UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10303

Buffalo Funds

(Exact name of registrant as specified in charter)

5420 W. 61st Place,

Mission, KS 66025

(Address of principal executive offices) (Zip code)

Laura Symon Browne

5420 W. 61st Place,

Mission, KS 66205

(Name and address of agent for service)

913-677-7778

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

Item 1. Reports to Stockholders.

(a)

ANNUAL REPORT

March 31, 2024

MESSAGE TO OUR SHAREHOLDERS

(UNAUDITED)

The U.S. markets advanced significantly over the 12-month period ending March 31, 2024. A resilient economic backdrop coupled with the view that the Federal Reserve's monetary policy may effectively control inflation helped push the major market averages to all-time highs. Concurrently, a big pivot in expectations for the Federal Reserve's monetary policy supported the market advance, as investors began to anticipate an eventual decline in interest rates during our annual reporting period.

In addition to the prospect of a more accommodative monetary policy and lower recession risk for the economy, one of the major themes propelling share prices of select companies during the period was artificial intelligence (AI). Simply put, AI refers to the creation of computer systems and machines that can perform tasks that would normally require human intelligence. AI's transformational impact on life as we know it will likely be at least on par with other key recent technological innovations, such as when personal computers became widely available in the 1980s/1990s and smart phones were introduced in the early 2000s.

The potential for businesses is huge as it should enable new and improved products and services, reduce labor costs, and increase productivity. AI requires specialized hardware and software to write machine learning algorithms and to train machines to use the data effectively for their objective purpose. Some of the earliest beneficiaries are companies supplying the equipment (hardware) required to create, train, and run AI models. Because of the incredible amounts of data and data manipulation involved, high-end servers with specific types of semiconductors are required. One of the companies benefitting most is Nvidia, which designs the fastest versions of the graphic processing unit (GPU) type of semiconductors that best "crunch" the data for AI models.

Manufacturers of the best performing memory chips have also performed well given their role to enable AI systems, and the increased use of generative AI is likely to draw more total IT spending to the cloud, which will benefit the large cloud providers like Microsoft, Amazon, and Google. Those companies have the equipment required in greatest scale, as well as the resources necessary to further invest in the AI build-out to meet growing demand.

As investors, we need to evaluate which companies have the resources and abilities to benefit from AI, and how the increasing ubiquity of AI-enabled systems will impact competitive dynamics within industries in both the long- and short-term. We also try to anticipate other "derivative" ideas that are less obvious, such as the enormous demand for electricity needed to operate the data centers where AI programs run. The potential implications of AI are wide-ranging and exciting, and we will continue to monitor the transformational impact closely.

As for our capital markets outlook, the economy is slowing to a more sustainable level of growth, as consumers have spent much of the excess savings accumulated during the pandemic. Higher capital costs are also helping to moderate demand, which is giving previously impaired supply chains time to mend. If demand continues to moderate and the job market continues to loosen, we believe inflationary pressures will moderate further. The Fed's aggressive tightening cycle appears to be addressing inflation, and an unwelcome scenario of stubbornly high inflation coupled with a consumer-led recession appears to be a remote possibility. Additionally, given the higher interest rate backdrop, the Fed now has firepower to stimulate the economy through rate cuts when needed, which we feel provides an important backstop to investor psychology.

As always, thank you for your continued trust and conviction in the Buffalo Funds.

Sincerely,

Laura Symon Browne

President

Buffalo Funds

TABLE OF CONTENTS

Investment Results (unaudited) | | | 6 | | |

Portfolio Management Review (unaudited) | | | 10 | | |

Expense Example (unaudited) | | | 20 | | |

Allocation of Portfolio Holdings (unaudited) | | | 24 | | |

Schedules of Investments or Options Written | | | 26 | | |

Buffalo Discovery Fund (BUFTX) | | | 26 | | |

Buffalo Dividend Focus Fund (BUFDX) | | | 32 | | |

Buffalo Early Stage Growth Fund (BUFOX) | | | 40 | | |

Buffalo Flexible Income Fund (BUFBX) | | | 45 | | |

Buffalo Growth Fund (BUFGX) | | | 50 | | |

Buffalo High Yield Fund (BUFHX) | | | 54 | | |

Buffalo International Fund (BUFIX) | | | 65 | | |

Buffalo Large Cap Fund (BUFEX) | | | 73 | | |

Buffalo Mid Cap Fund (BUFMX) | | | 79 | | |

Buffalo Small Cap Fund (BUFSX) | | | 84 | | |

Statements of Assets and Liabilities | | | 90 | | |

Statements of Operations | | | 92 | | |

Statements of Changes in Net Assets | | | 94 | | |

Financial Highlights | | | 98 | | |

Notes to Financial Statements | | | 118 | | |

Report of Independent Registered Public Accounting Firm | | | 131 | | |

Notice to Shareholders (unaudited) | | | 132 | | |

Privacy Policy (unaudited) | | | 144 | | |

INVESTMENT RESULTS (UNAUDITED)

Total Returns as of March 31, 2024

| | | | | | Average Annual | |

| | Gross Expense

Ratio* | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception | |

Buffalo Discovery Fund — Investor Class

(inception date 4/16/01) | | | 1.01 | % | | | 22.13 | % | | | 19.72 | % | | | 9.22 | % | | | 10.07 | % | | | 9.33 | % | | | N/A | | |

Buffalo Discovery Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.86 | % | | | 22.19 | % | | | 19.85 | % | | | 9.38 | % | | | 10.24 | % | | | N/A | | | | 9.49 | % | |

Russell Mid Cap Growth Index | | | N/A | | | | 25.42 | % | | | 26.28 | % | | | 11.82 | % | | | 11.35 | % | | | 9.55 | % | | | 9.55 | % | |

Buffalo Dividend Focus Fund — Investor Class

(inception date 12/3/12) | | | 0.95 | % | | | 22.16 | % | | | 27.31 | % | | | 14.36 | % | | | 12.27 | % | | | 13.24 | % | | | N/A | | |

Buffalo Dividend Focus Fund — Institutional

Class (inception date 7/1/19)1 | | | 0.80 | % | | | 22.20 | % | | | 27.47 | % | | | 14.53 | % | | | 12.43 | % | | | N/A | | | | 13.41 | % | |

Russell 1000 Index | | | N/A | | | | 23.49 | % | | | 29.87 | % | | | 14.76 | % | | | 12.68 | % | | | 14.31 | % | | | 14.31 | % | |

Buffalo Early Stage Growth Fund — Investor

Class (inception date 5/21/04) | | | 1.50 | % | | | 15.02 | % | | | 7.38 | % | | | 7.79 | % | | | 7.19 | % | | | 8.41 | % | | | N/A | | |

Buffalo Early Stage Growth Fund —

Institutional Class (inception date 7/1/19)1 | | | 1.35 | % | | | 15.04 | % | | | 7.45 | % | | | 7.94 | % | | | 7.34 | % | | | N/A | | | | 8.57 | % | |

Russell 2000 Growth Index | | | N/A | | | | 21.30 | % | | | 20.35 | % | | | 7.38 | % | | | 7.89 | % | | | 8.84 | % | | | 8.84 | % | |

Buffalo Flexible Income Fund — Investor Class

(inception date 8/12/94) | | | 1.01 | % | | | 15.84 | % | | | 19.37 | % | | | 10.66 | % | | | 7.99 | % | | | 7.79 | % | | | N/A | | |

Buffalo Flexible Income Fund —

Institutional Class (inception date 7/1/19)1 | | | 0.86 | % | | | 15.99 | % | | | 19.61 | % | | | 10.83 | % | | | 8.15 | % | | | N/A | | | | 7.95 | % | |

Russell 3000 Index | | | N/A | | | | 23.30 | % | | | 29.29 | % | | | 14.34 | % | | | 12.33 | % | | | 10.53 | % | | | 10.53 | % | |

Buffalo Growth Fund — Investor Class

(inception date 5/19/95) | | | 0.92 | % | | | 24.30 | % | | | 36.01 | % | | | 14.03 | % | | | 12.20 | % | | | 10.82 | % | | | N/A | | |

Buffalo Growth Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.77 | % | | | 24.41 | % | | | 36.16 | % | | | 14.19 | % | | | 12.36 | % | | | N/A | | | | 10.99 | % | |

Russell 3000 Growth Index | | | N/A | | | | 26.90 | % | | | 37.95 | % | | | 17.82 | % | | | 15.43 | % | | | 10.66 | % | | | 10.66 | % | |

Buffalo High Yield Fund — Investor Class

(inception date 5/19/95) | | | 1.03 | % | | | 7.63 | % | | | 12.07 | % | | | 5.92 | % | | | 4.76 | % | | | 6.75 | % | | | N/A | | |

Buffalo High Yield Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.87 | % | | | 7.72 | % | | | 12.24 | % | | | 6.06 | % | | | 4.90 | % | | | N/A | | | | 6.91 | % | |

ICE BofA US High Yield Index | | | N/A | | | | 8.72 | % | | | 11.12 | % | | | 4.06 | % | | | 4.38 | % | | | 6.63 | % | | | 6.63 | % | |

Buffalo International Fund — Investor Class

(inception date 9/28/07) | | | 1.04 | % | | | 17.20 | % | | | 10.89 | % | | | 9.59 | % | | | 7.64 | % | | | 5.79 | % | | | N/A | | |

Buffalo International Fund — Institutional

Class (inception date 7/1/19)1 | | | 0.89 | % | | | 17.27 | % | | | 11.08 | % | | | 9.76 | % | | | 7.80 | % | | | N/A | | | | 5.95 | % | |

FTSE All-World ex-US Index | | | N/A | | | | 14.75 | % | | | 13.99 | % | | | 6.70 | % | | | 4.95 | % | | | 3.20 | % | | | 3.20 | % | |

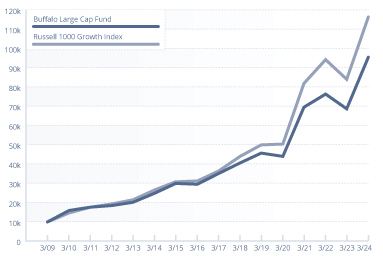

Buffalo Large Cap Fund — Investor Class

(inception date 5/19/95) | | | 0.95 | % | | | 27.80 | % | | | 39.04 | % | | | 15.85 | % | | | 14.35 | % | | | 10.73 | % | | | N/A | | |

Buffalo Large Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.80 | % | | | 27.86 | % | | | 39.19 | % | | | 16.02 | % | | | 14.52 | % | | | N/A | | | | 10.90 | % | |

Russell 1000 Growth Index | | | N/A | | | | 27.19 | % | | | 39.00 | % | | | 18.52 | % | | | 15.98 | % | | | 10.87 | % | | | 10.87 | % | |

6

| | | | | | Average Annual | |

| | Gross Expense

Ratio* | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception | |

Buffalo Mid Cap Fund — Investor Class

(inception date 12/17/01) | | | 1.03 | % | | | 21.10 | % | | | 23.74 | % | | | 11.40 | % | | | 8.98 | % | | | 8.78 | % | | | N/A | | |

Buffalo Mid Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.88 | % | | | 21.23 | % | | | 23.85 | % | | | 11.56 | % | | | 9.13 | % | | | N/A | | | | 8.94 | % | |

Russell Mid Cap Growth Index | | | N/A | | | | 25.42 | % | | | 26.28 | % | | | 11.82 | % | | | 11.35 | % | | | 9.77 | % | | | 9.77 | % | |

Buffalo Small Cap Fund — Investor Class

(inception date 4/14/98) | | | 0.99 | % | | | 12.44 | % | | | 3.88 | % | | | 9.22 | % | | | 8.34 | % | | | 11.12 | % | | | N/A | | |

Buffalo Small Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.87 | % | | | 12.51 | % | | | 4.07 | % | | | 9.37 | % | | | 8.49 | % | | | N/A | | | | 11.29 | % | |

Russell 2000 Growth Index | | | N/A | | | | 21.30 | % | | | 20.35 | % | | | 7.38 | % | | | 7.89 | % | | | 6.36 | % | | | 6.36 | % | |

1 The Institutional Class commenced operations on 7/1/2019. Performance for periods prior to 7/1/2019 is based on the performance of the Investor Class adjusted for the Shareholder Services fee of the Investor Class.

* As reported in the Funds' Prospectus dated July 28, 2023. Current period gross expense ratio for each Fund can be found on the Financial Highlights, beginning on page 98.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current as of the most recent month-end may be obtained by calling 1-800-49-BUFFALO or by visiting the website at www.buffalofunds.com.

The Funds' returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of shares. The benchmark returns shown, excluding the Lipper Indices, reflect the reinvestment of dividends and capital gains but do not reflect the deduction of any investment management fees, other expenses or taxes. The performance of the Lipper Indices is presented net of fees and expenses; however, applicable sales charges are not taken into consideration. One cannot invest directly in an index.

The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Growth Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The Russell Mid Cap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index represents the 1,000 companies by market capitalization in the USA. The Russell 3000 Index is a market-capitalization-weighted equity index that tracks the performance of the 3,000 largest US-traded stocks. The Russell 3000 Growth Index is a market-capitalization index that is comprised of companies that display signs of above-average growth. The FTSE All-World ex-US Index is part of the FTSE All-World Index, a global index covering approximately 4,000 mid cap and large cap stocks in 48 countries, excluding the USA. The ICE BofA US High Yield Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market.

Must be preceded or accompanied by a current prospectus. Please refer to the prospectus for special risks associated with investing in the Buffalo Funds, including, but not limited to, risks involved with investments in healthcare, information technology, energy, and industrial companies, foreign securities, debt securities, lower- or unrated securities and medium and small companies. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings. Distributed by Quasar Distributors, LLC.

7

INVESTMENT RESULTS (UNAUDITED) Continued

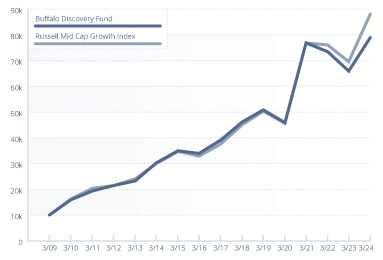

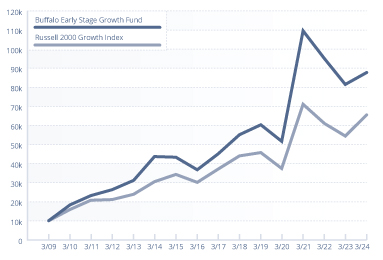

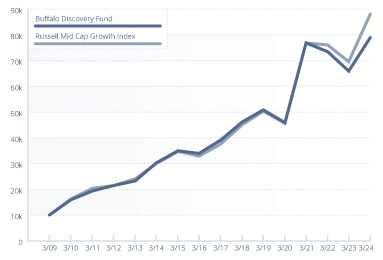

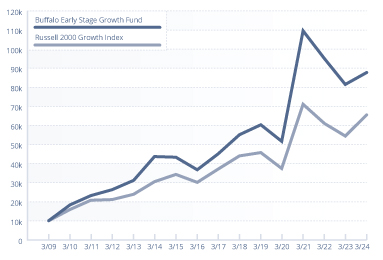

Growth of a $10,000 Investment — Investor Class

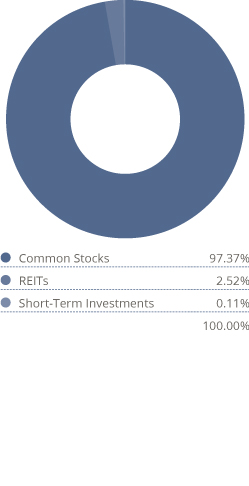

BUFFALO DISCOVERY FUND

BUFFALO DIVIDEND FOCUS FUND

BUFFALO EARLY STAGE

GROWTH FUND

BUFFALO FLEXIBLE INCOME FUND

BUFFALO GROWTH FUND

BUFFALO HIGH YIELD FUND

8

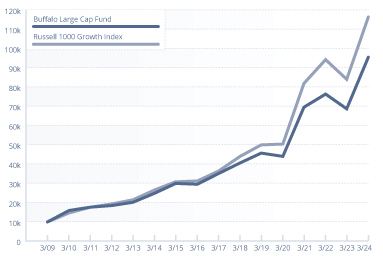

Growth of a $10,000 Investment — Investor Class

BUFFALO INTERNATIONAL FUND

BUFFALO LARGE CAP FUND

BUFFALO MID CAP FUND

BUFFALO SMALL CAP FUND

9

PORTFOLIO MANAGEMENT REVIEW (UNAUDITED)

BUFFALO DISCOVERY FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Discovery Fund — Investor Class produced a total return of 19.72%, a result that underperformed its benchmark, the Russell Midcap Growth Index, which advanced 26.28%.

What factors influenced performance?

Most economic sectors made a positive contribution to the fund's absolute performance results for the annual report period except for Consumer Staples and Real Estate, which are small sector weightings for the fund. However, weak stock selection within Consumer Discretionary, Information Technology and Financials compared to the benchmark led to relative underperformance. Growth, momentum, and earnings surprise were among the strongest factors driving performance of the benchmark for the period. Meanwhile, factors such as earnings quality and valuation have greatly underperformed. We remain committed to our valuation and higher-quality discipline, which resulted in benchmark relative underperformance over the last 12 months.

Contributors/Detractors

Securities that contributed the most to performance included CrowdStrike Holdings and Copart. Despite weakness from other firms in their industry, CrowdStrike is experiencing accelerating recurring revenue growth. CrowdStrike is well positioned to benefit from increasing spend on endpoint security and cloud workload protection for years to come.

Copart is a leading provider of auction services for the automotive industry. Values for used vehicles spiked following the COVID pandemic due to supply chain disruption and strong consumer demand, and that negatively impacted the number of "total loss" vehicles being brought to auction by insurance companies. That dynamic is now reversing as auto production rebounds and used vehicle prices normalize. Copart is now projecting healthy volume growth with improving margins. Longer term, we see opportunities for international expansion and believe domestic salvage

auction volumes will continue to rise as advanced vehicle technology and rising repair costs drive up total loss rates for insurers.

Securities that detracted from the fund's results included Calix and Aptiv PLC. Calix is a telecom equipment supplier that sells primarily to broadband service providers in small- to medium-sized markets. The company stands to benefit from the federal infrastructure bill, which aims to extend broadband access into rural markets. However, financial results missed expectations with some key customers delaying purchases as they evaluate these new federal programs and apply for funds. Estimates for 2024 have moved sharply lower, but we believe this is largely a timing issue and that Calix appears well-positioned for a strong recovery once these federal programs are underway.

Aptiv PLC is a supplier to the automotive industry with products that support electrical architectures, safety/perception systems, mobile connectivity, and in-vehicle software. These are some of the fastest growing segments within the auto industry. However, earnings estimates have been pressured by slowing production growth in Europe and Asia, as well as moderating demand for electric vehicles in North America. This is on top of numerous challenges faced over the past year, including supply chain shortages, raw materials inflation, foreign exchange headwinds, and a UAW strike. Investors have clearly grown weary of bad news, but we see substantial value at current levels. Aptiv continues to win market share, and margins should get a boost from pricing actions and cost reduction. The company has capacity to repurchase $3 billion of stock over the next two years, and it is looking to scale back investment in its money-losing autonomous driving joint venture. With earnings growing at an 18-20% pace over the next few years and returns on capital improving, shares look undervalued for this leader in automotive innovation.

Positioning/Outlook

The economy has been surprisingly robust, supported by solid job growth and healthy (but decelerating) wage gains. The upside from job growth has surprised investors and runs contrary to leading economic indicators that had suggested slower growth ahead.

10

Elevated levels of workers, infrastructure spending, investments in AI, and inventory rebuilding appear to be driving upside growth versus prior forecasts. This bodes well for economic expansion, but lowers the odds of rate cuts and makes it more challenging for the Fed to tame inflation. With consumer spending growth now normalizing in the 3% to 4% range, inflation is stickier than desired. It appears consumers are becoming more selective in their purchases, which was a consistent theme from management teams on recent earnings calls.

In this environment, we remain biased to stable-growth franchises and businesses with secular tailwinds that are taking market share. As mentioned above, growth, momentum, and earnings surprise were among the strongest factors driving performance as we write this update. Meanwhile, factors such as earnings quality and valuation have significantly underperformed. We remain committed to our valuation discipline and refrain from chasing crowded, expensive stocks. Given the wide valuation gap between secular growth and quality, we will look to selectively add to quality companies on weakness and trim stocks that have surpassed our price targets. We recognize these valuation disparities can run further and longer than desired, so we will move methodically and patiently with a keen focus on company fundamentals and risk mitigation.

We are still finding high-quality companies benefiting from disruptive innovation and secular tailwinds. Innovative growth businesses with strong balance sheets, scalable business models, and wide competitive moats — whether they manufacture medical devices, cybersecurity software, or innovative consumer products — are likely to outperform in a slower growth environment. This long-term, risk-aware view has served us well in the past and we believe it will lead to a continued compounding of attractive returns over time.

BUFFALO DIVIDEND FOCUS FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Dividend Focus Fund — Investor Class produced a total return of 27.31%, a result that underperformed its benchmark, the Russell 1000 Index, which advanced 29.87%.

What factors influenced performance?

All economic sectors made a positive contribution to the fund's absolute performance results for the period.

However, the fund's sector allocation impact led to benchmark underperformance, particularly the fund's underweight to Information Technology which was a strong performing sector for the benchmark during the period. Stock selection within Information Technology also trailed the benchmark results. Partially offsetting results in Information Technology was the fund's stock selection in Communication Services, Energy, Health Care, Materials, and Utilities, which delivered positive performance compared to the index.

Contributors/Detractors

Securities that contributed the most to performance included Meta Platforms, Microsoft Corporation, and Vistra Corporation. Meta Platforms rose on strong earnings, the initiation of a dividend, and the announcement of a $50 billion stock buyback program. Shares of Microsoft advanced on healthy earnings, as the company appears poised to benefit from the enthusiasm around AI (artificial intelligence). Vistra, a utility and power generation company, advanced as the company has become an AI beneficiary, as growth in data centers should increase demand for electricity.

Securities that detracted from the fund's results included Enviva Inc., Community Healthcare Trust Inc., and PTC Therapeutics. Enviva, which operates in the production, processing, and distribution of wood biomass to power generators, declined on disappointing earnings and the elimination of their dividend. Community Healthcare Trust, a healthcare real estate property and leasing company, declined as a result of a tenant bankruptcy filing and rising interest rates, which negatively impacted the company's cost of capital. PTC Therapeutics, a biopharmaceutical products company that focuses on rare disorders, declined on disappointing trial results and a negative opinion from the European Union on a drug marketing authorization.

Positioning/Outlook

Despite the uncertainty created by the Federal Reserve, domestic politics, and geopolitical tensions, we remain focused on wide moat, large capitalization companies trading at reasonable valuations, in our view. As always, the fund will continue to emphasize competitively-advantaged companies that can be purchased at a fair value. As stock market volatility spikes, we will look for opportunities to find companies that fit our investment criteria, and to be ready when market declines provide better entry points.

11

BUFFALO EARLY STAGE GROWTH FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Early Stage Growth Fund — Investor Class produced a total return of 7.38%, a result that underperformed its benchmark, the Russell 2000 Growth Index, which advanced 20.35%.

What factors influenced performance?

Stock selection within the Health Care and Information Technology sectors were primarily responsible for relative underperformance during the period. The index, made up of over 1,050 constituents, had a unique development in the fiscal year in that two holdings became some of the largest weightings in the history of the benchmark, and also produced outsized returns. Super Micro Computer and MicroStrategy are seen as beneficiaries of artificial intelligence (AI) investments and a play on bitcoin, respectively. The fund did not hold either company. Super Micro Computer, which advanced nearly 850% for the year, has a $60 billion market capitalization and falls outside the spirit of running a small cap portfolio. MicroStrategy, which advanced over 480%, is a speculative play on the price of bitcoin and does not have a fundamental story behind it.

We believe it is unlikely that we will experience anything like this past year's occurrence especially as Russell moves to reconstitute their indices twice per year to eliminate the potential for what just transpired.

Contributors/Detractors

Kinsale Capital was the top contributor over the past year. The fund has held Kinsale since its initial public offering (IPO) in 2016. The company is a property and casualty insurance company that focuses solely on excess and surplus insurance (E&S) where they write coverages for hard-to-place, small business and personal lines risks. Kinsale has grown at a 40%+ compound annual growth rate (CAGR) over a multi-year time period but still only has a 1.5% market share of the E&S industry. Senior management, which founded Kinsale in 2009, has an average experience of over 30 years in this marketplace and has shown a consistent ability to create value for shareholders. Superior underwriting and an in-house technology stack in a specialized marketplace positions Kinsale favorably to generate attractive growth and capture market share.

The largest detractor from performance was Calix, a provider of hardware and software to rural broadband providers. While a record amount of federal subsidies and incentives are available for rural broadband providers to upgrade and expand their networks, the industry is on pause for the moment as the various federal programs are being vetted and evaluated. This has caused a lull in spending for Calix equipment and software. We believe industry activity will expand in time and Calix is best positioned to capture this opportunity set. Additionally, Calix is early in its efforts to turn these hardware relationships into longer term revenue streams through associated software offerings to help these rural broadband providers better manage their businesses and subscriber bases.

Positioning/Outlook

The employment environment remains strong while consumer sentiment is being pressured by stubborn inflation. The outlook for the Fed to cut rates has dampened materially since late 2023 as economic readings continue to run hotter than expected. Consensus is now forming around two or fewer rate cuts in calendar 2024 versus as many as six rate cuts just five months ago. While inflation is showing progress against the Fed's target of 2%, this does not take away from inflation seen across food, shelter and used vehicles amongst other categories where prices are 25+% higher than pre-Covid levels.

The previous 13 rate cut cycles dating back to 1957 have been very favorable to small cap stocks, with the median return in the first six months approximating 11%. With lowered borrowing costs and lowered discount rates applied to future cash flows, small cap stocks should see immediate benefits from rate cuts. Regardless of the Fed actions, valuation levels of small caps relative to large caps remain at historically attractive levels. Additionally, the performance gap between small cap stocks and large cap stocks remains wide relative to historical levels, and we believe this performance gap will compress over time.

Our job remains to find and hold attractive small cap companies that have not been fully appreciated by the market or are mispriced due to recent results or events. We believe less investor interest in our segment of the market creates an opportunity for us to uncover value over the long term. The fund typically invests at the smaller end of the small cap growth spectrum and the managers continue to seek companies with sustainable growth due to secular growth trends or innovative, disruptive products.

12

BUFFALO FLEXIBLE INCOME FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Flexible Income Fund — Investor Class produced a total return of 19.37%, a result that underperformed its benchmark, the Russell 3000 Index, which advanced 29.29%.

What factors influenced performance?

All but one economic sector made a positive contribution to the fund's absolute performance results for the period, with the exception being Consumer Discretionary. However, the fund's sector allocation impact was a primary factor leading to underperformance relative to the benchmark. The fund's overweight to the Consumer Staples and Energy sectors impacted relative performance, as those sectors trailed the overall index return for the year. Additionally, the fund's underweight to Information Technology, which was a strong performing sector for the benchmark during the period, also negatively impacted relative performance.

Contributors/Detractors

Securities that contributed the most to performance included Eli Lilly and Microsoft. Eli Lilly's financial results were particularly strong during the period, driven by weight loss drugs. The company also provided 2024 top line and margin guidance that was above expectations and reported a positive Phase II clinical trial result for one of their drugs. Microsoft reported better than expected revenues throughout the period, and earnings consistently beat expectations. Revenue growth was strong across all of its segments and margins also improved.

Securities that detracted from the fund's results included Pfizer and General Mills. Pfizer's decline for the annual reporting period reflected weaker than expected earnings driven by a drop off in COVID vaccine revenues, a slowing base business, and the upcoming loss of exclusivity for certain key products (Eliquis and Ibrance). General Mills suffered from negative earnings revisions and a lower organic revenue forecast.

Positioning/Outlook

Despite the uncertainty created by the Federal Reserve, domestic politics, and geopolitical tensions, we remain focused on wide moat, large capitalization companies trading at reasonable valuations, in our view. As always,

the fund will continue to emphasize competitively-advantaged companies that can be purchased at a fair value. As stock market volatility spikes, we will look for opportunities to find companies that fit our investment criteria, and to be ready when market declines provide better entry points.

BUFFALO GROWTH FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Growth Fund — Investor Class produced a total return of 36.01%, a result that underperformed its benchmark, the Russell 3000 Growth Index, which advanced 37.95%.

What factors influenced performance?

All economic sectors made a positive contribution to the fund's strong absolute performance results for the period, however weak stock selection within Health Care and Information Technology led to benchmark underperformance. NVIDIA was a strong contributor to fund performance given the stock advanced over 225% in the period; however, the fund's average weight of about 3.25% vs. the benchmark's average weight of nearly 5% contributed to performance shortfall for the fund.

Contributors/Detractors

Securities that contributed the most to performance included Microsoft and NVIDIA. Microsoft gained over 47% in the period and is the fund's largest position. The company has been investing heavily in the development of AI-powered solutions across its various business segments, such as using AI to enhance productivity and efficiency in its Azure cloud infrastructure, Search, and Office software suite. Microsoft will likely continue to grow their leading share in cloud computing, gaming, and MS Office productivity applications.

As mentioned above, shares of NVIDIA advanced over 225% during the annual reporting period. The company consistently reported sales and earnings ahead of Wall Street's expectations throughout the year with greater than expected growth driven by its products that are in great demand for AI applications. The company has obtained a wide moat around the AI ecosystem and is well-positioned to capture the lion's share of AI infrastructure buildouts.

Securities that detracted from the fund's results included Bio-Rad Laboratories and Calix. Bio-Rad Laboratories is a

13

supplier of products and services to the life sciences industry, including reagents, consumables, diagnostic testing systems, and software. The company cut its earnings forecast following the release of first-quarter earnings. Life sciences and biopharma industries have not been immune from macroeconomic uncertainty and supply chain disruption, and some of the inventory stockpiling that took place during the pandemic is now being reduced. We believe the slowdown is temporary, though, and valuation is now compelling. Giving Bio-Rad Laboratories credit for its net cash position and stake in German bioprocess leader Sartorius, the company trades at roughly half the valuation of industry leaders Danaher and Thermo Fisher.

Calix is a telecom equipment supplier that sells primarily to broadband service providers in small- to medium-sized markets. The company stands to benefit from the federal infrastructure bill, which aims to extend broadband access into rural markets. However, financial results missed expectations with some key customers delaying purchases as they evaluate these new federal programs and apply for funds. Estimates for 2024 have moved sharply lower, but we believe this is largely a timing issue and that Calix appears well-positioned for a strong recovery once these federal programs are underway.

Positioning/Outlook

The outlook for growth stocks is encouraging. The economy is slowing to a more sustainable level of growth, as consumers have spent much of the excess savings accumulated during the pandemic. Higher capital costs are also helping to moderate demand, giving supply lines time to mend. With demand moderating and the job market loosening, we believe inflationary pressures will moderate. The Fed's aggressive tightening cycle appears to be addressing inflation, and an unwelcomed scenario of stubbornly-high inflation coupled with a consumer-led recession appears to be off the table. Moreover, the Fed now has firepower to stimulate when needed, which provides an important backstop to investor psychology. In our opinion, the market environment favors growing, high quality, self-funded companies with durable moats.

Our process is to invest in high quality, well-funded businesses that benefit from secular trends. Regardless of what happens with the economy or broader equity markets, we will strive to maximize risk-adjusted returns in the portfolio by investing in attractively-valued businesses with solid growth opportunities, durable competitive advantages, scalable business models, and exceptional management teams.

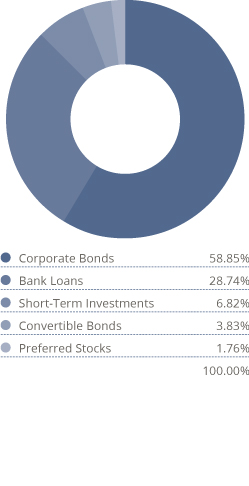

BUFFALO HIGH YIELD FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo High Yield Fund — Investor Class produced a total return of 12.07%, a result that outperformed its benchmark, the ICE BofA US High Yield Index, which advanced 11.12%.

What factors influenced performance?

The U.S. high yield bond sector generated posted positive returns in all four quarters of our annual reporting period, as the Fed paused hiking the Federal Funds rate in July, economic data continued to signal resiliency, and the market began anticipating rate cuts for 2024. According to JP Morgan, the return on CCC-rated bonds significantly outperformed the single-B rated and doubled the BB-rated issues during the fiscal year (CCC = 18.86%, B = 11.94%, BB = 9.16%) as investors searched for wider spreads in anticipation of more aggressive Fed rate cuts.

Contributors/Detractors

The top three contributors were Uniti Group LP 10.500% corporate bonds, Vista Outdoor 4.500% corporate bonds, and Energy Transfer LP 7.125% corporate bonds. The 10.500% coupon and annuity-like cash flows attracted investors to the Uniti Group's bonds during the year. Vista Outdoor benefited from the announcement that the company would be acquired by The Czechoslovak Group and the bonds will be repaid at par once the acquisition is finalized. Energy Transfer LP rallied as investors were drawn to its bonds due to their near-investment grade quality and longer-duration characteristics which should benefit the bonds in a declining interest rate environment.

Southwest Airlines 1.250% convertible bonds, Tutor Perini term loans, and the iHeart Communications 8.375% corporate bonds were the worst performers during the fiscal year. Southwest Airlines' convertible bonds were negatively impacted by disappointing earnings results reported in July as well as several safety issues at Boeing that have delayed the delivery of new planes, affecting the entire commercial airline industry. Tutor Perini's loans underperformed as the company reported multiple quarters of disappointing earnings and diminishing backlog. The iHeart Communication's bonds suffered

14

from multiple headwinds negatively affecting the radio/advertising industry throughout the year.

Positioning/Outlook

We are principally focused on the Federal Reserve's balancing act between taming inflation while avoiding a recession, lingering supply chain disruptions, and geopolitical uncertainty. The fund is being managed cautiously yet actively, focusing on high-quality issuers with defensive business models and manageable credit metrics. The portfolio managers will continue to deploy cash in opportunities that we believe offer the most appealing risk/reward tradeoff with a bias toward shorter durations and less levered credits. Additionally, we believe bank loans offer a more defensive position as they provide senior positioning in the capital structure and less interest rate sensitivity due to their floating rate structures. Finally, we continue to look for opportunities in convertible bonds and preferred stocks. We ended the year with 142 securities in the portfolio, up from the previous year's level of 137, excluding cash.

BUFFALO INTERNATIONAL FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo International Fund — Investor Class produced a total return of 10.89%, a result that underperformed its benchmark, the FTSE All-World exUS Index, which advanced 13.99%.

What factors influenced performance?

All economic sectors except for Consumer Staples made a positive contribution to the fund's performance results for the period. However, the fund's sector allocation impact and weak stock selection with Consumer Staples, specifically, led to underperformance compared to the benchmark. In terms of sector impact, the fund's underweight to Financials, a strong performing sector for the benchmark during the period, detracted from relative performance. Stock selection within Consumer Staples also trailed the benchmark, particularly beverage companies and luxury apparel and accessory brands which declined. Partially offsetting these results were the fund's investments to select Materials companies, which delivered positive performance compared to the index.

Contributors/Detractors

Securities that contributed significantly to performance included Disco Corporation and Taiwan Semiconductor

Manufacturing Company (TSMC). Shares of TSMC, the leading global contract semiconductor manufacturer, rose nearly 50% in the period. TSMC is seeing increased demand for its leading-edge foundry services due to growth in AI-related data center computation, and stabilization in smartphone and personal computer shipments. Management forecasts AI-related data center needs will approach a 50% compound annual growth rate (CAGR) over the next five years. Disco, a manufacturer of machinery for cutting and grinding silicon, rose nearly 220% in the annual period driven by demand for its AI packaging equipment. TSMC is their top customer, accounting for around 9% of Disco's revenue. Following TSMC's commentary on advanced packaging, we expect strong growth for both Disco's equipment and consumables over the next 3-5 years.

BayCurrent Consulting was the largest detractor from the fund's results during the annual period. BayCurrent, a Japanese consulting company, reported below-estimate revenue and earnings due to the loss of a major client and lower consultant utilization resulting from overhiring. Additionally, a shift into IT services alongside their consulting business raised investor concerns about growth, margins, and the new strategy overall. Despite the short-term results, we believe this shift toward a less cyclical, higher-volume business model will ultimately improve free cash flow, and we remain confident in the mid- to long-term story.

Positioning/Outlook

We continue to be cautiously optimistic about the prospects for global equity markets. It has become clearer that anticipated interest rate cuts in the United States will come later than previously hoped. In the European Union, interest rate cuts are becoming more imminent as inflation recedes and the economy remains sluggish. Barring any change in the data, it seems the European Central Bank will most likely cut rates before the U.S. Federal Reserve. The European labor market remains strong, and consumer and business confidence has stabilized, helped by positive real wage growth for the consumer; however, there has not been any pickup in economic growth to date. The continued strength of the U.S. economy, however, has been positive for many European multinational companies that do a portion of their business in America. In Japan, the central bank exiting negative rates could signal a new regime for the country where inflation takes hold and positive economic growth continues.

15

Whatever the future brings, we will continue to look for opportunities in the short term to invest with a long-term view. Our strategy remains the same, seeking quality companies that are benefiting from long-term secular growth trends that also have sound, sustainable business models, competitive advantages, and consistent free cash flow generation with good returns on their investments. We especially like proven management teams that are focused on creating value for shareholders. We will seek out opportunities during periods of market weakness or volatility to buy high quality growth companies at attractive valuations. We believe that by continuing our disciplined strategy we should be able to post attractive risk-adjusted returns over the long term.

BUFFALO LARGE CAP FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Large Cap Fund — Investor Class produced a total return of 39.04%, a result that matched its benchmark, the Russell 1000 Growth Index, which advanced 39.00%.

What factors influenced performance?

All economic sectors made a positive contribution to the fund's strong absolute performance results for the period. The fund's results within Information Technology were particularly impactful, gaining nearly 52%, providing the strongest contribution for the year. Fund results within Industrials added the most value compared to the benchmark, partially offset by weaker stock selection for the fund's investments within Financials.

Contributors/Detractors

Securities that contributed the most to performance included NVIDIA and Microsoft. NVIDIA shares continued their prodigious rise that started in January of 2023 with an "eye-popping" return of over 225% during the annual reporting period, as the company significantly raised its guidance and outlook for data center AI chip (GPU) shipments. The company has capitalized on the AI microprocessor opportunity and has, in the process, created the third most valuable company in the world. Some have suggested Nvidia will eventually possess the largest global market cap of any company — a strong possibility. Microsoft also contributed to the fund's strong performance over the past 12 months. The company remains a unique beneficiary of AI, as both an enabler and adopter of the technology.

Tesla was the largest detractor from fund results during the period. The share price of Tesla declined around 30% due to two primary factors: 1) a reduction in deliveries of its battery electric vehicles (BEV) and 2) ongoing uncertainty of the export by China manufacturers of low-cost electric vehicles into western markets, where Tesla currently has leading BEV market share. The reduction in auto deliveries is not unique to Tesla. The worldwide vehicle market has been hampered either by weak economies or an elevated interest rate environment. Inflation in the U.S. (including the "higher for longer" theme) is making the case for a series of interest rate cuts in 2024 more unlikely. This has heightened declining sentiment for Tesla's shares.

Positioning/Outlook

Market returns have been produced by relatively few stocks (the "Magnificent 7") across the large cap benchmarks. Time will tell if this is a leading indicator of market declines, or alternatively, positions other large cap companies to gain ground throughout 2024.

We see growing concerns around the health of the U.S. consumer. Consumer confidence has fallen below expectations, as higher interest rates and elevated gasoline prices impact pocketbooks. Moreover, student loan repayments commenced October 1st, 2023, adding an additional layer of concern on US households' propensity to spend. Partially offsetting these factors is that employment remains strong across the U.S.

Weight loss drugs (GLP-1's, such as Wegovy and Monjaro) created a profound investment narrative during the annual reporting period that has negatively impacted various medical device, consumer discretionary, and consumer staple stocks. The narrative implies structural changes to food and drink consumption and reduced need for medical procedures in areas such as cardiovascular disease and orthopedics. We see selective opportunities to take the other side of this potentially-exaggerated theme, investing in companies that have been overly penalized by GLP-1's perceived weight-loss impact.

Artificial Intelligence also remains a key driver of investor interest. The key question, in our opinion, is how much of the near-term growth is now priced into key AI beneficiary stocks. We have continued to have overweight exposure, generally to a handful of companies where the risk/reward upside is likely to persist over the next six to nine months. Notwithstanding the favorable long-term secular outlook of this macro

16

trend, we do believe there will likely be a digestion point sometime in late 2024 or 2025 where the aggregate AI investment, on a rate of change basis, will decelerate or possibly be negative on a year-over-year basis. The growth outlook of AI investment over the next 10+ years remains unambiguously positive, however.

BUFFALO MID CAP FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Mid Cap Fund — Investor Class produced a total return of 23.74%, a result that underperformed its benchmark, the Russell Midcap Growth Index, which advanced 26.28%.

What factors influenced performance?

All economic sectors made a positive contribution to the fund's absolute performance results for the period, however weak stock selection within Consumer Discretionary and Financials led to benchmark underperformance. Our investing style has been generally out of favor recently. According to the investment bank Jefferies, momentum has been the top performing factor, and quality has been the worst performing factor. This is not in alignment with our investment style. We do not chase stocks with strong recent performance, hoping that it can continue. We invest in high quality stocks as measured by return on invested capital (ROIC), return on assets (ROA), and return on equity (ROE) etc.

Contributors/Detractors

Securities that contributed the most to performance included CrowdStrike Holdings and Gartner. Despite weakness from other firms in their industry, CrowdStrike is experiencing accelerating recurring revenue growth. CrowdStrike is well positioned to benefit from increasing spend on endpoint security and cloud workload protection for years to come. Meanwhile Gartner provides research and advisory services, mainly on technology-related topics, to corporate clients. The stock advanced due to strong financial results, highlighted by stabilizing tech vendor spending and salesforce productivity improvements. While artificial intelligence is the current hot topic, we expect Gartner will continue to

benefit from the increasing ubiquity and complexity of IT in all types of businesses.

Securities that detracted from the fund's results included MarketAxess Holdings and Bio-Rad Laboratories. MarketAxess, which operates a platform for electronically trading fixed income securities, declined during annual reporting period driven by soft industry volumes, stagnant market share, and weaker than expected pricing. We believe that these issues are mainly short-term, or macro-driven, and expect the company to benefit from the continued shift to electronic trading in the bond market.

Bio-Rad Laboratories is a supplier of products and services to the life sciences industry, including reagents, consumables, diagnostic testing systems, and software. The company cut its earnings forecast following the release of first-quarter earnings. Life sciences and biopharma industries have not been immune from macroeconomic uncertainty and supply chain disruption, and some of the inventory stockpiling that took place during the pandemic is now being reduced. We believe the slowdown is temporary, though, and valuation is now compelling. Even after giving Bio-Rad Laboratories credit for its net cash position and stake in German bioprocess leader Sartorius, the company trades at roughly half the valuation of industry leaders Danaher and Thermo Fisher.

Positioning/Outlook

The outlook for the Fed to cut rates has dampened materially since late 2023 as economic readings continue to run hotter than expected. Consensus is now forming around two rate cuts in calendar 2024 versus as many as six rate cuts just five months ago. While inflation currently looks stickier than it did a few months ago, the good news is that the odds of a recession in the near term have declined.

Despite inflation being stickier than expected, businesses with pricing power should hold up better than most. Regardless of what happens with the Federal Reserve, economy, or broader equity markets, we will strive to maximize risk-adjusted returns in the portfolio by investing in attractively-valued businesses with solid growth opportunities, durable competitive advantages, scalable business models, and exceptional management teams.

17

BUFFALO SMALL CAP FUND

How did the Fund perform last year and what affected its performance?

For the 12-month period ended March 31, 2024, the Buffalo Small Cap Fund — Investor Class produced a total return of 3.88%, a result that underperformed its benchmark, the Russell 2000 Growth Index, which advanced 20.35%.

What factors influenced performance?

Stock selection within the Health Care and Information Technology sectors were primarily responsible for relative underperformance during the period. The index, made up of over 1,050 constituents, had a unique development in the fiscal year in that two holdings became some of the largest weightings in the history of the benchmark, and also produced outsized returns. Super Micro Computer and MicroStrategy are seen as beneficiaries of artificial intelligence (AI) investments and a play on bitcoin, respectively. The fund did not hold either company. Super Micro Computer, which advanced nearly 850% for the year, has a $60 billion market capitalization and falls outside the spirit of running a small cap portfolio. MicroStrategy, which advanced over 480%, is a speculative play on the price of bitcoin and does not have a fundamental story behind it.

We believe it is unlikely that we will experience anything like this past year's occurrence especially as Russell moves to reconstitute their indices twice per year to eliminate the potential for what just transpired.

Contributors/Detractors

Securities that contributed the most to performance included AZEK and PGT Innovations. AZEK, a manufacturer of wood-alternative decking, railing and exterior products for the residential market continues to perform well as the company is benefiting from the conversion away from wood. Currently, wood represents approximately 78% of the decking market and we believe the conversion away from wood provides a secular growth opportunity for the company. Additionally, AZEK should continue to expand margins as the company improves its recycling capabilities. PGT Innovations is a leading manufacturer of residential impact-resistant windows and doors. The company entered into an agreement to be acquired by Masonite International Corp., leading the shares to move higher on the proposed announced acquisition.

Securities that detracted from the fund's results included Avid Bioservices and Treace Medical Concepts. Avid Bioservices, a clinical and commercial manufacturer of biologics for biotechnology and pharmaceutical companies, reported that customer focus shifted from early-stage biotechnology to late-stage projects, which puts pressure on near-term revenues as later-phase work converts to revenue at a slower rate than early stage. Although the near-term might experience volatility, we believe the company's fundamentals are strong and remain confident in Avid's position within their industry as total backlog hit an all-time high and there is good visibility into bookings for next year.

Treace designs, manufactures, and markets orthopedic medical devices for the foot and ankle. Treace's share price action reflected current investor sentiment souring on longer duration stories that are currently unprofitable. Additionally, weight loss drugs, being front and center recently, weighed on many healthcare stocks. We do not believe weight loss drugs will reduce the need for foot and ankle procedures, which are largely caused by other factors, and we remain favorable on Treace's longer-term growth potential. Furthermore, the company is driving toward profitability, which should be a few quarters out.

Positioning/Outlook

The employment environment remains strong while consumer sentiment is being pressured by stubborn inflation. The outlook for the Fed to cut rates has dampened materially since late 2023 as economic readings continue to run hotter than expected. Consensus is now forming around two rate cuts in calendar 2024 versus as many as six rate cuts just five months ago. While inflation is showing progress against the Fed's target of 2%, this does not take away from inflation seen across food, shelter and used vehicles amongst other categories where prices are 25%+ higher than pre-Covid levels.

The previous 13 rate cut cycles dating back to 1957 have been very favorable to small cap stocks, with the median return in the first six months approximating 11%. With lowered borrowing costs and lowered discount rates applied to future cash flows, small cap stocks should see immediate benefits from rate cuts. Regardless of the Fed actions, valuation levels of small caps relative to large caps remain at historically attractive levels. Additionally, the performance gap between small cap stocks and large cap stocks remains wide relative to historical levels, and we believe this performance gap will compress over time.

18

We continue to seek high quality companies that meet our criteria including strong management teams, consistent free cash flow generation, scalable business models, and sustainable competitive advantages. We believe that such companies are well-positioned to weather economic headwinds and deliver sustainable returns, and we feel this approach allows the portfolio to perform well over full market cycles while being mindful of risk.

19

EXPENSE EXAMPLE (UNAUDITED)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs and (2) ongoing costs, including management fees, shareholder servicing fees (Investor Class only) and other Fund specific expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2023 – March 31, 2024).

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period. Although the Funds charge no sales load or transaction fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds' transfer agent. To the extent a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by

the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the examples below. The examples below include management fees, registration fees and other expenses. However, the examples below do not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under U.S. generally accepted accounting principles.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Funds' actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in our Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different Funds. In addition, if these transactional costs were included, your costs would have been higher.

BUFFALO DISCOVERY FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,221.30 | | | $ | 5.55 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.00 | | | $ | 5.05 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,221.90 | | | $ | 4.78 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.34 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.00%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

20

BUFFALO DIVIDEND FOCUS FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,221.60 | | | $ | 5.17 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.35 | | | $ | 4.70 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,222.00 | | | $ | 4.33 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.10 | | | $ | 3.94 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.93%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO EARLY STAGE GROWTH FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,150.20 | | | $ | 7.74 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.80 | | | $ | 7.49 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,150.40 | | | $ | 7.20 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.30 | | | $ | 6.76 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.44%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 1.34%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO FLEXIBLE INCOME FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,158.40 | | | $ | 5.45 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.95 | | | $ | 5.10 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,159.90 | | | $ | 4.64 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.34 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.01%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO GROWTH FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,243.00 | | | $ | 4.88 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.65 | | | $ | 4.39 | | |

Institutional Class | |

Actual | | $ | 1,000.00 | | | $ | 1,244.10 | | | $ | 4.32 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.15 | | | $ | 3.89 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.77%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

21

BUFFALO HIGH YIELD FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,076.30 | | | $ | 5.29 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.90 | | | $ | 5.15 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,077.20 | | | $ | 4.52 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.65 | | | $ | 4.39 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.02%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO INTERNATIONAL FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,172.00 | | | $ | 5.59 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.85 | | | $ | 5.20 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,172.70 | | | $ | 4.83 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.55 | | | $ | 4.50 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.03%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.89%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO LARGE CAP FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,278.00 | | | $ | 5.01 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.60 | | | $ | 4.45 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,278.60 | | | $ | 4.44 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.10 | | | $ | 3.94 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.88%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

BUFFALO MID CAP FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,211.00 | | | $ | 5.36 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.15 | | | $ | 4.90 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,212.30 | | | $ | 4.81 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.65 | | | $ | 4.39 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.97%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

22

BUFFALO SMALL CAP FUND | | Beginning

Account Value

October 1, 2023 | | Ending

Account Value

March 31, 2024 | | Expenses Paid During

Period October 1, 2023 -

March 31, 2024* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,124.40 | | | $ | 5.10 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.20 | | | $ | 4.85 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,125.10 | | | $ | 4.57 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.70 | | | $ | 4.34 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.96%, multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 183/366 to project a one-half year period.

23

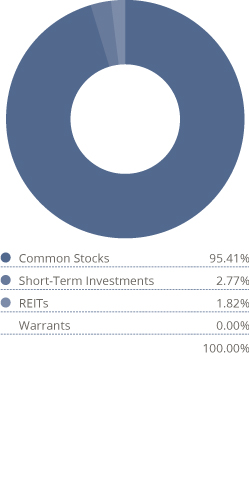

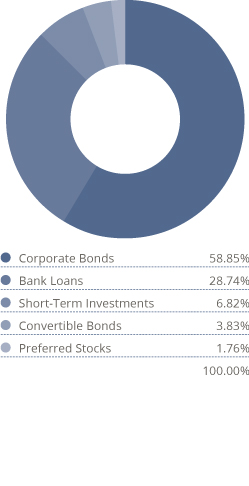

ALLOCATION OF PORTFOLIO HOLDINGS

(UNAUDITED)

Percentages represent market value as a percentage of investments as of March 31, 2024.

BUFFALO DISCOVERY

FUND

BUFFALO DIVIDEND

FOCUS FUND

BUFFALO EARLY STAGE

GROWTH FUND

BUFFALO FLEXIBLE

INCOME FUND

BUFFALO GROWTH

FUND

BUFFALO HIGH YIELD

FUND

24

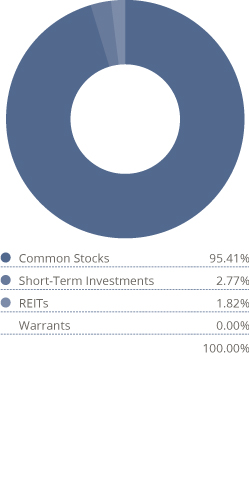

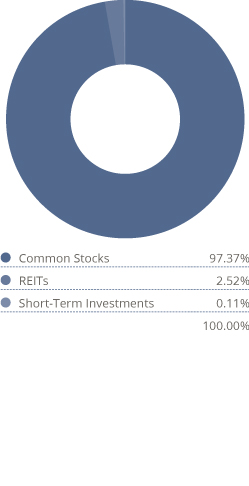

Percentages represent market value as a percentage of investments as of March 31, 2024.

BUFFALO

INTERNATIONAL FUND

BUFFALO LARGE CAP

FUND

BUFFALO MID CAP

FUND

BUFFALO SMALL CAP

FUND

25

BUFFALO DISCOVERY FUND

SCHEDULE OF INVESTMENTS

AS OF MARCH 31, 2024

Shares | | | | $ Value | |

Common Stocks | | | 98.4 | % | |

Communication Services | | | 6.2 | % | |

| | | | | Entertainment | | | 3.6 | % | |

| | 447,751 | | | Endeavor Group Holdings, Inc. — Class A | | | 11,520,633 | | |

| | 96,000 | | | Live Nation Entertainment, Inc.(a) | | | 10,153,920 | | |

| | 31,400 | | | Spotify Technology SA(a) | | | 8,286,460 | | |

| | | | 29,961,013 | | |

| | | | | Interactive Media & Services | | | 1.2 | % | |

| | 278,000 | | | Pinterest, Inc. — Class A(a) | | | 9,638,260 | | |

| | | | | Media | | | 1.4 | % | |

| | 137,873 | | | Trade Desk, Inc. — Class A(a) | | | 12,052,858 | | |

Total Communication Services | | | 51,652,131 | | |

Consumer Discretionary | | | 7.0 | % | |

| | | | | Automobile Components | | | 2.0 | % | |

| | 205,472 | | | Aptiv PLC(a) | | | 16,365,845 | | |

| | | | | Hotels, Restaurants & Leisure | | | 1.6 | % | |

| | 57,952 | | | Expedia Group, Inc.(a) | | | 7,982,888 | | |

| | 107,870 | | | MGM Resorts International(a) | | | 5,092,543 | | |

| | | | 13,075,431 | | |

| | | | | Specialty Retail | | | 2.0 | % | |

| | 55,346 | | | Five Below, Inc.(a) | | | 10,038,657 | | |

| | 12,200 | | | Ulta Beauty, Inc.(a) | | | 6,379,136 | | |

| | | | 16,417,793 | | |

| | | | | Textiles, Apparel & Luxury Goods | | | 1.4 | % | |

| | 11,260 | | | lululemon athletica, Inc.(a) | | | 4,398,719 | | |

| | 220,000 | | | On Holding AG — Class A(a) | | | 7,783,600 | | |

| | | | 12,182,319 | | |

Total Consumer Discretionary | | | 58,041,388 | | |

Consumer Staples | | | 1.8 | % | |

| | | | | Personal Care Products | | | 1.8 | % | |

| | 30,000 | | | Estee Lauder Companies, Inc. — Class A | | | 4,624,500 | | |

| | 472,000 | | | Kenvue, Inc. | | | 10,129,120 | | |

| | | | 14,753,620 | | |

Total Consumer Staples | | | 14,753,620 | | |

The accompanying notes are an integral part of these financial statements.

26

BUFFALO DISCOVERY FUND

SCHEDULE OF INVESTMENTS

AS OF MARCH 31, 2024 Continued

Shares | | | | $ Value | |

Energy | | | 1.6 | % | |

| | | | | Energy Equipment & Services | | | 1.6 | % | |

| | 246,845 | | | Schlumberger NV | | | 13,529,575 | | |

Total Energy | | | 13,529,575 | | |

Financials | | | 9.9 | % | |

| | | | | Capital Markets | | | 6.4 | % | |

| | 11,100 | | | FactSet Research Systems, Inc. | | | 5,043,729 | | |

| | 72,438 | | | Intercontinental Exchange, Inc. | | | 9,955,154 | | |

| | 18,000 | | | MarketAxess Holdings, Inc. | | | 3,946,500 | | |

| | 46,940 | | | MSCI, Inc. | | | 26,307,523 | | |

| | 19,151 | | | S&P Global, Inc. | | | 8,147,793 | | |

| | | | 53,400,699 | | |

| | | | | Financial Services | | | 3.5 | % | |

| | 28,691 | | | Corpay, Inc.(a) | | | 8,852,321 | | |

| | 87,708 | | | Global Payments, Inc. | | | 11,723,051 | | |

| | 126,667 | | | Shift4 Payments, Inc. — Class A(a) | | | 8,368,889 | | |

| | | | 28,944,261 | | |

Total Financials | | | 82,344,960 | | |

Health Care | | | 21.8 | % | |

| | | | | Biotechnology | | | 2.5 | % | |

| | 42,523 | | | BioMarin Pharmaceutical Inc.(a) | | | 3,713,959 | | |

| | 105,000 | | | Halozyme Therapeutics, Inc.(a) | | | 4,271,400 | | |

| | 139,281 | | | Natera, Inc.(a) | | | 12,738,640 | | |

| | | | 20,723,999 | | |

| | | | | Health Care Equipment & Supplies | | | 5.7 | % | |

| | 106,641 | | | Alcon, Inc. | | | 8,882,129 | | |

| | 142,064 | | | Boston Scientific Corp.(a) | | | 9,729,963 | | |

| | 57,700 | | | DexCom, Inc.(a) | | | 8,002,990 | | |

| | 70,000 | | | Edwards Lifesciences Corp.(a) | | | 6,689,200 | | |

| | 18,299 | | | IDEXX Laboratories, Inc.(a) | | | 9,880,179 | | |

| | 22,010 | | | Inspire Medical Systems, Inc.(a) | | | 4,727,528 | | |

| | | | 47,911,989 | | |

The accompanying notes are an integral part of these financial statements.

27

BUFFALO DISCOVERY FUND

SCHEDULE OF INVESTMENTS

AS OF MARCH 31, 2024 Continued

Shares | | | | $ Value | |

| | | | | Health Care Providers & Services | | | 2.0 | % | |

| | 10,000 | | | McKesson Corp. | | | 5,368,500 | | |

| | 287,000 | | | Progyny, Inc.(a) | | | 10,949,050 | | |

| | | | 16,317,550 | | |

| | | | | Health Care Technology | | | 2.4 | % | |

| | 149,924 | | | Doximity, Inc. — Class A(a) | | | 4,034,455 | | |

| | 70,534 | | | Veeva Systems, Inc. — Class A(a) | | | 16,342,022 | | |

| | | | 20,376,477 | | |

| | | | | Life Sciences Tools & Services | | | 9.2 | % | |

| | 64,972 | | | Agilent Technologies, Inc. | | | 9,454,076 | | |

| | 336,000 | | | Avantor, Inc.(a) | | | 8,591,520 | | |

| | 75,241 | | | Azenta, Inc.(a) | | | 4,535,528 | | |

| | 20,273 | | | Bio-Rad Laboratories, Inc. — Class A(a) | | | 7,011,823 | | |

| | 164,900 | | | Bio-Techne Corp. | | | 11,607,311 | | |

| | 20,000 | | | ICON PLC(a) | | | 6,719,000 | | |

| | 30,000 | | | Illumina, Inc.(a) | | | 4,119,600 | | |

| | 98,662 | | | IQVIA Holdings, Inc.(a) | | | 24,950,633 | | |

| | | | 76,989,491 | | |

Total Health Care | | | 182,319,506 | | |

Industrials | | | 20.8 | % | |

| | | | | Aerospace & Defense | | | 0.7 | % | |

| | 38,600 | | | HEICO Corp. — Class A | | | 5,942,084 | | |

| | | | | Building Products | | | 2.2 | % | |

| | 35,986 | | | Builders FirstSource, Inc.(a) | | | 7,504,880 | | |

| | 105,572 | | | Trex Co., Inc.(a) | | | 10,530,807 | | |

| | | | 18,035,687 | | |

| | | | | Commercial Services & Supplies | | | 2.0 | % | |

| | 289,088 | | | Copart, Inc.(a) | | | 16,743,977 | | |

| | | | | Electrical Equipment | | | 3.3 | % | |

| | 96,600 | | | AMETEK, Inc. | | | 17,668,140 | | |

| | 31,000 | | | Rockwell Automation, Inc. | | | 9,031,230 | | |

| | 93,196 | | | Shoals Technologies Group, Inc. — Class A(a) | | | 1,041,931 | | |

| | | | 27,741,301 | | |

| | | | | Machinery | | | 3.7 | % | |

| | 194,314 | | | Ingersoll Rand, Inc. | | | 18,450,114 | | |

| | 94,200 | | | Xylem, Inc. | | | 12,174,408 | | |

| | | | 30,624,522 | | |