Annual Report

Franklin Mutual Recovery Fund

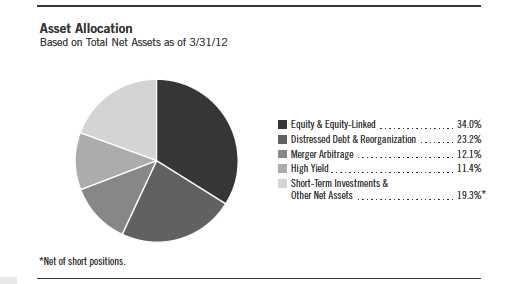

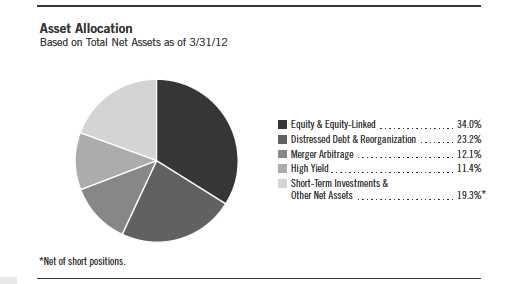

Your Fund’s Goal and Main Investments: Franklin Mutual Recovery Fund’s goal is

capital appreciation. The Fund seeks to achieve superior risk-adjusted returns with a moderate

correlation to U.S. equity markets by investing in distressed companies, merger arbitrage securities and

special situation/undervalued securities. The Fund may take long and short positions, with the latter

typically utilized in connection with the merger arbitrage strategy.

This annual report for Franklin Mutual Recovery Fund covers the fiscal year

ended March 31, 2012.

Performance Overview

For the 12 months under review, Franklin Mutual Recovery Fund – Class A

had a -3.38% cumulative total return. The Fund underperformed U.S. stocks

as measured by its benchmark, the Standard & Poor’s 500 Index (S&P 500),

which produced a total return of +8.54% for the same period.1 The Fund

1. Source: © 2012 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar

and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or

timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

this information. The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and

an index is not representative of the Fund’s portfolio.

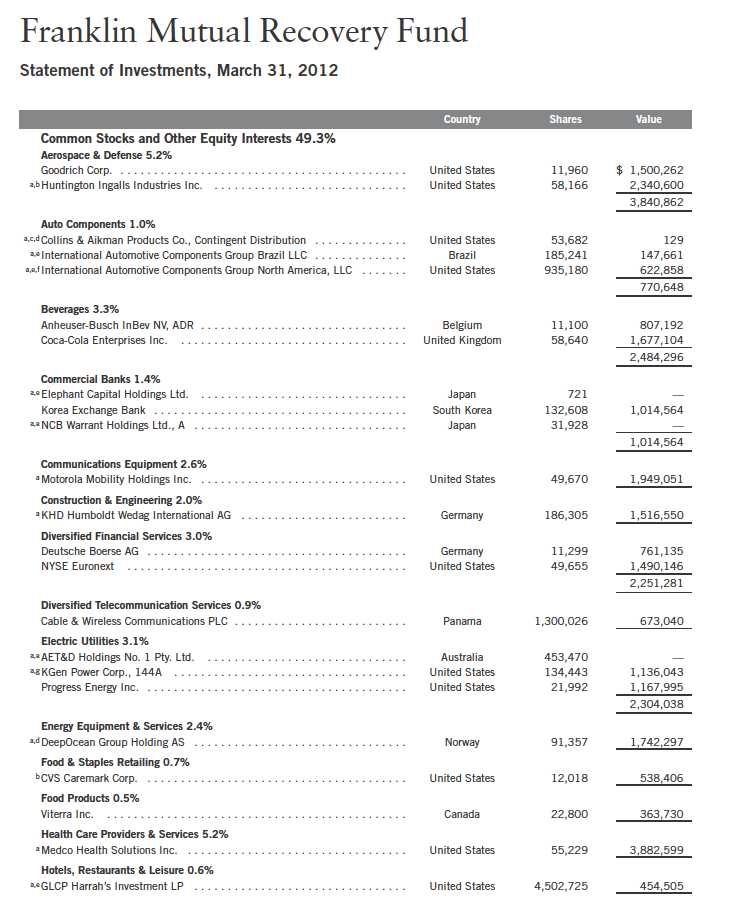

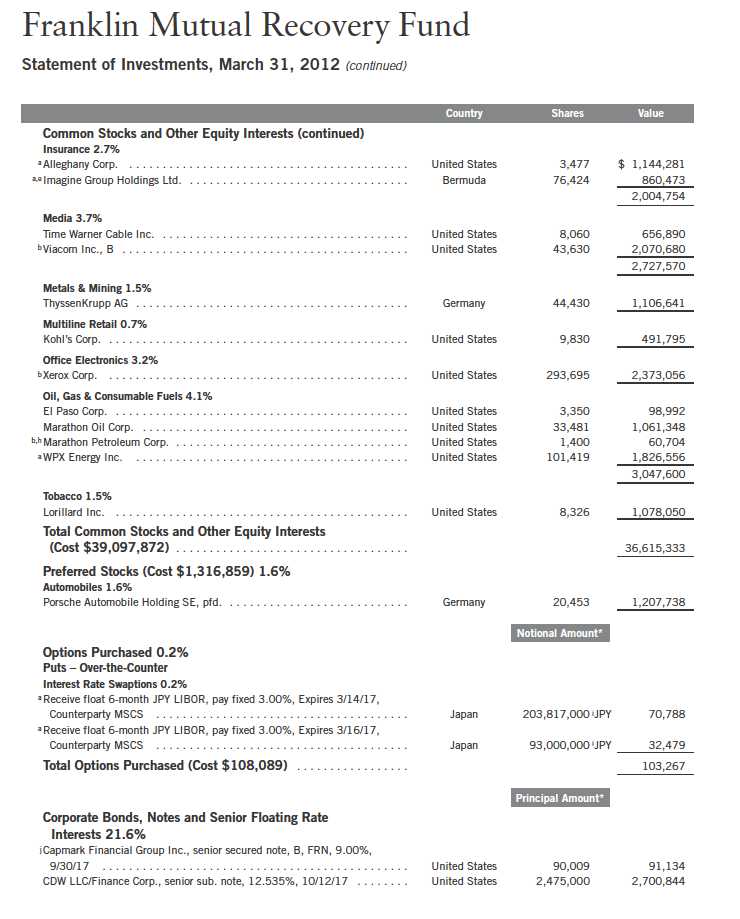

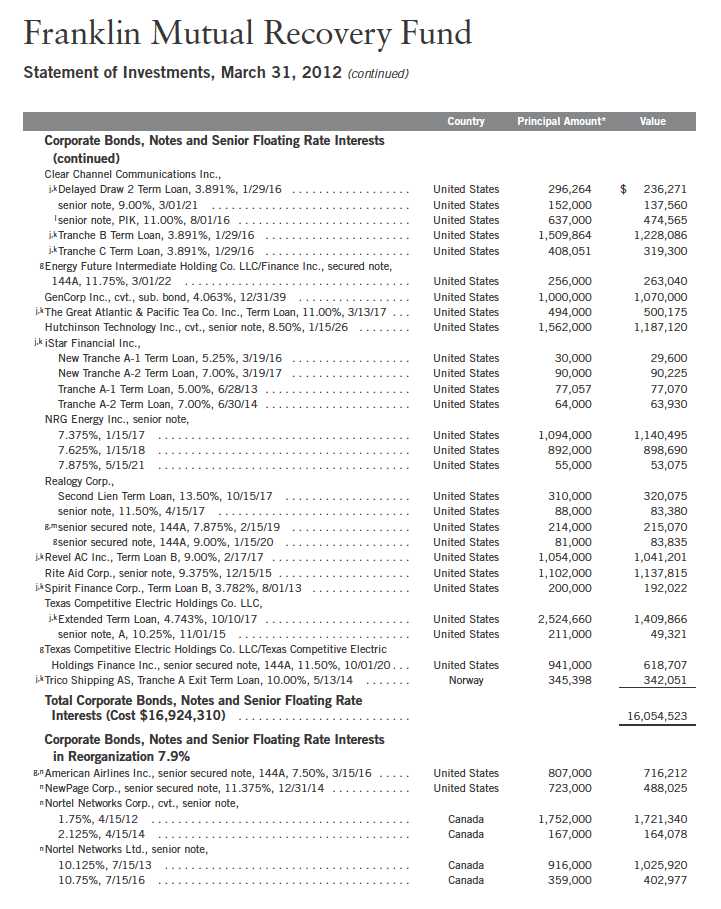

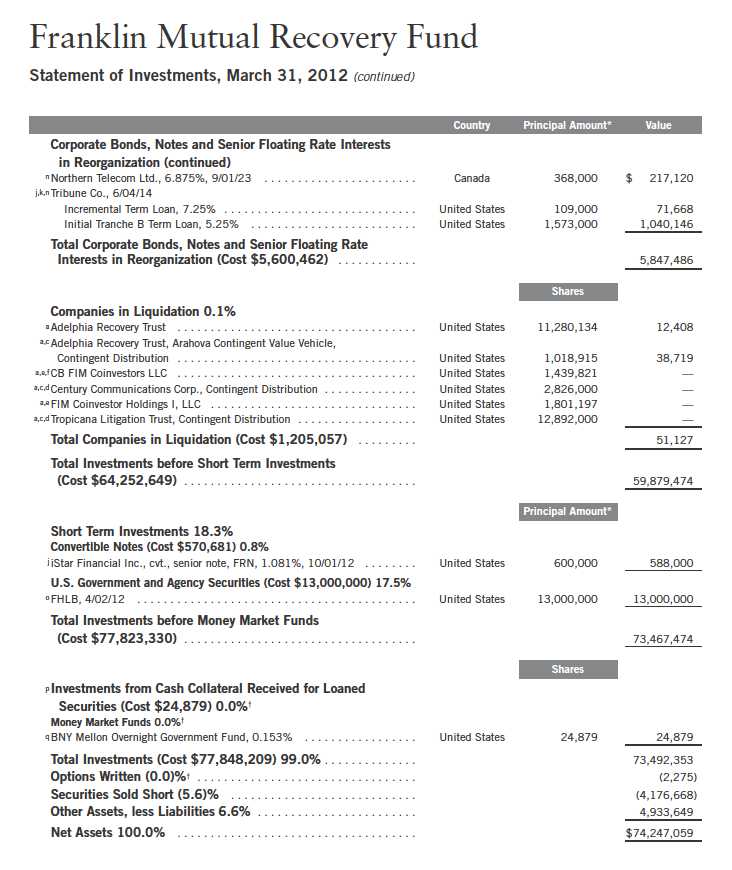

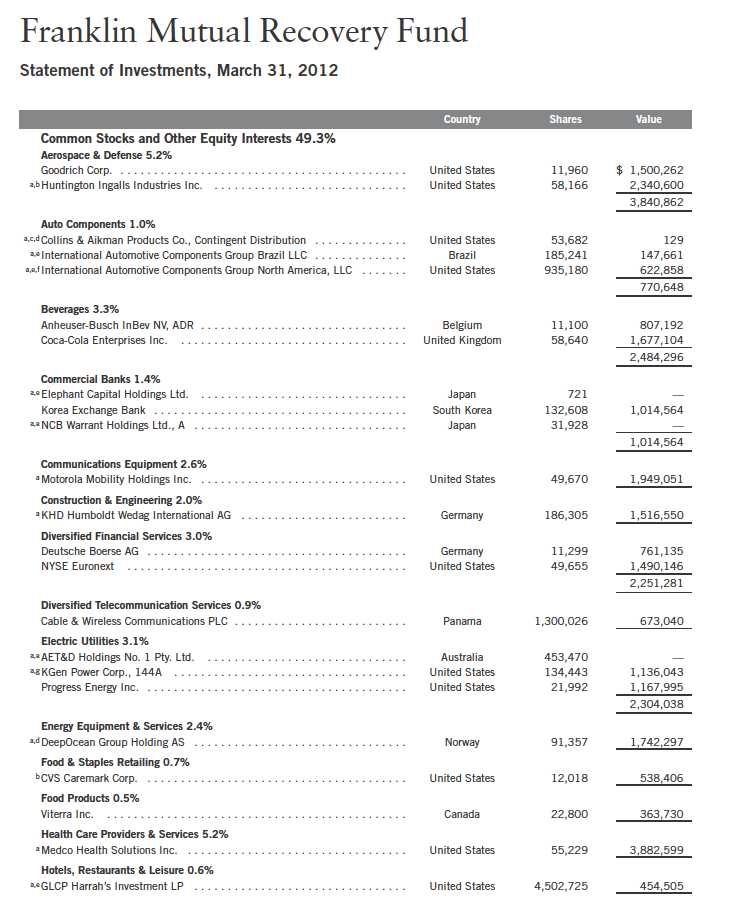

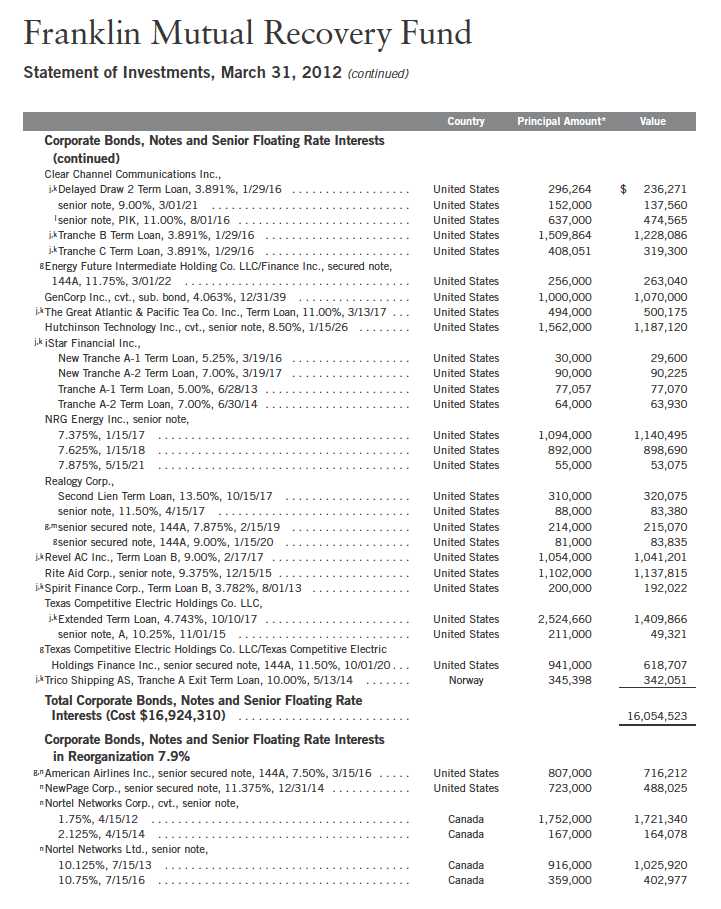

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s

Statement of Investments (SOI). The SOI begins on page 24.

Annual Report | 5

underperformed the +6.24% price-only return of the Bloomberg/EFFAS U.S.

Government 3-5 Years Total Return Index, which serves as a transparent

benchmark for the U.S. government bond market.2

The performance of the Fund relative to the Bloomberg index is used as the

basis for calculating the performance adjustment to the base management fee

paid to the Fund’s adviser. (Please refer to Note 4a in the Notes to Financial

Statements for additional information related to the performance adjustment

and the base management fee.) You can find more of the Fund’s performance

data in the Performance Summary beginning on page 12.

Economic and Market Overview

The U.S. economy, as measured by gross domestic product growth, notably

improved during the 12-month period ended March 31, 2012. The national

unemployment rate for March 2012 stood at 8.2%, compared with 9.0% at

the start of the period.3 Jobless claims touched a four-year low in February,

and job creation was fairly robust. Consistent with employment trends, indus-

trial production and manufacturing activity increased toward the end of the

period. Automobile sales rose to their highest levels since February 2008, and

consumer confidence climbed to pre-recession levels. Outside of the U.S.,

Greece secured bailout financing as bondholders agreed to concessions and the

country enacted austerity measures. Although the long-term resolution of the

European debt situation remained unclear, the European Central Bank’s plan

to increase liquidity through loans was well received and seemed to improve

investor sentiment in the short term.

At the end of the reporting period, however, significant challenges to the

economy remained, including uncertainty surrounding deeply indebted

European countries, soaring gas prices amid political turmoil in the Middle

East, indications of reduced economic stimulus from the federal government,

and continued malaise in the U.S. housing market. Signs of China’s economic

growth slowdown contributed to pessimism as, despite a higher overall level

of U.S. exports, the U.S. trade deficit widened following decreases in exports

to China and the eurozone.

Amid improved economic reports, U.S. stock markets responded well and

reached multi-year highs in the first quarter of 2012. The Dow Jones

Industrial Average exceeded the 13,000 level for the first time since 2008,

and the NASDAQ Composite Index hit an 11-year high. Large cap stocks

2. Source: Bloomberg LP. Please see Notes to Financial Statements for more information about the performance-based

management fee.

3. Source: Bureau of Labor Statistics.

6 | Annual Report

led gains, while small cap stocks had a slight loss, as measured by Russell

capitalization-weighted indexes. Overall, growth stocks outperformed value,

and sectors leading the market included information technology, consumer

discretionary and consumer staples. There was wide dispersion among sector

performance, with energy, materials and financials lagging the broader mar-

ket and posting the largest negative returns.

For the one-year period ended March 31, 2012, global merger and acquisition

(M&A) activity decreased from the prior year. The decreases in the value and

number of deals were arguably due to the ongoing European sovereign debt

crisis and persistent U.S. unemployment and regulatory challenges, which

likely caused executives to exercise caution for much of the period. Although

important conditions for an increase in M&A were present during the year —

high levels of corporate cash, slow growth, and lean, efficient operating

processes — the headwinds facing the global economy appeared to stifle activ-

ity. However, we believe improving fundamentals in 2012 may counteract the

prior year’s pessimism, moving forward.

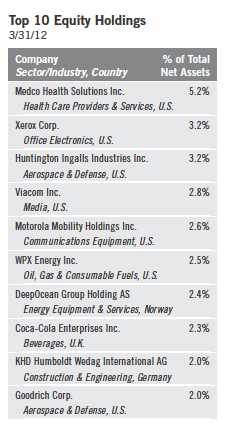

U.S. merger activity was especially robust in the health care sector during the

period, and the merger of pharmacy benefit managers Express Scripts and

Medco Health Solutions was one of the largest deals to occur during the year.

The U.S. financials sector also had significant activity, as did energy-related

industries. On a global scale, companies based in the U.K. announced a signifi-

cant number and value of deals, making their activity levels second to the U.S.

Within the distressed debt arena, new restructuring and reorganization oppor-

tunities generally remained scarce; to the extent capital was needed, many

companies were able to finance it by normal capital market activity. Into 2012,

a number of improving economic factors and a rising stock market led to a

significant volume of new, lower interest rate bond issuances, as corporate

leaders appeared wary of future rate increases. High yield spreads over

Treasuries narrowed to nearly 6% late in the period after reaching a high of

8.1% in the third quarter of 2011, making it somewhat easier for companies

with poor credit fundamentals to obtain relatively inexpensive financing.4 In

addition, U.S. corporate default rates remained well below the 25-year

average of 4.8%, making it unlikely for a high frequency of liquidations or

restructurings in the near future.4 However, we believe a case can be made that

any time there are high levels of new bonds issued — high yield or otherwise —

the potential for future distressed opportunities increases.

4. Source: Credit Suisse.

Annual Report | 7

Investment Strategy

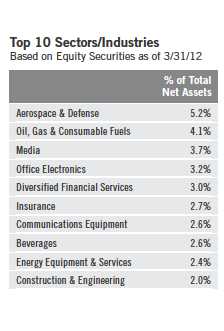

We follow a distinctive investment approach and can seek investments in dis-

tressed companies, merger arbitrage and special situations/undervalued stocks.

The availability of investments at attractive prices in each of these categories

varies with market cycles. Therefore, the percentage of the Fund’s assets

invested in each of these areas will fluctuate as we attempt to take advantage

of opportunities afforded by cyclical changes. We employ rigorous, fundamen-

tal analysis to find investment opportunities. In choosing investments, we look

at the market price of an individual company’s securities relative to our evalua-

tion of its asset value based on such factors as book value, cash flow potential,

long-term earnings and earnings multiples. We may invest in distressed compa-

nies if we believe the market overreacted to adverse developments or failed to

appreciate positive changes.

Manager’s Discussion

During a difficult fiscal year for the Fund, several of our holdings declined in

value. Positions that detracted notably from the Fund’s performance included

common stock holdings of U.S. for-profit hospital operator Community Health

Systems and Dutch mail and logistics service provider PostNL, as well as debt of

Texas Competitive Electric, a U.S.-based integrated power company.

In April 2011, Tenet Healthcare alleged that Community Health Systems had

engaged in inappropriate patient-admissions practices and had therefore made

false statements in proxy documents related to its proposed offer to acquire

Tenet Healthcare. The lawsuit and subsequent government investigations led to

a decline in Community Health’s share price. Community Health eventually

withdrew its proposal to acquire Tenet Healthcare, but its stock price remained

under pressure in August, when Congress passed the Budget Control Act of

2011. The Act created the Joint Select Committee on Deficit Reduction (also

known as the Supercommittee) tasked with finding $1.5 trillion in deficit reduc-

tion measures. If the Supercommittee failed to agree on a package or if Congress

failed to approve the Committee’s recommendation, a so-called “trigger mecha-

nism” would result in broad cuts to federal spending, including Medicare. The

increased uncertainty regarding future reimbursement rates for hospitals

weighed on the sector’s performance. We no longer held Community Health at

period-end.

Although PostNL reported better-than-expected operating results during the

period, its stock price remained under pressure as the company’s pension fund-

ing gap widened and its stake in express delivery company TNT Express fell in

8 | Annual Report

value. Despite the stock price decline, PostNL successfully managed aspects of

financial performance that were within its control, such as the performance of

its core postal operations and cost reduction program. In February, disclosure of

United Parcel Service’s indicative offer to acquire TNT Express at a significant

premium to market value boosted TNT shares. PostNL’s shares subsequently

appreciated reflecting the increased value of its TNT stake, strong operating per-

formance and an increase in the funding of the pension scheme, and we took

advantage of this opportunity to unwind our position.

The Fund’s holding of Texas Competitive Electric debt declined during the year

as depressed natural gas prices and uncertainty over the potential impact of the

Cross-State Air Pollution Rule resulted in a challenging operating environment.

Weak volumes and pricing continued to hinder performance, while depressed

forward power curves diminished prospects for business to improve. Should

fundamentals remain weak, company management will likely need to address

the company’s highly leveraged balance sheet.

Despite these difficulties, the Fund benefited from several positions that

increased in value during the Fund’s fiscal year. Among the top performers

were our common stock holdings of tobacco company Lorillard, our merger

arbitrage position in pharmacy benefits management (PBM) companies Medco

Health Solutions (MHS) and Express Scripts, and our senior subordinated debt

interest in CDW Corporation, a leading provider of information technology (IT)

solutions and services for clients in the business, government, health care and

education industries.

During the Fund’s fiscal year, several positive developments helped boost shares

of Lorillard, the third-largest U.S. cigarette manufacturer and the country’s

oldest continuously operating tobacco company. At the company’s investor day

in May, management provided details regarding plans to grow the Newport

cigarette brand. In the same month, the board expanded the company’s share

buyback program from $1 billion to $1.4 billion. Lorillard’s stock price con-

tinued to appreciate in 2012, after reporting positive fourth quarter results

that were well above consensus estimates on many metrics. Impressive rev-

enue results were driven by increased volumes and prices, which in turn led

to improved margins. Lorillard’s board of directors approved a dividend

increase, reflecting the company’s strong 2011 performance and management’s

confidence in its ability to deliver industry-leading fundamentals in 2012.

In July, Express Scripts announced the acquisition of MHS for a mix of cash

and stock. The companies announced their expectation that the combined firm

would be materially more efficient and able to lower costs for their customers.

Annual Report | 9

The acquisition was the latest in a long line of deals in the PBM industry. Like

all large deals, the companies required regulatory approval to merge under

antitrust laws. Community pharmacy trade associations protested vigorously,

worried that further industry concentration would give PBM companies the

power to lower the compensation for filling a prescription at a pharmacy.

Skeptics of the deal included some members of Congress, who expressed con-

cerns about the deal’s potentially negative consequences. During the antitrust

review, market prices of Express Scripts and MHS shares implied a strong prob-

ability that the deal would be blocked.

However, there were also strong arguments in favor of the transaction.

Proponents cited the attractive potential benefits, and one economic study esti-

mated that the deal could potentially save employers, the federal government,

labor unions and consumers up to $87 billion annually on the cost of prescrip-

tion medications. Based on our analysis, we were confident the deal would

eventually gain Federal Trade Commission (FTC) approval, which would lead

the Fund to benefit from the significant discount in the MHS shares. The Fund

bought shares in MHS and hedged its exposure to Express Scripts by shorting

Express Scripts shares, creating a position that would realize an over 15% gain

if the deal were completed. In March, news stories indicated the FTC was

leaning toward approving the deal, leading to a significant narrowing of the

spread. On the last day of the period, the FTC approved the deal, and on the

subsequent business day the deal closed, making the merger arbitrage position

one of the Fund’s top contributors for the year.

During the year, the Fund’s investment in CDW’s 12.535% coupon bonds

maturing in 2017 positively contributed to performance. In 2007, CDW was

taken private for over $7 billion, implying an earnings before interest, taxes,

depreciation and amortization (EBITDA) multiple of approximately 11.5

times. Overall IT spending has gradually recovered to pre-crisis levels, and

through these bonds we were able to invest in CDW’s capital structure at a

compelling valuation.

10 | Annual Report

Thank you for your interest and participation in Franklin Mutual Recovery

Fund. We are Fund owners as well as the portfolio managers, and we remain

steadfast in our commitment to deliver the kind of performance we all expect

from the Fund.

Portfolio Management Team

Franklin Mutual Recovery Fund

CFA® is a trademark owned by CFA Institute.

The foregoing information reflects our analysis, opinions and portfolio holdings as of March 31, 2012, the end of the

reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may

change depending on factors such as market and economic conditions. These opinions may not be relied upon as

investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of

any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the

investment manager makes no representation or warranty as to their completeness or accuracy. Although historical

performance is no guarantee of future results, these insights may help you understand our investment management

philosophy.

Annual Report | 11

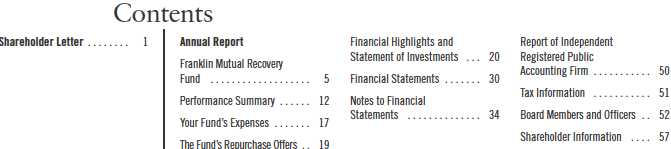

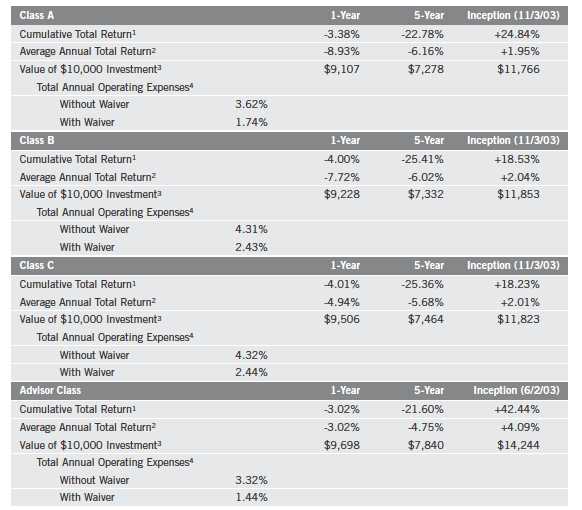

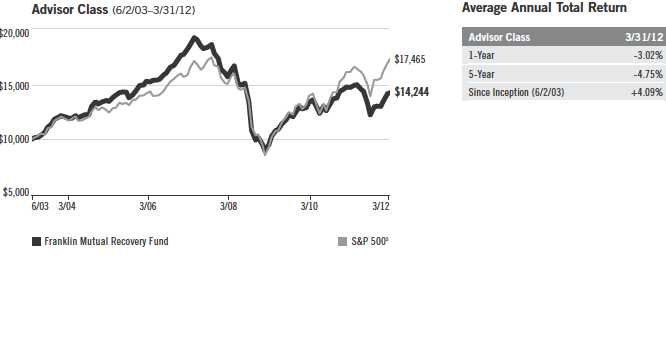

Performance Summary as of 3/31/12

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s

portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits

realized from the sale of portfolio securities. The performance table and graphs do not reflect any

taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any

realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends

and capital gain distributions, if any, and any unrealized gains or losses.

12 | Annual Report

Performance Summary (continued)

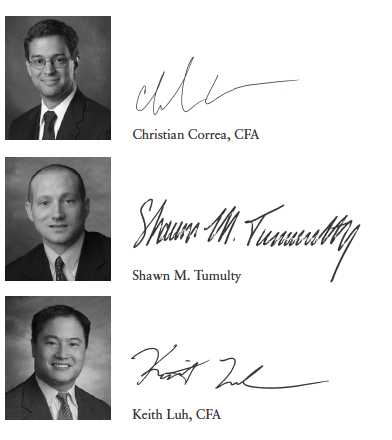

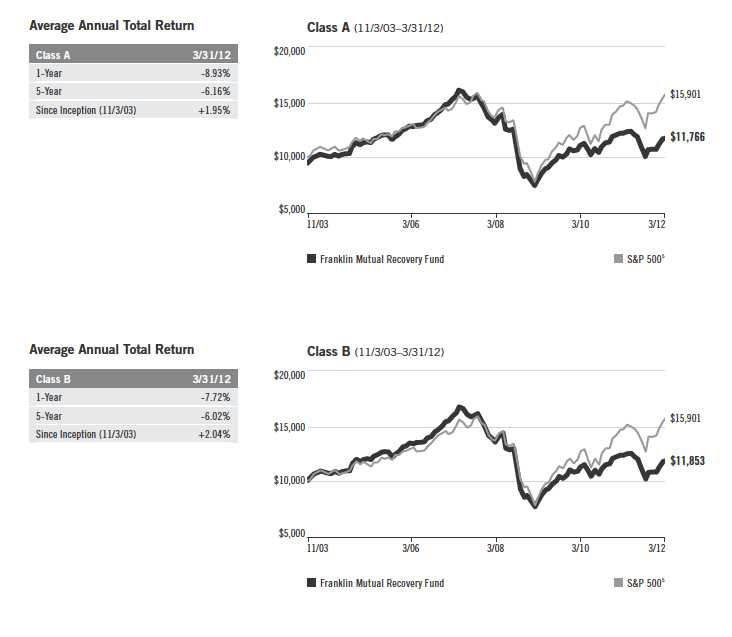

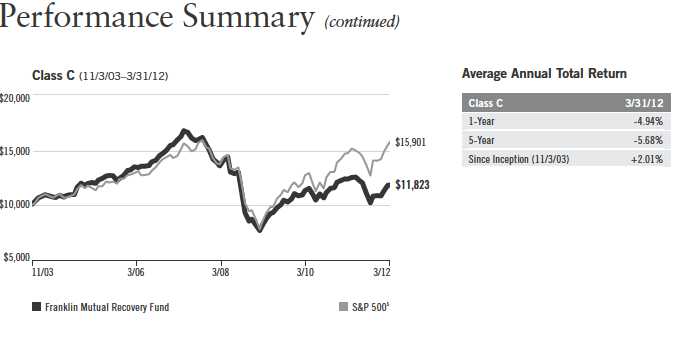

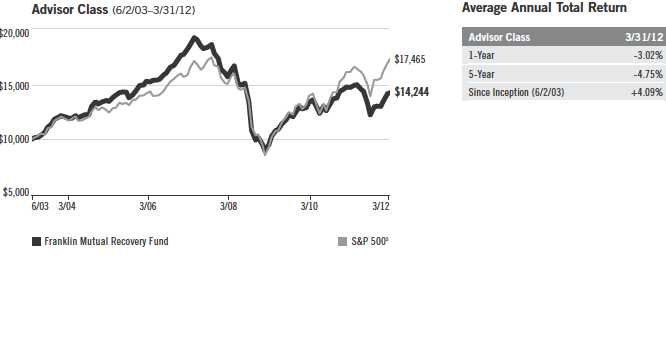

Performance

Cumulative total return excludes sales charges. Average annual total return and value of $10,000 investment include

maximum sales charges. Class A: 5.75% maximum initial sales charge; Class B: contingent deferred sales charge (CDSC)

declining from 4% to 1% over six years, and eliminated thereafter; Class C: 1% CDSC in first year only; Advisor Class: no

sales charges.

Performance data represent past performance, which does not guarantee future results. Investment return and principal

value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from

figures shown. For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

Effective 6/1/11, the investment manager contractually agreed to waive or limit its management fees so that the

management fees paid by the Fund do not exceed an annual rate of 0.50% of the Fund’s average daily net assets

through 7/31/12.

Annual Report | 13

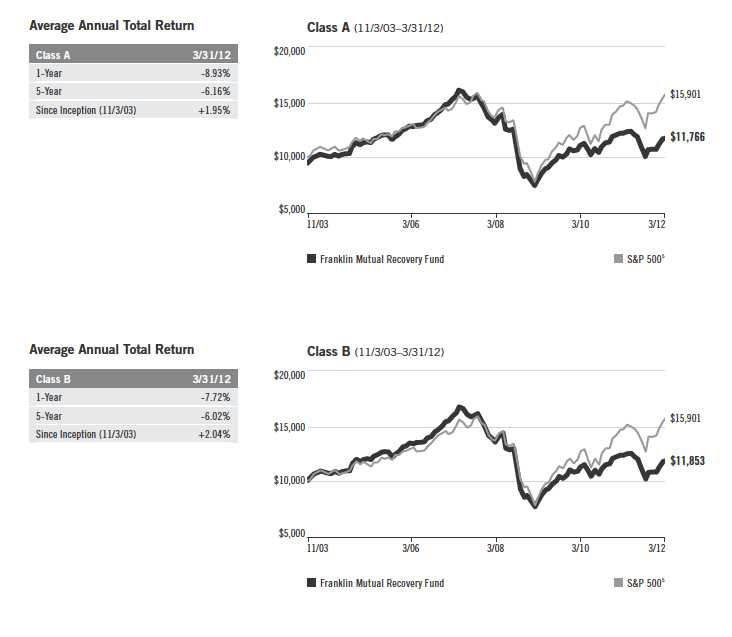

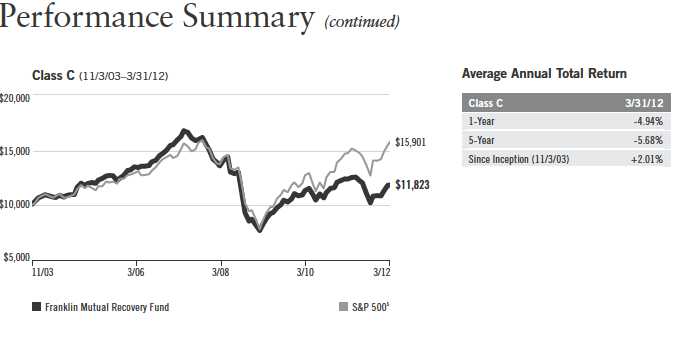

Performance Summary (continued)

Total Return Index Comparison for a Hypothetical $10,000 Investment

Total return represents the change in value of an investment over the periods shown. It includes

any current, applicable, maximum sales charge, Fund expenses, account fees and reinvested distri-

butions. The unmanaged index includes reinvestment of any income or distributions. It differs

from the Fund in composition and does not pay management fees or expenses. One cannot invest

directly in an index.

14 | Annual Report

Annual Report | 15

Performance Summary (continued)

Endnotes

All investments involve risks, including possible loss of principal. The Fund may invest in companies engaged in mergers, reorganizations or

liquidations, which involve special risks, as pending deals may not be completed on time or on favorable terms, as well as lower rated bonds,

which entail higher credit risk. The Fund is a nondiversified fund and may experience increased susceptibility to adverse economic or regula-

tory developments affecting similar issuers or securities. The Fund may invest in foreign securities whose risks include currency fluctuations,

and economic and political uncertainties. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will

produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

1. Cumulative total return represents the change in value of an investment over the periods indicated.

2. Average annual total return represents the average annual change in value of an investment over the periods indicated.

3. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

4. Figures are as stated in the Fund’s prospectus current as of the date of this report. In periods of market volatility, assets may decline significantly,

causing total annual Fund operating expenses to become higher than the figures shown.

5. Source: © 2012 Morningstar. The S&P 500 is a market capitalization-weighted index of 500 stocks designed to measure total U.S. equity market

performance.

16 | Annual Report

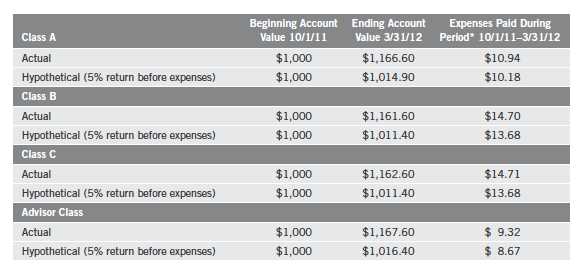

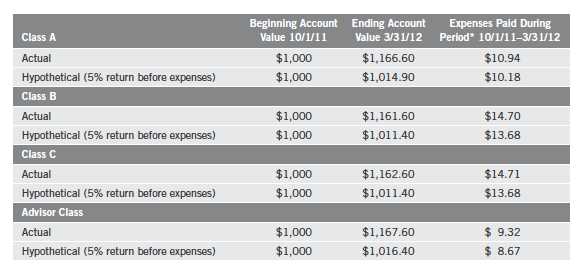

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribution and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Annual Report | 17

Your Fund’s Expenses (continued)

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect

any transaction costs, such as sales charges. Therefore, the second line for each class is useful in

comparing ongoing costs only, and will not help you compare total costs of owning different funds.

In addition, if transaction costs were included, your total costs would have been higher. Please refer

to the Fund prospectus for additional information on operating expenses.

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 2.02%; B: 2.72%;

C: 2.72%; and Advisor: 1.72%), multiplied by the average account value over the period, multiplied by 183/366 to reflect the one-half year period.

18 | Annual Report

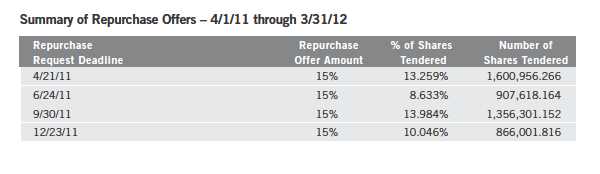

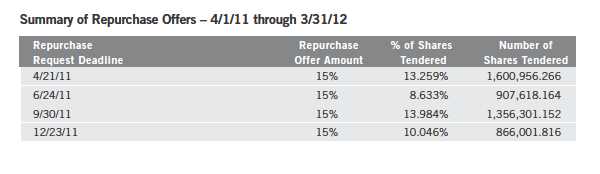

The Fund’s Repurchase Offers

The Fund will make quarterly repurchase offers for a portion of its shares. With any repurchase

offer, shareholders may elect to tender (have the Fund repurchase) all, a portion or none of their

shares. With each repurchase offer, shareholders will be notified in writing about the offer, how to

request that the Fund repurchase their shares and the deadline for submitting repurchase requests.

Each quarter the Board of Trustees will set the amount of the repurchase offer, as a percentage of

outstanding shares. This amount is known as the repurchase offer amount and will generally be

between 5% and 25% of the Fund’s outstanding shares. If repurchase requests exceed the repur-

chase offer amount, the Fund will prorate requests. The Fund may, however, first accept any

requests to repurchase all of a shareholder’s shares if the shareholder owns less than 100 shares.

The Board will also determine the date by which the Fund must receive shareholders’ repurchase

requests, which is known as the repurchase request deadline. The Board will base these decisions

on investment management considerations, market conditions, liquidity of the Fund’s assets, share-

holder servicing and administrative considerations and other factors it deems appropriate. Each

repurchase request deadline will occur within the period that begins 21 days before, and ends 21

days after, the end of the quarterly interval. The repurchase price of the shares will be the net asset

value as of the close of the NYSE on the date the Board sets as the repurchase pricing date. The

maximum number of days between the repurchase request deadline and the repurchase pricing

date is 14 days.

Annual Report | 19

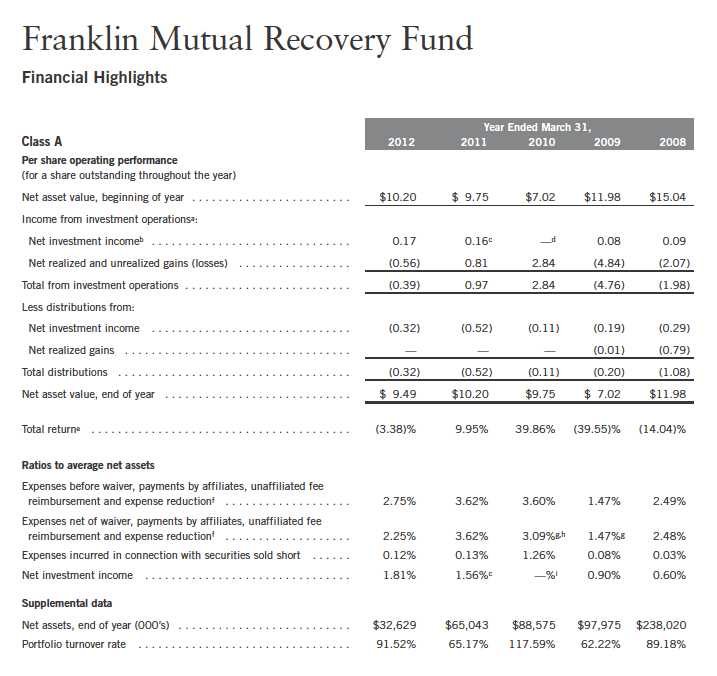

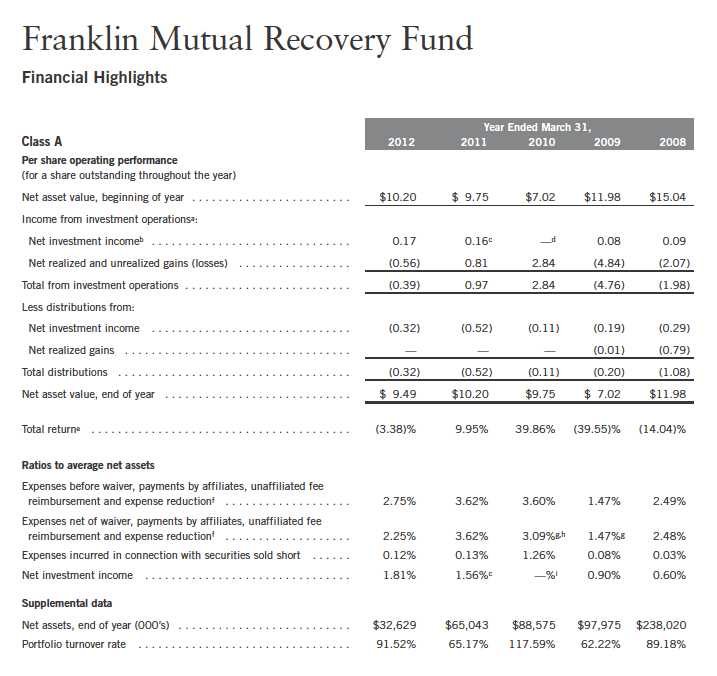

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate real estate investment trust

(REIT) conversion. Excluding this non-recurring amount, the ratio of net investment income to average net assets would have been 0.09%.

dAmount rounds to less than $0.01 per share.

eTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

fIncludes dividend and interest expense on securities sold short and borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented.

See Note 1(e).

gBenefit of expense reduction rounds to less than 0.01%.

hIncludes a one-time unaffiliated fee reimbursement of 0.25% associated with borrowing fees.

iRounds to less than 0.01%.

20 | The accompanying notes are an integral part of these financial statements. | Annual Report

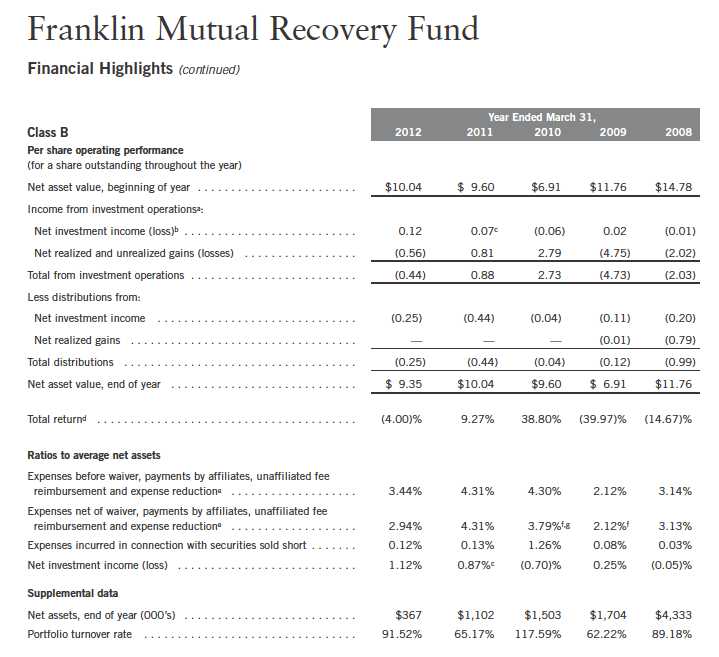

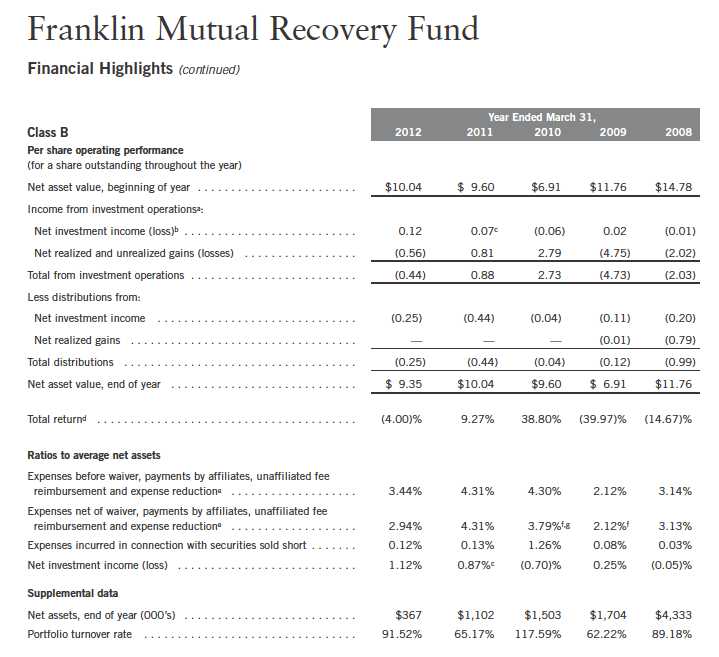

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate REIT conversion. Excluding

this non-recurring amount, the ratio of net investment income to average net assets would have been (0.60)%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eIncludes dividend and interest expense on securities sold short and borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented.

See Note 1(e).

fBenefit of expense reduction rounds to less than 0.01%.

gIncludes a one-time unaffiliated fee reimbursement of 0.25% associated with borrowing fees.

Annual Report | The accompanying notes are an integral part of these financial statements. | 21

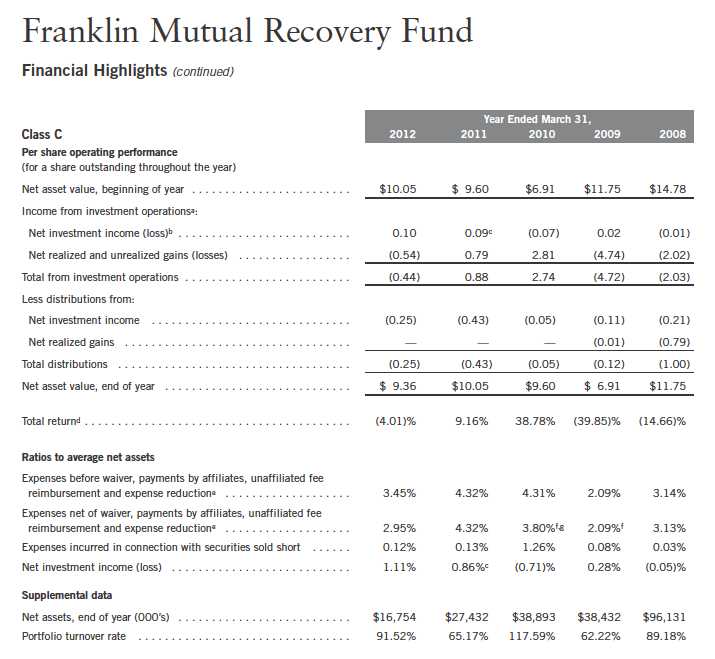

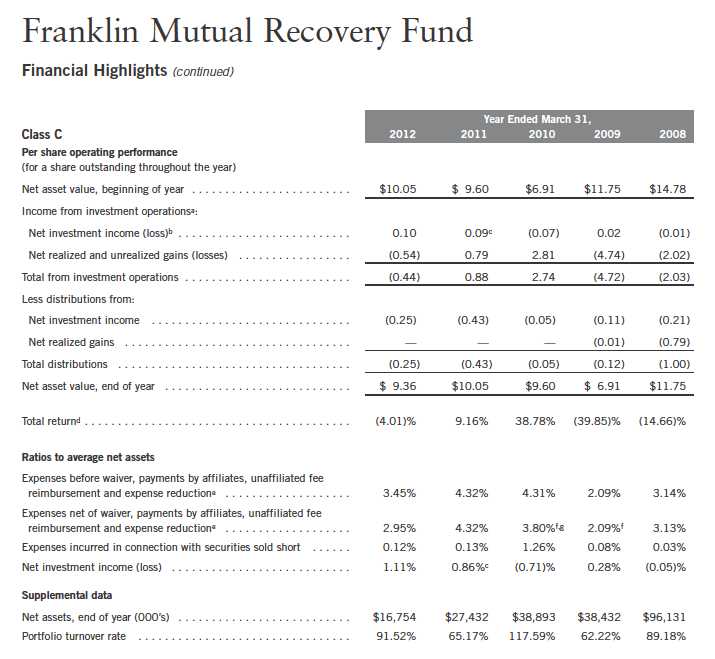

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate REIT conversion. Excluding

this non-recurring amount, the ratio of net investment income to average net assets would have been (0.61)%.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eIncludes dividend and interest expense on securities sold short and borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented.

See Note 1(e).

fBenefit of expense reduction rounds to less than 0.01%.

gIncludes a one-time unaffiliated fee reimbursement of 0.25% associated with borrowing fees.

22 | The accompanying notes are an integral part of these financial statements. | Annual Report

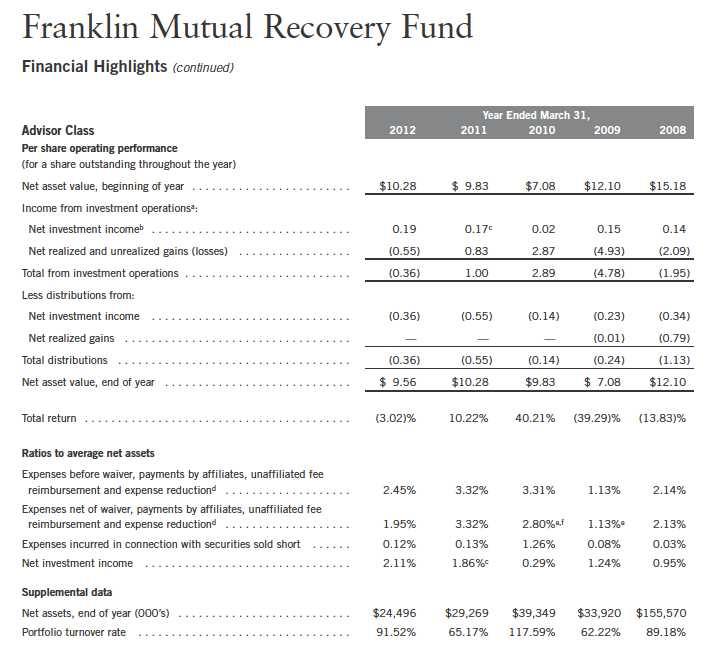

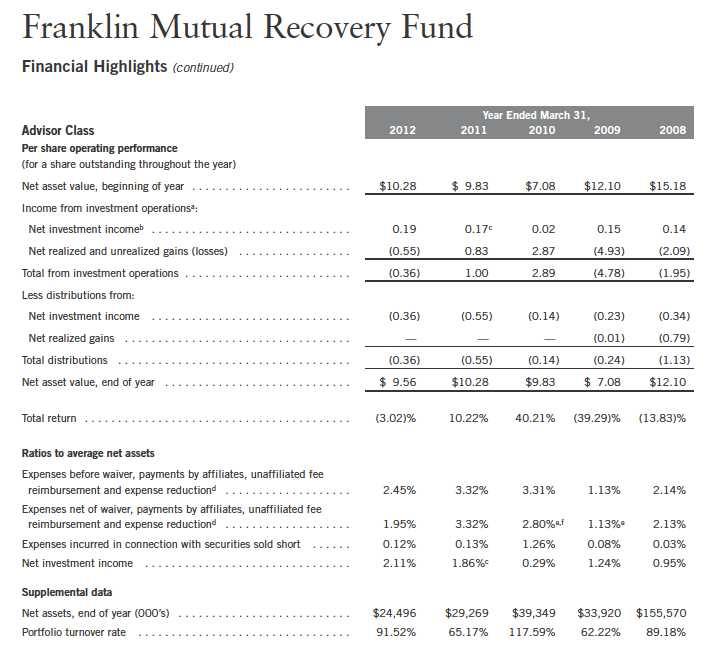

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of

the Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund.

bBased on average daily shares outstanding.

cNet investment income per share includes approximately $0.14 per share received in the form of a special dividend paid in connection with a corporate REIT conversion. Excluding

this non-recurring amount, the ratio of net investment income to average net assets would have been 0.39%.

dIncludes dividend and interest expense on securities sold short and borrowing fees, if any. See below for the ratios of such expenses to average net assets for the periods presented.

See Note 1(e).

eBenefit of expense reduction rounds to less than 0.01%.

fIncludes a one-time unaffiliated fee reimbursement of 0.25% associated with borrowing fees.

Annual Report | The accompanying notes are an integral part of these financial statements. | 23

24 | Annual Report

Annual Report | 25

26 | Annual Report

Annual Report | 27

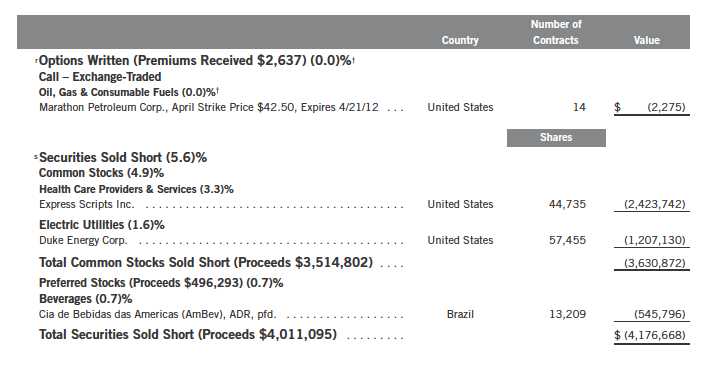

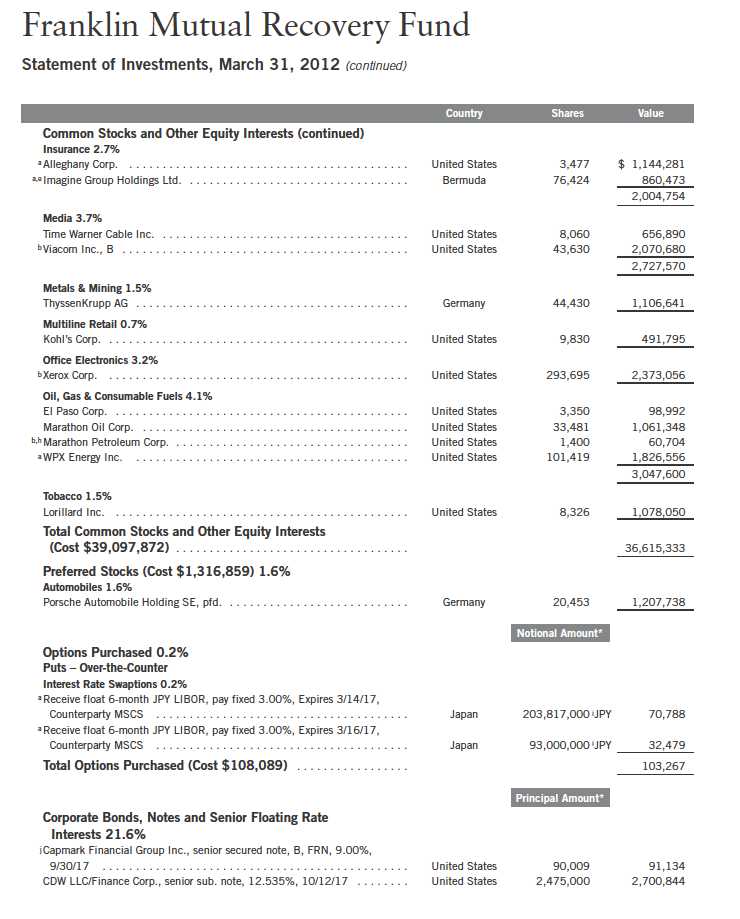

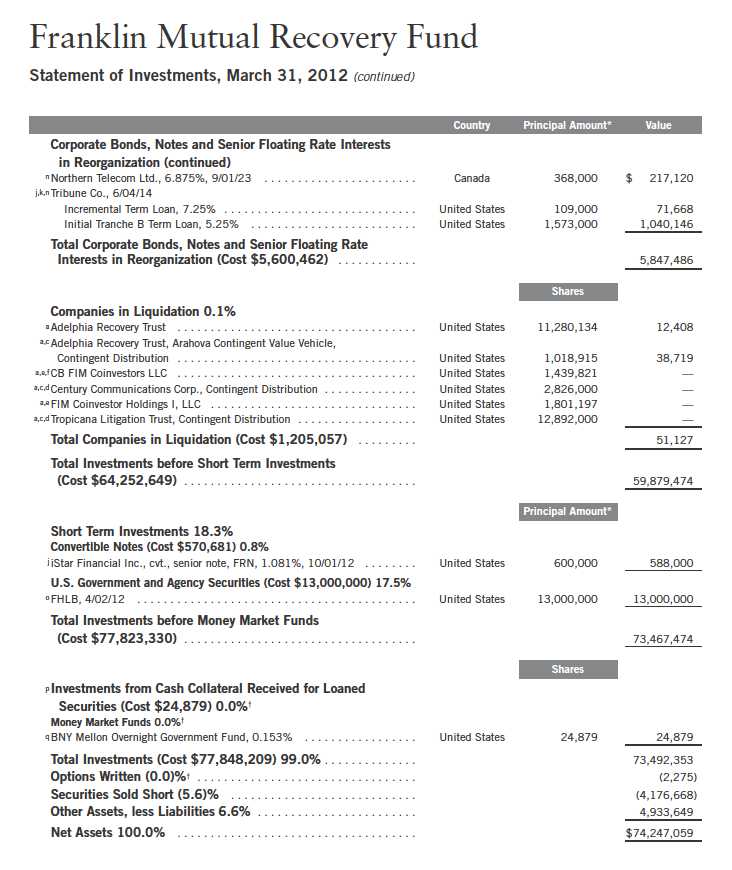

Franklin Mutual Recovery Fund

Statement of Investments, March 31, 2012 (continued)

†Rounds to less than 0.1% of net assets.

*The principal/notional amount is stated in U.S. dollars unless otherwise indicated.

aNon-income producing.

bSecurity or a portion of the security has been pledged as collateral for securities sold short and written options contracts. At March 31, 2012, the aggregate value of these

securities and/or cash pledged as collateral was $8,850,950, representing 11.92% of net assets.

cContingent distributions represent the right to receive additional distributions, if any, during the reorganization of the underlying company. Shares represent total underlying

principal of debt securities.

dSecurity has been deemed illiquid because it may not be able to be sold within seven days. At March 31, 2012, the aggregate value of these securities was $1,742,426,

representing 2.35% of net assets.

eSee Note 9 regarding restricted securities.

fAt March 31, 2012, pursuant to the Fund’s policies and the requirements of applicable securities law, the Fund may be restricted from trading these securities for a limited or

extended period of time due to ownership limits and/or potential possession of material non-public information.

gSecurity was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration only to qualified institutional buyers or in

a public offering registered under the Securities Act of 1933. These securities have been deemed liquid under guidelines approved by the Fund’s Board of Trustees. At March 31,

2012, the aggregate value of these securities was $3,032,907, representing 4.08% of net assets.

hA portion or all of the security is held in connection with written option contracts open at year end.

iAmount represents notional amount under the terms of the option.

jThe coupon rate shown represents the rate at period end.

kSee Note 1(g) regarding senior floating rate interests.

lIncome may be received in additional securities and/or cash.

mA portion or all of the security is on loan at March 31, 2012. See Note 1(f).

nSee Note 8 regarding credit risk and defaulted securities.

oThe security is traded on a discount basis with no stated coupon rate.

pSee Note 1(f) regarding securities on loan.

qThe rate shown is the annualized seven-day yield at period end.

rSee Note 1(c) regarding written options.

sSee Note 1(e) regarding securities sold short.

28 | Annual Report

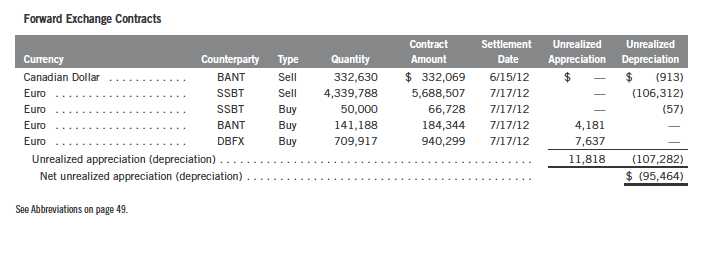

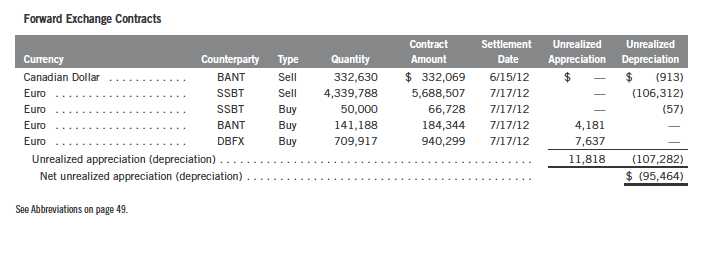

Franklin Mutual Recovery Fund

Statement of Investments, March 31, 2012 (continued)

At March 31, 2012, the Fund had the following forward exchange contracts outstanding. See Note 1(c).

Annual Report | The accompanying notes are an integral part of these financial statements. | 29

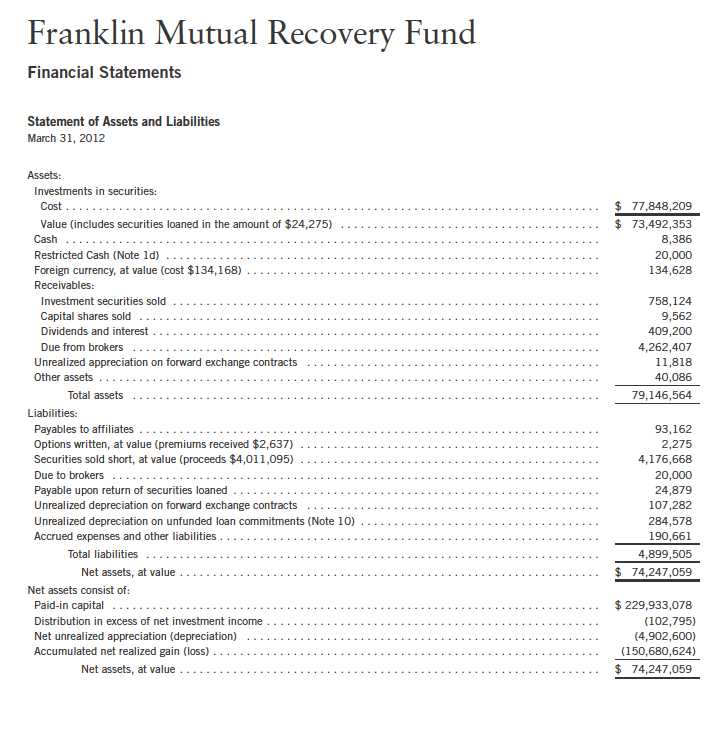

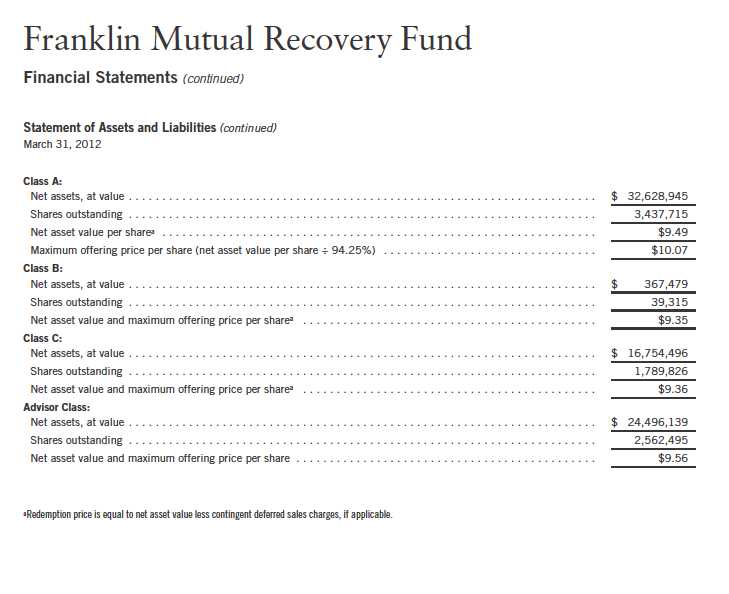

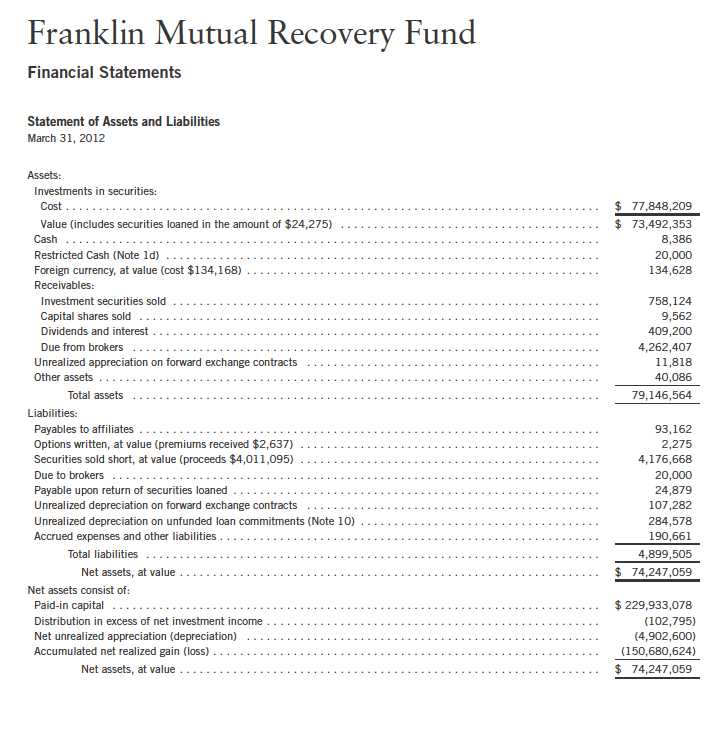

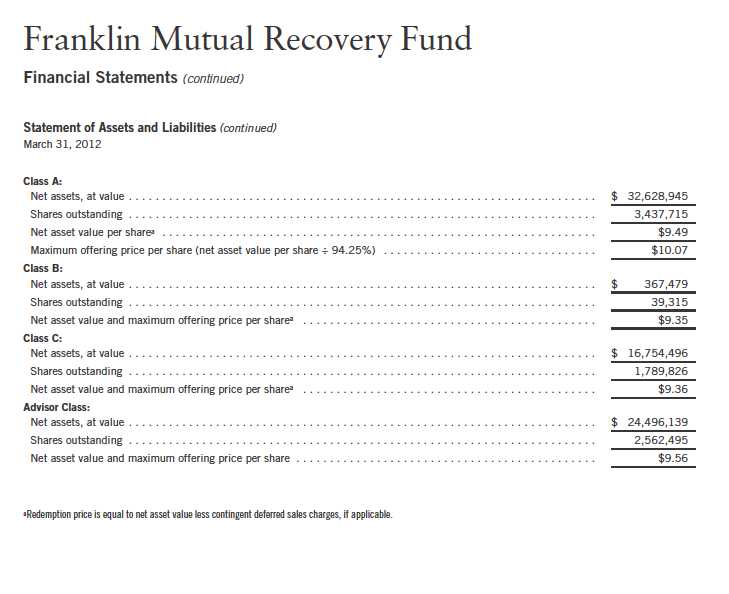

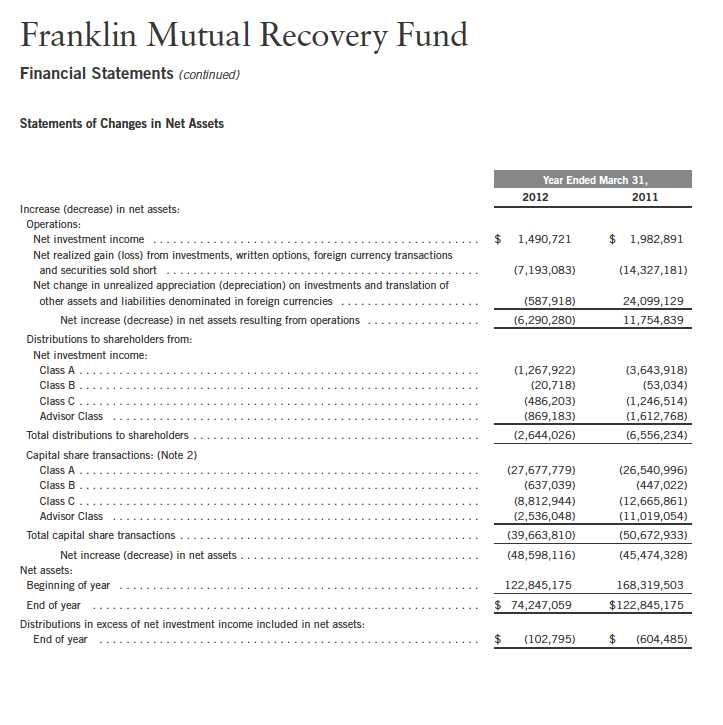

30 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 31

32 | The accompanying notes are an integral part of these financial statements. | Annual Report

Annual Report | The accompanying notes are an integral part of these financial statements. | 33

Franklin Mutual Recovery Fund

Notes to Financial Statements

1. ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES

The Franklin Mutual Recovery Fund (Fund) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as a closed-end, continuously offered investment company. The Fund offers four classes of shares: Class A, Class B, Class C, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, distribution fees, voting rights on matters affecting a single class and its exchange privilege.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in securities and other financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. Under procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator, investment manager and other affiliates have formed the Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities and derivative financial instruments (derivatives) listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Foreign equity securities are valued as of the close of trading on the foreign stock exchange on which the security is primarily traded, or the NYSE, whichever is earlier. The value is then converted into its U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the day that the value of the security is determined. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics or relationships to similar securities. Investments in non-registered money market funds are valued at the closing net asset value.

Debt securities generally trade in the over-the-counter market rather than on a securities exchange. The Fund’s pricing services use multiple valuation techniques to determine fair value. In instances where sufficient market activity exists, the pricing services may utilize a market-based approach through which quotes from market makers are used to determine fair value. In instances where sufficient market activity may not exist or is limited, the pricing services also utilize proprietary valuation models which may consider market characteristics such as benchmark yield curves, credit spreads, estimated default rates, anticipated market interest rate volatility, coupon rates, anticipated timing of principal repayments, underlying collateral, and other unique security features in order to estimate the relevant cash flows, which are then discounted to calculate the fair value.

34 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| a. | Financial Instrument Valuation (continued) |

Securities denominated in a foreign currency are converted into their U.S. dollar equivalent at the foreign exchange rate in effect at the close of the NYSE on the date that the values of the foreign debt securities are determined.

Certain derivatives trade in the over-the-counter market. The Fund’s pricing services use various techniques including industry standard option pricing models and proprietary discounted cash flow models to determine the fair value of those instruments. The Fund’s net benefit or obligation under the derivative contract, as measured by the fair market value of the contract, is included in net assets.

The Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such securities and considers a number of factors, including significant unobservable valuation inputs when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

Trading in securities on foreign securities stock exchanges and over-the-counter markets may be completed before the daily close of business on the NYSE. Occasionally, events occur between the time at which trading in a foreign security is completed and the close of the NYSE that might call into question the reliability of the value of a portfolio security held by the Fund. As a result, differences may arise between the value of the Fund’s portfolio securities as determined at the foreign market close and the latest indications of value at the close of the NYSE. In order to minimize the potential for these differences, the VLOC monitors price movements following the close of trading in foreign stock markets through a series of country specific market proxies (such as baskets of American Depositary Receipts, futures contracts and exchange traded funds). These price movements are measured against established trigger thresholds for each specific market proxy to assist in determining if an event has occurred that may call into question the reliability of the values of the foreign securities held by the Fund. If such an event occurs, the securities may be valued using fair value procedures, which may include the use of independent pricing services.

Annual Report | 35

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| b. | Foreign Currency Translation |

Portfolio securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based on the exchange rate of such currencies against U.S. dollars on the date of valuation. The Fund may enter into foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of securities, income and expense items denominated in foreign currencies are translated into U.S. dollars at the exchange rate in effect on the transaction date. Portfolio securities and assets and liabilities denominated in foreign currencies contain risks that those currencies will decline in value relative to the U.S. dollar. Occasionally, events may impact the availability or reliability of foreign exchange rates used to convert the U.S. dollar equivalent value. If such an event occurs, the foreign exchange rate will be valued at fair value using procedures established and approved by the Board.

The Fund does not separately report the effect of changes in foreign exchange rates from changes in market prices on securities held. Such changes are included in net realized and unrealized gain or loss from investments on the Statement of Operations.

Realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the recorded amounts of dividends, interest, and foreign withholding taxes and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in foreign exchange rates on foreign denominated assets and liabilities other than investments in securities held at the end of the reporting period.

c. Derivative Financial Instruments

The Fund invested in derivatives in order to manage risk or gain exposure to various other investments or markets. Derivatives are financial contracts based on an underlying or notional amount, require no initial investment or an initial net investment that is smaller than would normally be required to have a similar response to changes in market factors, and require or permit net settlement. Derivatives contain various risks including the potential inability of the counterparty to fulfill their obligations under the terms of the contract, the potential for an illiquid secondary market, and/or the potential for market movements which expose the Fund to gains or losses in excess of the amounts shown on the Statement of Assets and Liabilities. Realized gain and loss and unrealized appreciation and depreciation on these contracts for the period are included in the Statement of Operations.

The Fund entered into forward exchange contracts primarily to manage exposure to certain foreign currencies. A forward exchange contract is an agreement between the Fund and a counterparty to buy or sell a foreign currency for a specific exchange rate on a future date. Pursuant to the terms of the forward exchange contracts, cash or securities may be required to be deposited as collateral. Unrestricted cash may be invested according to the Fund’s investment objectives.

36 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| c. | Derivative Financial Instruments (continued) |

The Fund purchased or wrote option contracts primarily to manage and/or gain exposure to equity price and interest rate risk. An option is a contract entitling the holder to purchase or sell a specific amount of shares or units of an asset or notional amount of a swap (swaption), at a specified price. Options purchased are recorded as an asset while options written are recorded as a liability. Upon exercise of an option, the acquisition cost or sales proceeds of the underlying investment is adjusted by any premium received or paid. Upon expiration of an option, any premium received or paid is recorded as a realized gain or loss. Upon closing an option other than through expiration or exercise, the difference between the premium and the cost to close the position is recorded as a realized gain or loss. Pursuant to the terms of the written option contract, cash or securities may be required to be deposited as collateral.

See Notes 7 and 11 regarding investment transactions and other derivative information, respectively.

d. Restricted Cash

At March 31, 2012, the Fund held restricted cash in connection with investments in certain derivative securities. Restricted cash is held in a segregated account with the Fund’s custodian/ counterparty broker and is reflected in the Statement of Assets and Liabilities.

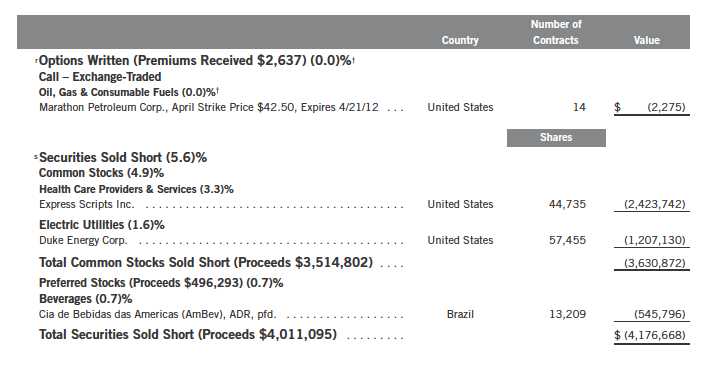

e. Securities Sold Short

The Fund is engaged in selling securities short, which obligates the Fund to replace a borrowed security with the same security at current market value. The Fund incurs a loss if the price of the security increases between the date of the short sale and the date on which the Fund replaces the borrowed security. The Fund realizes a gain if the price of the security declines between those dates. Gains are limited to the price at which the Fund sold the security short, while losses are potentially unlimited in size.

The Fund is required to establish a margin account with the broker lending the security sold short. While the short sale is outstanding, the broker retains the proceeds of the short sale and the Fund must maintain a deposit with the broker consisting of cash and/or securities having a value equal to a specified percentage of the value of the securities sold short. The Fund is obligated to pay fees for borrowing the securities sold short and is required to pay the counterparty any dividends or interest due on securities sold short. Such dividends or interest and any security borrowing fees are recorded as an expense to the Fund.

f. Securities Lending

The Fund participates in an agency based securities lending program. The Fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the market value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the market value of loaned securities, as determined at the close of Fund business

Annual Report | 37

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| f. | Securities Lending (continued) |

each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is invested in a non-registered money fund as indicated on the Statement of Investments. The Fund receives income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. The securities lending agent has agreed to indemnify the Fund in the event of default by a third party borrower.

g. Senior Floating Rate Interests

The Fund invests in senior secured corporate loans that pay interest at rates which are periodically reset by reference to a base lending rate plus a spread. These base lending rates are generally the prime rate offered by a designated U.S. bank or the London InterBank Offered Rate (LIBOR). Senior secured corporate loans often require prepayment of principal from excess cash flows or at the discretion of the borrower. As a result, actual maturity may be substantially less than the stated maturity.

Senior secured corporate loans in which the Fund invests are generally readily marketable, but may be subject to some restrictions on resale.

h. Income and Deferred Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund may be subject to foreign taxation related to income received, capital gains on the sale of securities and certain foreign currency transactions in the foreign jurisdictions in which it invests. Foreign taxes, if any, are recorded based on the tax regulations and rates that exist in the foreign markets in which the Fund invests. When a capital gain tax is determined to apply the Fund records an estimated deferred tax liability in an amount that would be payable if the securities were disposed of on the valuation date.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of March 31, 2012, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction statute of limitation.

38 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 1. | ORGANIZATION AND SIGNIFICANT ACCOUNTING POLICIES (continued) |

| i. | Security Transactions, Investment Income, Expenses and Distributions |

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Interest income and estimated expenses are accrued daily. Amortization of premium and accretion of discount on debt securities are included in interest income. Dividend income and dividends declared on securities sold short are recorded on the ex-dividend date except that certain dividends from foreign securities are recognized as soon as the Fund is notified of the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with accounting principles generally accepted in the United States of America. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

j. Accounting Estimates

The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

k. Guarantees and Indemnifications

Under the Fund’s organizational documents, its officers and trustees are indemnified by the Fund against certain liabilities arising out of the performance of their duties to the Fund. Additionally, in the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred. Currently, the Fund expects the risk of loss to be remote.

Annual Report | 39

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

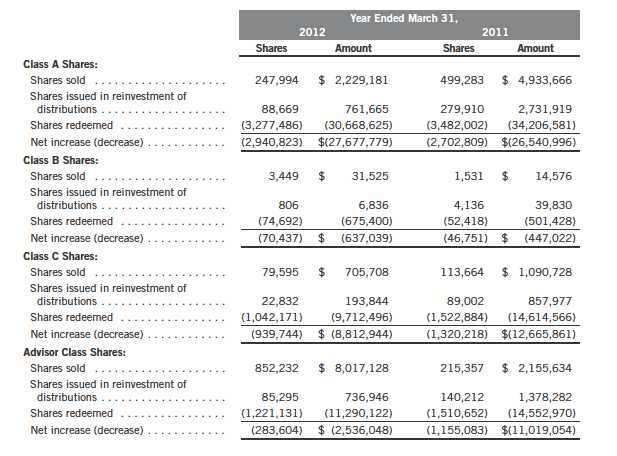

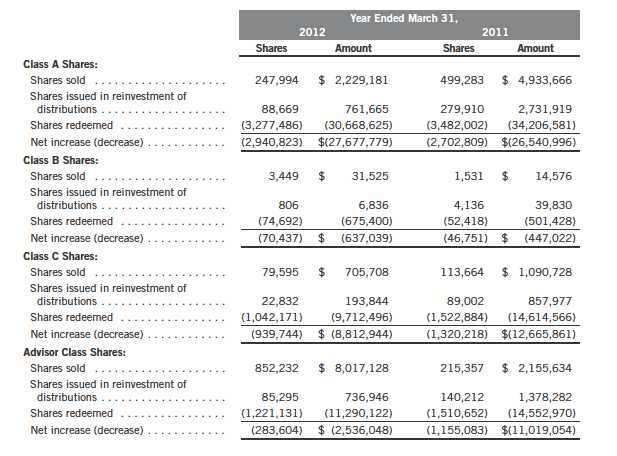

2. SHARES OF BENEFICIAL INTEREST

At March 31, 2012, there were an unlimited number of shares authorized ($0.01 par value).

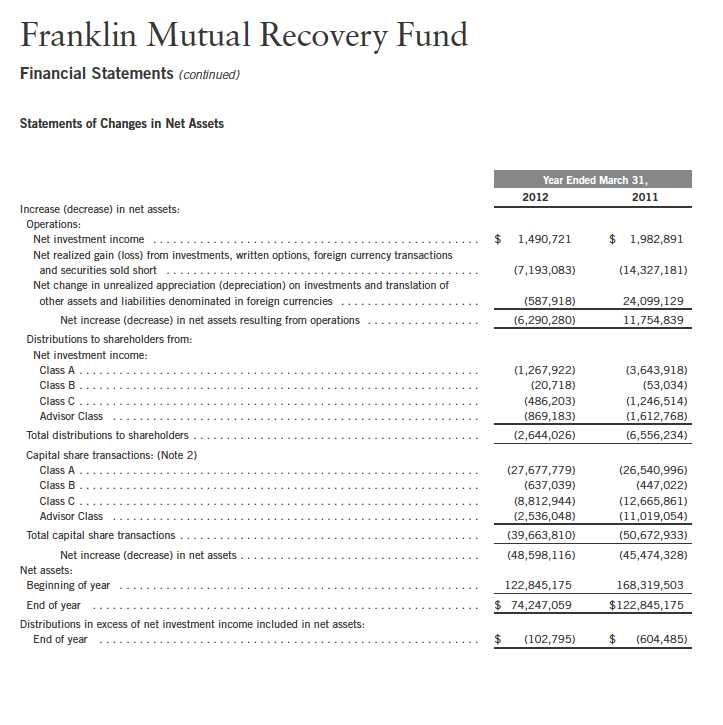

Transactions in the Fund’s shares were as follows:

3. TENDER SHARES

On a quarterly basis, the Fund may make tender offers, the amount of which is determined by

the Board, for the repurchase of at least 5% but not more than 25% of the shares outstanding.

The repurchase price is the net asset value on the repurchase pricing date.

40 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

4. TRANSACTIONS WITH AFFILIATES

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred

to as Franklin Templeton Investments. Certain officers and trustees of the Fund are also officers,

and/or directors of the following subsidiaries:

a. Management Fees

The Fund pays Franklin Mutual an investment management fee comprised of a “base fee” and a

“performance adjustment”. The base fee is calculated at the beginning of each month using an

annual rate of 1.50% of the prior month’s average daily net assets. The performance adjustment

is calculated at the beginning of each month based on how much the Fund’s total return exceeded

or lagged its performance fee index, the Bloomberg/EFFAS U.S. Government 3-5 Years Total Return

Index (Fund performance differential), over the preceding twelve-month period (performance

period). A performance adjustment is applicable if the Fund performance differential exceeds

1.00%, either upwards (an increase to the base fee) or downwards (a decrease to the base fee).

The performance adjustment rate is equal to 0.01% for each additional 0.05% that the Fund

performance differential exceeds 1.00%. The performance adjustment amount is determined by

multiplying the performance adjustment rate by the average daily net assets of the performance

period. The performance adjustment rate may not exceed 1.00% annualized, either upwards or

downwards. At the end of each month, an annualized investment management fee ratio is calcu-

lated (total investment management fees divided by fiscal year to date average daily net assets).

In accordance with the Investment Management Agreement, the investment management fee

ratio may not exceed 2.50% or fall below 0.50% for the fiscal year. For the period, the total

annualized management fee rate, including the performance adjustment, and prior to any

expense waiver, was 1.43% of the average daily net assets of the Fund.

Effective June 1, 2011, Franklin Mutual has contractually agreed to waive or limit its fees so that

the management fees paid by the Fund do not exceed an annual rate of 0.50% of the Fund’s

average daily net assets through July 31, 2012.

Annual Report | 41

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

| 4. | TRANSACTIONS WITH AFFILIATES (continued) |

| b. | Administrative Fees |

The Fund pays an administrative fee to FT Services of 0.20% per year of the average daily net

assets of the Fund.

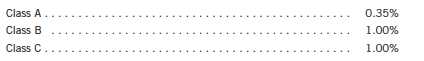

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Advisor

Class shares, pursuant to Rule 12b-1 under the 1940 Act. Under the Fund’s Class A reimburse-

ment distribution plan, the Fund reimburses Distributors for costs incurred in connection with

the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under

the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan

year cannot be reimbursed in subsequent periods.

In addition, under the Fund’s Class B and C compensation distribution plans, the Fund pays

Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s

shares up to the maximum annual plan rate for each class.

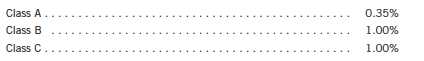

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

The Board has set the current rate at 0.30% per year for Class A shares until further notice and

approval by the Board.

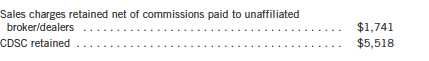

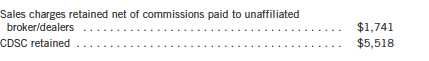

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses

of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to

investment or from redemption proceeds prior to remittance, as applicable. Distributors has

advised the Fund of the following commission transactions related to the sales and redemptions

of the Fund’s shares for the year:

e. Transfer Agent Fees

For the year ended March 31, 2012, the Fund paid transfer agent fees of $115,777, of which

$58,477 was retained by Investor Services.

42 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

5. EXPENSE OFFSET ARRANGEMENT

The Fund has entered into an arrangement with its custodian whereby credits realized as a result

of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During

the year ended March 31, 2012, there were no credits earned.

6. INCOME TAXES

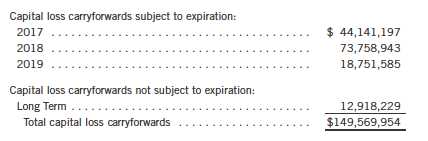

For tax purposes, capital losses may be carried over to offset future capital gains, if any. Under

the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the

Fund in taxable years beginning after December 22, 2010 are not subject to expiration and such

losses retain their character as either short-term or long-term, rather than being considered

short-term as under previous law. Post-enactment capital losses must be fully utilized prior to

utilizing any losses incurred in pre-enactment tax years.

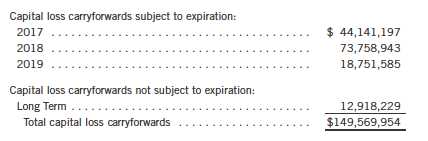

At March 31, 2012, capital loss carryforwards were as follows:

The tax character of distributions paid during the years ended March 31, 2012 and 2011, was

as follows:

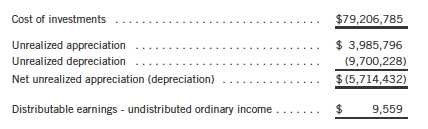

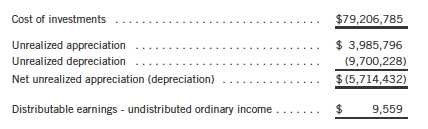

At March 31, 2012, the cost of investments, net unrealized appreciation (depreciation), and

undistributed ordinary income for income tax purposes were as follows:

Differences between income and/or capital gains as determined on a book basis and a tax basis

are primarily due to differing treatments of passive foreign investment company shares, recogni-

tion of partnership income, corporate actions, and defaulted securities.

Annual Report | 43

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

7. INVESTMENT TRANSACTIONS

Purchases and sales of investments (excluding short term securities and securities sold short) for

the year ended March 31, 2012, aggregated $72,655,443 and $110,490,336, respectively.

Transactions in options written during the year ended March 31, 2012, were as follows:

See Notes 1(c) and 11 regarding derivative financial instruments and other derivative informa-

tion, respectively.

8. CREDIT RISK AND DEFAULTED SECURITIES

The Fund may purchase the pre-default or defaulted debt of distressed companies. Distressed com-

panies are financially troubled and are about to be or are already involved in financial restructuring

or bankruptcy. Risks associated with purchasing these securities include the possibility that the

bankruptcy or other restructuring process takes longer than expected, or that distributions in

restructuring are less than anticipated, either or both of which may result in unfavorable conse-

quences to the Fund. If it becomes probable that the income on debt securities, including those

of distressed companies, will not be collected, the Fund discontinues accruing income and recog-

nizes an adjustment for uncollectible interest.

At March 31, 2012, the aggregate value of distressed company securities for which interest recog-

nition has been discontinued was $5,847,486, representing 7.88% of the Fund’s net assets. For

information as to specific securities, see the accompanying Statement of Investments.

9. RESTRICTED SECURITIES

The Fund invests in securities that are restricted under the Securities Act of 1933 (1933 Act) or

which are subject to legal, contractual, or other agreed upon restrictions on resale. Restricted

securities are often purchased in private placement transactions, and cannot be sold without prior

registration unless the sale is pursuant to an exemption under the 1933 Act. Disposal of these

securities may require greater effort and expense, and prompt sale at an acceptable price may

be difficult. The Fund may have registration rights for restricted securities. The issuer generally

incurs all registration costs.

44 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

9. RESTRICTED SECURITIES (continued)

At March 31, 2012, the Fund held investments in restricted securities, excluding certain securities

exempt from registration under the 1933 Act deemed to be liquid, as follows:

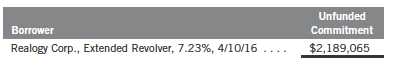

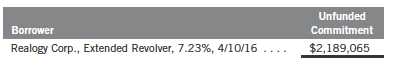

10. UNFUNDED LOAN COMMITMENTS

The Fund enters into certain credit agreements, all or a portion of which may be unfunded. The

Fund is obligated to fund these loan commitments at the borrowers’ discretion. Funded portions

of credit agreements are presented on the Statement of Investments.

At March 31, 2012, unfunded commitments were as follows:

Unfunded loan commitments and funded portions of credit agreements are marked to market

daily and any unrealized appreciation or depreciation is included in the Statement of Assets and

Liabilities and the Statement of Operations.

Annual Report | 45

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

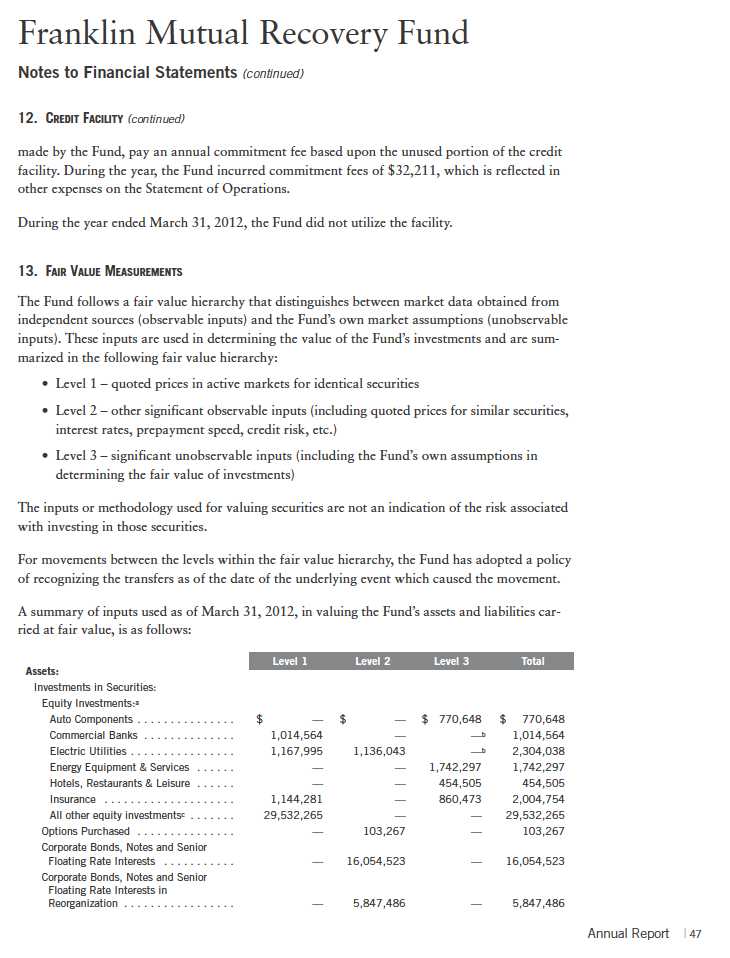

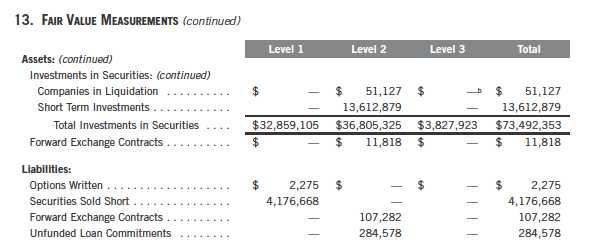

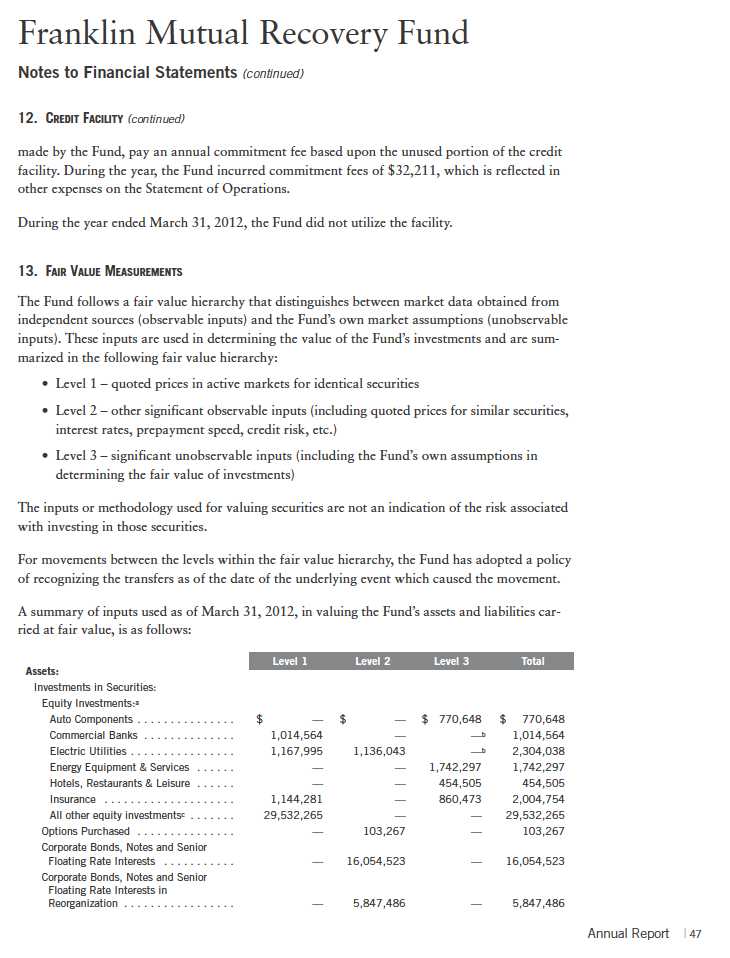

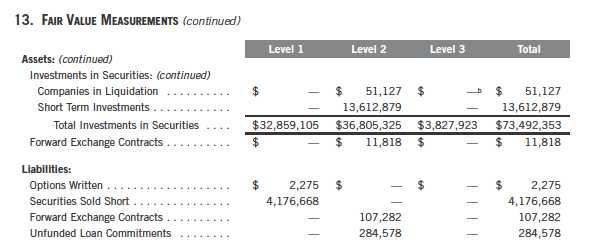

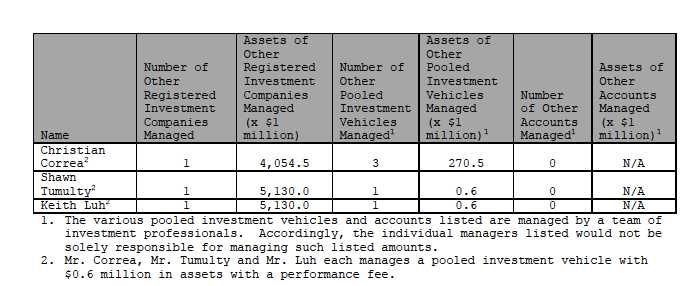

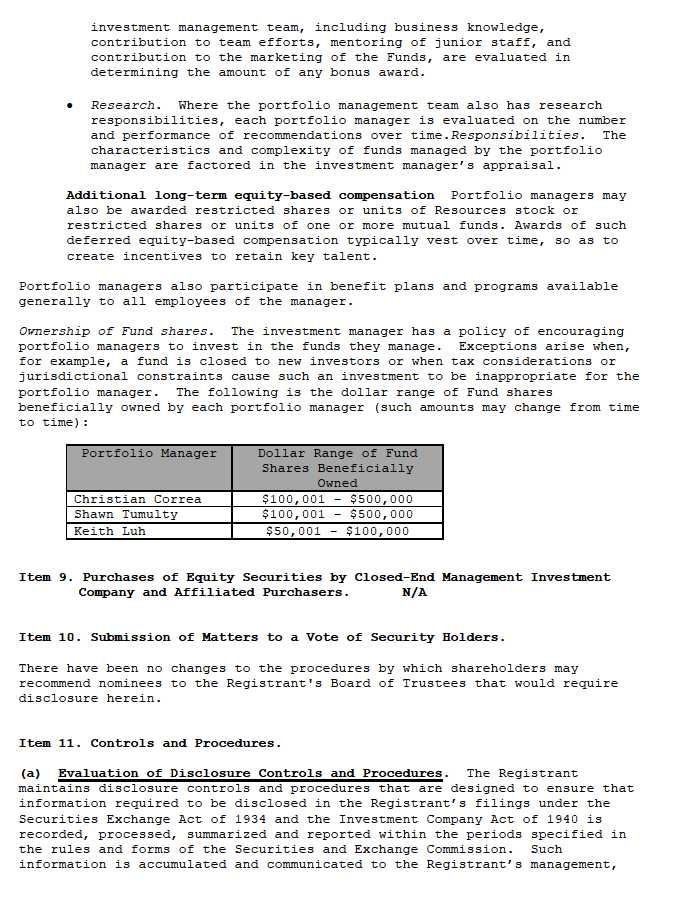

aIncludes common and preferred stocks as well as other equity investments.

bIncludes securities determined to have no value at March 31, 2012.

cFor detailed categories, see the accompanying Statement of Investments.

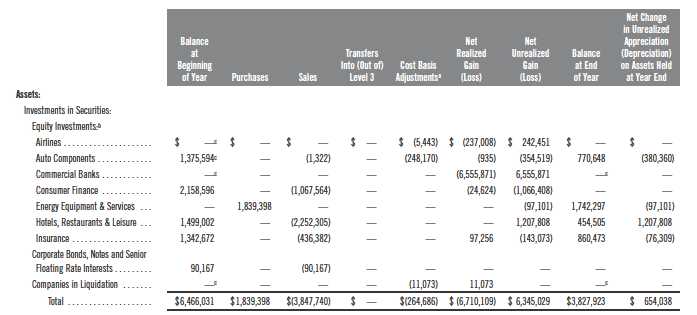

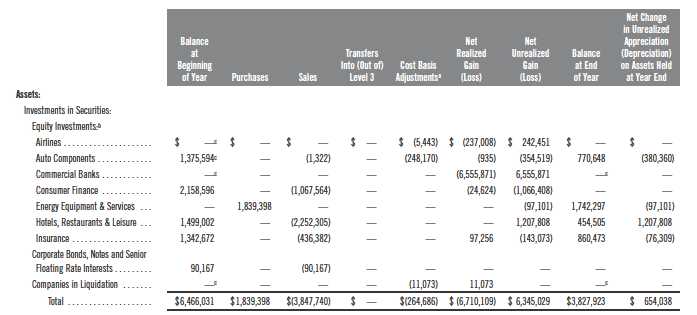

At March 31, 2012, the reconciliation of assets in which significant unobservable inputs (Level 3) were used in determining fair value, is as follows:

aMay include accretion, amortization, partnership adjustments, and/or other cost basis adjustments.

bIncludes common stocks as well as other equity investments.

cIncludes securities determined to have no value.

48 | Annual Report

Franklin Mutual Recovery Fund

Notes to Financial Statements (continued)

14. NEW ACCOUNTING PRONOUNCEMENTS

In May 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standards

Update (ASU) No. 2011-04, Fair Value Measurement (Topic 820): Amendments to Achieve

Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The

amendments in the ASU will improve the comparability of fair value measurements presented and

disclosed in financial statements prepared in accordance with U.S. GAAP (Generally Accepted

Accounting Principles) and IFRS (International Financial Reporting Standards) and include new

guidance for certain fair value measurement principles and disclosure requirements. The ASU is

effective for interim and annual periods beginning after December 15, 2011. The Fund believes

the adoption of this ASU will not have a material impact on its financial statements.

In December 2011, FASB issued ASU No. 2011-11, Balance Sheet (Topic 210): Disclosures

about Offsetting Assets and Liabilities. The amendments in the ASU enhance disclosures about

offsetting of financial assets and liabilities to enable investors to understand the effect of these

arrangements on a Fund’s financial position. The ASU is effective for interim and annual report-

ing periods beginning on or after January 1, 2013. The Fund believes the adoption of this ASU

will not have a material impact on its financial statements.

15. SUBSEQUENT EVENTS

The Fund has evaluated subsequent events through the issuance of the financial statements and

determined that no events have occurred that require disclosure.

Annual Report | 49

Franklin Mutual Recovery Fund

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Mutual Recovery Fund:

We have audited the accompanying statement of assets and liabilities of the Franklin Mutual

Recovery Fund (the “Fund”), including the statement of investments, as of March 31, 2012,

and the related statement of operations for the year then ended, the statements of changes in net

assets for each of the two years in the period then ended, and the financial highlights for each of

the five years in the period then ended. These financial statements and financial highlights are the

responsibility of the Fund’s management. Our responsibility is to express an opinion on these

financial statements and financial highlights based on our audits.

We conducted our audit in accordance with the standards of the Public Company Accounting

Oversight Board (United States). Those standards require that we plan and perform the audit to

obtain reasonable assurance about whether the financial statements and financial highlights are

free of material misstatement. We were not engaged to perform an audit of the Fund’s internal

control over financial reporting. Our audit included consideration of internal control over financial

reporting as a basis for designing audit procedures that are appropriate in the circumstances, but

not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control

over financial reporting. Accordingly, we express no such opinion. An audit also includes

examining, on a test basis, evidence supporting the amounts and disclosures in the financial

statements and financial highlights, assessing the accounting principles used and significant

estimates made by management, and evaluating the overall financial statement presentation. Our

procedures included confirmation of securities owned as of March 31, 2012, by correspondence

with the custodian and brokers. We believe that our audit provides a reasonable basis for our

opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly,

in all material respects, the financial position of Franklin Mutual Recovery Fund at March 31,

2012, the results of its operations for the year then ended, the changes in its net assets for each of

the two years in the period then ended, and the financial highlights for each of the five years in

the period then ended, in conformity with U.S. generally accepted accounting principles.

Boston, Massachusetts

May 18, 2012

50 | Annual Report

Franklin Mutual Recovery Fund

Tax Information (unaudited)

Under Section 854(b)(1)(A) of the Internal Revenue Code (Code), the Fund hereby reports 17.82% of the ordinary income dividends as income qualifying for the dividends received deduction for the fiscal year ended March 31, 2012.

Under Section 854(b)(1)(B) of the Code, the Fund hereby reports the maximum amount allowable but no less than $2,593,542 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended March 31, 2012. Distributions, including qualified dividend income, paid during calendar year 2012 will be reported to shareholders on Form 1099-DIV by mid-February 2013. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

Annual Report | 51

Franklin Mutual Recovery Fund

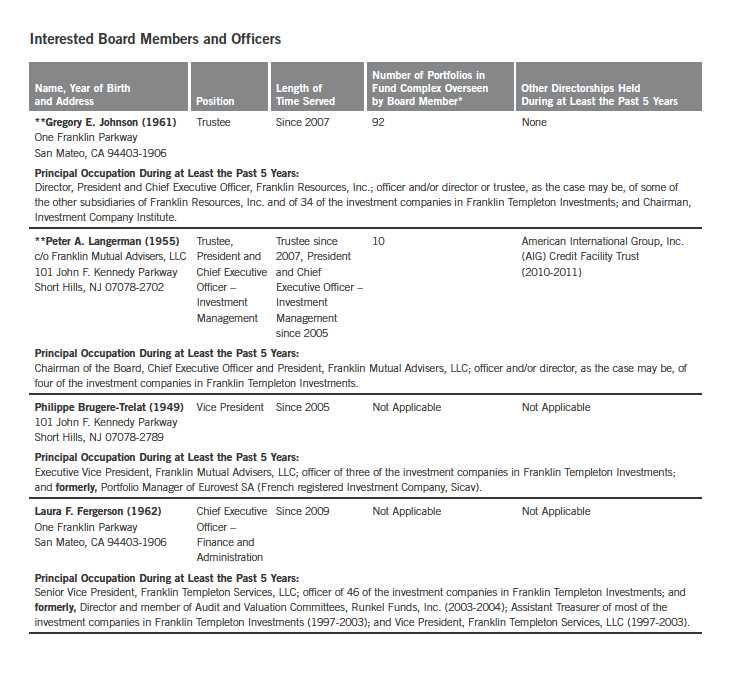

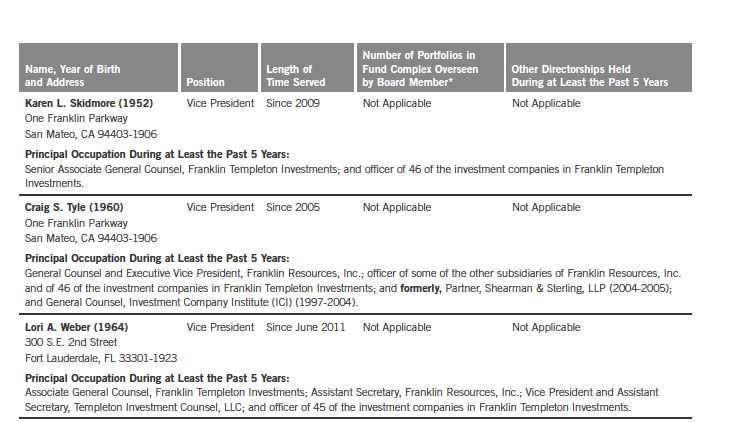

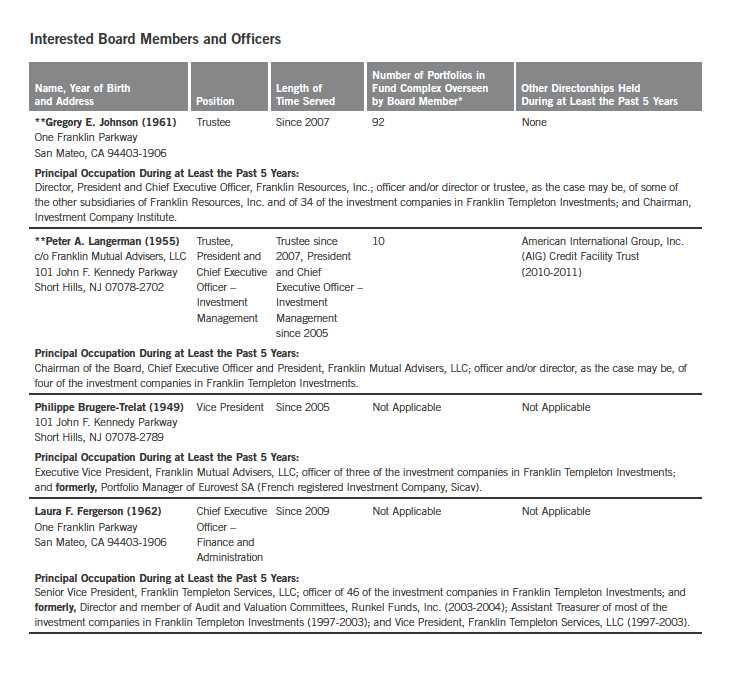

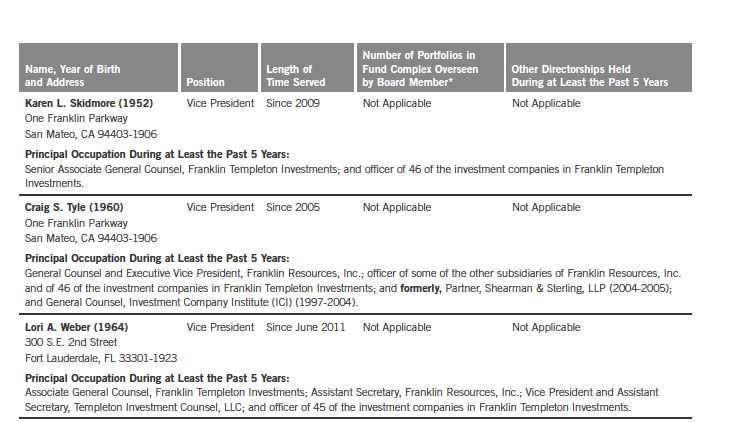

Board Members and Officers

The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with

the Fund, principal occupations during at least the past five years and number of portfolios overseen in the Franklin

Templeton Investments fund complex are shown below. Generally, each board member serves until that person’s

successor is elected and qualified.

52 | Annual Report

Annual Report | 53

54 | Annual Report

Annual Report | 55

*We base the number of portfolios on each separate series of the U.S. registered investment companies within the Franklin Templeton Investments fund complex. These portfolios

have a common investment manager or affiliated investment managers.

**Gregory E. Johnson is considered to be an interested person of the Trust under the federal securities laws due to his position as an officer and director of Franklin Resources, Inc.,

which is the parent company of the Fund's investment manager and distributor. Peter A. Langerman is considered to be an interested person of the Fund under the federal securi-

ties laws due to his position as an officer of Mutual Advisers, LLC, which is the Fund’s investment manager.

Note: Officer information is current as of the date of this report. It is possible that after this date, information about officers may change.

The Fund’s Board has determined that certain of the members of the Audit Committee, including Ann Torre Bates, are audit committee financial experts, and “independent,”

under those provisions of the Sarbanes-Oxley Act of 2002, and the rules and form amendments adopted by the Securities and Exchange Commission, relating to audit com-

mittee financial experts.

The Statement of Additional Information (SAI) includes additional information about the board members and is available, without charge, upon request. Shareholders may

call (800) DIAL BEN/ 342-5236 to request the SAI.

56 | Annual Report

Franklin Mutual Recovery Fund

Shareholder Information

Proxy Voting Policies and Procedures

The Fund’s investment manager has established Proxy Voting Policies and Procedures (Policies) that the Fund uses to determine how to vote proxies relating to portfolio securities. Shareholders may view the Fund’s complete Policies online at franklintempleton.com. Alternatively, shareholders may request copies of the Policies free of charge by calling the Proxy Group collect at (954) 527-7678 or by sending a written request to: Franklin Templeton Companies, LLC, 300 S.E. 2nd Street, Fort Lauderdale, FL 33301, Attention: Proxy Group. Copies of the Fund’s proxy voting records are also made available online at franklintempleton.com and posted on the U.S. Securities and Exchange Commission’s website at sec.gov and reflect the most recent 12-month period ended June 30.

Quarterly Statement of Investments

The Fund files a complete statement of investments with the U.S. Securities and Exchange Commission for the first and third quarters for each fiscal year on Form N-Q. Shareholders may view the filed Form N-Q by visiting the Commission’s website at sec.gov. The filed form may also be viewed and copied at the Commission’s Public Reference Room in Washington, DC. Information regarding the operations of the Public Reference Room may be obtained by calling (800) SEC-0330.

Householding of Reports and Prospectuses

You will receive the Fund’s financial reports every six months as well as an annual updated summary prospectus (prospectus available upon request). To reduce Fund expenses, we try to identify related shareholders in a household and send only one copy of the financial reports and summary prospectus. This process, called “householding,” will continue indefinitely unless you instruct us otherwise. If you prefer not to have these documents householded, please call us at (800) 632-2301. At any time you may view current prospectuses/summary prospectuses and financial reports on our website. If you choose, you may receive these documents through electronic delivery.

Annual Report | 57

This page intentionally left blank.

Item 2. Code of Ethics.

(a) The Registrant has adopted a code of ethics that applies to its principal executive officers and principal financial and accounting officer.

| (c) | N/A |

| (d) | N/A |

| (f) | Pursuant to Item 12(a)(1), the Registrant is attaching as an exhibit a |

copy of its code of ethics that applies to its principal executive officers and principal financial and accounting officer.

Item 3. Audit Committee Financial Expert.

(a)(1) The Registrant has an audit committee financial expert serving on its audit committee.

(2) The audit committee financial expert is Ann Torre Bates and she is "independent" as defined under the relevant Securities and Exchange Commission Rules and Releases.

Item 4. Principal Accountant Fees and Services.

(a) Audit Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant for the audit of the registrant’s annual financial statements or for services that are normally provided by the principal accountant in connection with statutory and regulatory filings or engagements were $75,070 for the fiscal year ended March 31, 2012 and $75,304 for the fiscal year ended March 31, 2011.

(b) Audit-Related Fees

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant that are reasonably related to the performance of the audit of the registrant's financial statements and are not reported under paragraph (a) of Item 4.

There were no fees paid to the principal accountant for assurance and related services rendered by the principal accountant to the registrant's investment adviser and any entity controlling, controlled by or under common control with the investment adviser that provides ongoing services to the registrant that are reasonably related to the performance of the audit of their financial statements.

(c) Tax Fees

The aggregate fees paid to the principal accountant for professional services rendered by the principal accountant to the registrant for tax compliance, tax advice and tax planning were $497 the fiscal year ended March 31, 2012 and $0 for the fiscal year ended March 31, 2011. The services for which these fees were paid included identifying passive foreign investment company to manage exposure to tax liabilities.

There were no fees paid to the principal accountant for professional services

rendered by the principal accountant to the registrant’s investment adviser

and any entity controlling, controlled by or under common control with the

investment adviser that provides ongoing services to the registrant for tax

compliance, tax advice and tax planning.

(d) All Other Fees

The were no fees paid to the principal accountant for products and services

rendered by the principal accountant to the registrant not reported in

paragraphs (a)-(c) of Item 4.

There were no paid to the principal accountant for products and services

rendered by the principal accountant to the registrant’s investment adviser

and any entity controlling, controlled by or under common control with the

investment adviser that provides ongoing services to the registrant other

than services reported in paragraphs (a)-(c) of Item 4.

(e) (1) The registrant’s audit committee is directly responsible for

approving the services to be provided by the auditors, including:

(i) pre-approval of all audit and audit related services;

(ii) pre-approval of all non-audit related services to be provided to

the Fund by the auditors;

(iii) pre-approval of all non-audit related services to be provided to

the registrant by the auditors to the registrant’s investment adviser or to

any entity that controls, is controlled by or is under common control with

the registrant’s investment adviser and that provides ongoing services to the

registrant where the non-audit services relate directly to the operations or

financial reporting of the registrant; and

(iv) establishment by the audit committee, if deemed necessary or

appropriate, as an alternative to committee pre-approval of services to be

provided by the auditors, as required by paragraphs (ii) and (iii) above, of

policies and procedures to permit such services to be pre-approved by other

means, such as through establishment of guidelines or by action of a

designated member or members of the committee; provided the policies and

procedures are detailed as to the particular service and the committee is

informed of each service and such policies and procedures do not include

delegation of audit committee responsibilities, as contemplated under the

Securities Exchange Act of 1934, to management; subject, in the case of (ii)

through (iv), to any waivers, exceptions or exemptions that may be available

under applicable law or rules.

(e) (2) None of the services provided to the registrant described in

paragraphs (b)-(d) of Item 4 were approved by the audit committee pursuant to

paragraph (c)(7)(i)(C) of Rule 2-01 of regulation S-X.

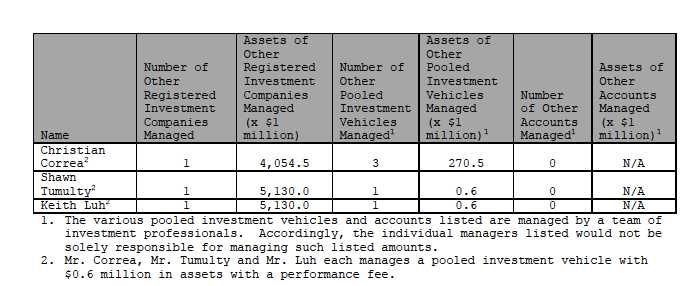

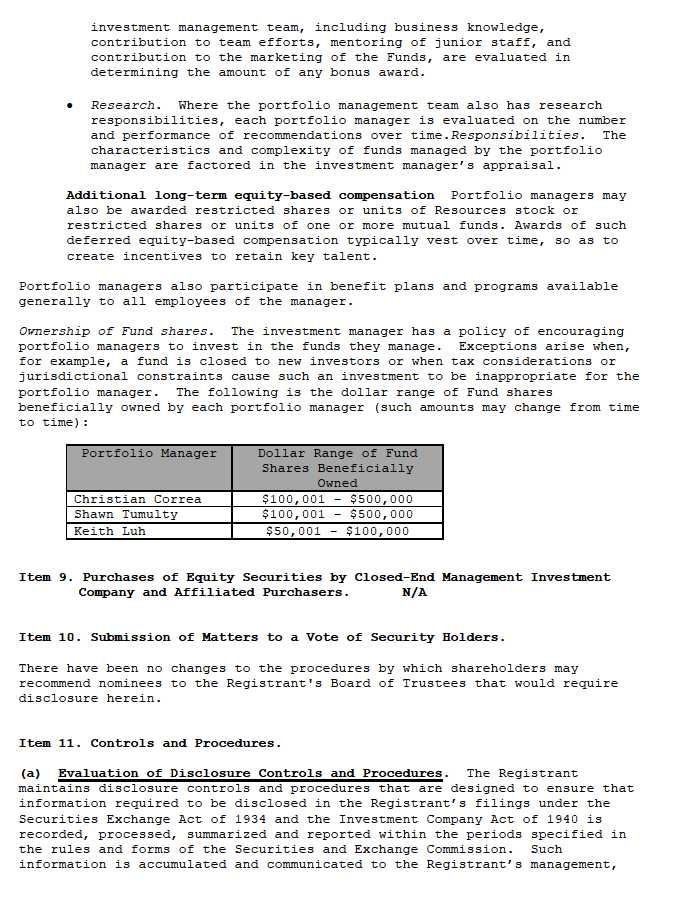

(f) No disclosures are required by this Item 4(f).