SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT ON FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date: Period August 4, 2003

WMC RESOURCES LTD

ACN 004 184 598

Level 16, IBM Centre

60 City Road

Southbank, Victoria 3006

Australia

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

This report on Form 6-K includes press releases of WMC Resources Ltd made during the period February 27, 2003 – August 4, 2003. Forms F-4 and 20-F have also been lodged separately with the SEC during this period.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

WMC RESOURCES LTD

By:

Name: R.E. Mallett

Title: Assistant Company Secretary

Date: 14 August 2003

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-7

WMC Resources Board Appointment

The WMC Resources Board today announced the appointment of Executive General Manager—Operations, Mr Alan Dundas, to the Board, effective 12 March 2003.

WMC Resources Chairman, Mr Ian Burgess, said that Mr Dundas would bring to the Board valuable expertise and a detailed understanding of the company’s operations.

Mr Dundas, 46, was appointed as EGM, Operations in December 2001. He joined WMC in 1994 as Resident Manager at the Kwinana Nickel Refinery and has held the positions of General Manager, Nickel Operations and EGM — Nickel.

Prior to joining WMC, Mr Dundas was General Operations Manager for Nabalco in the Northern Territory. He has held a variety of operational roles in the coal industry in Queensland and British Columbia, Canada and in the tarsand business in Northern Alberta, Canada.

Mr Dundas has a formal qualification in civil engineering and is a fellow of the Australasian Institute of Mining and Metallurgy.

The Board of WMC Resources now comprises 7 independent non-executive directors and 2 executive directors.

| |

Ross Mallett Assistant Company Secretary | | |

| | | WMC Resources Ltd |

| | | ACN 004 184 598 |

| |

13 March 2003 | | GPO Box 860K |

| | | Melbourne Vic. 3001 |

| | | Australia |

| |

| For further information, please call: | | Level 16 IBM Centre |

Tania Price, Group Manager Public Affairs on: | | 60 City Road |

(03) 96856233 or 0419 502 852 | | Southbank Vic. 3006 |

| | | Australia |

| |

| | | Tel +61 (0)3 9685 6000 |

| | | Fax +61 (0)3 9685 6115 |

To: | | The Manager |

| | | Announcements |

| | | Company Announcements Office |

Public Announcement 2003-8

Please find attached Initial Director’s Interest Notice (Appendix 3X) in respect of WMC Resources Ltd Director, Mr Alan Dundas.

A copy of this can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Peter Horton

Company Secretary

18 March 2003

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

Appendix 3X

Initial Director’s Interest Notice

Rule 3.19A.1

Appendix 3X

Initial Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC Resources Ltd |

| |

ABN | | 76 004 820 419 |

We (the entity) give ASX the following information under listing rule 3.19A.1 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of Director | | Alan Kevin DUNDAS |

| |

Date of appointment | | 12 March 2003 |

Part 1—Director’s relevant interests in securities of which the director is the registered holder

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Number & class of securities |

|

115,157 Ordinary Shares in WMC Resources Ltd 202,000 Options in WMC Resources Ltd |

Part 2—Director’s relevant interests in securities of which the director is not the registered holder

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Name of holder & nature of interest | | Number & class of Securities |

| Note: Provide details of the circumstances giving rise to the relevant interest. | | |

| |

Nil | | |

| + | | See chapter 19 for defined terms. |

11/3/2002 | | Appendix 3X Page 3 |

Appendix 3X

Initial Director’s Interest Notice

Part 3—Director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

Detail of contract | | N/A |

| |

Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

No. and class of securities to which

interest relates | | |

| + | | See chapter 19 for defined terms. |

Appendix 3X Page 2 | | 11/3/2002 |

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-10

Please find attached for immediate release, Public Announcement 2003-10 covering WMC Resources Ltd’s March 2003 Quarterly Production Report.

A copy of this public announcement will be published on WMC’s web site atwww.wmc.com later this morning.

WMC’s Chief Executive Officer, Mr Andrew Michelmore, will host an audio conference at 11.00am this morning which will be broadcast live from WMC’s web site. A recording of this conference will be available for playback on WMC’s web site later today.

Ross Mallett

Assistant Company Secretary

15 April 2003

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

WMC Resources Ltd

Quarterly Review, Quarter ended 31 March 2003

Safety, health & environment

Safety, health and environment

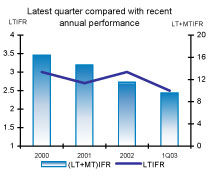

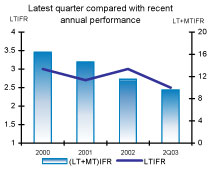

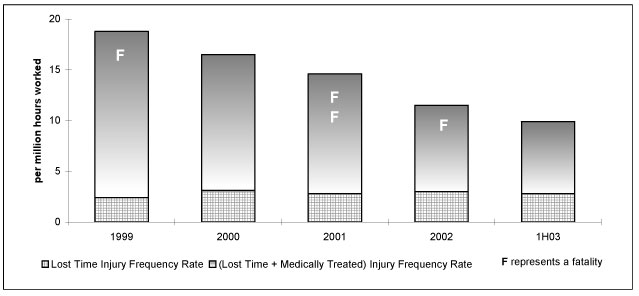

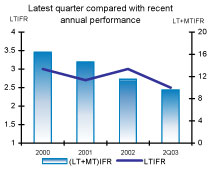

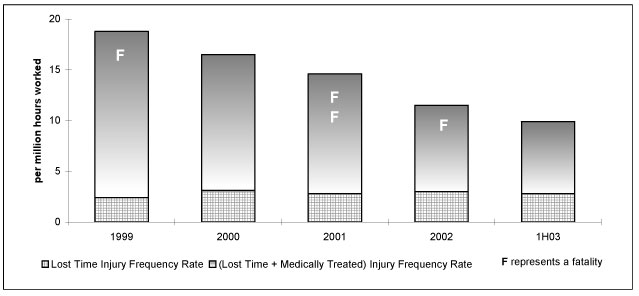

First quarter 2003 safety, health and environment performance continued to show improvement over previous quarters.

No significant safety or environmental incidents were recorded for the period.

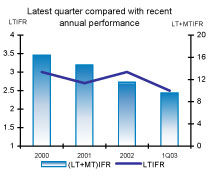

Our lost time and medical treatment injury frequency rate of 9.6 was a 17 per cent improvement over the 2002 average.

The continued downward trend in injury rates reflects the ongoing implementation and application of the WMC Resources’ EH&S Management System and improvement programs.

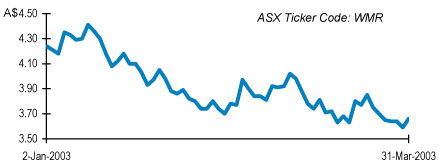

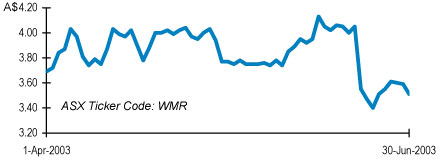

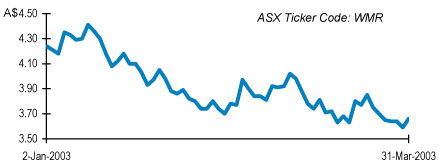

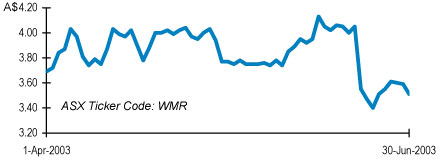

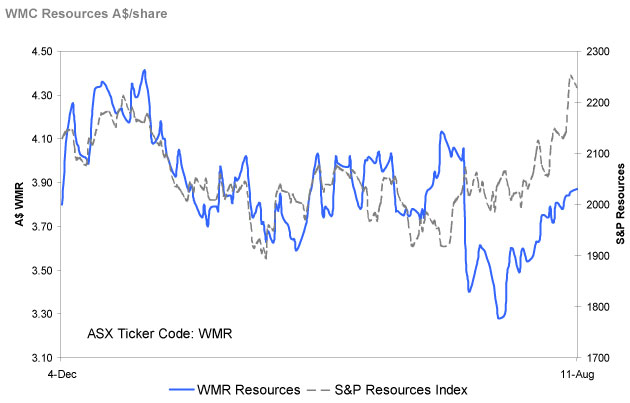

WMC Resources Ltd share price

Dear Shareholder

WMC Resources on track to meet the 2003 production targets.

We are on track for, and remain committed to, delivering the full year targeted production levels. Subdued first quarter production and first half forecast for our nickel operations are the result of scheduled maintenance programs, which are proceeding to plan.

The highlight for the quarter was record fertilizer production with stable operating performance at near design rates.

At Olympic Dam, gold production doubled during the March quarter. Copper production was 14 per cent lower due to a planned reline of the slag furnace and restocking of the refinery following strong production in the December quarter.

Scheduling and expenditure on the Olympic Dam copper and uranium solvent extraction plant rebuild are on track and remain as previously advised.

Reduced nickel-in-matte production reflected a planned statutory maintenance shutdown at the Kalgoorlie smelter. Metal production at the Kwinana refinery was correspondingly lower with statutory inspections scheduled to coincide with the smelter shutdown.

The Mount Keith feasibility study has confirmed expansion of nickel ore throughput by 25 per cent to 14 million tonnes per annum as a robust project with returns exceeding our targets. Implementation options to optimise returns are being assessed.

Corridor Sands project work continues on schedule across all technical and commercial streams.

The outlook for the June quarter is for increased copper, nickel-in-concentrate and nickel metal production with nickel-in-matte and fertilizer at similar levels to the March quarter. Consistent and optimal operating performance remains our priority and the key controllable value driver for WMC Resources.

|

A G MICHELMORE Chief Executive Officer 15 April 2003 |

WMC Resources Ltd

ABN 76 004 184 598

| Quarter ended 31 March 2003 | |  |

Production overview

Copper & Uranium

Smelter throughput was in line with the previous quarter.

The annual reline of the slag cleaning furnace commenced on 5 March. The reline takes one month and constrains copper production by 4,000 tonnes each year. The furnace has since been recommissioned on schedule. The slag furnace will be modified during the smelter shutdown in August/September to enhance cooling capacity and increase campaign durations from one to four years.

Copper production was lower in the March quarter, reflecting the slag furnace reline and restocking of the refinery following the strong December quarter.

Uranium oxide production was reduced due to lower head grades and deferral of some ore throughput to capitalise on planned higher recoveries from the new uranium solvent extraction circuit.

Gold production doubled in the March quarter with the conversion into bullion of stocks built up during the previous quarter.

The outlook for the June quarter is for copper production to increase with the slag furnace back in operation and commissioning of a new higher capacity concentrate burner in the smelter.

Planning for the smelter flash furnace reline and major maintenance is well advanced with the shutdown scheduled to start in the second half of August.

Production targets for 2003 remain at 185,000 tonnes of copper and 3,600 tonnes of uranium oxide.

Nickel

Nickel-in-matte production was lower, reflecting a planned statutory maintenance shutdown at the Kalgoorlie smelter which commenced on 25 March. The smelter was recommissioned on 11 April and is now operating at full production rates.

Production of concentrate and metal was correspondingly lower, with maintenance at other operations scheduled to coincide with the smelter shutdown. This included a mill reline at Leinster and statutory autoclave inspections at the Kwinana refinery.

Higher recoveries at Mount Keith and Leinster largely offset the impact on concentrate production of lower ore grades at Kambalda.

Full year production targets remain at 99,000 tonnes of nickel-in-matte and 67,000 tonnes of nickel metal.

The outlook for the June quarter includes:

| • | | higher concentrate production with higher ore grades and recoveries at Mount Keith and Leinster; |

| • | | maintaining first quarter matte production levels with the smelter ramping back up to full production rates by mid-April; |

| • | | slightly higher metal production with the balance of the 2003 autoclave inspections scheduled to be completed during April. |

The Mount Keith feasibility study has confirmed expansion of throughput by 25 per cent to 14 million tonnes per annum as a robust project. Implementation options, including incremental expansion, are being assessed.

Further drilling has identified the 11 Mile Well deposit near Leinster as a potential ore source to replace the Harmony open cut mine which is scheduled to close in the first half of 2004. The 11 Mile Well is a small satellite deposit located eight kilometres south of the Leinster concentrator and is suited to open cut mining. A feasibility study will be completed by year-end.

Geophysical results have indicated potential extensions to ore zones at the Cliffs nickel deposit eight kilometres south of Mount Keith. Further drilling is underway and metallurgical testing has confirmed that Cliffs ore is suitable for the Leinster concentrator. WMC Resources has an option to acquire Cliffs from MPI Nickel.

Fertilizers

In a period of improved fertilizer pricing, our fertilizer production increased to record levels, equivalent to an annualised rate of almost 950,000 tonnes. This reflects the benefits of a program to address minor process bottlenecks now that plant performance has stabilised near design rates.

Similar performance levels are expected in the June quarter.

Planning is well advanced for the scheduled statutory maintenance shutdown of the ammonia plant during the September quarter.

Fertilizer production is well placed for the target of 870,000 tonnes for 2003.

Business Development

Solvent Extraction Plant Rebuild

Rebuilding the uranium and copper solvent extraction plants at Olympic Dam continued during the quarter.

Schedule and expenditure remain as previously advised.

Construction of the uranium plant is nearing completion and a rigorous testing and commissioning program designed to ensure compliance with strict fire prevention, detection and containment standards has commenced. The plant is expected to be operating by the end of April.

Olympic Dam Expansion Study

The drilling phase of the expansion study commenced this quarter with approximately 6,500 metres drilled from a program of 40,000 metres. This program will deliver geological, geotechnical and hydrology data to enable an appropriate decision to be made on the future mining methods and scales at Olympic Dam. Work has also commenced to assess vital infrastructure requirements, in particular water and power, with initial discussion on these issues with the South Australian Government’s taskforce.

Corridor Sands

WMC Resources completed the acquisition of 100 per cent of the Corridor Sands Limitada (CSL) on 30 January 2003.

The Industrial Development Corporation of South Africa holds an option, exercisable during the first half of 2003 to acquire 10 per cent of CSL.

Project work continues across all technical and commercial streams. The project remains in line with previously advised timeframes.

Exploration Activities

West Musgrave

Analysis of the 2002 drilling results at the Nebo/Babel project is nearing completion and an update will be provided in the next quarterly report.

Global Exploration

Exploration for nickel sulphide continued in Australia, North America and China and for copper-gold deposits in Mongolia and Peru.

In Mongolia, a drilling program to test for copper-gold deposits at the Khuvyn Khar prospect has commenced.

Annual General Meeting

WMC Resources Ltd will hold its Annual General Meeting at 10.00am (Melbourne time) on Friday, 2 May 2003 in the Regent Theatre, 191 Collins Street, Melbourne.

The Annual General Meeting will be webcast live, together with the Chairman’s and CEO’s speeches and the formal meeting proceedings.

| Quarter ended 31 March 2003 | |  |

Summary of WMC Resources’ production

| | | | | Quarter ended

31 March

2003^

| | Quarter ended

31 December

2002^

| | Quarter ended

31 March

2002^

|

Copper (tonnes of refined copper) | | Olympic Dam Operations | | 41,678 | | 48,328 | | 48,849 |

| | | | |

Uranium Oxide concentrate(tonnes) | | Olympic Dam Operations | | 635 | | 826 | | 597 |

| | | | |

Silver (ounces) | | Olympic Dam Operations | | 149,666 | | 191,001 | | 164,044 |

| | | | |

Gold (ounces) | | Olympic Dam Operations | | 26,931 | | 13,682 | | 19,661 |

| | | | |

Nickel (tonnes contained nickel) | | Kambalda Nickel Operations | | 6,409 | | 7,720 | | 3,836 |

| | | Leinster Nickel Operations | | 9,700 | | 10,331 | | 8,524 |

| | | Mount Keith Operations | | 10,167 | | 9,465 | | 10,109 |

| | | Total nickel-in-concentrate | | 26,276 | | 27,516 | | 22,469 |

| | | Total nickel-in-matte | | 22,084 | | 26,901 | | 16,615 |

| | | Total nickel metal | | 15,171 | | 17,246 | | 13,902 |

| | | | |

Fertilizer | | | | | | | | |

Di-ammonium phosphate(tonnes) | | Phosphate Hill | | 202,928 | | 198,448 | | 213,055 |

Mono-ammonium phosphate(tonnes) | | Phosphate Hill | | 31,072 | | 30,264 | | — |

Total Fertilizer (tonnes) | | Phosphate Hill | | 234,000 | | 228,712 | | 213,055 |

A statistical supplement providing a detailed breakdown of WMC Resources’ production results is available on WMC Resources’ Internet home page at http://www.wmc.com

| ^ | | The figures quoted represent the production from the operations now comprising WMC Resources Ltd. |

| Quarter ended 31 March 2003 | |  |

Hedging

Commodity & Currency Hedging as at 31 March 2003

WMC Resources’ revenues vary significantly with movements in commodity prices and the AUD/USD exchange rate. There is an existing hedge position that will be continuously managed.

The hedge book was marked-to-market at the date of demerger. Consequently, the profit and loss for each hedge will be determined by the difference between that particular hedge’s fair value and the spot price at the date of the hedge’s maturity.

The following tables show both the rates at which the hedge transactions are contracted with third parties to determine the cash flow impact for each hedge and the rates for determining the profit and loss impact.

Currency (as at 31 March 2003)

| | | Forward Sale of US$

| | Synthetic Forward Sale of US$

| | |

Period

| | Amount

US$m

| | Cash Flow Rate

A$/US$

| | Amount US$m

| | Cash Flow Rate A$/US$

| | Profit & Loss Rate

A$/US$

|

2003 | | 155 | | 0.6745 | | 47 | | 0.6479 | | 0.5535 |

2004 | | 228 | | 0.6753 | | 73 | | 0.6402 | | 0.5452 |

2005-2008 | | 737 | | 0.6740 | | 345 | | 0.6239 | | 0.5426 |

A synthetic forward consists of a bought US$ put and a written US$ call option. The written US$ call option has the potential to knock out above certain exchange rates.

Gold (as at 31 March 2003)

| | | Forward Sale of Gold

| | |

Period

| | Amount

Ounces

| | Cash Flow Rate A$/oz

| | Profit & Loss Rate

A$/oz$

|

2003 | | 60,795 | | 548 | | 580 |

2004 | | 80,000 | | 559 | | 600 |

2005-2010 | | 450,200 | | 646 | | 678 |

Gold production from Olympic Dam is delivered into the gold hedging positions.

Some foreign exchange and gold hedges were reversed as a result of the gold asset sales in 2001. The cash flow impact of these reversals has been deferred to the original settlement date as follows:

| | | 2003 remainder

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| |

Deferred Cashflow(A$m) | | (22.8 | ) | | (26.5 | ) | | (37.4 | ) | | (28.6 | ) | | (23.4 | ) | | (21.2 | ) |

Scenario tables

As WMC Resources’ hedge positions comprise a combination of limiting and non-limiting cover, at various price levels, any one exchange rate or spot price cannot be used to predict the outcome of WMC Resources’ hedge position. The following table provides an estimate of the realised value under various scenarios, taking into account the hedged and unhedged exposures. All realised exchange rate and price estimates include applicable option premium.

Currency

A$/US$

| | Estimated realised rate - $A/US$

|

Rate at maturity

| | 2003

| | 2004

| | 2005-2008

|

0.65 | | 0.6546 | | 0.6543 | | 0.6511 |

0.60 | | 0.6146 | | 0.6164 | | 0.6081 |

0.55 | | 0.5766 | | 0.5769 | | 0.5641 |

0.50 | | 0.5352 | | 0.5357 | | 0.5191 |

| Quarter ended 31 March 2003 | |  |

Market conditions

Commodity prices

| | | Current

| | Average

| | Average

|

| | | Prices

at

31/03/03

| | Quarter

ended

31/03/03

| | Quarter

ended

31/12/02

|

Copper*

US$/lb | | 0.72 | | 0.75 | | 0.70 |

Nickel* US$/lb | | 3.52 | | 3.78 | | 3.22 |

Gold* US$/oz | | 333 | | 351 | | 323 |

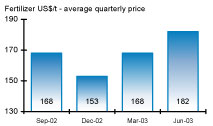

DAP^ US$/t | | 195 | | 168 | | 153 |

Source: Reuters

Copper

The copper price strengthened during the quarter and the average LME cash price was US$1,663/t (US$0.75/lb), up 7 per cent on the previous quarter. Prices rose strongly during the first part of the quarter, reaching $1,728/t (US$0.78/lb) before falling in line with other commodity prices and equity markets as a result of an uncertain global economic outlook and concerns about the duration of the conflict in Iraq.

LME copper stocks fell for the fourth consecutive quarter, down 4.8 per cent (40,700 tonnes) to 815,700 tonnes.

Copper consumption remains firm in Asia, particularly China, where double-digit consumption growth is expected again this year, while slower economic activity in Europe and the US has stalled consumption there. We continue to experience firm demand from our customers in Asia and Australia.

Uranium

Olympic Dam sells most of its uranium under long-term contracts that yield a premium over the spot price.

The spot price for uranium as represented by the Nuexco Exchange fell from US$10.20/lb at the beginning of the quarter to US$10.10/lb in March.

Nickel

The nickel price was significantly higher during the quarter, with the average LME cash price at US$8,337/t (US$3.78/lb), up 17 per cent over the previous quarter. The range over the period was US$7,210 to US$9,105/t (US$3.27 to US$4.13/lb), the highest price since June 2000.

Pricing support resulted from favourable market fundamentals, including higher stainless steel production, low inventories and tight scrap availability. Negative influences included global economic uncertainty, the conflict in Iraq and large deliveries of full plate cathodes into LME warehouses. LME stocks rose by 11 per cent (2,406 tonnes) to 24,396 tonnes.

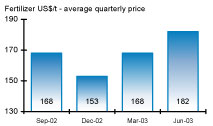

Fertilizer

The DAP price increased substantially over the period, with a range of US$149/t (fob Tampa) to US$195/t. Several factors contributed to the price strength, including strong demand for product on international markets and a rapid increase in raw material costs that has forced producers to raise prices or reduce output. The DAP price has also been undergoing cyclical recovery since mid 2001, and this improvement has continued.

Prices are expected to soften slightly in the short-term as seasonal demand in Europe, Latin America and Australia declines through May. Weakness should be limited due to high raw material prices and tight margins for producers.

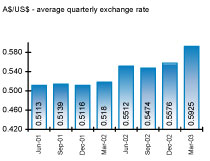

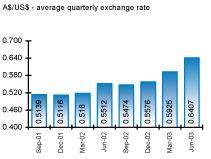

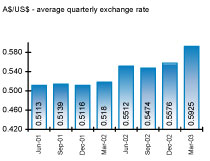

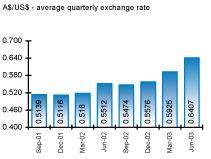

Currency

The Australian dollar was substantially stronger during the period, with the average rate 6 per cent higher than the previous period at A$/US$0.5925. A 3-year high of A$/US$0.6180 was reached before the A$ closed the quarter at A$/US$0.6006. Positive factors for the A$ included US$ weakness, resulting from poor economic and market conditions, along with strong interest rate differentials and a resilient domestic economy.

Attachment “A”

Details of Securities Issued

| | | Shares

| | Issue

Price

| | Issue Date

| | Expirry Date

| | Description

| | Share Capital

|

| | | 71,700 | | $ | 2.26 | | | | 21.12.03 | | Empolyee Options Exercised | | $ | 162,042 |

| | | 290,000 | | $ | 2.49 | | | | 21.12.03 | | | | | 722,100 |

| | | 162,600 | | $ | 3.90 | | | | 20.12.04 | | | | | 634,140 |

| | | 517,900 | | $ | 3.48 | | | | 18.12.05 | | | | | 1,802,292 |

| | | 26,200 | | $ | 4.33 | | | | 30.11.06 | | | | | 113,446 |

| | |

| | | | | | | | | | |

|

|

| Shares to be Quoted | | 1,068,400 | | | | | | | | | Total Share Capital to be Quoted | | $ | 3,434,020 |

| | |

| | | | | | | | | | |

|

|

Details of Securities Not Quoted on the ASX

Unquoted Securities as at 30/12/02

| | Description

| | Options

Exercised

| | Options Lapsed

| | Options Issued

| | Unquoted Securities As at

30/06/03

|

| 926,220 | | (a) employee options expiring 21/12/2003 exercisable at $2.26 | | 71,700 | | 0 | | | | 854,520 |

| 375,000 | | (b) employee options expiring 21/12/2003 exercisable at $2.49 | | 290,000 | | 0 | | | | 85,000 |

| 3,748,100 | | (c) employee options expiring 20/12/2004 exercisable at $3.90 | | 162,600 | | 36,900 | | | | 3,548,600 |

| 5,918,100 | | (d) employee options expiring 18/12/2005 exercisable at $3.48 | | 517,900 | | 9,000 | | | | 5,391,200 |

| 9,981,900 | | (e) employee options expiring 30/11/2006 exercisable at $4.33 | | 26,200 | | 374,400 | | | | 9,581,300 |

| 600,000 | | (f) employee options expiring 30/11/2006 exercisable at $4.33 | | 0 | | 0 | | | | 600,000 |

| 10,951,860 | | (g) employee options expiring 23/12/2007 exercised at $4.34 | | 0 | | 391,060 | | 322,800 | | 10,883,600 |

|

| 32,501,180 | | TOTAL OPTIONS | | 1,068,400 | | 811,360 | | 322,800 | | 30,944,220 |

|

| Quoted Securities as at 31.12.02 | | 1,128,351,047 |

| plus Securities subject to this application for quotation | | 1,068,400 |

| | |

|

| TOTAL SECURITIES TO BE QUOTED ON ASX | | 1,129,419,447 |

| | |

|

Value

| | Fee

|

| $3,434,020 | | | |

| (4,800+.0.05066667% on excess | | $ | 4,800.00 |

| over $2,500,000) | | $ | 473.24 |

| | |

|

|

| Total Fee | | $ | 5,273.24 |

| | |

|

|

11

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-11

WMC Resources Ltd is holding its Annual General Meeting on Friday, 2 May 2003 at 10.00am, in the Regent Theatre, 191 Collins Street, Melbourne.

Items of business to be considered at the meeting include the Company’s 2002 financial statements and reports and re-election of directors. The Chairman and CEO will also review the Company’s performance for 2002 and the outlook for 2003.

Shareholders unable to attend the Annual General Meeting at the Melbourne venue, can view the meeting through the live webcast from WMC’s website atwww.wmc.com

Enquiries should be directed to:

| • | | Media enquiries: Tania Price (03) 9685 6233 |

| • | | Investor enquiries: Nerida Mossop on (03) 9685 6236 |

| |

Ross Mallett Assistant Company Secretary | | |

| | | WMC Resources Ltd |

| | | ACN 004 184 598 |

| |

30 April 2003 | | GPO Box 860K |

| | | Melbourne Vic. 3001 |

| | | Australia |

| |

| | | Level 16 IBM Centre |

| | | 60 City Road |

| | | Southbank Vic. 3006 |

| | | Australia |

| |

| | | Tel +61 (0)3 9685 6000 |

| | | Fax +61 (0)3 9685 6115 |

To: | | The Manager |

| | | Announcements |

| | | Company Announcements Office |

Public Announcement 2003-12

Please find attached Change of Director’s Interest Notice (Appendix 3Y) in respect of WMC Resources Ltd Director, Mr Tommie Bergman.

A copy of this notice can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

1 May 2003

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC RESOURCES LTD |

| |

ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of Director | | Mr Tommie Carl-Eric Bergman |

| |

Date of last notice | | 11 December 2002 |

Part 1—Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Direct or indirect interest | | Direct |

| |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

| |

Date of change | | 28 April 2003 |

| |

No. of securities held prior to change | | 10,000 Fully paid shares |

| |

Class | | Ordinary Shares |

| |

Number acquired | | 30,000 Fully paid shares |

| |

Number disposed | | N/a |

| |

Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation | | $3.76 per share |

| |

No. of securities held after change | | 40,000 Fully paid shares |

| |

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | On-market purchase. |

| + | | See chapter 19 for defined terms. |

Appendix 3Y Page 2 | | 11/3/2002 |

Part 2—Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

Detail of contract | | N/a |

| |

Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

Date of change | | |

| |

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | |

| |

Interest acquired | | |

| |

Interest disposed | | |

| |

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | |

| |

Interest after change | | |

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-13

Please find attached for immediate release, a copy of the Annual General Meeting Address to be presented to shareholders today.

A copy of the Annual General Meeting Address will be published on WMC’s website atwww.wmc.com later this morning.

Ross Mallett

Assistant Company Secretary

2 May 2003

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

Chairman’s Address

Good morning ladies and gentlemen, I am Ian Burgess, Chairman of WMC Resources Ltd’s Board of Directors and I will be chairing today’s Annual General Meeting.

I would like to welcome you to the first annual meeting of WMC Resources Ltd following the demerger of WMC Limited and listing of WMC Resources Ltd on the Australian Stock Exchange in December last year.

I also welcome those observing the meeting through our Internet broadcast. We are broadcasting the meeting to provide access to as many shareholders and employees as possible.

Firstly, I am pleased to announce that the Board has agreed that Tommie Bergman will succeed me as Chairman from today.

Focus on performance

It is more than four months since the demerger and the board is pleased with how the company has adapted to its changed circumstances and performed. There are no surprises to report.

We have achieved a smooth transition and have a company that is very focused on operating and financial objectives.

The company and the board have made clear since the demerger that our focus going forward is very much on optimising performance of our existing assets and operations, as well as identifying and exploiting targeted growth opportunities.

Because we are a different company to when I last had the opportunity of addressing you, I will describe the company as it is today and outline some of the goals we are aspiring to.

Our assets

WMC Resources has some of the best resources assets in the world - large, long-life and low cost, in the businesses of nickel, copper/uranium and ammonia phosphate fertilizer.

We are the world’s third largest nickel producer, a particularly good position to be in at this time of strong nickel demand.

Olympic Dam in South Australia produces two percent of the world’s copper and seven percent of the world’s uranium needs and has the potential to be greatly expanded.

Out of northern Queensland, we are currently producing the world’s lowest cost fertilizer and, in an environment of industry consolidation, we are Australia’s only producer of ammonia phosphate fertilizers.

Late last year we announced the acquisition of the whole of the Corridor Sands titanium dioxide asset in Mozambique, whose resources are equivalent to one-third of the world’s known resources of titanium dioxide.

Project development of this asset initially would be in the order of US$500 million.

We continue to explore for nickel sulphides, copper and gold, around the globe, and remain committed to a vigorous exploration program.

We are also looking to access growth opportunities through partnerships, mergers and acquisitions and Andrew Michelmore will explain some of our growth prospects in greater detail later.

Safety performance

Turning to our people - regrettably, last year we had a fatal accident at Mt Keith, when a haul truck driven by Daniel Comrie, a 33-year-old contractor with Roche Mining, fell into the pit.

An investigation into that incident has been held and we are in the process of implementing the recommendations arising from it.

While a fatality is clearly unacceptable, safety continues to be a priority for us, demonstrated by a 21 percent decrease in injury frequency rate over 2001 and a 19 percent year-on-year reduction over the last five years.

We are pleased to say we are continuing to track at about one-third the injury rate of our Australian peer group.

Our people

World-wide, we employ just over 3000 people directly and another 1600 or so indirectly through contractors.

We have a policy of seeking to attract and retain the best available people and encourage them to work collaboratively to achieve the company’s overall goals.

This has been demonstrated in the past months with a number of excellent people joining our management ranks and committing themselves to the new WMC Resources.

With the formation of the new company following last year’s demerger, and a new chief executive in Andrew Michelmore, we have also taken the opportunity to review and refine our people-related goals.

The Board has been strengthened with the appointment of Alan Dundas, Executive General Manager—Operations, who brings to the board a real hands-on understanding of and involvement in the operations.

And our senior executive team of Andrew Michelmore, Alan Dundas, Greg Travers as Executive General Manager—Group Services, Bruce Brook as CFO and newly appointed Michael Nossal as Executive General Manager—Business Strategy and Development is a strong mix of WMC knowledge, industry experience and new ways of thinking.

Our objective

Many of you will know that corporate objectives can be elusive and something of an illusion.

Ours is to achieve total shareholder returns in the top quartile of our peer group companies over any five year time frame.

We recognise that the resources industry is cyclical and that some of our peer companies are in single commodities that may be particularly strong or weak in any given year.

So that is why we have identified a five-year time frame and a goal of being in the top quartile. We think, with this company, that this is achievable.

Our results

Due to the demerger transaction and the associated transfer of businesses between company structures, the statutory result for the year reflects the financials for twelve months of our nickel business operations but only one month of our copper and fertilizer operations.

It also reflects that WMC Resources bore the cost of the demerger and intra-group interest charges for the full 12 months.

So that figure, showing a loss of A$44 million, is not actually representative of how the businesses performed.

The figure which actually represents the performance of our on-going operations is a profit of $75 million, which you will have seen explained in the Special Purpose Report mailed to you with the annual Business Performance Report.

Importantly, this figure is consistent with the financial commitments we outlined in last year’s demerger Scheme Booklet and we are pleased to have been able to meet those commitments.

As indicated in the Scheme Booklet, we did not pay a dividend for the year. As was said last November, we do not have the franking credits that belonged to WMC Limited. For that reason, dividends are likely to be modest with cash flow directed to growing the business.

Those of you who continue to hold your Alumina Limited shares will have benefited from a generous dividend payment from Alumina—in fact the same dividend payment you would have received from the former WMC Limited.

In the short term, it is not WMC Resources’ dividend that you should be looking to as the measure of the company’s value, but rather the growth in share price created as the company performs and grows.

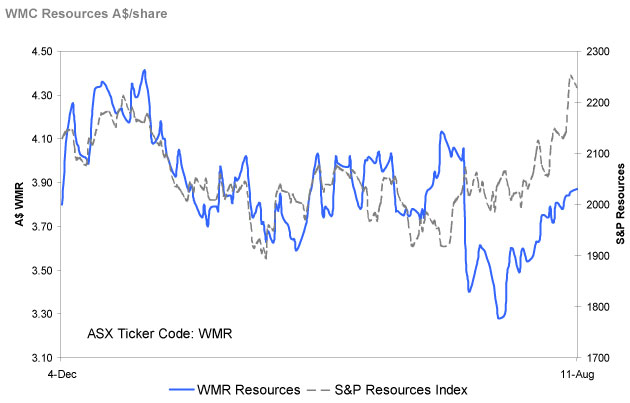

If you look at this graph, you can see that the combined share price of WMC Resources and Alumina Ltd, since the demerger, has outperformed both the All Ordinaries Index and the Resources Index.

So, we are pleased that in the period of time since the demerger, those shareholders who continue to hold both WMC Resources and Alumina Limited have definitely outperformed the market.

Now, if WMC Resources can achieve our objective of being in the top quartile of our peer companies over any five-year period, we will be fulfilling a large part of our long-term obligation to shareholders.

Corporate governance

Another obligation we have to shareholders is in the area of corporate governance. This is a much vexed subject.

It needs to be said and understood that directors do not manage companies and should not normally meddle in management. They appoint professional managers to do that.

Never-the-less, directors are responsible and accountable for the overall performance of the company and what it does to achieve good performance.

Boards bring variety of experience and perspective to their task and they are personally liable for what happens.

It is not an enviable task, especially when things go badly, as they do from time to time.

To be a director, or a chairman these days is not something that anyone should take on lightly. The responsibilities are large.

I believe directors in general and certainly your directors at WMC are open and honest and transparent within the law. You will understand that there will always be difficulties in airing incomplete negotiations because, if agreement is not reached, shareholders can be misled.

At this time we are not having serious talks with any other company about significant matters affecting the corporation.

With last year’s announcement to suspend the granting of options to senior managers and replace them with a fully costed and deductible Executive Share Plan, we led the way in Australia’s corporate response to shareholder concern around options.

In March this year, the ASX Corporate Governance Principles and Recommendations were released.

I am pleased to say we compare favorably. However, we are not being complacent and are continuing to review these and other measures to ensure we have best practice.

Despite the fact that we are not obliged to report against the recommendations until 2005, we have already moved to address two matters raised—one that we did not have a formal Nominations Committee in place to review the appointment of new directors and succession planning for the board—and two, that our directors’ total remuneration packages include a retirement benefit.

The role of a Nominations Committee has, in fact, been performed by the board as a whole, but to meet the ASX principles and recommendations, we have determined formally to appoint the full board as the Nominations Committee and we are in the process of finalising a charter for that committee.

We recognise that there has been public comment about directors’ retirement benefits. It needs to be said that to attract the best people to our board, we need to ensure directors’ fees reflect market rates and adequately reward directors for the experience they bring and the risks and liabilities they assume in undertaking their role.

While the ASX report did not specifically recommend a change to the structure of our directors’ remuneration, we have decided to implement different arrangements for new directors appointed to the board.

From now on, new directors will not accumulate a retirement benefit but rather be compensated entirely through their annual fee.

As part of our on-going commitment to transparency, our 2002 annual report, which you would have received about a month ago, outlined all of the relevant issues regarding payments to the former CEO, Hugh Morgan.

Our disclosure was early, complete and transparent. This is as it should be.

Given the current community discussion about departing CEOs, I would like to ensure that the composition of Hugh’s final payment is understood.

There is certainly no large retirement payment included and, in fact, of the figures given in our report, the amount referred to is largely comprised of his annual and long service leave, and other contractual entitlements after 26 years with WMC and 11 years with North Broken Hill.

The amount relating to a retirement payment to both Hugh Morgan and Don Morley, who have now left the company, was two times their annual salary.

Both retired before their 65th birthday and both greatly assisted the company in the transition to a new management team.

A new CEO

I’d also like to use this opportunity to thank Hugh Morgan for his service to the company over the past decades. It is rare indeed these days to be farewelling a Chief Executive who has had 16 years in the job, and it was a job well done.

We are of course, very fortunate to have, as Hugh’s successor, Andrew Michelmore as the new CEO of WMC Resources.

Let me tell you something about Andrew. He is a chemical engineer by training. He was a Rhodes Scholar and rowed for Oxford and Australia.

He has many years experience in minerals processing and was general manager of Nabalco for four years prior to joining WMC.

At WMC, he had a range of experience, variously managing operations, planning and development.

I will hand over to him to discuss the company’s performance last year and our priorities going forward.

So, to sum up, there are no surprises to report. We have excellent assets and our emphasis is on optimising performance. And there are growth opportunities that Andrew will go into in more detail.

Chief Executive Officer’s address

As the Chairman has said, at our full-year results announcement in February, we were pleased to be able to confirm that WMC Resources has delivered on the commitments set out in the Scheme Booklet for last year’s demerger.

Our performance

Overall last year, we achieved solid production results, although we were impacted by a number of operational issues, some of which we are continuing to manage this year. Let me take you through each of the businesses.

As the Chairman indicated, nickel is a strong performer for us.

It has been over the last 12 months and will continue to be this year.

We expect to produce a record level of nickel metal from the Kwinana refinery this year, and an increase in production of nickel-in-matte from the Kalgoorlie smelter.

The market outlook for nickel is strong, from both the demand and price points of view, and we are accessing new markets for nickel.

This was demonstrated last year with an agreement for the sale of nickel-in-matte to China’s largest nickel producer, Jinchuan.

At Olympic Dam, our focus this year is to position ourselves for full production from 2004.

We will be conducting a smelter reline and will complete the rebuild of the copper solvent extraction plant during the year, both of which will impact on this year’s production.

These repair and maintenance works have been factored into our forecasts and we now plan to produce 185,000 tonnes of copper.

The rebuilding of the uranium solvent extraction plant, following the fire in late 2001, has been completed, and we are pleased to say that we are in the process of handing over the uranium circuit to the operations, who will then start filling the circuit with solvent.

The global market for copper is still uncertain and we expect demand, and therefore price, to be largely driven by the economic growth of China and the economic sentiment of the United States.

At Queensland Fertilizers, with stable operating performance and production nearing full capacity, we can work towards our target of more than one million tonnes per annum. We remain the lowest cash cost producer of ammonium phosphate fertilizers in the world and are the only Australian producer.

With drought conditions improving, market sentiment and prices are strengthening and we are well-positioned to benefit from any upturn.

We are also watching global markets carefully, with China coming back into the market and India as a likely growth market.

Our sales and distribution business, Hi-Fert, is now number two in the largest part of the Australian market and we are expecting another good year.

We achieved the highest returns in the fertilizer industry last year. Overall, we are on track to meet the production and financial targets we outlined early this year, however, as I’ve discussed in other forums, the intensive maintenance programs of the first half, and some other issues, mean that our profit will be skewed towards the second half of the year. Throughout our operations, we have a focus on improving margins, and we are achieving significant financial

savings through a variety of programs.

We are dedicated users of the Six Sigma analytical approach, which enabled us to achieve savings of more than $30 million last year, and we are on track to achieve our previously stated target of $100 million in cumulative benefits by December 2004.

To date, we have well over 1,000 of our employees trained in the Six Sigma approach.

Generating shareholder value through growth

Improving shareholder value through growth is clearly a priority, and we have identified three directions through which growth will be achieved.

The first is by generating more from our current assets.

One of the ways of doing this is through targeted programs developed using the Six Sigma tools.

We also have plans to grow our existing businesses.

In the nickel business, we have a number of opportunities, including expansion of the refinery, expansion of Mt Keith and the use of spare capacity at the smelter.

At Olympic Dam, studies are underway for expansion, and we have the potential to more than double our capacity.

As part of the study, we are working with a South Australian government task force which is looking at how to best facilitate and resolve the complex issues involved in any expansion. These include water supply and environmental impact.

While our focus at Queensland Fertilizers is to ensure consistent performance, we know we are able to expand that business in response to market demand.

There are a number of fronts on which we are pursuing external growth and it is certainly our intention to grow beyond, as well as within Australia.

Our top priority in exploration is on nickel sulphides and secondly, on copper / gold.

We also have made it clear that we will evaluate merger and acquisition opportunities, including partnerships, as they arise.

But we will only pursue opportunities that create value for shareholders.

The Chairman has mentioned the Corridor Sands project in Mozambique, which is an exciting greenfields opportunity for us.

So, as you see, we are pursuing a number of avenues and strategies for growing the company and, through each, to increase shareholder value.

The way we do business

Beyond this, however, it is the way we do business today that will provide us the ability and leverage to grow in the future.

We have identified four key drivers for success.

They are our people, our assets, business excellence and our reputation. Certainly, much of our current internal emphasis is on developing a level of excellence in our processes and procedures, to give us the sustained, consistent performance necessary to reach our goals.

We continue to recruit high calibre people across the company to help us reach these levels of excellence and I am delighted to welcome Michael Nossal to the executive team as head of Business Strategy and Development.

Having most recently held that role myself, I have high expectations of what Michael and his team will be able to achieve.

The Chairman touched on our commitment to corporate governance and I’d like to take this opportunity to explain where we are heading with our public reporting program.

Our reputation

WMC has a long-held reputation for setting the standard in transparent reporting of our financial, environmental and social performance.

With our latest Business Performance Report, we have taken a major step forward to integrate these aspects of our business, each of which play a vital role in our success.

We believe that the financial, environmental and social elements of our business must work together seamlessly, and we will continue to reflect this integration in next year’s report.

We are pleased with our performance in the environment and community areas, having significantly reduced environmental incidents and committed ourselves to challenging site and company targets for improvements in areas such as water use, energy use, sulphur dioxide emissions and land rehabilitation.

We have in place a range of programs, based around partnerships with the communities in which we operate, to address specific local issues and concerns.

I am particularly pleased with our progress in implementing training programs for indigenous people and, even more importantly, our efforts to employ indigenous people across our operations.

We have generated more than $30 million in contract services with indigenous-based companies. At Leinster Downs in Western Australia and Phosphate Hill in Queensland, our training programs have had 41 graduates, with 38 taking up full-time work.

I would encourage anyone interested in finding out more about our community and environment programs to visit the Sustainability Report on our website atwww.wmc.com.

I would like to conclude today by paying tribute to Ian Burgess, who has been chairman of WMC since 1999 and who has overseen a significant chapter of this company’s life.

We will miss his forthright approach and his keen sense of humour.

Annual General Meeting Proceedings

At the meeting shareholders voted to receive the company’s financial statements and reports for the year ended 31 December 2002.

Shareholders also re-elected Professor Adrienne Clarke and elected Mr Alan Dundas as directors.

Both Mr Ian Burgess and Mr Roger Vines retired from the Board from the conclusion of the meeting. Mr Tommie Bergman succeeds Mr Burgess as Chairman of the company.

Share enquiries

Investors seeking information about their WMC Resources shareholding or dividends should contact Computershare Investor Services Pty Limited:

Mail to GPO Box 2975EE,

Melbourne, Victoria 3001,

Australia

Telephone +61 (0)3 9615 5970 or 1300 366 353 for callers within Australia

Facsimilie +61 (0)3 9611 5710

Email towmc.registry@computershare.com.au

Shareholders may also access shareholding details directly from our website atwww.wmc.com. When seeking information, shareholders must provide their Shareholder Reference Number of Holder Identification Number, which is recorded on their shareholding statements.

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-14

RESULTS OF ANNUAL GENERAL MEETING

In accordance with ASX Listing Rule 3.13.2 and section 251AA of the Corporations Act 2001, I advise the following results in relation to the items of business considered by members of WMC Resources Ltd at the Company’s Annual General Meeting held on 2 May 2003:

Resolution Results:

RESOLUTION NO.

| | RESOLUTION

| | RESULT

|

1 | | To receive and consider the Financial Report and the Reports of the Directors and the Auditor for the year ended 31 December 2002. | | Passed by a show of Hands |

| | |

2 | | To re-elect Professor A.E. Clarke as a Director | | Passed by a show of Hands |

| | |

3 | | To elect Mr A.K. Dundas as a Director | | Passed by a show of Hands |

Proxy Voting Intentions:

Resolution No.

| | For

| | Against

| | Open

| | Total

| | Abstentions

|

1 | | 460,520,697 | | 175,686 | | 35,378,613 | | 496,070,996 | | 16,150,111 |

| | | | | |

2 | | 473,141,508 | | 2,408,955 | | 35,459,430 | | 511,009,893 | | 1,183,320 |

| | | | | |

3 | | 473,889,096 | | 1,624,602 | | 35,495,295 | | 511,008,993 | | 1,183,320 |

Ross Mallett

Assistant Company Secretary

2 May 2003

WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-16

Please find attached a media release by WMC Resources Ltd relating to the pricing of the company’s US$700 million global bond.

A copy of this notice can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

6 May 2003

WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

MEDIA RELEASE

WMC Resources prices a debut

US$700 million Global Bond

WMC Resources, a diversified mining and resources company, announced today that it had priced via WMC Finance (USA) Limited a two tranche offering of $500 million 5 1/8% 10-year notes and $200 million 6 1/4% 30-year notes guaranteed by WMC Resources Ltd and its subsidiaries, WMC (Olympic Dam Corporation) Pty Ltd and WMC Fertilizers Pty Ltd. The net proceeds from the offering will be used to refinance short-term indebtedness.

The transaction represents WMC Resources’ debut issue in the U.S. bond market after the 2002 demerger of WMC Limited.

WMC Resources Chief Financial Officer, Bruce Brook, said “the offering achieves our objectives of diversifying our investor base and lengthening out maturity profile”.

WMC Resources initially approached the market with a 10-year $500 million transaction. The transaction was upsized from $500 million to $700 million, with a 30-year tranche added. More than 100 institutional investors purchased the offering, with over 90% from the U.S.

The notes have been offered only to qualified institutional buyers in the United States under Rule144A under the Securities Act of 1933, as amended (the “Securities Act”), and certain investors outside of the United States under Regulation S under the Securities Act. The offering of the notes has not been registered under the Securities Act or any state securities laws and the notes may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act and applicable state securities laws. In connection with the offering, the Company has agreed, subject to certain terms and conditions, to subsequently file an exchange offer registration statement under the Securities Act in order to effect the exchange of the unregistered notes for substantially identical registered notes.

This press release does not and will not constitute an offer to sell or the solicitation of an offer to buy the notes. This press release is being issued pursuant to and in accordance with Rule 135c under the Securities Act.

This press release contains forward-looking statements within the meaning of the Federal securities laws. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond WMC Resources Ltd’s control and could materially affect actual results, performance or achievements. These factors include, without limitation, that completion of the

WMC Resources Ltd |

ABN 76004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6265 |

|

A member of the |

WMC Resources |

group of companies |

1/2

aforementioned offering is subject to, among other things, market condition, that no assurance can be given that the offering can be completed under acceptable terms or on the anticipated timetable, and other risks and uncertainties detailed from time to time in the company’s filings with the Securities and Exchange Commission.

For further information contact:

Media contact:

Tania Price

Group Manager—Public Affairs

Telephone: (03) 9685 6233

Mobile: 0419 502 852

Analyst contact:

Nerida Mossop

Manager—Investor Relations

Mobile: 0418 378 809

2/2

Announcements

ASX Company Announcements Office

Public Announcement 2003-17

WMC Resources Ltd would like to announce that following the retirement of Mr Ian Burgess as Chairman at the company’s Annual General Meeting on 2 May 2003, Mr Tommie Bergman has been appointed as Chairman of the Board. Mr Roger Vines also retired from the board at the meeting.

In accordance with ASX Listing Rule 3.19A.3, we enclose Final Director’s Interest Notices (Appendix 3Z) for Mr Bergman and Mr Vines.

A Change of Director’s Interest Notice (Appendix 3Y) for Mr Bergman is also attached in accordance with ASX Listing Rule 3.19A.2.

Ross Mallett

Assistant Company Secretary

6 May 2003

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC RESOURCES LTD |

| |

ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

| Name of Director | | Mr Tommie Carl-Eric Bergman |

| |

| Date of last notice | | 1 May 2003 |

Part 1—Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Direct or indirect interest | | Direct |

| |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

| |

Date of change | | 2 May 2003 |

| |

No. of securities held prior to change | | 40,000 Fully paid shares |

| |

Class | | Ordinary Shares |

| |

Number acquired | | 10,000 Fully paid shares |

| |

Number disposed | | N/a |

| |

Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation | | Ranging from $4.00 to $4.06 per share |

| |

No. of securities held after change | | 50,000 Fully paid shares |

| |

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | On-market purchase. |

| + | | See chapter 19 for defined terms. |

Appendix 3Y Page 2 | | 11/3/2002 |

Part 2—Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

Detail of contract | | N/a |

| |

Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

Date of change | | |

| |

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | |

| |

Interest acquired | | |

| |

Interest disposed | | |

| |

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | |

| |

Interest after change | | |

Appendix 3Z

Final Director’s Interest Notice

Rule 3.19A.3

Appendix 3Z

Final Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC RESOURCES LTD |

| |

ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.3 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of director | | Mr Ian Glencross Radcliffe Burgess |

| |

Date of last notice | | 11 December 2002 |

| |

Date that director ceased to be director | | 2 May 2003 |

Part 1—Director’s relevant interests in securities of which the director is the registered holder

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Number & class of securities 18,039 ordinary shares in WMC Resources Ltd |

| + | | See chapter 19 for defined terms. |

Appendix 3Z Page 4 | | 11/3/2002 |

Part 2—Director’s relevant interests in securities of which the director is not the registered holder

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Name of holder & nature of interest Note: Provide details of the circumstances givingrise to the relevant interest N/a | | Number & class of securities N/a |

Part 3—Director’s interests in contracts

Detail of contract | | N/a |

| |

Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

No. and class of securities to which interest relates | | |

Appendix 3Z

Final Director’s Interest Notice

Rule 3.19A.3

Appendix 3Z

Final Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

Name of entity | | WMC RESOURCES LTD |

| |

ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.3 and as agent for the director for the purposes of section 205G of the Corporations Act.

Name of director | | Mr Roger Andrew Geoffrey Vines |

| |

Date of last notice | | 11 December 2002 |

| |

Date that director ceased to be director | | 2 May 2003 |

Part 1—Director’s relevant interests in securities of which the director is the registered holder

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

Number & class of securities

1,368 Ordinary shares in WMC Resources Ltd

| + | | See chapter 19 for defined terms. |

Appendix 3Z Page 6 | | 11/3/2002 |

Part 2 – Director’s relevant interests in securities of which the director is not the registered holder

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Name of holder & nature of interest Note: Provide details of the circumstances giving rise to the relevant interest N/a | | Number & class of securities N/a |

Part 3—Director’s interests in contracts

Detail of contract | | N/a |

| |

Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

No. and class of securities to which interest relates | | |

Announcements

Company Announcements Office

Public Announcement 2003-18

Please find attached media release regarding option over the Corridor Sands project.

A copy of this can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

23 May 2003

WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

MEDIA RELEASE

Release: | | Immediate |

Date: | | 23 May, 2003 |

WMC Resources today said it was pleased to announce that the Industrial Development Corporation of South Africa (IDC) had elected to exercise its option over 10% of the Corridor Sands titanium dioxide project in Mozambique, which was acquired by WMC in late 2002.

WMC Resources CEO, Andrew Michelmore said the IDC would pay an initial exercise price of US$0.1million, with the balance of US$9.9million (plus interest) payable on achievement of the earlier of the following key project milestones:

| | • | | Introduction of a major technical partner |

| | • | | Establishment of terms for Project financing |

Mr Michelmore said that the IDC’s decision to exercise its option reflected the significance of the Corridor Sands project to the region and its confidence in the project’s commercial strength.

“The IDC is a significant participant in the South African business scene, with a strong pro-development charter in South Africa and the region. WMC warmly welcomes the IDC as a partner and looks forward to jointly progressing the project with them.”

The IDC is now a fully participating project partner and is contributing its 10% share of project pre-development, construction and commissioning costs.

The Limpopo Corridor Sands project in Mozambique is the world’s largest known resource of ilmenite, an important feedstock for the titanium dioxide pigment industry. Development of the project is expected to cost about US$500m. It will produce about 375,000 tonnes per annum of titanium dioxide slag plus about 185,000 tonnes per annum of high purity pig iron and other valuable by-products.

WMC Resources Ltd |

ABN 76004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6265 |

|

A member of the WMC Resources group of companies |

Mr Michelmore said that production from the project was needed by the customers in late 2007 and this would require construction to begin in the first half of 2005.

The purchase by the IDC is subject to RSA Reserve Bank approval and the settlement of formal documentation.

For further information contact:

Media contact (South Africa): | | |

Brian Taylor | | Stephan Vermaak |

Project Manager | | Head Project Finance |

WMC Resources | | IDC |

Telephone: +27 11 722 5300 | | Telephone: +27 11 2693269 |

Mobile: +27 83 279 8013 | | |

| |

Paul Thomson | | Kevin Hodges |

Director | | Senior Projects Manager |

Corridor Sands Limitada | | IDC |

Telephone: +258 1 450567 | | Telephone: +27 11 2693630 |

Mobile: +258 82 303 909 | | |

| |

Media contact (Australia): | | |

David Griffiths | | |

General Manager—Corporate and Community Affairs |

WMC Resources | | |

Telephone: +61 (3) 9685 6489 | | |

Mobile: +61 0419 912 496 | | |

| |

Analyst contact (Australia): | | |

Nerida Mossop | | |

Manager—Investor Relations | | |

WMC Resources | | |

Telephone: +61 (3) 9685 6274 | | |

Mobile: +61 0418 378 809 | | |

To: | | The Manager |

| | | Announcements |

| | | ASX Company Announcements Office |

Public Announcement 2003-19

Please find attached for immediate release media announcement by WMC Resources Ltd providing an update on the company’s nickel business and on the status of Olympic Dam’s SX Plants.

A copy of this announcement can be viewed at WMC’s internet site atwww.wmc.com following its release to the market

Ross Mallett

Assistant Company Secretary

18 June 2003

|

| WMC Resources Ltd |

ACN 004 184 598 |

|

GPO Box 860K |

Melbourne Vic. 3001 |

Australia |

|

Level 16 IBM Centre |

60 City Road |

Southbank Vic. 3006 |

Australia |

|

Tel +61 (0)3 9685 6000 |

Fax +61 (0)3 9685 6115 |

Update on WMC Resources Ltd Nickel Business and Status

of Olympic Dam’s Solvent Extraction Plants

WMC Resources today advised that the strong Australian dollar exchange rate and a lower contribution from the nickel business are expected to offset the benefits of higher commodity prices in the first half of 2003. Consequently, first half earnings are expected to be similar to the pro forma earnings for WMC Resources’ second half of 2002.

The reduced contribution of the nickel business reflects lower production and sales of just under 6,000 tonnes, primarily as a result of the planned statutory maintenance shutdown at the Kalgoorlie smelter earlier this year.

Total nickel costs of sales, excluding on market purchases, are expected to be in line with those of the previous half. The consequent higher unit costs of production and sales are a result of several factors including increased volume and price of third party feed purchases and the lag impact of reduced production at Mt Keith for the fourth quarter of 2002 and the first quarter of 2003.

WMC Resources Chief Executive Officer, Andrew Michelmore, advised that commissioning of the new uranium solvent extraction (SX) plant at Olympic Dam has been substantially completed, with uranium production now running at planned rates.

Construction of the copper SX plant is progressing and is scheduled for completion by year end with final commissioning and production ramp up taking place during the first quarter 2004. A re-forecast of the total capital cost of the combined SX plants at Olympic Dam has indicated that it may exceed earlier estimates of $300 million by approximately 25%.

Following an extensive internal review of the company’s approach to the management of capital projects generally, and including the uranium section of the SX plant, WMC Resources has decided to restructure its approach to project management of the copper SX plant rebuild by increasing the company’s direct role in project management. A strengthened project team based at site will assume overall responsibility for project management.

Andrew Michelmore, said: “We are pleased to see the uranium plant completed and a return to full uranium production.

“While the likely cost outcome of the overall solvent extraction rebuild at Olympic Dam is disappointing, it is important to note that the new plant incorporates a large number of fire safety modifications which have added to the cost of the project but which were essential pre-conditions to our operating such facilities in the future”.

It is expected that certain extra costs associated with fire safety will eventually be offset by the settlement of related insurance claims.

For further information please contact:

Analyst contacts:

Gordon Drake

General Manager Investor Relations

WMC Resources

Telephone: +61 (3) 9685 6102

Mobile: +61 0419 894 059

Nerida Mossop

Manager—Investor Relations

WMC Resources

Telephone: +61 (3) 9685 6274

Mobile: +61 0418 378 809

Media contact:

David Griffiths

General Manager—Corporate and Community Affairs

WMC Resources

Telephone: +61 (3) 9685 6489

Mobile: +61 0419 912 496

18 June 2003

| |

To: | | The Manager |

| | | Announcements |

| | | Company Announcements Office |

Public Announcement 2003-21

Please find attached Change of Director’s Interest Notice (Appendix 3Y) in respect of WMC Resources Ltd Director, Mr Tommie Bergman.

A copy of this notice can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

25 June 2003

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

| Name of entity | | WMC RESOURCES LTD |

| |

| ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

| Name of Director | | Mr Tommie Carl-Eric Bergman |

| |

| Date of last notice | | 6 May 2003 |

Part 1—Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

| |

Direct or indirect interest | | Direct |

| |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

| |

Date of change | | 24 June 2003 |

| |

No. of securities held prior to change | | 50,000 Fully paid shares |

| |

Class | | Ordinary Shares |