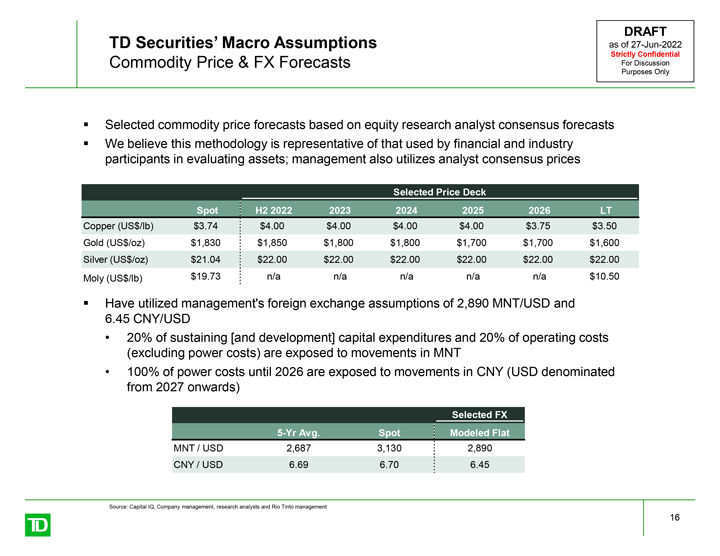

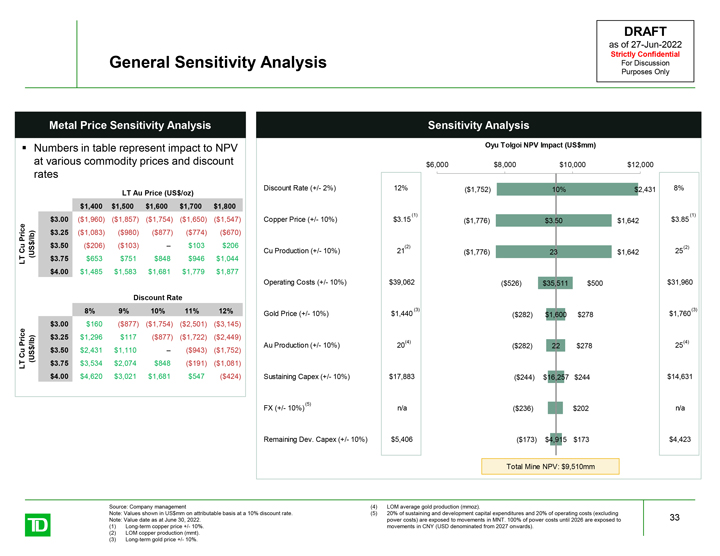

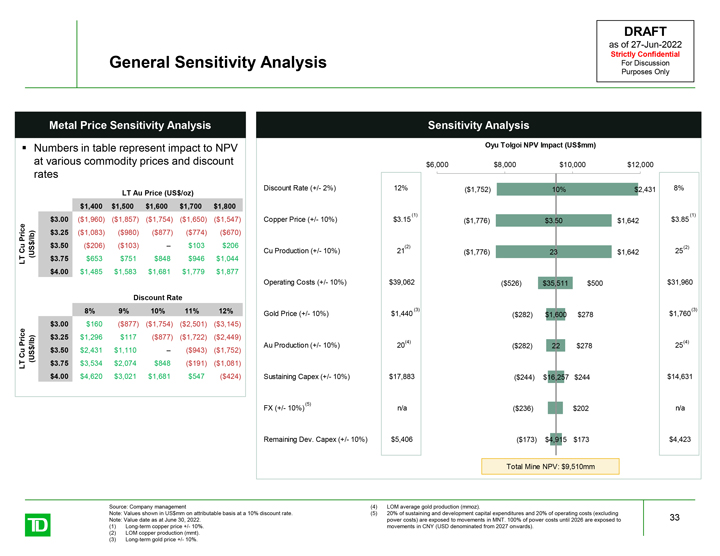

DRAFT as of 27-Jun-2022 Strictly Confidential General Sensitivity Analysis For Discussion Purposes Only Metal Price Sensitivity Analysis Sensitivity Analysis â–ª Numbers in table represent impact to NPV Oyu Tolgoi NPV Impact (US$mm) at various commodity prices and discount $6,000 $8,000 $10,000 $12,000 rates Discount Rate (+/- 2%) 12% ($1,752) 10% $2,431 8% LT Au Price (US$/oz) $1,400 $1,500 $1,600 $1,700 $1,800 (1) (1) $3.00 ($1,960) ($1,857) ($1,754) ($1,650) ($1,547) Copper Price (+/- 10%) $3.15 ($1,776) $3.50 $1,642 $3.85 Price /lb) $3.25 ($1,083) ($980) ($877) ($774) ($670) $ $3.50 ($206) ($103) – $103 $206 (2) (2) Cu (US Cu Production (+/- 10%) 21 ($1,776) 23 $1,642 25 LT $3.75 $653 $751 $848 $946 $1,044 $4.00 $1,485 $1,583 $1,681 $1,779 $1,877 Operating Costs (+/- 10%) $39,062 ($526) $35,511 $500 $31,960 Discount Rate 8% 9% 10% 11% 12% (3) (3) Gold Price (+/- 10%) $1,440 ($282) $1,600 $278 $1,760 $3.00 $160 ($877) ($1,754) ($2,501) ($3,145) c e lb) $3.25 $1,296 $117 ($877) ($1,722) ($2,449) (4) (4) Pri $ / $3.50 $2,431 $1,110 – ($943) ($1,752) Au Production (+/- 10%) 20 ($282) 22 $278 25 C u (US LT $3.75 $3,534 $2,074 $848 ($191) ($1,081) $4.00 $4,620 $3,021 $1,681 $547 ($424) Sustaining Capex (+/- 10%) $17,883 ($244) $16,257 $244 $14,631 (5) FX (+/- 10%) n/a ($236) $202 n/a Remaining Dev. Capex (+/- 10%) $5,406 ($173) $4,915 $173 $4,423 Total Mine NPV: $9,510mm Source: Company management (4) LOM average gold production (mmoz). Note: Values shown in US$mm on attributable basis at a 10% discount rate. (5) 20% of sustaining and development capital expenditures and 20% of operating costs (excluding 33 Note: Value date as at June 30, 2022. power costs) are exposed to movements in MNT. 100% of power costs until 2026 are exposed to (1) Long-term copper price +/- 10%. movements in CNY (USD denominated from 2027 onwards). (2) LOM copper production (mmt). (3) Long-term gold price +/- 10%.