UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER K. YARBROUGH 737 NORTH MICHIGAN AVENUE,

SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: January 31, 2015

Item 1: Report to Shareholders.

| Letter to shareholders | 1 |

| Commentaries and Performance Summaries | |

| All Asset Fund | 4 |

| Dividend & Income Builder Fund | 6 |

| Emerging Markets Opportunities Fund | 8 |

| European Focus Fund | 10 |

| Global Equity Income Fund | 12 |

| Global Technology Fund | 14 |

| High Yield Opportunities Fund | 16 |

| International Long/Short Equity Fund | 18 |

| International Opportunities Fund | 20 |

| International Select Equity Fund | 22 |

| Strategic Income Fund | 24 |

| Unconstrained Bond Fund | 26 |

| US Growth Opportunities Fund | 28 |

| Portfolios of investments | 30 |

| Statements of assets and liabilities | 118 |

| Statements of operations | 126 |

| Statements of changes in net assets | 134 |

| Statements of changes – capital stock activity | 147 |

| Statement of Cash Flows | 161 |

| Financial highlights | 162 |

| Notes to financial statements | 182 |

| Other information | 195 |

| Trustees and officers | 201 |

International and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks included currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies which typically involves greater risk than investing in larger companies. Certain of the Funds are non-diversified and therefore the change in value of a single holding may have a more pronounced effect on a Fund’s performance. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses. The Funds may be subject to frequent trading which may result in a turnover rate of 100% or more which will increase the cost of investing.

The All Asset Fund may invest in derivatives and commodities. Investing in commodities entails additional risks including instability regarding control and jurisdiction of governments, international companies and other entities. The Fund is subject to investment company and pooled vehicles risk, allocation risk, leverage risk, interest rate risk, private equity risk and high yield securities risk. An investment in pooled vehicles, including closed-end funds, trusts, and exchange-traded funds (“ETFs”), may involve paying a premium at the time of purchase or receiving a discounted price at the time of sale. Private equity investing generally has less publicly available information for investors. Investments in high yield securities may offer more attractive returns but also greater risk that a particular security may default.

The Dividend & Income Builder Fund may invest in illiquid securities and is subject to investment company and pooled vehicles risk, interest rate risk, credit/default risk and high yield securities risk. An investment in pooled vehicles, including closed-end funds, trusts, and ETFs, may involve paying a premium at the time of purchase or receiving a discounted price at the time of sale. The Fund is subject to interest rate risk which is the risk that debt securities in the Fund’s portfolio will decline in value because of increases in market interest rates. Credit risk refers to an issuer’s ability to make timely payments of principal and interest. Investments in high yield securities may offer more attractive returns but also greater risk that a particular security may default.

The High Yield Opportunities Fund, Strategic Income Fund and Unconstrained Bond Fund may invest in illiquid securities and are subject to investment company risk, interest rate risk, credit/default risk and high yield securities risk. Credit risk refers to bond issuers’ ability to make timely payments of principal and interest. High yield securities may increase the risk that a security may default. The Funds’ share price and yield will be affected by interest rate movements, as the value of bond investments and mortgage and asset backed securities are at greater risk during periods of rising interest rates than during periods of stable or falling rates. Impact of prepayments on the value of asset backed securities may be difficult to predict. Unsecured bank loans may not provide the Funds with payment of principal, interest, and other amounts due. Loans or securities that are part of highly leveraged transactions involve a greater risk (including default and bankruptcy) than other investments.

The Global Technology Fund’s returns may be considerably more volatile than a fund that does not invest in technology companies. Technology companies may react similarly to certain market pressure and events. These may be significantly affected by short product cycles, aggressive pricing of products and services, competition from new market entrants, and obsolescence of existing technology.

The High Yield Opportunities Fund, Strategic Income Fund, and Unconstrained Bond Fund may invest in high yield, lower rated (junk) bonds.Securities rated below investment grade generally entail greater credit, market, issuer and liquidity risk than investment grade securities. Moreover, the Funds are subject to interest rate risk which is the risk that debt securities in the portfolio will decline in value because of increases in market interest rates. The Funds may borrow money which may adversely affect the return to shareholders, also known as leverage risk.

The International Long/Short Equity Fund may invest in illiquid securities and is subject to short sale risk, issuer risk and leverage risk. The Fund may experience significant losses in a market where the value of both the Fund’s long and short positions are declining. When taking a short position, the Fund’s potential loss is unlimited, given the loss is calculated as the maximum attainable price of the security, less the price at which the Fund’s position in the security was established. The Fund is also subject to the risk that the third party to the short sale may fail to honor its contract terms, causing a loss to the Fund. An issuer in which the Fund invests may perform poorly, and the value of its securities may therefore decline, which would negatively affect the Fund’s performance. The Fund may borrow money which may adversely affect the return to shareholders, also known as leverage risk.

The US Growth Opportunities Fund is subject to issuer risk and growth investing risk. An issuer in which the Fund invests may perform poorly, and the value of its securities may therefore decline, which would negatively affect the Fund’s performance. Growth securities may be more volatile than other securities as they are more sensitive to investor perceptions of the issuing company’s potential. Market values of growth securities may never reach their expected market value and may decline in price.

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson Global Funds, which covers the six months ended January 31, 2015.

The period has been characterized by three dominant themes: subdued global growth, falling commodity prices and accommodative monetary policy. In the aftermath of the financial crisis, the global economy is suffering from excess economic supply and a shortage of economic demand, which has translated into lower growth, higher unemployment and price deflation. To provide context, look no further than the oil futures market. Since September, the price of oil in US dollars has declined over 50%, in part due to increased supply from the US and Saudi Arabia, and to slowing global demand from Europe and Asia. The divergence of economic growth became apparent in 2014 as the US and UK saw strong GDP growth of 2.2% and 3.0%, respectively, while Japan and the Eurozone lagged behind at 0.4% and 0.9%, respectively.

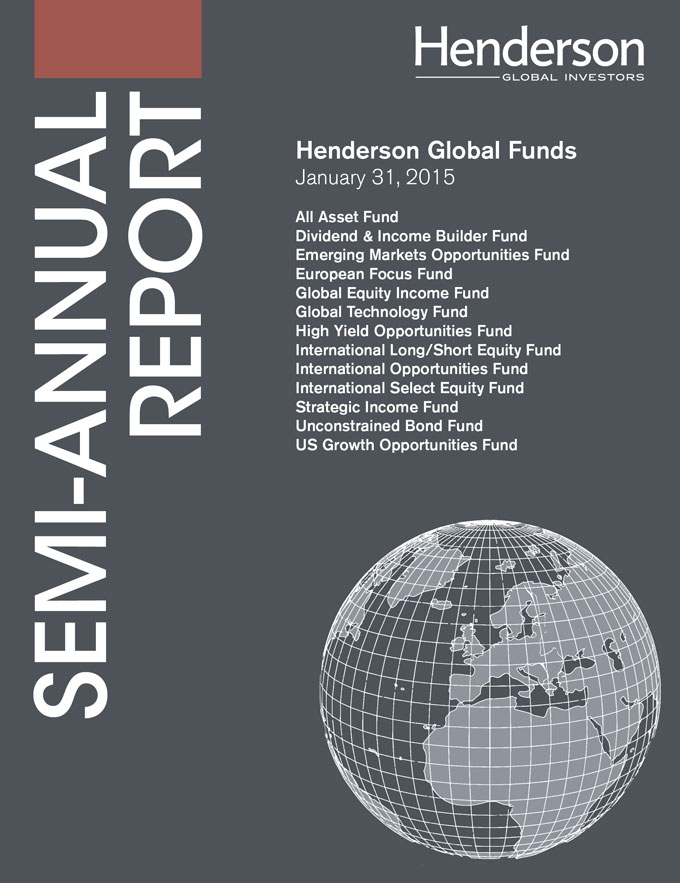

In order to fend off this disinflationary environment, central bankers around the globe have endeavored to devalue their currencies in order to boost exports and increase inflation. In October, Japan further increased its stimulus program, while China cut interest rates for the first time in two years. As central bankers in the US and UK were ending their historic stimulus programs, the European Central Bank (“ECB”) announced its own plan in January to inject €1.1 trillion into the Eurozone economy. This unified currency devaluation among international partners has translated into a 30% rise in the US dollar’s value since April 2011.

Against this difficult global backdrop, there are positive signs already emerging in 2015. The recent decline in oil prices translates roughly to a 3.1% boost in global GDP, which should act as a tailwind for global consumers and energy importers, such as Japan and Europe. The lower euro value (down 20% since April 2014) and ECB stimulus should also help bolster the region’s economic output and provide liquidity to nations that desperately need it. The US economy, which has benefited from strong labor and capital markets, should continue to be a bright spot, with investors focused on US wage growth and the Federal Reserve’s impending interest rate hike. Japan will continue its attempt to pull itself out of stagflation, with lower currency and energy costs acting as a springboard for future economic growth. As for emerging markets, much will depend on how lower energy prices affect key exporters like Russia and Venezuela, while China appears to remain focused on structural reforms aimed at long-term sustainability, at the expense of more aggressive GDP growth.

At Henderson, the acquisition of Geneva Capital Management (“Geneva”), the plans for which were announced in our last shareholder letter, closed on October 1, 2014. This is an important strategic milestone in the development of Henderson’s North American business, adding US equity investment capabilities and extending our US institutional client base. Geneva’s long track record managing US growth equities, underpinned by a disciplined and consistent investment process, expands an important capability for Henderson. Subsequent to this acquisition, we launched the US Growth Opportunities Fund on December 18, 2014. This Fund is managed by Michelle Picard, Scott Priebe and Derek Pawlak of Geneva, and follows a “bottom-up,” fundamental process with a focus on high quality growth companies.

In addition, we have launched two other Funds within the past six months. The International Select Equity Fund, a “bottom-up,” concentrated international equity fund, launched on September 30, 2014, and the International Long/Short Equity Fund, a long/short “best ideas” international equity fund, launched on December 9, 2014.

We believe that these Funds are key additions to the Henderson Global Funds family as we seek to provide you with further options to diversify your portfolios with products that are truly differentiated from the competition. We appreciate your trust in, and support of, our Funds, and we look forward to serving your financial needs in the years to come.

James G. O’Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

| Europe – 3 reasons for optimism: Quantitative Easing, |

We believe that the European Central Bank’s (ECB) commitment to a large and sustained Quantitative Easing (QE) program, rising exports and lower oil prices are the main factors that should provide a supportive environment for European progression during the year.

Central Banks and QE

| | • | The large and sustained ECB QE action is a necessary component for Europe’s progression |

| | • | On 1/22/2015, the ECB announced it will purchase €60 billion per month of euro-government debt, euro-agency debt and European institution debt for 18 months, or €1.1 trillion ($1.25 trillion USD) in total |

| | • | This equates to roughly 10% of the Eurozone GDP, which in GDP terms is in line with the QE programs of the US and UK |

Bank lending growth should be a positive effect of QE

| rising exports and lower oil prices |

Exports set to rise

A weaker euro is good for European exporters; it boosts earnings per share (EPS) and imports the inflation that Europe needs.

GDP and Oil

A cheaper oil price is clearly positive for Europe since most of the region imports energy.

| Impact to GDP based on oil prices |

| | | Crude Oil Price US$/bbl | | | Global Oil Cost (US$ Trillions) | | | Savings vs Oil at $110 (US$ Trillions) | | | Savings % Global GDP |

| | | 110 | | | 3.7 | | | 0.0 | | | 0.0% |

| | | 100 | | | 3.3 | | | 0.3 | | | 0.4% |

| | | 90 | | | 3.0 | | | 0.7 | | | 0.9% |

| | | 80 | | | 2.7 | | | 1.0 | | | 1.3% |

| | | 70 | | | 2.3 | | | 1.3 | | | 1.8% |

| | | 60 | | | 2.0 | | | 1.7 | | | 2.2% |

| | | 50 | | | 1.7 | | | 2.0 | | | 2.7% |

| | | 40 | | | 1.3 | | | 2.3 | | | 3.1% |

Note: Using $110 as the reference point, 2013 global oil consumption rate of 91 million barrels per day, 2013 Global GDP of $75 trillion. Data as of 12/31/13. Source: BP Statistical Review, IMF, KKR Global Macro & Asset Allocation analysis.

All Asset Fund

The disappointments of 2014 may open the door to a more palatable 2015 for world economies. That said, we suspect that investors are overly pessimistic about global economic vigor and that there are a number of ingredients that could produce a positive growth surprise.

The falling oil price is an important influential factor for 2015. The sharp decline effectively provides a global tax cut, a powerfully redistributive force that removes billions from oil-rich exporters and provides a tailwind for struggling economies, where fuel and energy inputs are a key factor in the costs of manufacturing and the prices that consumers pay for goods and services.

Falling inflation has very recently seen the European Central Bank (ECB) announce a significant quantitative easing (QE) program. Crucially, the measures will also involve the ECB buying government bonds, albeit with defined risk-sharing parameters. Although central banks’ paths have been diverging – Japan and Europe are firmly in easing mode with the US Federal Reserve having ended its QE program – the timing of interest rate rises in the US and UK continues to be pushed out. On the fiscal side of policy, measures taken by the US government to shrink the budget deficit have largely worked their way through US growth data, while European politicians are quietly abandoning austerity.

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Henderson Unconstrained Bond Fund | 4.6 | % |

| iShares TIPS Bond ETF | 4.5 | |

| iShares MSCI EAFE Minimum Volatility | | |

| Index Fund | 4.1 | |

| TIAA-CREF Asset Management | | |

| Core Property Fund LP | 4.0 | |

| MSIF Multi-Asset Portfolio | 3.3 | |

| ASG Global Alternatives Fund | 3.3 | |

| Vanguard Dividend Appreciation ETF | 2.9 | |

| iShares Core High Dividend ETF | 2.9 | |

| Sprott Physical Gold Trust | 2.9 | |

| iShares MSCI Emerging Markets | | |

| Minimum Volatility ETF | 2.7 | |

For the reporting period ended January 31, 2015, the Fund returned 0.59% (Class A at NAV) versus the benchmark, 3-month LIBOR (USD), which posted a return of 0.12%. Performance was largely driven by the allocation to equities, particularly in the US. The fixed income allocation was broadly flat while the allocation to private equity modestly detracted from performance.

Against a backdrop of economic expansion and the potential for a growth surprise, we continue to favor equities as an asset class. Coupled with a positive shorter-term cyclical picture, valuations are reasonable on most measures particularly when compared with areas of the bond market.

Within our regional allocations to equities, we have been reducing our exposure to the UK in favor of continental Europe. A more activist ECB, a falling oil price, a weaker euro, and the diminishing talk of austerity have been encouraging us back into European stocks for the first time since early 2013. In contrast, the UK has already experienced its fair share of positive growth surprises, and expectations are perhaps too high.

In the US, our current allocation poses a conundrum: the economy continues to exhibit macro momentum and fundamentals have been notably strong. However, monetary policy considerations potentially put a cap on market growth. We may be inclined to add to Europe at the expense of the US. The relative behavior of the two central banks will be an important determinant of what we do and when.

Looking ahead, we believe markets will be shaped by significant divergences in growth and policy during 2015, and we would therefore expect more volatility and less correlation between asset classes than in recent years. We see scope for positive growth surprises in the months ahead as the impact of monetary policy and weaker oil prices kicks in and the drag from fiscal tightening eases.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

All Asset Fund

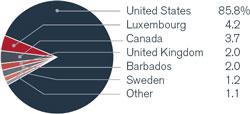

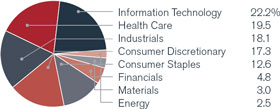

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | (3/30/2012)* | |

| Class A | | | HGAAX | | | 0.59 | % | | 4.47 | % | | 4.65 | % |

| Class C | | | HGACX | | | 0.26 | | | 3.78 | | | 3.87 | |

| Class I | | | HGAIX | | | 0.75 | | | 4.74 | | | 4.93 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -5.23 | % | | -1.52 | % | | 2.50 | % |

| Class C | | | | | | -0.74 | | | 3.78 | | | 3.87 | |

| Index | | | | | | | | | | | | | |

| 3-month LIBOR USD | | | | | | 0.12 | % | | 0.23 | % | | 0.31 | % |

| MSCI World Index | | | | | | -1.17 | | | 7.58 | | | 11.94 | |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.33%, 2.07% and 1.02%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.60% of the Fund’s average daily net assets, which is in effect until July 31, 2020. With respect to investments in affiliated underlying funds, the Fund’s adviser has contractually agreed to reduce or waive the Fund’s management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund’s management fee. Indirect net expenses associated with the Fund’s investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) USD is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Dividend & Income Builder Fund

For the majority of 2014, global equity markets performed well. It was another strong year for dividend investors, as global dividends grew 8% with countries such as the US growing dividends at double digit rates. The US equity market was amongst the strongest performers globally, as economic data proved resilient such that the Federal Reserve began to hint of interest rate increases in the coming year. This outperformance was reversed in January as companies began reporting earnings downgrades caused by the strong US dollar. Elsewhere, the European Central Bank announced a quantitative easing program that, while expected, exceeded expectations in size and scope.

For the reporting period ended January 31, 2015, the Fund returned -1.75% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of -1.17%. The Fund continued to meet its income objectives over the period. Performance relative to the benchmark was held back by a structural underweight to the US (where dividends are typically lower). The Fund made gains in Japanese and Australian holdings, particularly in the financials sector as well as European telecommunications.

Among the best performers was Japanese pharmaceutical company Takeda, where expectations that the company can reduce duplicate costs and approach a peer group margin have grown. Also

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Roche Holding AG | 2.2 | % |

| Orange S.A. | 2.2 | |

| Novartis AG | 2.1 | |

| Takeda Pharmaceutical Co., Ltd. | 2.0 | |

| WPP plc | 1.9 | |

| BCE, Inc. | 1.9 | |

| Imperial Tobacco Group plc | 1.8 | |

| Baxter International, Inc. | 1.8 | |

| Bayer AG | 1.7 | |

| Zurich Insurance Group AG | 1.7 | |

among the top performers was Imperial Tobacco. If the acquisition of Lorillard by Reynolds is approved by shareholders, Imperial Tobacco may further benefit from acquiring US assets divested as part of the transaction. This could give Imperial Tobacco a roughly 10% market share in the US along with opportunities for cost cutting.

In the equity allocation, the Fund continues to seek companies with both above-average yield and dividend growth. The equity allocation remained over 80% of the Fund, reflecting our current bias towards equities over bonds. While corporate earnings growth has remained mixed in recent years, dividend growth has proven more consistent. In comparison to other asset classes such as government or corporate bonds, it is our view that equities continue to look like a good value, especially given the prospects for ongoing dividend growth. In the fixed income allocation, we prefer credit over interest rate risk. We plan to continue our strategy of investing in high quality names with attractive coupons.

Inflation has reached record lows in many developed economies, with government bond yields continuing to fall as investors’ “price-in” the monetary stimulus in Europe and delays to interest rate increases elsewhere. Equities, therefore, remain an attractive source of income for investors in many markets. In addition, over the long term, dividends and dividend growth provide a significant proportion of an investor’s total equity return, and offer a compelling basis for valuing companies.

The outlook for dividend growth in local currencies remains encouraging – companies are increasingly focused on returning cash to shareholders and have strong (in many cases, net cash) balance sheets. The strength of the dollar, however, means that in US dollar terms the dividend growth will likely be more subdued for the Fund than in 2014.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Dividend & Income Builder Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | (8/1/2012) | |

| Class A | | | HDAVX | | | -1.75 | % | | 4.46 | % | | 11.03 | % |

| Class C | | | HDCVX | | | -2.20 | | | 3.62 | | | 10.19 | |

| Class I | | | HDIVX | | | -1.70 | | | 4.64 | | | 11.25 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -6.65 | % | | -0.76 | % | | 8.77 | % |

| Class C | | | | | | -3.20 | | | 3.62 | | | 10.19 | |

| Index | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -1.17 | % | | 7.58 | % | | 15.40 | % |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.95%, 2.69% and 1.67%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.05% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Emerging Markets Opportunities Fund

Throughout the period, developed market equities outperformed the emerging markets. Sharp drops in the price of oil and a steep rise in the US dollar led to a general lack of investor confidence in commodity demand and the performance of the asset class fell into negative territory towards the end of the period.

The strength of the US dollar and expectations of rising US interest rates had a significant impact on currencies and portfolios priced in US dollars across the emerging markets; for example, approximately half the local currency returns in southeast Asian markets were offset by significant currency weakness. US dollar strength could be a multiple year trend for some emerging markets but, not all. China pegs its currency to the US dollar and views it as in equilibrium and many of the other Asian markets are still running healthy current account surpluses (Korea and Taiwan for example). Latin American equities had a particularly difficult time over the period, underperforming their emerging market counterparts as declining commodity prices and a stronger US dollar raised questions over the region’s economic growth outlook. Elsewhere, continued geopolitical concerns in the Middle East and Ukraine dominated news flow in the Emerging Europe, Middle East and Africa (EMEA) region.

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Taiwan Semiconductor | | |

| Manufacturing Co., Ltd. | 5.0 | % |

| Agricultural Bank of China Ltd., Class H | 4.7 | |

| Tata Motors, Ltd., ADR | 4.3 | |

| Baidu, Inc., ADR | 4.1 | |

| Huaneng Power International, Inc., Class H | 3.5 | |

| Samsung Fire & Marine Insurance Co., Ltd. | 3.2 | |

| CTBC Financial Holding Co., Ltd. | 3.2 | |

| SK Hynix, Inc. | 3.2 | |

| Brilliance China Automotive Holdings, Ltd. | 3.0 | |

| Ayala Corp. | 3.0 | |

For the reporting period ended January 31, 2015, the Fund returned -8.66% (Class A at NAV) versus the benchmark, MSCI Emerging Markets Index, which posted a return of -8.92%. The Asian sub-portfolio was the strongest performer both in terms of asset allocation and stock selection. The standout region was China/Hong Kong which saw gains driven by positive sentiment in the A-share market which strongly impacted the financial sector, which had been lagging for a couple of years. The turnaround in sentiment is hard to pinpoint but overall a more positive view on the structural reform agenda the government has in place is a key driver. Both EMEA and Latin America struggled to make gains as macro events dominated individual company performance.

We have been very mindful of the risks and challenges faced by the emerging markets bloc with regards to geopolitical events, commodities and currencies. Over the period, the Fund moderately increased its allocation to EMEA, while the allocation to Asia grew on the back of market movements and Latin America naturally fell into an underweight. We believed that our approach to stock selection and focus on the growth of the Asian region would help to add value in a difficult period for the asset class.

We see some of the biggest risks to emerging markets equities in 2015 being found in further geopolitical destabilization in the Middle East and Ukraine as well as prolonged commodity price uncertainty. However, valuations in many emerging market countries are relatively low and economies still have the potential to grow faster than the developed world. We continue to believe an active approach to investing in emerging markets equities is needed as market overreactions to broad-based headline events are a continued source for selective stock opportunity.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Emerging Markets Opportunities Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | Three | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | years* | | | (12/31/2010)* | |

| Class A | | | HEMAX | | | -8.66 | % | | 4.79 | % | | 3.07 | % | | -2.05 | % |

| Class C | | | HEMCX | | | -9.05 | | | 4.05 | | | 2.31 | | | -2.79 | |

| Class I | | | HEMIX | | | -8.69 | | | 5.06 | | | 3.32 | | | -1.83 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -13.92 | % | | -1.21 | % | | 1.07 | % | | -3.46 | % |

| Class C | | | | | | -10.05 | | | 4.05 | | | 2.31 | | | -2.79 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -8.92 | % | | 5.61 | % | | 0.94 | % | | -1.58 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by IPOs to a greater degree than it may be in the future. IPO investments are not an integral component of the Fund’s investment process and may not be utilized to the same extent in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.97%, 2.74% and 1.66%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.54% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

European Focus Fund

It was a volatile period for European markets which were initially held back by mixed global economic data as well as ongoing geopolitical tensions between Russia and the West, an increased level of conflict in Israel and the Ebola outbreak. Scotland’s vote in September to stay in the UK did allay fears of any potential negative European implications on the back of a potential ‘no’ vote. A short-term rally during the second half of October and throughout November was followed by the region being weighed down once again by deflationary fears, slowing German growth and the re-emergence of a possible Greek exit from the euro. The euro continued its relative decline throughout the period and the precipitous fall in the price of oil weighed heavily on the energy sector; however, companies were encouraged by the prospect of lower prices helping consumers and reducing costs for many industries, although being clearly bad for producers. January saw the Swiss National Bank abandon its currency peg to the euro which sent further shockwaves through markets and led the Swiss franc over 15% higher versus the euro. Syriza, the Greek anti-austerity party, was voted into government and European investors got their wish as the European Central Bank (ECB) introduced a much anticipated quantitative easing (QE) program, driving equity prices higher in the region. While the situation in Greece highlighted the political risks that are

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| ProSiebenSat.1 Media AG | 4.0 | % |

| Rexel S.A. | 3.7 | |

| Teva Pharmaceutical Industries, Ltd., ADR | 3.3 | |

| AA, Ltd. | 3.2 | |

| Barclays plc | 3.0 | |

| Renault S.A. | 2.8 | |

| Roche Holding AG | 2.7 | |

| Publicis Groupe | 2.7 | |

| Continental AG | 2.6 | |

| ASML Holding N.V. | 2.4 | |

prevalent in Europe, the ECB action was a necessary component for Europe’s progression during 2015.

For the reporting period ended January 31, 2015, the Fund returned -3.95% (class A at NAV) versus the benchmark, MSCI Europe Index, which posted a return of -7.48%. A reduced commonality to the category helped relative Fund performance, which was led by the overweight positions to consumer discretionary, industrials and information technology. Highlights of outperformance included ProSiebenSat.1 Media, AA and ASML.

Holdings in media, advertising and industrials were increased as we believe, for the price, the risk is justified. We continued to avoid consumer staples because of the perception of overvalued companies; they are good businesses but are not candidates for the Fund at current prices. Among the newer purchases during the period were electrical equipment distributor, Rexel, Spanish infrastructure construction company, Obrascon, business information provider, Informa, national cable and satellite company, Liberty Global, and home product store, Kingfisher - which sells a range of home improvement consumer goods predominantly in the UK and France. Sales included the financial companies HSBC, Societe Generale and UniCredit.

Despite the economic and political uncertainties that remain, we believe that the ECB’s commitment to a large and sustained QE program and the lower price of oil price and euro are the main factors that should provide a good environment for European progression during 2015. We are mindful that valuations in the region are “pricing-in” little to no recovery and there could be significant opportunities – particularly within overly dismissed companies which are more cyclical and/or discretionary consumer spending.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

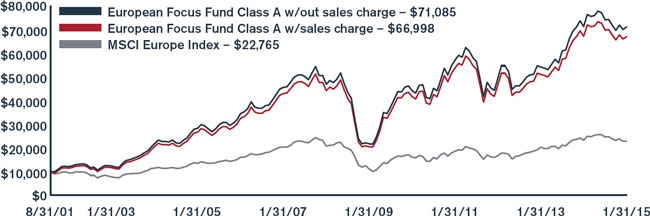

European Focus Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

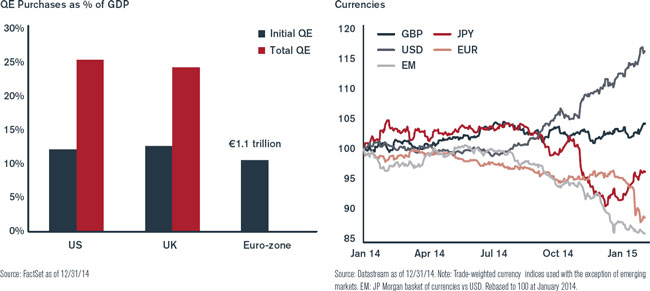

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | Three | | | Five | | | Ten | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | years* | | | years* | | | years* | | | (8/31/2001)* | |

| Class A | | | HFEAX | | | -3.95 | % | | -0.18 | % | | 12.90 | % | | 9.99 | % | | 9.67 | % | | 15.73 | % |

| Class B | | | HFEBX | | | -4.40 | | | -1.05 | | | 11.95 | | | 9.10 | | | 9.00 | | | 15.23 | |

| Class C | | | HFECX | | | -4.34 | | | -0.92 | | | 12.02 | | | 9.15 | | | 8.84 | | | 14.87 | |

| Class I** | | | HFEIX | | | -3.85 | | | 0.07 | | | 13.21 | | | 10.29 | | | 9.84 | | | 15.87 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -9.47 | % | | -5.92 | % | | 10.69 | % | | 8.70 | % | | 9.02 | % | | 15.23 | % |

| Class B | | | | | | -9.40 | | | -5.05 | | | 11.14 | | | 8.96 | | | 9.00 | | | 15.23 | |

| Class C | | | | | | -5.34 | | | -0.92 | | | 12.02 | | | 9.15 | | | 8.84 | | | 14.87 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | -7.48 | % | | -1.89 | % | | 10.80 | % | | 7.20 | % | | 5.40 | % | | 6.32 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC, which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.37%, 2.19%, 2.14% and 1.11% respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Global Equity Income Fund

Global economic growth was stronger in 2014 than had been anticipated, although the rate of growth remains low relative to recent history. Growth expectations were downgraded as the year progressed, which resulted in a more challenging competitive environment and lower profitability than both companies and investors originally expected. However, in this moderate growth environment, global dividend growth has continued to be strong, with global dividends rising 8%. Companies are increasingly recognizing the value in returning cash to shareholders, particularly in countries such as the US where dividends grew 11% in 2014. We have also seen evidence of this at the portfolio level. For example, Cisco, which prior to 2011 chose not to pay a dividend, increased its dividend a further 12% in 2014.

For the reporting period ended January 31, 2015, the Fund returned -3.76% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of -1.17%. The Fund continued to meet its high earned income objectives over the period. During the latter half of 2014 the Fund suffered a headwind in terms of the strengthening of the US dollar relative to most other currencies; the Fund is global with a foreign bias and therefore has the majority of its assets outside the US. Underlying that, however, the Fund had strong performance (in local terms) from

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Reynolds American, Inc. | 2.6 | % |

| Orange S.A. | 2.4 | |

| Sodexo S.A. | 2.4 | |

| Compass Group plc | 2.3 | |

| BT Group plc | 2.3 | |

| HSBC Holdings plc | 2.2 | |

| Vodafone Group plc | 2.2 | |

| Verizon Communications, Inc. | 2.1 | |

| SK Telecom Co., Ltd., ADR | 2.1 | |

| Novartis AG | 2.1 | |

the UK holdings which significantly outperformed the domestic indices there. The Fund also outperformed in Australia, where we had less exposure to mining and commodity companies and more local economically sensitive companies (such as Premier Investments) which did well over the period.Elsewhere, the European exposure was low for most of the period and stock selection was strong, notably in Germany, Switzerland and Denmark.

The Fund has broad sector exposure across the portfolio. A favored area currently is in telecommunications where we are finding not only a strong secular theme but also relatively attractive valuations and dividend yields. In telecommunications, the trends are fairly global where more users are adopting smart phones and therefore using the internet more heavily. Data has been increasing and this creates the opportunity to increase revenue per customer. We decreased exposure to energy and mining towards the end of 2014 as a result of the falling commodity price environment. Regionally we are beginning to increase our investments in Europe by reducing the UK exposure.

Our strategy of seeking a high dividend yield naturally draws us to markets which are higher yielding, such as the UK and Europe. Looking into 2015 we are optimistic that this preference will leave the Fund well positioned – monetary conditions in Europe are easing, currency weakness could boost earnings for global companies and real wage growth is beginning to come through in countries such as the UK. Valuations in the UK and Europe also continue to look attractive relative to US peers.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Global Equity Income Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | Three | | | Five | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | years* | | | years* | | | (11/30/2006)* | |

| Class A | | | HFQAX | | | -3.76 | % | | 3.98 | % | | 10.50 | % | | 8.36 | % | | 3.93 | % |

| Class C | | | HFQCX | | | -4.26 | | | 3.10 | | | 9.64 | | | 7.51 | | | 3.15 | |

| Class I** | | | HFQIX | | | -3.75 | | | 4.23 | | | 10.77 | | | 8.63 | | | 4.13 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -9.30 | % | | -2.02 | % | | 8.33 | % | | 7.07 | % | | 3.18 | % |

| Class C | | | | | | -5.26 | | | 3.10 | | | 9.64 | | | 7.51 | | | 3.15 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -1.17 | % | | 7.58 | % | | 13.54 | % | | 11.34 | % | | 4.49 | % |

| MSCI World High Dividend Yield Index | | | | | | -4.27 | | | 6.18 | | | 12.23 | | | 10.91 | | | 3.87 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.18%, 1.93% and 0.92%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.15% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within select MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Global Technology Fund

Global equity market volatility was high during the reporting period in which technology outperformed the broader market. Following an initial market correction in early August, equities recovered. However, by September, concerns over global growth and the direction of central bank policies led to a market sell-off and a significant rise in investor tension. Investors remained concerned over the resilience of global growth, geopolitical concerns and the decline in commodity prices, particularly oil, played an important role in share price action. During the end of 2014, the US continued its outperformance of global equity markets as a result of strong economic data and a largely positive company results season. There has been broad strength across European regions at the start of 2015 after the European Central Bank announcement of the increased quantitative easing program. However, in the US, incrementally weaker gross domestic product growth, coupled with an already highly valued equity market, saw equity markets lag on a relative basis and weighed on the technology sector.

For the reporting period ended January 31, 2015, the Fund returned 2.11% (Class A at NAV) versus the benchmark, MSCI AC World Information Technology Index, which posted a return of 3.18%. At the sector level, the underweight position and stock selection within technology hardware storage & peripherals,

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Apple, Inc. | 7.0 | % |

| Western Digital Corp. | 3.2 | |

| Baidu, Inc., ADR | 3.1 | |

| SK Hynix, Inc. | 3.1 | |

| Fidelity National Information Services, Inc. | 2.3 | |

| MasterCard, Inc., Class A | 2.2 | |

| Facebook, Inc., Class A | 2.2 | |

| NXP Semiconductor N.V. | 2.2 | |

| NetEase.com, Inc., ADR | 2.2 | |

| Visa, Inc., A Shares | 2.1 | |

and stock selection within internet software & services were the main drags on performance. At the stock level, the main detractors on a relative basis were Apple (which remained the largest position in the Fund, but a significantly larger index constituent and outperformed throughout the year), Web.com and Pandora Media. Stock selection within the IT services and software industries were the main positive contributors to performance with individual stock performers being NetEase, Avago Technologies and NXP Semiconductors.

Activity during the period included the sale of Fiserv in favor of Fidelity National Information, the latter being exposed to similar growth drivers but trading on a relative discount. NGK Spark Plug was added given its strong position in sensor markets and Broadcom was bought as the stock’s prospects look favorable following the exit of its baseband business. A position was added in YY, the Chinese social network, as monetization of its user base has driven revenue growth. We sold out of Infineon due to a lack of operating leverage and acquisition integration risk and initiated a position in CDW, a high quality distributor in the US, based on its competitive position and attractive valuation.

While further rounds of global quantitative easing are occurring, the uncertain economic environment continues to curtail capital spending. In addition, the strengthening dollar is proving an increasing headwind for US technology companies. While technology companies remain cheap relative to the market, these headwinds may mean that in the short term technology stocks will struggle to outperform the overall market. Longer term, the technology sector remains attractive given its structurally higher earnings growth rate and strong balance sheets.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

Global Technology Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | | | | | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | Three | | | Five | | | Ten | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | years* | | | years* | | | years* | | | (8/31/2001)* | |

| Class A | | | HFGAX | | | 2.11 | % | | 5.72 | % | | 12.92 | % | | 13.32 | % | | 9.67 | % | | 8.65 | % |

| Class B | | | HFGBX | | | 1.70 | | | 4.87 | | | 11.99 | | | 12.40 | | | 9.00 | | | 8.20 | |

| Class C | | | HFGCX | | | 1.75 | | | 4.92 | | | 12.06 | | | 12.46 | | | 8.85 | | | 7.86 | |

| Class I** | | | HFGIX | | | 2.31 | | | 6.03 | | | 13.24 | | | 13.61 | | | 9.85 | | | 8.79 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -3.77 | % | | -0.36 | % | | 10.70 | % | | 11.98 | % | | 9.03 | % | | 8.18 | % |

| Class B | | | | | | -3.30 | | | 0.87 | | | 11.19 | | | 12.28 | | | 9.00 | | | 8.20 | |

| Class C | | | | | | 0.75 | | | 4.92 | | | 12.06 | | | 12.46 | | | 8.85 | | | 7.86 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 3.18 | % | | 16.23 | % | | 15.71 | % | | 13.72 | % | | 8.26 | % | | 6.12 | % |

| S&P 500 | | | | | | 4.37 | | | 14.22 | | | 17.45 | | | 15.59 | | | 7.61 | | | 6.39 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the period prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of securities and have the same portfolio management. Class I shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class B shares are subject to a CDSC which declines from 5% the 1st year to 0% at the beginning of the 7th year. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, B, C and I shares are 1.35%, 2.16%, 2.12% and 1.10%, respectively. As stated in the Statement of Additional Information (SAI), the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

High Yield Opportunities Fund

The high yield (HY) market took a turn for the worse in the third quarter of 2014, a trend that continued for the remainder of the year and led to US HY bonds underperforming leveraged loans and other parts of the fixed income universe including investment grade corporates and 10-year Treasuries. Double B rated bonds and single B rated bonds outperformed triple C rated bonds, defensive industries outperformed cyclicals and natural resource based companies underperformed the category. The decline in the energy sector, which accounts for 14% of the benchmark, dragged down the US HY market over the majority of the period, although the energy sector drag on the HY market abated somewhat in January.

The reporting period contained some notable events. First, December was an epic month in the history of the HY market with record low issuance, high volatility, the fourth largest default ever (Caesars Entertainment Operating Co) and one of the largest retail outflows ever. This was mostly driven by the energy sector and highlighted the growing differences between the US HY market and the European HY market. Second, in January, for the first time since 2008, the volume of new issuance generated in the HY and leveraged loan markets for acquisitions exceeded the amount raised for refinancing. January was somewhat of a return to

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| Ally Financial, Inc. 7%, 03/02/15 | 4.0 | % |

| General Motors Financial Co., Inc. | 2.2 | |

| Calpine Corp. | 2.1 | |

| CHS/Community Health Systems, Inc. | 2.1 | |

| CCOH Safari LLC | 2.0 | |

| Kindred Escrow Corp. II | 2.0 | |

| ILFC E-Capital Trust II | 2.0 | |

| RCN Telecom Services LLC | 2.0 | |

| MGM Resorts International | 2.0 | |

| Post Holdings, Inc. | 1.9 | |

normalcy compared to December as retail flows turned positive and new issuance picked up as the asset class benefitted from the European Central Bank (ECB) rates action.

For the reporting period ended January 31, 2015, the Fund returned -0.81% (class A at NAV) versus the benchmark, Bank of America Merrill Lynch US High Yield Master II Constrained Index, which posted a return of -0.99%. In addition to credit selection, relative performance was aided by the credit upgrade process given our views on liquidity and valuation within the HY market. We reduced exposure to triple C’s and increased double B’s and targeted a holding of 10% in secured leveraged loans; the loans exposure having the dual effect of upgrading the credit quality of the portfolio while also giving us some interest rate protection. Our energy exposure was underweight entering the final quarter of the year which helped relative performance.

We have undertaken a credit upgrade process given our views on liquidity and valuation within the HY market. While we do not see an imminent risk of defaults due to degradation of credit fundamentals (except for the energy sector), we think it is appropriate to upgrade the portfolio before fundamentals begin to deteriorate given the valuations, low yields and challenging trading liquidity. By the end of January, our weighted average yield (i.e. the total yield on the portfolio, divided by the number of bonds, weighted for the size of each bond) and spread-to-worst (i.e. the difference in overall returns between two different classes of securities, or between different representative securities in the same class) were slightly below the benchmark. We have also reduced and upgraded the credit quality of our energy holdings, particularly in the exploration and production sub-sector.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

High Yield Opportunities Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

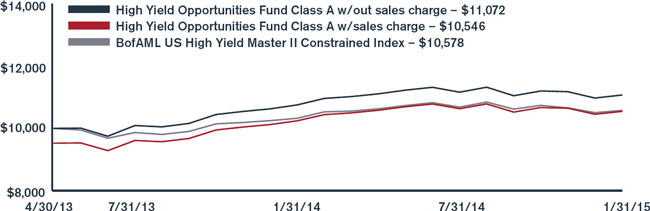

Investment comparison

| Total returns as of January 31, 2015 | | | | | | | | | | | | Since | |

| | | | NASDAQ | | | Six | | | One | | | inception | |

| At NAV | | | symbol | | | months | | | year | | | (4/30/2013)* | |

| Class A | | | HYOAX | | | -0.81 | % | | 2.95 | % | | 5.96 | % |

| Class C | | | HYOCX | | | -1.10 | | | 2.27 | | | 5.21 | |

| Class I | | | HYOIX | | | -0.61 | | | 3.28 | | | 6.25 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -5.55 | % | | -1.92 | % | | 3.06 | % |

| Class C | | | | | | -2.10 | | | 2.27 | | | 5.21 | |

| Index | | | | | | | | | | | | | |

| BofAML US High Yield Master II Constrained Index | | | | | | -0.99 | % | | 2.45 | % | | 3.26 | % |

* Average annual return.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund’s relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares are 1.68%, 2.45% and 1.38%, respectively. However, the Fund’s adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.85% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

International Long/Short Equity Fund

The Fund was launched on December 9, 2014 against a volatile market backdrop with December seeing heightened unease in international equity markets and investor concerns about the resilience of global growth, European deflation and the end of quantitative easing (QE) in the US. Economic data in Japan was negative and disappointed again in January with weaker than expected GDP numbers. In emerging markets, weak economic data in China led to the first interest rate cut in two years as well as injections into the banking system.

January proved more diverse for global markets with broad strength across European regions after the European Central Bank (ECB) introduced a much anticipated QE program. In the US, incrementally weaker GDP growth, coupled with an already highly valued equity market, saw equity markets lag on a relative basis. With the exception of precious metals, commodities (especially oil) continued to fall amidst evidence of oversupply and weak demand. The Shanghai Composite was notable for its weakness, given the rally seen in late 2014, after the China Securities Regulatory Commission banned the country’s three largest brokerages from opening new margin accounts in an effort to quell risky lending practices. There was heightened currency volatility early in January as the Swiss National Bank

Top 10 long-term holdings* (at January 31, 2015) |

| | As a percentage |

| Security | of net assets |

| ProSiebenSat.1 Media AG | 3.3 | % |

| Lundin Petroleum AB | 3.2 | |

| Teva Pharmaceutical Industries, Ltd., ADR | 3.0 | |

| Mitsubishi Heavy Industries, Ltd. | 2.8 | |

| Obrascon Huarte Lain S.A. | 2.3 | |

| Nippon Telegraph and Telephone Corp. | 2.3 | |

| Platinum Group Metals, Ltd. | 2.1 | |

| JGC Corp. | 2.1 | |

| Fanuc, Ltd. | 2.0 | |

| Seven & I Holdings Co., Ltd. | 2.0 | |

unexpectedly abandoned its currency peg to the euro, sending shockwaves through markets and the Swiss franc down 21.5% versus the US dollar on the day of the announcement.

For the reporting period (since inception) ended January 31, 2015, the Fund returned -2.20% (class A at NAV) versus the benchmark, MSCI EAFE Index (USD Hedged), which posted a return of 2.58%.

The biggest drag on performance was the UK mid-cap strategy; specifically, Quindell, on the short-book, and Oxford Instruments, on the long-book, were the biggest detractors. The Japan strategy also struggled with Yamato Holdings and Sumco, both short positions, as the biggest detractors. Europe and Asia fared better with Europe leading the way with top contributions from Rexel, Renault and ProSienbenSat.1.Media - but these were outweighed by the UK and Japan shortfalls.

Although growth concerns remain, as well as potential political and macroeconomic surprises, we still prefer equities as an asset class and the international markets look attractive on many metrics. The Fund follows a fundamental, “bottom-up” stock selection process with an unconstrained approach to portfolio construction and, against the uncertain and fragile backdrop, stock selection remains key to finding investment opportunities.

* For further detail about these holdings, please refer to the section entitled “Portfolios of investments.” Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

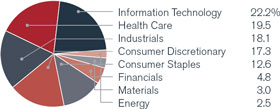

International Long/Short Equity Fund

Portfolio composition by country (as a % of long-term investments) | | Portfolio composition by sector (as a % of long-term investments) |

| | | |

| |  |

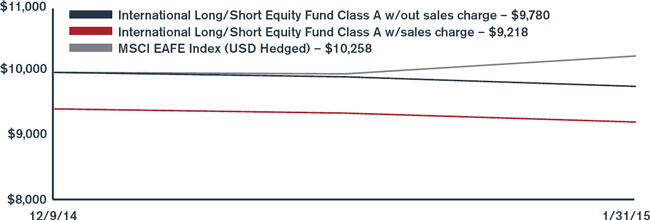

Investment comparison

Value of $10,000

| Total returns as of January 31, 2015 | | | | | | Since | |

| | | | NASDAQ | | | inception | |

| At NAV | | | symbol | | | (12/9/2014) | |

| Class A | | | HLNAX | | | -2.20 | % |

| Class C | | | HLNCX | | | -2.30 | |

| Class I | | | HLNIX | | | -2.20 | |

| With sales charge | | | | | | | |

| Class A | | | | | | -7.82 | % |

| Class C | | | | | | -3.30 | |

| Index | | | | | | | |

| MSCI EAFE Index (USD Hedged) | | | | | | 2.58 | % |

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge (“CDSC”). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund’s annual operating expense ratios (gross) for Class A, C and I shares, inclusive of distribution and service fees and dividends and interest expense on securities sold short, are estimated to be 5.25%, 6.00% and 5.00%, respectively, for the Fund’s first full fiscal year. However, the Fund’s adviser has agreed to contractually waive its management fee and, if necessary, reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies and dividends and interest expense on securities sold short) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.50% of the Fund’s average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds’ website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund’s inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI EAFE Index (USD Hedged) is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets, excluding the US and Canada, excluding the effect of currency translations. The Fund may invest in emerging markets while the Index only consists of companies in developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

International Opportunities Fund