united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 03/31

Date of reporting period: 03/31/21

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Absolute Core Strategy ETF (ABEQ)

NYSE Arca, Inc.

Annual Report

March 31, 2021

Absolute Investment Advisers LLC

4 North Street, Suite 2

Hingham, MA 02043

Telephone: 1-833-CORE ETF (267-3383)

Absolute Core Strategy ETF

Management’s Discussion of Fund Performance (Unaudited)

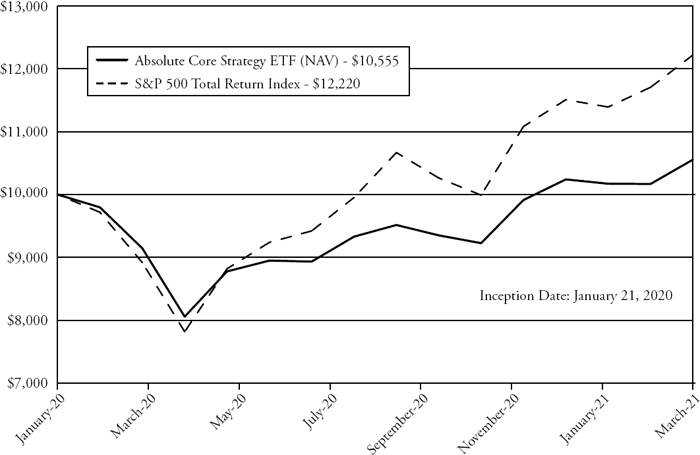

For the year ending March 31, 2021, the Absolute Core Equity ETF (ABEQ) returned 31.02%. By comparison, the S&P 500 Index returned 56.35%. These figures reflect a reflation of financial markets following the pandemic driven market drawdown in Q1 2020.

Dupont De Nemours, Berkshire Hathaway, and Corteva were larger gainers in the Fund during the period. Liberty Global, Kirkland Lake Gold, and Equity Commonwealth were detractors.

Our belief is that there is too much air and fragility underneath the market, a caution nobody wants to hear. We see disconnects everywhere between price and value. The total debt-to-GDP ratio across the entire U.S. economy stands at a record 365%. In just three quarters, the U.S. added as much debt to the country’s balance sheet as in the prior two decades combined - $77.4 trillion ($620,000 per household). At the 2000 technology bubble peak, the liability was $260,000 per household and at the peak of the 2007 housing bubble the ratio was $475,000. Perhaps this massive debt overhang explains the deflationary pressures that persist and why interest rates remain so low? We do not have the answer, but we know that these low rates can support elevated asset prices for a while.

Eventually, the underpinnings of low interest rates will wane when it becomes obvious that corporate profits can disappoint. The day will eventually arrive when profitless companies will no longer outperform those with solid business fundamentals. A credible plan to generate returns on invested capital and build future residual cash flow streams will be necessary, as markets can ignore fundamentals for only so long.

The key is to manage risk by continuously focusing on the quality of one’s investment and the price one pays. Timing market tops and bottoms is impossible, but one can assume that we are closer to a top than a bottom. We believe that valuations are so extreme that their starting point today represents limited future expected returns. As Jim Grant once warned, “The only permanent truth in finance is that people get bullish at the top and bearish at the bottom.” Therefore, if an investor can keep their head when all others are losing theirs, if one can wait and not be tired by waiting, if one can trust oneself when all men doubt them, yours is the Earth and everything that is in it.

Investment Results (Unaudited)

Average Annual Total Returns(a)

(for the periods ended March 31, 2021)

| | | Since Inception |

| | One Year | January 21, 2020 |

| Absolute Core Strategy ETF — NAV | 31.02% | 4.63% |

| Absolute Core Strategy ETF — Market | 30.61% | 4.67% |

| S&P 500 Total Return Index(b) | 56.35% | 18.32% |

| | | |

| | | Expense Ratios(c) |

| Gross | | 1.87% |

| With Applicable Waivers | | 0.88% |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Absolute Core Strategy ETF (the “Fund”) distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (833) 267-3383.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performances would have been lower. |

| (b) | The S&P 500 Total Return Index (“Index”) is a widely recognized unmanaged index of equity securities and is representative of a broader domestic equity market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in the Index; however, an individual can invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios which include acquired fund fees and expenses of 0.03%, are from the Fund’s prospectus dated July 29, 2020, which were estimated amounts for the Fund’s initial fiscal year. Absolute Investment Advisers, LLC (the “Adviser”) contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 0.85% through July 31, 2023. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios (not including acquired fund fees and expenses) as of March 31, 2021 can be found in the financial highlights. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling (833) 267-3383.

The Fund is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC.

Investment Results (Unaudited) (continued)

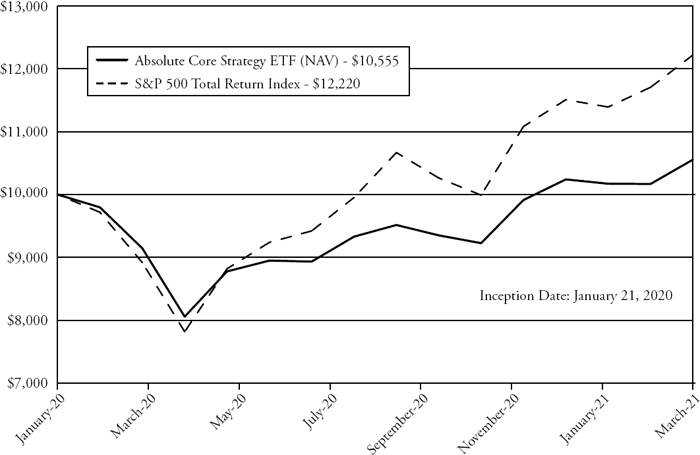

Comparison of the Growth of a $10,000 Investment in the

Absolute Core Strategy ETF and the S&P 500 Total Return Index

The chart above assumes an initial investment of $10,000 made on January 21, 2020 (commencement of operations) and held through March 31, 2021. The S&P 500 Total Return Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) 267-3383. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Northern Lights Distributors, LLC, member FINRA/SIPC.

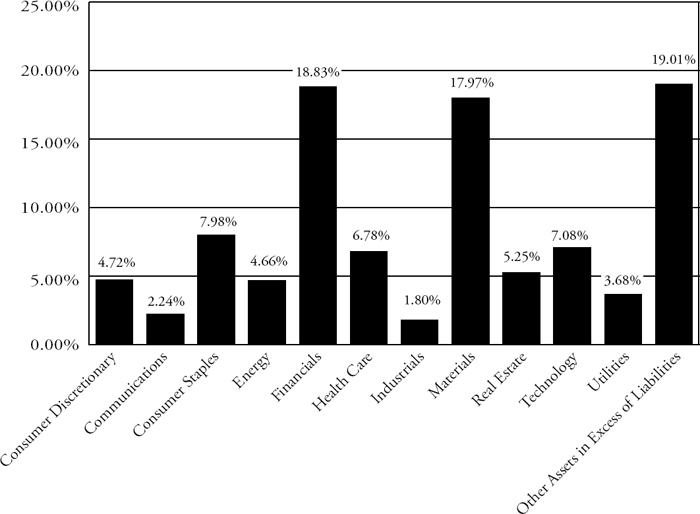

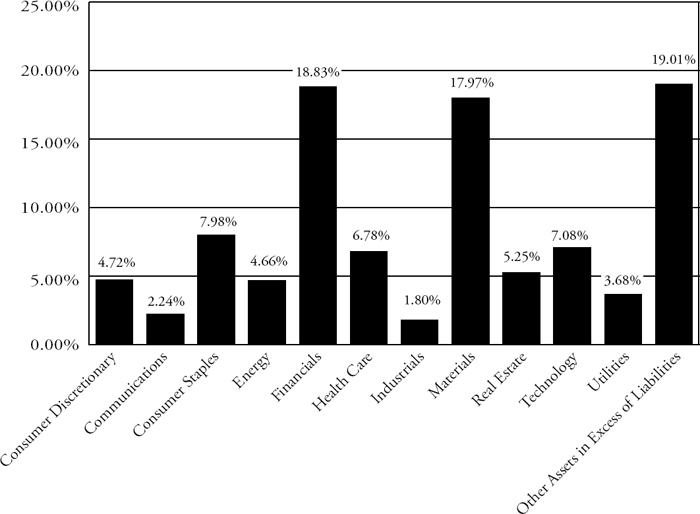

Portfolio Illustration (Unaudited)

March 31, 2021

The following chart gives a visual breakdown of the Fund’s holdings as a percentage of net assets.

Absolute Core Strategy ETF Holdings as of March 31, 2021(a)

| (a) | As a percent of net assets. |

The investment objective of the Absolute Core Strategy ETF (the “Fund”) is positive absolute returns.

Portfolio holdings are subject to change.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

| Absolute Core Strategy ETF |

| Schedule of Investments |

| March 31, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks — 80.99% | | | | | | | | |

| | | | | | | | | |

| Canada — 13.23% | | | | | | | | |

| Energy — 4.66% | | | | | | | | |

| Enbridge, Inc. | | | 58,733 | | | $ | 2,137,881 | |

| | | | | | | | | |

| Materials — 8.57% | | | | | | | | |

| Agnico Eagle Mines Ltd. | | | 23,293 | | | | 1,346,569 | |

| Barrick Gold Corp. | | | 58,398 | | | | 1,156,280 | |

| Kirkland Lake Gold Ltd. | | | 22,449 | | | | 758,776 | |

| Pan American Silver Corp. | | | 22,377 | | | | 671,981 | |

| | | | | | | | 3,933,606 | |

| Total Canada | | | | | | | 6,071,487 | |

| | | | | | | | | |

| Ireland — 2.22% | | | | | | | | |

| Health Care — 2.22% | | | | | | | | |

| Medtronic PLC | | | 8,609 | | | | 1,016,981 | |

| | | | | | | | | |

| Total Ireland | | | | | | | 1,016,981 | |

| | | | | | | | | |

| United Kingdom — 4.59% | | | | | | | | |

| Consumer Staples — 4.59% | | | | | | | | |

| Diageo PLC - ADR | | | 5,148 | | | | 845,353 | |

| Unilever PLC - ADR | | | 22,643 | | | | 1,264,159 | |

| | | | | | | | 2,109,512 | |

| Total United Kingdom | | | | | | | 2,109,512 | |

| | | | | | | | | |

| United States — 60.95% | | | | | | | | |

| Communications — 2.24% | | | | | | | | |

| Comcast Corp., Class A | | | 18,974 | | | | 1,026,683 | |

| | | | | | | | | |

| Consumer Discretionary — 4.72% | | | | | | | | |

| Graham Holdings Co., Class B | | | 1,012 | | | | 569,189 | |

| Starbucks Corp. | | | 8,875 | | | | 969,772 | |

| TJX Cos., Inc. (The) | | | 9,460 | | | | 625,779 | |

| | | | | | | | 2,164,740 | |

| Consumer Staples — 3.39% | | | | | | | | |

| Ingredion, Inc. | | | 17,279 | | | | 1,553,727 | |

| | | | | | | | | |

| Financials — 18.83% | | | | | | | | |

| Alleghany Corp.(a) | | | 1,615 | | | | 1,011,458 | |

| Berkshire Hathaway, Inc., Class B(a) | | | 15,337 | | | | 3,918,143 | |

| Loews Corp. | | | 44,550 | | | | 2,284,524 | |

| Travelers Cos., Inc. (The) | | | 9,500 | | | | 1,428,800 | |

| | | | | | | | 8,642,925 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Schedule of Investments (continued) |

| March 31, 2021 |

| | | Shares | | | Fair Value | |

| Common Stocks — (continued) | | | | | | | | |

| | | | | | | | | |

| United States — (continued) | | | | | | | | |

| Health Care — 4.56% | | | | | | | | |

| Pfizer, Inc. | | | 39,813 | | | $ | 1,442,426 | |

| UnitedHealth Group, Inc. | | | 1,602 | | | | 596,056 | |

| Viatris, Inc.(a) | | | 3,988 | | | | 55,712 | |

| | | | | | | | 2,094,194 | |

| Industrials — 1.80% | | | | | | | | |

| Expeditors International of Washington, Inc. | | | 5,327 | | | | 573,665 | |

| Mueller Water Products, Inc. - Series A | | | 18,010 | | | | 250,159 | |

| | | | | | | | 823,824 | |

| Materials — 9.40% | | | | | | | | |

| Corteva, Inc. | | | 39,704 | | | | 1,851,000 | |

| DuPont de Nemours, Inc. | | | 31,897 | | | | 2,465,001 | |

| | | | | | | | 4,316,001 | |

| Real Estate — 5.25% | | | | | | | | |

| Equity Commonwealth | | | 49,899 | | | | 1,387,192 | |

| Jones Lang LaSalle, Inc. | | | 5,701 | | | | 1,020,707 | |

| | | | | | | | 2,407,899 | |

| Technology — 7.08% | | | | | | | | |

| Cerner Corp. | | | 17,690 | | | | 1,271,557 | |

| Cisco Systems, Inc. | | | 27,798 | | | | 1,437,435 | |

| Guidewire Software, Inc.(a) | | | 5,311 | | | | 539,757 | |

| | | | | | | | 3,248,749 | |

| Utilities — 3.68% | | | | | | | | |

| Dominion Energy, Inc. | | | 22,201 | | | | 1,686,388 | |

| | | | | | | | | |

| Total United States | | | | | | | 27,965,130 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (Cost $32,278,718) | | | | | | | 37,163,110 | |

| | | | | | | | | |

| Total Investments — 80.99% (Cost $32,278,718) | | | | | | | 37,163,110 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 19.01% | | | | | | | 8,723,593 | |

| | | | | | | | | |

| Net Assets — 100.00% | | | | | | $ | 45,886,703 | |

| (a) | Non-income producing security. |

ADR - American Depositary Receipt.

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Statement of Assets and Liabilities |

| March 31, 2021 |

| Assets | | | |

| Investments in securities, at fair value (cost $32,278,718) | | $ | 37,163,110 | |

| Cash | | | 9,115,607 | |

| Receivable for investments sold | | | 1,601,232 | |

| Dividends receivable | | | 26,617 | |

| Tax reclaims receivable | | | 19,941 | |

| Total Assets | | | 47,926,507 | |

| Liabilities | | | | |

| Payable for fund shares redeemed | | | 1,975,689 | |

| Payable to Adviser, net of waiver | | | 11,560 | |

| Payable to Administrator | | | 7,161 | |

| Payable to trustees | | | 207 | |

| Other accrued expenses | | | 45,187 | |

| Total Liabilities | | | 2,039,804 | |

| Net Assets | | $ | 45,886,703 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 41,662,214 | |

| Accumulated earnings | | | 4,224,489 | |

| Net Assets | | $ | 45,886,703 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 1,750,000 | |

| Net asset value per share | | $ | 26.22 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Statement of Operations |

| For the year ended March 31, 2021 |

| Investment Income | | | |

| Dividend income (net of foreign taxes withheld of 26,330) | | $ | 466,654 | |

| Total investment income | | | 466,654 | |

| Expenses | | | | |

| Adviser | | | 277,453 | |

| Administration | | | 52,982 | |

| Chief Compliance Officer | | | 27,952 | |

| Legal | | | 23,109 | |

| Report printing | | | 19,450 | |

| Custodian | | | 19,041 | |

| Audit and tax | | | 18,423 | |

| Trustee | | | 13,541 | |

| Transfer agent | | | 10,489 | |

| Pricing | | | 772 | |

| Miscellaneous | | | 32,125 | |

| Total expenses | | | 495,337 | |

| Fees waived by Adviser | | | (217,326 | ) |

| Net operating expenses | | | 278,011 | |

| Net investment income | | | 188,643 | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain (loss) on: | | | | |

| Investment securities | | | 983,951 | |

| Foreign currency translations | | | 1,177 | |

| Change in unrealized appreciation on: | | | | |

| Investment securities | | | 7,054,329 | |

| Foreign currency translations | | | 386 | |

| Net realized and unrealized gain (loss) on investment securities and foreign currency translations | | | 8,039,843 | |

| Net increase in net assets resulting from operations | | $ | 8,228,486 | |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Statements of Changes in Net Assets |

| | | For the | | | For the | |

| | | Year Ended | | | Period Ended | |

| | | March 31, 2021 | | | March 31, 2020(a) | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 188,643 | | | $ | 27,729 | |

| Net realized gain (loss) on investment securities and foreign currency translations | | | 985,128 | | | | (744,558 | ) |

| Change in unrealized appreciation (depreciation) on investment securities and foreign currency translations | | | 7,054,715 | | | | (2,169,937 | ) |

| Net increase (decrease) in net assets resulting from operations | | | 8,228,486 | | | | (2,886,766 | ) |

| Distributions to Shareholders From: | | | | | | | | |

| Earnings | | | (212,839 | ) | | | — | |

| Total distributions | | | (212,839 | ) | | | — | |

| Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | 21,233,292 | | | | 25,037,624 | |

| Amount paid for shares redeemed | | | (5,513,094 | ) | | | — | |

| Net increase in net assets resulting from capital transactions | | | 15,720,198 | | | | 25,037,624 | |

| Total Increase in Net Assets | | | 23,735,845 | | | | 22,150,858 | |

| Net Assets | | | | | | | | |

| Beginning of period | | $ | 22,150,858 | | | $ | — | |

| End of period | | $ | 45,886,703 | | | $ | 22,150,858 | |

| Share Transactions | | | | | | | | |

| Shares sold | | | 875,000 | | | | 1,100,000 | |

| Shares redeemed | | | (225,000 | ) | | | — | |

| Net increase in shares outstanding | | | 650,000 | | | | 1,100,000 | |

| (a) | For the period January 21, 2020 (commencement of operations) to March 31, 2020. |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Financial Highlights |

| (For a share outstanding during each period) |

| | | For the | | | For the | |

| | | Year Ended | | | Period Ended | |

| | | March 31, 2021 | | | March 31, 2020(a) | |

| Selected Per Share Data: | | | | | | |

| Net asset value, beginning of period | | $ | 20.14 | | | $ | 25.00 | |

| Investment operations: | | | | | | | | |

| Net investment income (loss) | | | 0.13 | | | | 0.03 | |

| Net realized and unrealized gain (loss) on investments | | | 6.10 | | | | (4.89 | ) |

| Total from investment operations | | | 6.23 | | | | (4.86 | ) |

| Less distributions to shareholders from: | | | | | | | | |

| Net investment income | | | (0.15 | ) | | | — | |

| Total distributions | | | (0.15 | ) | | | — | |

| Net asset value, end of period | | $ | 26.22 | | | $ | 20.14 | |

| Market price, end of period | | $ | 26.23 | | | $ | 20.21 | |

| Total Return(b) | | | 31.02 | % | | | (19.44 | )% (c) |

| Ratios and Supplemental Data: | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 45,887 | | | $ | 22,151 | |

| Ratio of net expenses to average net assets | | | 0.85 | % | | | 0.85 | % (d) |

| Ratio of expenses to average net assets before waiver and reimbursement | | | 1.51 | % | | | 3.88 | % (d) |

| Ratio of net investment income to average net assets | | | 0.58 | % | | | 1.40 | % (d) |

| Portfolio turnover rate(e) | | | 36 | % | | | 30 | % (c) |

| (a) | For the period January 21, 2020 (commencement of operations) to March 31, 2020. |

| (b) | Total return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value per share on their respective payment dates. |

| (e) | Portfolio turnover rate excludes securities received or delivered from in-kind processing of creations or redemptions. |

See accompanying notes which are an integral part of these financial statements.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements |

| March 31, 2021 |

NOTE 1. ORGANIZATION

Absolute Core Strategy ETF (the “Fund”) was organized as a non-diversified series of Unified Series Trust (the “Trust”) on August 20, 2019, and is registered under the Investment Company Act of 1940, as amended (“1940 Act”). The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 17, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series. The Fund is one of a series of funds currently authorized by the Board. The Fund’s investment adviser is Absolute Investment Advisers LLC (the “Adviser”). The Adviser has retained St. James Investment Company, LLC (the “Sub-Adviser”) to serve as sub-adviser to the Fund. The investment objective of the Fund is to provide positive absolute returns.

Non-Diversification Risk – The Fund is non-diversified, which means it may invest a greater percentage of its assets in a fewer number of stocks as compared to other mutual funds that are more broadly diversified. As a result, the Fund’s share price may be more volatile than the share price of some other exchange traded funds, and the poor performance of an individual stock in the Fund’s portfolio may have a significant negative impact on the Fund’s performance.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Foreign Currency Translation – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments, and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the realized and unrealized

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

gain or loss from investments. Net realized gain (loss) on foreign currency translations on the Statement of Operations represents currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended March 31, 2021, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis. Distributions received from investments in real estate investment trusts (“REITs”) that represent a return of capital or capital gain are recorded as a reduction of the cost of investment or as a realized gain, respectively. The calendar year-end amounts of ordinary income, capital gains, and return of capital included in distributions received from the Fund’s investments in REITs are reported to the Fund after the end of the calendar year; accordingly, the Fund estimates these amounts for accounting purposes until the characterization of REIT distributions is reported. Estimates

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

are based on the most recent REIT distributions information available. Withholding taxes on foreign dividends and related reclaims have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Dividends and Distributions – The Fund intends to distribute substantially all of its net investment income, if any, at least semi-annually. The Fund intends to distribute its net realized long-term and short-term capital gains, if any, annually. Distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the year from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified in the components of the net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended March 31, 2021, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | Accumulated |

| Paid-In Capital | Earnings (Deficit) |

| $904,392 | $(904,392) |

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (the “NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/ or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

In accordance with the Trust’s valuation policies, the Adviser and/or Sub-Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser and/or Sub-Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser and/or Sub-Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser and/or Sub-Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of March 31, 2021:

| | | Valuation Inputs | | | | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks (a) | | $ | 37,163,110 | | | $ | — | | | $ | — | | | $ | 37,163,110 | |

| Total | | $ | 37,163,110 | | | $ | — | | | $ | — | | | $ | 37,163,110 | |

| (a) | Refer to Schedule of Investments for sector classifications. |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement with the Trust with respect to the Fund (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.85% of the Fund’s average daily net assets. The Adviser has hired the Sub-Adviser to manage the Fund’s assets on a day-to-day basis. The Sub-Adviser is paid by the Adviser. For the fiscal year ended March 31, 2021, before the waiver described below, the Adviser earned a fee of $277,453 from the Fund.

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses so that total annual operating expenses (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the 1940 Act; any administrative and/or shareholder servicing fees payable pursuant to a plan adopted by the Board of Trustees; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

in the ordinary course of the Fund’s business) do not exceed 0.85% of the Fund’s average daily net assets through July 31, 2023. For the fiscal year ended March 31, 2021, the Adviser waived fees of $217,326. At March 31, 2021, the Fund owed the Adviser $11,560.

Each fee waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date in which that particular waiver/ expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. As of March 31, 2021 the Adviser may seek repayment of investment advisory fees waived and expense reimbursements pursuant to the aforementioned conditions, from the Fund no later than the dates stated below:

| Recoverable through | | | | |

| March 31, 2023 | | $ | 59,995 | |

| March 31, 2024 | | | 217,326 | |

Ultimus Fund Solutions, LLC (the “Administrator”) and its affiliate, Northern Lights Compliance Services, LLC (“Northern Lights”) provide the Fund with administration, fund accounting and compliance services, including all regulatory reporting. For the fiscal year ended March 31, 2021, the Administrator earned fees of $52,982 for administration services and $27,952 for compliance services. At March 31, 2021, the Fund owed the Administrator $7,161 for such services.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. Each Independent Trustee of the Trust receives annual compensation of $2,510 per fund from the Trust, except that the Chairman of the Audit Committee, the Chairman of the Governance & Nominating Committee, and the Chairman of the Pricing & Liquidity Committee each receives annual compensation of $2,960 per fund from the Trust, and the Independent Chairman of the Board receives $3,160 per fund from the Trust. Independent Trustees also receive $1,000 for attending each special in-person meeting. Prior to January 1, 2021, these fees were $2,290 for non-chairmen and $2,740 for all chairmen. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

Northern Lights Distributors, LLC (the “Distributor”) acts as the principal distributor of the Fund’s shares. The Distributor acts as the principal distributor of the Fund’s shares. The Administrator is the parent company of the Distributor. One Trustee and certain officers of the Trust are members of management and/or employees of the Distributor or Administrator. Officers are not paid for services to the Trust, however, the Fund pays Northern Lights, which compensates the Assistant Chief Compliance Officer.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

NOTE 5. INVESTMENT TRANSACTIONS

For the fiscal year ended March 31, 2021, purchases and sales of investment securities, other than short-term investments, were $9,019,608 and $11,323,660, respectively.

For the fiscal year ended March 31, 2021, purchases and sales for in-kind transactions were $16,530,586 and $4,161,524, respectively

For the fiscal year ended March 31, 2021, the Fund had in-kind net realized gain of $904,501.

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended March 31, 2021.

NOTE 6. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of March 31, 2021, the Sub-Adviser owned 25.42% of the Fund’s outstanding shares. As a result, the Sub-Adviser may be deemed to control the Fund.

NOTE 7. CAPITAL SHARE TRANSACTIONS

Shares are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units” of 25,000 shares. Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase or redeem Creation Units from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances. In addition, the Fund may impose transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs incurred by the Fund in effecting trades. A fixed fee payable to the Custodian may be imposed on each creation and redemption transaction regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation Units for cash or involving cash-in-lieu are required to pay an additional variable charge to compensate the Fund and its ongoing shareholders for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed Fee, the “Transaction Fees”). Transactions in capital shares for the Fund are

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

disclosed in the Statement of Changes in Net Assets. For the fiscal year ended March 31, 2021, the Fund received $7,000 and $0 in Fixed Fees and Variable Charges, respectively. The Transaction Fees for the Fund are listed in the table below:

| Fixed Fee | Variable Charge |

| $250 | 2.00%* |

* The maximum Transaction Fee may be up to 2.00% of the amount invested.

NOTE 8. FEDERAL TAX INFORMATION

At March 31, 2021, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 5,431,715 | |

| Gross unrealized depreciation | | | (547,323 | ) |

| Net unrealized appreciation on investments | | $ | 4,884,392 | |

| Tax cost of investments | | $ | 32,278,718 | |

The tax character of distributions paid for the fiscal years ended March 31, 2021 was as follows:

| Distributions paid from: | | | | |

| Ordinary income(a) | | $ | 212,839 | |

| Total distributions paid | | $ | 212,839 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At March 31, 2021, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 4,679 | |

| Accumulated capital and other losses | | | (664,968 | ) |

| Unrealized appreciation on investments | | | 4,884,778 | |

| Total accumulated earnings | | $ | 4,224,489 | |

As of March 31, 2021, the Fund had short-term capital loss carryforwards available to offset future gains, not subject to expiration, in the amount of $664,968.

Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Fund’s March 31, 2021 year-end tax returns.

| Absolute Core Strategy ETF |

| Notes to the Financial Statements (continued) |

| March 31, 2021 |

NOTE 9. CORONAVIRUS (COVID-19) PANDEMIC

The COVID-19 pandemic has caused financial markets to experience periods of increased volatility due to uncertainty that exists around its long-term effects. COVID-19 has resulted in varying levels of travel restrictions, quarantines, disruptions to supply chains and customer activity, leading to general concern and economic uncertainty. The full impact and duration of the pandemic cannot necessarily be foreseen. Management continues to monitor developments and navigate accordingly, further evaluating the anticipated impact to financial markets.

NOTE 10. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 11. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Absolute Core Strategy ETF and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Absolute Core Strategy ETF (the “Fund”), a series of Unified Series Trust, as of March 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets and the financial highlights for each of the two periods in the period then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of March 31, 2021, the results of its operations for the year then ended, the changes in net assets and the financial highlights for each of the two periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of March 31, 2021, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2020.

COHEN & COMPANY, LTD.

Chicago, Illinois

May 27, 2021

Liquidity Risk Management Program (Unaudited)

The Fund has adopted and implemented a written liquidity risk management program (the “Program”) as required by Rule 22e-4 (the “Liquidity Rule”) under the 1940 Act. The Program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration, among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources. The Board approved the appointment of the Liquidity Administrator Committee, comprising certain Trust officers and employees of the Adviser. The Liquidity Administrator Committee maintains Program oversight and reports to the Board on at least an annual basis regarding the Program’s operational effectiveness through a written report (the “Report”). The Program’s initial Report, which was presented to the Board for consideration at its meeting held on November 17, 2020, outlined the operation of the Program and the adequacy and effectiveness of the Program’s implementation. During the review period, the Fund did not experience unusual stress or disruption to its operations related to purchase and redemption activity. Also, during the review period the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption activities in accordance with applicable requirements. The Report concluded that the Program is reasonably designed to prevent violation of the Liquidity Rule and has been effectively implemented.

Summary of Fund Expenses (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from October 1, 2020 through March 31, 2021. Investors may pay brokerage commissions on their purchases and sales of exchange traded fund shares, which are not reflected in the example.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | Beginning | | Ending | | | | |

| | Account Value | | Account Value | | Expenses Paid | | Annualized |

| | October 1, | | March 31, | | During | | Expense |

| | 2020 | | 2021 | | Period(a) | | Ratio |

| ABSOLUTE CORE STRATEGY ETF | | | | | | | |

| | Actual | $ 1,000.00 | | $ 1,128.80 | | $ 4.51 | | 0.85% |

| | Hypothetical(b) | $ 1,000.00 | | $ 1,020.69 | | $ 4.28 | | 0.85% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 182/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

Additional Federal Income Tax Information (Unaudited)

The Form 1099-DIV you receive in January 2022 will show the tax status of all distributions paid to your account in calendar year 2021. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 100% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Qualified Business Income. The Fund designates approximately 100% of its ordinary income dividends, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified business income.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s calendar year 2021 ordinary income dividends, 0% qualifies for the corporate dividends received deduction.

Trustees and Officers (Unaudited)

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

| Name, Address*, (Year of Birth), Position with Trust**, Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

Kenneth G.Y. Grant (1949)

Chairman, January 2017 to present; Independent Trustee, May 2008 to present | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 - present), a Donor Advised Fund. |

| | |

| | Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Daniel J. Condon (1950)

Chairman of the Audit Committee; Chairman of the Governance & Nominating Committee; Independent Trustee, December 2002 to present | Current: Retired (2017 - present)

Previous: Executive Advisor of Standard Steel LLC, a Railway manufacturing supply company (2016); Chief Executive Officer of Standard Steel LLC (2011 - 2015); Director of Standard Steel Holdings Co., which owns Standard Steel LLC (2011 - 2016); Director of International Crankshaft Inc. (2004 - 2016). |

Gary E. Hippenstiel (1947)

Chairman of the Pricing & Liquidity Committee; Independent Trustee, December 2002 to present | Current: President and founder of Hippenstiel Investment Counsel LLC (“Hippenstiel”) since 2008. Hippenstiel was registered as an investment adviser from 2008 to December 31, 2019. |

Stephen A. Little (1946)

Independent Trustee, December 2002 to present; Chairman, December 2004 to December 2016 | Current: President and founder of The Rose, Inc., a registered investment adviser, since 1993. |

Ronald C. Tritschler (1952)

Independent Trustee, January 2007 to present; Interested Trustee, December 2002 to December 2006 | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, since 2001; Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 25 series. |

Trustees and Officers (Unaudited) (continued)

The following table provides information regarding the Interested Trustee and the Officers of the Trust.

Name, Address*, (Year of Birth),

Position with Trust,

Term of Position with Trust | Principal Occupation During

Past 5 Years and Other Directorships |

David R. Carson (1958)

President, January 2016 to present; Interested Trustee, August 2020 to present | Current: Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC, since 2013. |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer, November 2014 to present | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, since 2015. |

Martin R. Dean (1963)

Vice President, November 2020 to present; Chief Compliance Officer, April 2021 to present; Assistant Chief Compliance Officer, January 2016 to April 2021 | Current: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC, since 2016. |

Elisabeth Dahl (1962)

Secretary, May 2017 to present; Assistant Secretary, March 2016 to May 2017 | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Stephen Preston (1966)

AML Compliance Officer, May 2017 to present | Current: Vice President and Chief Compliance Officer, Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, since 2011. |

Lynn E. Wood (1946)

Assistant Chief Compliance Officer, April 2021 to present; Chief Compliance Officer, October 2004 to April 2021 | Current: Managing Member, Buttonwood Compliance Partners, LLC, since 2013. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

Other Information

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the Trustees and is available without charge, upon request. You may call toll-free at (833) 267-3383 to request a copy of the SAI or to make shareholder inquiries.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (833) 267-3383 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

| TRUSTEES |

| Kenneth G.Y. Grant, Chairman |

| David R. Carson |

| Daniel J. Condon |

| Gary E. Hippenstiel |

| Stephen A. Little |

| Ronald C. Tritschler |

| |

| OFFICERS |

| David R. Carson, President |

| Martin R. Dean, |

| Vice President / Chief Compliance Officer |

| Zachary P. Richmond, |

| Treasurer and Chief Financial Officer |

| Lynn E. Wood, Assistant Chief Compliance Officer |

| |

| INVESTMENT ADVISER |

| Absolute Investment Advisers LLC |

| 4 North Street, Suite 2 |

| Hingham, MA 02043 |

| |

| DISTRIBUTOR |

| Northern Lights Distributors, LLC |

| 17605 Wright Street |

| Omaha, Nebraska 68130 |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| Cohen & Company, Ltd. |

| 151 N Franklin Street, Suite 575 |

| Chicago, IL 60606 |

| |

| LEGAL COUNSEL |

| Thompson Hine LLP |

| 312 Walnut Street, 20th Floor |

| Cincinnati, OH 45202 |

| |

| CUSTODIAN |

| Brown Brothers Harriman & Co. |

| 50 Post Office Square |

| Boston, MA 02110 |

| |

| ADMINISTRATOR |

| Ultimus Fund Solutions, LLC |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Northern Lights Distributors, LLC

Member FINRA/SIPC

Absolute Core-AR-21

Dean Small Cap Value Fund

Dean Mid Cap Value Fund

Annual Report

March 31, 2021

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

Management’s Discussion & Analysis

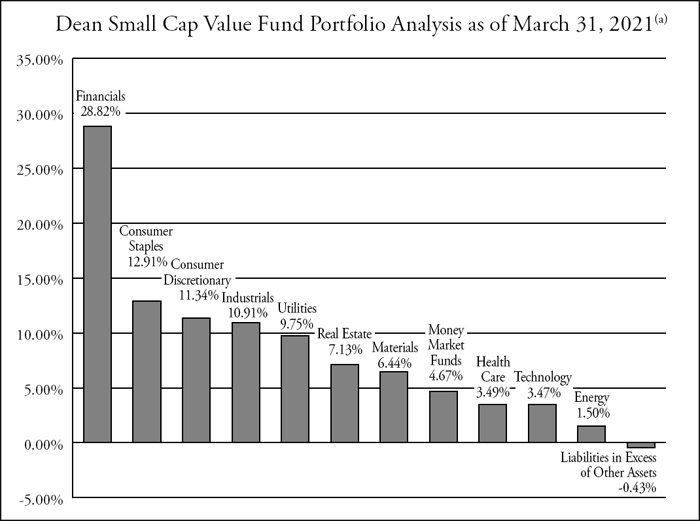

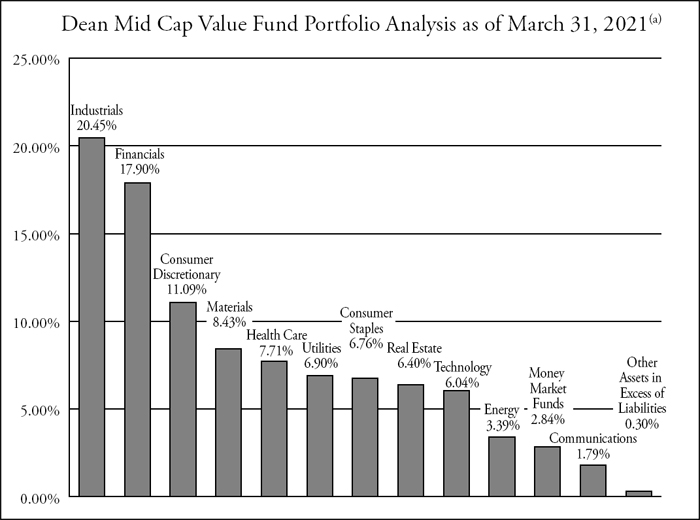

The Dean Small Cap Value Fund returned +86.33% net of fees for the twelve months ended March 31st, 2021, compared with a +97.05% return for the benchmark Russell 2000 Value Index and a +94.85% return for the broader Russell 2000 Index.

Macro Factors Impacting Performance

Macro factors were mixed this past fiscal year. The portfolio consistently held stocks with lower valuations than the benchmark throughout the year and greatly benefited from this positioning in the final quarter of the fiscal year. However, the portfolio also has a high-quality bias through which it holds stocks with lower volatility and higher profitability. Both of these factors worked against the portfolio throughout the year as low-quality stocks had a strong rally due to unprecedented monetary and fiscal stimulus in response to COVID-19.

Sector Performance (best/worst relative to benchmark)

The best performing sector relative to the benchmark for the twelve-month period was Industrials. The outperformance was a result of being overweight the outperforming sector, as well as having better-than-benchmark stock selection. The Industrials sector benefited from the “risk-on” reopening trade in the market. The portfolio particularly benefited from its heavy weighting in Capital Goods stocks as the market embraced increased probabilities for infrastructure spending and fiscal support.

The second best performing sector relative to the benchmark was Utilities. The outperformance stemmed from our dynamic sector allocation as well as having better-than-benchmark stock selection. Utilities outperformed in the COVID-19 market selloff causing them to appear expensive in our normalized earnings power framework. Thus, we exited all Utility positions to have no weight in the sector. As interest rates climbed throughout the year, Utility stocks underperformed, and we were able to initiate well timed additions to the sector during this underperformance. We were consistently adding to the portfolio’s Utility weight throughout the last half of the fiscal year as normalized valuations became more attractive. As of March 31st, 2021 Utilities are the portfolio’s second largest overweight sector as we believe the future risk-adjusted returns look promising.

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

The worst performing sector relative to the benchmark for the last twelve months was Consumer Discretionary. The underperformance was the result of below index stock selection as well as being underweight the best performing sector for the period during its steepest climb in the last two quarters. Drilling down even further, most of the sector underperformance came from being underweight the Retailing industry. Retail stocks benefited from the year’s “risk-on” mood, which resulted in Retail having the best performance of all the industries. Using our high-quality investing framework, in which we emphasize strong balance sheets, predictable earnings, and market leading positions, we feel like many of the Retail stocks that had strong performance this year appear to have a very wide range of outcomes, meaning the large gains from this year can just as easily turn into large losses at any given time in the future. We continue to see great uncertainty surrounding post-pandemic normalized earnings power levels in the Retailing industry, even in a “fully” opened economy.

The second worst performing sector relative to the benchmark was Consumer Staples. The underperformance was due to below index stock selection. Two stocks accounted for the underperformance, one was a name the portfolio did not hold, and one was a portfolio holding; Andersons (ANDE), which we discuss in more detail in the Individual Securities section. The largest consumer staples stock in the benchmark is Darling Ingredients (DAR), a former portfolio holding that we sold last fiscal year as it became too large and, in our opinion, too high of a valuation to continue holding in the portfolio. DAR is a rendering company that also has a joint venture in a biofuel refinery. DAR was swept up in the rush to invest in renewable energy companies and became, at one point, the largest holding in the benchmark. The combination of DAR’s large benchmark weight and strong performance led to over half of the portfolio’s underperformance in the Consumer Staples sector.

Individual Securities Performance (best/worst absolute contributors)

The largest contributing company in the fiscal year was Cooper Tire & Rubber (CTB). CTB manufactures replacement tires. Its brands include Coopertires, Roadmaster, and Mastercraft, amongst others. CTB benefited from hopes of an economic recovery as it began reopening its manufacturing facilities. CTB could also benefit, going forward, from its positioning as a less cyclical replacement manufacturer versus selling to OEM’s as consumers look to extend the life of their existing vehicles. These attributes attracted a cash and stock acquisition offer from Goodyear Tire (GT) that valued CTB at $54.26/share, which represented a 24% premium to CTB’s stock price prior to the announcement. The portfolio maintains a position in CTB as we wait for the acquisition to close.

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

The second largest contributing stock was Wesco International (WCC). WCC operates distribution centers that distribute electrical products and other industrial maintenance, repair, and operating supplies, while also providing integrated supply services. WCC closed on its acquisition of Anixter (AXE) midway through the period. The AXE acquisition will make WCC the largest domestic industrial distributor in a highly fragmented market. While there is execution risk, and WCC did leverage the balance sheet, the AXE acquisition has the potential to provide a very attractive return if management’s significant synergy targets are met. WCC’s stock price reacted favorably to the combination of the merger plus the reopening of the economy. Taking advantage of the price strength, we exited the position in WCC after a nice gain.

The largest detracting stock in the period was MTS Systems (MTSC). MTSC is a leading supplier of test, simulation, and measurement systems. The test and simulations segment produces high performance test systems and motion simulators for research, product design, and manufacturing applications. The sensors segment produces precise measurement devices that improve product performance, optimize machine operation, and provide safer environments. MTSC has global exposure with roughly 1/3 of its business in the Americas, Europe, and Asia, respectively, all places impacted by the COVID-19 lockdowns. It also has end market exposure to air traffic, autos, and amusement parks, which, once again, were all areas impacted by the pandemic; thus its stock price suffered during the market selloff related to COVID-19. We felt that MTSC was well positioned in niche businesses where it had a competitive advantage given its reputation and long-standing customer relationships. However, we became increasingly concerned about the less than pristine balance sheet, and the final straw was when the CEO exited to pursue another opportunity as the stock was cratering; thus, we exited the position in MTSC on the news while harvesting a tax loss.

The second largest detracting stock was Andersons (ANDE). ANDE merchandises grain, operates grain elevator facilities, repairs/sells/leases railcars, distributes wholesale agricultural fertilizer, and distributes agricultural inputs to dealers and farmers. Historically, ANDE’s diverse set of agricultural related businesses had produced reasonably steady fundamental growth as the businesses would offset each other with some prospering while others would struggle and vice versa. However, with commodity prices declining before COVID-19 and then collapsing when COVID-19 first hit, nearly all of ANDE’s businesses were in the down part of the cycle. We believe that ANDE has solid assets; however, we decided to move on to better risk/rewards coming out of the COVID-19 downturn; thus we exited the position and harvested a tax loss.

DEAN SMALL CAP VALUE FUND

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

Current Positioning and Opportunities

The portfolio’s largest overweight sectors relative to the benchmark are currently in the Consumer Staples and Utilities sectors. The largest underweight sectors relative to the benchmark are currently in the Industrials and Consumer Discretionary sectors. Throughout the year, the Financials and Utilities sectors increased the most in weight, while the Industrials and Information Technology sectors decreased the most in weight. As always, these relative weights are a residual of our bottom-up opportunities and not based on a top-down macro call on the market or economy.

The COVID-19 pandemic, and the global response to it, is an unprecedented event that has created enormous economic disruption and uncertainty. At this time, it appears the U.S. is on a good vaccine trajectory and coupled with the monetary and fiscal stimulus, seems to have weathered the worst of the storm, so far. However, it is difficult to know whether the COVID-19 virus mutates or reemerges in a different form and the extent of the economic damage that might cause. We are monitoring the situation closely, as we do all economic shocks, whether that be in the form of a pandemic or a normal economic cycle. We would expect further volatility ahead as the world works its way through this pandemic, vaccine rollout, and possible variants of the virus. However, we have dealt with elevated bouts of market volatility on many occasions since Dean Capital Management began sub-advising the funds in 2008. The pandemic might have been an unprecedented catalyst, but the volatility it caused was within the range of what we would consider historically normal for small cap and mid cap stocks. We stay focused on the normalized earnings power, the valuations, and the quality of the companies the portfolio holds, and this has served us well in the long run through times of elevated market volatility.

We remain focused on the fundamentals of the companies we own, and the price we are paying for those fundamentals. We are confident that a steadfast application of our proven and disciplined process should produce favorable results over time.

Thank you for your continued confidence in Dean.

DEAN SMALL CAP VALUE FUND

Performance Summary (Unaudited)

| Average Annual Total Returns* |

| (for the periods ended March 31, 2021) |

| |

| | | 1 Year | | 5 Year | | 10 year | |

| Dean Small Cap Value Fund | | 86.33% | | 9.68% | | 9.19% | |

| Russell 2000 Value Index** | | 97.05% | | 13.56% | | 10.06% | |

| Russell 2000 Index** | | 94.85% | | 16.35% | | 11.68% | |

| Total annual operating expenses, which include acquired fund fees and expenses of 0.01%, as disclosed in the Dean Small Cap Value Fund (the “Fund”) prospectus dated July 29, 2020, were 1.16% of the Fund’s average daily net assets. Additional information pertaining to the expense ratios as of March 31, 2021 can be found in the financial highlights. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (888) 899-8343.

| * | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| ** | The Russell 2000 and Russell 2000 Value Indices are unmanaged indices that assume reinvestment of all distributions and exclude the effect of taxes and fees. The indices are widely recognized unmanaged indices of equity prices and are representative of a broader market and range of securities than are found in the Fund’s portfolio. An individual cannot invest directly in an index or, the indices. However, an individual may be able to invest in exchange traded funds or other investment vehicles that attempt to track the performance of an index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month end by calling (888) 899-8343.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

DEAN SMALL CAP VALUE FUND

Performance Summary (Unaudited) – (continued)

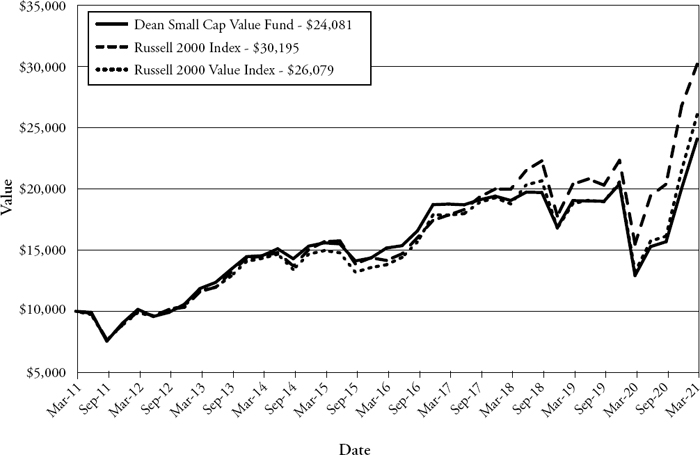

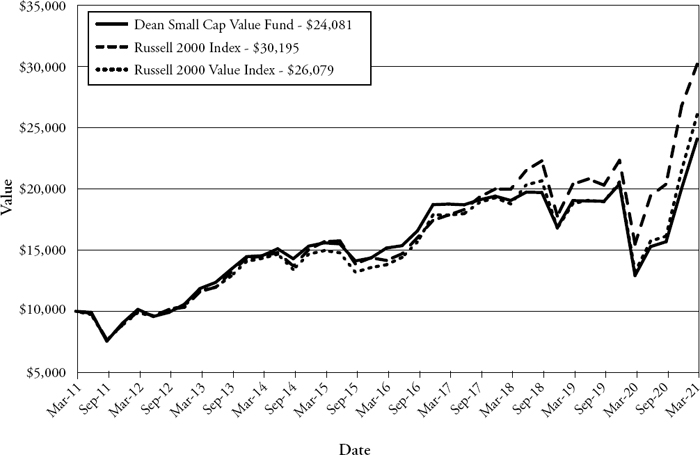

Comparison of the Change in Value of a $10,000 Investment in the Dean Small Cap Value

Fund, the Russell 2000 Index and the Russell 2000 Value Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 in the Fund, the Russell 2000 Index and the Russell 2000 Value Index on March 31, 2011 and held through March 31, 2021.