UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-10303

Buffalo Funds

(Exact name of registrant as specified in charter)

5420 W. 61st Place,

Mission, KS 66025

(Address of principal executive offices) (Zip code)

Laura Symon Browne

5420 W. 61st Place,

Mission, KS 66205

(Name and address of agent for service)

913-677-7778

Registrant's telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Item 1. Reports to Stockholders.

ANNUAL REPORT

March 31, 2023

MESSAGE TO OUR SHAREHOLDERS

DEAR SHAREHOLDERS,

The fiscal year ending March 31, 2023 was a choppy period for the markets as a dramatic increase in interest rates combined with data on inflation, economic growth, and corporate earnings were sending mixed signals. The S&P 500 Index declined by 7.74% during the fiscal year. Inflation is still running hotter than historic averages and the Fed's 2% target, but has begun to decelerate from recent generational highs. The Fed has continued to fight inflation with short term interest rate increases at each of its meetings in 2023, most recently by another 25 basis points to 4.75%-5% in mid-March. We just passed the one-year mark since the initial interest rate hike this tightening cycle, with the high end of the overnight money rate target moving from 0.25% to 5% in just a year.

Despite some high-profile job cuts in Technology and other sectors, the labor market remains tight overall, and workers are actively looking to gain pay increases to make up for lost purchasing power resulting from inflation. While continued employment income has helped keep consumer spending at reasonably high levels, it complicates the Fed's efforts to fight inflation given how much stickier wage levels are compared to commodity and other cost inputs that adjust faster.

The biggest event muddying the financial picture and making future Fed actions less predictable has been the recent test of confidence in the banking system, which has included the collapses of Credit Suisse, Silicon Valley Bank (SVB), and Signature Bank (their assets are being absorbed by other institutions) and extraordinary actions to support other banks. Interest rate increases during the past year have made the assets on bank balance sheets worth less (interest rates and fixed income prices are inversely related), which has called into question capital levels relative to deposits and prompted depositor runs on some banks, especially smaller local and regional banks that have a higher percentage of uninsured deposits (i.e., deposits in accounts that exceed the Federal Deposit Insurance Corp. guarantee of $250k).

An overriding, concerted effort is still underway to reassure the public and markets that the banking system is sound. Indeed, the banks are much better capitalized now compared to before the great financial crisis of 2008. Other measures such as Tier 1 capital ratios to total assets and risk-adjusted assets also support the notion of a less leveraged and risky U.S. banking system since prior to the great financial crisis. However, it seems likely that the banks will face a combination of greater capital

requirements and regulatory and compliance costs, including increases in FDIC insurance premiums — and perhaps more pressure to offer higher interest rates to retain deposits going forward. The net effect could be a reduced propensity to make new loans, a retrenchment that could inhibit overall economic growth (besides merely lowering banks' earnings). In effect, we could see a sea change away from the Fed fighting inflation by raising rates to slow the economy, to an environment where the banks limit the supply of available capital, either making it unavailable or more costly because lendable money supply will be reduced. Regardless of which moves the needle more, either could theoretically accomplish the goal of reducing inflation by slowing the economy.

Besides banking and monetary policy, the other area we remain highly focused on is energy which can impact inflation, growth, and corporate profitability. The recent OPEC+ production cut, led by the Saudis, further suggests that they are unlikely to let crude prices fall much below $70. Despite the recent uptick, oil and gas prices are still much lower today compared to a year ago following the breakout of war in Ukraine, and the headline consumer price index (CPI, a key measure of inflation) may start looking more benign on a year-over-year basis in the coming months, if further price rises can be contained.

Given elevated economic and geopolitical risk coupled with uncertainty around inflation-fighting measures outcomes, we continue to invest in companies benefiting from broadly-reaching secular growth trends with a bias to strong management teams, resilient balance sheets, and demonstrated cash flows that we can be confident owning through full economic cycles.

Thank you for your continued trust and conviction in the Buffalo Funds.

Sincerely,

Laura Symon Browne

President

Buffalo Funds

The Funds' investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectus contains this and other important information about the investment company, and it may be obtained by calling 1-800-49-BUFFALO or visiting www.buffalofunds.com. Read it carefully before investing.

Past performance does not guarantee future results. Mutual fund investing involves risk. Principal loss is possible.

Kornitzer Capital Management, Inc. is the Advisor to the Buffalo Funds which are distributed by Quasar Distributors, LLC.

Nothing contained in this communication constitutes tax, legal or investment advice. Investors must consult their tax advisors or legal counsel for advice and information concerning their particular situation.

The opinions expressed are those of the Portfolio Manager(s) and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

Fund performance may be subject to substantial short-term changes.

S&P 500 index — The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

Tier 1 Capital Ratios — Ratio of a bank's equity capital and disclosed reserves to its total risk-weighted assets.

TABLE OF CONTENTS

Investment Results (unaudited) | | | 6 | | |

Portfolio Management Review (unaudited) | | | 10 | | |

Expense Example (unaudited) | | | 20 | | |

Allocation of Portfolio Holdings (unaudited) | | | 24 | | |

Schedules of Investments or Options Written | | | 26 | | |

Buffalo Discovery Fund (BUFTX) | | | 26 | | |

Buffalo Dividend Focus Fund (BUFDX) | | | 32 | | |

Buffalo Early Stage Growth Fund (BUFOX) | | | 40 | | |

Buffalo Flexible Income Fund (BUFBX) | | | 45 | | |

Buffalo Growth Fund (BUFGX) | | | 51 | | |

Buffalo High Yield Fund (BUFHX) | | | 55 | | |

Buffalo International Fund (BUFIX) | | | 68 | | |

Buffalo Large Cap Fund (BUFEX) | | | 78 | | |

Buffalo Mid Cap Fund (BUFMX) | | | 84 | | |

Buffalo Small Cap Fund (BUFSX) | | | 89 | | |

Statements of Assets and Liabilities | | | 96 | | |

Statements of Operations | | | 98 | | |

Statements of Changes in Net Assets | | | 100 | | |

Financial Highlights | | | 104 | | |

Notes to Financial Statements | | | 124 | | |

Report of Independent Registered Public Accounting Firm | | | 137 | | |

Notice to Shareholders (unaudited) | | | 138 | | |

Privacy Policy (unaudited) | | | 149 | | |

INVESTMENT RESULTS (UNAUDITED)

Total Returns as of March 31, 2023

| | | | | | | Average Annual | |

| | | Gross Expense

Ratio* | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception2 | |

Buffalo Discovery Fund — Investor Class

(inception date 4/16/01) | | | 1.00 | % | | | 17.08 | % | | | -10.12 | % | | | 7.45 | % | | | 10.94 | % | | | 8.88 | % | | | N/A | | |

Buffalo Discovery Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.86 | % | | | 17.19 | % | | | -9.94 | % | | | 7.62 | % | | | 11.11 | % | | | N/A | | | | 9.04 | % | |

Russell Mid Cap Growth Index | | | N/A | | | | 16.67 | % | | | -8.52 | % | | | 9.07 | % | | | 11.17 | % | | | 8.84 | % | | | 8.84 | % | |

Buffalo Dividend Focus Fund — Investor Class

(inception date 12/03/12) | | | 0.93 | % | | | 12.60 | % | | | -4.22 | % | | | 10.55 | % | | | 11.76 | % | | | 11.96 | % | | | N/A | | |

Buffalo Dividend Focus Fund — Institutional

Class (inception date 7/1/19)1 | | | 0.78 | % | | | 12.69 | % | | | -4.04 | % | | | 10.72 | % | | | 11.92 | % | | | N/A | | | | 12.13 | % | |

Russell 1000 Index | | | N/A | | | | 15.24 | % | | | -8.39 | % | | | 10.87 | % | | | 12.01 | % | | | 12.91 | % | | | 12.91 | % | |

Buffalo Early Stage Growth Fund — Investor

Class (inception date 5/21/04) | | | 1.46 | % | | | 10.39 | % | | | -14.23 | % | | | 8.19 | % | | | 10.04 | % | | | 8.46 | % | | | N/A | | |

Buffalo Early Stage Growth Fund —

Institutional Class (inception date 7/1/19)1 | | | 1.33 | % | | | 10.47 | % | | | -14.05 | % | | | 8.36 | % | | | 10.21 | % | | | N/A | | | | 8.63 | % | |

Russell 2000 Growth Index | | | N/A | | | | 10.46 | % | | | -10.60 | % | | | 4.26 | % | | | 8.49 | % | | | 8.26 | % | | | 8.26 | % | |

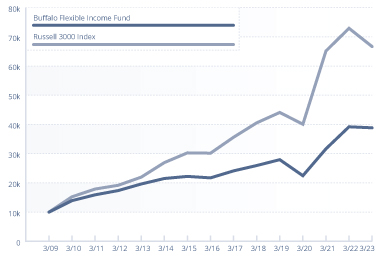

Buffalo Flexible Income Fund — Investor Class

(inception date 8/12/94) | | | 1.01 | % | | | 12.55 | % | | | -0.87 | % | | | 8.41 | % | | | 7.07 | % | | | 7.41 | % | | | N/A | | |

Buffalo Flexible Income Fund —

Institutional Class (inception date 7/1/19)1 | | | 0.86 | % | | | 12.64 | % | | | -0.78 | % | | | 8.57 | % | | | 7.22 | % | | | N/A | | | | 7.57 | % | |

Russell 3000 Index | | | N/A | | | | 14.88 | % | | | -8.58 | % | | | 10.45 | % | | | 11.73 | % | | | 9.93 | % | | | 9.93 | % | |

Buffalo Growth Fund — Investor Class

(inception date 5/19/95) | | | 0.92 | % | | | 18.76 | % | | | -12.55 | % | | | 9.91 | % | | | 11.52 | % | | | 10.01 | % | | | N/A | | |

Buffalo Growth Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.77 | % | | | 18.86 | % | | | -12.44 | % | | | 10.08 | % | | | 11.69 | % | | | N/A | | | | 10.18 | % | |

Russell 3000 Growth Index | | | N/A | | | | 16.49 | % | | | -10.88 | % | | | 13.02 | % | | | 14.16 | % | | | 9.79 | % | | | 9.79 | % | |

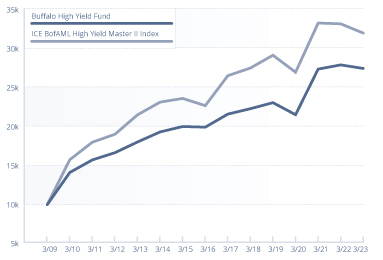

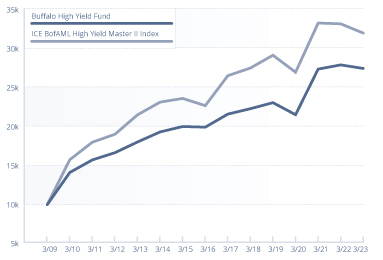

Buffalo High Yield Fund — Investor Class

(inception date 5/19/95) | | | 1.02 | % | | | 6.43 | % | | | -1.63 | % | | | 4.24 | % | | | 4.28 | % | | | 6.57 | % | | | N/A | | |

Buffalo High Yield Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.87 | % | | | 6.51 | % | | | -1.49 | % | | | 4.38 | % | | | 4.43 | % | | | N/A | | | | 6.72 | % | |

ICE BofAML US High Yield Master II Index | | | N/A | | | | 7.89 | % | | | -3.50 | % | | | 3.07 | % | | | 4.03 | % | | | 6.48 | % | | | 6.48 | % | |

Buffalo International Fund — Investor Class

(inception date 9/28/07) | | | 1.03 | % | | | 30.10 | % | | | -0.21 | % | | | 7.39 | % | | | 7.97 | % | | | 5.47 | % | | | N/A | | |

Buffalo International Fund — Institutional

Class (inception date 7/1/19)1 | | | 0.88 | % | | | 30.13 | % | | | -0.09 | % | | | 7.55 | % | | | 8.13 | % | | | N/A | | | | 5.63 | % | |

FTSE All-World ex-US Index | | | N/A | | | | 21.87 | % | | | -4.82 | % | | | 3.15 | % | | | 4.85 | % | | | 2.54 | % | | | 2.54 | % | |

Buffalo Large Cap Fund — Investor Class

(inception date 5/19/95) | | | 0.93 | % | | | 16.52 | % | | | -10.08 | % | | | 11.14 | % | | | 12.97 | % | | | 9.83 | % | | | N/A | | |

Buffalo Large Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.78 | % | | | 16.60 | % | | | -9.97 | % | | | 11.30 | % | | | 13.14 | % | | | N/A | | | | 10.00 | % | |

Russell 1000 Growth Index | | | N/A | | | | 16.88 | % | | | -10.90 | % | | | 13.66 | % | | | 14.59 | % | | | 9.97 | % | | | 9.97 | % | |

6

| | | | | | | Average Annual | |

| | | Gross Expense

Ratio* | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception2 | |

Buffalo Mid Cap Fund — Investor Class

(inception date 12/17/01) | | | 1.02 | % | | | 15.43 | % | | | -12.58 | % | | | 8.49 | % | | | 9.13 | % | | | 8.12 | % | | | N/A | | |

Buffalo Mid Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.87 | % | | | 15.57 | % | | | -12.46 | % | | | 8.66 | % | | | 9.29 | % | | | N/A | | | | 8.28 | % | |

Russell Mid Cap Growth Index | | | N/A | | | | 16.67 | % | | | -8.52 | % | | | 9.07 | % | | | 11.17 | % | | | 9.05 | % | | | 9.05 | % | |

Buffalo Small Cap Fund — Investor Class

(inception date 4/14/98) | | | 1.01 | % | | | 5.19 | % | | | -11.98 | % | | | 10.91 | % | | | 10.51 | % | | | 11.42 | % | | | N/A | | |

Buffalo Small Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.86 | % | | | 5.16 | % | | | -11.92 | % | | | 11.06 | % | | | 10.67 | % | | | N/A | | | | 9.51 | % | |

Russell 2000 Growth Index | | | N/A | | | | 10.46 | % | | | -10.60 | % | | | 4.26 | % | | | 8.49 | % | | | 5.83 | % | | | 5.83 | % | |

1 The Institutional Class commenced operations on 7/1/2019. Performance for periods prior to 7/1/2019 is based on the performance of the Investor Class adjusted for the Shareholder Services fee of the Investor Class.

2 Not annualized.

* As reported in the Funds' Prospectus dated July 29, 2022. Current period gross expense ratio for each Fund can be found on the Financial Highlights, beginning on page 100.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current as of the most recent month-end may be obtained by calling 1-800-49-BUFFALO or by visiting the website at www.buffalofunds.com.

The Funds' returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of shares. The benchmark returns shown, excluding the Lipper Indices, reflect the reinvestment of dividends and capital gains but do not reflect the deduction of any investment management fees, other expenses or taxes. The performance of the Lipper Indices is presented net of fees and expenses; however, applicable sales charges are not taken into consideration. One cannot invest directly in an index.

The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Growth Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The Russell Mid Cap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Index represents the 1,000 companies by market capitalization in the USA. The Russell 3000 Index is a market-capitalization-weighted equity index that tracks the performance of the 3,000 largest US-traded stocks. The Russell 3000 Growth Index is a market-capitalization index that is comprised of companies that display signs of above-average growth. The FTSE All-World ex-US Index is part of the FTSE All-World Index, a global index covering approximately 4,000 mid cap and large cap stocks in 47 countries, excluding the USA. The ICE BofAML US High Yield Master II Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market.

Please refer to the prospectus for special risks associated with investing in the Buffalo Funds, including, but not limited to, risks involved with investments in healthcare and information technology companies, foreign securities, debt securities, lower- or unrated securities and medium and small companies. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

7

INVESTMENT RESULTS (UNAUDITED) Continued

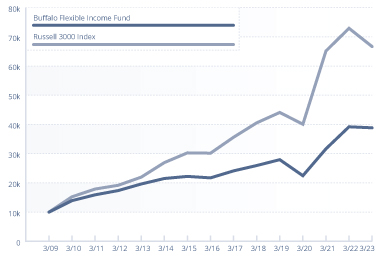

Growth of a $10,000 Investment

BUFFALO DISCOVERY FUND

BUFFALO DIVIDEND FOCUS FUND

BUFFALO EARLY STAGE

GROWTH FUND

BUFFALO FLEXIBLE INCOME FUND

BUFFALO GROWTH FUND

BUFFALO HIGH YIELD FUND

8

Growth of a $10,000 Investment

BUFFALO INTERNATIONAL FUND

BUFFALO LARGE CAP FUND

BUFFALO MID CAP FUND

BUFFALO SMALL CAP FUND

9

PORTFOLIO MANAGEMENT REVIEW (UNAUDITED)

BUFFALO DISCOVERY FUND

The Buffalo Discovery Fund produced a return of -10.12% for the 12 months ending March 31, 2023, a result that trailed the Russell Midcap Growth Index return of -8.52%. Equities saw broad-based declines across the market cap spectrum during our annual reporting period. After years of the Federal Reserve providing monetary support through both interest rate policy and asset purchases, persistent and rampant inflation generated an aggressive response from the Federal Reserve to attempt to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, which weighed heavily on equity markets.

Stock selection within the health care and consumer discretionary areas detracted from performance results during the period. Shares of Azenta pulled back significantly following the sale of its semiconductor business, Azenta is now a pure-play life sciences company with a cash-rich balance sheet. Investors reacted negatively to 2023 guidance that projected a slower pace of margin expansion due to investments in their global sales infrastructure. Headwinds from currency, China lockdowns, and declining COVID-related revenues have also weighed on recent results. However, the long-term trend towards cell and gene therapy and biologics has not slowed. These new drugs require a materially different infrastructure for storage and shipping of biological materials, and the company has carved out a clinical research niche by offering both cold storage repositories for tissue samples and genomic analysis services to leading biopharma companies.

Within consumer discretionary, Expedia was a large detractor from Fund performance. Expedia is an online travel agency (OTA) with brands that include Expedia, Hotels.com, Vrbo, and Travelocity. There has been a strong recovery in demand for consumer travel coming out of the COVID pandemic, but investors are increasingly concerned that fundamentals have peaked ahead of a potential recession, and that Expedia has ceded some market share in hotels to Booking.com. However, we believe the company is well positioned to benefit from a multiyear recovery in services spending that we expect to play out, and that share loss concerns have been overstated due to the divestment of a subsidiary in

Europe. We view the company's current valuation compelling, given the recent pullback.

Calix was the largest contributor to performance during the fiscal year. The company develops and markets communications software, systems, and services to smaller broadband service providers. The Fund initiated a position early in 2022 following a pullback in the stock despite no negative change in the company's fundamentals. Calix continued to see strong demand for its products and has successfully transformed its business into a higher margin platform company from a legacy hardware provider.

The Fed's aggressive tightening policy appears to be working, though, and inflation is steadily drifting lower. It can seem counterintuitive, but periods of weaker economic expansion are often great times to invest in innovative growth stocks. Valuations are more reasonable, companies tend to get smarter on expenses, modest increases in revenue can still drive expense leverage and outsized relative earnings growth, and these periods typically end with the Federal Reserve cutting interest rates to reaccelerate the economy, and that is good for growth stock valuation multiples. Investors certainly digested a lot of bad news in 2022: the launch of a war in Ukraine, decades-high inflation, the lapping of more than $1 trillion of stimulus payments, a strong U.S. dollar, and ongoing supply chain disruption. Putting these headwinds in the rear-view mirror ultimately creates a much more favorable outlook for long-term equity investors.

Our strategy is to take a long-term, risk-aware view and build positions in innovation-focused growth companies at attractive prices. Our investment time horizon is a competitive advantage, and we remain focused on dominant franchises with strong balance sheets and scalable business models. This should lead to the compounding of attractive returns over time. Thank you for your continued trust and support.

BUFFALO DIVIDEND FOCUS FUND

The Buffalo Dividend Focus Fund posted a return of -4.22% for the 12-month period ending March 31, 2023, a result that outperformed the Russell 1000 Index return of -8.39%.

10

Stocks experienced broad-based declines during our annual reporting period as persistent and rampant inflation generated an aggressive response from the Federal Reserve to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, a development which weighed heavily on equity markets.

The Fund was overweight energy during the annual reporting period, which benefitted relative results as energy was the top performing economic sector for the year. The Fund experienced strong stock selection in the consumer discretionary area relative to the benchmark which also aided relative performance. Additionally, a higher-than-normal cash position during the market drawdown over the past 12 months provided a buffer against deeper losses.

Specific securities that contributed most positively to performance included Marathon Petroleum Corporation and Energy Transfer LP, which operate in the energy sector (energy properties, refining and marketing, and transportation). Although energy commodity prices have declined from recent peaks, they remained elevated throughout the period allowing the companies in these industries to generate healthy profits and cash flow.

Elanco Animal Health was the top detractor from the Fund's performance during the period. Shares of Elanco, an animal health care company, fell as management lowered its forecast for the year citing the impact of foreign exchange rates and supply chain disruptions.

Looking ahead we are anticipating a period of slower economic expansion moving deeper into 2023 driven by higher interest rates and decelerating growth in both jobs and wages. Inflation has likely peaked, notwithstanding being a bit stickier than most would prefer. The Fed is very likely nearing the end of its interest rate-raising cycle with perhaps another 25 basis point increase in the Fed Funds Rate at the upcoming meeting in May. The recent banking crisis could also reduce money supply growth as loan volumes in the U.S. will most certainly be more constrained throughout the year. Despite the uncertainty, we remain focused on wide moat, large capitalization companies trading at reasonable valuations, in our view. As always, the Fund will continue to emphasize competitively advantaged companies that can be purchased at a fair value, in our opinion. As stock market volatility spikes, we will look for opportunities to find companies that fit our investment criteria, as we continue to follow our process of finding new investment ideas and to be ready when market declines provide better entry points.

BUFFALO EARLY STAGE GROWTH FUND

The Buffalo Early Stage Growth Fund returned -14.23% for the 12 months ending March 31, 2023, and underperformed the Russell 2000 Growth Index return of -10.60%. Stocks experienced broad-based declines across the market cap spectrum during our annual reporting period. After years of the Federal Reserve providing monetary support through both interest rate policy and asset purchases, persistent and rampant inflation generated an aggressive response from the Federal Reserve to attempt to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, which weighed heavily on equity markets.

Most of the relative underperformance came from stock selection as the Fund's sector allocation impact was neutral. The Fund's holdings in the Consumer Discretionary, Communication Services and Industrials, were the primary drag on relative performance.

Paya Holdings was the leading positive contributor to Fund performance during the period. The provider of payment transaction capabilities, which partners with software offerings serving the education industry, government agencies, and non-profit agencies along with other less cyclical industries, was acquired by a larger payments company in January 2023.

Open Lending was a significant drag on performance. Lower auto sales resulting from constrained auto supply, lower refinancing opportunities driven by rapidly rising interest rates, and lower profit share revenue from insurance partners proved challenging for the company. Investor expectations declined throughout the year and the stock fell proportionately.

8x8, a leading provider of cloud-based voice, chat, video meetings and contact center offerings was also a leading detractor. A major valuation multiple reset across the software industry along with increased concerns over competition led to the share price decline.

Financial conditions have continued to tighten in calendar 2023. The Fed Funds target rate has risen to 4.75-5.00% this year, although only one more increase is anticipated at this point. Additionally, pressure on regional banks' deposit bases along with holdings has the potential to induce further credit tightening.

As an offset, the economy remains at full employment, personal balance sheets remain strong, and corporate

11

margins remain at near record levels. Additionally, inflation readings have moderated and should continue to ease as we move throughout 2023. While we very well could see a more than modest economic downturn, there appears to continue to be a solid foundation on many fronts.

Regardless of the macroeconomic headwinds we face, our job remains to find attractive small cap companies that have not been fully appreciated by the market or are mispriced due to recent results or events. We believe less investor interest in our segment of the market creates opportunity for us to uncover value.

The Fund typically invests at the smaller end of the small cap growth spectrum and the managers continue to seek companies with sustainable growth due to secular growth trends or innovative, disruptive products.

The Buffalo Early Stage Growth Fund is focused primarily on identifying innovation within U.S. companies with primarily North American revenue bases. With an active share of greater than 90%, a lower turnover strategy with 50-70 holdings, the Fund will continue to offer a distinct offering.

BUFFALO FLEXIBLE INCOME FUND

The Buffalo Flexible Income Fund produced a return of -0.87% for the 12-month period ending March, 31, 2023, a result that outperformed the Russell 3000 Index return of -8.58%. Stocks experienced broad-based declines during our annual reporting period as persistent and rampant inflation generated an aggressive response from the Federal Reserve to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, a development which weighed heavily on equity markets.

The Fund was overweight energy and consumer staples during the annual reporting period, which benefitted relative results as energy was the top performing economic sector for the year with staples next. Exxon Mobil, Marathon Petroleum, Hess, Schlumberger ConocoPhillips, and Chevron were some the strongest contributors to portfolio results. Energy companies continued to benefit from higher oil and gas prices relative to prior years.

Health Care was another area of strength for portfolio results due to stock selection and a slight overweight allocation relative to the benchmark in this traditionally defensive area. Gilead, Merck, Pfizer and Eli Lilly were the strongest contributors to Fund results within Health Care.

Gilead benefited from a positive earnings release and better than expected guidance due to strong performance across multiple products. Merck also reported good earnings during the quarter driven by its flagship drug Keytruda as well as Gardasil and its animal health segment.

Looking ahead global economies continue to slow. Many companies have already lowered their financial guidance for the year. We believe a lot of bad news has been priced into market valuations, but volatility could remain elevated. The direction of the market will depend on inflation's trajectory, the Federal Reserve's actions to tame inflation, and the amount of economic damage caused by higher interest rates. We are seeing a decline in logistics costs, shipping rates, and most commodity prices, however component shortages/supply chain issues continue to persist.

Despite the uncertainty, we remain focused on wide moat, large capitalization dividend-paying companies trading at reasonable valuations, in our view. As always, the Fund will continue to emphasize competitively advantaged companies that can be purchased at a fair value. We will be ready to take advantage of opportunities created by stock market volatility using market declines as attractive entry points for long-term investors.

BUFFALO GROWTH FUND

The Buffalo Growth Fund produced a return of -12.55% for the 12 months ending March 31, 2023, a result that trailed the Russell 3000 Growth Index return of -10.88%. Equities saw broad-based declines across the market cap spectrum during our annual reporting period. After years of the Federal Reserve providing monetary support through both interest rate policy and asset purchases, persistent and rampant inflation generated an aggressive response from the Federal Reserve to attempt to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, which weighed heavily on equity markets.

The portfolio was overweight communication services throughout the year which weighed on performance and negatively impacted the sector selection effect as it was the worst performing benchmark sector during our fiscal year. Meanwhile stock selection within health care, financials, and industrials were also detractors from performance results during the period.

12

Fair Isaac Corporation was a top contributor to Fund performance for the year, as management reported strong earnings and issued 2023 guidance well ahead of investor expectations. Much of the upside to revenues is being driven by pricing. We believe that the company has a strong competitive position and that after years of forgoing price increases for their FICO scores, they have an opportunity to increase prices in excess of inflation for the foreseeable future.

Schlumberger was among the top contributors to fund results for the year. Schlumberger is an oilfield services company that supplies technology for reservoir characterization, drilling, production, and processing. The company reported better than expected revenues and earnings, driven by international well construction. The company generates attractive returns on capital and has a strong competitive position. Earnings estimates for the company are likely to move higher as the oil and gas industry stands to receive help from China's reopening, Europe's ban on Russian gas, and the U.S. government ultimately needing to refill the Strategic Petroleum Reserve.

Amazon.com was the top detractor from the portfolio's performance as management reported disappointing financial results. Revenues were in-line with expectations, but operating income disappointed driven by margin contraction at Amazon Web Services. Decelerating revenue growth and a weak guidance also weighed on the stock. While the near-term may be bumpy, we believe the company will continue to dominate ecommerce, benefit from growth in the public cloud, and continue to rapidly grow advertising revenues over the long-term.

We believe stock market multiples have largely adjusted to higher interest rates, but corporate earnings may still need to adjust downward to reflect a more difficult business environment. We expect companies will provide cautious earnings guidance due to slowing economic activity, higher funding costs and tightening credit conditions. On a positive note, we are seeing signs that the Federal Reserve's aggressive effort to combat inflation is working. Inflation has likely peaked and supply chains are loosening. If inflation continues to slow at the current pace, the Fed is likely nearing the end of its rate-raising cycle with perhaps one more 25 basis point increase at its May meeting.

Our strategy is to take a long-term risk aware view and build positions in premier growth companies as risk/reward improves. We are leaning into quality;

dominant companies with strong balance sheets and moaty businesses generating attractive returns. We're also keeping a watchful eye for price dislocations where near-term uncertainty creates long-term opportunity. As we move through this more tumultuous part of the economic cycle, heightened investor fear and market volatility can lead to incredibly attractive stock opportunities for prepared investors with a long-term investment horizon. We believe investing in well-managed companies with durable competitive advantages trading at attractive valuations will continue to generate outsized multiyear returns. Thank you for your continued trust and support.

BUFFALO HIGH YIELD FUND

The Buffalo High Yield Fund produced a return of -1.63% for the fiscal year ending March 31, 2023, a result that outperformed the ICE BofA US High Yield Index, which generated a return of -3.50% for the 12-month period.

For the first two quarters of our fiscal period, the U.S. high yield sector experienced a significant correction before reversing course in the back half of the year. The fiscal year started on shaky ground due to Russia's invasion of Ukraine and was only exacerbated by the Federal Reserve beginning an aggressive series of rate hikes in March which triggered a painful sell-off in high yield bonds. Negative returns for high yield bonds continued through June as the Fed increased interest rates another 150 basis points (bps), but then the high yield market began to pivot in July. Better than expected corporate earnings, investor sentiment that inflation was peaking, a lack of new issue supply and retail inflows into high yield funds, all began to drive positive returns. According to JP Morgan, high yield bond yields peaked at 9.31% in June, increasing 290bps from 6.31% in March, before rallying to close out the fiscal year at a yield to worst of 8.76%.

High yield mutual funds reported cash outflows of -$39 billion during the fiscal year with the third quarter (Oct-Dec) being the only period with inflows. New issuance of high yield bonds in the fiscal year was a very muted $100.6 billion and $40.5 billion of that new supply came in the fourth quarter. This compares to average quarterly new issuance volume of $112 billion in 2020 and $120.8 billion in 2021.

Over the course of the fiscal year, the 10-year Treasury bond yield increased 112bps from 2.35% to 3.47%, peaking at 4.24% in October. This was the first time the

13

10-year treasury yield had broken above the 4.0% threshold since the 2008 financial crisis. The 112bps move in the 10-year yield was outpaced by the 169bps move higher in 2-year Treasury yield over the fiscal year. The majority of this steepening of the 2/10 year spread occurred primarily in the September '22 quarter and negatively impacted spreads and yields in corporate bonds. Due to the floating rate nature of bank debt, term loans significantly outperformed high yield bonds during the fiscal year period. Per JP Morgan, leveraged loans generated positive 3.33% returns during the 12-month period ending March 2023.

According to JP Morgan, BB rated bonds outperformed both B and CCC rated issues during the fiscal year (BB = -1.17%, B = -2.68%, CCC = -11.68%). Due to the floating rate nature of bank debt, leveraged loans significantly outperformed high yield bonds during the fiscal year period generating positive 3.33% returns. The Fund's ~20% weighting in bank debt was a significant contributor to its relative outperformance. According to data from JP Morgan, the Diversified Media sector was the best performer with a positive 2.37% return and Broadcasting was the worst performing sector delivering negative returns of -17.14% during the fiscal year ending March 2023.

According to data from JP Morgan, the U.S. high yield market's spread to worst for the period-end was 4.99%, 100bps wider than the preceding March '22 period and 63 basis points tighter than its 20-year historical average of 5.62%. The yield to worst for the high yield market at fiscal year-end was 8.76%, above the 6.31% in the preceding March '22 period as well as the 20-year average of 7.82%.

The Fund's composition by asset class at quarter end was as follows:

| | 3/31/2022 | | 6/30/2022 | | 9/30/2022 | | 12/31/2022 | | 3/31/2023 | |

Straight

Corporates | | | 68.3 | % | | | 69.4 | % | | | 69.6 | % | | | 68.4 | % | | | 67.6 | % | |

Convertibles | | | 6.3 | % | | | 4.6 | % | | | 4.3 | % | | | 3.4 | % | | | 3.6 | % | |

Bank Loans | | | 18.5 | % | | | 18.9 | % | | | 19.1 | % | | | 19.1 | % | | | 21.5 | % | |

Preferred

Stocks | | | 2.7 | % | | | 2.9 | % | | | 2.5 | % | | | 2.2 | % | | | 2.7 | % | |

Convertible

Preferreds | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | |

Common

Stocks | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | |

Cash | | | 4.1 | % | | | 4.1 | % | | | 4.6 | % | | | 6.9 | % | | | 4.7 | % | |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | |

The approximate rate and contribution of return from the various asset classes in the Fund during the quarter ended March 31, 2023 is as follows:

| | Contribution

to Return | |

Straight Corporates | | | -1.06 | % | |

Convertibles | | | -0.53 | % | |

Bank Loans | | | 0.75 | % | |

Preferred Stocks | | | -0.03 | % | |

Convertible Preferreds | | | N/A | | |

Common Stocks | | | N/A | | |

Total | | | -1.63 | % | |

The three top contributors to the Fund's results during the 12-month period were Talos Production 12% corporate bonds, MPLX 6.875% corporate bonds and the DirecTV term loan. Talos Production 12% '26 bonds: The energy sector was one of the better performing industry groups during the fiscal year and Talos was no exception, basically maintaining its price level while reaping a sizeable 12% coupon. MPLX 6.875% '23 bonds: These bonds were not only energy related, but also had a fixed to floating coupon rate structure that made them attractive. The bonds matured in February 2023. DirecTV '27 term loan: This term loan was one of our largest positions in the portfolio during the fiscal period and its increasing floating rate coupon payments outpaced the small price decline during the rising rate environment.

The Diebold Nixdorf 8.5% '24 corporate bonds, the Entercom 6.75% '29 corporate bonds, and the Jo-Ann Stores '28 term loan were the worst performers during the 2023 fiscal year. Diebold Nixdorf 8.5% '24 bonds: In May, the company reported disappointing earnings and slashed full-year guidance which punished both the stock and the bonds. We made the decision to exit the position shortly thereafter. Entercom 6.75% '29 bonds: These bonds steadily declined over the year in tandem with the entire broadcasting industry group as worries mounted over declines in advertising revenue. Jo-Ann '28 term loans: The arts & crafts retailer reported three consecutive quarterly earnings disappointments due in large part to inventory destocking. There are also investor concerns that pending recession would threaten discretionary spending for retail stores like Jo-Ann's. We therefore exited this position in the fourth quarter.

We are focused first and foremost on the Federal Reserve's balancing act between taming inflation while avoiding a recession, economic weakness globally, and the geopolitical uncertainty caused by the tragic conflict in Ukraine. We are managing the Fund cautiously yet

14

actively, focusing on high-quality issuers with defensive business models and manageable credit metrics. We will continue to deploy cash in opportunities that we believe offer the most appealing risk/reward tradeoff with a bias toward shorter durations and less levered credits. Additionally, we believe bank loans offer a more defensive position as they provide senior positioning in the capital structure and less interest rate sensitivity due to their floating rate structures. Finally, we continue to look for opportunities in convertible bonds and preferred stocks. We ended the fiscal year with 137 positions, essentially unchanged from the previous year's level of 138 (excluding cash).

BUFFALO INTERNATIONAL FUND

Global equity markets, as measured by the MSCI ACWI ex-USA Index, declined -4.57% during the fiscal annual period ending March 31, 2023. Global markets experienced considerable volatility over the past 12 months, as expectations for the US Federal Reserve's monetary policy fluctuated, and bank failures in the US and the near failure of Credit Suisse rocked markets. Investor sentiment subsequently shifted away from inflation fears toward greater concerns about the broader global economy.

The Buffalo International Fund produced a return of -0.21% for the 12-month period ending March 31, 2023, a result that outperformed the prospectus benchmark FTSE All-World ex-US Index return of -4.82%. The Fund outperformed two growth indexes, the MSCI All-Country World ex-US Growth Index and the developed country MSCI EAFE Growth Index, which posted returns of -6.03% and -2.45%, respectively. Compared to the prospectus FTSE All-World ex-US Index, the Buffalo International Fund's outperformance was due to stock selection, particularly in Materials, Financials, and Industrials where the Fund's performance was positive overall for the fiscal year vs. negative returns produced for those sectors within the benchmark.

Shares of Linde within Materials advanced nearly 15% during the Fund's fiscal year. Linde, the global industrial gas giant, announced financial results that beat expectations and management raised guidance for the year. The company also announced a potential delisting from Germany's biggest stock exchange, but will maintain a listing in the US, a move the company says could help it attain a higher valuation.

ICICI Bank and Ashtead Group in Financials were positive contributors to Fund performance during the period with shares advancing 14% and nearly 21%, respectively. ICICI Bank, India's second-largest private bank, continued to benefit from the trend of private banks taking share from public banks. Management's efforts to restructure and digitalize are paying off as business normalizes post the pandemic. Ashtead, an equipment rental company that operates in the US and UK, has benefitted from increased rental penetration and market share gains from smaller peers in a historically fragmented market. The increasing cost of owning, operating, and complying with laws surrounding new equipment makes rental preferable, thus growth in outsourcing equipment rentals should be an ongoing long-term trend. However, we are keeping an eye on the outlook for US construction markets, an important end market for their business.

BayCurrent Consulting within Industrials gained nearly 16% during the Fund's fiscal year. BayCurrent Consulting benefitted from the structural growth in digitization/SaaS in Japan. Headed into the year, there were concerns about a slowdown in IT spend impacting BayCurrent, but the results and the guidance for the year is proving that with overall IT spend, the digitization trend in Japan is proving to be recession resilient due to the delayed digital transformation in Japan (Japan, while the 3rd largest IT spender globally behind the US and Europe, has lagged behind in digitization and SaaS over the past decade).

Looking forward, we continue to closely monitor the outlook for the United States economy, as the signs of an economic slowdown have been growing. We would anticipate that for the Fund's companies that sell into the US, this slowdown could start to appear in management comments or in the reported numbers over the next few quarters. Fortunately for many portfolio companies, the economies of the Eurozone have been more resilient this year than expected, and the recovery in China appears to be gaining momentum. So far, the Chinese recovery has led to increased spending by the wealthy, benefiting luxury goods. Consumer confidence is only beginning to return to a level where the Chinese middle class can feel comfortable enough to increase spending, which could boost businesses investment. For our global companies, we are optimistic that economic malaise will not occur in all regions simultaneously. Depending on the size of the potential slowdown in the US, however, we know that an impact will be felt by the rest of the world in time.

15

Nevertheless, we continue to seek out high quality companies that have sound, sustainable business models, competitive advantages, benefiting from secular growth drivers that should continue beyond an economic downturn. We prefer businesses that have strong balance sheets and generate consistent free cash flow. In this inflationary environment we also favor companies that can pass off cost pressures, such as those with competitive advantages, high recurring revenues, or companies whose products make up a small cost of a larger product. Faced with a potential recession, we are emphasizing companies that can preserve margins even in a weaker economic environment. This may include businesses that are asset light, have low fixed costs, or have the means to drive efficiency improvements through a downturn. As always, we are paying close attention to the valuation of the companies in our portfolio and seek out opportunities during periods of market weakness or volatility to buy high quality growth companies at attractive valuations. We believe that by continuing this time-tested, disciplined investment strategy we should be able to produce superior risk-adjusted returns over the long term.

BUFFALO LARGE CAP FUND

The Buffalo Large Cap Fund produced a return of -10.08% for the 12-month period ending March 31, 2023, a result that outperformed the Russell 1000 Growth Index return of -10.90%. Equities saw broad-based declines during our annual reporting period as persistent and rampant inflation generated an aggressive response from the Federal Reserve to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, a development which weighed heavily on equity markets.

Nvidia was the top contributor to Fund results for the annual reporting period. Nvidia is the leader in accelerated computing and is a critical enabler for deploying AI across a number of vertical industries. The company's next generation datacenter accelerator GPU, the H100, is ramping at the ideal time as generative AI becomes mainstream driving accelerating investments for both enterprises and public cloud providers in the leading AI chip and software company. After a rough 2022 with weakness across gaming and desktop computing, Nvidia's shares rebounded strongly in the first quarter of 2023, due to its leadership in AI. The risk/reward is more balanced given the strong share price runup and for the shares to work further from here, the company will need to compound its revenue growth

above 20% for the foreseeable future and keep making adroit decisions within their annual $8 billion in Research & Development (R&D) spending to stave off smart and well financed competitors.

Meanwhile Amazon.com was the top detractor from Fund results during the fiscal year. Amazon is the world's largest eCommerce and retailer in the world and it also operates with the largest market share of public cloud hosting services for enterprises and small businesses through its growing Amazon Web Services division. Shares declined by over 36% in the 12-month period owing to worse than expected revenue and earnings guidance in both the retail and the AWS divisions, the latter being the most surprising to Wall Street given its strong market position and the ongoing thrust to the cloud by large enterprises and government entities.

While the financial guidance was disappointing, we don't see any structural change in either its leading position in the global retailing space, or within its AWS positioning. We believe enterprises will continue to look for more efficiencies and cost savings within the business model and that's the strong use case provided by AWS. Moreover, with Amazon's large cap-ex investments on the retail or eComm side, we think the company retains the ability to continue to take share via its broad inventory availability, low price and fast, same day delivery. It will be important for company management to convey an increased level of confidence to investors that the fundamental value drivers mentioned above, along with better cost management, will improve performance going forward.

We continue to believe the risk/reward of the current market is skewed to the downside with the price/earnings ratio of the S&P 500 trading at 18x using what we believe are elevated earnings estimates, particularly as we have yet to enter the last phase of the bear market — the credit cycle downturn where revenue and earnings are most likely to be negatively impacted. Accordingly, the portfolio remains overweight defensive sectors, such as healthcare, and underweight technology and consumer discretionary, while holding a higher-than-normal level of cash. The earnings and economic outlook remains challenged through the next several quarters, in our view. Most leading indicators, and a highly inverted yield curve continue to signal some form of a recession that we believe is not adequately priced into the market. We continue to avoid any investments in banks as credit cycle revisions are rarely a good time to own that group. However, we continue to monitor developments in the

16

broader economy and the outlook for earnings revisions of our specific portfolio holdings.

Inflation has likely peaked, notwithstanding being a bit stickier than most would prefer. Coincident with peaking inflation, the Fed is very likely nearing the end of its interest rate-raising cycle with perhaps another 25 basis points of increase in the Fed Funds Rate at its May meeting.

We are still a bit early on this call, but we believe the recent banking crisis will further reduce market liquidity (money supply growth) as loan volumes within the U.S. will most certainly be more constrained throughout the next six to nine months. In fact, the most recent loan growth data shows a sharp decline of loans during the last week of March.

Combined with the lagging effect from the sharp rise in interest rates over the last 15 months, companies are likely to face a tougher revenue and earnings growth environment as the economy continues to weaken heading into the second half of the year.

As always, we appreciate your continued confidence in our investment strategy and approach. Our conviction comes from the belief that the investment process has historically demonstrated a track record of consistent outperformance through various market challenges and opportunities.

BUFFALO MID CAP FUND

The Buffalo Mid Cap Fund returned -12.58% for the 12 months ending March 31, 2023, and underperformed the Russell Midcap Growth Index return of -8.52%. Equities saw broad-based declines across the market cap spectrum during our annual reporting period. After years of the Federal Reserve providing monetary support through both interest rate policy and asset purchases, persistent and rampant inflation generated an aggressive response from the Federal Reserve to attempt to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, which weighed heavily on equity markets.

Weak stock selection in the health care, industrials, and consumer discretionary sectors offset strong relative performance in the technology sector. Sector allocation was a mild drag on performance.

MSCI Inc. was a standout positive contributor for the Fund as the company reported resilient revenue in a

down market driven by subscription products with ESG & Climate and Analytics as particular standouts. Meanwhile, profitability was generally better than expected as the firm exhibited impressive expense control.

ON Semiconductor was another positive contributor to performance. Demand for silicon carbide chips has led to strong demand and supply chain-related constraints have continued to ease. The automotive sector has shown particular strength, driven by the transition towards electrification, increased autonomy, and advanced safety.

Lyft, Inc. was a significant drag on performance. The company's results were challenged by an inability to source drivers and exacerbated by labor inflation, higher gas prices, and a tough macroeconomy. An absence of profitability and cash flow in a poor market for equities only contributed to investors' disdain.

Open Lending Corporation was also a drag on Fund performance. Lower auto sales resulting from constrained auto supply, lower refinancing opportunities driven by rapidly rising interest rates, and lower profit share revenue from insurance partners proved challenging for the company. Investor expectations declined throughout the year and the stock fell proportionately.

Financial conditions have continued to tighten in 2023. The Fed Funds target rate has risen to 4.75-5.00% this year, although only one more increase is anticipated at this point. Additionally, pressure on regional banks' deposit bases has the potential to induce further credit tightening. The Treasury yield curve inversion (short-term yields are greater than long-term yields) is signaling expectations of declining economic growth.

While these are undoubtedly challenging economic times, our mandate remains unchanged. We continue to look for attractively valued businesses with solid growth opportunities, durable competitive advantages, scalable business models, and exceptional management teams.

BUFFALO SMALL CAP FUND

The Buffalo Small Cap Fund produced a return of -11.98% for the 12-month period ending March 31, 2023, a result that slightly trailed the Russell 2000 Growth Index return of -10.60%. Equities saw broad-based declines across the market cap spectrum during our annual reporting period. After years of the Federal Reserve providing monetary support through both interest rate policy and asset

17

purchases, persistent and rampant inflation generated an aggressive response from the Federal Reserve to attempt to drive inflation back to the 2% target by raising the Fed Funds target to 4.75-5.00%, which weighed heavily on equity markets.

Weak stock selection within Industrials and Information Technology, two of the larger sector weightings in the Fund, weighed on performance during the fiscal year. Within Industrials, Kornit Digital, which develops and manufactures industrial digital printing technologies for the garment and apparel industries, fell significantly. While Kornit is a name we know well and owned successfully from 2017 to January of 2022, we returned to it in the middle of 2022 after a meaningful pullback in the stock that we felt was overdone. However, the stock continued to slide further as the company has yet to see an improvement in their business after inventory digestions from their customers caused the stock to retreat. Meanwhile, stock selection within software was a large detractor from results in the technology area. Shares of Varonis Systems, a provider of data security, was weak due to an unexpected move to a subscription service from term licenses which took investors by surprise. We believe the software may continue to face budgetary headwinds during a time where technology budgets are under pressure and therefore exited the position during the fiscal year.

As we look ahead to the remainder of the year, inflation continues to be of concern for investors despite the efforts from the Federal Reserve. Inflation has been decelerating but it is still far from the Fed's target of 2%. Furthermore, tighter credit standards as a result of the banking crisis that occurred in the first quarter of 2023 is clouding the economic picture. However, there are a few offsetting factors that point to a soft landing including a strong labor market, consumer resilience, and a stable housing market.

With that being said, we note that small cap company valuations have further re-rated as expectations have been reset by management. With the increase in volatility, we are taking advantage of compelling valuations and well-capitalized small cap companies with attractive business models and good fundamentals. Portfolio positioning will continue to be fairly defensive as we remain cautious on the ever-changing macro environment. We continue to appreciate your interest in the Fund.

Thank you for your continued support.

18

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as Standard & Poor's. The firm evaluates a bond issuer's financial strength, or its ability to pay a bond's principal and interest in a timely fashion. Ratings are expressed as letters ranging from 'AAA', which is the highest grade, to 'D', which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the Advisor will classify the security as nonrated.

Earnings growth is not representative of a Fund's future performance.

A basis point is one hundredth of a percentage point (0.01%).

Yield is the income return on an investment.

Yield to worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting. A Spread is the difference between the bid and the ask price of a security.

Spread to worst is the difference between the yield to worst of a bond and the yield to worst of a U.S. Treasury security with similar duration.

The London Interbank Offered Rate (LIBOR) is a benchmark interest rate at which major global banks lend to one another in the international interbank market for short-term loans.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Active share is a measure of the percentage of stock holdings in a manager's portfolio that differs from the benchmark index.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

Free Cash Flow is revenue less operating expenses including interest expense and maintenance capital spending. It is the discretionary cash that a company has after all expenses and is available for purposes such as dividend payments, investing back into the business, or share repurchases.

NASDAQ or National Association of Securities Dealers Automated Quotations is a global electronic marketplace for buying and selling securities.

S&P 500 index — The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets.

MSCI ACWI ex-USA Index — A broad measure of stock performance throughout the world, with the exception of U.S.-based companies. The MSCI ACWI Ex-U.S. Index includes both developed and emerging markets.

MSCI All-Country World ex-US Growth Index — A broad measure of growth stock performance throughout the world, with the exception of U.S.-based companies. The MSCI ACWI Ex-U.S. Growth Index includes both developed and emerging markets.

MSCI EAFE Growth Index — A broad measure of growth stock performance throughout the world, with the exception of Canadian and U.S.-based companies. The MSCI EAFE Growth Index includes international developed markets from 21 countries in Europe, Australasia and the Far East (East Asia).

Price/Earnings Ratio — The price-to-earnings ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

19

EXPENSE EXAMPLE (UNAUDITED)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs (including redemption fees) and (2) ongoing costs, including management fees, shareholder servicing fees (Investor Class only) and other Fund specific expenses. The examples below are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (October 1, 2022 – March 31, 2023).

ACTUAL EXPENSES

The first line of the tables below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During the Period" to estimate the expenses you paid on your account during the period. Although the Funds charge no sales load or trans- action fees, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds' transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds' transfer agent. To the extent a Fund invests in shares of other investment companies as part of its investment strategy, you will indirectly bear your proportionate share of any fees and expenses charged by

the underlying funds in which the Fund invests in addition to the expenses of the Fund. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the examples below. The examples below include management fees, registration fees and other expenses. However, the examples below do not include portfolio trading commissions and related expenses and other extraordinary expenses as determined under U.S. generally accepted accounting principles.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of each table below provides information about hypothetical account values and hypothetical expenses based on the Funds' actual expense ratios and an assumed rate of return of 5% per year before expenses, which are not the Funds' actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in our Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the tables is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different Funds. In addition, if these transactional costs were included, your costs would have been higher.

BUFFALO DISCOVERY FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,170.80 | | | $ | 5.47 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.90 | | | $ | 5.09 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,171.90 | | | $ | 4.66 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.24 | | | $ | 4.33 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.01%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

20

BUFFALO DIVIDEND FOCUS FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.00 | | | $ | 4.93 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.29 | | | $ | 4.68 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.90 | | | $ | 4.14 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.04 | | | $ | 3.93 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.93%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO EARLY STAGE GROWTH FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,103.90 | | | $ | 7.82 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,017.50 | | | $ | 7.49 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,104.70 | | | $ | 7.03 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,018.25 | | | $ | 6.74 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.49%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 1.34%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO FLEXIBLE INCOME FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,125.50 | | | $ | 5.35 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.90 | | | $ | 5.09 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,126.40 | | | $ | 4.56 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.64 | | | $ | 4.33 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.01%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO GROWTH FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,187.60 | | | $ | 5.02 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.34 | | | $ | 4.64 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,188.60 | | | $ | 4.20 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.09 | | | $ | 3.88 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.92%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.77%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

21

BUFFALO HIGH YIELD FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,064.30 | | | $ | 5.25 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.85 | | | $ | 5.14 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,065.10 | | | $ | 4.48 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.59 | | | $ | 4.38 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.02%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.87%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO INTERNATIONAL FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,301.00 | | | $ | 5.91 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.80 | | | $ | 5.19 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,301.30 | | | $ | 5.05 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.54 | | | $ | 4.43 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.03%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.88%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO LARGE CAP FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,165.20 | | | $ | 5.02 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.29 | | | $ | 4.68 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,166.00 | | | $ | 4.21 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,021.04 | | | $ | 3.93 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.93%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.78%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

BUFFALO MID CAP FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,154.30 | | | $ | 5.48 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,019.85 | | | $ | 5.14 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,155.70 | | | $ | 4.68 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.59 | | | $ | 4.38 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 1.02%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

22

BUFFALO SMALL CAP FUND | | Beginning

Account Value

October 1, 2022 | | Ending

Account Value

March 31, 2023 | | Expenses Paid During

Period October 1, 2022 -

March 31, 2023* | |

Investor Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.90 | | | $ | 4.91 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,020.14 | | | $ | 4.84 | | |

Institutional Class | | | | | | | |

Actual | | $ | 1,000.00 | | | $ | 1,051.60 | | | $ | 4.40 | | |

Hypothetical (5% return before expenses) | | $ | 1,000.00 | | | $ | 1,050.64 | | | $ | 4.33 | | |

* Expenses for the Investor Class are equal to the Fund's annualized expense ratio of 0.96%, multiplied by the average account value over the period, multiplied by 182/365 to reflect the one-half year period. Expenses for the Institutional Class are equal to the Fund's annualized expense ratio of 0.86%, multiplied by the average account value over the period, multiplied by 182/365 to project a one-half year period.

23

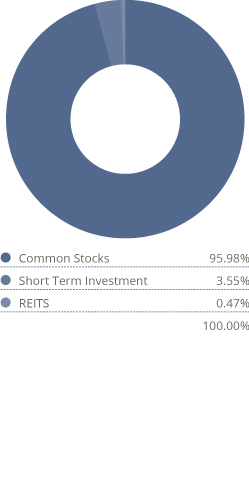

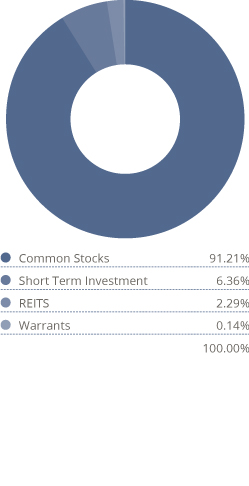

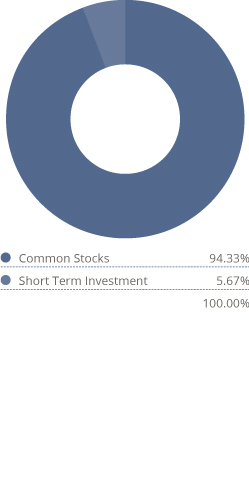

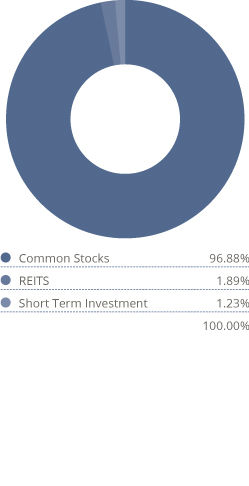

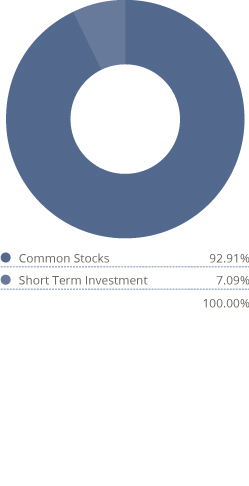

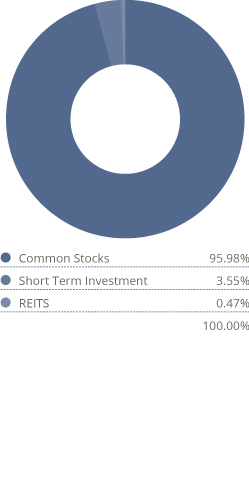

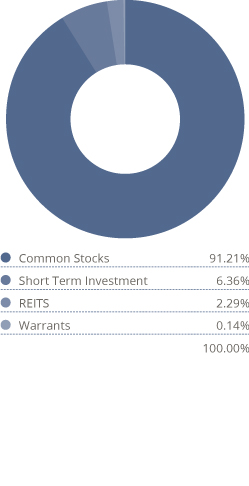

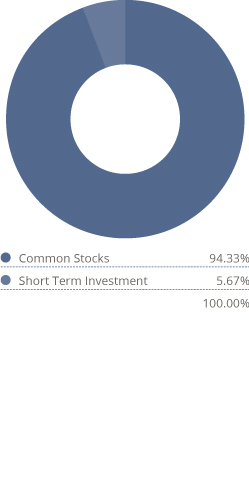

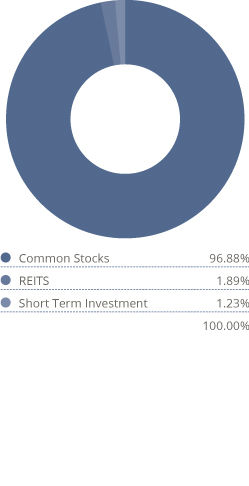

ALLOCATION OF PORTFOLIO HOLDINGS

Percentages represent market value as a percentage of investments as of March 31, 2023.

BUFFALO DISCOVERY

FUND

BUFFALO DIVIDEND

FOCUS FUND

BUFFALO EARLY STAGE

GROWTH FUND

BUFFALO FLEXIBLE

INCOME FUND

BUFFALO GROWTH

FUND

BUFFALO HIGH YIELD

FUND

24

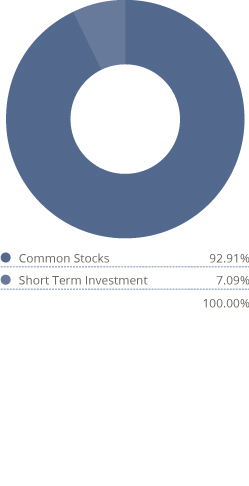

Percentages represent market value as a percentage of investments as of March 31, 2023.

BUFFALO

INTERNATIONAL FUND

BUFFALO LARGE CAP

FUND

BUFFALO MID CAP

FUND

BUFFALO SMALL CAP

FUND

25

BUFFALO DISCOVERY FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2023

Shares or Face Amount | | | | $ Fair Value* | |

Common Stocks | | | 96.22 | % | |

Communication Services | | | 0.97 | % | |

| | | | | Entertainment | | | 0.97 | % | |

| | 74,103 | | | Take-Two Interactive Software, Inc.(a) | | | 8,840,488 | | |

| Total Communication Services (Cost $7,331,780) | | | 8,840,488 | | |

Consumer Discretionary | | | 12.94 | % | |

| | | | | Auto Components | | | 2.07 | % | |

| | 167,736 | | | Aptiv PLC — ADR(a) (b) | | | 18,818,302 | | |

| | | | | Hotels, Restaurants & Leisure | | | 4.70 | % | |

| | 4,534 | | | Chipotle Mexican Grill, Inc.(a) | | | 7,745,387 | | |

| | 56,436 | | | Darden Restaurants, Inc. | | | 8,756,610 | | |

| | 591,386 | | | Everi Holdings Inc.(a) | | | 10,142,270 | | |

| | 361,010 | | | MGM Resorts International | | | 16,036,064 | | |

| | | | 42,680,331 | | |

| | | | | Internet & Direct Marketing Retail | | | 1.13 | % | |

| | 105,952 | | | Expedia Group, Inc.(a) | | | 10,280,523 | | |

| | | | | Leisure Products | | | 0.84 | % | |

| | 354,194 | | | Topgolf Callaway Brands Corp.(a) | | | 7,657,674 | | |

| | | | | Specialty Retail | | | 3.30 | % | |

| | 71,358 | | | Five Below, Inc.(a) | | | 14,697,607 | | |

| | 68,307 | | | Floor & Decor Holdings, Inc. — Class A(a) | | | 6,709,114 | | |

| | 36,309 | | | Tractor Supply Co. | | | 8,534,067 | | |

| | | | 29,940,788 | | |

| | | | | Textiles, Apparel & Luxury Goods | | | 0.90 | % | |

| | 22,432 | | | lululemon athletica, Inc.(a) | | | 8,169,510 | | |

| Total Consumer Discretionary (Cost $99,569,661) | | | 117,547,128 | | |

Energy | | | 1.34 | % | |

| | | | | Energy Equipment & Services | | | 1.34 | % | |

| | 246,845 | | | Schlumberger Ltd. — ADR(b) | | | 12,120,089 | | |

| Total Energy (Cost $8,319,022) | | | 12,120,089 | | |

The accompanying notes are an integral part of these financial statements.

26

BUFFALO DISCOVERY FUND

SCHEDULE OF INVESTMENTS

MARCH 31, 2023 Continued

Shares or Face Amount | | | | $ Fair Value* | |

Financials | | | 8.44 | % | |

| | | | | Capital Markets | | | 5.27 | % | |

| | 82,438 | | | Intercontinental Exchange, Inc. | | | 8,597,459 | | |

| | 46,940 | | | MSCI, Inc. | | | 26,271,849 | | |

| | 37,751 | | | S&P Global, Inc. | | | 13,015,412 | | |

| | | | 47,884,720 | | |

| | | | | Diversified Financial Services | | | 1.59 | % | |