SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT ON FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date: Period February 17, 2003

WMC RESOURCES LIMITED

ACN 004 820 419

Level 16, IBM Centre

60 City Road

Southbank, Victoria 3006

Australia

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82-

This report on Form 6-K includes press releases of WMC Limited made during the period December 12, 2002 to February 17, 2003.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

WMC RESOURCES LIMITED

By:

Name: R.E. Mallett

Title: Assistant Company Secretary

Date: February 17, 2002

Announcements

Company Announcements Office

Public Announcement 2002-3WMR

Option Scheme Exercise Price of WMC Resources Options

The Company advises that it has today issued the following number of Options set out in the table below, with the exercise prices set out in the table below, in accordance with the Option Scheme approved by WMC Limited (now Alumina Limited) shareholders and optionholders on 29 November 2002.

The exercise price of each tranche of Options was determined by reference to the exercise price of the existing WMC Limited Options and the volume weighted average price (VWAP) of Alumina Limited shares and WMC Resources shares on the ASX during the first 5 days of trading (ending on 10 December 2002). The VWAP of Alumina Limited shares was $4.72, and the VWAP of WMC Resources shares was $4.07.

WMC Limited Option Plan

| | Expiry Date

| | WMC Limited Exercise Price (A$)

| | WMC Resources Option Exercise Price (A$)

| | No of WMC Resources Options Issued under Option Scheme

|

1997 Option Plan | | 22 December 2002 | | 4.91 | | 2.27 | | 451,300 |

1997 Option Plan* | | 22 December 2002 | | 5.40 | | 2.50 | | 250,000 |

1998 Option Plan | | 21 December 2003 | | 4.88 | | 2.26 | | 963,120 |

1998 Option Plan* | | 21 December 2003 | | 5.37 | | 2.49 | | 375,000 |

1999 Option Plan | | 20 December 2004 | | 8.42 | | 3.90 | | 3,868,000 |

2000 Option Plan | | 18 December 2005 | | 7.52 | | 3.48 | | 6,007,050 |

2001 Option Plan | | 30 November 2006 | | 9.35 | | 4.33 | | 10,060,500 |

May 2002 Option Plan | | 30 November 2006 | | 9.35 | | 4.33 | | 600,000 |

* Options granted to executive directors of WMC Limited.

Each WMC Resources Option entitles the holder to subscribe for one fully paid ordinary share in the Company.

Full details of the Option Scheme were contained in the Scheme Booklet issued by WMC Limited dated 28 October 2002.

Ross Mallett

Assistant Company Secretary

12 December 2002

| | | WMC Resources Ltd |

| | | ACN 004 184 598 |

| | | |

| | | GPO Box 860K |

| | | Melbourne Vic. 3001 |

| | | Australia |

| | | |

| | | Level 16 IBM Centre |

| | | 60 City Road |

| | | Southbank Vic. 3006 |

| | | Australia |

| | | |

| | | Tel +61 (0)3 9685 6000 |

| | | Fax +61 (0)3 9685 6115 |

| | | Company Announcements Office |

Public Announcement 2002-4 WMR

Change of Director’s Interest Notices (Appendix 3Y)

Please find attached Change of Director’s Interest Notices in respect of Mr Hugh Matheson Morgan and Mr Andrew Gordon Michelmore. The above mentioned persons are directors of WMC Resources Ltd which was listed on 4th December 2002 as part of the WMC Limited demerger.

Ross Mallett

Assistant Company Secretary

24 December 2002

| | | WMC Resources Ltd |

| | | ACN 004 184 598 |

| | | |

| | | GPO Box 860K |

| | | Melbourne Vic. 3001 |

| | | Australia |

| | | |

| | | Level 16 IBM Centre |

| | | 60 City Road |

| | | Southbank Vic. 3006 |

| | | Australia |

| | | |

| | | Tel +61 (0)3 9685 6000 |

| | | Fax +61 (0)3 9685 6115 |

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

|

Name of entity | | WMC RESOURCES LTD | | |

|

|

ABN | | 76 004 184 598 | | |

|

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of Director | | Mr Andrew Gordon Michelmore | | |

|

|

Date of last notice | | 11 December 2002 | | |

|

Part 1 – Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Direct or indirect interest | | Direct |

|

|

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

|

|

Date of change | | (a) 20 December 2002 (b) 23 December 2002 |

|

|

No. of securities held prior to change | | Fully paid shares—21,341 Employee share options—380,000 |

|

|

Class | | Ordinary Shares |

|

|

Number acquired

| | (a) N/a (b) On 23 December 2002 Mr Andrew Gordon Michelmore purchased 138,640 fully paid shares under the WMC Limited Senior Executive Share Plan. |

|

| +See | | chapter 19 for defined terms. |

Appendix 3Y Page 2 | | 11/3/2002 |

|

|

Number disposed

| | (a) On 20 December 2002 the WMC Resources Ltd share plan administrator exercised 50,000 employee options upon the expiry of the WMC Limited 1997 Employee Option Plan. (b) N/a |

|

|

Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation

| | (a) The WMC Resources Ltd share plan trustee sold 50,000 shares at a sale price of $4.32 per share. (b) The 138,640 fully paid shares purchased by Mr Andrew Gordon Michelmore under the WMC Limited Senior Executive Share Plan were purchased at an average price of $4.3278 per share. |

|

|

No. of securities held after change

| | Fully paid shares—159,981 Employee share options—330,000 |

|

|

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | Exercise of options upon the expiry of the WMC Limited 1997 Employee Share Option Plan. |

|

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

|

|

Detail of contract | | |

|

|

Nature of interest | | |

|

|

Name of registered holder (if issued securities) | | |

|

|

Date of change | | |

|

|

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | |

|

|

Interest acquired | | |

|

|

Interest disposed | | |

|

|

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | |

|

Appendix 3Y

Change of Director’s Interest Notice

Interest after change

+ See chapter 19 for defined terms.

Appendix 3Y Page 4

11/3/2002

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC RESOURCES LTD |

|

ABN | | 76 004 184 598 |

|

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of Director | | Mr Hugh Matheson Morgan |

|

Date of last notice | | 11 December 2002 |

|

Part 1 - Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Direct or indirect interest | | Direct |

|

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

|

Date of change | | 20 December 2002 |

|

No. of securities held prior to change

| | Fully paid shares— 402,141 Employee share plan options—950,000 |

|

Class | | Ordinary Shares |

|

Number acquired | | N/a |

|

Number disposed

| | On 20 December 2002 the WMC Resources Ltd share plan administrator exercised 250,000 employee options upon the expiry of the WMC Limited 1997 Employee Option Plan. |

|

Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation | | The share plan trustee sold 250,000 shares at a sale price of $4.32 per share. |

|

No. of securities held after change

| | Fully paid shares—402,141 Employee share options—700,000 |

7

Appendix 3Y

Change of Director’s Interest Notice

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | Exercise of options upon the expiry of the WMC Limited 1997 Employee Share Option Plan. |

|

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

Detail of contract

| | Stock Appreciation Rights issued under August 2002 WMC Stock Appreciation Plan. |

|

|

Nature of interest

| | Stock Appreciation Rights are not securities. On redemption of a Stock Appreciation Right before its expiry, the holder is entitled to a payment equal to the difference between the closing price of the WMC Resources Ltd shares on the ASX on the trading day immediately before redemption, and a notional allotment price calculated in accordance with the Rules of the Stock Appreciation Plan, provided the former amount is higher. |

|

|

Name of registered holder (if issued securities) | | The Stock Appreciation Rights were issued to Mr Hugh Matheson Morgan. |

|

|

Date of change | | 2 September 2002 |

|

|

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | N/a |

|

|

Interest acquired | | 400,000 Stock Appreciation Rights |

|

|

Interest disposed | | N/a |

|

|

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | Refer above. |

|

|

Interest after change | | 400,000 Stock Appreciation Rights |

+ See chapter 19 for defined terms.

Appendix 3Y Page 6

11/3/2002

| | | Company Announcements Office |

Public Announcement 2003-1

Appointment of New CEO

As previously foreshadowed, Mr Hugh Morgan has retired as Chief Executive Officer and a director of WMC Resources Ltd with effect from 1 January 2003. Mr Andrew Michelmore has been appointed as Chief Executive Officer in place of Mr Morgan with effect from 1 January 2003.

Ross Mallett

Assistant Company Secretary

7 January 2003

| | | WMC Resources Ltd |

| | | ACN 004 184 598 |

| | | |

| | | GPO Box 860K |

| | | Melbourne Vic. 3001 |

| | | Australia |

| | | |

| | | Level 16 IBM Centre |

| | | 60 City Road |

| | | Southbank Vic. 3006 |

| | | Australia |

| | | |

| | | Tel +61 (0)3 9685 6000 |

| | | Fax +61 (0)3 9685 6115 |

| | | Company Announcements Office |

Public Announcement 2003-2

Please find attached for immediate release, Public Announcement 2003-2 covering WMC’s December 2002 Quarterly Production Report.

A copy of this public announcement will be published on WMC’s web site atwww.wmc.comlater this morning.

WMC’s Chief Executive Officer, Mr Andrew Michelmore, will host an audio conference at 11.00 am this morning which will be broadcast live from WMC’s web site. A recording of this conference will be available for playback on WMC’s web site later today.

Ross Mallett

Assistant Company Secretary

14 January 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

WMC Resources Ltd

Quarterly Review, Quarter ended 31 December 2002

BASIS OF REPORTING

This is the first quarterly production review post demerger and reflects the operating performance of the businesses now comprising WMC Resources Ltd. For comparative purposes, the production figures quoted represent the entire quarter’s performance, notwithstanding that the Copper and Fertilizer operations only transferred to WMC Resources Ltd on 1 December 2002.

Safety, health & environment

There were no significant incidents in the fourth quarter.

Overall, injury rates in 2002 were 21 per cent lower than 2001 and remain at less than one third of the industry average. The improved performance reflects the impact of the company’s safety programs.

Environmental

There were no significant new environmental incidents reported in the fourth quarter.

WMC has been included in the Dow Jones Sustainability Indexes for the third consecutive year. WMC was rated as a sustainability leader in the Basic Materials sector amongst more than 300 companies assessed in 2002. WMC is the only Australian company in the top 50 rated companies.

The listing relates solely to those operations under WMC Resources control.

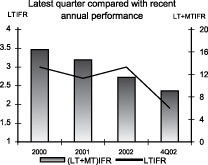

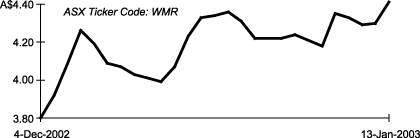

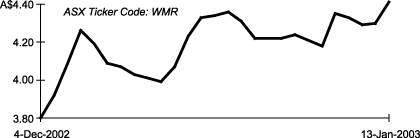

WMC Resources Ltd share price

Dear Shareholder

WMC Resources on track following strong final quarter performance.

Record quarterly production was achieved at Queensland Fertilizers (Phosphate Hill) and the Kwinana Nickel Refinery. Copper production increased 15 per cent at Olympic Dam and nickel-in-matte production increased 17 per cent at the Kalgoorlie Nickel Smelter, over the previous quarter.

Modifications to the sulphuric acid plant at Mount Isa have led to increased acid production and enabled the fertilizer plant at Phosphate Hill to operate at design capacity since early October.

Consistent smelter performance and process improvements contributed to the increased production at Olympic Dam.

Projects to further improve nickel recoveries at Mount Keith and Leinster were commissioned during the quarter.

Continued review of materials specifications, contractor productivity, added regulatory requirements and safety criteria (designated by insurance company representatives) have contributed to final estimated rebuild costs for the Solvent Extraction (SX) plant to be in the order of $300 million, with commissioning dates of March 2003 for the uranium plant and July 2003 for the copper plant.

Our production forecasts for 2003, which were reflected in the demerger scheme booklet, take account of the furnace reline at Olympic Dam, a statutory maintenance shutdown at the Kalgoorlie Nickel Smelter, and the ammonia plant shutdown at Phosphate Hill. While revised commissioning dates of the SX plants at Olympic Dam will reduce copper and uranium output, continued sound operational performances at all sites indicate that the forecasts will be met in all other aspects. Consistent and optimal operating performance is the key controllable value driver which WMC Resources will focus on, recognising that overall results in 2003 will be impacted by many factors, including markets, which face both global economic and political uncertainties.

A G MICHELMORE

Chief Executive Officer

14 January 2003

Production overview

Copper & Uranium

Ongoing performance improvements at Olympic Dam generated a 15 per cent increase in production compared with the previous quarter.

Consistent smelter operation and elimination of minor process bottlenecks were key contributors to the higher production rates.

Further recovery improvements in the uranium circuit offset the production impact of lower uranium grades in the ore processed.

Gold production was constrained by an electrical failure in the gold treatment facility. Production will be consequently higher next quarter.

Nickel

Record metal production of 17,246 tonnes was achieved at the Kwinana refinery. Nickel-in-matte production at the Kalgoorlie smelter was also 17 per cent higher than the previous quarter.

Concentrate production at Kambalda for the quarter was the highest in four years reflecting increased output from the independent operators of the Kambalda nickel mines.

At Mount Keith, concentrate production was lower with a higher proportion of mill feed sourced from lower grade stockpiles. Mining operations have resumed following the pit closure due to the tragic fatality in September 2002.

Projects to further improve nickel recoveries at the Mount Keith and Leinster concentrators were commissioned during the quarter. Recoveries are expected to increase by 1.5 per cent at Mount Keith and 2.3 per cent at Leinster as a result.

Fertilizers

Fertilizer production was at record levels for the quarter.

Modifications to the sulphuric acid plant in early October have facilitated increased acid production and enabled the fertilizer plant to perform at design capacity since that time.

Business Development

Project Activities

Solvent Extraction (SX) Plant Rebuild

The rebuild of the uranium and copper solvent extraction plants to world class risk standards has progressed during the quarter.

Our commitment to the highest safety and environmental standards in scoping the rebuild, as well as heightened regulatory obligations and our insurer’s improvement requirements, will result in this facility creating a benchmark standard.

Project delivery schedules have been impacted by the termination of certain contracts where quality of materials delivered has not met our stringent quality control standards.

A review by a team comprising senior staff of the EPCM contractor, Halliburton, and WMC, has indicated that the likely final cost of delivering the facility to the specified standard will be in the order of $300 million. While appreciably more than the revised September quarter preliminary estimate of $250 million, the financial returns on the redesigned facility remain excellent and the overall cost is consistent with the standards set for the rebuild.

As a consequence of the demanding standards and extended project delivery schedule, 2003 production of copper will be 6,000 tonnes below previous estimates and uranium 500 tonnes lower. Revised commissioning dates are March 2003 for uranium and July 2003 for copper.

Olympic Dam Expansion

Drilling will start late January 2003 to provide further geological, geotechnical and hydrogeological information in respect of the southern orebody. Discussions continued with local indigenous communities to ensure they are kept aware of our program.

Corridor Sands

On 9 December 2002, WMC announced that WMC Resources will acquire 100 per cent of the Corridor Sands titanium dioxide project (Corridor Sands), located in Mozambique, from Southern Mining Corporation Limited. The feasibility study completed in July 2002 confirmed Corridor Sands as a world class resource.

The titanium dioxide industry has demonstrated stable and attractive returns over many years. Corridor Sands is expected to make an important contribution to WMC Resources growth and earnings diversity.

Marketing

WMC Resources has entered into an agreement for the sale of nickel-in-matte with China’s largest nickel producer, Jinchuan Group Ltd (Jinchuan), commencing 2005. This transaction will give WMC Resources access to the fastest growing market for nickel consumption. The transaction involves deliveries of 30,000 tonnes of nickel-in-matte to be made over a number of years.

Exploration Activities

West Musgrave

A diamond drilling program focusing on the Babel, Nebo and Canaan prospects was completed during the quarter. It consisted of 31 holes at Babel, four at Nebo and three at Canaan (within the Scott joint venture). The program was designed to explore for concentrations of higher grade nickel sulphides at Babel and Nebo and to complete infill drilling to enable resource estimation.

Assay results for hole 1085 at Babel include 41.6m averaging 0.81% Ni and 1.37% Cu, beginning at approximately 34m from the surface. This intersection is located 200m east of previous tests in the same geological unit, however its overall significance will be ascertained when assays from remaining holes have been received and compiled.

Airborne electromagnetic surveys continue over selected areas.

Global Exploration

Exploration for nickel sulphide continues in Australia, North America and China.

Exploration for copper-gold and gold deposits continues in Mongolia and Peru. In Mongolia, results of an intense eight-month field reconnaissance campaign with partner Gallant Minerals Ltd are being evaluated. In Peru, exploration tenements have been acquired over promising gold and copper geochemical anomalies defined from reconnaissance surveys.

Timetable 2003

WMC Resources Ltd will release its full year results for 2002 on 26 February 2003.

This event will be webcast through WMC Resources internet site.

12

Summary of WMC Resources’ production

| | | | | Quarter ended 31 December 2002^

| | Quarter ended 30 September 2002^

| | Year ended 31 December 2002^

| | Year ended 31 December 2001^

|

Copper (tonnes of refined copper) | | Olympic Dam Operations | | 48,328 | | 41,966 | | 178,120 | | 200,523 |

|

Uranium Oxide concentrate (tonnes) | | Olympic Dam Operations | | 826 | | 872 | | 2,890 | | 4,379 |

|

Silver (ounces) | | Olympic Dam Operations | | 191,001 | | 131,706 | | 643,935 | | 912,859 |

|

Gold (ounces) | | Olympic Dam Operations | | 13,682 | | 13,003 | | 64,293 | | 113,412 |

|

Nickel (tonnes contained nickel) | | Kambalda Nickel Operations | | 7,720 | | 5,797 | | 23,225 | | 18,653 |

| | | Leinster Nickel Operations | | 10,331 | | 10,501 | | 40,006 | | 38,008 |

| | | Mount Keith Operations | | 9,465 | | 12,157 | | 43,192 | | 47,930 |

| | | Total nickel-in-concentrate | | 27,516 | | 28,455 | | 106,423 | | 104,591 |

| | | Total nickel-in-matte | | 26,901 | | 22,969 | | 91,574 | | 96,650 |

| | | Total nickel metal | | 17,246 | | 16,905 | | 65,055 | | 61,324 |

|

Fertilizer | | | | | | | | | | |

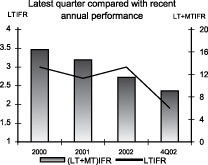

Di-ammonium phosphate (tonnes) | | Phosphate Hill | | 198,448 | | 180,770 | | 718,287 | | 651,498 |

Mono-ammonium phosphate (tonnes) | | Phosphate Hill | | 30,264 | | 13,341 | | 102,713 | | 57,947 |

Total Fertilizer (tonnes) | | Phosphate Hill | | 228,712 | | 194,111 | | 821,000 | | 709,445 |

A statistical supplement providing a detailed breakdown of WMC Resources production results is available on WMC Resources’ Internet home page at http://www.wmc.com

^ The figures quoted represent the production from the operations now comprising WMC Resources Ltd.

13

Hedging

WMC Resources’ revenues vary significantly with movements in commodity prices and the AUD/USD exchange rate. There is an existing hedge position that will be continuously managed.

The demerger of WMC Limited in December 2002 required the hedge book to be revalued to its fair value at the date of demerger. Subsequent to the demerger, the profit and loss for each hedge will be determined by the difference between that particular hedge’s fair value and the spot price at the date of the hedge’s maturity. The following tables show both the rates at which the hedge transactions are contracted with third parties to determine the cash flow impact for each hedge and the rates for determining the profit and loss impact.

Currency

Period

| | Hedged US$m

| | Rate A$/US$

| | Limiting cover* as % net revenue

| | Rate for determining Profit & Loss

|

2003 | | 258 | | 0.6735 | | 26% | | 0.5535 |

2004 | | 221 | | 0.6665 | | 27% | | 0.5452 |

2005-2008 | | 1081 | | 0.6572 | | 21% | | 0.5426 |

Net revenue is based on conservative assumptions and it includes forecast repayments of US$ debt. *’Limiting cover’ includes forward purchases and sales.

Gold

Period

| | Hedged ozs

| | Lowest case price (AUD/oz)

| | Limiting cover* as % of product

| | Rate for determining Profit & Loss

|

2003 | | 85,028 | | 547 | | 98% | | 580 |

2004 | | 80,000 | | 559 | | 82% | | 600 |

2005-2010 | | 450,200 | | 646 | | 67% | | 678 |

Gold production from Olympic Dam is delivered into the gold hedging positions.

Some foreign exchange and gold hedges were reversed as a result of the gold asset sale in 2001. The cash flow impact of these reversals has been deferred to the original settlement date as follows:

| | | 2003

| | 2004

| | 2005

| | 2006

| | 2007

| | 2008

|

Deferred Cashflow | | (33.4) | | (26.6) | | (37.5) | | (28.6) | | (23.4) | | (21.4) |

Scenario tables

As WMC Resources’ hedge positions comprise a combination of limiting and non-limiting cover, at various price levels, any one exchange rate or spot price cannot be used to predict the outcome of WMC Resources’ hedge position. The following table provide an estimate of the realised value under various scenarios taking into account the hedged and unhedged exposures. All realised exchange rate and price estimates include applicable option premium.

Currency

A$/US$

| | Estimated realised rate—$A/US$

|

Rate at maturity

| | 2003

| | 2004

| | 2005-2008

|

0.65 | | 0.6559 | | 0.6544 | | 0.6510 |

0.60 | | 0.6173 | | 0.6168 | | 0.6072 |

0.55 | | 0.5772 | | 0.5775 | | 0.5625 |

0.50 | | 0.5355 | | 0.5365 | | 0.5168 |

Market conditions

Commodity prices

| | | Current | | Average | | Average |

|

| | | Prices at 31/12/02 | | Quarter ended 31/12/02 | | Quarter ended 31/12/01 |

|

Copper* US$/lb | | 0.70 | | 0.70 | | 0.64 |

Nickel* US$/lb | | 3.22 | | 3.22 | | 2.29 |

Gold* US$/oz | | 343 | | 323 | | 279 |

DAP^ US$/t | | 149 | | 153 | | 147 |

Source: Reuters

* Spot prices

^ fob Tampa prices

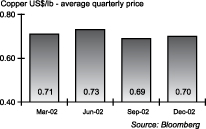

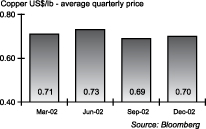

Copper

Copper prices strengthened during the quarter, with the London Metal Exchange (LME) cash price closing at US$1,536 a tonne (US$0.70 a pound), giving an average of US$1,550 a tonne (US$0.70 a pound). The range was US$1,419 to US$1,650 a tonne (US$0.65 to US$0.75 a pound). Prices appear to have found support, with buying from the major funds as they increase their positions.

LME stocks fell for the third consecutive quarter, down 15,675 tonnes (1.8 per cent) to 856,400 tonnes, confirming the views of many market analysts that global supply and demand have moved into balance.

Copper consumption in Asia is firm, while a slower recovery in the US and Europe has contributed to weak demand. With 75 per cent of LME stocks in the US, high freight and handling costs may lead to rising contract premiums and further market tightness.

We continued to experience firm demand from customers in Asia and Australia.

Uranium

Olympic Dam sells most of its uranium under long term contracts which yield a premium over the spot price.

The spot price for uranium as represented by the Nuexco Exchange Value rose from US$9.75 a pound at the beginning of the quarter to US$10.20 at the end of December.

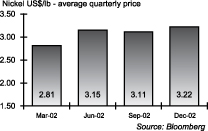

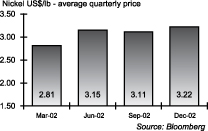

Nickel

Nickel prices strengthened during the quarter, and the average LME price was US$7,095 a tonne (US$3.22 a pound). The range over the period was US$6,445 to US$7,565 a tonne (US$2.92 to US$3.43 a pound). Pricing support came from market fundamentals, including higher stainless steel production and lower inventories. Negative influences included economic uncertainty and concerns in the Middle East.

LME stocks rose by 804 tonnes (3.8 per cent) to 21,990 tonnes.

The outlook for nickel demand is generally positive, and no new major supply is expected over the next few years. However the volume of exports from Norilsk remains uncertain.

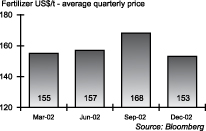

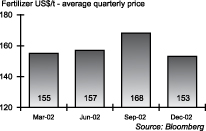

Fertilizer

Di-ammonium phosphate (DAP) prices were weaker during the quarter, falling below US$150 a tonne. Additional supply resulted from increased production as capacity was restarted, and Chinese demand was weak. Pricing is expected to remain soft in the near term due to high Chinese inventories in a seasonally quiet period.

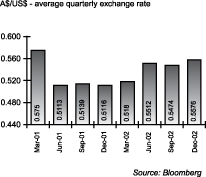

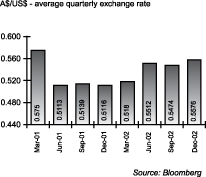

Currency

The Australian dollar (A$/US$) was range-bound during the quarter, trading between 0.5400 and 0.5683 as a result of well-publicised option barriers. These constrained the currency and led to the tightest quarter range in over six years.

The A$ finished the period at 0.5666, supported by higher interest rates relative to the US and Japan as investors seek more attractive yields.

15

WMC Resources Ltd Quarterly Statistical Supplement—Total Production

Quarter Ended 31 December 2002

| | | Quarter ending 31/12/02

| | Quarter ending 30/09/2002

| | Quarter ending 30/06/2002

| | Quarter ending 31/03/2002

| | Quarter ending 31/12/2001

|

COPPER & URANIUM | | | | | | | | | | | | | | | | | | | | |

Ore treated/crushed & head grade | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % |

Olympic Dam Operations | | 2,172,677 | | 2.57 | | 2,235,437 | | 2.67 | | 2,276,650 | | 2.53 | | 2,189,822 | | 2.53 | | 2,225,514 | | 2.52 |

Copper produced | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Olympic Dam Operations | | 48,328 | | 41,966 | | 38,977 | | 48,849 | | 43,606 |

Uranium oxide concentrate produced & head grade | | tonnes | | kg/tonne | | tonnes | | kg/tonne | | tonnes | | kg/tonne | | tonnes | | kg/tonne | | tonnes | | kg/tonne |

Olympic Dam Operations | | 826 | | 0.69 | | 872 | | 0.76 | | 595 | | 0.64 | | 597 | | 0.66 | | 678 | | 0.75 |

Refined silver produced & head grade | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne |

Olympic Dam Operations | | 191,001 | | 4.12 | | 131,706 | | 4.86 | | 157,184 | | 4.08 | | 164,044 | | 4.09 | | 226,959 | | 4.30 |

Refined gold produced & head grade | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne | | ounces | | g/tonne |

Olympic Dam Operations | | 13,682 | | 0.51 | | 13,002 | | 0.52 | | 17,948 | | 0.53 | | 19,661 | | 0.55 | | 28,596 | | 0.50 |

| | | | | | | | | | | | | | | | | | | | | |

NICKEL | | | | | | | | | | | | | | | | | | | | |

Ore treated and head grade | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % |

Kambalda Nickel Operations1 | | 216,687 | | 4.03 | | 168,392 | | 3.95 | | 183,590 | | 3.58 | | 119,801 | | 3.46 | | 177,611 | | 3.36 |

Leinster Nickel Operations | | 657,619 | | 2.01 | | 682,303 | | 2.02 | | 700,142 | | 1.95 | | 530,621 | | 1.99 | | 623,697 | | 1.95 |

Mount Keith Nickel Operations | | 2,752,407 | | 0.54 | | 2,829,929 | | 0.62 | | 2,731,299 | | 0.60 | | 2,741,317 | | 0.56 | | 2,672,090 | | 0.59 |

Concentrate produced & concentrate grade | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % | | tonnes | | grade % |

Kambalda Nickel Operations | | 50,727 | | 15.22 | | 40,276 | | 14.39 | | 40,049 | | 14.66 | | 27,982 | | 13.71 | | 38,513 | | 14.10 |

Leinster Nickel Operations | | 78,230 | | 13.21 | | 81,587 | | 12.87 | | 82,309 | | 12.94 | | 69,376 | | 12.29 | | 80,281 | | 12.10 |

Mount Keith Nickel Operations | | 42,071 | | 22.50 | | 63,171 | | 19.24 | | 58,232 | | 19.68 | | 54,128 | | 18.68 | | 63,010 | | 17.80 |

Nickel contained in concentrate | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Kambalda Nickel Operations | | 7,720 | | 5,797 | | 5,872 | | 3,836 | | 5,436 |

Leinster Nickel Operations | | 10,331 | | 10,501 | | 10,650 | | 8,524 | | 9,703 |

Mount Keith Nickel Operations | | 9,465 | | 12,157 | | 11,461 | | 10,109 | | 11,185 |

Total | | 27,516 | | 28,455 | | 27,983 | | 22,469 | | 26,324 |

Smelter feed & matte produced (tonnes) | | Feed | | Matte | | Feed | | Matte | | Feed | | Matte | | Feed | | Matte | | Feed | | Matte |

Kalgoorlie Nickel Smelter | | 179,695 | | 38,858 | | 160,610 | | 33,511 | | 175,651 | | 37,222 | | 124,557 | | 24,847 | | 180,888 | | 35,722 |

Nickel contained in matte | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Kalgoorlie Nickel Smelter | | 26,901 | | 22,969 | | 25,089 | | 16,615 | | 24,153 |

Matte treated | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Kwinana Nickel Refinery | | 26,041 | | 25,613 | | 26,471 | | 22,568 | | 26,000 |

Nickel packaged | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Kwinana Nickel Refinery | | 17,246 | | 16,905 | | 17,002 | | 13,902 | | 16,864 |

| | | | | | | | | | | | | | | | | | | | | |

FERTILIZER | | | | | | | | | | | | | | | | | | | | |

Fertilizer | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

DAP—Phosphate Hill | | 198,448 | | 180,770 | | 126,014 | | 213,055 | | 163,351 |

MAP—Phosphate Hill | | 30,264 | | 13,341 | | 59,108 | | 0 | | 57,947 |

Total Fertilizer | | tonnes | | tonnes | | tonnes | | tonnes | | tonnes |

Phosphate Hill | | 228,712 | | 194,111 | | 185,122 | | 213,055 | | 221,298 |

| | 1 | | 97% represents purchase third party feeds. Corresponding data for the previous period is 90%, 77%, 64%, and 59% respectively. |

| | | Company Announcements Office |

Public Announcement 2003-3

In accordance with Listing Rule 2.7 please find enclosed Appendix 3B, application for quotation of additional securities.

Ross Mallett

Assistant Company Secretary

30 January 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

Rule 2.7, 3.10.3, 3.10.4, 3.10.5

Appendix 3B

New issue announcement,

application for quotation of additional securities

and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 1/7/96. Origin: Appendix 5. Amended 1/7/98, 1/9/99, 1/7/2000, 30/9/2001, 11/3/2002.

Name of entity |

|

WMC Resources Limited |

|

We (the entity) give ASX the following information.

Part 1—All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | |

|

1 | | +Class of +securities issued or to be issued | | Fully Paid Ordinary Shares |

| | | |

|

| | | | | |

| | | |

|

2 | | Number of +securities issued or to be issued (if known) or maximum number which may be issued | | 947,050 |

| | | |

|

| | | | | |

| | | |

|

3 | | Principal terms of the +securities (eg, if options, exercise price and expiry date; if partly paid +securities, the amount outstanding and due dates for payment; if +convertible securities, the conversion price and dates for conversion) | | The securities in (2) above comprise of 947,050 shares arising from options that were exercised during the period. Option exercise prices and expiry dates are detailed in Attachment “A”. |

| | | |

|

+ See chapter 19 for defined terms.

11/3/2002

Appendix 3B Page 1

| | | |

|

4

| | Do the +securities rank equally in all respects from the date of allotment with an existing +class of quoted +securities? If the additional securities do not rank equally, please state: • the date from which they do • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | Securities rank equally from date of allotment. | | |

| | | |

|

| | | | | | | |

| | | |

|

5 | | Issue price or consideration | | Refer to Attachment “A” | | |

| | | |

|

| | | | | | | |

| | | |

|

6 | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets) | | Refer to Item 3 above. | | |

| | | |

|

| | | | | | | |

| | | |

|

7 | | Dates of entering +securities into uncertificated holdings or despatch of certificates | | Following allotment. | | |

| | | |

|

| | | | | | | |

| | | |

|

| | | | | Number | | +Class |

| | | |

|

8 | | Number and +class of all +securities quoted on ASX (including the securities in clause 2 if applicable) | | 1,128,351,047 | | Fully paid Ordinary Shares. |

| | | |

|

| | | |

|

| | | | | Number | | +Class |

| | | |

|

9 | | Number and +class of all +securities not quoted on ASX (including the securities in clause 2 if applicable) | | Refer to Attachment “A”. | | |

| | | |

|

| | | | | | | |

| | | |

|

10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | N/A | | |

| | | |

|

Part 2 - Bonus issue or pro rata issue

| | | |

|

11 | | Is security holder approval required? | | |

| | | |

|

| | | | | |

| | | |

|

12 | | Is the issue renounceable or non-renounceable? | | |

| | | |

|

| | | | | |

| | | |

|

13 | | Ratio in which the +securities will be offered | | |

| | | |

|

| | | | | |

| | | |

|

14 | | +Class of +securities to which the offer relates | | |

| | | |

|

| | | | | |

| | | |

|

15 | | +Record date to determine entitlements | | |

| | | |

|

| | | | | |

| | | |

|

16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | |

| | | |

|

| | | | | |

| | | |

|

17 | | Policy for deciding entitlements in relation to fractions | | |

| | | |

|

| | | | | |

| | | |

|

18

| | Names of countries in which the entity has +security holders who will not be sent new issue documents Note: Security holders must be told how their entitlements are to be dealt with. Cross reference: rule 7.7. | | |

| | | |

|

| | | | | |

| | | |

|

19 | | Closing date for receipt of acceptances or renunciations | | |

| | | |

|

+See chapter 19 for defined terms.

11/3/2002

Appendix 3B Page 3

| | | |

|

20 | | Names of any underwriters | | |

| | | |

|

|

21 | | Amount of any underwriting fee or commission | | |

| | | |

|

|

22 | | Names of any brokers to the issue | | |

| | | |

|

|

23 | | Fee or commission payable to the broker to the issue | | |

| | | |

|

|

24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of +security holders | | |

| | | |

|

|

25 | | If the issue is contingent on +security holders’ approval, the date of the meeting | | |

| | | |

|

|

26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | |

| | | |

|

|

27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | |

| | | |

|

|

28 | | Date rights trading will begin (if applicable) | | |

| | | |

|

|

29 | | Date rights trading will end (if applicable) | | |

| | | |

|

|

30 | | How do +security holders sell their entitlementsinfull through a broker? | | |

| | | |

|

|

31 | | How do +security holders sellpart of their entitlements through a broker and accept for the balance? | | |

| | | |

|

+ See chapter 19 for defined terms.

Appendix 3B Page 4

11/3/2002

32 | | How do +security holders dispose of their entitlements (except by sale through a broker)? | | |

| | | |

|

|

33 | | +Despatch date | | |

| | | |

|

Part 3 – Quotation of securities

You need only complete this section if you are applying for quotation of securities

|

34 | | Type of securities (tick one) |

|

(a) | | x Securities described in Part 1 |

|

(b) | | ¨ All other securities Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities |

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

(If the additional securities do not form a new class, go to 43)

Tick to indicate you are providing the information or documents |

35 | | ¨ | | If the +securities are +equity securities, the names of the 20 largest holders of the additional +securities, and the number and percentage of additional +securities held by those holders |

|

36 | | ¨

| | If the +securities are +equity securities, a distribution schedule of the additional +securities setting out the number of holders in the categories 1 – 1,000 1,001 – 5,000 5,001 – 10,000 10,001 – 100,000 100,001 and over |

|

37 | | ¨ | | A copy of any trust deed for the additional +securities |

(now go to 43)

+ See chapter 19 for defined terms.

11/3/2002

Appendix 3B Page 5

Entities that have ticked box 34(b)

| | | |

|

38 | | Number of securities for which +quotation is sought | | |

| | | |

|

39 | | Class of +securities for which quotation is sought | | |

| | | |

|

40

| | Do the +securities rank equally in all respects from the date of allotment with an existing +class of quoted +securities? If the additional securities do not rank equally, please state: • the date from which they do • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | |

| | | |

|

41

| | Reason for request for quotation now Example: In the case of restricted securities, end of restriction period (if issued upon conversion of another security, clearly identify that other security) | | |

| | | |

|

| | | |

|

| | | | | Number | | +Class |

| | | |

|

42 | | Number and +class of all +securities quoted on ASX (including the securities in clause 38) | | | | |

| | | |

|

(now go to 43)

| + | | See chapter 19 for defined terms. |

Appendix 3B Page 6

11/3/2002

All entities

Fees

43 | | Payment method (tick one) |

|

| | | ¨ | | Cheque attached |

|

| | | x | | Electronic payment made Note: Payment may be made electronically if Appendix 3B is given to ASX electronically at the same time. |

|

| | | ¨ | | Periodic payment as agreed with the home branch has been arranged Note: Arrangements can be made for employee incentive schemes that involve frequent issues of securities. |

Quotation agreement

1 | | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

|

2 | | We warrant the following to ASX. |

|

| | | · | | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

|

| | | · | | There is no reason why those+securities should not be granted+quotation. |

|

| | | · | | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

|

| | | | | Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty |

|

| | | · | | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

|

| | | · | | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

|

| | | · | | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

| + | | See chapter 19 for defined terms. |

11/3/2002

Appendix 3B Page 7

3 | | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

|

4 | | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

Sign here: | | | | Date: | | 30 January 2003 |

| | | (Company Secretary) | | | | |

|

Print name: | | Ross E. Mallett | | | | |

| +See | | chapter 19 for defined terms. |

Appendix 3B Page 8 | 11/3/2002 |

Attachment “A”

Details of Securities Issued

| | | Shares

| | Issue Price

| | Issue Date

| | Share Capital

|

| | | 701,300 | | $2.27 | | | | 1,591,951 |

| | | 36,900 | | $2.26 | | | | 83,394 |

| | | 119,900 | | $3.90 | | | | 467,610 |

| | | 88,950 | | $3.48 | | | | 309,546 |

| | |

| | | | | |

|

Shares to be Quoted | | 947,050 | | | | | | $2,452,501 |

| | |

| | | | | |

|

Details of Securities Not Quoted on the ASX

Unquoted Securities as at 04/12/02

| | Description

| | Options exercised

| | Options lapsed

| | Options issued

| | Unquoted Securities As at 31/12/02

|

701,300 | | (a) | | employee options expiring 22/12/2002 exerciseable at $2.27 ($4.91 pre-demerger) | | 701,300 | | 0 | | | | 0 |

1,338,120 | | (b) | | employee options expiring 21/12/2003 exerciseable at $2.26 ($4.88 pre-demerger) | | 36,900 | | 0 | | | | 1,301,220 |

3,868,000 | | (c) | | employee options expiring 20/12/2004 exerciseable at $3.90 ($8.42 pre-demerger) | | 119,900 | | 0 | | | | 3,748,100 |

6,007,050 | | (d) | | employee options expiring 18/12/2005 exerciseable at $3.48 ($7.52 pre-demerger) | | 88,950 | | 0 | | | | 5,918,100 |

10,060,500 | | (e) | | employee options expiring 30/11/2006 exerciseable at $4.33 (9.35 pre-demerger) | | 0 | | 78600 | | | | 9,981,900 |

600,000 | | (f) | | employee options expiring 30/11/2006 exerciseable at $4.33 ($9.35 pre-demerger) | | 0 | | 0 | | | | 600,000 |

| | | (g) | | employee options expiring 23/12/2007 exercised at 4.34 | | 0 | | 0 | | 10,951,860 | | 10,951,860 |

| | | | | | | | | | | | | 0 |

| | | | | | |

| |

| |

| |

|

22,574,970 | | TOTAL OPTIONS | | 947,050 | | 78,600 | | 10,951,860 | | 32,501,180 |

| | | | | | |

| |

| |

| |

|

Quoted Securities as at 30.06.02 | | 1,127,403,997 |

plus Securities subject to this application for quotation | | 947,050 |

| | |

|

TOTAL SECURITIES TO BE QUOTED ON ASX | | 1,128,351,047 |

| | |

|

Value

| | Fee

|

| | | $2,452,501 | | |

| | |

| | |

($1,740+.093% on excess | | | | $1,740.00 |

over $500,000) | | | | $1,815.83 |

| | | | |

|

Total Fee | | | | $3,555.83 |

| | | | |

|

To: | | The Manager Announcements Company Announcements Office | | |

Public Announcement 2003-4

WMC Resources Ltd today announced that the conditions precedent to the acquisition of 100% of the Corridor Sands titanium dioxide project in Mozambique had been satisfied. This followed the approval of the sale by shareholders of the Johannesburg listed Southern Mining Corporation Limited (SMC).

The final tranche of the purchase price, which will be up to US$25 million to be paid in shares or cash, is to be made before the end of 2003.

The Industrial Development Corporation of South Africa retains its existing option to acquire a 10% interest in the project.

Chief Executive Officer, Andrew Michelmore, said that with the conditions to which the acquisition was subject being satisfied, WMC Resources could now continue to progress the Corridor Sands project, which is the world’s largest known undeveloped resource of titaniferous mineral sands.

“A feasibility study completed in the third quarter of 2002 confirmed that the Corridor Sands titanium dioxide resource is capable of supporting the development of a large, long-life, profitable and growing business. Since the announcement of the agreement with SMC in December last year, a number of parties have expressed interest in joining us in developing the project,” Mr Michelmore said.

Peter Horton

Company Secretary

31 January 2003

| | | WMC Resources Ltd ACN 004 184 598 |

For further information, please call: Tania Price, Group Manager Public Affairs on; (03) 96856233 or 0419 502 852 | | GPO Box 860K Melbourne Vic. 3001 Australia |

|

| | | Level 16 IBM Centre 60 City Road Southbank Vic. 3006 Australia |

|

| | | Tel +61 (0)3 9685 6000 Fax +61 (0)3 9685 6115 |