UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-10399

______________________________________________

HENDERSON GLOBAL FUNDS

______________________________________________________________________________

(Exact name of registrant as specified in charter)

737 NORTH MICHIGAN AVENUE, SUITE 1700

CHICAGO, ILLINOIS 60611

______________________________________________________________________________

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) | Copy to: |

CHRISTOPHER GOLDEN 737 NORTH MICHIGAN AVENUE, SUITE 1700 CHICAGO, ILLINOIS 60611 | CATHY G. O’KELLY VEDDER PRICE P.C. 222 NORTH LASALLE STREET CHICAGO, ILLINOIS 60601 |

Registrant’s telephone number, including area code: (312) 397-1122

Date of fiscal year end: July 31

Date of reporting period: January 31, 2016

Item 1: Report to Shareholders.

| Letter to shareholders | 1 |

| Commentaries and Performance summaries | |

| All Asset Fund | 4 |

| Dividend & Income Builder Fund | 6 |

| Emerging Markets Fund | 8 |

| European Focus Fund | 10 |

| Global Equity Income Fund | 12 |

| Global Technology Fund | 14 |

| High Yield Opportunities Fund | 16 |

| International Long/Short Equity Fund | 18 |

| International Opportunities Fund | 20 |

| International Select Equity Fund | 22 |

| Strategic Income Fund | 24 |

| Unconstrained Bond Fund | 26 |

| US Growth Opportunities Fund | 28 |

| Portfolios of investments | 30 |

| Statements of assets and liabilities | 118 |

| Statements of operations | 126 |

| Statements of changes in net assets | 134 |

| Statements of changes – capital stock activity | 147 |

| Statement of cash flows | 164 |

| Financial highlights | 166 |

| Notes to financial statements | 186 |

| Other information | 201 |

| Trustees and officers | 206 |

International and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies which typically involve greater risk than investing in larger companies. Certain of the Funds are non-diversified and therefore the change in value of a single holding may have a more pronounced effect on a Fund's performance. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition, the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses. The Funds may be subject to frequent trading which may result in a turnover rate of 100% or more. Additional fund-specific risk is described in more detail in the Prospectus and Statement of Additional Information.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains these items and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson Global Funds, which covers the six months ended January 31, 2016.

2015 was a year of heightened volatility and idiosyncratic market events. The policy-driven, high-return markets that have characterized the post-crisis era are evolving into more challenging conditions where economic and financial tensions play a prominent role. 2016 has begun with what could be understatedly described as a difficult start, with equity markets selling off sharply in one of the worst starts to a calendar year on record.

The epicenter of this market turmoil was the slowing Chinese economy, as authorities intervened with trading halts and liquidity injections; ultimately, the Shanghai Composite Index ended January down -22.7% for the month. The oil price has been the other key driver of markets, as NYMEX WTI Crude fell to a low of $27 per barrel in January, bringing other commodity prices lower with it. Weakening industrial spending stemming from the low oil price is being felt worldwide. As a result, investors in both developed and emerging equity markets are growing increasingly concerned about the path of global economic growth.

In Asia, it is important to remember that the drivers of developed economies like Australia, Singapore and Hong Kong are very different than China, India and Indonesia, for example. In many Asian economies, economic development is producing a rising middle class, which in turn should lead to sustainable consumption growth. Moreover, relative to other emerging market regions, Asia is a net importer of oil and commodities, hence most Asian economies are benefitting from the low oil price. This should also feed through to corporate profit margins. However, global investor flows and sentiment still have a significant, and potentially negative, impact on Asian markets.

Europe remains in a slow recovery characterized by low growth and muted inflationary pressures. The European Central Bank's monetary policy has been accommodative, maintaining negative interest rates. Additionally, low oil prices are positive for most European economies, as Europe is the world's largest net importer of oil. Nonetheless, there are still risks for European investors, including doubts around the potential impact of currency movements and challenging global economic conditions affecting the European region. However, as we mention in our "Case for Europe" whitepaper that immediately follows this letter, the European economy is more diverse and complex than just the stock markets, and opportunities abound for "bottom-up" stock selectors to find attractive investments amidst the turmoil.

At Henderson we believe that active management and good security selection remains the primary driver of long-term performance for our portfolios, and we remain focused on seeking out attractive global investment opportunities that can bring value to our clients' portfolios. Now, as much as ever, we believe the "Henderson Difference" is a key factor in helping to manage funds that are truly differentiated from the competition. We appreciate your trust in, and support of, our Funds, and we look forward to serving your financial needs in the years to come.

James G. O'Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

1

Europe comprises liquid, well-regulated markets that offer exposure to all major sectors. The market's depth and breadth, with its regional variations and, at times, political uncertainty, provide investors with a wealth of opportunities across the market capitalization scale. Here we look at key market drivers for the region and explore the opportunities and risks they present.

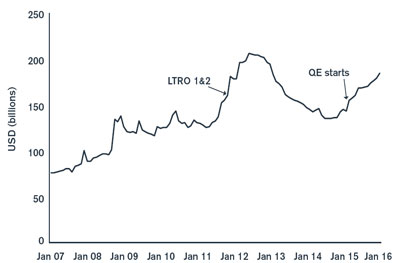

Accommodative monetary policy

European Central Bank (ECB) President Mario Draghi remains committed to exploring extraordinary monetary policy measures, as evidenced by record low interest rates and the ongoing $65 billion per month asset purchase program (now extended until March 2017 'or beyond'). These are alongside other measures, such as the Longer-Term Refinancing Operations (LTROs) and Outright Monetary Transactions (OMT). The ECB has been concerned by the low rate of growth in the Eurozone and these stimulus measures support the case for a stronger regional recovery.

While questions remain about how effective these initiatives can be, the fact that the ECB is committed to decisive action to create inflationary pressures should help to steady nerves.

Chart 1 – ECB total assets

Source: Henderson Global Investors, as of 1/5/16. Note: Base year December 2007

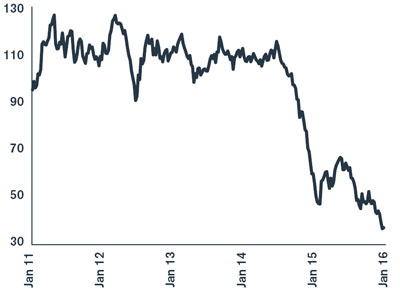

Tailwind from low oil price

A sustained period of low oil prices would be a major positive for most European economies, putting more money into the pockets of consumers, while also helping to reduce the region's notoriously high industry energy costs – Europe is the world's largest net importer of oil and related products (approximately $406 billion in 2014). There are concerns, however, that lower oil prices could fuel a deflationary trend, while falling oil prices have also had a negative impact on oil producers and oil services companies based in Europe.

Chart 2 – Falling oil prices - good for businesses and consumers, but possibly deflationary

Source: Datastream, Brent crude oil price, US dollars per barrel, as of 1/8/16.

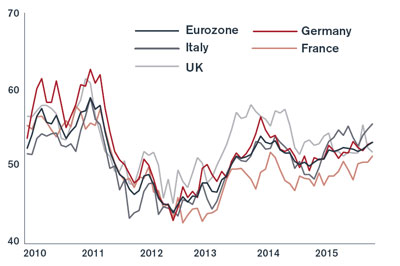

An improving economy

Europe remains in a slow and protracted recovery characterized by low growth and muted inflationary pressures. The region is no longer the weak link when it comes to the global economy, with Spain and Italy among the countries revising their expectations for growth upwards.

Purchasing managers' indices (PMIs), credit demand and wages data remain positive, while unemployment is falling. Nonetheless, there are pockets of uncertainty, with conditions in the global economy certainly more challenging than they were in recent years.

Chart 3 – Manufacturing PMIs still point to expansion

Source: Bloomberg, as of 1/4/16. A PMI above 50 suggests expansion in manufacturing activity, a leading indicator for the state of the broader economy.

2

Platform for earnings growth in Europe

Performance within European markets over the past few years has been driven primarily by a re-rating in valuations from very low levels, rather than any improvement in corporate earnings. One of the challenges for 2016 is whether the step-up in corporate earnings growth justifies higher valuations. There have been previous false starts – the strength of the euro weighed on corporate earnings between 2012 and 2014, while Europe's earnings recovery in 2015 was threatened by China's slowdown and the bear market in commodities. The hope is that the ECB's quantitative easing (QE) stimulus package, combined with a weaker euro and lower energy costs, can provide the impetus to drive corporate earnings higher.

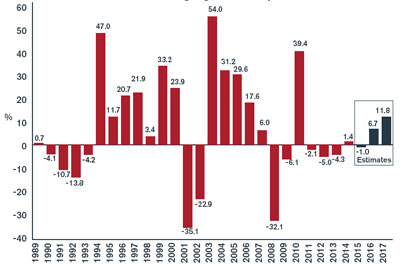

Chart 4 – Reasonable earnings growth expectations

Source: Henderson Global Investors, Goldman Sachs research, Citi group research, as of 12/31/15, including estimates for 2015, 2016 and 2017.

Europe - no longer cheap, but still offering value

European equities are no longer discounted relative to history. On a 12-month forward price-to-earnings basis the MSCI Europe Index is trading on a multiple of 15.5x earnings (as of 31 December 2015), compared to around 7.3x earnings in October 2008 and an historic average of 13.9x earnings. Nonetheless, European equities remain attractively priced relative to other regions and asset classes, particularly versus their US peers.

Sustained demand for quality stocks and alternative sources of income could well push price ratios higher, suggesting that the region still represents value on a selective basis. Many investors remain underweight the region, which should support future demand as reallocations are made. Any improvement in earnings growth in Europe should also be a catalyst for further gains.

Well diversified market

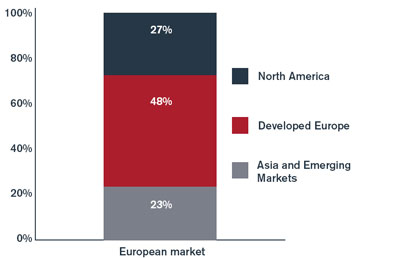

The global reach of European companies is evident in the breadth of their sources of revenue (see chart 5), with many European-listed businesses deriving a significant proportion of their revenues from overseas. This allows European equity portfolios to be adjusted towards those firms with exposure to the regions with the most compelling opportunities – both domestic and global.

Many businesses in the region also benefit from reliable future revenues, through long-term supply contracts and service level agreements. Well managed companies with these resilient attributes can outperform in both rising and falling markets.

Chart 5 – European companies: diverse revenue sources

Source: Henderson Global Investors, as of 9/30/15. Note: Totals may not add up to 100 due to rounding.

Summary

Despite the gradually improving economic outlook, the outlook for European equities is not without its risks. It is important to remember that the economy is not purely the stock market. Good stock selection remains the primary driver of long-term performance in Europe, with significant divergence in prospects across countries and sectors.

Among the visible risks, doubts remain around the potential impact of currency movements, following the US Federal Reserve's decision to begin normalizing interest rates and the potential ramifications of slowing growth in China. The success, or otherwise, of the ECB's attempts to inject inflation back into the European economy will of course have an impact. There is also the risk of political contagion, with the rise in anti-austerity sentiment likely to influence the future balance of power across the region, as seen in the Spanish election in December 2015. However, the region offers strength in depth when it comes to well managed companies with good growth prospects and stock selection is likely to remain key through 2016.

3

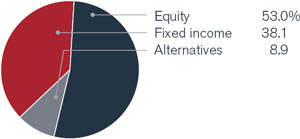

All Asset Fund

The second half of 2015 was arguably the most significant phase of global monetary policy since the US Federal Reserve Bank (Fed) concluded its quantitative easing program. In the US, the target for the Federal Funds rate was increased to 0.5% marking the first increase in the base rate in over nine years. The rate rise was cushioned by the reiteration that the path to interest rate normalization would be shallow, and reassurance that the Fed would remain pragmatic. In Europe, the European Central Bank (ECB) announced a 0.10% cut in the deposit rate and broadened the remit and extended the duration of its quantitative easing program.

In emerging markets, macroeconomic instability prompted by falling commodity prices was compounded by a major Chinese stock market correction, the severity of which forced the government to intervene to restore price stability. The Chinese authorities' devaluation of the renminbi versus the dollar was cited as the main catalyst for the sell-off. The effects of falling commodity prices, particularly oil, furthered the woes of the emerging markets bloc with Latin America faring particularly poorly.

For the six month period ended January 31, 2016, the Fund returned -6.60% (Class A at NAV) versus the benchmark, 3-month LIBOR (USD), which posted a return of 0.14%. The Fund's international equity holdings were the main detractor from performance with the continued appreciation of the dollar

| Top 10 long-term holdings* |

| (at January 31, 2016) |

| | | As a percentage |

| Security | | of net assets |

| TIAA-CREF Asset Management | | | 5.4 | % |

| Core Property Fund LP | | | | |

| iShares MSCI EAFE Minimum Volatility | | | | |

| Index Fund | | | 4.7 | |

| Henderson Unconstrained Bond Fund | | | 4.4 | |

| iShares TIPS Bond ETF | | | 4.4 | |

| iShares iBoxx Investment Grade | | | | |

| Corporate Bond Fund | | | 3.9 | |

| ASG Global Alternatives Fund | | | 3.7 | |

| Gateway Fund | | | 3.1 | |

| Calamos Market Neutral Income Fund | | | 3.0 | |

| PowerShares Senior Loan Portfolio | | | 2.9 | |

| Henderson Global Equity Income Fund | | | 2.8 | |

accentuating negative performance in the underlying markets. In dollar terms, European equities fell 16% and Japanese equities fell 12% over the period. Investor positioning also contributed as both Europe and Japan were widely held by market participants looking to benefit from the influx of liquidity due to easy monetary policy.

Key changes to the portfolio over the period were largely driven by monetary policy. The ECB's policy-easing announcement and increasingly hawkish rhetoric from the Fed underlined our belief that we are entering a phase of monetary divergence. We reflected this view by further increasing the Fund's weight in the policy-supportive environments of Japan and Europe at the expense of the UK and US and further increased hedging to both the euro and yen.

As an extension of this theme, we switched the Fund's direct exposure to emerging markets into an indirect position through the FTSE 100 Index which has a high proportion of emerging market-dependent earnings. We also sold the Fund's holding in the Russell 2000 Value ETF as falling global liquidity levels reduced our appetite for holding smaller market capitalization equities. Elsewhere in the portfolio, we increased the Fund's allocation to US investment grade credit and global high yield bonds, which we believe are more attractive than nominal treasury bonds in the face of rising interest rates and very attractive credit spreads.

Notwithstanding the recent market volatility, we remain relatively constructive on the macro environment as a whole. It is easy to forget that 2015 saw the fastest growth in the developed markets in five years. The US recovery appears solid and we have confidence that the Chinese authorities can effectively balance their competing policy objectives, although further monetary easing may be required.

In Europe and Japan, accommodative policy looks set to support sustained currency weakness and promote earnings growth; although, at the margin, monetary policy appears to be losing its effectiveness. The key risks remain a financial accident stemming from the emerging markets weakness, oil, or a major geopolitical event affecting all risk assets.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

All Asset Fund

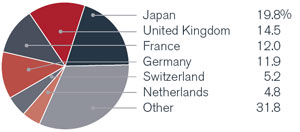

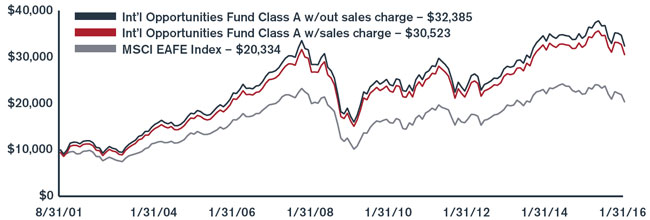

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

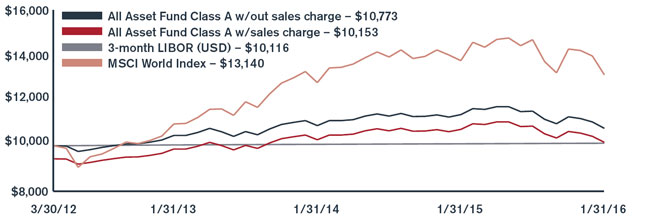

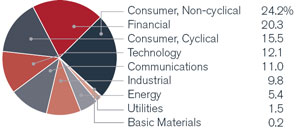

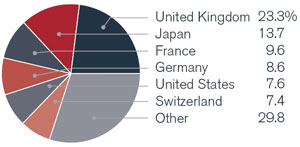

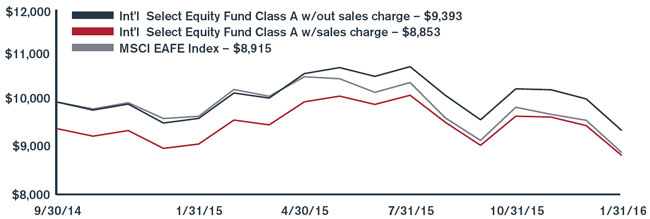

Investment comparison

Value of $10,000

| | | | | | | | | | | | | | | | | |

| Total returns as of January 31, 2016 | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | inception |

| At NAV | | | symbol | | months | | year | | years* | | (3/30/2012)* |

| Class A | | | HGAAX | | | -6.60 | % | | -5.35 | % | | 0.99 | % | | 1.96 | % |

| Class C | | | HGACX | | | -6.92 | | | -6.02 | | | 0.22 | | | 1.20 | |

| Class I | | | HGAIX | | | -6.37 | | | -5.01 | | | 1.28 | | | 2.24 | |

| Class R6** | | | HGARX | | | -6.36 | | | -5.01 | | | 1.29 | | | 2.24 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -11.94 | % | | -10.83 | % | | -0.98 | % | | 0.40 | % |

| Class C | | | | | | -7.92 | | | -6.02 | | | 0.22 | | | 1.20 | |

| Index | | | | | | | | | | | | | | | | |

| 3-month LIBOR (USD) | | | | | | 0.14 | % | | 0.26 | % | | 0.26 | % | | 0.30 | % |

| MSCI World Index | | | | | | -10.58 | | | -4.55 | | | 6.21 | | | 7.51 | |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.41%, 2.18%, 1.13% and 1.10% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.60% of the Fund's average daily net assets, which is in effect until July 31, 2020. With respect to investments in affiliated underlying funds, the Fund's adviser has contractually agreed to reduce or waive the Fund's management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund's management fee. Indirect net expenses associated with the Fund's investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) (USD) is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

Dividend & Income Builder Fund

Global equities performed poorly over a volatile six month period. Investor concerns centered on the speed of global economic growth (and lack thereof), and in particular the speed at which the Chinese economy is slowing following disappointing manufacturing data and an unexpected currency devaluation. Commodity prices were also under pressure, as the oil price fell below $30/barrel due to supply growth. Given the debate around the strength of the global economy, cyclical sectors, such as materials and financials, were among the worst performers, while traditionally more defensive sectors, such as telecommunications, utilities and consumer staples, fared better.

For the six month period ended January 31, 2016, the Fund returned -6.89% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of -10.58%. The Fund continued to meet its objectives for earning and distributing income over the period. Performance was led by stock selection in the Fund's underweight position in the US and overweight position in Europe. The fixed income allocation was also accretive over the period. The Fund further benefitted from its relatively defensive positioning, for example, an overweight position in the tobacco and telecommunications sectors. This was also reflected at the stock level where it tended to be the more defensive holdings such as Reynolds American, Orange and Imperial Tobacco that performed well, while more cyclical positions such as BHP Billiton and Royal Dutch Shell struggled. The

Top 10 long-term holdings*

(at January 31, 2016) | | | | |

| | | | As a percentage |

| Security/Issuer | | | of net assets |

| Microsoft Corp. | | | 2.9 | % |

| Imperial Tobacco Group plc | | | 2.5 | |

| Roche Holding AG | | | 2.5 | |

| Novartis AG | | | 2.4 | |

| Pfizer, Inc. | | | 2.2 | |

| RELX N.V. | | | 2.2 | |

| Verizon Communications, Inc. | | | 2.2 | |

| Reynolds American, Inc. | | | 2.2 | |

| Orange S.A. | | | 1.9 | |

| Nestle S.A. | | | 1.8 | |

outlier to this trend was the Fund's holding in the pharmaceutical company, Novartis. For a number of quarters, Novartis has had problems with a slowdown in growth and lower margins from its eye care division, Alcon. While the results were disappointing, they have taken measures to improve performance such as a reinvestment in research and development and putting in place a new head of the division.

In the equity allocation the Fund continued to seek companies with both above-average yield and dividend growth. The equity allocation remained over 80% of the Fund, reflecting the managers' current bias towards equities over bonds. While corporate earnings growth has remained mixed in recent years, dividend growth has proven more consistent. In comparison to other asset classes such as government or corporate bonds, it is our view that equities continue to have attractive valuations, especially given the prospects for ongoing dividend growth. In the fixed income allocation, we prefer credit over interest rate risk, continuing our strategy of investing in high quality names with attractive coupons.

Inflation has reached record lows in many developed economies, with government bond yields continuing to fall as investors "price in" monetary stimulus in Europe and delays to interest rate increases elsewhere. We believe equities, therefore, remain an attractive source of income for investors in many markets. Over the long term, dividends and dividend growth have provided a significant proportion of an investor's total equity return, and offer a compelling basis for valuing companies.

In an uncertain global growth environment, we are comfortable with the overweight positioning of the Fund in defensive sectors. Until we see evidence of improving top-line growth that can lead to operating leverage, we are likely to maintain this position. Within fixed income, credit markets now yield significantly more than a year ago. We now find markets much more interesting from a risk/reward perspective. As a result we have recently moderately increased the Fund's fixed income allocation to reflect relative value emerging here.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

Dividend & Income Builder Fund

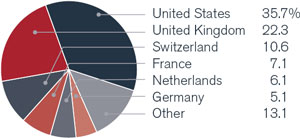

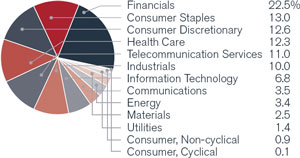

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

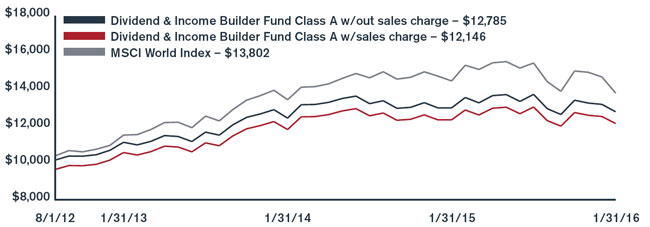

Investment comparison

Value of $10,000

| | | | | | | | | | | | | | | | | |

| Total returns as of January 31, 2016 | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | inception |

| At NAV | | | symbol | | months | | year | | years* | | (8/1/2012)* |

| Class A | | | HDAVX | | | -6.89 | % | | -1.62 | % | | 4.74 | % | | 7.26 | % |

| Class C | | | HDCVX | | | -7.23 | | | -2.30 | | | 3.96 | | | 6.47 | |

| Class I | | | HDIVX | | | -6.71 | | | -1.33 | | | 4.98 | | | 7.51 | |

| Class R6** | | | HDRVX | | | -6.47 | | | -1.07 | | | 5.07 | | | 7.59 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -11.55 | % | | -6.53 | % | | 2.97 | % | | 5.69 | % |

| Class C | | | | | | -8.23 | | | -2.30 | | | 3.96 | | | 6.47 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -10.58 | % | | -4.55 | % | | 6.21 | % | | 9.32 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.47%, 2.24%, 1.25% and 1.19% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.05% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Emerging Markets Fund

During the period, nervousness over the health of the Chinese economy continued to spread around the world. In what appeared a quite significant policy shift, the Chinese authorities allowed the yuan to move outside its normal band. Negative knock-on effects were felt in both commodity exporting countries and in the developed world, where many companies rely on a healthy Chinese market for their goods.

For the six month period ended January 31, 2016, the Fund returned -12.81% (Class A at NAV) versus the Fund's benchmark, the MSCI Emerging Markets Index, which returned -16.83%. While the Fund fell in value during the period, our strategy of owning quality companies trading at reasonable valuations meant it outperformed the index. Relative returns were helped by the Fund's limited exposure to China. This is based less on a macroeconomic view and more on, in our opinion, a lack of alignment between foreign minority shareholders and the Chinese government. Even when we analyze a healthy, state-owned company on a reasonable valuation, we worry it may be asked to do 'national service' which could include rescuing less healthy peers.

In Asia, recent short-term concerns regarding the Thai economy presented us with an opportunity to begin building a position in Mega Lifesciences, a consumer and healthcare product manufacturer. The company has a portfolio of popular branded products in Thailand, as well as a foothold in fast-growing

| Top 10 long-term holdings* |

| (at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Grupo Herdez SAB de CV | | | 3.7 | % |

| Shoprite Holdings, Ltd. | | | 3.5 | |

| Inversiones Aguas Metropolitanas S.A. | | | 3.4 | |

| Unilever plc | | | 3.3 | |

| Bank Pekao S.A. | | | 3.2 | |

| Cia Cervecerias Unidas S.A., ADR | | | 3.2 | |

| Housing Development Finance Corp., Ltd. | | | 3.2 | |

| Uni-President Enterprises Corp. | | | 3.1 | |

| Mahle-Metal Leve S.A. | | | 3.0 | |

| Standard Bank Group, Ltd. | | | 3.0 | |

frontier Asian markets, including Myanmar, via its distribution business. We also added a new position in Fuyao Glass, a Chinese privately-owned glass manufacturer that has built up a globally competitive business serving well-known auto manufacturers in the US and China, trading at an attractive valuation. Fuyao's founder remains with the company as Chairman, but a significant part of his share of the company has been donated to a charitable foundation.

Over the period, the Fund took the opportunity to initiate positions in two high quality banking franchises, Commercial International Bank in Egypt and Komercni Banca in the Czech Republic. Both banks exemplify characteristics we believe can lead to attractive long term returns. These banks operate under private control as opposed to state control which is often the case for many emerging market banks. Over the long-term these relatively simple banks tend to compound returns and gain market share at the expense of the bureaucratic state-controlled competition. Another market where we find similar banks offering attractive investment opportunities is India. The Fund holds a sizeable position in HDFC, a leading privately owned Indian financial institution.

During the period, the Fund also exited a number of positions including Jeronimo Martins, the Portuguese and Polish discount retailer, after strong performance of the company's shares left the valuation looking stretched. Finally, the Fund sold its position in SABMiller. With increasingly attractive opportunities elsewhere, we exited our position as shares appeared to fully reflect Anheuser-Busch InBev's merger offer.

Following a sustained period of poor stock and currency market performance relative to much of the developed world, some quality emerging market companies have become considerably less popular than they once were. As "bottom-up" stock pickers, we relish this opportunity to comb less popular markets for quality companies trading at reasonable valuations.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

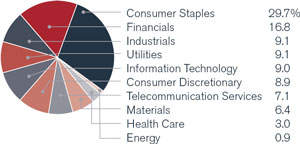

Emerging Markets Fund

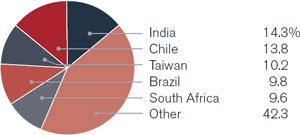

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2016 | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | months | | year | | years* | | years* | | (12/31/2010)* |

| Class A | | | HEMAX | | | -12.81 | % | | -16.41 | % | | -6.32 | % | | -4.82 | % | | -5.06 | % |

| Class C | | | HEMCX | | | -13.17 | | | -17.05 | | | -7.06 | | | -5.55 | | | -5.78 | |

| Class I | | | HEMIX | | | -12.70 | | | -16.20 | | | -6.12 | | | -4.61 | | | -4.84 | |

| Class R6** | | | HEMRX | | | -11.74 | | | -15.27 | | | -5.78 | | | -4.40 | | | -4.63 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -17.78 | % | | -21.24 | % | | -8.16 | % | | -5.94 | % | | -6.16 | % |

| Class C | | | | | | -14.17 | | | -17.05 | | | -7.06 | | | -5.55 | | | -5.78 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | -16.83 | % | | -20.62 | % | | -8.91 | % | | -5.23 | % | | -5.56 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 2.14%, 2.91%, 1.86% and 1.78% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.54% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

European Focus Fund

Market volatility which began in August dominated the third quarter of 2015, with European equities suffering in tandem with equities worldwide. Concerns over global implications of a slowing Chinese economy precipitated a global sell-off which extended to Europe. German equities, in particular, were hit quite hard due to their export relationship with China, while autos were a notable sufferer on an industry level due to the slowdown in the Chinese economy, as well as the Volkswagen emissions scandal.

Following the noted market volatility, there were growth expectation downgrades in Europe. The third quarter also saw a new bailout agreement between Greece and the European Union, and a snap election was called shortly afterwards with the incumbent Syriza party remaining as the largest party in the Greek parliament. European equities did produce a strong final quarter of the year with December recovering some steep losses incurred in the first half of the month. European Central Bank President Mario Draghi announced the extension of their quantitative easing program in December while also cutting the deposit rate to a historic low. This indicated to markets that the central bank is willing to take whatever policy action is necessary to support the burgeoning recovery. January proved to be a negative month for global risk assets, and European equity markets fell steeply as investors were gripped by nervousness. China fears, a further slump in oil, a broader slowdown in emerging markets and rising

| Top 10 long-term holdings* |

| (at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Nokia Oyj | | | 8.6 | % |

| BG Group plc | | | 4.9 | |

| Teva Pharmaceutical Industries, Ltd., ADR | | | 4.0 | |

| Roche Holding AG | | | 3.9 | |

| AstraZeneca plc | | | 3.7 | |

| Poste Italiane SpA | | | 2.8 | |

| ASML Holding N.V. | | | 2.7 | |

| Barclays plc | | | 2.6 | |

| Dufry AG | | | 2.5 | |

| Renault S.A. | | | 2.5 | |

chatter of a US recession were some of the headlines that dominated January's trading.

For the six month period ended January 31, 2016, the Fund returned -15.17% (Class A at NAV) versus the Fund's benchmark, the MSCI Europe Index, which posted a return of -15.17%. Positive returns were driven from health care and IT exposure; Genmab, Alcatel-Lucent and Nokia were highlights. However, gains were negated by the overweight to consumer discretionary; Volkswagen, NH Hotel Group and Liberty Global were among the biggest drags. Barclays was the biggest detraction to overall Fund performance.

During the period the Fund took advantage of the adverse price movements in emerging markets-exposed companies, for example, British oil services provider Amec Foster Wheeler and asset manager Aberdeen Asset Management. AstraZeneca, the pharmaceuticals company, was also added as the Fund increased its health care exposure. Exposure to financials was increased towards the end of 2015 with the inclusion of Dutch bank ABN Amro after it was re-listed on the Amsterdam stock exchange.

The Fund initiated a hedge on the euro via a short forward currency contract in the third quarter in case of any adverse movements versus the US dollar; this was subsequently closed in January via an equal and offsetting long forward currency contract as we feel we have seen the best of a very strong US dollar.

We are facing a potentially more volatile period for equities globally but this will present more opportunities at the stock level. This is especially valid in equities that have sensitivity towards emerging markets. While economic expectations have been pared back for Europe, we remain confident in the European recovery and are constructive for 2016.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

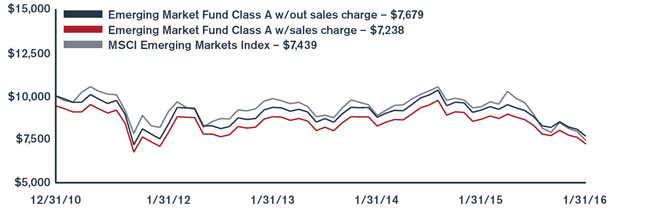

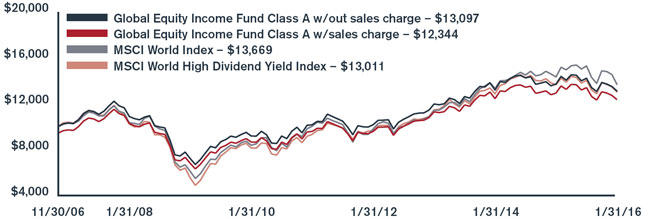

European Focus Fund

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

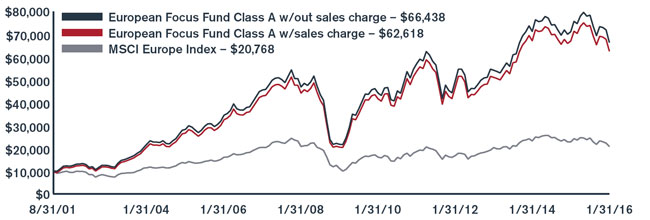

Investment comparison

Value of $10,000

| | | | | | | | | | | | | | | | | | | | | | | |

| Total returns as of January 31, 2016 | | | | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | months | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFEAX | | | -15.17 | % | | -6.54 | % | | 7.04 | % | | 3.11 | % | | 6.79 | % | | 14.03 | % |

| Class C | | | HFECX | | | -15.52 | | | -7.28 | | | 6.21 | | | 2.32 | | | 5.97 | | | 13.18 | |

| Class I** | | | HFEIX | | | -15.10 | | | -6.32 | | | 7.30 | | | 3.40 | | | 6.98 | | | 14.18 | |

| Class R6*** | | | HFERX | | | -15.08 | | | -6.30 | | | 7.31 | | | 3.40 | | | 6.98 | | | 14.18 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -20.05 | % | | -11.90 | % | | 4.95 | % | | 1.90 | % | | 6.16 | % | | 13.56 | % |

| Class C | | | | | | -16.52 | | | -7.28 | | | 6.21 | | | 2.32 | | | 5.97 | | | 13.18 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | -15.17 | % | | -8.77 | % | | 0.79 | % | | 2.27 | % | | 2.61 | % | | 5.21 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.31%, 2.10%, 1.08% and 1.01% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

Global Equity Income Fund

The six months ended January 31, 2016 were a weak period for equity markets as resilient economic data from countries such as the US and UK were offset by concerns over the speed of global economic growth and the knock-on effects of a lower oil price. Investor concern was once again focused on China as disappointing economic data (such as manufacturing figures) reignited the debate about the speed at which their economy is slowing. The oil price was also making headline news as it fell to a low of $27/barrel, causing the energy sector to be among the worst performing sectors globally.

For the six month period ended January 31, 2016, the Fund returned -7.84% (Class A at NAV) versus the benchmark, MSCI World Index, which posted a return of -10.58%. The Fund continued to meet its objectives for earning and distributing income over the period. Positive relative performance was largely due to the Fund's defensive positioning in certain sectors. This was reflected at the stock level where the best performing stocks tended to be defensive, such as telecommunications companies Verizon and Orange as well as pharmaceutical company GlaxoSmithKline. One of the Fund's weakest performing sectors was in financials where stocks such as HSBC and Barclays performed poorly. As global growth expectations have declined, this has pushed out expectations of further interest rate

| Top 10 long-term holdings* |

| (at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Novartis AG | | | 3.2 | % |

| Roche Holding AG | | | 2.9 | |

| HSBC Holdings plc | | | 2.8 | |

| British American Tobacco plc | | | 2.6 | |

| Royal Dutch Shell plc, A Shares | | | 2.3 | |

| BAE Systems plc | | | 2.2 | |

| Verizon Communications, Inc. | | | 2.2 | |

| GlaxoSmithKline plc | | | 2.1 | |

| BP plc | | | 2.1 | |

| DUET Group | | | 2.1 | |

increases in the US and an initial rate hike in countries such as the UK. If interest rates remain at current low levels this has an implication for banks' margin progression, and in turn, future earnings and dividend growth.

Investments continue to be focused on those companies capable of delivering earnings and free cash flow growth, subsequently leading to dividend growth. A good example of this would be the telecommunications sector where for several years these companies have been investing heavily in expanding fourth generation ('4G') coverage for customers, and this capital expenditure is beginning to roll over (boosting cash generation) at the same time data usage among customers is increasing.

Our work around dividends is showing that dividend growth is still reported in most markets around the world, but that growth should moderate this year compared to 2015. There is also a need to be quite selective with dividend investing in 2016 as there are, in our view, more dividends 'at risk' due to low commodity prices.

The Fund's strategy of seeking a high dividend yield naturally draws us to markets which are higher yielding, such as the UK and Europe. In Europe in particular, we are encouraged by the loose monetary conditions put in place by the European Central Bank and improving economic growth.

Looking to 2016, we expect global economic growth to continue at a moderate pace. In this environment, many companies are struggling to achieve the level of organic sales growth necessary to grow operating margins. For this reason we expect earnings growth in most areas to continue to be modest. Given this backdrop, the Fund is positioned defensively with a significant weighting in sectors such as telecommunications, utilities and pharmaceuticals.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

12

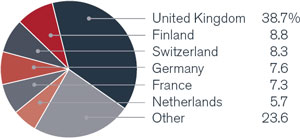

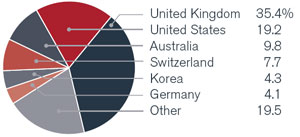

Global Equity Income Fund

| | |

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

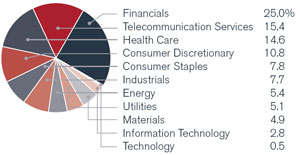

Investment comparison

Value of $10,000

| | | | | | | | | | | | | | | | | | | | |

| Total returns as of January 31, 2016 | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | months | | year | | years* | | years* | | (11/30/2006)* |

| Class A | | | HFQAX | | | -7.84 | % | | -4.44 | % | | 3.06 | % | | 5.22 | % | | 2.99 | % |

| Class C | | | HFQCX | | | -8.19 | | | -5.15 | | | 2.24 | | | 4.42 | | | 2.21 | |

| Class I** | | | HFQIX | | | -7.74 | | | -4.24 | | | 3.31 | | | 5.48 | | | 3.19 | |

| Class R6*** | | | HFQRX | | | -7.50 | | | -3.98 | | | 3.40 | | | 5.54 | | | 3.22 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -13.15 | % | | -9.95 | % | | 1.05 | % | | 3.98 | % | | 2.32 | % |

| Class C | | | | | | -9.19 | | | -5.15 | | | 2.24 | | | 4.42 | | | 2.21 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | -10.58 | % | | -4.55 | % | | 6.21 | % | | 6.39 | % | | 3.50 | % |

| MSCI World High Dividend Yield Index | | | | | | -7.22 | | | -4.62 | | | 4.33 | | | 6.91 | | | 2.93 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.19%, 1.96%, 0.96% and 0.89% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.15% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within the MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

Global Technology Fund

It was a volatile period for the technology market which underperformed during the third quarter of 2015 as international equity sell-offs, which began in China, spread globally. The final quarter of the year saw international equity markets bounce back. Central banks dominated the news flow as the European Central Bank extended its quantitative easing program and the US Federal Reserve Bank hiked interest rates for the first time this cycle. Technology outperformed the broader market against this backdrop. The start of 2016 has seen heightened volatility and January was a negative month for global risk assets due to ongoing fears over China, a further slump in oil and a broader emerging markets slowdown. The volatility and fears of a macro slowdown led the technology index lower; however, over the period the MSCI World IT index outperformed the broader market.

For the six month period ended January 31, 2016, the Fund returned -7.38% (Class A at NAV) versus the benchmark, MSCI AC World IT Index, which posted a return of -5.22%. Stock specifics within semiconductors and semiconductor equipment sectors were the biggest detractor to performance, with NXP Semiconductors and SK Hynix among the biggest drags. The underweight in software was also detrimental. In particular, the Fund underperformed over the period as a result of not holding Microsoft, though a position has been taken in the company

Top 10 long-term holdings*

(at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Facebook, Inc., Class A | | | 6.9 | % |

| Alphabet, Inc., Class C | | | 6.2 | |

| Apple, Inc. | | | 6.0 | |

| Alphabet, Inc., Class A | | | 4.8 | |

| Visa, Inc., A Shares | | | 4.0 | |

| Samsung Electronics Co., Ltd. | | | 3.7 | |

| Cisco Systems, Inc. | | | 3.3 | |

| Tencent Holdings, Ltd. | | | 3.1 | |

| Avago Technologies, Ltd. | | | 2.8 | |

| MasterCard, Inc., Class A | | | 2.8 | |

subsequent to period end. The main positive contributors came from within the exposure to internet software & services, and technology hardware storage & peripherals sectors. SanDisk, Alphabet and NetEase were leading positions.

Notable activity over the period included the sale of Oracle and switch into Adobe. We believe the former will face challenges against more nascent software offerings. Adobe is positioned well in its creative product offering and the transition to a subscription model makes it relatively attractive. We increased our holding in Facebook given its dominant position in internet advertising. A new position was initiated in Paypal post the pullback, given the company's exposure to the faster growth areas of our paperless payments theme, its strong platform and reasonable valuation. We sold Netflix as we believed that valuation had gotten excessive following a strong run. We reduced more macro-sensitive names such as Cisco, HP Enterprise and Ciena. We have been actively reducing our higher beta positions, increasing our cash position and trying to position the portfolio more defensively.

While further rounds of global quantitative easing are occurring, the uncertain economic environment continues to curtail capital spending, including technology expenditure. In addition, the strengthening dollar is proving an increasing headwind for US technology companies. However, longer term, we believe the technology sector is attractive as it continues to take share in the economy and valuations remain reasonable relative to the rest of the market, especially given its balance sheet strength.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

14

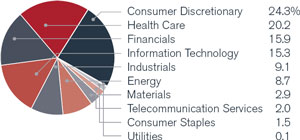

Global Technology Fund

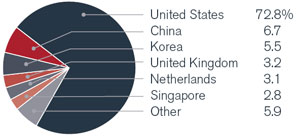

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

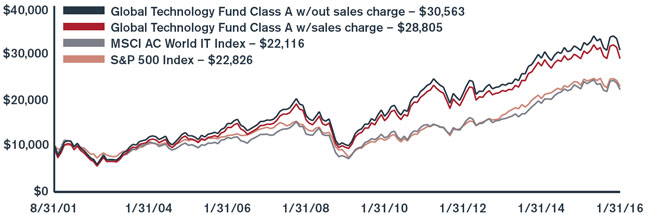

Investment comparison

Value of $10,000

| Total returns as of January 31, 2016 | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | months | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFGAX | | | -7.38 | % | | 0.33 | % | | 9.64 | % | | 6.59 | % | | 7.54 | % | | 8.06 | % |

| Class C | | | HFGCX | | | -7.78 | | | -0.53 | | | 8.78 | | | 5.76 | | | 6.72 | | | 7.25 | |

| Class I** | | | HFGIX | | | -7.28 | | | 0.49 | | | 9.89 | | | 6.86 | | | 7.73 | | | 8.19 | |

| Class R6*** | | | HFGRX | | | -7.03 | | | 0.75 | | | 9.99 | | | 6.92 | | | 7.76 | | | 8.21 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -12.69 | % | | -5.43 | % | | 7.49 | % | | 5.34 | % | | 6.91 | % | | 7.61 | % |

| Class C | | | | | | -8.78 | | | -0.53 | | | 8.78 | | | 5.76 | | | 6.72 | | | 7.25 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | -5.22 | % | | -0.40 | % | | 12.08 | % | | 8.97 | % | | 6.53 | % | | 5.69 | % |

| S&P 500 | | | | | | -6.77 | | | -0.67 | | | 11.30 | | | 10.91 | | | 6.48 | | | 5.92 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.35%, 2.13%, 1.12% and 1.04% (estimated), respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

High Yield Opportunities Fund

The US high yield market suffered steep declines over the period driven by unclear US Federal Reserve Bank expectations, languishing commodity prices, persistent retail outflows and emerging market growth concerns. For most of the period, higher quality rated bonds (double-B) outperformed lower quality rated bonds (triple-C) while both energy and metals/mining were the worst performing sectors. The energy sector now represents over 24% of the emerging market high yield market as compared to 10% for US high yield and only 6% for European high yield. By region, European high yield outperformed both US high yield and emerging market high yield.

Throughout 2015, retail fund flows were negative (-$13.4 billion) and new issuance was 18% below last year's rate. Over the same period, approximately 73% of all defaults and distressed debt exchanges ($48 billion) occurred in the energy and metals and mining (mostly coal) sectors; excluding these sectors, the trailing 12-month default rate was only 0.34%.

For the six month period ended January 31, 2016, the Fund returned -5.29% (Class A at NAV) versus the benchmark, BofAML US High Yield Master II Constrained Index, which returned -7.84%. Over the period, the Fund benefitted from maintaining a higher quality bias within the lower rating tiers. While an underweight allocation to double-B rated bonds was maintained, the Fund outperformed on strong

Top 10 long-term holdings*

(at January 31, 2016) |

| | | | As a percentage |

| Security/Issuer | | | of net assets |

| ILFC E-Capital Trust II | | | 2.9 | % |

| Post Holdings, Inc. | | | 2.1 | |

| Argos Merger Sub, Inc. | | | 2.0 | |

| Orbital ATK, Inc. | | | 1.9 | |

| Plastipak Holdings, Inc. | | | 1.9 | |

| RCN Telecom Services LLC | | | 1.9 | |

| CCO Holdings LLC | | | 1.8 | |

| First Data Corp. 2015 Term Loan | | | 1.8 | |

| Group 1 Automotive, Inc. | | | 1.8 | |

| MacDermid, Inc. | | | 1.7 | |

credit selection, an allocation to loans and an underweight stance in the energy sector. Though the Fund incurred some losses in the energy sector, it benefitted from a higher quality bias in this space. The Fund's best sector and contributors were in defensive industries like healthcare and media, while the worst detractors were almost exclusively in the energy and mining segments.

The portfolio is currently positioned firmly below the benchmark in terms of credit risk as measured by yield and spread, and in-line with weighted average credit ratings. Within the energy sector, we remain underweight versus the benchmark and have focused on higher quality exploration and product companies as well as midstream companies. We continue to remain underweight in the energy service sector. We remain cautious on the metals mining and steel sectors (on both an allocation and a credit quality basis).

We continue to view default risk in excess of consensus expectations (2-3%) and highly dependent on what happens in the energy space. We believe that $40/barrel oil for sustained periods will be troublesome for the default outlook in US high yield. We continue to be selective in the new issue calendar as we are witnessing declining credit quality in this market as measured by higher leverage, less robust covenants and smaller equity contributions in leveraged buyout deals. We are not seeing much value in the US leveraged loan market at the moment and have pared back our exposure from the 8% peak level that we reached in the first quarter of 2015 to 4% currently. We are monitoring opportunities in the investment grade rated commodity sector as well as the energy pipeline sector.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

16

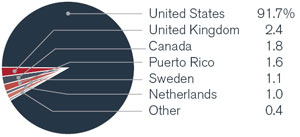

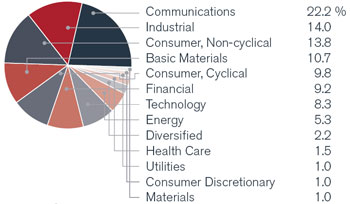

High Yield Opportunities Fund

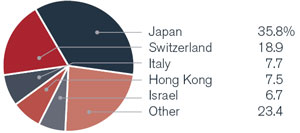

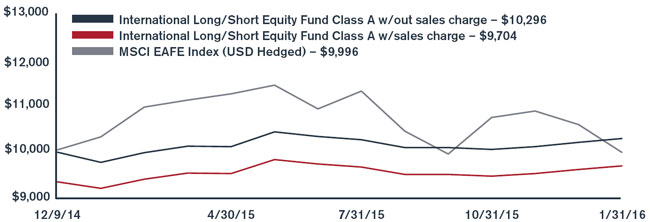

| Portfolio composition by country | Portfolio composition by sector |

| (as a % of long-term investments) | (as a % of long-term investments) |

| | |

| |

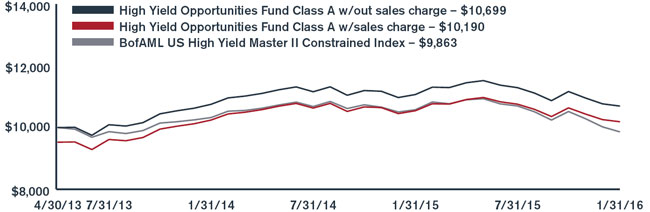

Investment comparison

Value of $10,000

| | | | | | | | | | | | | | |

| Total returns as of January 31, 2016 | | | | | | | | | | | | Since |

| | | | NASDAQ | | Six | | One | | inception |

| At NAV | | | symbol | | months | | year | | (4/30/2013)* |

| Class A | | | HYOAX | | | -5.29 | % | | -3.38 | % | | 2.48 | % |

| Class C | | | HYOCX | | | -5.60 | | | -4.18 | | | 1.71 | |

| Class I | | | HYOIX | | | -5.16 | | | -3.16 | | | 2.74 | |

| Class R6** | | | HYORX | | | -5.26 | | | -3.27 | | | 2.70 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -9.76 | % | | -8.01 | % | | 0.68 | % |

| Class C | | | | | | -6.60 | | | -4.18 | | | 1.71 | |

| Index | | | | | | | | | | | | | |

| BofAML US High Yield Master II Constrained Index | | | | | | -7.84 | % | | -6.76 | % | | -0.43 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments. Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.39%, 2.01%, 1.16% and 1.16% (estimated), respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.85% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

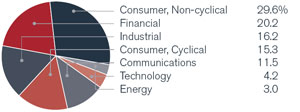

International Long/Short Equity Fund

The third quarter of 2015 saw international equity markets fall as concerns over slowing Chinese economic growth and the surprise decision to allow the yuan to move outside the fixed band against the dollar sounded the starting gun for a global sell-off. Asian markets reacted negatively to Chinese events, not welcoming the prospect of a more export-competitive China or the prospect of weakening demand from a huge market for consumption of many countries in the region's exports. European markets were weak and markets in Japan also declined as enthusiasm for Abenomics and quantitative easing waned after failing to jolt the economy back to life. International equity markets bounced back in the final quarter; central banks dominated the news flow as the European Central Bank extended its quantitative easing program while the US Federal Reserve Bank hiked interest rates for the first time this cycle. Japanese markets produced the best returns on the back of their gross domestic product growth revision from a recessionary number to an expansionary one. Asian markets were also positive following some well received policy action from China, including a rate cut. The start of 2016 saw a sharp sell-off with China once again the main area of concern where authorities intervened with trading halts and liquidity injections which further weakened the Chinese currency. A further slump in oil drove other commodity prices

Top 5 "Long" Holdings (including equity swaps)*

(at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| BG Group plc | | | 4.1 | % |

| Nokia Oyj | | | 3.6 | |

| Roche Holding AG | | | 3.5 | |

| Dufry AG | | | 3.3 | |

| Poste Italiane SpA | | | 3.3 | |

Top 5 "Short" Holdings (including equity swaps)*

(at January 31, 2016) |

| | | | As a percentage |

| Security | | | of net assets |

| Neste Oyj | | | (3.4 | )% |

| ICA Gruppen AB | | | (3.0 | ) |

| Kuehne & Nagel International AG | | | (2.9 | ) |

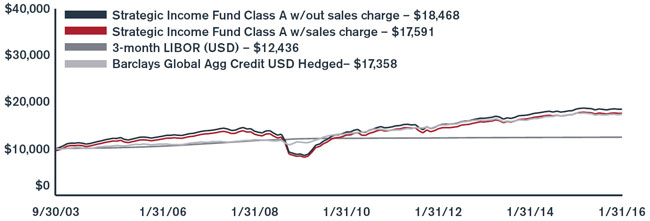

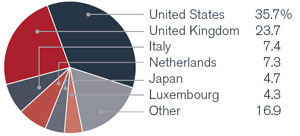

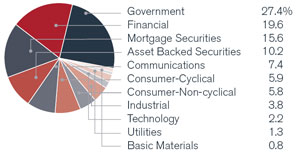

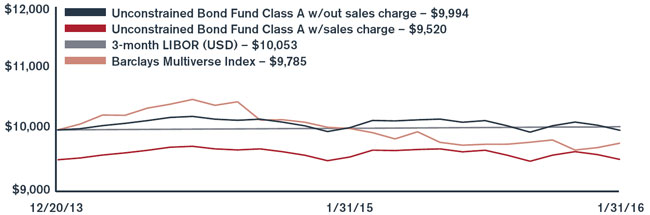

| SSE Plc | | | (2.8 | ) |