UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED ANNUAL SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21410

The Weitz Funds

(Exact name of registrant as specified in charter)

Suite 200

1125 South 103 Street

Omaha, NE 68124-1071

(Address of principal executive offices) (Zip code)

Wallace R. Weitz & Company

The Weitz Funds

Suite 200

1125 South 103 Street

Omaha, NE 68124-1071

(Name and address of agent for service)

Registrant’s telephone number, including area code: 402-391-1980

Date of fiscal year end: March 31

Date of reporting period: March 31, 2011

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Report to Stockholders.

WEITZ INVESTMENT PHILOSOPHY

Over the 25+ year history of Weitz Funds, we have seen many changes. Advancements in technology combined with economic, political and global events have continued to shape investors’ thoughts and actions.

Our mission has remained constant— we have an unwavering commitment to our shareholders and a focus on finding strong, well-managed companies priced significantly below their true business value.

We “eat our own cooking.”

We believe in putting our money where our mouth is. All of our employees and trustees have significant personal investments in our “family” of funds. This does not guarantee that the Funds will go up, but it does mean that we win or lose together and that shareholders definitely have our full attention.

We are patient, long-term investors.

When we analyze potential equity investments, we think about the business behind the stock. We buy shares only when we believe they are selling at a large discount to the company’s underlying business value. Ideally, the business value rises over time, and the stock price follows. This often allows us to hold the stock for many years.

Knowing what you don’t know is important in all aspects of life, but it is crucial in investing.

We think our odds of investment success are much higher when we invest in securities of companies we understand and where we may have an edge over other investors. As a result, our portfolios are not diversified among all the various sectors of the economy. Instead, we expect to have a deeper knowledge and understanding of the industries and companies in which we do invest. Our experienced research team has a broad “circle of competence,” and we believe in staying within it.

We worry about permanent loss of capital—not price volatility.

Our Funds are designed for long-term shareholders. We believe concentrating our portfolios in the most attractive investment ideas, although it may cause short-term price volatility, is the best way to earn consistent returns over the long term.

We believe in being flexible and using common sense.

We are often contrarian and do not pay attention to benchmarks when making investment decisions. We also believe that cash is sometimes the most attractive investment.

Our goal is to earn good absolute investment returns over long periods of time without exposing our clients’ and our own capital to undue risk.

2 Weitz Funds

TABLE OF CONTENTS

| 4 |

| | |

| 5 |

| | |

| 8 |

| | |

| 9 |

| | |

| 13 |

| | |

| 18 |

| | |

| 23 |

| | |

| 27 |

| | |

| 32 |

| | |

| 37 |

| | |

| 44 |

| | |

| 50 |

| | |

| 52 |

| | |

| 62 |

| | |

| 74 |

| | |

| 75 |

| | |

| 76 |

| | |

| 80 |

| The management of Weitz Funds has chosen paper for the 80 page body of this financial report from a paper manufacturer certified under the Sustainable Forestry Initiative standard. | | |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this report are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

weitzfunds.com 3

MARCH 31, 2011

| | | | | | Total Returns | | Average Annual Total Returns |

| Fund Name | | Inception Date | | | 3 Mos. | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | 20 Year | | 25 Year | | Since Inception |

| Value | | 5/09/86 | | | 5.7 | % | | 15.0 | % | | 3.1 | % | | 0.4 | % | | 2.5 | % | | 9.0 | % | | 10.5 | % | | — | % | | 10.4 | % |

Russell 1000**(a) | | | | | 6.2 | | | 16.7 | | | 3.0 | | | 2.9 | | | 3.8 | | | 7.1 | | | N/A | | | — | | | N/A | |

Russell 1000 Value**(b) | | | | | 6.5 | | | 15.2 | | | 0.6 | | | 1.4 | | | 4.5 | | | 7.7 | | | N/A | | | — | | | N/A | |

| Partners Value* | | 6/01/83 | | | 7.1 | | | 20.9 | | | 8.4 | | | 3.8 | | | 3.8 | | | 10.3 | | | 11.7 | | | 11.2 | | | 12.7 | |

| Partners III Opportunity* | | 6/01/83 | | | 8.5 | | | 24.4 | | | 13.9 | | | 6.6 | | | 8.1 | | | 12.2 | | | 13.5 | | | 12.1 | | | 13.6 | |

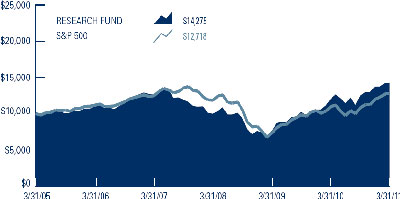

Research*(c) | | 4/01/05 | | | 3.8 | | | 18.5 | | | 12.7 | | | 5.4 | | | — | | | — | | | — | | | — | | | 6.1 | |

Russell 3000**(d) | | | | | 6.4 | | | 17.4 | | | 3.4 | | | 3.0 | | | 4.1 | | | 7.1 | | | N/A | | | N/A | | | N/A | |

Russell 3000 Value**(e) | | | | | 6.5 | | | 15.6 | | | 1.1 | | | 1.4 | | | 4.9 | | | 7.8 | | | N/A | | | N/A | | | N/A | |

| Hickory | | 4/01/93 | | | 8.3 | | | 29.4 | | | 10.5 | | | 4.1 | | | 5.4 | | | 10.0 | | | — | | | — | | | 10.6 | |

Russell 2500**(f) | | | | | 8.7 | | | 26.1 | | | 8.9 | | | 4.4 | | | 8.9 | | | 9.5 | | | — | | | — | | | N/A | |

Russell 2500 Value**(g) | | | | | 7.7 | | | 22.7 | | | 8.0 | | | 3.3 | | | 9.6 | | | 10.7 | | | — | | | — | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

S&P 500**(h) | | | | | 5.9 | | | 15.7 | | | 2.4 | | | 2.6 | | | 3.3 | | | 6.8 | | | 8.7 | | | 9.6 | | | — | |

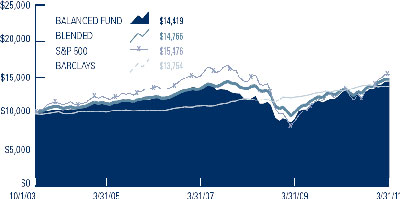

| Balanced | | 10/01/03 | | | 3.4 | | | 11.8 | | | 6.7 | | | 3.5 | | | — | | | — | | | — | | | — | | | 5.0 | |

Blended Index**(i) | | | | | 3.7 | | | 11.3 | | | 3.2 | | | 3.8 | | | — | | | — | | | — | | | — | | | 5.3 | |

| Short-Intermediate Income | | 12/23/88 | | | 0.6 | | | 3.5 | | | 5.3 | | | 5.7 | | | 4.8 | | | 5.5 | | | 5.8 | | | — | | | 6.1 | |

Barclays Intermediate Credit**(j) | | | | | 0.3 | | | 4.6 | | | 4.5 | | | 5.7 | | | 5.2 | | | 5.8 | | | 6.3 | | | — | | | 6.8 | |

Nebraska Tax-Free Income* | | 10/01/85 | | | 0.3 | | | 1.9 | | | 3.5 | | | 3.5 | | | 3.8 | | | 4.4 | | | 4.8 | | | 5.1 | | | 5.4 | |

Barclays 5-Year Muni. Bond**(k) | | | | | 0.6 | | | 3.2 | | | 5.1 | | | 5.1 | | | 4.6 | | | 4.9 | | | 5.4 | | | — | | | — | |

These performance numbers reflect the deduction of each Fund’s annual operating expenses. Annual operating expenses for the Value, Partners Value, Partners III, Research, Hickory, Balanced, Short-Intermediate Income and Nebraska Tax-Free Income Funds, as stated in the most recent Prospectus are 1.25%, 1.26%, 1.80%, 1.50% (estimated gross), 1.33%, 1.19%, 0.71% and 0.78%, respectively, of each Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses by the Adviser. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in any of the Funds will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be higher or lower than the performance data quoted above. Performance data current to the most recent month end may be obtained at www.weitzfunds.com/performance/monthly.asp.

| | |

| * | See pages 14, 19 and 45 for additional performance disclosures. |

| ** | Index performance is hypothetical and is shown for illustrative purposes only. |

| (a) | The Russell 1000 is an unmanaged index of large capitalization common stocks. It consists of the 1,000 largest companies in the Russell 3000 Index. |

| (b) | The Russell 1000 Value is an unmanaged index of large capitalization common stocks. It consists of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values. |

| (c) | Annual operating expenses for the Research Fund, as stated in the Research Fund’s Prospectus, are 1.50% (estimated gross) and 0.90% (net) of the Fund’s net assets. The investment adviser has agreed, in writing, to limit the total annual fund operating expenses (excluding taxes, interest, brokerage commissions, and acquired fund fees and expenses) to 0.90% of the Fund’s average daily net assets through July 31, 2012. |

| (d) | The Russell 3000 is an unmanaged index of the 3,000 largest U.S. companies based on market capitalization. |

| (e) | The Russell 3000 Value is an unmanaged index of the largest capitalization common stocks. It consists of those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. |

| (f) | The Russell 2500 is an unmanaged index of small to mid-capitalization common stocks. It consists of the 2,500 smallest companies in the Russell 3000 Index. |

| (g) | The Russell 2500 Value is an unmanaged index of small to mid-capitalization common stocks. It consists of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values. |

| (h) | The S&P 500 is an unmanaged index consisting of 500 companies generally representative of the market for the stocks of large-size U.S. companies. |

| (i) | The Blended Index is a blend of 60% S&P 500 and 40% Barclays Capital Intermediate U.S. Government/Credit Index. |

| (j) | Barclays Capital Intermediate U.S. Government/Credit Index is a total return performance benchmark consisting of government securities and publicly issued corporate debt with maturities from one to ten years and rated at least BBB by Standard & Poor’s or Baa by Moody’s Investor Service. |

| (k) | Barclays Capital 5-Year Municipal Bond Index is an unmanaged index of long-term, fixed-rate, investment-grade, tax-exempt bonds representative of the municipal bond market. |

| N/A | Indicates information is not available. |

4 Weitz Funds

APRIL 11, 2011

Dear Fellow Shareholder:

In spite of a number of unsettling global events during the quarter, the market continued its recovery from the March 2009 lows. Our stock funds enjoyed a very good quarter, providing a strong finish to our March 31 fiscal year. The table below shows results for the stock funds for the quarter and year ended March 31.

| | | | | | | | |

| | | | Period Ended 3/31/2011 | |

| | | | Quarter | | | Fiscal Year | |

| | | | | | |

| Value | | | 5.7 | % | | 15.0 | % |

| Partners Value | | | 7.1 | | | 20.9 | |

| Partners III | | | 8.5 | | | 24.4 | |

| Research | | | 3.8 | | | 18.5 | |

| Hickory | | | 8.3 | | | 29.4 | |

| S&P 500 | | | 5.9 | | | 15.7 | |

Smaller company stocks continued to lead the recovery from the bear market lows, and the effect of that leadership is evident in the recent returns of our Funds. The Value Fund, which focuses on large- and mega-capitalization stocks, has kept pace with the S&P 500 (very large companies), but has trailed our other Funds that can own smaller companies. Partners Value and Partners III are “go-anywhere” or “all-cap” funds and their performance has been helped by their small- and mid-cap holdings. Hickory, which holds only small and medium-sized companies, has had the best numbers lately.

The popularity of various market sectors tends to rotate, and some of the cheapest stocks available in today’s market appear to be those of very large, high-quality companies, so we have no doubt that the Value Fund will eventually have its turn in the spotlight.

The Balanced Fund also had a good quarter as its stocks carried it to a gain of 3.4%. Bonds have been “priced for perfection” for some time and our bond funds—Short-Intermediate Income and Nebraska Tax-Free Income—generated modest positive returns of 0.6% and 0.3%, respectively, as we collected coupons and maintained very defensive portfolio positions.

The table on the page preceding this letter shows results for each of our Funds over various intervals since our firm was founded in 1983. It also shows comparative results for market indexes that some investors find relevant. There is additional information on each of the Funds in the pages following this letter.

Impact of Recent World Events

Our investment process focuses on the business values of individual companies, so we usually do not write much about macro-economic or geopolitical developments. Recently though, a number of major news stories have raised questions among our clients, and we thought we would address some of them in this letter.

North Africa and the Middle East

Dramatic changes are underway in a dozen or so countries in North Africa and the Middle East. From an historical point of view, this series of events may be the most significant, but it is too early to predict winners and losers or to draw conclusions. Optimists see the promise of new democratic governments, modernized societies, protection of human rights (especially for women), and the birth of new “emerging markets” that could increase economic opportunity both for these countries and their potential trading partners.

Pessimists see increased political instability in the region, ever-broadening military entanglements and skyrocketing oil prices. The only direct portfolio impact we have seen is strength in our energy company holdings. While we do not minimize the short-term impact of higher energy prices on worldwide economic growth, this part of the world does not figure prominently in our near term search for new investments.

Japan

The loss of life in the earthquake and tsunami in Japan was horrendous. The death toll is expected to top 20,000. Property losses have been estimated at $100-$200 billion or more. An element that makes this event different from other natural disasters is the damage to the nuclear reactors and the release of radiation that make recovery efforts vastly more complicated.

Japan’s economy has been stuck in a stagnant, slow-/no-growth mode for over 20 years and some think the rebuilding process will provide much-needed economic stimulation. Many Japanese stocks appeared to be very cheap statistically even before the earthquake. However, we have not devoted much research time to potential investments in Japanese companies, in part due to concerns about capital allocation and governance.

The impact on our U.S.-based companies is expected to be modest. While property damage is expected to reach into the hundreds of billions of dollars, Ajit Jain of Berkshire Hathaway has estimated that insured losses may be “only” $15-30 billion. Berkshire’s share of that is not expected to be significant. (Ajit also pointed out that business interruption insurance could be a significant and problematic wild card for some companies—not

weitzfunds.com 5

Berkshire—because the contract language can be vague and open to varying interpretation. He expects lawyers to be the major beneficiaries.)

Insurance brokers, like Aon, Willis and Brown & Brown (we own all three) could actually benefit from high insured losses for the industry since that may lead to higher premiums (and thus higher brokers’ commissions) in the future.

QVC (Liberty Interactive) earned 13% of its 2010 revenues from a joint venture in Japan. Studio damage was relatively minor and the station is back on the air. The more significant issue for QVC Japan, though, is that the Japanese viewers’ appetite for video shopping may be affected for some time.

A Texas Instruments plant was damaged and it will be several months before it is repaired and restored to full production. Manufacturing at two other plants is also being hampered by interruptions to electrical power supplies. The company estimates that its earnings could be impacted by 10-12 cents per share in 2011. This would not be a significant negative.

Sovereign Debt Crises in the Euro-Zone

A version of the real estate debt crisis that afflicted American banks a few years ago has surfaced in Europe. While the U.S. could borrow all the dollars it needed to provide liquidity to banks and stimulate the economy, members of the European Union use a common currency and cannot just borrow at will.

A year ago, it became clear that Greece would not be able to repay the government debt coming due in the next few years so the European Union arranged a “bailout” fund from which Greece could borrow when needed. In return, Greece agreed to cut government spending and make greater efforts to collect the taxes it levies. Needless to say, this was unpopular in Greece and its citizens are resisting the changes.

Later last year, Ireland’s major banks conceded that they could not repay their debt because of real estate-related credit issues, so the Irish government guaranteed that debt. It then became clear that Ireland would not be able to repay both its own debt and that of the banks and that it too would need to draw on the Euro-Zone bailout fund. The Irish people, and in turn their parliament, balked at the EU-ordered austerity measures and the Irish government fell. Resolution of the situation is pending.

Recently, Portugal has gone through a similar series of events and world financial markets fear that Spain, whose banks also have major real estate-related credit problems, will be next. Italy, the fifth member of the group of countries rudely referred to by the unfortunate acronym “P.I.I.G.S.,” has not been in the financial news lately (perhaps because its prime minister’s personal life has monopolized the headlines), but some believe it is only a matter of time before Italy’s national balance sheet comes in for uncomfortable scrutiny.

The members of the European Union face a serious dilemma. It seems fairly clear that some of these countries cannot repay their debt on schedule without a bailout by the stronger countries, primarily Germany and France. Citizens of the stronger countries do not like the idea of bearing the cost of the bailouts. The owners of the debt, which include banks and pension plans in EU countries, have their own strong opinions on the matter. It is conceivable that the European Union could come apart and that the common use of the Euro would give way to individual national currencies.

We do not have a prediction as to the outcome of this crisis. We do not believe we have invested in companies that are directly exposed to the risk of sovereign debt default. Nevertheless, it seems quite likely that business activity will be depressed to some extent by the austerity measures and uncertainty over the outcome. We do own some companies that have direct exposure to European markets—pay TV provider Liberty Global gets most of its cable revenues from Europe and many of our multinational companies have significant European interests—but at this point, we do not see major downside risk to our portfolio from Europe.

China—Inflation, Growth Rate and Currency

China is a complicated and confusing element in the mix. We read that China is concerned about inflation and is tightening credit to dampen economic activity and fight inflation. That raises concerns among the producers and traders of all sorts of commodities associated with the growth of the Chinese economy. Skeptics about the Chinese economy point to significant overbuilding of residential and commercial real estate and a growing problem of credit issues among the banks that have financed the construction. U.S. Treasury officials and a growing number of their counterparts in other countries accuse China of maintaining an undervalued currency that supports its exports at the expense of its trading partners. Business people from the U.S. and other countries complain bitterly about the problems of counterfeiting and the theft of trade secrets by Chinese business “partners.”

Several of our companies are doing business with Chinese companies and are cautiously exploring direct investment in China. One of our analysts, Barton Hooper, has traveled to China and is scheduled to make another trip in

6 Weitz Funds

late May. He has visited both U.S. companies’ Chinese operations and domestic Chinese companies.

The American companies we follow seem to be proceeding with a healthy dose of skepticism as they seek business relationships in a country in which it is hard for foreigners to do business. We are excited about the prospects of entering a market of 1.2 billion consumers, but we are very cautious about the profits and cash flows we expect our companies to generate in China.

U.S. Budget Battles and Municipal Finance

Regardless of one’s political leanings, it is hard to be proud of the spectacle of our political leaders doing their jobs in Washington or in their various municipal venues. At all levels, it seems that office holders of both parties are more interested in scoring political points than making progress in solving the nation’s budget problems.

The haggling over short-term spending cuts seems to miss the point that the country has tens of trillions of dollars of unfunded Social Security, Medicare and Medicaid liabilities. One wag likened the debate to arguing over the bar bill on the Titanic. Without addressing the rate of growth of entitlement spending, it would seem inevitable that (short of default) the solution to our national debt burden will have to be inflation that dilutes the value of the lenders’ claims.

Bond investors are concerned about both credit risk and rising interest rates. We believe that fears of mass defaults by cities and states are badly overstated, but we are being very careful about each of the individual credits in our Nebraska Tax-Free Income Fund.

On the interest rate front, we face two separate issues. The Fed is holding interest rates at artificially low levels to encourage an economic recovery. That policy will eventually change. Also, current and prospective levels of government spending seem likely to eventually lead to inflation and higher interest rates.

Given this negative outlook for interest rates, Tom Carney is keeping the average maturity length of our bond portfolios at extremely short (conservative) levels. Tom elaborates on this dilemma in his portfolio manager’s review of the bond funds later in this report.

The impact of inflation on stocks is more complicated. When interest rates rise, bonds present stiffer investment competition to stocks. All things being equal, that would lead to lower valuations for stocks. On the other hand, companies with pricing power can cope with inflation and perform well. Most of our businesses have enough control over both their input costs and their product pricing to deal with gradually rising price levels.

Outlook

In spite of the foregoing tales of economic woe, we are actually very upbeat about the outlook for our Funds. Stocks are not as cheap as they were a year or two ago, but they are “reasonably” priced. This leaves room for appreciation in line with business value growth.

To earn “unreasonably” good returns, we will have to take advantage of market dips. We have to be careful what we cheer for, but it seems pretty likely that something in the news will make investors nervous from time to time. If we can be patient until opportunities arise, then have the courage of our convictions, we should be able to generate good returns over the next several years.

Our annual meeting will be held at 4:30 pm on May 19th at the Scott Conference Center. As usual, the format will be primarily Q&A with the portfolio managers and analysts. We look forward to seeing you there.

Sincerely,

| | |

| |

| | |

| Wallace R. Weitz | Bradley P. Hinton |

| wally@weitzfunds.com | brad@weitzfunds.com |

Portfolio composition is subject to change at any time and references to specific securities, industries, and sectors referenced in this letter are not recommendations to purchase or sell any particular security. Current and future portfolio holdings are subject to risk. See the Schedules of Investments included in this report for the percent of assets in each of the Funds invested in particular industries or sectors.

weitzfunds.com 7

A PERSPECTIVE ON GRAND CANYON EDUCATION

By David Perkins

Grand Canyon Education is home to Grand Canyon University, a private, regionally-accredited provider of post-secondary education based in Phoenix, Arizona. Originally founded as a non-profit Baptist university in 1949, Grand Canyon was purchased by current Chairman Brent Richardson and his brother, Chris Richardson, in 2004 and subsequently converted to a for-profit institution. Grand Canyon operates a traditional 100-acre campus located in Phoenix, as well as a sizeable online platform focused on serving working adults across the country. As of the end of 2010, Grand Canyon had total enrollment of approximately 41,500 students, 91% of whom attended classes online.

Challenging Environment

Grand Canyon is a contrarian investment, and we recognize that education is an emotionally-charged subject. Still, the reality is that the United States faces hard choices. Taxpayer funding for higher education is under pressure. Traditional universities often do not meet the educational needs of a growing number of non-traditional students, especially working adults. Community colleges receive enormous taxpayer subsidies and, as a whole, deliver sub-par student outcomes. Status quo does not appear sustainable, leaving higher education ripe for disruptive change. We think investor-funded education, when operated sensibly and regulated appropriately, can serve to benefit society and investors. We also openly wonder how the current U.S. post-secondary platform might look if we could start from scratch today. Our sense is that it would be quite different, incorporating a hybrid model built upon the strengths of both the traditional classroom and online settings. Regulations could be focused on incenting and encouraging the best student outcomes regardless of funding mechanism. Higher education would embrace technology as means of improving efficiency as opposed to viewing it as a threat.

Change does not always occur smoothly. The for-profit education industry has attracted significant congressional, regulatory, and investor scrutiny over the past year. Many have called into question the value proposition afforded its students, and a Government Accountability Office investigation last fall uncovered examples of aggressive and dishonest recruiting practices at several publicly-traded institutions (Grand Canyon was not one of them). In response, the U.S. Department of Education has tightened regulation of the industry and proposed rules that would tie eligibility for federal student aid to graduate incomes and federal loan repayment rates. The Department’s goal is to “weed out” institutions that have not acted in the best interest of students. We applaud this effort and agree that “bad actors” should be dealt with swiftly and severely.

Slower growth, lower profitability and the fear of collateral regulatory damage have dampened investor enthusiasm for the group after a decade of significant growth. Enrollments at for-profit institutions have slowed abruptly over the past couple of quarters, further pressuring the group. While it is difficult to determine the exact drivers of the recent slowdown, the following factors appear to have contributed: company-specific operational responses to the above-mentioned regulatory changes, increased competition for students with stronger academic profiles, the improving economy, a general unwillingness to borrow for college in the face of high unemployment and future economic uncertainty, and possible industry-wide reputational damage from months of negative press. While Grand Canyon has fared better than many of its peers thus far, it has certainly not been immune as enrollment growth has slowed considerably of late.

Unique Strategy in an Industry Ripe for Change

Given the list of challenges, why do we find shares of Grand Canyon attractive today? Our thesis centers on the company’s unique positioning amongst its for-profit peers. In short, we do not believe all for-profits are the same. Grand Canyon offers an attractive combination of programmatic focus (education and nursing students account for just shy of three quarters of the university’s enrollment), degree offerings (roughly half of GCU students are pursuing graduate-level degrees), and low tuition rates. We think Grand Canyon offers good value to its students and do not believe that the university’s educational platform will be materially impacted by heightened regulation.

Grand Canyon’s management team, headed by CEO Brian Mueller, has significant industry experience. The team has been building the university’s brand in the southwest region of the U.S. by investing heavily in its traditional campus, continuing to focus on the university’s Christian heritage and pursuing a move to Division I athletics. Despite the rise of online education over the past 10 years, many students still gravitate toward institutions that offer the look and feel of a traditional college experience. Grand Canyon offers this unique combination of old and new which, together with successful student outcomes, should fare well given the large and fragmented working adult market in the United States.

The outlook for Grand Canyon over our 3-5 year investment horizon remains positive, despite more limited visibility into the company’s near-term earnings power. The growing ground campus in a geographically appealing location has the potential to reach annual enrollment levels between 10,000-15,000 students (versus 3,000 today). Online growth avenues include expansion of Grand Canyon’s doctorate-level degree offerings, as well as the possible addition of a fourth educational vertical in Information Technology. Grand Canyon’s balance sheet currently boasts cash equaling roughly 10% of the company’s market cap and $50 million in owned real estate. We think earnings can grow, albeit modestly in the near term, from last year’s reported $1.08 per share. At $13.50, we believe Grand Canyon’s stock has an attractive risk / reward profile with an underlying business value well north of $20 per share.

David Perkins, CFA, joined Weitz in 2004. He graduated from Taylor University in Upland, IN and previously spent 2 ½ years as an equity analyst at McCarthy Group Asset Management. In addition to covering Grand Canyon Education, David has an emphasis on the Health Care, Energy and Materials sectors. |

8 Weitz Funds

PORTFOLIO MANAGERS’ DISCUSSION & ANALYSIS

Co-Portfolio Managers:

Wallace R. Weitz & Bradley P. Hinton

The Value Fund returned +5.7% in the quarter, compared to a +5.9% return for the S&P 500 and a +6.2% return for the Russell 1000. ConocoPhillips (+18%) posted solid gains as upheaval in the Middle East and North Africa drove oil prices higher. Insurance broker Aon Corporation (+16%) continued to integrate the Hewitt acquisition and to execute on its plan to grind margins higher over the next few years. Global consultant Accenture plc (+13%) posted terrific quarterly results and raised its outlook again. Microsoft (-9%) was the largest detractor from performance during the quarter. The company reported strong results with a reasonably positive outlook, yet the stock’s valuation continued to lag. We remain optimistic about Microsoft’s potential to deliver acceptable or better returns for the Fund over the next few years.

For the fiscal year ended March 31, 2011, the Fund increased +15.0% compared to a +15.7% gain for the S&P 500 and a +16.7% return for the Russell 1000. ConocoPhillips, Texas Instruments and Liberty Global were three standout contributors to results. ConocoPhillips executed on its strategic plan to sell non-core assets and return capital to shareholders. Texas Instruments delivered solid operating results, and the analog chip maker increased its share repurchase program and boosted its dividend. European cable operator Liberty Global announced another large acquisition in Germany, providing additional scale in a key market. Comcast, United Parcel Service, Accenture plc and Omnicom Group also generated strong returns as the economy rebounded. Apollo Group detracted from results as for-profit education companies faced increased regulatory and competitive headwinds. We sold the position last year, and the Fund no longer has exposure to the industry.

We purchased three new stocks during the quarter. CVS Caremark marries a leading retail pharmacy chain with a large pharmacy benefit manager (“PBM”). The combined company is the largest purchaser of drugs in the world, providing unrivaled scale. CVS trades at a substantial discount to the potential market value of its component parts, largely because many investors are skeptical that these two businesses belong together. Either way, we like the company’s free cash flow generation, growth potential, and shareholder-friendly capital plan.

Target is the well-known, leading discount retailer headquartered in Minneapolis. The company’s “PFresh” initiative, which adds more grocery items to its general merchandise stores, is off to a strong start. The company also introduced a revamped Target REDCard, a store-brand credit card that provides a 5% discount on nearly all purchases. We expect these investments to drive incremental traffic and profitable sales. In addition, Target will soon bring its “Expect More, Pay Less” tagline to Canada as it re-brands a portfolio of recently acquired stores. The company generates more cash than it needs to run its business, and management is returning excess capital to shareholders via dividend and share repurchase.

Anheuser-Busch InBev NV is a leading global brewer headquartered in Belgium. The company has dominant positions in several attractive beer markets, and a portfolio that includes thirteen billion dollar brands. The beer business is very profitable with handsome margins and strong returns on equity. Management is disciplined and shareholder-friendly. The company should have an opportunity to increase dividends and repurchase shares with its growing free cash flow over the next several years. The stock trades at a reasonable valuation compared to current earnings and a very low multiple of potential free cash flow per share in 2012 and beyond.

The Value Fund tilts toward our best larger company ideas. We continued to tighten the Fund’s focus without sacrificing on price, as many world-class businesses traded at discounts to their underlying values. The Fund remains relatively concentrated, with the twenty largest positions representing more than 70% of net assets. The Fund’s residual cash position is relatively unchanged at 16% of net assets at quarter end.

| New and Eliminated Securities for Quarter Ended March 31, 2011 |

| New Purchases ($mil) | | | | | Eliminations ($mil) |

| Target | | $ | 15.2 | | None |

| CVS Caremark | | | 14.9 | | |

| Anheuser-Busch InBev | | | 5.5 | | |

weitzfunds.com 9

VALUE FUND

PERFORMANCE • (UNAUDITED)

| | Total Returns | Average Annual Total Returns |

| | 3 Mos. | 1 Year | 3 Year | 5 Year | 10 Year | 15 Year | 20 Year |

| Value | 5.7% | 15.0% | 3.1% | 0.4% | 2.5% | 9.0% | 10.5% |

| S&P 500 | 5.9 | 15.7 | 2.4 | 2.6 | 3.3 | 6.8 | 8.7 |

| Russell 1000 | 6.2 | 16.7 | 3.0 | 2.9 | 3.8 | 7.1 | N/A |

| Russell 1000 Value | 6.5 | 15.2 | 0.6 | 1.4 | 4.5 | 7.7 | N/A |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Value Fund for the period March 31 2001 through March 31, 2011, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

| | | | Value | | | S&P 500 | | | Relative | |

| Year | | | (1) | | | (2) | | | Results (1)-(2) | |

| | | | | | | | |

| 1986 (5/9/86) | | | 3.5 | % | | 4.1 | % | | -0.6 | % |

| 1987 | | | -0.5 | | | 5.1 | | | -5.6 | |

| 1988 | | | 16.4 | | | 16.6 | | | -0.2 | |

| 1989 | | | 22.1 | | | 31.7 | | | -9.6 | |

| 1990 | | | -5.2 | | | -3.1 | | | -2.1 | |

| 1991 | | | 27.6 | | | 30.5 | | | -2.9 | |

| 1992 | | | 13.6 | | | 7.6 | | | 6.0 | |

| 1993 | | | 20.0 | | | 10.1 | | | 9.9 | |

| 1994 | | | -9.8 | | | 1.3 | | | -11.1 | |

| 1995 | | | 38.4 | | | 37.6 | | | 0.8 | |

| 1996 | | | 18.7 | | | 23.0 | | | -4.3 | |

| 1997 | | | 38.9 | | | 33.4 | | | 5.5 | |

| 1998 | | | 28.9 | | | 28.6 | | | 0.3 | |

| 1999 | | | 21.0 | | | 21.0 | | | 0.0 | |

| 2000 | | | 19.6 | | | -9.1 | | | 28.7 | |

| 2001 | | | 0.2 | | | -11.9 | | | 12.1 | |

| 2002 | | | -17.1 | | | -22.1 | | | 5.0 | |

| 2003 | | | 28.7 | | | 28.7 | | | 0.0 | |

| 2004 | | | 15.7 | | | 10.9 | | | 4.8 | |

| 2005 | | | -2.8 | | | 4.9 | | | -7.7 | |

| 2006 | | | 21.8 | | | 15.8 | | | 6.0 | |

| 2007 | | | -10.3 | | | 5.5 | | | -15.8 | |

| 2008 | | | -40.7 | | | -37.0 | | | -3.7 | |

| 2009 | | | 27.6 | | | 26.5 | | | 1.1 | |

| 2010 | | | 19.9 | | | 15.1 | | | 4.8 | |

| 2011 (3/31/11) | | | 5.7 | | | 5.9 | | | -0.2 | |

| Since Inception: | | | | | | | | | | |

| Cumulative Return | | | 1,067.6 | | | 890.5 | | | 177.1 | |

| Avg. Annual Return | | | 10.4 | | | 9.6 | | | 0.8 | |

These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent Prospectus are 1.25% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses by the Adviser. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp.

See page 4 for additional performance disclosures.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10 Weitz Funds

VALUE FUND

PORTFOLIO PROFILE • (UNAUDITED)

| Top Ten Stocks |

| Aon | | | 5.0 | % |

| Liberty Media - Interactive | | | 4.7 | |

| Microsoft | | | 4.7 | |

| Dell | | | 4.5 | |

| Texas Instruments | | | 4.3 | |

| ConocoPhillips | | | 4.1 | |

| Berkshire Hathaway | | | 4.1 | |

| United Parcel Service | | | 4.1 | |

| Omnicare | | | 4.0 | |

| Accenture | | | 4.0 | |

| % of Net Assets | | | 43.5 | % |

| Industry Sectors | |

| Information Technology | | | 20.9 | % |

| Consumer Discretionary | | | 15.6 | |

| Financials | | | 11.6 | |

| Industrials | | | 9.1 | |

| Materials | | | 7.9 | |

| Consumer Staples | | | 7.7 | |

| Energy | | | 5.9 | |

| Health Care | | | 5.8 | |

| Short-Term Securities/Other | | | 15.5 | |

| Net Assets | | | 100.0 | % |

| Top Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| ConocoPhillips | 18.3% | 4.7% | 0.8% |

| Omnicare | 18.3 | 4.4 | 0.8 |

| Aon | 15.5 | 5.0 | 0.7 |

| Liberty Global | 18.0 | 3.4 | 0.6 |

| Accenture | 13.4 | 4.3 | 0.6 |

Source: FactSet Portfolio Analytics

| Bottom Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| Microsoft | (8.6)% | 5.1% | (0.4)% |

| Martin Marietta Materials | (2.3) | 2.7 | (0.1) |

| Wal-Mart | (2.8) | 2.8 | (0.1) |

| Procter & Gamble | (3.5) | 1.4 | (0.1) |

| Google | (1.3) | 3.6 | 0.0 |

Source: FactSet Portfolio Analytics

weitzfunds.com 11

VALUE FUND

SCHEDULE OF INVESTMENTS • MARCH 31, 2011

| COMMON STOCKS — 84.5% | | Shares | | | Value | |

| Information Technology — 20.9% | | | | | | |

| Software — 4.7% | | | | | | |

| Microsoft Corp. | | | 1,800,000 | | | $ | 45,648,000 | |

| Computers & Peripherals — 4.5% | | | | | | | | |

| Dell, Inc.* | | | 3,000,000 | | | | 43,530,000 | |

| Semiconductors — 4.3% | | | | | | | | |

| Texas Instruments, Inc. | | | 1,200,000 | | | | 41,472,000 | |

| IT Services — 3.9% | | | | | | | | |

| Accenture plc - CL A | | | 700,000 | | | | 38,479,000 | |

| Internet Software & Services — 3.5% | | | | | | | | |

| Google, Inc. - CL A* | | | 58,000 | | | | 34,000,180 | |

| | | | | | | | 203,129,180 | |

| Consumer Discretionary — 15.6% | | | | | | | | |

| Cable & Satellite — 6.5% | | | | | | | | |

| Liberty Global, Inc. - Series C* | | | 850,000 | | | | 33,991,500 | |

| Comcast Corp. - CL A Special | | | 1,250,000 | | | | 29,025,000 | |

| | | | | | | | 63,016,500 | |

| Internet & Catalog Retail — 4.7% | | | | | | | | |

| Liberty Media Corp. - | | | | | | | | |

| Interactive - Series A* | | | 2,850,000 | | | | 45,714,000 | |

| Advertising — 2.9% | | | | | | | | |

| Omnicom Group, Inc. | | | 575,000 | | | | 28,209,500 | |

| Multiline Retail — 1.5% | | | | | | | | |

| Target Corp. | | | 300,000 | | | | 15,003,000 | |

| | | | | | | | 151,943,000 | |

| Financials — 11.6% | | | | | | | | |

| Insurance Brokers — 5.0% | | | | | | | | |

| Aon Corp. | | | 925,000 | | | | 48,988,000 | |

| Property & Casualty Insurance — 4.1% | | | | | | | | |

| Berkshire Hathaway, Inc. - CL B* | | | 475,000 | | | | 39,724,250 | |

| Mortgage REIT’s — 2.5% | | | | | | | | |

| Redwood Trust, Inc. | | | 1,541,322 | | | | 23,967,557 | |

| | | | | | | | 112,679,807 | |

| Industrials — 9.1% | | | | | | | | |

| Air Freight & Logistics — 4.0% | | | | | | | | |

| United Parcel Service, Inc. - CL B | | | 530,000 | | | | 39,389,600 | |

| Industrial Conglomerates — 3.2% | | | | | | | | |

| Tyco International Ltd. | | | 700,000 | | | | 31,339,000 | |

| Aerospace & Defense — 1.9% | | | | | | | | |

| Lockheed Martin Corp. | | | 225,000 | | | | 18,090,000 | |

| | | | | | | | 88,818,600 | |

| Materials — 7.9% | | | | | | | | |

| Construction Materials — 4.7% | | | | | | | | |

| Martin Marietta Materials, Inc. | | | 300,000 | | | | 26,901,000 | |

| Vulcan Materials Co. | | | 400,000 | | | | 18,240,000 | |

| | | | | | | | 45,141,000 | |

| Fertilizers & Agricultural Chemicals — 1.8% | | | | | | | | |

| Monsanto Co. | | | 240,000 | | | | 17,342,400 | |

| | | Principal | | | | |

| | | amount | | | | |

| | | or shares | | | Value | |

| Industrial Gases — 1.4% | | | | | | |

| Praxair, Inc. | | | 135,000 | | | $ | 13,716,000 | |

| | | | | | | | 76,199,400 | |

| Consumer Staples — 7.7% | | | | | | | | |

| Food & Staples Retailing — 4.2% | | | | | | | | |

| Wal-Mart Stores, Inc. | | | 500,000 | | | | 26,025,000 | |

| CVS Caremark Corp. | | | 450,000 | | | | 15,444,000 | |

| | | | | | | | 41,469,000 | |

| Beverages — 2.1% | | | | | | | | |

| Diageo plc - Sponsored ADR | | | 190,000 | | | | 14,481,800 | |

| Anheuser-Busch InBev SA/NV - | | | | | | | | |

| Sponsored ADR | | | 100,000 | | | | 5,717,000 | |

| | | | | | | | 20,198,800 | |

| Household Products — 1.4% | | | | | | | | |

| The Procter & Gamble Co. | | | 220,000 | | | | 13,552,000 | |

| | | | | | | | 75,219,800 | |

| Energy — 5.9% | | | | | | | | |

| Integrated Oil & Gas — 4.1% | | | | | | | | |

| ConocoPhillips | | | 500,000 | | | | 39,930,000 | |

| Oil & Gas Exploration & Production — 1.8% | | | | | | | | |

| Southwestern Energy Co.* | | | 402,653 | | | | 17,302,000 | |

| | | | | | | | 57,232,000 | |

| Health Care — 5.8% | | | | | | | | |

| Health Care Services — 4.0% | | | | | | | | |

| Omnicare, Inc. | | | 1,300,000 | | | | 38,987,000 | |

| Health Care Equipment — 1.8% | | | | | | | | |

| Baxter International, Inc. | | | 315,000 | | | | 16,937,550 | |

| | | | | | | | 55,924,550 | |

| Other — 0.0% | | | | | | | | |

| Other — 0.0% | | | | | | | | |

| Adelphia Recovery Trust, | | | | | | | | |

Series ACC-7* # | | | 3,535,000 | | | | — | |

| Total Common Stocks | | | | | | | | |

| (Cost $687,224,475) | | | | | | | 821,146,337 | |

| | | | | | | | | |

| SHORT-TERM SECURITIES — 13.7% | | | | | | | | |

| Wells Fargo Advantage Government Money Market Fund - | | | | | | | | |

Institutional Class 0.01%(a) | | | 11,578,635 | | | | 11,578,635 | |

| U.S. Treasury Bills, 0.06% to 0.14%, | | | | | | | | |

4/07/11 to 6/30/11(b) | | $ | 121,500,000 | | | | 121,491,312 | |

| Total Short-Term Securities | | | | | | | | |

| (Cost $133,066,393) | | | | | | | 133,069,947 | |

| Total Investments in Securities | | | | | | | | |

| (Cost $820,290,868) | | | | | | | 954,216,284 | |

| Other Assets Less Other Liabilities — 1.8% | | | | | | | 17,068,803 | |

| Net Assets — 100.0% | | | | | | $ | 971,285,087 | |

| Net Asset Value Per Share | | | | | | $ | 30.07 | |

| * | Non-income producing |

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Rate presented represents the annualized 7-day yield at March 31, 2011. |

| (b) | Interest rates presented represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

12 Weitz Funds

PORTFOLIO MANAGERS’ DISCUSSION & ANALYSIS

Co-Portfolio Managers:

Wallace R. Weitz & Bradley P. Hinton

The Partners Value Fund returned +7.1% in the first calendar quarter, compared to a +5.9% return for the S&P 500 and a +6.4% return for the Russell 3000. Oil and gas companies SandRidge Energy (+75%) and ConocoPhillips (+18%) posted strong gains as upheaval in the Middle East and North Africa drove oil prices higher. Omnicare (+18%) rose as new CEO John Figueroa laid out an encouraging two-year road map for transforming the company into a more customer-centric and profitable organization. Insurance broker Aon Corporation (+16%) continued to integrate the Hewitt acquisition and to execute on its plan to grind margins higher over the next few years. Grand Canyon Education (-26%) was the largest detractor from results for the quarter and fiscal year. David Perkins describes our investment thesis in depth in this report’s Analyst Corner.

For the fiscal year ended March 31, 2011, the Fund increased +20.9% compared to a +15.7% gain for the S&P 500 and a +17.4% gain for the Russell 3000. SandRidge Energy and Coinstar were two standout contributors to results. SandRidge’s strategic asset sales have exceeded expectations, and the company’s acreage in the Horizontal Mississippian play has shown very promising early results. Coinstar continued to roll out Redbox DVD kiosks and take market share. We sold the stock in the low-$60’s late last year as it reached our value estimate. Other strong performers highlight the investment flexibility of the Fund. Large-cap bellwethers Accenture, ConocoPhillips and Texas Instruments delivered strong returns, as did smaller companies such as Nebraska-based retailer Cabela’s and software maker ACI Worldwide. For-profit education companies detracted from results as they faced regulatory and competitive headwinds during the fiscal year. We have focused our industry investment primarily in Grand Canyon, which we think has several unique attributes (see Analyst Corner for details).

We purchased three new stocks during the quarter. Southwestern Energy is a best-in-class, low-cost natural gas producer with attractive growth prospects. The company is the dominant player in the Fayetteville Shale, a large and prolific gas field in Arkansas. Southwestern generates solid all-in returns on capital in the Fayetteville, even at today’s low natural gas prices. While our thesis does not depend on it, we also think the stock provides a cheap option on higher natural gas prices over the next several years. CVS Caremark marries a leading retail pharmacy chain with a large pharmacy benefit manager (“PBM”). The combined company is the largest purchaser of drugs in the world, providing unrivaled scale. CVS trades at a substantial discount to the potential market value of its component parts, largely because many investors are skeptical that these two businesses belong together. Either way, we like the company’s free cash flow generation, growth potential, and shareholder-friendly capital plan. Finally, we purchased leading discount retailer Target at what we think is a compelling valuation.

We sold three stocks at substantial gains during the quarter. We eliminated Liberty Media – Starz near our value estimate as investors became excited about the potential for a more lucrative distribution agreement with Netflix. From today’s stock price, the investment thesis relies more on original programming success, which we feel less confident about our ability to predict. We also sold long-time holding Cabela’s when the stock spiked in February. We applaud the job that management has done over the years and would gladly partner with the Cabela’s team again at the right price. Finally, we eliminated short-time holding Iron Mountain as activist investors agitated for change, driving the stock up to our value estimate. While cage rattling may create incremental value over time, we are not willing to depend on it.

Partners Value is a flexible, multi-cap fund that invests in companies of all sizes. We have continued to tilt the portfolio towards larger and, we think, higher quality companies where we are finding the most value. New additions Southwestern Energy, CVS Caremark and Target are three examples. The Fund’s residual cash position remained unchanged at 22% of net assets.

| New and Eliminated Securities for Quarter Ended March 31, 2011 |

| New Purchases ($mil) | | Eliminations ($mil) |

| Target | | $ | 9.9 | | | Liberty Media - Starz | | $ | 11.5 | |

| Southwestern Energy | | | 7.9 | | | Cabela’s | | | 9.1 | |

| CVS Caremark | | | 7.4 | | | Iron Mountain | | | 6.2 | |

weitzfunds.com 13

PARTNERS VALUE FUND

PERFORMANCE • (UNAUDITED)

| | | | Total Returns | | Average Annual Total Returns |

| | | | 3 Mos. | | 1 Year | | 3 Year | | 5 Year | | 10 Year | | 15 Year | | 20 Year | | 25 Year |

| | Partners Value | | 7.1% | | 20.9% | | 8.4% | | 3.8% | | 3.8% | | 10.3% | | 11.7% | | 11.2% |

| | S&P 500 | | 5.9 | | 15.7 | | 2.4 | | 2.6 | | 3.3 | | 6.8 | | 8.7 | | 9.6 |

| | Russell 3000 | | 6.4 | | 17.4 | | 3.4 | | 3.0 | | 4.1 | | 7.1 | | N/A | | N/A |

| | Russell 3000 Value | | 6.5 | | 15.6 | | 1.1 | | 1.4 | | 4.9 | | 7.8 | | N/A | | N/A |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in the Partners Value Fund for the period March 31, 2001 through March 31, 2011, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

| | | | | Partners | | | | Relative |

| | | | | Value | | S&P 500 | | Results |

| | Year | | | (1) | | (2) | | (1)-(2) |

| | 1983 (6/1/83) | | | 9.9 | % | | 4.2 | % | | 5.7 | % |

| | 1984 | | | 14.5 | | | 6.1 | | | 8.4 | |

| | 1985 | | | 40.7 | | | 31.6 | | | 9.1 | |

| | 1986 | | | 11.1 | | | 18.6 | | | -7.5 | |

| | 1987 | | | 4.3 | | | 5.1 | | | -0.8 | |

| | 1988 | | | 14.9 | | | 16.6 | | | -1.7 | |

| | 1989 | | | 20.3 | | | 31.7 | | | -11.4 | |

| | 1990 | | | -6.3 | | | -3.1 | | | -3.2 | |

| | 1991 | | | 28.1 | | | 30.5 | | | -2.4 | |

| | 1992 | | | 15.1 | | | 7.6 | | | 7.5 | |

| | 1993 | | | 23.0 | | | 10.1 | | | 12.9 | |

| | 1994 | | | -9.0 | | | 1.3 | | | -10.3 | |

| | 1995 | | | 38.7 | | | 37.6 | | | 1.1 | |

| | 1996 | | | 19.1 | | | 23.0 | | | -3.9 | |

| | 1997 | | | 40.6 | | | 33.4 | | | 7.2 | |

| | 1998 | | | 29.1 | | | 28.6 | | | 0.5 | |

| | 1999 | | | 22.1 | | | 21.0 | | | 1.1 | |

| | 2000 | | | 21.1 | | | -9.1 | | | 30.2 | |

| | 2001 | | | -0.9 | | | -11.9 | | | 11.0 | |

| | 2002 | | | -17.0 | | | -22.1 | | | 5.1 | |

| | 2003 | | | 25.4 | | | 28.7 | | | -3.3 | |

| | 2004 | | | 15.0 | | | 10.9 | | | 4.1 | |

| | 2005 | | | -2.4 | | | 4.9 | | | -7.3 | |

| | 2006 | | | 22.5 | | | 15.8 | | | 6.7 | |

| | 2007 | | | -8.5 | | | 5.5 | | | -14.0 | |

| | 2008 | | | -38.1 | | | -37.0 | | | -1.1 | |

| | 2009 | | | 31.3 | | | 26.5 | | | 4.8 | |

| | 2010 | | | 27.5 | | | 15.1 | | | 12.4 | |

| | 2011 (3/31/11) | | | 7.1 | | | 5.9 | | | 1.2 | |

| | Since Inception: | | | | | | | | | | |

| | Cumulative | | | | | | | | | | |

| | Return | | | 2,698.9 | | | 1,545.1 | | | 1,153.8 | |

| | Avg. Annual | | | | | | | | | | |

| | Return | | | 12.7 | | | 10.6 | | | 2.1 | |

These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent Prospectus are 1.26% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses by the Adviser. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp. See page 4 for additional performance disclosures.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance of the Partners Value Fund (the “Fund”) is measured from June 1, 1983, the inception of Weitz Partners II Limited Partnership (the “Partnership”). As of December 31, 1993, the Fund succeeded to substantially all of the assets of the Partnership. The investment objectives, policies and restrictions of the Fund are materially equivalent to those of the Partnership and the Partnership was managed at all times with full investment authority by Wallace R. Weitz & Company. The performance information includes performance for the period before the Fund became an investment company registered with the Securities and Exchange Commission. During this period, the Partnership was not registered under the Investment Company Act of 1940 and, therefore, was not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If the Partnership had been registered under the 1940 Act during this period, the Partnership’s performance might have been adversely affected.

14 Weitz Funds

PARTNERS VALUE FUND

PORTFOLIO PROFILE • (UNAUDITED)

| Top Ten Stocks |

| Omnicare | | | 4.5 | % |

| Aon | | | 4.2 | |

| Microsoft | | | 4.2 | |

| SandRidge Energy | | | 4.1 | |

| Liberty Media - Interactive | | | 4.0 | |

| Berkshire Hathaway | | | 3.9 | |

| Dell | | | 3.7 | |

| Accenture | | | 3.4 | |

| Texas Instruments | | | 3.3 | |

| Redwood Trust | | | 3.3 | |

| % of Net Assets | | | 38.6 | % |

| Industry Sectors |

| Consumer Discretionary | | | 20.7 | % |

| Information Technology | | | 18.1 | |

| Financials | | | 13.7 | |

| Energy | | | 8.5 | |

| Health Care | | | 7.3 | |

| Materials | | | 6.5 | |

| Industrials | | | 2.2 | |

| Consumer Staples | | | 1.0 | |

| Short-Term Securities/Other | | | 22.0 | |

| Net Assets | | | 100.0 | % |

| Top Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| SandRidge Energy | 74.9% | 3.6% | 2.1% |

| Omnicare | 18.3 | 4.7 | 0.8 |

| Aon | 15.5 | 3.9 | 0.6 |

| Liberty Global | 18.0 | 3.1 | 0.5 |

| ConocoPhillips | 18.3 | 3.0 | 0.5 |

Source: FactSet Portfolio Analytics

| Bottom Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| Grand Canyon Education | (26.0)% | 2.3% | (0.7)% |

| Microsoft | (8.6) | 4.0 | (0.3) |

| Live Nation Entertainment | (12.4) | 1.9 | (0.3) |

| Martin Marietta Materials | (2.3) | 1.9 | (0.1) |

| Strayer Education | (13.6) | 0.3 | (0.1) |

Source: FactSet Portfolio Analytics

weitzfunds.com 15

PARTNERS VALUE FUND

SCHEDULE OF INVESTMENTS • MARCH 31, 2011

| COMMON STOCKS — 78.0% | | Shares | | | Value | |

| Consumer Discretionary — 20.7% | | | | | | |

| Cable & Satellite — 6.7% | | | | | | |

| Liberty Global, Inc. - Series C* | | | 585,000 | | | $ | 23,394,150 | |

| Comcast Corp. - CL A Special | | | 650,000 | | | | 15,093,000 | |

| Liberty Media Corp. - | | | | | | | | |

| Capital - Series A* | | | 160,000 | | | | 11,787,200 | |

| | | | | | | | 50,274,350 | |

| Internet & Catalog Retail — 4.0% | | | | | | | | |

| Liberty Media Corp. - | | | | | | | | |

| Interactive - Series A* | | | 1,900,000 | | | | 30,476,000 | |

| Education Services — 2.3% | | | | | | | | |

| Grand Canyon Education, Inc.* | | | 1,047,804 | | | | 15,193,158 | |

| Strayer Education, Inc. | | | 18,000 | | | | 2,348,820 | |

| | | | | | | | 17,541,978 | |

| Household Durables — 2.0% | | | | | | | | |

| Mohawk Industries, Inc.* | | | 250,000 | | | | 15,287,500 | |

| Movies & Entertainment — 1.9% | | | | | | | | |

| Live Nation Entertainment, Inc.* | | | 1,400,000 | | | | 14,000,000 | |

| Hotels, Restaurants & Leisure — 1.6% | | | | | | | | |

| Interval Leisure Group, Inc.* | | | 750,000 | | | | 12,262,500 | |

| Multiline Retail — 1.3% | | | | | | | | |

| Target Corp. | | | 200,000 | | | | 10,002,000 | |

| Publishing — 0.9% | | | | | | | | |

| The Washington Post Co. - CL B | | | 15,000 | | | | 6,563,400 | |

| | | | | | | | 156,407,728 | |

| Information Technology — 18.1% | | | | | | | | |

| Software — 4.5% | | | | | | | | |

| Microsoft Corp. | | | 1,250,000 | | | | 31,700,000 | |

| ACI Worldwide, Inc.* | | | 61,300 | | | | 2,010,640 | |

| | | | | | | | 33,710,640 | |

| Computers & Peripherals — 3.7% | | | | | | | | |

| Dell, Inc.* | | | 1,900,000 | | | | 27,569,000 | |

| IT Services — 3.3% | | | | | | | | |

| Accenture plc - CL A | | | 460,000 | | | | 25,286,200 | |

| Semiconductors — 3.3% | | | | | | | | |

| Texas Instruments, Inc. | | | 730,000 | | | | 25,228,800 | |

| Internet Software & Services — 3.3% | | | | | | | | |

| Google, Inc. - CL A* | | | 26,000 | | | | 15,241,460 | |

| The Knot, Inc.* | | | 802,691 | | | | 9,672,427 | |

| | | | | | | | 24,913,887 | |

| | | | | | | | 136,708,527 | |

| Financials — 13.7% | | | | | | | | |

| Insurance Brokers — 6.5% | | | | | | | | |

| Aon Corp. | | | 600,000 | | | | 31,776,000 | |

| Willis Group Holdings Ltd. | | | 300,000 | | | | 12,108,000 | |

| Brown & Brown, Inc. | | | 200,000 | | | | 5,160,000 | |

| | | | | | | | 49,044,000 | |

| Property & Casualty Insurance — 3.9% | | | | | | | | |

| Berkshire Hathaway, Inc. - CL B* | | | 350,000 | | | | 29,270,500 | |

| | | | | | | | | |

| | | Shares | | | Value | |

| Mortgage REIT’s — 3.3% | | | | | | | | |

| Redwood Trust, Inc. | | | 1,610,000 | | | $ | 25,035,500 | |

| | | | | | | | 103,350,000 | |

| Energy — 8.5% | | | | | | | | |

| Oil & Gas Exploration & Production — 5.3% | | | | | | | | |

| SandRidge Energy, Inc.* | | | 2,400,000 | | | | 30,720,000 | |

| Southwestern Energy Co.* | | | 212,100 | | | | 9,113,937 | |

| | | | | | | | 39,833,937 | |

| Integrated Oil & Gas — 3.2% | | | | | | | | |

| ConocoPhillips | | | 300,000 | | | | 23,958,000 | |

| | | | | | | | 63,791,937 | |

| Health Care — 7.3% | | | | | | | | |

| Health Care Services — 7.3% | | | | | | | | |

| Omnicare, Inc. | | | 1,134,700 | | | | 34,029,653 | |

| Laboratory Corp. of America Holdings* | | | 225,000 | | | | 20,729,250 | |

| | | | | | | | 54,758,903 | |

| Materials — 6.5% | | | | | | | | |

| Construction Materials — 4.7% | | | | | | | | |

| Eagle Materials, Inc. | | | 550,000 | | | | 16,643,000 | |

| Martin Marietta Materials, Inc. | | | 160,000 | | | | 14,347,200 | |

| Vulcan Materials Co. | | | 100,000 | | | | 4,560,000 | |

| | | | | | | | 35,550,200 | |

| Fertilizers & Agricultural Chemicals — 1.3% | | | | | | | | |

| Monsanto Co. | | | 140,000 | | | | 10,116,400 | |

| Metals & Mining — 0.5% | | | | | | | | |

| Compass Minerals International, Inc. | | | 40,700 | | | | 3,806,671 | |

| | | | | | | | 49,473,271 | |

| Industrials — 2.2% | | | | | | | | |

| Industrial Conglomerates — 2.2% | | | | | | | | |

| Tyco International Ltd. | | | 365,000 | | | | 16,341,050 | |

| Consumer Staples — 1.0% | | | | | | | | |

| Food & Staples Retailing — 1.0% | | | | | | | | |

| CVS Caremark Corp. | | | 225,000 | | | | 7,722,000 | |

| Other — 0.0% | | | | | | | | |

| Other — 0.0% | | | | | | | | |

| Adelphia Recovery Trust, | | | | | | | | |

Series ACC-7* # | | | 2,310,000 | | | | — | |

| Total Common Stocks | | | | | | | | |

| (Cost $487,236,158) | | | | | | | 588,553,416 | |

The accompanying notes form an integral part of these financial statements.

16 Weitz Funds

| | | Principal | | | | |

| SHORT-TERM | | amount | | | | |

| SECURITIES — 22.7% | | or shares | | | Value | |

| Wells Fargo Advantage Government Money Market Fund - | | | | | | |

Institutional Class 0.01%(a) | | | 12,870,700 | | | $ | 12,870,700 | |

| U.S. Treasury Bills, 0.06% to 0.14%, | | | | | | | | |

4/07/11 to 6/30/11(b) | | $ | 158,500,000 | | | | 158,490,195 | |

| Total Short-Term Securities | | | | | | | | |

| (Cost $171,356,316) | | | | | | | 171,360,895 | |

| Total Investments in Securities | | | | | | | | |

| (Cost $658,592,474) | | | | | | | 759,914,311 | |

| Other Liabilities in Excess of Other Assets — (0.7%) | | | | | | | (5,316,655 | ) |

| Net Assets — 100.0% | | | | | | $ | 754,597,656 | |

| Net Asset Value Per Share | | | | | | $ | 22.05 | |

| * | Non-income producing |

| # | Illiquid and/or restricted security that has been fair valued. |

| (a) | Rate presented represents the annualized 7-day yield at March 31, 2011. |

| (b) | Interest rates presented represent the yield to maturity at the date of purchase. |

The accompanying notes form an integral part of these financial statements.

weitzfunds.com 17

PORTFOLIO MANAGER’S DISCUSSION & ANALYSIS

Portfolio Manager: Wallace R. Weitz

The Partners III Opportunity Fund returned +8.5% in the quarter, compared to a +5.9% return for the S&P 500 and a +6.4% return for the Russell 3000. Oil and gas companies SandRidge Energy (+75%) and ConocoPhillips (+18%) posted strong gains as upheaval in the Middle East and North Africa drove oil prices higher. Omnicare (+18%) rose as new CEO John Figueroa laid out an encouraging two-year road map for transforming the company into a more customer-centric and profitable organization. Ascent Media (+26%) continued its climb as investors digested the company’s strategic shift into the security-monitoring business. Grand Canyon Education (-26%) was the largest individual detractor from results for the quarter and fiscal year. David Perkins describes our investment thesis in depth in this report’s Analyst Corner.

For the fiscal year ended March 31, 2011, the Fund increased +24.4% compared to a +15.7% gain for the S&P 500 and a +17.4% gain for the Russell 3000. SandRidge Energy, Liberty Media – Capital and Coinstar were three standout contributors to results. SandRidge’s strategic asset sales have exceeded expectations, and the company’s acreage in the Horizontal Mississippian play has shown very promising early results. Liberty Media – Capital’s investment in Sirius XM Radio has been the gift that keeps giving. While Liberty Capital’s stock more than doubled during the fiscal year, our value estimate for the company rose dramatically as well. Coinstar continued to roll out Redbox DVD kiosks and take market share. We sold the stock in the low-$60’s late last year as it reached our value estimate. Other strong performers included recent portfolio additions Texas Instruments, Aon Corporation and Accenture plc. In addition to Grand Canyon, software giant Microsoft and the Fund’s short positions were the weakest performers for the fiscal year.

We purchased three new stocks during the quarter. Target is the well-known, leading discount retailer headquartered in Minneapolis. The company’s “PFresh” initiative, which adds more grocery items to its general merchandise stores, is off to a strong start. The company also introduced a revamped Target REDCard, a store-brand credit card that provides a 5% discount on nearly all purchases. We expect these investments to drive incremental traffic and profitable sales. Target generates more cash than it needs to run its business, and management is returning excess capital to shareholders via dividend and share repurchase. Texas Industries is a regional cement, aggregates and concrete company based in Dallas. We think the company’s strategic asset base is worth far more than today’s enterprise valuation. While the near-term outlook remains muted, patient investors have several possible ways to win over time. Finally, we purchased a small position in Knology, a cable operator in smaller markets in the Southeast and Midwest.

We sold three stocks at substantial gains during the quarter. We eliminated Liberty Media – Starz near our value estimate as investors became excited about the potential for a more lucrative distribution agreement with Netflix. From today’s stock price, the investment thesis depends more on original programming success, which we feel less confident about our ability to predict. We also sold long-time holding Cabela’s when the stock spiked in February. We applaud the job that management has done over the years, and we would gladly own the stock again at the right price. Finally, we eliminated short-time holding Iron Mountain as activist investors agitated for change, driving the stock up to our value estimate. While cage rattling may create incremental value over time, we are not willing to depend on it.

Partners III Opportunity has the broadest toolkit of our equity funds. The Fund invests in companies of all sizes, and typically maintains short positions to help manage risk. Partners III is 68% “net long” at quarter end. Long positions are 82% of net assets, while short positions are 14% of net assets. The Fund’s short positions remain tilted to broad-based small and mid-cap stock ETF’s.

| New and Eliminated Securities for Quarter Ended March 31, 2011 |

| New Purchases ($mil) | | Eliminations ($mil) |

| Target | | $ | 7.5 | | | Liberty Media - Starz | | $ | 7.0 | |

| Texas Industries | | | 2.4 | | | Cabela’s | | | 3.7 | |

| Knology | | | 0.4 | | | Iron Mountain | | | 3.1 | |

18 Weitz Funds

PARTNERS III OPPORTUNITY FUND

PERFORMANCE • (UNAUDITED)

| | | Total Returns | | | | Average Annual Total Returns |

| | | 3 Mos. | | 1Year | | 3Year | | 5Year | | 10Year | | 15Year | | 20Year | | 25Year |

| Partners III | | 8.5% | | 24.4% | | 13.9% | | 6.6% | | 8.1% | | 12.2% | | 13.5% | | 12.1% |

| S&P 500 | | 5.9 | | 15.7 | | 2.4 | | 2.6 | | 3.3 | | 6.8 | | 8.7 | | 9.6 |

| Russell 3000 | | 6.4 | | 17.4 | | 3.4 | | 3.0 | | 4.1 | | 7.1 | | N/A | | N/A |

| Russell 3000 Value | | 6.5 | | 15.6 | | 1.1 | | 1.4 | | 4.9 | | 7.8 | | N/A | | N/A |

Growth of $10,000

This chart depicts the change in the value of a $10,000 investment in Partners III for the period March 31, 2001 through March 31, 2011, as compared with the growth of the Standard & Poor’s 500 Index during the same period. Index performance is hypothetical and is shown for illustrative purposes only.

| | | | | Partners III | | S&P 500 | | Relative |

| | Year | | | (1) | | (2) | | Results (1)-(2) |

| | 1983 (6/1/83) | | | 8.6 | % | | 4.2 | % | | 4.4 | % |

| | 1984 | | | 11.2 | | | 6.1 | | | 5.1 | |

| | 1985 | | | 38.6 | | | 31.6 | | | 7.0 | |

| | 1986 | | | 8.5 | | | 18.6 | | | -10.1 | |

| | 1987 | | | -1.4 | | | 5.1 | | | -6.5 | |

| | 1988 | | | 19.5 | | | 16.6 | | | 2.9 | |

| | 1989 | | | 19.4 | | | 31.7 | | | -12.3 | |

| | 1990 | | | -5.5 | | | -3.1 | | | -2.4 | |

| | 1991 | | | 23.2 | | | 30.5 | | | -7.3 | |

| | 1992 | | | 13.5 | | | 7.6 | | | 5.9 | |

| | 1993 | | | 32.3 | | | 10.1 | | | 22.2 | |

| | 1994 | | | -11.1 | | | 1.3 | | | -12.4 | |

| | 1995 | | | 43.3 | | | 37.6 | | | 5.7 | |

| | 1996 | | | 25.0 | | | 23.0 | | | 2.0 | |

| | 1997 | | | 37.1 | | | 33.4 | | | 3.7 | |

| | 1998 | | | 10.9 | | | 28.6 | | | -17.7 | |

| | 1999 | | | 10.6 | | | 21.0 | | | -10.4 | |

| | 2000 | | | 32.4 | | | -9.1 | | | 41.5 | |

| | 2001 | | | 6.6 | | | -11.9 | | | 18.5 | |

| | 2002 | | | -16.1 | | | -22.1 | | | 6.0 | |

| | 2003 | | | 42.6 | | | 28.7 | | | 13.9 | |

| | 2004 | | | 22.1 | | | 10.9 | | | 11.2 | |

| | 2005 | | | -0.7 | | | 4.9 | | | -5.6 | |

| | 2006 | | | 20.4 | | | 15.8 | | | 4.6 | |

| | 2007 | | | -12.9 | | | 5.5 | | | -18.4 | |

| | 2008 | | | -34.4 | | | -37.0 | | | 2.6 | |

| | 2009 | | | 42.0 | | | 26.5 | | | 15.5 | |

| | 2010 | | | 33.0 | | | 15.1 | | | 17.9 | |

| | 2011 (3/31/11) | | | 8.5 | | | 5.9 | | | 2.6 | |

| | Since Inception: | | | | | | | | | | |

| | Cumulative | | | | | | | | | | |

| | Return | | | 3,350.0 | | | 1,545.1 | | | 1,804.9 | |

| | Avg. Annual | | | | | | | | | | |

| | Return | | | 13.6 | | | 10.6 | | | 3.0 | |

These performance numbers reflect the deduction of the Fund’s annual operating expenses which as stated in its most recent Prospectus are 1.80% of the Fund’s net assets. The returns assume redemption at the end of each period and reinvestment of dividends. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses by the Adviser. This information represents past performance and past performance does not guarantee future results. The investment return and the principal value of an investment in this Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance data quoted. Performance data current to the most recent month-end may be obtained at www.weitzfunds.com/performance/monthly.asp. See page 4 for additional performance disclosures.

Performance information does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance of the Partners III Opportunity Fund (“the Fund “) is measured from June 1, 1983, the inception of Weitz Partners III Limited Partnership (the “Partnership”). As of December 30, 2005, the Fund succeeded to substantially all of the assets of the Partnership. The investment objectives, policies and restrictions of the Fund are materially equivalent to those of the Partnership and the Partnership was managed at all times with full investment authority by Wallace R. Weitz & Company. The performance information includes performance for the period before the Fund became an investment company registered with the Securities and Exchange Commission. During this period, the Partnership was not registered under the Investment Company Act of 1940 and, therefore, was not subject to certain investment or other restrictions or requirements imposed by the 1940 Act or the Internal Revenue Code. If the Partnership had been registered under the 1940 Act during this period, the Partnership’s performance might have been adversely affected.

weitzfunds.com 19

PARTNERS III OPPORTUNITY FUND

PORTFOLIO PROFILE • (UNAUDITED)

| Top Ten Stocks |

| Omnicare | | | 5.2 | % |

| Microsoft | | | 4.9 | |

| SandRidge Energy | | | 4.9 | |

| Aon | | | 4.6 | |

| Liberty Media - Interactive | | | 4.5 | |

| Dell | | | 3.8 | |

| Ascent Media | | | 3.7 | |

| Liberty Global | | | 3.6 | |

| Berkshire Hathaway | | | 3.6 | |

| Texas Instruments | | | 3.6 | |

| % of Net Assets | | | 42.4 | % |

| Industry Sectors |

| Consumer Discretionary | | | 23.4 | % |

| Information Technology | | | 18.7 | |

| Financials | | | 12.2 | |

| Energy | | | 10.0 | |

| Health Care | | | 7.4 | |

| Industrials | | | 6.4 | |

| Materials | | | 3.8 | |

| Consumer Staples | | | 0.5 | |

| Telecommunication Services | | | 0.1 | |

| Total Long Positions | | | 82.5 | |

| Securities Sold Short | | | (14.1 | ) |

| Net Long Positions | | | 68.4 | |

| Short Proceeds/Other | | | 31.6 | |

| Net Assets | | | 100.0 | % |

| Top Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| SandRidge Energy | 74.9% | 4.6% | 2.7% |

| Omnicare | 18.3 | 5.5 | 1.0 |

| Ascent Media | 26.0 | 3.7 | 0.8 |

| Aon | 15.5 | 4.5 | 0.7 |

| Liberty Global | 18.0 | 3.6 | 0.7 |

Source: FactSet Portfolio Analytics

| Bottom Five Performers for Quarter Ended March 31, 2011 |

| | QTD Return | Average Weight | Contribution to |

| Security Name | of Security | in Portfolio | Fund Performance |

| Short Positions (ETFs) | 21.7% | (11.0)% | (0.8)% |

| Grand Canyon Education | (26.0) | 2.2 | (0.7) |

| Microsoft | (8.6) | 4.1 | (0.4) |

| Live Nation Entertainment | (12.4) | 2.6 | (0.3) |

| Martin Marietta Materials | (2.3) | 1.8 | (0.1) |

Source: FactSet Portfolio Analytics

20 Weitz Funds

PARTNERS III OPPORTUNITY FUND

SCHEDULE OF INVESTMENTS • MARCH 31, 2011

| COMMON STOCKS — 82.5% | | Shares | | Value | |

| Consumer Discretionary — 23.4% | | | | | | | |

| Cable & Satellite — 6.4% | | | | | | | |

Liberty Global, Inc. - Series C* (a) | | | 420,011 | | $ | 16,796,240 | |

| Liberty Media Corp. - | | | | | | | |

Capital - Series A* (a) | | | 170,000 | | | 12,523,900 | |

| Knology, Inc.* | | | 27,600 | | | 356,316 | |

| | | | | | | 29,676,456 | |

| Internet & Catalog Retail — 4.5% | | | | | | | |

| Liberty Media Corp. - | | | | | | | |

Interactive - Series A* (a) | | | 1,300,000 | | | 20,852,000 | |

| Broadcasting — 3.8% | | | | | | | |

Discovery Communications, Inc. - CL C* (a) | | | 330,000 | | | 11,619,300 | |

| Cumulus Media, Inc. - CL A* | | | 1,340,000 | | | 5,815,600 | |

| | | | | | | 17,434,900 | |

| Movies & Entertainment — 2.5% | | | | | | | |

| Live Nation Entertainment, Inc.* | | | 1,148,300 | | | 11,483,000 | |

| Education Services — 1.8% | | | | | | | |

Grand Canyon Education, Inc.* (a) | | | 558,900 | | | 8,104,050 | |

| Multiline Retail — 1.6% | | | | | | | |

| Target Corp. | | | 150,000 | | | 7,501,500 | |

| Hotels, Restaurants & Leisure — 1.4% | | | | | | | |

| Interval Leisure Group, Inc.* | | | 400,000 | | | 6,540,000 | |

| Household Durables — 1.4% | | | | | | | |