| | 8. | IRS Form W-9 — U.S. Shareholders |

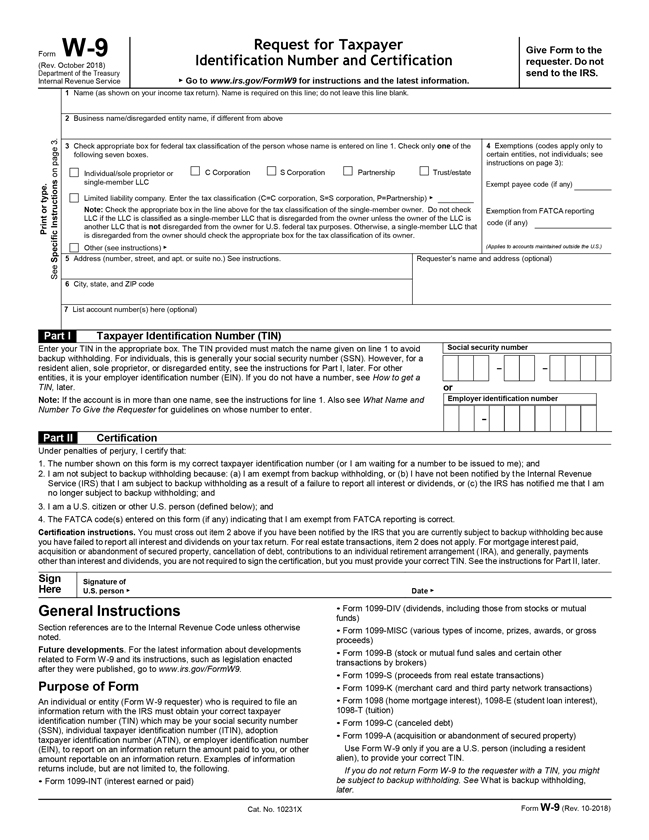

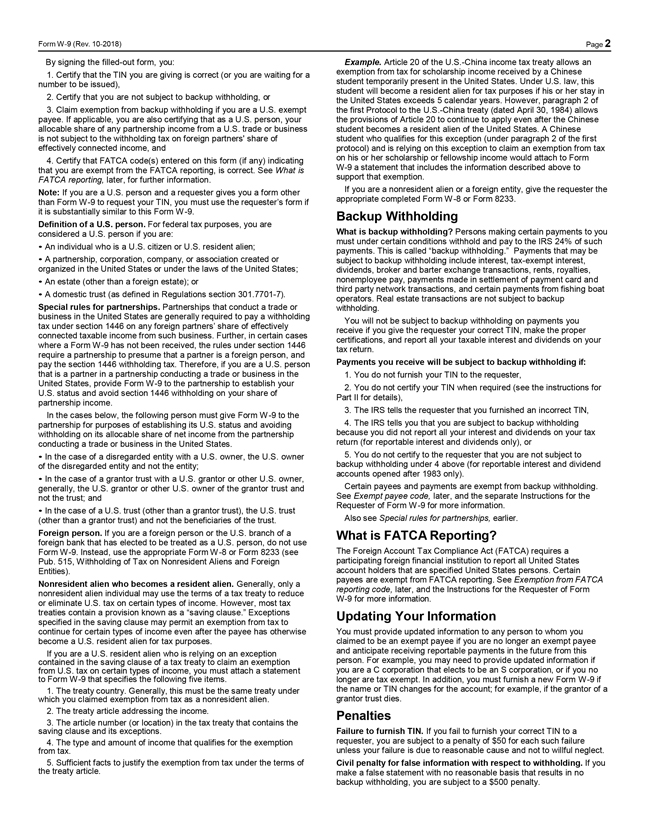

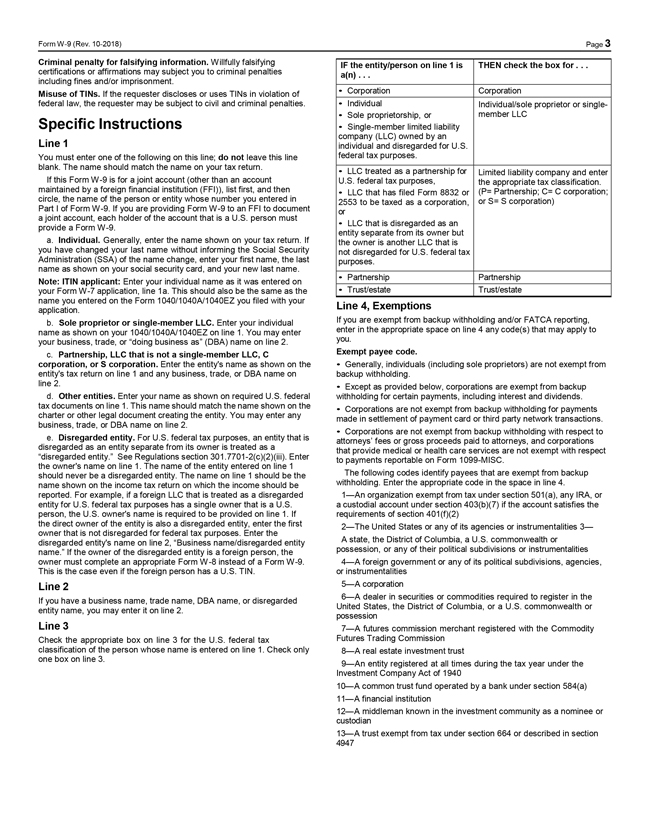

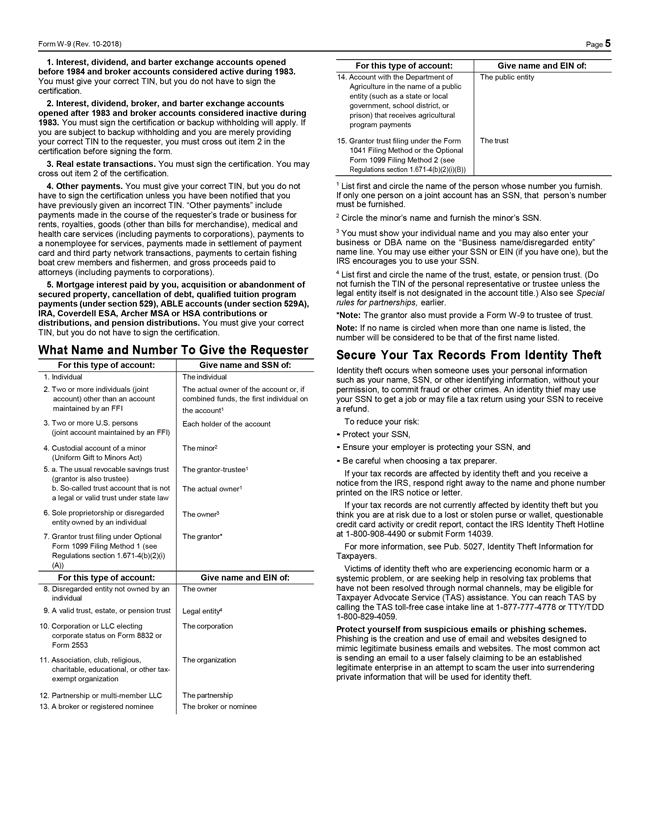

In order to avoid “backup withholding” of United States income tax on payments made on the Shares, a Shareholder that is a U.S. holder (as defined below) must generally provide the person’s correct taxpayer identification number (“TIN”) on the Form W-9 included herewith and certify, under penalties of perjury, that such number is correct, that such Shareholder is not subject to backup withholding, and that such Shareholder is a U.S. person (including a U.S. resident alien). If the correct TIN is not provided or if any other information is not correctly provided, payments made with respect to the Shares may be subject to backup withholding at a rate of 24%.

For the purposes of this Letter of Transmittal, a “U.S. holder” or “U.S. person” means: a beneficial owner of Shares that, for United States federal income tax purposes, is (a) an individual citizen or resident of the United States, (b) a corporation, or other entity classified as a corporation for United States federal income tax purposes, that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia, (c) an estate if the income of such estate is subject to United States federal income tax regardless of the source of such income, (d) a trust if (i) such trust has validly elected to be treated as a U.S. person for United States federal income tax purposes or (ii) a United States court is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of such trust, or (e) a partnership, limited liability company or other entity classified as a partnership for United States federal income tax purposes that is created or organized in or under the laws of the United States, any state thereof or the District of Columbia.

Backup withholding is not an additional United States income tax. Rather, the United States income tax liability of persons subject to backup withholding will be reduced by the amount of tax withheld. If backup withholding results in an overpayment of taxes, a refund may be obtained provided that the required information is furnished to the IRS.

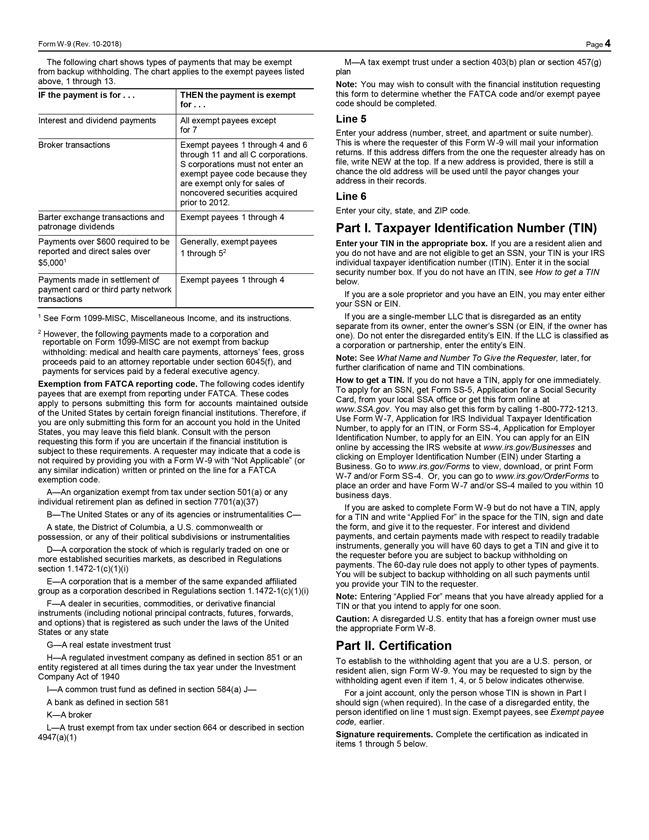

Certain persons (including, among others, corporations, certain “not-for-profit” organizations, and certain non-U.S. persons) are not subject to backup withholding. A Shareholder should consult his or her tax advisor as to the shareholder’s qualification for an exemption from backup withholding and the procedure for obtaining such exemption.

The TIN for an individual United States citizen or resident is the individual’s social security number.

If a U.S. holder does not have a TIN, such U.S. holder should: (a) consult the W-9 Instructions for instructions as to how to apply for a TIN; (b) write “Applied For” in the space for the TIN in Part I of IRS Form W-9; and (c) sign and date IRS Form W-9. The Depositary may withhold on all payments made prior to the time a properly certified TIN is provided to it. A U.S. holder who writes “Applied For” in Part I of IRS Form W-9 should furnish the Depositary with such U.S. Shareholder’s TIN as soon as it is received. In such case, the Depositary may withhold 24% of the gross proceeds of any payment made to such U.S. holder prior to the time a properly certified TIN is provided to the Depositary, and if the Depositary is not provided with a TIN within sixty (60) days, such amounts will be paid over to the IRS.

Failure to furnish TIN — If you fail to furnish your correct TIN, you are subject to a penalty of US$50 for each such failure unless your failure is due to reasonable cause and not to willful neglect.

Non-U.S. holders that receive payments in the U.S. or that provide an address located in the U.S. should return a properly completed Form W-8 that is appropriate to the Non-U.S. holder’s circumstances, a copy of which is available from the Depositary upon request, or at www.irs.gov. All non-U.S. holders should consult their tax advisors regarding the appropriate Form W-8 to be provided by such holder. Failure to provide the proper Form W-8 could result in backup withholding at a rate of 24%.

All U.S. and non-U.S. holders are urged to consult their own tax advisors to determine which forms should be used and whether they are exempt from U.S. backup withholding.

| | 9. | Payment Entitlement Pick-up Locations |

The Depositary will mail the Consideration payable to such Shareholder in accordance with the information provided in Box “A” or Box “B”, as applicable. If Box “A” or, as applicable, Box “B”, are not properly completed, any cheques representing the Consideration will be issued in the name of the registered holder of the Deposited Shares and mailed to the address of the registered holder of the Deposited Shares as it appears on the register of the Corporation’s transfer agent. Any cheques representing the Consideration mailed in accordance with this Letter of Transmittal will be deemed to be delivered at the time of mailing.

18