(Address of principal executive offices) (Zip code)

A. Vason Hamrick

116 South Franklin Street, Post Office Box 69, Rocky Mount, North Carolina 27802

Item 1. REPORTS TO STOCKHOLDERS.

Annual Report 2011

September 30, 2011

The Hillman Advantage Equity Fund

The Hillman Focused Advantage Fund

No Load Shares

Class A Shares

Class C Shares

This report and the financial statements contained herein are submitted for the general information of the shareholders of the Hillman Capital Management Funds (the “Funds”). This report is not authorized for distribution to prospective investors in the Funds unless preceded or accompanied by an effective prospectus. The Funds’ shares are not deposits or obligations of, or guaranteed by, any depository institution. The Funds’ shares are not insured by the FDIC, Federal Reserve Board or any other agency, and are subject to investment risks, including possible loss of principal amount invested. Neither the Funds nor the Funds’ distributor is a bank.

The Hillman Capital Management Funds are distributed by Capital Investment Group, Inc., Member FINRA/SIPC, 17 Glenwood Ave, Raleigh, NC, 27603. There is no affiliation between the Hillman Capital Management Funds, including its principals, and Capital Investment Group, Inc.

Statements in this Annual Report that reflect projections or expectations of future financial or economic performance of the Hillman Capital Management Funds (“Funds”) and of the market in general and statements of the Funds’ plans and objectives for future operations are forward-looking statements. No assurance can be given that actual results or events will not differ materially from those projected, estimated, assumed or anticipated in any such forward-looking statements. Important factors that could result in such differences, in addition to the other factors noted with such forward-looking statements, include, without limitation, general economic conditions such as inflation, recession and interest rates. Past performance is not a guarantee of future results.

Investments in the Funds are subject to investment risks, including the possible loss of some or the entire principal amount invested. There can be no assurance that the Funds will be successful in meeting their investment objective. Investment in the Funds is subject to the following risks: market risk, management style risk, investment advisor risk, and Small-Cap and Mid-Cap companies risk. In addition to the risks outlined above, the Focused Advantage Fund is also subject to non-diversified status risk and sector focus risk. More information about these risks and other risks can be found in the Funds’ prospectus.

The performance information quoted in this annual report represents past performance, which is not a guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data current to the most recent month-end by visiting www.hillmancapital.com.

This Annual Report was first distributed to shareholders on or about November 29, 2011.

For More Information on your Hillman Capital Management (Hillman) Mutual Funds:

See Our Website @ www.hillmancapital.com

or

Call Our Shareholder Services Group Toll-Free at 1-800-773-3863

Letter to Shareholders

Dear Hillman Fund Shareholder,

We are pleased to provide the annual report for the Hillman Funds for the fiscal year ended 09/30/2011.

We have enclosed the attached commentary to remind our shareholders of Hillman Capital Management’s approach and to share some perspective on current economic conditions.

On behalf of the team at Hillman Capital Management, I thank you for your ongoing confidence. It is our hope that we may continue to serve you throughout the years to come.

Sincerely,

Mark A. Hillman

President and Chief Investment Officer

Hillman Capital Management, Inc.

Market Commentary

At Hillman Capital Management (HCM) we take a long-term approach to investing, focusing on the identification of companies with sustainable competitive advantage. Our goal is to purchase securities of advantaged firms when they sell at a discount to our estimates of intrinsic value. We believe that our approach offers a prudent way to attempt to control risk and potentially outperform the market over time.

Investor anxiety heightened in the second half of the Funds’ 2011 fiscal year, as a broad series of macro-economic concerns weighed on future expectations for the global economy. Sell side brokerage reports have increasingly highlighted the potential pitfalls for global economic growth. As an example, a recent JP Morgan research report entitled “Too many banana peels” suggested that investors retain a “defensive posture”. The report cites issues including the European sovereign debt crisis, an impending Western European recession, probable fiscal tightening in the U.S. in 2012, and the weakening pace of growth in Asian economies. Significant economic challenges exist as the European Union and the United States face up to the fiscal realities imposed by slow economic growth, high levels of sovereign debt relative to GDP, and ballooning budget deficits. We believe that there are available paths forward that could result in positive outcomes for equity values. However, many of the necessary decisions will be made by select groups behind closed doors. As a result, we believe that specific policy outcomes may be hard to foresee.

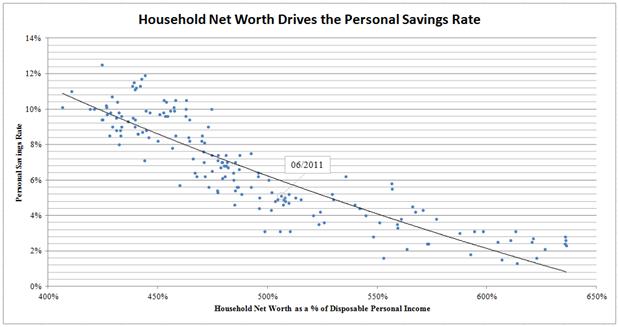

As speculation regarding the direction of government regulatory and fiscal actions has dominated headlines, many investors do not appear to be focused on long-term economic drivers. Economies achieve varying levels of activity as a result of the willingness and ability of populations to satisfy their needs and material wants. Observing savings patterns within the United States’ economy, we believe that consumer spending levels relative to discretionary income have been directly influenced by household net worth. The chart below depicts the quarterly U.S. personal

savings rate experienced for each level of net worth relative to disposable personal income since 1970. The data in this chart indicates that the current savings rate is within the range expected for the current level of household net worth. The data also provides evidence demonstrating that the wealth effect has had a meaningful impact on consumer behavior over time.

The chart reflects quarterly data points for period between 2Q 1970 and 2Q 2011.

Source: U. S. Federal Reserve, U.S. Bureau of Economic Analysis, Stifel Nicolaus.

Consumer expectations play a vital role in the U.S. economy’s health. For many who aim to smooth consumption over long periods, income expectations are a key factor when making decisions to purchase large durable goods, including automobiles and houses. With the exception of a brief spike in 2010, expectations for income growth have been at historically low levels since the onset of the financial crisis. The Conference Board’s Consumer Confidence Surveys suggest that since October of 2008, an average of 11.9% of people have expected to increase earnings in the ensuing 6 months versus an average of 20.9% of people over the prior decade. This factor, among others, helps to explain the tepid level of large capital purchases by consumers during the past several years.

Similar to consumers, business leaders’ future expectations drive capital allocation decisions as they attempt to gauge future demand. Business spending on capital equipment represents only about 7% of GDP, however it has accounted for a full third of GDP growth since the recovery began.1 The recent strength in capital spending among large companies is likely attributable to robust corporate profit growth, a low cost of capital, and the need to backfill capital budgets due to reduced outlays during the recent recession. Although capital spending growth has been a driver of the broader economy, recent surveys conducted by the regional Federal Reserve banks suggest that the pace of growth in business’ capital spending is likely to moderate. Furthermore, as has been widely reported, U.S. corporations have accumulated over two trillion in cash on their balance sheets. Such levels of liquidity suggest that management teams are wary of the current economic climate

Although the pace of economic growth is likely to be slow, we believe that the near-term risk of a deep contraction is low. Since the financial crisis, economic activity has been maintained despite persistently low expectations among economic participants. Therefore, we believe that the United States would need to experience a significant decline in household net worth to seriously reduce consumer behavior. Today’s asset values appear to already encapsulate investors’ expectations of poor economic outcomes. For example, many housing markets are currently

1 JP Morgan Chase, Economic Research Global Data Watch

supported by an improved balance of the cost to own versus rent and are experiencing minimal levels of new construction. In equity markets, the Standard and Poor’s 500 Index pays a dividend yield in excess of what is available in 10 year treasuries with the underlying companies expected to pay out only 27% of earnings as dividends2. Due to the combination of reasonable asset prices and the predisposition of the Federal Reserve to avoid a deflationary episode, we believe that a sustained decline in household net worth is unlikely in the near-term.

We believe that the global marketplace offers ample opportunities for large U.S. companies not only to expand sales, but also to reinforce their competitive strengths. In light of the remaining imbalances within many developed economies, the path of economic growth is likely to be choppy. Through this period, we will continue to focus our energies on the financial prospects of companies that we view to have sustainable competitive advantage and sufficient financial flexibility to weather troughs in economic activity. We believe that competitively advantaged companies will outperform their peers through economic cycles and market cycles. Our goal is to invest in great enterprises at attractive prices. We will continue to invest according to this precept for the long-term interests of our clients.

Performance Summary

For the fiscal year ended 09/30/2011, the Hillman Advantage Equity Fund and the Hillman Focused Advantage Equity Fund returned -4.06% and -6.38% respectively versus a return of 1.14% for the Standard and Poor’s 500 TR Index (the Index). We believe that the Funds’ recent underperformance is largely a result of their exposures to a number of best of breed companies within industries that have moved further out of favor with investors. Although we are disappointed by the Funds’ near-term share price performance, we recognize that investing is a marathon and not a sprint. Despite disappointing near-term performance the Funds have outperformed the Index over longer periods of time. Since their inception at the outset of 2001 the Hillman Advantage Equity Fund and the Hillman Focused Advantage Equity Fund have generated positive annualized total returns of 2.91% and 2.04% respectively versus an annualized total return of 0.46% for the Index (please refer to the “performance update” page for additional performance information). We have confidence in our portfolio holdings and believe that their value will prove compelling over time.

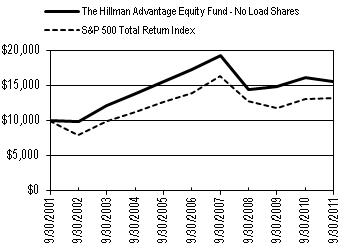

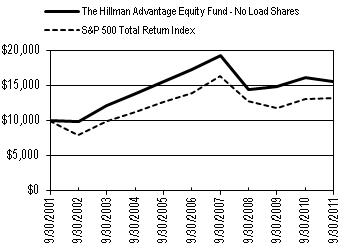

The Hillman Advantage Equity Fund No Load Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from September 30, 2001 to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Ten Year | Gross Expense Ratio* |

| The Hillman Advantage Equity Fund No Load Shares | (4.06)% | | (2.03)% | 4.52% | 2.50% |

Cumulative Total Investment Returns | Ten Year | | Final Value of $10,000 Investment |

The Hillman Advantage Equity Fund No Load Shares | 55.54% | $15,554 |

| S&P 500 Total Return Index | 32.00% | $13,200 |

The graph assumes an initial $10,000 investment at September 30, 2001. All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Advantage Equity Fund - No Load Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $856.00 | $6.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.55 | $7.59 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 1.50%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

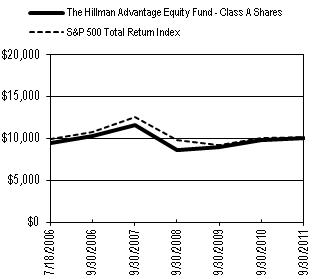

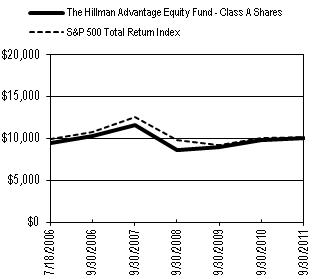

The Hillman Advantage Equity Fund Class A Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from July 18, 2006 (Date of Initial Public Offering) to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Since Inception* | Gross Expense Ratio** |

The Hillman Advantage Equity Fund Class A Shares - No Sales Load | (3.88)% | (1.70)% | 0.07% | 2.50% |

| The Hillman Advantage Equity Fund Class A Shares - 5.75% Maximum Sales Load | (9.41)% | (2.86)% | (1.06)% | 2.50% |

Cumulative Total Investment Returns | Since Inception* | Final Value of $10,000 Investment |

The Hillman Advantage Equity Fund Class A Shares - No Sales Load | 0.36% | $10,045 |

The Hillman Advantage Equity Fund Class A Shares - 5.75% Maximum Sales Load | (5.41)% | $9,467 |

| S&P 500 Total Return Index | 2.19% | $10,219 |

The graph assumes an initial $10,000 investment ($9,425 after maximum sales load of 5.75%) at July 18, 2006 (Date of Initial Public Offering). All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Advantage Equity Fund – Class A Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The Fund’s inception date – July 18, 2006 (Date of Initial Public Offering). ** The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $856.00 | $6.98 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.55 | $7.59 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 1.50%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

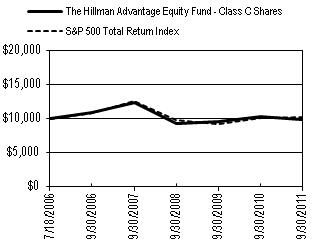

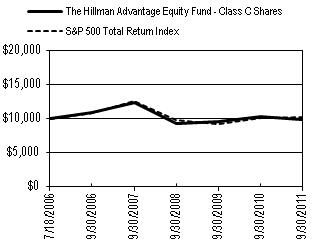

The Hillman Advantage Equity Fund Class C Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from July 18, 2006 (Date of Initial Public Offering) to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Since Inception* | Gross Expense Ratio** |

The Hillman Advantage Equity Fund Class C Shares - No Sales Load | (4.73)% | (2.04)% | (0.29)% | 3.25% |

Cumulative Total Investment Returns | Since Inception* | Final Value of $10,000 Investment |

The Hillman Advantage Equity Fund Class C Shares - No Sales Load | (1.52)% | $9,848 |

| S&P 500 Total Return Index | 2.19% | $10,219 |

The graph assumes an initial $10,000 investment at July 18, 2006 (Date of Initial Public Offering). The deduction of the maximum contingent deferred sales charge (“CDSC”) is not reflected in the graph or chart above because the 1% CDSC for the Class C Shares is imposed on proceeds redeemed within 1 year of the purchase date. The CDSC may be waived or reduced under certain circumstances. All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Advantage Equity Fund – Class C Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The Fund’s inception date – July 18, 2006 (Date of Initial Public Offering). ** The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include CDSC fees on redemption payments and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $852.60 | $10.45 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.79 | $11.36 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 2.25%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

| The Hillman Advantage Equity Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| As of September 30, 2011 | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| COMMON STOCKS - 97.97% | | | | | | |

| | | | | | | | | | |

| | Consumer Discretionary - 8.33% | | | | | | |

| | * | Apollo Group, Inc. - Cl. A | | | | 5,100 | $ | 202,011 |

| | | Best Buy Co., Inc. | | | | 9,000 | | 209,700 |

| | | Starbucks Corp. | | | | 6,200 | | 231,198 |

| | | The Walt Disney Co. | | | | 6,200 | | 186,992 |

| | | | | | | | | | 829,901 |

| | Consumer Staples - 11.23% | | | | | | |

| | | Campbell Soup Co. | | | | 7,100 | | 229,827 |

| | | HJ Heinz Co. | | | | | 4,200 | | 211,974 |

| | | Sysco Corp. | | | | | 8,000 | | 207,120 |

| | | The Clorox Co. | | | | | 3,800 | | 252,054 |

| | | Wal-Mart Stores, Inc. | | | | 4,200 | | 217,980 |

| | | | | | | | | | 1,118,955 |

| | Energy - 4.45% | | | | | | | |

| | | Exxon Mobil Corp. | | | | 3,400 | | 246,942 |

| | | Transocean Ltd. | | | | 4,100 | | 195,734 |

| | | | | | | | | | 442,676 |

| | Financials - 16.90% | | | | | | |

| | | American Express Co. | | | | 5,100 | | 228,939 |

| | | Bank of America Corp. | | | | 34,000 | | 207,740 |

| | | JPMorgan Chase & Co. | | | | 6,700 | | 201,871 |

| | | The Allstate Corp | | | | 8,200 | | 194,258 |

| | | The Goldman Sachs Group, Inc. | | | | 2,000 | | 188,960 |

| | | The Western Union Co. | | | | 12,600 | | 192,654 |

| | | Visa, Inc. - Cl. A | | | | 2,800 | | 240,016 |

| | | Wells Fargo & Co. | | | | 9,500 | | 229,140 |

| | | | | | | | | | 1,683,578 |

| | Health Care - 11.11% | | | | | | |

| | | Amgen, Inc. | | | | | 4,500 | | 247,320 |

| | | Johnson & Johnson | | | | 3,300 | | 210,177 |

| | * | Laboratory Corp of America Holdings | | | 2,600 | | 205,530 |

| | | Merck & Co, Inc. | | | | 7,200 | | 235,440 |

| | | Pfizer, Inc. | | | | | 11,800 | | 208,624 |

| | | | | | | | | | 1,107,091 |

| | Industrials - 14.67% | | | | | | |

| | | 3M Co. | | | | | 2,700 | | 193,671 |

| | | General Electric Co. | | | | 14,700 | | 223,734 |

| | | Goodrich Corp. | | | | | 1,800 | | 217,260 |

| | | Honeywell International, Inc. | | | | 5,100 | | 224,043 |

| | | Ingersoll-Rand PLC | | | | 5,800 | | 162,870 |

| | | Raytheon Co. | | | | | 5,000 | | 204,350 |

| | | The Boeing Co. | | | | | 3,900 | | 235,989 |

| | | | | | | | | | 1,461,917 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | (Continued) |

| The Hillman Advantage Equity Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| As of September 30, 2011 | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| COMMON STOCKS - (Continued) | | | | | | |

| | | | | | | | | | |

| | Information Technology - 24.66% | | | | | | |

| | * | Apple, Inc. | | | | | 700 | $ | 266,924 |

| | | Cisco Systems, Inc. | | | | 14,700 | | 227,850 |

| | | Corning, Inc. | | | | | 13,500 | | 166,928 |

| | * | Google, Inc. - Cl. A | | | | 400 | | 206,016 |

| | | Hewlett-Packard Co. | | | | 8,500 | | 190,825 |

| | | Intel Corp. | | | | | 11,500 | | 245,352 |

| | | International Business Machines Corp. | | | 1,500 | | 262,305 |

| | | Microsoft Corp. | | | | | 9,100 | | 226,499 |

| | | Oracle Corp. | | | | | 8,600 | | 247,164 |

| | | Texas Instruments, Inc. | | | | 7,700 | | 205,205 |

| | * | Yahoo!, Inc. | | | | | 16,100 | | 212,037 |

| | | | | | | | | | 2,457,105 |

| | Materials - 4.13% | | | | | | | |

| | | E.I. du Pont de Nemours & Co. | | | | 5,300 | | 211,682 |

| | | Nucor Corp. | | | | | 6,300 | | 199,395 |

| | | | | | | | | | 411,077 |

| | Telecommunications - 2.49% | | | | | | |

| | | AT&T, Inc. | | | | | 8,700 | | 247,950 |

| | | | | | | | | | 247,950 |

| | | | | | | | | | |

| | | Total Common Stocks (Cost $9,569,222) | | | | | 9,760,250 |

| | | | | | | | | | |

| INVESTMENT COMPANY - 2.09% | | | | | | |

| | § | HighMark 100% US Treasury Money Market Fund, 0.00% Ω | | 208,541 | | 208,541 |

| | | | | | | | | | |

| | | Total Investment Company (Cost $208,541) | | | | | 208,541 |

| | | | | | | | | | |

| Total Value of Investments (Cost $9,777,763) - 100.06% | | | $ | 9,968,791 |

| | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.06)% | | | | | (5,529) |

| | | | | | | | | | |

| | Net Assets - 100% | | | | | | $ | 9,963,262 |

| | | | | | | | | | |

| * | Non-income producing investment | | | | | | |

| § | Represents 7 day effective yield | | | | | | |

| Ω | Actual amount is less than 0.01% | | | | | | |

| | | | | | | | | | |

| | The following acronym is used in this portfolio: | | | | | |

| | PLC - Public Limited Company | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | (Continued) |

| The Hillman Advantage Equity Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| As of September 30, 2011 | | | | | | |

| | | | | | | | | | |

| | | | Summary of Investments by Sector | | | | |

| | | | | | % of Net | | | | |

| | | | Sector | | Assets | | Value | | |

| | | | Consumer Discretionary | 8.33% | $ | 829,901 | | |

| | | | Consumer Staples | | 11.23% | | 1,118,955 | | |

| | | | Energy | | 4.45% | | 442,676 | | |

| | | | Financials | | 16.90% | | 1,683,578 | | |

| | | | Health Care | | 11.11% | | 1,107,091 | | |

| | | | Industrials | | 14.67% | | 1,461,917 | | |

| | | | Information Technology | 24.66% | | 2,457,105 | | |

| | | | Materials | | 4.13% | | 411,077 | | |

| | | | Telecommunications | 2.49% | | 247,950 | | |

| | | | Other | | 2.09% | | 208,541 | | |

| | | | Total | | 100.06% | $ | 9,968,791 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

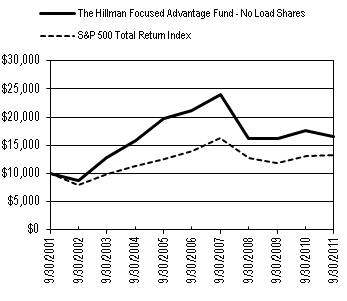

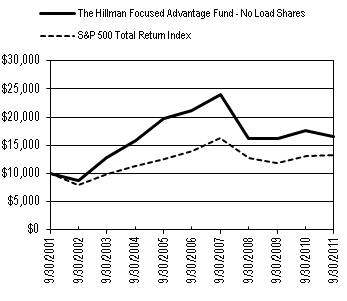

The Hillman Focused Advantage Fund No Load Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from September 30, 2001 to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Ten Year | Gross Expense Ratio* |

| The Hillman Focused Advantage Fund No Load Shares | (6.38)% | (4.77)% | 5.18% | 2.50% |

Cumulative Total Investment Returns | | Ten Year | Final Value of $10,000 Investment |

| The Hillman Focused Advantage Fund No Load Shares | | 65.65% | $16,565 |

| S&P 500 Total Return Index | | 32.00% | $13,200 |

The graph assumes an initial $10,000 investment at September 30, 2001. All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Focused Advantage Fund - No Load Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $795.00 | $6.75 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.55 | $7.59 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 1.50%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

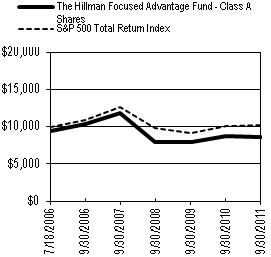

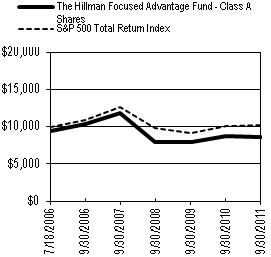

The Hillman Focused Advantage Fund Class A Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from July 18, 2006 (Date of Initial Public Offering) to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Since Inception* | Gross Expense Ratio** |

The Hillman Focused Advantage Fund Class A Shares - No Sales Load | (6.28)% | (4.72)% | (2.82)% | 2.50% |

| The Hillman Focused Advantage Fund Class A Shares - 5.75% Maximum Sales Load | (11.67)% | (5.84)% | (3.92)% | 2.50% |

Cumulative Total Investment Returns | Since Inception* | Final Value of $10,000 Investment |

The Hillman Focused Advantage Fund Class A Shares - No Sales Load | (13.84)% | $8,616 |

| The Hillman Focused Advantage Fund Class A Shares - 5.75% Maximum Sales Load | (18.79)% | $8,121 |

| S&P 500 Total Return Index | 2.19% | $10,219 |

The graph assumes an initial $10,000 investment ($9,425 after maximum sales load of 5.75%) at July 18, 2006 (Date of Initial Public Offering). All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Focused Advantage Fund – Class A Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The Fund’s inception date – July 18, 2006 (Date of Initial Public Offering). ** The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $795.30 | $6.75 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,017.55 | $7.59 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 1.50%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

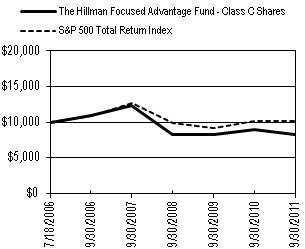

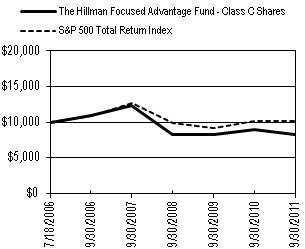

The Hillman Focused Advantage Fund Class C Shares

Performance Update - $10,000 Investment (Unaudited)

For the period from July 18, 2006 (Date of Initial Public Offering) to September 30, 2011

| Performance Returns for the periods ended September 30, 2011 |

Average Annual Total Returns | One Year | Five Year | Since Inception* | Gross Expense Ratio** |

The Hillman Focused Advantage Fund Class C Shares - No Sales Load | (7.03)% | (5.43)% | (3.55)% | 3.25% |

Cumulative Total Investment Returns | Since �� Inception* | Final Value of $10,000 Investment |

The Hillman Focused Advantage Fund Class C Shares - No Sales Load | (17.16)% | $8,284 |

| S&P 500 Total Return Index | 2.19% | $10,219 |

The graph assumes an initial $10,000 investment at July 18, 2006 (Date of Initial Public Offering). The deduction of the maximum contingent deferred sales charge (“CDSC”) is not reflected in the graph or chart above because the 1% CDSC for the Class C Shares is imposed on proceeds redeemed within 1 year of the purchase date. The CDSC may be waived or reduced under certain circumstances. All dividends and distributions are reinvested. This graph depicts the performance of The Hillman Focused Advantage Fund – Class C Shares (the “Fund”) versus the S&P 500 Total Return Index. It is important to note that the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. * The Fund’s inception date – July 18, 2006 (Date of Initial Public Offering). ** The gross expense ratio shown is from the Fund’s prospectus dated January 28, 2011. This number may vary from the expense ratio shown elsewhere in this report because it is based on a different time period and, if applicable, does not include fee or expense waivers. |

Performance quoted above represents past performance, which is no guarantee of future results. Investment return and principal value will fluctuate so that shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. An investor may obtain performance data, current to the most recent month-end, by visiting www.hillmancapital.com.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Average annual total returns are historical in nature and measure net investment income and capital gain or loss from portfolio investments assuming reinvestments of dividends.

Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction costs, which may include CDSC fees on redemption payments and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period as indicated below. Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period. Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. |

| Expense Example | Beginning Account Value April 1, 2011 | Ending Account Value September 30, 2011 | Expenses Paid During Period* |

| Actual | $1,000.00 | $791.90 | $10.11 |

| Hypothetical (5% return before expenses) | $1,000.00 | $1,013.79 | $11.36 |

* Actual expenses are based on expenses incurred in the most recent six-month period. The Fund’s annualized six-month expense ratio is 2.25%. The values under “Expenses Paid During Period” are equal to the annualized ratio multiplied by the average account value over the period, multiplied by 183/365 (to reflect the number of days in the six month period ending September 30, 2011).

| The Hillman Focused Advantage Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| As of September 30, 2011 | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| COMMON STOCKS - 97.63% | | | | | | |

| | | | | | | | | | |

| | Consumer Discretionary - 5.85% | | | | | | |

| | | Starbucks Corp. | | | | 17,500 | $ | 652,575 |

| | | | | | | | | | 652,575 |

| | Energy - 9.25% | | | | | | | |

| | | Exxon Mobil Corp. | | | | 8,100 | | 588,303 |

| | | Transocean Ltd. | | | | 9,300 | | 443,982 |

| | | | | | | | | | 1,032,285 |

| | Financials - 21.96% | | | | | | |

| | | American Express Co. | | | | 14,300 | | 641,927 |

| | | Bank of America Corp. | | | | 52,800 | | 322,608 |

| | | JPMorgan Chase & Co. | | | | 16,700 | | 503,171 |

| | | The Goldman Sachs Group, Inc. | | | | 4,600 | | 434,608 |

| | | The Western Union Co. | | | | 35,900 | | 548,911 |

| | | | | | | | | | 2,451,225 |

| | Health Care - 12.12% | | | | | | |

| | | Johnson & Johnson | | | | 11,000 | | 700,590 |

| | | Pfizer, Inc. | | | | | 36,900 | | 652,392 |

| | | | | | | | | | 1,352,982 |

| | Industrials - 14.11% | | | | | | |

| | | General Electric Co. | | | | 36,000 | | 547,920 |

| | | Ingersoll-Rand PLC | | | | 16,100 | | 452,104 |

| | | The Boeing Co. | | | | | 9,500 | | 574,845 |

| | | | | | | | | | 1,574,869 |

| | Information Technology - 23.78% | | | | | | |

| | * | Apple, Inc. | | | | | 1,800 | | 686,376 |

| | | Cisco Systems, Inc. | | | | 36,400 | | 564,200 |

| | | Corning, Inc. | | | | | 34,100 | | 421,647 |

| | | Hewlett-Packard Co. | | | | 15,900 | | 356,955 |

| | | Microsoft Corp. | | | | | 25,100 | | 624,739 |

| | | | | | | | | | 2,653,917 |

| | Materials - 4.58% | | | | | | | |

| | | E.I. du Pont de Nemours & Co. | | | | 12,800 | | 511,232 |

| | | | | | | | | | 511,232 |

| | Telecommunications - 5.98% | | | | | | |

| | | AT&T, Inc. | | | | | 23,400 | | 666,900 |

| | | | | | | | | | 666,900 |

| | | | | | | | | | |

| | | Total Common Stocks (Cost $13,263,987) | | | | | 10,895,985 |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | (Continued) |

| The Hillman Focused Advantage Fund | | | | | | |

| | | | | | | | | | |

| Schedule of Investments | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| As of September 30, 2011 | | | | | | |

| | | | | | | | Shares | | Value (Note 1) |

| | | | | | | | | | |

| INVESTMENT COMPANY - 2.45% | | | | | | |

| | § | HighMark 100% US Treasury Money Market Fund, 0.00% Ω | 273,406 | $ | 273,406 |

| | | | | | | | | | |

| | | Total Investment Company (Cost $273,406) | | | | | 273,406 |

| | | | | | | | | | |

| Total Value of Investments (Cost $13,537,393) - 100.08% | | | $ | 11,169,391 |

| | | | | | | | | | |

| Liabilities in Excess of Other Assets - (0.08)% | | | | | (9,030) |

| | | | | | | | | | |

| | Net Assets - 100% | | | | | | $ | 11,160,361 |

| | | | | | | | | | |

| * | Non-income producing investment | | | | | | |

| § | Represents 7 day effective yield | | | | | | |

| Ω | Actual amount is less than 0.01% | | | | | | |

| | | | | | | | | | |

| | The following acronym is used in this portfolio: | | | | | |

| | PLC - Public Limited Company | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Summary of Investments by Sector | | | | |

| | | | | | % of Net | | | | |

| | | | Sector | | Assets | | Value | | |

| | | | Consumer Discretionary | 5.85% | $ | 652,575 | | |

| | | | Energy | | 9.25% | | 1,032,285 | | |

| | | | Financials | | 21.96% | | 2,451,225 | | |

| | | | Health Care | | 12.12% | | 1,352,982 | | |

| | | | Industrials | | 14.11% | | 1,574,869 | | |

| | | | Information Technology | 23.78% | | 2,653,917 | | |

| | | | Materials | | 4.58% | | 511,232 | | |

| | | | Telecommunications | 5.98% | | 666,900 | | |

| | | | Other | | 2.45% | | 273,406 | | |

| | | | Total | | 100.08% | $ | 11,169,391 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| Hillman Capital Management Funds | | | | | | | | |

| | | | | | | | | | | | | |

| Statements of Assets and Liabilities | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | Advantage Equity | | | Focused Advantage |

| As of September 30, 2011 | | | | | | Fund | | | Fund |

| | | | | | | | | | | | | |

| Assets: | | | | | | | | | | |

| | Investments, at cost | | | | | $ | 9,777,763 | | $ | 13,537,393 |

| | Investments, at value (note 1) | | | | $ | 9,968,791 | | $ | 11,169,391 |

| | Receivables: | | | | | | | | | | |

| | | Fund shares sold | | | | | | 645 | | | 7,988 |

| | | Dividends | | | | | | | 15,185 | | | 10,180 |

| | | | | | | | | | | | | |

| | Total Assets | | | | | | | 9,984,621 | | | 11,187,559 |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | |

| | Accrued expenses | | | | | | | | | |

| | | Administration fees | | | | | | 2,268 | | | 2,590 |

| | | Advisor fees | | | | | | 9,110 | | | 10,404 |

| | | Distribution fees | | | | | | 9,981 | | | 14,204 |

| | | | | | | | | | | | | |

| | Total Liabilities | | | | | | 21,359 | | | 27,198 |

| | | | | | | | | | | | | |

| Net Assets | | | | | | $ | 9,963,262 | | $ | 11,160,361 |

| | | | | | | | | | | | | |

| Net Assets Consist of: | | | | | | | | | |

| | Capital | | | | | | $ | 11,489,752 | | $ | 41,150,279 |

| | Undistributed net investment income | | | | | 55,104 | | | 79,694 |

| | Accumulated net realized loss on investments | | | | (1,772,622) | | | (27,701,610) |

| | Net unrealized appreciation (depreciation) in investments | | | | 191,028 | | | (2,368,002) |

| | | | | | | | | | | | | |

| Net Assets | | | | | | $ | 9,963,262 | | $ | 11,160,361 |

| | | | | | | | | | | | | |

| No Load Shares Outstanding, no par value (unlimited shares authorized) | | 956,810 | | | 1,090,048 |

| | Net Assets - No Load Shares | | | | $ | 9,953,424 | | $ | 10,650,951 |

| | Net Asset Value, Maximum Offering Price and Redemption Price Per Share | | | $ | 10.40 | | $ | 9.77 |

| | | | | | | | | | | | | |

| Class A Shares Outstanding, no par value (unlimited shares authorized) | | 158 | | | 21,714 |

| | Net Assets - Class A Shares | | | | $ | 1,685 | | $ | 212,485 |

| | Net Asset Value and Redemption Price Per Share | | | $ | 10.64 | (b) | $ | 9.79 |

| | Maximum Offering Price Per Share (Net Asset Value ÷ 94.25%) | $ | 11.29 | | $ | 10.39 |

| | | | | | | | | | | | | |

| Class C Shares Outstanding, no par value (unlimited shares authorized) (a) | | 779 | | | 30,831 |

| | Net Assets - Class C Shares | | | | $ | 8,153 | | $ | 296,925 |

| | Net Asset Value, Maximum Offering Price and Redemption Price Per Share (a) | | | | $ | 10.47 | | $ | 9.63 |

| (a) | Class C shares have a contingent deferred sales charge (note 1). | | | | | |

| (b) | Net Asset Value may not recompute due to rounding | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Hillman Capital Management Funds | | | | | | |

| | | | | | | | | | | |

| Statements of Operations | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | Advantage Equity | Focused Advantage |

| For the fiscal year ended September 30, 2011 | | | | Fund | | Fund |

| | | | | | | | | | | |

| Investment Income: | | | | | | | |

| | Dividends | | | | | $ | 230,594 | $ | 298,202 |

| | | | | | | | | | | |

| | Total Investment Income | | | | | 230,594 | | 298,202 |

| | | | | | | | | | | |

| Expenses: | | | | | | | | |

| | Advisory fees (note 2) | | | | | 117,005 | | 143,681 |

| | Administration fees (note 2) | | | | 29,134 | | 35,777 |

| | Distribution and service fees (note 3) | | | | 29,351 | | 39,050 |

| | | | | | | | | | | |

| | Net Expenses | | | | | | 175,490 | | 218,508 |

| | | | | | | | | | | |

| Net Investment Income | | | | | 55,104 | | 79,694 |

| | | | | | | | | | | |

| Net Realized and Unrealized Gain (Loss) from Investments: | | | | | |

| | Net realized gain from investments | | | | 807,952 | | 688,835 |

| | Change in unrealized appreciation (depreciation) on investments | | | (1,202,453) | | (1,197,268) |

| | | | | | | | | | | |

| Net Realized and Unrealized Loss on Investments | | | | (394,501) | | (508,433) |

| | | | | | | | | | | |

| Net Decrease in Net Assets Resulting from Operations | | | $ | (339,397) | $ | (428,739) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | |

| Hillman Capital Management Funds | | | | | | | | |

| | | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Advantage Equity Fund | | Focused Advantage Fund |

| For the fiscal years ended September 30, | | 2011 | | 2010 | | 2011 | | 2010 |

| | | | | | | | | | | | | |

| Operations: | | | | | | | | | | |

| | Net investment income (loss) | $ | 55,104 | $ | (42,811) | $ | 79,694 | $ | 35,629 |

| | Net realized gain from investment transactions | | 807,952 | | 479,413 | | 688,835 | | 738,293 |

| | Change in unrealized (depreciation) appreciation | | | | | | | | |

| | | on investments | | | (1,202,453) | | 554,136 | | (1,197,268) | | 718,829 |

| Net (Decrease) Increase in Net Assets | | | | | | | | |

| | | Resulting from Operations | | (339,397) | | 990,738 | | (428,739) | | 1,492,751 |

| | | | | | | | | | | | | |

Distributions to Shareholders: (note 5) | | | | | | | | |

| | Net investment income | | | | | | | | | |

| | | No Load Shares | | | - | | (38,842) | | (33,303) | | (180,343) |

| | | Class A Shares | | | - | | (117) | | (880) | | (4,148) |

| | | Class C Shares | | | - | | (56) | | (1,446) | | (3,536) |

| Decrease in Net Assets Resulting from Distributions | | - | | (39,015) | | (35,629) | | (188,027) |

| | | | | | | | | | | | | |

| Capital Share Transactions: | | | | | | | | | |

| | No Load Shares | | | | | | | | | |

| | | Shares sold | | | 933,557 | | 640,537 | | 669,283 | | 675,036 |

| | | Reinvested distributions | | - | | 37,516 | | 32,075 | | 168,884 |

| | | Shares repurchased | | | (1,963,303) | | (1,494,437) | | (3,359,941) | | (5,793,189) |

| | Class A Shares | | | | | | | | | |

| | | Shares sold | | | 2,000 | | 42,000 | | 14,377 | | 485,392 |

| | | Reinvested distributions | | - | | 117 | | 863 | | 4,032 |

| | | Shares repurchased | | | (11,913) | | (41,899) | | (223,259) | | (395,767) |

| | Class C Shares | | | | | | | | | |

| | | Shares sold | | | 7,000 | | - | | 201,764 | | 54,914 |

| | | Reinvested distributions | | - | | 56 | | 1,446 | | 3,536 |

| | | Shares repurchased | | | (23,549) | | - | | (202,090) | | (111,122) |

| Decrease in Net Assets | | | | | | | | | |

| | Resulting from Capital Share Transactions | | (1,056,208) | | (816,110) | | (2,865,482) | | (4,908,284) |

| Net (Decrease) Increase in Net Assets | | (1,395,605) | | 135,613 | | (3,329,850) | | (3,603,560) |

| | | | | | | | | | | | | |

| Net Assets: | | | | | | | | | | |

| | Beginning of Year | | | 11,358,867 | | 11,223,254 | | 14,490,211 | | 18,093,771 |

| | End of Year | | | $ | 9,963,262 | $ | 11,358,867 | $ | 11,160,361 | $ | 14,490,211 |

| | | | | | | | | | | | | |

| Undistributed Net Investment (Loss) Income | $ | 55,104 | $ | - | $ | 79,694 | $ | 35,629 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | (Continued) |

| Hillman Capital Management Funds | | | | | | | | |

| | | | | | | | | | | | | |

| Statements of Changes in Net Assets | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | Advantage Equity Fund | | Focused Advantage Fund |

| For the fiscal year ended September 30, | | 2011 | | 2010 | | 2011 | | 2010 |

| | | | | | | | | | | | | |

| Share Information: | | | | | | | | | |

| | | | | | | | | | | | | |

| | No Load Shares | | | | | | | | | |

| | | Shares Sold | | | | 78,978 | | 60,737 | | 58,886 | | 65,005 |

| | | Reinvested distributions | | - | | 3,400 | | 2,794 | | 16,239 |

| | | Shares repurchased | | | (166,639) | | (140,531) | | (286,446) | | (568,489) |

| | Net Decrease in Capital Shares | | (87,661) | | (76,394) | | (224,766) | | (487,245) |

| | Shares Outstanding, Beginning of Year | | 1,044,471 | | 1,120,865 | | 1,314,814 | | 1,802,059 |

| | Shares Outstanding, End of Year | | 956,810 | | 1,044,471 | | 1,090,048 | | 1,314,814 |

| | | | | | | | | | | | | |

| | Class A Shares | | | | | | | | | |

| | | Shares Sold | | | 158 | | 3,846 | | 1,179 | | 47,467 |

| | | Reinvested distributions | | - | | 10 | | 75 | | 387 |

| | | Shares repurchased | | | (943) | | (3,854) | | (18,891) | | (38,398) |

| | Net (Decrease) Increase in Capital Shares | | (785) | | 2 | | (17,637) | | 9,456 |

| | Shares Outstanding, Beginning of Year | | 943 | | 941 | | 39,351 | | 29,895 |

| | Shares Outstanding, End of Year | | 158 | | 943 | | 21,714 | | 39,351 |

| | | | | | | | | | | | | |

| | Class C Shares | | | | | | | | | |

| | | Shares Sold | | | 562 | | - | | 16,952 | | 5,353 |

| | | Reinvested distributions | | - | | 5 | | 127 | | 340 |

| | | Shares repurchased | | | (1,882) | | - | | (18,090) | | (10,935) |

| | Net (Decrease) Increase in Capital Shares | | (1,320) | | 5 | | (1,011) | | (5,242) |

| | Shares Outstanding, Beginning of Year | | 2,099 | | 2,094 | | 31,842 | | 37,084 |

| | Shares Outstanding, End of Year | | 779 | | 2,099 | | 30,831 | | 31,842 |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | |

| | | | | | | | | | | | | |

| Hillman Capital Management Funds | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | |

| | | | | | | Advantage Equity Fund |

| For a share outstanding during the | | No Load Shares |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 10.84 | $ | 9.99 | $ | 9.87 | $ | 14.24 | $ | 13.75 | |

| Income (Loss) from Investment Operations: | | | | | | | | | | | |

| | Net investment income (loss) | | 0.06 | | (0.05) | | 0.09 | | 0.12 | | 0.07 | |

| | Net realized and unrealized (loss) gain on securities | | (0.50) | | 0.93 | | 0.16 | | (3.48) | | 1.53 | |

| Total from Investment Operations | | (0.44) | | 0.88 | | 0.25 | | (3.36) | | 1.60 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | - | | (0.03) | | (0.09) | | (0.11) | | (0.09) | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (0.90) | | (1.02) | |

| Total Distributions | | | | - | | (0.03) | | (0.13) | | (1.01) | | (1.11) | |

| Net Asset Value, End of Year | $ | 10.40 | $ | 10.84 | $ | 9.99 | $ | 9.87 | $ | 14.24 | |

| Total Return (a)(b) | | | | (4.06%) | | 8.85% | | 2.96% | | (25.05%) | | 11.99% | |

| Net Assets, End of Year (in thousands) | $ | 9,953 | $ | 11,325 | $ | 11,192 | $ | 14,408 | $ | 25,950 | |

| Average Net Assets for the Year (in thousands) | $ | 11,677 | $ | 11,840 | $ | 9,885 | $ | 19,919 | $ | 25,544 | |

| Ratio of Gross Expenses to Average Net Assets (c) | | 1.50% | | 3.61% | | 3.78% | | 2.66% | | 2.40% | |

| Ratio of Net Expenses to Average Net Assets (c) | | 1.50% | | 2.46% | | 1.45% | | 1.48% | | 1.49% | |

| Ratio of Net Investment Income (Loss) to | | | | | | | | | | | |

| | Average Net Assets | | | 0.47% | | (0.36%) | | 1.10% | | 0.86% | | 0.51% | |

| Portfolio Turnover Rate | | | 13.40% | | 17.89% | | 52.28% | | 33.61% | | 12.18% | |

| | | | | | | | | | | | | | | | |

| | | | | | | Advantage Equity Fund |

| For a share outstanding during the | | Class A Shares |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 11.05 | $ | 10.18 | $ | 9.96 | $ | 14.38 | $ | 13.79 | |

| Income (Loss) from Investment Operations: | | | | | | | | | | | |

| | Net investment income (loss) | | 0.15 | | (0.08) | | 0.15 | | 0.09 | | 0.10 | |

| | Net realized and unrealized (loss) gain on securities | | (0.56) | | 0.97 | | 0.20 | | (3.48) | | 1.55 | |

| Total from Investment Operations | | (0.41) | | 0.89 | | 0.35 | | (3.39) | | 1.65 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | - | | (0.02) | | (0.09) | | (0.13) | | (0.04) | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (0.90) | | (1.02) | |

| Total Distributions | | | | - | | (0.02) | | (0.13) | | (1.03) | | (1.06) | |

| Net Asset Value, End of Year | $ | 10.64 | $ | 11.05 | $ | 10.18 | $ | 9.96 | $ | 14.38 | |

| Total Return (a)(b) | | | | (3.71)% | | 8.78% | | 3.94% | | (25.01%) | | 12.36% | |

| Net Assets, End of Year (in thousands) | $ | 2 | $ | 10 | $ | 10 | $ | 60 | $ | 12 | |

| Average Net Assets for the Year (in thousands) | $ | 5 | $ | 21 | $ | 11 | $ | 75 | $ | 12 | |

| Ratio of Gross Expenses to Average Net Assets (c) | | 1.50% | | 3.61% | | 3.78% | | 2.66% | | 2.15% | |

| Ratio of Net Expenses to Average Net Assets (c) | | 1.50% | | 2.01% | | 1.24% | | 1.46% | | 1.24% | |

| Ratio of Net Investment Income to Average Net Assets | | 0.47% | | 0.11% | | 1.23% | | 0.90% | | 0.76% | |

| Portfolio Turnover Rate | | | 13.40% | | 17.89% | | 52.28% | | 33.61% | | 12.18% | |

| | | | | | | | | | | | | | | | |

| (a) | Total return does not reflect payment of sales charge, if any. | | | | | | | | | |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, | |

| | consequently, the net asset value for financial reporting purposes and the returns based upon those net asset | |

| | values may differ from the net asset values and returns for shareholder transactions. | | | | | |

| (c) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) | |

| | and after any waivers and reimbursements (net expense ratio). | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | (Continued) |

| Hillman Capital Management Funds | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | |

| | | | | | | Advantage Equity Fund |

| For a share outstanding during the | | Class C Shares |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 11.00 | $ | 10.14 | $ | 10.01 | $ | 14.44 | $ | 13.81 | |

| (Loss) Income from Investment Operations: | | | | | | | | | | | |

| | Net investment (loss) income | | (0.05) | | (0.06) | | 0.09 | | 0.11 | | 0.10 | |

| | Net realized and unrealized (loss) gain on securities | | (0.48) | | 0.95 | | 0.17 | | (3.50) | | 1.55 | |

| Total from Investment Operations | | (0.53) | | 0.89 | | 0.26 | | (3.39) | | 1.65 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | - | | (0.03) | | (0.09) | | (0.14) | | - | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (0.90) | | (1.02) | |

| Total Distributions | | | - | | (0.03) | | (0.13) | | (1.04) | | (1.02) | |

| Net Asset Value, End of Year | $ | 10.47 | $ | 11.00 | $ | 10.14 | $ | 10.01 | $ | 14.44 | |

| Total Return (a)(b) | | | (4.82%) | | 8.74% | | 3.03% | | (24.87%) | | 12.33% | |

| Net Assets, End of Year (in thousands) | $ | 8 | $ | 23 | $ | 21 | $ | 11 | $ | 12 | |

| Average Net Assets for the Year (in thousands) | $ | 15 | $ | 23 | $ | 12 | $ | 12 | $ | 12 | |

| Ratio of Gross Expenses to Average Net Assets (c) | | 2.25% | | 4.36% | | 4.53% | | 3.41% | | 2.15% | |

| Ratio of Net Expenses to Average Net Assets (c) | | 2.25% | | 2.69% | | 1.25% | | 1.36% | | 1.24% | |

| Ratio of Net Investment (Loss) Income to | | | | | | | | | | | |

| | Average Net Assets | | | (0.28%) | | (0.59%) | | 1.15% | | 1.02% | | 0.76% | |

| Portfolio Turnover Rate | | | 13.40% | | 17.89% | | 52.28% | | 33.61% | | 12.18% | |

| | | | | | | | | | | | | | | | |

| | | | | | | Focused Advantage Fund |

| For a share outstanding during the | | No Load Shares |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 10.46 | $ | 9.68 | $ | 9.76 | $ | 16.15 | $ | 15.26 | |

| Income (Loss) from Investment Operations: | | | | | | | | | | | |

| | Net investment income | | | 0.07 | | 0.04 | | 0.13 | | 0.20 | | 0.09 | |

| | Net realized and unrealized (loss) gain on securities | | (0.73) | | 0.85 | | (0.11) | | (5.17) | | 1.97 | |

| Total from Investment Operations | | (0.66) | | 0.89 | | 0.02 | | (4.97) | | 2.06 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | (0.03) | | (0.11) | | (0.06) | | (0.17) | | (0.13) | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (1.25) | | (1.04) | |

| Total Distributions | | | (0.03) | | (0.11) | | (0.10) | | (1.42) | | (1.17) | |

| Net Asset Value, End of Year | $ | 9.77 | $ | 10.46 | $ | 9.68 | $ | 9.76 | $ | 16.15 | |

| Total Return (a)(b) | | | (6.38%) | | 9.15% | | 0.43% | | (32.96%) | | 13.81% | |

| Net Assets, End of Year (in thousands) | $ | 10,651 | $ | 13,747 | $ | 17,445 | $ | 29,674 | $ | 105,093 | |

| Average Net Assets for the Year (in thousands) | $ | 13,620 | $ | 16,460 | $ | 16,774 | $ | 84,158 | $ | 93,766 | |

| Ratio of Gross Expenses to Average Net Assets (c) | | 1.50% | | 2.91% | | 2.89% | | 1.74% | | 1.71% | |

| Ratio of Net Expenses to Average Net Assets (c) | | 1.50% | | 2.05% | | 1.45% | | 1.48% | | 1.48% | |

| Ratio of Net Investment Income to Average Net Assets | | 0.58% | | 0.23% | | 1.29% | | 0.98% | | 0.60% | |

| Portfolio Turnover Rate | | | 16.10% | | 13.84% | | 29.79% | | 47.31% | | 37.86% | |

| | | | | | | | | | | | | | | | |

| (a) | Total return does not reflect payment of sales charge, if any. | | | | | | | | | |

| (b) | Includes adjustments in accordance with accounting principles generally accepted in the United States and, | |

| | consequently, the net asset value for financial reporting purposes and the returns based upon those net asset | |

| | values may differ from the net asset values and returns for shareholder transactions. | | | | | |

| (c) | The expense ratios listed reflect total expenses prior to any waivers and reimbursements (gross expense ratio) | |

| | and after any waivers and reimbursements (net expense ratio). | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| See Notes to Financial Statements | | | | | | | | | | (Continued) |

| Hillman Capital Management Funds | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Financial Highlights | | | | | | | | | | | | |

| | | | | | | Focused Advantage Fund | |

| For a share outstanding during the | | Class A Shares | |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 10.47 | $ | 9.70 | $ | 9.78 | $ | 16.21 | $ | 15.31 | |

| Income (Loss) from Investment Operations: | | | | | | | | | | | |

| | Net investment income | | | 0.09 | | 0.01 | | 0.08 | | 0.18 | | 0.06 | |

| | Net realized and unrealized (loss) gain on securities | | (0.74) | | 0.87 | | (0.06) | | (5.17) | | 2.03 | |

| Total from Investment Operations | | (0.65) | | 0.88 | | 0.02 | | (4.99) | | 2.09 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | (0.03) | | (0.11) | | (0.06) | | (0.19) | | (0.15) | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (1.25) | | (1.04) | |

| Total Distributions | | | (0.03) | | (0.11) | | (0.10) | | (1.44) | | (1.19) | |

| Net Asset Value, End of Year | $ | 9.79 | $ | 10.47 | $ | 9.70 | $ | 9.78 | $ | 16.21 | |

| Total Return (a)(b) | | | (6.28)% | | 9.04% | | 0.47% | | (32.94%) | | 14.03% | |

| Net Assets, End of Year (in thousands) | $ | 212 | $ | 412 | $ | 290 | $ | 294 | $ | 589 | |

| Average Net Assets for the Year (in thousands) | $ | 319 | $ | 417 | $ | 198 | $ | 437 | $ | 269 | |

| Ratio of Gross Expenses to Average Net Assets (c) | | 1.50% | | 2.91% | | 2.89% | | 1.74% | | 1.71% | |

| Ratio of Net Expenses to Average Net Assets (c) | | 1.50% | | 2.13% | | 1.49% | | 1.48% | | 1.48% | |

| | | | | | | | | | | | | | | | |

| Ratio of Net Investment Income to Average Net Assets | | 0.56% | | 0.13% | | 1.23% | | 1.17% | | 0.60% | |

| Portfolio Turnover Rate | | | 16.10% | | 13.84% | | 29.79% | | 47.31% | | 37.86% | |

| | | | | | | | | | | | | | | | |

| | | | | | | Focused Advantage Fund | |

| For a share outstanding during the | | Class C Shares | |

| fiscal years ended September 30, | | 2011 | | 2010 | | 2009 | | 2008 | | 2007 | |

| | | | | | | | | | | | | | | | |

| Net Asset Value, Beginning of Year | $ | 10.40 | $ | 9.69 | $ | 9.78 | $ | 16.15 | $ | 15.33 | |

| (Loss) Income from Investment Operations: | | | | | | | | | | | |

| | Net investment (loss) income | | (0.02) | | (0.09) | | 0.04 | | 0.06 | | 0.01 | |

| | Net realized and unrealized (loss) gain on securities | | (0.70) | | 0.89 | | (0.06) | | (5.11) | | 1.91 | |

| Total from Investment Operations | | (0.72) | | 0.80 | | (0.02) | | (5.05) | | 1.92 | |

| Less Distributions: | | | | | | | | | | | | |

| | Dividends (from net investment income) | | (0.05) | | (0.09) | | (0.03) | | (0.07) | | (0.06) | |

| | Distributions (from capital gains) | | - | | - | | (0.04) | | (1.25) | | (1.04) | |

| Total Distributions | | | (0.05) | | (0.09) | | (0.07) | | (1.32) | | (1.10) | |

| Net Asset Value, End of Year | $ | 9.63 | $ | 10.40 | $ | 9.69 | $ | 9.78 | $ | 16.15 | |

| Total Return (a)(b) | | | (7.03)% | | 8.24% | | (0.06%) | | (33.45)% | | 13.01% | |

| Net Assets, End of Year (in thousands) | $ | 297 | $ | 331 | $ | 359 | $ | 304 | $ | 592 | |