UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-10303

Buffalo Funds

(Exact name of registrant as specified in charter)

5420 W. 61st Place,

Shawnee Mission, KS 66025

(Address of principal executive offices) (Zip code)

Kent Gasaway

5420 W. 61st Place,

Shawnee Mission, KS 66025

(Name and address of agent for service)

913-677-7778

Registrant's telephone number, including area code

Date of fiscal year end:March 31

Date of reporting period:March 31, 2020

Item 1. Reports to Stockholders.

ANNUAL REPORT

March 31, 2020

Beginning on January 1, 2021, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Funds' annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank if you hold your shares through such an institution. Instead, the reports will be made available on the Funds' website (buffalofunds.com/our-funds/performance/#literature), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting your financial intermediary or, if you hold your shares directly with the Funds, by calling (800) 492-8332.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call (800) 492-8332 to let the Funds know you wish to continue receiving paper copies of your shareholder reports. Your election to receive shareholder reports in paper will apply to all funds that you hold through the financial intermediary or directly with the Funds.

MESSAGE TO OUR SHAREHOLDERS

DEAR SHAREHOLDERS,

My new role as President of the Buffalo Funds comes at a challenging time. However, having previously served in this position from 1990 to 2013 and in the industry since 1980, there is not much I haven't seen. There have been wars, oil price spikes and crashes, mild recessions, deep recessions, computer driven bear markets, tech bubbles and real estate bubbles. Yet, never have we seen a pandemic with such a wide reach globally. The amount of deaths, the breathtaking declines in economic activity and the steepness of the climb in unemployment has been tragic. Conversely, the avalanche of grants, loans and government stimulus money provided to businesses and individuals, as well as massive purchases by the Federal Reserve, has been unprecedented.

No one knows what lies on the other side of this health and economic crisis. In the U.S. alone, over 38 million workers have lost their jobs as a result of the forced lockdown of businesses and stay at home edicts by cities and states. The unemployment rate has spiked from under 4% to near 15% in a matter of months. As mentioned above, even with significant help from the government it is highly uncertain how many small businesses will reopen and how many workers will be rehired.

The tug of war between investors that foresee a v-shaped recovery and those that expect a slow and drawn out recovery continues. This explains the extreme volatility exhibited in the stock market. With cities and states reopening and the volume of COVID-19 cases falling sharply the v-shaped crowd is currently in charge. The market is rallying and has a good feel. However, this could change quickly if one or more of a myriad of potential negatives came to the forefront. These could include serious discussion of higher federal and state taxes needed to pay for a mountain of spending and debt accumulation, a fading of optimism for a coronavirus vaccine, uncertainty surrounding the Presidential election or "new normal" of conservative spending by consumers.

Regardless of what's on the other side, you can expect a steady hand at the Buffalo Funds. The majority of our funds are growth oriented and you can have confidence we will maintain our long-term investment strategy of investing in companies benefitting from identifiable secular trends. We rely only on internal research, we stress teamwork and pay close attention to risk management both within and between our ten funds. Current versus historical valuation analysis, balance

sheet strength and free cashflow generation are important factors.

A majority of the Buffalo funds have generated favorable results to shareholders over the long-term. This report serves as an example as a number of our funds have held up quite well relative to the indexes during the downturn. Our goal is for this performance to continue. I am proud to serve another term as President and I'm proud of our talented fund managers, analysts, customer service and relationship reps and our back-office staff.

Sincerely,

Kent W. Gasaway

President

The Funds' investment objectives, risks, charges and expenses must be considered carefully before investing. The summary and statutory prospectus contains this and other important information about the investment company, and it may be obtained by calling 1-800-49-BUFFALO or visiting www.buffalofunds.com. Read it carefully before investing.

Past performance does not guarantee future results. Mutual fund investing involves risk. Principal loss is possible.

Kornitzer Capital Management, Inc. is the Advisor to the Buffalo Funds which are distributed by Quasar Distributors, LLC.

Nothing contained in this communication constitutes tax, legal or investment advice. Investors must consult their tax advisors or legal counsel for advice and information concerning their particular situation.

The opinions expressed are those of the Portfolio Manager(s) and are subject to change, are not guaranteed and should not be considered recommendations to buy or sell any security.

This page intentionally left blank.

TABLE OF CONTENTS

Portfolio Management Review (unaudited) | | | 6 | | |

Investment Results (unaudited) | | | 18 | | |

Expense Example (unaudited) | | | 24 | | |

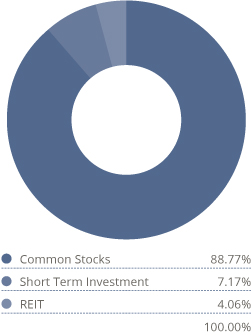

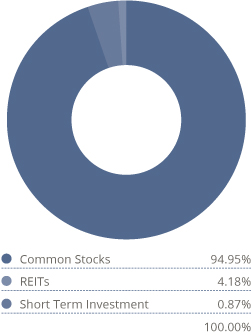

Allocation of Portfolio Holdings (unaudited) | | | 28 | | |

Schedules of Investments or Options Written | | | 30 | | |

Buffalo Discovery Fund (BUFTX) | | | 30 | | |

Buffalo Dividend Focus Fund (BUFDX) | | | 36 | | |

Buffalo Emerging Opportunities Fund (BUFOX) | | | 44 | | |

Buffalo Flexible Income Fund (BUFBX) | | | 49 | | |

Buffalo Growth Fund (BUFGX) | | | 55 | | |

Buffalo High Yield Fund (BUFHX) | | | 60 | | |

Buffalo International Fund (BUFIX) | | | 73 | | |

Buffalo Large Cap Fund (BUFEX) | | | 83 | | |

Buffalo Mid Cap Fund (BUFMX) | | | 88 | | |

Buffalo Small Cap Fund (BUFSX) | | | 93 | | |

Statements of Assets and Liabilities | | | 98 | | |

Statements of Operations | | | 100 | | |

Statements of Changes in Net Assets | | | 102 | | |

Financial Highlights | | | 106 | | |

Notes to Financial Statements | | | 126 | | |

Report of Independent Registered Public Accounting Firm | | | 138 | | |

Notice to Shareholders (unaudited) | | | 139 | | |

Privacy Policy (unaudited) | | | 151 | | |

PORTFOLIO MANAGEMENT REVIEW (UNAUDITED)

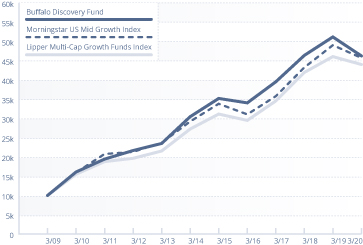

BUFFALO DISCOVERY FUND

For the annual reporting period ending March 31, 2020, the Buffalo Discovery Fund (the "Fund") fell 9.64% versus the Morningstar U.S. Mid Cap Growth Index's (the "Index") decline of 6.73% and the Morningstar Mid Growth Peer Group decline of 11.17%. The Fund outperformed the benchmark in the Energy, Industrials, Financials, Real Estate, Telecom Services and Materials sectors while the Consumer Discretionary, Health Care and Technology sectors weighed on relative returns. Cyclically dependent and financially leveraged stocks performed worst in the Fund and Index with Energy, Materials, Travel, Entertainment and Consumer Retail stocks particularly hard hit. The energy sector, where the Fund is underweight, was the worst performing sector suffering from a nasty combination of excess supply and diminished global energy demand. The Fund continues to invest in innovative growth companies with relatively attractive valuations; a strategy we believe should be a key driver of above-Index risk-adjusted returns over the long term.

Dexcom Inc. is a leading manufacturer of continuous glucose monitoring devices for the management of diabetes. The company's differentiated products excel at accuracy, comfort and ease of use resulting in share gains and a favorable long-term outlook within the diabetes care industry. Its stock price was up 78% during the fiscal year as investors flocked to Dexcom's durable growth, low elective procedure risk and relatively recession resistant business model.

MSCI Inc. is a leading index and exchange-traded fund (ETF) provider. The company continued to benefit from the shift to low-cost passive investing while in the near term, investors cheered the resiliency of the subscription business, high switching costs inherent in the benchmark index business segment and the exciting potential of the newer analytics and environmental, social and governance (ESG) focused business initiatives.

Equinix, Inc. was also a standout performer for the Fund during the fiscal year, with the stock rising over 40%. The company is the biggest provider of co-located data centers in the world, and enables customer access to networks, partners, and cloud service providers. The growth in remote-work driven by social distancing has

increased demand for Equinix's internet communication services, and we expect the company to benefit from this increased demand in coming quarters.

Align Technology is a leading supplier of clear aligners for dental malocclusion. Its stock price fell on expectations COVID-19 fears will lead to lower case volume growth in the near term, which could make it more challenging for the company to fend off new entrants in its market. We believe prosperous growth is sustainable over the intermediate to long term as the company has expanded its products to address nearly 70% of the orthodontic market, which continues to convert from metal braces to clear aligners.

Arista Networks, Inc. a datacenter software and equipment provider fell after it guided to lower than expected revenue growth as its tier 1 cloud customers temporarily slowed spending to digest heavy capacity additions in recent years.

IAC/Interactive is a diversified internet services company offering dating websites, a digital home services marketplace and other emerging internet businesses. Social distancing and shelter at home initiatives have negatively impacted demand for home services and advertising on their branded internet sites.

The fiscal and monetary response to the pandemic has been relatively swift and expansive, with indications that if conditions do not improve world leaders and global central banks will do whatever is necessary to revive growth. Their efforts so far are encouraging, and markets have begun to stabilize and become more hopeful. In the near term, investors appear myopically focused on the state of new case volumes resulting in high stock correlations and volatility. Upcoming earnings results seem far less important than an assessment of 2021/2022 earnings power. Over the intermediate term, the revival of global growth will depend on how soon the pandemic can be contained through a combination of social distancing, better testing, improved therapies, vaccine development, and perhaps seasonal curtailment. Time will tell.

In the meantime, global economic uncertainty and low business and consumer confidence is weighing on the

6

market and near term corporate fundamentals. This is opening up attractive buying opportunities for some of our favorite secular growth beneficiaries on the wish list.

We are not blindly buying lower stock prices. Instead we are mindful of the macroeconomic backdrop, the sensitivity of our companies to discretionary spending and the negative effect excessive leverage can have on corporate profit cycles in bad-time scenarios. We keep a keen eye on the degree of contraction that current prices discount and the degree to which management teams can protect profits and shed risk while retaining the competitive advantages that position them to excel on the upturn. Our work is beginning to tell us growing reward and upside opportunity trumps downside risk in many instances. We are patiently waiting for these good-odds situations and strike when we get them.

Economic conditions may ebb and flow, but our focus is steady; to invest in attractively priced, financially strong, well-managed companies benefitting from innovative strategies and disruptive megatrends.

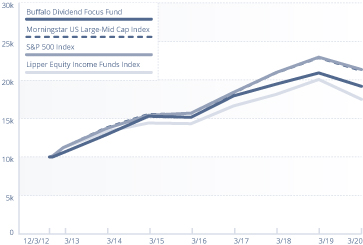

BUFFALO DIVIDEND FOCUS FUND

The Buffalo Dividend Focus Fund posted a return of -8.32% for the annual period ending March 31, 2020, underperforming the Morningstar U.S. Large-Mid Cap Index return of -7.35% and the S&P 500 Index return of -6.98%. Only two out of the eleven economic sectors in the benchmark posted positive returns during the period, which were Information Technology and Telecommunication Services. The Fund had four sectors with positive returns, including Information Technology, Healthcare, Real Estate, and Consumer Staples. Financials and Health Care posted favorable relative performance compared to the benchmark's sectors. The Fund's results in Information Technology posted a higher total return than the benchmark, but experienced a lagging relative total effect in the sector due to the Fund's underweight to the strong performing benchmark sector.

Specific securities that contributed most positively to fund performance over the past 12 months included Medicines Company (MDCO), Microsoft Corporation (MSFT), and Apple Inc. (AAPL). Medicines Company, a pharmaceutical drug development company, jumped on favorable study results for Inclisiran (cholesterol therapy) which led to the company's acquisition by Norvartis. Microsoft Corporation improved on growing momentum from its cloud services and enterprise products boosting

results above analysts' estimates, winning the pentagon's JEDI cloud contract, and expansion in the company's valuation metrics. Apple Inc. advanced on solid operating results, guidance on iPhone sales, strength in services and wearables, better trends in China, and reduced trade tensions.

Specific securities that detracted from performance include Boeing Company (BA), Energy Transfer, L.P. (ET), and Viper Energy Partners LP (VNOM). Boeing Company, the aerospace and defense manufacturer, fell after two tragic aircraft crashes of its 737 MAX commercial airplane which has resulted in production and delivery delays as the company seeks to get the aircraft recertified for commercial operation. Energy Transfer, L.P., an energy transportation services partnership and Viper Energy Partners dropped as energy prices plunged in response to the failure of an agreement between the Organization of the Petroleum Exporting Countries (OPEC) members on production cutbacks and the drop in demand caused by the Coronavirus pandemic.

The stock market's bull-run ended in March, as the market experienced a sharp decline due to the pandemic and the efforts to contain it and limit the economic damage. Governments and healthcare experts have responded to the crisis by issuing stay at home orders to try to curtail the spread of the disease and reduce fatalities. The economic impact from the orders has been a sharp decline in spending and an explosion in unemployment as consumers stay home. To limit the economic damage governments are passing various financial aid programs and health care measures to combat the pandemic. Central Banks have also cut benchmark lending rates and expanded their balance sheets as they buy various assets of eligible securities. The fiscal and monetary response to the pandemic expansion has been relatively swift and expansive, with indications that if conditions do not improve, they will do whatever it takes. Their efforts so far are encouraging, and markets have begun to rebound. Over the intermediate term, the pandemic will need to be contained through a combination of better testing, improved therapies, vaccine development, and seasonal curtailment for the economy to recover and generate sustainable growth.

Despite the uncertainty created by the pandemic, we remain focused on wide moat, large capitalization companies trading at reasonable valuations, in our view. As always, the Fund will continue to emphasize on

7

competitively advantaged companies that can be purchased at a fair value, in our opinion. As stock market volatility spikes, we will look for opportunities to find companies that fit our investment criteria, as we continue to follow our process of finding new investment ideas and to be ready when market declines provide better entry points.

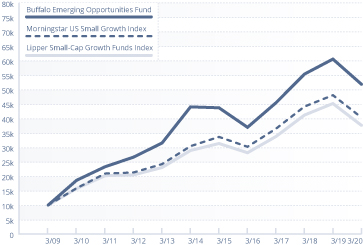

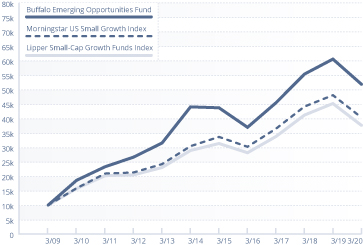

BUFFALO EMERGING OPPORTUNITIES FUND

The Buffalo Emerging Opportunities Fund posted a return of negative 14.38% in the 12-month period ending March 31, 2020. The Fund's primary benchmark, the Morningstar U.S. Small Growth Index, produced a return of negative 16.07% during the period while the Russell 2000 Growth Index and the Russell MicroCap Growth Index returned negative 18.58% and negative 21.96%, respectively.

The spread of COVID-19 and the resulting pandemic created a new chapter in history books in the first quarter of 2020. The major issues just a few quarters ago that included U.S./China trade war and flare ups in geopolitical issues between U.S./Iran have become nearly irrelevant as COVID-19 has taken center stage and created an environment few of us could have ever foreseen. The market sell-off as the virus spread throughout the European Union and the U.S. was the swiftest in history, with the S&P 500 Index falling 35% from peak-to-trough in just over one month. Even worse was the performance of smaller growth stocks, as measured by the Russell 2000 Growth Index, which declined 43% from peak-to-trough. The final annual period returns were however less ugly than the peak-to-trough declines given a strong start to the year and a sharp rebound in the final week of March 2020.

During the year, investors preferred the perceived relative safety of larger companies. This is best illustrated by the fact that the large cap Russell 1000 Index dramatically outperformed both the small cap Russell 2000 Growth Index and the Russell MicroCap Growth Index. Domestically, growth stocks outperformed value stocks by a wide margin. As an example, the Russell 2000 Value Index declined 29.64% in the year ended March 31, 2020, more than ten percentage points worse than its growth counterpart.

With shelter-in-place orders across the U.S. and the world affecting close to half the global population, numerous industries saw sales and profits decrease dramatically. At

the time of this writing in late April, states in the U.S. and countries in Europe are beginning to ease restrictions on households and businesses. However, it remains unknown as to how consumers and businesses will rebound. Additionally, there is significant risk that COVID-19 cases could spike again as a result of the loosening of these restrictions and the potential government response the second time around. In this environment, almost universally, companies are withdrawing previous financial guidance and declining to give updated financial guidance for upcoming quarters and the remainder of the year.

Regarding portfolio positioning, fund management exited investments where the outlook was more challenged than most, particularly those companies linked to travel/leisure and the aerospace industries. Additionally, we examined the Fund's investments for balance sheet/cash flow related problems given the drastic nature of the downturn and the financial issues it could create. The Fund ended the annual reporting period with 58 holdings.

The Fund remains overweight the technology sector and we continue to have high confidence that, small cap technology companies with solid fundamentals (solid growth potential, recurring revenue, high margins or the potential for high margins) that are disrupting previous ways of conducting business could be the place to allocate capital as long as valuations remain reasonable.

Looking ahead there remains a lot of uncertainty regarding the return to a new normal. Additional market risk exists around the coming U.S. elections in November. However, we believe the federal government has shown and appears willing to continue to do whatever is necessary to support the economy, and especially the financial markets.

While we acknowledge the challenging macro-economic backdrop, our job continues to be to find attractive small cap companies where the stock price has not been fully appreciated by the market or has been mispriced due to near-term results or events. The Fund's investments are focused on the smaller end of the small cap growth spectrum where management seeks to identify innovation among U.S. companies with North American revenue bases. We continue to believe that the lack of investor interest in the smaller, early-stage segment of the market creates opportunity to uncover value. Given recent volatility, this is perhaps even truer today. Finally, with an active share of greater than 95%, the Fund will continue to offer a distinct offering from the passive indexes and category peers.

8

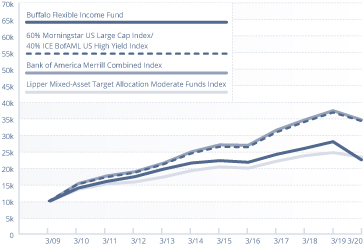

BUFFALO FLEXIBLE INCOME FUND

For the twelve months ended 3/31/20, the Buffalo Flexible Income Fund declined 19.63% compared to a loss of 9.63% for the Morningstar Moderately Aggressive Target Risk Index. The primary sectors that led to the underperformance were Energy and Industrials. The underperformance in Energy was primarily due to sector allocation and to a lesser degree security selection. Energy has been negatively impacted by shocks to both the supply and demand for the commodity. On the supply side, Saudi Arabia decided to increase production which put downward pressure on prices and then shortly thereafter the COVID-19 global pandemic reduced demand due as nations restricted travel for their populations. The industrial sector was also a detractor primarily due to security selection. The primary detractor in the Industrial sector was Boeing. Boeing was negatively impacted by both lingering manufacturing issues associated with the 737 Max commercial airplane but even more significant was the impact of the global COVID-19 pandemic and various government initiatives to minimize or halt travel. The top contributors during the annual reporting period were Microsoft, Medicines Company and Digital Realty while the top detractors were Boeing, Apache and Schlumberger.

The global spread of the pandemic has carved out significant uncertainty about the direction of the global economy and large cap stocks. Large portions of the U.S. and European economies are closed in an attempt to contain the spread of the virus, and the timing at which they will begin to completely reopen is unclear. The fiscal stimulus passed by Congress in March to help individuals and businesses impacted by virus shutdowns, and aggressive moves by the Federal Reserve to support liquidity in the financial system are expected to soften the depth of the economic downturn the U.S. economy is facing. At the same time, the exact timing and process to reopen the economy remains uncertain. Because of this, we expect the market to stay on a path of elevated volatility influenced by the spread and recovery rates of COVID-19 and potential treatments or vaccines for the virus. Other factors such as data showing how consumers are impacted and behaving, and corporate earnings, which will show the extent of the damage they are seeing in their operations and balance sheets will also be monitored closely.

BUFFALO GROWTH FUND

For the annual reporting period ending March 31, 2020, the Buffalo Growth Fund (the "Fund") fell 3.90% compared to the Morningstar U.S. Growth Index's (the "Index") advance of 1.45%. The Fund's performance was in-line with the Morningstar Large Cap Growth Peer Group decline of 3.72%. The Fund outperformed the benchmark in Real Estate, Materials, and Consumer Staples while the remaining sectors weighed on relative returns. Cyclically dependent and financially leveraged stocks performed worst with energy, materials, travel, entertainment and consumer retail stocks particularly hard hit. The Fund continues to invest in high quality growth companies with relatively attractive valuations; a strategy we believe should be a key driver of above-index risk-adjusted returns over the long term.

Amazon.com Inc., one of the world's largest online retail shopping services company, saw significant revenue acceleration during the year as consumers shifted to eCommerce and online grocery shopping with the nation-wide lockdown resulting from the COVID-19 pandemic. While Amazon's disruption of the retail industry is well documented, the recent shelter-at-home mandate has accelerated the shift from brick and mortar to online commerce. We believe that Amazon has significant runway for growth as it continues to find ways to evolve its business model.

Microsoft was also a top contributor for the Fund. The company has generated strong growth across all product lines including server, enterprise and cloud products. The company appears well positioned to continue this steady growth in upcoming quarters.

Schlumberger, an oil services company, was the worst-performing investment position during the year. Its business was hurt by the large decline in energy prices, as well as, COVID-19 driven demand destruction throughout the global economy.

Wells Fargo, one of the largest banks in the United States, declined largely due to the impact of the COVID-19 pandemic on the global economy and lower interest rates as the Federal Reserve cut its benchmark lending rate to zero. Despite the difficult near term environment the company remains profitable and should maintain adequate capital levels even after modeling for the Federal Reserve's severely adverse stress test in a worst case scenario. We are monitoring developments closely but we believe current valuation of the company's stock makes a relatively compelling risk-reward tradeoff longer term.

9

The fiscal and monetary response to the pandemic has been relatively swift and expansive, with indications that if conditions do not improve world leaders and global central banks will do whatever is necessary to revive growth. Their efforts so far are encouraging and markets have begun to stabilize and become more hopeful. In the near term, investors appear myopically focused on the state of new case volumes resulting in high stock correlations and volatility. Upcoming earnings results seem far less important than an assessment of 2021/2022 earnings power. Over the intermediate term, the revival of global growth will depend on how soon the pandemic can be contained through a combination of social distancing, better testing, improved therapies, vaccine development, and perhaps seasonal curtailment. Time will tell.

In the meantime, global economic uncertainty and low business and consumer confidence is weighing on the market and near term corporate fundamentals. This is opening up attractive buying opportunities for some of our favorite secular growth beneficiaries on the wish list.

We are not blindly buying lower stock prices. Instead, we are mindful of the macroeconomic backdrop, the sensitivity of our companies to discretionary spending and the negative effect excessive leverage can have on corporate profit cycles in bad-time scenarios. We keep a keen eye on the degree of contraction that current prices discount and the degree to which management teams can protect profits and shed risk while retaining the competitive advantages that position them to excel on the upturn. Our work is beginning to tell us growing reward and upside opportunity trumps downside risk in many instances. We are patiently waiting for these good-odds situations and strike when we get them.

Economic conditions may ebb and flow, but our focus is steady; to invest in attractively priced, financially strong, well-managed companies benefitting from innovative strategies and disruptive megatrends.

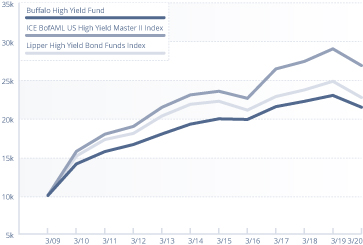

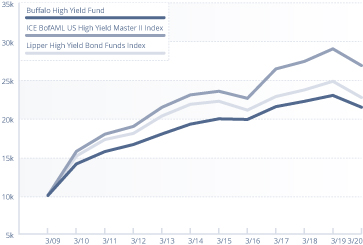

BUFFALO HIGH YIELD FUND

The Buffalo High Yield Fund generated a return of -6.67% for the fiscal year ending March 31, 2020, outperforming the ICE BofA Merrill Lynch US High Yield Master II Index (the "Index") return of -7.45% and the Lipper High Yield Bond Funds Index return of -8.47%.

After producing positive returns in the first three quarters of the fiscal year, the performance for the high yield sector suffered a significant correction in the first quarter

of 2020 driven by the COVID-19 outbreak and plunging crude oil prices which pushed returns well into negative territory. The market's positive performance during the first three quarters was driven by: (i) continued, albeit modest, economic growth of U.S. gross domestic product (GDP); (ii) a healthy labor market with additional jobs added and the unemployment rate near cycle lows; (iii) and an accommodative Federal Reserve policy. The Saudi-Russian power struggle over oil output and the virus pandemic overshadowed everything in the month of March. The Fed enacted extraordinary measures including slashing rates, removing the caps on the size of asset purchases, and restarting the Term Asset-Backed Securities Loan Facility (TALF) program. In concert with the Fed moves, Congress passed its +$2 trillion economic relief package but the damage was done and the flight to quality ensued quickly and painfully. The 10-year Treasury bond returned a positive 18.74% during the fiscal year while the S&P 500 Index returned negative -6.98%.

The flight to quality along with increased market volatility resulted in high yield mutual funds experiencing cash outflows of about $16.7 billion during the quarter. In fact, the $13 billion outflow in the month of March was the second largest monthly outflow for high yield trailing only the $13.6 billion outflow in June 2013. This follows a $3.0 billion inflow in the previous quarter and a $3.2 billion inflow in the 3rd quarter of 2019. Despite the large March quarter outflow, the annual $7.4 billion outflow was still less than the $12.5 billion of outflows in the previous fiscal year according to data from JP Morgan. The high yield new issuance calendar in the fiscal year 2020 increased $113 billion from the previous year to $294 billion despite the non-existent primary market in the final month of March due to the COVID-19 pandemic.

During the fiscal year, the 10-year Treasury bond yield declined by 174 bps from 2.41% to 0.67% while the 2-year Treasury bond shed 209 bps ending the year at 24 bps. The drop in the yield curve was driven by the flight to quality from risky assets into U.S. government securities. As would be expected, the higher quality end of the high yield risk spectrum outperformed the lower credit quality issues. According to data from JP Morgan, the CCC-rated segment lost -13.76%, underperforming the B-rated and BB-rated segments, which lost -7.96% and -4.42% respectively. The Fund has historically taken a more defensive position relative to the indices which lead to relative outperformance during the period.

According to data from JP Morgan, the U.S. high yield market's spread to worst for the period end was 949 bps,

10

497 bps wider than the preceding March 2019 quarter and 339 bps wider than its 20-year historical average of 610 bps. The yield to worst for the high yield market at fiscal year-end was 10.00%, above the 8.70% 20-year average, and above the 6.83% yield at the end of calendar year 2019.

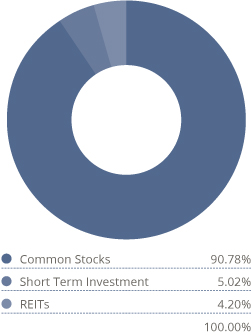

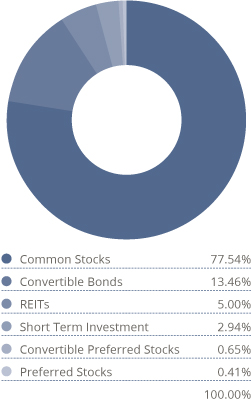

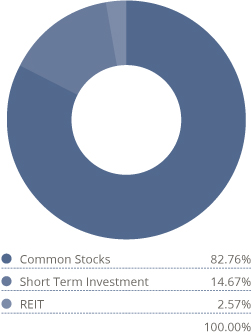

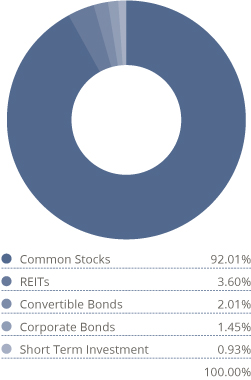

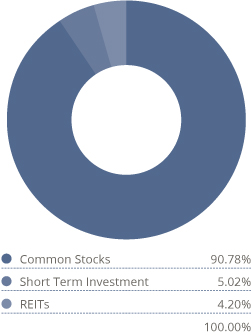

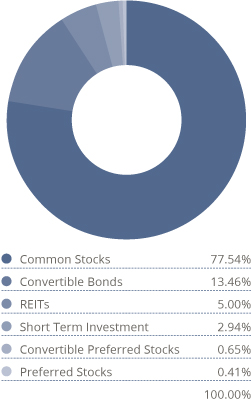

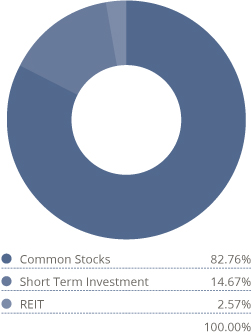

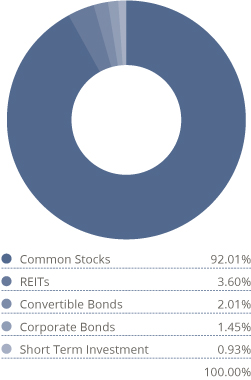

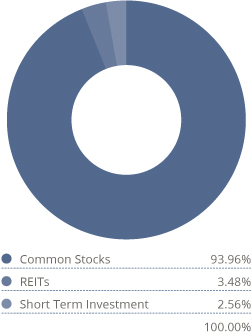

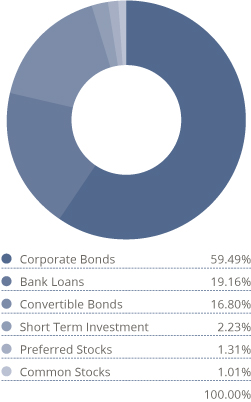

The Fund's cash balance at the end of the year decreased from the previous year's levels by over 4% as new security purchases eclipsed the holdings in the Fund that were called by the issuers or sold outright. The Fund's composition by asset class at fiscal year-end was as follows:

| | 3/31/2019 | | 6/30/2019 | | 9/30/2019 | | 12/31/2019 | | 3/31/2020 | |

Straight

Corporates | | | 65.4 | % | | | 64.7 | % | | | 65.0 | % | | | 55.6 | % | | | 60.1 | % | |

Convertibles | | | 10.1 | % | | | 12.1 | % | | | 13.4 | % | | | 17.7 | % | | | 16.7 | % | |

Bank Loans | | | 17.2 | % | | | 15.2 | % | | | 16.0 | % | | | 16.2 | % | | | 19.1 | % | |

Preferred

Stocks | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 1.1 | % | | | 1.3 | % | |

Convertible

Preferreds | | | 0.6 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | | | 0.0 | % | |

Common

Stocks | | | 0.7 | % | | | 1.4 | % | | | 1.2 | % | | | 1.7 | % | | | 1.0 | % | |

Cash | | | 6.0 | % | | | 6.5 | % | | | 4.4 | % | | | 7.6 | % | | | 1.8 | % | |

Total | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | | | 100.0 | % | |

The approximate rate and contribution of return from the various asset classes in the Fund during the fiscal year is as follows:

| | Approximate

Contribution

to Return | |

Straight Corporates | | | -3.11 | % | |

Convertibles | | | -0.33 | % | |

Bank Loans | | | -0.90 | % | |

Preferred Stocks | | | -0.56 | % | |

Convertible Preferreds | | | -0.01 | % | |

Common Stocks | | | -1.04 | % | |

Total | | | -6.67 | % | |

Specific securities that contributed most positively to performance include Medicines Co. 2.750% convertible bonds, Maxar Technology bank debt, and Brunswick 7.375% straight corporate bonds. Medicines Co. was acquired by Novartis late in the year for a 48% premium and the convertible bond price responded in kind before being redeemed. Maxar Technology was one of the Fund's worst performers in the prior year and resolved its issues and made asset sales which improved the outlook for the bank debt. Brunswick is an investment grade credit with a high coupon with a relatively short maturity in 2023 which protected it somewhat from the downturn.

Specific securities that detracted the most from performance include MPLX 6.875% corporate bonds, US Silica bank debt, and Energy Transfer L.P. All three companies are directly exposed to the U.S. exploration and production (E&P) sector which was significantly hurt by plummeting crude prices in March.

Until March, the United States had been enjoying a growing economy with modest inflation that had created a favorable environment for risky assets. However, near the end of February, early March, the COVID-19 pandemic and plummeting crude oil prices wreaked havoc on the markets. The U.S. high yield default rate increased to a three year high of 3.54% in March which was up 91 bps from the 2.63% level in December 2019, 0.95% level last March and above the 3.44% long-term average. We are concerned first and foremost about the ongoing COVID-19 pandemic and the fallout on global economies while previous issues such as China trade talks and the upcoming presidential election become a secondary focus. We are managing the Fund cautiously yet actively, focusing on high-quality issuers with defensive business models and manageable credit metrics. We will continue to deploy the Fund's cash in opportunities that we believe offer the most appealing risk/reward tradeoff with a bias toward shorter durations and less levered credits. Additionally, we believe bank loans offer a more defensive position as they provide senior positioning in the capital structure. Finally, we continue to look for opportunities in convertible bonds and preferred securities. We ended the fiscal year with 136 positions in the portfolio, up from the previous year-end level (excluding cash) of 122 positions.

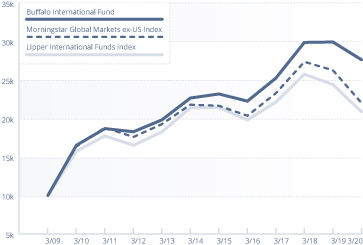

BUFFALO INTERNATIONAL FUND

Global equity markets fell sharply to close out the final quarter of the annual reporting period in reaction to the global spread of COVID-19. As the case count increased exponentially, the only effective response was for countries to go into lockdown. The economic impact of these actions became clear near the end of the fiscal year and virtually all asset classes suffered as a result. The Buffalo International Fund declined by 7.67% during the fiscal year but outperformed the Morningstar Global Markets ex-US Index's drop of 16.12%. Within developed international markets, the United Kingdom and Australia were among the biggest decliners while Switzerland held up relatively well. Counterintuitively, China was a relatively strong country performer posting a relatively

11

modest 5% decline, based on the MSCI country indexes, while Brazil was among the worst losing over 40%.

From a sector perspective, Energy and Consumer-related areas suffered the most as the Saudis and Russians engaged in an oil price war and consumers globally went into quarantine. The Health Care and Information Technology sectors were relative outperformers as Health Care even managed to post a positive return during the period.

One of the contributors to our relative outperformance for the period was Sartorius Stedim, which supplies equipment and disposables for the biological pharmaceutical industry. As you can imagine, with the rush to find prophylactics and treatments for COVID-19 supplies to this supply chain have been relative beneficiaries. So too with our investment in Lonza Group which produces media, active ingredients and helps pharmaceutical companies produce their biologic drugs and drug candidates. Interxion Holdings was also among the group of contributors as the company provides cloud and internet gateway access and was acquired in the first quarter of 2020.

Some of the top detractors from portfolio performance included ICICI Bank, CTS Eventim, and Ashtead Group. ICICI Bank provides financial services throughout India and as the COVID-19 virus brought many businesses to a standstill, investors worried about deteriorating health in their loan book, as was the case with all financial institutions. CTS Eventim provides tickets for large gatherings like concerts, and sporting events. With social distancing and stay-at-home orders, these large gatherings have been completely canceled until further notice. We exited the position during the period as we try to assess how and when these gatherings might return. Ashtead Group provides rental equipment primarily for construction related activities. The company's stock was hit unduly due to fears of a complete economic shutdown. We feel Ashtead will come out of a recession better positioned than ever and companies may increasingly be likely to rent equipment rather than purchase their own as they try to maintain larger cash balances.

In Europe in an eventual post-crisis economic recovery, fiscal deficits and populism may continue to weigh on sentiment, spending, and investment. Emerging signs of stabilizing growth in the continent earlier this year now seem like a distant memory. In Japan, structural reforms have had limited success, and the consumer tax hike in

October 2019 contributed to a sharp economic contraction in the fourth quarter. This market period has obviously been extremely volatile and difficult to navigate. As we saw signs of the virus spreading rapidly, we began taking action by trimming positions where valuation was getting full and/or where an eventual recovery may take longer. We initiated new positions in a few stocks we have been watching and waiting for a more attractive entry point provided the nature of their businesses would still thrive in such an odd economic period.

The markets will have to endure some very terrible economic data for at least several quarters and most companies have very little visibility into forward business .While we do not want to underestimate the impact of the coronavirus outbreak, history shows that events like this tend to offer opportunities for investors that are long-term oriented. Despite the uptick in market volatility, we will continue to invest in businesses with durable competitive advantages and superior growth profiles trading at attractive valuations. We believe that a portfolio of these companies will continue to offer attractive risk adjusted returns over the long haul.

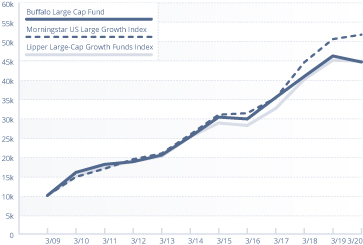

BUFFALO LARGE CAP FUND

The Buffalo Large Cap Fund declined by 3.40% during the 12-month period ending March 31, 2020, underperforming the Morningstar U.S. Large Growth Index, which gained 2.29%. Stock selection in the Consumer Discretionary sector was the biggest driver of the Fund's relative underperformance during the period. This source of underperformance relative to the index was offset, in part, by stock selection in the Real Estate and Financial sectors. Both the Fund and the Index generated strong positive returns in the 9-month period ending December 31, 2019, but these gains were largely offset by the market declines in the final three months of the annual reporting period ending driven by the global spread of the global COVID-19 pandemic.

The Fund ended the fiscal year with 52 holdings (excluding cash) representing 51 companies, up from 48 holdings representing 47 companies at the end of the previous fiscal year ending March 31, 2019. The cash position ended the fiscal year at about 6% of Fund assets.

Microsoft was the top-contributing investment for the Fund during the fiscal year with the stock returning nearly 36%. The company generated strong growth across all product lines including server and cloud products and office commercial products. The company

12

appeared positioned to perform relatively well in an environment of heightened concern about the COVID-19 virus given the recurring nature of its revenue and fast-growing cloud products.

Apple was the next top-contributing investment for the Fund during the fiscal year, also returning nearly 36%. Although consumer demand for its products could be pressured due to the COVID-19 outbreak, the company appeared to be relatively well positioned for the coming quarters. The company has a very strong balance sheet, could benefit from the launch of 5G phones later in 2021, and stands to potentially benefit from rapid growth in its high margin digital services products as well.

Equinix was also among the top contributors for the Fund during the fiscal year, with the stock returning just over 40%. The company is the biggest provider of co-located data centers in the world, and enables customers' access to networks, partners, and cloud service providers with a largely recurring revenue base. Growth in remote-work driven by COVID-19 containment measures has increased demand for Equinix's internet communication services, and we expect the company to benefit from this increased demand in coming quarters.

Schlumberger was the Fund's worst performing investment during the fiscal year. This is an exploration and production (E&P) services company whose business was hurt by the large decline in energy prices as well as COVID-19 driven operational slowdowns in its customer base. The company's ability to maintain its dividend and the trajectory of its operating performance in coming quarters are uncertain given the difficult macro environment.

Xilinx, a high-quality semiconductor manufacturing company, was another weak-performing position for the Fund during the period. The stock was under pressure for much of 2019 due to fears of a trade war with China. The economic slowdown caused by the COVID-19 outbreak has hurt the company's prospects for 2020, and dampened demand in its end markets including auto, consumer, and data centers. While we believe the company's long-term prospects in a recovery would be positive there is minimal clarity about its operating performance in the near term.

As we enter the new fiscal year, the global spread of COVID-19 has created significant uncertainty about the direction of the global economy and large cap growth stocks. Large portions of the U.S. and European

economies are closed to contain the spread of the virus, and the timing at which they will fully reopen is unclear. The fiscal stimuluses passed by the Congress in March and April to help individuals and businesses impacted by virus shutdowns, and aggressive moves by the Federal Reserve to support liquidity in the financial system have likely worked, at least in part, to soften the depth of the economic downturn the U.S. economy is facing. At the same time, the exact timing and process to reopen the economy remains a big uncertainty. Because of this, we expect large cap stocks to stay on their path of elevated volatility in the early part of the new fiscal year. Factors including, evolving data about the spread and recovery rates of COVID-19, potential treatments or vaccines for the virus, data showing how consumers are impacted and behaving are expected to contribute to the volatility. The next several earnings cycles will show the extent of the damage companies are seeing in their operations and balance sheets.

Within this environment, we are managing the Fund cautiously yet opportunistically. Large cap growth stocks have declined less than some other asset classes through April, but we have seen the opportunity to trim holdings whose operations are highly exposed to the economic shutdown and add to investments that are relatively more insulated. We have also taken the opportunity to initiate new positions in several appealing ideas that have pulled back to attractive levels, even after accounting for near-term declines in revenue and earnings. We continue to focus on companies with strong business models and margin structures, that generate solid cash flow and have solid balance sheets.

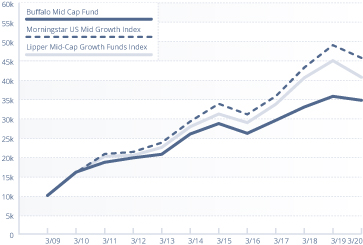

BUFFALO MID CAP FUND

The Buffalo Mid Cap Fund returned -2.89% for the 12-month period ending March 31, 2020, outperforming the Morningstar U.S. Mid Growth Index's return of -6.73%. Fund performance was driven by stock selection in the Financial and Industrial sectors, and almost no exposure to the weak performing Energy sector, and a slightly elevated cash position. This was partially offset by poor stock selection in the Information Technology and Consumer Discretionary sectors.

MSCI Inc. was a strong performer for the Fund throughout the year. Results benefited from the continued growth in assets under management tied to their indices. Rapid growth in analytics and environmental, social and governance (ESG) offerings

13

contributed to the upside. Amongst the market turmoil later in the quarter, investors flocked to MSCI as they sought safety in the relative stability of their business model. We continue to hold a favorable view of MSCI's long-term growth prospects.

CoStar Group was another top contributor during the period. Their multifamily segment drove growth, where the Apartments.com acquisition continued to surprise to the upside. Their core commercial real estate data business is the kind of sticky, recurring business that investors have continued to reward with a high valuation multiple. Management at CoStar has earned a reputation as strong allocators of capital, and it would not be a surprise if they used any economic weakness as an opportunity to acquire adjacent businesses at attractive terms.

Equinix shares were also among the top performers for the Fund driven by the continued adoption of cloud computing by enterprises. In addition, shares outperformed during the recent market decline, as increased working from home is serving to accelerate cloud adoption. Equinix also has a strong base of recurring revenue that is less exposed to adjustment from weaker economic activity.

Shares of Palo Alto Networks were weaker as sales growth slowed in its more mature firewall market. Despite rapid growth in its cloud security business and results that exceeded expectations, investors fear that the subscription nature of cloud security could be a continued headwind for growth in the core business of selling next generation firewalls, which is a hardware plus subscription business model.

Norwegian Cruise Line Holdings declined and detracted from Fund performance as the company was at the center of COVID-19 concerns. With the virus spreading on several cruise ships, the fallout could lead to lower cruise demand for several years. We were uncomfortable with the company's financial and operating leverage and decided to exit the position.

VMware shares sold off significantly in the recent market decline. The company's infrastructure software is sensitive to overall IT spending because their product is often priced on a usage basis, related to servers and CPUs. Despite being one of the largest vendors of virtual desktop software that enables remote work from home, a bigger portion of its business is tied to computing in data centers where a drop in capital spending would be negative for future growth.

The near-term outlook is extremely uncertain. We expect to see heightened volatility as investors assess the length and severity of the coronavirus pandemic and the economic fallout from social distancing policies. Consumer confidence is shaken, and we expect the economy to struggle until a vaccine or drug treatment are widely available. The good news is that, given the number of businesses and governments working on this, a breakthrough could occur at any time.

In these turbulent times, we have not changed our investment philosophy or process. We are using the heightened volatility to look for new opportunities. Portfolio turnover has ticked up over the last couple of months, but we continue to take a long-term view when making new investments. We are also increasing our efforts to stress test the balance sheets and business models of portfolio holdings and prospective investments to make sure they can survive the current economic downturn. We will continue to invest in businesses with durable competitive advantages and superior growth outlooks, when they are selling at attractive valuations. We believe that a portfolio of these companies will continue to offer attractive risk adjusted returns. Thank you for your continued support.

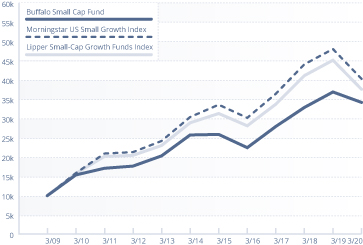

BUFFALO SMALL CAP FUND

As is common in rapid, macro-driven declines such as the one experienced in March 2020, smaller company stocks declined more than mid and large caps, as market liquidity declined and investors sought the greater liquidity and relative safety of larger cap stocks. Small cap growth outperformed small cap value meaningfully during the fiscal year. Energy and Materials suffered the most in the Morningstar US Small Growth Index, as the Saudis and Russians engaged in a price war late in the fiscal year pressuring stocks tied to oil, and the economy slowed dramatically hurting cyclical stocks. The Health Care sector, which is not as economically sensitive but still witnessed pockets of weakness tied to reduced elective procedures during COVID 19, outperformed the broad market.

The Buffalo Small Cap Fund (BUFSX) declined by 7.33% during the fiscal year, but outperformed the Morningstar U.S. Small Growth Index, which declined by 16.07%. The outperformance was driven by stock selection in Health Care, Financials, and Technology which more than offset relative weakness in Consumer Discretionary and Consumer Staples. The Health Care performance is

14

notable as the Fund's investments were up 5.2% on average versus a decline of 7.6% for the index sector. The portfolio benefitted from an emphasis on companies that are commercial stage and not overly reliant on the capital markets for additional funding, as well as owning some stocks in companies that could benefit from the fight against COVID 19 like Teledoc, a leading telemedicine company, and Quidel, a diagnostic company that will produce assays for COVID 19. Outperformance in Financials was driven by our focus on high recurring revenue companies like Hamilton Lane, an asset management company focusing on private equity, and Palomar, a specialty insurance company. Technology outperformance was driven by broad positive contribution across software, semiconductors, and communications equipment.

Overall, eHealth was the best performing stock during the fiscal year. The company posted outstanding results in its seasonally-strong December and March quarters and had an excellent outlook for the rest of 2020. With Joe Biden getting the nod from the Democratic Party over Bernie Sanders, the risk to the stock of a single payer healthcare system has been greatly reduced. Medicare continues to have broad bipartisan support and may even enjoy greater access and coverage going forward. As a market leader in helping seniors select the best Medicare Advantage, Supplemental Medicare, and/or Part D plan, we believe eHealth has a favorable runway for additional growth.

Teladoc was also a meaningful contributor to the Fund's results this year. The market leader in telemedicine could not have had a more favorable setup than a pandemic and mandated global quarantine that has massively accelerated the use of telemedicine by both doctors and patients. The company is quickly ramping to fulfill demand and announced in mid-April that consultations have doubled since the first week of March 2020. This is clearly the tipping point the industry needed to go mainstream, and, as the leader in telehealth, Teladoc should continue to benefit disproportionately.

The biggest disappointment during the year was our investment in Everi Holdings, a producer of gaming equipment and financial technology products for casinos. During the March, 2020 quarter, Everi went from making new highs in its share price due to market share gains, record performances in its slot machine business, and a new product cycle coming in its financial technology business, to having its customers close their doors for an indefinite period due to the pandemic. While it had a

majority of revenue from recurring sources like slot play and ATM transactions, it needs its customers to be operating in order to get that recurring revenue. Because the company is dependent on casino traffic and capital spending from an ailing casino industry, we exited the position late in the fiscal year.

This market period has obviously been extremely volatile and difficult to navigate, and we would like to offer some comments on how we have been managing the Fund during this time and how we have positioned the portfolio going forward. As we saw signs of the virus spreading rapidly outside of Wuhan, we began taking action by selling some investments that had been outperformers where valuation was getting full, and selling in some areas of Consumer and Energy. We also sold some positions in Health Care that were reliant on elective procedures or doctor visits that would likely get canceled and reduced exposure to advertising, as this usually gets cut quickly in weak economic periods. We then circled back to a few stocks we have been watching and waiting for a more attractive entry point, provided that the nature of their businesses would still thrive in such an odd economic period. For example, e-commerce, bankruptcy consulting, and telecom equipment companies should benefit while travel, live events, and oil service companies likely do not.

As always, during downturns, we also seek to take advantage of quality, mid cap companies whose share prices have fallen into our market cap range. This is especially true in the Consumer Discretionary sector where we know the companies have solid balance sheets and will be survivors in industries that are likely to see a lot of capacity leave the market, such as restaurants and retail. Furthermore, knowing that there will be very few companies that will not see negative estimate revisions, we have looked to take advantage of lower share prices by buying more of those companies we already own that should continue to benefit from the same long-term trends they experienced before the pandemic. While their relative importance in the world may have decreased in the short term, as everyone focuses on their basic needs and adjusts to a weaker economy, the underlying trends remain, and we as a nation will eventually adjust to our new realities.

As during most periods of high volatility and a rapid change in economic growth, portfolio turnover increased in the latter part of the fiscal year. While the average cash balance was a little higher at times in the final quarter of the fiscal year, the Fund ended the annual period

15

practically fully-invested with less than a 2% weighting in cash. Overall, the portfolio's cyclical weighting is below average, as it has been for some time, and this is something we will be watching closely in the quarters ahead, as the economy eventually improves. While the market has been enjoying a nice bounce since the lows in mid-March, it is tough to say whether we will revisit the lows, as is typical, or retain the gains off the bottom. Clearly, the markets will have to endure some very terrible economic numbers for at least the next two quarters, and most companies have very little visibility into forward business trends. There is also significant uncertainty related to the spread and recovery rates for COVID-19 and potential treatments or vaccines for the virus. We expect evolving data on this will drive significant volatility in our small cap investments in coming months. So far, in mid-April, the market is digesting withdrawn guidance fairly well and some hard-hit areas like consumer are seeing dramatic moves off the bottom, if companies can at least show that they are not in danger of going bankrupt. At some point, the market will want more than that for share prices to move higher, but it is hard to see when that period is and where share prices will be at that time.

So far, the Fed and the Treasury Department have done a good job of providing liquidity to markets and cash strapped consumers and businesses, but there are still a few areas like mortgage issuance and rent payment by restaurants and retailers where issues remain. The one fact we take solace in is that small cap usually outperforms as we head out of bear markets and recessions. In fact, small cap has outperformed large cap coming out of nine out of the last ten recessions, and we do not feel this time will be any different. We continue to manage the portfolio the same as we always have — bottom up, investing one name at a time based on the fundamental merits and valuation parameters of each company. Our time-tested process of investing in premier companies, which could benefit from long-term trends and trade at attractive valuations, remains the cornerstone of our work, and we appreciate your continued confidence in our efforts.

Sincerely,

John C. Kornitzer

President, KCM

16

Bond ratings are grades given to bonds that indicate their credit quality as determined by a private independent rating service such as Standard & Poor's. The firm evaluates a bond issuer's financial strength, or its ability to pay a bond's principal and interest in a timely fashion. Ratings are expressed as letters ranging from 'AAA', which is the highest grade, to 'D', which is the lowest grade. In limited situations when the rating agency has not issued a formal rating, the Advisor will classify the security as nonrated.

Earnings growth is not representative of a fund's future performance.

A basis point is one hundredth of a percentage point (0.01%) Yield is the income return on an investment.

Yield to worst is the lowest potential yield that can be received on a bond without the issuer actually defaulting. A Spread is the difference between the bid and the ask price of a security.

Spread to worst is the difference between the yield to worst of a bond and the yield to worst of a U.S. Treasury security with similar duration.

The London Interbank offered Rate (LIBOR) is a benchmark interest rate at which major global banks lead to one another in the international interbank market for short-term loans.

Duration is a commonly used measure of the potential volatility of the price of a debt security, or the aggregate market value of a portfolio of debt securities, prior to maturity. Securities with a longer duration generally have more volatile prices than securities of comparable quality with a shorter duration.

Active share is a measure of the percentage of stock holdings in a manager's portfolio that differs from the benchmark index.

Cash flow is the net amount of cash and cash-equivalents being transferred into and out of a business.

17

INVESTMENT RESULTS (UNAUDITED)

Total Returns as of March 31, 2020

| | | | | | Average Annual | |

| | Gross Expense

Ratio*** | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception2 | |

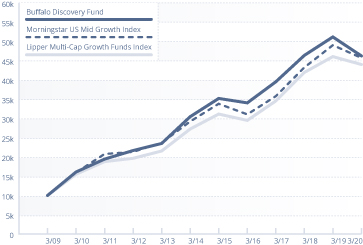

Buffalo Discovery Fund — Investor Class

(inception date 4/16/01) | | | 1.01 | % | | | -14.38 | % | | | -9.64 | % | | | 5.60 | % | | | 11.13 | % | | | 8.27 | % | | | N/A | | |

Buffalo Discovery Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.86 | % | | | -14.29 | % | | | -9.48 | % | | | 5.77 | % | | | 11.30 | % | | | N/A | | | | -15.55 | % | |

Morningstar US Mid Growth Index | | | N/A | | | | -10.11 | % | | | -6.73 | % | | | 6.22 | % | | | 11.10 | % | | | 7.19 | % | | | -13.62 | % | |

Lipper Multi-Cap Growth Funds Index | | | N/A | | | | -7.94 | % | | | -4.45 | % | | | 7.16 | % | | | 10.98 | % | | | 6.31 | % | | | -9.85 | % | |

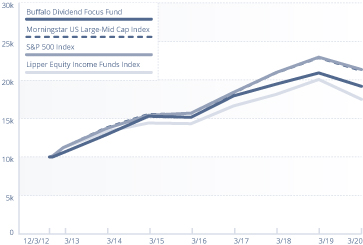

Buffalo Dividend Focus Fund — Investor Class

(inception date 12/03/12) | | | 0.94 | % | | | -14.07 | % | | | -8.32 | % | | | 4.64 | % | | | N/A | | | | 9.29 | % | | | N/A | | |

Buffalo Dividend Focus Fund —

Institutional Class (inception date 7/1/19)1 | | | 0.79 | % | | | -14.04 | % | | | -8.17 | % | | | 4.79 | % | | | N/A | | | | N/A | | | | -12.34 | % | |

Morningstar US Large-Mid Cap Index | | | N/A | | | | -12.52 | % | | | -7.35 | % | | | 6.35 | % | | | N/A | | | | 10.78 | % | | | -11.88 | % | |

S&P 500 Index | | | N/A | | | | -12.31 | % | | | -6.98 | % | | | 6.73 | % | | | N/A | | | | 10.90 | % | | | -11.50 | % | |

Lipper Equity Income Funds Index | | | N/A | | | | -18.11 | % | | | -12.85 | % | | | 3.23 | % | | | N/A | | | | 7.48 | % | | | -16.48 | % | |

Buffalo Emerging Opportunities Fund —

Investor Class (inception date 5/21/04) | | | 1.49 | % | | | -15.92 | % | | | -14.38 | % | | | 3.48 | % | | | 10.80 | % | | | 7.00 | % | | | N/A | | |

Buffalo Emerging Opportunities Fund —

Institutional Class (inception date 7/1/19)1 | | | 1.34 | % | | | -15.91 | % | | | -14.28 | % | | | 3.63 | % | | | 10.96 | % | | | N/A | | | | -20.25 | % | |

Morningstar US Small Growth Index | | | N/A | | | | -14.29 | % | | | -16.07 | % | | | 3.71 | % | | | 9.79 | % | | | 7.70 | % | | | -18.48 | % | |

Lipper Small-Cap Growth Funds Index | | | N/A | | | | -17.61 | % | | | -16.72 | % | | | 3.73 | % | | | 9.10 | % | | | 7.13 | % | | | -21.21 | % | |

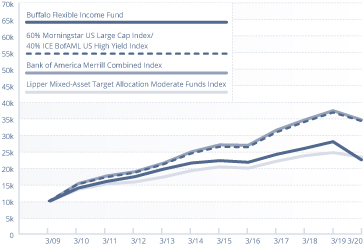

Buffalo Flexible Income Fund —

Investor Class (inception date 8/12/94) | | | 1.00 | % | | | -20.81 | % | | | -19.63 | % | | | 0.22 | % | | | 4.89 | % | | | 6.02 | % | | | N/A | | |

Buffalo Flexible Income Fund —

Institutional Class (inception date 7/1/19)1 | | | 0.85 | % | | | -20.74 | % | | | -19.51 | % | | | 0.37 | % | | | 5.05 | % | | | N/A | | | | -20.20 | % | |

60% Morningstar US Large Cap Index/

40% ICE BofAML US High Yield Master II Index | | | N/A | | | | -10.26 | % | | | -5.48 | % | | | 5.69 | % | | | 8.79 | % | | | 8.25 | % | | | -9.35 | % | |

Bank of America Merrill Combined Index

(60% S&P 500® Index/40% Bank of America

Merrill Lynch U.S. High Yield Master II Index)

(reflects no deduction for fees, expenses

or taxes) | | | N/A | | | | -11.66 | % | | | -7.03 | % | | | 5.19 | % | | | 8.60 | % | | | 8.33 | % | | | -10.80 | % | |

Lipper Mixed-Asset Target Allocation

Moderate Funds Index | | | N/A | | | | -9.20 | % | | | -5.43 | % | | | 2.74 | % | | | 5.55 | % | | | 6.33 | % | | | -8.62 | % | |

Buffalo Growth Fund — Investor Class

(inception date 5/19/95) | | | 0.91 | % | | | -9.83 | % | | | -3.90 | % | | | 7.20 | % | | | 10.82 | % | | | 9.72 | % | | | N/A | | |

Buffalo Growth Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.76 | % | | | -9.79 | % | | | -3.79 | % | | | 7.35 | % | | | 10.98 | % | | | N/A | | | | -10.92 | % | |

Morningstar US Growth Index* | | | N/A | | | | -2.54 | % | | | 1.45 | % | | | 9.97 | % | | | 12.96 | % | | | N/A | | | | -4.40 | % | |

Lipper Large Cap Growth Funds Index | | | N/A | | | | -4.62 | % | | | -0.55 | % | | | 9.26 | % | | | 11.57 | % | | | 7.95 | % | | | -5.87 | % | |

18

| | | | | | Average Annual | |

| | Gross Expense

Ratio*** | | Six

Months | | One Year | | Five Years | | Ten Years | | Investor

Class

Since

Inception | | Institutional

Class

Since

Inception2 | |

Buffalo High Yield Fund — Investor Class

(inception date 5/19/95) | | | 1.00 | % | | | -9.98 | % | | | -6.67 | % | | | 1.47 | % | | | 4.29 | % | | | 6.35 | % | | | N/A | | |

Buffalo High Yield Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.85 | % | | | -10.00 | % | | | -6.62 | % | | | 1.60 | % | | | 4.44 | % | | | N/A | | | | -8.94 | % | |

ICE BofAML US High Yield Master II Index | | | N/A | | | | -10.86 | % | | | -7.45 | % | | | 2.67 | % | | | 5.50 | % | | | 6.84 | % | | | -9.93 | % | |

Lipper High Yield Bond Funds Index | | | N/A | | | | -11.91 | % | | | -8.47 | % | | | 1.68 | % | | | 4.80 | % | | | 6.55 | % | | | -11.17 | % | |

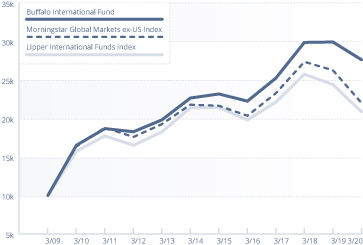

Buffalo International Fund — Investor Class

(inception date 9/28/07) | | | 1.04 | % | | | -12.02 | % | | | -7.67 | % | | | 3.57 | % | | | 5.27 | % | | | 3.18 | % | | | N/A | | |

Buffalo International Fund —

Institutional Class (inception date 7/1/19)1 | | | 0.89 | % | | | -12.01 | % | | | -7.57 | % | | | 3.72 | % | | | 5.43 | % | | | N/A | | | | -13.95 | % | |

Morningstar Global Markets ex-US Index | | | N/A | | | | -17.03 | % | | | -16.12 | % | | | -0.19 | % | | | 2.52 | % | | | 0.16 | % | | | -18.80 | % | |

Lipper International Funds Index | | | N/A | | | | -16.35 | % | | | -14.49 | % | | | -0.54 | % | | | 2.85 | % | | | 0.15 | % | | | -17.84 | % | |

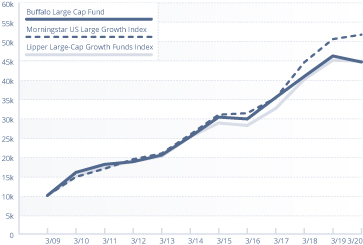

Buffalo Large Cap Fund — Investor Class

(inception date 5/19/95) | | | 0.93 | % | | | -8.70 | % | | | -3.40 | % | | | 8.03 | % | | | 10.81 | % | | | 9.13 | % | | | N/A | | |

Buffalo Large Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.78 | % | | | -8.66 | % | | | -3.27 | % | | | 8.19 | % | | | 10.98 | % | | | N/A | | | | -8.55 | % | |

Morningstar US Large Growth Index** | | | N/A | | | | -2.54 | % | | | 2.29 | % | | | 10.81 | % | | | 13.32 | % | | | N/A | | | | -3.53 | % | |

Lipper Large-Cap Growth Funds Index | | | N/A | | | | -4.62 | % | | | -0.55 | % | | | 9.26 | % | | | 11.57 | % | | | 7.95 | % | | | -5.87 | % | |

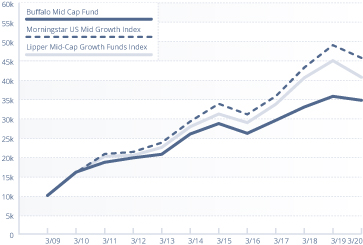

Buffalo Mid Cap Fund — Investor Class

(inception date 12/17/01) | | | 1.00 | % | | | -10.41 | % | | | -2.89 | % | | | 3.90 | % | | | 8.01 | % | | | 7.40 | % | | | N/A | | |

Buffalo Mid Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.85 | % | | | -10.41 | % | | | -2.78 | % | | | 4.04 | % | | | 8.16 | % | | | N/A | | | | -9.72 | % | |

Morningstar US Mid Growth Index | | | N/A | | | | -10.11 | % | | | -6.73 | % | | | 6.22 | % | | | 11.10 | % | | | 7.79 | % | | | -13.62 | % | |

Lipper Mid-Cap Growth Funds Index | | | N/A | | | | -13.73 | % | | | -9.59 | % | | | 5.48 | % | | | 9.79 | % | | | 7.29 | % | | | -15.70 | % | |

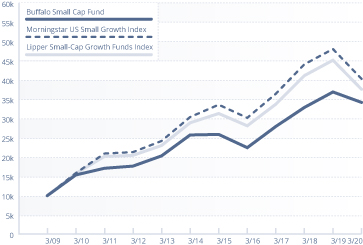

Buffalo Small Cap Fund — Investor Class

(inception date 4/14/98) | | | 1.00 | % | | | -9.51 | % | | | -7.33 | % | | | 5.72 | % | | | 8.32 | % | | | 10.64 | % | | | N/A | | |

Buffalo Small Cap Fund — Institutional Class

(inception date 7/1/19)1 | | | 0.85 | % | | | -9.50 | % | | | -7.22 | % | | | 5.87 | % | | | 8.48 | % | | | N/A | | | | -13.24 | % | |

Morningstar US Small Growth Index | | | N/A | | | | -14.29 | % | | | -16.07 | % | | | 3.71 | % | | | 9.79 | % | | | 5.05 | % | | | -18.48 | % | |

Lipper Small-Cap Growth Funds Index | | | N/A | | | | -17.61 | % | | | -16.72 | % | | | 3.73 | % | | | 9.10 | % | | | 5.85 | % | | | -21.21 | % | |

1 The Institutional Class commenced operations on 7/1/2019. Performance for periods prior to 7/1/2019 is based on the performance of the Investor Class adjusted for the Shareholder Services fee of the Investor Class.

2 Not annualized.

* The inception date of the Morningstar US Growth Index is July 3, 2002. The annualized return since inception as of March 31, 2020 is 6.35%

** The inception date of the Morningstar US Large Growth Index is July 3, 2002. The annualized return since inception as of March 31, 2020 is 5.82%

*** As reported in the Funds' Prospectus dated July 1, 2019. Current period gross expense ratio for each Fund can be found on the Financial Highlights, beginning on page 100.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance of the Funds may be lower or higher than the performance quoted. Performance data current as of the most recent month-end may be obtained by calling 1-800-49-BUFFALO or by visiting the website at www.buffalofunds.com.

19

The Morningstar US Mid Growth Index has replaced the Russell Midcap® Growth Index as the Buffalo Discovery Fund's primary benchmark. The Morningstar US Large-Mid Cap Index has replaced the S&P 500® Index as the Buffalo Dividend Focus Fund's primary benchmark. The Morningstar US Small Growth Index has replaced the Russell 2000® Growth Index as the Buffalo Emerging Opportunities Fund's primary benchmark. The Morningstar Moderately Aggressive Target Risk Index has replaced the 60% Morningstar US Large Cap Index/40% ICE BofAML US High Yield Index as the Buffalo Flexible Income Fund's primary benchmark. The Morningstar US Growth Index has replaced the Russell 1000® Growth Index as the Buffalo Growth Fund's primary benchmark. The Morningstar Global Markets ex-US Index has replaced the Russell Global (ex-US)® Index as the Buffalo International Fund's primary benchmark. The Morningstar US Large Growth Index has replaced the Russell 1000® Growth Index as the Buffalo Large Cap Fund's primary benchmark.

The Morningstar US Mid Growth Index has replaced the Russell Midcap® Growth Index as the Buffalo Mid Cap Fund's primary benchmark. The Morningstar US Small Growth Index has replaced the Russell 2000® Growth Index as the Buffalo Small Cap Fund's primary benchmark. The Advisor believes that each of the new indices is more appropriate given each Fund's holdings.

The Funds' returns shown do not reflect the deduction of taxes that a shareholder would pay on distributions or the redemption of shares. The benchmark returns shown, excluding the Lipper Indices, reflect the reinvestment of dividends and capital gains but do not reflect the deduction of any investment management fees, other expenses or taxes. The performance of the Lipper Indices is presented net of the funds' fees and expenses; however, applicable sales charges are not taken into consideration. One cannot invest directly in an index.

The Morningstar US Mid Growth Index measures the performance of US mid-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales. The Lipper Multi-Cap Growth Funds Index is an unmanaged index that reflects the net asset value weighted return of 30 of the largest multi-cap growth funds tracked by Lipper. Its returns include net reinvested dividends. The Morningstar US Large-Mid Cap Index measures the performance of the US equity market targeting the top 90% of stocks by market capitalization. Lipper Equity Income Funds Index tracks funds that seek relatively high current income and growth of income by investing at least 65% of their portfolio in dividend-paying equity securities. These funds' gross or net yield must be at least 125% of the average gross or net yield of the U.S. diversified equity fund universe. The Morningstar US Small Growth Index measures the performance of US small-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flows and sales. The Lipper Small-Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Small-Cap classification. The Morningstar US Large Cap Index measures the performance of the US equity market targeting the top 70% of stocks by market capitalization. The ICE BofAML US High Yield Master II Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Lipper Mixed-Asset Target Allocation Moderate Funds Index is an average of funds that, by portfolio practice, maintain a mix of between 40%-60% equity securities, with the remainder invested in bonds, cash, and cash equivalents. The total return of the Lipper Average does not include the effect of sales charges. The Morningstar US Growth Index measures the performance of US stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales. The Lipper Large Cap Growth Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Large-Cap classification. The Lipper High Yield Bond Funds Index is a widely recognized index of the 30 largest mutual funds that invest primarily in high yield bonds. The Morningstar Global Market ex-US Index is designed to provide exposure to the top 97% market capitalization in each of two market segments, developed markets, excluding the United States, and emerging markets. The Lipper International Funds Index is an unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper International classification. The Morningstar US Large Growth Index measures the performance of US large-cap stocks that are expected to grow at a faster pace than the rest of the market as measured by forward earnings, historical earnings, book value, cash flow and sales. The Lipper Mid-Cap Growth Funds Index is an

20

unmanaged, equally weighted performance index of the 30 largest qualifying mutual funds (based on net assets) in the Lipper Mid-Cap classification. The Russell 1000 Growth Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The S&P 500 Index is a capitalization weighted index of 500 large capitalization stocks which is designed to measure broad domestic securities markets. The Russell Mid Cap Growth Index measures the performance of those Russell Midcap companies with higher price-to-book ratios and higher forecasted growth values. The Russell 2000 Growth Index is a small-cap stock market index of the bottom 2,000 stocks in the Russell 3000 Index. The Russell 2000 Value Index measures the performance of small-cap value segment of the US equity universe. It includes those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000 Value Index is constructed to provide a comprehensive and unbiased barometer for the small-cap value segment. The Russell 2000 is by far the most common benchmark for mutual funds that identify themselves as "small-cap", while the S&P 500 index is used primarily for large capitalization stocks. The Russell Microcap Growth Index measures the performance of the microcap growth segment of the U.S. equity market. It includes Russell Microcap companies that are considered more growth oriented relative to the overall market as defined by Russell's leading style methodology. The Russell Microcap Growth Index is constructed to provide a comprehensive and unbiased barometer for the microcap growth segment of the market. The Russell Global (ex USA) Index Net measures the performance of the global equity market based on all investable equity securities, excluding companies assigned to the United States. The Morningstar Moderately Aggressive Target Risk Index is designed to meet the needs of investors who would like to maintain a target level of equity exposure through a portfolio diversified across equities, bonds and inflation-hedged instruments.

Please refer to the prospectus for special risks associated with investing in the Buffalo Funds, including, but not limited to, risks involved with investments in science and technology companies, foreign securities, debt securities, lower- or unrated securities and smaller companies. Fund holdings and sector allocations are subject to change at any time and should not be considered a recommendation to buy or sell any security. Please refer to the Schedule of Investments for a complete list of Fund holdings.

21

INVESTMENT RESULTS (UNAUDITED) Continued

Growth of $10,000 Investment — Investor Class

BUFFALO DISCOVERY FUND

BUFFALO DIVIDEND FOCUS FUND

BUFFALO EMERGING

OPPORTUNITIES FUND

BUFFALO GROWTH FUND

BUFFALO HIGH YIELD FUND

BUFFALO INTERNATIONAL FUND

22

Growth of $10,000 Investment

BUFFALO FLEXIBLE INCOME FUND

BUFFALO MID CAP FUND

BUFFALO LARGE CAP FUND

BUFFALO SMALL CAP FUND

23

EXPENSE EXAMPLE (UNAUDITED)