united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 06/30

Date of reporting period: 06/30/21

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

ANNUAL REPORT

Silk Invest New Horizons

Frontier Fund

June 30, 2021

Fund Adviser:

Silk Invest Limited

68 Lombard Street

London, EC3V 9LJ

United Kingdom

(800) 797-9745

invest@silkinvest.com

MANAGEMENT DISCUSSION OF FUND PERFORMANCE – (Unaudited)

Dear Shareholders:

The investment objective of the Silk Invest New Horizons Frontier Fund (the “Fund”) is capital appreciation. The objective is measured against the MSCI Frontier Markets Index (Net).

Performance Review

The Fund returned 48.61% net of fees, for the year ended June 30th 2021, compared to the 38.50% of its main benchmark the MSCI Frontier Markets Index (Net). As a further reference, the Fund also outperformed the MSCI Emerging Markets Index which returned 40.90% for the same period. The Fund’s significant outperformance was mainly attributable to stock selection effects which were especially strong in selected stocks in Vietnam and Morocco. The Fund also benefited from positive country allocation decisions but was affected by negative currency depreciation effects in Nigeria and Kenya.

This reporting period was one of the strongest performance periods that the Fund has experienced. The global market environment has been helpful due a combination of recovering world economy, accommodating central bank policies and positive investor sentiment. We believe that the world has slowly but surely learned to manage the COVID-19 pandemic and the results of the global vaccination programs have been relatively positive. Frontier Markets have been able to handle well the global pandemic from a health point of view. According to data compiled by “Our World In Data” Frontier Markets (as defined by Silk Invest) had only around 6k COVID cases by 1 million in comparison with 65k in Europe, 67k in North America and 76k in South America. Frontier Markets performed closer in line with Asia where cases per 1 million capita were 12k and Africa where cases per 1 million capita were 4k. We believe that most Frontier Markets experienced significantly lower COVID-19 cases and deaths due a combination of stricter early action and younger demographics. Most countries have however been impacted economically with more pressure on government budgets and rising poverty levels.

One of the most striking highlights of the last 12 months was the strength of corporate earnings and companies have across the world been able to recover from the pandemic and earnings have in many cases risen above pre-COVID-19 levels. Key explanations for this phenomenon include technology, increasing productivity levels and globally accommodating fiscal and economic policies. Earnings in our investment universe were similarly strong with some exceptions like the real estate sector which in most countries didn’t show the resilience that we have seen in Developed markets.

Most currencies across Emerging and Frontier markets continued to show a high degree of resilience in comparison with other crises (e.g. the 2016 oil slump or the 2013 taper tantrum) and were helped by better prepared central banks and global co-ordination among policy makers. Interest rates in most of the Fund’s core markets continued to hover at historically low levels with Egypt continuing to decrease its interest rates due its high level of real interest rates (i.e. nominal interest rates vs. inflation) in comparison with other markets.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE – (Unaudited) (continued)

Vaccination programs have unfortunately been unequally spread across the world with Developed Markets moving closer to optimal vaccination levels but with Developing Markets lagging behind. Most Emerging and Frontier markets struggled to secure sufficient vaccine supplies and have not been able so far to vaccinate a significant part of their population. Countries like Morocco in Africa and UAE in the Middle East have on the other hand run successful vaccination programs. The low vaccination levels are delaying the further easing of pandemic related restrictions and has left different countries exposed to new waves of cases. This is impacting local economies and companies and is furthermore slowing down the recovery in the global economy. On the plus side, the demographic structure of many Developing Markets and the Fund’s target countries is helping although new mutations like the Delta variant had a big impact on India and Tunisia.

Fund Outlook and Strategy

The threat of further mutations in the COVID-19 virus is still significant and this may impact Frontier Markets that have so far not experienced big waves of cases and deaths. That said, we believe that the world will continue to recover and move beyond this pandemic. Most countries in Developed markets have made impressive progress in their vaccination programs and we believe that most Emerging and Frontier markets will follow the lead of the Developed markets.

The overall outlook for Frontier markets equities continues to be positive. On the macro side, we believe that the global economic recovery will be a further catalyst for these markets and will increase the demand of the products and services in Frontier markets. The world is starting to realize that fertility rates have started to decrease globally and that Frontier markets have some of the most attractive demographic profiles in the world. These countries are attractive from a local consumer point of view and are potential sources of labour talent going forward. Remittances have steadily increased over the years and are today across Frontier markets around 2x the level of Foreign Direct Investments. This is helping Frontier markets to secure more “captive” capital sources and is supporting the incomes of many layers of local consumers. Inflation is another theme that will potentially be a net positive for Frontier markets. We believe that the increasingly tight product supplies will increase the demand for labour from Frontier markets and will increase the demand for commodities that are been produced in some of these markets.

Frontier Markets continue to trade at significant valuation discounts in comparison with the rest of the world. As reference, the MSCI Frontier Markets is trading at a PE ratio of 18.2x while the MSCI World is trading at a PE ratio of 27.4x. Investor allocation to Emerging and Frontier markets remains at historically low levels with data from JP Morgan showing that Emerging market Funds AUM are only at 7% of global AUM in comparison with the historical highs of 14%. We believe that Emerging markets and Frontier markets that today account for close to 50% of global GDP will eventually gain more allocations from international investors. This sets the tone for continued positive momentum for Frontier markets and more broadly Emerging Markets.

The Fund

For the year ended June 30, 2021, the three investments with the largest contribution to the Fund’s absolute return were Vietnam’s financial services company Saigon Securities (+303.3% in local currency), Nigeria’s cement company Lafarge Nigeria (+123.1%) and Vietnam Prosperity Bank (+163.9%). Bangladesh based telecom company Grameenphone and Pakistan based IT business Systems were other names in the top 5 positive contributors.

MANAGEMENT DISCUSSION OF FUND PERFORMANCE – (Unaudited) (continued)

Conversely, the three investments that detracted the most were pharmaceutical distribution company Ibnsina Pharma in Egypt which declined -31.1% in local currency, Kenya’s diversified holding Centum Investment which lost -27.7% and Egyptian medical Tenth of Ramadan which was down -34.2% over the reporting period.

Most countries in which the Fund had invested, contributed positively to the Fund’s returns in both absolute and relative terms. The biggest relative positive contributors were Nigeria, Vietnam, Pakistan, United Arab Emirates and Bangladesh. Bahrain, Kuwait and Romania were on the other hand negative relative contributors. The Fund doesn’t have any exposure to these markets and continues to favour other markets.

We believe that the Fund is well positioned to benefit from a further recovery in the global economy and potentially higher allocation of international investors to Frontier Markets and smaller Emerging Markets. The Fund has a unique proposition within the Frontier markets universe and offers exposure to companies with attractive valuations in their respective sectors and countries. The Forward Price to Earnings (P/E) of the Fund stands at 8.9x versus the MSCI FM Index’s P/E of 18.2x, the MSCI EM Index of 18.7x and the MSCI World Index’s of 27.4x.

Silk Invest Ltd.

INVESTMENT RESULTS – (Unaudited)

| Average Annual Total Returns(a) | |

| (for the periods ended June 30, 2021) | |

| | |

| | One | | Three | | Five | | Since Inception | |

| | Year | | Year | | Year | | (05/25/16) | |

| Silk Invest New Horizons Frontier Fund - Institutional Class | 48.61% | | 1.66% | | 3.37% | | 2.71% | |

| MSCI Frontier Markets Index (b) | 38.50% | | 8.86% | | 9.36% | | 8.34% | |

| | | | | | | | | |

Total annual operating expenses, as disclosed in the Silk Invest New Horizons Frontier Fund (the “Fund”) prospectus dated October 28, 2020, were 2.75% of average daily net assets, including acquired fund fees and expenses that rounded to less than 0.005% (1.76% after fee waivers, including line of credit and interest expenses of 0.02%). Silk Invest Limited (the “Adviser”) contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 1.74% of the Fund’s average daily net assets for Institutional Class shares through October 31, 2021. This expense cap may not be terminated prior to this date except by the Board of Trustees. Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios as of June 30, 2021 can be found in the financial highlights. | |

| | | | | | | | | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 797-9745.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The MSCI Frontier Markets Index (the “Index”) captures large- and mid-cap representation across 27 Frontier Markets (FM) countries: Bahrain, Bangladesh, Burkina Faso, Benin, Croatia, Estonia, Guinea-Bissau, Ivory Coast, Jordan, Kenya, Lithuania, Kazakhstan, Mauritius, Mali, Morocco, Niger, Nigeria, Oman, Romania, Serbia, Senegal, Slovenia, Sri Lanka, Togo, Tunisia and Vietnam. The index includes 81 constituents, covering about 85% of the free float-adjusted market capitalization in each country. The index includes the re-investment of dividends and is not reduced for any assumed trading costs or management fees or other assumed occurred expenses. Individuals cannot invest directly in an index; however, an individual may invest in exchange-traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling (800) 797-9745.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

INVESTMENT RESULTS – (Unaudited) (continued)

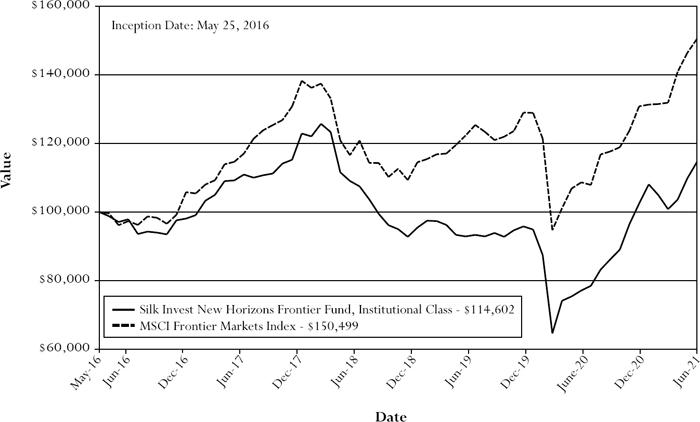

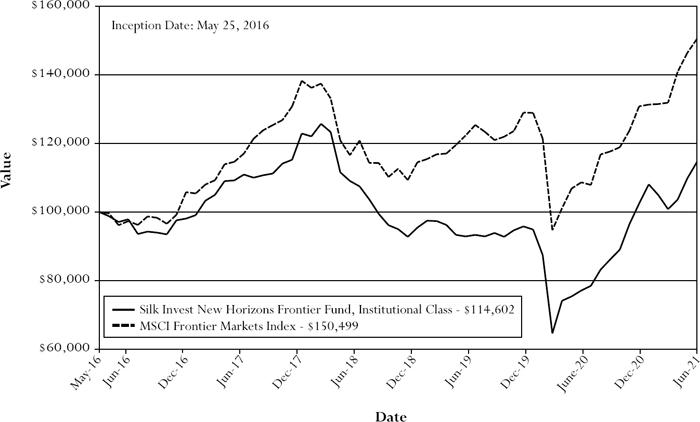

Comparison of the Change in the Value of a $100,000 Investment in the Silk Invest New Horizons

Frontier Fund, Institutional Class and the MSCI Frontier Markets Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $100,000 made on May 25, 2016 (commencement of operations) for the Fund’s Institutional Class and held through June 30, 2021. The MSCI Frontier Markets Index is a widely recognized unmanaged index of equity prices and is representative of a broader market and range of securities than is found in the Fund’s portfolio. Individuals cannot invest directly in an index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 797-9745. You should carefully consider the investment objectives, risks, charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

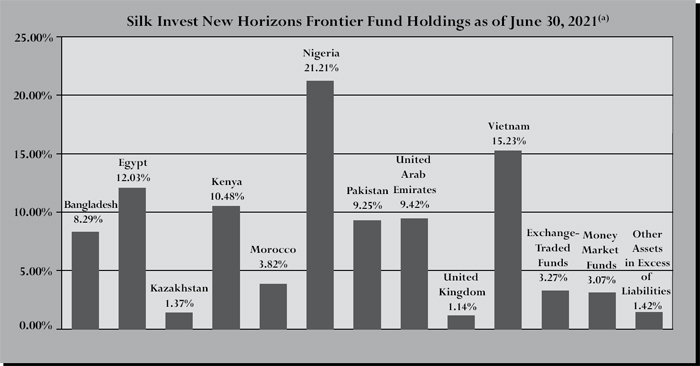

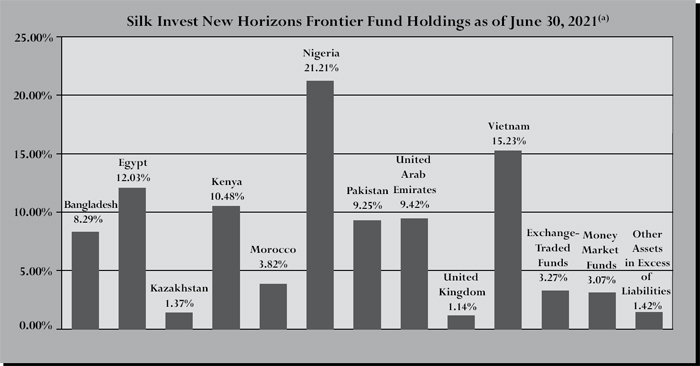

FUND HOLDINGS – (Unaudited)

| (a) | As a percentage of total net assets. |

The investment objective of the Fund is capital appreciation.

AVAILABILITY OF PORTFOLIO SCHEDULE – (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

| Silk Invest New Horizons Frontier Fund |

| SCHEDULE OF INVESTMENTS |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| COMMON STOCKS — 92.24% | | | | | | | | |

| | | | | | | | | |

| Bangladesh — 8.29% | | | | | | | | |

| BRAC Bank Ltd. | | | 1,560,931 | | | $ | 910,365 | |

| GrameenPhone Ltd. | | | 216,500 | | | | 891,745 | |

| | | | | | | | 1,802,110 | |

| Egypt — 12.03% | | | | | | | | |

| Edita Food Industries S.A.E. | | | 352,000 | | | | 182,506 | |

| EFG-Hermes Holding Co.(a) | | | 562,625 | | | | 475,601 | |

| Ibnsina Pharma S.A.E.(a) | | | 2,100,000 | | | | 498,207 | |

| Integrated Diagnostics Holdings PLC | | | 450,000 | | | | 535,482 | |

| Taaleem Management Services Co., S.A.E.(a) | | | 650,000 | | | | 225,690 | |

| Telecom Egypt Co. | | | 511,540 | | | | 438,308 | |

| Tenth of Ramadan Pharmaceuticals and Diagnostics Reagents Co.(a) | | | 1,490,000 | | | | 259,156 | |

| | | | | | | | 2,614,950 | |

| Kazakhstan — 1.37% | | | | | | | | |

| Kapsi.kz JSC | | | 2,800 | | | | 296,791 | |

| | | | | | | | | |

| Kenya — 10.48% | | | | | | | | |

| Centum Investment Co. Ltd.(b) | | | 2,590,670 | | | | 417,764 | |

| Equity Group Holdings Ltd.(a) | | | 1,050,000 | | | | 435,283 | |

| KCB Group Ltd. | | | 1,085,000 | | | | 428,706 | |

| Safaricom Ltd. | | | 2,595,000 | | | | 996,341 | |

| | | | | | | | 2,278,094 | |

| Morocco — 3.82% | | | | | | | | |

| Douja Promotion Groupe Addoha SA(a) | | | 439,000 | | | | 514,399 | |

| Mutandis SCA | | | 2,122 | | | | 61,729 | |

| Residences Dar Saada(a) | | | 62,000 | | | | 253,869 | |

| | | | | | | | 829,997 | |

| Nigeria — 21.21% | | | | | | | | |

| Access Bank PLC | | | 45,550,000 | | | | 938,617 | |

| Guaranty Trust Holding Co., PLC | | | 9,527,752 | | | | 693,982 | |

| Lafarge Africa PLC | | | 16,730,000 | | | | 865,189 | |

| MTN Nigeria Communications PLC | | | 3,150,000 | | | | 1,259,000 | |

| Zenith Bank PLC | | | 14,769,452 | | | | 854,280 | |

| | | | | | | | 4,611,068 | |

| Pakistan — 9.25% | | | | | | | | |

| Bank Al Habib Ltd. | | | 650,000 | | | | 288,712 | |

| MCB Bank Ltd. | | | 313,500 | | | | 317,489 | |

| Meezan Bank Ltd. | | | 268,000 | | | | 195,958 | |

| Nishat Mills Ltd. | | | 664,500 | | | | 392,225 | |

| Systems Ltd. | | | 150,920 | | | | 534,869 | |

| Unity Foods Ltd.(a) | | | 1,000,400 | | | | 281,561 | |

| | | | | | | | 2,010,814 | |

| United Arab Emirates — 9.42% | | | | | | | | |

| Aramex PJSC | | | 790,000 | | | | 839,516 | |

| Emaar Properties PJSC | | | 1,064,000 | | | | 1,208,465 | |

| | | | | | | | 2,047,981 | |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| SCHEDULE OF INVESTMENTS (continued) |

| June 30, 2021 |

| | | Shares | | | Fair Value | |

| United Kingdom — 1.14% | | | | | | | | |

| Airtel Africa PLC | | | 233,000 | | | $ | 248,811 | |

| | | | | | | | | |

| Vietnam — 15.23% | | | | | | | | |

| SSI Securities Corp. | | | 430,480 | | | | 1,026,680 | |

| Vietnam Prosperity JSC Bank(a) | | | 293,500 | | | | 862,011 | |

| Vincom Retail JSC(a) | | | 341,500 | | | | 470,346 | |

| Vinhomes JSC(a) | | | 186,000 | | | | 951,830 | |

| | | | | | | | 3,310,867 | |

| | | | | | | | | |

| Total Common Stocks (Cost $17,718,448) | | | | | | | 20,051,483 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 3.27% | | | | | | | | |

| | | | | | | | | |

| Vietnam — 3.27% | | | | | | | | |

| VFMVN Diamond ETF | | | 638,000 | | | | 711,280 | |

| | | | | | | | |

| Total Exchange-Traded Funds (Cost $408,989) | | | | | | | 711,280 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 3.07% | | | | | | | | |

| First American Government Obligations Fund, Class X, 0.03%(c) | | | 667,228 | | | | 667,228 | |

| | | | | | | | |

| Total Money Market Funds (Cost $667,228) | | | | | | | 667,228 | |

| | | | | | | | |

| Total Investments — 98.58% (Cost $18,794,665) | | | | | | | 21,429,991 | |

| | | | | | | | | |

| Other Assets in Excess of Liabilities — 1.42% | | | | | | | 308,831 | |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 21,738,822 | |

| (a) | Non-income producing security. |

| (b) | All or a portion of this security has been deemed illiquid by the Adviser. The total fair value of these securities as of June 30, 2021 was $242,968, representing 1.12% of net assets. |

| (c) | Rate disclosed is the seven day effective yield as of June 30, 2021. |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| STATEMENT OF ASSETS AND LIABILITIES |

| June 30, 2021 |

| Assets | | | |

| Investments in securities at fair value (cost $18,794,665) | | $ | 21,429,991 | |

| Foreign currency (cost $450,950) | | | 448,597 | |

| Dividends receivable | | | 55,866 | |

| Prepaid expenses | | | 3,798 | |

| Total Assets | | | 21,938,252 | |

| | | | | |

| Liabilities | | | | |

| Payable to Adviser | | | 10,448 | |

| Payable to Affiliates | | | 8,683 | |

| Deferred foreign capital gains taxes | | | 125,378 | |

| Other accrued expenses | | | 54,921 | |

| Total Liabilities | | | 199,430 | |

| | | | | |

| Net Assets | | $ | 21,738,822 | |

| | | | | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 27,890,263 | |

| Accumulated deficit | | | (6,151,441 | ) (a) |

| | | | | |

| Net Assets | | $ | 21,738,822 | |

| | | | | |

| Institutional Class: | | | | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,210,940 | |

| Net asset value, offering and redemption price per share(b) | | $ | 9.83 | |

| (a) | Net of $125,378 in deferred foreign capital gain taxes. |

| (b) | The Fund charges a 2.00% redemption fee on shares redeemed within 180 days of purchase. |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| STATEMENT OF OPERATIONS |

| For the year ended June 30, 2021 |

| Investment Income | | | |

| Dividend income (net of foreign taxes withheld of $84,174) | | $ | 785,630 | |

| Total investment income | | | 785,630 | |

| | | | | |

| Expenses | | | | |

| Adviser | | | 257,321 | |

| Custodian | | | 74,094 | |

| Fund accounting | | | 37,930 | |

| Audit and tax | | | 30,100 | |

| Legal | | | 20,873 | |

| Administration | | | 20,000 | |

| Trustee | | | 13,658 | |

| Transfer agent | | | 12,000 | |

| Compliance services | | | 12,000 | |

| Registration | | | 8,589 | |

| Report printing | | | 7,020 | |

| Pricing | | | 4,547 | |

| Insurance | | | 1,942 | |

| Line of credit | | | 1,353 | |

| Interest expense | | | 342 | |

| Miscellaneous | | | 26,394 | |

| Total expenses | | | 528,163 | |

| Fees waived by Adviser | | | (194,036 | ) |

| Net operating expenses | | | 334,127 | |

| Net investment income | | | 451,503 | |

| | | | | |

| Net Realized and Change in Unrealized Gain (Loss) on Investments | | | | |

| Net realized gain on investment securities transactions | | | 257,562 | (a) |

| Net realized loss on foreign currency translations | | | (46,603 | ) |

| Net change in unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 6,848,288 | (b) |

| Foreign currency | | | (2,064 | ) |

| | | | | |

| Net realized and change in unrealized gain on investments and foreign currency transactions | | | 7,057,183 | |

| | | | | |

| Net increase in net assets resulting from operations | | $ | 7,508,686 | |

| (a) | Net of $20,219 in foreign capital gains taxes. |

| (b) | Net of increase in deferred foreign capital gain taxes of $125,378. |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| STATEMENTS OF CHANGES IN NET ASSETS |

| | | For the Year

Ended | | | For the Year

Ended | |

| | | June 30, 2021 | | | June 30, 2020 | |

| Increase (Decrease) in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment income | | $ | 451,503 | | | $ | 396,744 | |

| Net realized gain (loss) on investment securities transactions and foreign currency translations | | | 210,959 | | | | (5,793,356 | ) |

| Net change in unrealized appreciation of investment securities | | | 6,846,224 | | | | 852,116 | |

| Net increase (decrease) in net assets resulting from operations | | | 7,508,686 | | | | (4,544,496 | ) |

| | | | | | | | | |

| Distributions to Shareholders from Earnings | | | | | | | | |

| Institutional Class | | | (301,848 | ) | | | (739,803 | ) |

| Total distributions | | | (301,848 | ) | | | (739,803 | ) |

| | | | | | | | | |

| Capital Transactions - Institutional Class | | | | | | | | |

| Proceeds from shares sold | | | 177,484 | | | | 681,116 | |

| Proceeds from redemption fees(a) | | | — | | | | 392 | |

| Reinvestment of distributions | | | 289,521 | | | | 725,371 | |

| Amount paid for shares redeemed | | | (2,003,314 | ) | | | (17,136,316 | ) |

| Net decrease in net assets resulting from capital transactions | | | (1,536,309 | ) | | | (15,729,437 | ) |

| Total Increase (Decrease) in Net Assets | | | 5,670,529 | | | | (21,013,736 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 16,068,293 | | | | 37,082,029 | |

| End of year | | $ | 21,738,822 | | | $ | 16,068,293 | |

| | | | | | | | | |

| Share Transactions - Institutional Class | | | | | | | | |

| Shares sold | | | 20,081 | | | | 85,267 | |

| Shares issued in reinvestment of distributions | | | 33,744 | | | | 87,289 | |

| Shares redeemed | | | (233,841 | ) | | | (2,248,943 | ) |

| Total Institutional Class | | | (180,016 | ) | | | (2,076,387 | ) |

| (a) | The Fund charges a 2.00% redemption fee on shares redeemed within 180 days of purchase. |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| FINANCIAL HIGHLIGHTS - Institutional Class(a) |

| For a share outstanding during each period |

| | | | | | | | | | | | | | | For the | |

| | | For the | | | For the | | | For the | | | For the | | | Period | |

| | | Year Ended | | | Year Ended | | | Year Ended | | | Year Ended | | | Ended | |

| | | June 30, | | | June 30, | | | June 30, | | | June 30, | | | June 30, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017(b) | |

| | | | | | | | | | | | | | | | | | | | | |

| Selected Per Share Data: | | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 6.72 | | | $ | 8.30 | | | $ | 10.40 | | | $ | 10.83 | | | $ | 9.40 | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment gain | | | 0.22 | | | | 0.21 | | | | 0.16 | | | | 0.23 | | | | 0.14 | |

| Net realized and unrealized gain (loss) | | | 3.03 | | | | (1.58 | ) | | | (1.70 | ) | | | (0.16 | ) | | | 1.32 | |

| Total from investment operations | | | 3.25 | | | | (1.37 | ) | | | (1.54 | ) | | | 0.07 | | | | 1.46 | |

| �� | | | | | | | | | | | | | | | | | | | | |

| Less Distributions: | | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.14 | ) | | | (0.21 | ) | | | (0.22 | ) | | | (0.14 | ) | | | (0.03 | ) |

| Net realized gains | | | — | | | | — | | | | (0.34 | ) | | | (0.36 | ) | | | — | |

| Total distributions | | | (0.14 | ) | | | (0.21 | ) | | | (0.56 | ) | | | (0.50 | ) | | | (0.03 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid in capital from redemption fees | | | — | | | | — | (c) | | | — | (c) | | | — | (c) | | | — | |

| Net asset value, end of period | | $ | 9.83 | | | $ | 6.72 | | | $ | 8.30 | | | $ | 10.40 | | | $ | 10.83 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(d) | | | 48.61 | % | | | (16.99 | )% | | | (14.83 | )% | | | 0.40 | % | | | 15.56 | % (e) |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 21,739 | | | $ | 16,068 | | | $ | 37,082 | | | $ | 35,195 | | | $ | 36,504 | |

| Ratio of net expenses to average net assets | | | 1.75 | % (f) | | | 1.76 | % (g) | | | 1.74 | % | | | 1.83 | % | | | 1.85 | % (h) |

| Ratio of gross expenses to average net assets before waiver and reimbursement | | | 2.76 | % (f) | | | 2.75 | % (g) | | | 2.19 | % | | | 2.14 | % | | | 2.21 | % (h) |

| Ratio of net investment income to average net assets | | | 2.36 | % | | | 1.46 | % | | | 2.07 | % | | | 2.02 | % | | | 2.29 | % (h) |

| Portfolio turnover rate | | | 33 | % | | | 35 | % | | | 27 | % | | | 39 | % | | | 25 | % (e) |

| (a) | Effective December 20, 2018, Service Class shares were converted to Institutional Class shares. The amounts presented represent the results of the Institutional Class shares for the periods prior to the conversion and the results of the combined share class for the period subsequent to the conversion. |

| (b) | Effective December 12, 2016, the Fund changed its fiscal year end to June 30 from October 31. |

| (c) | Rounds to less than $0.005 per share. |

| (d) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

| (f) | Includes line of credit and interest expense of 0.01%. |

| (g) | Includes line of credit and interest expense of 0.02%. |

The accompanying notes are an integral part of these financial statements.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS |

| June 30, 2021 |

NOTE 1. ORGANIZATION

The Silk Invest New Horizons Frontier Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a diversified series of Unified Series Trust (the “Trust”) on December 15, 2017. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 17, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is the legal successor to the Frontier Silk Invest New Horizons Fund, a series of Frontier Funds, Inc., an unaffiliated registered investment company. On April 6, 2018, the Fund (which had no prior activity or net assets) acquired all the net assets of the Predecessor Fund pursuant to a plan of reorganization. The Fund is one of a series of funds currently authorized by the Board. The Fund commenced operations on May 25, 2016. The investment adviser to the Fund is Silk Invest Limited (the “Adviser”). The investment objective of the Fund is capital appreciation. Prior to December 21, 2018, the Fund offered two classes of shares: the Institutional Class and the Service Class. The Institutional Class commenced operations on May 25, 2016. The Service Class commenced operations on May 27, 2016. Effective on the close of business on December 20, 2018, Service Class shares were converted into Institutional Class shares. Each share of the Fund has the same voting and other rights and preferences as any other share of the Fund.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended June 30, 2021, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

In addition to the requirements of the Code, the Fund may also be subject to capital gains tax in certain foreign jurisdictions on gains realized upon sale of securities, payable upon repatriation of sales proceeds. The Fund accrues a deferred liability for unrealized gains in excess of available loss carryforwards on certain foreign securities based on existing tax rates and holding periods of the securities. As of June 30, 2021, the Fund recorded a deferred liability for potential future capital gain taxes of $125,378.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Redemption Fee – The Fund charges a 2.00% redemption fee for shares redeemed within 180 calendar days of purchase. These fees are deducted from the redemption proceeds otherwise payable to the shareholder. The Fund will retain the fee charged as an increase in paid-in capital and such fees become part of the Fund’s daily net asset value (“NAV”) calculation.

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statements and income tax purposes. Dividend income, less foreign taxes withheld, is recorded on the ex-dividend date, except that certain dividends from foreign securities are recorded as soon as the information becomes available to the Fund. Withholding taxes on foreign dividends and foreign capital gain taxes have been provided for in accordance with the Fund’s understanding of the applicable country’s tax codes and regulations.

Income recognized, if any, for foreign tax reclaims is reflected as dividend income in the Statement of Operations and related receivables, if any, are reflected as tax reclaims receivable in the Statement of Assets and Liabilities.

Foreign Currency Translation and Risks – The accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts are translated into U.S. dollars at the current rate of exchange each business day to determine the value of investments and other assets and liabilities. Purchases and sales of foreign securities, and income and expenses, are translated at the prevailing rate of exchange on the respective date of these transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from fluctuation arising from changes in market prices of securities held. These fluctuations are included with the net realized and unrealized gain or loss from investments. Net realized gain (loss) on foreign currency translations on the Statement of Operations represents currency gains (losses) realized between the trade and settlement dates on securities transactions, and the difference between the amount of investment income and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. The change in unrealized currency gains (losses) on foreign currency translations for the period is reflected in the Statement of Operations.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

The Fund bears the risk of changes in the foreign currency exchange rates and their impact on the value of assets and liabilities denominated in foreign currency. The Fund also bears the risk of a counterparty failing to fulfill its obligation under a foreign currency contract. Investments in securities of foreign companies involve additional risks including:

Foreign Securities Risks – Investments in securities of foreign companies involve additional risks, including less liquidity, currency-rate fluctuations, political and economic instability, differences in financial reporting standards and securities market regulation, and imposition of foreign taxes. Geopolitical events, including those in the Middle East, may also cause market disruptions.

Frontier Markets Risks – Investments in frontier markets can involve risks in addition to and greater than those generally associated with investing in more developed foreign markets. Frontier market countries generally have smaller economies or less developed capital markets than traditional emerging market countries and, as a result, the risks of investing in emerging market countries are magnified in frontier market countries. Frontier market economies can be subject to greater social, economic, regulatory, and political uncertainties. Adverse government policies, taxation, restrictions on foreign investment and on currency convertibility and repatriation, currency fluctuations and other developments in laws and regulations of frontier countries in which Fund investments may be made, including expropriation, nationalism and other confiscation, could result in loss. Frontier market securities also tend to be less liquid.

Currency Risks – The value of the Fund’s foreign holdings as measured in U.S. dollars may be affected unfavorably by changes in foreign currency exchange rates. The Fund may also incur costs in connection with conversions between various currencies. Currency rates in foreign countries may fluctuate significantly over short periods of time for a number of reasons, including but not limited to, changes in interest rates, intervention by central banks or supranational entities such as the International Monetary Fund (“IMF”), managed adjustments in relative currency values and other protectionist measures imposed or negotiated by countries with which frontier markets companies trade.

Restricted and Illiquid Securities – A restricted security is a security that has been purchased through a private offering and cannot be resold to the general public without prior registration under the Securities Act of 1933, as amended (the “Act”), pursuant to the resale limitations provided by Rule 144A or Regulation S under the Act, or an exemption from the registration requirements of the Act. As of June 30, 2021, the Fund did not hold any restricted securities.

The Fund may invest up to 15% of its net assets in illiquid securities. Illiquid securities are those investments that may not reasonably be expected to be sold or disposed of in current market conditions in seven calendar days or less without the conversion to cash significantly changing the market value of the investment. As of June 30, 2021, the Fund had investments in illiquid securities with a total value of $242,968 or 1.12% of total net assets.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value NAV per share of the Fund.

NOTE 3. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three -tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using the market quotations and when the market is considered active, the security

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with procedures established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

With respect to foreign equity securities that are principally traded on a market outside the United States, the Board has approved the utilization of an independent fair value pricing service to evaluate the effect of market fluctuations on these securities after the close of trading in that foreign market. To the extent that securities are valued using this service, they will be classified as Level 2 securities.

When the last day of the reporting period is a non-business day, certain foreign markets may be open on those days that the Fund’s NAV is not calculated, which could result in differences between the value of the Fund’s portfolio securities on the last business day and the last calendar day of the reporting period. Security valuation changes due to an open foreign market are adjusted and reflected by the Fund for financial reporting purposes.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV.

These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2021:

| | | Valuation Inputs | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Assets | | | | | | | | | | | | | | | | |

| Common Stocks(a) | | $ | 919,672 | | | $ | 19,131,811 | | | $ | — | | | $ | 20,051,483 | |

| Exchange-Traded Funds | | | — | | | | 711,280 | | | | — | | | | 711,280 | |

| Money Market Funds | | | 667,228 | | | | — | | | | — | | | | 667,228 | |

| Total | | $ | 1,586,900 | | | $ | 19,843,091 | | | $ | — | | | $ | 21,429,991 | |

| (a) | Refer to Schedule of Investments for country classifications. |

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period.

NOTE 4. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement with the Trust with respect to the Fund (the “Agreement”), manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 1.35% of the Fund’s average daily net assets. For the fiscal year ended June 30, 2021, the Adviser earned a fee of $257,321 from the Fund before the waiver and reimbursement described below. At June 30, 2021, the Fund owed the Adviser $10,448 for advisory services.

The Adviser contractually has agreed to waive its management fee and/or reimburse expenses so that total annual Fund operating expenses, excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business, do not exceed 1.74% of the Fund’s average daily net assets for Institutional Class shares through October 31, 2021. This expense cap may not be terminated prior to this date except by the Board. For the fiscal year ended June 30, 2021, the Adviser waived fees in the amount of $194,036 for the Fund.

Each waiver/expense payment by the Adviser is subject to recoupment by the Adviser from the Fund in the three years following the date the particular waiver/expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the waiver/expense payment and any expense limitation in effect at the time of the recoupment. As of June 30, 2021, the Adviser may seek repayment of investment advisory fees waived and expense reimbursements as follows:

| Recoverable through | | | |

| June 30, 2022 | | $ | 196,779 | |

| June 30, 2023 | | | 268,669 | |

| June 30, 2024 | | | 194,036 | |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund. Prior to April 1, 2021, Ultimus provided certain compliance services and Buttonwood Compliance Partners provided the Chief Compliance Officer to the Trust.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also employees of Ultimus and are not paid by the Fund for serving in such capacities.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. Each Independent Trustee of the Trust receives annual compensation of $2,510 per fund from the Trust, except that the Chairman of the Audit Committee, the Chairman of the Governance & Nominating Committee, and the Chairman of the Pricing & Liquidity Committee each receives annual compensation of $2,960 per fund from the Trust, and the Independent Chairman of the Board receives $3,160 per fund from the Trust. Independent Trustees also receive $1,000 for attending each special in-person meeting and $250 for special telephonic meetings. Prior to January 1, 2021, these fees were $2,290 for non-chairmen and $2,740 for all chairmen. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

NOTE 5. LOAN AGREEMENT

The Trust, on behalf of the Fund, has in place a Loan Agreement (the “Agreement”) with its custodian, U.S. Bank, N.A. (the “Bank”) expiring September 21, 2021. Borrowings under this Agreement bear interest at the Prime Rate, which was 3.25% as of June 30, 2021. Maximum borrowings for the Fund is the lesser of $750,000, or 5% of the gross market value of the Fund, or 33 1/3% of the gross market value (as determined solely by the Bank using consistently-applied valuation methods disclosed to the Trust) of the unencumbered assets of the Fund (i) which are recorded on the Trust’s books and records as belonging solely to the Fund and (ii) which are not subject to segregation or any special purpose usage, and (iii) as to which no third party has any pledge, security, interest, lien or any other rights, and (iv) which are held by the Bank as sole Custodian. During the fiscal year ended June 30, 2021, the Fund’s borrowing activity was as follows:

| Highest | | Average | | | | | | |

| Outstanding | | Outstanding | | Average | | Interest | | Number of |

| Balance | | Balance | | Interest Rate | | Expense | | Days Utilized(a) |

| $703,000 | | $541,286 | | 3.25% | | $342 | | 7 |

| (a) | Number of days utilized represents the total days during the fiscal year ended June 30, 2021 that the Fund had an outstanding balance. |

NOTE 6. INVESTMENT TRANSACTIONS

For the fiscal year ended June 30, 2021, purchases and sales of investment securities, other than short-term investments, were $5,949,052 and $7,750,029, respectively.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

There were no purchases or sales of long-term U.S. government obligations during the fiscal year ended June 30, 2021.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the Fund, under Section 2(a) (9) of the 1940 Act. At June 30, 2021, The Mercy Investment Services, Inc. owned 94.42% of the Fund. As a result, the Mercy Investment Services, Inc. may be deemed to control the Fund.

NOTE 8. FEDERAL TAX INFORMATION

At June 30, 2021, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | 4,101,189 | |

| Gross unrealized depreciation | | | (1,912,544 | ) |

| Net unrealized appreciation/(depreciation) on investments | | $ | 2,188,645 | |

| | | | | |

| Tax cost of investments | | $ | 19,241,346 | |

The difference between book basis and tax basis of unrealized appreciation (depreciation) is primarily attributable to differences due to Transfers In-Kind and Passive Foreign Investment Company un-reversed inclusions.

The tax character of distributions paid for the fiscal years ended June 30, 2021 and June 30, 2020 were as follows:

| | | 2021 | | | 2020 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income(a) | | $ | 301,848 | | | $ | 739,803 | |

| Total distributions paid | | $ | 301,848 | | | $ | 739,803 | |

| (a) | Short-term capital gain distributions are treated as ordinary income for tax purposes. |

At June 30, 2021, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 706,284 | |

| Accumulated capital and other losses | | | (9,043,670 | ) |

| Unrealized appreciation on investments | | | 2,185,945 | |

| Total accumulated deficit | | $ | (6,151,441 | ) |

As of June 30, 2021, the Fund had short-term and long-term capital loss carryforwards available to offset future gains and not subject to expiration in the amount of $1,370,426 and $7,547,865, respectively and utilized short-term capital loss carryforwards in the amount of $885,824.

| Silk Invest New Horizons Frontier Fund |

| NOTES TO FINANCIAL STATEMENTS (continued) |

| June 30, 2021 |

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

At a meeting held on August 17, 2021, the Board approved the appointment of Martin Dean as President of the Trust (replacing David Carson) and Gwen Gosselink as Chief Compliance Officer (replacing Martin Dean).

Management of the Fund has evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

| Silk Invest New Horizons Frontier Fund |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| June 30, 2021 |

To the Shareholders of Silk Invest New Horizons Frontier Fund and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Silk Invest New Horizons Frontier Fund (the “Fund”), a series of Unified Series Trust, as of June 30, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of June 30, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Fund’s auditor since 2016.

COHEN & COMPANY, LTD.

Chicago, Illinois

August 26, 2021

SUMMARY OF FUND EXPENSES – (Unaudited)

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from January 1, 2021 through June 30, 2021.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs. Therefore, the second line of the table below is useful in comparing ongoing costs only and will not help you determine the relative costs of owning different funds. In addition, if transaction costs were included, your costs would have been higher.

| | | | | Beginning | | Ending | | | | |

| | | | | Account Value | | Account Value | | Expenses | | |

| | | | | January 1, | | June 30, | | Paid During | | Annualized |

| | | | | 2021 | | 2021 | | Period(a) | | Expense Ratio |

| Silk Invest New Horizons Frontier Fund | | | | | | | | |

| Institutional Class | | Actual | | $1,000.00 | | $1,118.30 | | $9.21 | | 1.75% |

| | | Hypothetical (b) | | 1,000.00 | | 1,016.20 | | 8.77 | | 1.75% |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

ADDITIONAL FEDERAL INCOME TAX INFORMATION - (Unaudited)

The Form 1099-DIV you receive in January 2022 will show the tax status of all distributions paid to your account in calendar year 2021. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately 70% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Foreign Tax Credit Pass Through. The Fund intends to elect to pass through to shareholders the income tax credit for taxes paid to foreign countries. The Fund’s foreign source income per share was $0.39 and the foreign tax expense per share was $0.05.

TRUSTEES AND OFFICERS – (Unaudited)

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

| Name, Address*, (Year of Birth), | |

| Position with Trust**, | |

| Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

Kenneth G.Y. Grant (1949)

Chairman, January 2017 to present; Independent Trustee, May 2008 to present | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 - present), a Donor Advised Fund. Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Daniel J. Condon (1950)

Chairman of the Audit Committee; Chairman of the Governance & Nominating Committee; Independent Trustee, December 2002 to present | Current: Retired (2017 - present) Previous: Executive Advisor of Standard Steel LLC, a Railway manufacturing supply company (2016); Chief Executive Officer of Standard Steel LLC (2011 - 2015); Director of Standard Steel Holdings Co., which owns Standard Steel LLC (2011 - 2016); Director of International Crankshaft Inc. (2004 - 2016). |

Gary E. Hippenstiel (1947)

Chairman of the Pricing & Liquidity Committee; Independent Trustee, December 2002 to present | Current: President and founder of Hippenstiel Investment Counsel LLC (“Hippenstiel”) since 2008. Hippenstiel was registered as an investment adviser from 2008 to December 31, 2019. |

Stephen A. Little (1946)

Indepedent Trustee, December 2002 to present; Chairman, December 2004 to December 2016 | Current: President and founder of The Rose, Inc., a registered investment adviser, since 1993. |

Ronald C. Tritschler (1952)

Independent Trustee, January 2007 to present; Interested Trustee, December 2002 to December 2006 | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, since 2001; Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 22 series. |

TRUSTEES AND OFFICERS – (Unaudited) (continued)

The following table provides information regarding the Interested Trustee and the Officers of the Trust.

| Name, Address*, (Year of Birth), | |

| Position with Trust, | |

| Term of Position with Trust | Principal Occupation During Past 5 Years and Other Directorships |

David R. Carson (1958)

President, January 2016 to present; Interested Trustee, August 2020 to present | Current: Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC, since 2013. |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer, November 2014 to present | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, since 2015. |

Martin R. Dean (1963)

Vice President, November 2020 to present; Chief Compliance Officer, April 2021 to present; Assistant Chief Compliance Officer, January 2016 to April 2021 | Current: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC, since 2016. |

Elisabeth Dahl (1962)

Secretary, May 2017 to present; Assistant Secretary, March 2016 to May 2017 | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Stephen Preston (1966)

AML Compliance Officer, May 2017 to present | Current: Vice President and Chief Compliance Officer, Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, since 2011. |

Lynn E. Wood (1946)

Assistant Chief Compliance Officer, April 2021 to present; Chief Compliance Officer, October 2004 to April 2021 | Current: Managing Member, Buttonwood Compliance Partners, LLC, since 2013. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

MANAGEMENT AGREEMENT RENEWAL – (Unaudited)

The Silk Invest New Horizons Frontier Fund (the “Fund”) is a series of Unified Series Trust (the “Trust”). The Trust’s Board of Trustees (the “Board”) oversees the management of the Fund and, as required by law, has considered the approval of the continuance of the Fund’s management agreement with its investment adviser, Silk Invest Limited (“Silk”).

The Board requested and evaluated all information that the Trustees deemed reasonably necessary under the circumstances in connection with the approval of the continuance of the management agreement.

The Trustees held a teleconference on February 17, 2021 to review and discuss materials compiled by Ultimus Fund Solutions, LLC, the Trust’s administrator, with regard to the management agreement between the Trust and Silk. At the Trustees’ quarterly meeting held in February 2021, the Board interviewed certain executives of Silk, including Silk’s Chief Executive Officer and Chief Investment Officer and its Chief Finance Officer and Chief Compliance Officer. After discussion, the Trustees, including the Trustees who are not “interested persons” (as that term is defined in the Investment Company Act of 1940) of the Trust or Silk (the “Independent Trustees”), approved the continuance of the management agreement between the Trust and Silk for an additional year. The Trustees’ approval of the continuance of the Fund’s management agreement was based on a consideration of all the information provided to the Trustees, and was not the result of any single factor. Some of the factors that figured particularly in the Trustees’ deliberations are described below, although individual Trustees may have evaluated this information differently, ascribing different weights to various factors.

(i) The Nature, Extent, and Quality of Services. The Trustees reviewed and considered information regarding the nature, extent, and quality of services that Silk provides to the Fund, which include, but are not limited to, providing a continuous investment program for the Fund, adhering to the Fund’s investment restrictions, complying with the Trust’s policies and procedures, and voting proxies on behalf of the Fund. The Trustees noted that Silk provides a well-defined and disciplined investment methodology that has evolved over time. They noted Silk aims to generate alpha over different market cycles and seeks to reduce volatility in a consistent and diversified manner. The Trustees considered the qualifications and experience of Silk’s portfolio managers who are responsible for the day-to-day management of the Fund’s portfolio, as well as the qualifications and experience of the other individuals at Silk who provide services to the Fund and changes to such personnel since the last renewal. The Trustees concluded that they were satisfied with the nature, extent, and quality of investment management services provided by Silk to the Fund.

(ii) Fund Performance. The Trustees next reviewed and discussed the Fund’s performance for periods ended December 31, 2020. The Trustees observed that the Fund had outperformed its benchmark, the MSCI Frontier Markets NR USD, for the one-year period, but had underperformed its benchmark for the three-year and since inception periods. The Trustees noted that the Fund had underperformed the average and median of its Morningstar Diversified Emerging Markets category for the one-year, three-year and since inception periods. The Trustees also observed that the Fund has very little participation in the benchmark (approximately 1%). The Trustees also considered that the Fund is a frontier markets fund while its category is emerging markets, and that the Fund is underweighted in sectors that emerging markets emphasize, such as technology and consumer staples. The Trustees considered Silk’s explanation that the companies in which the Fund is invested are performing as expected, and that the discount to value in frontier markets is currently high. Based upon the foregoing, the Trustees concluded the Fund’s performance is acceptable.

MANAGEMENT AGREEMENT RENEWAL – (Unaudited) (continued)

(iii) Fee Rate and Profitability. The Trustees reviewed a fee and expense comparison for funds in the Fund’s Morningstar Diversified Emerging Markets category, which indicated that the Fund’s management fee is higher than the average and the median of the category. The Trustees also considered a profitability analysis prepared by Silk for its management of the Fund, which indicated that, both before and after the deduction of marketing expenses, Silk is not earning a profit as a result of managing the Fund. The Trustees also considered that Silk’s expense limitation agreement is in effect through October 31, 2021. The Trustees reviewed information provided by Silk regarding the management fee it charges for managing separate accounts in Europe using similar strategies it uses to manage the Fund. The Trustees noted that the management fee for separate accounts is higher than the Fund’s management fee.

The Trustees considered other potential benefits that Silk may receive in connection with its management of the Fund and noted Silk’s representation that it does not enter into soft-dollar transactions on behalf of the Fund. After considering the above information, the Trustees concluded that the current management fee for the Fund represents reasonable compensation in light of the nature and quality of Silk’s services to the Fund, the fees paid by competitive mutual funds, and the fact that Silk is not profitable with respect to the Fund.

(iv) Economies of Scale. In determining the reasonableness of the management fee, the Trustees also considered the extent to which Silk will realize economies of scale as the Fund grows larger. The Trustees concluded that, in light of the size of the Fund and Silk’s lack of profitability in managing the Fund, it does not appear that Silk is realizing benefits from economies of scale in managing the Fund to such an extent that breakpoints should be implemented at this time.