ) |

Shares outstanding at beginning of period | | | 459,644,354 | | | | 459,798,289 | |

Shares outstanding at end of period | | | 464,570,576 | | | | 459,644,354 | |

See accompanying notes to financial statements.

Hussman Strategic Total Return Fund Statements of Changes in Net Assets |

|

| | | Six Months Ended December 31, 2011 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | |

Net investment income | | $ | 7,174,382 | | | $ | 14,156,089 | |

Net realized gains from security transactions | | | 31,169,444 | | | | 103,765,444 | |