united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 12/31

Date of reporting period: 12/31/20

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| Annual Report

December 31, 2020 |

| | |

| | |

| CDGCX | Crawford Large Cap Dividend Fund

(formerly known as Crawford Dividend Growth Fund) Class C |

| | |

| CDGIX | Crawford Large Cap Dividend Fund

(formerly known as Crawford Dividend Growth Fund) Class I |

| | |

| CDOFX | Crawford Small Cap Dividend Fund

Class I |

| | |

| CMALX | Crawford Multi-Asset Income Fund |

For a prospectus and more information, including charges and expenses call (800) 431-1716. The prospectus should be read carefully before investing. Past performance does not guarantee future results. Shares when redeemed may be worth more or less than their original cost.

Distributed by Ultimus Fund Distributors, LLC

225 Pictoria Drive,

Suite 450

Cincinnati, OH 45246 | Fund Investment Adviser:

Crawford Investment Counsel, Inc.

600 Galleria Parkway SE, Suite 1650

Atlanta, Georgia 30339

www.CrawfordInvestmentFunds.com |

MANAGEMENT DISCUSSION OF FUND PERFORMANCE – (Unaudited)

At Crawford Investment Counsel, we believe that within an uncertain investment landscape, many market participants continuously underestimate the potential range of investment outcomes. In 2020, we were reminded that there is much inherent uncertainty in investing. In anticipation of environments such as this, we focus our investment approach on high-quality companies with the belief that quality characteristics enhance visibility and predictability of the portfolio, which improves the likelihood of success and reduces the potential range of investment outcomes.

Dividends are an important part of our investment philosophy and process. Dividends represent a key component of total return over time, and a consistent and growing dividend often demonstrates a company’s ability to generate a sustainable and growing cash flow stream. We believe quality and dividends are inexorably linked and look to a company’s dividend history as an initial indicator of quality.

In our view, the success or failure of any investment is primarily determined by two attributes:

| 1. | Fundamental growth in intrinsic value of a business: Our focus on high-quality companies increases the likelihood that fundamental progress of the company will be achieved year after year, continually enhancing intrinsic value in the process. |

| 2. | Valuation at time of investment: Our value orientation and price sensitivity reflect the belief that valuation is an important component of both return and risk of any investment. |

Investment Process Goals:

| ● | Identify high-quality companies with a positively skewed risk/reward trade-off. |

| ● | Invest when short-term business or market considerations impair valuation. |

| ● | Allow the company’s fundamental progress, valuation improvement, and dividend stream to contribute to the total investment return over a longer-term time horizon. |

2020 will long be remembered as one of the more unusual and difficult periods in investment history. While stocks both began and finished the year at all-time highs, the pandemic led to a recession and severe decline in equity markets. This was followed quickly by a sharp recovery, election results, and additional stimulus. The market leadership shifted from growth to value late in the year, but overall growth did better and non-dividend paying companies outperformed dividend payers across the capitalization spectrum. Amidst the greatest single quarterly contraction in the economy since the Great Depression, many companies suspended or eliminated dividend payments.

Dividend Growth Fund:

“Crawford Large Cap Dividend Fund” as of January 19th, 2021

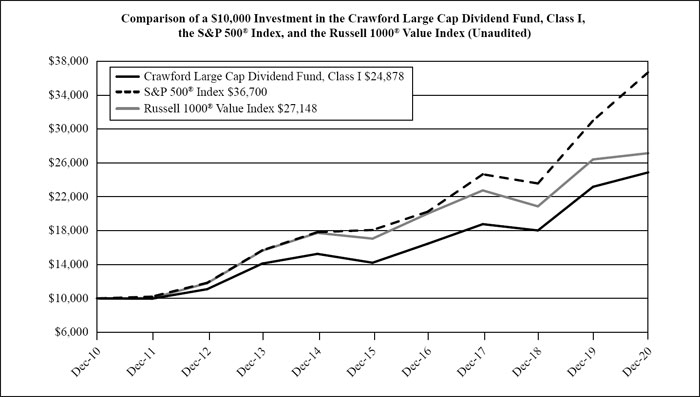

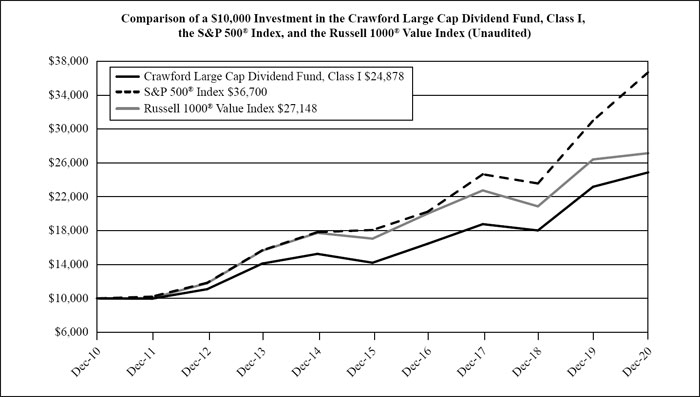

For the year ending December 31, 2020, the Crawford Large Cap Dividend Fund Class I Shares and Class C Shares produced total returns of 7.32% and 6.26%, respectively. This compares to total returns for the same time period of 2.80% for the Fund’s primary benchmark, the Russell 1000 Value Index and 18.40% for the Fund’s secondary benchmark, the S&P 500 Index. The Fund’s outperformance relative to the primary benchmark is a reflection of superior downside protection in the stock market decline experienced in the first quarter of 2020. Also, strong contributions from the technology sector, an underweighting in the energy sector, and financial sector returns all helped relative to the primary benchmark. The detractors from relative returns compared to the primary benchmark were communication services, materials, and healthcare. For the year overall, dividend-paying companies underperformed non-dividend payers and value-oriented stocks did not keep up with growth stocks nor the S&P 500 Index.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE – (Unaudited) (continued)

The strategy continues to maintain a high-quality orientation, and the adviser believes the portfolio is well positioned to obtain attractive, long-term, risk-adjusted returns.

Over our 40-year history, Crawford has found that investing in companies with strong histories of raising their dividends is a great way to identify consistency and predictability in the market. This, in turn, leads to strong protection of capital in down markets relative to both the overall market and our portfolio’s respective peer group. The Dividend Growth strategy experienced no dividend cuts or eliminations during the year, and we are encouraged that as we embark on 2021, the average holding within the strategy is paying a higher dividend than last year. The dividend integrity displayed by our portfolio’s businesses contrasts with what is taking place broadly in this destabilized financial environment. We believe that this commitment to quality, which begins with a company’s dividend history, has helped lead to solid investment results over time.

Small Cap Dividend Fund:

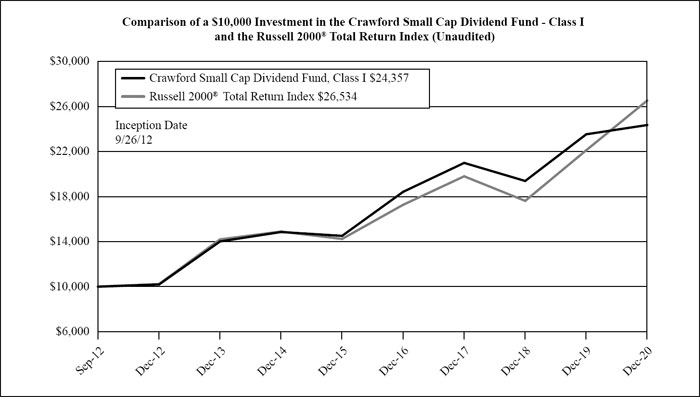

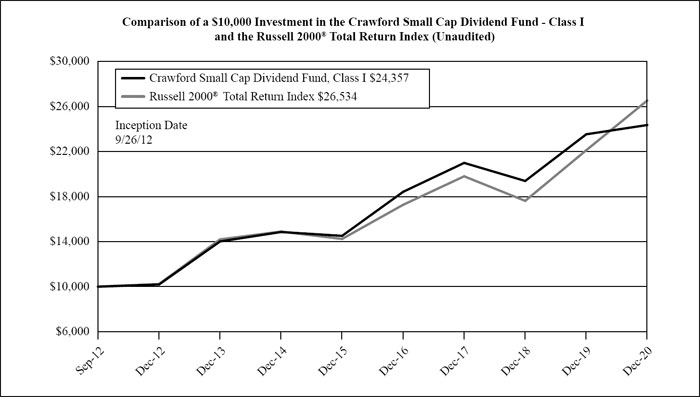

For the year ending December 31, 2020, the Crawford Small Cap Dividend Fund Class I Shares produced a total return of 3.50%. For the same period, this compares to a total return of 19.96% for the Fund’s benchmark, the Russell 2000 Index.

During 2020, the Fund’s value tilt and quality bias did not help as growth stocks, non-dividend paying small caps, and lower quality companies performed better. In fact, the return disparity between Russell 2000 dividend payers and Russell 2000 non-dividend payers was approximately 40% in 2020. The best contributing sectors on a relative basis, compared to the Fund’s primary benchmark, were energy, communications services, and real estate. The worst relative contributions compared to the Fund’s primary benchmark came from consumer discretionary, healthcare and information technology.

The adviser believes the Fund’s quality-focused, bottom-up investment process aligns well with the objectives of the fund, and expects that the fund is positioned to continue to benefit from an information advantage in smaller company stocks and a behavioral bias among investors against more consistent, predictable, dividend-paying companies with smaller market capitalizations.

Multi-Asset Income Fund:

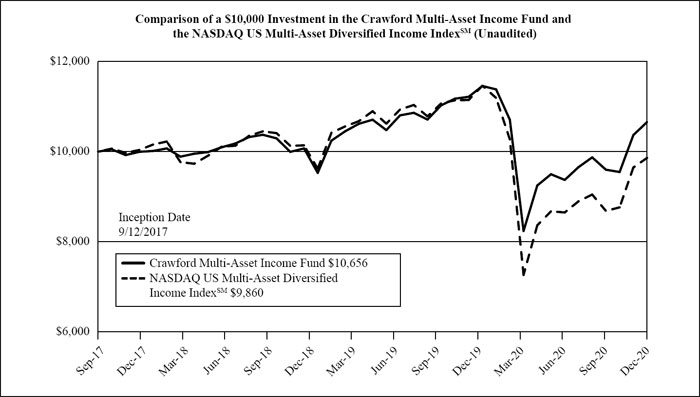

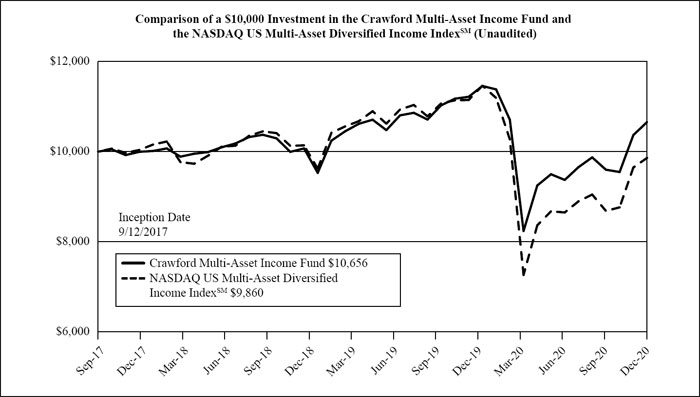

For the year ending December 31, 2020, the Crawford Multi-Asset Income Fund produced a total return of -7.00%. For the same time period, this compares to a total return of -13.99% for the Fund’s benchmark, the NASDAQ U.S. Multi-Asset Diversified Income Index. The advisor attributes the outperformance to superior security selection within the higher yielding opportunity set, risk management, and maintaining a high level of current income.

The Crawford Multi-Asset Income Fund’s portfolio management process is oriented toward generating a high level of current income. In order to achieve the desired yield, the Fund accepts and manages four sources of risk. These four risks are 1) Stock market risk, 2) Interest rate risk, 3) Energy price risk, and 4) Credit risk. Allocations to various asset categories such as high-dividend equities, preferred stocks, corporate bonds, real estate investment trusts, and energy infrastructure companies will vary over time as changes occur in individual security pricing and based on the overall income opportunity set. The adviser believes that the income-producing ability of the portfolio is intact and will continue to serve shareholders well going forward.

CONCLUSION: The world is uncertain and the advisor believes that many investors underestimate the potential range of outcomes. 2020 brought a pandemic, bear market and swift recovery that were virtually unpredictable. The events are a reminder that quality can help overcome the inherent uncertainty associated with investing. The advisor will continue to identify high-quality companies with a balanced risk/reward trade-off, and will attempt to invest in these companies when valuations are attractive. This should enable participation in up markets and protection in down markets. Investing in quality over the long term has proven to be an effective means of achieving investment objectives, and we expect it will be in the future.

INVESTMENT RESULTS – (Unaudited)

| Average Annual Total Returns (a) |

| (for the periods ended December 31, 2020) |

| | | | | |

| | Crawford Large Cap | | | | | |

| | Dividend Fund | | | | | |

| | | | | | Russell 1000® | | S&P 500® | |

| | Class I | | Class C (b) | | Value Index (c) | | Index (c) | |

| One Year | 7.32% | | 6.26% | | 2.80% | | 18.40% | |

| Five Year | 11.85% | | 10.73% | | 9.74% | | 15.22% | |

| Ten Year | 9.54% | | 8.45% | | 10.50% | | 13.88% | |

| | | | | | | | | |

| | Expense Ratios (d) | | | | | |

| | Class I | | Class C | | | | | |

| Gross | 0.98% | | 1.98% | | | | | |

| With Applicable Waivers | 0.98% | | 1.98% | | | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Crawford Large Cap Dividend Fund (the “Fund”), formerly Crawford Dividend Growth Fund, distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 431-1716.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus and summary prospectus contain this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

| (a) | The average annual total returns set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Total returns shown assume reinvestment of all capital gains and dividend distributions and reflect any changes in price per share. |

| (b) | Class C shares are sold with no initial sales charge, but are subject to a Contingent Deferred Sales Charge (CDSC) of 1.00% if redeemed within one year of purchase and an annual 12b-1 fee of 1.00%. |

| (c) | The Russell 1000® Value Index and the S&P 500® Index are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an Index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (d) | The expense ratios reflect information from the Fund’s prospectus dated April 29, 2020, as amended November 19, 2020. In the fiscal year ended December 31, 2019, Crawford Investment Counsel, Inc. (the “Adviser”) waived less than 0.01% of its management fee. The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments inother collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 0.98% through April 30, 2021. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020 can be found in the financial highlights. |

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

INVESTMENT RESULTS – (Unaudited) (continued)

The chart above assumes an initial investment of $10,000 made on December 31, 2010 and held through December 31, 2020. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The S&P 500® Index and the Russell 1000® Value Index are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, to obtain performance data current to the most recent month end, or to obtain a prospectus or summary prospectus, please call (800) 431-1716. The Fund’s prospectus and summary prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information. Please read the prospectus or summary prospectus carefully before you invest or send money.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

INVESTMENT RESULTS – (Unaudited) (continued)

| Average Annual Total Returns (a) |

| (for the periods ended December 31, 2020) |

| | |

| | Crawford Small Cap Dividend Fund | | Russell 2000® | |

| | Class I | | Index (b) | |

| One Year | 3.50% | | 19.96% | |

| Five Year | 10.91% | | 13.26% | |

| Since Inception (9/26/12) | 11.38% | | 12.54% | |

| | | | | |

| | Expense Ratios (c) | | | |

| Gross | 1.17% | | | |

| With Applicable Waivers | 0.99% | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Crawford Small Cap Dividend Fund (the “Fund”), distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 431-1716.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus and summary prospectus contain this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

| (a) | The average annual total returns set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Total returns shown assume reinvestment of all capital gains and dividend distributions and reflect any changes in price per share. |

| (b) | The Russell 2000® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios reflect information from the Fund’s prospectus dated April 29, 2020. The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 0.99% through April 30, 2021. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/ expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios as of December 31, 2020 can be found in the financial highlights. |

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

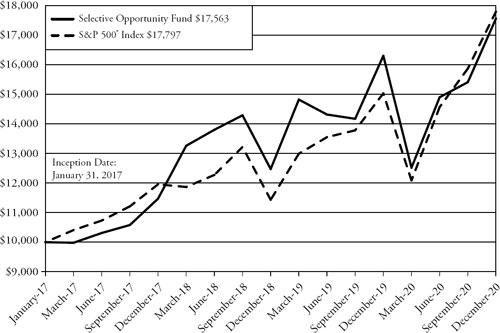

INVESTMENT RESULTS – (Unaudited) (continued)

The chart above assumes an initial investment of $10,000 made on September 26, 2012 (commencement of operations) and held through December 31, 2020. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The Russell 2000® Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than are found in the Fund’s portfolio. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, to obtain performance data current to the most recent month end, or to obtain a prospectus or summary prospectus, please call (800) 431-1716. The Fund’s prospectus and summary prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information. Please read the prospectus or summary prospectus carefully before you invest or send money.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

INVESTMENT RESULTS – (Unaudited) (continued)

| Average Annual Total Returns (a) |

| (for the periods ended December 31, 2020) |

| |

| | | | NASDAQ US | |

| | | | Multi-Asset | |

| | | | Diversified Income | |

| | Crawford Multi-Asset Income Fund | | IndexSM (b) | |

| One Year | -7.00% | | -13.99% | |

| Since Inception (9/12/17) | 1.94% | | -0.43% | |

| | | | | |

| | Expense Ratios (c) | | | |

| Gross | 1.33% | | | |

| With Applicable Waivers | 1.01% | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Crawford Multi-Asset Income Fund (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 431-1716.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The prospectus and summary prospectus contain this and other important information about the Fund and may be obtained by calling the same number as above. Please read it carefully before investing.

| (a) | The average annual total returns set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower. Total returns shown assume reinvestment of all capital gains and dividend distributions and reflect any changes in price per share. Total returns for less than one year are not annualized. |

| (b) | The NASDAQ US Multi-Asset Diversified Income Index SM is designed to provide exposure to multiple asset segments, each selected to result in a consistent and high yield. The index is comprised of securities classified as U.S. equities, U.S. Real Estate Investment Trusts, U.S. preferred securities, U.S. Master Limited Partnerships, and a high-yield corporate debt Exchange Traded Fund and is representative of a broader market and range of securities than are found in the Fund’s portfolio. Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios, which include acquired fund fees and expenses of 0.01%, reflect information from the Fund’s prospectus dated April 29, 2020. Crawford Investment Counsel, Inc. (the “Adviser”) contractually has agreed to waive its management fee and/ or reimburse expenses so that total annual operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 1.00% through April 30, 2021. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios (not including acquired fund fees and expenses) as of December 31, 2020 can be found in the financial highlights. |

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

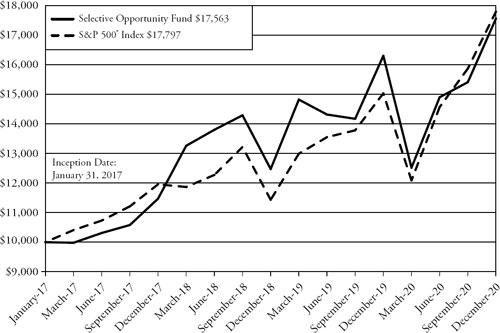

INVESTMENT RESULTS – (Unaudited) (continued)

The chart above assumes an initial investment of $10,000 made on September 12, 2017 (commencement of operations) and held through December 31, 2020. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The NASDAQ US Multi-Asset Diversified Income Index SM is designed to provide exposure to multiple asset segments, each selected to result in a consistent and high yield. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, to obtain performance data current to the most recent month end, or to obtain a prospectus or summary prospectus, please call (800) 431-1716. The Fund’s prospectus and summary prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information. Please read the prospectus or summary prospectus carefully before you invest or send money.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

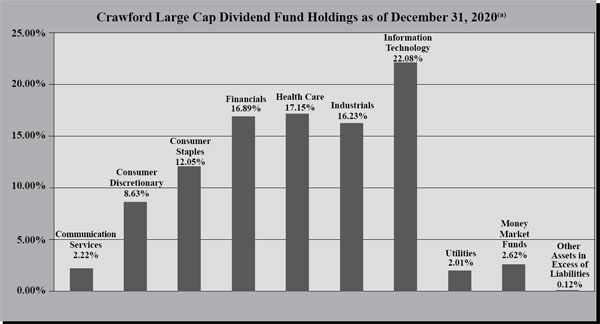

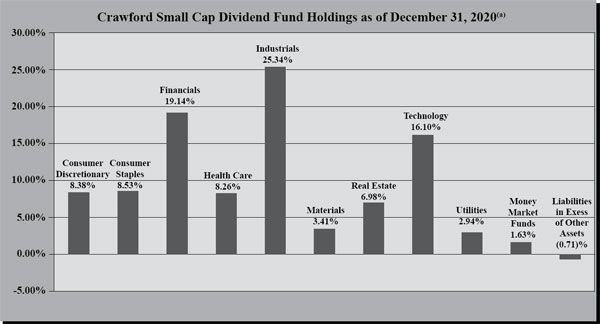

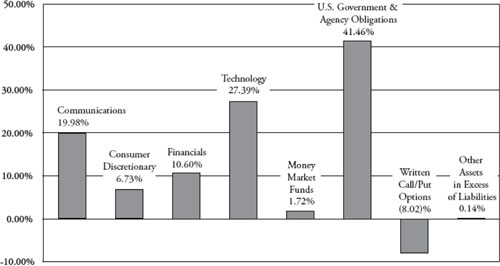

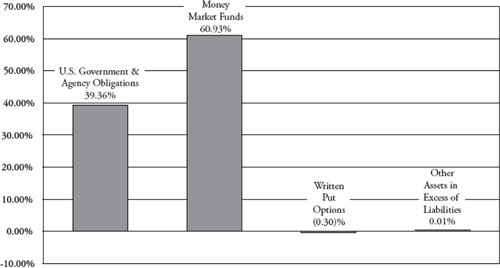

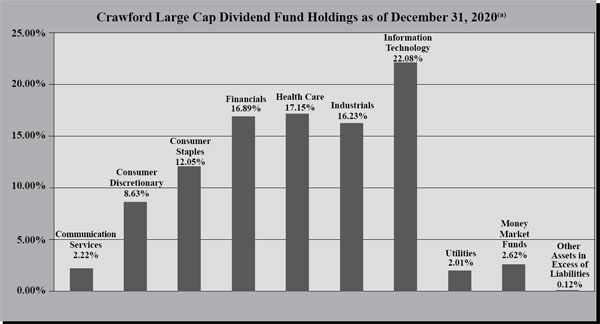

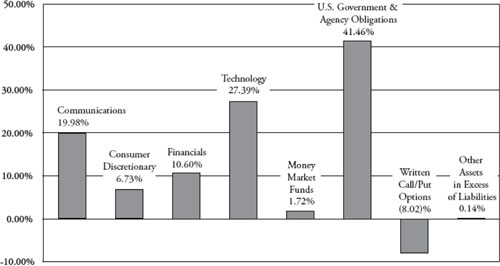

FUND HOLDINGS – (Unaudited)

| (a) | As a percentage of net assets. |

The investment objective of the Crawford Large Cap Dividend Fund is total return. Total return is comprised of both capital appreciation and income. Under normal circumstances, the Crawford Large Cap Dividend Fund will invest at least 80% of its assets in securities of large cap companies that pay or are expected to pay regular dividends.

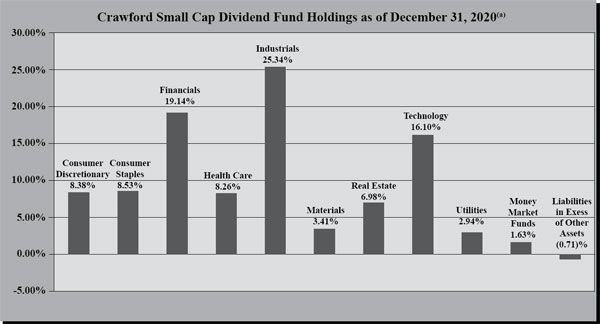

| (a) | As a percentage of net assets. |

The investment objective of the Crawford Small Cap Dividend Fund is to provide attractive long-term total return with below market risk as measured by standard deviation in comparison with the Russell 2000® Index. Total return is comprised of both capital appreciation and income.

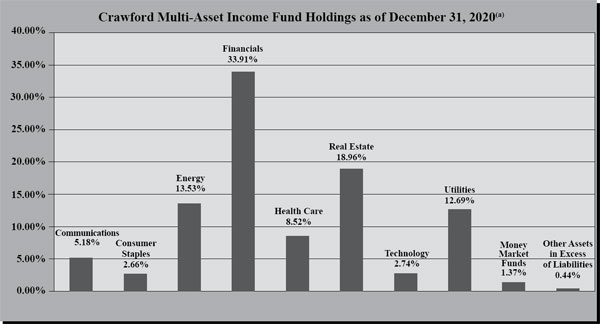

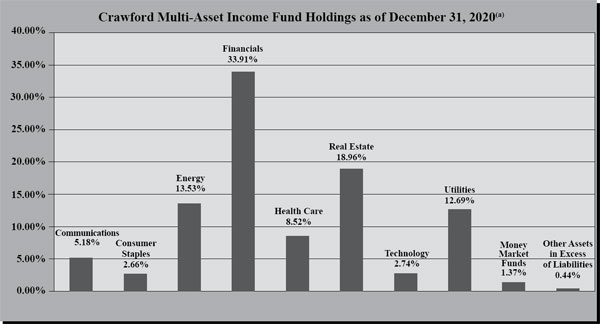

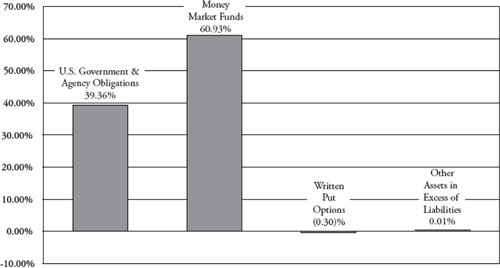

FUND HOLDINGS – (Unaudited) (continued)

| (a) | As a percentage of net assets. |

The investment objective of the Crawford Multi-Asset Fund is to provide current income.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Funds file a complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters as an exhibit to its reports on Form N-PORT. The Funds’ Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| CRAWFORD LARGE CAP DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2020 |

| COMMON STOCKS — 97.26% | | Shares | | | Fair Value | |

| | | | | | | |

| Communications — 2.22% | | | | | | | | |

| Omnicom Group, Inc. | | | 19,110 | | | $ | 1,191,891 | |

| | | | | | | | | |

| Consumer Discretionary — 8.63% | | | | | | | | |

| Genuine Parts Co. | | | 17,170 | | | | 1,724,383 | |

| Home Depot, Inc. (The) | | | 6,960 | | | | 1,848,715 | |

| Starbucks Corp. | | | 10,000 | | | | 1,069,800 | |

| | | | | | | | 4,642,898 | |

| Consumer Staples — 12.05% | | | | | | | | |

| Coca-Cola Co. (The) | | | 26,500 | | | | 1,453,260 | |

| Colgate-Palmolive Co. | | | 11,500 | | | | 983,365 | |

| Mondelez International, Inc., Class A | | | 18,850 | | | | 1,102,160 | |

| Philip Morris International, Inc. | | | 19,250 | | | | 1,593,708 | |

| Procter & Gamble Co. (The) | | | 9,700 | | | | 1,349,657 | |

| | | | | | | | 6,482,150 | |

| Financials — 16.89% | | | | | | | | |

| American Express Co. | | | 12,900 | | | | 1,559,739 | |

| BlackRock, Inc. | | | 2,100 | | | | 1,515,234 | |

| Chubb Ltd. | | | 10,500 | | | | 1,616,160 | |

| JPMorgan Chase & Co. | | | 6,700 | | | | 851,369 | |

| Marsh & McLennan Cos., Inc. | | | 7,000 | | | | 819,000 | |

| Northern Trust Corp. | | | 12,320 | | | | 1,147,485 | |

| Willis Towers Watson PLC | | | 7,478 | | | | 1,575,465 | |

| | | | | | | | 9,084,452 | |

| Health Care — 17.15% | | | | | | | | |

| AbbVie, Inc. | | | 10,500 | | | | 1,125,075 | |

| AstraZeneca PLC - ADR | | | 28,000 | | | | 1,399,720 | |

| Cardinal Health, Inc. | | | 18,000 | | | | 964,080 | |

| Johnson & Johnson | | | 13,140 | | | | 2,067,973 | |

| Medtronic PLC | | | 15,000 | | | | 1,757,100 | |

| Merck & Co., Inc. | | | 18,920 | | | | 1,547,656 | |

| Stryker Corp. | | | 1,500 | | | | 367,560 | |

| | | | | | | | 9,229,164 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD LARGE CAP DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS – (continued) |

| December 31, 2020 |

| COMMON STOCKS — 97.26% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials — 16.23% | | | | | | | | |

| 3M Co. | | | 4,000 | | | $ | 699,160 | |

| Honeywell International, Inc. | | | 9,500 | | | | 2,020,650 | |

| Hubbell, Inc. | | | 7,440 | | | | 1,166,518 | |

| Johnson Controls International PLC | | | 29,300 | | | | 1,365,087 | |

| Raytheon Technologies Corp. | | | 12,500 | | | | 893,875 | |

| United Parcel Service, Inc., Class B | | | 12,930 | | | | 2,177,412 | |

| W.W. Grainger, Inc. | | | 1,000 | | | | 408,340 | |

| | | | | | | | 8,731,042 | |

| Technology — 22.08% | | | | | | | | |

| Accenture PLC, Class A | | | 5,840 | | | | 1,525,466 | |

| Fidelity National Information Services, Inc. | | | 5,000 | | | | 707,300 | |

| International Business Machines Corp. | | | 8,000 | | | | 1,007,040 | |

| Microsoft Corp. | | | 10,370 | | | | 2,306,495 | |

| Paychex, Inc. | | | 13,750 | | | | 1,281,225 | |

| S&P Global, Inc. | | | 3,600 | | | | 1,183,428 | |

| SAP SE - ADR | | | 7,500 | | | | 977,925 | |

| Texas Instruments, Inc. | | | 13,350 | | | | 2,191,136 | |

| Visa, Inc., Class A | | | 3,200 | | | | 699,936 | |

| | | | | | | | 11,879,951 | |

| Utilities — 2.01% | | | | | | | | |

| American Electric Power Co., Inc. | | | 13,000 | | | | 1,082,510 | |

| | | | | | | | | |

| Total Common Stocks (Cost $30,372,427) | | | | | | | 52,324,058 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 2.62% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 0.01%(a) | | | 1,411,289 | | | | 1,411,289 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $1,411,289) | | | | | | | 1,411,289 | |

| Total Investments — 99.88% (Cost $31,783,716) | | | | | | | 53,735,347 | |

| Other Assets in Excess of Liabilities — 0.12% | | | | | | | 65,810 | |

| NET ASSETS — 100.00% | | | | | | $ | 53,801,157 | |

| (a) | Rate disclosed is the seven day effective yield as of December 31, 2020. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD SMALL CAP DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2020 |

| COMMON STOCKS — 99.08% | | Shares | | | Fair Value | |

| | | | | | | |

| Consumer Discretionary — 8.38% | | | | | | | | |

| Carter’s, Inc. | | | 31,574 | | | $ | 2,970,166 | |

| Choice Hotels International, Inc. | | | 11,503 | | | | 1,227,715 | |

| Columbia Sportswear Co. | | | 28,200 | | | | 2,464,116 | |

| Gildan Activewear, Inc. | | | 116,500 | | | | 3,263,165 | |

| Leggett & Platt, Inc. | | | 67,843 | | | | 3,005,445 | |

| Monro, Inc. | | | 80,648 | | | | 4,298,538 | |

| Wolverine World Wide, Inc. | | | 170,499 | | | | 5,328,094 | |

| | | | | | | | 22,557,239 | |

| Consumer Staples — 8.53% | | | | | | | | |

| Casey’s General Stores, Inc. | | | 28,995 | | | | 5,179,087 | |

| Core-Mark Holding Co., Inc. | | | 93,528 | | | | 2,746,917 | |

| Flowers Foods, Inc. | | | 191,461 | | | | 4,332,762 | |

| J&J Snack Foods Corp. | | | 17,578 | | | | 2,731,094 | |

| MGP Ingredients, Inc. | | | 52,699 | | | | 2,480,015 | |

| PriceSmart, Inc. | | | 60,198 | | | | 5,483,436 | |

| | | | | | | | 22,953,311 | |

| Financials — 19.14% | | | | | | | | |

| BancFirst Corp. | | | 60,660 | | | | 3,560,742 | |

| Bryn Mawr Bank Corp. | | | 84,055 | | | | 2,571,663 | |

| First Hawaiian, Inc. | | | 133,400 | | | | 3,145,572 | |

| First of Long Island Corp. (The) | | | 145,183 | | | | 2,591,517 | |

| Glacier Bancorp, Inc. | | | 65,977 | | | | 3,035,602 | |

| Hanover Insurance Group, Inc. | | | 45,472 | | | | 5,316,586 | |

| Houlihan Lokey, Inc. | | | 39,107 | | | | 2,629,164 | |

| Lazard Ltd., Class A | | | 62,239 | | | | 2,632,710 | |

| Mercury General Corp. | | | 55,700 | | | | 2,908,097 | |

| Old Republic International Corp. | | | 285,718 | | | | 5,631,502 | |

| South State Corp. | | | 54,940 | | | | 3,972,162 | |

| Sterling Bancorp | | | 234,320 | | | | 4,213,074 | |

| Trico Bancshares | | | 134,977 | | | | 4,761,988 | |

| Valley National Bancorp | | | 467,456 | | | | 4,557,695 | |

| | | | | | | | 51,528,074 | |

| Health Care — 8.26% | | | | | | | | |

| Atrion Corp. | | | 6,039 | | | | 3,878,487 | |

| Cantel Medical Corp. | | | 63,443 | | | | 5,003,115 | |

| CONMED Corp. | | | 43,885 | | | | 4,915,120 | |

| Luminex Corp. | | | 188,840 | | | | 4,365,981 | |

| Psychemedics Corp. | | | 242,076 | | | | 1,232,167 | |

| U.S. Physical Therapy, Inc. | | | 23,713 | | | | 2,851,488 | |

| | | | | | | | 22,246,358 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD SMALL CAP DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS – (continued) |

| December 31, 2020 |

| COMMON STOCKS — 99.08% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Industrials — 25.34% | | | | | | | | |

| ESCO Technologies, Inc. | | | 46,434 | | | $ | 4,792,917 | |

| Franklin Electric Co., Inc. | | | 56,318 | | | | 3,897,769 | |

| Hackett Group, Inc. | | | 347,404 | | | | 4,999,143 | |

| Healthcare Services Group, Inc. | | | 161,535 | | | | 4,539,134 | |

| Hubbell, Inc. | | | 17,900 | | | | 2,806,541 | |

| Kaman Corp. | | | 64,393 | | | | 3,678,772 | |

| Landstar System, Inc. | | | 17,718 | | | | 2,385,906 | |

| Littelfuse, Inc. | | | 20,902 | | | | 5,322,904 | |

| Moog, Inc., Class A | | | 53,872 | | | | 4,272,049 | |

| MSC Industrial Direct Co., Inc., Class A | | | 47,357 | | | | 3,996,458 | |

| Mueller Water Products, Inc., Series A | | | 404,851 | | | | 5,012,056 | |

| National Instruments Corp. | | | 114,679 | | | | 5,038,995 | |

| nVent Electric PLC | | | 200,622 | | | | 4,672,486 | |

| Standex International, Inc. | | | 38,000 | | | | 2,945,760 | |

| Valmont Industries, Inc. | | | 24,141 | | | | 4,222,985 | |

| Watsco, Inc. | | | 6,759 | | | | 1,531,251 | |

| Woodward, Inc. | | | 33,690 | | | | 4,094,346 | |

| | | | | | | | 68,209,472 | |

| Materials — 3.41% | | | | | | | | |

| Cameco Corp. | | | 212,331 | | | | 2,845,235 | |

| Compass Minerals International, Inc. | | | 39,958 | | | | 2,466,208 | |

| HB Fuller Co. | | | 74,804 | | | | 3,880,832 | |

| | | | | | | | 9,192,275 | |

| Real Estate — 6.98% | | | | | | | | |

| American Campus Communities, Inc. | | | 46,833 | | | | 2,003,047 | |

| Armada Hoffler Properties, Inc. | | | 109,184 | | | | 1,225,044 | |

| CoreSite Realty Corp. | | | 26,909 | | | | 3,371,160 | |

| Four Corners Property Trust, Inc. | | | 91,401 | | | | 2,721,008 | |

| Independence Realty Trust, Inc. | | | 187,151 | | | | 2,513,438 | |

| Physicians Realty Trust | | | 121,592 | | | | 2,164,338 | |

| Piedmont Office Realty Trust, Inc., Class A | | | 152,575 | | | | 2,476,292 | |

| STAG Industrial, Inc. | | | 73,817 | | | | 2,311,948 | |

| | | | | | | | 18,786,275 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD SMALL CAP DIVIDEND FUND |

| SCHEDULE OF INVESTMENTS – (continued) |

| December 31, 2020 |

| COMMON STOCKS — 99.08% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Technology — 16.10% | | | | | | | | |

| American Software, Inc., Class A | | | 322,737 | | | $ | 5,541,395 | |

| Avnet, Inc. | | | 79,804 | | | | 2,801,918 | |

| Brooks Automation, Inc. | | | 74,127 | | | | 5,029,517 | |

| Cass Information Systems, Inc. | | | 106,467 | | | | 4,142,631 | |

| Computer Programs & Systems, Inc. | | | 137,571 | | | | 3,692,406 | |

| Pegasystems, Inc. | | | 29,405 | | | | 3,918,510 | |

| Power Integrations, Inc. | | | 66,514 | | | | 5,444,836 | |

| Sapiens International Corp. NV | | | 116,458 | | | | 3,564,779 | |

| Simulations Plus, Inc. | | | 66,260 | | | | 4,765,419 | |

| TTEC Holdings, Inc. | | | 60,906 | | | | 4,441,875 | |

| | | | | | | | 43,343,286 | |

| Utilities — 2.94% | | | | | | | | |

| Black Hills Corp. | | | 86,552 | | | | 5,318,620 | |

| IDACORP, Inc. | | | 27,000 | | | | 2,592,810 | |

| | | | | | | | 7,911,430 | |

| Total Common Stocks (Cost $216,114,397) | | | | | | | 266,727,720 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.63% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 0.01%(a) | | | 4,398,362 | | | | 4,398,362 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $4,398,362) | | | | | | | 4,398,362 | |

| Total Investments — 100.71% (Cost $220,512,759) | | | | | | | 271,126,082 | |

| Liabilities in Excess of Other Assets — (0.71)% | | | | | | | (1,899,482 | ) |

| NET ASSETS — 100.00% | | | | | | $ | 269,226,600 | |

| (a) | Rate disclosed is the seven day effective yield as of December 31, 2020. |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD MULTI-ASSET INCOME FUND |

| SCHEDULE OF INVESTMENTS |

| December 31, 2020 |

| COMMON STOCKS — 56.97% | | Shares | | | Fair Value | |

| | | | | | | |

| Communications — 5.18% | | | | | | | | |

| AT&T, Inc. | | | 70,000 | | | $ | 2,013,200 | |

| BCE, Inc. | | | 51,080 | | | | 2,186,224 | |

| Verizon Communications, Inc. | | | 22,120 | | | | 1,299,550 | |

| | | | | | | | 5,498,974 | |

| Consumer Staples — 2.66% | | | | | | | | |

| Philip Morris International, Inc. | | | 34,050 | | | | 2,819,000 | |

| | | | | | | | | |

| Energy — 9.44% | | | | | | | | |

| Kinder Morgan, Inc. | | | 169,880 | | | | 2,322,260 | |

| ONEOK, Inc. | | | 56,440 | | | | 2,166,167 | |

| Valero Energy Corp. | | | 38,360 | | | | 2,170,025 | |

| Williams Cos., Inc. (The) | | | 167,490 | | | | 3,358,175 | |

| | | | | | | | 10,016,627 | |

| Financials — 14.24% | | | | | | | | |

| AGNC Investment Corp. | | | 204,490 | | | | 3,190,044 | |

| Huntington Bancshares, Inc. | | | 169,000 | | | | 2,134,470 | |

| New Residential Investment Corp. | | | 278,100 | | | | 2,764,314 | |

| Old Republic International Corp. | | | 122,000 | | | | 2,404,620 | |

| People’s United Financial, Inc. | | | 161,540 | | | | 2,088,712 | |

| Valley National Bancorp | | | 259,170 | | | | 2,526,907 | |

| | | | | | | | 15,109,067 | |

| Health Care — 8.52% | | | | | | | | |

| AbbVie, Inc. | | | 33,730 | | | | 3,614,170 | |

| Cardinal Health, Inc. | | | 38,650 | | | | 2,070,094 | |

| GlaxoSmithKline PLC - ADR | | | 34,050 | | | | 1,253,040 | |

| Pfizer, Inc. | | | 56,930 | | | | 2,095,593 | |

| | | | | | | | 9,032,897 | |

| Real Estate — 10.66% | | | | | | | | |

| Brandywine Realty Trust | | | 173,630 | | | | 2,067,933 | |

| Four Corners Property Trust, Inc. | | | 72,350 | | | | 2,153,860 | |

| Physicians Realty Trust | | | 123,840 | | | | 2,204,352 | |

| STAG Industrial, Inc. | | | 73,780 | | | | 2,310,790 | |

| WP Carey, Inc. | | | 36,430 | | | | 2,571,228 | |

| | | | | | | | 11,308,163 | |

| Technology — 2.74% | | | | | | | | |

| International Business Machines Corp. | | | 23,110 | | | | 2,909,087 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD MULTI-ASSET INCOME FUND |

| SCHEDULE OF INVESTMENTS – (continued) |

| December 31, 2020 |

| COMMON STOCKS — 56.97% (continued) | | Shares | | | Fair Value | |

| | | | | | | |

| Utilities — 3.53% | | | | | | | | |

| Duke Energy Corp. | | | 18,090 | | | $ | 1,656,320 | |

| NorthWestern Corp. | | | 35,720 | | | | 2,082,834 | |

| | | | | | | | 3,739,154 | |

| Total Common Stocks (Cost $60,850,737) | | | | | | | 60,432,969 | |

| | | | | | | | | |

| PREFERRED STOCKS — 30.68% | | | | | | | | |

| | | | | | | | | |

| Energy — 1.16% | | | | | | | | |

| Energy Transfer Operating LP, Series D, 7.63% | | | 57,530 | | | | 1,225,389 | |

| | | | | | | | | |

| Financials — 16.88% | | | | | | | | |

| Allstate Corp., Series G, 5.63% | | | 64,550 | | | | 1,831,284 | |

| Annaly Capital Management, Inc., Series F, 6.95% | | | 103,520 | | | | 2,613,880 | |

| Bank of America Corp., Series KK, 5.38% | | | 51,050 | | | | 1,394,176 | |

| Charles Schwab Corp. (The), Series D, 5.95% | | | 51,250 | | | | 1,334,550 | |

| Invesco Mortgage Capital, Inc., Series A, 7.75% | | | 14,700 | | | | 369,558 | |

| Invesco Mortgage Capital, Inc., Series C, 7.50% | | | 60,130 | | | | 1,443,120 | |

| State Street Corp., Series G, 5.35% | | | 78,180 | | | | 2,264,093 | |

| Two Harbors Investment Corp., Series B, 7.63% | | | 161,400 | | | | 3,855,845 | |

| Wells Fargo & Co., Series L, 7.50% | | | 1,850 | | | | 2,808,115 | |

| | | | | | | | 17,914,621 | |

| Real Estate — 8.30% | | | | | | | | |

| Digital Realty Trust, Inc., Series L, 5.20% | | | 102,150 | | | | 2,788,695 | |

| Hersha Hospitality Trust, Series D, 6.50% | | | 66,910 | | | | 1,259,915 | |

| Monmouth Real Estate Investment Corp., Series C, 6.13% | | | 79,840 | | | | 2,003,984 | |

| Vornado Realty Trust, Series M, 5.25% | | | 104,150 | | | | 2,745,394 | |

| | | | | | | | 8,797,988 | |

| Utilities — 4.34% | | | | | | | | |

| Nisource, Inc., Series B, 6.50% | | | 63,250 | | | | 1,801,993 | |

| Sempra Energy, 5.75% | | | 33,400 | | | | 949,562 | |

| Spire, Inc., Series A, 5.90% | | | 66,580 | | | | 1,846,929 | |

| | | | | | | | 4,598,484 | |

| Total Preferred Stocks (Cost $30,975,526) | | | | | | | 32,536,482 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD MULTI-ASSET INCOME FUND |

| SCHEDULE OF INVESTMENTS – (continued) |

| December 31, 2020 |

| | | Principal | | | | |

| CORPORATE BONDS — 10.54% | | Amount | | | Fair Value | |

| | | | | | | |

| Energy — 2.93% | | | | | | | | |

| Transcanada Trust, 5.63%, 5/20/2075 | | $ | 2,830,000 | | | $ | 3,108,381 | |

| | | | | | | | | |

| Financials — 2.79% | | | | | | | | |

| American Express Co., 3.65%, Perpetual (3MO LIBOR + 342.8bps)(a) | | | 2,975,000 | | | | 2,960,125 | |

| | | | | | | | | |

| Utilities — 4.82% | | | | | | | | |

| Centerpoint Energy, Inc. , Series A, 6.13%, Perpetual | | | 1,920,000 | | | | 2,012,184 | |

| Southern Co. (The) , Series B, 5.50%, 3/15/2057 | | | 2,975,000 | | | | 3,093,798 | |

| | | | | | | | 5,105,982 | |

| Total Corporate Bonds (Cost $10,101,727) | | | | | | | 11,174,488 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 1.37% | | | | | | | | |

| Federated Hermes Treasury Obligations Fund, Institutional Shares, 0.01%(b) | | | 1,449,046 | | | | 1,449,046 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $1,449,046) | | | | | | | 1,449,046 | |

| Total Investments — 99.56% (Cost $103,377,036) | | | | | | | 105,592,985 | |

| Other Assets in Excess of Liabilities — 0.44% | | | | | | | 463,310 | |

| NET ASSETS — 100.00% | | | | | | $ | 106,056,295 | |

| (a) | Variable rate security. The rate shown is the effective interest rate as of December 31, 2020. The benchmark on which the rate is calculated is shown parenthetically. |

| (b) | Rate disclosed is the seven day effective yield as of December 31, 2020. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES |

| December 31, 2020 |

| | | Crawford | | | Crawford | | | Crawford | |

| | | Large Cap | | | Small Cap | | | Multi-Asset | |

| | | Dividend Fund | | | Dividend Fund | | | Income Fund | |

| Assets | | | | | | | | | | | | |

| Investments in securities at value (cost $31,783,716, $220,512,759 and $103,377,036) | | $ | 53,735,347 | | | $ | 271,126,082 | | | $ | 105,592,985 | |

| Receivable for fund shares sold | | | 1,975 | | | | 101,421 | | | | 85,000 | |

| Receivable for investments sold | | | — | | | | 121,437 | | | | — | |

| Dividends and interest receivable | | | 115,461 | | | | 308,725 | | | | 480,072 | |

| Prepaid expenses | | | 14,229 | | | | 21,988 | | | | 6,119 | |

| Total Assets | | | 53,867,012 | | | | 271,679,653 | | | | 106,164,176 | |

| | | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | | |

| Payable for fund shares redeemed | | | — | | | | 1,704,044 | | | | — | |

| Payable for investments purchased | | | — | | | | 504,995 | | | | — | |

| Payable to Adviser | | | 25,178 | | | | 189,882 | | | | 67,858 | |

| 12b-1 fees accrued - Class C | | | 7,690 | | | | — | | | | — | |

| Payable to Administrator | | | 8,439 | | | | 18,628 | | | | 10,019 | |

| Payable to trustees | | | 3,266 | | | | 3,266 | | | | 3,266 | |

| Other accrued expenses | | | 21,282 | | | | 32,238 | | | | 26,738 | |

| Total Liabilities | | | 65,855 | | | | 2,453,053 | | | | 107,881 | |

| Net Assets | | $ | 53,801,157 | | | $ | 269,226,600 | | | $ | 106,056,295 | |

| | | | | | | | | | | | | |

| Net Assets consist of: | | | | | | | | | | | | |

| Paid-in capital | | | 31,759,736 | | | | 222,725,717 | | | | 111,685,292 | |

| Accumulated earnings (deficit) | | | 22,041,421 | | | | 46,500,883 | | | | (5,628,997 | ) |

| Net Assets | | $ | 53,801,157 | | | $ | 269,226,600 | | | $ | 106,056,295 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF ASSETS AND LIABILITIES – (continued) |

| December 31, 2020 |

| | | Crawford | | | Crawford | | | Crawford | |

| | | Large Cap | | | Small Cap | | | Multi-Asset | |

| | | Dividend Fund | | | Dividend Fund | | | Income Fund | |

| Class I | | | | | | | | | | | | |

| Net Assets | | $ | 50,750,853 | | | $ | 269,226,600 | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 4,080,953 | | | | 6,338,095 | | | | | |

| Net asset value (“NAV”) and offering price per share | | $ | 12.44 | | | $ | 42.48 | | | | | |

| | | | | | | | | | | | | |

| Class C | | | | | | | | | | | | |

| Net Assets | | $ | 3,050,304 | | | | | | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 247,365 | | | | | | | | | |

| Net asset value (“NAV”) and offering price per share | | $ | 12.33 | | | | | | | | | |

| Net Assets | | | | | | | | | | $ | 106,056,295 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | | | | | | | | | 4,609,267 | |

| Net asset value (“NAV”) and offering price per share | | | | | | | | | | $ | 23.01 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF OPERATIONS |

| For the year ended December 31, 2020 |

| | | Crawford | | | Crawford | | | Crawford | |

| | | Large Cap | | | Small Cap | | | Multi-Asset | |

| | | Dividend Fund | | | Dividend Fund | | | Income Fund | |

| Investment Income | | | | | | | | | | | | |

| Dividend income | | $ | 1,409,879 | | | $ | 5,435,821 | | | $ | 3,725,340 | |

| Interest income | | | — | | | | — | | | | 660,337 | |

| Foreign dividend taxes withheld | | | (32,989 | ) | | | (11,142 | ) | | | (24,658 | ) |

| Total investment income | | | 1,376,890 | | | | 5,424,679 | | | | 4,361,019 | |

| | | | | | | | | | | | | |

| Expenses | | | | | | | | | | | | |

| Adviser | | | 244,056 | | | | 2,210,070 | | | | 934,136 | |

| Fund accounting | | | 40,554 | | | | 54,359 | | | | 39,161 | |

| 12b-1 fees- Class C | | | 32,540 | | | | 2,240 | | | | — | |

| Administration | | | 30,010 | | | | 132,782 | | | | 58,132 | |

| Registration | | | 28,445 | | | | 30,497 | | | | 14,104 | |

| Transfer agent | | | 26,662 | | | | 24,458 | | | | 17,836 | |

| Audit and tax preparation | | | 18,404 | | | | 18,403 | | | | 19,392 | |

| Legal | | | 18,379 | | | | 18,379 | | | | 18,378 | |

| Compliance services | | | 13,282 | | | | 13,282 | | | | 13,282 | |

| Trustee | | | 12,559 | | | | 12,559 | | | | 12,559 | |

| Custodian | | | 7,125 | | | | 27,369 | | | | 12,230 | |

| Insurance | | | 2,992 | | | | 5,260 | | | | 3,524 | |

| Report printing | | | 2,790 | | | | 13,951 | | | | 3,164 | |

| Pricing | | | 1,023 | | | | 2,392 | | | | 2,408 | |

| Miscellaneous | | | 19,900 | | | | 32,623 | | | | 24,076 | |

| Total expenses | | | 498,721 | | | | 2,598,624 | | | | 1,172,382 | |

| | | | | | | | | | | | | |

| Recoupment of prior expenses waived by Adviser | | | 12,546 | | | | — | | | | — | |

| Fees contractually waived by Adviser | | | — | | | | (386,201 | ) | | | (238,010 | ) |

| Net operating expenses | | | 511,267 | | | | 2,212,423 | | | | 934,372 | |

| Net investment income | | | 865,623 | | | | 3,212,256 | | | | 3,426,647 | |

| | | | | | | | | | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | | | | | | | | | |

| Net realized gain (loss) on investment securities transactions | | | 2,920,470 | | | | (3,819,195 | ) | | | (7,797,201 | ) |

| Net change in unrealized appreciation (depreciation) of investment securities and translation of assets and liabilities in foreign currency | | | (323,453 | ) | | | 12,326,703 | | | | (816,582 | ) |

| | | | | | | | | | | | | |

| Net realized and change in unrealized gain (loss) on investments and foreign currency | | | 2,597,017 | | | | 8,507,508 | | | | (8,613,783 | ) |

| | | | | | | | | | | | | |

| Net increase (decrease) in net assets resulting from operations | | $ | 3,462,640 | | | $ | 11,719,764 | | | $ | (5,187,136 | ) |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | Crawford Large Cap Dividend Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2020 | | | December 31,

2019 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 865,623 | | | $ | 745,303 | |

| Net realized gain (loss) on investment securities transactions | | | 2,920,470 | | | | (54,349 | ) |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (323,453 | ) | | | 11,026,433 | |

| Net increase in net assets resulting from operations | | | 3,462,640 | | | | 11,717,387 | |

| | | | | | | | | |

| Distributions to Shareholders from | | | | | | | | |

| Earnings | | | | | | | | |

| Class I | | | (3,375,504 | ) | | | (722,448 | ) |

| Class C | | | (179,279 | ) | | | (27,304 | ) |

| Total distributions | | | (3,554,783 | ) | | | (749,752 | ) |

| | | | | | | | | |

| Capital Transactions - Class I | | | | | | | | |

| Proceeds from shares sold | | | 5,550,415 | | | | 4,812,076 | |

| Reinvestment of distributions | | | 2,938,581 | | | | 480,490 | |

| Amount paid for shares redeemed | | | (5,469,889 | ) | | | (5,150,031 | ) |

| Total Class I | | | 3,019,107 | | | | 142,535 | |

| | | | | | | | | |

| Capital Transactions - Class C | | | | | | | | |

| Proceeds from shares sold | | | 22,169 | | | | 14,996 | |

| Reinvestment of distributions | | | 178,913 | | | | 26,403 | |

| Amount paid for shares redeemed | | | (1,208,235 | ) | | | (923,744 | ) |

| Total Class C | | | (1,007,153 | ) | | | (882,345 | ) |

| Net increase (decrease) in net assets resulting from capital transactions | | | 2,011,954 | | | | (739,810 | ) |

| | | | | | | | | |

| Total Increase in Net Assets | | | 1,919,811 | | | | 10,227,825 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 51,881,346 | | | | 41,653,521 | |

| End of year | | $ | 53,801,157 | | | $ | 51,881,346 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS – (continued) |

| | | Crawford Large Cap Dividend Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2020 | | | December 31,

2019 | |

| Share Transactions - Class I | | | | | | | | |

| Shares sold | | | 464,662 | | | | 425,473 | |

| Shares issued in reinvestment of distributions | | | 243,482 | | | | 41,293 | |

| Shares redeemed | | | (463,874 | ) | | | (451,870 | ) |

| Total Class I | | | 244,270 | | | | 14,896 | |

| | | | | | | | | |

| Share Transactions - Class C | | | | | | | | |

| Shares sold | | | 1,919 | | | | 1,280 | |

| Shares issued in reinvestment of distributions | | | 14,943 | | | | 2,312 | |

| Shares redeemed | | | (107,478 | ) | | | (82,690 | ) |

| Total Class C | | | (90,616 | ) | | | (79,098 | ) |

| Net increase (decrease) in shares outstanding | | | 153,654 | | | | (64,202 | ) |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS – (continued) |

| | | Crawford Small Cap Dividend Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2020 | | | December 31,

2019 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 3,212,256 | | | $ | 3,014,162 | |

| Net realized gain (loss) on investment securities transactions | | | (3,819,195 | ) | | | 10,241,847 | |

| Net change in unrealized appreciation of investment securities | | | 12,326,703 | | | | 28,111,891 | |

| Net increase in net assets resulting from operations | | | 11,719,764 | | | | 41,367,900 | |

| | | | | | | | | |

| Distributions to Shareholders from | | | | | | | | |

| Earnings | | | | | | | | |

| Class I | | | (5,284,700 | ) | | | (12,293,966 | ) |

| Class C | | | — | | | | (59,857 | ) |

| Total distributions | | | (5,284,700 | ) | | | (12,353,823 | ) |

| | | | | | | | | |

| Capital Transactions - Class I | | | | | | | | |

| Proceeds from shares sold | | | 46,445,371 | | | | 53,898,478 | |

| Reinvestment of distributions | | | 4,505,607 | | | | 8,925,353 | |

| Amount paid for shares redeemed | | | (38,138,275 | ) | | | (20,311,907 | ) |

| Total Class I | | | 12,812,703 | | | | 42,511,924 | |

| | | | | | | | | |

| Capital Transactions - Class C(a) | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 1,076,850 | |

| Reinvestment of distributions | | | — | | | | 51,457 | |

| Amount paid for shares redeemed | | | (1,342,811 | ) | | | (19,010 | ) |

| Total Class C | | | (1,342,811 | ) | | | 1,109,297 | |

| Net increase in net assets resulting from capital transactions | | | 11,469,892 | | | | 43,621,221 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 17,904,956 | | | | 72,635,298 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 251,321,644 | | | | 178,686,346 | |

| End of year | | $ | 269,226,600 | | | $ | 251,321,644 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS – (continued) |

| | | Crawford Small Cap Dividend Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2020 | | | December 31,

2019 | |

| Share Transactions - Class I | | | | | | | | |

| Shares sold | | | 1,326,403 | | | | 1,327,338 | |

| Shares issued in reinvestment of distributions | | | 119,445 | | | | 213,333 | |

| Shares redeemed | | | (1,059,459 | ) | | | (492,200 | ) |

| Total Class I | | | 386,389 | | | | 1,048,471 | |

| | | | | | | | | |

| Share Transactions - Class C(a) | | | | | | | | |

| Shares sold | | | — | | | | 26,631 | |

| Shares issued in reinvestment of distributions | | | — | | | | 1,236 | |

| Shares redeemed | | | (34,893 | ) | | | (439 | ) |

| Total Class C | | | (34,893 | ) | | | 27,428 | |

| Net increase in shares outstanding | | | 351,496 | | | | 1,075,899 | |

| (a) | The Small Cap Dividend Fund Class C shares ceased operations on February 26, 2020 |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| STATEMENTS OF CHANGES IN NET ASSETS – (continued) |

| | | Crawford Multi-Asset Income Fund | |

| | | For the | | | For the | |

| | | Year Ended | | | Year Ended | |

| | | December 31,

2020 | | | December 31,

2019 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 3,426,647 | | | $ | 2,718,445 | |

| Net realized gain (loss) on investment securities transactions | | | (7,797,201 | ) | | | 923,959 | |

| Net change in unrealized appreciation (depreciation) of investment securities | | | (816,582 | ) | | | 8,376,632 | |

| Net increase (decrease) in net assets resulting from operations | | | (5,187,136 | ) | | | 12,019,036 | |

| | | | | | | | | |

| Distributions to Shareholders from | | | | | | | | |

| Earnings | | | (3,540,919 | ) | | | (3,941,144 | ) |

| Return of capital | | | (103,691 | ) | | | (26,156 | ) |

| Total distributions | | | (3,644,610 | ) | | | (3,967,300 | ) |

| | | | | | | | | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 29,078,143 | | | | 34,727,519 | |

| Reinvestment of distributions | | | 2,882,934 | | | | 1,598,769 | |

| Amount paid for shares redeemed | | | (10,399,035 | ) | | | (1,975,221 | ) |

| Net increase in net assets resulting from capital transactions | | | 21,562,042 | | | | 34,351,067 | |

| | | | | | | | | |

| Total Increase in Net Assets | | | 12,730,296 | | | | 42,402,803 | |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 93,325,999 | | | | 50,923,196 | |

| End of year | | $ | 106,056,295 | | | $ | 93,325,999 | |

| | | | | | | | | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 1,291,122 | | | | 1,382,840 | |

| Shares issued in reinvestment of distributions | | | 135,508 | | | | 63,066 | |

| Shares redeemed | | | (442,878 | ) | | | (79,289 | ) |

| Net increase in shares outstanding | | | 983,752 | | | | 1,366,617 | |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD LARGE CAP DIVIDEND FUND – CLASS I |

| FINANCIAL HIGHLIGHTS |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.44 | | | $ | 9.83 | | | $ | 10.63 | | | $ | 9.99 | | | $ | 9.84 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.21 | | | | 0.19 | | | | 0.18 | | | | 0.16 | | | | 0.16 | |

| Net realized and unrealized gain (loss) | | | 0.65 | | | | 2.61 | | | | (0.59 | ) | | | 1.24 | | | | 1.39 | |

| Total from investment operations | | | 0.86 | | | | 2.80 | | | | (0.41 | ) | | | 1.40 | | | | 1.55 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.21 | ) | | | (0.19 | ) | | | (0.18 | ) | | | (0.17 | ) | | | (0.16 | ) |

| Net realized gains | | | (0.65 | ) | | | — | | | | (0.21 | ) | | | (0.59 | ) | | | (1.24 | ) |

| Total distributions | | | (0.86 | ) | | | (0.19 | ) | | | (0.39 | ) | | | (0.76 | ) | | | (1.40 | ) |

| Net asset value, end of year | | $ | 12.44 | | | $ | 12.44 | | | $ | 9.83 | | | $ | 10.63 | | | $ | 9.99 | |

| Total Return(a) | | | 7.32 | % | | | 28.61 | % | | | (3.97 | )% | | | 14.08 | % | | | 15.76 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 50,751 | | | $ | 47,713 | | | $ | 37,585 | | | $ | 33,272 | | | $ | 29,829 | |

| Ratio of net expenses to average net assets | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % | | | 0.98 | % |

| Ratio of expenses to average net assets before waiver or recoupment | | | 0.95 | % | | | 0.98 | % | | | 1.03 | % | | | 1.07 | % | | | 1.19 | % |

| Ratio of net investment income to average net assets | | | 1.84 | % | | | 1.64 | % | | | 1.70 | % | | | 1.57 | % | | | 1.51 | % |

| Portfolio turnover rate | | | 43 | % | | | 7 | % | | | 14 | % | | | 21 | % | | | 13 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD LARGE CAP DIVIDEND FUND – CLASS C |

| FINANCIAL HIGHLIGHTS – (continued) |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 12.33 | | | $ | 9.76 | | | $ | 10.54 | | | $ | 9.91 | | | $ | 9.77 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.10 | | | | 0.07 | | | | 0.08 | | | | 0.06 | | | | 0.06 | |

| Net realized and unrealized gain (loss) | | | 0.64 | | | | 2.57 | | | | (0.59 | ) | | | 1.22 | | | | 1.37 | |

| Total from investment operations | | | 0.74 | | | | 2.64 | | | | (0.51 | ) | | | 1.28 | | | | 1.43 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.09 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.06 | ) | | | (0.05 | ) |

| Net realized gains | | | (0.65 | ) | | | — | | | | (0.21 | ) | | | (0.59 | ) | | | (1.24 | ) |

| Total distributions | | | (0.74 | ) | | | (0.07 | ) | | | (0.27 | ) | | | (0.65 | ) | | | (1.29 | ) |

| Net asset value, end of year | | $ | 12.33 | | | $ | 12.33 | | | $ | 9.76 | | | $ | 10.54 | | | $ | 9.91 | |

| Total Return(a) | | | 6.26 | % | | | 27.16 | % | | | (4.84 | )% | | | 12.95 | % | | | 14.61 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 3,050 | | | $ | 4,168 | | | $ | 4,069 | | | $ | 5,385 | | | $ | 5,503 | |

| Ratio of net expenses to average net assets | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % | | | 1.98 | % |

| Ratio of expenses to average net assets before waiver or recoupment | | | 1.95 | % | | | 1.98 | % | | | 2.03 | % | | | 2.07 | % | | | 2.19 | % |

| Ratio of net investment income to average net assets | | | 0.84 | % | | | 0.64 | % | | | 0.68 | % | | | 0.56 | % | | | 0.51 | % |

| Portfolio turnover rate | | | 43 | % | | | 7 | % | | | 14 | % | | | 21 | % | | | 13 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD SMALL CAP DIVIDEND FUND – CLASS I |

| FINANCIAL HIGHLIGHTS – (continued) |

| (For a share outstanding during each year) |

| | | For the | | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017 | | | 2016 | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | | $ | 41.98 | | | $ | 36.39 | | | $ | 42.42 | | | $ | 39.32 | | | $ | 31.51 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.52 | | | | 0.55 | | | | 0.47 | | | | 0.40 | | | | 0.52 | |

| Net realized and unrealized gain (loss) | | | 0.83 | | | | 7.20 | | | | (3.70 | ) | | | 5.06 | | | | 7.90 | |

| Total from investment operations | | | 1.35 | | | | 7.75 | | | | (3.23 | ) | | | 5.46 | | | | 8.42 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.48 | ) | | | (0.58 | ) | | | (0.45 | ) | | | (0.43 | ) | | | (0.51 | ) |

| Net realized gains | | | (0.37 | ) | | | (1.58 | ) | | | (2.35 | ) | | | (1.93 | ) | | | (0.10 | ) |

| Total distributions | | | (0.85 | ) | | | (2.16 | ) | | | (2.80 | ) | | | (2.36 | ) | | | (0.61 | ) |

| Net asset value, end of year | | $ | 42.48 | | | $ | 41.98 | | | $ | 36.39 | | | $ | 42.42 | | | $ | 39.32 | |

| Total Return(a) | | | 3.50 | % | | | 21.38 | % | | | (7.64 | )% | | | 13.94 | % | | | 26.95 | % |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year (000 omitted) | | $ | 269,227 | | | $ | 249,865 | | | $ | 178,416 | | | $ | 181,709 | | | $ | 141,098 | |

| Ratio of net expenses to average net assets | | | 0.99 | % | | | 1.03 | % | | | 1.05 | % | | | 1.05 | % | | | 1.05 | % |

| Ratio of expenses to average net assets before waiver or recoupment | | | 1.17 | % | | | 1.18 | % | | | 1.20 | % | | | 1.23 | % | | | 1.33 | % |

| Ratio of net investment income to average net assets | | | 1.44 | % | | | 1.36 | % | | | 1.11 | % | | | 1.00 | % | | | 1.61 | % |

| Portfolio turnover rate | | | 32 | % | | | 28 | % | | | 33 | % | | | 36 | % | | | 31 | % |

| (a) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD MULTI-ASSET INCOME FUND |

| FINANCIAL HIGHLIGHTS – (continued) |

| (For a share outstanding during each period) |

| | | For the | | | For the | | | For the | | | For the | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Period Ended | |

| | | December 31, | | | December 31, | | | December 31, | | | December 31, | |

| | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 25.74 | | | $ | 22.54 | | | $ | 24.79 | | | $ | 25.00 | |

| Investment operations: | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.79 | | | | 0.94 | | | | 1.05 | | | | 0.24 | |

| Net realized and unrealized gain (loss) | | | (2.68 | ) | | | 3.56 | | | | (2.20 | ) | | | (0.21 | ) |

| Total from investment operations | | | (1.89 | ) | | | 4.50 | | | | (1.15 | ) | | | 0.03 | |

| Less distributions to shareholders from: | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.82 | ) | | | (1.00 | ) | | | (1.04 | ) | | | (0.23 | ) |

| Net realized gains | | | — | | | | (0.29 | ) | | | (0.06 | ) | | | — | |

| Return of capital | | | (0.02 | ) | | | (0.01 | ) | | | — | | | | (0.01 | ) |

| Total distributions | | | (0.84 | ) | | | (1.30 | ) | | | (1.10 | ) | | | (0.24 | ) |

| Net asset value, end of period | | $ | 23.01 | | | $ | 25.74 | | | $ | 22.54 | | | $ | 24.79 | |

| Total Return(b) | | | (7.00 | )% | | | 20.25 | % | | | (4.86 | )% | | | 0.14 | % (c) |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 106,056 | | | $ | 93,326 | | | $ | 50,923 | | | $ | 30,488 | |

| Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % (d) |

| Ratio of expenses to average net assets before waiver or recoupment | | | 1.26 | % | | | 1.32 | % | | | 1.39 | % | | | 2.46 | % (d) |

| Ratio of net investment income to average net assets | | | 3.67 | % | | | 3.89 | % | | | 4.51 | % | | | 4.54 | % (d) |

| Portfolio turnover rate | | | 33 | % | | | 20 | % | | | 28 | % | | | 5 | % (c) |

| (a) | For the period September 12, 2017(commencement of operations) to December 31, 2017. |

| (b) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| CRAWFORD FUNDS |

| NOTES TO THE FINANCIAL STATEMENTS |

| December 31, 2020 |

| |

NOTE 1. ORGANIZATION

Crawford Large Cap Dividend Fund (the “Large Cap Dividend Fund”, formerly known as Crawford Dividend Growth Fund), Crawford Small Cap Dividend Fund (the “Small Cap Dividend Fund”) and Crawford Multi-Asset Income Fund (the “Multi-Asset Income Fund”) (each a “Fund” and collectively, the “Funds”) are each registered under the Investment Company Act of 1940, as amended (“1940 Act”), as an open-ended diversified series of Unified Series Trust (the “Trust”). The Large Cap Dividend Fund, Small Cap Dividend Fund, and Multi-Asset Income Fund were organized on December 7, 2003, June 21, 2012, and August 7, 2017, respectively. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 17, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. Each Fund is one of a series of funds currently authorized by the Board. The investment adviser to the Funds is Crawford Investment Counsel, Inc. (the “Adviser”). The investment objective of the Large Cap Dividend Fund is to provide total return. Total return is comprised of both capital appreciation and income. The investment objective of the Small Cap Dividend Fund is to provide attractive long-term total return with below market risk as measured by standard deviation in comparison with the Russell 2000® Index. Total return is comprised of both capital appreciation and income. The investment objective of the Multi-Asset Income Fund is to provide current income.

The Large Cap Dividend Fund currently offers two classes of shares: Class C and Class I. Large Cap Dividend Fund Class I shares were first offered to the public on January 5, 2004, and Large Cap Dividend Fund Class C shares were first offered to the public on January 27, 2004. Small Cap Dividend Fund Class I shares were first offered to the public on September 26, 2012, and Small Cap Dividend Fund Class C shares were first offered to the public on April 29, 2015; closed for sale on December 3, 2019, and ceased operation on February 26, 2020. Shares of the Multi-Asset Income Fund were first offered to the public on September 12, 2017. Each class votes separately on matters affecting only that class, or on matters expressly required to be voted on separately by state or federal law. Shares of each class of a series have the same voting and other rights and preferences as the other classes and series of the Trust for matters that affect the Trust as a whole. Each share represents an equal proportionate interest in the assets and liabilities belonging to the Funds and is entitled to such dividends and distributions out of income belonging to the Funds as are declared by the Board.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and follow accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements. These policies are in conformity with the generally accepted accounting principles in the United States of America (“GAAP”).