| | |

OMB APPROVAL |

OMB Number: | | 3235 - 0570 |

Expires: | | January 31, 2014 |

Estimated average burden |

hours per response . . . | | 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number: 811-21296 | | |

BARON SELECT FUNDS

|

| (Exact name of registrant as specified in charter) |

| | |

| 767 Fifth Avenue, 49th Floor | | New York, NY 10153 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Patrick M. Patalino, Esq.

c/o Baron Select Funds

767 Fifth Avenue, 49th Floor

New York, NY 10153

|

| (Name and Address of Agent for Service) |

Registrant’s Telephone Number, including Area Code: 212-583-2000

Date of fiscal year end: December 31

Date of reporting period: December 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 5th Street, NW, Washington, D.C. 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. Section 3507.

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

SEC 2569 (5-07)

Item 1. Reports to Stockholders.

Baron Select Funds Annual Report for the period ended December 31, 2010.

Baron Partners Fund

Baron Focused Growth Fund

Baron International Growth Fund

Baron Real Estate Fund

December 31, 2010

Baron Funds®

Annual Financial Report

DEAR BARON SELECT FUNDS SHAREHOLDER:

In this report you will find audited financial statements for Baron Partners Fund, Baron Focused Growth Fund, Baron International Growth Fund and Baron Real Estate Fund (the “Funds”) for the fiscal year ended December 31, 2010. The U.S. Securities and Exchange Commission (the “SEC”) requires mutual funds to furnish these statements semi-annually to their shareholders. We hope you find these statements informative and useful.

We thank you for choosing to join us as fellow shareholders in Baron Funds. We will continue to work hard to justify your confidence.

Sincerely,

| | | | |

| |  | |  |

Ronald Baron Chief Executive Officer and Chief Investment Officer February 24, 2011 | | Linda S. Martinson Chairman, President and Chief Operating Officer February 24, 2011 | | Peggy Wong Treasurer and Chief Financial Officer February 24, 2011 |

This Annual Financial Report is for the Baron Select Funds which currently has five series: Baron Partners Fund, Baron Focused Growth Fund (formerly, Baron Retirement Income Fund), Baron International Growth Fund, Baron Real Estate Fund and Baron Emerging Markets Fund. Baron Emerging Markets Fund commenced operations on January 1, 2011 and, therefore, is not included in this report. If you are interested in Baron Investment Funds Trust, which contains the Baron Asset Fund, Baron Growth Fund, Baron Small Cap Fund, Baron Opportunity Fund and Baron Fifth Avenue Growth Fund series, please visit the Funds’ website at www.BaronFunds.com or contact us at 1-800-99BARON.

A description of the Funds’ proxy voting policies and procedures is available without charge on the Funds’ website at www.BaronFunds.com, or by calling 1-800-99BARON and on the SEC’s website at www.sec.gov. The Funds’ most current proxy voting record, Form N-PX, is also available on the Funds’ website and on the SEC’s website.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds’ Forms N-Q are available on the SEC’s website at www.sec.gov. The Funds’ Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC; information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090. A copy of the Funds’ Forms N-Q may also be obtained upon request by contacting Baron Funds at 1-800-99BARON. Schedules of portfolio holdings current to the most recent quarter are also available on the Funds’ website.

Some of the comments are based on current management expectations and are considered “forward-looking statements.” Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as “estimate,” “may,” “expect,” “should,” “could,” “believe,” “plan” and other similar terms. We cannot promise future returns and our opinions are a reflection of our best judgment at the time this report is compiled.

The views expressed in this report reflect those of BAMCO, Inc. (“BAMCO” or the “Adviser”) only through the end of the period stated in this report. The views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time without notice based on market and other conditions.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. For more complete information about Baron Funds, including charges and expenses, call or write for a prospectus. Read it carefully before you invest or send money. This report is not authorized for use as an offer of sale or a solicitation of an offer to buy shares of Baron Funds, unless accompanied or preceded by the Funds’ current prospectus.

767 Fifth Avenue

NY, NY 10153

212-583-2100

| | |

| Baron Partners Fund | | December 31, 2010 |

| | | | | | | | |

Baron Partners Fund | | | | | | | | |

| | |

Ticker Symbols: | | | | | | | | |

Retail Shares: BPTRX | | | | | | | | |

Institutional Shares: BPTIX | | | | | | | | |

Performance | | | 2 | | | | | |

Top Ten Holdings | | | 3 | | | | | |

Sector Breakdown | | | 3 | | | | | |

Management’s Discussion of Fund Performance | | | 3 | | | | | |

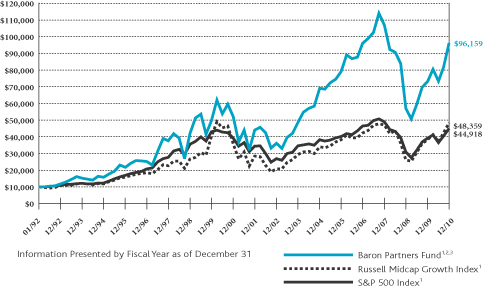

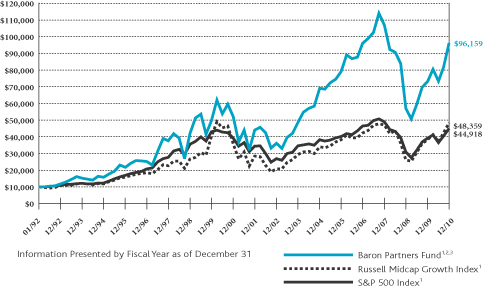

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENT

IN BARON PARTNERS FUND†INRELATIONTOTHE RUSSELL MIDCAP GROWTH INDEXANDTHE S&P 500 INDEX

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2010

| | | | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(January 31,

1992) | |

Baron Partners Fund — Retail Shares1,2,3 | | | 31.52% | | | | –3.48% | | | | 4.00% | | | | 6.32% | | | | 12.71% | |

Baron Partners Fund — Institutional Shares1,2,3,4 | | | 31.93% | | | | –3.34% | | | | 4.09% | | | | 6.37% | | | | 12.74% | |

Russell Midcap Growth1 | | | 26.38% | | | | 0.97% | | | | 4.88% | | | | 3.12% | | | | 8.69% | |

S&P 5001 | | | 15.06% | | | | –2.85% | | | | 2.29% | | | | 1.41% | | | | 8.27% | |

| 1 | The Russell Midcap Growth Index and S&P 500 Index are unmanaged. The Russell Midcap Growth Index measures the performance of medium-sized companies classified as growth. The S&P 500 Index measures the performance of larger-cap equities in the stock market in general. The indexes and the Baron Partners Fund are with dividends, which positively impact the performance results. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. The predecessor partnership charged a 20% performance fee after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fee for the years it was a partnership, the returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for the periods before the Fund’s registration statement was effective, which was April 30, 2003. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to registered investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2011 All Rights Reserved

2

| | |

| December 31, 2010 | | Baron Partners Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2010

| | | | |

| | | Percent of

Net Assets | |

FactSet Research Systems, Inc. | | | 8.9% | |

Hyatt Hotels Corp. (Cl A) | | | 8.3% | |

ITC Holdings Corp. | | | 7.8% | |

Fastenal Co. | | | 7.5% | |

Arch Capital Group, Ltd. | | | 7.2% | |

Dick’s Sporting Goods, Inc. | | | 6.6% | |

Charles Schwab Corp. | | | 6.5% | |

MSCI, Inc. (Cl A) | | | 6.0% | |

Edwards Lifesciences Corp. | | | 5.2% | |

C.H. Robinson Worldwide, Inc. | | | 4.7% | |

| | | | 68.7% | |

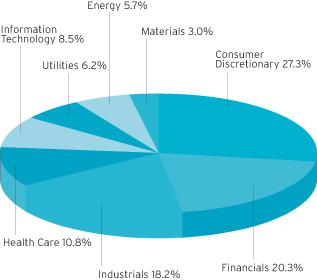

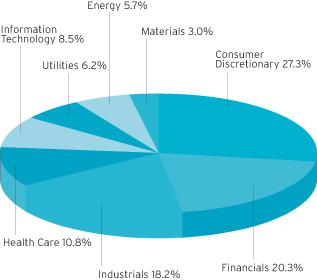

SECTOR BREAKDOWNASOF DECEMBER 31, 2010†

(as a percentage of long positions)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the year ended December 31, 2010, Baron Partners Fund (Retail Shares) gained 31.52%, outperforming both the Russell Midcap Growth Index, up 26.38%, and the S&P 500 Index, up 15.06%.

Baron Partners Fund has performed well since its conversion to an open-end mutual fund on April 30, 2003. In the period since the Fund’s conversion through December 31, 2010, the Fund gained

an annualized 13.76%. This compares to an annualized 10.80% for the Russell Midcap Growth and 6.32% for the S&P 500. Since its inception on January 31, 1992, the Fund also has outperformed, gaining an annualized 12.71%*. This compares to 8.69% for the Russell Midcap Growth and 8.27% for the S&P 500.

Baron Partners Fund uses value purchase disciplines to invest in all-cap companies that we believe have significant long-term growth opportunities. We believe that our independent research will identify investment opportunities that are attractively priced relative to their future prospects. However, Baron Partners Fund is different from most of the other Baron Funds with its non-diversified portfolio and its ability to leverage, which are more risky investment strategies.

The market achieved a 52-week high in December, overcoming declines in May and June and a choppy third quarter. At the end of the year, with fear of a “double-dip” recession abated, U.S. stock prices were within 14% of their value at the market peak in October, 2007.

Economic recovery continues, with corporate profits and GDP growth on the rise. The “bellwether” auto and housing industries are delivering positive news. Even with the recent positive movement of the U.S. stock market, we think stocks remain inexpensive relative to their earnings growth potential and are poised for multiple expansion. Investors are regaining confidence in the equity markets as net flows to small- and mid-cap growth funds were positive in the fourth quarter for the first time since April.

Buoyed by strong financial results, FactSet Research Systems, Inc. made the largest contribution to the Fund’s performance in 2010. For the 12 months ended in November, the company grew its seat count by almost 17%, well ahead of industry growth that we estimate at less than 5%. We believe that FactSet is continuing to benefit from improved spending on market data systems, market-share gains due to its superior product offerings, growing adoption of its new fixed-income tools, and the launch of proprietary content. The company is continuing to roll out its next-generation platform, which is designed to widen the company’s technological edge, lower barriers to adoption, and increase utilization.

Strayer Education, Inc., a 115-year-old provider of post-secondary education, was the largest detractor from Fund performance in 2010. New Gainful Employment rules, expected to be released in early 2011, together with a slowdown in enrollment, resulted in sharp stock-price declines. Given its emphasis on academic quality, strong student outcomes, programmatic diversity, more measured historic enrollment growth, long history of regulatory compliance, and its somewhat selective admission practices, we continue to believe that Strayer is favorably positioned in the sector.

In 2011, the Fund expects to continue to invest in securities of businesses that, in our opinion, have favorable price-to-value characteristics based on our assessment of their prospects for future growth and profitability.

| * | Please see Footnote 2 on page 2. |

| † | Industry sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

3

| | |

| Baron Focused Growth Fund | | December 31, 2010 |

| | | | | | | | |

| | | | | |

Baron Focused Growth Fund | | | | | | | | |

| | |

Ticker Symbols: | | | | | | | | |

Retail Shares: BFGFX | | | | | | | | |

Institutional Shares: BFGIX | | | | | | | | |

Performance | | | 4 | | | | | |

Top Ten Holdings | | | 5 | | | | | |

Sector Breakdown | | | 5 | | | | | |

Management’s Discussion of

Fund Performance | | | 5 | | | | | |

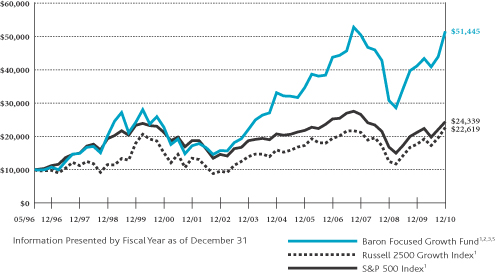

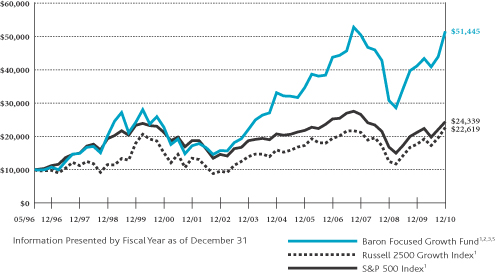

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENT

IN BARON FOCUSED GROWTH FUND†INRELATIONTOTHE RUSSELL 2500 GROWTH INDEXANDTHE S&P 500 INDEX

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2010

| | | | | | | | | | | | | | | | | | | | |

| | | One

Year | | | Three

Years | | | Five

Years | | | Ten

Years | | | Since

Inception

(May 31,

1996) | |

Baron Focused Growth Fund — Retail Shares1,2,3,5 | | | 25.17% | | | | 0.68% | | | | 8.29% | | | | 8.53% | | | | 11.89% | |

Baron Focused Growth Fund — Institutional Shares1,2,3,4,5 | | | 25.39% | | | | 0.77% | | | | 8.35% | | | | 8.57% | | | | 11.91% | |

Russell 2500 Growth1 | | | 28.86% | | | | 2.21% | | | | 5.63% | | | | 4.19% | | | | 5.76% | |

S&P 5001 | | | 15.06% | | | | –2.85% | | | | 2.29% | | | | 1.41% | | | | 6.29% | |

| 1 | The Russell 2500 Growth Index and S&P 500 Index are unmanaged. The Russell 2500 Growth Index measures the performance of small to medium-sized companies that are classified as growth. The S&P 500 Index measures the performance of larger cap equities in the stock market in general. The indexes and Baron Focused Growth Fund are with dividends, which positively impact the performance results. |

| 2 | Reflects the actual fees and expenses that were charged when the Fund was a partnership. Prior to 2003, the predecessor partnership charged a 15% performance fee after reaching a certain performance benchmark. If the annual returns for the Fund did not reflect the performance fee for the years it was a partnership, the returns would be higher. The Fund’s shareholders will not be charged a performance fee. The predecessor partnership’s performance is only for the periods before the Fund’s registration statement was effective, which was June 30, 2008. During those periods, the predecessor partnership was not registered under the Investment Company Act of 1940 and was not subject to its requirements or the requirements of the Internal Revenue Code relating to registered investment companies, which, if it were, might have adversely affected its performance. |

| 3 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 4 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

| 5 | The Fund had a distribution policy, which required the Fund to pay a minimum annual distribution of 4% of the Fund’s net assets per share measured as of December 31 of the preceding year. All or a portion of the 4% annual distribution was a return of capital for the fiscal years ended December 31, 2009 and December 31, 2008. This distribution policy has been terminated as of December 31, 2010. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2011 All Rights Reserved

4

| | |

| December 31, 2010 | | Baron Focused Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2010

| | | | |

| | | Percent of

Net Assets | |

MSCI, Inc. (Cl A) | | | 6.4% | |

Genesee & Wyoming, Inc. (Cl A) | | | 5.8% | |

Hyatt Hotels Corp. (Cl A) | | | 5.1% | |

Verisk Analytics, Inc. (Cl A) | | | 4.8% | |

Molycorp, Inc. | | | 4.4% | |

Dick’s Sporting Goods, Inc. | | | 4.1% | |

SM Energy Co. | | | 3.9% | |

Concho Resources, Inc. | | | 3.9% | |

Choice Hotels International, Inc. | | | 3.8% | |

Anhanguera Educacional Participacoes SA | | | 3.7% | |

| | | | 45.9% | |

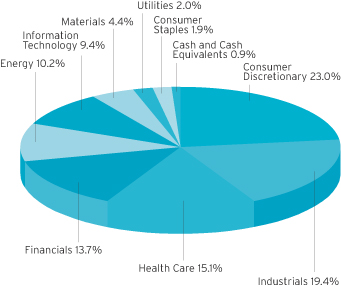

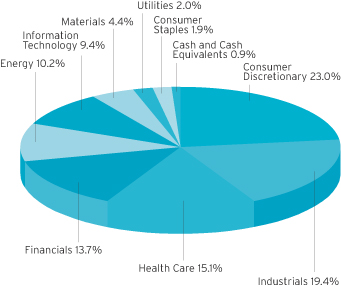

SECTOR BREAKDOWNASOF DECEMBER 31, 2010†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

For the year ended December 31, 2010, Baron Focused Growth Fund (Retail Shares) gained 25.17%, compared to a 28.86% gain for the Russell 2500 Growth Index and a 15.06% gain for the S&P 500 Index.

The Fund converted to an open-end mutual fund on June 30, 2008. In the period since the Fund’s conversion through December 31, 2010, the Fund gained an annualized 4.64% versus an annualized 6.08% for the Russell 2500 Growth and 1.61% for the S&P 500.

The Fund has performed well for the five and ten-year periods ended December 31, 2010, as well as since its inception. For the five-year period ended December 31, 2010, the Fund gained an annualized 8.29% versus an annualized 5.63% for the Russell 2500 Growth Index

and an annualized 2.29% for the S&P 500 Index. For the ten years ended December 31, 2010, the Fund gained an annualized 8.53% versus an annualized 4.19% for the Russell 2500 Growth Index and an annualized 1.41% for the S&P 500 Index.

Since its inception on May 31, 1996 to December 31, 2010, the Fund also outperformed its comparative indexes, gaining an annualized 11.89%* compared to an annualized 5.76% for the Russell 2500 Growth and 6.29% for the S&P 500.

The Fund has achieved these returns while assuming less risk than the overall market as measured by the Russell 2500 Growth Index. For the five-year period ended December 31, 2010, the Fund’s Beta was 0.91. Since the Fund’s inception on May 31, 1996 through December 31, 2010, the Fund’s Beta was 0.77. Beta is a measure of the Fund’s volatility, or systematic risk, compared to the market as a whole.

Baron Focused Growth Fund invests in a focused portfolio of companies that we believe are well capitalized with exceptional management, significant growth potential, and sustainable barriers to competition. We seek to invest in companies that we believe will double in size within four or five years. Of course there can be no assurance that the Adviser will be successful in achieving its goals.

The market achieved a 52-week high in December, overcoming declines in May and June and a choppy third quarter. At the end of the year, with fear of a “double-dip” recession abated, U.S. stock prices were within 14% of their value at the market peak in October, 2007.

Economic recovery continues, with corporate profits and GDP growth on the rise. The “bellwether” auto and housing industries are delivering positive news. Even with the recent positive movement of the U.S. stock market, we think stocks remain inexpensive relative to their earnings growth potential and are poised for multiple expansion. Investors are regaining confidence in the equity markets as net flows to small and mid-cap growth funds were positive in the fourth quarter for the first time since April.

Genesee & Wyoming, Inc., a leading short-line railroad, was the leading contributor to the Fund’s performance in 2010. The company reported strong, double-digit growth in carload volumes, increased prices and announced a significant new acquisition. In June, Genesee said it would acquire an Australian rail line that is poised to benefit from several mining projects with key export customers in China and India. Combined with Genesee’s existing Australian business, we expect the new line will boost international revenue to roughly one-third of the company’s total business, offering good diversity and leverage to secular growth drivers in emerging Asian markets.

Charles Schwab, a leading discount brokerage, was the Fund’s most significant detractor. Low interest rates resulted in the company earning a lower net interest margin on client cash balances, as well as the company waiving a significant portion of its asset management fees to avoid a negative yield on its money market funds. In the fourth quarter, interest rates rallied significantly, which bodes well for an improvement in Charles Schwab’s earnings power in 2011.

This non-diversified Fund utilizes value purchase disciplines when investing in small and mid-sized growth companies that we believe have significant long-term growth opportunities. We believe that our independent research will identify investment opportunities that are attractively priced relative to their future prospects.

In 2011, the Fund expects to continue to establish positions in small and mid-sized businesses that, in our opinion, have favorable price-to-value characteristics based on our assessment of prospects for future growth and profitability.

| * | Please see Footnote 2 on page 4. |

| † | Industry sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

5

| | |

| Baron International Growth Fund | | December 31, 2010 |

| | | | | | | | |

| | | | | |

Baron International Growth Fund | | | | | |

| | |

Ticker Symbols: | | | | | | | | |

Retail Shares: BIGFX | | | | | | | | |

Institutional Shares: BINIX | | | | | | | | |

Performance | | | 6 | | | | | |

Top Ten Holdings | | | 7 | | | | | |

Sector Breakdown | | | 7 | | | | | |

Management’s Discussion of Fund Performance | | | 7 | | | | | |

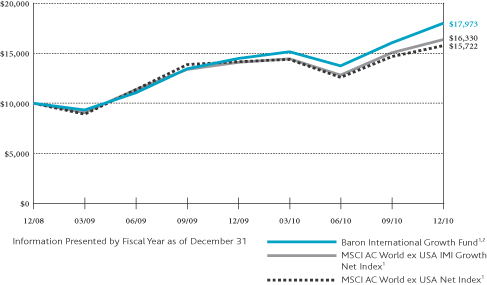

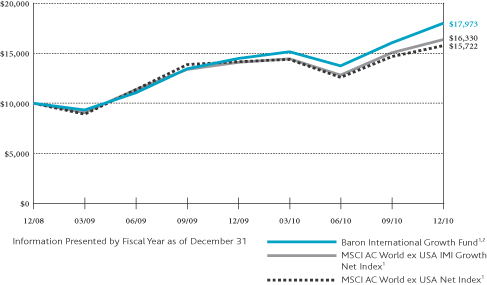

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENT

IN BARON INTERNATIONAL GROWTH FUND†INRELATIONTOTHE MSCI AC WORLDEX USA IMI GROWTH NET (USD) INDEXANDTHE MSCI AC WORLDEX USA NET (USD) INDEX

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2010

| | | | | | | | |

| | | One

Year | | | Since Inception

(December 31,

2008) | |

Baron International Growth Fund — Retail Shares1,2 | | | 24.22% | | | | 34.06% | |

Baron International Growth Fund — Institutional Shares1,2,3 | | | 24.54% | | | | 34.33% | |

MSCI AC World ex USA IMI Growth Net (USD)1 | | | 15.90% | | | | 27.79% | |

MSCI AC World ex USA Net (USD)1 | | | 11.15% | | | | 25.39% | |

| 1 | The MSCI AC World ex USA indexes are an unmanaged, free float-adjusted market capitalization weighted indexes. The MSCI AC World ex USA IMI Growth Net Index measures the equity market performance of large, mid, and small-cap growth securities across developed and emerging markets, excluding the United States. The MSCI AC World ex USA Net Index measures the equity market performance of large and mid-cap securities across developed and emerging markets, excluding the United States. The indexes and Baron International Growth Fund include reinvestment of dividends, net of foreign withholding taxes, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. |

| 3 | Performance for the Institutional Shares prior to May 29, 2009 is based on the performance of the Retail Shares, which have a distribution fee. The Institutional Shares do not have a distribution fee. If the annual returns prior to May 29, 2009 did not reflect this fee, the returns would be higher. |

| † | Performance information reflects results of the Retail Shares. |

1.800.99 BARON

www.BaronFunds.com

©2011 All Rights Reserved

6

| | |

| December 31, 2010 | | Baron International Growth Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2010

| | | | |

| | | Percent of

Net Assets | |

NII Holdings, Inc. | | | 3.2% | |

Fanuc, Ltd. | | | 2.8% | |

Sony Financial Holdings, Inc. | | | 2.7% | |

Symrise AG | | | 2.6% | |

TOTVS SA | | | 2.4% | |

Ingenico SA | | | 2.4% | |

Compagnie Financiere Richemont SA | | | 2.3% | |

China-Biotics, Inc. | | | 2.3% | |

Wynn Macau, Ltd. | | | 2.2% | |

Julius Baer Group, Ltd. | | | 2.2% | |

| | | | 25.1% | |

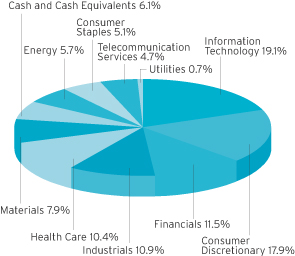

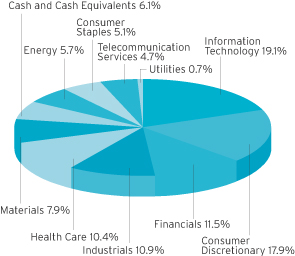

SECTOR BREAKDOWNASOF DECEMBER 31, 2010†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron International Growth Fund (Retail Shares) gained 24.22% for the year ended December 31, 2010, significantly outperforming both of its comparative indexes. The MSCI AC World ex USA IMI Growth Net Index gained 15.90% while the MSCI AC World ex USA Net Index gained 11.15%.

Baron International Growth Fund is a diversified fund that invests for the long term primarily in securities of non-U.S. growth companies. The Fund expects to diversify among several developed countries and developing countries throughout the world, although the Fund’s total exposure to developing countries will not exceed 30%. The Fund may purchase securities of companies of any size, but expects to focus on small- and mid-sized growth companies with market capitalization of $10 billion or less at the time of purchase. The Fund seeks to purchase companies with the potential to increase in value 100% within four to five years based on our evaluation of the company’s prospects for future growth, profitability and competitive advantages. Of course, there can be no assurance that the Adviser will be successful in achieving its goals.

The markets’ steep second-quarter declines were erased in the second half of the year as concern over the European debt crisis eased, fear of a “double-dip” recession abated and the Federal Reserve indicated it would engage in additional qualitative easing, if necessary, to prevent deflation. For the first time in a while, and particularly in a strong equity market, the developed world markets began to outperform the developing markets. This phenomenon could continue for an extended period if, as we suspect, it is a consequence of vanquishing fears of deflation in the U.S.

Kingdee International Software Group, China’s No. 2 Enterprise Resource Planning (ERP) software and service provider, was the Fund’s largest contributor in 2010. The company focuses on small and medium-size companies. Kingdee appreciated more than 150%, mainly due to China’s need to improve productivity and efficiency. China’s ERP market is growing 3.5 times faster than world’s average. With its strong technology and local knowledge, we think Kingdee is well positioned to take advantage of a significant growth opportunity.

Thales SA was the Fund’s largest detractor in 2010. We were attracted to Thales given its position as a world-class defense electronics, aerospace and security systems contractor and the potential for significant margin expansion. During 2009, the Company announced a major restructuring review that resulted in potentially material write-downs of existing contracts. Considering the balance of opportunity and risk, we chose to sell Thales in favor of more compelling ideas.

The Fund expects to continue making investments in non-U.S. companies that we believe have superior long-term growth prospects. The Adviser believes that there are exciting business prospects that are driven by the increasing demand for consumer goods and services in developing countries, which we think creates growth opportunities for both local businesses in those countries as well as for companies in developed countries that can help satisfy that demand.

| † | Industry sector or sub-industry group levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

7

| | |

| Baron Real Estate Fund | | December 31, 2010 |

| | | | | | | | |

| | | | | |

Baron Real Estate Fund | | | | | | | | |

Retail Shares: BREFX | | | | | | | | |

Institutional Shares: BREIX | | | | | | | | |

Performance | | | 8 | | | | | |

Top Ten Holdings | | | 9 | | | | | |

Sector Breakdown | | | 9 | | | | | |

Management’s Discussion of

Fund Performance | | | 9 | | | | | |

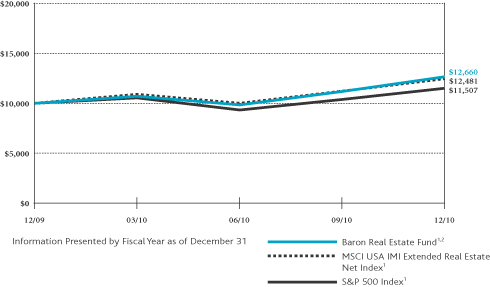

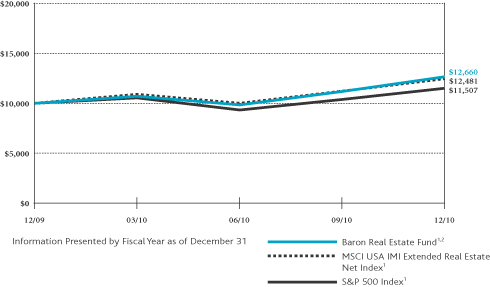

COMPARISONOFTHECHANGEIN VALUEOF $10,000INVESTMENT

IN BARON REAL ESTATE FUND†INRELATIONTOTHE MSCI USA IMI EXTENDED REAL ESTATE NET INDEXANDTHE S&P 500 INDEX

AVERAGE ANNUAL TOTAL RETURNSFORTHEPERIODSENDED DECEMBER 31, 2010

| | | | | | | | |

| | | One

Year | | | Since

Inception

(December 31,

2009) | |

Baron Real Estate Fund — Retail Shares1,2 | | | 26.60% | | | | 26.60% | |

Baron Real Estate Fund — Institutional Shares1,2 | | | 26.90% | | | | 26.90% | |

MSCI USA IMI Extended Real Estate Net1 | | | 24.81% | | | | 24.81% | |

S&P 5001 | | | 15.06% | | | | 15.06% | |

| 1 | The MSCI USA IMI Extended Real Estate Net Index is a custom index calculated by MSCI for, and as requested by, BAMCO, Inc. The index includes real estate and real estate-related GICS classification securities. MSCI makes no express or implied warranties or representation and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indexes or any securities or financial products. This report is not approved, reviewed or produced by MSCI. The S&P 500 measures the performance of larger cap U.S. equities in the stock market in general. The indexes and the Fund are with dividends, which positively impact the performance results. |

| 2 | Past performance is not predictive of future performance. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. The Adviser has reimbursed certain Fund expenses without which performance would have been lower. |

| † | Performance information reflects results of the Retail shares. |

1.800.99 BARON

www.BaronFunds.com

©2011 All Rights Reserved

8

| | |

| December 31, 2010 | | Baron Real Estate Fund |

TOP TEN HOLDINGSASOF DECEMBER 31, 2010

| | | | |

| | | Percent of

Net Assets | |

Brookfield Asset Management, Inc. (Cl A) | | | 3.1% | |

RealPage, Inc. | | | 2.9% | |

Penn National Gaming, Inc. | | | 2.6% | |

Brookdale Senior Living, Inc. | | | 2.5% | |

Targa Resources Corp. | | | 2.5% | |

SBA Communications Corp. (Cl A) | | | 2.5% | |

Hyatt Hotels Corp. (Cl A) | | | 2.4% | |

Wyndham Worldwide Corp. | | | 2.4% | |

Forest City Enterprises, Inc. (Cl A) | | | 2.3% | |

Carnival Corp. | | | 2.2% | |

| | | | 25.4% | |

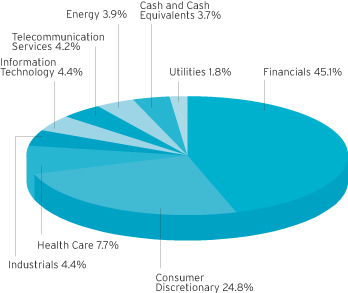

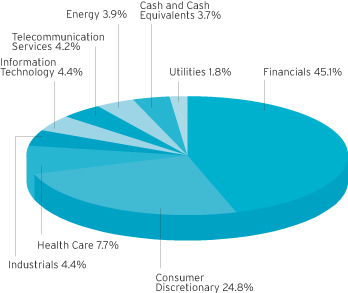

SECTOR BREAKDOWNASOF DECEMBER 31, 2010†

(as a percentage of net assets)

MANAGEMENT’S DISCUSSIONOF FUND PERFORMANCE

Baron Real Estate Fund (Retail Shares) gained 26.60% in its first full year of operation ended December 31, 2010, outperforming both of its comparative indexes. The MSCI USA IMI Extended Real Estate Net Index gained 24.81% and the S&P 500 Index gained 15.06%

Baron Real Estate Fund is a non-diversified fund that invests primarily in securities of real estate and real estate-related companies of all sizes. The Fund seeks to invest in well managed companies that the Adviser believes have significant long-term

growth opportunities. Unlike many other real estate funds that invest primarily in real estate investment trusts (REITs), the Fund expands its investment universe to include a more comprehensive group of real estate and real estate-related companies. These include home builders, hotels, manufacturers of building supplies and products, retailers with significant real estate holdings, real estate service companies, real estate operating companies, and infrastructure-related companies.

Baron Real Estate Fund invests in securities that we believe have favorable price-to-value characteristics, are well managed, have significant long-term growth prospects, have significant barriers to competition and are attractively priced relative to the Adviser’s assessment of the businesses’ long-term growth prospects, future cash flows and asset values.

In 2010, strong business conditions and economic prosperity were not absolute prerequisites for strong performance in real estate. Despite the difficult economic environment, several categories of real estate companies generated solid returns. These include office, apartment, retail, hotel, industrial, select homebuilder, and certain other real estate-related categories.

Some of the factors that contributed to positive performance are: business conditions bottomed across a number of real estate categories; interest rates fell (the 10-year treasury reached 2.41%!) making costs of borrowing attractive; high dividend paying companies, like REITs, were appealing in a world of low returns on savings and investment; the long-term nature of the revenue streams for several real estate categories (i.e., multi-year leases) became attractive to investors in an uncertain economic environment; and valuations were favorable for certain real estate-related companies.

RealPage, Inc. was the largest contributor to Fund performance in 2010. Its shares more than doubled since its mid-August IPO. RealPage sells a comprehensive suite of property management software and analytical tools for the rental housing industry, all delivered on a SaaS (software as a service) basis. Investors were enthusiastic over the company’s vast addressable market opportunity, scalable margin structure, robust free cash flow generation, and defensible market position. We believe that RealPage’s addressable market opportunity is in excess of $5 billion annually, or more than 25 times larger than the company’s current revenue base.

Equinix, Inc. was the largest detractor from Fund performance in 2010. Shares were volatile throughout the year before selling off sharply in October, following the company’s announcement that it would miss both third-quarter and full-year 2010 revenue expectations by 1% to 2%. This focused additional attention on pricing concessions for certain magnet customers, and a slightly elevated level of client churn. We continue to perform rigorous due diligence and remain comfortable that the company maintains a solid competitive advantage in its core, interconnection-focused offering and remains undervalued relative to what appears to be a solid, multi-year opportunity.

In 2011, the Adviser expects to continue to establish positions in “best-in-class” real estate companies that we believe have talented management, are well positioned against competitors and are attractively priced.

| † | Industry sector levels are provided from the Global Industry Classification Standard (“GICS”), developed and exclusively owned by MSCI, Inc. and Standard & Poor’s Financial Services LLC, unless otherwise stated that they have been reclassified or classified by the Adviser. All GICS data is provided “as is” with no warranties. |

9

| | |

| Baron Partners Fund | | December 31, 2010 |

STATEMENT OF NET ASSETS

DECEMBER 31, 2010

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (123.23%) | | | | | | | | |

| Consumer Discretionary (33.68%) | | | | | |

| | | | Broadcasting (2.89%) | |

| | 950,000 | | | Discovery Communications, Inc., Cl A1 | | $ | 23,332,159 | | | $ | 39,615,000 | |

| |

| | | | Casinos & Gaming (2.69%) | |

| | 1,050,000 | | | Penn National Gaming, Inc.1 | | | 31,457,686 | | | | 36,907,500 | |

| |

| | | | Education Services (5.59%) | |

| | 275,000 | | | Anhanguera Educacional

Participacoes SA (Brazil)2 | | | 5,872,171 | | | | 6,626,506 | |

| | 825,000 | | | DeVry, Inc. | | | 35,163,137 | | | | 39,583,500 | |

| | 200,000 | | | Strayer Education, Inc. | | | 22,931,492 | | | | 30,444,000 | |

| | | | | | | | | | | | |

| | | | | | | 63,966,800 | | | | 76,654,006 | |

| |

| | | | Hotels, Resorts & Cruise

Lines (11.85%) | |

| | 450,000 | | | Carnival Corp.2 | | | 17,814,673 | | | | 20,749,500 | |

| | 2,500,000 | | | Hyatt Hotels Corp., Cl A1 | | | 66,878,141 | | | | 114,400,000 | |

| | 450,000 | | | Starwood Hotels & Resorts

Worldwide, Inc. | | | 24,409,170 | | | | 27,351,000 | |

| | | | | | | | | | | | |

| | | | | | | 109,101,984 | | | | 162,500,500 | |

| |

| | | | Leisure Facilities (4.10%) | |

| | 1,081,800 | | | Vail Resorts, Inc.1 | | | 34,304,772 | | | | 56,296,872 | |

| |

| | | | Specialty Stores (6.56%) | |

| | 2,400,000 | | | Dick’s Sporting Goods, Inc.1 | | | 38,814,999 | | | | 90,000,000 | |

| | | | | | | | | | | | |

| Total Consumer Discretionary | | | 300,978,400 | | | | 461,973,878 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Energy (7.11%) | | | | | |

| | | | Oil & Gas Drilling (2.48%) | |

| | 700,000 | | | Helmerich & Payne, Inc. | | | 16,484,771 | | | | 33,936,000 | |

| |

| | | | Oil & Gas Exploration &

Production (4.63%) | |

| | 725,000 | | | Concho Resources, Inc.1 | | | 30,513,642 | | | | 63,560,750 | |

| | | | | | | | | | | | |

| Total Energy | | | 46,998,413 | | | | 97,496,750 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financials (23.80%) | | | | | |

| | | | Asset Management &

Custody Banks (1.93%) | |

| | 875,000 | | | Eaton Vance Corp. | | | 23,431,074 | | | | 26,451,250 | |

| |

| | | | Investment Banking &

Brokerage (6.55%) | |

| | 5,250,000 | | | Charles Schwab Corp. | | | 56,269,218 | | | | 89,827,500 | |

| |

| | | | Reinsurance (7.22%) | |

| | 1,125,000 | | | Arch Capital Group, Ltd.1,2 | | | 54,553,658 | | | | 99,056,250 | |

| |

| | | | Specialized Finance (8.10%) | |

| | 1,650,000 | | | Interactive Brokers Group, Inc., Cl A1 | | | 25,308,214 | | | | 29,403,000 | |

| | 2,100,000 | | | MSCI, Inc., Cl A1 | | | 57,146,328 | | | | 81,816,000 | |

| | | | | | | | | | | | |

| | | | | | | 82,454,542 | | | | 111,219,000 | |

| | | | | | | | | | | | |

| Total Financials | | | 216,708,492 | | | | 326,554,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Health Care (13.51%) | | | | | |

| | | | Health Care Equipment (9.42%) | |

| | 875,000 | | | Edwards Lifesciences Corp.1 | | | 20,361,601 | | | | 70,735,000 | |

| | 250,000 | | | IDEXX Laboratories, Inc.1 | | | 15,397,555 | | | | 17,305,000 | |

| | 160,000 | | | Intuitive Surgical, Inc.1 | | | 42,124,119 | | | | 41,240,000 | |

| | | | | | | | | | | | |

| | | | | | | 77,883,275 | | | | 129,280,000 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | | | | | | | | |

| Health Care (continued) | | | | | |

| | | | Health Care Facilities (4.09%) | |

| | 1,500,000 | | | Community Health Systems, Inc.1 | | $ | 40,771,130 | | | $ | 56,055,000 | |

| | | | | | | | | | | | |

| Total Health Care | | | 118,654,405 | | | | 185,335,000 | |

| | | | | | | | | | | | |

| Industrials (22.85%) | | | | | |

| | | | Air Freight & Logistics (6.27%) | |

| | 800,000 | | | C. H. Robinson Worldwide, Inc. | | | 20,066,739 | | | | 64,152,000 | |

| | 400,000 | | | Expeditors International of

Washington, Inc. | | | 10,195,163 | | | | 21,840,000 | |

| | | | | | | | | | | | |

| | | | | | | 30,261,902 | | | | 85,992,000 | |

| |

| | | | Diversified Support

Services (2.35%) | |

| | 1,400,000 | | | Ritchie Bros. Auctioneers, Inc.2 | | | 34,297,483 | | | | 32,270,000 | |

| |

| | | | Research & Consulting

Services (6.70%) | |

| | 500,000 | | | CoStar Group, Inc.1 | | | 19,068,649 | | | | 28,780,000 | |

| | 1,850,000 | | | Verisk Analytics, Inc., Cl A1 | | | 51,366,473 | | | | 63,048,000 | |

| | | | | | | | | | | | |

| | | | | | | 70,435,122 | | | | 91,828,000 | |

| |

| | | | Trading Companies &

Distributors (7.53%) | |

| | 1,725,000 | | | Fastenal Co. | | | 61,849,446 | | | | 103,344,750 | |

| | | | | | | | | | | | |

| Total Industrials | | | 196,843,953 | | | | 313,434,750 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Information Technology (10.65%) | | | | | |

| | | | Application Software (8.89%) | |

| | 1,300,000 | | | FactSet Research Systems, Inc. | | | 74,181,103 | | | | 121,888,000 | |

| |

| | | | Data Processing & Outsourced

Services (1.22%) | |

| | 900,000 | | | Western Union Co. | | | 15,582,921 | | | | 16,713,000 | |

| |

| | | | Home Entertainment

Software (0.54%) | |

| | 600,000 | | | Activision Blizzard, Inc. | | | 6,638,244 | | | | 7,464,000 | |

| | | | | | | | | | | | |

| Total Information Technology | | | 96,402,268 | | | | 146,065,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Materials (3.84%) | | | | | |

| | | | Diversified Metals &

Mining (1.64%) | |

| | 450,075 | | | Molycorp, Inc.1 | | | 18,465,143 | | | | 22,458,742 | |

| |

| | | | Specialty Chemicals (2.20%) | |

| | 600,000 | | | Ecolab, Inc. | | | 22,391,513 | | | | 30,252,000 | |

| | | | | | | | | | | | |

| Total Materials | | | 40,856,656 | | | | 52,710,742 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Utilities (7.79%) | | | | | |

| | | | Electric Utilities (7.79%) | | | | | | | | |

| | 1,725,000 | | | ITC Holdings Corp. | | | 58,794,451 | | | | 106,915,500 | |

| | | | | | | | | | | | |

| Total Common Stocks | | | 1,076,237,038 | | | | 1,690,485,620 | |

| | | | | | | | | | | | |

| | |

| 10 | | See Notes to Financial Statements. |

| | |

| December 31, 2010 | | Baron Partners Fund |

STATEMENT OF NET ASSETS (Continued)

DECEMBER 31, 2010

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Value | |

| Private Equity Investments (2.24%) | |

| Consumer Discretionary (0.57%) | | | | | |

| | | | Hotels, Resorts &

Cruise Lines (0.57%) | |

| | 3,900,000 | | | Kerzner International Holdings, Ltd., Cl A1,2,3,4,6 | | $ | 39,000,000 | | | $ | 7,800,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financials (1.67%) | | | | | |

| | | | Asset Management &

Custody Banks (1.67%) | |

| | 6,014,997 | | | Windy City Investments

Holdings LLC1,3,4,6 | | | 38,319,447 | | | | 22,856,987 | |

| | | | | | | | | | | | |

| Total Private Equity Investments | | | 77,319,447 | | | | 30,656,987 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Principal

Amount | | | | | | | | | |

| Short Term Investments (0.01%) | | | | | |

| | $133,335 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 12/31/2010, 0.04% due 01/03/2011; Proceeds at maturity - $133,336; (Fully collateralized by U.S. Treasury Note, 1.25% due 10/31/2015; Market value - $140,469)5 | | | 133,335 | | | | 133,335 | |

| | | | | | | | | | | | |

| Total Investments (125.48%) | | $ | 1,153,689,820 | | | | 1,721,275,942 | |

| | | | | | | | | | | | |

| Liabilities Less Cash and Other

Assets (-25.48%) | | | | (349,473,717 | ) |

| | | | | | | | | | | | |

| Net Assets | | | $ | 1,371,802,225 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $20.57 per share based on

60,847,931 shares outstanding) |

| | $ | 1,251,912,829 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $20.66 per share based on

5,803,391 shares outstanding) |

| | $ | 119,889,396 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | At December 31, 2010, the market value of restricted and fair valued securities amounted to $30,656,987 or 2.24% of net assets. None of these securities are deemed liquid. See Note 6 regarding restricted securities. |

| 4 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| 6 | Level 3 security. See Note 7 regarding Fair Value Measurements. |

| | |

| See Notes to Financial Statements. | | 11 |

| | |

| Baron Focused Growth Fund | | December 31, 2010 |

STATEMENT OF NET ASSETS (Continued)

DECEMBER 31, 2010

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (99.12%) | |

| Consumer Discretionary (22.96%) | |

| | | | Education Services (6.84%) | |

| | 140,557 | | | Anhanguera Educacional Participacoes

SA (Brazil)2 | | $ | 2,091,343 | | | $ | 3,386,916 | |

| | 35,000 | | | DeVry, Inc. | | | 1,497,572 | | | | 1,679,300 | |

| | 7,500 | | | Strayer Education, Inc. | | | 1,179,518 | | | | 1,141,650 | |

| | | | | | | | | | | | |

| | | | | | | 4,768,433 | | | | 6,207,866 | |

| |

| | | | Hotels, Resorts & Cruise Lines (8.84%) | |

| | 90,000 | | | Choice Hotels International, Inc. | | | 2,969,235 | | | | 3,444,300 | |

| | 100,000 | | | Hyatt Hotels Corp., Cl A1 | | | 2,666,530 | | | | 4,576,000 | |

| | | | | | | | | | | | |

| | | | | | | 5,635,765 | | | | 8,020,300 | |

| |

| | | | Internet Retail (3.15%) | |

| | 50,000 | | | Blue Nile, Inc.1 | | | 1,951,755 | | | | 2,853,000 | |

| |

| | | | Specialty Stores (4.13%) | |

| | 100,000 | | | Dick’s Sporting Goods, Inc.1 | | | 1,630,006 | | | | 3,750,000 | |

| | | | | | | | | | | | |

| Total Consumer Discretionary | | | 13,985,959 | | | | 20,831,166 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Consumer Staples (1.90%) | |

| | | | Household Products (1.90%) | |

| | 25,000 | | | Church & Dwight Co., Inc. | | | 1,274,171 | | | | 1,725,500 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Energy (10.16%) | |

| | | | Oil & Gas Drilling (2.40%) | |

| | 45,000 | | | Helmerich & Payne, Inc. | | | 1,763,828 | | | | 2,181,600 | |

| |

| | | | Oil & Gas Exploration & Production (7.76%) | |

| | 40,000 | | | Concho Resources, Inc.1 | | | 1,202,056 | | | | 3,506,800 | |

| | 60,000 | | | SM Energy Co. | | | 3,438,184 | | | | 3,535,800 | |

| | | | | | | | | | | | |

| | | | | | | 4,640,240 | | | | 7,042,600 | |

| | | | | | | | | | | | |

| Total Energy | | | 6,404,068 | | | | 9,224,200 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financials (13.71%) | |

| | | | Asset Management & Custody Banks (2.00%) | |

| | 60,000 | | | Eaton Vance Corp. | | | 962,587 | | | | 1,813,800 | |

| |

| | | | Reinsurance (2.91%) | |

| | 30,000 | | | Arch Capital Group, Ltd.1,2 | | | 1,469,556 | | | | 2,641,500 | |

| |

| | | | Specialized Finance (8.80%) | |

| | 120,000 | | | Interactive Brokers Group, Inc., Cl A1 | | | 1,882,249 | | | | 2,138,400 | |

| | 150,000 | | | MSCI, Inc., Cl A1 | | | 3,990,189 | | | | 5,844,000 | |

| | | | | | | | | | | | |

| | | | | | | 5,872,438 | | | | 7,982,400 | |

| | | | | | | | | | | | |

| Total Financials | | | 8,304,581 | | | | 12,437,700 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Health Care (15.12%) | |

| | | | Health Care Distributors (2.37%) | |

| | 35,000 | | | Henry Schein, Inc.1 | | | 1,394,758 | | | | 2,148,650 | |

| |

| | | | Health Care Equipment (4.91%) | |

| | 38,000 | | | Edwards Lifesciences Corp.1 | | | 1,057,771 | | | | 3,071,920 | |

| | 20,000 | | | IDEXX Laboratories, Inc.1 | | | 1,211,865 | | | | 1,384,400 | |

| | | | | | | | | | | | |

| | | | | | | 2,269,636 | | | | 4,456,320 | |

| |

| | | | Health Care Facilities (2.88%) | |

| | 70,000 | | | Community Health Systems, Inc.1 | | | 1,210,356 | | | | 2,615,900 | |

| |

| | | | Health Care Technology (2.13%) | |

| | 100,000 | | | Allscripts Healthcare Solutions, Inc.1 | | | 1,756,017 | | | | 1,927,000 | |

| |

| | | | Life Sciences Tools & Services (2.83%) | |

| | 17,000 | | | Mettler-Toledo International, Inc.1 | | | 797,334 | | | | 2,570,570 | |

| | | | | | | | | | | | |

| Total Health Care | | | 7,428,101 | | | | 13,718,440 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Industrials (19.38%) | |

| | | | Air Freight & Logistics (3.53%) | |

| | 40,000 | | | C. H. Robinson Worldwide, Inc. | | $ | 1,466,812 | | | $ | 3,207,600 | |

| |

| | | | Diversified Support Services (1.90%) | |

| | 75,000 | | | Ritchie Bros. Auctioneers, Inc.2 | | | 1,866,297 | | | | 1,728,750 | |

| |

| | | | Railroads (5.84%) | |

| | 100,000 | | | Genesee & Wyoming, Inc., Cl A1 | | | 3,101,975 | | | | 5,295,000 | |

| |

| | | | Research & Consulting Services (4.81%) | |

| | 128,050 | | | Verisk Analytics, Inc., Cl A1 | | | 3,651,694 | | | | 4,363,944 | |

| |

| | | | Trading Companies & Distributors (3.30%) | |

| | 50,000 | | | Fastenal Co. | | | 2,169,716 | | | | 2,995,500 | |

| | | | | | | | | | | | |

| Total Industrials | | | 12,256,494 | | | | 17,590,794 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Information Technology (9.44%) | |

| | | | Application Software (8.37%) | |

| | 30,000 | | | ANSYS, Inc.1 | | | 658,716 | | | | 1,562,100 | |

| | 35,000 | | | FactSet Research Systems, Inc. | | | 1,982,041 | | | | 3,281,600 | |

| | 75,000 | | | Pegasystems, Inc. | | | 2,140,474 | | | | 2,747,250 | |

| | | | | | | | | | | | |

| | | | | | | 4,781,231 | | | | 7,590,950 | |

| |

| | | | Communications Equipment (1.07%) | |

| | 25,000 | | | Polycom, Inc.1 | | | 1,001,143 | | | | 974,500 | |

| | | | | | | | | | | | |

| Total Information Technology | | | 5,782,374 | | | | 8,565,450 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Materials (4.40%) | |

| | | | Diversified Metals & Mining (4.40%) | |

| | 80,000 | | | Molycorp, Inc.1 | | | 2,220,549 | | | | 3,992,000 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Utilities (2.05%) | |

| | | | Electric Utilities (2.05%) | |

| | 30,000 | | | ITC Holdings Corp. | | | 1,552,701 | | | | 1,859,400 | |

| | | | | | | | | | | | |

| Total Common Stocks | | | 59,208,998 | | | | 89,944,650 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Principal

Amount | | | | | | |

| Short Term Investments (0.87%) | |

| | $790,401 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 12/31/2010, 0.04% due 01/03/2011; Proceeds at maturity - $790,404; (Fully collateralized by U.S. Treasury Note, 2.125% due 12/31/2015; Market value - $833,113)3 | | | 790,401 | | | | 790,401 | |

| | | | | | | | | | | | |

| Total Investments (99.99%) | | $ | 59,999,399 | | | | 90,735,051 | |

| | | | | | | | | | | | |

| Cash and Other Assets Less Liabilities (0.01%) | | | | 7,336 | |

| | | | | | | | | | | | |

| Net Assets | | | $ | 90,742,387 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $9.85 per share

based on 4,709,277 shares outstanding) |

| | $ | 46,385,376 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $9.88 per share

based on 4,488,831 shares outstanding) |

| | $ | 44,357,011 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| | |

| 12 | | See Notes to Financial Statements. |

| | |

| December 31, 2010 | | Baron International Growth Fund |

STATEMENT OF NET ASSETS

DECEMBER 31, 2010

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (93.86%) | |

| Australia (1.11%) | |

| | 115,000 | | | Wotif.com Holdings, Ltd. | | $ | 471,689 | | | $ | 585,758 | |

| | | | | | | | | | | | |

| Austria (1.42%) | |

| | 19,000 | | | bwin Interactive Entertainment AG5 | | | 1,023,278 | | | | 750,825 | |

| | | | | | | | | | | | |

| Brazil (8.06%) | |

| | 40,000 | | | Anhanguera Educacional Participacoes SA | | | 525,991 | | | | 963,856 | |

| | 48,000 | | | Companhia Hering SA | | | 310,331 | | | | 780,723 | |

| | 32,000 | | | Itau Unibanco Holding SA, ADR | | | 507,851 | | | | 768,320 | |

| | 45,000 | | | Restoque Comercio e Confeccoes de Roupas SA2 | | | 63,654 | | | | 463,554 | |

| | 12,500 | | | TOTVS SA | | | 325,803 | | | | 1,272,590 | |

| | | | | | | | | | | | |

| Total Brazil | | | 1,733,630 | | | | 4,249,043 | |

| | | | | | | | | | | | |

| Canada (2.70%) | |

| | 70,000 | | | Kirkland Lake Gold, Inc.1 | | | 508,906 | | | | 1,124,308 | |

| | 13,000 | | | Ritchie Bros. Auctioneers, Inc.2 | | | 262,486 | | | | 299,650 | |

| | | | | | | | | | | | |

| Total Canada | | | 771,392 | | | | 1,423,958 | |

| | | | | | | | | | | | |

| China (12.32%) | |

| | 40,000 | | | Bona Film Group, Ltd., ADR1 | | | 324,885 | | | | 218,000 | |

| | 30,000 | | | China Automotive Systems, Inc.1,2 | | | 384,636 | | | | 408,000 | |

| | 83,000 | | | China-Biotics, Inc.1,2,3 | | | 1,020,538 | | | | 1,220,100 | |

| | 41,000 | | | E-Commerce China Dangdang, Inc., ADR1 | | | 656,000 | | | | 1,109,870 | |

| | 25,000 | | | Harbin Electric, Inc.1 | | | 436,979 | | | | 433,750 | |

| | 2,003,800 | | | Kingdee International Software

Group Co., Ltd. | | | 238,789 | | | | 1,123,992 | |

| | 65,000 | | | Origin Agritech, Ltd.1 | | | 577,929 | | | | 692,250 | |

| | 190,000 | | | Shandong Weigao Group Medical

Polymer Co., Ltd. | | | 249,563 | | | | 537,773 | |

| | 20,000 | | | Tencent Holdings, Ltd. | | | 272,772 | | | | 439,996 | |

| | 121,500 | | | Tingyi Holding Corp. | | | 137,065 | | | | 314,192 | |

| | | | | | | | | | | | |

| Total China | | | 4,299,156 | | | | 6,497,923 | |

| | | | | | | | | | | | |

| France (4.56%) | |

| | 6,020 | | | Edenred1 | | | 83,136 | | | | 142,509 | |

| | 14,000 | | | Eurofins Scientific | | | 869,424 | | | | 1,008,372 | |

| | 34,650 | | | Ingenico SA | | | 653,238 | | | | 1,254,574 | |

| | | | | | | | | | | | |

| Total France | | | 1,605,798 | | | | 2,405,455 | |

| | | | | | | | | | | | |

| Germany (6.24%) | |

| | 13,000 | | | Gerresheimer AG1,5 | | | 292,731 | | | | 571,385 | |

| | 37,500 | | | QIAGEN N.V.1,2 | | | 795,798 | | | | 733,125 | |

| | 50,000 | | | Symrise AG5 | | | 705,337 | | | | 1,370,004 | |

| | 7,530 | | | Wincor Nixdorf AG5 | | | 358,783 | | | | 616,399 | |

| | | | | | | | | | | | |

| Total Germany | | | 2,152,649 | | | | 3,290,913 | |

| | | | | | | | | | | | |

| Hong Kong (2.22%) | |

| | 525,000 | | | Wynn Macau, Ltd.1,2 | | | 689,724 | | | | 1,172,550 | |

| | | | | | | | | | | | |

| India (1.77%) | |

| | 35,000 | | | Financial Technologies , Ltd. | | | 853,268 | | | | 699,765 | |

| | 50,000 | | | Jain Irrigation Systems, Ltd. | | | 246,540 | | | | 235,492 | |

| | | | | | | | | | | | |

| Total India | | | 1,099,808 | | | | 935,257 | |

| | | | | | | | | | | | |

| Ireland (1.75%) | |

| | 30,000 | | | Ryanair Holdings plc, ADR | | | 779,604 | | | | 922,800 | |

| | | | | | | | | | | | |

| Italy (1.89%) | |

| | 200,000 | | | Amplifon SpA5 | | | 1,035,184 | | | | 996,747 | |

| | | | | | | | | | | | |

| Japan (12.92%) | |

| | 30,000 | | | Bridgestone Corp.5 | | | 576,956 | | | | 577,469 | |

| | 22,000 | | | Canon, Inc., ADR | | | 769,004 | | | | 1,129,480 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Japan (continued) | |

| | 9,500 | | | Fanuc, Ltd.5 | | $ | 808,893 | | | $ | 1,452,135 | |

| | 55,000 | | | Kubota Corp.5 | | | 495,367 | | | | 518,161 | |

| | 22,000 | | | Softbank Corp.5 | | | 744,863 | | | | 758,570 | |

| | 350 | | | Sony Financial Holdings, Inc.5 | | | 1,122,484 | | | | 1,409,567 | |

| | 2,500 | | | Yahoo! Japan Corp.5 | | | 815,100 | | | | 966,319 | |

| | | | | | | | | | | | |

| Total Japan | | | 5,332,667 | | | | 6,811,701 | |

| | | | | | | | | | | | |

| Korea, Republic Of (2.21%) | |

| | 1,350 | | | LG Household & Health Care, Ltd.1,5 | | | 367,341 | | | | 464,186 | |

| | 3,500 | | | NHN Corp.1,5 | | | 585,056 | | | | 698,667 | |

| | | | | | | | | | | | |

| Total Korea, Republic Of | | | 952,397 | | | | 1,162,853 | |

| | | | | | | | | | | | |

| Mexico (2.16%) | |

| | 289,600 | | | Compartamos SAB de CV (formerly, Banco Compartamos SA de CV)1 | | | 128,306 | | | | 629,851 | |

| | 210,000 | | | Genomma Lab Internacional SA1 | | | 336,612 | | | | 509,781 | |

| | | | | | | | | | | | |

| Total Mexico | | | 464,918 | | | | 1,139,632 | |

| | | | | | | | | | | | |

| Norway (0.91%) | |

| | 425,000 | | | Sevan Marine ASA1,5 | | | 592,703 | | | | 479,406 | |

| | | | | | | | | | | | |

| Peru (1.35%) | |

| | 6,000 | | | Credicorp, Ltd. | | | 346,447 | | | | 713,460 | |

| | | | | | | | | | | | |

| Spain (1.15%) | |

| | 23,000 | | | Telvent GIT SA1,2 | | | 580,682 | | | | 607,660 | |

| | | | | | | | | | | | |

| Switzerland (8.88%) | |

| | 21,000 | | | Compagnie Financiere Richemont SA5 | | | 380,490 | | | | 1,234,880 | |

| | 9,500 | | | GAM Holding, Ltd.1,5 | | | 55,338 | | | | 157,032 | |

| | 25,000 | | | Julius Baer Group, Ltd.5 | | | 658,587 | | | | 1,170,576 | |

| | 5,000 | | | Sonova Holding AG5 | | | 635,075 | | | | 644,532 | |

| | 1,200 | | | Swatch Group AG-BR5 | | | 407,743 | | | | 535,045 | |

| | 16,000 | | | Syngenta AG, ADR | | | 769,642 | | | | 940,480 | |

| | | | | | | | | | | | |

| Total Switzerland | | | 2,906,875 | | | | 4,682,545 | |

| | | | | | | | | | | | |

| United Kingdom (9.92%) | |

| | 450,000 | | | Borders & Southern Petroleum plc1,2 | | | 407,229 | | | | 442,005 | |

| | 90,000 | | | Cairn Energy plc1 | | | 279,673 | | | | 589,340 | |

| | 200,000 | | | Caparo Energy, Ltd.1 | | | 366,401 | | | | 349,238 | |

| | 75,000 | | | Experian plc | | | 476,937 | | | | 933,121 | |

| | 30,000 | | | Intertek Group plc | | | 533,516 | | | | 830,220 | |

| | 25,000 | | | Micro Focus International plc | | | 136,575 | | | | 151,505 | |

| | 130,000 | | | PartyGaming plc1 | | | 534,755 | | | | 416,513 | |

| | 25,000 | | | Premier Oil plc1 | | | 466,957 | | | | 760,061 | |

| | 28,125 | | | Standard Chartered plc | | | 611,130 | | | | 756,626 | |

| | | | | | | | | | | | |

| Total United Kingdom | | | 3,813,173 | | | | 5,228,629 | |

| | | | | | | | | | | | |

| United States (10.32%) | |

| | 12,000 | | | Agilent Technologies, Inc.1 | | | 181,967 | | | | 497,160 | |

| | 5,000 | | | Arch Capital Group, Ltd.1 | | | 293,022 | | | | 440,250 | |

| | 8,000 | | | Core Laboratories N.V. | | | 351,996 | | | | 712,400 | |

| | 6,000 | | | Liberty Global, Inc., Cl A1 | | | 89,578 | | | | 212,280 | |

| | 50,000 | | | Net 1 UEPS Technologies, Inc.1 | | | 632,847 | | | | 613,000 | |

| | 38,000 | | | NII Holdings, Inc.1 | | | 1,112,005 | | | | 1,697,080 | |

| | 12,000 | | | Schweitzer-Mauduit International, Inc. | | | 542,139 | | | | 755,040 | |

| | 10,000 | | | Solera Holdings, Inc. | | | 232,074 | | | | 513,200 | |

| | | | | | | | | | | | |

| Total United States | | | 3,435,628 | | | | 5,440,410 | |

| | | | | | | | | | | | |

| Total Common Stocks | | | 34,087,402 | | | | 49,497,525 | |

| | | | | | | | | | | | |

| | |

| See Notes to Financial Statements. | | 13 |

| | |

| Baron International Growth Fund | | December 31, 2010 |

STATEMENT OF NET ASSETS (Continued)

DECEMBER 31, 2010

| | | | | | | | | | | | |

Principal

Amount | | | | | Cost | | | Value | |

| Short Term Investments (7.65%) | |

| | $2,754,252 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 12/31/2010, 0.04% due 01/03/2011; Proceeds at maturity - $2,754,261; (Fully collateralized by U.S. Treasury Note, 1.25% - due 10/31/2015; Market value - $2,896,563)5 | | $ | 2,754,252 | | | $ | 2,754,252 | |

| | 1,280,000 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 12/31/2010, 0.04% due 01/03/2011; Proceeds at maturity - $1,280,004; (Fully collateralized by U.S. Treasury Note, 1.25% - due 10/31/2015; Market value - $1,346,563)4,5 | | | 1,280,000 | | | | 1,280,000 | |

| | | | | | | | | | | | |

| Total Short Term Investments | | | 4,034,252 | | | | 4,034,252 | |

| | | | | | | | | | | | |

| Total Investments (101.51%) | | $ | 38,121,654 | | | | 53,531,777 | |

| | | | | | | | | | | | |

| Liabilities Less Cash and Other Assets (-1.51%) | | | | (797,735 | ) |

| | | | | | | | | | | | |

| Net Assets | | | $ | 52,734,042 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $17.29 per share

based on 886,987 shares outstanding) |

| | $ | 15,337,532 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $17.36 per share

based on 2,153,789 shares outstanding) |

| | $ | 37,396,510 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 2 | The Adviser has classified certain securities into this country. MSCI does not currently provide a classification for these securities. |

| 3 | All or a portion of this security is on loan. The value of all securities loaned at December 31, 2010 amounted to $1,176,000, which represents 2.23% of net assets. See Note 2(d) regarding “Securities Lending.” |

| 4 | Represents security purchased with the cash collateral received for security on loan. |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| ADR | American Depositary Receipt. |

| | | | |

Summary of Investments by Sector

as of December 31, 2010 | | Percentage

of Net Assets | |

| |

Information Technology | | | 19.1 | % |

| |

Consumer Discretionary | | | 17.9 | |

| |

Financials | | | 11.5 | |

| |

Industrials | | | 10.9 | |

| |

Health Care | | | 10.4 | |

| |

Materials | | | 7.9 | |

| |

Energy | | | 5.7 | |

| |

Consumer Staples | | | 5.1 | |

| |

Telecommunication Services | | | 4.7 | |

| |

Utilities | | | 0.7 | |

| |

Cash and Cash Equivalents* | | | 6.1 | |

| | | | 100.0 | % |

| * | Includes short term investments. |

| | |

| 14 | | See Notes to Financial Statements. |

| | |

| December 31, 2010 | | Baron Real Estate Fund |

STATEMENT OF NET ASSETS

DECEMBER 31, 2010

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (96.27%) | |

| Consumer Discretionary (24.79%) | |

| | | | Casinos & Gaming (3.69%) | |

| | 1,950 | | | Las Vegas Sands Corp.1 | | $ | 45,107 | | | $ | 89,603 | |

| | 6,570 | | | Penn National Gaming, Inc.1 | | | 184,386 | | | | 230,935 | |

| | | | | | | | | | | | |

| | | | | | | 229,493 | | | | 320,538 | |

| |

| | | | Home Furnishings (1.02%) | |

| | 1,560 | | | Mohawk Industries, Inc.1 | | | 74,942 | | | | 88,546 | |

| |

| | | | Home Improvement Retail (1.33%) | |

| | 4,650 | | | Lumber Liquidators Holdings, Inc.1 | | | 105,962 | | | | 115,831 | |

| |

| | | | Homebuilding (2.34%) | |

| | 2,825 | | | Brookfield Homes Corp.1 | | | 19,810 | | | | 26,555 | |

| | 7,400 | | | Lennar Corp., Cl A | | | 120,273 | | | | 138,750 | |

| | 2,010 | | | Toll Brothers, Inc.1 | | | 37,284 | | | | 38,190 | |

| | | | | | | | | | | | |

| | | | | | | 177,367 | | | | 203,495 | |

| |

| | | | Hotels, Resorts & Cruise Lines (12.56%) | |

| | 4,150 | | | Carnival Corp.2 | | | 165,209 | | | | 191,356 | |

| | 42,350 | | | Great Wolf Resorts, Inc.1 | | | 108,504 | | | | 110,957 | |

| | 4,625 | | | Hyatt Hotels Corp., Cl A1 | | | 160,352 | | | | 211,640 | |

| | 48,000 | | | Mandarin Oriental International, Ltd. (Singapore)2 | | | 79,018 | | | | 99,360 | |

| | 10,050 | | | Morgans Hotel Group Co.1 | | | 54,391 | | | | 91,154 | |

| | 3,000 | | | Starwood Hotels & Resorts Worldwide, Inc. | | | 133,513 | | | | 182,340 | |

| | 6,850 | | | Wyndham Worldwide Corp. | | | 192,477 | | | | 205,226 | |

| | | | | | | | | | | | |

| | | | | | | 893,464 | | | | 1,092,033 | |

| |

| | | | Household Appliances (1.98%) | |

| | 2,565 | | | Stanley Black & Decker, Inc. | | | 143,510 | | | | 171,522 | |

| |

| | | | Leisure Facilities (1.87%) | |

| | 3,128 | | | Vail Resorts, Inc.1 | | | 123,309 | | | | 162,781 | |

| | | | | | | | | | | | |

| Total Consumer Discretionary | | | 1,748,047 | | | | 2,154,746 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Energy (3.90%) | | | | | |

| | | | Oil & Gas Storage & Transportation (3.90%) | |

| | 5,000 | | | PAA Natural Gas Storage LP | | | 108,621 | | | | 124,700 | |

| | 8,000 | | | Targa Resources Corp.1 | | | 184,180 | | | | 214,480 | |

| | | | | | | | | | | | |

| Total Energy | | | 292,801 | | | | 339,180 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Financials (45.07%) | |

| | | | Diversified Capital Markets (1.50%) | |

| | 13,450 | | | HFF, Inc., Cl A1 | | | 129,198 | | | | 129,927 | |

| |

| | | | Diversified Real Estate Activities (6.97%) | |

| | 8,005 | | | Brookfield Asset Management, Inc., Cl A2 | | | 192,124 | | | | 266,486 | |

| | 11,550 | | | Campus Crest Communities, Inc. | | | 144,565 | | | | 161,931 | |

| | 8,100 | | | St. Joe Co.1 | | | 163,532 | | | | 176,985 | |

| | | | | | | | | | | | |

| | | | | | | 500,221 | | | | 605,402 | |

| |

| | | | Diversified REITs (3.80%) | |

| | 8,350 | | | Colonial Properties Trust | | | 122,502 | | | | 150,717 | |

| | 2,160 | | | Vornado Realty Trust | | | 154,494 | | | | 179,993 | |

| | | | | | | | | | | | |

| | | | | | | 276,996 | | | | 330,710 | |

| |

| | | | Industrial REITs (2.85%) | |

| | 4,200 | | | AMB Property Corp. | | | 98,989 | | | | 133,182 | |

| | 7,950 | | | ProLogis | | | 82,757 | | | | 114,798 | |

| | | | | | | | | | | | |

| | | | | | | 181,746 | | | | 247,980 | |

| |

| | | | Mortgage REITs (2.00%) | |

| | 8,100 | | | Starwood Property Trust, Inc. | | | 156,573 | | | | 173,988 | |

| |

| | | | Office REITs (4.20%) | |

| | 4,200 | | | Corporate Office Properties Trust | | | 143,633 | | | | 146,790 | |

| | 7,800 | | | Douglas Emmett, Inc. | | | 113,562 | | | | 129,480 | |

| | 1,315 | | | SL Green Realty Corp. | | | 65,748 | | | | 88,776 | |

| | | | | | | | | | | | |

| | | | | | | 322,943 | | | | 365,046 | |

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Financials (continued) | |

| | | | Real Estate Operating Companies (2.33%) | |

| | 12,150 | | | Forest City Enterprises, Inc., Cl A1 | | $ | 159,219 | | | $ | 202,783 | |

| |

| | | | Real Estate Services (1.52%) | |

| | 6,450 | | | CB Richard Ellis Group, Inc., Cl A1 | | | 88,156 | | | | 132,096 | |

| |

| | | | Residential REITs (4.73%) | |

| | 4,184 | | | American Campus Communities, Inc. | | | 109,401 | | | | 132,884 | |

| | 11,350 | | | Associated Estates Realty Corp. | | | 159,722 | | | | 173,541 | |

| | 930 | | | AvalonBay Communities, Inc. | | | 76,173 | | | | 104,672 | |

| | | | | | | | | | | | |

| | | | | | | 345,296 | | | | 411,097 | |

| |

| | | | Retail REITs (1.77%) | |

| | 1,550 | | | Simon Property Group, Inc. | | | 124,048 | | | | 154,210 | |

| |

| | | | Specialized REITs (13.40%) | |

| | 2,395 | | | Alexandria Real Estate Equities, Inc.3 | | | 157,287 | | | | 175,458 | |

| | 3,100 | | | Chesapeake Lodging Trust3 | | | 56,340 | | | | 58,311 | |

| | 3,000 | | | Chesapeake Lodging Trust3,4,5 | | | 56,400 | | | | 55,290 | |

| | 2,450 | | | Entertainment Properties Trust | | | 93,424 | | | | 113,312 | |

| | 5,800 | | | LaSalle Hotel Properties | | | 129,765 | | | | 153,120 | |

| | 7,400 | | | Pebblebrook Hotel Trust | | | 143,724 | | | | 150,368 | |

| | 1,600 | | | Public Storage | | | 139,065 | | | | 162,272 | |

| | 18,900 | | | U-Store-It Trust | | | 147,752 | | | | 180,117 | |

| | 2,220 | | | Ventas, Inc. | | | 100,306 | | | | 116,506 | |

| | | | | | | | | | | | |

| | | | | | | 1,024,063 | | | | 1,164,754 | |

| | | | | | | | | | | | |

| Total Financials | | | 3,308,459 | | | | 3,917,993 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Health Care (7.74%) | |

| | | | Health Care Facilities (7.74%) | |

| | 3,542 | | | Assisted Living Concepts, Inc.1 | | | 102,521 | | | | 115,221 | |

| | 10,130 | | | Brookdale Senior Living, Inc.1 | | | 179,009 | | | | 216,884 | |

| | 28,550 | | | Capital Senior Living Corp.1 | | | 143,293 | | | | 191,285 | |

| | 7,600 | | | Emeritus Corp.1 | | | 147,623 | | | | 149,796 | |

| | | | | | | | | | | | |

| Total Health Care | | | 572,446 | | | | 673,186 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Industrials (4.43%) | |

| | | | Building Products (2.46%) | |

| | 2,100 | | | Armstrong World Industries, Inc. 1 | | | 43,796 | | | | 90,300 | |

| | 3,950 | | | Owens Corning, Inc.1 | | | 98,545 | | | | 123,042 | |

| | | | | | | | | | | | |

| | | | | | | 142,341 | | | | 213,342 | |

| |

| | | | Construction & Engineering (0.91%) | |

| | 2,830 | | | AECOM Technology Corp.1 | | | 76,333 | | | | 79,155 | |

| |

| | | | Research & Consulting Services (1.06%) | |

| | 1,603 | | | CoStar Group, Inc.1 | | | 81,992 | | | | 92,269 | |

| | | | | | | | | | | | |

| Total Industrials | | | 300,666 | | | | 384,766 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Information Technology (4.40%) | |

| | | | Application Software (2.95%) | |

| | 8,296 | | | RealPage, Inc.1 | | | 159,298 | | | | 256,595 | |

| |

| | | | IT Consulting & Other Services (1.45%) | |

| | 1,545 | | | Equinix, Inc.1,3 | | | 153,060 | | | | 125,547 | |

| | | | | | | | | | | | |

| Total Information Technology | | | 312,358 | | | | 382,142 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Telecommunication Services (4.18%) | |

| | | | Wireless Telecommunication Services (4.18%) | |

| | 2,900 | | | American Tower Corp., Cl A1 | | | 128,490 | | | | 149,756 | |

| | 5,225 | | | SBA Communications Corp., Cl A1 | | | 184,893 | | | | 213,911 | |

| | | | | | | | | | | | |

| Total Telecommunication Services | | | 313,383 | | | | 363,667 | |

| | | | | | | | | | | | |

| | |

| See Notes to Financial Statements. | | 15 |

| | |

| Baron Real Estate Fund | | December 31, 2010 |

STATEMENT OF NET ASSETS (Continued)

DECEMBER 31, 2010

| | | | | | | | | | | | |

| Shares | | | | | Cost | | | Value | |

| Common Stocks (continued) | |

| Utilities (1.76%) | |

| | | | Electric Utilities (1.76%) | |

| | 7,250 | | | Brookfield Infrastructure Partners LP2 | | $ | 122,809 | | | $ | 152,613 | |

| | | | | | | | | | | | |

| Total Common Stocks | | | 6,970,969 | | | | 8,368,293 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Principal

Amount | | | | | | |

| Short Term Investments (2.81%) | |

| | $244,045 | | | Repurchase Agreement with Fixed Income Clearing Corp., dated 12/31/2010, 0.04% due 01/03/2011; Proceeds at maturity - $244,046; (Fully collateralized by U.S. Treasury Note, 2.125% due 12/31/2015; Market value - $260,975)5 | | | 244,045 | | | | 244,045 | |

| | | | | | | | | | | | |

| Total Investments (99.08%) | | $ | 7,215,014 | | | | 8,612,338 | |

| | | | | | | | | | | | |

| Cash and Other Assets Less Liabilities (0.92%) | | | | 80,012 | |

| | | | | | | | | | | | |

| Net Assets | | | $ | 8,692,350 | |

| | | | | | | | | | | | |

| Retail Shares (Equivalent to $12.66 per share

based on 432,489 shares outstanding) |

| | $ | 5,473,834 | |

| | | | | | | | | | | | |

| Institutional Shares (Equivalent to $12.69 per share

based on 253,649 shares outstanding) |

| | $ | 3,218,516 | |

| | | | | | | | | | | | |

| % | Represents percentage of net assets. |

| 1 | Non-income producing securities. |

| 3 | The Adviser has reclassified/classified certain securities in or out of this sub-industry. Such reclassifications/classifications are not supported by S&P or MSCI. |

| 4 | At December 31, 2010, the market value of restricted and fair valued securities amounted to $55,290 or 0.64% of net assets. All of these securities are deemed liquid. See Note 6 regarding restricted securities. |

| 5 | Level 2 security. See Note 7 regarding Fair Value Measurements. |

| | |

| 16 | | See Notes to Financial Statements. |

| | |

| December 31, 2010 | | Baron Select Funds |

STATEMENTS OF ASSETS AND LIABILITIES

DECEMBER 31, 2010

| | | | | | | | | | | | | | | | |

| | | Baron Partners

Fund | | | Baron Focused

Growth Fund | | | Baron International

Growth Fund | | | Baron Real

Estate Fund | |

Assets: | | | | | | | | | | | | | | | | |

Investments in securities, at cost | | $ | 1,153,689,820 | | | $ | 59,999,399 | | | $ | 38,121,654 | | | $ | 7,215,014 | |

Foreign currency, at cost | | | — | | | | — | | | | 505,530 | | | | — | |

| | | | |

Investments in securities, at value | | $ | 1,721,275,942 | | | $ | 90,735,051 | | | $ | 53,531,777 | | | $ | 8,612,338 | |