Washington, D.C. 20549

Item 1: Report to Shareholders.

| Letter to shareholders | 1 |

| Commentaries and Performance summaries | |

| All Asset Fund | 4 |

| Dividend & Income Builder Fund | 6 |

| Emerging Markets Fund | 8 |

| European Focus Fund | 10 |

| Global Equity Income Fund | 12 |

| Global Technology Fund | 14 |

| High Yield Opportunities Fund | 16 |

| International Long/Short Equity Fund | 18 |

| International Opportunities Fund | 20 |

| International Small Cap Fund | 22 |

| Strategic Income Fund | 24 |

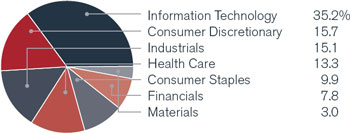

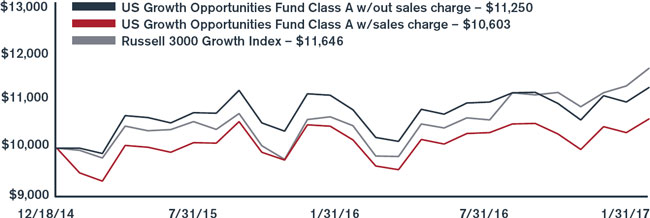

| US Growth Opportunities Fund | 26 |

| Portfolios of investments | 28 |

| Statements of assets and liabilities | 102 |

| Statements of operations | 110 |

| Statements of changes in net assets | 118 |

| Statements of changes – capital stock activity | 130 |

| Statement of cash flows | 152 |

| Financial highlights | 154 |

| Notes to financial statements | 178 |

| Other information | 194 |

| Trustees and officers | 201 |

International and emerging markets investing involves certain risks and increased volatility not associated with investing solely in the US. These risks include currency fluctuations, economic or financial instability, lack of timely or reliable financial information or unfavorable political or legal developments. The Funds may invest in securities issued by smaller companies which typically involve greater risk than investing in larger companies. Certain of the Funds are non-diversified and therefore the change in value of a single holding may have a more pronounced effect on a Fund's performance. Also, the Funds may invest in limited geographic areas and/or sectors which may result in greater market volatility. In addition, the Funds may invest in derivatives. Derivatives involve special risks different from, and potentially greater than, the risks associated with investing directly in securities and may result in greater losses. The Funds may be subject to frequent trading which may result in a turnover rate of 100% or more. Additional fund-specific risk is described in more detail in the Prospectus and Statement of Additional Information.

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains these items and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

Dear shareholder,

We are pleased to provide the semi-annual report for the Henderson Global Funds, which covers the six months ended January 31, 2017.

The past six months have been dominated by geo-political uncertainty and a fundamental shift in global monetary policy. The US posted strong returns in 2016 with almost half of the year's performance coming after the election of Donald Trump, as investors bet that the President's commitment to swift tax cuts, larger infrastructure spending and tough renegotiations of trade deals would translate into stronger economic growth and topline revenue for businesses.

In Europe and the United Kingdom, political uncertainty has also caught the attention of investors. The UK has now begun to implement its 'Brexit' strategy by sending the Article 50 legislation, a part of European Union law that sets out the process to withdraw from the EU, to the British Parliament for approval. Outside of the UK, there are tight presidential races in France and Germany to be decided in the second half of 2017, where candidates have different views on globalism and the role of the EU. In the face of this uncertainty, Europe and the UK continue to post better than expected economic growth and improving fundamentals: higher wage growth, lower unemployment, and double digit earnings growth forecasted for 2017.

Emerging markets had a strong start to 2016 but struggled in the final months of the year, with the MSCI Emerging Markets Index falling 4% after the US elections and emerging markets funds (including ETFs) shedding $3.5 billion in the final two months of the year, reversing the trend of consecutive five months of inflows. The main reasons for the pullback: a stronger US Dollar, a rising US interest rate environment and the uncertainty of trade negotiations under the Trump administration.

Global fixed income continued its rally as interest rates remained low in much of the developed world. By the end of 2016, there was roughly $35.6 trillion in outstanding government debt globally, and of that amount, over 70% was yielding 1% or less. However, a shift has begun from monetary stimulus to better fiscal policy, and as such central banks have begun to slow their quantitative easing programs: the Bank of Japan announced in September that they will stop expanding their balance sheet; the European Central Bank announced a reduction to €60 billion in purchases through end of 2017; and the US Fed implemented their second interest rate hike in a decade. This fundamental shift will have a profound impact on bond markets in 2017, highlighting the need for high performing active managers.

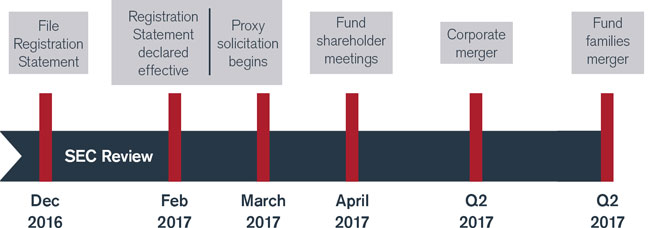

Also during the period, on October 3, 2016, Henderson Global Investors announced its intention to merge with Janus Capital Group. The merger, slated for the second quarter of 2017, will create a truly global active management firm with $320B in assets under management (as of 9/30/16). The new firm will offer a broader range of investment options and the combined resources of Henderson and Janus. Please see the following pages for more information on the effect of the Plan of Reorganization for the Henderson Global Funds which has been approved by its Board. Subject to satisfaction of closing conditions, including approval by shareholders of the participating Funds, included is an anticipated timeline for the integration. We hope this information gives you a sense of what to expect in the coming months as we approach the anticipated merger close date.

As always, we appreciate your trust in and support of our Funds, and we look forward to serving your financial needs in the years to come.

James G. O'Brien

President, Henderson Global Funds

Investors should consider the investment objectives, risks, charges and expenses of a mutual fund carefully before investing. For a free Prospectus, which contains this and other important information about the Funds, visit www.henderson.com. The Prospectus should be read carefully before investing.

1

| Proposed reorganization of Henderson Funds |

Please see the tables below for the effect of the Plan of Reorganization for the Henderson Global Funds.

Existing Funds proposed to be offered in Janus Henderson Fund family

(The portfolio managers currently managing each of the following Henderson Funds are anticipated to serve as the portfolio managers of the corresponding Janus Henderson Fund, subject to the same investment objectives, principal investment strategies and risks as the corresponding Henderson Fund.)

| Henderson Fund name | Janus Henderson Fund name | | Inception

date |

| Henderson All Asset Fund | Janus Henderson All Asset Fund | | 3/30/12 |

| Henderson Dividend & Income Builder Fund | Janus Henderson Dividend & Income Builder Fund | | 8/01/12 |

| Henderson Emerging Markets Fund | Janus Henderson Emerging Markets Fund | | 12/31/10 |

| Henderson European Focus Fund | Janus Henderson European Focus Fund | | 8/31/01 |

| Henderson Global Equity Income Fund | Janus Henderson Global Equity Income Fund | | 11/30/06 |

| Henderson International Opportunities Fund | Janus Henderson International Opportunities Fund | | 8/31/01 |

| Henderson International Long/Short Equity Fund | Janus Henderson International Long/Short Equity Fund | | 12/9/14 |

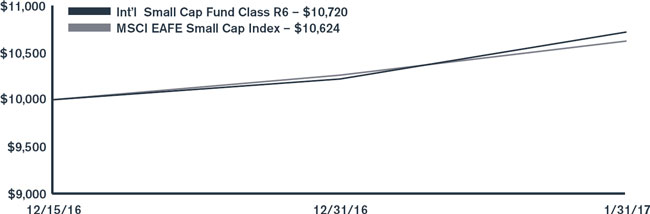

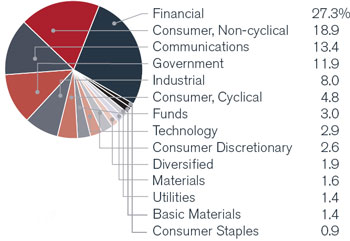

| Henderson International Small Cap Fund* | Janus Henderson International Small Cap Fund | | 12/15/16 |

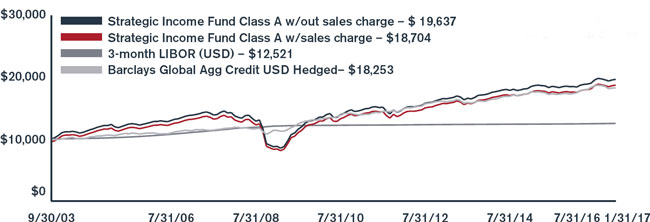

| Henderson Strategic Income Fund | Janus Henderson Strategic Income Fund | | 9/30/03 |

| Henderson US Growth Opportunities Fund | Janus Henderson US Growth Opportunities Fund | | 12/18/14 |

*Not available for public investment until merger completion in 2017

Proposed Fund merger into an existing Janus Fund, to be renamed

(The following Henderson Fund will merge into an existing Janus Fund and will be managed by the Janus Fund's current portfolio managers and according to the Janus Fund's existing investment process.

| Henderson Fund name | | Merged Fund name |

| Henderson Global Technology Fund | | Janus Henderson Global Technology Fund

(currently named Janus Global Technology Fund) |

The Henderson High Yield Opportunities Fund will not be transitioned to the Janus Henderson platform. Please see Note 10. Subsequent Events in the Notes to financial statements. At this time, the Fund's current portfolio manager continues to manage the Fund under its normal investment policies.

2

| Anticipated integration timetable |

Note: Dates are subject to approvals and may be subject to change

The foregoing is for informational purposes only and is not intended to, and shall not, constitute an offer to purchase or sell shares of any of the Funds in connection with the proposed Fund reorganizations, nor is it a solicitation of a proxy from any shareholder of the participating Henderson Global Funds.3 The solicitation of proxies will only be made by a final, effective registration statement on Form N-14, including a definitive proxy statement/prospectus.3 The proxy materials include important information about the proposed Fund reorganizations that shareholders of the participating Henderson Global Funds should carefully consider.

3

All Asset Fund

The latter-half of 2016 saw the start of a regime change in the global economy and financial markets. This was most clearly encapsulated by the recovery of inflation, after an 18-month period in which deflation and secular stagnation were overarching themes. The resulting moves in markets, which were accentuated by the US election, were characterized by a material shift from deflationary assets such as government bonds and gold towards more reflationary areas such as value and small cap equity styles, high yield and commodities. The focal point for the market rotation was the US, where investors interpreted the possibility of a major fiscal expansion in a late-cycle economy as highly inflationary. The period was characterized by a strong dollar and weak treasury market as a result.

For the six-month reporting period ended January 31, 2017, the Fund returned 1.91% (Class A at NAV) versus the benchmark, 3-month LIBOR (USD), which posted a return of 0.40%. The Fund's equity allocations were the largest contributors to performance, with US equities contributing the most. Elsewhere, the Fund's diversifying assets also added value with allocations to investment grade and high yield credit generating positive returns despite the

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| PIMCO Enhanced Short Maturity ETF | 5.2 | % |

| iShares TIPS Bond ETF | 4.5 | |

| iShares iBoxx Investment Grade | 4.0 | |

| Corporate Bond Fund | | |

| PowerShares Senior Loan Portfolio | 4.0 | |

| ASG Global Alternatives Fund, Class Y | 3.8 | |

| Henderson Emerging Markets Fund, | 3.8 | |

| Class R6 | | |

| Henderson High Yield Opportunities | 3.5 | |

| Fund, Class R6 | | |

| Henderson Global Equity Income Fund, | 3.2 | |

| Class R6 | | |

| AQR Equity Market Neutral Fund, Class R6 | 3.0 | |

| AQR Managed Futures Strategy Fund, | 2.9 | |

| Class R6 | | |

broader sell-off in sovereign bonds. The Fund's hedging assets were the worst performing area of the portfolio with defensive positions in US treasuries and gold suffering from the highly positive investor sentiment over the period.

Over the period, we made a number of portfolio changes in the run-up to, and immediate aftermath of, the US presidential election. Prior to the election, we reduced our emerging markets exposure through the sale of the iShares MSCI Emerging Markets ETF to reduce the sensitivity to a potential election shock while also taking profits on the position that had generated strong returns in the preceding six months.

Post-election, we entered two tactical trades, a position in the SPDR US Regional Banks ETF and the iShares Russell 2000 Value ETF. Both trades took advantage of the cyclical rotation that took place as investors priced in expansionary fiscal policy in the US. Both positions were highly successful, so much so that we exited the banks position in early-January and trimmed back our holding in the Russell 2000 Value ETF.

Looking forward, we continue to believe that we are entering a more supportive macro backdrop than we have seen in recent years. Growth and inflation across the global economy are normalizing and macro momentum is broadening. The challenge is that concurrent to this pick-up in economic growth, central banks are beginning to withdraw policy support and political shocks appear to be more frequent. Therefore, the potential for periods of market satisfaction to be disturbed by political shocks is high. With this in mind, we have balanced an increase in our allocation to risk assets with a renewed position in nominal treasuries. We prefer equities to bonds but are a long way from 'all-in'. A significant improvement in corporate earnings and a period of relative calm in the political sphere would likely be sufficient to draw us further in this direction.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

4

All Asset Fund

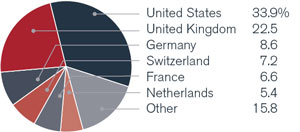

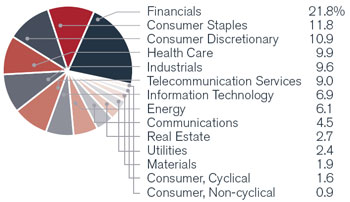

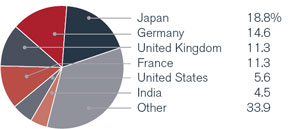

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | |

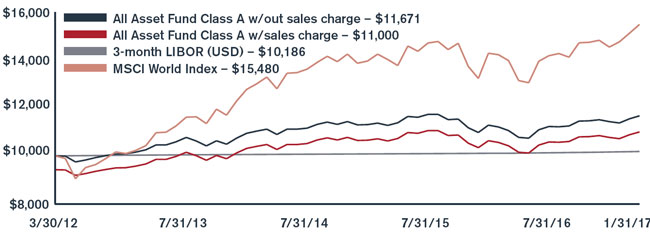

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | Since |

| | NASDAQ | | | Six | | One | | Three | | inception |

| At NAV | symbol | | | months | | year | | years* | | (3/30/2012)* |

| Class A | HGAAX | | | 1.91 | % | | 8.34 | % | | 2.32 | % | | 3.24 | % |

| Class C | HGACX | | | 1.51 | | | 7.46 | | | 1.58 | | | 2.47 | |

| Class I | HGAIX | | | 2.10 | | | 8.54 | | | 2.59 | | | 3.51 | |

| Class R6** | HGARX | | | 2.13 | | | 8.59 | | | 2.58 | | | 3.50 | |

| With sales charge | | | | | | | | | | | | | | |

| Class A | | | | -3.97 | % | | 2.12 | % | | 0.33 | % | | 1.99 | % |

| Class C | | | | 0.51 | | | 7.46 | | | 1.58 | | | 2.47 | |

| Index | | | | | | | | | | | | | | |

| 3-month LIBOR (USD) | | | | 0.40 | % | | 0.69 | % | | 0.39 | % | | 0.38 | % |

| MSCI World Index | | | | 5.20 | | | 17.81 | | | 6.55 | | | 9.56 | |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.40%, 2.16%, 1.13% and 1.09%, respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.60% of the Fund's average daily net assets, which is in effect until July 31, 2020. With respect to investments in affiliated underlying funds, the Fund's adviser has contractually agreed to reduce or waive the Fund's management fee to limit the combined management fees paid to the adviser for those assets to the greater of 1.00% or the affiliated underlying fund's management fee. Indirect net expenses associated with the Fund's investments in underlying investment companies are not subject to the contractual waiver. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. 3-Month LIBOR (London Interbank Offered Rate) (USD) is the interest rate participating banks offer to other banks for loans on the London market. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

Dividend & Income Builder Fund

Global equity markets rose during the six-month reporting period ended January 31, 2017. Within this period, the US market outperformed following the Republican victory in the US presidential election on the expectation of corporate tax reform and higher infrastructure spending. Other notable moves during the period included higher oil prices following an agreement from OPEC to curb production and higher US government bond yields following the election. Higher bond yields were driven by the expectation that expansionary fiscal policy could cause inflationary pressures to rise.

At the sector level, continued strength in economic data (such as US manufacturing production), meant cyclical sectors such as consumer discretionary and information technology performed well, while defensive sectors such as utilities and healthcare lagged.

For the six-month reporting period ended January 31, 2017, the Fund returned 0.80% (Class A at NAV) versus the benchmark MSCI World Index, which posted a return of 5.20%. The Fund continued to meet its income objectives over the period and is on track for annual dividend growth. Part of the reason for the underperformance was due to sector allocation, in particular, the overweight position in high dividend yield sectors such as telecommunications and consumer staples. The fixed income allocation was also a relative detractor over the period. At the individual stock level, the largest contributor to performance was Microsoft as it continues to successfully transition towards a subscription-based model for its software (such as Office 365).

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security/Issuer | of net assets |

| Microsoft Corp. | 2.9 | % |

| Pfizer, Inc. | 2.4 | |

| Nestle S.A. | 2.3 | |

| Imperial Brands plc | 2.2 | |

| Novartis AG | 2.0 | |

| Chevron Corp. | 2.0 | |

| RELX N.V. | 2.0 | |

| Roche Holding AG | 1.9 | |

| Siemens AG | 1.8 | |

| Orange S.A. | 1.8 | |

Where we have fundamental concerns regarding a currency or have a material overweight position relative to the benchmark, we often choose to hedge a portion of the currency risk. For example, over the referendum regarding EU membership in the UK, we hedged a material portion of our Sterling exposure. This was a positive contributor to performance and we have reduced our hedge following the subsequent fall.

Within the equity allocation, the Fund continues to seek companies with both above-average yield and dividend growth. The equity allocation remained over 80% of the Fund, reflecting the managers' current bias towards equities over bonds. While corporate earnings growth has remained mixed in recent years, dividend growth has proven more consistent. In comparison to other asset classes, such as government or corporate bonds, it is our view that equities continue to be a good value, especially given the prospects for ongoing dividend growth. Within the fixed income allocation, the managers prefer credit risk over interest-rate risk; continuing their strategy of investing in high quality companies with attractive coupons.

If corporate tax reforms and greater infrastructure spending in the US drive higher economic growth, US and global equities should benefit. Higher economic growth should allow for greater sales and earnings growth for companies; ultimately driving dividend growth for shareholders. We continue to believe this outlook favors our existing strategy of identifying companies that pay an attractive and sustainable dividend and that have the capacity to grow over the medium- to long-term.

Within the fixed income allocation, we are beginning to see value in corporate bond markets which have repriced with the recent move in interest rates. Whilst the shift to fiscal stimulus under President Trump and divergent monetary policy in the US versus other major developed markets provide fundamental support for higher yields, in the short term it looks increasingly stretched in our eyes and opportunities are presenting themselves. In general, we remain relatively untroubled by default concerns within the portfolio.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

6

Dividend & Income Builder Fund

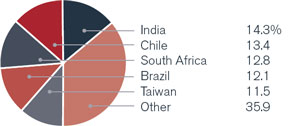

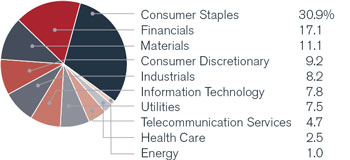

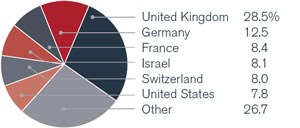

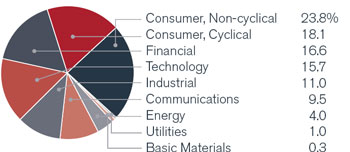

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | | |

| | |

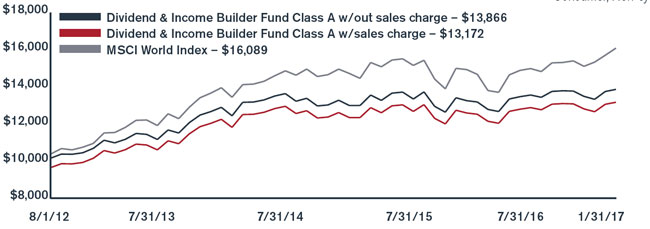

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | inception |

| At NAV | | | symbol | | | months | | year | | years* | | (8/1/2012)* |

| Class A | | | HDAVX | | | 0.80 | % | | 8.45 | % | | 3.68 | % | | 7.53 | % |

| Class C | | | HDCVX | | | 0.37 | | | 7.57 | | | 2.88 | | | 6.71 | |

| Class I | | | HDIVX | | | 0.94 | | | 8.71 | | | 3.93 | | | 7.77 | |

| Class R6** | | | HDRVX | | | 0.94 | | | 8.64 | | | 3.90 | | | 7.76 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | -4.24 | % | | 3.06 | % | | 1.92 | % | | 6.30 | % |

| Class C | | | | | | -0.63 | | | 7.57 | | | 2.88 | | | 6.71 | |

| Index | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 5.20 | % | | 17.81 | % | | 6.55 | % | | 11.14 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.00%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.28%, 2.05%, 1.05% and 1.10%, respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.05% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Emerging Markets Fund

Following a prolonged period of poor returns for the asset class, appetite for emerging market risk stabilized over the course of 2016. For the six-month reporting period ended January 31, 2017, the Fund returned -0.04% (Class A at NAV), lagging the Fund's benchmark, the MSCI Emerging Markets Index, which returned 5.08%.

Over the period, our search for risk-aware exposure to the demographic opportunity offered by some emerging markets resulted in a due diligence review of family-controlled Heineken Holding N.V. The holding company, where the majority of the family's financial interests lie, trades at a discount to the more liquid Heineken N.V. In line with our investment philosophy, we are comfortable sacrificing liquidity for greater alignment with controlling shareholders. Heineken, which has been family-controlled for more than 140 years, has become a truly global brand. We have come to know the company via investments in its listed subsidiary, Nigerian Breweries, and Latin American partner, Quinenco. Heineken's volume mix is changing in favor of faster-growing developing markets where price points have scope to increase. We believe these factors underpin the investment case for longer-term investors, leading the Fund to accumulate a significant position during the period.

The portfolio continues to have a bias towards companies listed in markets that bore the brunt of commodity price declines such as Brazil, Chile and

| | |

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| Tiger Brands, Ltd. | 3.4 | % |

| Uni-President Enterprises Corp. | 3.3 | |

| Standard Bank Group, Ltd. | 3.2 | |

| Newcrest Mining, Ltd. | 3.0 | |

| Cia Cervecerias Unidas S.A., ADR | 2.9 | |

| Housing Development Finance Corp., Ltd. | 2.9 | |

| Duratex S.A. | 2.8 | |

| Standard Foods Corp. | 2.7 | |

| Mahle-Metal Leve S.A. | 2.5 | |

| Quinenco S.A. | 2.5 | |

South Africa. The resulting economic shock resulted in weaker currencies, more attractive valuations and the tantalizing possibility of improving national governance. During the period, we initiated positions in African Oxygen, which sells industrial gasses across Africa, and Nampak, Africa's leading packaging company. Both businesses face short-term headwinds that have resulted in attractive valuations for long-term investors to invest in the secular growth of African markets.

Despite a small decline in the valuation of some good quality companies towards the end of 2016, many of Asia's best domestic businesses remain too expensive for our taste. With that said, the correction did provide us with an opportunity to purchase a stake in LG Household & Healthcare, an extremely well-run and leading consumer business in Korea, at what appears to be a reasonable valuation. We have been investors in the parent company LG Corporation for some time and are comfortable with the governance at the LG group thanks to its transparent corporate structure.

Less positively, some emerging markets that have come to be seen as relatively stable may not be insulated from the populist wave sweeping the developed world. During 2016, the Polish government adopted a more interventionist stance and left-wing politicians in Chile recently proposed changes to the regulation of water utilities. Both of these developments negatively affected the strategy over the period. In the absence of an improvement in broad-based economic growth this type of populist risk to investment returns is likely to increase.

Our strict valuation discipline and focus on only the highest-quality companies aims to provide downside protection over and above seeking exposure to the long-term opportunity of rising living standards in some parts of the developing world. We will not sacrifice quality for the benefit of short-term momentum. In line with our more cautious view, the strategy's cash level increased over the course of the reporting period.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

8

Emerging Markets Fund

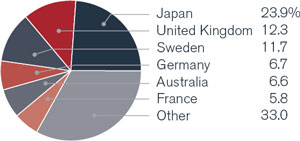

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | | |

| | |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | Five | | inception |

| At NAV | | | symbol | | | months | | year | | years* | | years* | | (12/31/2010)* |

| Class A | | | HEMAX | | | -0.04 | % | | 21.61 | % | | 2.13 | % | | 2.17 | % | | -1.12 | % |

| Class C | | | HEMCX | | | -0.39 | | | 20.77 | | | 1.39 | | | 1.42 | | | -1.86 | |

| Class I | | | HEMIX | | | 0.11 | | | 22.03 | | | 2.42 | | | 2.44 | | | -0.87 | |

| Class R6** | | | HEMRX | | | 0.13 | | | 22.05 | | | 2.42 | | | 2.44 | | | -0.87 | |

| With sales charge | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -5.84 | % | | 14.56 | % | | 0.14 | % | | 0.97 | % | | -2.08 | % |

| Class C | | | | | | -1.39 | | | 20.77 | | | 1.39 | | | 1.42 | | | -1.86 | |

| Index | | | | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets Index | | | | | | 5.08 | % | | 25.88 | % | | 1.81 | % | | 0.55 | % | | -0.99 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 2.37%, 3.17%, 2.10% and 2.18%, respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.20% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of emerging markets. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

European Focus Fund

European equities posted a slight gain in dollar terms over the six-month reporting period ended January 31, 2017, which was dominated by the lead up to and aftermath of the US Presidential election. After declining leading into November, developed markets rallied globally upon the election of Donald Trump driven by upgrades to global growth expectations and hopes for reflation given Trump's planned fiscal spending. While Europe rallied alongside the US in local currency terms, US dollar strength weighed on returns until its depreciation in January. The 'Trump Rally' also helped push through the rotation in market leadership from growth/defensive stocks to value/cyclical stocks in Europe which was a big phenomenon in European equity markets after several years of growth/defensives outperformance. This caused unloved areas of the market like banks and the broad consumer discretionary sector to perform strong while predictable and high yielding areas such as consumer staples and utilities sold off. We believe that the improving macroeconomic backdrop in Europe, increased optimism for earnings growth and signs of the return of inflation should help the effects of the rotation to persist for a while longer and this should suit the valuation sensitive, opportunistic style of the Fund.

For the six-month reporting period ended January 31, 2017, the Fund returned -3.26% (Class A at NAV) versus a return of 2.94% by the Fund's benchmark, MSCI Europe Index. The Fund's exposure to

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| Teva Pharmaceutical Industries, Ltd., ADR | 7.8 | % |

| Bayer AG | 4.7 | |

| Renault S.A. | 4.5 | |

| Nokia Oyj | 4.2 | |

| Continental AG | 4.0 | |

| Dufry AG | 4.0 | |

| BT Group plc | 4.0 | |

| Shire plc | 3.7 | |

| TUI AG | 3.2 | |

| Saga plc | 3.0 | |

pharmaceutical companies proved to be detractive with holdings such as Teva Pharmaceutical, Roche and Shire among the weaker performers. There was also underperformance from telecom-related holdings; Inmarsat, BT Group and Nokia. Travel-related exposure was a positive with TUI, Carnival and Norwegian Cruise Lines all performing well while financials holdings Barclays, Aviva and Intesa Sanpaolo also contributed positively to performance.

During the period, the Fund took a position in Koç Holding, a Turkish conglomerate that owns several businesses with leading competitive positions in Turkey in areas such as autos, energy, finance and white goods. A position was added in British telecommunications company BT Group; telecoms was the worst performing sector in Europe in 2016 but this provided the opportunity to add a fairly steady company which is making inroads in UK TV subscriptions given their strong sports offering. Other positions added included clothing retailer Hennes & Mauritz, telecoms equipment firm Ericsson and British retailer Marks & Spencer.

The Fund exited its position in Genmab, the Danish biotech company, taking profits on a long-term holding. The takeover of UK chip designer, ARM Holdings, by Japan's SoftBank allowed the Fund to exit at a large profit. Aberdeen Asset Management was also sold after the tailwinds for the share price provided by stronger investor appetite for emerging markets took a turn for the worse upon President Trump's election. Other sales included telecoms group Liberty Global, Finnish steel company Outokumpu and Italian postal and financial services provider Poste Italiane.

Expectations for European equity performance in 2017 are low despite a solid macro backdrop and increasing optimism on earnings growth. We believe that the political risks to Europe are now well understood and, to a degree, priced in. Therefore, our stance is more cautiously optimistic for European equities in 2017 but we are also conscious of the impact currencies may have on returns for US investors.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

10

European Focus Fund

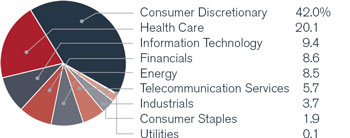

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | | |

| | |

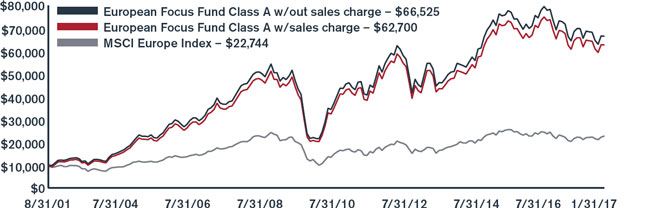

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | months | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFEAX | | | -3.26 | % | | 0.13 | % | | -2.24 | % | | 6.13 | % | | 3.86 | % | | 13.07 | % |

| Class C | | | HFECX | | | -3.64 | | | -0.66 | | | -3.00 | | | 5.30 | | | 3.07 | | | 12.23 | |

| Class I** | | | HFEIX | | | -3.13 | | | 0.39 | | | -2.00 | | | 6.42 | | | 4.08 | | | 13.23 | |

| Class R6*** | | | HFERX | | | -3.15 | | | 0.38 | | | -2.01 | | | 6.41 | | | 4.08 | | | 13.23 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -8.82 | % | | -5.64 | % | | -4.15 | % | | 4.88 | % | | 3.25 | % | | 12.64 | % |

| Class C | | | | | | -4.64 | | | -0.66 | | | -3.00 | | | 5.30 | | | 3.07 | | | 12.23 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI Europe Index | | | | | | 2.94 | % | | 9.52 | % | | -0.67 | % | | 6.33 | % | | 1.11 | % | | 5.48 | % |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.29%, 2.08%, 1.05% and 1.06%, respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI Europe Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the developed markets in Europe. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

Global Equity Income Fund

Global equity markets rose during the six-month reporting period ended January, 31, 2017, as global economic data as a whole (such as unemployment rates and industrial production) surpassed expectations. However, geographic performance was widely dispersed. The US outperformed following the Republican victory in the presidential election on the expectation of future corporate tax reform and higher infrastructure spending. This also caused the US dollar to rise relative to other global currencies such as the Euro and the Japanese yen.

At the sector level, energy was among the best performers following an agreement by OPEC to curb oil production and a subsequent rise in the oil price to over $55/barrel. Financials also performed well following an interest rate hike from the Federal Reserve in December based on the expectation that in a rising rate environment their margins can begin to improve, leading to earnings upgrades. In contrast, a rise in bond yields meant that more defensive sectors (such as consumer staples and healthcare) underperformed.

For the reporting period ended January 31, 2017, the Fund returned 1.76% (Class A at NAV) versus the benchmark MSCI World Index which posted a return of 5.20%. The Fund continued to meet its high income objectives over the period. Relative performance was largely a result of country allocation, in particular the underweight position in

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| Royal Dutch Shell plc, A Shares | 3.3 | % |

| Siemens AG | 3.1 | |

| BP plc | 3.0 | |

| Novartis AG | 2.9 | |

| British American Tobacco plc | 2.6 | |

| Sumitomo Mitsui Financial Group, Inc. | 2.5 | |

| Nordea Bank AB | 2.1 | |

| Singapore Telecommunications, Ltd. | 2.1 | |

| Vodafone Group plc | 2.0 | |

| Roche Holding AG | 1.9 | |

the US market as a result of its low dividend yield. By sector, the Fund's overweight in defensive sectors such as telecommunications and utilities detracted from relative performance. The Fund did, however, benefit from good stock selection in sectors such as health care, consumer staples and industrials.

Where we hold material overweight positions in a country relative to the benchmark or have fundamental concerns regarding a currency we often choose to hedge some of the currency risk. Over the referendum regarding EU membership in the UK we hedged a material portion of our Sterling exposure. This was a positive contributor to performance and following the subsequent fall we have reduced our hedge. We continue to hold a small hedge on the Australian dollar, which is a high dividend yield market so the Fund tends to hold a structural overweight position.

The Fund's strategy of seeking a high dividend yield naturally draws us to markets which are higher yielding, such as the UK and Europe. In Europe we are encouraged by the loose monetary conditions put in place by the European Central Bank and improving economic growth. We also find valuations more attractive relative to US peers.

If the US enters a period of higher economic growth driven by higher infrastructure spending and corporate tax reform, this should be positive for US and global equities. Muted global economic growth in recent years has led to low sales growth and a lack of operating leverage for companies. If we enter a period of higher economic growth, this should allow companies to grow sales and earnings (and therefore dividends) at a faster pace. We will continue with our existing strategy of identifying companies that pay an attractive and sustainable dividend that have capacity to grow over the medium- to long-term.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

12

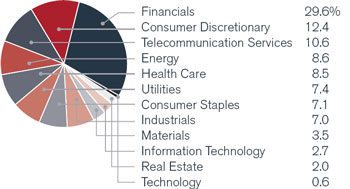

Global Equity Income Fund

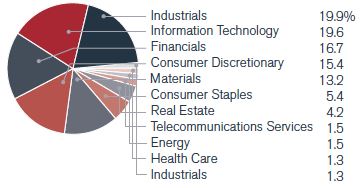

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments)

|

| | | |

| | |

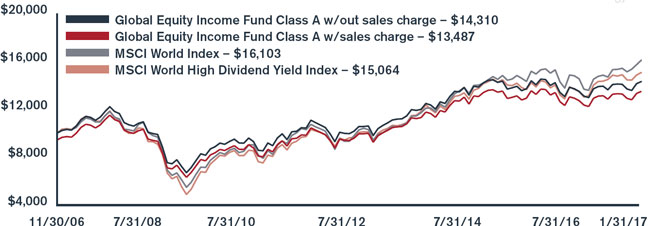

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | months | | year | | years* | | years* | | years | | (11/30/2006)* |

| Class A | | | HFQAX | | | 1.76 | % | | 9.26 | % | | 2.78 | % | | 7.09 | % | | 3.34 | % | | 3.59 | % |

| Class C | | | HFQCX | | | 1.39 | | | 8.49 | | | 1.99 | | | 6.29 | | | 2.56 | | | 2.81 | |

| Class I** | | | HFQIX | | | 2.04 | | | 9.68 | | | 3.06 | | | 7.38 | | | 3.57 | | | 3.81 | |

| Class R6*** | | | HFQRX | | | 2.06 | | | 9.74 | | | 3.08 | | | 7.39 | | | 3.57 | | | 3.81 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | -4.03 | % | | 3.00 | % | | 0.76 | % | | 5.83 | % | | 2.73 | % | | 2.99 | % |

| Class C | | | | | | 0.39 | | | 8.49 | | | 1.99 | | | 6.29 | | | 2.56 | | | 2.81 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI World Index | | | | | | 5.20 | % | | 17.81 | % | | 6.55 | % | | 10.48 | % | | 4.54 | % | | 4.83 | % |

| MSCI World High Dividend Yield Index | | | | | | 1.52 | | | 15.78 | | | 5.45 | | | 9.32 | | | 3.80 | | | 4.12 | |

* Average annual return

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.17%, 1.93%, 0.92% and 0.87%, respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.15% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers during those periods, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed markets. The MSCI World High Dividend Yield Index aims to objectively reflect the high dividend yield opportunity set within the MSCI World Index. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

Global Technology Fund

It was a strong period for technology equities as they outperformed global equities. Buoyed by optimism for global growth and reflation, global equities rallied strongly after the election of Donald Trump as US President.

For the six-month reporting period ended January 31, 2017, the Fund returned 9.85% (Class A at NAV) versus the benchmark, MSCI AC World Information Technology Index, which posted a return of 9.96%. Specific detractors included Nokia, the Finnish telecoms equipment company; the industry faced challenges in 2016 as carriers reigned in spending. However, Nokia boasts a management with a good track record in capital allocation and in operational efficiency that trades on a very attractive valuation. Nokia's results later in January demonstrated this. Cognizant also underperformed. The IT services company is a user of visas that allows offshore workers to work in countries where they are not citizens. Rhetoric surrounding visa restriction and its potential impact from the new US administration weighed on the name. Other detractors included Vipshop, the Chinese online discount retailer, IT services company, EPAM, and the fund's cash position (in light of market strength).

Micron performed well. Having operated in a very fragmented memory industry that has now consolidated to three players (including Samsung), coupled with a slowing Moore's Law (reduction in

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| Apple, Inc. | 7.6 | % |

| Facebook, Inc., Class A | 7.2 | |

| Alphabet, Inc., Class A | 5.6 | |

| Samsung Electronics Co., Ltd. | 4.7 | |

| Alphabet, Inc., Class C | 4.3 | |

| Visa, Inc., A Shares | 3.9 | |

| Microsoft Corp. | 3.7 | |

| Tencent Holdings, Ltd. | 3.6 | |

| Cisco Systems, Inc. | 3.5 | |

| Broadcom, Ltd. | 3.4 | |

pace of computer power advancement), we believe Micron should benefit from more restrained supply leading to better pricing and margins. Cavium and Broadcom contributed to performance. Both Cavium and Broadcom are exposed to growth areas in semiconductors like networking, datacenter and cloud infrastructure. NXP Semiconductors also performed well. The company agreed to a $110 bid from Broadcom with the deal due to be completed by the end of 2017. Other positive performers included Samsung and Western Digital.

Notable activity over the period included the initiation of a position in Xilinx, a fabless semiconductor design company. The company has a strong franchise in wireless chips alongside some interesting and underappreciated opportunities in artificial intelligence and autonomous driving. A position was also added in Texas Instruments. Texas Instruments has a very strong franchise in analog semiconductors and a strong track record in capital allocation. Texas Instruments is also likely a beneficiary of US tax reform. Qualcomm was sold, as was Paypal.

The long-term drivers of technology remain intact as it continues to take share versus the old economy, driven by demographics and innovation. The relative valuation of the sector is attractive, especially given the balance sheet strength. We continue to focus bottom-up on powerful secular themes and growth at a reasonable price.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

14

Global Technology Fund

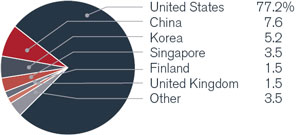

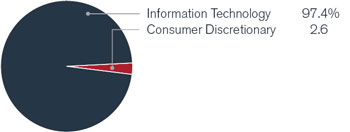

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | | |

| | |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | Five | | Ten | | inception |

| At NAV | | | symbol | | | months | | year | | years* | | years* | | years* | | (8/31/2001)* |

| Class A | | | HFGAX | | | 9.85 | % | | 21.00 | % | | 8.68 | % | | 11.82 | % | | 9.09 | % | | 8.85 | % |

| Class C | | | HFGCX | | | 9.43 | | | 20.12 | | | 7.83 | | | 10.95 | | | 8.26 | | | 8.04 | |

| Class I** | | | HFGIX | | | 10.04 | | | 21.36 | | | 8.94 | | | 12.11 | | | 9.32 | | | 9.00 | |

| Class R6*** | | | HFGRX | | | 9.99 | | | 21.30 | | | 8.94 | | | 12.11 | | | 9.32 | | | 9.00 | |

| With sales charge | | | | | | | | | | | | | | | | | | | | | | |

| Class A | | | | | | 3.55 | % | | 14.05 | % | | 6.55 | % | | 10.50 | % | | 8.45 | % | | 8.43 | % |

| Class C | | | | | | 8.43 | | | 20.12 | | | 7.83 | | | 10.95 | | | 8.26 | | | 8.04 | |

| Index | | | | | | | | | | | | | | | | | | | | | | |

| MSCI AC World IT Index | | | | | | 9.96 | % | | 26.06 | % | | 13.43 | % | | 14.24 | % | | 8.39 | % | | 6.90 | % |

| S&P 500 | | | | | | 5.96 | | | 20.04 | | | 10.85 | | | 14.09 | | | 6.99 | | | 6.78 | |

* Average annual return.

** Class I (formerly Class W) shares commenced operations on March 31, 2009. The performance for Class I shares for the periods prior to March 31, 2009 is based on the performance of Class A shares. Performance for Class I shares would be similar because the shares are invested in the same portfolio of investments. Class I shares are not subject to a front-end sales charge or a distribution fee.

*** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 5.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.35%, 2.12%, 1.11% and 1.10%, respectively. As stated in the Statement of Additional Information (SAI), the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 1.75% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during certain periods shown. Absent these waivers, results would have been less favorable for certain periods. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index and an industry focused index. The MSCI AC World IT Index is a free float adjusted market capitalization weighted index designed to measure the equity market performance of the Information Technology stocks within the MSCI AC World Index. The S&P 500 Index is a broad based measurement of changes in stock market conditions based on the average of 500 widely held common stocks. The Fund is professionally managed while the Indices are unmanaged and not available for investment and do not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

High Yield Opportunities Fund

The US high yield market performed well over the six-month period led by a recovery in oil prices and commodity sub-sectors. The high yield market yield spreads have tightened as the asset class performed admirably since the election in early November given the steep increase in rates. The sharp increase in LIBOR rates has created a strong technical demand for loans; however, over 70% of leveraged loans tracked by JPM are now trading over par.

For most of the period, higher quality rated bonds (double-B) outperformed lower quality rated bonds (triple-C). The energy sector now represents over 26% of the emerging markets high yield segment as compared to 15% for US high yield and only 6% for European high yield.

The 12 month default rate is 3.6% (4.3% including distressed debt exchanges), but only 0.80% excluding energy and metals and mining. Not only have the commodity sectors had a big impact on the headline default rate, but they have also created an historical skew to recovery rates. Last twelve month recovery rates for high yield debt has been only 27% as compared to historical averages of 40-45%. During January, there were 38 credit rating upgrades ($65 billion) versus 45 credit rating downgrades ($63 billion) in the high yield market.

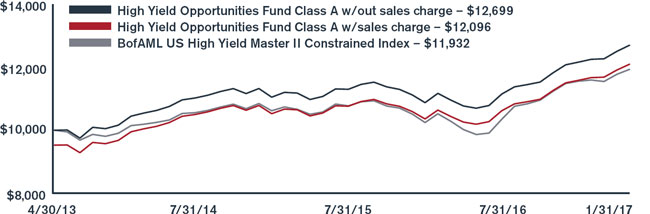

For the six-month reporting period ended January 31, 2017, the Fund returned 7.44% (Class A at NAV) versus the benchmark BofAML US High Yield

| Top 10 long-term holdings* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security/Issuer | of net assets |

| Intelsat Jackson Holdings S.A. | 2.7 | % |

| Nuance Communications, Inc. | 2.6 | |

| CCO Holdings LLC | 2.5 | |

| SFR Group S.A. | 2.2 | |

| Frontier Communications Corp. | 2.1 | |

| PetSmart, Inc. | 1.8 | |

| Sprint Corp. | 1.7 | |

| Murray Energy Corp. 2015 Term Loan B | 1.7 | |

| NRG Energy, Inc. | 1.6 | |

| Valeant Pharmaceuticals International, Inc. | 1.5 | |

Constrained Index return of 6.23%. The portfolio benefited from positioning in the higher quality part of the triple-C space and an increase in weighting to the energy and mining sectors. We believe that the peer group is relatively underweight to energy as well given the deficit (shrinking) between the peer group average return and the benchmark return over the reporting period.

The Fund is currently positioned in line with the benchmark as far as credit risk (as measured by yield), spread, and weighted average credit rating. Within the energy sector, we decreased the underweight position since the second quarter of 2016 and have focused on higher quality Exploration & Production companies as well as midstream companies. We continue to be selective in the new issue market. We have made a conscious effort to add risk to the portfolio over the last nine months but have found it difficult given the challenging secondary market liquidity and the higher quality bias of the new issue calendar.

Our energy outlook has improved given the fact that oil has moved from $25 to $53 per barrel; furthermore, most of the defaults and distressed exchanges that we expected to occur in the energy sector have taken place. We will look to keep the portfolio slightly above the benchmark as far as yield and spread and rely on credit selection as the main driver of alpha over the next few months and quarters. Low global government bond yields continue to drive strong demand for high yield bonds and leveraged loans on both the retail and institutional side. We expect this trend to continue. We are less excited about leveraged loans as valuations are stretched. We expect the prospects for trade tariffs, changes in tax deductibility of interest and potentially lower corporate tax rates in the US to have a muted impact on US HY issuers when compared to US investment grade issuers.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

16

High Yield Opportunities Fund

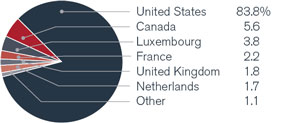

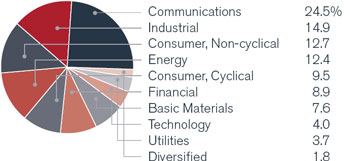

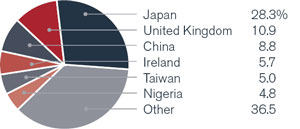

| Portfolio composition by country | | Portfolio composition by sector |

(as a % of long-term investments)

| | (as a % of long-term investments)

|

| | | |

| | |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | Three | | inception |

| At NAV | | | symbol | | | months | | year | | year* | | (4/30/2013)* |

| Class A | | | HYOAX | | | 7.44 | % | | 18.70 | % | | 5.69 | % | | 6.56 | % |

| Class C | | | HYOCX | | | 7.08 | | | 17.83 | | | 4.91 | | | 5.77 | |

| Class I | | | HYOIX | | | 7.61 | | | 18.87 | | | 5.93 | | | 6.80 | |

| Class R6** | | | HYORX | | | 7.64 | | | 18.96 | | | 5.96 | | | 6.82 | |

| With sales charge | | | | | | | | | | | | | | | | |

| Class A | | | | | | 2.33 | % | | 13.00 | % | | 4.00 | % | | 5.19 | % |

| Class C | | | | | | 6.08 | | | 17.83 | | | 4.91 | | | 5.77 | |

| Index | | | | | | | | | | | | | | | | |

| BofAML US High Yield Master II Constrained Index | | | | | | 6.23 | % | | 20.98 | % | | 4.94 | % | | 4.86 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.

Performance data quoted represents past performance and is no guarantee of future results. Due to the Fund's relatively small asset base, performance may be impacted by portfolio turnover to a greater degree than it may be in the future. Performance results with sales charges reflect the deduction of the maximum front-end sales charge or the deduction of the applicable contingent deferred sales charge ("CDSC"). Class A shares are subject to a maximum front-end sales charge of 4.75%. Class C shares are subject to a CDSC of up to 1% on certain redemptions made within 12 months of purchase. Performance presented at Net Asset Value (NAV), which does not include a sales charge, would be lower if this charge were reflected. NAV is the value of one share of the Fund excluding any sales charges. Performance quoted is based on the transacted NAV at each period end, which may differ from the US Generally Accepted Accounting Principles ("GAAP")-adjusted NAV and the total return presented in the Financial Highlights. Current performance may be lower or higher than the performance data quoted. Investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than original cost. As stated in the current prospectus, the Fund's annual operating expense ratios (gross) for Class A, C, I and R6 shares are 1.25%, 2.06%, 1.05% and 0.99%, respectively. However, the Fund's adviser has contractually agreed to waive its management fee and, if necessary, to reimburse other operating expenses (excluding Acquired Fund Fees and Expenses from underlying investment companies) in order to limit total annual ordinary operating expenses, less distribution and service fees, to 0.68% of the Fund's average daily net assets, which is in effect until July 31, 2020. For the most recent month-end performance, please call 1.866.443.6337 or visit the Funds' website at www.henderson.com.

Performance results also reflect expense subsidies and waivers in effect during periods shown. Absent these waivers, results would have been less favorable. All results assume the reinvestment of dividends and capital gains.

The investment comparison graph above reflects the change in value of a $10,000 hypothetical investment since the Fund's inception, including reinvested dividends and distributions, compared to a broad based securities market index. The Bank of America Merrill Lynch U.S. High Yield Master II Constrained Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. The Fund is professionally managed while the Index is unmanaged and not available for investment and does not include fees, expenses or other costs. Results in the table and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

17

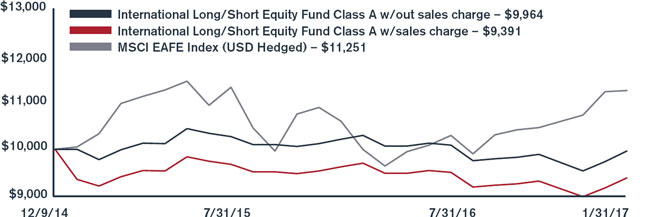

International Long/Short Equity Fund

International equities rallied over the period with developed markets buoyed by hopes for reflation and growth upgrades as a result of Donald Trump's election as President of the United States. After performing strongly in the first three quarters of 2016, Asian (ex-Japan) and emerging markets equities sold off quite strongly in November with the new President striking a protectionist tone, however both recovered ground in January. A major theme in the markets was the rotation from deflationary to reflationary assets and this caused a sharp shift from growth and defensives equity market leadership to value and cyclicals; a big change given the significant period, especially in Europe, defensives and growth had outperformed value and cyclicals.

For the six-month reporting period ended January 31, 2017, the Fund returned 1.69% (class A at NAV) versus the benchmark, MSCI EAFE USD Hedged Index, which posted a return of 9.15%. The Fund ran with an average net exposure to the market of around 20% over the period, this underexposure to the rising market saw the Fund underperform relative to the benchmark; however, the Fund did post a positive absolute return.

| | |

| Top 5 "Long" Holdings (including equity swaps)* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| Providence Resources plc | 2.8 | % |

| Lekoil, Ltd. | 2.4 | |

| BNN Technology plc | 2.1 | |

| Samsung Electronics Co., Ltd. | 2.1 | |

| Teva Pharmaceutical Industries, Ltd., ADR | 2.0 | |

| Top 5 "Short" Holdings (including equity swaps)* | |

| (at January 31, 2017) | |

| | As a percentage |

| Security | of net assets |

| ICA Gruppen AB | (2.2) | % |

| ANA Holdings, Inc. | (2.0) | |

| Kuehne & Nagel International AG | (1.9) | |

| Mitie Group plc | (1.7) | |

| Komatsu, Ltd. | (1.7) | |

The Fund's long books contributed positively to performance, in particular the UK and Europe strategies' long books performed well. The Fund's long exposure to energy was a positive with Providence Resources, Lekoil and African Petroleum all contributing to performance as oil companies continue to recover. Long technology exposure was another positive with positions in e2v technologies, Samsung and Largan Precision all performing well. Detractors from the long books included Teva Pharmaceutical, due to the invalidation of some of its drug copaxone's patents, BNN Technology and BT Group which reported a deeper than expected write down on its Italian business. In aggregate, the Fund's short books detracted from performance.

Fund activity included the purchase of a long position in German pharma and agribusiness company, Bayer, by the Europe strategy. The Europe strategy also added long positions in Swedish engineering firm, Alfa Laval and exited long positions in Aberdeen Asset Management and Finnish cranes company, Konecranes. The Japan strategy closed out its long positions in financial holdings, Mitsubishi UFJ and Tokio Marine and also exited its position in manufacturer, Murata. Also sold over the period were Catcher Technology, the Taiwanese die-casting firm by the Asia strategy, and e2v Technologies, a semiconductor firm by the UK strategy. The Japan strategy added a long position in Mitsubishi Motors and exited long positions in bank, Mitsubishi UFJ, and insurer, Tokio Marine.

Developed market equities finished 2016 strongly on a wave of optimism. Our sense, however, is that some of the optimism may have gone slightly too far in the case of the US. International has its challenges but we believe that with the relatively solid macro backdrop in Europe, Japan continuing to look intriguing, and depressed valuations in emerging markets, International could be a good place to be for investors in 2017.

* For further detail about these holdings, please refer to the section entitled "Portfolios of investments." Fund holdings are as of the date given, are subject to change at any time, and are not recommendations to buy or sell any security.

18

International Long/Short Equity Fund

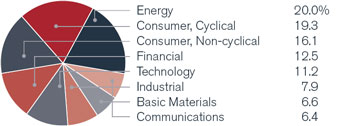

| Portfolio composition by country | | Portfolio composition by sector |

| (as a % of long-term investments) | | (as a % of long-term investments)

|

| | | |

| | |

Investment comparison

Value of $10,000

| Total returns as of January 31, 2017 | | | | | | | | | | Since |

| | | | NASDAQ | | | Six | | One | | inception |

| At NAV | | | symbol | | | months | | year | | (12/9/2014)* |

| Class A | | | HLNAX | | | 1.69 | % | | -3.22 | % | | -0.17 | % |

| Class C | | | HLNCX | | | 1.62 | | | -3.71 | | | -0.82 | |

| Class I | | | HLNIX | | | 2.10 | | | -2.72 | | | 0.22 | |

| Class R6** | | | HLNRX | | | 2.12 | | | -2.81 | | | 0.19 | |

| With sales charge | | | | | | | | | | | | | |

| Class A | | | | | | -4.19 | % | | -8.82 | % | | -2.88 | % |

| Class C | | | | | | 0.62 | | | -3.71 | | | -0.82 | |

| Index | | | | | | | | | | | | | |

| MSCI EAFE Index (USD Hedged) | | | | | | 9.15 | % | | 13.38 | % | | 5.64 | % |

* Average annual return.

** Class R6 shares commenced operations on November 30, 2015. The performance for Class R6 shares for periods prior to November 30, 2015 is based on the performance of Class I shares. Performance for Class R6 shares would be similar because the shares are invested in the same portfolio of investments, and like Class I shares, Class R6 shares are not subject to a front-end sales charge or a distribution fee.