SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT ON FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date: Period January 6, 2004

WMC RESOURCES LTD

ACN 004 184 598

Level 16, IBM Centre

60 City Road

Southbank, Victoria 3006

Australia

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

This report on Form 6-K includes press releases of WMC Resources Ltd made during the period August 14, 2003 – January 6, 2004.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

WMC RESOURCES LTD

| |

By: | | /s/ R.E. Mallett

|

| |

Name: | | R.E. Mallett |

| |

Title: | | Assistant Company Secretary |

| |

Date: | | 8 January 2004 |

Announcements

ASX Company Announcements Office

Public Announcement 2003-26

Please find attached media release regarding the signing of a A$1 billion nickel deal in China between WMC Resources Ltd and Jinchuan Group Limited.

A copy of this can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

26 August 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

MEDIA RELEASE

26 August, 2003

WMC AND JINCHUAN SIGN A$1 BILLION NICKEL DEAL IN CHINA

WMC Resources Ltd (“WMC”) and China’s largest nickel producer, Jinchuan Group Limited (“Jinchuan”) today signed a nickel supply agreement worth A$1 billion.

Speaking from China, WMC CEO Andrew Michelmore said, “this agreement strengthens our 15 year relationship with Jinchuan and our position in the world’s fastest growing nickel market.”

The agreement signed today is for the supply of 90,000 tonnes of nickel-in-matte* and adds to a 30,000 tonne agreement signed with Jinchuan in December last year.

“We began our relationship with Jinchuan in 1988, assisting with the construction of their nickel smelter. I’m proud to say that we are now a major part of their growing success,” said Mr Michelmore.

WMC will export 120,000 tonnes of nickel-in-matte to Jinchuan between 2005 – 2010 from its Kalgoorlie Nickel Smelter in Western Australia. When refined, this nickel-in-matte will represent more than 20% of the total domestic production of nickel metal in China to 2010.

“China is a secure and high-growth market for WMC nickel products,” Mr Michelmore said. “A stronger relationship with Jinchuan opens up new commercial and exploration opportunities in the region for WMC.”

“Together, our agreements with Jinchuan will drive an improved and secure revenue stream from WMC’s nickel business towards 2010 and beyond.”

Jinchuan Group Ltd is China’s largest integrated producer of nickel for the domestic market. Jinchuan’s nickel output accounts for over 88% of Chinese production, producing 60,000 tons of nickel annually.

Mr Li Yong-jun, President and Chairman of Jinchuan Group Ltd, said at the launch, “the signing of this agreement will play a positive role in realizing our respective objectives and enhancing mutual cooperation.”

The six year agreement for the supply of 90,000 tonnes of nickel-in-matte was signed at a ceremony in Lanzhou in central China earlier today.

WMC Resources Ltd

ABN 76 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9686 3569

The Jinchuan Group Ltd is located in Jinchang, known as China’s nickel capital, in the Gansu province of central China. The agreement was signed by Jinchuan Group Ltd Chairman and President, Li Yong-jun and WMC Resources Ltd Chief Executive Officer, Andrew Michelmore.

| * | Nickel-in-matte is a value-added product, following concentration and smelting of nickel ore. It contains approximately 68% nickel. |

For further information:

Media contact: | | Analyst contact: |

Troy Hey | | Nerida Mossop |

Group Manager – Public Affairs | | Manager – Investor Relations |

Telephone: (61 3) 9685 6233 | | Telephone: (61 3) 9685 6274 |

Mobile: 0419 502 852 | | Mobile: 0418 378 809 |

Announcements

ASX Company Announcements Office

Public Announcement 2003-27

WMC Resources Board Appointments

The WMC Resources Board today announced that Mr G.J. (John) Pizzey and Mr Graeme McGregor have accepted invitations to join the Board of the Company with effect from 1 December 2003.

Mr Pizzey, 58, is an Executive Vice President of Alcoa Inc. where he is responsible for Alcoa’s Primary Products group, comprising alumina refineries and primary aluminium smelters and associated businesses worldwide. Since joining Alcoa in Australia in 1970, Mr Pizzey has had a variety of engineering, sales and product management, operations, and senior management positions, based in Australia and the United States.

Mr Pizzey is also Chairman of the London Metals Exchange (LME), Deputy Chairman of ION Ltd and a director of Amcor Ltd. Mr Pizzey currently lives in New York, but is returning to Australia in the first quarter of 2004.

Mr McGregor, 64, is a director of Fosters Group Ltd, Santos Limited, Nufarm Limited and Were Securities Limited.

Mr McGregor had a long career with BHP (1961-1999), during which time he held a number of financial and senior management roles, culminating in the role of Director of Finance. Mr McGregor lives in Melbourne.

WMC Resources Chairman, Mr Tommie Bergman, said that each of Mr McGregor and Mr Pizzey had valuable expertise and experience which would complement the existing Board’s skills.

Peter Horton

Company Secretary

30 September 2003

For further information, please call:

Peter Horton, Company Secretary on (03) 9685-6430

Andrew Michelmore, Chief Executive Officer on (03) 9685-6380

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

Announcements

ASX Company Announcements Office

Public Announcement 2003-28

Please find attached media release regarding the commissioning of the Olympic Dam Smelter following major maintenance work.

A copy of this can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

2 October 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

MEDIA RELEASE

2 OCTOBER, 2003

COMMISSIONING OF OLYMPIC DAM SMELTER UNDERWAY FOLLOWING MAJOR MAINTENANCE

Scheduled maintenance and construction work on the Olympic Dam smelter is now complete and reheating of all furnaces is underway.

Completion of the $127m project will see concentrate fed into the smelter from next week.

Additional remediation work was added to the work schedule following the identification of damage to brickwork in the smelter hearth. The additional works involved the demolition and replacement of one third of the hearth. To maximise the life of the current rebuild, all brickwork exhibiting signs of degradation has been replaced.

“The $127m program of scheduled works, involving over 800 people has come in on budget”, said WMC Resources CEO, Andrew Michelmore.

“On the back of a record four and a half year smelter campaign, some unforeseen damage was always a possibility and we indicated this prior to the shut. Some of the additional work was able to be completed in parallel and some, in particular the replacement of hearth bricks, has extended the project sequence,” he said.

“The better than expected performance on ‘in-scope’ activities has enabled us to cover this additional work within the overall project cost of $127m,” Mr Michelmore said. “We have taken the decision to wear a few days delay to start-up in order to maximise the life of the rebuilt smelter.”

A further update on the commissioning and ramp up will be presented at WMC’s September Quarter Production Report on 15 October 2003. Ramp up to full production will continue during October.

For further information:

Media contact: | | Analyst contact: |

Troy Hey | | Nerida Mossop |

Group Manager – Public Affairs | | Manager – Investor Relations |

Telephone: (61 3) 9685 6233 | | Telephone: (61 3) 9685 6274 |

Mobile: 0419 502 852 | | Mobile: 0418 378 809 |

WMC Resources Ltd

ABN 76 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9686 3569

MEDIA RELEASE

Additional Information – Questions and Answers

Why are you putting this release out now?

We are at the end of the scheduled period for the smelter reline so it is timely to provide a progress update.

What did the work involve?

This has been a major project, with the following items of work now complete:

| • | Relining of the flash anode and slag furnaces |

| • | Refurbishment and repairs to the boiler, acid plant and utilities, |

| • | Capability improvement to the gas handling system and slag furnace, |

| • | Replacement of the electrostatic precipitator; and |

| • | Additional repairs to damage of bricks in the smelter hearth. |

What was the extent of damage to the hearth?

It is not uncommon to see wear around the edges of the hearth, particularly below tapholes as a result of normal operations. We had allowed contingency for this, but the degradation of brickwork was more extensive than anticipated. The result has been that approximately one third of the hearth has had to be demolished and replaced.

What impact did the emergent work have on the planned schedule?

Rescheduling and accelerating other work helped to offset the time taken. Some of the additional work could be completed in parallel with the scheduled work. The remainder of the work was completed at the end of the schedule, which delayed the timing of the reheat.

How does this affect your ramp up?

The smelter ramp up was always scheduled to occur progressively over the month of October, with approximately 75% of full production rates being achieved. At this stage, it is too early to provide a statement on the ramp up. However, some parts of the plant are already commissioned. This includes the acid plant, which has been operating for a couple of weeks to provide acid to the solvent extraction circuit.

Does the extra work to the hearth mean that you will get better performance from the smelter?

The additional work should certainly add to the integrity of the next campaign, and it is pleasing to have been able to identify the degradation at a time when we were able to address the issue at only a small cost to the planned ramp up.

Are you still forecasting 185kt of copper cathode this year?

We are in the early stages of the ramp up. The delay does put pressure on the 185kt target, but it is really too early to say what the likely impact would be. We will provide a further update on 15 October in our quarterly production review.

Announcements

ASX Company Announcements Office

Public Announcement 2003-29

WMC Resources Marketing Limited (“WMCM”), a wholly owned Canadian subsidiary of WMC Resources Ltd today completed the acquisition of 903,930 flow-through shares and 4,296,070 common shares in the capital of Canadian resources company, Comaplex Minerals Corp (“Comaplex”).

Under this transaction, reported as a proposed transaction on 17 July 2003, WMCM has acquired a 5,200,000 (14%) shareholding in Comaplex and received a cash payment of US$6,750,000. Comaplex has assumed control of all of WMCM’s exploration properties, including it’s 56% interest in the Meliadine West gold project in Canada’s lower Arctic territories. This has increased Comaplex’s interest in that project from 22% to 78%.

A copy of the Comaplex Canadian Newswire Release is attached.

A copy of this announcement can be viewed at WMC’s internet site atwww.wmc.com following its release to the market.

Ross Mallett

Assistant Company Secretary

9 October 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

Comaplex Announces Closing of its Transaction With WMC Resources Ltd. (WMC)

CALGARY, Oct. 8 /CNW/ - Comaplex Minerals Corp. (“Comaplex”) (TSX-CMF) announces that it has closed its previously disclosed transaction involving WMC’s wholly owned Canadian subsidiary, WMC International Limited (WIL) which will, amongst other things, result in Comaplex increasing its interest in the Meliadine West gold property from 22 percent to 78 percent.

The major components of the deal are:

| - | WMC received $6,750,000 U.S. cash that was paid from Comaplex’s existing working capital. |

| - | WMC received 5,200,000 shares of Comaplex (of which 903,930 are issued on a flow-through basis) and now owns 14 percent of Comaplex. |

Future Plans

| - | Comaplex will proceed with an aggressive exploration project as soon as possible with the intent of advancing the project towards feasibility. Comaplex will also consider third party financing and operational arrangements if they are deemed beneficial to Comaplex shareholders. |

| - | WMC and Comaplex have agreed, on a non-binding basis, to share consulting services and expertise and to pursue mutually beneficial arrangements for mineral exploration consistent with their respective strategies. |

Meliadine Property

| - | The Meliadine property is an advanced gold exploration project with total expenditures to date of approximately $80,000,000. |

| - | Comaplex has a 78 percent interest in Meliadine West (Cumberland’s 22 percent is a carried interest that will be repaid by Cumberland to Comaplex from Meliadine West cash flow). Comaplex will continue to own 50 percent in Meliadine East (Cumberland 50%). |

| - | The Tiriganiaq deposit is the most advanced zone in Meliadine West and Comaplex intends to accelerate the project to feasibility in a timely manner. The property has numerous other highly prospective anomalies that have little or no drilling completed to date. |

Special Warrants

Closing of this transaction satisfies the condition to release from escrow the remaining fifty percent of the $4,125,000 gross proceeds raised under the previously announced bought deal private placement underwritten by Haywood Securities Inc. of 1,500,000 Special Warrants which closed on August 12, 2003.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

10/08/2003

For further information: George F. Fink, President and Chief Executive Officer, or Mark J. Balog, Vice President, Exploration, Telephone: (403) 265-2846, Fax: (403) 265-7488

Announcements

ASX Company Announcements Office

Public Announcement 2003-30

Please find attached for immediate release, Public Announcement 2003-30 covering WMC Resources Ltd’s September 2003 Quarterly Production Report.

A copy of this public announcement will be published on WMC’s web site atwww.wmc.com later this afternoon.

WMC’s Chief Executive Officer, Mr Andrew Michelmore, will host an audio conference at 4.00pm this afternoon which will be broadcast live from WMC’s web site. A recording of this conference will be available for playback on WMC’s web site later this evening.

Peter Horton

Company Secretary

15 October 2003

WMC Resources Ltd

ACN 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9685 6115

WMC Resources Ltd

Quarterly Review, Quarter ended 30 September 2003

Safety, health & environment

Safety, health and environment

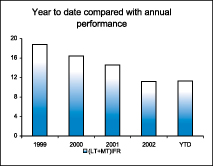

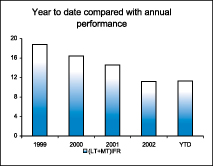

The third quarter saw the completion of major shutdowns at Queensland Fertilizer Operations and Olympic Dam with no major safety incidents. The year to date injury rate of 11.3 (lost time plus medical treatment injuries per million hours worked) is a 2 per cent improvement over the full year 2002 result.

No significant environmental incidents were recorded for the period.

We continue to focus on sustaining our improved safety performance by building the foundations for an injury and incident free workplace through robust systems and positive workplace behaviours.

Note: Unless otherwise stated, comparisons contained in this production report are quarter on previous quarter. Statements, particularly those regarding the possible or assumed future performance, production levels, prices, reserves, divestments, growth or other trend projections are or may be forward looking statements. Actual results, actions and developments may differ materially from those expressed or implied by these forward looking statements depending on a variety of factors including known and unknown risks and uncertainties

WMC Resources Ltd share price

Overview

Dear Shareholder

Scheduled major maintenance of the Olympic Dam smelter is complete. Additional repairs were required to the hearth bricks which showed greater degradation than expected. This extended the project sequence and will result in a reduction in 2003 copper production of approximately 5,000 to 7,000 tonnes. Total project costs are within the $127 million budget and the smelter is ramping up to full production rates during October.

Uranium production improved during the quarter reflecting the contribution from the rebuilt uranium solvent extraction plant, and is expected to increase further in the coming quarter.

Nickel-in-concentrate production increased to the highest levels achieved in the past five years with record production from Mount Keith and the Perseverance mine at Leinster. Nickel-in-matte production at the Kalgoorlie smelter was up 27 per cent on the previous quarter and remains on track for the 2003 target of 99,000 tonnes.

Nickel metal production at the Kwinana refinery was interrupted by boiler repairs with the 2003 metal target revised downwards by 5,000 tonnes. The interruption will not materially impact 2003 profit as the resulting surplus matte will be sold into a strong market. Total contained nickel sales volumes for the year are expected to be maintained.

Fertilizer production has returned to full capacity following completion of scheduled maintenance early in the quarter. The statutory maintenance and inspections were completed on time and under budget. Fertilizer production is now expected to exceed the 870,000 target for 2003.

With major scheduled maintenance now complete, the outlook for the remainder of 2003 is for strong production performance across all operations.

A G MICHELMORE

Chief Executive Officer

15 October 2003

WMC Resources Ltd

ABN 76 004 184 598

Production overview

Copper & Uranium

The major maintenance shutdown of the Olympic Dam smelter is complete, with concentrate feed to the furnace recommencing on 9 October. The smelter is currently ramping up to full production rates.

Additional unanticipated remediation work was included in the shutdown schedule following the identification of damage to brickwork in the smelter hearth once the smelter cooled and was inspected. The additional works involved the demolition and replacement of one third of the hearth. To maximise the life of the current rebuild, all brickwork exhibiting signs of degradation was replaced.The increased duration of the smelter reline is expected to result in a reduction of full year copper cathode production by approximately 5,000 to 7,000 tonnes to 178,000 to 180,000 tonnes.

Better than expected performance on in-scope activities enabled the additional work to be covered within the project budget.The total cost of the furnace reline and associated works was completed within the budget of $127 million.

Uranium production was 19 per cent higher than the previous quarter reflecting the contribution of the rebuilt uranium solvent extraction plant. Uranium production is expected to increase further during the December quarter with full acid supply restored following completion of the smelter shutdown.

Gold production reduced in line with the lower copper production.

Mine production increased 9 per cent as planned to an annualized rate equivalent to 9 million tonnes.

Nickel

Nickel-in-concentrate production increased to the highest levels achieved in the past five years.

This performance was underpinned by record production at Mount Keith, which benefited from higher ore grades, increased throughput and record metallurgical recovery of 73 per cent.

Record ore production was also achieved at Perseverance underground mine at Leinster.

Strong performance at the Kalgoorlie smelter for the quarter reflects higher throughput combined with increased grade from a higher proportion of Mount Keith concentrate in smelter feed.

Nickel-in-matte production is on track for the full year target of 99,000 tonnes.

Nickel metal production at Kwinana was 4 per cent lower than the previous quarter. Production was interrupted in September by boiler repairs which will reduce full year output by approximately 5,000 tonnes to an estimated 60,000 to 61,000 tonnes. The refinery has returned to full production rates.

Total contained nickel sales volumes in 2003 are expected to remain unchanged with the additional 5,000 tonnes of matte not converted at the refinery being sold into a strong nickel market.

Studies continued on the Cliffs and 11 Mile Well projects, and drilling commenced at the Collurabbie exploration project.

Fertilizers

Fertilizer production has returned to design capacity following completion of the planned shutdown in early August. Production for the month of September was at rates equivalent to 101 per cent of design capacity.

The shutdown for major maintenance and statutory inspections was completed on time and under budget.

Fertilizer production is now expected to exceed the target of 870,000 tonnes in 2003.

Business Development

Solvent Extraction Plant Rebuild

Construction of the copper solvent extraction plant continues on time and in line with the revised budget of $375 million. Construction of the plant will be completed this year, with commissioning in the first quarter of 2004.

Olympic Dam Expansion Study

Drilling continued during the quarter with 45 holes and over 37,500 metres now having been drilled. Results to date have further delineated the existing resource and identified some additional resource. Drilling will be finalised and results modelled during the course of the December quarter.

Meliadine

The transaction to merge WMC International Ltd (WIL) into Comaplex Minerals Corp. (Comaplex) was closed as of 8 October 2003. Comaplex now holds 100 per cent of WIL shares, and in exchange, WMC has received US$6.75 million in cash and approximately 15 per cent of Comaplex. Among the WIL assets is WMC’s 56 per cent interest in the Meliadine West gold project. Comaplex’s interest in Meliadine West is now 78 per cent.

Exploration Activities

Mundra South, Western Australia

Heritage clearance has been obtained and ground-based exploration activities have commenced.

Global Exploration

Exploration for nickel sulphide deposits continued in Australia, North America and China and for copper-gold deposits in Mongolia, Peru and Turkey.

Marketing

On 26 August, WMC entered into a further long term agreement for the sale of nickel-in-matte with China’s largest nickel producer, Jinchuan Group Ltd (Jinchuan). The transaction enhances WMC’s access to the fastest growing market for nickel.

The agreement is for the supply of 90,000 tonnes of nickel-in-matte over six years commencing 2005 and adds to a 30,000 tonne agreement signed with Jinchuan in December last year. Both contracts are based on spot LME nickel metal prices.

The product will be exported in the same form as that provided to WMC’s Kwinana Nickel Refinery, which will enable performance of the Kalgoorlie smelter to be optimized through the production of a single matte product.

Summary of WMC Resources’ production

| | | | | Quarter ended

30 Sept 2003

| | Quarter ended

30 June 2003

| | Quarter ended

30 Sept 2002^

|

Copper (tonnes of refined copper) | | Olympic Dam Operations | | 35,337 | | 49,644 | | 41,966 |

| | | | |

Uranium Oxide concentrate (tonnes) | | Olympic Dam Operations | | 906 | | 764 | | 873 |

| | | | |

Gold (ounces) | | Olympic Dam Operations | | 16,910 | | 23,371 | | 13,002 |

| | | | |

Silver (ounces) | | Olympic Dam Operations | | 113,632 | | 173,340 | | 131,706 |

| | | | |

Nickel (tonnes contained nickel) | | Kambalda Nickel Operations | | 5,828 | | 7,100 | | 5,797 |

| | | Leinster Nickel Operations | | 10,667 | | 10,099 | | 10,501 |

| | | Mount Keith Operations | | 13,661 | | 11,590 | | 12,157 |

| | | Total nickel-in-concentrate | | 30,156 | | 28,789 | | 28,455 |

| | | Total nickel-in-matte | | 27,799 | | 21,923 | | 22,969 |

| | | Total nickel metal | | 13,969 | | 14,498 | | 16,905 |

| | | | |

Fertilizer | | | | | | | | |

Di-ammonium phosphate (tonnes) | | Phosphate Hill | | 173,441 | | 168,075 | | 180,770 |

Mono-ammonium phosphate (tonnes) | | Phosphate Hill | | 27,484 | | 70,726 | | 13,341 |

Total Fertilizer (tonnes) | | Phosphate Hill | | 200,925 | | 238,801 | | 194,111 |

A statistical supplement providing a detailed breakdown of WMC production results is available on WMC Internet home page at http://www.wmc.com

^ The figures quoted represent the production from the operations now comprising WMC Resources Ltd.

Hedging

Commodity & Currency Hedging as at 30 September 2003

WMC Resources’ revenues vary significantly with movements in commodity prices and the AUD/USD exchange rate. There is an existing hedge position that will be continuously managed.

The hedge book was fair valued at the date of demerger. Consequently, the profit and loss for each hedge will be determined by the difference between a particular hedge’s fair valued rate and the spot price at the date of the hedge’s maturity. The following tables show both the rates at which the hedge transactions are contracted with third parties to determine the cash flow impact for each hedge and the fair valued rates for determining the profit and loss impact.

Currency (as at 30 September 2003)

Period

| | Forward Sale of US$

| | Synthetic Forward

Sale of US$

| | Non-limiting Cover

| | Profit & Loss Rate A$/US$

|

| | Amount

US$m

| | Cash Flow

Rate A$/US$

| | Amount

US$m

| | Cash Flow

Rate A$/US$

| | Amount

US$m

| | Cash Flow

Rate A$/US$

| |

2003 (remainder) | | 52 | | 0.6849 | | 10 | | 0.6812 | | 6 | | 0.5961 | | 0.5490 |

2004 | | 228 | | 0.6753 | | 63 | | 0.6494 | | 10 | | 0.5883 | | 0.5449 |

2005-2008 | | 737 | | 0.6742 | | 315 | | 0.6275 | | 30 | | 0.5883 | | 0.5424 |

A synthetic forward consists of a bought US$ put and a written US$ call option. The written US$ call option has the potential to knock out above certain exchange rates. US$46m of written call options were knocked out during the quarter.

Gold (as at 30 September 2003)

Period

| | Forward Sale of Gold

| | Profit & Loss Rate A$/oz

|

| | Ounces

| | Cash Flow Rate A$/oz

| |

2003 (remainder) | | 25,293 | | 549 | | 588 |

2004 | | 80,000 | | 559 | | 600 |

2005 | | 80,000 | | 579 | | 620 |

Gold production from Olympic Dam is delivered into the gold hedging positions.

Deferred Cashflow

In 2001 some foreign exchange and gold hedges were reversed as a result of the gold asset sales. The cash flow impact of these reversals has been deferred to the original settlement date as follows:

| | | 2003 (remainder)

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| |

Deferred Cashflow(A$m) | | (8.1 | ) | | (26.4 | ) | | (37.4 | ) | | (28.5 | ) | | (23.4 | ) | | (21.2 | ) |

Interest Rates

During the quarter, WMC entered into a series of interest rate swap transactions exchanging the fixed rate interest exposure on the 10 year Global Bond (US$500m) to a fixed interest rate exposure for 2004 and 2005 followed by a floating interest rate exposure for the remainder of the bond. The interest rate swap enabled WMC to lock in an interest cost saving of approximately A$25 million per annum in 2004 and 2005.

Scenario tables

As WMC hedge positions comprise a combination of limiting and non-limiting cover, at various price levels, any one exchange rate or spot price cannot be used to predict the outcome of WMC’s hedge position. The following table provides an estimate of the realised rate to determine cash flow under various scenarios, taking into account the hedged and unhedged exposures. All realised exchange rate and price estimates include applicable option premium.

Currency

A$/US$

| | Estimated realised rate - $A/US$

|

Rate at maturity

| | 2003 (remainder)

| | 2004

| | 2005-2008

|

0.80 | | 0.7724 | | 0.7596 | | 0.7688 |

0.75 | | 0.7344 | | 0.7258 | | 0.7308 |

0.70 | | 0.6952 | | 0.6908 | | 0.6916 |

0.65 | | 0.6549 | | 0.6543 | | 0.6514 |

0.60 | | 0.6134 | | 0.6163 | | 0.6099 |

0.55 | | 0.5699 | | 0.5764 | | 0.5671 |

Market conditions

Commodity prices

| | | Current

| | Average

| | Average

|

| | | Prices

at

30/09/03

| | Quarter

ended

30/09/03

| | Quarter

ended

30/09/02

|

Copper* US$/lb | | 0.81 | | 0.79 | | 0.65 |

Nickel* US$/lb | | 4.64 | | 4.25 | | 2.93 |

Gold* US$/oz | | 382 | | 363 | | 324 |

DAP^ US$/t | | 177 | | 180 | | 165 |

Source: Reuters

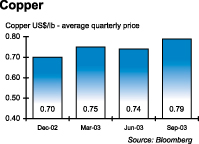

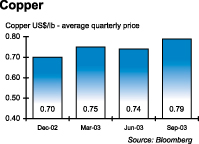

Copper prices trended higher during the September quarter ending the period at US$0.81/lb. The average price for the quarter was up US$0.5/lb (6.8 per cent) from the previous quarter average.

The LME official copper cash price (against which all WMC copper sales are priced) increased from a low of US$0.74/lb on July 1st and peaked at US$0.83/lb in early August.

LME copper stocks fell 83,070 tonnes (12.5 per cent) to end the quarter at a 27 month low of 582,600 tonnes.

We continue to experience firm demand from our customers in Asia and Australia. A general shortage of metal for prompt delivery in these regional markets has kept spot premiums at relatively high levels.

Uranium

Olympic Dam sells most of its uranium under long term contracts.

The spot price for uranium as represented by the Nuexco Exchange Value rose from US$10.90 lb at the beginning of the quarter to US$12.25 at the end of September.

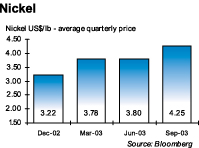

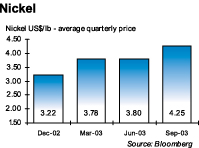

The nickel price was significantly higher during the quarter, with the average LME cash price up 11.8 per cent to US$4.25/lb. The range over the period was US$3.78/lb to US$4.68/lb, the highest price since May 2000. Pricing support resulted from the three-month long strike at Inco’s Ontario operations, heavy speculative buying and favourable market fundamentals, including strong Chinese demand, higher stainless steel production and historic low inventories. Negative influences, such as large deliveries of full plate cathodes into LME warehouses and a labour contract settlement at Inco failed to dampen market sentiment. LME stocks rose by 38.5 per cent (9,522 tonnes) to 34,284 tonnes.

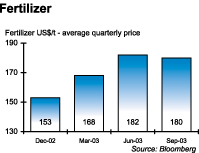

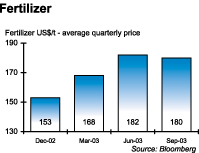

The DAP price was relatively unchanged during the quarter, with the average price down 1 per cent on the June quarter at US$180/t (fob Tampa). The price increased from US$176/t to reach a high of US$182/t in late July before declining in late September to close at US$177/t.

Whilst prices remain stronger than the first half of 2003, some recent price weakness is evident as a result of the seasonal decline in demand and the reintroduction of additional production capacity.

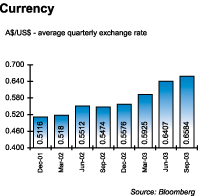

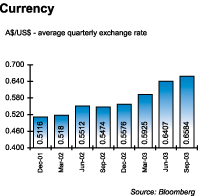

The Australian dollar strengthened in the quarter reaching a 5 year high of 0.6845. The dollar closed the quarter at 0.6759 with an average rate of 0.6584. Key factors influencing the currency are continued weakness in the USD - especially post the G-7 meeting in late September, continued resilience in the domestic economy and favourable interest rate differentials.

| WMC Resources Ltd Quarterly StatisticalSupplement - Total Production | | Quarter Ended 30 September 2003 |

| | | Quarter ending

30/09/2003

| | Quarter ending

30/06/2003

| | Quarter ending

31/03/2003

| | Quarter ending

31/12/2002

| | Quarter ending

30/09/2002

|

COPPER & URANIUM - OLYMPIC DAM OPERATIONS | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

COPPER | | | | | | | | | | |

Ore hoisted | | 2,281,673 | | 2,089,739 | | 2,056,895 | | 2,151,978 | | 2,303,859 |

| | | | | | | | | | |

| | | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Ore treated and head grade | | 2,151,125 | | 2.45 | | 2,334,685 | | 2.19 | | 1,941,782 | | 2.57 | | 2,172,677 | | 2.57 | | 2,235,437 | | 2.67 |

Concentrate smelted | | 64,322 | | 51.3 | | 125,159 | | 47.4 | | 101,209 | | 47.5 | | 99,823 | | 45.1 | | 98,328 | | 46.9 |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Copper cathode produced | | 35,337 | | 49,644 | | 41,678 | | 48,328 | | 41,966 |

| | | | | | | | | | |

| | | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

|

Uranium oxide concentrate produced & head grade | | 906 | | 0.65 | | 764 | | 0.64 | | 635 | | 0.61 | | 826 | | 0.69 | | 873 | | 0.76 |

| | | | | | | | | | |

| | | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

|

Refined gold produced & head grade | | 16,910 | | 0.46 | | 23,371 | | 0.48 | | 26,931 | | 0.49 | | 13,682 | | 0.51 | | 13,002 | | 0.52 |

| | | | | | | | | | |

| | | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

|

Refined silver produced & head grade | | 113,632 | | 4.90 | | 173,340 | | 4.32 | | 149,666 | | 4.22 | | 191,001 | | 4.12 | | 131,706 | | 4.86 |

| | | | | | | | | | |

NICKEL | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Ore treated and head grade | | | | | | | | | | | | | | | | | | | | |

Kambalda Nickel Operations1 | | 178,990 | | 3.62 | | 218,327 | | 3.57 | | 203,376 | | 3.56 | | 216,687 | | 4.03 | | 168,392 | | 3.95 |

Leinster Nickel Operations | | 664,652 | | 1.92 | | 581,944 | | 2.02 | | 620,927 | | 1.97 | | 657,619 | | 2.01 | | 682,303 | | 2.02 |

Mount Keith Nickel Operations | | 2,838,202 | | 0.66 | | 2,698,898 | | 0.59 | | 2,688,597 | | 0.56 | | 2,752,407 | | 0.54 | | 2,829,929 | | 0.62 |

| | | | | | | | | | |

| | | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Concentrate produced & concentrate grade | | | | | | | | | | | | | | | | | | | | |

Kambalda Nickel Operations | | 41,821 | | 13.9 | | 50,748 | | 14.0 | | 42,808 | | 15.0 | | 50,727 | | 15.2 | | 40,276 | | 14.4 |

Leinster Nickel Operations | | 89,509 | | 11.9 | | 84,963 | | 11.9 | | 78,770 | | 12.3 | | 78,230 | | 13.2 | | 81,587 | | 12.9 |

Mount Keith Nickel Operations | | 66,366 | | 20.6 | | 54,386 | | 21.3 | | 55,796 | | 18.2 | | 42,071 | | 22.5 | | 63,171 | | 19.2 |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Nickel contained in concentrate | | | | | | | | | | |

Kambalda Nickel Operations | | 5,828 | | 7,100 | | 6,409 | | 7,720 | | 5,797 |

Leinster Nickel Operations | | 10,667 | | 10,099 | | 9,700 | | 10,331 | | 10,501 |

Mount Keith Nickel Operations | | 13,661 | | 11,590 | | 10,167 | | 9,465 | | 12,157 |

Total | | 30,156 | | 28,789 | | 26,276 | | 27,516 | | 28,455 |

| | | | | | | | | | |

| | | Feed

| | Matte

| | Feed

| | Matte

| | Feed

| | Matte

| | Feed

| | Matte

| | Feed

| | Matte

|

Smelter feed & matte produced (tonnes) | | | | | | | | | | | | | | | | | | | | |

Kalgoorlie Nickel Smelter | | 194,407 | | 43,688 | | 167,471 | | 31,854 | | 160,593 | | 32,517 | | 179,695 | | 38,858 | | 160,610 | | 33,511 |

18

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Nickel contained in matte | | | | | | | | | | |

Kalgoorlie Nickel Smelter | | 27,799 | | 21,923 | | 22,084 | | 26,901 | | 22,969 |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Matte treated | | | | | | | | | | |

Kwinana Nickel Refinery | | 20,867 | | 21,706 | | 23,109 | | 26,041 | | 25,613 |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Nickel packaged | | | | | | | | | | |

Kwinana Nickel Refinery | | 13,969 | | 14,498 | | 15,171 | | 17,246 | | 16,905 |

| | | | | |

FERTILIZER - PHOSPHATE HILL | | | | | | | | | | |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

DAP | | 173,441 | | 168,075 | | 202,928 | | 198,448 | | 180,770 |

MAP | | 27,484 | | 70,726 | | 31,072 | | 30,264 | | 13,341 |

| | |

| |

| |

| |

| |

|

Total Fertilizer | | 200,925 | | 238,801 | | 234,000 | | 228,712 | | 194,111 |

| | |

| |

| |

| |

| |

|

| 1 | 100% represents purchase third party feeds. Corresponding data for the previous period is 100%, 100%, 97% and 90% respectively. |

19

Announcements

ASX Company Announcements Office

Public Announcement 2003-31

Please find attached for immediate release, Public Announcement 2003-31 covering WMC Resources Ltd Olympic Dam Acid Plant Damage and Review of Operations.

A copy of this public announcement will be published on WMC’s web site atwww.wmc.com later this morning.

Peter Horton

Company Secretary

24 November 2003

WMC Resources Ltd

ABN 76 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9686 3569

| 24 NOVEMBER 2003 | |  |

PUBLIC RELEASE

OLYMPIC DAM ACID PLANT DAMAGE AND REVIEW OF OPERATIONS

Production at WMC Resources’ Olympic Dam operations in South Australia has been interrupted following the failure of a heat exchanger in the sulphuric acid plant late last week.

Investigations over the weekend revealed the likely cause was a failure of a cooling tube, leading to severe corrosion within the heat exchanger. A replacement heat exchanger is currently being sourced. The cause of the initial tube failure is still being investigated.

The acid plant converts sulphur dioxide gas produced during copper smelting to sulphuric acid which is used in other parts of the operations.

The copper smelter and associated surface plants remain offline, however mining operations are continuing at full capacity building stockpiles and advancing mine development schedules.

Early indications are that sourcing and installation of a replacement unit will take between two and three weeks. The impact on operations is currently estimated at 600t of copper and approximately 12t of uranium oxide per day. The impact on pre-tax profit is expected to be in the order of A$1.5m per day with total replacement and installation costs of the heat exchanger in the order of A$3million.

While we are investigating a range of options to mitigate production and financial impacts, full year targets will be reduced in line with the replacement and commissioning timeframe.

2004 production is not expected to be impacted.

Reliability Review

Following this incident, WMC Resources CEO Andrew Michelmore has initiated a review of operational performance at Olympic Dam. The review, to be headed by Dick Pettigrew, former Director of Asset Management Services at US chemical company Rohm & Haas, will focus on plant reliability and improvements necessary for consistent production performance.

“To operate consistently at full rates, we need to know we’ll get a clearer run out of the plant than we have experienced in 2003”, Mr Michelmore said. “These interruptions have hurt our credibility and more importantly, they overshadow the underlying improvements occurring across our operations. That includes some major operating improvements at Olympic Dam.”

“Sustained production performance depends on improved levels of plant reliability”, Mr Michelmore said. “We aren’t there yet and I am determined to turn this around.”

For further information:

| Media contact: | | Analyst contact: |

| Troy Hey | | Nerida Mossop |

Group Manager – Public Affairs | | Manager – Investor Relations |

Telephone: (61 3) 9685 6233 | | Telephone: (61 3) 9685 6274 |

Mobile: 0419 502 852 | | Mobile: 0418 378 809 |

A copy of this release is available online at www.wmc.com.

WMC Resources Ltd

ABN 76 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9686 3569

Announcements

ASX Company Announcements Office

Public Announcement 2003-32

Small Shareholder Share Sale

and Top-up Facility.

WMC Resources Ltd is offering a Small Shareholder Share Sale and Top-Up Facility for eligible shareholders holding 1,000 or less shares.

Attached are copies of the letters which are being sent to shareholders, explaining the terms and conditions of the facility, together with sale and buy instruction forms associated with the facility.

R E Mallett

Assistant Company Secretary

28 November 2003

WMC Resources Ltd

ABN 76 004 184 598

GPO Box 860K

Melbourne Vic. 3001

Australia

Level 16 IBM Centre

60 City Road

Southbank Vic. 3006

Australia

Tel +61 (0)3 9685 6000

Fax +61 (0)3 9686 3569

28 November 2003

IMPORTANT

IF YOU DO NOT RESPOND TO THIS LETTER YOUR SHARES IN WMC RESOURCES

MAY BE SOLD AND THE PROCEEDS SENT TO YOU.

Dear Shareholder

Small Holding Sale Facility and Top-Up Facility

Our records indicate that you held less than A$500 worth of shares in the Company as at 21 November 2003.

This letter contains important information about your shareholding and provides you with the following options (which are outlined in more detail below):

| • | If you wish toretain your WMC Resources shares – you must complete andreturn the yellow “Notice of Retention” form which accompanies this letter, so that it is received by the Share Registry no later than 5.00pm (Melbourne time) on Friday, 23 January 2004. |

If you do nothing, your WMC Resources shares will be sold on your behalf (as outlined below) and the proceeds of sale will be posted to you.

| • | If you had a registered address in Australia or New Zealand as at 21 November 2003 and wish to purchase additional shares in WMC Resources– you must complete and return thegreen “Buy Instruction Form” for the Top-Up Facility which accompanies this letter, along with your cheque, so that it is received by the Share Registry no later than 5.00pm (Melbourne time) on Friday, 23 January 2004. If you choose to participate in the Top-Up Facility, none of your existing WMC Resources shares will be sold under the Small Holding Sale Facility. |

| | Forms can be returned using the enclosed envelope (reply paid for mailing in Australia) or using the postal or hand delivery addresses for WMC Resources’ Share Registry listed on each of the forms. |

Why is WMC Resources implementing a Top-Up Facility and Small Holding Sale Facility?

Following the WMC Demerger late last year WMC Resources emerged as a separately listed company on the Australian Stock Exchange. One of the consequences of the demerger was the creation of a number of small shareholdings in the Company. Indeed, of the 95,000 shareholders who hold WMC Resources shares, approximately 7,700 hold less than a marketable parcel (i.e. A$500 worth of shares).

The Company welcomes the support of all shareholders, especially retail investors. However, WMC Resources incurs administrative costs in producing and distributing shareholding statements, annual reports and all other forms of shareholder communication, irrespective of the size of the shareholding. This cost of maintaining shareholder accounts can be disproportionately high when compared with the dollar value of small shareholdings. In addition, investors holding a small number of shares may find it difficult or expensive to dispose of those shares through the normal means.

In order to efficiently manage the costs of being a listed public company, the Company has arranged for the following facilities to be available to shareholders (“Small Shareholders”) who hold less than A$500 worth of WMC Resources shares (ie 104 shares or less).

Top-Up Facility

Small Shareholders with a registered address in Australia or New Zealand as at 21 November 2003 have the opportunity to purchase either A$1,000, A$2,000 or A$4,000 in value of additional WMC Resources shares.

This Top-Up Facility enables eligible shareholders to purchase additional WMC Resources shares for a simple flat fee of A$19. The Company has arranged for E.L.&C. Baillieu Stockbroking Ltd (“Baillieus”) to act as broker to make purchases under this facility.

Shares to be purchased under the Top-Up Facility will be purchased in batches on the Australian Stock Exchange by Baillieus as your stockbroker. You should note, however, that the number of WMC Resources shares purchased for you will be dependent upon a number of factors, including the volume weighted average price for WMC Resources shares purchased under the Top-Up Facility in the same batch as your shares. The A$19 fee will be deducted from the amount you provide for purchases.

I encourage you to read the documents enclosed with this letter, especially the Terms and Conditions on the reverse of the “Buy Instruction Form” for further details concerning the Top-Up Facility.

In addition to Small Shareholders, the Top-Up Facility is being made available to all shareholders with a registered address in Australia or New Zealand as at 21 November 2003 who hold no more than 1000 shares.

Small Holding Sale Facility

In addition to the Top-Up Facility, the Company will be operating a Small Holding Sale Facility in respect of all Small Shareholders, regardless of their registered address.

Under Rule 142 of WMC Resources’ Constitution, the Company may notify shareholders who hold less than A$500 worth of WMC Resources shares that it intends to sell their shares.

This letter, and theyellow “Notice of Retention” form which accompanies this letter, satisfy the notice requirements under Rule 142 of the Company’s Constitution.

Small Shareholders have an opportunity, however, to inform the Company that they wish to retain their shareholding. If a Small Shareholder notifies the Company within the notice period, the Company will not sell those shares.

Similarly, if the size of a Small Shareholder’s shareholding increases so that it is worth more than A$500 at the end of the notice period, or the Small Shareholder sells its shareholding, the Company will not sell those shares.

Otherwise, after the notice period, the Company is entitled to sell the shares with the proceeds of sale remitted to the Small Shareholders whose shares were sold. Shares will be sold on the Australian Stock Exchange under the Small Holding Sale Facility at prevailing market prices.

Importantly, the Company will bear the brokerage and handling costs in respect of the sales. WMC Resources has arranged for Baillieus to act as broker to effect these sales. These sales will take place within 7 days after the end of the notice period. The proceeds (in Australian dollars) will be mailed to you within ten business days after all sales under the Small Holding Sale Facility have been completed.

What you need to do

Top-Up Facility – Australian and New Zealand Small Shareholders

If you had a registered address in Australia or New Zealand as at 21 November 2003 and wish to provide either A$1,000, A$2,000 or A$4,000 to purchase additional WMC Resources shares through the Top-Up Facility, you must complete and return the following so that they are received by WMC Resources’ Share Registry by no later than 5.00pm (Melbourne time) on Friday, 23 January 2004:

| • | a completed and signedgreen “Buy Instruction Form”; and |

| • | a cheque for either A$1,000, A$2,000 or A$4,000 made payable to “WMC Resources Ltd – Facility Account”. |

If you choose to participate in the Top-Up Facility, none of your existing WMC Resources shares will be sold under the Small Holding Sale Facility.

Small Holding Sale Facility – all Small Shareholders

If you wish toRETAIN your WMC Resources shares, you must complete theyellow “Notice of Retention” form and return it in the enclosed envelope so that it is received by the Share Registry before the end of the notice period—5.00pm (Melbourne time) on Friday, 23 January 2004.

If you do nothing (i.e. you do not return a completed “Buy Instruction Form” or a “Notice of Retention” form and do not buy additional WMC Resources shares so that your holding is worth more than A$500), your WMC Resources shares will be sold after the end of the notice period.

Important Notes

Please read the attached Terms and Conditions carefully as they contain important information. Neither WMC Resources, Computershare Investor Services nor Baillieus makes any recommendation or gives any advice to you regarding whether to participate in the Top-Up Facility, or to sell or retain your shares under the Small Holding Sale Facility.

If you are in any doubt about whether to participate, please consult your own financial adviser.

If you have any questions in regard to how the Top-Up Facility or the Small Holding Sale Facility works, please contact the WMC Resources Share Registry Call Centre on1300 366 353 (within Australia) or on+61 3 9615 5970 (outside Australia).

Yours sincerely

[GRAPHIC APPEARS HERE]

TOMMIE BERGMAN

Chairman

WMC RESOURCES LTD ABN 76 004 184 598 | | All correspondence to: Computershare Investor Services Pty Limited GPO Box 2975EE Melbourne Victoria 8060 Australia Enquiries (within Australia) 1300 366 353 (Outside Australia) 61 3 9275 7985 Facsimile 61 3 9670 7723 web.queries@computershare.com.au www.computershare.com |

TOP-UP FACILITY

Buy Instruction Form- Use this Form if you wish to buy more ordinary shares in WMC Resources Ltd

A. Existing Number of WMC Resources Ordinary Shares

Number of shares held as at 7.00pm (Melbourne time) on 21 November 2003 | |

|

B. Contact Details.

Please provide a telephone number where we may reach you during business hours if we have any questions about this form.

Area Code and Daytime | | | | |

Phone Number: | | ( )

| | |

Contact Name: | | | | |

| | |

|

C. Instruction to Buy Additional WMC Resources Ordinary Shares

Mark (X) in one box below to select the value of Shares you wish to purchase:

A$1,000 | | ¨ | | A$2,000 | | ¨ | | A$4,000 | | ¨ |

Record Cheque Details Below

Drawer | | BSB Number | | Account Number |

| |

| |

|

D. Signature (s)

By signing this Form and attaching a cheque for payment of the amount nominated in C above, I/we

| | • | agree to purchase Share up to that amount, less a fee of $19; |

| | • | appoint the Broker to act on my/our behalf as execution only broker to purchase such Shares on the terms and conditions set out on the reverse of this Form, and authorise Computershare and the Broker to do all thinks and execute all documents to purchase such Shares; and |

| | • | give the warranties and acknowledgments set out on the reverse of this Form |

Please see below for signature and lodgement instructions.

Shareholder 1 or Individual | | Shareholder 2 | | Shareholder 3 |

| |

| |

|

Sole Director and Sole Company Secretary | | Director/Company Secretary | | Director |

Signature Instructions

This Form must be signed by the Shareholder (all joint Shareholders must sign) or by the Shareholder’s authorised attorney(s). It need not be witnessed.

If the Shareholder is a corporation, this Form must be signed either: under Common Seal of the corporation; by two directors or one director and a secretary; by an authorised officer or attorney; or if the corporation has a sole director/secretary, by that director (and it must state this on the Form).

If signed by an attorney or authorised officer, the Power of Attorney or other authority under which this Form is signed must be forwarded to Computershare at the address below. A certified copy of the Power of Attorney or other authority is acceptable.

Lodgement Instructions

Sale Instruction Forms must be received prior to 5.00pm (Melbourne time) on 23 January 2004, subject to the Offer Period being extended or shortened in accordance with the terms and conditions set out on the reverse of the Form. It is your responsibility to allow sufficient time to meet the closing date, as your Sale Instruction Form will only be accepted when it is received by Computershare at an address below.

A reply paid envelope is enclosed

Your Sale Instruction Form must be sent to:

| |

Postal Address: | | Hand Delivery |

WMC Resources Ltd OR | | WMC Resources Ltd |

C/-Computershare Investor | | C/-Computershare Investor Services Pty Limited |

Services Pty Limited | | Level 12, 565 Collins Street Melbourne VIC 3001 |

Reply Paid 52 Melbourne VIC 3001 | | |

All enquiries: WMC Resources Share Registry Call Centre: 1300 366 353 (within Australia) or + 61 3 9615 5970 (outside Australia).

TERMS & CONDITIONS

Top Up Facility

1. Terms of Participation

1.1 All persons (“Eligible Shareholders”) who hold 1000 ordinary shares (“Shares”) or less in WMC Resources Ltd (“WMR”) as at 7pm on 21 November 2003 and have a registered address in Australia or New Zealand are entitled to participate in the Top-Up Facility. Participation is voluntary. Applications to participate must be made on this Buy Instruction Form.

1.2 An Eligible Shareholder who elects to participate in the Top-Up Facility (“Participating Shareholder”) does so on the basis of this Buy Instruction Form (including these Terms and Conditions) and any associated documents provided or made available by WMR to Eligible Shareholders (“Facility Documents”). Participation is also on the basis that a Participating Shareholder may only elect to purchase up to A$1000, A$2000 or A$4000 of Shares (less the fee referred to in clause 1.3) under the Top-Up Facility.

1.3 A Participating Shareholder will not be liable to pay any brokerage or fees for the purchase of Shares under the Top-Up Facility, other than a fee of A$19 payable to WMR.

2. Offer Period

The Top-Up Facility will operate from 28 November 2003 to 23 January 2004 or such shorter or longer period as may be determined by WMR (“Offer Period”). WMR reserves the right, on behalf of the Broker and for any reason, to modify the timetable for, or to terminate or suspend, the Top-Up Facility in its sole discretion. Extension or shortening of the Offer Period, or suspension or termination of the Top-Up Facility, will be advertised as soon as practicable by WMR in “The Australian” newspaper.

3. Roles of Computershare and the Broker

3.1 Each Participating Shareholder irrevocably appoints E.L. & C. Baillieu Stockbroking Ltd (“Broker”) as execution-only broker to purchase Shares on behalf of the Participating Shareholder in accordance with the Facility Documents. WMR will pay brokerage (and any Australian GST) to the Broker in relation to the purchase of Shares through the Top-Up Facility.

3.2 Computershare Investor Services Pty Limited (“Computershare”) will assist in the administration of the Top-Up Facility, including by processing received Buy Instruction Forms, banking cheques, communicating with Eligible Shareholders, liaising with the Broker in relation to purchases of Shares and issuing transaction confirmation notes. WMR will pay a handling fee (and any Australian GST) to Computershare in respect of its role in relation to the Top-Up Facility.

3.3 Each of the Broker and Computershare is irrevocably authorised to do all things and execute all documents, including to effect any holding adjustment, securities transformation or other transmission or transaction in relation to Shares purchased for a Participating Shareholder under the Top-Up Facility, to facilitate the purchase of those Shares by the Broker as broker under the Top-Up Facility.

4. Buy Instruction Forms

4.1 To participate in the Top-Up Facility, an Eligible Shareholder must complete and sign this Buy Instruction Form and return it to Computershare at an address overleaf, together with an Australian dollar cheque for the amount nominated in the Buy Instruction Form made payable to “WMC Resources Ltd – Facility Account”. Buy Instruction Forms and cheques must be received by Computershare by 5pm on the last day of the Offer Period.

4.2 Computershare or the Broker may, in its sole discretion, at any time determine that a Buy Instruction Form is valid in accordance with the Facility Documents, even if the Buy Instruction Form is incomplete, contains errors or is otherwise defective. Computershare and the Broker may correct any error in or omission from a Buy Instruction Form and complete the Buy Instruction Form by the insertion of any missing details. However, neither Computershare, the Broker nor WMR is under any obligation to accept any Buy Instruction Form, whether completed correctly or not, and in particular is not under any obligation to accept or act on any Buy Instruction Form where a cheque for the amount nominated in the Buy Instruction Form has not been provided by the Eligible Shareholder, or is not denominated in Australian dollars and drawn on an Australian bank or an Australian branch of a foreign bank, or is not honoured on presentation.

5. Purchases of Shares

5.1 WMR will establish and maintain an account called the “WMC Resources Ltd – Facility Account” for the purposes of the Top-Up Facility, into which Computershare will deposit cheques received from Participating Shareholders and from which the required amounts will be remitted to the Broker for the settlement of purchases of Shares under the Top-Up Facility.

5.2 Purchases of Shares under the Top-Up Facility will be made by the Broker on the Australian Stock Exchange in the ordinary course of business (including, in the Broker’s sole discretion, by crossings other than special crossings). The Broker may purchase Shares for a Participating Shareholder at any time during the period commencing when the relevant Buy Instruction Form is processed by Computershare and ending on the date that is two weeks after the end of the Offer Period. The Broker may, in its sole discretion, delay the purchase of some or all of the Shares available to be purchased on a trading day, if it considers market conditions to be unsuitable or to avoid an excessive concentration of purchases on a particular trading day.

5.3 Computershare will process Buy Instruction Forms received by it as soon as practicable after receipt and may, from time to time and in consultation with the Broker, aggregate valid Buy Instruction Forms in respect of two or more Participating Shareholders for the purpose of the Shares to be purchased by the Broker in accordance with those Buy Instruction Forms forming one batch. Computershare will advise the Broker of the Australian dollar amount available to purchase Shares from time to time in respect of a batch (after deducting the fee referred to in clause 1.3 in respect of each Participating Shareholder to which the batch relates). Shares purchased by the Broker as part of a batch may be purchased in one or more trades and on one or more trading days, as determined by the Broker in its sole discretion.

5.4 The price at which each Share will be purchased for a Participating Shareholder through the Top-Up Facility will be the volume weighted average price achieved by the Broker for the purchase of all Shares purchased by the Broker through the Top-Up Facility in the batch in which the Participating Shareholder’s Shares were purchased. That price will be calculated by the Broker and may not be challenged in the absence of manifest error.

5.5The price calculated in accordance with clause 5.4 may be different to the price for Shares appearing in the newspaper or quoted by the Australian Stock Exchange on the day that a Participating Shareholder’s Buy Instruction Form is sent or on any other day, and may not be the best execution price on the trading day or trading days that the Participating Shareholder’s Shares are purchased. None of WMR, Computershare, the Broker nor any other person will on any account be liable, and a Participating Shareholder may not bring any claim or action against the aforementioned, for not having purchased Shares at any specific price or on any specific date.

5.6 The number of Shares purchased for a Participating Shareholder through the Top-Up Facility will be calculated on the basis of the amount nominated in the relevant Buy Instruction Form (being a value of A$1000, A$2000 or A$4000 only) less the fee referred to in clause 1.3, divided by the price referred to in clause 5.4 in respect of that Participating Shareholder, rounded down to the nearest whole number of Shares. Participating Shareholders will not have any entitlement to any residual Shares remaining following such rounding. If, after execution of a Participating Shareholder’s purchase order through the Top-Up Facility, any amount remains of the amount provided by the Participating Shareholder for the purposes of the Top-Up Facility which is insufficient to purchase a Share, then that amount remaining will vest in WMR.

6. Confirmation

Computershare will notify each Participating Shareholder, by way of a transaction confirmation note issued on behalf of the Broker, of the number of Shares purchased for that Participating Shareholder through the Top-Up Facility, and the volume weighted average price for those Shares, within 10 business days of the last purchase of those Shares.

7. Warranties and Acknowledgements

By signing and returning this Buy Instruction Form, a Participating Shareholder:

| (a) | acknowledges that the Participating Shareholder has read, and agrees to, the terms and conditions of the Facility Documents; |

| (b) | warrants that the Participating Shareholder has not (if eligible) participated in the Share Sale Facility being made available in conjunction with the Top-Up Facility, and has not before participated in the Top-Up Facility; |

| (c) | acknowledges that none of WMR, Computershare, the Broker nor any other party involved in the Top-Up Facility has any liability to the Participating Shareholder other than for the provision of the Shares purchased for the Participating Shareholder in accordance with these Terms and Conditions; |

| (d) | acknowledges that none of WMR, Computershare, the Broker nor any other party involved in the Top-Up Facility has provided the Participating Shareholder with any investment advice or made any securities recommendations, nor has any obligation to provide such advice or make any such recommendations, concerning the Participating Shareholder’s decision to purchase Shares, and that the Participating Shareholder has made its own decision to purchase Shares through the Top-Up Facility based on its own investigations of the affairs of WMR and its own analysis of the Facility Documents; |

| (e) | acknowledges that if the Participating Shareholder’s cheque is not honoured on presentation, Computershare or the Broker may place a holding lock (or similar) on, and cause to be sold, any Shares purchased for the Participating Shareholder through the Top-Up Facility, and the Participating Shareholder must pay all costs and losses incurred as a result; and |

| (f) | acknowledges that the Facility Documents are governed by the laws in force in Victoria. |

Personal information may be collected on this Buy Instruction Form by WMR and/or Computershare for the purpose of the administration of, and the purchase of Shares by the Broker as broker under, the Top-Up Facility. That information may be disclosed by each company to each other, to each company’s respective related bodies corporate, to the Broker, to external service companies such as mail service providers or as otherwise required or permitted by law. Please contact WMR or Computershare for details of your personal information held by it or to correct inaccurate or out of date information.

28 November 2003 | |  |

| |

Dear Shareholder | | |

Share Sale Facility and Top-Up Facility

WMC Resources Ltd (“WMR”), as part of the company’s ongoing drive to minimise administrative costs, has established a Share Sale Facility and a Top-Up Facility, aimed at reducing the number of small shareholdings. While the Company welcomes the support of all shareholders, especially retail investors, the cost of small shareholder accounts can be disproportionately high when compared with the level of investment. In addition, small shareholders can find it difficult or expensive to dispose of their shares through the normal means.

This program is entirely voluntary. The Share Sale Facility will allow Australian and New Zealand WMR shareholders who hold at least 105 shares but no more than 1,000 shares to sell all their shares at market value in a cost effective manner. In addition, the Top-Up Facility will allow Australian and New Zealand WMR shareholders with 1,000 shares or less to purchase A$1,000, A$2,000 or A$4,000 in value of additional WMR shares at discounted brokerage rates. WMR shareholders holding 104 shares or less (ie, an unmarketable parcel) have the opportunity to participate in the Top-Up Facility, as well as in a Small Holding Sale Facility which the Company is also arranging for those shareholders.

If you elect to take advantage of the Share Sale Facility or the Top-Up Facility, WMR will meet all transaction costs, including brokerage and handling charges, for a flat fee of A$19. These arrangements represent a discount to standard industry brokerage rates on offer.

If you do not wish to sell or top-up your shareholding, please disregard this letter.

Share Sale Facility

If you choose to sellall your WMR shares now to take advantage of the discounted transaction costs, please complete and sign the enclosedcream Sale Instruction Form, and return it in the enclosed envelope so that it reaches WMR’s Share Registry by 5.00pm (Melbourne time) on Friday, 23 January 2004.Please note that if you return this Form, all of your WMR shares will be sold under the Share Sale Facility.

Shares to be sold under the Share Sale Facility will be aggregated in batches and sold on the Australian Stock Exchange by E.L.&C. Baillieu Stockbroking Ltd (“Baillieus”) as your stockbroker. You will receive market value for your shares, determined on the basis of the volume weighted average price for WMR shares sold under the Share Sale Facility in the same batch as your shares.

The proceeds from the sale, less the A$19 fee, will be paid to you by cheque within 10 business days of your shares being sold.

Top-Up Facility

If you wish to purchase an additional A$1,000, A$2,000 or A$4,000 worth of WMR shares through the Top-Up Facility to take advantage of discounted transaction costs, please complete and return the following in the enclosed envelope so that they reach WMR’s Share Registry by 5.00pm (Melbourne time) on Friday, 23 January 2004:

| • | a completed and signedgreen “Buy Instruction Form”; and |

| • | a cheque for either A$1,000, A$2,000 or A$4,000 made payable to “WMC Resources Ltd – Facility Account”. |

Shares to be purchased under the Top-Up Facility will be purchased in batches on the Australian Stock Exchange by Baillieus as your stockbroker. You should note, however, that the number of WMR shares purchased for you will be dependent upon a number of factors, including the volume weighted average price for WMR shares purchased under the Top-Up Facility in the same batch as your shares. The A$19 fee will be deducted from the amount you provide for purchases.

I encourage you to read the documents enclosed with this letter, especially the Terms and Conditions on the reverse side of the “Buy Instruction Form”, for further details concerning the Top-Up Facility.

Important Notes

Please read the enclosed Terms and Conditions carefully as they contain important information. Neither WMR, Computershare Investor Services nor Baillieus makes any recommendation or gives any advice to you regarding whether to participate in the Top-Up Facility, or to sell your shares under the Share Sale Facility.

If you are in doubt about whether to participate, please consult your own financial adviser.

If you have any questions as to how the Top-Up Facility or Share Sale Facility works, please contact the WMC Resources Share Registry Call Centre on1300 366 353 (within Australia) or on+61 3 9615 5970 (outside Australia).

Your eligibility to participate in the Share Sale Facility and the Top-Up Facility has been determined by your shareholding and registered address as at 7.00pm (Melbourne time) on 21 November 2003.

Yours sincerely

TOMMIE BERGMAN

Chairman

WMC RESOURCES LTD ABN 76 004 184 598 | | All correspondence to: Computershare Investor Services Pty Limited GPO Box 2975EE Melbourne Victoria 8060 Australia Enquiries (within Australia) 1300 366 353 (Outside Australia) 61 3 9275 7985 Facsimile 61 3 9670 7723 web.queries@computershare.com.au www.computershare.com |

A. Shareholder Name and Address: | | |

| | | SMALL HOLDING SALE FACILITY |

Notice of Retention of Small Shareholding

IMPORTANT:

If you wish to retain your shareholding in WMC Resources Ltd (“WMC Resources Ltd”), it will be necessary for you to complete this Form and return it to WMC Resources’ Share Registry so that it is received by no later than 5.00pm (Melbourne time) on Friday, 23 January 2004. This Form can be returned using the enclosed envelope to one of the addresses on the reverse of this Form.

If this Form is not received by WMC Resources’ Share Registry by 5.00pm (Melbourne time) on Friday, 23 January 2004, your shares will be sold. If your shares are in a CHESS holding, WMC Resources may, without further notice, initiate a holding adjustment to move those shares from that CHESS holding to an issuer sponsored or certified holding for the purpose of sale.

If you wish to sell your shares under the Small Holding Sale Facility, you do not need to complete or return this Form.

B. Number of WMC Resources ordinary shares that you held at 7.00pm (Melbourne time) on 21 November 2003

C. Retention of Shares

| ¨ | I/we the shareholder(s) described above hereby give notice that I/we wish to retain my/our shareholding in WMC Resources and that I/we do not want the provisions of Rule 142 of WMC Resources’ Constitution to apply to my/our shares at this time |

D. Contact Details

| Area Code and Daytime | | ( ) |

| Phone Number: | |

|

| Contact Name: | |

|

E. Signature(s)

Please see below for signature instructions. Please see the reverse of this Form for lodgement instructions.

| | | Shareholder 2

| | Shareholder 3

|

| |

| |

|

| Sole Director and Sole Secretary | | Director/Company Secretary | | Director |

Signature Instructions

This Form must be signed by the Shareholder (all joint Shareholders must sign) or by the Shareholder’s authorised attorney(s). It need not be witnessed.

If the Shareholder is a corporation, this Form must be signed either: under Common Seal of the corporation; by two directors or one director and a secretary; by an authorised officer or attorney; or if the corporation has a sole director/secretary, by that director (and it must state this on the Form).

If signed by an attorney or authorised officer, the Power of Attorney or other authority under which this Form is signed must be forwarded to Computershare at the address below. A certified copy of the Power of Attorney or other authority is acceptable.

Shareholders who wish to retain their WMC Resources shares must lodge a Notice of Retention Form

This is an important document and requires your immediate attention. If you are in any doubt how to deal with it, please consult your financial or other professional advisor.

Consolidations of shareholdings

If you have more than one holding on WMC Resources’ register, you should consider consolidating them. For further advice in this regard, please contact Computershare Investor Services Pty Limited on 1300 366 353 (within Australia) or 61 3 9615 5970 (outside Australia).

Lodgement Instructions

Notice of Retention Form must be received prior to 5.00pm (Melbourne time) on 23 January 2004. Return the Notice of Retention Form to:

| Postal Address: | | | | Hand Delivery |

WMC Resources Ltd | | OR | | WMC Resources Ltd |

C/-Computershare Investor | | | | C/- Computershare Investor Services Pty Limited |

Services Pty Limited | | | | Level 12, 565 Collins Street Melbourne VIC 3001 |

Reply Paid 52 Melbourne VIC | | 3001 | | |

Privacy Statement

Personal information is collected on this Form by Computershare Investor Services Pty Limited (“CIS”), as a registrar for the securities issues (“the issuer”) for the purpose of maintaining registers of securityholders, facilitating distribution payments and other corporate actions and communications. Your personal information may be disclosed to our related bodies corporate, to external service companies such as print or mail service providers, or as otherwise required or permitted by law. If you would like details of your personal information held by CIS, or you would like to correct information that is inaccurate, incorrect or out of date, please contact CIS. In accordance with the Corporations Act 2001, you may be sent material (including marketing material) approved by the issuer in addition to general corporate communications. You may elect not to receive marketing material by contact CIS. You can contact CIS using the details provided on the front of this form or email priacy@computershare.com.au

If you have any enquiries concerning your Securityholding, please contact Computershare Investor Services Pty Limited on telephone 1300 366 353 (within Australia) or +61 3 9615 5970 (outside Australia)

WMC RESOURCES LTD ABN 76 004 184 598 | | All correspondence to: Computershare Investor Services Pty Limited GPO Box 2975EE Melbourne Victoria 8060 Australia Enquiries (within Australia) 1300 366 353 (Outside Australia) 61 3 9275 7985 Facsimile 61 3 9670 7723 web.queries@computershare.com.au www.computershare.com |

SHARE SALE FACILITY

Sale Instruction Form- Use this Form if you wish to sellall of your ordinary shares in WMC Resources Ltd

A. Existing Number of WMC Resources Ordinary Shares

Number of shares held as at 7.00pm (Melbourne time) on 21 November 2003

Please note that, if you decide to sign and return this Form and participate in the Share Sale Facility, all of your shares will be sold, whether or not the number of those Shares is less or more than the number specified here.

B. Contact Details.