united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-21237

Unified Series Trust

(Exact name of registrant as specified in charter)

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices)

(Zip code)

Zachary P. Richmond

Ultimus Fund Solutions, LLC

225 Pictoria Drive. Suite 450

Cincinnati, OH 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 08/31

Date of reporting period: 08/31/21

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | PRINTER: Insert the Tactical and FIIG Retirement, FIIG Large Cap, FIIG Small Cap, and FIIG All Foreign Equity Funds 8/31/21 annual reports here. |

| |

| |

| Tactical Multi-Purpose Fund |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Annual Report |

| |

| |

| August 31, 2021 |

| |

| |

| |

| |

| |

| Fund Adviser: |

| |

| |

| Fisher Asset Management, LLC |

| |

| 5525 NW Fisher Creek Drive |

| Camas, Washington 98607 |

| (800) 550-1071 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Tactical Multi-Purpose Fund |

| Management’s Discussion of Fund Performance (Unaudited) |

| |

Dear Shareholder:

Market Commentary and Outlook

Global stocks rose +34.4% in the fiscal year ended August 31, 2021, continuing strong returns since the March 2020 bottom. Equity markets rose as COVID-19 lockdowns and restrictions loosened, vaccines were developed and distributed, and monetary and fiscal policy remained accommodative. The recovery wasn’t perfectly smooth. The path ahead won’t be, either. In our view, there is little reason stocks shouldn’t do well from here—finishing 2021 strong.

We expect recent jumps in economic growth and inflation to prove temporary. Interestingly, the consensus view now seems more in line with ours, which is normally concerning. But the facts and logic supporting our view still hold.

Specifically, pundits now cite falling lumber prices and long-term interest rates as signs inflation pressures are temporary. They also note the base effect from last year’s pandemic-induced deflation in April and May. These are correct observations, if incomplete. One, spiking resource prices due to supply shortages don’t represent lasting inflation. We see this more as a false fear resolving and people realizing what the market already knew. Two, inflation is a monetary phenomenon. While broad measures of money supply soared, most of the components aren’t actually money, i.e., mediums of exchange. Note, we aren’t arguing there is no inflation. Just that there is a huge difference between the hot, 1970s-style inflation many fear and the slow, pre-pandemic inflation rates we expect.

Pundits are also cooling on infrastructure spending as stimulus, noting the slow rollout. Instead of overheating and a new Roaring Twenties, many now anticipate slow growth. We largely agree. After a temporary pop tied to reopening, we have long believed pre-pandemic slow growth was likely to return. “Stimulus” was never likely to stimulate, considering shovel-ready infrastructure projects are largely a myth and households spent only a portion of their COVID-19 relief money. Most measures proposed now aren’t even stimulus—just normal government spending called “stimulus” for marketing purposes. Regardless, government spending can aid growth when the conditions are right, but that isn’t now. Most economic data are near or even above pre-pandemic levels now. The notion the economy needs support from here strains credulity.

While some legislation has passed and other ideas could come to fruition, overall, far less should squeak through than some hope and others fear. Gridlock is blocking some ideas and diluting others. Tax hikes have already fizzled. The G7’s vaunted global minimum corporate tax rate agreement seems set to do the same. In addition, we are three months away from the traditional start of midterm campaigning. Politicians are already shifting gears. The rhetoric around a bipartisan infrastructure deal looks more like campaign talk than serious progress on legislation. Moreover, markets are familiar with all this. If major legislative disruption were likely, stocks would show it. However, they are looking through the noise and notching new highs. That is telling.

Volatility has been low all year, despite pundits latching onto every wiggle as something huge. It wouldn’t surprise us if actual volatility picked up, as that is part and parcel of bull markets. A correction is also possible, for any or no reason. But volatility is the price for stocks’ high longer-term returns.

Performance Attribution

The Tactical Multi-Purpose Fund (the “Fund”) seeks positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets. The Fund is designed to be used by the Adviser to facilitate moving groups of clients into and out of defensive and special situation investments efficiently, based on the Adviser’s perceptions of market risks and opportunities.

During the fiscal year ended August 31, 2021, the Adviser did not take a defensive position; therefore the Fund was limited in size, with its assets invested mostly in T-Bills and cash equivalents. The Fund returned -0.91% during the fiscal year ended August 31, 2021. During the same period, the Fund’s primary benchmark, the ICE BofA ML 3-month U.S. Treasury Bill Index returned 0.08%.

The Fund’s underperformance is reflective of its modest investment in T-Bills at the beginning of the period and cash equivalents for the remainder of the period, which generated minimal interest. Underperformance as compared

| Tactical Multi-Purpose Fund |

| Management’s Discussion of Fund Performance (Unaudited) (continued) |

| |

to the index is also in part due to the Fund’s 1.00% expense ratio (the performance of the index does not reflect the deduction of expenses). Due to the size of the investment, the Fund maintained a sizeable portion of the investments in cash equivalents to meet expense obligations. However, T-Bills were purchased at the beginning of the period with a portion of the Fund to opportunistically benefit from changes by the Fed to short rates. It is anticipated that similar returns will continue until the Adviser utilizes the Fund for defensive purposes or prevailing short-term interest rates meaningfully change.

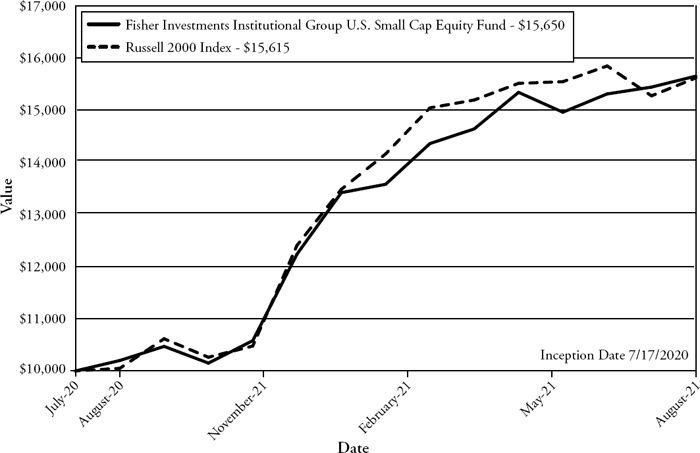

| Tactical Multi-Purpose Fund |

| Investment Results (Unaudited) |

Average Annual Total Returns(a)

(for the periods ended August 31, 2021) |

| | | | |

| | | | | | | Since | |

| | | | | | | Inception | |

| | | One Year | | Three Year | | (3/30/17) | |

| Tactical Multi-Purpose Fund | | (0.91)% | | (0.30)% | | (0.36)% | |

| ICE BofA ML 3-Month U.S. Treasury Bill Index | | 0.08% | | 1.23% | | 1.27% | |

| | | | | | | | |

| Total annual operating expenses, as disclosed in the Tactical Multi-Purpose Fund (the “Fund”) prospectus dated December 29, 2020, were 596.00% of average daily net assets (1.00% after fee waivers/expense reimbursements). Fisher Asset Management, LLC, d/b/a Fisher Investments (the “Adviser”) is contractually obligated to limit the Fund’s total annual operating expenses to 1.00% of the Fund’s average daily net assets through December 31, 2025 (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the Investment Company Act of 1940; any administrative and/or shareholder servicing fees payable to financial intermediaries; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers, and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business). This expense cap may not be terminated prior to this date except by the Board of Trustees. Each expense payment by the Adviser (but not management fee waiver) is subject to recoupment by the Adviser from the Fund in the three years following the date the particular expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the expense payment and any expense limitation in effect at the time of the recoupment. Additional information pertaining to the Fund’s expense ratios as of August 31, 2021 can be found in the financial highlights. |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Current performance of the Fund may be lower or higher than the performance quoted. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Performance data current to the most recent month end may be obtained by calling (800) 550-1071.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (b) | The ICE BofA ML 3-Month U.S. Treasury Bill Index (the “Index”) is comprised of a single issue purchased at the beginning of the month and held for a full month. Each month the Index is rebalanced and the issue selected is the outstanding Treasury Bill that matures closest to, but not beyond 3 months from the rebalancing date. The Index returns assume reinvestment of all distributions and do not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index; however, an individual may invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

You should consider the Fund’s investment objectives, risks, charges and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling (800) 550-1071.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

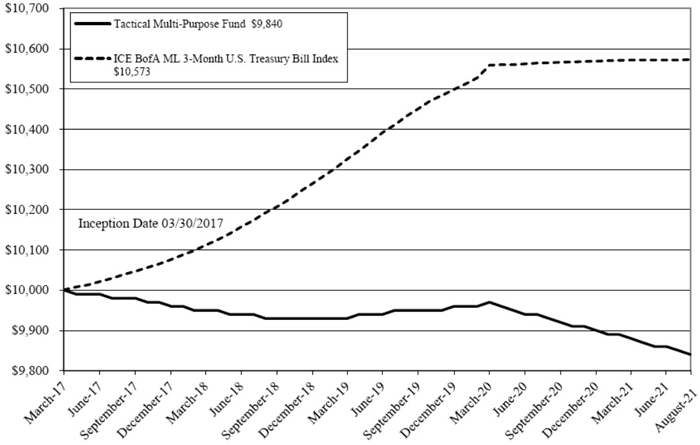

| Tactical Multi-Purpose Fund |

| Investment Results (Unaudited) (continued) |

| |

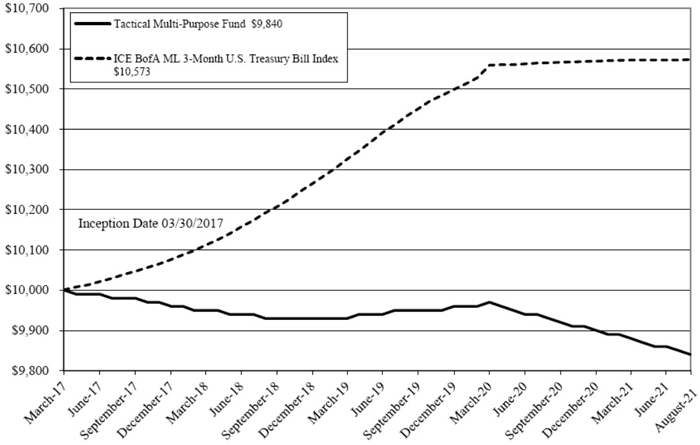

Comparison of the Growth of a $10,000 Investment in the Tactical Multi-Purpose Fund and the

ICE BofA ML 3-Month U.S. Treasury Bill Index (Unaudited)

This graph shows the value of a hypothetical initial investment of $10,000 made on March 30, 2017 (commencement of operations) and held through August 31, 2021. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE FUTURE RESULTS. The ICE BofA ML 3-Month U.S. Treasury Bill Index is an unmanaged index of Treasury securities that assumes reinvestment of all income. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may be worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 550-1071. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund, and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, member FINRA/SIPC.

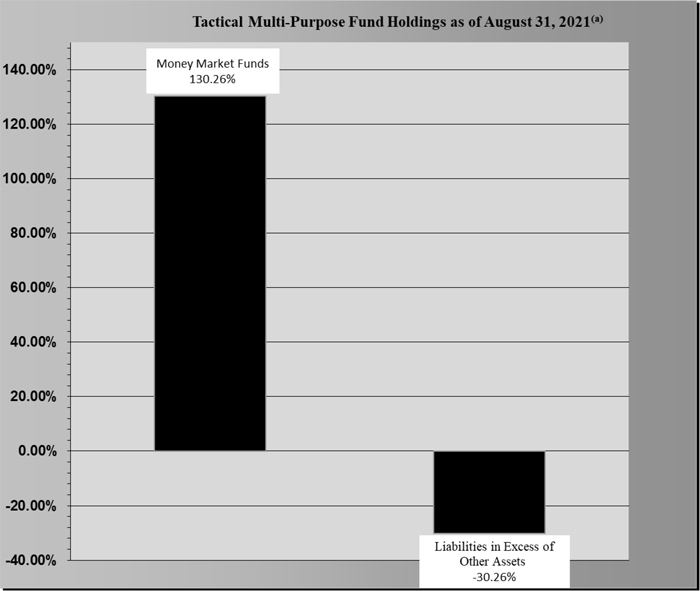

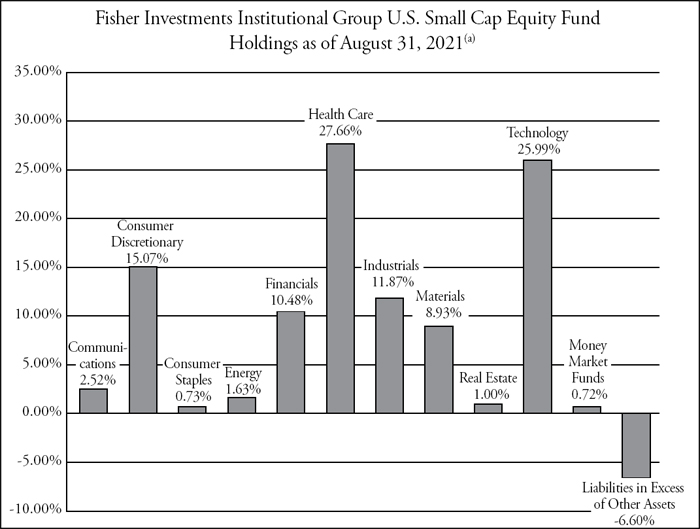

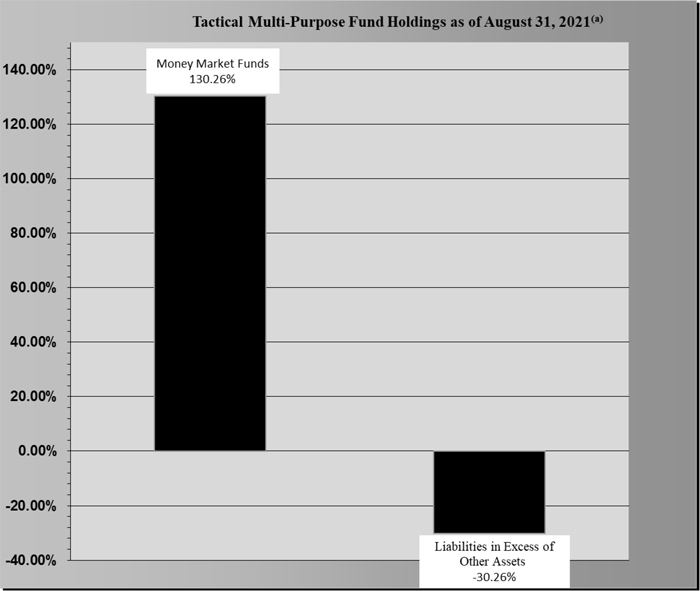

| Tactical Multi-Purpose Fund |

| Fund Holdings (Unaudited) |

| |

| (a) | As a percentage of net assets. |

The investment objective of the Fund is to seek positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets.

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (the “SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

| Tactical Multi-Purpose Fund |

| Schedule of Investments |

| August 31, 2021 |

| | | Shares | | | Fair Value | |

| MONEY MARKET FUNDS - 130.26% | | | | | | |

| | | | | | | |

| First American Government Obligations Fund, Class X, 0.03%(a) | | | 32,057 | | | $ | 32,057 | |

| | | | | | | | | |

| Total Money Market Funds (Cost $32,057) | | | | | | | 32,057 | |

| | | | | | | | | |

| Total Investments — 130.26% (Cost $32,057) | | | | | | | 32,057 | |

| | | | | | | | | |

| Liabilities in Excess of Other Assets — (30.26)% | | | | | | | (7,447 | ) |

| | | | | | | | | |

| NET ASSETS — 100.00% | | | | | | $ | 24,610 | |

| | | | | | | | | |

| (a) | Rate disclosed is the seven day effective yield as of August 31, 2021. |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statement of Assets and Liabilities |

| August 31, 2021 |

| Assets | | | | |

| Investments in securities at fair value (cost $32,057) | | $ | 32,057 | |

| Interest receivable | | | 1 | |

| Receivable from Adviser | | | 11,854 | |

| Prepaid expenses | | | 3,799 | |

| Total Assets | | | 47,711 | |

| Liabilities | | | | |

| Payable to affiliates | | | 7,253 | |

| Payable to auditors | | | 10,800 | |

| Other accrued expenses | | | 5,048 | |

| Total Liabilities | | | 23,101 | |

| Net Assets | | $ | 24,610 | |

| Net Assets consist of: | | | | |

| Paid-in capital | | | 24,761 | |

| Accumulated deficit | | | (151 | ) |

| Net Assets | | $ | 24,610 | |

| Shares outstanding (unlimited number of shares authorized, no par value) | | | 2,501 | |

| Net asset value, offering and redemption price per share | | $ | 9.84 | |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statement of Operations |

| For the year ended August 31, 2021 |

| Investment Income | | | | |

| Interest income | | $ | 23 | |

| Total investment income | | | 23 | |

| | | | | |

| Expenses | | | | |

| Fund accounting | | | 30,003 | |

| Administration | | | 30,000 | |

| Legal | | | 21,355 | |

| Trustee | | | 13,983 | |

| Transfer agent | | | 12,000 | |

| Compliance services | | | 12,000 | |

| Audit and tax | | | 11,760 | |

| Custodian | | | 4,583 | |

| Report printing | | | 1,652 | |

| Registration | | | 371 | |

| Adviser | | | 62 | |

| Pricing | | | 49 | |

| Miscellaneous | | | 19,237 | |

| Total expenses | | | 157,055 | |

| Fees waived and expenses reimbursed by Adviser | | | (156,061 | ) |

| Fees reduced by Administrator | | | (747 | ) |

| Net operating expenses | | | 247 | |

| Net investment loss | | | (224 | ) |

| | | | | |

| Net decrease in net assets resulting from operations | | $ | (224 | ) |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Statements of Changes in Net Assets |

| | | For the Year | | | For the Year | |

| | | Ended August 31, | | | Ended August 31, | |

| | | 2021 | | | 2020 | |

| Decrease in Net Assets due to: | | | | | | | | |

| Operations | | | | | | | | |

| Net investment loss | | $ | (224 | ) | | $ | (49 | ) |

| Net change in unrealized depreciation of investment securities | | | — | | | | (1 | ) |

| Net decrease in net assets resulting from operations | | | (224 | ) | | | (50 | ) |

| | | | | | | | | |

| Total Decrease in Net Assets | | | (224 | ) | | | (50 | ) |

| | | | | | | | | |

| Net Assets | | | | | | | | |

| Beginning of year | | | 24,834 | | | | 24,884 | |

| End of year | | $ | 24,610 | | | $ | 24,834 | |

| | | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Financial Highlights |

| |

| (For a share outstanding during each period) |

| | | For the Year | | | For the Year | | | For the Year | | | For the Year | | | For the Period | |

| | | Ended August 31, | | | Ended August 31, | | | Ended August 31, | | | Ended August 31, | | | Ended August 31, | |

| | | 2021 | | | 2020 | | | 2019 | | | 2018 | | | 2017(a) | |

| Selected Per Share Data: | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | | $ | 9.93 | | | $ | 9.95 | | | $ | 9.93 | | | $ | 9.98 | | | $ | 10.00 | |

| | | | | | | | | | | | | | | | | | | | | |

| Investment operations: | | | | | | | | | | | | | | | | | | | | |

| Net investment income (loss) | | | (0.09 | ) | | | (0.02 | ) | | | 0.02 | | | | (0.05 | ) | | | (0.02 | ) |

| Net realized and unrealized gain | | | — | | | | — | (b) | | | — | (b) | | | — | | | | — | |

| Total from investment operations | | | (0.09 | ) | | | (0.02 | ) | | | 0.02 | | | | (0.05 | ) | | | (0.02 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | |

| Net asset value, end of period | | $ | 9.84 | | | $ | 9.93 | | | $ | 9.95 | | | $ | 9.93 | | | $ | 9.98 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total Return(c) | | | (0.91 | )% | | | (0.20 | )% | | | 0.20 | % | | | (0.50 | )% | | | (0.20 | )% (d) |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (000 omitted) | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | | | $ | 25 | |

| Ratio of net expenses to average net assets | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % (e) |

| Ratio of gross expenses to average net assets before waiver and reimbursement | | | 635.29 | % | | | 596.00 | % | | | 589.45 | % | | | 534.46 | % | | | 558.98 | % (e) |

| Ratio of net investment income (loss) to average net assets | | | (0.91 | )% | | | (0.20 | )% | | | 0.15 | % | | | (0.46 | )% | | | (0.49 | )% (e) |

| Portfolio turnover rate | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % | | | 0 | % (d) |

| | | | | | | | | | | | | | | | | | | | | |

| (a) | For the period March 30, 2017 (commencement of operations) to August 31, 2017. |

| (b) | Rounds to less than $0.005 per share. |

| (c) | Total return represents the rate that the investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions. |

See accompanying notes which are an integral part of these financial statements.

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements |

| August 31, 2021 |

| |

NOTE 1. ORGANIZATION

Tactical Multi-Purpose Fund (the “Fund”) is registered under the Investment Company Act of 1940, as amended (“1940 Act”), as a non-diversified series of Unified Series Trust (the “Trust”) on November 14, 2016. The Trust is an open-end investment company established under the laws of Ohio by an Agreement and Declaration of Trust dated October 14, 2002 (the “Trust Agreement”). The Trust Agreement permits the Board of Trustees of the Trust (the “Board”) to issue an unlimited number of shares of beneficial interest of separate series without par value. The Fund is one of a series of funds currently authorized by the Board. The Fund commenced operations on March 30, 2017. The investment adviser to the Fund is Fisher Asset Management, LLC, d/b/a Fisher Investments (the “Adviser”). The investment objective of the Fund is to seek positive total returns over the long-term regardless of market conditions in the U.S. and foreign equity markets.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification (“ASC”) Topic 946, “Financial Services-Investment Companies.” The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with generally accepted accounting principles in the United States of America (“GAAP”).

Estimates – The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Federal Income Taxes – The Fund makes no provision for federal income or excise tax. The Fund has qualified and intends to qualify each year as a regulated investment company (“RIC”) under subchapter M of the Internal Revenue Code of 1986, as amended, by complying with the requirements applicable to RICs and by distributing substantially all of its taxable income. The Fund also intends to distribute sufficient net investment income and net realized capital gains, if any, so that it will not be subject to excise tax on undistributed income and gains. If the required amount of net investment income or gains is not distributed, the Fund could incur a tax expense.

As of and during the fiscal year ended August 31, 2021, the Fund did not have any liabilities for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations when incurred. During the year, the Fund did not incur any interest or penalties. Management of the Fund has reviewed tax positions taken in tax years that remain subject to examination by all major tax jurisdictions, including federal (i.e., the previous three tax year ends and the interim tax period since then, as applicable) and has concluded that no provision for unrecognized tax benefits or expenses is required in these financial statements and does not expect this to change over the next twelve months.

Expenses – Expenses incurred by the Trust that do not relate to a specific fund of the Trust are allocated to the individual funds based on each fund’s relative net assets or another appropriate basis (as determined by the Board).

Security Transactions and Related Income – The Fund follows industry practice and records security transactions on the trade date for financial reporting purposes. The specific identification method is used for determining gains or losses for financial statement and income tax purposes. Dividend income is recorded on the ex-dividend date and interest income is recorded on an accrual basis.

Dividends and Distributions – The Fund intends to distribute its net investment income and net realized long-term and short-term capital gains, if any, at least annually. Dividends and distributions to shareholders, which are determined in accordance with income tax regulations, are recorded on the ex-dividend date. The treatment for financial reporting purposes of distributions made to

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements (continued) |

| August 31, 2021 |

| |

shareholders during the period from net investment income or net realized capital gains may differ from their ultimate treatment for federal income tax purposes. These differences are caused primarily by differences in the timing of the recognition of certain components of income, expense or realized capital gain for federal income tax purposes. Where such differences are permanent in nature, they are reclassified among the components of net assets based on their ultimate characterization for federal income tax purposes. Any such reclassifications will have no effect on net assets, results of operations or net asset value (“NAV”) per share of the Fund.

For the fiscal year ended August 31, 2021, the Fund made the following reclassifications to increase (decrease) the components of net assets:

| | | | Accumulated | |

| Paid-In Capital | | | Earnings (Deficit) | |

| $ | (122 | ) | | $ | 122 | |

| | | | | | | |

NOTE 3. NON-DIVERSIFICATION RISK

The Fund is non-diversified, which means it may invest a greater percentage of its assets in a limited number of issuers as compared to other mutual funds that are more broadly diversified. As a result, the Fund’s share price may be more volatile than the share price of some other mutual funds, and the poor performance of an individual holding in the Fund’s portfolio may have a significant negative impact on the Fund’s performance.

NOTE 4. SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund values its portfolio securities at fair value as of the close of regular trading on the New York Stock Exchange (“NYSE”) (normally 4:00 p.m. Eastern time) on each business day the NYSE is open for business. Fair value is defined as the price that the Fund would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. GAAP establishes a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes.

Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk (the risk inherent in a particular valuation technique used to measure fair value including a pricing model and/or the risk inherent in the inputs to the valuation technique). Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability developed based on market data obtained and available from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability developed based on the best information available in the circumstances.

Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in the three broad levels listed below.

| ● | Level 1 – unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date |

| ● | Level 2 – other significant observable inputs (including, but not limited to, quoted prices for an identical security in an inactive market, quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.) |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments based on the best information available) |

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements (continued) |

| August 31, 2021 |

| |

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy which is reported is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Debt securities are valued by using the mean between the closing bid and ask prices provided by a pricing service. If the closing bid and ask prices are not readily available, the pricing service may provide a price determined by a matrix pricing method. Matrix pricing is a mathematical technique used to value fixed income securities without relying exclusively on quoted prices. Matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, coupon, maturity, type of issue and any other factors or market data the pricing service deems relevant for the actual security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Adviser, in conformity with guidelines adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

Equity securities that are traded on any stock exchange are generally valued at the last quoted sale price on the security’s primary exchange. Lacking a last sale price, an exchange-traded security is generally valued at its last bid price. Securities traded in the NASDAQ over-the-counter market are generally valued at the NASDAQ Official Closing Price. When using market quotations and when the market is considered active, the security is classified as a Level 1 security. In the event that market quotations are not readily available or are considered unreliable due to market or other events, the Fund values its securities and other assets at fair value in accordance with policies established by and under the general supervision of the Board. Under these policies, the securities will be classified as Level 2 or 3 within the fair value hierarchy, depending on the inputs used.

Investments in mutual funds, including money market mutual funds, are generally priced at the ending NAV. These securities are categorized as Level 1 securities.

In accordance with the Trust’s valuation policies, the Adviser is required to consider all appropriate factors relevant to the value of securities for which it has determined other pricing sources are not available or reliable as described above. No single method exists for determining fair value, because fair value depends upon the circumstances of each individual case. As a general principle, the current fair value of a security being valued by the Adviser would be the amount that the Fund might reasonably expect to receive upon the current sale. Methods that are in accordance with this principle may, for example, be based on (i) a multiple of earnings; (ii) a discount from market prices of a similar freely traded security (including a derivative security or a basket of securities traded on other markets, exchanges or among dealers); or (iii) yield to maturity with respect to debt issues, or a combination of these and other methods. Fair-value pricing is permitted if, in the Adviser’s opinion, the validity of market quotations appears to be questionable based on factors such as evidence of a thin market in the security based on a small number of quotations, a significant event occurs after the close of a market but before the Fund’s NAV calculation that may affect a security’s value, or the Adviser is aware of any other data that calls into question the reliability of market quotations.

The following is a summary of the inputs used to value the Fund’s investments as of August 31, 2021:

| | | Valuation Inputs | |

| Assets | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Money Market Funds | | $ | 32,057 | | | $ | — | | | $ | — | | | $ | 32,057 | |

| Total | | $ | 32,057 | | | $ | — | | | $ | — | | | $ | 32,057 | |

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements (continued) |

| August 31, 2021 |

| |

The Fund did not hold any investments at the end of the reporting period for which significant unobservable inputs (Level 3) were used in determining fair value; therefore, no reconciliation of Level 3 securities is included for this reporting period. The Fund did not hold any derivative instruments during the reporting period.

NOTE 5. FEES AND OTHER TRANSACTIONS WITH AFFILIATES

The Adviser, under the terms of the management agreement (the “Agreement”) with the Trust with respect to the Fund, manages the Fund’s investments. As compensation for its management services, the Fund is obligated to pay the Adviser a fee computed and accrued daily and paid monthly at an annual rate of 0.25% of the Fund’s average daily net assets. For the fiscal year ended August 31, 2021, the Adviser earned fees of $62 from the Fund before the waiver and reimbursement described below.

The Adviser is contractually obligated to limit the Fund’s total annual operating expenses to 1.00% of the Fund’s average daily net assets through December 31, 2025 (excluding portfolio transaction and other investment-related costs (including brokerage fees and commissions); taxes; borrowing costs (such as interest and dividend expenses on securities sold short); acquired fund fees and expenses; fees and expenses associated with investments in other collective investment vehicles or derivative instruments (including for example option and swap fees and expenses); any amounts payable pursuant to a distribution or service plan adopted in accordance with Rule 12b-1 under the 1940 Act; any administrative and/or shareholder servicing fees payable to financial intermediaries; expenses incurred in connection with any merger or reorganization; extraordinary expenses (such as litigation expenses, indemnification of Trust officers and Trustees and contractual indemnification of Fund service providers); and other expenses that the Trustees agree have not been incurred in the ordinary course of the Fund’s business. This expense cap may not be terminated prior to this date except by the Board of Trustees.

Each expense payment by the Adviser (but not management fee waiver) is subject to recoupment by the Adviser from the Fund in the three years following the date the particular expense payment occurred, but only if such recoupment can be achieved without exceeding the annual expense limitation in effect at the time of the expense payment and any expense limitation in effect at the time of the recoupment. As of August 31, 2021, the Adviser may seek repayment of expense reimbursements in the amount as follow:

| Recoverable through | | | | |

| August 31, 2022 | | $ | 145,625 | |

| August 31, 2023 | | | 146,296 | |

| August 31, 2024 | | | 155,999 | |

| | | | | |

Ultimus Fund Solutions, LLC (“Ultimus”) provides administration, fund accounting and transfer agent services to the Fund. The Fund pays Ultimus fees in accordance with the agreements for such services.

The Administrator has agreed to waive fees to the extent necessary that the Fund’s total annual operating expenses (excluding taxes, borrowing costs such as interest and dividend expenses on securities sold short, brokerage commissions, acquired fund fees and expenses, shareholder servicing fees paid to financial intermediaries, extraordinary expenses and expenses outside the normal course of business) do not exceed $156,000 annually, based on a twelve-month period commencing April 1 and ending March 31 (the “Annual Period”). The waiver will accrue on a monthly basis such that the Fund’s operating expenses for any month during the Annual Period will not exceed the sum of $13,000 (the “Monthly Expense Cap”), provided that Ultimus may recoup any fees waived by Ultimus in a prior month during the Annual Period to the extent of any unused amount of the Monthly Expense Cap in the current month. The waiver will be suspended and forfeited in any month that the Adviser is not the sole shareholder of the Fund. During the fiscal year ended August 31, 2021, the total amount waived by the Administrator was $747.

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements (continued) |

| August 31, 2021 |

| |

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides a Chief Compliance Officer to the Trust, as well as related compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board. Prior to April 1, 2021, Ultimus provided certain compliance services and Buttonwood Compliance Partners provided the Chief Compliance Officer to the Trust.

Under the terms of a Distribution Agreement with the Trust, Ultimus Fund Distributors, LLC (the “Distributor”) serves as principal underwriter to the Fund. The Distributor is a wholly-owned subsidiary of Ultimus. The Distributor is compensated by the Adviser (not the Fund) for acting as principal underwriter.

Certain officers and a Trustee of the Trust are also employees of Ultimus and such persons are not paid by the Fund for serving in such capacities.

The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” as defined in the 1940 Act. Each Independent Trustee of the Trust receives annual compensation of $2,510 per fund from the Trust, except that the Chairman of the Audit Committee, the Chairman of the Governance & Nominating Committee, and the Chairman of the Pricing & Liquidity Committee each receives annual compensation of $2,960 per fund from the Trust, and the Independent Chairman of the Board receives $3,160 per fund from the Trust. Independent Trustees also receive $250 for the first hour and $200 for each additional hour for attending special meetings. Prior to January 1, 2021, these fees were $2,290 for non-chairmen and $ 2,740 for all chairmen. In addition, the Trust reimburses Independent Trustees for out-of-pocket expenses incurred in conjunction with attendance at meetings.

NOTE 6. INVESTMENT TRANSACTIONS

For the fiscal year ended August 31, 2021, there were no purchases or sales of investment securities, other than short-term investments.

NOTE 7. BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of a fund, under Section 2(a)(9) of the 1940 Act. As of August 31, 2021, the Adviser owned 99.96% of the Fund’s outstanding shares. As a result, the Adviser may be deemed to control the Fund.

NOTE 8. FEDERAL TAX INFORMATION

At August 31, 2021, the net unrealized appreciation (depreciation) and tax cost of investments for tax purposes was as follows:

| Gross unrealized appreciation | | $ | — | |

| Gross unrealized depreciation | | | — | |

| Net unrealized appreciation on investments | | $ | — | |

| | | | | |

| Tax cost of investments | | $ | 32,057 | |

| | | | | |

At August 31, 2021, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Accumulated capital and other losses | | | (151 | ) |

| Total accumulated earnings | | $ | (151 | ) |

| Tactical Multi-Purpose Fund |

| Notes to the Financial Statements (continued) |

| August 31, 2021 |

| |

For tax purposes no distributions were paid by the Fund for the fiscal years 2020 and 2021.

Certain capital losses and specified gains realized after October 31, and net investment losses realized after December 31 of the Fund’s fiscal year may be deferred and treated as occurring on the first business day of the Fund’s following taxable year. For the tax period ended August 31, 2021, the Fund deferred qualified late year ordinary losses in the amount of $151.

NOTE 9. COMMITMENTS AND CONTINGENCIES

The Trust indemnifies its officers and Trustees for certain liabilities that may arise from their performance of their duties to the Trust or the Fund. Additionally, in the normal course of business, the Trust enters into contracts that contain a variety of representations and warranties which provide general indemnifications. The Trust’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Trust that have not yet occurred.

NOTE 10. SUBSEQUENT EVENTS

Management of the Fund has evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date at which these financial statements were issued. Based upon this evaluation, management has determined there were no items requiring adjustment of the financial statements or additional disclosure.

Report of Independent Registered Public Accounting Firm

To the Shareholders of Tactical Multi-Purpose Fund and

Board of Trustees of Unified Series Trust

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Tactical Multi-Purpose Fund (the “Fund”), a series of Unified Series Trust, as of August 31, 2021, the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the related notes, and the financial highlights for each of the five periods in the period then ended (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of August 31, 2021, the results of its operations for the year then ended, the changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2021, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the auditor of one or more investment companies advised by Fisher Asset Management, LLC since 2017.

COHEN & COMPANY, LTD.

Chicago, Illinois

October 28, 2021

| Shareholder Voting Results (Unaudited) |

| |

Upon written consent of a majority of shareholders of the Fund, effective August 16, 2021, the following resolutions were adopted and approved:

| 1) | The amended and restated Commodities investment restriction for the Fund, as shown below, replaces and supersedes in its entirety the original Commodities investment restriction. |

Commodities. The Fund will not directly purchase or sell commodities, but may acquire exposure as a result of ownership of securities or through derivative instruments linked to commodities. This limitation does not preclude the Fund from purchasing or selling options or futures contracts, including commodities futures contracts, from investing in securities or other instruments backed by commodities or from investing in companies which are engaged in a commodities business or have a significant portion of their assets in commodities.

| 2) | Pursuant to Section 13(a)(1) of the 1940 Act, the Fund’s subclassification is changed from a diversified company to a non-diversified company. |

| 3) | The officers of the Trust are authorized and instructed to amend the Fund’s registration statement, as necessary, to reflect approved changes. |

| Summary of Fund Expenses (Unaudited) |

| |

As a shareholder of the Fund, you incur two types of costs: (1) transaction and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2021 through August 31, 2021.

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $ 1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | Beginning | | | Ending | | | | | | |

| | | Account | | | Account | | | Expenses | | | |

| | | Value | | | Value | | | Paid | | | Annualized |

| | | March 1, | | | August 31, | | | During the | | | Expense |

| | | 2021 | | | 2021 | | | Period(a) | | | Ratio |

| Actual | | $ | 1,000.00 | | | $ | 994.90 | | | $ | 5.02 | | | 1.00% |

| Hypothetical(b) | | $ | 1,000.00 | | | $ | 1,020.17 | | | $ | 5.08 | | | 1.00% |

| | | | | | | | | | | | | | | |

| (a) | Expenses are equal to the Fund’s annualized expense ratios, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

| (b) | Hypothetical assumes 5% annual return before expenses. |

| Trustees and Officers (Unaudited) |

| |

GENERAL QUALIFICATIONS. The Board supervises the business activities of the Trust. Each Trustee serves as a trustee until termination of the Trust unless the Trustee dies, resigns, retires, or is removed. The Chairman of the Board and more than 75% of the Trustees are “Independent Trustees,” which means that they are not “interested persons” (as defined in the 1940 Act) of the Trust or any adviser, sub-adviser or distributor of the Trust.

The following table provides information regarding the Independent Trustees.

Name, Address*, (Year of Birth),

Position with Trust**,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

Kenneth G.Y. Grant (1949)

Chairman, January 2017 to present;

Independent Trustee, May 2008 to present | Current: Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2019 – present); Director, Advisors Charitable Gift Fund (2020 - present), a Donor Advised Fund. Previous: EVP, Benefit Plans Administrative Services, Inc., provider of retirement benefit plans administration (2019 – 2020); Director, Northeast Retirement Services (NRS) LLC, a transfer agent and fund administrator; and Director, Global Trust Company (GTC), a non-depository trust company sponsoring private investment product (2003 – 2019); EVP, NRS (2003 – 2019); GTC, EVP (2008 – 2019); EVP, Savings Banks Retirement Association (2003 – 2019), provider of qualified retirement benefit plans. |

Daniel J. Condon (1950)

Chairman of the Audit Committee;

Chairman of the Governance &

Nominating Committee; Independent

Trustee, December 2002 to present | Current: Retired (2017 - present) |

Gary E. Hippenstiel (1947)

Chairman of the Pricing & Liquidity

Committee; Independent Trustee,

December 2002 to present | Current: President and founder of Hippenstiel Investment Counsel LLC (“Hippenstiel”) since 2008. Hippenstiel was registered as an investment adviser from 2008 to December 31, 2019. |

Stephen A. Little (1946)

Independent Trustee, December 2002 to

present; Chairman, December 2004 to

December 2016 | Current: President and founder of The Rose, Inc., a registered investment adviser, since 1993. |

Ronald C. Tritschler (1952)

Independent Trustee, January 2007 to

present; Interested Trustee, December 2002

to December 2006 | Current: Chief Executive Officer, Director and Legal Counsel of The Webb Companies, a national real estate company, since 2001; Director, Standpoint Multi-Asset (Cayman) Fund, Ltd. (2020 – present). |

| * | The address for each Trustee is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

| ** | As of the date of this report, the Trust consists of 21 series. |

Trustees and Officers (Unaudited) (continued)

The following table provides information regarding the Interested Trustee and Officers of the Trust.

Name, Address*, (Year of Birth), Position

with Trust,

Term of Position with Trust | Principal Occupation During Past 5 Years and Other

Directorships |

David R. Carson (1958)

President, January 2016 to August 2021;

Interested Trustee, August 2020 to present | Current: Senior Vice President Client Strategies of Ultimus Fund Solutions, LLC, since 2013; Interested Trustee of Ultimus Mangers Trust, since 2020. |

Zachary P. Richmond (1980)

Treasurer and Chief Financial Officer,

November 2014 to present | Current: Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC, since 2015. |

Martin R. Dean (1963)

President, August 2021 to present; Vice

President, November 2020 to August 2021;

Chief Compliance Officer, April 2021 to

August 2021; Assistant Chief Compliance

Officer, January 2016 to April 2021 | Current: Senior Vice President, Head of Fund Compliance of Ultimus Fund Solutions, LLC, since 2016. |

Gweneth K. Gosselink (1955)

Chief Compliance Officer, August 2021 to

present | Current: Assistant Vice President, Senior Compliance Officer of Ultimus Fund Solutions, LLC, since 2019.

Previous: Chief Operating Officer & CCO at Miles Capital, Inc. (2013 – 2019). |

Elisabeth Dahl (1962)

Secretary, May 2017 to present; Assistant

Secretary, March 2016 to May 2017 | Current: Attorney, Ultimus Fund Solutions, LLC since March 2016. |

Stephen Preston (1966)

AML Compliance Officer, May 2017 to

present | Current: Vice President and Chief Compliance Officer, Ultimus Fund Solutions, LLC and Ultimus Fund Distributors, LLC, since 2011. |

Lynn E. Wood (1946)

Assistant Chief Compliance Officer, April

2021 to present; Chief Compliance Officer,

October 2004 to April 2021 | Current: Managing Member, Buttonwood Compliance Partners, LLC, since 2013. |

| * | The address for each Officer is 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246. |

PRIVACY NOTICE

Rev: January 2020

| FACTS | WHAT DOES TACTICAL MULTI-PURPOSE FUND (THE “FUND”) DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ● Social Security number ● account balances and account transactions ● transaction or loss history and purchase history When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the Fund chooses to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does the Fund share? | Can you limit this

sharing? |

| For our everyday business purposes— | | |

| such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes— | | |

| to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes—

information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes—

information about your creditworthiness | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call (800) 550-1071 |

| Who we are |

| Who is providing this notice? | Tactical Multi-Purpose Fund Ultimus Fund Distributors, LLC (Distributor) Ultimus Fund Solutions, LLC (Administrator) |

| What we do |

| How does the Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does the Fund collect my personal information? | We collect your personal information, for example, when you ● open an account or deposit money ● make deposits or withdrawals from your account or provide account information We also collect your personal information from other companies. |

| Why can’t I limit all sharing? | Federal law gives you the right to limit only ● sharing for affiliates’ everyday business purposes—information about your creditworthiness ● affiliates from using your information to market to you ● sharing for nonaffiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● Fisher Asset Management, LLC, d/b/a Fisher Investments, the investment adviser to the Fund, could be deemed to be an affiliate. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies. ● The Fund does not share your personal information with nonaffiliates so they can market to you |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you.

● The Fund doesn’t jointly market. |

| | |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available without charge, upon request. You may call toll-free at (800) 550-1071 to request a copy of the SAI or to make shareholder inquiries.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30, are available (1) without charge upon request by calling the Fund at (800) 550-1071 and (2) in Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

| TRUSTEES | INDEPENDENT REGISTERED PUBLIC |

| Kenneth G.Y. Grant, Chairman | ACCOUNTING FIRM |

| David R. Carson | Cohen & Company, Ltd. |

| Daniel J. Condon | 151 N Franklin Street, Suite 575 |

| Gary E. Hippenstiel | Chicago, IL 60606 |

| Stephen A. Little | |

| Ronald C. Tritschler | |

| | |

| OFFICERS | LEGAL COUNSEL |

| Martin R. Dean, President | Thompson Hine LLP |

| Gweneth K. Gosselink, | 312 Walnut Street, 20th Floor |

| Chief Compliance Officer | Cincinnati, OH 45202 |

| Zachary P. Richmond, | |

| Treasurer and Chief Financial Officer | |

| Lynn E. Wood, Assistant Chief | |

| Compliance Officer | |

| | |

| INVESTMENT ADVISER | CUSTODIAN |

| Fisher Asset Management, LLC | U.S. Bank, N.A. |

| 5525 NW Fisher Creek Drive | 425 Walnut Street |

| Camas, WA 98607 | Cincinnati, OH 45202 |

| | |

| DISTRIBUTOR | ADMINISTRATOR, TRANSFER AGENT AND FUND |

| Ultimus Fund Distributors, LLC | ACCOUNTANT |

| 225 Pictoria Drive, Suite 450 | Ultimus Fund Solutions, LLC |

| Cincinnati, OH 45246 | 225 Pictoria Drive, Suite 450 |

| | Cincinnati, OH 45246 |

| | |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC

Member FINRA/SIPC

FISHER INVESTMENTS INSTITUTIONAL GROUP FUND FAMILY |

Annual Report

August 31, 2021

Fisher Investments Institutional Group

Stock Fund for Retirement Plans

Fisher Investments Institutional Group

ESG Stock Fund for Retirement Plans

Fisher Investments Institutional Group

Fixed Income Fund for Retirement Plans

Fisher Investments Institutional Group

ESG Fixed Income Fund for Retirement Plans

Fund Adviser:

Fisher Asset Management, LLC

5525 NW Fisher Creek Drive,

Camas, Washington 98607

(800) 851-8845

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited)

Dear Shareholder:

Market Outlook

Global developed markets and emerging markets (EM) has continued to rise, turning in a positive first half to the year. Despite growth stocks outperformance in global developed markets, value stocks have been outperforming lately, beating growth stocks. However, that trend, as well as several sector and country winners and losers, reversed in June — a sign of things to come in our view. We think this trend is durable as stocks focus on the likelihood of global economies slowing after an initial reopening surge.

In our view, stocks are beginning to look beyond the next few months and ahead to a post-pandemic normal. Future growth likely returns to pre-pandemic trends—an environment that favors growth stocks over value, in our view. While countertrends have no preset durations, growth stocks have made up some ground in the last couple of months. Although COVID-19 could always stir sentiment in the short term, we think markets are focusing more on the global economy’s likelihood of slowing after an initial reopening surge. While the bull market in developed world stocks likely continues for the foreseeable future, growth stocks’ recent leadership is a sign of things to come, in our view.

After reaching post-Brexit trade deal in December 2020, the UK proposed a free-trade deal with Australia despite strong resistance from British farmers. The EU and Emerging Market India agreed to resume talks, which have been dormant since 2013, on a comprehensive trade deal. Yet Brussels also suffered a setback with Switzerland. After seven years of talks, Bern left negotiations for an updated EU deal, which sought to simplify and modernize their economic relationship by replacing scores of bilateral agreements with an overarching treaty. However, markets largely looked past all of this news as trade agreement progress did not correlate with regional outperformance. In our view, this is a reminder that trade developments don’t have a preset market impact. Changes often take a long time to become reality—usually beyond the timeframe we think stocks focus on. Even if both sides reach an agreement after long negotiations, the terms are usually implemented over many years. This gradual, drawn-out process dampens most surprise power.

Regional elections in France grabbed headlines, as President Emmanuel Macron’s La Republique en Marche (LREM) party and presidential challenger Marine Le Pen’s National Rally both had worse-than-expected showings. Many treated the results as a sign for next year’s national elections, penciling in the Republicans’ Xavier Bertrand with President Macron and Marine Le Pen in a three-person race, potentially upending

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

the long-running presumption that the second round would be a rematch between the latter two. However, in our view, local elections don’t predict national votes. For one, LREM is a young party, lacking the grass roots operations necessary to thrive at the local level. Two, voter turnout was just under 35%—well below the two-thirds of voters who participated in 2017’s presidential race. Politically, the outcome may be a wakeup call for LREM and President Macron, who will probably focus on less controversial matters (e.g., COVID-19 relief) as next year’s election looms.

India’s battle with COVID-19 during the quarter was a humanitarian tragedy. Yet at times like this, we believe it is crucial to remember that markets are unemotional and, as a result, see through events like this and focus on corporate prospects over the next 3 – 30 months. Illustrating this, Indian stocks rose overall. Indian banks got a big boost as they revised their estimated loan losses lower from the prolonged lockdown, easing widespread concerns over the financial impact of the country’s tragic ordeal with COVID-19. Buoyed by Financials and the prospect of much lower loan loss reserves, Indian stocks overall surged in May 2021. Markets have been familiar with India’s infrastructure challenges for many years now, making the vaccine distribution difficulties sadly unsurprising. Overall, we think that as time passes, the faster recoveries in developed nations will help pull the rest of the world along.

Chinese data probably remains inconsistent a while longer, but the overall trend of slowing growth probably continues as the government continues trying to rein in perceived excess in the shadow financing world. The degree of government intervention was arguably one of investors’ main concerns during China’s correction, as regulators increasingly concentrated on Tech and Tech-like firms’ forays into commercial finance, sparking fears of drastic intervention. Those fears seemingly came true when The Wall Street Journal reported that regulators ordered large Internet platforms to unload all extra financial services from their mobile payment apps. The move drove speculation that if they want to continue providing financial services beyond mobile payments, big Chinese Tech firms will have to follow Ant Financial’s lead and reorganize as traditional financial institutions subject to normal banking regulations. This might seem negative, but markets barely reacted, which we think is logical. For one, markets seemingly dealt with this fear in March 2021, as rumors of future intervention swirled. Two, the largest Chinese internet platforms are well equipped to handle these changes, which may create barriers to entry for new competition, making these changes a long-term benefit. Overall, though, this seems like further confirmation that Chinese officials have shifted fully from their pandemic recovery efforts to their longer-running aims of promoting financial stability, illustrating the return to normal.

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

We expect a brief spike in economic growth largely from base-effect. Following the bounce, we expect the economic trends pre-COVID-19 to return highlighted by a shallow yield curve, tough access to credit and increasingly late cycle sentiment. This favors growth over value with high-quality firms in Tech or Tech-like industries of Internet Retail and Interactive Media as best positioned. Growth companies typically thrive in modest-growth environments as their sales and earnings are less dependent upon a strong economy, and investors seek out firms consistently able to grow. Value companies benefit more from an accelerating economic trajectory, with improved volume and higher operating leverage. We believe economic growth likely begins to inflect as last March’s base effect fades and the economy settles back into a trajectory similar to 2019, before the disruption.

Over halfway into 2021, markets are well familiar with the pandemic’s issues and setbacks—and are looking beyond them. We believe they are pricing in the return to pre-pandemic growth trends, an environment that favors growth stocks over value. In our view, that most benefits the nations and sectors with growth characteristics, though we think maintaining exposure to high-growth value areas makes sense for diversification. Most of all, we expect the bull market in developed world stocks to continue and deliver a good-to-great year.

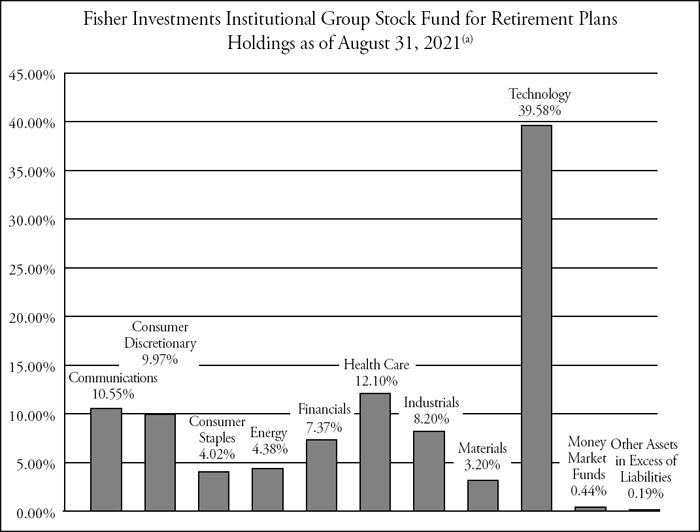

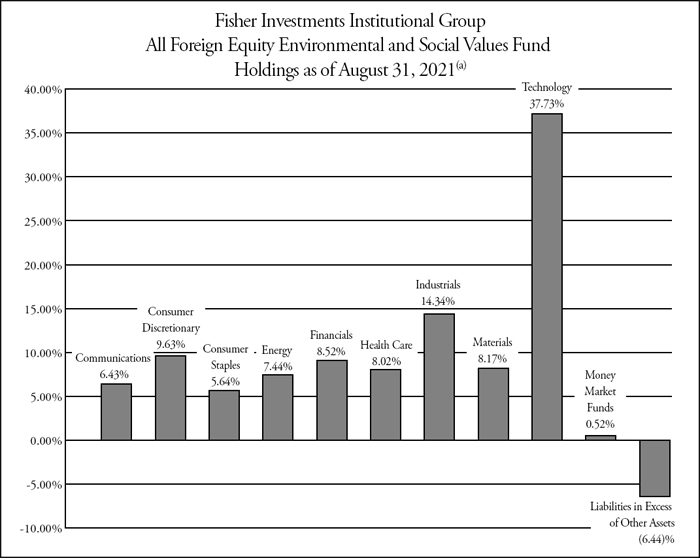

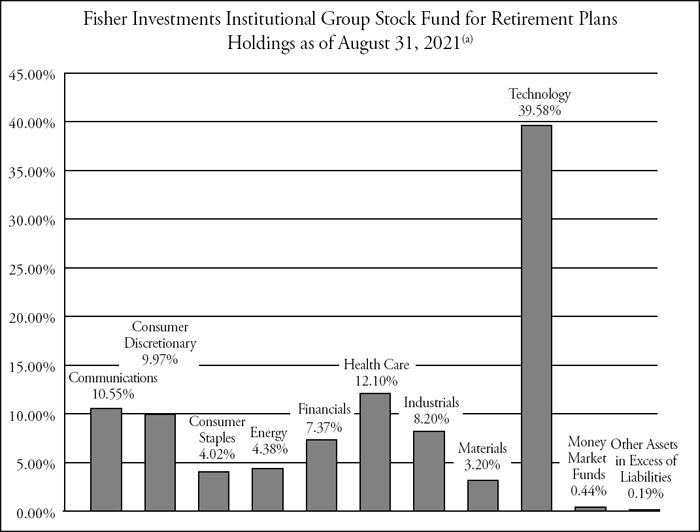

Fisher Investments Institutional Group Stock Fund for Retirement Plans

Performance Attribution

The Fisher Investments Institutional Group Stock Fund for Retirement Plans outperformed the MSCI ACWI Investable Markets Index for the period from September 1, 2020 through August 31, 2021. During this period, the Fund returned 32.06% while the Fund’s primary benchmark, the MSCI ACWI Investable Markets Index, returned 30.10%. Sector and equity selection contributed to relative return, while country allocation detracted. An overweight to and selection within the United States was the largest contributor to relative return, driven by multinational conglomerate Google holding company Alphabet, visual computing company Nvidia and medical device company Align Technology. Additionally, an overweight to and selection within Dutch Information Technology, as the category outperformed the broader benchmark. Conversely, an overweight to and selection within China was the largest detractor from relative return, driven by internet retailer Alibaba, medicine products enterprise Sino Biopharm and internet media company Tencent. Further, a lack of exposure to India detracted, as the country outperformed.

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

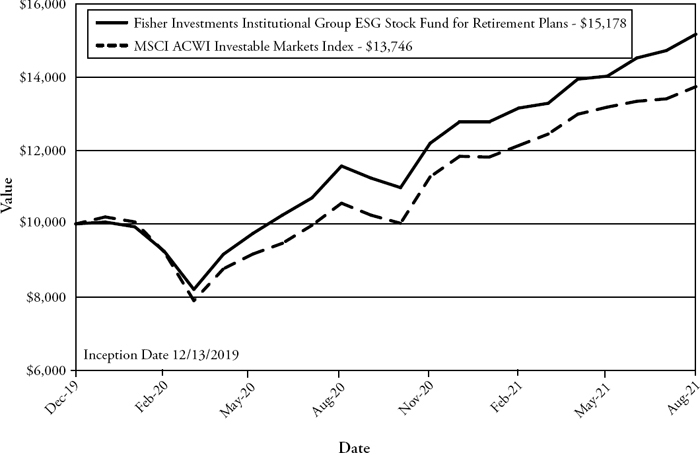

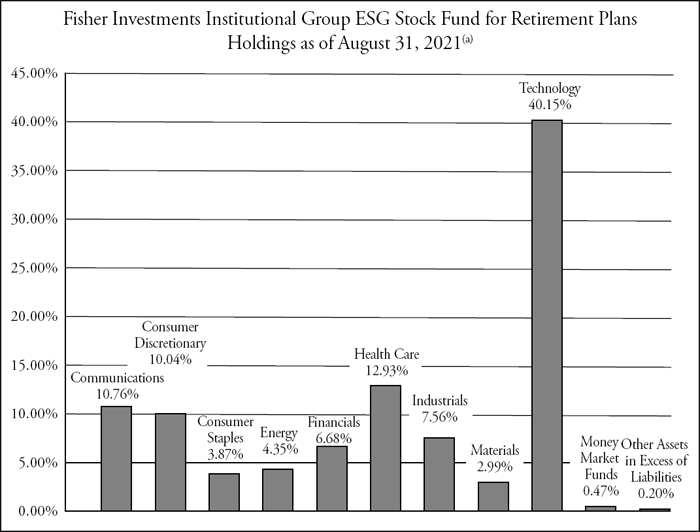

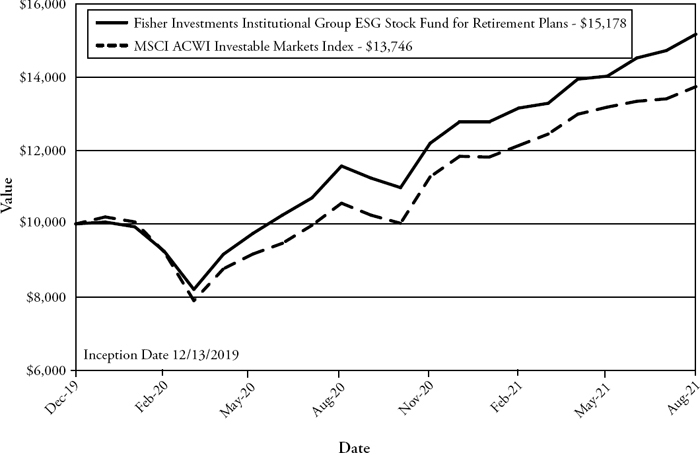

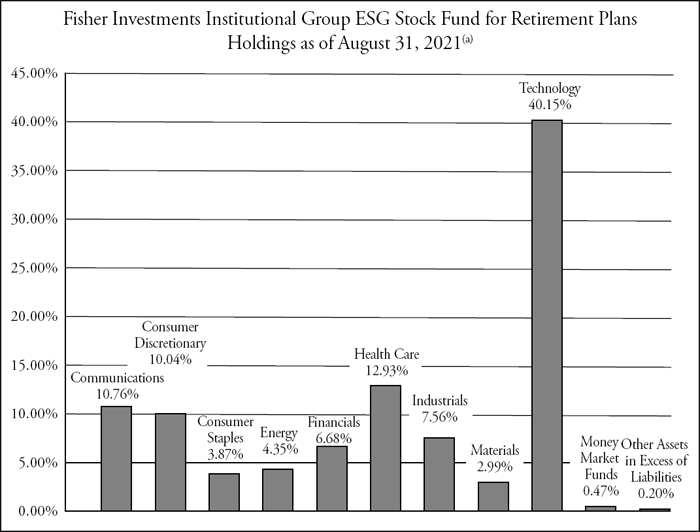

Fisher Investments Institutional Group ESG Stock Fund for Retirement Plans

Performance Attribution

The Fisher Investments Institutional Group ESG Stock Fund for Retirement Plans performed in line with the MSCI ACWI Investable Markets Index for the period from September 1, 2020 through August 31, 2021. During this period, the Fund returned 31.07% while the Fund’s primary benchmark, the MSCI ACWI Investable Markets Index, returned 30.10%. Sector and equity selection contributed to relative return, while country allocation detracted. An overweight to and selection within the United States was the largest contributor to relative return, driven by multinational conglomerate Google holding company Alphabet, visual computing company Nvidia and medical device company Align Technology. Additionally, an overweight to Dutch Information Technology contributed, as the category outperformed the broader benchmark. Conversely, an overweight to and selection within China was the largest detractor from relative return, driven by internet retailer Alibaba, medicine products enterprise Sino Biopharm and internet media company Tencent. Further, selection within United Kingdom detracted, as fast-moving consumer goods company Unilever, global pharmaceutical company GlaxoSmithKline and pharmaceutical and biotechnology company Astra Zeneca underperformed.

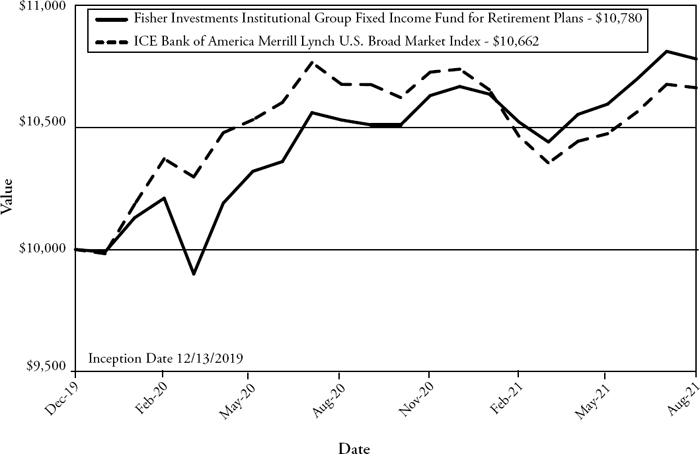

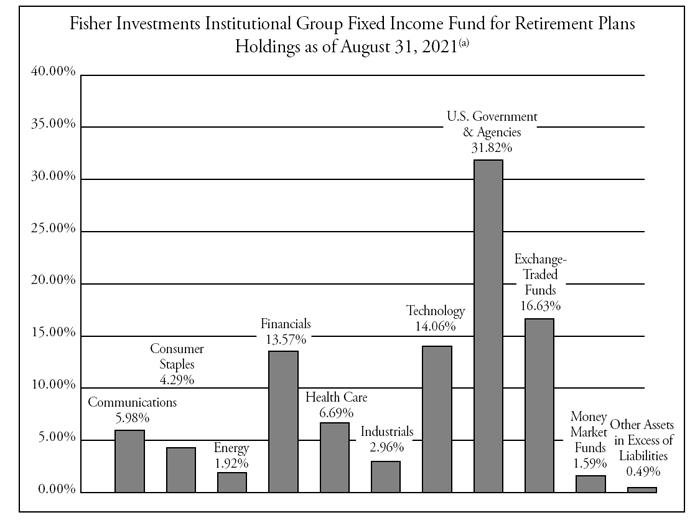

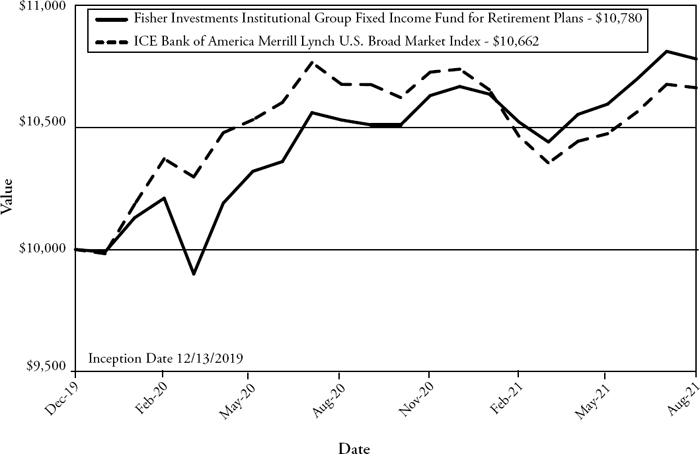

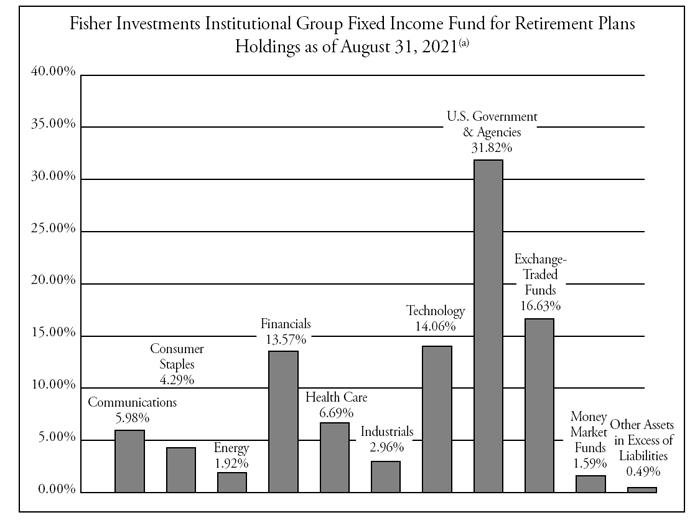

Fisher Investments Institutional Group Fixed Income Fund for Retirement Plans

Performance Attribution

The Fisher Investments Institutional Group Fixed Income Fund for Retirement Plans outperformed ICE Bank of America Merrill Lynch U.S. Broad Market Index for the period from September 1, 2020 through August 31, 2021. During this period, the Fund returned 2.38% while the Fund’s primary benchmark, the ICE Bank of America Merrill Lynch U.S. Broad Market Index, returned -0.14%. An underweight to and selection within Sovereign debt was the largest contributor to relative return. Additionally, an overweight to Corporate Debt contributed as the category outperformed the broader benchmark. Further, a lack of exposure to securitized debt was the largest detractor from relative return as the category outperformed.

FISHER INVESTMENTS INSTITUTIONAL GROUP

MANAGEMENT’S DISCUSSION OF FUND PERFORMANCE

(Unaudited) – (continued)

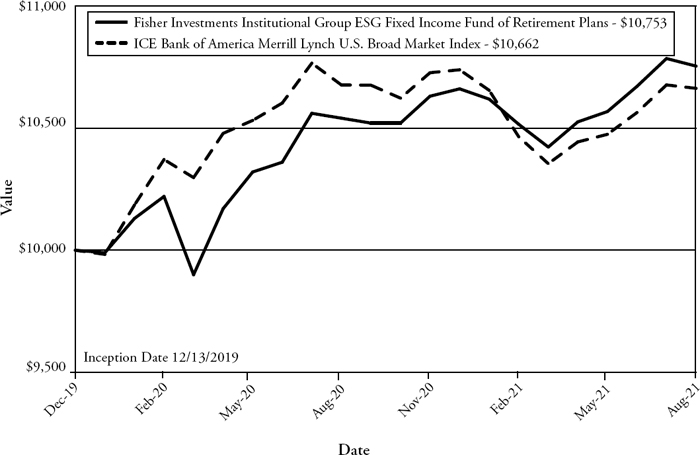

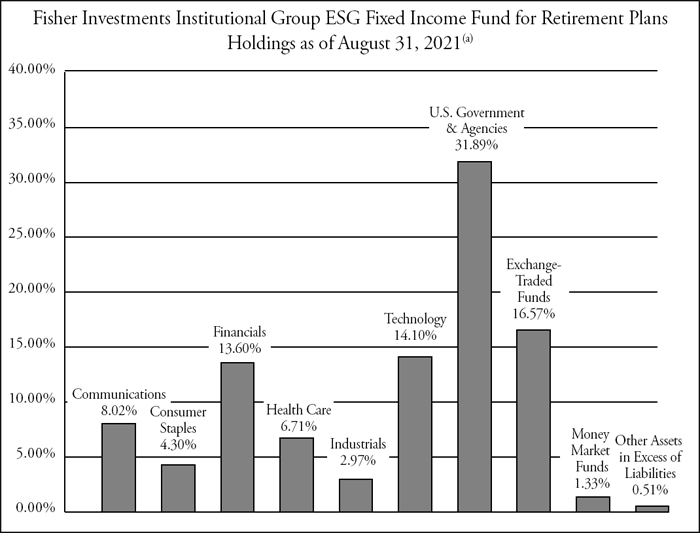

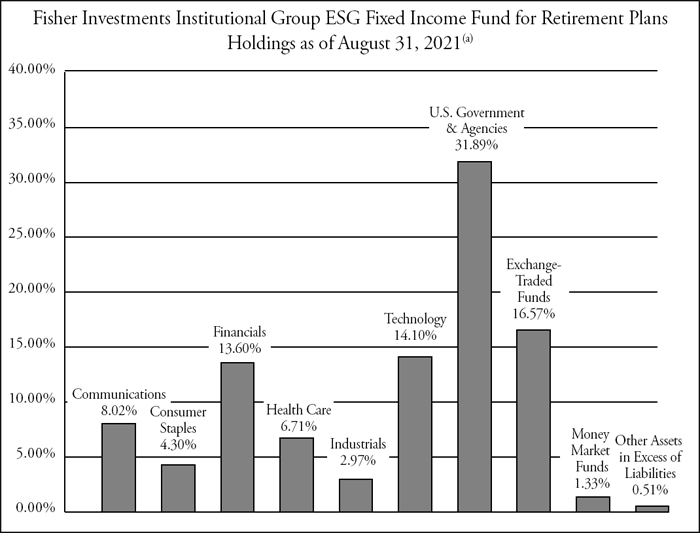

Fisher Investments Institutional Group ESG Fixed Income Fund for Retirement Plans

Performance Attribution

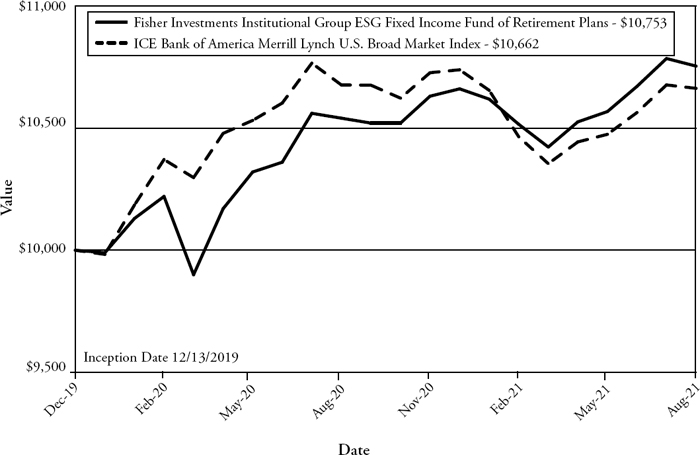

The Fisher Investments Institutional Group ESG Fixed Income Fund for Retirement Plans outperformed the ICE Bank of America Merrill Lynch U.S. Broad Market Index for the period from September 1, 2020 through August 31, 2021. During this period, the Fund returned 2.02% while the Fund’s primary benchmark, the ICE Bank of America Merrill Lynch U.S. Broad Market Index, returned -0.14%. An underweight and selection within Sovereign debt was the largest contributor to relative return. Additionally, an overweight to Corporate Debt contributed as the category outperformed the broader benchmark. Further, a lack of exposure to securitized debt was the largest detractor from relative return as the category outperformed.

FISHER INVESTMENTS INSTITUTIONAL GROUP

STOCK FUND FOR RETIREMENT PLANS

Investment Results (Unaudited)

| Average Annual Total Returns as of August 31, 2021(a) |

| | | | | | Since | |

| | | | | | Inception | |

| | Fund/Index | | 1 Year | | (12/13/19) | |

| | Fisher Investments Institutional Group Stock Fund for Retirement Plans | | 32.06% | | 28.05% | |

| | MSCI ACWI Investable Markets Index(b) | | 30.10% | | 20.35% | |

| | | | | | | |

| | | | | | Expense | |

| | | | | | Ratios(c) | |

| | Gross | | | | 0.00% | |

| | With Applicable Waivers | | | | 0.00% | |

The performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fisher Investments Institutional Group Stock Fund for Retirement Plans (the “Fund”) distributions or the redemption of Fund shares. The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling (800) 851-8845.

| (a) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. |

| (b) | The MSCI ACWI Investable Markets Index is designed to represent performance of the full opportunity set of large, mid, and small-cap stocks across 23 developed and 27 emerging markets. Individuals cannot invest directly in an index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (c) | The expense ratios are from the Fund’s prospectus dated December 29, 2020. Fisher Asset Management, LLC, d/b/a Fisher Investments (the “Adviser”) pays all of the operating expenses of the Funds except portfolio transaction and other investment related costs (including brokerage fees and commissions, and fees and expenses associated with investments in derivative instruments, such as option and swap fees and expenses), taxes, borrowing costs (such as interest and dividend expense on securities sold short), extraordinary expenses, and any indirect expenses (such as fees and expenses associated with investment in acquired funds and other collective investment vehicles). The Fund is available only to eligible retirement plans receiving the Adviser’s managed account or other services. The Fund does not pay a management fee to the Adviser. Retirement plans, plan sponsors and/or plan participants pay a separate fee for the Adviser’s services and also pay fees to record keepers and administrators. If paid from plan assets, these fees will reduce the net return to plan participants but are not reflected in net fund performance. |

The Fund’s investment objective, strategies, risks, charges and expenses must be considered carefully before investing. The Fund’s prospectus contains this and other important information about the investment company and may be obtained by calling (800) 851-8845. Please read it carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

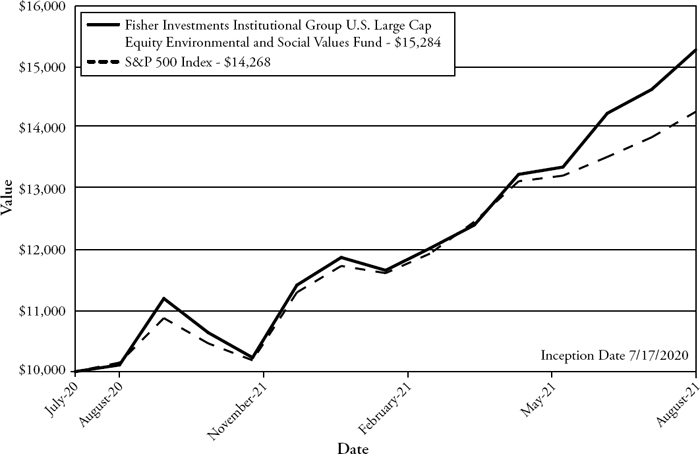

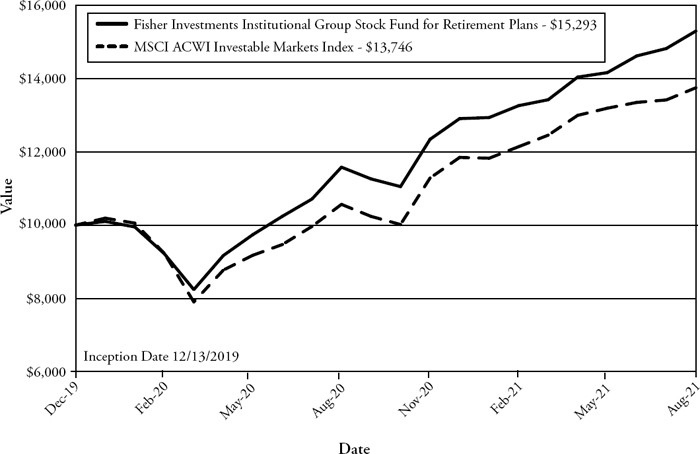

FISHER INVESTMENTS INSTITUTIONAL GROUP

STOCK FUND FOR RETIREMENT PLANS

Investment Results (Unaudited) – (continued)

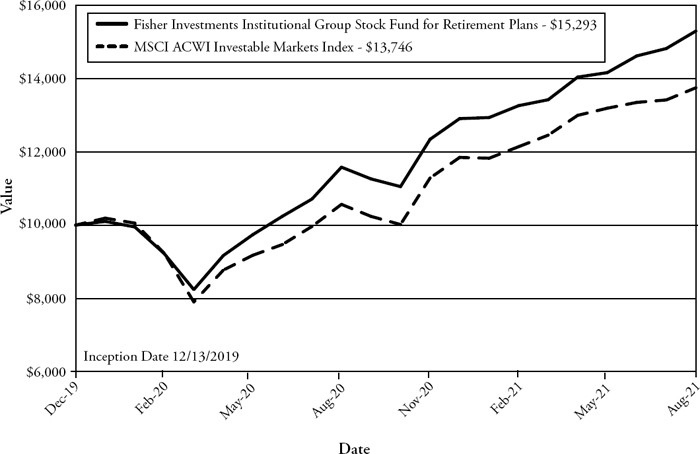

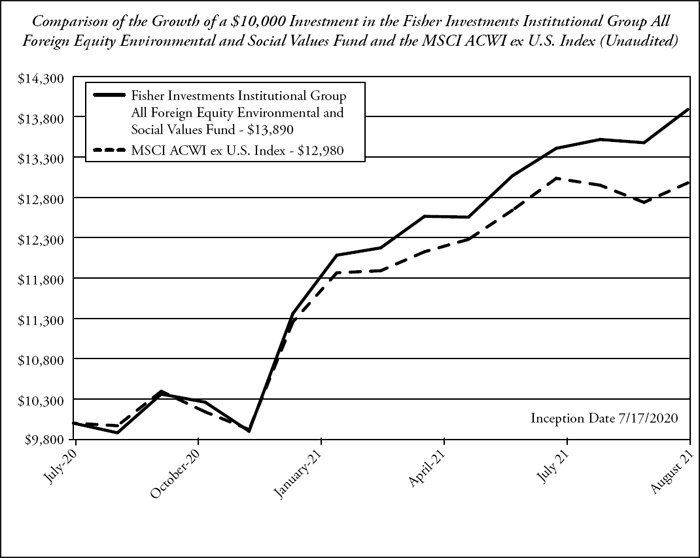

Comparison of the Growth of a $10,000 Investment in the Fisher Investments

Institutional Group Stock Fund for Retirement Plans and the MSCI ACWI Investable

Markets Index (Unaudited)

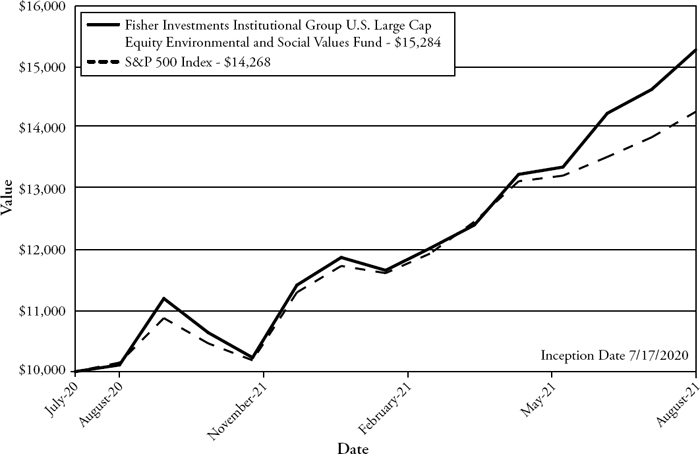

This graph shows the value of a hypothetical initial investment of $10,000 made on December 13, 2019 (commencement of operations) and held through August 31, 2021. The MSCI ACWI Investable Markets Index is designed to represent performance of the full opportunity set of large, mid, and small-cap stocks across 23 developed and 27 emerging markets. THE FUND’S RETURN REPRESENTS PAST PERFORMANCE AND DOES NOT GUARANTEE OR PREDICT FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (800) 851-8845.