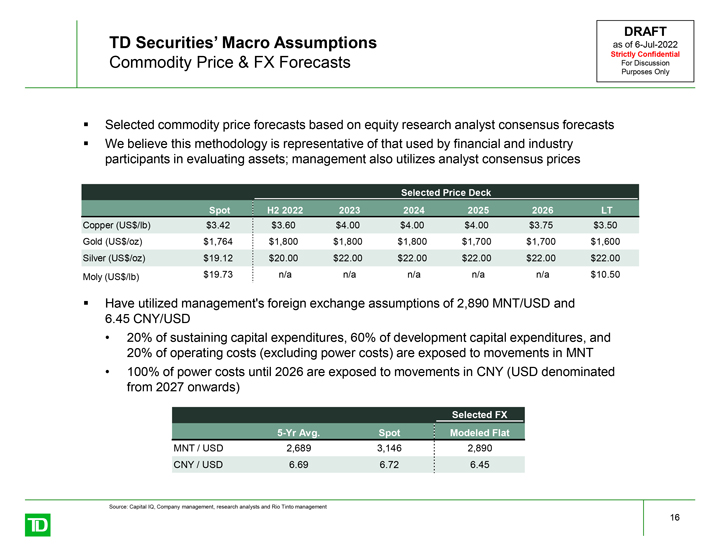

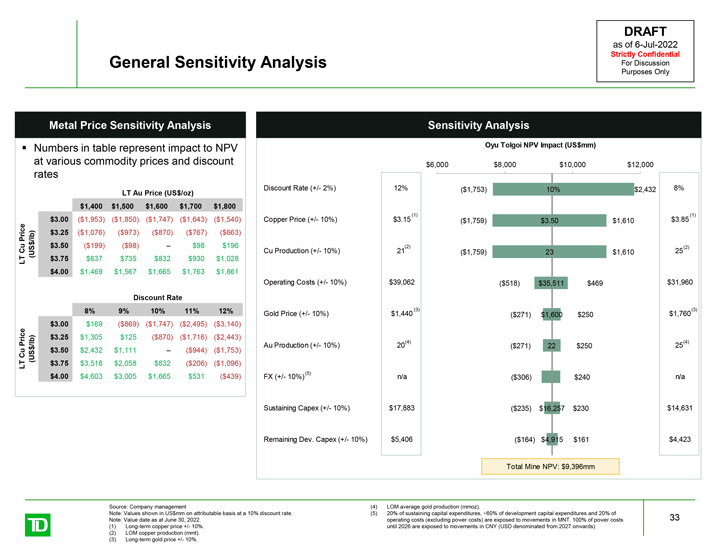

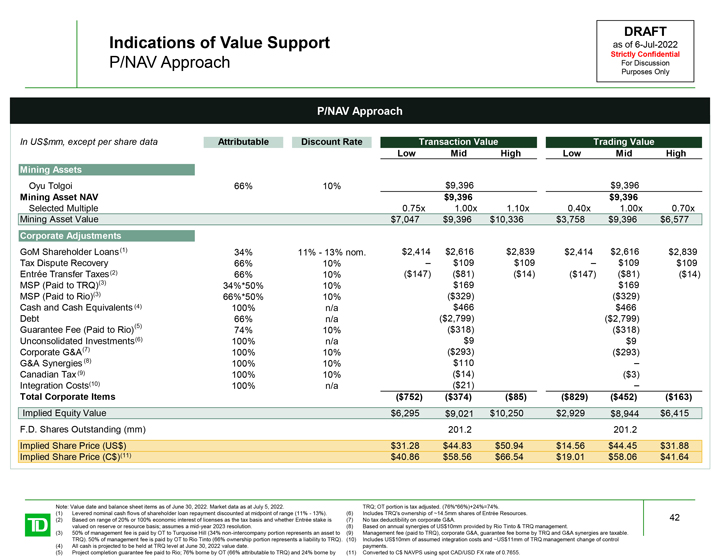

DRAFT as of 6-Jul-2022 Strictly Confidential General Sensitivity Analysis For Discussion Purposes Only Metal Price Sensitivity Analysis Sensitivity Analysis Numbers in table represent impact to NPV Oyu Tolgoi NPV Impact (US$mm) at various commodity prices and discount $6,000 $8,000 $10,000 $12,000 rates Discount Rate (+/- 2%) 12% ($1,753) 10% $2,432 8% LT Au Price (US$/oz) $1,400 $1,500 $1,600 $1,700 $1,800 (1) (1) $3.00 ($1,953) ($1,850) ($1,747) ($1,643) ($1,540) Copper Price (+/- 10%) $3.15 ($1,759) $3.50 $1,610 $3.85 Price /lb) $3.25 ($1,076) ($973) ($870) ($767) ($663) $ $3.50 ($199) ($98) – $98 $196 (2) (2) Cu (US Cu Production (+/- 10%) 21 ($1,759) 23 $1,610 25 LT $3.75 $637 $735 $832 $930 $1,028 $4.00 $1,469 $1,567 $1,665 $1,763 $1,861 Operating Costs (+/- 10%) $39,062 ($518) $35,511 $469 $31,960 Discount Rate 8% 9% 10% 11% 12% (3) (3) Gold Price (+/- 10%) $1,440 ($271) $1,600 $250 $1,760 $3.00 $169 ($869) ($1,747) ($2,495) ($3,140) c e lb) $3.25 $1,305 $125 ($870) ($1,716) ($2,443) (4) (4) Pri $ / $3.50 $2,432 $1,111 – ($944) ($1,753) Au Production (+/- 10%) 20 ($271) 22 $250 25 C u (US LT $3.75 $3,518 $2,058 $832 ($206) ($1,096) $4.00 $4,603 $3,005 $1,665 $531 ($439) FX (+/- 10%)(5) n/a n/a ($306) $240 Sustaining Capex (+/- 10%) $17,883 ($235) $16,257 $230 $14,631 Remaining Dev. Capex (+/- 10%) $5,406 ($164) $4,915 $161 $4,423 Total Mine NPV: $9,396mm Source: Company management (4) LOM average gold production (mmoz). Note: Values shown in US$mm on attributable basis at a 10% discount rate. (5) 20% of sustaining capital expenditures, ~60% of development capital expenditures and 20% of 33 Note: Value date as at June 30, 2022. operating costs (excluding power costs) are exposed to movements in MNT. 100% of power costs (1) Long-term copper price +/- 10%. until 2026 are exposed to movements in CNY (USD denominated from 2027 onwards). (2) LOM copper production (mmt). (3) Long-term gold price +/- 10%.