SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT ON FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

Date: Period February, 2004

WMC RESOURCES LTD

ACN 004 184 598

Level 16, IBM Centre

60 City Road

Southbank, Victoria 3006

Australia

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

This report on Form 6-K includes press releases made during the period January 15, 2004—February 11, 2004 (and includes WMC Resources Ltd’s December 2003 Quarterly Production Report and WMC Resources Ltd’s 2003 Full Year Results).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| | |

| WMC RESOURCES LTD |

| |

| By: | | /s/ R.E. Mallett |

| | |

|

Name: | | R.E. Mallett |

Title: | | Assistant Company Secretary |

Date: | | 12 February 2004 |

To: The Manager

Announcements

ASX Company Announcements Office

Public Announcement 2004-1

Please find attached for immediate release, Public Announcement 2004-1 covering WMC Resources Ltd’s December 2003 Quarterly Production Report.

A copy of this public announcement will be published on WMC’s web site atwww.wmc.com later this morning.

WMC’s Chief Executive Officer, Mr Andrew Michelmore, will host an audio conference at 11.00am this morning which will be broadcast live from WMC’s web site. A recording of this conference will be available for playback on WMC’s web site this afternoon.

Ross Mallett

Assistant Company Secretary

15 January 2004

| | | | |

| | | | | WMC Resources Ltd ACN 004 184 598 |

| | |

| | | | | GPO Box 860K Melbourne Vic. 3001 Australia Level 16 IBM Centre 60 City Road Southbank Vic. 3006 Australia Tel +61 (0)3 9685 6000 Fax +61 (0)3 9685 6115 |

WMC Resources Ltd

Quarterly Review, Quarter ended 31 December 2003

Safety, health & environment

We regret to advise that Teodosio Gabriel Macumbue, a security guard employed at our Corridor Sands Pilot Plant near Chibuto in Mozambique, was attacked and killed during a robbery in October. We are cooperating with local authorities who are investigating the crime.

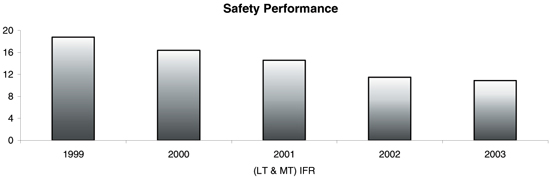

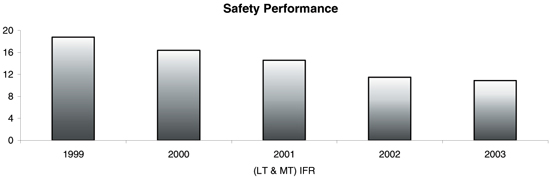

The (LT+MT)IFR of 8.5 for the quarter is equal to the best quarterly performance on record. The full year (LT+MT)IFR of 10.9 represents a 5 per cent improvement over 2002.

There were three spills of process materials at Olympic Dam this quarter. While none of these spills caused injury or impact to the environment they were reportable under the South Australian Government’s spill reporting guidelines.

Note: Unless otherwise stated, comparisons contained in this production report are quarter on previous quarter. Statements, particularly those regarding the possible or assumed future performance, production levels, prices, reserves, divestments, growth or other trend projections are or may be forward looking statements. Actual results, actions and developments may differ materially from those expressed or implied by these forward looking statements depending on a variety of factors including known and unknown risks and uncertainties

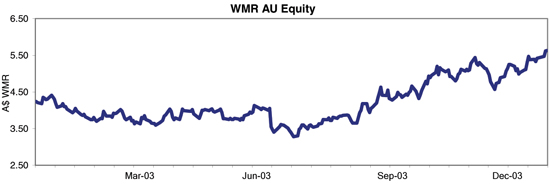

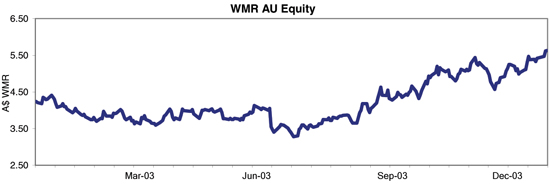

WMC Resources Ltd share price

Overview

Dear Shareholder,

Record production performance from our nickel and fertilizer businesses were highlights for the quarter.

Construction of the copper solvent extraction plant was completed as planned by year end, with commissioning to continue throughout the first quarter of 2004.

The nickel business had another strong quarter with record production of nickel-in-concentrate – up 8% on the September quarter. Excellent second half performance from the Kalgoorlie smelter ensured WMC reached its 2003 target of 99,000 tonnes of nickel-in-matte and quarterly metal production at the Kwinana refinery was at record levels.

Queensland Fertilizer Operations again exceeded design capacity for the quarter with the plant operating at 103 per cent of design capacity. Annual production exceeded the 2003 target by 6 per cent.

Copper production was lower for the quarter following a smelter foam-up and failure of an acid plant heat exchanger. A reliability review was initiated in November, with an initial focus on smelter and acid plant performance at Olympic Dam. Uranium production was in line with the previous quarter.

Major maintenance programs at the Kalgoorlie smelter, Queensland Fertilizer Operations and the Olympic Dam smelter and construction of the copper and uranium solvent extraction plants at Olympic Dam were key milestones completed in 2003.

Looking forward, we remain focused on delivering safe, sustained and consistent production performance into a continuing strong market for our major commodities.

A G MICHELMORE

Chief Executive Officer

15 January 2004

| | |

| Quarter ended 31 December 2003 | |  |

Production overview

Copper & Uranium

The Olympic Dam smelter was recommissioned on 9 October following completion of the planned major maintenance shutdown, with anode production at full rates by late October.

Smelter operations were subsequently interrupted by a foam-up of the furnace bath and failure of a heat exchanger in the acid plant. Uranium production was correspondingly constrained by the shortage of acid for leaching. The combined production impact was approximately 18,000 tonnes of copper and 340 tonnes of uranium.

A review of operational performance at Olympic Dam has been commissioned with an initial focus on the smelter and acid plant. The review will concentrate on plant reliability and improvements necessary for consistent production performance.

Gold production was 12 per cent higher for the quarter.

Mine production increased 13 per cent to record levels equivalent to an annualized rate of 10 million tonnes.

Nickel

Nickel-in-concentrate production increased 8 per cent to record levels for the quarter.

This performance was underpinned by record production at Mount Keith based on continued high ore grades from the bottom of Stage E pit, record throughput and metallurgical recovery (74 per cent).

Production at Leinster increased 6 per cent with higher ore grades and metallurgical recovery. The increase in recovery to over 85 per cent reflects the benefits of improvement projects based on Mount Keith experience and is 4 per cent higher than previously achieved on similar ore blends.

Concentrate production at Kambalda was 13 per cent higher reflecting increased ore deliveries from the operators of nickel mines in the area.

Strong performance continued at the Kalgoorlie smelter with production similar to the previous quarter yielding a record 55,145 tonnes of nickel-in-matte for the half-year.

Refinery performance was also at record levels with 17,780 tonnes of nickel metal produced for the quarter.

The following milestones are scheduled for the March quarter:

| • | completion of mining from Stage E pit at Mount Keith with ore progressively sourced from the new Stage F cutback during the June quarter |

| • | completion of mining from Harmony open cut at Leinster late in the period |

| • | a planned three week statutory maintenance shutdown at the Kwinana refinery in March |

| • | Sub-lease of the Lanfranchi mine at Kambalda subject to regulatory approval. |

Fertilizers

Record performance continued at Queensland Fertilizer Operations with quarterly production equivalent to 103 per cent of design capacity.

A key milestone was also achieved for the full year with 2003 production equivalent to 100 per cent of design capacity after accounting for the planned 15 day statutory maintenance shutdown in the third quarter.

Business Development

Solvent Extraction Plant Rebuild

Construction of the copper solvent extraction plant has been completed on schedule and the total cost is expected to be in line with the revised budget. Commissioning has commenced and will continue throughout the first quarter as planned.

Exploration Activities

Western Australia

Collurabbie

Drilling has intersected disseminated nickel-copper-PGE sulphide mineralisation over a 7 kilometre mineralised zone. Results are currently being assessed and drilling is planned to recommence in March.

Mundra South

Ground-based exploration progressed at the Mundra South nickel prospect, with geological targets currently under assessment for drilling later this year.

West Musgrave

We expanded our exploration agreement with the Ngaanyatjarra Land Council to gain ground access to new areas that contain previously identified airborne electromagnetic anomalies.

Global Exploration

We began a program to assess exploration tenements considered prospective for nickel sulphides in Malawi in Southern Africa. An airborne EM survey was flown during the quarter and data compilation is in progress.

Exploration for nickel sulphide deposits also continued in North America, Africa and China and for copper-gold deposits in Mongolia and Peru.

Other

Hedge Book Closeout

The 2005 to 2008 legacy currency hedge book was closed out during the quarter resulting in a net cash gain of $18m. The accounting profit of $367m will be deferred and recognised over 2005 to 2008.

2003 Full Year Results

WMC Resources Ltd will release its full year results for 2003 on 11 February 2004.

This event will be webcast live at www.wmc.com

| | |

| Quarter ended 31 December 2003 | |  |

Summary of WMC Resources’ production

| | | | | | | | | | |

| | | | | Quarter ended 31 Dec 2003

| | Quarter ended 30 Sept 2003

| | Year ended

31 Dec 2003

| | Year ended

31 Dec 2002^

|

Copper (tonnes of refined copper) | | Olympic Dam Operations | | 33,420 | | 35,337 | | 160,080 | | 178,120 |

Uranium Oxide concentrate(tonnes) | | Olympic Dam Operations | | 898 | | 906 | | 3,203 | | 2,890 |

Gold (ounces) | | Olympic Dam Operations | | 18,904 | | 16,910 | | 86,117 | | 64,293 |

Silver (ounces) | | Olympic Dam Operations | | 164,757 | | 113,632 | | 601,395 | | 643,935 |

Nickel (tonnes contained nickel) | | Kambalda Nickel Operations | | 6,576 | | 5,828 | | 25,912 | | 23,225 |

| | | Leinster Nickel Operations | | 11,340 | | 10,667 | | 41,806 | | 40,006 |

| | | Mount Keith Operations | | 14,586 | | 13,661 | | 50,004 | | 43,192 |

| | | Total nickel-in-concentrate | | 32,502 | | 30,156 | | 117,722 | | 106,423 |

| | | Total nickel-in-matte | | 27,346 | | 27,799 | | 99,152 | | 91,574 |

| | | Total nickel metal | | 17,780 | | 13,969 | | 61,417 | | 65,055 |

| | | | | |

Fertilizer | | | | | | | | | | |

Di-ammonium phosphate (tonnes) | | Phosphate Hill | | 215,412 | | 173,441 | | 759,856 | | 718,287 |

Mono-ammonium phosphate (tonnes) | | Phosphate Hill | | 32,839 | | 27,484 | | 162,121 | | 102,713 |

Total Fertilizer(tonnes) | | Phosphate Hill | | 248,251 | | 200,925 | | 921,977 | | 821,000 |

A statistical supplement providing a detailed breakdown of WMC production results is available on WMC Internet home page at http://www.wmc.com

| ^ | The figures quoted represent the production from the operations now comprising WMC Resources Ltd. |

| | |

| Quarter ended 31 December 2003 | |  |

Commodity and Currency Hedging as at 31 December 2003

Following the close out of the 2005 to 2008 legacy currency hedge positions and the majority of the gold hedge positions, the following hedges remain as at 31 December 2003:

Currency

| | | | | | | | | | | | | | |

Period

| | Forward Sale of US$

| | Synthetic Forward Sale of US$

| | Non-limiting Cover

| | Profit & Loss Rate A$/US$

|

| | Amount US$m

| | Cash Flow Rate

A$/US$

| | Amount US$m

| | Cash Flow Rate A$/US$

| | Amount US$m

| | Cash Flow Rate

A$/US$

| |

2004 | | 228 | | 0.6753 | | 20 | | 0.6772 | | 53 | | 0.6271 | | 0.5292 |

A synthetic forward consists of a bought US$ put and a written US$ call option. The written US$ call option has the potential to knock out above certain exchange rates. US$43m of written call options were knocked out during the quarter.

Gold

| | | | | | |

Period

| | Forward Sale of Gold

| | Profit & Loss Rate A$/oz

|

| | Ounces

| | Cash Flow Rate A$/oz

| |

2005 | | 44,600 | | 573 | | 622 |

Gold production from Olympic Dam is delivered into the gold hedging positions.

The legacy hedges were fair valued at the date of demerger. Consequently, the profit and loss for each hedge will be determined by the difference between a particular hedge’s fair valued rate and the spot price at the date of the hedge’s maturity. The tables above show both the rates at which the hedge transactions are contracted with third parties to determine the cash flow impact for each hedge and the fair valued rates for determining the profit and loss impact.

Currency Scenarios

As WMC 2004 hedge positions comprise a combination of limiting and non-limiting cover, at various price levels, any one exchange rate or spot price cannot be used to predict the outcome of WMC’s hedge position. The following table provides an estimate of the realised rate to determine cash flow under various scenarios, taking into account the hedged and unhedged exposures. All realised exchange rate and price estimates include applicable option premium.

| | |

A$/US$ Rate at maturity

| | Estimated realised rate – $A/US 2004

|

0.80 | | 0.7649 |

0.75 | | 0.7291 |

0.70 | | 0.6920 |

0.65 | | 0.6531 |

0.60 | | 0.6128 |

0.55 | | 0.5699 |

Deferred Profits

Profits arising on the close out of the legacy hedge book during 2003 has been deferred and recognized during 2005 to 2008 as shown in the tables below.

Currency

| | | | | | | | | | | | | | | | |

| | | 2005

| | 2006

| | 2007

| | 2008

|

| | | H1

| | H2

| | H1

| | H2

| | H1

| | H2

| | H1

| | H2

|

Deferred Profit (A$m) | | 54.5 | | 60.2 | | 37.3 | | 41.8 | | 40.5 | | 42.1 | | 43.0 | | 47.4 |

Gold

| | | | | | | | | | | | | | |

| | | 2004

| | 2005

| | 2006

| | 2007

| | 2008

| | 2009

| | 2010

|

Deferred Profit (A$m) | | 3.6 | | 1.2 | | 2.5 | | 2.8 | | 2.6 | | 3.0 | | 3.2 |

Deferred Cashflow

In 2001 some foreign exchange and gold hedges were reversed as a result of the gold asset sales. The cash flow impact of these transactions is shown in the table below.

| | | | | | | | | | | | | | | |

| | | 2004

| | | 2005

| | | 2006

| | | 2007

| | | 2008

| |

Deferred Cashflow (A$m) | | (26.4 | ) | | (37.4 | ) | | (28.5 | ) | | (23.4 | ) | | (21.2 | ) |

| | |

| WMC Resources Ltd Quarterly Statistical Supplement – Total Production | | Quarter Ended 31 December 2003 |

| | | | | | | | | | | | | | | | | | | | | |

| | | Quarter ending

31/12/2003

| | Quarter ending

30/09/2003

| | Quarter ending

30/06/2003

| | Quarter ending

31/03/2003

| | Quarter ending

31/12/2002

|

COPPER & URANIUM – OLYMPIC DAM OPERATIONS | | | | | | | | | | | | | | | | | | | | | |

| COPPER | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Ore hoisted | | 2,575,092 | | 2,281,673 | | 2,089,739 | | 2,056,895 | | 2,151,978 |

| | | | | | | | | | |

| | | tonnes

| | | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Ore treated and head grade | | 1,959,037 | | | 2.50 | | 2,151,125 | | 2.45 | | 2,334,685 | | 2.19 | | 1,941,782 | | 2.57 | | 2,172,677 | | 2.57 |

Concentrate smelted | | 67,723 | | | 50.3 | | 64,322 | | 51.3 | | 125,159 | | 47.4 | | 101,209 | | 47.5 | | 99,823 | | 45.1 |

| | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Copper cathode produced | | 33,420 | | | | | 35,337 | | | | 49,644 | | | | 41,678 | | | | 48,328 | | |

| | | | | | | | | | |

| | | tonnes

| | | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

| | tonnes

| | kg/tonne

|

Uranium oxide concentrate produced & head grade | | 898 | | | 0.62 | | 906 | | 0.65 | | 764 | | 0.64 | | 635 | | 0.61 | | 826 | | 0.69 |

| | | | | | | | | | |

| | | ounces

| | | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

|

Refined gold produced & head grade | | 18,904 | | | 0.45 | | 16,910 | | 0.46 | | 23,371 | | 0.48 | | 26,931 | | 0.49 | | 13,682 | | 0.51 |

| | | | | | | | | | |

| | | ounces

| | | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

| | ounces

| | g/tonne

|

Refined silver produced & head grade | | 164,757 | | | 5.11 | | 113,632 | | 4.90 | | 173,340 | | 4.32 | | 149,666 | | 4.22 | | 191,001 | | 4.12 |

| | | | | | | | | | |

NICKEL | | | | | | | | | | | | | | | | | | | | | |

| Ore treated and head grade | | tonnes

| | | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Kambalda Nickel Operations | | 204,016 | * | | 3.56 | | 178,990 | | 3.62 | | 218,327 | | 3.57 | | 203,376 | | 3.56 | | 216,687 | | 4.03 |

Leinster Nickel Operations | | 621,748 | | | 2.13 | | 664,652 | | 1.92 | | 581,944 | | 2.02 | | 620,927 | | 1.97 | | 657,619 | | 2.01 |

Mount Keith Nickel Operations | | 2,974,189 | | | 0.66 | | 2,838,202 | | 0.66 | | 2,698,898 | | 0.59 | | 2,688,597 | | 0.56 | | 2,752,407 | | 0.54 |

| | | | | | | | | | |

| Concentrate produced & concentrate grade | | tonnes

| | | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

| | tonnes

| | grade %

|

Kambalda Nickel Operations | | 45,930 | | | 14.3 | | 41,821 | | 13.9 | | 50,748 | | 14.0 | | 42,808 | | 15.0 | | 50,727 | | 15.2 |

Leinster Nickel Operations | | 93,661 | | | 12.1 | | 89,509 | | 11.9 | | 84,963 | | 11.9 | | 78,770 | | 12.3 | | 78,230 | | 13.2 |

Mount Keith Nickel Operations | | 70,681 | | | 20.6 | | 66,366 | | 20.6 | | 54,386 | | 21.3 | | 55,796 | | 18.2 | | 42,071 | | 22.5 |

| | | | | |

| Nickel contained in concentrate | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Kambalda Nickel Operations | | 6,576 | | 5,828 | | 7,100 | | 6,409 | | 7,720 |

Leinster Nickel Operations | | 11,340 | | 10,667 | | 10,099 | | 9,700 | | 10,331 |

Mount Keith Nickel Operations | | 14,586 | | 13,661 | | 11,590 | | 10,167 | | 9,465 |

Total | | 32,502 | | 30,156 | | 28,789 | | 26,276 | | 27,516 |

| | | | | | | | | | |

| Smelter feed & matte produced (tonnes) | | Feed

| | | Matte

| | Feed

| | Matte

| | Feed

| | Matte

| | Feed

| | Matte

| | Feed

| | Matte

|

Kalgoorlie Nickel Smelter | | 188,631 | | | 39,654 | | 194,407 | | 43,688 | | 167,471 | | 31,854 | | 160,593 | | 32,517 | | 179,695 | | 38,858 |

| | | | | |

| Nickel contained in matte | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Kalgoorlie Nickel Smelter | | 27,346 | | 27,799 | | 21,923 | | 22,084 | | 26,901 |

| | | | | |

| Matte treated | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Kwinana Nickel Refinery | | 26,354 | | 20,867 | | 21,706 | | 23,109 | | 26,041 |

| | | | | |

| Nickel packaged | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

Kwinana Nickel Refinery | | 17,780 | | 13,969 | | 14,498 | | 15,171 | | 17,246 |

| | | | | | | | | | |

FERTILIZER – PHOSPHATE HILL | | | | | | | | | | | | | | | | | | | | | |

| | | tonnes

| | tonnes

| | tonnes

| | tonnes

| | tonnes

|

DAP | | 215,412 | | 173,441 | | 168,075 | | 202,928 | | 198,448 |

MAP | | 32,839 | | 27,484 | | 70,726 | | 31,072 | | 30,264 |

Total Fertilizer | | 248,251 | | 200,925 | | 238,801 | | 234,000 | | 228,712 |

| * | 100% sourced from purchased third party feeds. Corresponding data for the previous period is 100%, 100%, 100% and 97% respectively. |

To: The Manager

Announcements

ASX Company Announcements Office

Public Announcement 2004-2

In accordance with Listing Rule 2.7 please find enclosed Appendix 3B, application for quotation of additional securities.

Ross Mallett

Assistant Company Secretary

27 January 2004

| | | | |

| | | | | WMC Resources Ltd ABN 76 004 184 598 GPO Box 860K Melbourne Vic. 3001 Australia Level 16 IBM Centre 60 City Road Southbank Vic. 3006 Australia Tel +61 (0)3 9685 6000 Fax +61 (0)3 9686 3569 |

Appendix 3B

New issue announcement

Rule 2.7, 3.10.3, 3.10.4, 3.10.5

Appendix 3B

New issue announcement, application for quotation of additional securities and agreement

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 1/7/96. Origin: Appendix 5. Amended 1/7/98, 1/9/99, 1/7/2000, 30/9/2001, 11/3/2002, 1/1/2003.

| | |

| Name of entity | | |

| | |

WMC Resources Ltd | | |

| | |

| | | |

We (the entity) give ASX the following information.

Part 1 – All issues

You must complete the relevant sections (attach sheets if there is not enough space).

| | | | | | |

| | | | |

| | |

| | | |

| 1 | | +Class of +securities issued or to be issued | | Fully paid ordinary shares. | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 2 | | Number of +securities issued or to be issued (if known) or maximum number which may be issued | | 5,230,105 | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 3 | | Principal terms of the +securities (eg, if options, exercise price and expiry date; if partly paid +securities, the amount outstanding and due dates for payment; if +convertible securities, the conversion price and dates for conversion) | | The securities in (2) above comprise of 5,230,105 shares arising from options which were exercised during the period. Option exercise prices and expiry dates are detailed in Attachment “A”. | | |

| | | | |

| | |

| | | | | | | |

+ See chapter 19 for defined terms.

| | |

1/1/2003 | | Appendix 3B Page 1 |

Appendix 3B

New issue announcement

| | | | | | | | | | |

| | | | | |

| | |

| 4 | | Do the +securities rank equally in all respects from the date of allotment with an existing +class of quoted +securities? | | Securities rank equally from date of allotment. | | |

| | | | |

| | | If the additional securities do not rank equally, please state: | | | | | | |

| | | | |

| | | • the date from which they do | | | | | | |

| | | | |

| | | • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment | | | | | | |

| | | | |

| | | • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | | | |

| | | | | | | | | |

| | | | | |

| | |

| 5 | | Issue price or consideration | | Refer to Attachment “A”. | | | | |

| | | | | | | | | |

| | | | | |

| | |

| 6 | | Purpose of the issue (If issued as consideration for the acquisition of assets, clearly identify those assets) | | Refer to Item 3 above. | | | | |

| | | | | |

| | |

| | | | | | | | | | | |

| | | | | |

| | |

| 7 | | Dates of entering +securities into uncertificated holdings or despatch of certificates | | Following allotment of shares | | | | |

| | | | | | | | | |

| | | | | |

| | |

| | | | | Number | | +Class | | |

| | | | | |

| | |

| 8 | | Number and +class of all +securities quoted on ASX(including the securities in clause 2 if applicable) | | 1,150,070,945 | | Fully paid ordinary shares. | | |

| | | | | |

| | |

| | | | | | | | | |

+ See chapter 19 for defined terms.

| | |

Appendix 3B Page 2 | | 1/1/2003 |

Appendix 3B

New issue announcement

| | | | | | | | |

| | | | |

| | |

| | | | | Number | | +Class | | |

| | | | |

| | |

| 9 | | Number and +class of all +securities not quoted on ASX(including the securities in clause 2 if applicable) | | Refer to Attachment “A”. | | | | |

| | | | | | | | | |

| | | | |

| | |

| | | | |

| 10 | | Dividend policy (in the case of a trust, distribution policy) on the increased capital (interests) | | N/A. | | | | |

| | | | |

| | |

Part 2 – Bonus issue or pro rata issue

| | | | | | |

| | | | |

| | |

| | | |

| 11 | | Is security holder approval required? | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 12 | | Is the issue renounceable or non-renounceable? | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 13 | | Ratio in which the +securities will be offered | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 14 | | +Class of +securities to which the offer relates | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 15 | | +Record date to determine entitlements | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 16 | | Will holdings on different registers (or subregisters) be aggregated for calculating entitlements? | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 17 | | Policy for deciding entitlements in relation to fractions | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 18 | | Names of countries in which the entity has +security holders who will not be sent new issue documents | | | | |

| | | |

| | | Note: Security holders must be told how their entitlements are to be dealt with. | | | | |

| | | |

| | | Cross reference: rule 7.7. | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 19 | | Closing date for receipt of acceptances or renunciations | | | | |

| | | | |

| | |

| | | | | | | |

+ See chapter 19 for defined terms.

| | |

1/1/2003 | | Appendix 3B Page 3 |

Appendix 3B

New issue announcement

| | | | | | |

| | | | |

| | |

| | | |

| 20 | | Names of any underwriters | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 21 | | Amount of any underwriting fee or commission | | | | |

| | | | | | | |

| | | | |

| | |

| | | |

| 22 | | Names of any brokers to the issue | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 23 | | Fee or commission payable to the broker to the issue | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 24 | | Amount of any handling fee payable to brokers who lodge acceptances or renunciations on behalf of +security holders | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 25 | | If the issue is contingent on +security holders’ approval, the date of the meeting | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 26 | | Date entitlement and acceptance form and prospectus or Product Disclosure Statement will be sent to persons entitled | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 27 | | If the entity has issued options, and the terms entitle option holders to participate on exercise, the date on which notices will be sent to option holders | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 28 | | Date rights trading will begin (if applicable) | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 29 | | Date rights trading will end (if applicable) | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 30 | | How do +security holders sell their entitlementsin full through a broker? | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 31 | | How do +security holders sellpart of their entitlements through a broker and accept for the balance? | | | | |

| | | | |

| | |

| | | | | | | |

+ See chapter 19 for defined terms.

| | |

Appendix 3B Page 4 | | 1/1/2003 |

Appendix 3B

New issue announcement

| | | | | | |

| | | | |

| | |

| 32 | | How do +security holders dispose of their entitlements (except by sale through a broker)? | | | | |

| | | | |

| | |

| | | | | | | |

| | | | |

| | |

| | | |

| 33 | | +Despatch date | | | | |

| | | | |

| | |

Part 3 – Quotation of securities

You need only complete this section if you are applying for quotation of securities

| | | | |

| 34 | | Type of securities

(tick one) |

| | |

| (a) | | x | | Securities described in Part 1 |

| | |

| (b) | | ¨ | | All other securities Example: restricted securities at the end of the escrowed period, partly paid securities that become fully paid, employee incentive share securities when restriction ends, securities issued on expiry or conversion of convertible securities |

Entities that have ticked box 34(a)

Additional securities forming a new class of securities

| | | | |

| Tick to indicate you are providing the information or documents |

| | |

| 35 | | ¨ | | If the +securities are +equity securities, the names of the 20 largest holders of the additional +securities, and the number and percentage of additional +securities held by those holders |

| | |

| 36 | | ¨ | | If the +securities are +equity securities, a distribution schedule of the additional +securities setting out the number of holders in the categories |

| | | | | 1 – 1,000 |

| | | | | 1,001 – 5,000 |

| | | | | 5,001 – 10,000 |

| | | | | 10,001 – 100,000 |

| | | | | 100,001 and over |

| | |

| 37 | | ¨ | | A copy of any trust deed for the additional +securities |

+ See chapter 19 for defined terms.

| | |

| 1/1/2003 | | Appendix 3B Page 5 |

Appendix 3B

New issue announcement

Entities that have ticked box 34(b)

| | | | | | | | |

| | | | |

| | |

| 38 | | Number of securities for which +quotation is sought | | | | | | |

| | | | |

| | |

| | | | | | | | | |

| | | | |

| | |

| | | | |

| 39 | | Class of +securities for which quotation is sought | | | | | | |

| | | | |

| | |

| | | | | | | | | |

| | | | |

| | |

| | | | |

| 40 | | Do the +securities rank equally in all respects from the date of allotment with an existing +class of quoted +securities? If the additional securities do not rank equally, please state: • the date from which they do • the extent to which they participate for the next dividend, (in the case of a trust, distribution) or interest payment • the extent to which they do not rank equally, other than in relation to the next dividend, distribution or interest payment | | | | | | |

| | | | |

| | |

| | | | | | | | | |

| | | | |

| | |

| | | | |

| 41 | | Reason for request for quotation now Example: In the case of restricted securities, end of restriction period (if issued upon conversion of another security, clearly identify that other security) | | | | | | |

| | | | |

| | |

| | | | | | | | | |

| | | | |

| | |

| | | | | Number | | +Class | | |

| | | | |

| | |

| 42 | | Number and +class of all +securities quoted on ASX(including the securities in clause 38) | | | | | | |

| | | | |

| | |

+ See chapter 19 for defined terms.

| | | | |

| Appendix 3B Page 6 | | | | 1/1/2003 |

Appendix 3B

New issue announcement

Quotation agreement

| 1 | +Quotation of our additional+securities is in ASX’s absolute discretion. ASX may quote the+securities on any conditions it decides. |

| 2 | We warrant the following to ASX. |

| | • | The issue of the+securities to be quoted complies with the law and is not for an illegal purpose. |

| | • | There is no reason why those+securities should not be granted+quotation. |

| | • | An offer of the+securities for sale within 12 months after their issue will not require disclosure under section 707(3) or section 1012C(6) of the Corporations Act. |

Note: An entity may need to obtain appropriate warranties from subscribers for the securities in order to be able to give this warranty

| | • | Section 724 or section 1016E of the Corporations Act does not apply to any applications received by us in relation to any+securities to be quoted and that no-one has any right to return any+securities to be quoted under sections 737, 738 or 1016F of the Corporations Act at the time that we request that the+securities be quoted. |

| | • | We warrant that if confirmation is required under section 1017F of the Corporations Act in relation to the+securities to be quoted, it has been provided at the time that we request that the+securities be quoted. |

| | • | If we are a trust, we warrant that no person has the right to return the+securities to be quoted under section 1019B of the Corporations Act at the time that we request that the+securities be quoted. |

+ See chapter 19 for defined terms.

| | |

| |

| 1/1/2003 | | Appendix 3B Page 7 |

Appendix 3B

New issue announcement

| 3 | We will indemnify ASX to the fullest extent permitted by law in respect of any claim, action or expense arising from or connected with any breach of the warranties in this agreement. |

| 4 | We give ASX the information and documents required by this form. If any information or document not available now, will give it to ASX before+quotation of the+securities begins. We acknowledge that ASX is relying on the information and documents. We warrant that they are (will be) true and complete. |

| | | | |

Sign here: | | Ross E. Mallett | | Date: 27 January 2004 |

| | | (Assistant Company Secretary) | | |

| | |

| Print name: | | Ross E. Mallett | | |

== == == == ==

+ See chapter 19 for defined terms.

| | |

| |

| Appendix 3B Page 8 | | 1/1/2003 |

31 December 2003

Attachment “A”

Details of Securities Issued

| | | | | | | | | | | | | | |

| | | Shares

| | Issue

Price

| | Issue Date

| | Expiry Date

| | Description

| | Share Capital

|

| | | 296,250 | | $ | 2.26 | | 21.12.1998 | | 21.12.03 | | Employee Options Exercised | | | 669,525 |

| | | 45,000 | | $ | 2.49 | | 21.12.1998 | | 21.12.03 | | | | | 112,050 |

| | | 520,955 | | $ | 3.90 | | 20.12.1999 | | 20.12.04 | | | | | 2,031,725 |

| | | 675,000 | | $ | 3.48 | | 18.12.2000 | | 18.12.05 | | | | | 2,349,000 |

| | | 1,980,900 | | $ | 4.33 | | 30.11.2001 | | 30.11.06 | | | | | 8,577,297 |

| | | 1,712,000 | | $ | 4.34 | | 23.12.2002 | | 23.12.07 | | | | | 7,430,080 |

| | |

| | | | | | | | | | |

|

|

Total Shares Issued | | 5,230,105 | | | | | | | | | | | | 21,169,677 |

| | |

| | | | | | | | | | |

|

|

(Exercise of Employee Options) | | | | | | | | | | | | | | |

| | | | | | |

Shares to be Quoted | | 5,230,105 | | | | | | | | | Total Share Capital to be Quoted | | $ | 21,169,677 |

| | |

| | | | | | | | | | |

|

|

Details of Securities Not Quoted on the ASX

| | | | | | | | | | |

Unquoted

Securities as

at 31/10/03

| | Description

| | Options

exercised

| | Options

lapsed

| | Options

issued

| | Unquoted

Securities As

at 31/12/03

|

| 296,250 | | (a) employee options expiring 21/12/2003 exerciseable at $2.26 | | 296,250 | | 0 | | | | 0 |

| 45,000 | | (b) employee options expiriting 21/12/2003 exercisable at $2.49 | | 45,000 | | 0 | | | | 0 |

| 1,910,900 | | (c) employee options expiring 20/12/2004 exerciseable at $3.90 | | 520,955 | | 0 | | | | 1,389,945 |

| 2,473,500 | | (d) employee options expiring 18/12/2005 exerciseable at $3.48 | | 675,000 | | 0 | | | | 1,798,500 |

| 6,380,800 | | (e) employee options expiring 30/11/2006 exerciseable at $4.33 | | 1,980,900 | | 0 | | | | 4,399,900 |

| 10,476,800 | | (g) employee options expiring 23/12/2007 exercised at $4.34 | | 1,712,000 | | 146,000 | | | | 8,618,800 |

| |

| |

| |

| |

| |

|

| 21,583,250 | | TOTAL OPTIONS | | 5,230,105 | | 146,000 | | — | | 16,207,145 |

| |

| |

| |

| |

| |

|

| | |

Quoted Securities as at 31.10.03 | | 1,144,840,840 |

plus Securities subject to this application for quotation | | 5,230,105 |

| | |

|

TOTAL SECURITIES TO BE QUOTED ON ASX | | 1,150,070,945 |

| | |

|

| | | |

| Value | | Fee |

21169677 Issued Capital | | | |

In excess of: 10,000,000 | | $ | 8,600.00 |

Excess 11,169,677 @0.014% | | $ | 1,563.75 |

| | |

|

|

Total Fee | | $ | 10,163.75 |

| | |

|

|

To: The Manager

Announcements

ASX Company Announcements Office

Public Announcement 2004-3

Please find attached Change of Director’s Interest Notices (Appendix 3Y) in respect of WMC Resources Ltd executive directors, Messrs Andrew Michelmore and Alan Dundas representing shares allocated to them as their entitlement under the WMC Resources Ltd Senior Executive Share Plan. These entitlements form part of the total shares purchased on behalf of employees under the 2003 Employee Share Purchase Plan by the Share Plan Secretary.

A copy of these notices can be viewed at WMC’s internet site atwww.wmc.com following their release to the market.

Ross Mallett

Assistant Company Secretary

4 February 2004

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

| | |

| Name of entity | | WMC RESOURCES LTD |

| |

| ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

| | |

| Name of Director | | Mr Andrew Gordon Michelmore |

| Date of last notice | | 24 December 2003 |

Part 1 – Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | |

| Direct or indirect interest | | Direct |

| |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

| |

| Date of change | | 2 February 2004 |

| |

| No. of securities held prior to change | | Fully paid shares—159,981 Employee share plan options—280,000 |

| |

| Class | | Fully paid ordinary shares |

| |

| Number acquired | | On 2 February 2004 192,001 fully paid shares were allocated to Mr Andrew Gordon Michelmore by the WMC Share Plan Secretary under the terms of the 2003 Senior Executive Share Plan. This allocation was part of the total number of shares purchased on behalf of employees under the 2003 Employee Share Purchase Plan by the Share Plan Secretary |

| |

| Number disposed | | N/a |

+ See chapter 19 for defined terms.

| | | | |

| Appendix 3Y Page 2 | | | | 11/3/2002 |

| | |

Value/Consideration Note: If consideration is non-cash, provide details and estimated

valuation | | $5.19 per share. |

| |

| No. of securities held after change | | Fully paid shares—351,982 Employee share plan options—280,000 |

| |

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | Issue of fully paid ordinary shares under senior executive share plan. |

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | |

| Detail of contract | | N/a |

| |

| Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

| Date of change | | |

| |

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | |

| |

| Interest acquired | | |

| |

| Interest disposed | | |

| |

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | |

| |

| Interest after change | | |

Appendix 3Y

Change of Director’s Interest Notice

Rule 3.19A.2

Appendix 3Y

Change of Director’s Interest Notice

Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public.

Introduced 30/9/2001.

| | |

| Name of entity | | WMC RESOURCES LTD |

| |

| ABN | | 76 004 184 598 |

We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act.

| | | | |

| Name of Director | | Mr Alan Kevin Dundas | | |

| | |

| Date of last notice | | 17 March 2003 | | |

Part 1—Change of director’s relevant interests in securities

In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust

Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | |

| Direct or indirect interest | | Direct |

| |

Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. | | N/a |

| |

| Date of change | | 2 February 2004 |

| |

| No. of securities held prior to change | | Fully paid shares—115,157 Employee share plan options—202,000 |

| |

| Class | | Fully paid ordinary shares |

| |

| Number acquired | | On 2 February 2004 108,000 fully paid shares were allocated to Mr Alan Kevin Dundas by the WMC Share Plan Secretary under the terms of the 2003 Senior Executive Share Plan. This allocation was part of the total number of shares purchased on behalf of employees under the 2003 Employee Share Purchase Plan by the Share Plan Secretary. |

| |

| Number disposed | | N/a |

+ See chapter 19 for defined terms.

| | | | |

| Appendix 3Y Page 4 | | | | 11/3/2002 |

| | |

Value/Consideration Note: If consideration is non-cash, provide details and estimated

valuation | | $5.19 per share. |

| |

| No. of securities held after change | | Fully paid shares - 223,157 Employee share plan options - 202,000 |

| |

Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy-back | | Issue of fully paid ordinary shares under senior executive share plan. |

Part 2 – Change of director’s interests in contracts

Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part.

| | |

| Detail of contract | | N/a |

| |

| Nature of interest | | |

| |

Name of registered holder (if issued securities) | | |

| |

| Date of change | | |

| |

No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed | | |

| |

| Interest acquired | | |

| |

| Interest disposed | | |

| |

Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation | | |

| |

| Interest after change | | |

| | |

| To: | | The Manager Announcements ASX Company Announcements Office |

Public Announcement 2004-4

WMC Resources Ltd 2003 Full Year Results

Please find attached for immediate release Public Announcement 2004-4 covering the release of WMC Resources Ltd’s Financial Results for the year ended 31 December 2003.

The following documents are included as part of the release:

| • | Appendix 4E – Preliminary Final ASX Report |

| • | Business Performance Report (Fact File) |

WMC’s Chief Executive Officer, Mr Andrew Michelmore, will host an audio conference at 2.00pm this afternoon which will be broadcast live from WMC’s web site. A recording of this conference will be available for playback on WMC’s web site later this evening.

Peter Horton

Company Secretary

11 February 2004

| | | | |

For further information, please call: Nerida Mossop, Manager Investor Relations on; 0418 378 809, or Troy Hey, Group Manager Public Affairs on; 0419 502 852 | | | | WMC Resources Ltd ACN 004 184 598 GPO Box 860K Melbourne Vic. 3001 Australia Level 16 IBM Centre 60 City Road Southbank Vic. 3006 Australia Tel +61 (0)3 9685 6000 Fax +61 (0)3 9685 6115 |

Statements contained in this material, particularly those regarding the possible or assumed future performance, costs, dividends, returns, production levels or rates, prices, reserves, divestments, potential growth of WMC, industry growth or other trend projections and any estimated company earnings are or may be forward looking statements. Such statements relate to future events and expectations and as such involve known and unknown risks and uncertainties. Actual results actions and developments may differ materially from those expressed or implied by these forward looking statements depending on a variety of factors, including: variations in the market price of the minerals and metals produced by WMC, the impact of foreign currency exchange rates on these market prices, WMC’s ability to profitably produce and transport minerals and metals extracted to applicable markets, WMC’s ability to achieve projected cost and scheduling targets for repair and construction activities and the activities of governmental authorities in certain countries where WMC has projects, facilities or mines that are being explored or developed, as well as the factors discussed under the caption “Risk Factors” at pages 13 to 16 of WMC’s Annual Report on Form 20-F for the fiscal year ended 31 December 2002.

This report (Fact File) contains a comparison of WMC Resources Ltd’s 2003 full year actual statutory results to pro forma historical results for the 2002 year. The 2003 statutory results have been drawn from the Full Year ASX report for the twelve months ended 31 December 2003 as lodged with the ASX and ASIC on 11 February 2004. The 2002 pro forma comparatives are drawn from the Special Purpose Report lodged with the ASX and ASIC on 26 February 2003. The 2002 comparatives are not a substitute for the WMC Resources Ltd consolidated financial report. A copy of all documents referred to are available on our website www.wmc.com.

Presentation

The presentation of the statement of financial performance and statement of cash flows is consistent with the format of these statements in the WMC Limited’s Scheme Booklet dated 28 October 2002 and the Special Purpose Report dated 26 February 2003. The presentation of the statement of financial position is designed to provide information in relation to each of the business segments and is therefore not set out in accordance with Australian Generally Accepted Accounting Principles (GAAP).

All amounts are in Australian dollars unless otherwise stated.

2002 Pro Forma Comparatives

The Pro Forma 2002 Results and Cash Flows of WMC Resources Ltd, set out in this report, have been prepared on a consolidated entity basis for WMC Resources Ltd and its controlled entities and assumes for the comparative period shown, that the entities acquired by WMC Resources Ltd as part of the demerger (principally the copper and fertilizer businesses and the finance companies) were controlled entities for the full period reported (from 1 January 2002).

The transactions that occurred in conjunction with the demerger and the manner in which the demerger was implemented has had an effect on WMC Resources Ltd’s results and financial position in 2003 and will have an effect in all future years relative to its historical results and financial position.

The 2002 comparatives in this report have been prepared as if the following transactions and events had occurred at 1 January 2002:

| | • | the copper, fertilizer and international exploration assets and business were acquired at their fair value as required under Australian GAAP. The fair value adjustments, principally copper (uplift) and fertilizer (write down) impact on the carrying values in the statement of financial position and consequently result in higher net amortisation charges compared with prior periods but with no cash flow implications; |

| | • | overall level of debt was reduced and higher yield long dated securities repurchased and refinanced with consequently lower interest charges in 2002 and future years; |

| | • | derivative and financial instruments (primarily the hedge book) were fair valued at the forward price prevailing at demerger date. This resulted in the extinguishment of deferred hedge losses with future gains and losses being determined with reference to the new forward price including the base exchange rate at demerger of 0.5608. This does not impact the underlying contract prices; and |

| | • | demerger costs were borne by WMC Resources Ltd. Some of these have been capitalised into asset values increasing future depreciation and amortisation charges. |

3

This page left intentionally blank

4

PUBLIC ANNOUNCEMENT

WMC EARNINGS UP – DESPITE $A STRENGTH

| | • | Full year profit after tax of $246 million. |

Compares with 2002 statutory loss of $44 million and 2002 pro forma earnings of $75 million as described in the attached Fact File.

| | • | Higher $A offsets improving $US commodity prices. |

| | • | Directors declare 2003 unfranked dividend of 6 cents per share. |

| | • | Cashflow from operations up $318 million on 2002. |

| | • | Construction of copper solvent extraction plant completed. |

| | • | Nickel earnings up on higher volumes and realised $A prices. |

| | • | Scheduled smelter maintenance and heat exchanger failure cut copper earnings. |

| | • | Higher fertilizer production offsets lower realised $A prices. |

| | • | Sound financial position – gearing of 24%, interest cover 13.2 times. |

KEY FINANCIALS

| | | | | | |

| | | Pro forma 2002

| | | Actual 2003

| |

Profit (after tax) ($M) | | 75.4 | | | 245.6 | |

EBIT from operations (pre hedging) ($M) | | 249.9 | | | 290.0 | |

EBITDA (pre hedging) ($M) | | 664.1 | | | 730.4 | |

Revenue from operations (pre-hedging) ($M) | | 2,690.5 | | | 2,933.4 | |

Cash flow from operations ($M) | | 324.4 | | | 642.5 | |

Capital expenditure ($M) | | 471.1 | | | 661.9 | |

Cash flow before debt and equity funding ($M) | | (30.3 | ) | | (85.8 | ) |

Return on equity (%) | | 2.6 | | | 6.2 | |

Net assets ($M) | | 3,606.6 | | | 3,949.7 | |

Gearing (%) | | 30.3 | | | 24.1 | |

Interest cover (times) | | 10.5 | | | 13.2 | |

Dividend per share (cents) | | — | | | 6.0 | |

Earnings per share (cents) | | — | | | 21.7 | |

“After a tough year, I’m pleased to report strong earnings growth, improved cashflow from operations and a maiden dividend,” said WMC Resources CEO, Andrew Michelmore

“While US dollar commodity prices surged during 2003, the Australian dollar’s strength largely offset gains.”

“Second half production records across our nickel and fertilizer businesses and strong performance from the mine at Olympic Dam have positioned us well for 2004.”

“Commissioning of the copper solvent extraction plant at Olympic Dam in 2004 will complete our schedule of major projects.

“Improving returns, reinvestment for the future and delivering operating reliability is our focus in 2004.”

The outlook for WMC is for sustained and consistent production performance in a continuing strong market for our major commodities,” Mr Michelmore said.

5

This page left intentionally blank

6

RESULTS SUMMARY

KEY POINTS

| | • | Profit after income tax was $246m for the year ended 31 December 2003 compared with $75m on a pro forma basis for 2002. The current year tax charge of $2m includes a credit of $39m in respect of tax loss recognition. |

| | • | Directors declared a maiden dividend of 6 cents per share. |

| | • | EBIT from operations increased $40m from the prior year. This improvement reflects a strong performance from the nickel business during a time of high nickel prices. The gains from the nickel business were partially offset by a decline in EBIT from the copper business, which benefited in 2002 from a $90m insurance credit, higher sales and higher Australian dollar prices. EBIT from Queensland Fertilizer Operation improved despite lower realised Australian dollar prices, reflecting significantly improved production volumes. EBIT from Hi-Fert declined $10m due to lower margins and sales volumes caused by the drought. |

| | • | Cashflow from operations increased $318m from 2002. |

| | • | Capital expenditure of $662m included costs associated with the construction of the uranium and copper solvent extraction plants at Olympic Dam, and major planned maintenance in each business. |

| | • | The return on equity has improved to 6.2%. |

| | • | The company’s financial position remains sound, with gearing of 24 per cent and interest cover of 13.2 times. |

OUTLOOK FOR 2004

| | • | Buoyant markets for each of our commodities are expected to continue throughout 2004. The strength in commodity prices is expected to be partially offset by a strong Australian dollar relative to US dollar. |

| | • | Strong production is expected from each operation. |

| | • | We remain focused on delivering safe, sustained and consistent performance from each of our operations. |

| | | | | | | | | | | |

(A$ Million)

| | Actual

1H03

| | | Actual

2H03

| | Actual

FY03

| | | Pro forma

FY02

| |

Revenue from operations (pre hedging) | | 1,394.9 | | | 1,538.5 | | 2,933.4 | | | 2,690.5 | |

Profit after tax | | 47.0 | | | 198.6 | | 245.6 | | | 75.4 | |

EBIT from operations (pre hedging) | | 71.3 | | | 218.7 | | 290.0 | | | 249.9 | |

| | |

|

| |

| |

|

| |

|

|

Cashflow from Operations | | 187.8 | | | 454.7 | | 642.5 | | | 324.3 | |

Capital Expenditure | | 305.0 | | | 356.9 | | 661.9 | | | 471.1 | |

Cashflow before debt and equity funding | | (210.9 | ) | | 125.1 | | (85.8 | ) | | (30.3 | ) |

Net Debt | | 1,556 | | | 1,253 | | 1,253 | | | 1,567 | |

| | |

|

| |

| |

|

| |

|

|

Total Assets | | 7,542 | | | 7,560 | | 7,560 | | | 7,348 | |

Equity | | 3,661 | | | 3,950 | | 3,950 | | | 3,607 | |

| | |

|

| |

| |

|

| |

|

|

Return on equity (%) | | 2.6 | | | 10.1 | | 6.2 | | | 2.6 | |

Cash flow from Operations to Net Debt (%) | | 24.1 | | | 72.6 | | 51.3 | | | 20.7 | |

Net Debt / Net Debt + Equity (%) | | 29.8 | | | 24.1 | | 24.1 | | | 30.3 | |

Interest Cover (times) | | 11.4 | | | 14.6 | | 13.2 | | | 10.5 | |

Earnings per share (cents) | | 4.2 | | | 17.5 | | 21.7 | | | N/A | |

Dividend per share - unfranked (cents) | | — | | | 6.0 | | 6.0 | | | — | |

| | |

|

| |

| |

|

| |

|

|

7

Environment Health and Safety

The full year lost time and medically treated injury frequency rate of 10.9 represents a 5 per cent improvement over 2002. The continued downward trend in injury rates reflects the ongoing implementation and application of our environment, health and safety management system. Despite this excellent improvement, we regret to advise that Teodosio Gabriel Macumbue, a security guard employed at our Corridor Sands pilot plant near Chibuto in Mozambique was attacked and killed during a robbery in October.

During 2003, we recorded a 28 per cent reduction in environmental non compliances, and carbon dioxide and sulphur dioxide emissions were reduced by 0.7 per cent and 2.2 per cent respectively.

During the year the Kwinana refinery reported that routine monitoring and follow up testing had identified historic arsenic contamination beneath the plant and contained within the site boundaries. Remediation has commenced in accordance with a plan approved by the Western Australian Department of Environmental Protection.

Five environmental spills were reported at Olympic Dam – four following the introduction of new reporting criteria introduced by the South Australian Government. None of these incidents produced any occupational health or environmental impacts. The spills were contained within the extensive bunding and drainage systems and returned to process or tailings circuits.

WMC Resources Share Price

8

Marketing

Commodity markets were volatile in 2003 with prices improving significantly in the second half of the year. Improvement was driven by better supply and demand fundamentals. We have experienced strong demand for our products, particularly in Asian markets, and have received good sales premiums on all commodities. A major contract with the Jinchuan Group was entered into during the year in which WMC will supply 90,000 tonnes of nickel-in-matte between the years 2005 to 2010.

Treasury

Significant financing activities during 2003 included issuing US$700 million of bonds (US$500 million maturing in 2013 and US$200 million in 2033) to extend the tenor of our debt profile following the demerger. During the third quarter of 2003, we exchanged our fixed rate interest exposure on the 10-year bonds to a fixed exposure for 2004 and 2005 followed by a floating interest rate for the remainder of the bond. This swap enabled us to lock in an annual interest cost saving of A$23 million for 2004 and 2005.

We also closed out our 2005 to 2008 legacy currency hedge book at a net cash gain of $18 million. The hedge book for 2004, which comprises forward cover and options for US$300 million of revenue, remains in place. At the end of year Australian dollar exchange rate, the 2004 book has a positive cash mark to market value of $40 million.

Corporate costs

The move toward shared service delivery continued in 2003. Under the approach adopted by WMC, functional expertise and service delivery is centralised with standardised processes applied consistently and continually improved. The approach delivers economies of scale, minimises duplication and waste and ensures knowledge is shared across our operations. During 2003, we reviewed our approach to ensure we maintain cost effective service delivery to our operations and ongoing efficiency improvements.

Corporate costs include the Board, the office of the Chief Executive Officer, Executive General Managers and support and governance functions including Company Secretariat, Treasury, Investor Relations, Corporate Affairs and Corporate Accounting.

The shared service costs associated with supporting the operations are fully allocated to the respective business units. WMC has historically allocated such costs to business units, however, a broader pool of costs representative of the full suite of support services provided is now being allocated. Business unit and corporate costs have been restated for comparative purposes.

Unit cost of sales for each business now includes the shared service cost allocations - prior periods have been restated accordingly.

We have also disclosed certain corporate costs as one-off. In 2003, these constitute restructuring costs associated with the further rationalisation of our shared services model. In 2002, the one-offs included retirement allowances in respect of contractual arrangements with certain directors, charges arising from a reduction in leased office space and a number of non-recurring smaller charges not directly related to our operations.

9

Employee share plan

During 2002 WMC discontinued the executive share option plan for senior management, and during 2003 discontinued option plans for employees generally. This reflects the Board’s decision for full transparency in the value of employee reward and had regard for governance concerns regarding option valuation and the diluting effect of options on shareholders. The equity plans provide employees with company shares purchased on-market. The plans provide rewards based on overall company performance.

The cost of purchasing the shares to meet plan entitlements has been accrued against 2003 profit.

Insurance claim

WMC has an outstanding insurance claim in relation to the 2001 Olympic Dam fire. An amount of $120 million was recognized in relation to the claim in the 2002 accounts. To date, we have received $82 million of cash in relation to the claim. We will continue to progress collection of outstanding amounts. The final amount of the claim will be in excess of the $120 million already brought to account. Any amount in excess of the $120 million will be recorded in the 2004 financial statements in accordance with accounting standards.

Tax

The effective tax rate for the group is less than 30 per cent and is impacted by tax credits associated with cash payments made in respect of the legacy foreign currency hedge book. These credits shield approximately the first $100 million of pre-tax income each year up to and including 2008. The tax credit is calculated by treating cash movements on the hedge as taxable and the accounting hedge result as effectively not taxable.

At demerger, a significant proportion of the Australian tax losses were fair valued to zero due to the uncertainty of full recoverability, tax law and accounting standard requirements, for recovery and recognition.

The recoverability of off balance sheet tax benefits was reviewed following a favourable tax ruling in respect of prior period tax losses and the close out of the legacy foreign exchange contracts in 2003. The 2003 income tax charge includes a tax credit of $39 million arising from the partial recognition of Australian tax losses and other timing differences not previously brought to account.

The recoverability of the off-balance sheet tax benefits is not certain nor capable of reliable measurement. Accordingly, Accounting Standards do not permit any further recognition at this time. The amounts will be regularly assessed in accordance with Accounting Standards and Tax Law and recognised only when the criteria are satisfied.

10

| | | | | | | | |

| | | Actual

1H03

| | Actual

2H03

| | Actual

FY03

| | Pro forma

FY02

|

Contained nickel (‘000 tonnes) | | | | | | | | |

- Concentrate | | 55.1 | | 62.6 | | 117.7 | | 106.4 |

- Matte | | 44.0 | | 55.2 | | 99.2 | | 91.6 |

- Metal | | 29.7 | | 31.7 | | 61.4 | | 65.1 |

| | |

| |

| |

| |

|

Copper (‘000 tonnes) | | 91.3 | | 68.8 | | 160.1 | | 178.1 |

Uranium (tonnes) | | 1,399 | | 1,804 | | 3,203 | | 2,891 |

Gold (‘000 ounces) | | 50.3 | | 35.8 | | 86.1 | | 64.3 |

| | |

| |

| |

| |

|

Fertilizer (‘000 tonnes) | | | | | | | | |

- Di-ammonium phosphate | | 371 | | 389 | | 760 | | 718 |

- Mono-ammonium phosphate | | 102 | | 60 | | 162 | | 103 |

Total Fertilizer | | 473 | | 449 | | 922 | | 821 |

| | |

| |

| |

| |

|

Production Summary

For production commentary, please refer to Nickel, Copper and Fertilizer sections of this document.

11

Statement of Financial Performance

| | | | | | | | | | | | |

(A$ Million)

| | Actual

1H03

| | | Actual

2H03

| | | Actual

FY03

| | | Pro forma

FY02

| |

REVENUE | | | | | | | | | | | | |

Nickel | | 758.8 | | | 1,024.7 | | | 1,783.5 | | | 1,373.5 | |

Copper / Uranium | | 362.6 | | | 333.7 | | | 696.3 | | | 765.0 | |

Fertilizer (QFO and Hi-Fert) | | 255.9 | | | 158.9 | | | 414.8 | | | 432.6 | |

Other sales revenue | | 17.3 | | | 17.3 | | | 34.6 | | | 28.0 | |

| | |

|

| |

|

| |

|

| |

|

|

Sales revenue (pre hedging) | | 1,394.6 | | | 1,534.6 | | | 2,929.2 | | | 2,599.1 | |

Revenue received/receivable from insurance claim and other | | 0.3 | | | 3.9 | | | 4.2 | | | 91.4 | |

| | |

|

| |

|

| |

|

| |

|

|

REVENUE from operations (pre hedging) | | 1,394.9 | | | 1,538.5 | | | 2,933.4 | | | 2,690.5 | |

| | |

|

| |

|

| |

|

| |

|

|

COSTS | | | | | | | | | | | | |

Cash (includes commodity trading expenses) | | (964.4 | ) | | (915.3 | ) | | (1,879.7 | ) | | (1,785.8 | ) |

Non Cash | | (266.8 | ) | | (316.4 | ) | | (583.2 | ) | | (594.1 | ) |

Third party purchases | | (154.2 | ) | | (173.8 | ) | | (328.0 | ) | | (259.2 | ) |

Change in stock | | 29.0 | | | 50.6 | | | 79.6 | | | 93.4 | |

| | |

|

| |

|

| |

|

| |

|

|

TOTAL COST OF SALES | | (1,356.4 | ) | | (1,354.9 | ) | | (2,711.3 | ) | | (2,545.7 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Total EBIT (pre hedging) | | 38.5 | | | 183.6 | | | 222.1 | | | 144.8 | |

| | |

|

| |

|

| |

|

| |

|

|

EBIT | | | | | | | | | | | | |

Nickel | | 103.2 | | | 325.6 | | | 428.8 | | | 249.7 | |

Copper / Uranium | | (42.2 | ) | | (78.0 | ) | | (120.2 | ) | | 27.6 | |

Fertilizer | | 4.5 | | | (35.8 | ) | | (31.3 | ) | | (27.2 | ) |

Other EBIT from operations1 | | 5.8 | | | 6.9 | | | 12.7 | | | (0.2 | ) |

| | |

|

| |

|

| |

|

| |

|

|

EBIT from operations (pre hedging) | | 71.3 | | | 218.7 | | | 290.0 | | | 249.9 | |

Net currency and commodity hedging gains/(losses) | | 22.1 | | | 50.0 | | | 72.1 | | | (13.5 | ) |

| | |

|

| |

|

| |

|

| |

|

|

EBIT from operations (post hedging) | | 93.4 | | | 268.7 | | | 362.1 | | | 236.4 | |

Corporate | | (8.7 | ) | | (11.9 | ) | | (20.6 | ) | | (22.0 | ) |

Corporate one-off items | | 0.0 | | | (8.4 | ) | | (8.4 | ) | | (15.5 | ) |

Finance and other costs | | (1.1 | ) | | (1.4 | ) | | (2.5 | ) | | 1.0 | |

Exploration and new business | | (23.0 | ) | | (13.4 | ) | | (36.4 | ) | | (68.6 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Total EBIT | | 60.6 | | | 233.6 | | | 294.2 | | | 131.3 | |

| | |

|

| |

|

| |

|

| |

|

|

Net borrowing costs | | (21.2 | ) | | (25.1 | ) | | (46.3 | ) | | (57.4 | ) |

| | |

|

| |

|

| |

|

| |

|

|

PROFIT before income tax credit/(expense) | | 39.4 | | | 208.5 | | | 247.9 | | | 73.9 | |

| | |

|

| |

|

| |

|

| |

|

|

Income tax credit/(expense) | | 7.6 | | | (9.9 | ) | | (2.3 | ) | | 1.5 | |

| | |

|

| |

|

| |

|

| |

|

|

PROFIT AFTER TAX | | 47.0 | | | 198.6 | | | 245.6 | | | 75.4 | |

| | |

|

| |

|

| |

|

| |

|

|

| 1 | Other EBIT from operations is matched by costs in Business Units with minimal net contribution to Group earnings |

Comparatives have been restated to reflect the reclassification of intragroup sales and purchases and additionalshared services cost allocations. As a result, Business Unit EBITs and unit costs have changed. There is noimpact on the overall consolidated pro forma results.

The table above includes line items which are not prepared under Australian GAAP. They have been included asthey are considered a useful measure of operational performance because they are commonly used by investorsto evaluate company results. Financial statements prepared in accordance with Australian GAAP can befound in the ASX Preliminary Final Report.

12

Statement of Financial Position

| | | | | | | | | |

(A$ Million)

| | Actual Dec-03

| | | Actual Jun-03

| | | Actual Dec-02

| |

Property, Plant & Equipment (including Acquired Mineral Rights) | | | | | | | | | |

Nickel | | 1,242.5 | | | 1,279.8 | | | 1,269.3 | |

Copper | | 3,930.7 | | | 3,806.1 | | | 3,745.1 | |

Fertilizer | | 565.7 | | | 561.2 | | | 567.3 | |

Other1 | | 136.4 | | | 96.6 | | | 23.9 | |

| | |

|

| |

|

| |

|

|

| | | 5,875.3 | | | 5,743.7 | | | 5,605.6 | |

| | |

|

| |

|

| |

|

|

Working Capital | | | | | | | | | |

Nickel | | 297.8 | | | 212.2 | | | 236.6 | |

Copper | | 215.5 | | | 213.8 | | | 250.0 | |

Fertilizer | | 81.2 | | | 165.4 | | | 97.5 | |

Other | | (61.4 | ) | | (36.1 | ) | | (76.5 | ) |

| | |

|

| |

|

| |

|

|

| | | 533.1 | | | 555.3 | | | 507.6 | |

| | |

|

| |

|

| |

|

|

Corporate | | | | | | | | | |

Net deferred gains and creditor balances relating to hedging and debt revaluations | | (915.8 | ) | | (818.6 | ) | | (707.5 | ) |

Tax balances (net of provision for deferred tax) | | (337.3 | ) | | (327.2 | ) | | (336.3 | ) |

Exploration and evaluation expenditure capitalised | | 68.5 | | | 83.8 | | | 152.7 | |

| | | |

Provisions | | (189.5 | ) | | (185.7 | ) | | (175.7 | ) |

| | | |

Other | | 168.3 | | | 166.7 | | | 127.3 | |

| | |

|

| |

|

| |

|

|

NET ASSETS FUNDED BY DEBT AND EQUITY | | 5,202.6 | | | 5,217.9 | | | 5,173.6 | |

| | |

|

| |

|

| |

|

|

Net Debt | | 1,252.9 | | | 1,556.5 | | | 1,567.0 | |

| | | |

Shareholders’ Equity | | 3,949.7 | | | 3,661.4 | | | 3,606.6 | |

| | |

|

| |

|

| |

|

|

NET DEBT AND EQUITY | | 5,202.6 | | | 5,217.9 | | | 5,173.6 | |

| | |

|

| |

|

| |

|

|

| 1 | During the year $77.2m was transferred on finalisation of the Corridor Sands acquisition from Explorationand Evaluation to Acquired Mineral Rights. |

13

Statement of Cash Flows

| | | | | | | | | | | | |

(A$ Million)

| | Actual

1H03

| | | Actual

2H03

| | | Actual

FY03

| | | Pro forma

FY02

| |

EBITDA (pre hedging) | | | | | | | | | | | | |

Nickel | | 206.9 | | | 464.6 | | | 671.5 | | | 458.8 | |

Copper | | 72.8 | | | 25.0 | | | 97.8 | | | 283.4 | |

Fertilizer | | 25.3 | | | (13.5 | ) | | 11.8 | | | 15.9 | |

Corporate/New Business/Exploration/Other | | (23.1 | ) | | (27.7 | ) | | (50.8 | ) | | (94.1 | ) |

| | |

|

| |

|

| |

|

| |

|

|

| | | 281.9 | | | 448.4 | | | 730.3 | | | 664.0 | |

| | |

|

| |

|

| |

|

| |

|

|

Movements in working capital | | | | | | | | | | | | |

Nickel | | 24.4 | | | (85.5 | ) | | (61.1 | ) | | (66.8 | ) |

Copper | | 36.2 | | | (1.7 | ) | | 34.5 | | | (72.9 | ) |

Fertilizer | | (67.9 | ) | | 84.2 | | | 16.3 | | | (7.6 | ) |

Corporate/New Business/Exploration/Other | | (40.4 | ) | | 24.4 | | | (16.0 | ) | | 51.1 | |

| | |

|

| |

|

| |

|

| |

|

|

| | | (47.7 | ) | | 21.4 | | | (26.3 | ) | | (96.2 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Other Balance Sheet movements | | (0.4 | ) | | 18.2 | | | 17.8 | | | (26.9 | ) |

| | | | |

Hedging payments / receipts | | (38.4 | ) | | 12.8 | | | (25.6 | ) | | (158.1 | ) |

| | | | |

Net borrowing costs paid | | (6.0 | ) | | (44.8 | ) | | (50.8 | ) | | (58.5 | ) |

| | | | |

Income tax paid | | (1.6 | ) | | (1.3 | ) | | (2.9 | ) | | — | |

| | |

|

| |

|

| |

|

| |

|

|

Cash flow from operations | | 187.8 | | | 454.7 | | | 642.5 | | | 324.3 | |

| | |

|

| |

|

| |

|

| |

|

|

Capital expenditure | | | | | | | | | | | | |

Nickel | | (118.9 | ) | | (100.1 | ) | | (219.0 | ) | | (192.0 | ) |

Copper | | (171.0 | ) | | (225.7 | ) | | (396.7 | ) | | (215.6 | ) |

Fertilizer | | (13.9 | ) | | (26.6 | ) | | (40.5 | ) | | (50.3 | ) |

Corporate/New Business/Exploration/Other | | (1.2 | ) | | (4.5 | ) | | (5.7 | ) | | (13.2 | ) |

| | |

|

| |

|

| |

|

| |

|

|

| | | (305.0 | ) | | (356.9 | ) | | (661.9 | ) | | (471.1 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Other investing cashflows | | (1.2 | ) | | 28.4 | | | 27.2 | | | 45.2 | |

| | |

|

| |

|

| |

|

| |

|

|

Net cash flow before financing and demerger costs | | (118.4 | ) | | 126.2 | | | 7.8 | | | (101.6 | ) |

| | |

|

| |

|

| |

|

| |

|

|

Bond issue costs paid | | (8.9 | ) | | (1.0 | ) | | (9.9 | ) | | — | |

| | | | |

Interest rate swap close out | | — | | | — | | | — | | | 71.2 | |

| | | | |

Payment on close out of interest rate hedge | | (38.5 | ) | | — | | | (38.5 | ) | | — | |

| | | | |

Demerger costs paid | | (45.2 | ) | | — | | | (45.2 | ) | | — | |

| | |

|

| |

|

| |

|

| |

|

|

Net cash flow before debt and equity funding | | (210.9 | ) | | 125.1 | | | (85.8 | ) | | (30.3 | ) |

| | |

|

| |

|

| |

|

| |

|

|

14

Reconciliation of Income Tax Credit / (Expense)

| | | | | | | | | | | | |

(A$ Million)

| | Actual 1H03

| | | Actual 2H03

| | | Actual FY03

| | | Pro forma FY02

| |

Operating profit before tax | | 39.4 | | | 208.5 | | | 247.9 | | | 73.9 | |

| | |

|

| |

|

| |

|

| |

|

|