UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10263

GuideStone Funds

(Exact name of registrant as specified in charter)

2401 Cedar Springs Road

Dallas, TX 75201-1407

(Address of principal executive offices) (Zip code)

Rodney R. Miller, Esq.

GuideStone Financial Resources of the Southern Baptist Convention

2401 Cedar Springs Road

Dallas, TX 75201-1407

(Name and address of agent for service)

registrant’s telephone number, including area code: 214-720-2142

Date of fiscal year end: December 31

Date of reporting period: December 31, 2006

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

The Report to Shareholders is attached herewith.

GuideStone Funds

GuideStone Financial Resources of the Southern Baptist Convention (“GuideStone Financial Resources”)

GuideStone Capital Management (“GSCM”)

GuideStone Financial Services (“GSFS”)

PFPC Distributors, Inc. (“PFPC”)

NOTICE CONCERNING YOUR PRIVACY RIGHTS

This notice will provide you with information concerning our policies with respect to nonpublic personal information that we collect about you in connection with the following financial products and services provided and/or serviced by the entities listed above: individual retirement accounts (“IRAs”) and/or personal mutual fund accounts.

The confidentiality of your information is important to us as we recognize that you depend on us to keep your information confidential, as described in this notice.

We collect nonpublic personal information about you with regard to your IRA and/or personal mutual fund accounts from the following sources:

| | • | | Information we receive from you on applications or other forms; |

| | • | | Information about your transactions with us, our affiliates or others (including our third-party service providers); |

| | • | | Information we receive from others such as service providers, broker-dealers and your personal agents or representatives; and |

| | • | | Information you and others provide to us in correspondence sent to us, whether written, electronic or by telephone. |

We may disclose such nonpublic personal financial information about you to one or more of our affiliates. An affiliate of an organization means any entity that controls, is controlled by, or is under common control with that organization. For example, GuideStone Financial Resources, GSCM and GSFS are affiliates of one another. GuideStone Funds, GuideStone Financial Resources, GSCM, GSFS and PFPC do not sell your personal information to nonaffiliated third parties.

We may also disclose any of the personal information that we collect about you to nonaffiliated third parties as permitted by law. For example, we may provide your information to nonaffiliated companies that provide account services or that perform marketing services on our behalf and to other financial institutions with whom we have joint marketing agreements. We restrict access to nonpublic personal information about you to those of our employees who need to know that information in order for us to provide and/or service products or services to you. We also maintain physical, electronic, and procedural safeguards to guard your personal information.

These procedures will continue to remain in effect after you cease to receive financial products and services from us.

If you have any questions concerning our customer information policy, please contact a customer service representative at 1-888-98-GUIDE.

TABLE OF CONTENTS

| | |

Letter from the President | | 2 |

| |

From the Chief Investment Officer | | 3 |

| |

About Your Expenses | | 6 |

| |

Blended Funds: | | |

Flexible Income Fund | | 10 |

Growth & Income Fund | | 13 |

Capital Opportunities Fund | | 16 |

Global Equity Fund | | 19 |

| |

Financial Statements | | 22 |

| |

Flexible Income Fund I | | 28 |

Growth & Income Fund I | | 31 |

Capital Opportunities Fund I | | 34 |

Global Equity Fund I | | 37 |

Financial Statements | | 40 |

| |

Select Funds: | | |

Money Market Fund | | 45 |

Low-Duration Bond Fund | | 49 |

Medium-Duration Bond Fund | | 60 |

Extended-Duration Bond Fund | | 79 |

Global Bond Fund | | 84 |

Equity Index Fund | | 90 |

Real Estate Securities Fund | | 97 |

Value Equity Fund | | 99 |

Growth Equity Fund | | 105 |

Small Cap Equity Fund | | 109 |

International Equity Fund | | 117 |

| |

Schedule of Investments – Abbreviations and Footnotes 126 | | |

| |

Financial Statements | | 128 |

| |

Notes to Financial Statements | | 141 |

| |

Report of Independent Registered Public Accounting Firm | | 159 |

| |

Fund Management (Unaudited) | | 160 |

| |

BOARD REVIEW OF ADVISORY AGREEMENTS | | 162 |

This report has been prepared for shareholders of GuideStone Funds. It is not authorized for distribution to prospective investors unless accompanied or preceded by a current prospectus, which contains more complete information about the Funds. Investors are reminded to read the prospectus carefully before investing. Past performance is no guarantee of future results. Share prices will fluctuate and there may be a gain or loss when shares are redeemed.

1

LETTER FROM THE PRESIDENT

We are pleased to bring you the 2006 Annual Report for GuideStone Funds. Within these pages you will find the results of another successful year of mutual fund performance and investment operations.

During 2006, GuideStone Funds celebrated a milestone event – the five year anniversary of our registered mutual funds! This event highlighted our commitment now and in the future to Christian-based funds with competitive performance.

As we review the year, we can report assets for GuideStone Funds totaled $9.3 billion as of December 31, 2006, representing a 10.46% increase from the prior year. The global economy, including U.S. stocks, rallied in the fourth quarter of 2006 to cap off a year of strong performance. The 2006 year ended on a positive note with lower oil prices, healthy corporate earnings, and generally positive economic data. Overall we are pleased that all of the GuideStone Funds closed the year with positive performance as well as positive returns since their inception on August 27, 2001.

In December, GuideStone Funds increased its fund offerings to include two new funds: the Real Estate Securities Fund and Global Bond Fund. Our goal is to enhance and broaden the availability of funds in multiple asset classes to better meet the needs of our participants. Effective January 3, 2007, the Real Estate Securities Fund will be available to investors through a Personal Investment Account or an Individual Retirement Account. The new Global Bond Fund is not available for direct investment by shareholders, but will be utilized within our new Date Target Funds family.

We are excited to announce that in January 2007, GuideStone Funds will launch five Date Target Funds, known as MyDestination Funds. Each MyDestination Fund invests in pre-selected GuideStone Select Funds so the investor gets a well-rounded portfolio, managed by investment professionals to help meet their objectives.

With date target funds – or life cycle funds – participants choose the fund closest to their retirement date. This gives the investor the opportunity to invest in one fund that is diversified and age appropriate. The funds are targeted to retirement dates in 10-year increments from 2005 to 2045. GuideStone Funds is the nation’s only mutual fund company with Christian-based date target funds.

We look forward to a new year of serving you. We appreciate your business and thank you for the confidence you place in us.

Sincerely,

John R. Jones

The MyDestination Funds attempt to achieve their objectives by investing in the GuideStone Select Funds. By investing in these fund-of-funds, you will incur the expenses of the MyDestination Funds in addition to those of the underlying Select Funds. You may invest in the Select Funds directly, except the Global Bond Fund. The MyDestination Funds are also subject to the risks of the underlying funds they hold.

2

FROM THE CHIEF INVESTMENT OFFICER

Rodric E. Cummins, CFA

The year 2006 was a year of two halves. With the Federal Reserve, economic growth and inflation in the spotlight, it was a year that under-promised early and over-delivered late. Investors that succeeded did so by embracing the sound investment principles of diversification and patience.

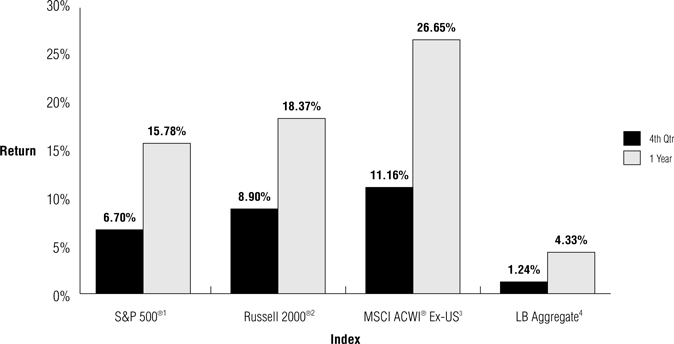

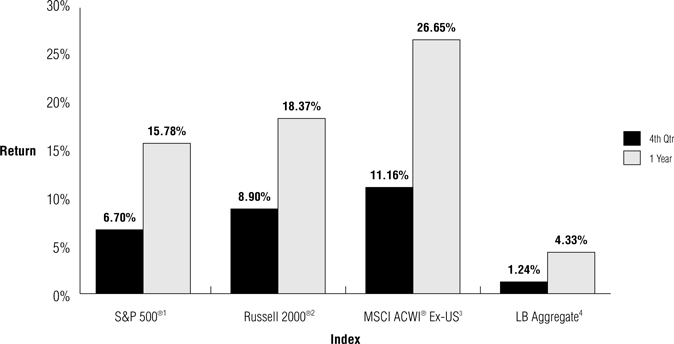

The inflection point for 2006 came at the mid-year peak in oil prices which closely coincided with a pause in the Federal Reserve’s tightening monetary policy. These two factors combined to renew investors confidence that inflationary pressures were easing and that the Federal Reserve was successfully steering the U.S. economy toward continued growth. With corporate profits booming and equity valuations at cyclical lows, equity investors celebrated the prospects for continued economic growth by pushing prices in many major indices to record highs during a strong fourth quarter rally. The S&P 500® Index gained 6.70% during the fourth quarter, netting a total return for the year of 15.78%.

With financial markets posting a wide range of returns in 2006, risk-oriented investors with well-diversified global portfolios were handsomely rewarded. Strong corporate earnings and continued economic growth favored stocks over bonds and value-oriented stock strategies over historically high growth companies. For the fourth consecutive year, stock markets showed the strongest returns from companies located in foreign countries. The MSCI® EAFE Index (Net), representative of non-U.S. developed markets, returned 10.35% during the fourth quarter and 26.34% for the year. Emerging market stocks, as represented by the MSCI® Emerging Market Index (Net), returned 17.60% for the quarter and 32.17% for the year. In contrast, single digit returns were posted for the year in investments such as cash, bonds and certain equity segments. The bond market, as represented by the Lehman Brothers Aggregate Bond Index, posted a return of 4.33% in 2006.

Asset Class Performance Comparison

The following graph illustrates the performance of the major assets classes during 2006.

1 | The S&P 500® Index includes 500 of the largest stocks (in terms of market value) in the United States. |

2 | The Russell 2000® Index is a small-cap index consisting of the smallest 2000 companies in the Russell 3000® index, representing approximately 8% of the Russell 3000® Index total market capitalization. |

3 | The MSCI ACWI® Ex-U.S. is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global developed and emerging markets excluding the U.S. |

4 | The Lehman Brothers Aggregate Bond Index includes fixed rate debt issues rated investment grade or higher by Moody’s Investor’s Service, Standard and Poor’s® Corporation, or Fitch Investor’s Service, in that order. |

3

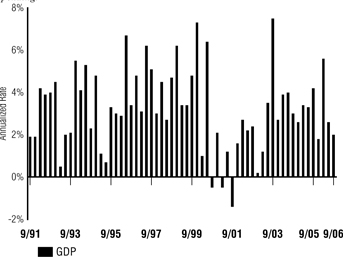

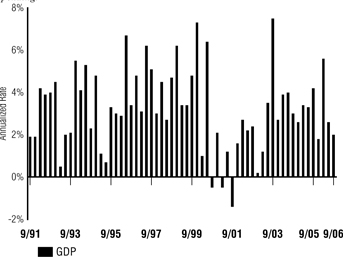

U.S. Economy — Real Gross Domestic Product

Following a poor showing in the 4th quarter of 2005, the U.S. economy, as measured by the real gross domestic product, rebounded at an annual rate of 5.6% in the 1st quarter of 2006. The acceleration in real GDP growth in the 1st quarter reflected an upturn in expenditures for durable goods, acceleration in exports and an upturn in federal government spending. Second quarter GDP came in at an annual rate of 2.6% reflecting a cooling of the housing market and decelerating spending. Growth slowed further in the third quarter leading to an annual GDP rate of 2.0% reflecting an acceleration in imports, a larger decrease in residential fixed investment, and lower state and local government spending.

Real Gross Domestic Product (“GDP”) is one of the most widely used economic measures for the overall U.S. economy. GDP measures the output of all goods and services produced by labor and property within the U.S. during a specific period. The output is usually expressed as an annualized rate for a quarter. Generally, it is viewed as positive for the equity markets when GDP expands reflecting an environment of economic growth and profitability. The converse is true when GDP is contracting.

Data Source: Bloomberg

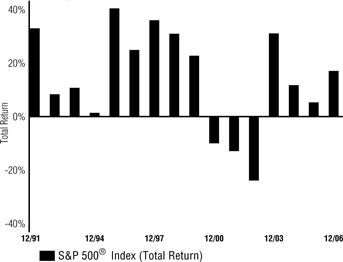

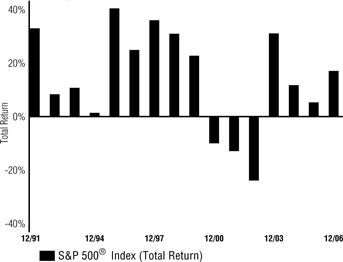

S&P 500® Index Returns

The broad U.S. equity market, as measured by the S&P 500® Index, posted a positive annual return of 15.78% during 2006, capping a fourth consecutive year in positive territory. Performance for the year came in three distinct phases: markets rallied out of the gate with the S&P 500® Index gaining 6.9% through early May, stocks then pulled back significantly through mid-June (down 7.5%) on fears that interest rates had risen to a level that would stifle economic growth both here and abroad. The third phase was marked by renewed confidence that inflation and interest rates were at acceptable levels. This confidence drove equity markets sharply higher off their June 13th lows, with the S&P 500® gaining 17.1% from that point. Value stocks significantly outpaced growth stocks within the index for the year by almost a two-to-one margin.

The S&P 500® Index includes 500 leading companies in major industries of the U.S. economy. The index represents about 75% of U.S. equity market capitalization. It is a capitalization-weighted index calculated on a total return basis with dividends reinvested. Constituents are selected by a team of Standard & Poor’s® economists and analysts.

Data Source: Standard & Poor’s®

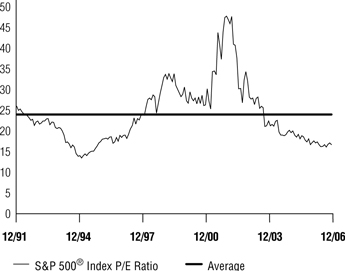

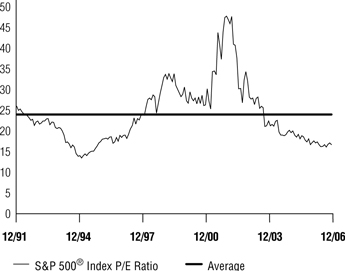

S&P 500® P/E (Excluding Negative Earnings)

The price-to-earnings (P/E) ratio for the S&P 500® Index ended the year at virtually the same level as the end of 2005. With a 15.78% total return, this shows the “earnings” side of the equation also rose about 15% for the companies within the index. For the fifteen year period show in the graph, the average P/E is just above 24. It is worth noting this valuation measure for the broad market index has consistently declined over the last three years, a testament to strong corporate profitability. While the market may appear to be valued at a discount, longer period historical P/E ratios suggest the market is trading closer to its historical average.

P/E is the ratio of a stock’s price divided by its earnings per share. In this case, the P/E ratio is represented for the entire index. The ratio, or multiple, reflects the price an investor is willing to pay for a dollar of expected earnings per share.

Data Source: Ned Davis Research Group

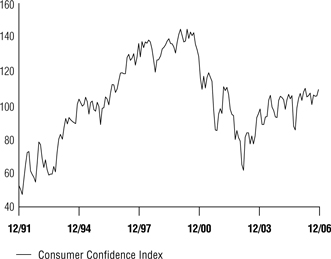

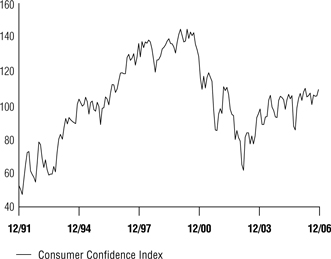

The Conference Board Consumer Confidence Index

U.S. consumer confidence, as measured by the Conference Board’s Index, generally moved with the fortunes of the stock market and energy prices for most of 2006. The index peaked at 109.8 in April (its highest level since May 2002) just prior to the sharp pullback in the equity markets in May and June. Consumer sentiment dipped accordingly in ensuing months. High oil prices contributed to a year-low reading of 100.2 during August. A subsequent reversal of energy prices to the downside during September eventually trickled through to an improving outlook by Americans. Consumer confidence rebounded strongly in December to 109.0.

The Conference Board Consumer Confidence Index is a based on a monthly survey of a sample of 5000 U.S. households for the purpose of measuring consumer sentiment. The trend in this economic measure is closely monitored given consumers comprise approximately two-thirds of the U.S. Economy. Generally, it is viewed as positive to the economy and equity markets when the index increases. This reflects the fact that consumers are positive regarding their economic outlook and that they are more willing to spend money providing further economic stimulus.

Data Source: Bloomberg

4

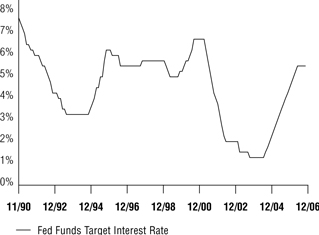

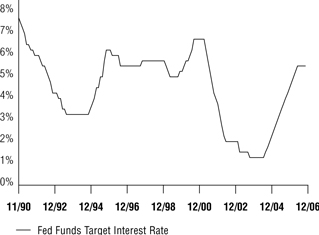

Federal Reserve

January 2006 may have marked a change in leadership at the Federal Reserve (“Fed”) but its tightening campaign, which began in June 2004, continued without pause. Rebounding economic growth and the resulting inflationary concerns forced incoming Fed Chairman Ben Bernanke to raise the Fed Funds Rate by .25% on four separate occasions during the first half of 2006. Such action elevated the key interest rate to 5.25% by June 29th. A slumping housing market, an equity market slump, and fresh geopolitical concerns eventually resulted in the sporadic weakening of economic data during the summer. This was enough to give the Fed “pause” and at its August 8th meeting, interest rates were held steady. No further interest rate hikes occurred over the remainder of the year, but the Fed remained on watch for signs that inflation was not contained.

The Federal Reserve, often referred to as “the Fed,” is the central bank of the United States. It was created by Congress to provide the nation with a safer, more flexible, and more stable monetary and financial system. The federal funds rate is the interest rate at which depository institutions lend balances at the Federal Reserve to other depository institutions overnight. The rate is one tool the Fed can use in their efforts of controlling the supply of money. Changes in the federal funds rate trigger a chain of events that affect other short-term interest rates, foreign exchange rates, long-term interest rates, the amount of money and credit, and, ultimately, a range of economic variables, including employment, output, and prices of goods and services.

Data Source: Bloomberg

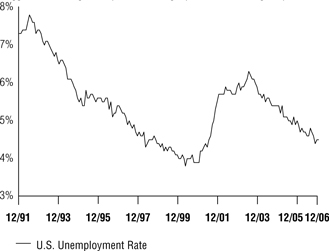

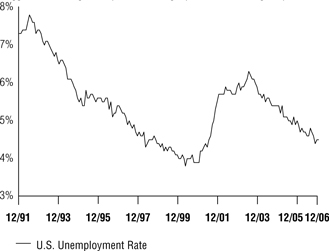

U.S. Unemployment

Overall employment levels improved during 2006. The unemployment rate fell from 4.9% at the end of 2005 to 4.5% at the end of 2006. The lowest level occurred in October at 4.4%, a level not seen since the spring of 2001. During 2006, payroll employment rose by 1.8 million jobs. The largest numbers of jobs created occurred in the professional and business services, healthcare, and food service industries. Manufacturing lost 72,000 jobs during 2006. The number of unemployed persons was essentially unchanged in December at 6.8 million; down from 7.3 million a year earlier. While the unemployment rate dropped, the average hourly rate rose slightly above 4% during the year.

The U.S. unemployment rate measures the numbers of persons unemployed as a percentage of the labor force. Typically, unemployment tends to increase during difficult economic periods and declines during expansionary economic times. Additionally, very low unemployment can place inflationary pressure on the economy as labor markets become very competitive and expensive.

Data Source: Bloomberg

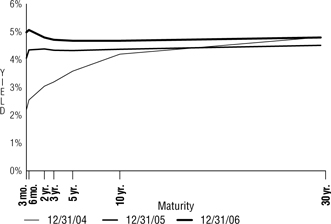

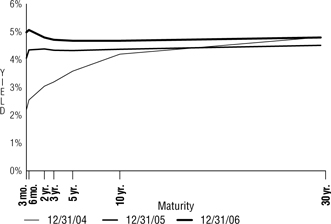

U.S. Treasury Yield Curve

Interest rates across the curve rose sharply during the first quarter of 2006 in response to a rebounding economy, record Treasury issuance, and Federal Reserve tightening. The 30- year Treasury Bond came out of retirement to help finance the burgeoning federal deficit. Rates continued higher during the second quarter driven by concerns over rising inflation with the curve slightly inverted from 6-months to 5 years out. On the back of weaker economic data and geopolitical concerns, treasuries rallied and yields fell during the third quarter particularly at the long end. The 2-10 year portion of the curve was inverted at the end of the third quarter. Interest rates were higher in the fourth quarter driven by the realization that the Fed was not likely to ease monetary policy during the first half of 2007. The yield curve continued its slow but steady flattening trend. The yield on the bellwether 30-year Treasury Bond ended the year at 4.81%, up from 4.54% 12 months earlier.

The Treasury yield curve illustrates the relationship between yields on short-term, intermediate-term and long-term Treasury securities. Normally, the shape of the yield curve is upward sloping with rates increasing from the short end of the curve moving higher to the long end. The short end of the curve is impacted more by monetary policy (demand for money) while inflationary expectations and market forces impact the long end of the curve.

Data Source: Bloomberg

5

About Your Expenses

As a shareholder of the Funds, you incur ongoing costs, including advisory fees and to the extent applicable, distribution (12b-1) fees and/or shareholder services fees, as well as other Fund expenses. This example is intended to help you to understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. It is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from July 1, 2006 to December 31, 2006.

Actual Expenses

The first section of the table below provides information about actual account values and actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you incurred over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During Period” to estimate the expenses attributable to your investment during this period.

Hypothetical Example for Comparison Purposes

The second section of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. Thus, you should not use the hypothetical account values and expenses to estimate the actual ending account balance or your expenses for the period. Rather, these figures are provided to enable you to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | | | |

ACTUAL |

Fund | | Class | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Annualized

Expense

Ratio (1) | | | Expenses

Paid During

Period (2) |

Flexible Income | | GS4 | | $ | 1,000.00 | | $ | 1,046.15 | | 0.13 | % | | $ | 0.67 |

| | GS6 | | | 1,000.00 | | | 1,043.86 | | 0.49 | | | | 2.52 |

| | GS8 | | | 1,000.00 | | | 1,043.24 | | 0.80 | | | | 4.12 |

| | | | | |

Growth & Income | | GS4 | | | 1,000.00 | | | 1,077.18 | | 0.13 | | | | 0.68 |

| | GS6 | | | 1,000.00 | | | 1,076.06 | | 0.37 | | | | 1.94 |

| | GS8 | | | 1,000.00 | | | 1,073.42 | | 0.84 | | | | 4.39 |

| | | | | |

Capital Opportunities | | GS4 | | | 1,000.00 | | | 1,091.22 | | 0.13 | | | | 0.69 |

| | GS6 | | | 1,000.00 | | | 1,089.41 | | 0.49 | | | | 2.58 |

| | GS8 | | | 1,000.00 | | | 1,087.02 | | 0.81 | | | | 4.26 |

| | | | | |

Global Equity | | GS4 | | | 1,000.00 | | | 1,104.89 | | 0.13 | | | | 0.69 |

| | GS6 | | | 1,000.00 | | | 1,103.32 | | 0.38 | | | | 2.01 |

| | GS8 | | | 1,000.00 | | | 1,100.99 | | 0.83 | | | | 4.40 |

| | | | | |

Flexible Income I | | GS2 | | | 1,000.00 | | | 1,046.61 | | 0.17 | | | | 0.88 |

| | | | | |

Growth & Income I | | GS2 | | | 1,000.00 | | | 1,078.02 | | 0.17 | | | | 0.89 |

| | | | | |

Capital Opportunities I | | GS2 | | | 1,000.00 | | | 1,092.18 | | 0.17 | | | | 0.90 |

| | | | | |

Global Equity I | | GS2 | | | 1,000.00 | | | 1,105.67 | | 0.17 | | | | 0.90 |

| | | | | |

Money Market | | GS2 | | | 1,000.00 | | | 1,025.97 | | 0.26 | | | | 1.33 |

| | GS4 | | | 1,000.00 | | | 1,024.99 | | 0.46 | | | | 2.35 |

| | GS6 | | | 1,000.00 | | | 1,022.85 | | 0.86 | | | | 4.38 |

| | GS8 | | | 1,000.00 | | | 1,021.32 | | 1.17 | | | | 5.96 |

6

ACTUAL

| | | | | | | | | | | | | | |

Fund | | Class | | Beginning

Account Value

7/1/2006 | | Ending Account Value

12/31/2006 | | Annualized

Expense

Ratio (1) | | | Expenses

Paid During

Period (2) |

Low-Duration Bond | | GS2 | | $ | 1,000.00 | | $ | 1,028.33 | | 0.45 | % | | $ | 2.30 |

| | GS4 | | | 1,000.00 | | | 1,027.16 | | 0.61 | | | | 3.12 |

| | GS6 | | | 1,000.00 | | | 1,024.81 | | 1.00 | | | | 5.10 |

| | GS8 | | | 1,000.00 | | | 1,023.54 | | 1.30 | | | | 6.63 |

| | | | | |

Medium-Duration Bond | | GS2 | | | 1,000.00 | | | 1,050.99 | | 0.50 | | | | 2.58 |

| | GS4 | | | 1,000.00 | | | 1,050.48 | | 0.62 | | | | 3.20 |

| | GS6 | | | 1,000.00 | | | 1,048.76 | | 1.05 | | | | 5.42 |

| | GS8 | | | 1,000.00 | | | 1,045.87 | | 1.35 | | | | 6.96 |

| | | | | |

Extended-Duration Bond | | GS2 | | | 1,000.00 | | | 1,081.98 | | 0.55 | | | | 2.89 |

| | GS4 | | | 1,000.00 | | | 1,082.11 | | 0.73 | | | | 3.83 |

| | GS6 | | | 1,000.00 | | | 1,078.06 | | 1.00 | | | | 5.24 |

| | GS8 | | | 1,000.00 | | | 1,076.74 | | 1.50 | | | | 7.85 |

| | | | | |

Global Bond (3) | | GS4 | | | 1,000.00 | | | 1,000.00 | | 1.04 | | | | 5.24 |

| | | | | |

Equity Index | | GS2 | | | 1,000.00 | | | 1,124.03 | | 0.23 | | | | 1.23 |

| | GS4 | | | 1,000.00 | | | 1,123.55 | | 0.40 | | | | 2.14 |

| | GS6 | | | 1,000.00 | | | 1,122.33 | | 0.60 | | | | 3.21 |

| | GS8 | | | 1,000.00 | | | 1,120.62 | | 0.90 | | | | 4.81 |

| | | | | |

Real Estate Securities (3) | | GS4 | | | 1,000.00 | | | 1,000.00 | | 1.33 | | | | 6.70 |

| | | | | |

Value Equity | | GS2 | | | 1,000.00 | | | 1,131.38 | | 0.71 | | | | 3.81 |

| | GS4 | | | 1,000.00 | | | 1,130.97 | | 0.89 | | | | 4.78 |

| | GS6 | | | 1,000.00 | | | 1,128.93 | | 1.19 | | | | 6.39 |

| | GS8 | | | 1,000.00 | | | 1,127.22 | | 1.59 | | | | 8.53 |

| | | | | |

Growth Equity | | GS2 | | | 1,000.00 | | | 1,055.45 | | 0.89 | | | | 4.61 |

| | GS4 | | | 1,000.00 | | | 1,055.22 | | 1.01 | | | | 5.23 |

| | GS6 | | | 1,000.00 | | | 1,053.69 | | 1.42 | | | | 7.35 |

| | GS8 | | | 1,000.00 | | | 1,052.07 | | 1.71 | | | | 8.84 |

| | | | | |

Small Cap Equity | | GS2 | | | 1,000.00 | | | 1,060.98 | | 1.01 | | | | 5.25 |

| | GS4 | | | 1,000.00 | | | 1,060.43 | | 1.19 | | | | 6.18 |

| | GS6 | | | 1,000.00 | | | 1,059.04 | | 1.54 | | | | 7.99 |

| | GS8 | | | 1,000.00 | | | 1,056.82 | | 1.89 | | | | 9.80 |

| | | | | |

International Equity | | GS2 | | | 1,000.00 | | | 1,148.06 | | 0.95 | | | | 5.14 |

| | GS4 | | | 1,000.00 | | | 1,147.23 | | 1.13 | | | | 6.12 |

| | GS6 | | | 1,000.00 | | | 1,145.65 | | 1.42 | | | | 7.68 |

| | GS8 | | | 1,000.00 | | | 1,144.39 | | 1.78 | | | | 9.62 |

HYPOTHETICAL (assuming a 5% return before expenses)

| | | | | | | | | | | | | | |

Fund | | Class | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Annualized

Expense

Ratio (1) | | | Expenses

Paid During

Period (2) |

Flexible Income | | GS4 | | $ | 1,000.00 | | $ | 1,024.55 | | 0.13 | % | | $ | 0.66 |

| | GS6 | | | 1,000.00 | | | 1,022.74 | | 0.49 | | | | 2.50 |

| | GS8 | | | 1,000.00 | | | 1,021.17 | | 0.80 | | | | 4.08 |

| | | | | |

Growth & Income | | GS4 | | | 1,000.00 | | | 1,024.55 | | 0.13 | | | | 0.66 |

| | GS6 | | | 1,000.00 | | | 1,023.34 | | 0.37 | | | | 1.89 |

| | GS8 | | | 1,000.00 | | | 1,020.97 | | 0.84 | | | | 4.28 |

7

About Your Expenses (Continued)

HYPOTHETICAL (assuming a 5% return before expenses)

| | | | | | | | | | | | | | |

Fund | | Class | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Annualized

Expense Ratio

(1) | | | Expenses

Paid During

Period (2) | |

Capital Opportunities | | GS4 | | $ | 1,000.00 | | $ | 1,024.55 | | 0.13 | % | | 0.66 | % |

| | GS6 | | | 1,000.00 | | | 1,022.74 | | 0.49 | | | 2.50 | |

| | GS8 | | | 1,000.00 | | | 1,021.12 | | 0.81 | | | 4.13 | |

| | | | | |

Global Equity | | GS4 | | | 1,000.00 | | | 1,024.55 | | 0.13 | | | 0.66 | |

| | GS6 | | | 1,000.00 | | | 1,023.29 | | 0.38 | | | 1.94 | |

| | GS8 | | | 1,000.00 | | | 1,021.02 | | 0.83 | | | 4.23 | |

| | | | | |

Flexible Income I | | GS2 | | | 1,000.00 | | | 1,024.35 | | 0.17 | | | 0.87 | |

| | | | | |

Growth & Income I | | GS2 | | | 1,000.00 | | | 1,024.35 | | 0.17 | | | 0.87 | |

| | | | | |

Capital Opportunities I | | GS2 | | | 1,000.00 | | | 1,024.35 | | 0.17 | | | 0.87 | |

| | | | | |

Global Equity I | | GS2 | �� | | 1,000.00 | | | 1,024.35 | | 0.17 | | | 0.87 | |

| | | | | |

Money Market | | GS2 | | | 1,000.00 | | | 1,023.89 | | 0.26 | | | 1.33 | |

| | GS4 | | | 1,000.00 | | | 1,022.89 | | 0.46 | | | 2.35 | |

| | GS6 | | | 1,000.00 | | | 1,020.87 | | 0.86 | | | 4.38 | |

| | GS8 | | | 1,000.00 | | | 1,019.31 | | 1.17 | | | 5.96 | |

| | | | | |

Low-Duration Bond | | GS2 | | | 1,000.00 | | | 1,022.94 | | 0.45 | | | 2.29 | |

| | GS4 | | | 1,000.00 | | | 1,022.13 | | 0.61 | | | 3.11 | |

| | GS6 | | | 1,000.00 | | | 1,020.16 | | 1.00 | | | 5.09 | |

| | GS8 | | | 1,000.00 | | | 1,018.65 | | 1.30 | | | 6.61 | |

| | | | | |

Medium-Duration Bond | | GS2 | | | 1,000.00 | | | 1,022.68 | | 0.50 | | | 2.55 | |

| | GS4 | | | 1,000.00 | | | 1,022.08 | | 0.62 | | | 3.16 | |

| | GS6 | | | 1,000.00 | | | 1,019.91 | | 1.05 | | | 5.35 | |

| | GS8 | | | 1,000.00 | | | 1,018.40 | | 1.35 | | | 6.87 | |

| | | | | |

Extended-Duration Bond | | GS2 | | | 1,000.00 | | | 1,022.43 | | 0.55 | | | 2.80 | |

| | GS4 | | | 1,000.00 | | | 1,021.53 | | 0.73 | | | 3.72 | |

| | GS6 | | | 1,000.00 | | | 1,020.16 | | 1.00 | | | 5.09 | |

| | GS8 | | | 1,000.00 | | | 1,017.64 | | 1.50 | | | 7.63 | |

| | | | | |

Global Bond (3) | | GS4 | | | 1,000.00 | | | 1,019.96 | | 1.04 | | | 5.30 | |

| | | | | |

Equity Index | | GS2 | | | 1,000.00 | | | 1,024.05 | | 0.23 | | | 1.17 | |

| | GS4 | | | 1,000.00 | | | 1,023.19 | | 0.40 | | | 2.04 | |

| | GS6 | | | 1,000.00 | | | 1,022.18 | | 0.60 | | | 3.06 | |

| | GS8 | | | 1,000.00 | | | 1,020.67 | | 0.90 | | | 4.58 | |

| | | | | |

Real Estate Securities (3) | | GS4 | | | 1,000.00 | | | 1,018.50 | | 1.33 | | | 6.77 | |

| | | | | |

Value Equity | | GS2 | | | 1,000.00 | | | 1,021.63 | | 0.71 | | | 3.62 | |

| | GS4 | | | 1,000.00 | | | 1,020.72 | | 0.89 | | | 4.53 | |

| | GS6 | | | 1,000.00 | | | 1,019.21 | | 1.19 | | | 6.06 | |

| | GS8 | | | 1,000.00 | | | 1,017.19 | | 1.59 | | | 8.08 | |

| | | | | |

Growth Equity | | GS2 | | | 1,000.00 | | | 1,020.72 | | 0.89 | | | 4.53 | |

| | GS4 | | | 1,000.00 | | | 1,020.11 | | 1.01 | | | 5.14 | |

| | GS6 | | | 1,000.00 | | | 1,018.05 | | 1.42 | | | 7.22 | |

| | GS8 | | | 1,000.00 | | | 1,016.59 | | 1.71 | | | 8.69 | |

| | | | | |

Small Cap Equity | | GS2 | | | 1,000.00 | | | 1,020.11 | | 1.01 | | | 5.14 | |

| | GS4 | | | 1,000.00 | | | 1,019.21 | | 1.19 | | | 6.06 | |

| | GS6 | | | 1,000.00 | | | 1,017.44 | | 1.54 | | | 7.83 | |

| | GS8 | | | 1,000.00 | | | 1,015.68 | | 1.89 | | | 9.60 | |

8

HYPOTHETICAL (assuming a 5% return before expenses)

| | | | | | | | | | | | | | |

Fund | | Class | | Beginning

Account Value

7/1/2006 | | Ending

Account Value

12/31/2006 | | Annualized

Expense

Ratio (1) | | | Expenses

Paid During

Period (2) |

International Equity | | GS2 | | $ | 1,000.00 | | $ | 1,020.42 | | 0.95 | % | | $ | 4.84 |

| | GS4 | | | 1,000.00 | | | 1,019.51 | | 1.13 | | | | 5.75 |

| | GS6 | | | 1,000.00 | | | 1,018.05 | | 1.42 | | | | 7.22 |

| | GS8 | | | 1,000.00 | | | 1,016.23 | | 1.78 | | | | 9.05 |

| (1) | Expenses include the effect of contractual waivers by GuideStone Capital Management. The Blended Funds’ proportionate share of the operating expenses of the Select Funds is not reflected in the tables above. |

| (2) | Expenses are equal to the Fund’s annualized expense ratios for the period July 1, 2006 through December 31, 2006, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| (3) | The Global Bond Fund and Real Estate Securities Fund commenced operations on 12/29/2006. The expense figures shown reflect the expenses that would have been paid over the time period 07/01/2006-12/31/2006, assuming the Funds were in operation throughout the entire period. |

9

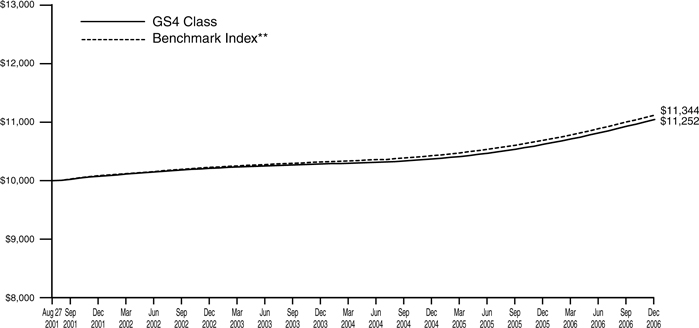

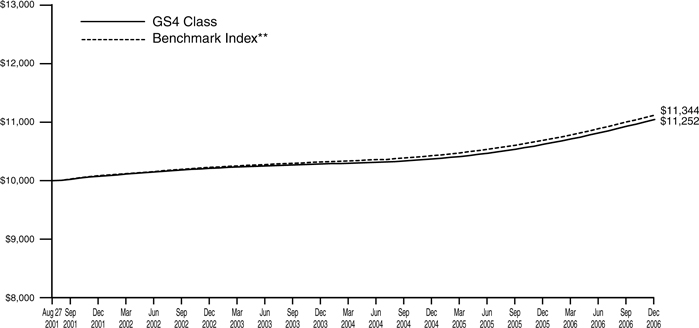

Flexible Income Fund

The Fund is constructed using a blend of seven GuideStone Funds Select Funds GS4. The Fund’s actual asset allocation at quarter-end was 19% U.S. Equity, 6% Non-U.S. Equity, and 75% Fixed Income. The Fund’s returns were positive for the quarter and the year; however it trailed its composite benchmark. The largest component of the Fund, the Low-Duration Bond Fund GS4, generated a positive return for the quarter and the year, with performance slightly trailing its underlying benchmark (Merrill Lynch 1-3 Year Treasury Index). The Fund’s benchmark-relative underperformance for the year was most impacted by its exposure to the Growth Equity Fund GS4. The Growth Equity Fund’s returns were slightly positive for the year but it significantly trailed its underlying benchmark index.

Please see page 12 for information regarding specific portfolio allocations. Portfolio holdings are subject to change at any time.

The Blended Funds attempt to achieve their objectives by investing in the GuideStone Select Funds. By investing in these fund-of-funds, you will incur the expenses of the Blended Funds in addition to those of the underlying funds. You may invest in the Select Funds directly, except the Global Bond Fund. The Blended Funds are also subject to the risks of the underlying funds they hold.

10

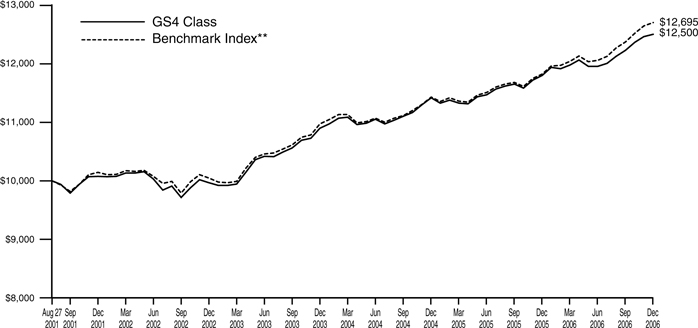

Flexible Income Fund

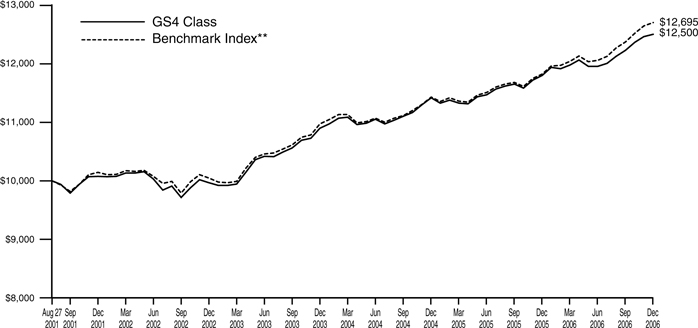

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 12/31/06 | |

| | | GS4 Class* | | | GS6 Class* | | | Benchmark** | | | GS8 Class* | | | GS8 Class Benchmark** | |

One Year | | 5.99 | % | | 5.66 | % | | 7.43 | % | | 5.36 | % | | 7.43 | % |

Five Year | | 4.40 | % | | 4.12 | % | | 4.60 | % | | N/A | | | N/A | |

Since Inception | | 4.26 | % | | 3.98 | % | | 4.56 | % | | 4.46 | % | | 5.75 | % |

Inception Date | | 08/27/01 | | | 08/27/01 | | | 08/27/01 | | | 11/08/04 | | | 11/08/04 | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.GuideStone.org. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

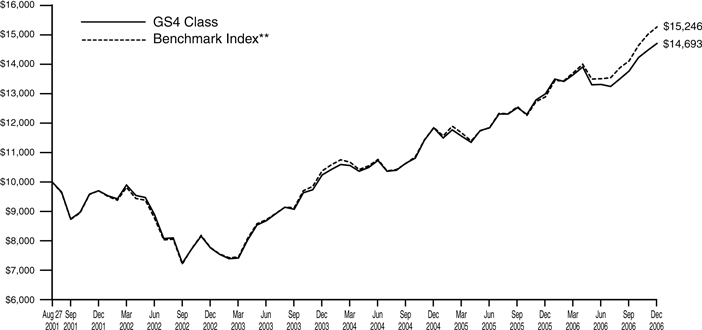

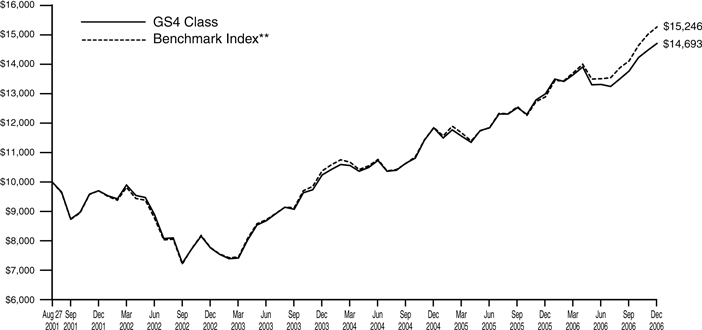

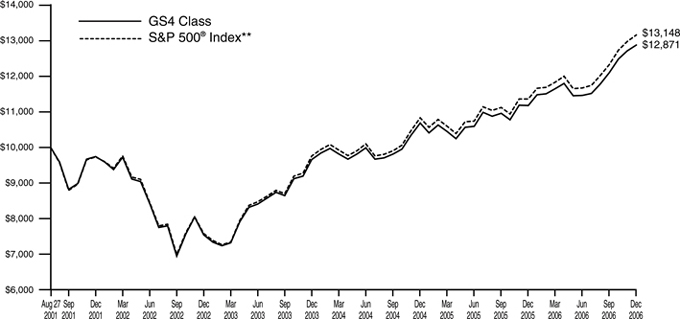

The graph compares the results of a hypothetical $10,000 investment in the GS4 Class of the Fund since August 27, 2001 (commencement of operations), with all dividends and capital gains reinvested, with the Fund’s weighted composite benchmark index.

| * | These returns reflect expense waivers by the Fund’s investment advisor. Without these waivers, returns would have been lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

** | Represents a weighted composite benchmark index consisting of the Russell 3000® Index, the MSCI ACWI® Ex-U.S. and the Merrill Lynch 1-3 Year Treasury Index. |

The Russell 3000® Index measures the performance of the 2,959 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The MSCI ACWI® Ex-U.S. is a market-capitalization weighted index composed of companies representative of the market structure of developed and emerging market countries in the Americas (excluding the U.S.), Europe/Middle East, and Asia/ Pacific Regions. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners.

The Merrill Lynch 1-3 Year Treasury Index is composed of all U.S. Treasury Notes and Bonds with maturities greater than or equal to one year and less than three years.

Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses.

11

| | |

| Flexible Income Fund | | |

| SCHEDULE OF INVESTMENTS | | December 31, 2006 |

| | | | | |

| | | Shares | | Value |

AFFILIATED MUTUAL FUNDS — 98.8% | | | | | |

GuideStone Funds Equity Index Fund (GS4 Class)¥ | | 299,208 | | $ | 5,735,827 |

GuideStone Funds Growth Equity Fund (GS4 Class)¥ | | 1,424,667 | | | 25,316,326 |

GuideStone Funds International Equity Fund (GS4 Class)¥ | | 1,064,551 | | | 20,322,280 |

GuideStone Funds Low-Duration Bond Fund (GS4 Class)¥ | | 18,836,731 | | | 237,907,912 |

GuideStone Funds Money Market Fund (GS4 Class)¥ | | 3,026,183 | | | 3,026,183 |

GuideStone Funds Small Cap Equity Fund (GS4 Class)¥ | | 397,467 | | | 6,359,472 |

GuideStone Funds Value Equity Fund (GS4 Class)¥ | | 1,324,030 | | | 24,693,158 |

| | | | | |

Total Affiliated Mutual Funds | | | | | |

(Cost $ 278,212,983) | | | | | 323,361,158 |

| | | | | |

| | | | | | |

| | | Par | | |

U.S. TREASURY OBLIGATIONS — 1.1% | | | | | | |

U.S. Treasury Bill 4.85%, 02/22/07‡‡ | | $ | 70,000 | | | 69,512 |

U.S. Treasury Note 5.00%, 07/31/08 | | | 3,605,000 | | | 3,612,044 |

| | | | | | |

Total U.S. Treasury Obligations | | | | | | |

(Cost $3,687,274) | | | | | | 3,681,556 |

| | | | | | |

TOTAL INVESTMENTS — 99.9% | | | | | | |

(Cost $281,900,257) | | | | | | 327,042,714 |

| | |

Other Assets in Excess of | | | | | | |

Liabilities — 0.1% | | | | | | 363,372 |

| | | | | | |

NET ASSETS — 100.0% | | | | | $ | 327,406,086 |

| | | | | | |

| | |

PORTFOLIO SUMMARY (based on net assets) | | |

| |

| | | % |

Bond Fund | | 72.7 |

Domestic Equity Funds | | 19.0 |

International Equity Fund | | 6.2 |

U.S. Treasury Obligations | | 1.1 |

Money Market Fund | | 0.9 |

Futures Contracts | | 0.3 |

| | |

| | 100.2 |

| | |

| | | | |

| 12 | | See Notes to Financial Statements. | | |

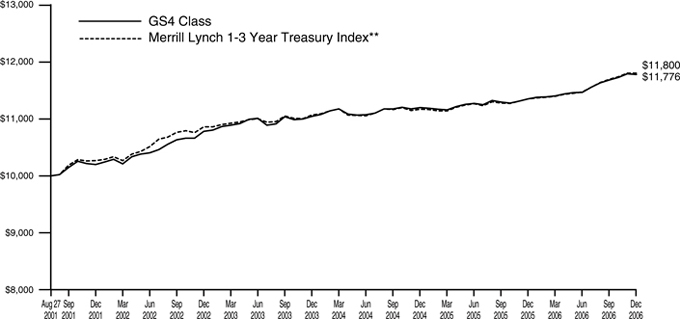

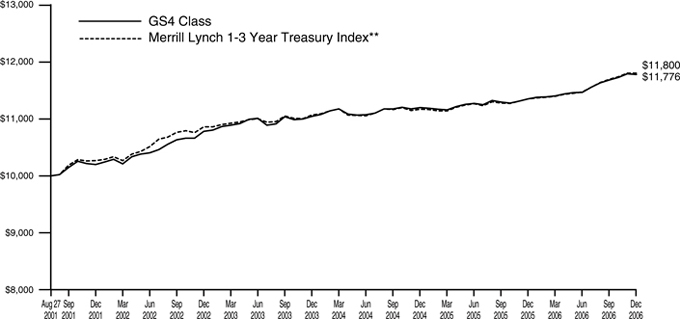

Growth & Income Fund

The Fund is constructed using a blend of nine GuideStone Funds Select Funds GS4. The Fund’s asset allocation at quarter-end was 37% U.S. Equity, 13% Non-U.S. Equity, and 50% Fixed Income. The Fund experienced a positive return for the quarter and the year yet underperformed its composite benchmark. For the year, the Fund’s positive performance was primarily due to the Fund’s underlying investment in the International Equity Fund GS4 and the Value Equity Fund GS4. The Fund’s benchmark-relative underperformance for the year was primarily driven by its exposure to the Growth Equity Fund GS4. The largest component of the Fund, the Medium-Duration Bond Fund GS4, posted a return that slightly trailed its underlying benchmark, the Lehman Brothers Aggregate Bond Index, for the year.

Please see page 15 for information regarding specific portfolio allocations. Portfolio holdings are subject to change at any time.

The Blended Funds attempt to achieve their objectives by investing in the GuideStone Select Funds. By investing in these fund-of-funds, you will incur the expenses of the Blended Funds in addition to those of the underlying funds. You may invest in the Select Funds directly, except the Global Bond Fund. The Blended Funds are also subject to the risks of the underlying funds they hold.

13

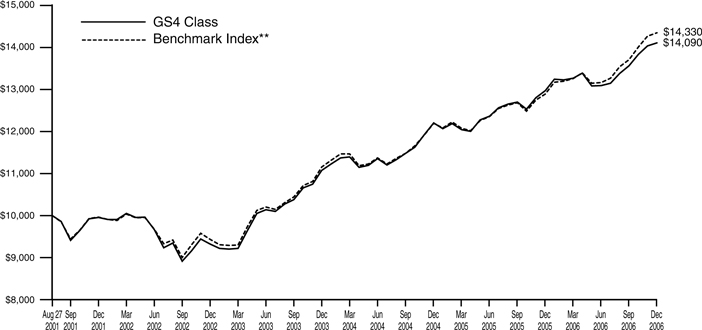

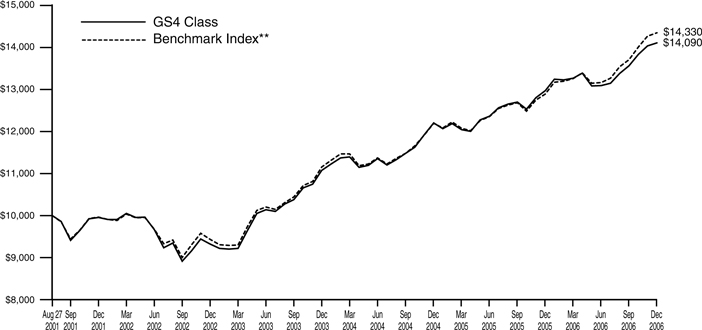

Growth & Income Fund

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 12/31/06 | |

| | | GS4 Class* | | | GS6 Class* | | | Benchmark** | | | GS8 Class* | | | GS8 Class Benchmark** | |

One Year | | 8.78 | % | | 8.30 | % | | 11.29 | % | | 8.03 | % | | 11.29 | % |

Five Year | | 7.20 | % | | 6.86 | % | | 7.56 | % | | N/A | | | N/A | |

Since Inception | | 6.62 | % | | 6.29 | % | | 6.96 | % | | 7.95 | % | | 9.46 | % |

Inception Date | | 08/27/01 | | | 08/27/01 | | | 08/27/01 | | | 11/08/04 | | | 11/08/04 | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.GuideStone.org. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

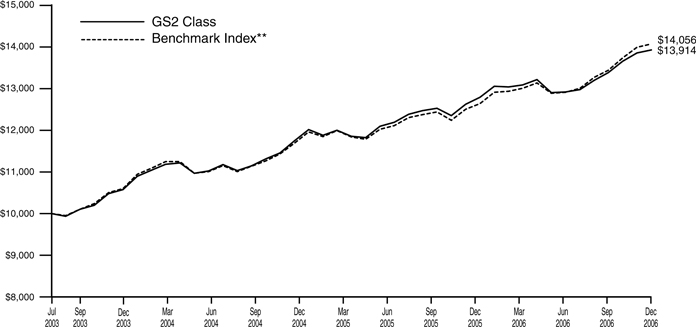

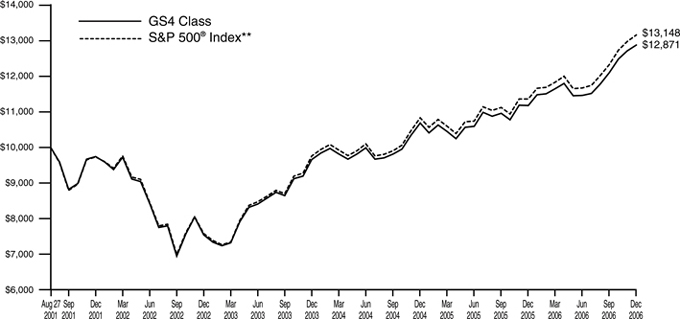

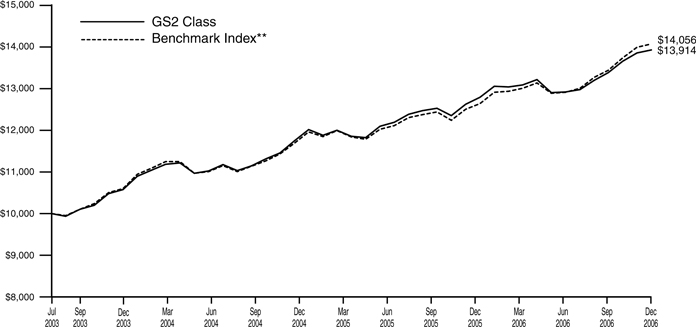

The graph compares the results of a hypothetical $10,000 investment in the GS4 Class of the Fund since August 27, 2001 (commencement of operations), with all dividends and capital gains reinvested, with the Fund’s weighted composite benchmark index.

| * | These returns reflect expense waivers by the Fund’s investment advisor. Without these waivers, returns would have been lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

** | Represents a weighted composite benchmark index consisting of the Russell 3000® Index, the MSCI ACWI® Ex-U.S. and the Lehman Brothers Aggregate Bond Index. |

The Russell 3000® Index measures the performance of the 2,959 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The MSCI ACWI® Ex-U.S. is a market-capitalization weighted index composed of companies representative of the market structure of developed and emerging market countries in the Americas (excluding the U.S.), Europe/Middle East, and Asia/ Pacific Regions. It excludes closed markets and those shares in otherwise free markets that are not purchased by foreigners.

The Lehman Brothers Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses.

14

| | |

Growth & Income Fund | | |

SCHEDULE OF INVESTMENTS | | December 31, 2006 |

| | | | | | |

| | | Shares | | Value |

AFFILIATED MUTUAL FUNDS — 99.1% | | | | | | |

GuideStone Funds Equity Index Fund (GS4 Class)¥ | | | 2,455,697 | | $ | 47,075,708 |

GuideStone Funds Extended-Duration Bond Fund (GS4 Class)¥ | | | 9,361,180 | | | 138,545,465 |

GuideStone Funds Growth Equity Fund (GS4 Class)¥ | | | 11,679,976 | | | 207,553,181 |

GuideStone Funds International Equity Fund (GS4 Class)¥ | | | 9,889,904 | | | 188,798,274 |

GuideStone Funds Low-Duration Bond Fund (GS4 Class)¥ | | | 16,027,252 | | | 202,424,191 |

GuideStone Funds Medium-Duration Bond Fund (GS4 Class)¥ | | | 25,656,028 | | | 344,047,334 |

GuideStone Funds Money Market Fund (GS4 Class)¥ | | | 18,010,225 | | | 18,010,225 |

GuideStone Funds Small Cap Equity Fund (GS4 Class)¥ | | | 3,335,598 | | | 53,369,567 |

GuideStone Funds Value Equity Fund (GS4 Class)¥ | | | 11,374,733 | | | 212,138,774 |

| | | | | | |

Total Affiliated Mutual Funds | | | | | | |

(Cost $1,180,653,781) | | | | | | 1,411,962,719 |

| | | | | | |

| | |

| | | Par | | |

U.S. TREASURY OBLIGATIONS — 0.9% | | | | | | |

U.S. Treasury Bills | | | | | | |

4.82%, 02/22/07‡‡ | | $ | 50,000 | | | 49,651 |

4.85%, 02/22/07‡‡ | | | 550,000 | | | 546,166 |

| | | | | | |

| | | | | | 595,817 |

| | | | | | |

U.S. Treasury Note | | | | | | |

4.88%, 02/15/12 | | | 11,790,000 | | | 11,901,462 |

| | | | | | |

Total U.S. Treasury Obligations | | | | | | |

(Cost $12,494,310) | | | | | | 12,497,279 |

| | | | | | |

TOTAL INVESTMENTS — 100.0% | | | | | | |

(Cost $1,193,148,091) | | | | | | 1,424,459,998 |

| | |

Other Assets in Excess of | | | | | | |

Liabilities — 0.0% | | | | | | 64,787 |

| | | | | | |

NET ASSETS — 100.0% | | | | | $ | 1,424,524,785 |

| | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | |

| | | % |

Bond Funds | | 48.1 |

Domestic Equity Funds | | 36.5 |

International Equity Fund | | 13.2 |

Money Market Fund | | 1.3 |

U.S. Treasury Obligations | | 0.9 |

Futures Contracts | | 0.9 |

| | |

| | 100.9 |

| | |

| | | | |

| | See Notes to Financial Statements. | | 15 |

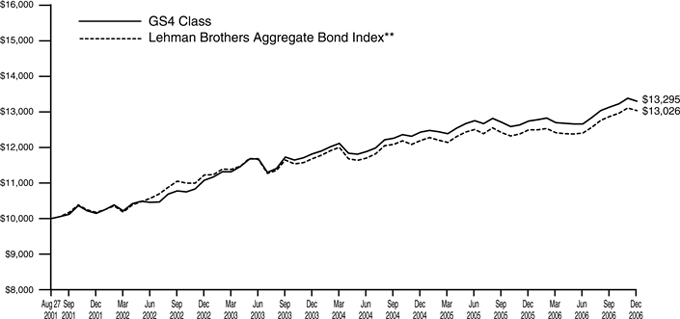

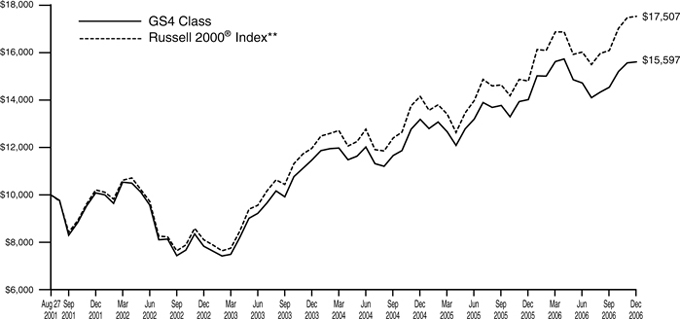

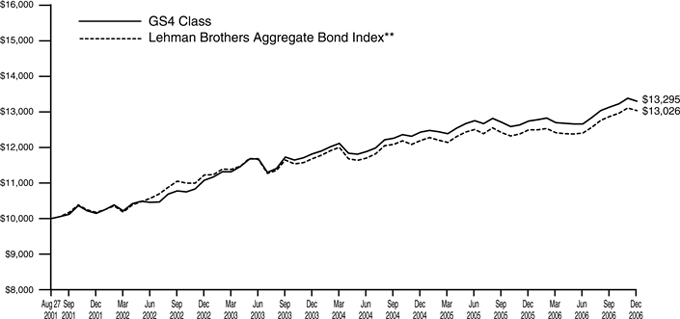

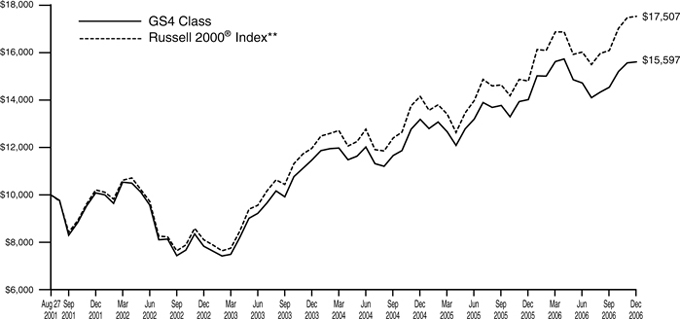

Capital Opportunities Fund

The Fund is constructed using a blend of nine GuideStone Funds Select Funds GS4. The Fund’s asset allocation at quarter-end was 56% U.S. Equity, 19% Non-U.S. Equity, and 25% Fixed Income. The Fund posted a positive return for the quarter and the year yet trailed its composite benchmark. Strong overall performance can be attributed to positive returns in domestic and non-U.S. equity markets. For the year, the Fund’s positive performance was primarily driven by its underlying investment in the International Equity Fund GS4 and the Value Equity Fund GS4. The largest detractor to benchmark-relative underperformance was the Fund’s investment in the Growth Equity Fund GS4.

Please see page 18 for information regarding specific portfolio allocations. Portfolio holdings are subject to change at any time.

The Blended Funds attempt to achieve their objectives by investing in the GuideStone Select Funds. By investing in these fund-of-funds, you will incur the expenses of the Blended Funds in addition to those of the underlying funds. You may invest in the Select Funds directly, except the Global Bond Fund. The Blended Funds are also subject to the risks of the underlying funds they hold.

16

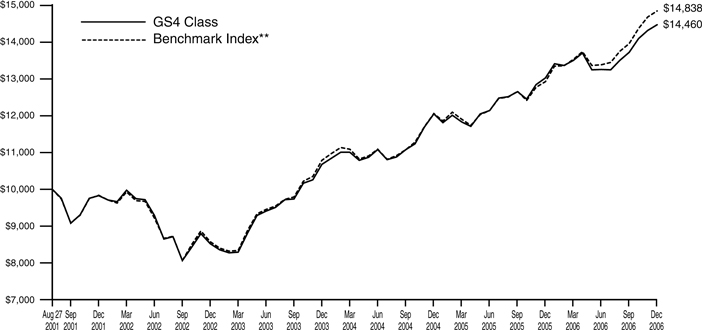

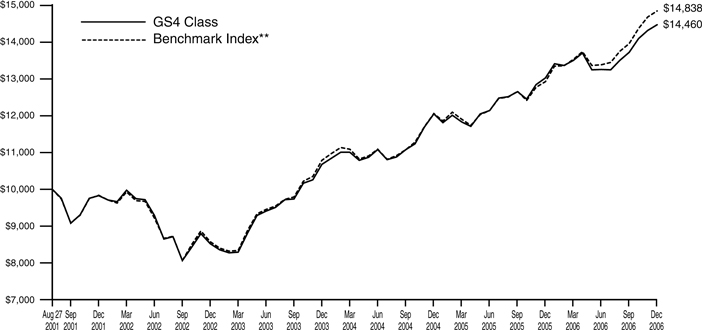

Capital Opportunities Fund

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 12/31/06 | |

| | | GS4 Class* | | | GS6 Class* | | | Benchmark** | | | GS8 Class* | | | GS8 Class Benchmark** | |

One Year | | 11.03 | % | | 10.58 | % | | 14.81 | % | | 10.24 | % | | 14.81 | % |

Five Year | | 8.02 | % | | 7.57 | % | | 8.58 | % | | N/A | | | N/A | |

Since Inception | | 7.14 | % | | 6.73 | % | | 7.65 | % | | 10.41 | % | | 12.46 | % |

Inception Date | | 08/27/01 | | | 08/27/01 | | | 08/27/01 | | | 11/08/04 | | | 11/08/04 | |

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.GuideStone.org. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

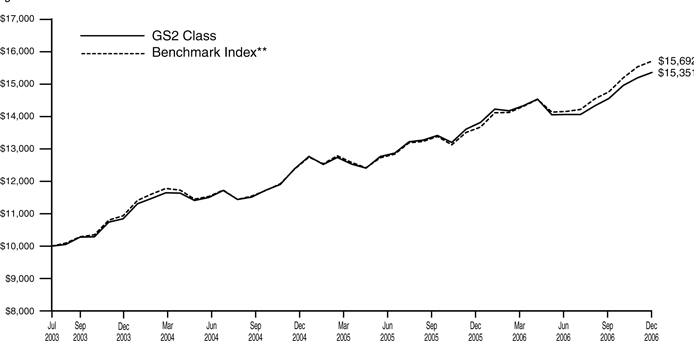

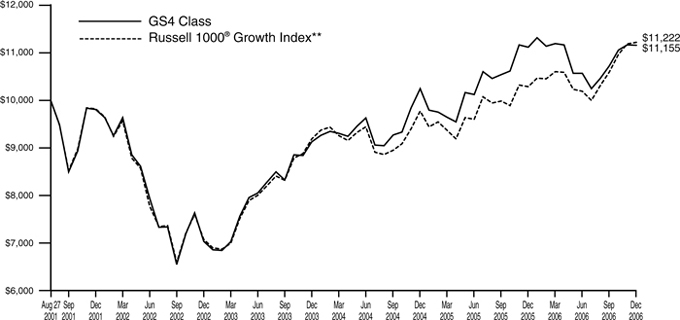

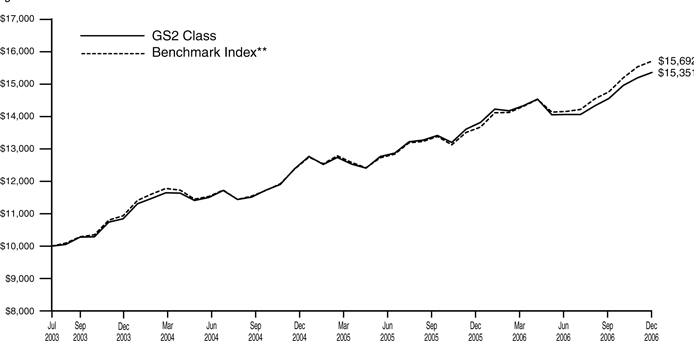

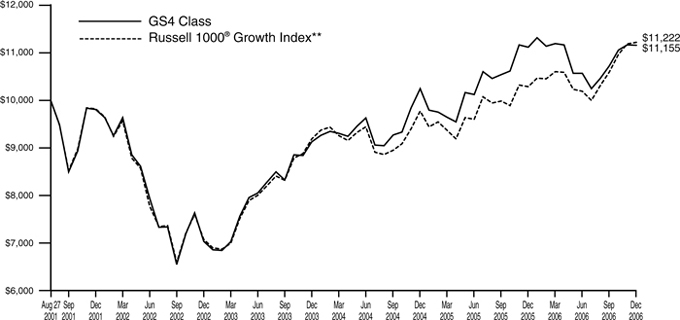

The graph compares the results of a hypothetical $10,000 investment in the GS4 Class of the Fund since August 27, 2001 (commencement of operations), with all dividends and capital gains reinvested, with the Fund’s weighted composite benchmark index.

| * | These returns reflect expense waivers by the Fund’s investment advisor. Without these waivers, returns would have been lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

** | Represents a weighted composite benchmark index consisting of the Russell 3000® Index, the MSCI ACWI® Ex-U.S. and the Lehman Brothers Aggregate Bond Index. |

The Russell 3000® Index measures the performance of the 2,959 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The MSCI ACWI® Ex-U.S. is a market-capitalization weighted index composed of companies representative of the market structure of developed and emerging market countries in the Americas (excluding the U.S.), Europe/Middle East, and Asia/ Pacific Regions. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners.

The Lehman Brothers Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses.

17

| | |

| Capital Opportunities Fund | | |

| SCHEDULE OF INVESTMENTS | | December 31, 2006 |

| | | | | | |

| | | Shares | | Value |

AFFILIATED MUTUAL FUNDS — 99.5% | | | | | | |

GuideStone Funds Equity Index Fund (GS4 Class)¥ | | | 2,984,703 | | $ | 57,216,752 |

GuideStone Funds Extended-Duration Bond Fund (GS4 Class)¥ | | | 3,799,492 | | | 56,232,485 |

GuideStone Funds Growth Equity Fund (GS4 Class)¥ | | | 14,173,212 | | | 251,857,978 |

GuideStone Funds International Equity Fund (GS4 Class)¥ | | | 11,555,852 | | | 220,601,217 |

GuideStone Funds Low-Duration Bond Fund (GS4 Class)¥ | | | 6,588,117 | | | 83,207,921 |

GuideStone Funds Medium-Duration Bond Fund (GS4 Class)¥ | | | 10,327,015 | | | 138,485,274 |

GuideStone Funds Money Market Fund (GS4 Class)¥ | | | 19,406,341 | | | 19,406,341 |

GuideStone Funds Small Cap Equity Fund (GS4 Class)¥ | | | 3,995,457 | | | 63,927,308 |

GuideStone Funds Value Equity Fund (GS4 Class)¥ | | | 13,841,182 | | | 258,138,043 |

| | | | | | |

Total Affiliated Mutual Funds | | | | | | |

(Cost $923,758,612) | | | | | | 1,149,073,319 |

| | | | | | |

| | |

| | | Par | | |

U.S. TREASURY OBLIGATIONS — 0.5% | | | | | | |

U.S. Treasury Bill 4.85%, 02/22/07‡‡ | | $ | 730,000 | | | 724,911 |

U.S. Treasury Note 4.88%, 02/15/12 | | | 4,720,000 | | | 4,764,623 |

| | | | | | |

Total U.S. Treasury Obligations | | | | | | |

(Cost $5,467,387) | | | | | | 5,489,534 |

| | | | | | |

TOTAL INVESTMENTS — 100.0% | | | | | | |

(Cost $929,225,999) | | | | | | 1,154,562,853 |

Other Assets in Excess of | | | | | | |

Liabilities — 0.0% | | | | | | 22,381 |

| | | | | | |

NET ASSETS — 100.0% | | | | | $ | 1,154,585,234 |

| | | | | | |

PORTFOLIO SUMMARY (based on net assets)

| | |

| | | % |

Domestic Equity Funds | | 54.6 |

Bond Funds | | 24.1 |

International Equity Fund | | 19.1 |

Money Market Fund | | 1.7 |

Futures Contracts | | 1.3 |

U.S. Treasury Obligations | | 0.5 |

| | |

| | 101.3 |

| | |

| | | | |

| 18 | | See Notes to Financial Statements. | | |

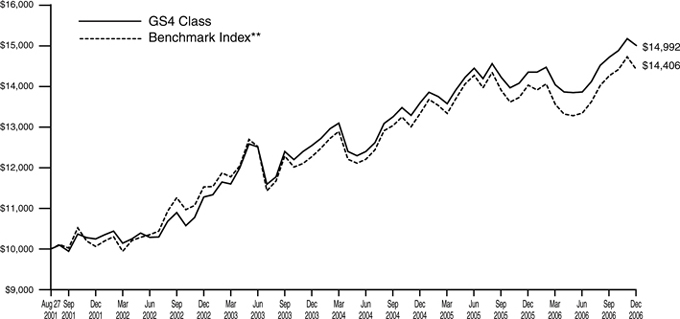

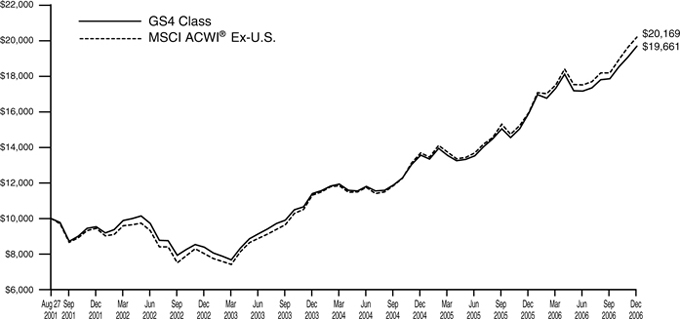

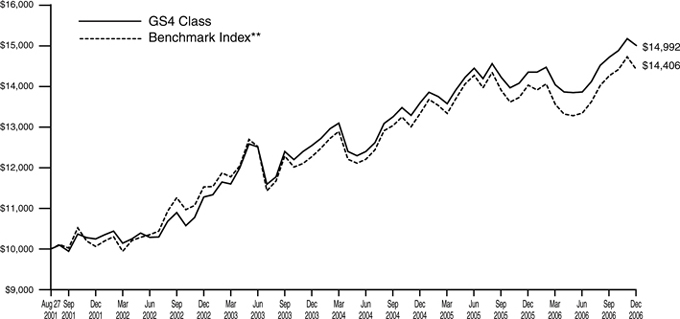

Global Equity Fund

The Fund is constructed using a blend of six GuideStone Funds Select Funds GS4. The Fund’s asset allocation at quarter-end was 74% U.S. Equity, 25% Non-U.S. Equity, and 1% Fixed Income. The Fund posted a positive return for the quarter and the year yet trailed its composite benchmark. Strong overall performance can be attributed to positive returns in the domestic and non-U.S. equity markets. For the year, the Fund’s positive performance was primarily driven by its underlying investment in the International Equity Fund GS4 and the Value Equity Fund GS4. The Fund’s benchmark-relative underperformance was due to exposure to the Growth Equity Fund GS4.

Please see page 21 for information regarding specific portfolio allocations. Portfolio holdings are subject to change at any time.

The Blended Funds attempt to achieve their objectives by investing in the GuideStone Select Funds. By investing in these fund-of-funds, you will incur the expenses of the Blended Funds in addition to those of the underlying funds. You may invest in the Select Funds directly, except the Global Bond Fund. The Blended Funds are also subject to the risks of the underlying funds they hold.

19

Global Equity Fund

| | | | | | | | | | | | | | | |

Average Annual Total Returns as of 12/31/06 | |

| | | GS4 Class* | | | GS6 Class* | | | Benchmark** | | | GS8 Class* | | | GS8 Class Benchmark** | |

One Year | | 13.20 | % | | 12.79 | % | | 18.40 | % | | 12.36 | % | | 18.40 | % |

Five Year | | 8.65 | % | | 8.31 | % | | 9.48 | % | | N/A | | | N/A | |

Since Inception | | 7.46 | % | | 7.19 | % | | 8.20 | % | | 12.89 | % | | 15.66 | % |

Inception Date | | 08/27/01 | | | 08/27/01 | | | 08/27/01 | | | 11/08/04 | | | 11/08/04 | |

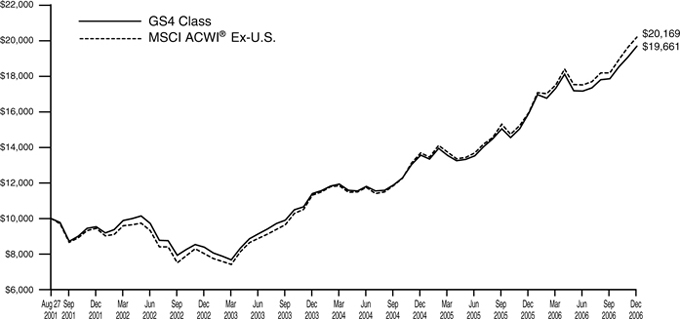

The performance data quoted represents past performance and does not guarantee future results. Current performance may be lower or higher. Performance data current to the most recent month-end may be obtained at www.GuideStone.org. The investment return and principal value of an investment will fluctuate so that shares, when redeemed, may be worth more or less than their original cost.

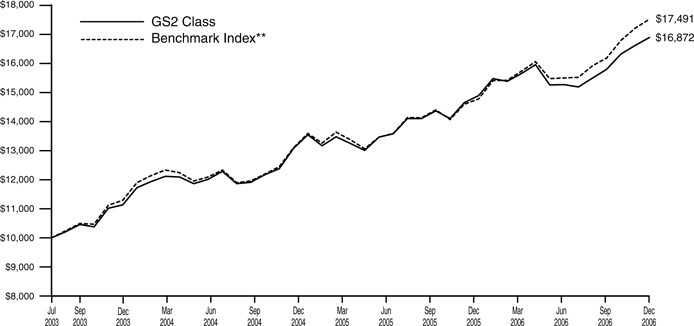

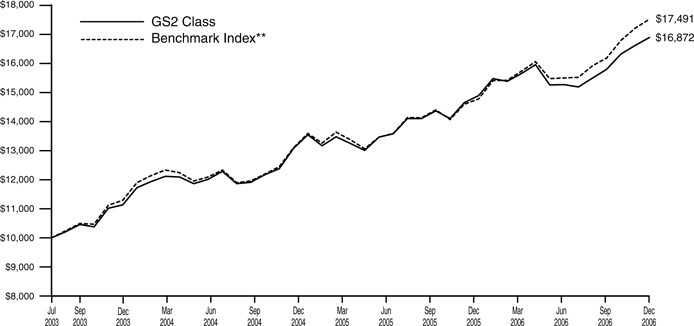

The graph compares the results of a hypothetical $10,000 investment in the GS4 Class of the Fund since August 27, 2001 (commencement of operations), with all dividends and capital gains reinvested, with the Fund’s weighted composite benchmark index.

| * | These returns reflect expense waivers by the Fund’s investment advisor. Without these waivers, returns would have been lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

** | Represents a weighted composite benchmark index consisting of the Russell 3000® Index and the MSCI ACWI® Ex-U.S. |

The Russell 3000® Index measures the performance of the 2,959 largest U.S. companies based on total market capitalization, which represents approximately 98% of the investable U.S. equity market.

The MSCI ACWI® Ex-U.S. is a market-capitalization weighted index composed of companies representative of the market structure of developed and emerging market countries in the Americas (excluding the U.S.), Europe/Middle East, and Asia/ Pacific Regions. It excludes closed markets and those shares in otherwise free markets that are not purchasable by foreigners.

Unlike a mutual fund, the performance of an index assumes no taxes, transaction costs, management fees or other expenses.

20

| | |

| Global Equity Fund | | |

SCHEDULE OF INVESTMENTS | | December 31, 2006 |

| | | | | |

| | | Shares | | Value |

AFFILIATED MUTUAL FUNDS — 99.9% | | | | | |

GuideStone Funds Equity Index Fund (GS4 Class)¥ | | 3,649,412 | | $ | 69,959,231 |

GuideStone Funds Growth Equity Fund (GS4 Class)¥ | | 17,395,220 | | | 309,113,061 |

GuideStone Funds International Equity Fund (GS4 Class)¥ | | 13,651,667 | | | 260,610,316 |

GuideStone Funds Money Market Fund (GS4 Class)¥ | | 16,867,592 | | | 16,867,592 |

GuideStone Funds Small Cap Equity Fund (GS4 Class)¥ | | 4,892,517 | | | 78,280,279 |

GuideStone Funds Value Equity Fund (GS4 Class)¥ | | 17,169,248 | | | 320,206,476 |

| | | | | |

Total Affiliated Mutual Funds | | | | | |

(Cost $808,464,455) | | | | | 1,055,036,955 |

| | | | | |

| | | | | | |

| | | Par | | |

U.S. TREASURY OBLIGATION — 0.1% | | | | | | |

U.S. Treasury Bill 4.85%, 02/22/07‡‡ | | | | | | |

(Cost $695,096) | | $ | 700,000 | | | 695,120 |

| | | | | | |

TOTAL INVESTMENTS — 100.0% | | | | | | |

(Cost $809,159,551) | | | | | | 1,055,732,075 |

Other Assets in Excess of Liabilities — 0.0% | | | | | | 311,976 |

| | | | | | |

NET ASSETS — 100.0% | | | | | $ | 1,056,044,051 |

| | | | | | |

| | |

PORTFOLIO SUMMARY (based on net assets) | | |

| | | % |

Domestic Equity Funds | | 73.6 |

International Equity Fund | | 24.7 |

Money Market Fund | | 1.6 |

Futures Contracts | | 1.1 |

U.S. Treasury Obligation | | 0.1 |

| | |

| | 101.1 |

| | |

| | | | |

| | See Notes to Financial Statements. | | 21 |

STATEMENTS OF ASSETS AND LIABILITIES

December 31, 2006

| | | | | | | | | | | | |

| | | Flexible

Income Fund | | Growth &

Income Fund | | Capital

Opportunities Fund | | Global

Equity Fund |

Assets | | | | | | | | | | | | |

Investments in securities of affiliated issuers, at value | | $ | 323,361,158 | | $ | 1,411,962,719 | | $ | 1,149,073,319 | | $ | 1,055,036,955 |

Investments in securities of unaffiliated issuers, at value | | | 3,681,556 | | | 12,497,279 | | | 5,489,534 | | | 695,120 |

| | | | | | | | | | | | |

Total investments (1) | | | 327,042,714 | | | 1,424,459,998 | | | 1,154,562,853 | | | 1,055,732,075 |

Receivables: | | | | | | | | | | | | |

Dividends | | | 12,525 | | | 70,673 | | | 76,597 | | | 76,345 |

Interest | | | 75,430 | | | 217,006 | | | 86,913 | | | — |

Fund shares sold | | | 374,875 | | | 92,504 | | | 155,383 | | | 388,733 |

Prepaid expenses and other assets | | | 22,859 | | | 32,963 | | | 39,848 | | | 29,702 |

| | | | | | | | | | | | |

Total Assets | | | 327,528,403 | | | 1,424,873,144 | | | 1,154,921,594 | | | 1,056,226,855 |

| | | | | | | | | | | | |

| | | | |

Liabilities | | | | | | | | | | | | |

Payables: | | | | | | | | | | | | |

Fund shares redeemed | | | 53,347 | | | 112,065 | | | 126,594 | | | 1,554 |

Variation margin | | | 4,050 | | | 44,550 | | | 55,350 | | | 43,200 |

Distributions payable | | | — | | | 10,024 | | | — | | | — |

Accrued expenses: | | | | | | | | | | | | |

Advisory fees | | | 14,583 | | | 94,968 | | | 79,960 | | | 66,141 |

Distribution (12b-1) fees | | | 2,540 | | | 3,444 | | | 2,832 | | | 3,195 |

Shareholder servicing fees | | | 2,218 | | | 2,951 | | | 2,302 | | | 2,805 |

Other expenses | | | 45,579 | | | 80,357 | | | 69,322 | | | 65,909 |

| | | | | | | | | | | | |

Total Liabilities | | | 122,317 | | | 348,359 | | | 336,360 | | | 182,804 |

| | | | | | | | | | | | |

Net Assets | | $ | 327,406,086 | | $ | 1,424,524,785 | | $ | 1,154,585,234 | | $ | 1,056,044,051 |

| | | | | | | | | | | | |

| | | | |

Net Assets Consist of: | | | | | | | | | | | | |

Paid-in-capital | | $ | 277,527,318 | | $ | 1,154,997,728 | | $ | 882,690,836 | | $ | 751,758,456 |

Undistributed net investment income | | | 233 | | | — | | | 9,400 | | | — |

Accumulated net realized gain on investments | | | 4,739,067 | | | 38,164,869 | | | 46,488,264 | | | 57,692,436 |

Net unrealized appreciation (depreciation) on investments and futures transactions | | | 45,139,468 | | | 231,362,188 | | | 225,396,734 | | | 246,593,159 |

| | | | | | | | | | | | |

Net Assets | | $ | 327,406,086 | | $ | 1,424,524,785 | | $ | 1,154,585,234 | | $ | 1,056,044,051 |

| | | | | | | | | | | | |

| | | | |

Net Asset Value: | | | | | | | | | | | | |

$0.001 par value, unlimited shares authorized | | | | | | | | | | | | |

Net assets applicable to the GS4 Class | | $ | 308,801,752 | | $ | 1,400,000,742 | | $ | 1,137,038,764 | | $ | 1,031,998,719 |

| | | | | | | | | | | | |

GS4 shares outstanding | | | 23,483,634 | | | 95,802,119 | | | 70,855,796 | | | 59,885,848 |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per GS4share | | $ | 13.15 | | $ | 14.61 | | $ | 16.05 | | $ | 17.23 |

| | | | | | | | | | | | |

Net assets applicable to the GS6 Class | | $ | 12,859,573 | | $ | 16,080,209 | | $ | 9,447,752 | | $ | 16,886,634 |

| | | | | | | | | | | | |

GS6 shares outstanding | | | 1,424,737 | | | 1,722,807 | | | 885,847 | | | 1,407,324 |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per GS6share | | $ | 9.03 | | $ | 9.33 | | $ | 10.67 | | $ | 12.00 |

| | | | | | | | | | | | |

Net assets applicable to the GS8 Class | | $ | 5,744,761 | | $ | 8,443,834 | | $ | 8,098,718 | | $ | 7,158,698 |

| | | | | | | | | | | | |

GS8 shares outstanding | | | 636,481 | | | 906,334 | | | 760,396 | | | 597,403 |

| | | | | | | | | | | | |

Net asset value, offering and redemption price per GS8share | | $ | 9.03 | | $ | 9.32 | | $ | 10.65 | | $ | 11.98 |

| | | | | | | | | | | | |

(1) Investments in securities of affiliated issuers, at cost | | $ | 278,212,983 | | $ | 1,180,653,781 | | $ | 923,758,612 | | $ | 808,464,455 |

Investments in securities of unaffiliated issuers, at cost | | | 3,687,274 | | | 12,494,310 | | | 5,467,387 | | | 695,096 |

| �� | | | | | | | | | | | |

Total investments at cost | | $ | 281,900,257 | | $ | 1,193,148,091 | | $ | 929,225,999 | | $ | 809,159,551 |

| | | | | | | | | | | | |

| | | | |

| 22 | | See Notes to Financial Statements. | | |

STATEMENTS OF OPERATIONS

For the Year Ended December 31, 2006

| | | | | | | | | | | | | | | | |

| | | Flexible

Income Fund | | | Growth &

Income Fund | | | Capital

Opportunities Fund | | | Global Equity Fund | |

Investment Income | | | | | | | | | | | | | | | | |

Income dividends received from affiliated funds | | $ | 9,875,173 | | | $ | 33,936,835 | | | $ | 19,313,838 | | | $ | 10,244,008 | |

Interest | | | 169,981 | | | | 515,887 | | | | 228,077 | | | | 51,225 | |

| | | | | | | | | | | | | | | | |

Total Investment Income | | | 10,045,154 | | | | 34,452,722 | | | | 19,541,915 | | | | 10,295,233 | |

| | | | | | | | | | | | | | | | |

| | | | |

Expenses | | | | | | | | | | | | | | | | |

Investment advisory fees | | | 316,527 | | | | 1,356,970 | | | | 1,103,636 | | | | 1,014,030 | |

Transfer agent fees | | | | | | | | | | | | | | | | |

GS4 shares | | | 35,839 | | | | 60,708 | | | | 48,373 | | | | 48,620 | |

GS6 shares | | | 7,632 | | | | 7,750 | | | | 7,799 | | | | 7,744 | |

GS8 shares | | | 7,768 | | | | 7,877 | | | | 7,858 | | | | 7,859 | |

Custodian fees | | | 13,688 | | | | 30,662 | | | | 24,552 | | | | 24,057 | |

Distribution (12b-1) fees: | | | | | | | | | | | | | | | | |

GS6 shares | | | 12,431 | | | | 14,368 | | | | 7,991 | | | | 15,191 | |

GS8 shares | | | 16,400 | | | | 19,992 | | | | 21,311 | | | | 19,159 | |

Shareholder servicing fees: | | | | | | | | | | | | | | | | |

GS6 shares | | | 13,672 | | | | 15,799 | | | | 8,782 | | | | 16,704 | |

GS8 shares | | | 11,477 | | | | 13,969 | | | | 14,898 | | | | 13,402 | |

Accounting and administration fees | | | 94,484 | | | | 217,928 | | | | 192,600 | | | | 183,452 | |

Professional fees | | | 58,426 | | | | 58,426 | | | | 58,426 | | | | 58,426 | |

Blue sky fees | | | | | | | | | | | | | | | | |

GS4 shares | | | 8,417 | | | | 11,084 | | | | 8,163 | | | | 8,376 | |

GS6 shares | | | 11,870 | | | | 12,574 | | | | 12,125 | | | | 12,530 | |

GS8 shares | | | 5,957 | | | | 7,362 | | | | 6,638 | | | | 5,403 | |

Shareholder reporting fees | | | | | | | | | | | | | | | | |

GS4 shares | | | 12,959 | | | | 41,644 | | | | 29,602 | | | | 28,501 | |

GS6 shares | | | 31 | | | | 31 | | | | 31 | | | | 31 | |

GS8 shares | | | 45 | | | | 105 | | | | 86 | | | | 87 | |

Trustee fees | | | 2,445 | | | | 10,560 | | | | 8,421 | | | | 7,742 | |

Line of credit facility fees | | | 1,423 | | | | 6,181 | | | | 4,953 | | | | 4,546 | |

Other expenses | | | 17,576 | | | | 26,647 | | | | 21,034 | | | | 19,573 | |

| | | | | | | | | | | | | | | | |

Total Expenses | | | 649,067 | | | | 1,920,637 | | | | 1,587,279 | | | | 1,495,433 | |

Expenses waived/reimbursed (See Footnote 3a and 3c) | | | (159,859 | ) | | | (77,128 | ) | | | (80,467 | ) | | | (92,374 | ) |

Fees paid indirectly | | | (2,153 | ) | | | (2,114 | ) | | | (2,750 | ) | | | (3,574 | ) |

| | | | | | | | | | | | | | | | |

Net Expenses | | | 487,055 | | | | 1,841,395 | | | | 1,504,062 | | | | 1,399,485 | |

| | | | | | | | | | | | | | | | |

Net Investment Income | | | 9,558,099 | | | | 32,611,327 | | | | 18,037,853 | | | | 8,895,748 | |

| | | | | | | | | | | | | | | | |

Realized and Unrealized Gain (Loss) | | | | | | | | | | | | | | | | |

Capital gain distributions received from affiliated funds | | | 4,675,836 | | | | 41,573,319 | | | | 49,657,625 | | | | 60,913,778 | |

Net realized gain on investment securities of affiliated issuers | | | 2,768,363 | | | | 22,525,012 | | | | 29,009,908 | | | | 30,886,284 | |

Net realized loss on investment securities of unaffiliated issuers | | | (21,760 | ) | | | (122,619 | ) | | | (61,582 | ) | | | — | |

Net realized gain on futures transactions | | | 99,134 | | | | 899,336 | | | | 883,130 | | | | 1,041,873 | |

| | | | | | | | | | | | | | | | |

Net realized gain | | | 7,521,573 | | | | 64,875,048 | | | | 79,489,081 | | | | 92,841,935 | |

| | | | | | | | | | | | | | | | |

Change in unrealized appreciation (depreciation) on investment securities of affiliated issuers | | | 1,177,397 | | | | 16,324,289 | | | | 17,138,713 | | | | 23,120,670 | |

Change in unrealized appreciation (depreciation) on investment securities of unaffiliated issuers | | | (8,727 | ) | | | (52,541 | ) | | | 491 | | | | (101 | ) |

Change in unrealized appreciation (depreciation) on futures | | | 7,340 | | | | 215,606 | | | | 250,503 | | | | 187,122 | |

| | | | | | | | | | | | | | | | |

Net change in unrealized appreciation (depreciation) | | | 1,176,010 | | | | 16,487,354 | | | | 17,389,707 | | | | 23,307,691 | |

| | | | | | | | | | | | | | | | |

Net Realized and Unrealized Gain (Loss) | | | 8,697,583 | | | | 81,362,402 | | | | 96,878,788 | | | | 116,149,626 | |

| | | | | | | | | | | | | | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 18,255,682 | | | $ | 113,973,729 | | | $ | 114,916,641 | | | $ | 125,045,374 | |

| | | | | | | | | | | | | | | | |

| | | | |

| | See Notes to Financial Statements. | | 23 |

STATEMENTS OF CHANGES IN NET ASSETS

| | | | | | | | | | | | | | | | |

| | | Flexible Income Fund | | | Growth & Income Fund | |

| | | For the Year Ended | | | For the Year Ended | |

| | | 12/31/06 | | | 12/31/05 | | | 12/31/06 | | | 12/31/05 | |

Operations: | | | | | | | | | | | | | | | | |

Net investment income | | $ | 9,558,099 | | | $ | 6,710,228 | | | $ | 32,611,327 | | | $ | 26,617,634 | |

Net realized gain on investment securities and futures transactions | | | 7,521,573 | | | | 8,806,341 | | | | 64,875,048 | | | | 67,104,253 | |

Net change in unrealized appreciation (depreciation) on investment securities and futures | | | 1,176,010 | | | | (6,564,844 | ) | | | 16,487,354 | | | | (18,769,800 | ) |

| | | | | | | | | | | | | | | | |

Net increase in net assets resulting from operations | | | 18,255,682 | | | | 8,951,725 | | | | 113,973,729 | | | | 74,952,087 | |

| | | | | | | | | | | | | | | | |

| | | | |

Dividends and Distributions to Shareholders: | | | | | | | | | | | | | | | | |

Dividends from net investment income(1) | | | | | | | | | | | | | | | | |

GS4 shares | | | (9,432,798 | ) | | | (6,681,233 | ) | | | (37,055,835 | ) | | | (31,655,255 | ) |

GS6 shares | | | (521,636 | ) | | | (368,835 | ) | | | (608,167 | ) | | | (472,113 | ) |

GS8 shares | | | (217,451 | ) | | | (145,933 | ) | | | (298,157 | ) | | | (178,317 | ) |

Distributions from net realized capital gains | | | | | | | | | | | | | | | | |

GS4 shares | | | (3,380,204 | ) | | | (7,416,359 | ) | | | (39,876,138 | ) | | | (50,654,356 | ) |

GS6 shares | | | (202,252 | ) | | | (453,084 | ) | | | (688,428 | ) | | | (813,928 | ) |

GS8 shares | | | (90,433 | ) | | | (197,762 | ) | | | (369,454 | ) | | | (339,052 | ) |

| | | | | | | | | | | | | | | | |

Total dividends and distributions | | | (13,844,774 | ) | | | (15,263,206 | ) | | | (78,896,179 | ) | | | (84,113,021 | ) |

| | | | | | | | | | | | | | | | |

| | | | |

Capital Share Transactions: | | | | | | | | | | | | | | | | |

Proceeds from shares sold | | | | | | | | | | | | | | | | |

GS4 shares | | | 48,268,169 | | | | 51,005,980 | | | | 97,344,717 | | | | 111,946,233 | |

GS6 shares | | | 18,487 | | | | — | | | | 1,078,834 | | | | — | |

GS8 shares | | | 190,451 | | | | 80,457 | | | | 2,360,849 | | | | 375,343 | |

Reinvestment of dividends and distributions | | | | | | | | | | | | | | | | |

GS4 shares | | | 12,806,009 | | | | 14,088,998 | | | | 76,917,838 | | | | 82,297,754 | |

GS6 shares | | | 723,888 | | | | 821,918 | | | | 1,296,595 | | | | 1,286,043 | |

GS8 shares | | | 307,884 | | | | 343,695 | | | | 667,611 | | | | 517,368 | |

| | | | | | | | | | | | | | | | |

Total proceeds from shares sold and reinvested | | | 62,314,888 | | | | 66,341,048 | | | | 179,666,444 | | | | 196,422,741 | |

| | | | | | | | | | | | | | | | |

Value of shares redeemed | | | | | | | | | | | | | | | | |

GS4 shares | | | (37,007,976 | ) | | | (50,125,060 | ) | | | (83,449,394 | ) | | | (195,957,184 | ) |

GS6 shares | | | (34 | ) | | | — | | | | (57,598 | ) | | | — | |

GS8 shares | | | (23,806 | ) | | | — | | | | (290,737 | ) | | | (93 | ) |

| | | | | | | | | | | | | | | | |

Total value of shares redeemed | | | (37,031,816 | ) | | | (50,125,060 | ) | | | (83,797,729 | ) | | | (195,957,277 | ) |

| | | | | | | | | | | | | | | | |

Net increase (decrease) from capital share transactions (See Footnote 7) | | | 25,283,072 | | | | 16,215,988 | | | | 95,868,715 | | | | 465,464 | |

| | | | | | | | | | | | | | | | |

Total increase (decrease) in net assets | | | 29,693,980 | | | | 9,904,507 | | | | 130,946,265 | | | | (8,695,470 | ) |

| | | | | | | | | | | | | | | | |

Net Assets: | | | | | | | | | | | | | | | | |

Beginning of Period | | | 297,712,106 | | | | 287,807,599 | | | | 1,293,578,520 | | | | 1,302,273,990 | |

| | | | | | | | | | | | | | | | |

End of Period* | | $ | 327,406,086 | | | $ | 297,712,106 | | | $ | 1,424,524,785 | | | $ | 1,293,578,520 | |

| | | | | | | | | | | | | | | | |

* Including undistributed (distributions in excess of) net investment income | | $ | 233 | | | $ | 1,857 | | | $ | — | | | $ | 4,573 | |

| | | | | | | | | | | | | | | | |

(1) | Includes dividends paid from the short-term portion of capital gain distributions received from affiliated funds. |

| | | | |

| 24 | | See Notes to Financial Statements. | | |

| | | | | | | | | | | | | | |

Capital Opportunities Fund | | | Global Equity Fund | |

| For the Year Ended | | | For the Year Ended | |

| 12/31/06 | | | 12/31/05 | | | 12/31/06 | | | 12/31/05 | |

| | | | | | | | | | | | | | |

| $ | 18,037,853 | | | $ | 14,963,030 | | | $ | 8,895,748 | | | $ | 7,527,757 | |

| | 79,489,081 | | | | 56,530,883 | | | | 92,841,935 | | | | 61,273,033 | |

| | | | | | | | | | | | | | |

| | 17,389,707 | | | | 6,915,250 | | | | 23,307,691 | | | | 16,984,803 | |

| | | | | | | | | | | | | | | |

| | 114,916,641 | | | | 78,409,163 | | | | 125,045,374 | | | | 85,785,593 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (23,978,727 | ) | | | (20,445,230 | ) | | | (16,325,661 | ) | | | (13,392,673 | ) |

| | (260,944 | ) | | | (179,258 | ) | | | (330,326 | ) | | | (236,192 | ) |

| | (205,398 | ) | | | (131,752 | ) | | | (116,960 | ) | | | (77,886 | ) |

| | | | | | | | | | | | | | |

| | (50,378,326 | ) | | | (31,761,906 | ) | | | (52,469,226 | ) | | | (30,910,635 | ) |

| | (611,374 | ) | | | (328,938 | ) | | | (1,183,298 | ) | | | (651,282 | ) |

| | (536,666 | ) | | | (264,881 | ) | | | (505,083 | ) | | | (268,175 | ) |

| | | | | | | | | | | | | | | |

| | (75,971,435 | ) | | | (53,111,965 | ) | | | (70,930,554 | ) | | | (45,536,843 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 50,622,132 | | | | 50,580,207 | | | | 75,250,021 | | | | 62,443,657 | |

| | 1,063,580 | | | | — | | | | 648,927 | | | | — | |

| | 1,966,580 | | | | 513,587 | | | | 692,148 | | | | 151,657 | |

| | 74,356,367 | | | | 52,206,192 | | | | 68,793,854 | | | | 44,301,986 | |

| | 872,318 | | | | 508,197 | | | | 1,513,624 | | | | 887,475 | |

| | 742,063 | | | | 396,633 | | | | 622,043 | | | | 346,061 | |

| | | | | | | | | | | | | | | |

| | 129,623,040 | | | | 104,204,816 | | | | 147,520,617 | | | | 108,130,836 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | (73,037,809 | ) | | | (125,641,164 | ) | | | (106,442,575 | ) | | | (142,475,893 | ) |

| | (144 | ) | | | — | | | | (66,258 | ) | | | — | |

| | (707,360 | ) | | | (30 | ) | | | (218,026 | ) | | | — | |

| | | | | | | | | | | | | | | |

| | (73,745,313 | ) | | | (125,641,194 | ) | | | (106,726,859 | ) | | | (142,475,893 | ) |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 55,877,727 | | | | (21,436,378 | ) | | | 40,793,758 | | | | (34,345,057 | ) |

| | | | | | | | | | | | | | | |

| | 94,822,933 | | | | 3,860,820 | | | | 94,908,578 | | | | 5,903,693 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | 1,059,762,301 | | | | 1,055,901,481 | | | | 961,135,473 | | | | 955,231,780 | |

| | | | | | | | | | | | | | | |

| $ | 1,154,585,234 | | | $ | 1,059,762,301 | | | $ | 1,056,044,051 | | | $ | 961,135,473 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| $ | 9,400 | | | $ | 3,668 | | | $ | — | | | $ | 3,258 | |

| | | | | | | | | | | | | | | |

| | | | |

| | See Notes to Financial Statements. | | 25 |

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ending December 31, unless otherwise indicated | | Ratios to Average Net Assets | |

| | | Net Asset

Value,

Beginning

of Period | | Net

Investment

Income (1) | | | Capital Gain

Distributions

Received

from

Affiliated

Funds | | Realized

and

Unrealized

Gain (Loss)

on

Investments | | | Dividends

from Net

Investment

Income (2) | | | Distributions

from Net

Realized

Capital

Gains | | | Net

Asset

Value,

End of

Period | | Total

Return (3) | | | Net Assets,

End of

Period (000) | | Expenses,

Net (4)(5) | | | Expenses,

Including

Expense

Reduction

(4)(5) | | | Expenses,

Before

Waivers

and

Expense

Reduction

(4)(5) | | | Investment

Income,

Net (1)(4) | | | Investment

Income/

(Loss),

Excluding

Waivers

and

Expense

Reduction

(1)(4) | | | Portfolio

Turnover

Rate (3) | |

Flexible Income Fund | |

GS4 Class | |

2006 | | $ | 12.94 | | $ | 0.40 | # | | $ | 0.17 | | $ | 0.20 | | | $ | (0.41 | ) | | $ | (0.15 | ) | | $ | 13.15 | | 5.99 | % | | $ | 308,802 | | 0.13 | % | | 0.13 | % | | 0.18 | % | | 3.08 | % | | 3.03 | % | | 9 | % |

2005 | | | 13.18 | | | 0.33 | # | | | 0.09 | | | 0.02 | | | | (0.32 | ) | | | (0.36 | ) | | | 12.94 | | 3.31 | | | | 280,256 | | 0.13 | | | 0.13 | | | 0.19 | | | 2.51 | | | 2.45 | | | 20 | |

2004 | | | 13.00 | | | 0.21 | # | | | 0.04 | | | 0.37 | | | | (0.31 | ) | | | (0.13 | ) | | | 13.18 | | 4.76 | | | | 270,913 | | 0.13 | | | 0.13 | | | 0.17 | | | 1.60 | | | 1.56 | | | 11 | |

2003 | | | 12.40 | | | 0.31 | | | | 0.02 | | | 0.82 | | | | (0.22 | ) | | | (0.33 | ) | | | 13.00 | | 9.33 | | | | 253,828 | | 0.13 | | | 0.13 | | | 0.20 | | | 2.01 | | | 1.94 | | | 13 | |

2002 | | | 13.15 | | | 0.38 | | | | 0.10 | | | (0.62 | ) | | | (0.44 | ) | | | (0.17 | ) | | | 12.40 | | (1.10 | ) | | | 263,646 | | 0.13 | | | 0.13 | | | 0.17 | | | 2.86 | | | 2.82 | | | 14 | |

2001(6) | | | 13.29 | | | 0.17 | | | | 0.06 | | | (0.12 | ) | | | (0.22 | ) | | | (0.03 | ) | | | 13.15 | | 0.79 | | | | 286,628 | | 0.13 | | | 0.13 | | | 0.18 | | | 3.67 | | | 3.62 | | | 4 | |

|

GS6 Class | |

2006 | | $ | 9.05 | | $ | 0.25 | # | | $ | 0.17 | | $ | 0.09 | | | $ | (0.38 | ) | | $ | (0.15 | ) | | $ | 9.03 | | 5.66 | % | | $ | 12,860 | | 0.50 | % | | 0.50 | % | | 0.53 | % | | 2.70 | % | | 2.67 | % | | 9 | % |