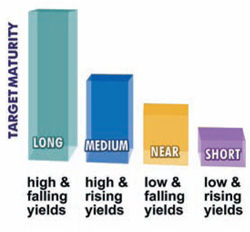

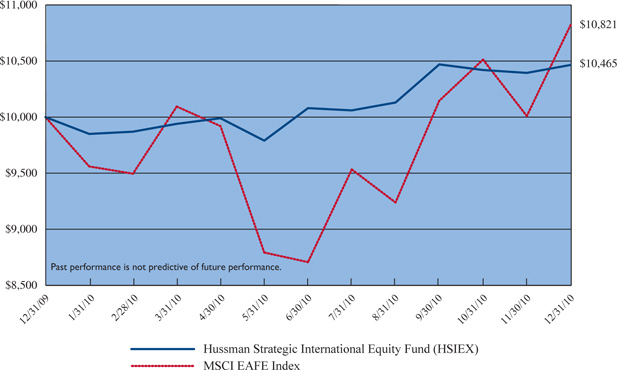

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Growth Fund

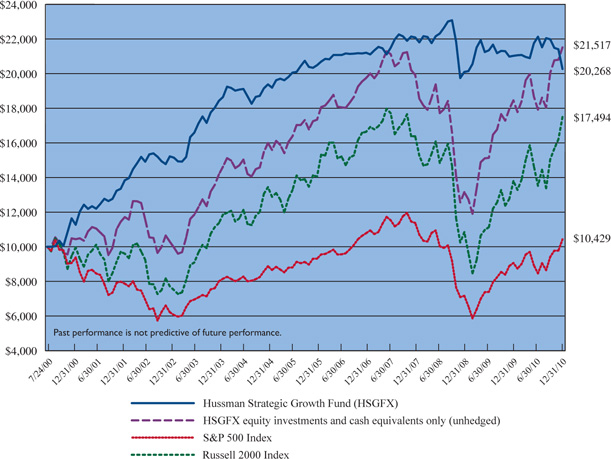

Comparison of the Change in Value of a $10,000 Investment in Hussman Strategic Total Return Fund

versus the Barclays Capital U.S. Aggregate Bond Index

For the year ended December 31, 2010, Hussman Strategic Growth Fund achieved a total return of -3.62%, compared with a total return of 15.06% for the Standard & Poor’s 500 Index. Meanwhile, Hussman Strategic Total Return Fund achieved a total return of 7.03%, compared with a gain of 6.54% for the Barclays Capital U.S. Aggregate Bond Index. While we successfully navigated bond market conditions in 2010, the stock market proved far more challenging in the final months of the year.

Strategic Growth Fund has achieved an average annual total return of 7.00% from its inception on July 24, 2000 through December 31, 2010, compared with an average annual return of 0.40% for the S&P 500 Index over the same period. An initial $10,000 investment in the Fund on July 24, 2000 would have grown to $20,268, compared with $10,429 for the same investment in the S&P 500 Index.

Strategic Total Return Fund has achieved an average annual total return of 7.46% from its inception on September 12, 2002 through December 31, 2010, compared with an average annual total return of 5.11% for the Barclays Capital U.S. Aggregate Bond Index. An initial $10,000 investment in the Fund on September 12, 2002 would have grown to $18,175, compared with $15,124 for the same investment in the Barclays Capital U.S. Aggregate Bond Index.

Since the inception of Strategic Growth Fund in 2000, the Fund has outperformed the S&P 500 Index by 6.60% (660 basis points) annually, on average. Since the inception of Strategic Total Return Fund in 2002, the Fund has outperformed the Barclays Capital U.S. Aggregate Bond Index by 2.35% (235 basis points) annually, on average.

As late as September 2010, Strategic Growth Fund had a 2010 year-to-date performance that was ahead of the S&P 500 Index. During the fourth quarter of 2010, the Federal Reserve embarked on an aggressive policy of “quantitative easing,” coupled with an Op-Ed article by Fed Chairman Ben Bernanke in the Washington Post, which all but endorsed speculation in stocks, on the theory that higher stock prices produce a “wealth effect” that increases economic output and earnings, which in turn justifies higher stock prices in a “virtuous circle.”

Despite extensive historical evidence against this proposition, Bernanke’s rhetoric and his repeated mention of the stock market provoked a surge in stocks associated with what Wall Street typically calls the “risk trade.” These included stocks in cyclical and commodity-related industries, small capitalization stocks, and companies with uneven revenue growth and unstable profit margins, which we typically characterize

|

Letter to Shareholders (continued) |

as “low quality.” At the same time, many conservative stocks fell out of favor. Ironically, the prices of Treasury bonds – the direct objects of the Fed’s purchases – also plunged. Though the individual stocks owned in Strategic Growth Fund actually slightly outperformed the S&P 500 Index for 2010 as a whole, a small portion of our hedge included the Nasdaq 100 and Russell 2000 Indices, and the late-year surge in those indices produced enough additional hedging losses to leave the Fund with a slightly negative return for 2010.

In pursuing the investment objective of Strategic Growth Fund, our goal is to outperform the S&P 500 Index over the complete market cycle (bull market peak to bull market peak, bear market trough to bear market trough), while having smaller periodic losses than a passive investment strategy. Consistent with this goal, and despite the most turbulent market environment since the Great Depression, Strategic Growth Fund remained ahead of the S&P 500 Index for the period from the 2007 market peak through December 31, 2010, and experienced substantially smaller interim losses during this period.

During the most recent market cycle, we continued to be very good at selecting stocks. For the three-year period ended December 31, 2010, the stocks held by Strategic Growth Fund appreciated by a cumulative 6.30%, versus an overall loss of -9.33% for the S&P 500 Index. In the interim, our stock selections experienced substantial losses during the 2008-2009 market plunge, albeit smaller than those experienced by the S&P 500 Index, but our hedging approach successfully reduced the impact of those losses. Still, taking the period since 2007 as a whole, we were not nearly as successful as we would have liked in achieving positive absolute returns from our ability to effectively identify stocks for investment.

Overall, this recent performance is a disappointment. Ultimately, successful investment requires positive absolute returns – losing less than the market is not enough. While hedging has helped us to largely avoid the impact of two spectacular market plunges during the past decade, the hedging component of our investment strategy has also been a source of periodic disappointment in recent years, and some explanation is in order.

Both day-to-day, and over the long-term, we pursue a straightforward investment discipline: find a set of daily actions that can be expected to produce results if they are followed consistently, and then follow them consistently. Having a well-tested investment discipline, evaluated by analyzing decades of historical data, is what gives us confidence in what we do. With regard to hedging, our approach is also fairly straightforward: accept market risk in proportion to the return that can be expected, on average, per unit of risk.

|

Letter to Shareholders (continued) |

Although we correctly foresaw the credit strains of 2008 and the likelihood of significant market losses, we did not foresee the speed and relentlessness of the decline, nor the policy responses of the Treasury and Federal Reserve, which I viewed as reckless and misguided. It quickly became clear that the behavior of the markets was “out of sample” from the standpoint of the post-1940 data that we had generally used as the basis for our hedging discipline. Indeed, on most measures, the market was acting in a way that was much more characteristic of other periods of credit crisis in the U.S. and internationally, including the Great Depression. We believed that it was a mistake to treat the downturn as a typical, run-of-the-mill post-war recession, but it was an enormous challenge to integrate the often contradictory implications of other crisis-related historical data in a satisfactory way.

Averaging the implications of post-war and post-credit crisis data proved to be inadequate, because the outcomes during comparable crises were so hostile, even if we gave them very little weight. For example, during the Depression era, by the time that the S&P 500 Index was priced to achieve 10-year expected returns of 10% annually (based on our standard valuation methodology), the stock market had already declined by half. But this was only the beginning – the market would continue to lose another two-thirds of its value before its final low. Even trend-following systems experienced false signals and deep losses. The threshold for accepting market risk during periods of credit crisis was typically much higher than in post-war data, requiring much more stringent valuation criteria. Even during lesser crises in the post-war period, stocks had typically established their lows at much cheaper valuations than existed at the 2009 trough. It was not enough to measure “risk” - the chance of rolling something other than 7, given that you know two six-sided dice are being thrown; we also needed to deal with “uncertainty” - the chance that the dice themselves might have actually eight, twelve, or twenty sides without our knowledge.

It was not until 2010 that we finally established an adequate and robust solution to these challenges, which we recently put into practice after extensive validation testing. I’ve described these methods at more length in my Weekly Market Comment on the Hussman Funds website. Briefly, rather than assuming that any single set of investment criteria is “best,” we evaluate scores of criteria over numerous historical data samples. If an observed set of market conditions would have resulted in strong average market returns regardless of which model or subset of data we examine, we conclude that significant exposure to market risk is warranted. In contrast, if a given set of conditions is associated with a wide range of possible outcomes depending on the subset of data we examine, we take a more cautious approach, even if the outcomes are positive on average. In this way, our exposure to market fluctuations can reflect the expected return, risk and uncertainty that has historically been associated with the investment

|

Letter to Shareholders (continued) |

conditions we observe at each point in time, without relying on any one particular view of the world. The implication for Strategic Growth Fund is that shareholders can expect a greater range of positive market exposures than we have accepted in past years, but also a tightly defensive stance in response to historically hostile market conditions.

It is tempting to believe that somehow Federal Reserve policy or other factors have changed the world in ways that make historical valuation relationships obsolete. I believe this is incorrect. These relationships have performed quite well over the past decade, and have correctly identified important valuation extremes. The challenges we faced as a result of having to consider Depression-era data had nothing to do with difficulties in valuing stocks. The basic fact remains that stocks are a claim on a long-term stream of cash flows that will be delivered to investors over time. Numerous factors can affect the day-to-day price that investors pay for stocks, but the historical record suggests that not even the wildest speculation materially changes the underlying stream of long-term cash flows they will deliver – it only changes the rate of return that investors can expect in the future, as the result of the price they pay.

The importance of careful investment valuation is easily ignored during periods of speculation, but as the great value investor Benjamin Graham wrote decades ago:

“Speculators often prosper through ignorance; it is a cliché that in a roaring bull market knowledge is superfluous and experience is a handicap. But the typical experience of the speculator is one of temporary profit and ultimate loss.”

In short, the hedging challenges we’ve faced in recent years resulted from a profound economic crisis that forced us to expand the range of historical data that we needed to contemplate. I have no faith that the underlying credit and solvency problems in the U.S. economy have been addressed, but changes in accounting rules coupled with large government deficits and extraordinary monetary interventions have successfully kicked the can down the road, allowing some amount of economic recovery. While I believe that the lessons from our research will be enormously useful during future periods of market turbulence, they unfortunately don’t give us a time machine to do anything differently in 2008 or 2009, nor would our investment decisions have been much different since about April 2010 than they have been in practice. Despite the challenges posed by the recent credit crisis, I remain convinced that the most reliable source of investment returns is to follow a consistent investment discipline that has stood the exhaustive test of history.

The table below presents the total returns for Strategic Growth Fund and S&P 500 Index since the inception of the Fund. In order to assist in attributing the effects of stock selection and hedging on the Fund, the table separately presents the returns of the stock positions and cash equivalents held by the Fund (after expenses), without the impact of hedging transactions.

|

Letter to Shareholders (continued) |

| | | |

| 2000* | 16.40% | 4.86% | -9.37% |

| 2001 | 14.67% | 9.13% | -11.89% |

| 2002 | 14.02% | -10.03% | -22.10% |

| 2003 | 21.08% | 37.68% | 28.68% |

| 2004 | 5.16% | 12.81% | 10.88% |

| 2005 | 5.71% | 8.43% | 4.91% |

| 2006 | 3.51% | 13.88% | 15.79% |

| 2007 | 4.16% | 0.89% | 5.49% |

| 2008 | -9.02% | -33.97% | -37.00% |

| 2009 | 4.63% | 38.12% | 26.46% |

| 2010 | -3.62% | 16.57% | 15.06% |

Since Inception (Average annual return) | 7.00% | 7.62% | 0.40% |

| * | July 24, 2000 – December 31, 2000, not annualized |

Given the weak total return of the S&P 500 Index since the inception of the Fund, and the general tendency of the Fund to hedge its exposure to market fluctuations during this generally unrewarding period, the performance of the stocks held by the Fund has been an essential source of overall investment performance. Since inception, the average annualized return of the stocks held by the Fund has been 7.62% after expenses. The primary effect of the Fund’s hedging has been to significantly reduce volatility and drawdown risk over time.

| Strategic Total Return Fund |

For the year ended December 31, 2010, Strategic Total Return Fund achieved a total return of 7.03%, compared with a total return of 6.54% for the Barclays Capital U.S. Aggregate Bond Index.

The Fund’s exposure to interest rate fluctuations was generally modest during 2010, typically less than 2 years. This means that a 100 basis point change in interest rates could be expected to impact the Fund’s value by less than 2%. While the Fund briefly increased its exposure to interest rate fluctuations to a duration of about 4 years in response to the spike in Treasury yields that followed the Federal Reserve’s policy of quantitative easing, we quickly cut the Fund’s duration back below 2 years

|

Letter to Shareholders (continued) |

on the nearly immediate upward pressure on commodity prices and global inflation measures that followed.

During 2010, Strategic Total Return Fund also held an allocation to precious metals shares generally ranging between 1% and 10% of assets. The Fund’s modest and variable exposure to precious metals shares has been an important contributor to its performance, but was also responsible for much of the Fund’s day-to-day volatility at times when the Fund was invested in this sector.

The table below presents the total returns for Strategic Total Return Fund since inception.

| | Barclays Capital U.S. Aggregate Bond Index |

| 2002* | 2.30% | 2.56% |

| 2003 | 9.80% | 4.10% |

| 2004 | 6.50% | 4.34% |

| 2005 | 6.00% | 2.43% |

| 2006 | 5.66% | 4.33% |

| 2007 | 12.61% | 6.97% |

| 2008 | 6.34% | 5.24% |

| 2009 | 5.84% | 5.93% |

| 2010 | 7.03% | 6.54% |

Since Inception (Average Annual Returns) | 7.46% | 5.11% |

| * | September 12, 2002 – December 31, 2002, not annualized |

| Portfolio Composition and Performance Drivers |

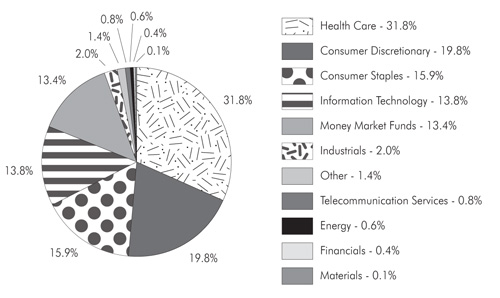

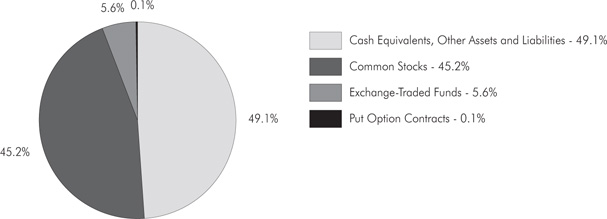

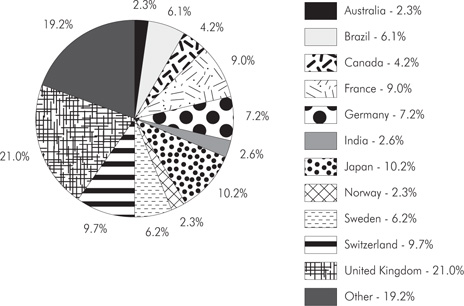

As of December 31, 2010, Strategic Growth Fund had net assets of $6,273,095,403, and held 120 stocks in a wide variety of industries. The largest sector holdings as a percent of net assets were health care (37.2%), consumer discretionary (23.2%), consumer staples (18.6%), and information technology (16.1%). The smallest industry weights relative to the S&P 500 Index were in industrials (2.4%), telecommunications (0.9%), energy (0.7%), financials (0.5%) and materials (0.1%).

The Fund’s holdings of individual stocks as of December 31, 2010 accounted for $6,256,722,934, or 99.7% of net assets. Against these stock positions, the Fund also held 39,000 option combinations (long put option, short call option) on the S&P

|

Letter to Shareholders (continued) |

500 Index, 8,000 option combinations on the Russell 2000 Index and 3,000 option combinations on the Nasdaq 100 Index. Each option combination behaves as a short sale on the underlying index, with a notional value of $100 times the index value. On December 31, 2010, the S&P 500 Index closed at 1,257.64, while the Russell 2000 Index and the Nasdaq 100 Index closed at 783.65 and 2,217.86, respectively. The Fund’s total hedge therefore represented a short position of $6,197,074,000, thereby hedging 99.0% of the dollar value of the Fund’s long investment positions in individual stocks.

Though the performance of Strategic Growth Fund’s diversified portfolio cannot be attributed to any narrow group of stocks, the following holdings achieved gains in excess of $35 million during the semi-annual period ended December 31, 2010: Amazon, Endo Pharmaceutical, Panera Bread, Joy Global, Network Appliances, Checkpoint Software, Bucyrus International, Walgreens, and Illumina. Holdings with losses in excess of $5 million during this same period were Cisco, Intuitive Surgical, and Aeropostale.

Strategic Growth Fund continues to be very manageable, with substantial flexibility to respond to changing market conditions, low market impact of trading, commission costs well below estimated industry averages, and continued reductions in the Fund’s expense ratio. The Fund’s positions in individual stocks generally represent less than a single day’s average trading volume in those securities. Even during the volatile and often low-volume trading of the past year, the Fund’s average market impact of trading (the difference between the last sale at the time of order placement and the actual price at which the Fund’s stock transactions are executed) has been a fraction of 1%, and the Fund’s average commission is currently 1.3 cents per share, compared with industry averages estimated to be several times that amount. Finally, the Fund’s expense ratio during its fiscal year ended June 30, 2010 was 1.05%, and has since declined further due to breakpoints in management fees and economies of scale in other Fund expenses. According to recent statistics, the average expense ratio among the limited group of mutual funds pursuing similar strategies and classified as “long-short” by Morningstar is 2.03%.

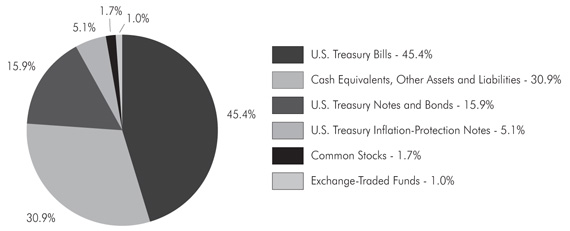

As of December 31, 2010, Strategic Total Return Fund had net assets of $2,426,035,797. Short-term Treasury bills accounted for 45.4% of the Fund’s net assets, with Treasury notes, Treasury bonds, Treasury Inflation Protected Securities (TIPS) and money market funds representing an additional 51.8% of the Fund’s net assets. Exchange-traded funds, precious metals shares and utility shares accounted for 1.0%, 1.4% and 0.3% of net assets, respectively. The Fund carried a duration of less than 2 years (meaning that a 1% change in interest rates would be expected to impact the Fund’s asset value by less than 2% on the basis of bond price fluctuations).

|

Letter to Shareholders (continued) |

In Strategic Total Return Fund, during the semi-annual period ended December 31, 2010, portfolio gains in excess of $5 million were achieved in U.S. Treasury Note (3.375%, due 11/15/2019), U.S. Treasury Note (3.625%, due 8/15/2019), Agnico-Eagle Mines, and Cia De Minas Buena - ADR . Holdings with losses in excess of $1 million during this same period were U.S. Treasury Bond (3.875%, due 8/15/2040), U.S. Treasury Note (4.25%, due 11/15/2040), U.S. Treasury Bond (4.25%, due 5/15/2039), and U.S. Treasury Note (2.625%, due 11/15/2020).

For the third time in a decade, the Federal Reserve has embarked on a policy that addresses structural economic problems by provoking speculation in asset prices. The first two attempts were ultimately followed by stock market declines greater than 50% each. As we enter 2011, the stock market remains in what we view as an already strenuously overvalued advance, which has driven our estimates for S&P 500 Index total returns to less than 3.2% annually over the coming decade. My expectation is that this attempt to create what the economist Ludwig von Mises called “illusory prosperity” will end no better than it has in the past. As von Mises wrote in 1931, before the worst portion of the Great Depression:

“Credit expansion cannot increase the supply of real goods. It merely brings about a rearrangement. It diverts capital investment away from the course prescribed by the state of economic wealth and market conditions. It causes production to pursue paths which it would not follow unless the economy were to acquire an increase in material goods. As a result, the upswing lacks a solid base. It is not a real prosperity. It is illusory prosperity. It did not develop from an increase in economic wealth [i.e. the accumulation of savings made available for productive investment]. Rather, it arose because the credit expansion created the illusion of such an increase. Sooner or later, it must become apparent that this economic situation is built on sand.”

None of this, however, implies that a severe market downturn should be expected over the near term. Though it is not possible to rule out a substantial decline in market valuations, our main reason for defensiveness as we enter 2011 is that the market environment is characterized by a syndrome of elevated valuations, overextended price trends, overbullish investor sentiment, and rising interest rates. This combination of conditions typically does not persist for more than a few months, but when the complete set has been observed, the stock market has often been vulnerable to abrupt losses that can erase weeks or months of gains in a few trading sessions.

|

Letter to Shareholders (continued) |

Over the past decade, I’ve typically written in our annual reports that our investment performance has been “as intended,” describing our record of outperforming the market with restrained risk as “neither extraordinary nor disappointing.” However, this characterization is not accurate for the period since the 2007 market peak. By nearly every measure, this recent period has been both extraordinary and disappointing for the economy, the stock market, and occasionally, for our own performance. Though we experienced far less volatility than the major stock market indices, we would have expected to also achieve positive absolute returns over this period, regardless of the overall decline in the stock market.

From the standpoint of the research we have recently implemented, I know where I could have done things differently, particularly in late 2008 and 2009. But given the exceptional uncertainties we faced at the time, I chose first to do no harm. The deepest pullback experienced by Strategic Growth Fund since its inception has been a 21.45% loss, versus a 55.25% loss in the S&P 500 Index. To appreciate the relative difference between the two, note that a 27.31% gain is required to recover a 21.45% loss, while a 123.46% gain is required to recover a 55.25% loss. This underscores the fact that risk management tends to be generous. Despite the possibility of missed returns, avoiding market risk during historically unfavorable market conditions need not be costly to long-term performance, provided that deep periodic losses are largely avoided.

We have emerged from this period with an expanded set of analytical tools that I expect to be useful regardless of future market conditions, and which I believe will extend our long-term record of outperforming the market over full market cycles with restrained volatility. Importantly, we also expect a beneficial impact on our analysis of bonds, precious metals, and other securities that we hold in Strategic Total Return Fund.

In recent quarters, the U.S. economy has enjoyed a sluggish recovery, with positive but weak employment growth, and strong corporate profits benefiting from government deficit spending coupled with labor substitution from the U.S. to China. Both for the labor market and for corporate profits, recent inflation pressure in China is an important development because it raises the “real” exchange rate for Chinese goods and labor services. While we would consider a substantial revaluation of the Chinese yuan to be favorable for U.S. employment prospects, it would also tend to reduce the record share of corporate profits-to-GDP that U.S. corporations temporarily enjoy. Careful attention to profit margins is as important as ever, and I remain concerned that analysts who value stocks based on a simplistic multiple of

|

Letter to Shareholders (continued) |

“forward operating earnings” are ignoring the strong historical tendency for elevated profit margins to retreat.

With regard to credit conditions in the U.S. economy, I disagree with the view that the extraordinary government interventions of recent years have corrected the underlying imbalances. In hindsight, the advance from the 2009 market low immediately followed a change in accounting rules by the FASB, which eliminated the need for financial companies to report their assets at market value, and instead allowed “substantial discretion” in the valuation of those assets. This effectively relieved banks of the regulatory burden of holding adequate capital. At the same time, the U.S. Federal Reserve purchased nearly $1.5 trillion of mortgage securities issued by Fannie Mae and Freddie Mac, both of which were insolvent and in conservatorship. I continue to believe that these purchases were not authorized under Section 14.1 of the Federal Reserve Act (which applies to open market purchases, but is restricted to bona-fide government agencies, Treasury debt and fully-guaranteed foreign government debt), nor under Section 13.3 (which applies to “discounting” of short-term obligations under the Act). Though the collective effect has been to obscure accounting transparency and to shift private sector losses to the public sector, none of this cures the insolvent debt. My impression is that by placing troubled debt out of sight, it has been possible for the investing public to focus on easy money and the temporarily high corporate profit margins that result from coupling mass layoffs with enormous government outlays. But I do not consider this situation to be permanent.

We already observe strong pressure in the U.S. and internationally to reduce fiscal deficits, while states, municipalities, and peripheral European countries that cannot print their own currencies are facing even more severe budget austerity. With the Federal Reserve already committed to expanding the U.S. monetary base to a record 16 cents of currency and reserves for every dollar of nominal GDP, monetary policy also appears to be approaching its unstable limits. It is quite true that by holding short-term interest rates near zero, bank profits can be enhanced by allowing them a cheap source of funding, but this is at the expense of individuals on fixed incomes who rely on interest from deposits, and accept lower yields in return for principal safety. It also risks creating a “zombie” banking system like that of Japan, where the primary activity of banks for nearly a decade was recapitalizing their balance sheets instead of making productive loans.

Meanwhile, the bailout of Fannie Mae and Freddie Mac has already cost more than five times the annual budget of the National Institutes of Health, which is the major source of funding for basic research in diseases such as cancer, Alzheimer’s, Parkinson’s, and autism. I strongly believe that by avoiding the continuing need to restructure mortgage debt, bank liabilities, and sovereign debt, the welfare of the

|

Letter to Shareholders (continued) |

general public has been pushed beneath that of bondholders who sought higher yields, knowingly accepted greater risk, financed bad loans, and now characterize any risk of loss on their part with words like “failure” and “meltdown.” Unfortunately, most of this debt is of short and intermediate maturity, requiring it to be repeatedly refinanced, and making it virtually impossible to inflate away because interest rates can be reset at each point of refunding. All of this may end without further turmoil, but I doubt it.

Nevertheless, it is important to emphasize that these are background considerations, and as we’ve seen over the past two years, intermediate-term risks do not persistently drive short-term market behavior. Our defensive stance as we enter 2011 is based on a syndrome of observable factors (elevated valuations, overextended price trends, overbullish sentiment, and rising interest rates) that has historically produced a negative return/risk profile, on average. As some of these conditions clear, we expect periodic opportunities to establish at least moderate exposure to market fluctuations, even against an economic backdrop that warrants continued concern.

The experience of the past decade emphasizes that speculators should not declare victory at halftime. Still, I expect that as we move forward, Strategic Growth Fund will exercise greater latitude in accepting moderate, if temporary, exposure to market fluctuations more frequently than we have in recent years, even if valuations do not normalize for some time.

With interest rates moving sharply higher from their recent lows, bond investors have increasingly recognized that the long bull market in bonds since the 1980’s may be behind us. With regard to our investment approach in Strategic Total Return, it is important to recognize that we tend to shift the Fund’s investment stance in response to shifts in market conditions a few times a year, on average. The strategy of Strategic Total Return has never relied much on the existence of a bull market in bonds (indeed, the Fund’s average bond market duration has rarely exceeded 4 years since the inception of the Fund, and has typically been limited to just 1-2 years). Since bond yields rarely advance in a straight line, I expect that we will continue to observe opportunities to shift the Fund’s investment positions a few times annually. Indeed, from an investment standpoint, higher average yields present much better periodic investment opportunities than low average yields do, again provided that yields are not rising in a straight line.

As always, we continue to focus on outperforming our investment benchmarks over the complete market cycle, with smaller periodic losses than a passive investment strategy. Despite the challenges of the recent market cycle, we are confident that adhering to a well-tested investment discipline is the best way to pursue strong absolute

|

Letter to Shareholders (continued) |

returns and long-term investment results. The ability to systematically vary the Funds’ investment exposure in response to changes in market conditions will be essential. I remain watchful of risk, and despite many continued concerns, I am excited about the opportunities ahead.

Sincerely,

John P. Hussman, Ph.D.

Past performance is not predictive of future performance. Investment results and principal value will fluctuate so that shares of the Funds, when redeemed, may be worth more or less than their original cost. Current performance may be higher or lower than the performance data quoted. Weekly updates regarding market conditions and investment strategy, as well as special reports, analysis, and performance data current to the most recent month end, are available at the Hussman Funds website www.hussmanfunds.com.

An investor should consider the investment objectives, risks, charges and expenses of the Funds carefully before investing. The Funds’ prospectuses contain this and other important information. To obtain a copy of the Hussman Funds’ prospectuses please visit our website at www.hussmanfunds.com or call 1-800-487-7626 and a copy will be sent to you free of charge. Please read the prospectus carefully before you invest. The Hussman Funds are distributed by Ultimus Fund Distributors, LLC.

The Letter to Shareholders seeks to describe some of the adviser’s current opinions and views of the financial markets. Although the adviser believes it has a reasonable basis for any opinions or views expressed, actual results may differ, sometimes significantly so, from those expected or expressed. The securities held by the Funds that are discussed in the Letter to Shareholders were held during the period covered by this Report. They do not comprise the entire investment portfolios of the Funds, may be sold at any time and may no longer be held by the Funds. The opinions of the Funds’ adviser with respect to those securities may change at any time.

Hussman Strategic Growth Fund Portfolio Information |

December 31, 2010 (Unaudited) |

| Sector Allocation (% of Total Investments and Money Market Funds) |

Hussman Strategic Total Return Fund Portfolio Information |

December 31, 2010 (Unaudited) |

| Asset Allocation (% of Net Assets) |

Hussman Strategic Growth Fund Schedule of Investments |

December 31, 2010 (Unaudited) |

| | | | | | |

| Consumer Discretionary — 23.2% | | | | | | |

| Hotels, Restaurants & Leisure — 5.8% | | | | | | |

Cheesecake Factory, Inc. (The) (a) | | | 2,292,000 | | | $ | 70,272,720 | |

Chipotle Mexican Grill, Inc. - Class A (a) | | | 250,000 | | | | 53,165,000 | |

McDonald's Corp. | | | 500,000 | | | | 38,380,000 | |

Panera Bread Co. - Class A (a) | | | 1,250,000 | | | | 126,512,500 | |

PF Chang's China Bistro, Inc. | | | 317,000 | | | | 15,361,820 | |

Royal Caribbean Cruises Ltd. (a) | | | 750,000 | | | | 35,250,000 | |

Starbucks Corp. | | | 750,000 | | | | 24,097,500 | |

| | | | | | | | 363,039,540 | |

| Internet & Catalog Retail — 0.3% | | | | | | | | |

Netflix, Inc. (a) | | | 100,000 | | | | 17,570,000 | |

| | | | | | | | | |

| Media — 1.9% | | | | | | | | |

ComCast Corp. - Class A | | | 1,050,000 | | | | 23,068,500 | |

Gannett Co., Inc. | | | 300,000 | | | | 4,527,000 | |

McClatchy Co. (The) - Class A (a) | | | 143,000 | | | | 667,810 | |

McGraw-Hill Cos., Inc. (The) | | | 2,500,000 | | | | 91,025,000 | |

| | | | | | | | 119,288,310 | |

| Multiline Retail — 3.7% | | | | | | | | |

Big Lots, Inc. (a) | | | 1,000,000 | | | | 30,460,000 | |

Dollar Tree, Inc. (a) | | | 910,000 | | | | 51,032,800 | |

Family Dollar Stores, Inc. | | | 750,000 | | | | 37,282,500 | |

Kohl's Corp. (a) | | | 1,000,000 | | | | 54,340,000 | |

Target Corp. | | | 1,000,000 | | | | 60,130,000 | |

| | | | | | | | 233,245,300 | |

| Specialty Retail — 9.6% | | | | | | | | |

Aéropostale, Inc. (a) | | | 5,250,000 | | | | 129,360,000 | |

American Eagle Outfitters, Inc. | | | 4,770,000 | | | | 69,785,100 | |

AutoZone, Inc. (a) | | | 100,000 | | | | 27,259,000 | |

Bed Bath & Beyond, Inc. (a) | | | 2,500,000 | | | | 122,875,000 | |

Best Buy Co., Inc. | | | 1,500,000 | | | | 51,435,000 | |

GameStop Corp. - Class A (a) | | | 800,000 | | | | 18,304,000 | |

Home Depot, Inc. (The) | | | 1,100,000 | | | | 38,566,000 | |

RadioShack Corp. | | | 1,000,000 | | | | 18,490,000 | |

Ross Stores, Inc. | | | 450,000 | | | | 28,462,500 | |

TJX Cos., Inc. (The) | | | 2,250,000 | | | | 99,877,500 | |

| | | | | | | | 604,414,100 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

COMMON STOCKS — 99.7% (continued) | | | | | | |

| Consumer Discretionary — 23.2% (continued) | | | | | | |

| Textiles, Apparel & Luxury Goods — 1.9% | | | | | | |

Coach, Inc. | | | 400,000 | | | $ | 22,124,000 | |

Deckers Outdoor Corp. (a) | | | 250,000 | | | | 19,935,000 | |

NIKE, Inc. - Class B | | | 600,000 | | | | 51,252,000 | |

Under Armour, Inc. - Class A (a) | | | 445,000 | | | | 24,403,800 | |

| | | | | | | | 117,714,800 | |

| Consumer Staples — 18.6% | | | | | | | | |

| Beverages — 2.6% | | | | | | | | |

Coca-Cola Co. (The) | | | 500,000 | | | | 32,885,000 | |

PepsiCo, Inc. | | | 2,000,000 | | | | 130,660,000 | |

| | | | | | | | 163,545,000 | |

| Food & Staples Retailing — 5.6% | | | | | | | | |

BJ's Wholesale Club, Inc. (a) | | | 2,335,000 | | | | 111,846,500 | |

CVS Caremark Corp. | | | 750,000 | | | | 26,077,500 | |

Sysco Corp. | | | 1,965,000 | | | | 57,771,000 | |

Walgreen Co. | | | 2,245,000 | | | | 87,465,200 | |

Whole Foods Market, Inc. (a) | | | 1,344,000 | | | | 67,992,960 | |

| | | | | | | | 351,153,160 | |

| Food Products — 4.6% | | | | | | | | |

Campbell Soup Co. | | | 1,055,000 | | | | 36,661,250 | |

Dean Foods Co. (a) | | | 1,155,000 | | | | 10,210,200 | |

General Mills, Inc. | | | 3,200,000 | | | | 113,888,000 | |

H.J. Heinz Co. | | | 600,000 | | | | 29,676,000 | |

J.M. Smucker Co. (The) | | | 250,000 | | | | 16,412,500 | |

Kellogg Co. | | | 1,250,000 | | | | 63,850,000 | |

Sara Lee Corp. | | | 1,000,000 | | | | 17,510,000 | |

| | | | | | | | 288,207,950 | |

| Household Products — 5.8% | | | | | | | | |

Clorox Co. (The) | | | 1,973,000 | | | | 124,851,440 | |

Colgate-Palmolive Co. | | | 1,750,000 | | | | 140,647,500 | |

Kimberly-Clark Corp. | | | 1,250,000 | | | | 78,800,000 | |

Procter & Gamble Co. (The) | | | 300,000 | | | | 19,299,000 | |

| | | | | | | | 363,597,940 | |

| Energy — 0.7% | | | | | | | | |

| Energy Equipment & Services — 0.7% | | | | | | | | |

Dresser-Rand Group, Inc. (a) | | | 650,000 | | | | 27,683,500 | |

Rowan Cos., Inc. (a) | | | 500,000 | | | | 17,455,000 | |

| | | | | | | | 45,138,500 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

COMMON STOCKS — 99.7% (continued) | | | | | | |

| Financials — 0.5% | | | | | | |

| Insurance — 0.5% | | | | | | |

Berkshire Hathaway, Inc. - Class B (a) | | | 375,000 | | | $ | 30,041,250 | |

| | | | | | | | | |

| Health Care — 37.2% | | | | | | | | |

| Biotechnology — 2.9% | | | | | | | | |

Amgen, Inc. (a) | | | 1,250,000 | | | | 68,625,000 | |

Biogen Idec, Inc. (a) | | | 1,500,000 | | | | 100,575,000 | |

Gilead Sciences, Inc. (a) | | | 400,000 | | | | 14,496,000 | |

| | | | | | | | 183,696,000 | |

| Health Care Equipment & Supplies — 7.5% | | | | | | | | |

Alcon, Inc. | | | 250,000 | | | | 40,850,000 | |

Align Technology, Inc. (a) | | | 1,337,000 | | | | 26,124,980 | |

ArthroCare Corp. (a) | | | 975,000 | | | | 30,283,500 | |

Becton, Dickinson and Co. | | | 484,000 | | | | 40,907,680 | |

C.R. Bard, Inc. | | | 760,000 | | | | 69,745,200 | |

IDEXX Laboratories, Inc. (a) | | | 386,000 | | | | 26,718,920 | |

Integra LifeSciences Holdings Corp. (a) | | | 1,001,000 | | | | 47,347,300 | |

Intuitive Surgical, Inc. (a) | | | 150,000 | | | | 38,662,500 | |

Medtronic, Inc. | | | 1,000,000 | | | | 37,090,000 | |

ResMed, Inc. (a) | | | 500,000 | | | | 17,320,000 | |

Stryker Corp. | | | 1,250,000 | | | | 67,125,000 | |

Varian Medical Systems, Inc. (a) | | | 273,000 | | | | 18,913,440 | |

Zimmer Holdings, Inc. (a) | | | 156,000 | | | | 8,374,080 | |

| | | | | | | | 469,462,600 | |

| Health Care Providers & Services — 8.2% | | | | | | | | |

Amedysis, Inc. (a) | | | 305,000 | | | | 10,217,500 | |

Humana, Inc. (a) | | | 3,000,000 | | | | 164,220,000 | |

Laboratory Corp. of America Holdings (a) | | | 685,000 | | | | 60,225,200 | |

LifePoint Hospitals, Inc. (a) | | | 327,000 | | | | 12,017,250 | |

Patterson Cos., Inc. | | | 1,000,000 | | | | 30,630,000 | |

Quest Diagnostics, Inc. | | | 608,000 | | | | 32,813,760 | |

UnitedHealth Group, Inc. | | | 2,500,000 | | | | 90,275,000 | |

WellPoint, Inc. (a) | | | 2,000,000 | | | | 113,720,000 | |

| | | | | | | | 514,118,710 | |

| Life Sciences Tools & Services — 6.1% | | | | | | | | |

Illumina, Inc. (a) | | | 1,534,000 | | | | 97,163,560 | |

Life Technologies Corp. (a) | | | 3,026,000 | | | | 167,943,000 | |

Pharmaceutical Product Development, Inc. | | | 720,000 | | | | 19,540,800 | |

Waters Corp. (a) | | | 1,240,000 | | | | 96,360,400 | |

| | | | | | | | 381,007,760 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

COMMON STOCKS — 99.7% (continued) | | | | | | |

| Health Care — 37.2% (continued) | | | | | | |

| Pharmaceuticals — 12.5% | | | | | | |

Abbott Laboratories | | | 1,500,000 | | | $ | 71,865,000 | |

AstraZeneca plc - ADR | | | 3,750,000 | | | | 173,212,500 | |

Bristol-Myers Squibb Co. | | | 3,500,000 | | | | 92,680,000 | |

Endo Pharmaceuticals Holdings, Inc. (a) | | | 2,555,000 | | | | 91,239,050 | |

Forest Laboratories, Inc. (a) | | | 150,000 | | | | 4,797,000 | |

Impax Laboratories, Inc. (a) | | | 282,000 | | | | 5,671,020 | |

Johnson & Johnson | | | 1,250,000 | | | | 77,312,500 | |

Merck & Co., Inc. | | | 2,500,000 | | | | 90,100,000 | |

Novartis AG - ADR | | | 635,000 | | | | 37,433,250 | |

Pfizer, Inc. | | | 5,000,000 | | | | 87,550,000 | |

Shire plc - ADR | | | 183,000 | | | | 13,245,540 | |

Valeant Pharmaceuticals International, Inc. | | | 1,500,000 | | | | 42,435,000 | |

| | | | | | | | 787,540,860 | |

| Industrials — 2.4% | | | | | | | | |

| Construction & Engineering — 0.1% | | | | | | | | |

KBR, Inc. | | | 197,000 | | | | 6,002,590 | |

| | | | | | | | | |

| Machinery — 2.3% | | | | | | | | |

Bucyrus International, Inc. | | | 642,000 | | | | 57,394,800 | |

Joy Global, Inc. | | | 800,000 | | | | 69,400,000 | |

Timken Co. | | | 350,000 | | | | 16,705,500 | |

| | | | | | | | 143,500,300 | |

| Information Technology — 16.1% | | | | | | | | |

| Communications Equipment — 1.4% | | | | | | | | |

Cisco Systems, Inc. (a) | | | 4,000,000 | | | | 80,920,000 | |

InterDigital, Inc. (a) | | | 132,000 | | | | 5,496,480 | |

| | | | | | | | 86,416,480 | |

| Computers & Peripherals — 4.8% | | | | | | | | |

Dell, Inc. (a) | | | 7,000,000 | | | | 94,850,000 | |

NetApp, Inc. (a) | | | 1,250,000 | | | | 68,700,000 | |

QLogic Corp. (a) | | | 2,559,000 | | | | 43,554,180 | |

Synaptics, Inc. (a) | | | 3,135,000 | | | | 92,106,300 | |

| | | | | | | | 299,210,480 | |

| Electronic Equipment & Instruments — 0.0% | | | | | | | | |

FUJIFILM Holdings Corp. - ADR | | | 49,400 | | | | 1,765,556 | |

Sanmina-SCI Corp. (a) | | | 12,000 | | | | 137,760 | |

| | | | | | | | 1,903,316 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

COMMON STOCKS — 99.7% (continued) | | | | | | |

| Information Technology — 16.1% (continued) | | | | | | |

| Internet Software & Services — 1.4% | | | | | | |

eBay, Inc. (a) | | | 2,000,000 | | | $ | 55,660,000 | |

VistaPrint N.V. (a) | | | 691,000 | | | | 31,786,000 | |

| | | | | | | | 87,446,000 | |

| IT Services — 2.1% | | | | | | | | |

Amdocs Ltd. (a) | | | 1,000,000 | | | | 27,470,000 | |

Cognizant Technology Solutions Corp. - Class A (a) | | | 500,000 | | | | 36,645,000 | |

Computer Sciences Corp. | | | 899,000 | | | | 44,590,400 | |

Sapient Corp. | | | 2,000,000 | | | | 24,200,000 | |

| | | | | | | | 132,905,400 | |

| Semiconductors & Semiconductor Equipment — 2.1% | | | | | | | | |

Altera Corp. | | | 1,000,000 | | | | 35,580,000 | |

SunPower Corp. - Class A (a) | | | 1,400,000 | | | | 17,962,000 | |

Xilinx, Inc. | | | 2,790,000 | | | | 80,854,200 | |

| | | | | | | | 134,396,200 | |

| Software — 4.3% | | | | | | | | |

Check Point Software Technologies Ltd. (a) | | | 1,500,000 | | | | 69,390,000 | |

FactSet Research Systems, Inc. | | | 160,000 | | | | 15,001,600 | |

Microsoft Corp. | | | 5,500,000 | | | | 153,560,000 | |

Oracle Corp. | | | 1,000,000 | | | | 31,300,000 | |

| | | | | | | | 269,251,600 | |

| Materials — 0.1% | | | | | | | | |

| Chemicals — 0.1% | | | | | | | | |

BASF SE - ADR | | | 76,800 | | | | 6,140,928 | |

| | | | | | | | | |

| Telecommunication Services — 0.9% | | | | | | | | |

| Diversified Telecommunication Services — 0.6% | | | | | | | | |

Verizon Communications, Inc. | | | 1,122,000 | | | | 40,145,160 | |

| | | | | | | | | |

| Wireless Telecommunication Services — 0.3% | | | | | | | | |

China Mobile Ltd. - ADR | | | 335,000 | | | | 16,622,700 | |

| | | | | | | | | |

Total Common Stocks (Cost $5,451,600,360) | | | | | | $ | 6,256,722,934 | |

Hussman Strategic Growth Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

PUT OPTION CONTRACTS — 1.6% | | | | | | |

Nasdaq 100 Index Option, 01/22/2011 at $2,100 | | | 3,000 | | | $ | 2,505,000 | |

Russell 2000 Index Option, 02/19/2011 at $750 | | | 8,000 | | | | 13,168,000 | |

S&P 500 Index Option, 02/19/2011 at $1,230 | | | 39,000 | | | | 83,148,000 | |

Total Put Option Contracts (Cost $103,960,715) | | | | | | $ | 98,821,000 | |

| | | | | | | | | |

Total Investments at Value — 101.3% (Cost $5,555,561,075) | | | | | | $ | 6,355,543,934 | |

MONEY MARKET FUNDS — 15.7% | | | | | | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.01% (b) | | | 337,129,386 | | | $ | 337,129,386 | |

First American Treasury Obligations Fund - Class Y, 0.00% (b) | | | 647,406,552 | | | | 647,406,552 | |

Total Money Market Funds (Cost $984,535,938) | | | | | | $ | 984,535,938 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 117.0% | | | | | | | | |

(Cost $6,540,097,013) | | | | | | $ | 7,340,079,872 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (17.0%) | | | | | | | (1,066,984,469 | ) |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 6,273,095,403 | |

| ADR - American Depositary Receipt. |

| |

| (a) | Non-income producing security. |

| | |

| (b) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Schedule of Open Written Option Contracts |

December 31, 2010 (Unaudited) |

WRITTEN CALL OPTION CONTRACTS | | | | | | | | | |

| Nasdaq 100 Index Option, | | | | | | | | | |

01/22/2011 at $1,800 | | | 3,000 | | | $ | 125,160,000 | | | $ | 116,396,060 | |

| Russell 2000 Index Option, | | | | | | | | | | | | |

01/22/2011 at $620 | | | 8,000 | | | | 130,800,000 | | | | 108,789,492 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

01/22/2011 at $980 | | | 20,000 | | | | 553,980,000 | | | | 481,973,730 | |

| S&P 500 Index Option, | | | | | | | | | | | | |

01/22/2011 at $1,030 | | | 19,000 | | | | 431,262,000 | | | | 360,975,043 | |

Total Written Option Contracts | | | | | | $ | 1,241,202,000 | | | $ | 1,068,134,325 | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Schedule of Investments |

December 31, 2010 (Unaudited) |

| | | | | | |

| Materials — 1.4% | | | | | | |

| Metals & Mining — 1.4% | | | | | | |

Agnico-Eagle Mines Ltd. | | | 100,000 | | | $ | 7,670,000 | |

AngloGold Ashanti Ltd. - ADR | | | 100,000 | | | | 4,923,000 | |

Barrick Gold Corp. | | | 50,000 | | | | 2,659,000 | |

| Compania De Minas Buenaventura S.A. - ADR | | | 100,000 | | | | 4,896,000 | |

Goldcorp, Inc. | | | 100,000 | | | | 4,598,000 | |

Harmony Gold Mining Co. Ltd. - ADR | | | 264,000 | | | | 3,310,560 | |

Newmont Mining Corp. | | | 50,000 | | | | 3,071,500 | |

Randgold Resources Ltd. - ADR | | | 25,000 | | | | 2,058,250 | |

Stillwater Mining Co. (a) | | | 10,000 | | | | 213,500 | |

| | | | | | | | 33,399,810 | |

| Utilities — 0.3% | | | | | | | | |

| Electric Utilities — 0.2% | | | | | | | | |

Pepco Holdings, Inc. | | | 136,000 | | | | 2,482,000 | |

Pinnacle West Capital Corp. | | | 57,000 | | | | 2,362,650 | |

| | | | | | | | 4,844,650 | |

| Multi-Utilities — 0.1% | | | | | | | | |

Ameren Corp. | | | 43,000 | | | | 1,212,170 | |

DTE Energy Co. | | | 54,000 | | | | 2,447,280 | |

| | | | | | | | 3,659,450 | |

| | | | | | | | | |

Total Common Stocks (Cost $35,754,059) | | | | | | $ | 41,903,910 | |

U.S. TREASURY OBLIGATIONS — 66.4% | | | | | | |

U.S. Treasury Bills (b) - 45.4% | | | | | | |

0.19%, due 01/06/2011 | | $ | 500,000,000 | | | $ | 499,999,500 | |

0.16%, due 04/07/2011 | | | 500,000,000 | | | | 499,834,000 | |

0.15%, due 05/05/2011 | | | 100,000,000 | | | | 99,953,600 | |

| | | | | | | | 1,099,787,100 | |

| U.S. Treasury Bonds — 1.0% | | | | | | | | |

4.25%, due 05/15/2039 | | | 25,000,000 | | | | 24,632,825 | |

| | | | | | | | | |

| U.S. Treasury Inflation-Protected Notes — 5.1% | | | | | | | | |

2.00%, due 04/15/2012 | | | 26,944,250 | | | | 27,944,124 | |

| 2.00%, due 07/15/2014 | | | 29,006,000 | | | | 31,383,129 | |

| 2.375%, due 01/15/2027 | | | 16,267,350 | | | | 18,119,030 | |

| 2.50%, due 01/15/2029 | | | 40,745,600 | | | | 46,360,873 | |

| | | | | | | | 123,807,156 | |

Hussman Strategic Total Return Fund Schedule of Investments (continued) |

December 31, 2010 (Unaudited) |

U.S. TREASURY OBLIGATIONS — 66.4% (continued) | | | | | | |

| U.S. Treasury Notes — 14.9% | | | | | | |

3.00%, due 08/31/2016 | | $ | 75,000,000 | | | $ | 77,871,075 | |

2.625%, due 11/15/2020 | | | 300,000,000 | | | | 283,031,400 | |

| | | | | | | | 360,902,475 | |

| | | | | | | | | |

Total U.S. Treasury Obligations (Cost $1,598,715,220) | | | | | | $ | 1,609,129,556 | |

| | | | | | | |

EXCHANGE-TRADED FUNDS — 1.0% | | | | | | |

CurrencyShares British Pound Sterling Trust (a) (c) | | | 100,000 | | | $ | 15,577,000 | |

| SPDR DB International Government Inflation-Protected Bond ETF | | | 160,000 | | | | 9,297,600 | |

Total Exchange-Traded Funds (Cost $22,697,300) | | | | | | $ | 24,874,600 | |

| | | | | | | | | |

Total Investments at Value — 69.1% (Cost $1,657,166,579) | | | | | | $ | 1,675,908,066 | |

| | | | | | | |

MONEY MARKET FUNDS — 30.8% | | | | | | |

Federated U.S. Treasury Cash Reserve Fund - Institutional Shares, 0.01% (d) | | | 189,281,731 | | | $ | 189,281,731 | |

First American Treasury Obligations Fund - Class Y, 0.00% (d) | | | 558,469,354 | | | | 558,469,354 | |

Total Money Market Funds (Cost $747,751,085) | | | | | | $ | 747,751,085 | |

| | | | | | | | | |

| Total Investments and Money Market Funds at Value — 99.9% | | | | | | | | |

(Cost $2,404,917,664) | | | | | | $ | 2,423,659,151 | |

| | | | | | | | | |

Other Assets in Excess of Liabilities — 0.1% | | | | | | | 2,376,646 | |

| | | | | | | | | |

Net Assets — 100.0% | | | | | | $ | 2,426,035,797 | |

| ADR - American Depositary Receipt. |

| |

| (a) | Non-income producing security. |

| | |

| (b) | Rate shown is the annualized yield at time of purchase, not a coupon rate. |

| | |

| (c) | For federal income tax purposes, structured as a grantor trust. |

| | |

| (d) | Variable rate security. The rate shown is the 7-day effective yield as of December 31, 2010. |

| | |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Assets and Liabilities |

December 31, 2010 (Unaudited) |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| ASSETS | | | | | | |

| Investments in securities: | | | | | | |

At acquisition cost | | $ | 5,555,561,075 | | | $ | 1,657,166,579 | |

At value (Note 1) | | $ | 6,355,543,934 | | | $ | 1,675,908,066 | |

Investments in money market funds | | | 984,535,938 | | | | 747,751,085 | |

Cash | | | 500,000 | | | | — | |

Dividends and interest receivable | | | 4,308,441 | | | | 3,214,316 | |

Receivable for investment securities sold | | | 180,722,737 | | | | — | |

Receivable for capital shares sold | | | 8,484,345 | | | | 4,454,909 | |

Other assets | | | 323,456 | | | | 151,668 | |

Total Assets | | | 7,534,418,851 | | | | 2,431,480,044 | |

| | | | | | | | | |

| LIABILITIES | | | | | | | | |

Dividends payable | | | 4,090,773 | | | | 1,419,499 | |

Written call options, at value (Notes 1 and 4)

(premiums received $1,068,134,325) | | | 1,241,202,000 | | | | — | |

Payable for capital shares redeemed | | | 9,918,467 | | | | 2,584,713 | |

Accrued investment advisory fees (Note 3) | | | 4,903,156 | | | | 965,773 | |

Payable to administrator (Note 3) | | | 444,000 | | | | 179,200 | |

Payable to Trustees | | | 5,500 | | | | 5,500 | |

Other accrued expenses | | | 759,552 | | | | 289,562 | |

Total Liabilities | | | 1,261,323,448 | | | | 5,444,247 | |

| | | | | | | | | |

NET ASSETS | | $ | 6,273,095,403 | | | $ | 2,426,035,797 | |

| | | | | | | | | |

| Net assets consist of: | | | | | | | | |

Paid-in capital | | $ | 7,203,850,084 | | | $ | 2,393,418,483 | |

| Accumulated undistributed net investment income | | | 36,493 | | | | 109,870 | |

Accumulated net realized gains (losses) from security

transactions and option contracts | | | (1,557,706,358 | ) | | | 13,765,957 | |

| Net unrealized appreciation on investments and option contracts | | | 626,915,184 | | | | 18,741,487 | |

| | | | | | | | | |

NET ASSETS | | $ | 6,273,095,403 | | | $ | 2,426,035,797 | |

| | | | | | | | | |

Shares of beneficial interest outstanding (unlimited number

of shares authorized, no par value) | | | 510,253,786 | | | | 200,053,291 | |

| | | | | | | | | |

Net asset value, offering price and redemption

price per share(a) (Note 1) | | $ | 12.29 | | | $ | 12.13 | |

| (a) | Redemption price varies based on length of time shares are held. |

| | |

| See accompanying notes to financial statements. |

Hussman Investment Trust Statements of Operations |

For the Six Months Ended December 31, 2010 (Unaudited) |

| | | Hussman Strategic Growth Fund | | | Hussman Strategic Total Return Fund | |

| INVESTMENT INCOME | | | | | | |

Dividends | | $ | 46,032,157 | | | $ | 1,872,322 | |

Foreign withholding taxes on dividends | | | (284,263 | ) | | | (31,946 | ) |

Interest | | | — | | | | 11,427,551 | |

Total Income | | | 45,747,894 | | | | 13,267,927 | |

| | | | | | | | | |

| EXPENSES | | | | | | | | |

Investment advisory fees (Note 3) | | | 29,236,861 | | | | 5,320,905 | |

Transfer agent, account maintenance and

shareholder services fees (Note 3) | | | 2,066,170 | | | | 632,004 | |

Administration fees (Note 3) | | | 1,264,714 | | | | 614,738 | |

Registration and filing fees | | | 347,585 | | | | 188,847 | |

Custodian and bank service fees | | | 217,443 | | | | 82,197 | |

Fund accounting fees (Note 3) | | | 192,277 | | | | 84,078 | |

Postage and supplies | | | 158,767 | | | | 66,440 | |

Printing of shareholder reports | | | 85,480 | | | | 42,122 | |

Professional fees | | | 43,648 | | | | 32,752 | |

Compliance service fees (Note 3) | | | 51,113 | | | | 19,219 | |

Trustees’ fees and expenses | | | 33,053 | | | | 33,053 | |

Insurance expense | | | 44,525 | | | | 14,078 | |

Other expenses | | | 19,039 | | | | 18,461 | |

Total Expenses | | | 33,760,675 | | | | 7,148,894 | |

| | | | | | | | | |

NET INVESTMENT INCOME | | | 11,987,219 | | | | 6,119,033 | |

| | | | | | | | | |

REALIZED AND UNREALIZED GAINS (LOSSES) ON

INVESTMENTS AND OPTION CONTRACTS (Note 4) | | | | | | | | |

| Net realized gains (losses) from: | | | | | | | | |

Security transactions | | | 469,393,454 | | | | 88,315,078 | |

Option contracts | | | (1,417,961,100 | ) | | | — | |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | 761,085,048 | | | | (39,264,525 | ) |

Option contracts | | | (400,480,310 | ) | | | — | |

| | | | | | | | | |

NET REALIZED AND UNREALIZED GAINS (LOSSES)

ON INVESTMENTS AND OPTION CONTRACTS | | | (587,962,908 | ) | | | 49,050,553 | |

| | | | | | | | | |

NET INCREASE (DECREASE) IN NET ASSETS

RESULTING FROM OPERATIONS | | $ | (575,975,689 | ) | | $ | 55,169,586 | |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Statements of Changes in Net Assets |

|

| | | Six Months Ended December 31, 2010 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | |

Net investment income | | $ | 11,987,219 | | | $ | 2,164,645 | |

| Net realized gains (losses) from: | | | | | | | | |

Security transactions | | | 469,393,454 | | | | 1,022,837,564 | |

Option contracts | | | (1,417,961,100 | ) | | | (1,057,179,191 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | | | | | |

Investments | | | 761,085,048 | | | | (60,548,943 | ) |

Option contracts | | | (400,480,310 | ) | | | 302,121,068 | |

| Net increase (decrease) in net assets resulting from operations | | | (575,975,689 | ) | | | 209,395,143 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (14,114,668 | ) | | | (7,151,672 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 1,601,216,191 | | | | 3,031,392,017 | |

Net asset value of shares issued in reinvestment of

distributions to shareholders | | | 10,023,895 | | | | 5,351,985 | |

| Proceeds from redemption fees collected (Note 1) | | | 270,606 | | | | 474,913 | |

Payments for shares redeemed | | | (933,666,827 | ) | | | (2,029,932,592 | ) |

| Net increase in net assets from capital share transactions | | | 677,843,865 | | | | 1,007,286,323 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 87,753,508 | | | | 1,209,529,794 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of period | | | 6,185,341,895 | | | | 4,975,812,101 | |

End of period | | $ | 6,273,095,403 | | | $ | 6,185,341,895 | |

| | | | | | | | | |

ACCUMULATED UNDISTRIBUTED NET

INVESTMENT INCOME | | $ | 36,493 | | | $ | 2,163,942 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 122,128,093 | | | | 233,800,402 | |

Shares reinvested | | | 815,614 | | | | 418,778 | |

Shares redeemed | | | (72,488,210 | ) | | | (157,582,321 | ) |

Net increase in shares outstanding | | | 50,455,497 | | | | 76,636,859 | |

Shares outstanding at beginning of period | | | 459,798,289 | | | | 383,161,430 | |

Shares outstanding at end of period | | | 510,253,786 | | | | 459,798,289 | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Statements of Changes in Net Assets |

|

| | | Six Months Ended December 31, 2010 (Unaudited) | | | | |

| FROM OPERATIONS | | | | | | |

Net investment income | | $ | 6,119,033 | | | $ | 22,353,210 | |

Net realized gains from security transactions | | | 88,315,078 | | | | 52,358,507 | |

Net change in unrealized appreciation (depreciation)

on investments | | | (39,264,525 | ) | | | 27,845,203 | |

| Net increase in net assets resulting from operations | | | 55,169,586 | | | | 102,556,920 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | |

From net investment income | | | (15,325,552 | ) | | | (19,991,520 | ) |

From net realized gains | | | (102,020,396 | ) | | | (18,352,276 | ) |

| Decrease in net assets from distributions to shareholders | | | (117,345,948 | ) | | | (38,343,796 | ) |

| | | | | | | | | |

| FROM CAPITAL SHARE TRANSACTIONS | | | | | | | | |

Proceeds from shares sold | | | 853,033,645 | | | | 1,259,791,954 | |

Net asset value of shares issued in reinvestment of

distributions to shareholders | | | 101,123,217 | | | | 33,519,756 | |

| Proceeds from redemption fees collected (Note 1) | | | 206,465 | | | | 244,066 | |

Payments for shares redeemed | | | (351,136,408 | ) | | | (496,374,834 | ) |

| Net increase in net assets from capital share transactions | | | 603,226,919 | | | | 797,180,942 | |

| | | | | | | | | |

TOTAL INCREASE IN NET ASSETS | | | 541,050,557 | | | | 861,394,066 | |

| | | | | | | | | |

| NET ASSETS | | | | | | | | |

Beginning of period | | | 1,884,985,240 | | | | 1,023,591,174 | |

End of period | | $ | 2,426,035,797 | | | $ | 1,884,985,240 | |

| | | | | | | | | |

ACCUMULATED UNDISTRIBUTED NET

INVESTMENT INCOME | | $ | 109,870 | | | $ | 3,367,648 | |

| | | | | | | | | |

| CAPITAL SHARE ACTIVITY | | | | | | | | |

Shares sold | | | 68,000,060 | | | | 104,030,315 | |

Shares reinvested | | | 8,235,210 | | | | 2,758,642 | |

Shares redeemed | | | (28,119,632 | ) | | | (41,070,483 | ) |

Net increase in shares outstanding | | | 48,115,638 | | | | 65,718,474 | |

Shares outstanding at beginning of period | | | 151,937,653 | | | | 86,219,179 | |

Shares outstanding at end of period | | | 200,053,291 | | | | 151,937,653 | |

| See accompanying notes to financial statements. |

Hussman Strategic Growth Fund Financial Highlights |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period |

| | | Six Months Ended December 31, 2010 (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value at

beginning of period | | $ | 13.45 | | | $ | 12.99 | | | $ | 15.73 | | | $ | 15.85 | | | $ | 16.13 | | | $ | 15.90 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Income (loss) from

investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.02 | | | | 0.00 | (a) | | | 0.03 | | | | 0.04 | | | | 0.14 | | | | 0.08 | |

Net realized and unrealized

gains (losses) on investments and options | | | (1.15 | ) | | | 0.48 | | | | (0.88 | ) | | | 0.55 | | | | 0.16 | | | | 0.69 | |

Total from investment

operations | | | (1.13 | ) | | | 0.48 | | | | (0.85 | ) | | | 0.59 | | | | 0.30 | | | | 0.77 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net

investment income | | | (0.03 | ) | | | (0.02 | ) | | | (0.03 | ) | | | (0.09 | ) | | | (0.13 | ) | | | (0.05 | ) |

Distributions from net

realized gains | | | — | | | | — | | | | (1.87 | ) | | | (0.63 | ) | | | (0.46 | ) | | | (0.50 | ) |

Total distributions | | | (0.03 | ) | | | (0.02 | ) | | | (1.90 | ) | | | (0.72 | ) | | | (0.59 | ) | | | (0.55 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption

fees collected (Note 1) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.01 | | | | 0.01 | | | | 0.01 | | | | 0.01 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 12.29 | | | $ | 13.45 | | | $ | 12.99 | | | $ | 15.73 | | | $ | 15.85 | | | $ | 16.13 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | (8.42% | )(c) | | | 3.68% | | | | (4.35% | ) | | | 3.84% | | | | 1.98% | | | | 5.05% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 6,273,095 | | | $ | 6,185,342 | | | $ | 4,975,812 | | | $ | 3,275,008 | | | $ | 2,718,324 | | | $ | 2,816,108 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of expenses to

average net assets | | | 1.03% | (d) | | | 1.05% | | | | 1.09% | | | | 1.11% | | | | 1.11% | | | | 1.14% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income to

average net assets | | | 0.36% | (d) | | | 0.04% | | | | 0.28% | | | | 0.28% | | | | 0.91% | | | | 0.63% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 25% | (c) | | | 111% | | | | 69% | | | | 150% | | | | 106% | | | | 63% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | Not annualized. |

| | |

| (d) | Annualized. |

| | |

| See accompanying notes to financial statements. |

Hussman Strategic Total Return Fund Financial Highlights |

Selected Per Share Data and Ratios for a Share Outstanding Throughout Each Period |

| | | Six Months Ended December 31, 2010 (Unaudited) | | | | | | | | | | | | | | | | |

Net asset value at

beginning of period | | $ | 12.41 | | | $ | 11.87 | | | $ | 11.99 | | | $ | 10.92 | | | $ | 11.30 | | | $ | 10.94 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net investment income | | | 0.03 | | | | 0.18 | | | | 0.05 | | | | 0.24 | | | | 0.32 | | | | 0.32 | |

Net realized and unrealized

gains on investments and foreign currencies | | | 0.31 | | | | 0.69 | | | | 0.35 | | | | 1.59 | | | | 0.06 | | | | 0.65 | |

Total from investment operations | | | 0.34 | | | | 0.87 | | | | 0.40 | | | | 1.83 | | | | 0.38 | | | | 0.97 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Dividends from net

investment income | | | (0.08 | ) | | | (0.16 | ) | | | (0.01 | ) | | | (0.23 | ) | | | (0.33 | ) | | | (0.31 | ) |

Distributions from net

realized gains | | | (0.54 | ) | | | (0.17 | ) | | | (0.53 | ) | | | (0.54 | ) | | | (0.43 | ) | | | (0.30 | ) |

Total distributions | | | (0.62 | ) | | | (0.33 | ) | | | (0.54 | ) | | | (0.77 | ) | | | (0.76 | ) | | | (0.61 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Proceeds from redemption

fees collected (Note 1) | | | 0.00 | (a) | | | 0.00 | (a) | | | 0.02 | | | | 0.01 | | | | 0.00 | (a) | | | 0.00 | (a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net asset value at end of period | | $ | 12.13 | | | $ | 12.41 | | | $ | 11.87 | | | $ | 11.99 | | | $ | 10.92 | | | $ | 11.30 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total return(b) | | | 2.69% | (d) | | | 7.44% | | | | 3.94% | | | | 17.23% | | | | 3.46% | | | | 9.01% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Net assets at end of period (000’s) | | $ | 2,426,036 | | | $ | 1,884,985 | | | $ | 1,023,591 | | | $ | 330,965 | | | $ | 174,480 | | | $ | 158,735 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net expenses

to average net assets | | | 0.63% | (e) | | | 0.67% | | | | 0.75% | | | | 0.90% | | | | 0.90% | | | | 0.90% | (c) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Ratio of net investment income

to average net assets | | | 0.54% | (e) | | | 1.59% | | | | 0.26% | | | | 2.05% | | | | 2.86% | | | | 2.94% | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio turnover rate | | | 118% | (d) | | | 69% | | | | 36% | | | | 212% | | | | 41% | | | | 55% | |

| (a) | Amount rounds to less than $0.01 per share. |

| | |

| (b) | Total return is a measure of the change in value of an investment in the Fund over the period covered, which assumes any dividends or capital gains distributions are reinvested in shares of the Fund. Returns do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares. |

| | |

| (c) | Absent investment advisory fee reductions by the Adviser, the ratio of expenses to average net assets would have been 0.92% for the year ended June 30, 2006. |

| | |

| (d) | Not annualized. |

| | |

| (e) | Annualized. |

| | |

| See accompanying notes to financial statements. |

Hussman Investment Trust Notes to Financial Statements |

December 31, 2010 (Unaudited) |

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES |

Hussman Strategic Growth Fund and Hussman Strategic Total Return Fund (each, a “Fund”, and collectively, the “Funds”) are diversified series of Hussman Investment Trust (the “Trust”), which is registered under the Investment Company Act of 1940 as an open-end managment investment company. Each Fund is authorized to issue an unlimited number of shares. Hussman Strategic Growth Fund commenced operations on July 24, 2000. Hussman Strategic Total Return Fund commenced operations on September 12, 2002.

Hussman Strategic Growth Fund’s investment objective is to provide long-term capital appreciation, with added emphasis on protection of capital during unfavorable market conditions.

Hussman Strategic Total Return Fund’s investment objective is to provide long-term total return from income and capital appreciation, with added emphasis on protection of capital during unfavorable market conditions.

Securities and Options Valuation — The Funds’ portfolio securities are valued at market value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally, 4:00 Eastern time) on each business day the NYSE is open. Securities, other than options, listed on the NYSE or other exchanges are valued on the basis of their last sale prices on the exchanges on which they are primarily traded. However, if the last sale price on the NYSE is different than the last sale price on any other exchange, the NYSE price will be used. If there are no sales on that day, the securities are valued at the last bid price on the NYSE or other primary exchange for that day. Securities traded on a foreign stock exchange are valued based upon the closing price on the principal exchange where the security is traded. Securities which are quoted by NASDAQ are valued at the NASDAQ Official Closing Price. If there are no sales on that day, the securities are valued at the last bid price as reported by NASDAQ. Securities traded in over-the-counter markets, other than NASDAQ quoted securities, are valued at the last sales price, or if there are no sales on that day, at the mean of the closing bid and asked prices. Values of foreign securities are translated from the local currency into U.S. dollars using currency exchange rates supplied by an independent pricing quotation service.

Pursuant to procedures approved by the Board of Trustees, options traded on a national securities exchange are valued at prices between the closing bid and ask prices determined by Hussman Econometrics Advisors, Inc. (the “Adviser”) to most closely reflect market value as of the time of computation of net asset value. As of December 31, 2010, all options held by Hussman Strategic Growth Fund have been valued in this manner. Options not traded on a national securities exchange or board

Hussman Investment Trust Notes to Financial Statements (continued) |

December 31, 2010 (Unaudited) |

of trade, but for which over-the-counter market quotations are readily available, are valued at the mean of their closing bid and ask prices. Futures contracts and options thereon, which are traded on commodities exchanges, are valued at their last sale price or, if not available, at the mean of the bid and ask prices as of the close of such commodities exchanges.

Fixed income securities not traded or dealt in upon any securities exchange but for which over-the-counter market quotations are readily available generally are valued at the mean of their closing bid and asked prices. Fixed income securities may also be valued on the basis of prices provided by an independent pricing service. The fair value of securities with remaining maturities of 60 days or less may be determined in good faith by the Board of Trustees to be represented by amortized cost value, absent unusual circumstances.

In the event that market quotations are not readily available or are determined by the Adviser to not be reflective of fair market value due to market events or developments, securities and options are valued at fair value as determined by the Adviser in accordance with procedures adopted by the Board of Trustees. Such methods of fair valuation may include, but are not limited to: multiple of earnings, multiple of book value, discount from market of a similar freely traded security, purchase price of security, subsequent private transactions in the security or related securities, or a combination of these and other factors.

Accounting principles generally accepted in the United States (“GAAP”) establish a single authoritative definition of fair value, set out a framework for measuring fair value and require additional disclosures about fair value measurements.

Various inputs are used in determining the value of each of the Fund’s investments. These inputs are summarized in the three broad levels listed below:

| | • | Level 1 – quoted prices in active markets for identical securities |

| | • | Level 2 – other significant observable inputs |

| | • | Level 3 – significant unobservable inputs |

For example, options contracts purchased and written by Hussman Strategic Growth Fund are classified as Level 2 since they are valued at prices between the closing bid and ask prices determined by the Adviser to most closely reflect market value. U.S. Treasury obligations held by Hussman Strategic Total Return Fund are classified as Level 2 since values are based on prices provided by an independent pricing service that utilizes various “other significant observable inputs” including bid and ask quotations, prices of similar securities and interest rates, among other factors. The inputs or methodology used for valuing securities are not necessarily an

Hussman Investment Trust Notes to Financial Statements (continued) |

December 31, 2010 (Unaudited) |

indication of the risks associated with investing in those securities. The inputs used to measure the value of a particular security may fall into more than one level of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement of that security is determined to fall in its entirety is the lowest level input that is significant to the fair value measurement.

The following is a summary of the inputs used to value each Fund’s investments and other financial instruments as of December 31, 2010 by security type:

| Hussman Strategic Growth Fund |

| | | | | | | | | | | | | |

Investments in Securities and Money Market Funds: | | | | | | | | | | | | |

Common Stocks | | $ | 6,256,722,934 | | | $ | — | | | $ | — | | | $ | 6,256,722,934 | |

Put Option Contracts | | | — | | | | 98,821,000 | | | | — | | | | 98,821,000 | |

Money Market Funds | | | — | | | | 984,535,938 | | | | — | | | | 984,535,938 | |

Total Investments in Securities and Money Market Funds | | $ | 6,256,722,934 | | | $ | 1,083,356,938 | | | $ | — | | | $ | 7,340,079,872 | |

| | | | | | | | | | | | | | | | | |

Other Financial Instruments: | | | | | | | | | | | | | | | | |

Written Call Option Contracts | | $ | — | | | $ | (1,241,202,000 | ) | | $ | — | | | $ | (1,241,202,000 | ) |

Total Other Financial Instruments | | $ | — | | | $ | (1,241,202,000 | ) | | $ | — | | | $ | (1,241,202,000 | ) |

| Hussman Strategic Total Return Fund |

| | | | | | | | | | | | | |

Investments in Securities and Money Market Funds: | | | | | | | | | | | | |

Common Stocks | | $ | 41,903,910 | | | $ | — | | | $ | — | | | $ | 41,903,910 | |

U.S. Treasury Obligations | | | — | | | | 1,609,129,556 | | | | — | | | | 1,609,129,556 | |

Exchange-Traded Funds | | | 24,874,600 | | | | — | | | | — | | | | 24,874,600 | |

Money Market Funds | | | — | | | | 747,751,085 | | | | — | | | | 747,751,085 | |

Total Investments in Securities and Money Market Funds | | $ | 66,778,510 | | | $ | 2,356,880,641 | | | $ | — | | | $ | 2,423,659,151 | |

Each Fund’s Schedule of Investments identifies the specific securities (by type of security and industry type) that comprise that Funds holdings within the Level 1 and Level 2 categories shown in the tables above. During the six months ended December 31, 2010, the Funds did not have any significant transfers in and out of Level 1 or

Hussman Investment Trust Notes to Financial Statements (continued) |

December 31, 2010 (Unaudited) |

Level 2. In addition, the Funds did not have any assets or liabilities that were measured at fair value on a recurring basis using significant unobservable inputs (Level 3) as of or during the six months ended December 31, 2010.

Futures Contracts and Option Transactions — Hussman Strategic Growth Fund may purchase and write put and call options on broad-based stock indices. The Fund may also purchase and write call and put options on individual securities. Hussman Strategic Total Return Fund may use financial futures contracts and related options to hedge against changes in the market value of its portfolio securities. The Fund may also purchase a foreign currency option to establish or modify the Fund’s exposure to foreign currencies, or an interest rate futures contract to protect against a decline in the value of its portfolio.