- MMLP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC 13E3 Filing

Martin Midstream Partners (MMLP) SC 13E3Going private transaction

Filed: 25 Oct 24, 5:31pm

PRELIMINARY AND CONFIDENTIAL SUBJECT TO MATERIAL REVISION FOR DISCUSSION PURPOSES ONLY July 30, 2024 Exhibit (c)(7) Project Augusta Discussion Materials for the Conflicts Committee Strictly Confidential. Not for Distribution.

EXECUTIVE SUMMARY 3 01 7 PRELIMINARY FINANCIAL ANALYSES 02 19 PRELIMINARY PREMIUMS PAID DATA 03 23 APPENDIX 04 24 Weighted Average Cost of Capital 29 Preliminary Selected Benchmarking Data 38 Company Projection Comparison 45 DISCLAIMER 05

EXECUTIVE SUMMARY 01 01 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

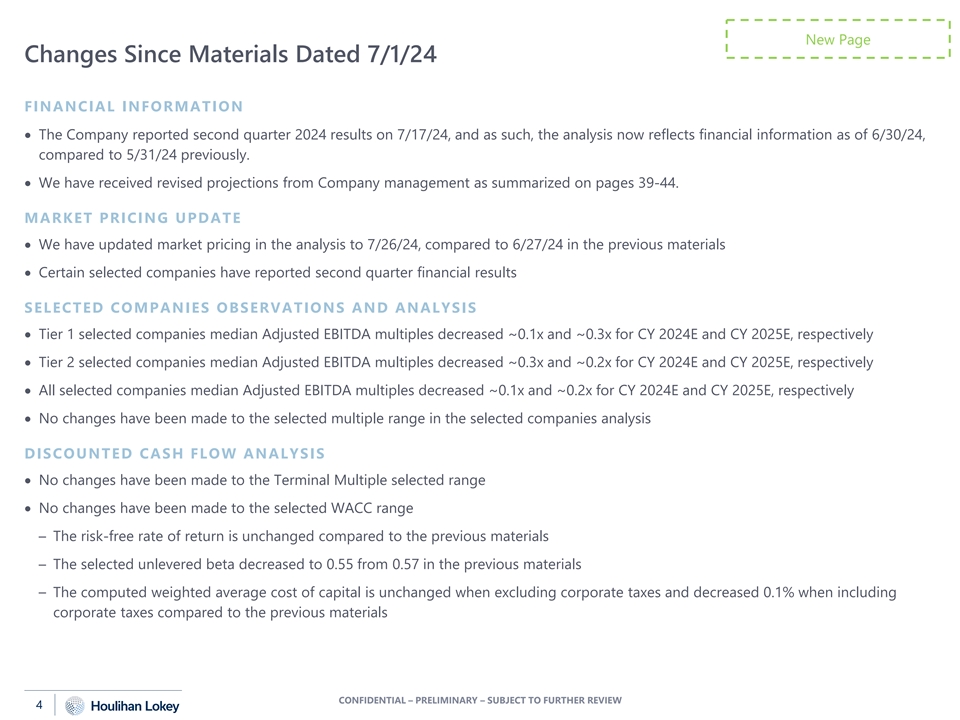

New Page Changes Since Materials Dated 7/1/24 FINANCIAL INFORMATION • The Company reported second quarter 2024 results on 7/17/24, and as such, the analysis now reflects financial information as of 6/30/24, compared to 5/31/24 previously. • We have received revised projections from Company management as summarized on pages 39-44. MARKET PRICING UPDATE • We have updated market pricing in the analysis to 7/26/24, compared to 6/27/24 in the previous materials • Certain selected companies have reported second quarter financial results SELECTED COMPANIES OBSERVATIONS AND ANALYSIS • Tier 1 selected companies median Adjusted EBITDA multiples decreased ~0.1x and ~0.3x for CY 2024E and CY 2025E, respectively • Tier 2 selected companies median Adjusted EBITDA multiples decreased ~0.3x and ~0.2x for CY 2024E and CY 2025E, respectively • All selected companies median Adjusted EBITDA multiples decreased ~0.1x and ~0.2x for CY 2024E and CY 2025E, respectively • No changes have been made to the selected multiple range in the selected companies analysis DISCOUNTED CASH FLOW ANALYSIS • No changes have been made to the Terminal Multiple selected range • No changes have been made to the selected WACC range – The risk-free rate of return is unchanged compared to the previous materials – The selected unlevered beta decreased to 0.55 from 0.57 in the previous materials – The computed weighted average cost of capital is unchanged when excluding corporate taxes and decreased 0.1% when including corporate taxes compared to the previous materials CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 4

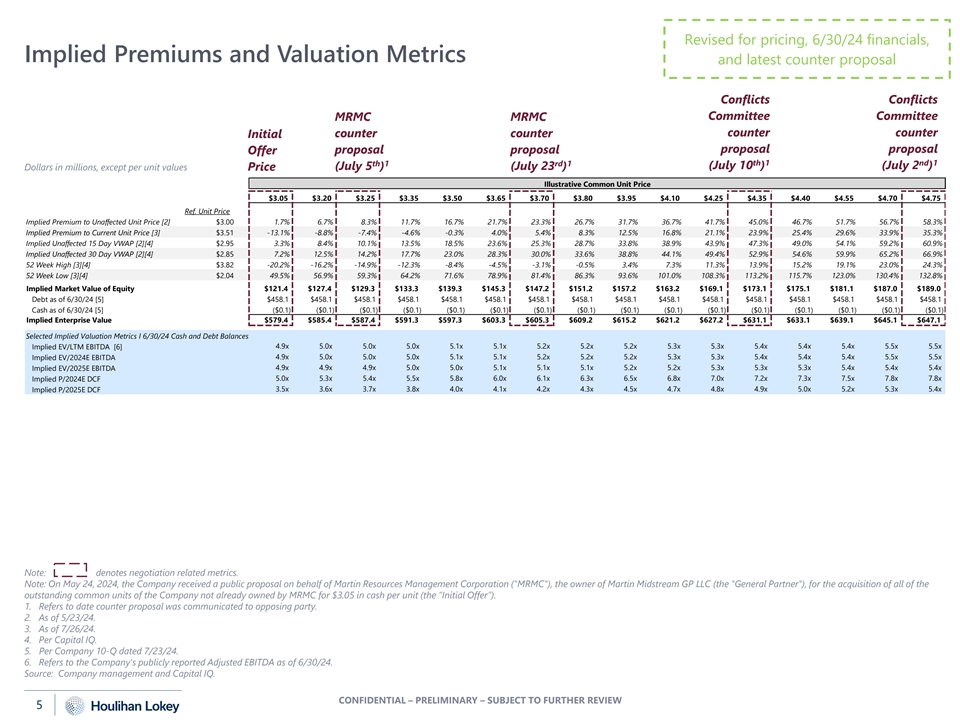

Revised for pricing, 6/30/24 financials, Implied Premiums and Valuation Metrics and latest counter proposal Conflicts Conflicts Committee Committee MRMC MRMC counter counter counter counter Initial proposal proposal proposal proposal Offer th 1 nd 1 th 1 rd 1 (July 10 ) (July 2 ) Dollars in millions, except per unit values Price (July 5 ) (July 23 ) Illustrative Common Unit Price $3.05 $3.20 $3.25 $3.35 $3.50 $3.65 $3.70 $3.80 $3.95 $4.10 $4.25 $4.35 $4.40 $4.55 $4.70 $4.75 Ref. Unit Price Implied Premium to Unaffected Unit Price [2] $3.00 1.7% 6.7% 8.3% 11.7% 16.7% 21.7% 23.3% 26.7% 31.7% 36.7% 41.7% 45.0% 46.7% 51.7% 56.7% 58.3% Implied Premium to Current Unit Price [3] $3.51 -13.1% -8.8% -7.4% -4.6% -0.3% 4.0% 5.4% 8.3% 12.5% 16.8% 21.1% 23.9% 25.4% 29.6% 33.9% 35.3% Implied Unaffected 15 Day VWAP [2][4] $2.95 3.3% 8.4% 10.1% 13.5% 18.5% 23.6% 25.3% 28.7% 33.8% 38.9% 43.9% 47.3% 49.0% 54.1% 59.2% 60.9% Implied Unaffected 30 Day VWAP [2][4] $2.85 7.2% 12.5% 14.2% 17.7% 23.0% 28.3% 30.0% 33.6% 38.8% 44.1% 49.4% 52.9% 54.6% 59.9% 65.2% 66.9% 52 Week High [3][4] $3.82 -20.2% -16.2% -14.9% -12.3% -8.4% -4.5% -3.1% -0.5% 3.4% 7.3% 11.3% 13.9% 15.2% 19.1% 23.0% 24.3% 52 Week Low [3][4] $2.04 49.5% 56.9% 59.3% 64.2% 71.6% 78.9% 81.4% 86.3% 93.6% 101.0% 108.3% 113.2% 115.7% 123.0% 130.4% 132.8% Implied Market Value of Equity $121.4 $127.4 $129.3 $133.3 $139.3 $145.3 $147.2 $151.2 $157.2 $163.2 $169.1 $173.1 $175.1 $181.1 $187.0 $189.0 Debt as of 6/30/24 [5] $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 $458.1 Cash as of 6/30/24 [5] ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) ($0.1) Implied Enterprise Value $579.4 $585.4 $587.4 $591.3 $597.3 $603.3 $605.3 $609.2 $615.2 $621.2 $627.2 $631.1 $633.1 $639.1 $645.1 $647.1 Selected Implied Valuation Metrics I 6/30/24 Cash and Debt Balances Implied EV/LTM EBITDA [6] 4.9x 5.0x 5.0x 5.0x 5.1x 5.1x 5.2x 5.2x 5.2x 5.3x 5.3x 5.4x 5.4x 5.4x 5.5x 5.5x Implied EV/2024E EBITDA 4.9x 5.0x 5.0x 5.0x 5.1x 5.1x 5.2x 5.2x 5.2x 5.3x 5.3x 5.4x 5.4x 5.4x 5.5x 5.5x Implied EV/2025E EBITDA 4.9x 4.9x 4.9x 5.0x 5.0x 5.1x 5.1x 5.1x 5.2x 5.2x 5.3x 5.3x 5.3x 5.4x 5.4x 5.4x Implied P/2024E DCF 5.0x 5.3x 5.4x 5.5x 5.8x 6.0x 6.1x 6.3x 6.5x 6.8x 7.0x 7.2x 7.3x 7.5x 7.8x 7.8x Implied P/2025E DCF 3.5x 3.6x 3.7x 3.8x 4.0x 4.1x 4.2x 4.3x 4.5x 4.7x 4.8x 4.9x 5.0x 5.2x 5.3x 5.4x Note: denotes negotiation related metrics. Note: On May 24, 2024, the Company received a public proposal on behalf of Martin Resources Management Corporation ( MRMC ), the owner of Martin Midstream GP LLC (the General Partner ), for the acquisition of all of the outstanding common units of the Company not already owned by MRMC for $3.05 in cash per unit (the “Initial Offer”). 1. Refers to date counter proposal was communicated to opposing party. 2. As of 5/23/24. 3. As of 7/26/24. 4. Per Capital IQ. 5. Per Company 10-Q dated 7/23/24. 6. Refers to the Company's publicly reported Adjusted EBITDA as of 6/30/24. Source: Company management and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 5

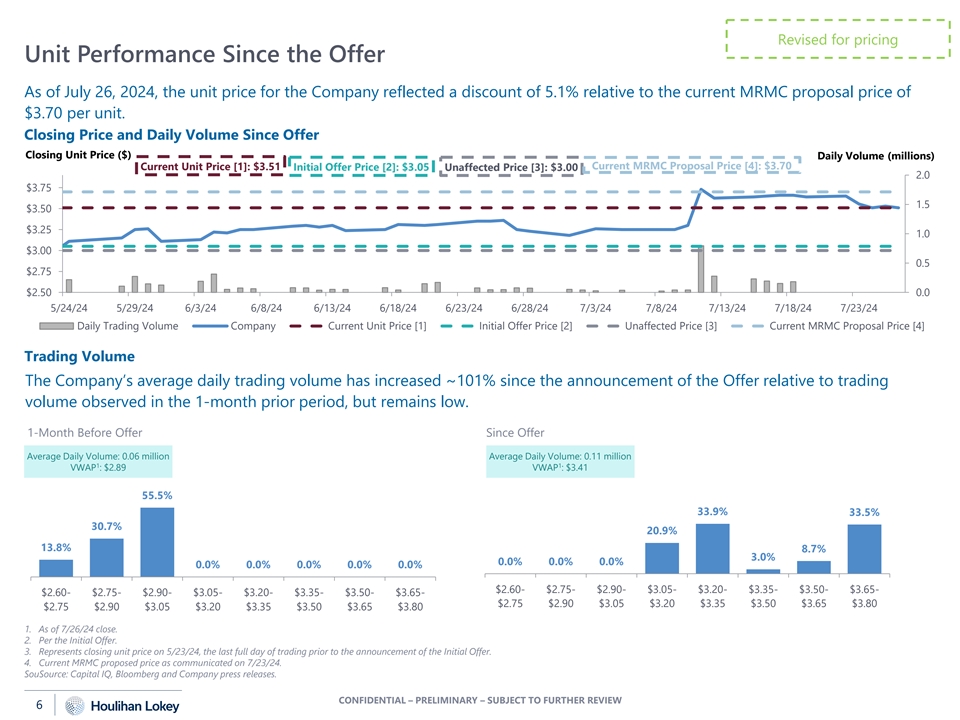

Revised for pricing Unit Performance Since the Offer As of July 26, 2024, the unit price for the Company reflected a discount of 5.1% relative to the current MRMC proposal price of $3.70 per unit. Closing Price and Daily Volume Since Offer Closing Unit Price ($) Daily Volume (millions) Current MRMC Proposal Price [4]: $3.70 Current Unit Price [1]: $3.51 Initial Offer Price [2]: $3.05 Unaffected Price [3]: $3.00 2.0 $3.75 1.5 $3.50 $3.25 1.0 $3.00 0.5 $2.75 $2.50 0.0 5/24/24 5/29/24 6/3/24 6/8/24 6/13/24 6/18/24 6/23/24 6/28/24 7/3/24 7/8/24 7/13/24 7/18/24 7/23/24 Daily Trading Volume Company Current Unit Price [1] Initial Offer Price [2] Unaffected Price [3] Current MRMC Proposal Price [4] Trading Volume The Company’s average daily trading volume has increased ~101% since the announcement of the Offer relative to trading volume observed in the 1-month prior period, but remains low. 1-Month Before Offer Since Offer Average Daily Volume: 0.06 million Average Daily Volume: 0.11 million 1 1 VWAP : $2.89 VWAP : $3.41 55.5% 33.9% 33.5% 30.7% 20.9% 13.8% 8.7% 3.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% $2.60- $2.75- $2.90- $3.05- $3.20- $3.35- $3.50- $3.65- $2.60- $2.75- $2.90- $3.05- $3.20- $3.35- $3.50- $3.65- $2.75 $2.90 $3.05 $3.20 $3.35 $3.50 $3.65 $3.80 $2.75 $2.90 $3.05 $3.20 $3.35 $3.50 $3.65 $3.80 1. As of 7/26/24 close. 2. Per the Initial Offer. 3. Represents closing unit price on 5/23/24, the last full day of trading prior to the announcement of the Initial Offer. 4. Current MRMC proposed price as communicated on 7/23/24. SouSource: Capital IQ, Bloomberg and Company press releases. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 6

PRELIMINARY FINANCIAL ANALYSES 02 02 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

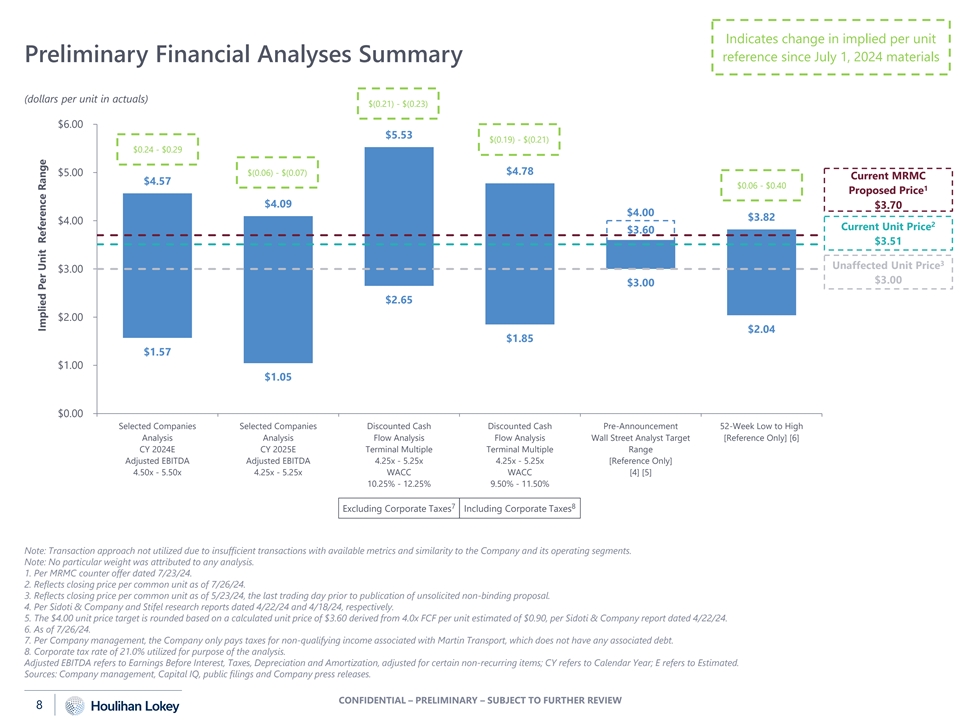

Indicates change in implied per unit reference since July 1, 2024 materials Preliminary Financial Analyses Summary (dollars per unit in actuals) $(0.21) - $(0.23) $6.00 $5.53 $(0.19) - $(0.21) $0.24 - $0.29 $4.78 $5.00 $(0.06) - $(0.07) Current MRMC $4.57 $0.06 - $0.40 1 Proposed Price $4.09 $3.70 $4.00 $3.82 $4.00 2 Current Unit Price $3.60 $3.51 3 Unaffected Unit Price $3.00 $3.00 $3.00 $2.65 $2.00 $2.04 $1.85 $1.57 $1.00 $1.05 $0.00 Selected Companies Selected Companies Discounted Cash Discounted Cash Pre-Announcement 52-Week Low to High Analysis Analysis Flow Analysis Flow Analysis Wall Street Analyst Target [Reference Only] [6] CY 2024E CY 2025E Terminal Multiple Terminal Multiple Range Adjusted EBITDA Adjusted EBITDA 4.25x - 5.25x 4.25x - 5.25x [Reference Only] 4.50x - 5.50x 4.25x - 5.25x WACC WACC [4] [5] 10.25% - 12.25% 9.50% - 11.50% 7 8 Excluding Corporate Taxes Including Corporate Taxes Note: Transaction approach not utilized due to insufficient transactions with available metrics and similarity to the Company and its operating segments. Note: No particular weight was attributed to any analysis. 1. Per MRMC counter offer dated 7/23/24. 2. Reflects closing price per common unit as of 7/26/24. 3. Reflects closing price per common unit as of 5/23/24, the last trading day prior to publication of unsolicited non-binding proposal. 4. Per Sidoti & Company and Stifel research reports dated 4/22/24 and 4/18/24, respectively. 5. The $4.00 unit price target is rounded based on a calculated unit price of $3.60 derived from 4.0x FCF per unit estimated of $0.90, per Sidoti & Company report dated 4/22/24. 6. As of 7/26/24. 7. Per Company management, the Company only pays taxes for non-qualifying income associated with Martin Transport, which does not have any associated debt. 8. Corporate tax rate of 21.0% utilized for purpose of the analysis. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated. Sources: Company management, Capital IQ, public filings and Company press releases. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 8 Implied Per Unit Reference Range

Revised for 6/30/24 financials Preliminary Financial Analyses Summary (cont.) and Current Projections (dollars and units in millions, except per unit values) Excluding Corporate Taxes [1] Including Corporate Taxes [2] Selected Companies Selected Companies Discounted Cash Discounted Cash Analysis Analysis Flow Analysis Flow Analysis CY 2024E CY 2025E Terminal Multiple Terminal Multiple Adjusted EBITDA Adjusted EBITDA 4.25x -- 5.25x 4.25x -- 5.25x Discount Rate Discount Rate Corresponding Base Amount $117.3 $119.3 10.25% -- 12.25% 9.50% -- 11.50% Selected Multiples Range 4.50x -- 5.50x 4.25x -- 5.25x Implied Enterprise Value Reference Range $528.0 -- $645.3 $507.1 -- $626.5 $570.9 -- $683.5 $539.1 -- $653.6 Cash and Cash Equivalents as of 6/30/24 [3] 0.1 -- 0.1 0.1 -- 0.1 0.1 -- 0.1 0.1 -- 0.1 Implied Total Enterprise Value Reference Range $528.0 -- $645.4 $507.2 -- $626.5 $571.0 -- $683.6 $539.1 -- $653.6 Total Debt and Capital Leases as of 6/30/24 [3] (458.1) -- (458.1) (458.1) -- (458.1) (458.1) -- (458.1) (458.1) -- (458.1) Implied Total Equity Value Reference Range Pre-Contingent Liability $70.0 -- $187.3 $49.1 -- $168.5 $112.9 -- $225.5 $81.1 -- $195.5 Contingent Liability [4] (7.5) -- (5.5) (7.5) -- (5.5) (7.5) -- (5.5) (7.5) -- (5.5) Implied Total Equity Value Reference Range $62.5 -- $181.8 $41.6 -- $163.0 $105.4 -- $220.0 $73.6 -- $190.0 Units Outstanding [5] 39.8 -- 39.8 39.8 -- 39.8 39.8 -- 39.8 39.8 -- 39.8 Implied Per Unit Reference Range $1.57 -- $4.57 $1.05 -- $4.09 $2.65 -- $5.53 $1.85 -- $4.78 1. Per Company management, the Company only pays taxes for non-qualifying income associated with Martin Transport, which does not have any associated debt. 2. Corporate tax rate of 21.0% utilized for purpose of the analysis. 3. Per Company 10-Q dated 7/23/24. 4. Refers to the Company's potential financial exposure associated with certain litigation related matters and potential insurance claims related to the oil spill that occurred on 6/15/24 and Marine bridge incident that occurred on 5/15/24, per Company management. 5. Represents ~39.0 million common units and ~0.8 million units to account for the General Partner's 2% economic interest, per Company 10-Q dated 7/23/24. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items. CY refers to Calendar Year. E refers to Estimated. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 9

Selected Historical and Projected Financial Information Revised for Current Projections Consolidated Calendar Year Ended December 31, LTM Ended Calendar Year Ending December 31, CAGR 2022A [1] 2023A [1] 6/30/24 [1] 2024E 2025E 2026E 2027E 2028E 2023A to 2028E (dollars in millions, except per unit figures) Total Revenue $1,073.7 $834.3 $753.4 $763.0 $794.1 $789.3 $772.9 $784.9 -1.2% A Growth % 15.8% NMF -8.5% 4.1% -0.6% -2.1% 1.6% Total Cost of Products Sold (675.1) (423.1) (334.4) (348.7) (378.4) (367.2) (346.5) (353.9) Gross Profit $398.6 $411.1 $419.0 $414.3 $415.7 $422.0 $426.4 $431.0 Margin % 37.1% 49.3% 55.6% 54.3% 52.4% 53.5% 55.2% 54.9% Total Operating Expenses ($254.8) ($254.9) ($260.8) ($259.0) ($255.0) ($261.0) ($265.8) ($267.9) Total SG&A [2] (41.9) (40.9) (40.9) (39.9) (42.3) (43.2) (44.1) (44.9) Other Income (Expense) [3] (0.0) 0.1 0.0 0.0 0.9 1.3 1.3 1.3 Note: The Company is currently not Net loss associated with Butane optimization business 20.0 2.3 - - - - - - Bridge Allision and Crude Oil Spill Adjustment [4] - - 2.0 2.0 - - - - adjusting these items in its reported Adjusted EBITDA $121.9 $117.6 $119.3 $117.3 $119.3 $119.1 $117.7 $119.5 0.3% Adjusted EBITDA or 2024 guidance A Margin % 11.4% 14.1% 15.8% 15.4% 15.0% 15.1% 15.2% 15.2% Growth % 6.4% -3.5% -0.2% 1.7% -0.2% -1.2% 1.5% Other Adjustments [5] ($7.2) ($15.1) (2.0) - - - - Cash Interest ($50.5) ($54.1) ($51.7) ($49.6) ($47.7) ($33.7) ($27.8) Non-Cash Unit-Based Compensation $0.2 $0.2 $0.2 $0.2 $0.2 $0.2 $0.2 Cash Taxes ($2.2) ($1.7) ($4.5) ($5.2) ($5.3) ($5.1) ($5.1) Maintenance Capex ($24.3) ($29.1) ($35.2) ($29.6) ($30.8) ($24.9) ($23.5) Distributable Cash Flow $37.9 $17.7 $24.1 $35.0 $35.5 $54.1 $63.4 Other Adjustments [6] ($12.9) $2.6 - - - - - Phantom Stock - - ($2.0) $1.5 ($1.6) - - Working Capital ($17.4) $78.5 ($4.0) $1.9 ($0.1) ($12.7) ($0.5) B Growth Capex ($6.9) ($11.0) ($22.5) ($5.9) ($10.8) ($12.6) ($15.1) Proceeds from Asset Sales $7.8 $5.5 $1.8 $0.3 $0.3 $0.3 $0.6 Free Cash Flow Before Distributions $8.6 $93.2 ($2.7) $32.8 $23.4 $29.2 $48.4 Distributions ($0.8) ($0.8) ($0.8) ($0.8) ($0.8) ($0.8) ($0.8) C Free Cash Flow After Distributions $7.8 $92.5 ($3.4) $32.1 $22.6 $28.4 $47.6 Revolver Draw / (Paydown) ($6.8) ($131.1) $3.8 ($29.9) ($13.4) $167.8 ($47.5) D High Yield Issuance (Redemptions) ($0.6) $54.9 - - - ($200.0) - Other [7] ($0.3) ($16.2) $0.1 ($2.2) -- ($5.3) -- Free Cash Flow ($0.0) $0.0 $0.4 ($0.0) $9.1 ($9.1) ($0.0) Additional Financial Information Net Income ($10.3) ($4.5) $6.5 $6.7 $17.1 $15.7 $26.3 $35.2 Total Capital Expenditures $31.1 $40.1 $60.3 $57.7 $35.5 $41.6 $37.5 $38.6 Decrease (Increase) in Net Working Capital [8] ($48.0) $75.7 ($5.3) $1.9 ($0.1) ($0.5) ($0.5) Annual Distributions per unit $0.02 $0.02 $0.02 $0.02 $0.02 $0.02 $0.02 $0.02 Net Debt [9] $516.1 $442.4 $458.0 $442.9 $413.0 $390.4 $367.3 $319.7 A B C D 2024 growth capital expenditures mainly related to Sulfur Services segment (ELSA JV $18 $400 mm High Yield Notes redeemed post expiration of See following page Distributions per unit mm and Seneca warehouse expansion $2 mm). 2025-2027 growth capital expenditures the call premium period in February 2027. Redemption for details and held constant across the ~80-90% attributable to Specialty Storage, with 2028 growth spend split between financed by a $167.8 mm new revolver drawdown and commentary. projection period. Specialty Storage and Land Transportation. $200 mm of new 8.5% notes. Note: Historical and projected revenue, costs and expenses exclude intercompany eliminations. 1. CY 2022A, CY 2023A, and LTM Adj. EBITDA shown proforma for Company's exit from the Butane optimization business. CY 2022A, CY 2023A, and LTM revenue not adjusted for the exit from the Butane optimization business. 2. Includes non-cash unit based compensation. 3. Includes (i) preferred distribution from ELSA JV of $0.9 million/year from 2025E to 2028E and (ii) excess common distributions of $0.4 million/year from 2026E to 2028E. 4. Represents $0.5 million related to the bridge allision in May 2024 and $1.5 million related to the crude oil spill from a crude pipeline connecting the Sandyland Terminal to the Smackover refinery in June 2024. 5. Includes net loss and non-cash adjustments related to the Butane optimization business, bridge allision, and crude oil spill from a crude pipeline connecting the Sandyland Terminal to the Smackover refinery. 6. Includes non-cash adjustments related to the Butane optimization business. In 2023, also includes early extinguishment of debt adjustment. 7. Includes certain debt securities related expenses. 8. Excludes accrued interest. 9. LTM represents figures as of 6/30/24, per Company management. A refers to Actual; Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CAGR refers to Compound Annual Growth Rate; CY refers to Calendar Year; E refers to Estimated; LTM refers to Latest 12 Months; NA refers to not available; NMF refers to not meaningful figure. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 10

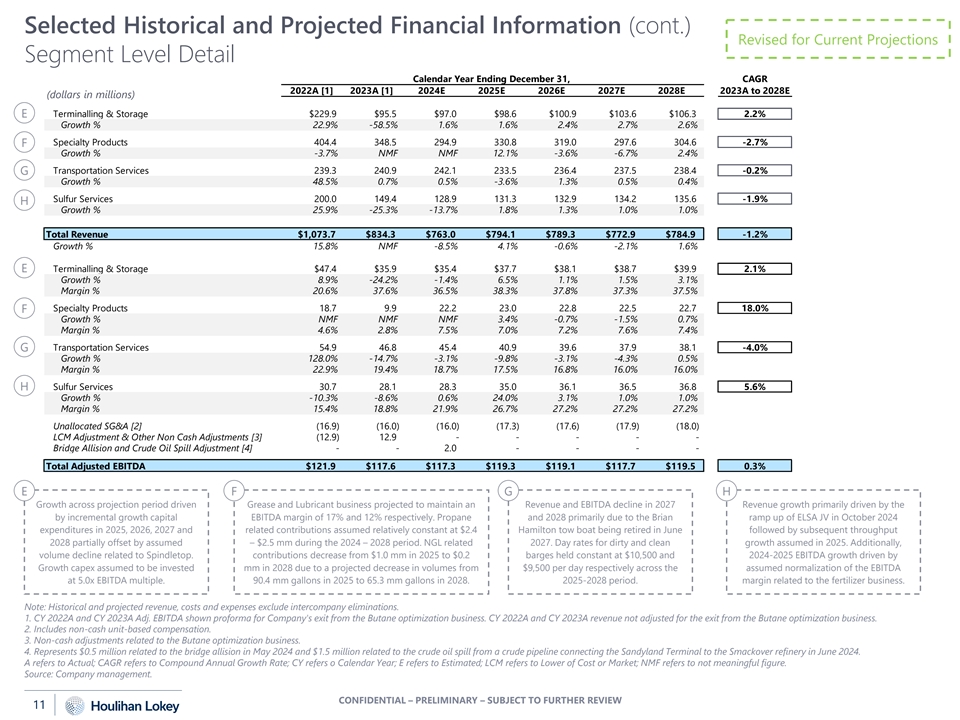

Selected Historical and Projected Financial Information (cont.) Revised for Current Projections Segment Level Detail Calendar Year Ending December 31, CAGR 2022A [1] 2023A [1] 2024E 2025E 2026E 2027E 2028E 2023A to 2028E (dollars in millions) E Terminalling & Storage $229.9 $95.5 $97.0 $98.6 $100.9 $103.6 $106.3 2.2% Growth % 22.9% -58.5% 1.6% 1.6% 2.4% 2.7% 2.6% Specialty Products 404.4 348.5 294.9 330.8 319.0 297.6 304.6 -2.7% F Growth % -3.7% NMF NMF 12.1% -3.6% -6.7% 2.4% G Transportation Services 239.3 240.9 242.1 233.5 236.4 237.5 238.4 -0.2% Growth % 48.5% 0.7% 0.5% -3.6% 1.3% 0.5% 0.4% Sulfur Services 200.0 149.4 128.9 131.3 132.9 134.2 135.6 -1.9% H Growth % 25.9% -25.3% -13.7% 1.8% 1.3% 1.0% 1.0% Total Revenue $1,073.7 $834.3 $763.0 $794.1 $789.3 $772.9 $784.9 -1.2% Growth % 15.8% NMF -8.5% 4.1% -0.6% -2.1% 1.6% Terminalling & Storage $47.4 $35.9 $35.4 $37.7 $38.1 $38.7 $39.9 2.1% E Growth % 8.9% -24.2% -1.4% 6.5% 1.1% 1.5% 3.1% Margin % 20.6% 37.6% 36.5% 38.3% 37.8% 37.3% 37.5% Specialty Products 18.7 9.9 22.2 23.0 22.8 22.5 22.7 18.0% F Growth % NMF NMF NMF 3.4% -0.7% -1.5% 0.7% Margin % 4.6% 2.8% 7.5% 7.0% 7.2% 7.6% 7.4% Transportation Services 54.9 46.8 45.4 40.9 39.6 37.9 38.1 -4.0% G Growth % 128.0% -14.7% -3.1% -9.8% -3.1% -4.3% 0.5% Margin % 22.9% 19.4% 18.7% 17.5% 16.8% 16.0% 16.0% H Sulfur Services 30.7 28.1 28.3 35.0 36.1 36.5 36.8 5.6% Growth % -10.3% -8.6% 0.6% 24.0% 3.1% 1.0% 1.0% Margin % 15.4% 18.8% 21.9% 26.7% 27.2% 27.2% 27.2% Unallocated SG&A [2] (16.9) (16.0) (16.0) (17.3) (17.6) (17.9) (18.0) LCM Adjustment & Other Non Cash Adjustments [3] (12.9) 12.9 - - - - - Bridge Allision and Crude Oil Spill Adjustment [4] - - 2.0 - - - - Total Adjusted EBITDA $121.9 $117.6 $117.3 $119.3 $119.1 $117.7 $119.5 0.3% E F G H Growth across projection period driven Grease and Lubricant business projected to maintain an Revenue and EBITDA decline in 2027 Revenue growth primarily driven by the by incremental growth capital EBITDA margin of 17% and 12% respectively. Propane and 2028 primarily due to the Brian ramp up of ELSA JV in October 2024 expenditures in 2025, 2026, 2027 and related contributions assumed relatively constant at $2.4 Hamilton tow boat being retired in June followed by subsequent throughput 2028 partially offset by assumed – $2.5 mm during the 2024 – 2028 period. NGL related 2027. Day rates for dirty and clean growth assumed in 2025. Additionally, volume decline related to Spindletop. contributions decrease from $1.0 mm in 2025 to $0.2 barges held constant at $10,500 and 2024-2025 EBITDA growth driven by Growth capex assumed to be invested mm in 2028 due to a projected decrease in volumes from $9,500 per day respectively across the assumed normalization of the EBITDA at 5.0x EBITDA multiple. 90.4 mm gallons in 2025 to 65.3 mm gallons in 2028. 2025-2028 period. margin related to the fertilizer business. Note: Historical and projected revenue, costs and expenses exclude intercompany eliminations. 1. CY 2022A and CY 2023A Adj. EBITDA shown proforma for Company's exit from the Butane optimization business. CY 2022A and CY 2023A revenue not adjusted for the exit from the Butane optimization business. 2. Includes non-cash unit-based compensation. 3. Non-cash adjustments related to the Butane optimization business. 4. Represents $0.5 million related to the bridge allision in May 2024 and $1.5 million related to the crude oil spill from a crude pipeline connecting the Sandyland Terminal to the Smackover refinery in June 2024. A refers to Actual; CAGR refers to Compound Annual Growth Rate; CY refers o Calendar Year; E refers to Estimated; LCM refers to Lower of Cost or Market; NMF refers to not meaningful figure. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 11

Comparison of Management Projections vs. Wall Street Analyst Estimates 1 Revised for current projections Total Revenue Comparison (FY 2024 – FY 2025) (dollars in millions) and latest Wall Street Research $1,000.0 $794.1 $763.0 $773.6 $773.6 $748.3 $748.3 $500.0 NA NA $0.0 FY 2024 FY 2025 2 Adjusted EBITDA Comparison (FY 2024 – FY 2025) (dollars in millions) $119.3 $120.0 $118.9 $118.3 $117.8 $117.3 $118.0 $116.2 $116.1 $116.0 $116.0 $114.0 FY 2024 FY 2025 Distributable Cash Flow Comparison (FY 2024 – FY 2025) (dollars in millions) $60.0 $39.5 $35.0 $33.9 $32.3 $40.0 $28.3 $26.0 $24.1 $19.8 $20.0 $0.0 FY 2024 FY 2025 Management Projections Stifel Wall Street Estimates Sidoti & Company, LLC 1. Stifel estimates not available for revenue. 2. Adjusted EBITDA shown does not include add-back for stock-based compensation expense. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for unit-based compensation expense. FY refers to Fiscal Year. Source: Bloomberg, Company management and Wall Street Research. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 12

Revised for market pricing and updated Preliminary Selected Companies Analysis Company financials where available Enterprise Value [1] to (dollars in millions, except per share values) Share Equity Market Enterprise Adjusted EBITDA Tier 1 Price [2] Value [2] [3] Value [2] [3] CY 2024E [4] CY 2025E [4] Adams Resources & Energy, Inc. $26.75 $72.3 $79.3 3.1x [5] 2.9x [5] Ardmore Shipping Corporation $20.53 $867.4 $922.1 4.7x 5.8x Genesis Energy, L.P. $14.26 $1,746.3 [6] $6,746.7 9.6x 8.0x Navios Maritime Partners L.P. $47.22 $1,454.7 [7] $3,064.7 3.8x 3.5x NGL Energy Partners LP $4.68 $620.8 [8] $4,350.4 6.8x 6.2x Tsakos Energy Navigation Limited $25.46 $751.2 $2,078.6 4.4x [5] 3.8x [5] Low 3.1x 2.9x High 9.6x 8.0x Median 4.6x 4.8x Mean 5.4x 5.0x Tier 2 Delek Logistics Partners, LP $41.21 $1,946.5 [6] $3,538.0 8.5x 8.1x Mullen Group Ltd. $10.61 $1,023.3 $1,437.5 6.1x 5.7x Oil States International, Inc. $4.74 $315.1 $427.2 5.1x 4.5x Ranger Energy Services, Inc. $11.46 $267.9 $268.2 4.1x 3.2x RPC, Inc. $6.96 $1,521.0 $1,264.0 4.6x 3.7x Suburban Propane Partners, L.P. $18.69 $1,218.3 [6] $2,426.2 8.8x 8.2x World Kinect Corporation $26.85 $1,592.2 $1,951.9 5.2x 4.7x Low 4.1x 3.2x High 8.8x 8.2x Median 5.2x 4.7x Mean 6.0x 5.4x All Selected Companies Low 3.1x 2.9x High 9.6x 8.2x Median 5.1x 4.7x Mean 5.7x 5.3x Current Company | Consensus Estimates [9] $3.51 $139.7 $597.7 5.1x 5.1x Company | Management Projections [10] $3.51 $139.7 $597.7 5.1x 5.0x Unaffected [11] $3.00 $119.4 $581.3 5.0x 4.9x Company | Consensus Estimates [9] $3.00 $119.4 $581.3 5.0x 4.9x Company | Management Projections [10] Note: No company used in this analysis for comparative purposes is identical to Company. 1. Enterprise Value equals equity market value + debt outstanding + preferred stock + minority interests – cash and cash equivalents. 2. Based on closing prices as of 7/26/24. 3. Based on diluted shares. 4. Multiples based on forward looking financial information have been calendarized to Company’s fiscal year end of December 31st. 5. Represents Adjusted EBITDA estimates per Capital IQ. 6. General partner interest is non-economic. 7. Includes ~2% general partner interest. 8. Includes 0.1% general partner interest. 9. Adjusted EBITDA for forward periods reflects consensus analyst estimates excludes stock-based compensation expense addback. 10. Adjusted EBITDA for forward periods reflects Company projections. 11. Represents figures as of 5/23/24, the last full day of trading prior to the announcement of the Initial Offer. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated; FY refers to Fiscal Year; NA refers to not available. Sources: Bloomberg, Capital IQ, and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 13

Revised for current projections Preliminary Selected Companies Analysis and Benchmarking and consensus estimates Enterprise Value [1] to CY 2024E Adjusted EBITDA 12.0x 9.6x 10.0x 8.8x 8.0x Median: Median: 6.0x 2 4.6x 5.2x Company 5.1x 4.0x 4.1x 3.1x 2.0x 0.0x Tier 1 [3] Tier 2 [3] CY 2023 to CY 2025E Adjusted EBITDA CAGR (LTM Adj. EBITDA - Int. Expense - Capex) / LTM Adj. EBITDA 46.1% 5.4% 4.0% 24.5% 0.7% 5.8% Company Tier 1 Median Tier 2 Median Company Tier 1 Median Tier 2 Median 1. Enterprise Value equals equity market value + debt outstanding + preferred stock + minority interests – cash and cash equivalents. 2. Adjusted EBITDA for forward periods reflects consensus analyst estimates excludes stock-based compensation expense addback. 3. Low and high multiples per range shown on the Preliminary Selected Companies Analysis page. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items. CAGR refers to Compound Annual Growth Rate; Capex refers to Capital Expenditures; CY refers to Calendar Year; E refers to Estimated; Int. Expense refers to Interest Expense; LTM refers to Latest 12 Months. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 14

Revised for Current Projections Preliminary Discounted Cash Flow Analysis Excluding Corporate Taxes (dollars in millions, except per unit values) Projected Calendar Year Ending December 31, 2024E [1] 2025E 2026E 2027E 2028E Total Revenue $382.5 $794.1 $789.3 $772.9 $784.9 Growth % 4.1% -0.6% -2.1% 1.6% Total Cost of Products Sold (180.7) (378.4) (367.2) (346.5) (353.9) Total Operating Expenses (128.3) (255.0) (261.0) (265.8) (267.9) Total SG&A [2] (20.3) (42.3) (43.2) (44.1) (44.9) Other Income (Expense) [3] 0.0 0.9 1.3 1.3 1.3 Adjusted EBITDA $53.3 $119.3 $119.1 $117.7 $119.5 Margin % 13.9% 15.0% 15.1% 15.2% 15.2% Total Depreciation & Amortization (22.1) (42.5) (45.7) (48.1) (49.5) Adjusted EBIT $31.3 $76.8 $73.4 $69.6 $70.0 Taxes [4] (2.3) (5.2) (5.3) (5.1) (5.1) Unlevered Earnings $29.0 $71.6 $68.2 $64.5 $64.9 Total Depreciation & Amortization 22.1 42.5 45.7 48.1 49.5 Proceeds from sale of assets 1.1 0.3 0.3 0.3 0.6 Phantom Stock (1.0) 1.5 (1.6) 0.0 0.0 Total Capital Expenditures (20.2) (35.5) (41.6) (37.5) (38.6) Decrease (Increase) in Net Working Capital [5] 8.9 1.9 (0.1) (0.5) (0.5) Unlevered Free Cash Flows $39.8 $82.3 $70.9 $74.9 $76.0 Present Value PV of Terminal Value PV of Terminal Value of Cash Flows as a Multiple of Implied Enterprise Value as a % of Enterprise Value (2024 - 2028) 2028 Adjusted EBITDA Discount Rate 4.25x 4.75x 5.25x 4.25x 4.75x 5.25x Discount Rate 4.25x 4.75x 5.25x 10.25% $279.0 $327.4 $365.9 $404.5 $606.5 $645.0 $683.5 10.25% 54.0% 56.7% 59.2% 10.75% $276.4 $320.8 $358.6 $396.3 $597.3 $635.0 $672.8 10.75% 53.7% 56.5% 58.9% 11.25% $273.9 $314.4 $351.4 $388.4 $588.3 $625.3 $662.3 11.25% 53.4% 56.2% 58.6% + = 11.75% $271.4 $308.1 $344.4 $380.6 $579.5 $615.8 $652.0 11.75% 53.2% 55.9% 58.4% 12.25% $269.0 $302.0 $337.5 $373.0 $570.9 $606.5 $642.0 12.25% 52.9% 55.7% 58.1% Note: Present values as of 7/1/24; mid-year convention applied. Refer to WACC calculation for derivation of discount rate. 1. Represents projections from July to December 2024. 2. Includes non-cash unit-based compensation. 3. Includes (i) preferred distribution from ELSA JV of $0.9 million/year from 2025E to 2028E and (ii) excess common distributions of $0.4 million/year from 2026E to 2028E. 4. Cash Taxes related to Martin Transport, per Company management. 5. Excludes working capital related to accrued interest. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items. Adjusted EBIT refers to Earnings Before Interest and Taxes, adjusted for certain non-recurring items. E refers to Estimated. PV refers to Present Value. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 15

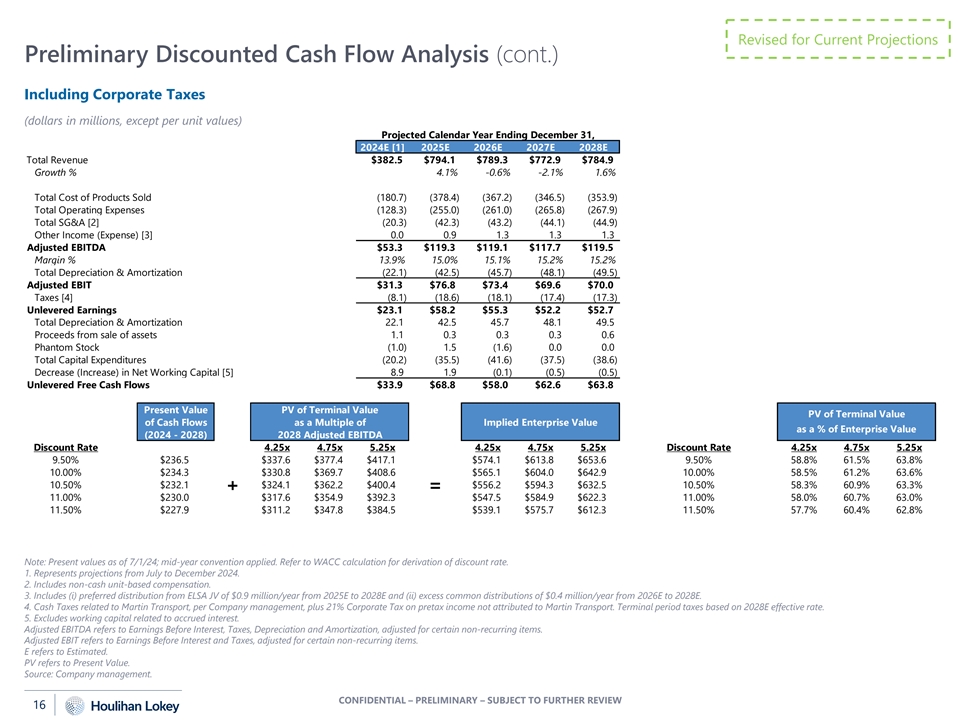

Revised for Current Projections Preliminary Discounted Cash Flow Analysis (cont.) Including Corporate Taxes (dollars in millions, except per unit values) Projected Calendar Year Ending December 31, 2024E [1] 2025E 2026E 2027E 2028E Total Revenue $382.5 $794.1 $789.3 $772.9 $784.9 Growth % 4.1% -0.6% -2.1% 1.6% Total Cost of Products Sold (180.7) (378.4) (367.2) (346.5) (353.9) Total Operating Expenses (128.3) (255.0) (261.0) (265.8) (267.9) Total SG&A [2] (20.3) (42.3) (43.2) (44.1) (44.9) Other Income (Expense) [3] 0.0 0.9 1.3 1.3 1.3 Adjusted EBITDA $53.3 $119.3 $119.1 $117.7 $119.5 Margin % 13.9% 15.0% 15.1% 15.2% 15.2% Total Depreciation & Amortization (22.1) (42.5) (45.7) (48.1) (49.5) Adjusted EBIT $31.3 $76.8 $73.4 $69.6 $70.0 Taxes [4] (8.1) (18.6) (18.1) (17.4) (17.3) Unlevered Earnings $23.1 $58.2 $55.3 $52.2 $52.7 Total Depreciation & Amortization 22.1 42.5 45.7 48.1 49.5 Proceeds from sale of assets 1.1 0.3 0.3 0.3 0.6 Phantom Stock (1.0) 1.5 (1.6) 0.0 0.0 Total Capital Expenditures (20.2) (35.5) (41.6) (37.5) (38.6) Decrease (Increase) in Net Working Capital [5] 8.9 1.9 (0.1) (0.5) (0.5) Unlevered Free Cash Flows $33.9 $68.8 $58.0 $62.6 $63.8 Present Value PV of Terminal Value PV of Terminal Value of Cash Flows as a Multiple of Implied Enterprise Value as a % of Enterprise Value (2024 - 2028) 2028 Adjusted EBITDA Discount Rate 4.25x 4.75x 5.25x 4.25x 4.75x 5.25x Discount Rate 4.25x 4.75x 5.25x 9.50% $236.5 $337.6 $377.4 $417.1 $574.1 $613.8 $653.6 9.50% 58.8% 61.5% 63.8% 10.00% $234.3 $330.8 $369.7 $408.6 $565.1 $604.0 $642.9 10.00% 58.5% 61.2% 63.6% 10.50% $232.1 $324.1 $362.2 $400.4 $556.2 $594.3 $632.5 10.50% 58.3% 60.9% 63.3% + = 11.00% $230.0 $317.6 $354.9 $392.3 $547.5 $584.9 $622.3 11.00% 58.0% 60.7% 63.0% 11.50% $227.9 $311.2 $347.8 $384.5 $539.1 $575.7 $612.3 11.50% 57.7% 60.4% 62.8% Note: Present values as of 7/1/24; mid-year convention applied. Refer to WACC calculation for derivation of discount rate. 1. Represents projections from July to December 2024. 2. Includes non-cash unit-based compensation. 3. Includes (i) preferred distribution from ELSA JV of $0.9 million/year from 2025E to 2028E and (ii) excess common distributions of $0.4 million/year from 2026E to 2028E. 4. Cash Taxes related to Martin Transport, per Company management, plus 21% Corporate Tax on pretax income not attributed to Martin Transport. Terminal period taxes based on 2028E effective rate. 5. Excludes working capital related to accrued interest. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items. Adjusted EBIT refers to Earnings Before Interest and Taxes, adjusted for certain non-recurring items. E refers to Estimated. PV refers to Present Value. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 16

Illustrative Present Value of Future Distributions (cont.) Note: Present values as of 7/1/24; mid-year convention applied. 1. Reflects stub period as of 7/1/24. 2. Held constant after 2028E. 3. For purpose of the illustrative analysis, assumes total distribution amounts of $10 mm, $20 mm, $30 mm and $40 mm for each of 2028E, 2029E, 2030E and 2031E respectively. 4. Defined as Distributable Cash Flow divided by total Distributions in a given year. 5. Defined as total Distributions divided by Distributable Cash Flow in a given year. 6. Includes incremental 50,000 partner units granted to the Board of Directors per year. Per Company management. 0.8 million General Partner units implied based on 2.0% general partner interest. 7. For purpose of the illustrative analysis, (i) 2028 Free Cash Flow After Distributions is assumed to be utilized to pay down the revolver and (ii) the revolver balance is held constant after 2028. 8. For purpose of the illustrative analysis, the Company's adjusted EBITDA is assumed to be held constant after 2028. 9. Defined as Free Cash Flow Before Distributions divided by total Distributions in a given year. 10. Assumes $150 mm of total credit facility availability from 2024 till January 2027 and $200 mm thereafter. Per Company management. 11. For purpose of the illustrative analysis, utilizes terminal perpetual growth rate of 0%. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 17

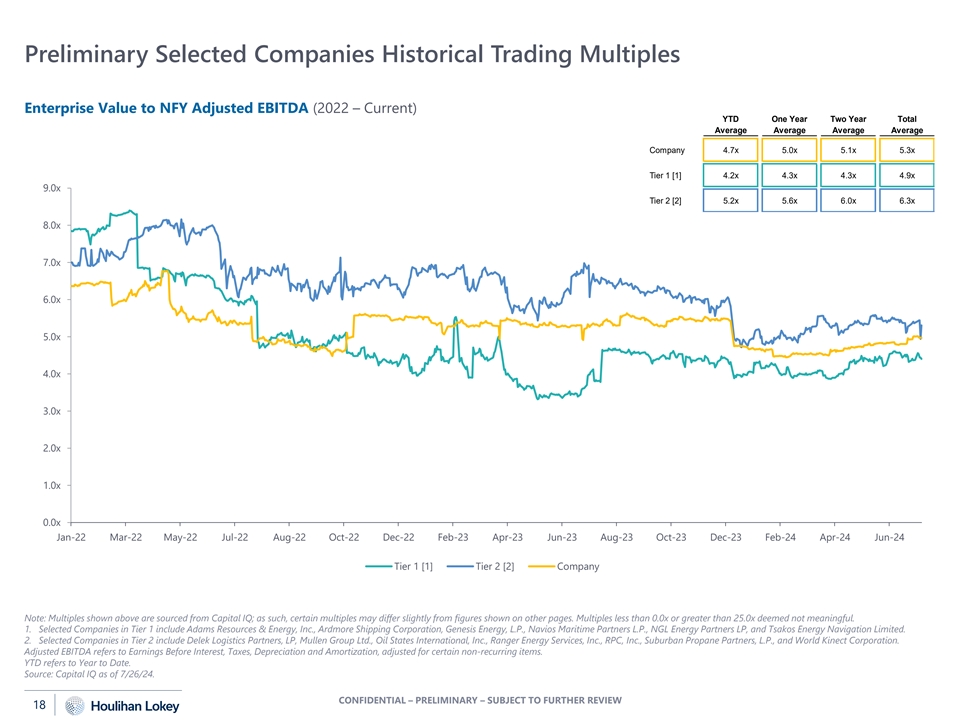

Preliminary Selected Companies Historical Trading Multiples Enterprise Value to NFY Adjusted EBITDA (2022 – Current) YTD One Year Two Year Total Average Average Average Average Company 4.7x 5.0x 5.1x 5.3x Tier 1 [1] 4.2x 4.3x 4.3x 4.9x 9.0x Tier 2 [2] 5.2x 5.6x 6.0x 6.3x 8.0x 7.0x 6.0x 5.0x 4.0x 3.0x 2.0x 1.0x 0.0x Jan-22 Mar-22 May-22 Jul-22 Aug-22 Oct-22 Dec-22 Feb-23 Apr-23 Jun-23 Aug-23 Oct-23 Dec-23 Feb-24 Apr-24 Jun-24 Tier 1 [1] Tier 2 [2] Company Note: Multiples shown above are sourced from Capital IQ; as such, certain multiples may differ slightly from figures shown on other pages. Multiples less than 0.0x or greater than 25.0x deemed not meaningful. 1. Selected Companies in Tier 1 include Adams Resources & Energy, Inc., Ardmore Shipping Corporation, Genesis Energy, L.P., Navios Maritime Partners L.P., NGL Energy Partners LP, and Tsakos Energy Navigation Limited. 2. Selected Companies in Tier 2 include Delek Logistics Partners, LP, Mullen Group Ltd., Oil States International, Inc., Ranger Energy Services, Inc., RPC, Inc., Suburban Propane Partners, L.P., and World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items. YTD refers to Year to Date. Source: Capital IQ as of 7/26/24. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 18

PRELIMINARY PREMIUMS PAID DATA 02 03 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

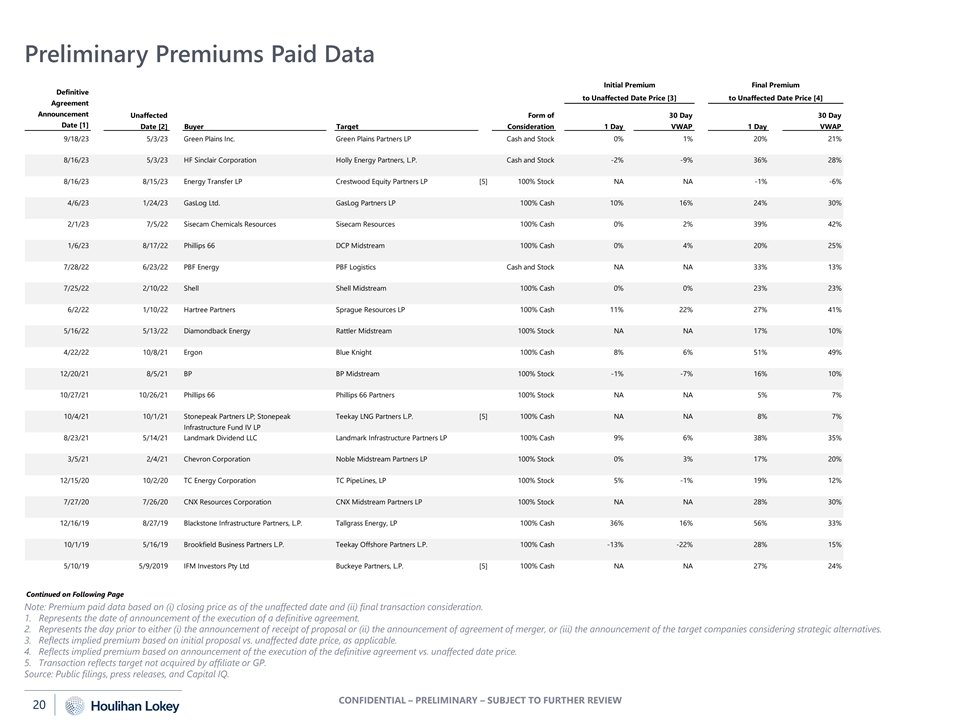

Preliminary Premiums Paid Data Initial Premium Final Premium Definitive to Unaffected Date Price [3] to Unaffected Date Price [4] Agreement Announcement Unaffected Form of 30 Day 30 Day Date [1] Date [2] Buyer Target Consideration 1 Day VWAP 1 Day VWAP 9/18/23 5/3/23 Green Plains Inc. Green Plains Partners LP Cash and Stock 0% 1% 20% 21% 8/16/23 5/3/23 HF Sinclair Corporation Holly Energy Partners, L.P. Cash and Stock -2% -9% 36% 28% 8/16/23 8/15/23 Energy Transfer LP Crestwood Equity Partners LP [5] 100% Stock NA NA -1% -6% 4/6/23 1/24/23 GasLog Ltd. GasLog Partners LP 100% Cash 10% 16% 24% 30% 2/1/23 7/5/22 Sisecam Chemicals Resources Sisecam Resources 100% Cash 0% 2% 39% 42% 1/6/23 8/17/22 Phillips 66 DCP Midstream 100% Cash 0% 4% 20% 25% 7/28/22 6/23/22 PBF Energy PBF Logistics Cash and Stock NA NA 33% 13% 7/25/22 2/10/22 Shell Shell Midstream 100% Cash 0% 0% 23% 23% 6/2/22 1/10/22 Hartree Partners Sprague Resources LP 100% Cash 11% 22% 27% 41% 5/16/22 5/13/22 Diamondback Energy Rattler Midstream 100% Stock NA NA 17% 10% 4/22/22 10/8/21 Ergon Blue Knight 100% Cash 8% 6% 51% 49% 12/20/21 8/5/21 BP BP Midstream 100% Stock -1% -7% 16% 10% 10/27/21 10/26/21 Phillips 66 Phillips 66 Partners 100% Stock NA NA 5% 7% 10/4/21 10/1/21 Stonepeak Partners LP; Stonepeak Teekay LNG Partners L.P. [5] 100% Cash NA NA 8% 7% Infrastructure Fund IV LP 8/23/21 5/14/21 Landmark Dividend LLC Landmark Infrastructure Partners LP 100% Cash 9% 6% 38% 35% 3/5/21 2/4/21 Chevron Corporation Noble Midstream Partners LP 100% Stock 0% 3% 17% 20% 12/15/20 10/2/20 TC Energy Corporation TC PipeLines, LP 100% Stock 5% -1% 19% 12% 7/27/20 7/26/20 CNX Resources Corporation CNX Midstream Partners LP 100% Stock NA NA 28% 30% 12/16/19 8/27/19 Blackstone Infrastructure Partners, L.P. Tallgrass Energy, LP 100% Cash 36% 16% 56% 33% 10/1/19 5/16/19 Brookfield Business Partners L.P. Teekay Offshore Partners L.P. 100% Cash -13% -22% 28% 15% 5/10/19 5/9/2019 IFM Investors Pty Ltd Buckeye Partners, L.P. [5] 100% Cash NA NA 27% 24% Continued on Following Page Note: Premium paid data based on (i) closing price as of the unaffected date and (ii) final transaction consideration. 1. Represents the date of announcement of the execution of a definitive agreement. 2. Represents the day prior to either (i) the announcement of receipt of proposal or (ii) the announcement of agreement of merger, or (iii) the announcement of the target companies considering strategic alternatives. 3. Reflects implied premium based on initial proposal vs. unaffected date price, as applicable. 4. Reflects implied premium based on announcement of the execution of the definitive agreement vs. unaffected date price. 5. Transaction reflects target not acquired by affiliate or GP. Source: Public filings, press releases, and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 20

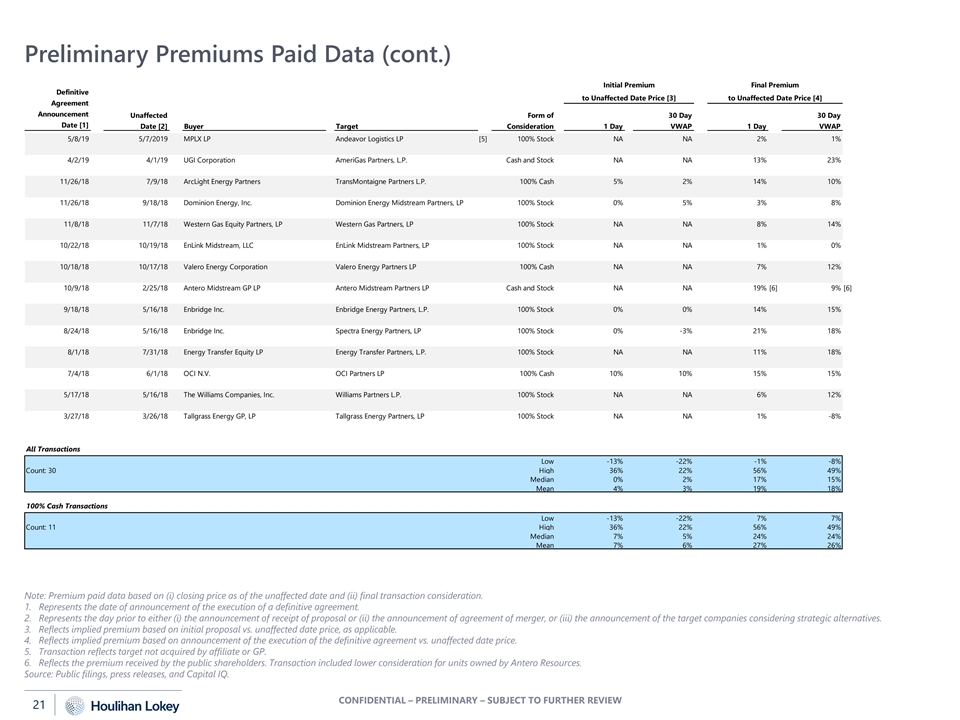

Preliminary Premiums Paid Data (cont.) Initial Premium Final Premium Definitive to Unaffected Date Price [3] to Unaffected Date Price [4] Agreement Announcement Unaffected Form of 30 Day 30 Day Date [1] Date [2] Buyer Target Consideration 1 Day VWAP 1 Day VWAP 5/8/19 5/7/2019 MPLX LP Andeavor Logistics LP [5] 100% Stock NA NA 2% 1% 4/2/19 4/1/19 UGI Corporation AmeriGas Partners, L.P. Cash and Stock NA NA 13% 23% 11/26/18 7/9/18 ArcLight Energy Partners TransMontaigne Partners L.P. 100% Cash 5% 2% 14% 10% 11/26/18 9/18/18 Dominion Energy, Inc. Dominion Energy Midstream Partners, LP 100% Stock 0% 5% 3% 8% 11/8/18 11/7/18 Western Gas Equity Partners, LP Western Gas Partners, LP 100% Stock NA NA 8% 14% 10/22/18 10/19/18 EnLink Midstream, LLC EnLink Midstream Partners, LP 100% Stock NA NA 1% 0% 10/18/18 10/17/18 Valero Energy Corporation Valero Energy Partners LP 100% Cash NA NA 7% 12% 10/9/18 2/25/18 Antero Midstream GP LP Antero Midstream Partners LP Cash and Stock NA NA 19% [6] 9% [6] 9/18/18 5/16/18 Enbridge Inc. Enbridge Energy Partners, L.P. 100% Stock 0% 0% 14% 15% 8/24/18 5/16/18 Enbridge Inc. Spectra Energy Partners, LP 100% Stock 0% -3% 21% 18% 8/1/18 7/31/18 Energy Transfer Equity LP Energy Transfer Partners, L.P. 100% Stock NA NA 11% 18% 7/4/18 6/1/18 OCI N.V. OCI Partners LP 100% Cash 10% 10% 15% 15% 5/17/18 5/16/18 The Williams Companies, Inc. Williams Partners L.P. 100% Stock NA NA 6% 12% 3/27/18 3/26/18 Tallgrass Energy GP, LP Tallgrass Energy Partners, LP 100% Stock NA NA 1% -8% All Transactions Low -13% -22% -1% -8% Count: 30 High 36% 22% 56% 49% Median 0% 2% 17% 15% Mean 4% 3% 19% 18% 100% Cash Transactions Low -13% -22% 7% 7% Count: 11 High 36% 22% 56% 49% Median 7% 5% 24% 24% Mean 7% 6% 27% 26% Note: Premium paid data based on (i) closing price as of the unaffected date and (ii) final transaction consideration. 1. Represents the date of announcement of the execution of a definitive agreement. 2. Represents the day prior to either (i) the announcement of receipt of proposal or (ii) the announcement of agreement of merger, or (iii) the announcement of the target companies considering strategic alternatives. 3. Reflects implied premium based on initial proposal vs. unaffected date price, as applicable. 4. Reflects implied premium based on announcement of the execution of the definitive agreement vs. unaffected date price. 5. Transaction reflects target not acquired by affiliate or GP. 6. Reflects the premium received by the public shareholders. Transaction included lower consideration for units owned by Antero Resources. Source: Public filings, press releases, and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 21

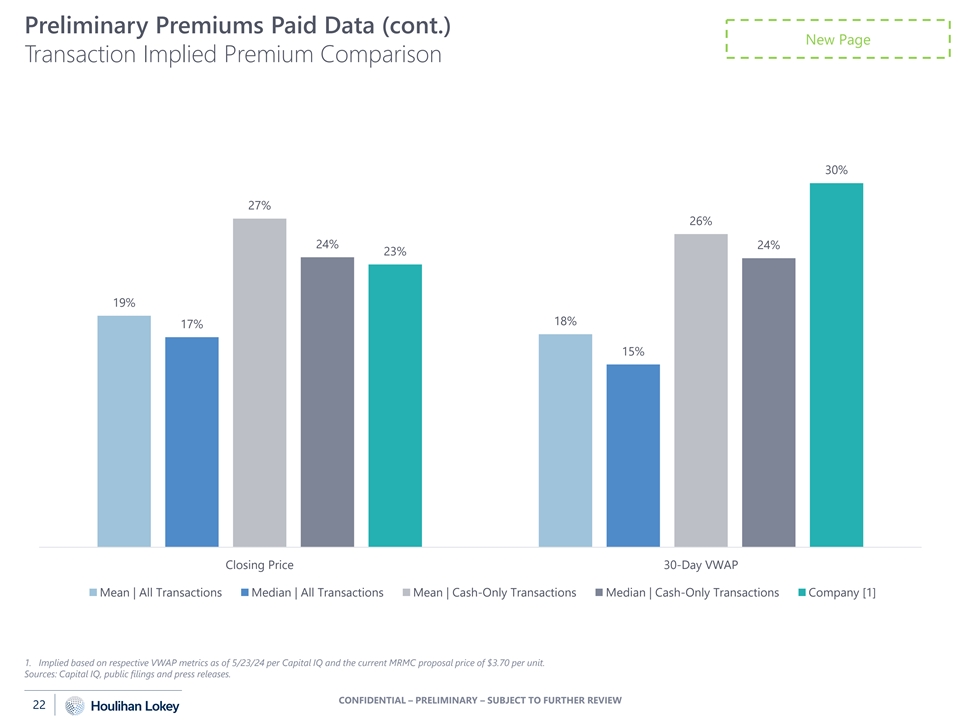

Preliminary Premiums Paid Data (cont.) New Page Transaction Implied Premium Comparison 30% 27% 26% 24% 24% 23% 19% 18% 17% 15% Closing Price 30-Day VWAP Mean | All Transactions Median | All Transactions Mean | Cash-Only Transactions Median | Cash-Only Transactions Company [1] 1. Implied based on respective VWAP metrics as of 5/23/24 per Capital IQ and the current MRMC proposal price of $3.70 per unit. Sources: Capital IQ, public filings and press releases. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 22

APPENDIX 06 04 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

APPENDIX Weighted Average Cost of Capital 06 04 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

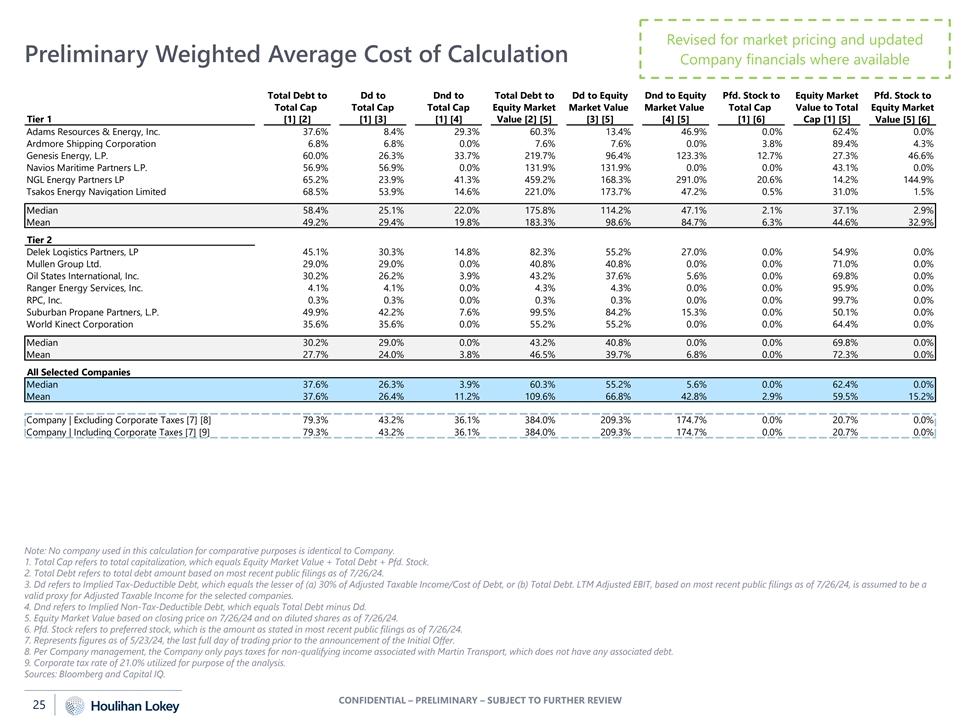

Revised for market pricing and updated Preliminary Weighted Average Cost of Calculation Company financials where available Total Debt to Dd to Dnd to Total Debt to Dd to Equity Dnd to Equity Pfd. Stock to Equity Market Pfd. Stock to Total Cap Total Cap Total Cap Equity Market Market Value Market Value Total Cap Value to Total Equity Market Tier 1 [1] [2] [1] [3] [1] [4] Value [2] [5] [3] [5] [4] [5] [1] [6] Cap [1] [5] Value [5] [6] Adams Resources & Energy, Inc. 37.6% 8.4% 29.3% 60.3% 13.4% 46.9% 0.0% 62.4% 0.0% Ardmore Shipping Corporation 6.8% 6.8% 0.0% 7.6% 7.6% 0.0% 3.8% 89.4% 4.3% Genesis Energy, L.P. 60.0% 26.3% 33.7% 219.7% 96.4% 123.3% 12.7% 27.3% 46.6% Navios Maritime Partners L.P. 56.9% 56.9% 0.0% 131.9% 131.9% 0.0% 0.0% 43.1% 0.0% NGL Energy Partners LP 65.2% 23.9% 41.3% 459.2% 168.3% 291.0% 20.6% 14.2% 144.9% Tsakos Energy Navigation Limited 68.5% 53.9% 14.6% 221.0% 173.7% 47.2% 0.5% 31.0% 1.5% Median 58.4% 25.1% 22.0% 175.8% 114.2% 47.1% 2.1% 37.1% 2.9% Mean 49.2% 29.4% 19.8% 183.3% 98.6% 84.7% 6.3% 44.6% 32.9% Tier 2 Delek Logistics Partners, LP 45.1% 30.3% 14.8% 82.3% 55.2% 27.0% 0.0% 54.9% 0.0% Mullen Group Ltd. 29.0% 29.0% 0.0% 40.8% 40.8% 0.0% 0.0% 71.0% 0.0% Oil States International, Inc. 30.2% 26.2% 3.9% 43.2% 37.6% 5.6% 0.0% 69.8% 0.0% Ranger Energy Services, Inc. 4.1% 4.1% 0.0% 4.3% 4.3% 0.0% 0.0% 95.9% 0.0% RPC, Inc. 0.3% 0.3% 0.0% 0.3% 0.3% 0.0% 0.0% 99.7% 0.0% Suburban Propane Partners, L.P. 49.9% 42.2% 7.6% 99.5% 84.2% 15.3% 0.0% 50.1% 0.0% World Kinect Corporation 35.6% 35.6% 0.0% 55.2% 55.2% 0.0% 0.0% 64.4% 0.0% Median 30.2% 29.0% 0.0% 43.2% 40.8% 0.0% 0.0% 69.8% 0.0% Mean 27.7% 24.0% 3.8% 46.5% 39.7% 6.8% 0.0% 72.3% 0.0% All Selected Companies Median 37.6% 26.3% 3.9% 60.3% 55.2% 5.6% 0.0% 62.4% 0.0% Mean 37.6% 26.4% 11.2% 109.6% 66.8% 42.8% 2.9% 59.5% 15.2% Company | Excluding Corporate Taxes [7] [8] 79.3% 43.2% 36.1% 384.0% 209.3% 174.7% 0.0% 20.7% 0.0% Company | Including Corporate Taxes [7] [9] 79.3% 43.2% 36.1% 384.0% 209.3% 174.7% 0.0% 20.7% 0.0% Note: No company used in this calculation for comparative purposes is identical to Company. 1. Total Cap refers to total capitalization, which equals Equity Market Value + Total Debt + Pfd. Stock. 2. Total Debt refers to total debt amount based on most recent public filings as of 7/26/24. 3. Dd refers to Implied Tax-Deductible Debt, which equals the lesser of (a) 30% of Adjusted Taxable Income/Cost of Debt, or (b) Total Debt. LTM Adjusted EBIT, based on most recent public filings as of 7/26/24, is assumed to be a valid proxy for Adjusted Taxable Income for the selected companies. 4. Dnd refers to Implied Non-Tax-Deductible Debt, which equals Total Debt minus Dd. 5. Equity Market Value based on closing price on 7/26/24 and on diluted shares as of 7/26/24. 6. Pfd. Stock refers to preferred stock, which is the amount as stated in most recent public filings as of 7/26/24. 7. Represents figures as of 5/23/24, the last full day of trading prior to the announcement of the Initial Offer. 8. Per Company management, the Company only pays taxes for non-qualifying income associated with Martin Transport, which does not have any associated debt. 9. Corporate tax rate of 21.0% utilized for purpose of the analysis. Sources: Bloomberg and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 25

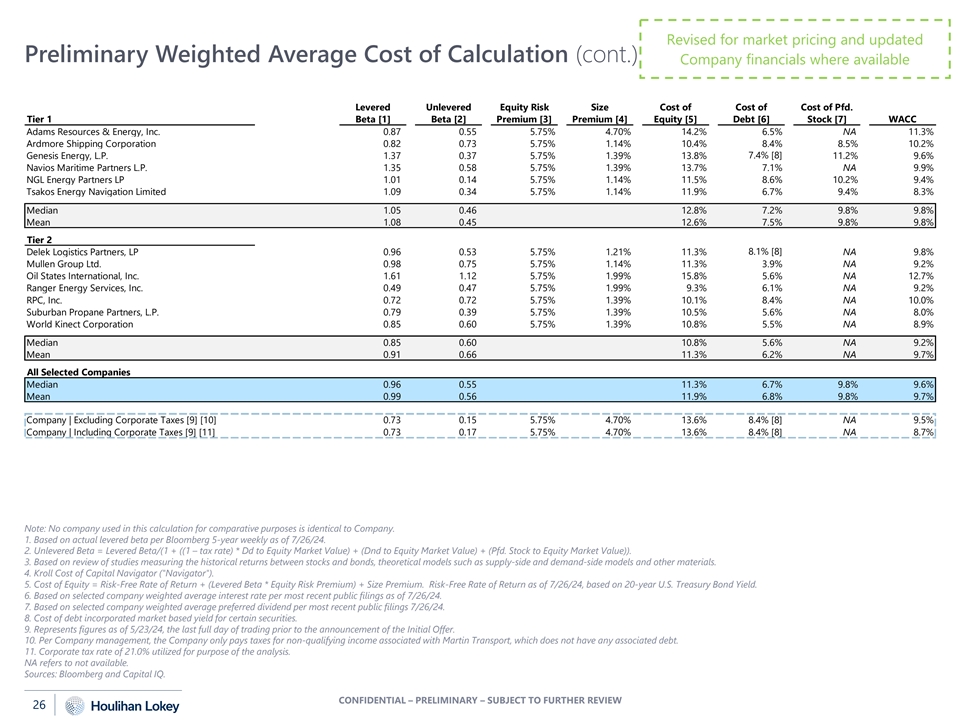

Revised for market pricing and updated Preliminary Weighted Average Cost of Calculation (cont.) Company financials where available Levered Unlevered Equity Risk Size Cost of Cost of Cost of Pfd. Tier 1 Beta [1] Beta [2] Premium [3] Premium [4] Equity [5] Debt [6] Stock [7] WACC Adams Resources & Energy, Inc. 0.87 0.55 5.75% 4.70% 14.2% 6.5% NA 11.3% Ardmore Shipping Corporation 0.82 0.73 5.75% 1.14% 10.4% 8.4% 8.5% 10.2% Genesis Energy, L.P. 1.37 0.37 5.75% 1.39% 13.8% 7.4% [8] 11.2% 9.6% Navios Maritime Partners L.P. 1.35 0.58 5.75% 1.39% 13.7% 7.1% NA 9.9% NGL Energy Partners LP 1.01 0.14 5.75% 1.14% 11.5% 8.6% 10.2% 9.4% Tsakos Energy Navigation Limited 1.09 0.34 5.75% 1.14% 11.9% 6.7% 9.4% 8.3% Median 1.05 0.46 12.8% 7.2% 9.8% 9.8% Mean 1.08 0.45 12.6% 7.5% 9.8% 9.8% Tier 2 8.1% [8] Delek Logistics Partners, LP 0.96 0.53 5.75% 1.21% 11.3% NA 9.8% Mullen Group Ltd. 0.98 0.75 5.75% 1.14% 11.3% 3.9% NA 9.2% Oil States International, Inc. 1.61 1.12 5.75% 1.99% 15.8% 5.6% NA 12.7% Ranger Energy Services, Inc. 0.49 0.47 5.75% 1.99% 9.3% 6.1% NA 9.2% RPC, Inc. 0.72 0.72 5.75% 1.39% 10.1% 8.4% NA 10.0% Suburban Propane Partners, L.P. 0.79 0.39 5.75% 1.39% 10.5% 5.6% NA 8.0% World Kinect Corporation 0.85 0.60 5.75% 1.39% 10.8% 5.5% NA 8.9% Median 0.85 0.60 10.8% 5.6% NA 9.2% Mean 0.91 0.66 11.3% 6.2% NA 9.7% All Selected Companies Median 0.96 0.55 11.3% 6.7% 9.8% 9.6% Mean 0.99 0.56 11.9% 6.8% 9.8% 9.7% Company | Excluding Corporate Taxes [9] [10] 0.73 0.15 5.75% 4.70% 13.6% 8.4% [8] NA 9.5% Company | Including Corporate Taxes [9] [11] 0.73 0.17 5.75% 4.70% 13.6% 8.4% [8] NA 8.7% Note: No company used in this calculation for comparative purposes is identical to Company. 1. Based on actual levered beta per Bloomberg 5-year weekly as of 7/26/24. 2. Unlevered Beta = Levered Beta/(1 + ((1 – tax rate) * Dd to Equity Market Value) + (Dnd to Equity Market Value) + (Pfd. Stock to Equity Market Value)). 3. Based on review of studies measuring the historical returns between stocks and bonds, theoretical models such as supply-side and demand-side models and other materials. 4. Kroll Cost of Capital Navigator ( Navigator ). 5. Cost of Equity = Risk-Free Rate of Return + (Levered Beta * Equity Risk Premium) + Size Premium. Risk-Free Rate of Return as of 7/26/24, based on 20-year U.S. Treasury Bond Yield. 6. Based on selected company weighted average interest rate per most recent public filings as of 7/26/24. 7. Based on selected company weighted average preferred dividend per most recent public filings 7/26/24. 8. Cost of debt incorporated market based yield for certain securities. 9. Represents figures as of 5/23/24, the last full day of trading prior to the announcement of the Initial Offer. 10. Per Company management, the Company only pays taxes for non-qualifying income associated with Martin Transport, which does not have any associated debt. 11. Corporate tax rate of 21.0% utilized for purpose of the analysis. NA refers to not available. Sources: Bloomberg and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 26

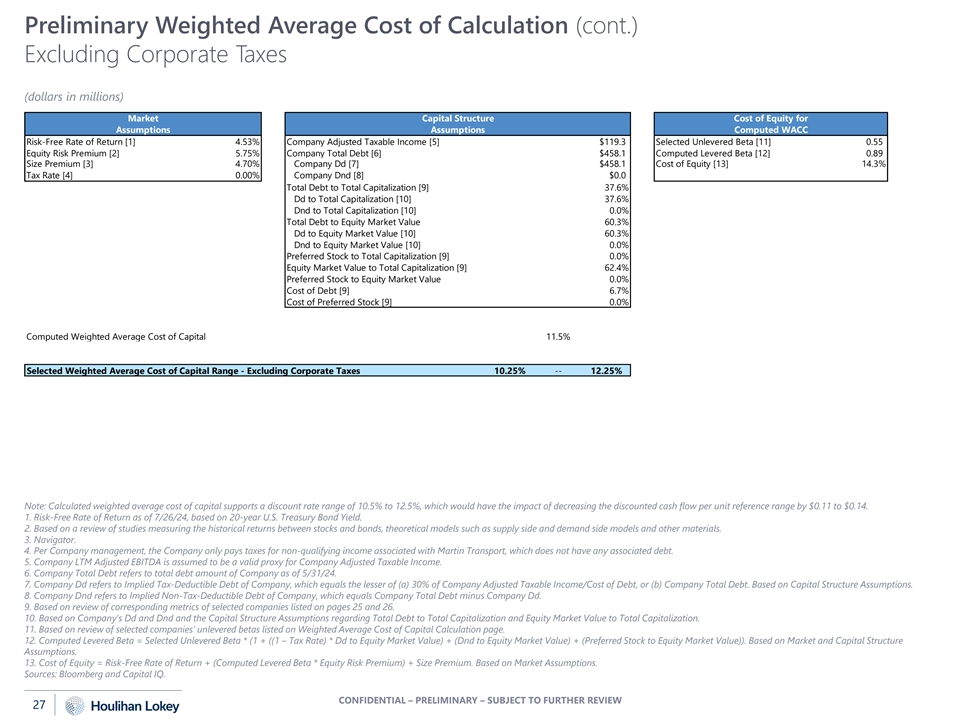

Preliminary Weighted Average Cost of Calculation (cont.) Excluding Corporate Taxes (dollars in millions) Market Capital Structure Cost of Equity for Assumptions Assumptions Computed WACC Risk-Free Rate of Return [1] 4.53% Company Adjusted Taxable Income [5] $119.3 Selected Unlevered Beta [11] 0.55 Equity Risk Premium [2] 5.75% Company Total Debt [6] $458.1 Computed Levered Beta [12] 0.89 Size Premium [3] 4.70% Company Dd [7] $458.1 Cost of Equity [13] 14.3% Tax Rate [4] 0.00% Company Dnd [8] $0.0 Total Debt to Total Capitalization [9] 37.6% Dd to Total Capitalization [10] 37.6% Dnd to Total Capitalization [10] 0.0% Total Debt to Equity Market Value 60.3% Dd to Equity Market Value [10] 60.3% Dnd to Equity Market Value [10] 0.0% Preferred Stock to Total Capitalization [9] 0.0% Equity Market Value to Total Capitalization [9] 62.4% Preferred Stock to Equity Market Value 0.0% Cost of Debt [9] 6.7% Cost of Preferred Stock [9] 0.0% Computed Weighted Average Cost of Capital 11.5% Selected Weighted Average Cost of Capital Range - Excluding Corporate Taxes 10.25% -- 12.25% Note: Calculated weighted average cost of capital supports a discount rate range of 10.5% to 12.5%, which would have the impact of decreasing the discounted cash flow per unit reference range by $0.11 to $0.14. 1. Risk-Free Rate of Return as of 7/26/24, based on 20-year U.S. Treasury Bond Yield. 2. Based on a review of studies measuring the historical returns between stocks and bonds, theoretical models such as supply side and demand side models and other materials. 3. Navigator. 4. Per Company management, the Company only pays taxes for non-qualifying income associated with Martin Transport, which does not have any associated debt. 5. Company LTM Adjusted EBITDA is assumed to be a valid proxy for Company Adjusted Taxable Income. 6. Company Total Debt refers to total debt amount of Company as of 5/31/24. 7. Company Dd refers to Implied Tax-Deductible Debt of Company, which equals the lesser of (a) 30% of Company Adjusted Taxable Income/Cost of Debt, or (b) Company Total Debt. Based on Capital Structure Assumptions. 8. Company Dnd refers to Implied Non-Tax-Deductible Debt of Company, which equals Company Total Debt minus Company Dd. 9. Based on review of corresponding metrics of selected companies listed on pages 25 and 26. 10. Based on Company's Dd and Dnd and the Capital Structure Assumptions regarding Total Debt to Total Capitalization and Equity Market Value to Total Capitalization. 11. Based on review of selected companies’ unlevered betas listed on Weighted Average Cost of Capital Calculation page. 12. Computed Levered Beta = Selected Unlevered Beta * (1 + ((1 – Tax Rate) * Dd to Equity Market Value) + (Dnd to Equity Market Value) + (Preferred Stock to Equity Market Value)). Based on Market and Capital Structure Assumptions. 13. Cost of Equity = Risk-Free Rate of Return + (Computed Levered Beta * Equity Risk Premium) + Size Premium. Based on Market Assumptions. Sources: Bloomberg and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 27

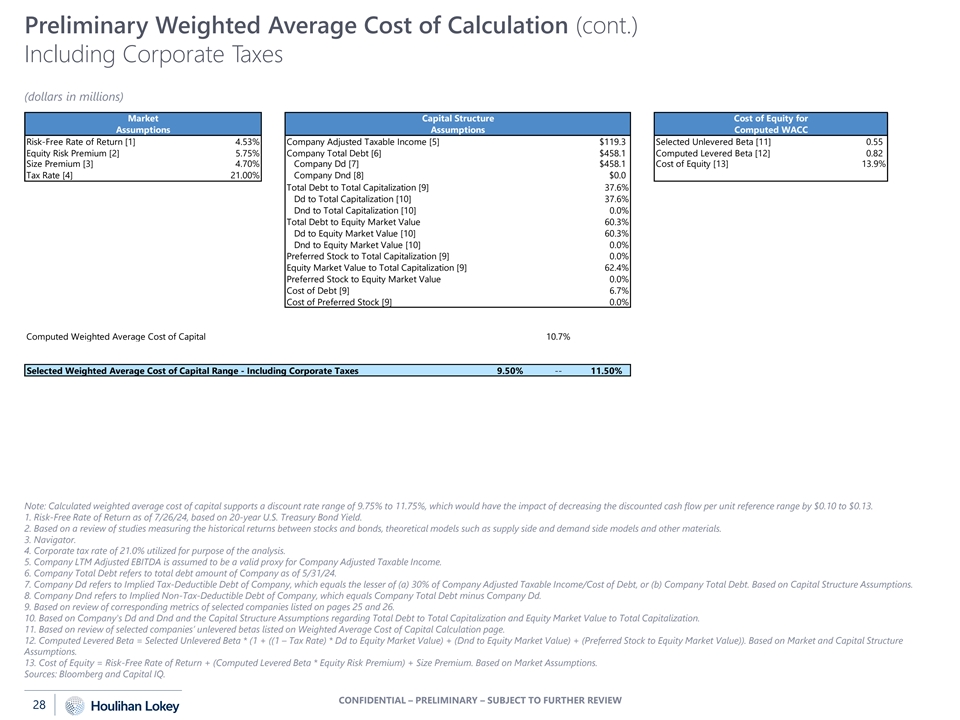

Preliminary Weighted Average Cost of Calculation (cont.) Including Corporate Taxes (dollars in millions) Market Capital Structure Cost of Equity for Assumptions Assumptions Computed WACC Risk-Free Rate of Return [1] 4.53% Company Adjusted Taxable Income [5] $119.3 Selected Unlevered Beta [11] 0.55 Equity Risk Premium [2] 5.75% Company Total Debt [6] $458.1 Computed Levered Beta [12] 0.82 Size Premium [3] 4.70% Company Dd [7] $458.1 Cost of Equity [13] 13.9% Tax Rate [4] 21.00% Company Dnd [8] $0.0 Total Debt to Total Capitalization [9] 37.6% Dd to Total Capitalization [10] 37.6% Dnd to Total Capitalization [10] 0.0% Total Debt to Equity Market Value 60.3% Dd to Equity Market Value [10] 60.3% Dnd to Equity Market Value [10] 0.0% Preferred Stock to Total Capitalization [9] 0.0% Equity Market Value to Total Capitalization [9] 62.4% Preferred Stock to Equity Market Value 0.0% Cost of Debt [9] 6.7% Cost of Preferred Stock [9] 0.0% Computed Weighted Average Cost of Capital 10.7% Selected Weighted Average Cost of Capital Range - Including Corporate Taxes 9.50% -- 11.50% Note: Calculated weighted average cost of capital supports a discount rate range of 9.75% to 11.75%, which would have the impact of decreasing the discounted cash flow per unit reference range by $0.10 to $0.13. 1. Risk-Free Rate of Return as of 7/26/24, based on 20-year U.S. Treasury Bond Yield. 2. Based on a review of studies measuring the historical returns between stocks and bonds, theoretical models such as supply side and demand side models and other materials. 3. Navigator. 4. Corporate tax rate of 21.0% utilized for purpose of the analysis. 5. Company LTM Adjusted EBITDA is assumed to be a valid proxy for Company Adjusted Taxable Income. 6. Company Total Debt refers to total debt amount of Company as of 5/31/24. 7. Company Dd refers to Implied Tax-Deductible Debt of Company, which equals the lesser of (a) 30% of Company Adjusted Taxable Income/Cost of Debt, or (b) Company Total Debt. Based on Capital Structure Assumptions. 8. Company Dnd refers to Implied Non-Tax-Deductible Debt of Company, which equals Company Total Debt minus Company Dd. 9. Based on review of corresponding metrics of selected companies listed on pages 25 and 26. 10. Based on Company's Dd and Dnd and the Capital Structure Assumptions regarding Total Debt to Total Capitalization and Equity Market Value to Total Capitalization. 11. Based on review of selected companies’ unlevered betas listed on Weighted Average Cost of Capital Calculation page. 12. Computed Levered Beta = Selected Unlevered Beta * (1 + ((1 – Tax Rate) * Dd to Equity Market Value) + (Dnd to Equity Market Value) + (Preferred Stock to Equity Market Value)). Based on Market and Capital Structure Assumptions. 13. Cost of Equity = Risk-Free Rate of Return + (Computed Levered Beta * Equity Risk Premium) + Size Premium. Based on Market Assumptions. Sources: Bloomberg and Capital IQ. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 28

APPENDIX Preliminary Selected Benchmarking Data 06 04 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

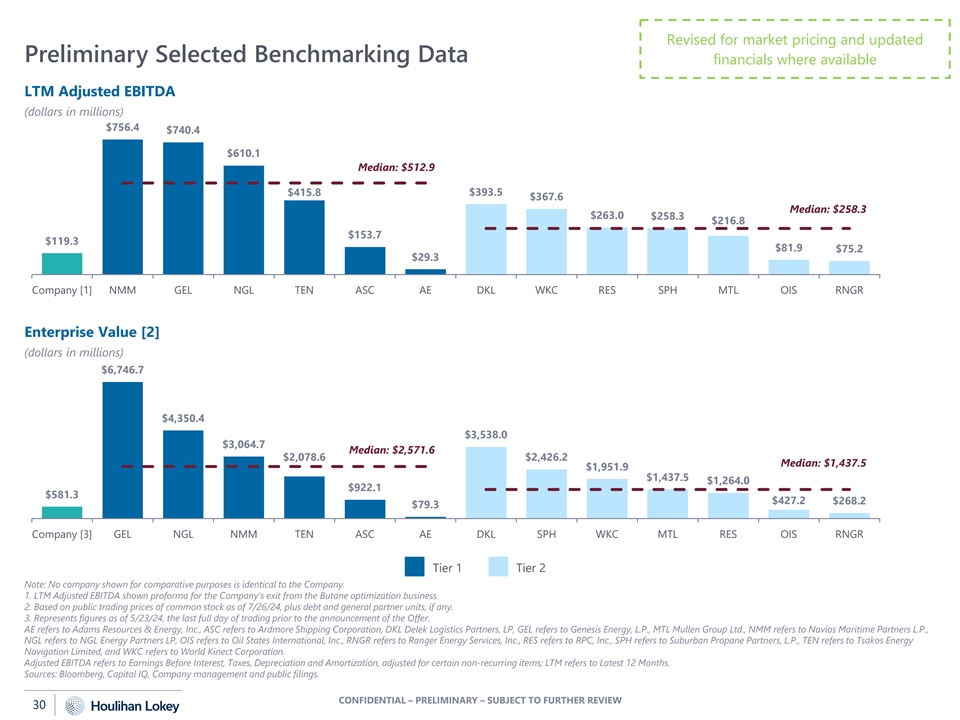

Revised for market pricing and updated Preliminary Selected Benchmarking Data financials where available LTM Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 (dollars in millions) $756.4 $740.4 $610.1 Median: $512.9 $415.8 $393.5 $367.6 Median: $258.3 $263.0 $258.3 $216.8 $153.7 $119.3 $81.9 $75.2 $29.3 Company [1] NMM GEL NGL TEN ASC AE DKL WKC RES SPH MTL OIS RNGR Enterprise Value [2] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 (dollars in millions) $6,746.7 $4,350.4 $3,538.0 $3,064.7 Median: $2,571.6 $2,078.6 $2,426.2 Median: $1,437.5 $1,951.9 $1,437.5 $1,264.0 $922.1 $581.3 $427.2 $268.2 $79.3 Company [3] GEL NGL NMM TEN ASC AE DKL SPH WKC MTL RES OIS RNGR Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. LTM Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. 2. Based on public trading prices of common stock as of 7/26/24, plus debt and general partner units, if any. 3. Represents figures as of 5/23/24, the last full day of trading prior to the announcement of the Offer. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; LTM refers to Latest 12 Months. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 30

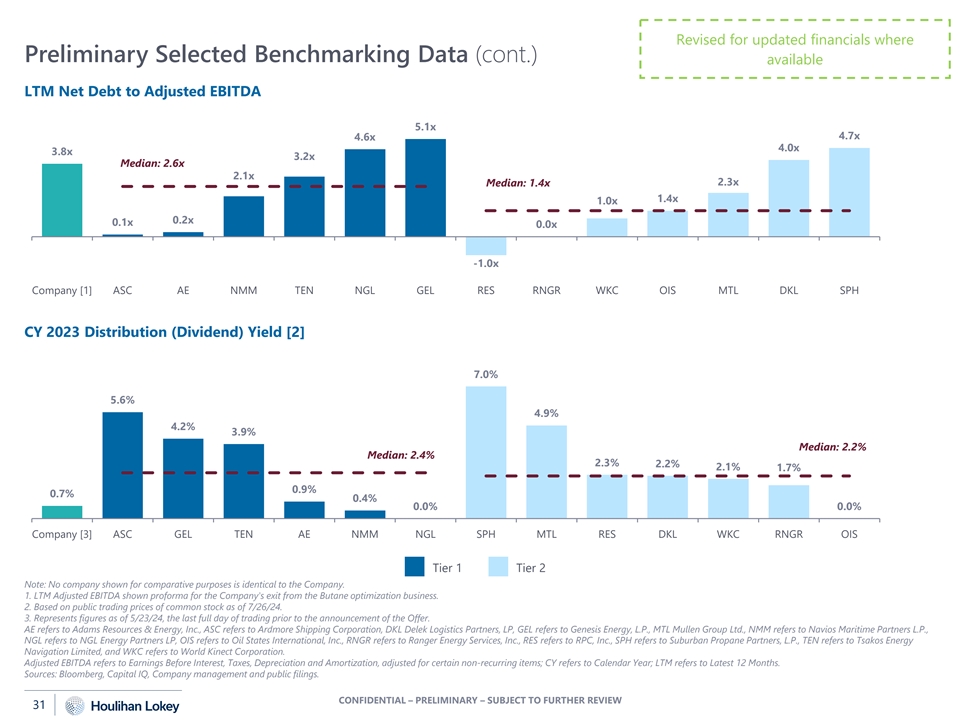

Revised for updated financials where Preliminary Selected Benchmarking Data (cont.) available LTM Net Debt to Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 5.1x 4.7x 4.6x 4.0x 3.8x 3.2x Median: 2.6x 2.1x 2.3x Median: 1.4x 1.4x 1.0x 0.2x 0.1x 0.0x -1.0x Company [1] ASC AE NMM TEN NGL GEL RES RNGR WKC OIS MTL DKL SPH CY 2023 Distribution (Dividend) Yield [2] 0 0 0 0 0 0 0 0 0 0 0 0 0 0 7.0% 5.6% 4.9% 4.2% 3.9% Median: 2.2% Median: 2.4% 2.3% 2.2% 2.1% 1.7% 0.9% 0.7% 0.4% 0.0% 0.0% Company [3] ASC GEL TEN AE NMM NGL SPH MTL RES DKL WKC RNGR OIS Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. LTM Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. 2. Based on public trading prices of common stock as of 7/26/24. 3. Represents figures as of 5/23/24, the last full day of trading prior to the announcement of the Offer. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; LTM refers to Latest 12 Months. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 31

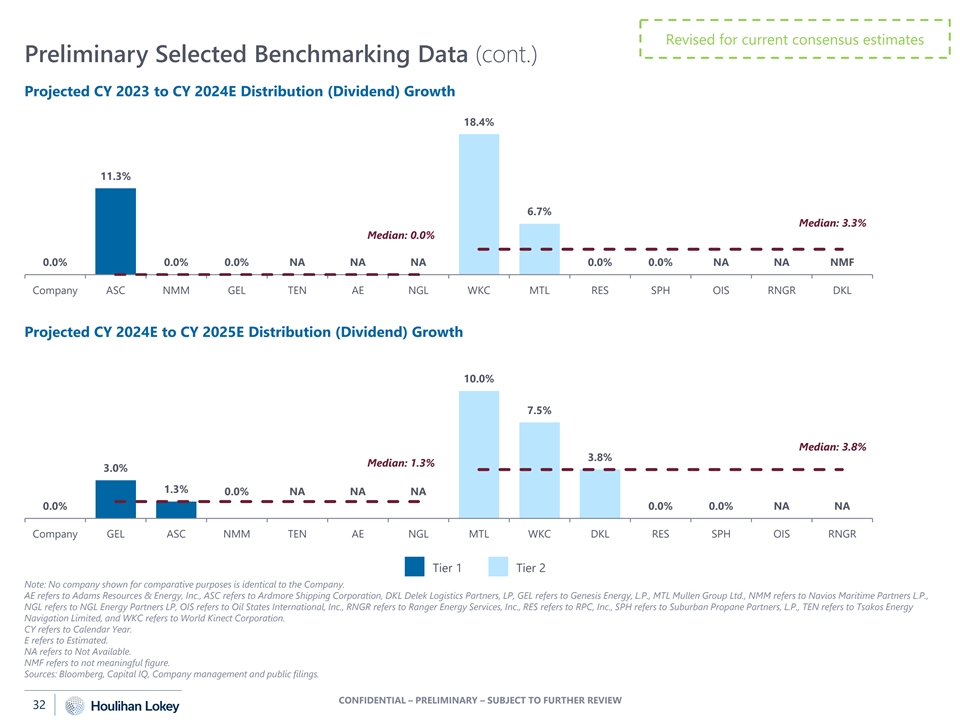

Revised for current consensus estimates Preliminary Selected Benchmarking Data (cont.) Projected CY 2023 to CY 2024E Distribution (Dividend) Growth 0 0 0 0 0 0 0 0 0 0 0 0 0 0 18.4% 11.3% 6.7% Median: 3.3% Median: 0.0% 0.0% 0.0% 0.0% NA NA NA 0.0% 0.0% NA NA NMF Company ASC NMM GEL TEN AE NGL WKC MTL RES SPH OIS RNGR DKL Projected CY 2024E to CY 2025E Distribution (Dividend) Growth 0 0 0 0 0 0 0 0 0 0 0 0 0 0 10.0% 7.5% Median: 3.8% 3.8% Median: 1.3% 3.0% 1.3% 0.0% NA NA NA 0.0% 0.0% 0.0% NA NA Company GEL ASC NMM TEN AE NGL MTL WKC DKL RES SPH OIS RNGR Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. CY refers to Calendar Year. E refers to Estimated. NA refers to Not Available. NMF refers to not meaningful figure. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 32

Revised for current consensus estimates Preliminary Selected Benchmarking Data (cont.) Projected CY 2023 to CY 2024E Adjusted EBITDA Growth 0 0 0 0 0 0 0 0 0 0 0 0 0 0 23.3% Median: 1.0% 8.4% 8.0% 6.4% 3.5% Median: -3.3% 2.6% -0.2% -0.6% -3.3% -4.3% -6.1% -7.1% -21.8% -26.5% Company [1] ASC NMM NGL TEN [2] AE [2] GEL DKL SPH MTL WKC OIS RNGR RES Projected CY 2024E to CY 2025E Adjusted EBITDA Growth 0 0 0 0 0 0 0 0 0 0 0 0 0 0 27.6% 25.6% 19.3% Median: 11.0% 16.3% Median: 8.0% 13.0% 11.0% 8.2% 6.3% 8.7% 7.2% 6.5% 4.1% 1.7% -19.1% Company GEL TEN [2] NGL NMM AE [2] ASC RNGR RES OIS WKC MTL SPH DKL Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. CY 2023 Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. 2. Represents Adjusted EBITDA estimates per Capital IQ. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 33

Revised for current consensus estimates Preliminary Selected Benchmarking Data (cont.) Projected CY 2025E to CY 2026E Adjusted EBITDA Growth 0 0 0 0 0 0 0 0 0 0 0 0 0 0 12.9% Median: 4.1% 9.5% 6.6% 4.4% 4.1% NA 2.9% NA NA NA -0.2% Median: -0.5% -7.6% -17.8% -24.4% Company TEN [1] GEL NMM ASC NGL AE WKC SPH MTL DKL RES RNGR OIS CY 2023 Adjusted EBITDA to CY 2023 Revenue 0 0 0 0 0 0 0 0 0 0 0 0 0 0 57.2% 52.9% 40.3% Median: 32.0% 37.7% Median: 15.7% 23.1% 23.8% 18.6% 15.7% 14.1% 11.2% 13.3% 8.5% 1.0% 0.8% Company [2] NMM TEN ASC GEL NGL AE DKL RES SPH MTL RNGR OIS WKC Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. Represents Adjusted EBITDA estimates per Capital IQ. 2. CY 2023 Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 34

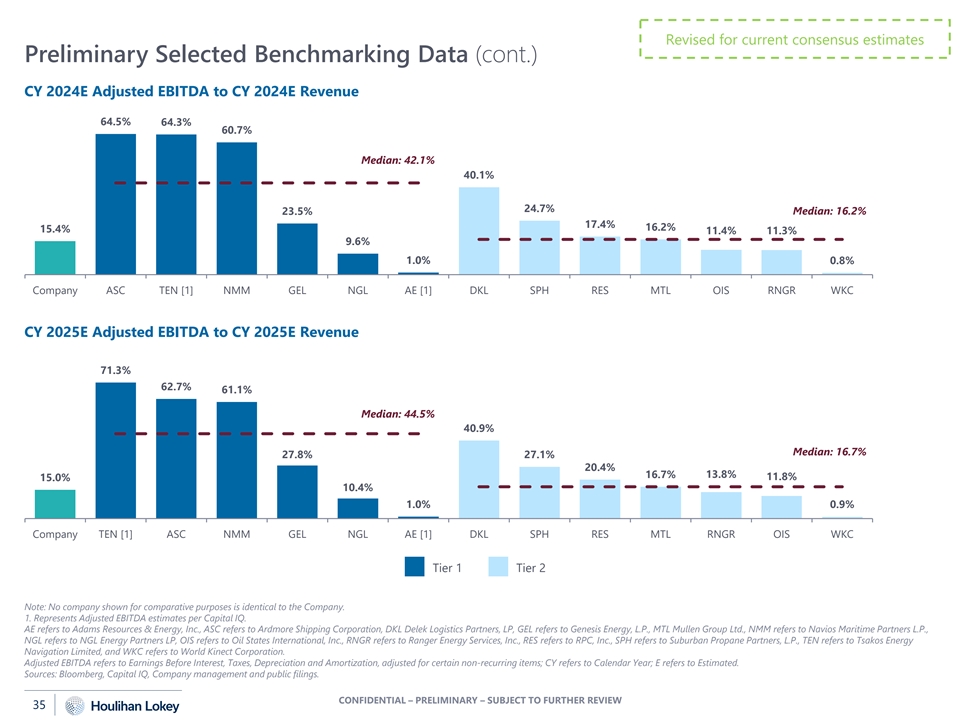

Revised for current consensus estimates Preliminary Selected Benchmarking Data (cont.) CY 2024E Adjusted EBITDA to CY 2024E Revenue 0 0 0 0 0 0 0 0 0 0 0 0 0 0 64.5% 64.3% 60.7% Median: 42.1% 40.1% 24.7% 23.5% Median: 16.2% 17.4% 16.2% 15.4% 11.4% 11.3% 9.6% 1.0% 0.8% Company ASC TEN [1] NMM GEL NGL AE [1] DKL SPH RES MTL OIS RNGR WKC CY 2025E Adjusted EBITDA to CY 2025E Revenue 0 0 0 0 0 0 0 0 0 0 0 0 0 0 71.3% 62.7% 61.1% Median: 44.5% 40.9% Median: 16.7% 27.8% 27.1% 20.4% 16.7% 13.8% 11.8% 15.0% 10.4% 1.0% 0.9% Company TEN [1] ASC NMM GEL NGL AE [1] DKL SPH RES MTL RNGR OIS WKC Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. Represents Adjusted EBITDA estimates per Capital IQ. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 35

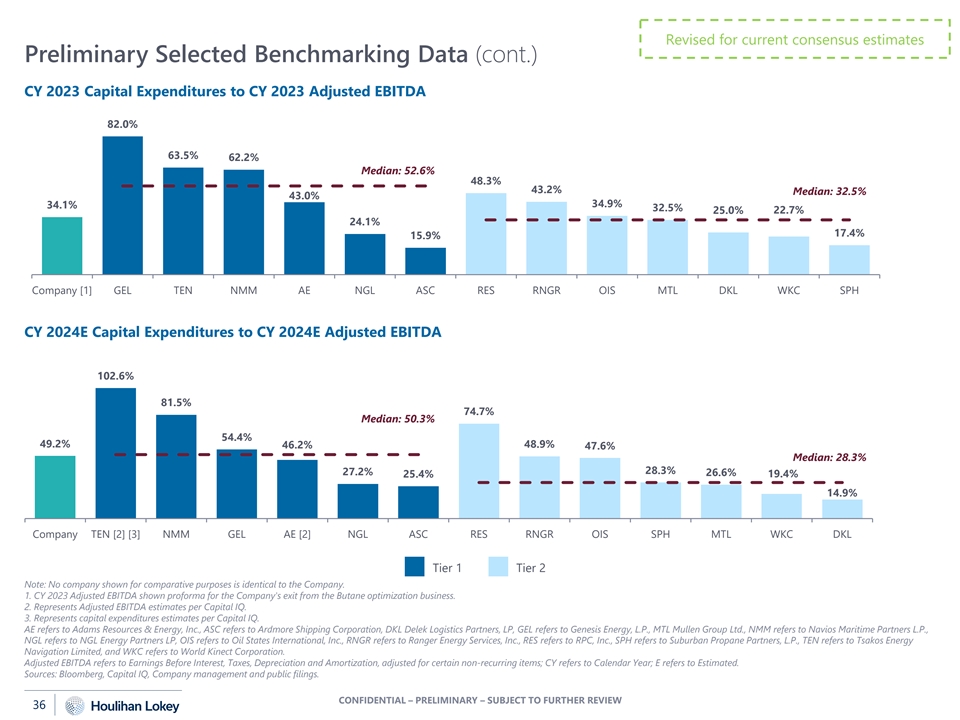

Revised for current consensus estimates Preliminary Selected Benchmarking Data (cont.) CY 2023 Capital Expenditures to CY 2023 Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 82.0% 63.5% 62.2% Median: 52.6% 48.3% 43.2% Median: 32.5% 43.0% 34.9% 34.1% 32.5% 22.7% 25.0% 24.1% 17.4% 15.9% Company [1] GEL TEN NMM AE NGL ASC RES RNGR OIS MTL DKL WKC SPH CY 2024E Capital Expenditures to CY 2024E Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 102.6% 81.5% 74.7% Median: 50.3% 54.4% 49.2% 46.2% 48.9% 47.6% Median: 28.3% 28.3% 27.2% 26.6% 25.4% 19.4% 14.9% Company TEN [2] [3] NMM GEL AE [2] NGL ASC RES RNGR OIS SPH MTL WKC DKL Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. CY 2023 Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. 2. Represents Adjusted EBITDA estimates per Capital IQ. 3. Represents capital expenditures estimates per Capital IQ. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 36

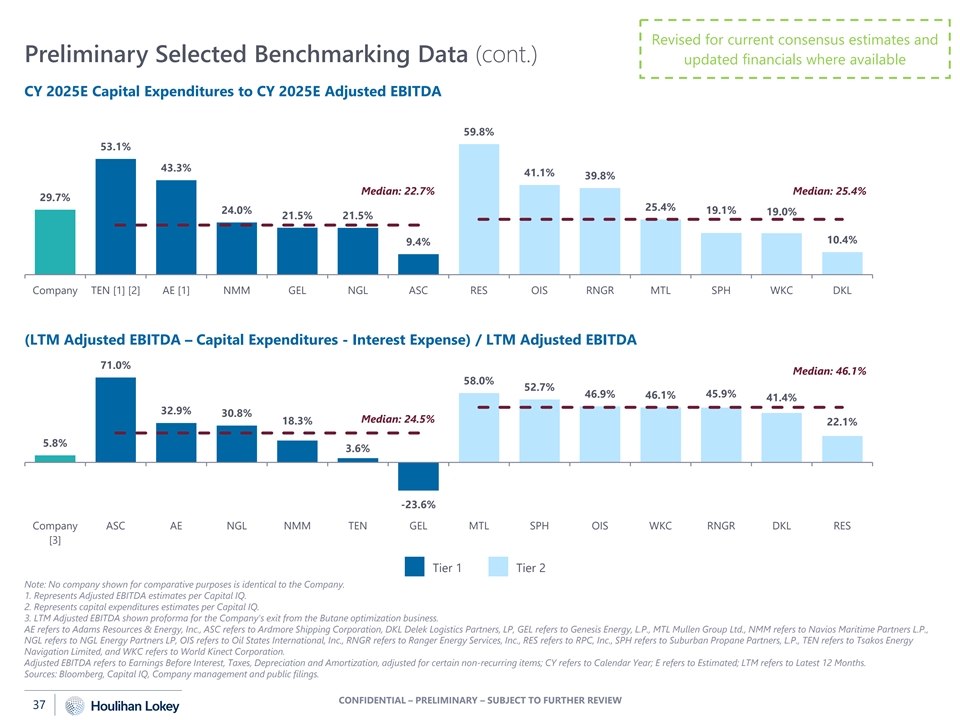

Revised for current consensus estimates and Preliminary Selected Benchmarking Data (cont.) updated financials where available CY 2025E Capital Expenditures to CY 2025E Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 59.8% 53.1% 43.3% 41.1% 39.8% Median: 22.7% Median: 25.4% 29.7% 25.4% 24.0% 19.1% 19.0% 21.5% 21.5% 10.4% 9.4% Company TEN [1] [2] AE [1] NMM GEL NGL ASC RES OIS RNGR MTL SPH WKC DKL (LTM Adjusted EBITDA – Capital Expenditures - Interest Expense) / LTM Adjusted EBITDA 0 0 0 0 0 0 0 0 0 0 0 0 0 0 71.0% Median: 46.1% 58.0% 52.7% 46.9% 45.9% 46.1% 41.4% 32.9% 30.8% Median: 24.5% 18.3% 22.1% 5.8% 3.6% -23.6% Company ASC AE NGL NMM TEN GEL MTL SPH OIS WKC RNGR DKL RES [3] Tier 1 Tier 2 Note: No company shown for comparative purposes is identical to the Company. 1. Represents Adjusted EBITDA estimates per Capital IQ. 2. Represents capital expenditures estimates per Capital IQ. 3. LTM Adjusted EBITDA shown proforma for the Company's exit from the Butane optimization business. AE refers to Adams Resources & Energy, Inc., ASC refers to Ardmore Shipping Corporation, DKL Delek Logistics Partners, LP, GEL refers to Genesis Energy, L.P., MTL Mullen Group Ltd., NMM refers to Navios Maritime Partners L.P., NGL refers to NGL Energy Partners LP, OIS refers to Oil States International, Inc., RNGR refers to Ranger Energy Services, Inc., RES refers to RPC, Inc., SPH refers to Suburban Propane Partners, L.P., TEN refers to Tsakos Energy Navigation Limited, and WKC refers to World Kinect Corporation. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items; CY refers to Calendar Year; E refers to Estimated; LTM refers to Latest 12 Months. Sources: Bloomberg, Capital IQ, Company management and public filings. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 37

APPENDIX Company Projection Comparison 03 04 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW

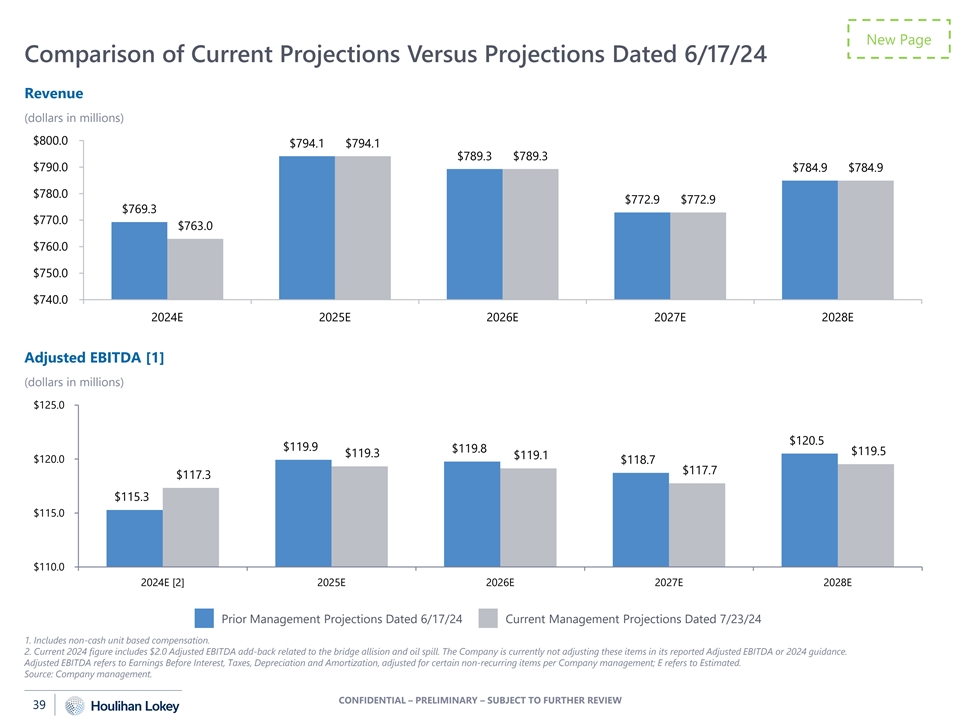

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 Revenue (dollars in millions) $800.0 $794.1 $794.1 $789.3 $789.3 $790.0 $784.9 $784.9 $780.0 $772.9 $772.9 $769.3 $770.0 $763.0 $760.0 $750.0 $740.0 2024E 2025E 2026E 2027E 2028E Adjusted EBITDA [1] (dollars in millions) $125.0 $120.5 $119.9 $119.8 $119.5 $119.3 $119.1 $120.0 $118.7 $117.7 $117.3 $115.3 $115.0 $110.0 2024E [2] 2025E 2026E 2027E 2028E Prior Management Projections Dated 6/17/24 Current Management Projections Dated 7/23/24 1. Includes non-cash unit based compensation. 2. Current 2024 figure includes $2.0 Adjusted EBITDA add-back related to the bridge allision and oil spill. The Company is currently not adjusting these items in its reported Adjusted EBITDA or 2024 guidance. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items per Company management; E refers to Estimated. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 39

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 (cont.) Distributable Cash Flow (dollars in millions) $64.7 $70.0 $63.4 $55.3 $60.0 $54.1 $50.0 $36.3 $35.9 $35.5 $35.0 $40.0 $26.0 $30.0 $24.1 $20.0 $10.0 $0.0 2024E 2025E 2026E 2027E 2028E Free Cash Flow Before Distributions (dollars in millions) $60.0 $49.7 $48.4 $50.0 $40.0 $32.6 $32.8 $30.4 $29.2 $30.0 $24.7 $23.4 $20.0 $10.0 $0.6 $0.0 ($2.7) ($10.0) 2024E 2025E 2026E 2027E 2028E Prior Management Projections Dated 6/17/24 Current Management Projections Dated 7/23/24 E refers to Estimated. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 40

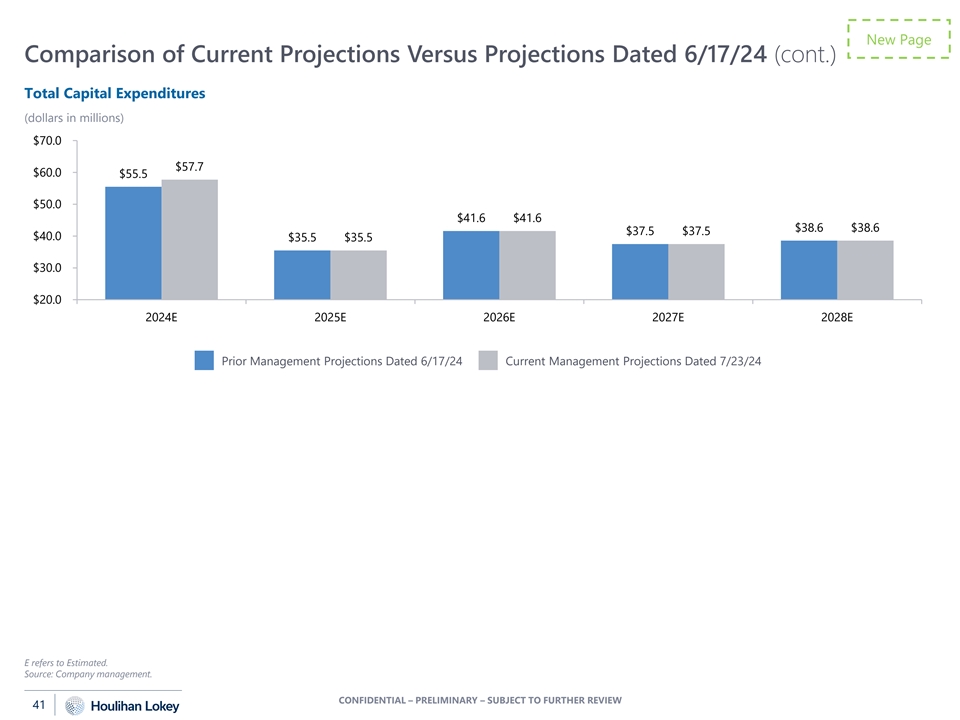

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 (cont.) Total Capital Expenditures (dollars in millions) $70.0 $57.7 $60.0 $55.5 $50.0 $41.6 $41.6 $38.6 $38.6 $37.5 $37.5 $40.0 $35.5 $35.5 $30.0 $20.0 2024E 2025E 2026E 2027E 2028E Prior Management Projections Dated 6/17/24 Current Management Projections Dated 7/23/24 E refers to Estimated. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 41

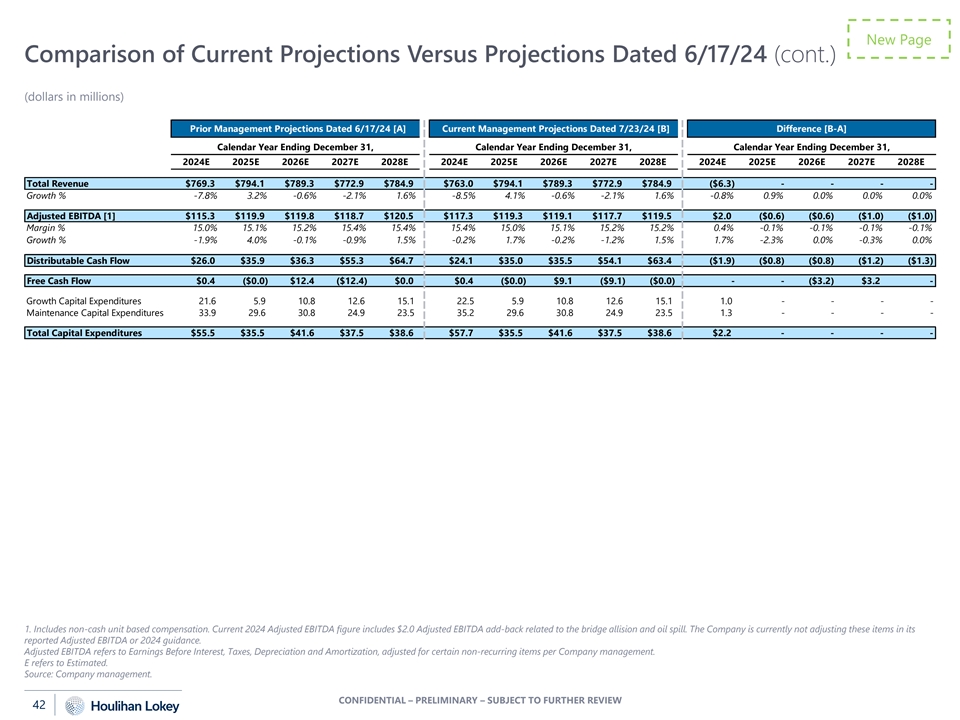

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 (cont.) (dollars in millions) Prior Management Projections Dated 6/17/24 [A] Current Management Projections Dated 7/23/24 [B] Difference [B-A] Calendar Year Ending December 31, Calendar Year Ending December 31, Calendar Year Ending December 31, 2024E 2025E 2026E 2027E 2028E 2024E 2025E 2026E 2027E 2028E 2024E 2025E 2026E 2027E 2028E Total Revenue $769.3 $794.1 $789.3 $772.9 $784.9 $763.0 $794.1 $789.3 $772.9 $784.9 ($6.3) - - - - Growth % -7.8% 3.2% -0.6% -2.1% 1.6% -8.5% 4.1% -0.6% -2.1% 1.6% -0.8% 0.9% 0.0% 0.0% 0.0% Adjusted EBITDA [1] $115.3 $119.9 $119.8 $118.7 $120.5 $117.3 $119.3 $119.1 $117.7 $119.5 $2.0 ($0.6) ($0.6) ($1.0) ($1.0) Margin % 15.0% 15.1% 15.2% 15.4% 15.4% 15.4% 15.0% 15.1% 15.2% 15.2% 0.4% -0.1% -0.1% -0.1% -0.1% Growth % -1.9% 4.0% -0.1% -0.9% 1.5% -0.2% 1.7% -0.2% -1.2% 1.5% 1.7% -2.3% 0.0% -0.3% 0.0% Distributable Cash Flow $26.0 $35.9 $36.3 $55.3 $64.7 $24.1 $35.0 $35.5 $54.1 $63.4 ($1.9) ($0.8) ($0.8) ($1.2) ($1.3) Free Cash Flow $0.4 ($0.0) $12.4 ($12.4) $0.0 $0.4 ($0.0) $9.1 ($9.1) ($0.0) - - ($3.2) $3.2 - Growth Capital Expenditures 21.6 5.9 10.8 12.6 15.1 22.5 5.9 10.8 12.6 15.1 1.0 - - - - Maintenance Capital Expenditures 33.9 29.6 30.8 24.9 23.5 35.2 29.6 30.8 24.9 23.5 1.3 - - - - Total Capital Expenditures $55.5 $35.5 $41.6 $37.5 $38.6 $57.7 $35.5 $41.6 $37.5 $38.6 $2.2 - - - - 1. Includes non-cash unit based compensation. Current 2024 Adjusted EBITDA figure includes $2.0 Adjusted EBITDA add-back related to the bridge allision and oil spill. The Company is currently not adjusting these items in its reported Adjusted EBITDA or 2024 guidance. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items per Company management. E refers to Estimated. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 42

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 (cont.) (dollars in millions) Prior Management Projections Dated 6/17/24 [A] Current Management Projections Dated 7/23/24 [B] Difference [B-A] Calendar Year Ending December 31, Calendar Year Ending December 31, Calendar Year Ending December 31, 2024E 2025E 2026E 2027E 2028E 2024E 2025E 2026E 2027E 2028E 2024E 2025E 2026E 2027E 2028E Terminalling & Storage $37.3 $37.7 $38.1 $38.7 $39.9 $35.4 $37.7 $38.1 $38.7 $39.9 ($1.8) - - - - Growth % 3.8% 1.2% 1.1% 1.5% 3.1% -1.4% 6.5% 1.1% 1.5% 3.1% -5.1% 5.3% - - - Margin % 38.6% 38.3% 37.8% 37.3% 37.5% 36.5% 38.3% 37.8% 37.3% 37.5% -2.1% - - - - Specialty Products 22.1 23.0 22.8 22.5 22.7 22.2 23.0 22.8 22.5 22.7 0.1 - - - - Growth % NMF 4.0% -0.7% -1.5% 0.7% NMF 3.4% -0.7% -1.5% 0.7% NA -0.6% - - - Margin % 7.2% 7.0% 7.2% 7.6% 7.4% 7.5% 7.0% 7.2% 7.6% 7.4% 0.3% - - - - Transportation Services 44.4 40.9 39.6 37.9 38.1 45.4 40.9 39.6 37.9 38.1 0.9 - - - - Growth % -5.1% -7.9% -3.1% -4.3% 0.5% -3.1% -9.8% -3.1% -4.3% 0.5% 2.0% -1.9% - - - Margin % 18.6% 17.5% 16.8% 16.0% 16.0% 18.7% 17.5% 16.8% 16.0% 16.0% 0.1% - - - - Sulfur Services 27.5 35.0 36.1 36.5 36.8 28.3 35.0 36.1 36.5 36.8 0.7 - - - - Growth % -2.0% 27.3% 3.1% 1.0% 1.0% 0.6% 24.0% 3.1% 1.0% 1.0% 2.6% -3.3% - - - Margin % 21.6% 26.7% 27.2% 27.2% 27.2% 21.9% 26.7% 27.2% 27.2% 27.2% 0.3% - - - - Unallocated SG&A [1] (16.0) (16.7) (16.9) (16.9) (17.0) (16.0) (17.3) (17.6) (17.9) (18.0) 0.1 (0.6) (0.6) (1.0) (1.0) Bridge Allision and Crude Oil Spill Adjustment [2] 0.0 0.0 0.0 0.0 0.0 2.0 0.0 0.0 0.0 0.0 2.0 - - - - Total Adjusted EBITDA $115.3 $119.9 $119.8 $118.7 $120.5 $117.3 $119.3 $119.1 $117.7 $119.5 $2.0 ($0.6) ($0.6) ($1.0) ($1.0) 1. Includes non-cash unit based compensation. Current 2024 Adjusted EBITDA figure includes $2.0 Adjusted EBITDA add-back related to the bridge allision and oil spill. The Company is currently not adjusting these items in its reported Adjusted EBITDA or 2024 guidance. 2. Represents $0.5 million related to the bridge allision in May 2024 and $1.5 million related to the crude oil spill from a crude pipeline connecting the Sandyland Terminal to the Smackover refinery in June 2024. Adjusted EBITDA refers to Earnings Before Interest, Taxes, Depreciation and Amortization, adjusted for certain non-recurring items per Company management. E refers to Estimated. NA refers to not available. NMF refers to not meaningful figure. Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 43

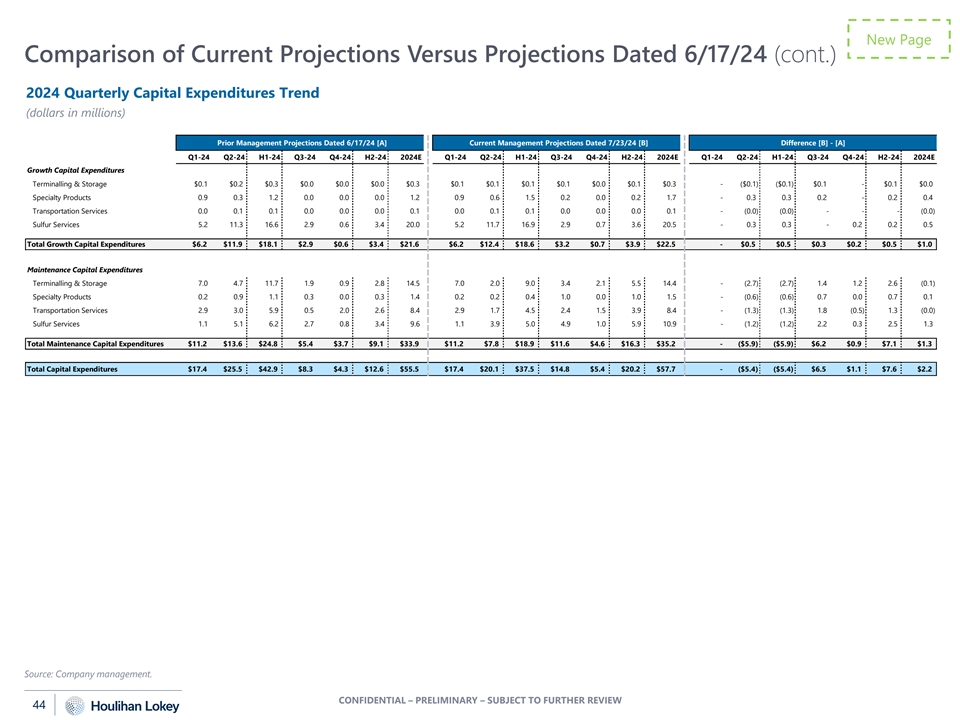

New Page Comparison of Current Projections Versus Projections Dated 6/17/24 (cont.) 2024 Quarterly Capital Expenditures Trend (dollars in millions) Prior Management Projections Dated 6/17/24 [A] Current Management Projections Dated 7/23/24 [B] Difference [B] - [A] Q1-24 Q2-24 H1-24 Q3-24 Q4-24 H2-24 2024E Q1-24 Q2-24 H1-24 Q3-24 Q4-24 H2-24 2024E Q1-24 Q2-24 H1-24 Q3-24 Q4-24 H2-24 2024E Growth Capital Expenditures Terminalling & Storage $0.1 $0.2 $0.3 $0.0 $0.0 $0.0 $0.3 $0.1 $0.1 $0.1 $0.1 $0.0 $0.1 $0.3 - ($0.1) ($0.1) $0.1 - $0.1 $0.0 Specialty Products 0.9 0.3 1.2 0.0 0.0 0.0 1.2 0.9 0.6 1.5 0.2 0.0 0.2 1.7 - 0.3 0.3 0.2 - 0.2 0.4 Transportation Services 0.0 0.1 0.1 0.0 0.0 0.0 0.1 0.0 0.1 0.1 0.0 0.0 0.0 0.1 - (0.0) (0.0) - - - (0.0) Sulfur Services 5.2 11.3 16.6 2.9 0.6 3.4 20.0 5.2 11.7 16.9 2.9 0.7 3.6 20.5 - 0.3 0.3 - 0.2 0.2 0.5 Total Growth Capital Expenditures $6.2 $11.9 $18.1 $2.9 $0.6 $3.4 $21.6 $6.2 $12.4 $18.6 $3.2 $0.7 $3.9 $22.5 - $0.5 $0.5 $0.3 $0.2 $0.5 $1.0 Maintenance Capital Expenditures Terminalling & Storage 7.0 4.7 11.7 1.9 0.9 2.8 14.5 7.0 2.0 9.0 3.4 2.1 5.5 14.4 - (2.7) (2.7) 1.4 1.2 2.6 (0.1) Specialty Products 0.2 0.9 1.1 0.3 0.0 0.3 1.4 0.2 0.2 0.4 1.0 0.0 1.0 1.5 - (0.6) (0.6) 0.7 0.0 0.7 0.1 Transportation Services 2.9 3.0 5.9 0.5 2.0 2.6 8.4 2.9 1.7 4.5 2.4 1.5 3.9 8.4 - (1.3) (1.3) 1.8 (0.5) 1.3 (0.0) Sulfur Services 1.1 5.1 6.2 2.7 0.8 3.4 9.6 1.1 3.9 5.0 4.9 1.0 5.9 10.9 - (1.2) (1.2) 2.2 0.3 2.5 1.3 Total Maintenance Capital Expenditures $11.2 $13.6 $24.8 $5.4 $3.7 $9.1 $33.9 $11.2 $7.8 $18.9 $11.6 $4.6 $16.3 $35.2 - ($5.9) ($5.9) $6.2 $0.9 $7.1 $1.3 Total Capital Expenditures $17.4 $25.5 $42.9 $8.3 $4.3 $12.6 $55.5 $17.4 $20.1 $37.5 $14.8 $5.4 $20.2 $57.7 - ($5.4) ($5.4) $6.5 $1.1 $7.6 $2.2 Source: Company management. CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW 44

DISCLAIMER 07 05 CONFIDENTIAL – PRELIMINARY – SUBJECT TO FURTHER REVIEW