UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM NCSR/A

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Tara Tilbury

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 376-7132

Date of fiscal year end: March 31

Date of reporting period: March 31, 2023

Explanatory Note

The Registrant is filing this amendment to its Form N-CSR for the period ended March 31, 2023, originally filed with the Securities and Exchange Commission on May 31, 2023 (Accession Number 0001193125-23-157767), to amend Item 1, “Reports to Stockholders.” The purpose of the amendment to Item 1 is to supplement the Annual Reports to include material inadvertently omitted.

Item 1. Reports to Stockholders.

(a) The Report to Shareholders is attached herewith.

RBC FUNDS TRUST

(the “Trust”)

RBC Emerging Markets Equity Fund

RBC Emerging Markets ex-China Equity Fund

RBC Emerging Markets Value Equity Fund

RBC Global Opportunities Fund

RBC Global Equity Leaders Fund

RBC International Opportunities Fund

RBC International Equity Fund

RBC International Small Cap Equity Fund

RBC China Equity Fund

RBC BlueBay Short Duration Fixed Income Fund (formerly, RBC Short Duration Fixed Income Fund)

RBC BlueBay Ultra-Short Fixed Income Fund (formerly, RBC Ultra-Short Fixed Income Fund)

(each, a “Fund” and collectively, the “Funds”)

Supplement dated March 15, 2024 to the Funds’ Annual Reports for the period ended March 31, 2023

(the “Annual Reports”)

This Supplement updates certain information contained in the Funds’ Annual Reports. A copy of each Annual Report is available (i) without charge, upon request, by calling 1-800-422-2766; (ii) on the Fund’s website at www.rbcgam.com; and (iii) on the Securities and Exchange Commission’s (the “Commission”) website at http://www.sec.gov.

Effective immediately, the following section is hereby inserted after the “Supplemental Information” section of each Annual Report:

Voting Results of Special Meeting of Shareholders (Unaudited)

A Special Meeting of Shareholders (the “Meeting”) of RBC Funds Trust (the “Trust”) was held on March 15, 2023 to consider and elect trustees to serve on the Board of Trustees of the Trust. At the Meeting, Ms. Lucy Hancock Bode, Mr. David Eikenberg, Mr. Leslie H. Garner Jr., Mr. Phillip G. Goff, Mr. Ronald James, Mr. James Seward and Ms. Christie Zarkovich were elected to the Trust’s Board of Trustees. In electing the nominees, the Trust’s shareholders voted as follows:

| | | | |

Proposal Election of Trustees | | For | | Withheld |

Ms. Lucy Hancock Bode | | 3,715,603,957 | | 27,077,182 |

Mr. David Eikenberg | | 3,737,584,400 | | 5,113,746 |

Mr. Leslie H. Garner Jr. | | 3,719,510,847 | | 23,187,296 |

Mr. Phillip G. Goff | | 3,721,800,083 | | 20,898,062 |

Mr. Ronald James | | 3,716,118,779 | | 26,579,363 |

Mr. James Seward | | 3,721,239,523 | | 21,458,624 |

Ms. Christie Zarkovich | | 3,736,221,805 | | 6,476,342 |

INVESTORS SHOULD RETAIN THIS SUPPLEMENT FOR FUTURE REFERENCE

RBC Global Asset Management Annual Report For the year ended March 31, 2023 RBC Emerging Markets Equity Fund RBC Emerging Markets ex-China Equity Fund RBC Emerging Markets Value Equity Fund RBC Global Opportunities Fund RBC Global Equity Leaders Fund RBC International Opportunities Fund RBC International Equity Fund RBC International Small Cap Equity Fund RBC China Equity Fund

|

LETTER FROM THE PORTFOLIO MANAGERS |

Dear Shareholder:

Market Review

2022 was a challenging year for global equity markets as central bankers tightened monetary policy in an attempt to combat persistent and elevated inflation. Entering the year, many investors and central bankers believed inflation would be transitory and gradually drift lower as major economies surfaced from COVID-19-related lockdowns and subsequent supply chain challenges eased. However, as it became increasingly apparent that inflation was more prevalent and stubborn, interest rate expectations needed to be ratcheted higher significantly, putting pressure on long duration growth stocks that are more sensitive to changes in the discount rate’s being applied to future cash flows. Instead, investors gravitated towards ‘old economy’ sectors such as energy, materials and traditional banks that were seen as beneficiaries of the high inflation/interest rate backdrop. Russia’s invasion of Ukraine introduced more geo-political uncertainty, creating fears around the significantly diminished flow of natural gas to European energy markets.

Following a late summer swoon, equity markets rallied into the year end on hopes that central banks were approaching the latter stages of their tightening cycles. In addition, China unexpectedly announced a loosening of their zero-COVID-19 policies, allowing the economy to re-open and return to some degree of normalcy.

Portfolio Review – RBC Global Opportunities Fund

For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -11.44% (Class I shares). That compares to an annualized total return of -7.44% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in Financials, Health Care and Energy holdings offset positive alpha derived from positions in Consumer Staples, Consumer Discretionary and Information Technology. At the stock level, relative returns were aided by Anheuser-Busch InBev, as the Belgium-based brewer delivered robust revenue growth aided by strong pricing power. Other positive contributors included AutoZone, T-Mobile and Fortive. Stocks that detracted from returns were First Republic Bank, SVB Financial and Alphabet.

Portfolio Review – RBC Global Equity Leaders Fund

For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -9.48% (Class I shares). That compares to an annualized total return of -7.44% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in Financials, Energy and Health Care holdings offset positive alpha derived from positions in Consumer Staples, Consumer Discretionary and Communication Services. At the stock level, relative returns were aided by the discount retailer TJX’s delivering robust sales growth. Other positive contributors included T-Mobile, Anheuser-Busch InBev and PepsiCo. Stocks that detracted from returns were Charles Schwab, Blackstone and Alphabet.

Portfolio Review – RBC International Opportunities Fund

For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -8.33% (Class I shares). That compares to an annualized total return of -5.07% for the MSCI ACWI ex USA Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in Health Care, Industrials and Utilities holdings offset positive alpha derived from positions in Consumer Staples, Consumer Discretionary and Information Technology. At the stock level, relative returns were aided by technology investor Naspers, as management engaged in various shareholder value-enhancing actions. Other positive contributors included HDFC Bank, Essity and Anheuser-Busch InBev. Stocks that detracted from returns were Nidec, Roche and E.Sun Financial.

2

|

LETTER FROM THE PORTFOLIO MANAGERS |

Portfolio Review – RBC International Equity Fund

For the period from December 14, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 4.50% (Class I shares). That compares to a total return of 7.54% for the MSCI EAFE Total Return Net Index, the Fund’s primary benchmark, for the same period.

Stock selection was responsible for the majority of negative excess returns. Underperformance in Financials, Industrials and Energy holdings offset positive alpha derived from positions in Communications Services, Real Estate and Information Technology. At the stock level, relative returns were aided by LVMH Moet Hennessy Louis Vuitton, Mitsubishi UFJ Financial and Novo Nordisk. Stocks that detracted from returns were Aker BP, Roche and Sampo.

Portfolio Review – RBC International Small Cap Equity Fund

For the period from December 14, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 2.60% (Class I shares). That compares to a total return of 4.37% for the MSCI ACWI ex USA Small Cap Total Return Net Index, the Fund’s primary benchmark, for the same period.

Stock selection was responsible for the majority of negative excess returns. Underperformance in Information Technology, Materials and Energy holdings offset positive alpha derived from positions in Real Estate, Financials and Consumer Discretionary. At the stock level, relative returns were aided by Howden Joinery, MIPS and BayCurrent Consulting. Stocks that detracted from returns were Mineral Resources, Aker BP and Abcam.

Portfolio Review – RBC Emerging Markets Equity Fund

For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -4.38% (Class I shares). That compares to an annualized total return of -10.70% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection, particularly in the Consumer Discretionary and Health Care sectors, was the primary driver of outperformance for the period. Stock selection in India and China also benefited relative returns along with the Fund’s overweight exposure to Turkey. However, stock selection in South Korea partially offset those gains.

Portfolio Review – RBC Emerging Markets ex-China Equity Fund

For the period from December 15, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 4.10% (Class I shares). That compares to a total return of 3.51% for the MSCI Emerging Markets ex-China Total Return Net Index, the Fund’s primary benchmark, for the same period.

Stock selection and asset weighting contributed positively at the sector level for the period. Weaker stock selection in Information Technology was offset by strong stock selection in Health Care and Industrials sectors. Overweight exposure to Taiwan and Mexico benefited relative returns along with strong stock selection in India.

Portfolio Review – RBC Emerging Markets Value Equity Fund

For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -6.10% (Class I shares). That compares to an annualized total return of -10.70% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was the primary driver of outperformance for the period. Stock selection was particularly strong in Financials and Information Technology sectors, while underweight exposure and stock selection within Communication Services detracted. Stock selection in India and Taiwan also benefited relative returns, though partially offset by selection in Vietnam.

Portfolio Review – RBC China Equity Fund

For the period from April 11, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of -5.44% (Class I shares). That compares to a total return of -0.44% for the MSCI China Net Total Return USD Index, the Fund’s primary benchmark, for the same period.

3

|

LETTER FROM THE PORTFOLIO MANAGERS |

Stock selection was the primary driver of underperformance. Strong stock selection in the Real Estate and Information Technology sectors was offset by weaker stock selection in Consumer Discretionary and Financials.

Outlook

Despite markets’ starting 2023 in a more buoyant mood, significant uncertainties remain. The outlook for corporate profitability appears uncertain. The full impact of previous rate increases likely has yet to be fully realized and companies may have to deal with the prospect of slowing demand in coming quarters as tighter monetary policy weighs on economic activity. On the other hand, if interest rates are close to peaking and may in fact revert lower at some point, such a development might be supportive for equity valuations. Against such a backdrop, stock prices may remain volatile, which we believe will place extra emphasis on effective portfolio construction and disciplined risk management.

Our long-held belief in owning great businesses at attractive valuations remains unwavering. Whilst the near-term outlook is uncertain, over the long run, share prices have historically followed company fundamentals. By investing in leading companies that enjoy strong competitive advantages, we remain optimistic that we can deliver attractive risk-adjusted returns for our investors.

Phil Langham

Senior Portfolio Manager and Head, Emerging Market Equities

RBC Global Asset Management (UK) Limited

Habib Subjally

Senior Portfolio Manager and Head, Global Equities

RBC Global Asset Management (UK) Limited

David Lambert

Senior Portfolio Manager and Head, European Equities

RBC Global Asset Management (UK) Limited

The information provided herein represents the opinions of the Funds’ Portfolio Managers and is not intended to be a forecast of future events, a guarantee of future results or investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The RBC Global Equity Leaders Fund and the RBC China Equity Fund are non-diversified, which means they may concentrate their assets in fewer individual holdings than a diversified fund. Therefore, the Funds are more exposed to individual security volatility than a diversified fund. The RBC International Equity Fund, the RBC International Small Cap Equity Fund, the RBC Emerging Markets ex-China Equity Fund and the RBC China Equity Fund are new with no operating history or track record on which to base investment decisions. The RBC Emerging Markets Value Equity Fund invests in value stocks, which may not increase in price as anticipated by the Adviser if they fall out of favor with investors or the markets favor faster growing companies. Investing in securities economically tied to China may subject the RBC China Equity Fund to a higher degree of risk of loss than investing in other countries or groups of countries because of the risks associated with, among other things, adverse securities markets, negative foreign currency rate fluctuations and social, political, regulatory, economic or environmental instabilities and natural disasters. The Funds may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. A Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectuses.

The MSCI ACWI Index is a free floatadjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax.

4

|

LETTER FROM THE PORTFOLIO MANAGERS |

The MSCI ACWI ex USA Index is a free floatadjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI EAFE Index is an equity index which captures large- and mid-capitalization representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI ACWI ex USA Small Cap Index captures small capitalization representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI Emerging Markets Index is a free floatadjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. The MSCI Emerging Markets ex-China Index captures large- and mid-capitalization representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. The MSCI China and MSCI China All Shares Indices capture large- and mid-capitalization representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (e.g., ADRs). The MSCI China Index covers about 85% of this China equity universe, and currently includes large- and mid-capitalization A shares represented at 20% of their free float-adjusted market capitalization. The MSCI China All Shares Index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen, and outside of China, and is based on the concept of the integrated MSCI China equity universe with China A shares included. The Net Indices are net of any foreign withholding tax.

You cannot invest directly in an index.

Excess return is the difference between the benchmark return and the portfolio return, which may be either positive or negative.

Alpha is a risk-adjusted performance measurement of a portfolio’s excess return relative to its benchmark after considering its risk relative to the benchmark.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for complete lists of Fund holdings.

Fund performance attribution data excludes Fund holdings that are fair-valued.

Past performance does not guarantee future results.

5

| | | | | | |

| | | | | | PORTFOLIO MANAGERS |

| | | | | | |

| | | | | | RBC Global Asset Management (U.S.) Inc. (“RBC GAM-US”) serves as the investment advisor and RBC Global Asset Management (UK) Limited (“RBC GAM-UK”) serves as the investment sub-advisor to the Funds and is responsible for the overall management of the Funds’ portfolios. The individual primarily responsible for the day-to-day management of each Fund’s portfolio is set forth below. |

| | | | | | Philippe Langham Senior Portfolio Manager and Head of Emerging Market Equities Philippe Langham is Head of Emerging Market Equities at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Equity Fund and RBC Emerging Markets ex-China Equity Fund. Philippe joined RBC GAM-UK in November 2009 from Societe Generale Asset Management, where he was Head of Global Emerging Markets. He was previously Director and Head of Emerging Markets and Asia at Credit Suisse in Zurich. Prior to that, he managed Global Emerging Markets, Asian, Latin American and U.S. portfolios for nine years at the Kuwait Investment Office. Philippe holds a BSc in economics from the University of Manchester in England and is a Chartered Accountant. |

| | | | | | Laurence Bensafi Senior Portfolio Manager and Deputy Head of Emerging Markets Equity Laurence Bensafi is Deputy Head of Emerging Markets Equity at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Value Equity Fund. Prior to joining RBC GAM-UK in 2013, Laurence was the Head of Aviva Investors’ Emerging Markets team, where she was responsible for managing Global Emerging Markets income funds and for developing quantitative stock selection and analysis models. Laurence began her investment career as a Quantitative Analyst at Societe Generale Asset Management, supporting European and Global Equity portfolio management by developing quantitative models to assist in the portfolio construction and security selection process. In 1997, Laurence obtained a Magistere d’Economiste Statisticien & D.E.S.S. Statistique et Econometrie from Toulouse University in France. Laurence is a CFA charterholder. |

| | | | | | Habib Subjally Senior Portfolio Manager and Head of Global Equities Habib Subjally is Head of Global Equities at RBC GAM-UK and is responsible for portfolio management of RBC Global Opportunities Fund, RBC International Opportunities Fund and RBC Global Equity Leaders Fund. Prior to joining RBC GAM-UK in 2014 Habib and his team spent eight years together at First State managing global equities. Previously he was Head of Small & Mid Cap Research at Credit Suisse and Head of the Global equities team at Invesco. Habib began his fund management career at Merrill Lynch Investment Managers, where he was Head of North American and Global equities research. He holds a BSc (Hons) from the London School of Economics and holds Chartered Accountant and ASIP designations. |

| | | | | | Siguo Chen Portfolio Manager Siguo Chen is a portfolio manager on the RBC Asian Equity team at RBC Global Asset Management and for RBC China Equity Fund. She is the lead |

| | | | | | |

| | | | | | |

| | | | | | |

6

| | | | | | |

PORTFOLIO MANAGERS | | | | | | |

manager for the team’s China strategy and is also the team’s healthcare specialist. Prior to joining RBC in 2017, Siguo was a sell-side equity analyst with a multinational investment bank where she specialized in China and Hong Kong consumer sectors and Hong Kong Equity strategy. | | | | | | |

Mayur Nallamala Head of Asian Equity, Senior Portfolio Manager Mayur Nallamala is a senior portfolio manager on the RBC Asian Equity team at RBC Global Asset Management and for RBC China Equity Fund. Prior to joining the firm in 2013, he was a portfolio manager at a global asset management firm, responsible for Asia Pacific ex-Japan mandates, managing assets on behalf of sovereign wealth, institutional and retail clients around the world. Mayur had earlier worked at major brokerage firms in London and Hong Kong, working in derivatives and equity research. He began his career in the investment industry in 1998. | | | | | | |

David Lambert Senior Portfolio Manager and Head of European Equities David Lambert is Senior Portfolio Manager and Head of the European Equity Team at RBC GAM-UK and is responsible for portfolio management of RBC International Equity Fund and RBC International Small Cap Equity Fund. He joined the organization directly from university in 1999, originally as a quantitative analyst. During his time at RBC GAM-UK, David has completed the UK Institute of Investment Management and Research (now UKSIP) examinations. He has managed a number of UK and European portfolios for the firm over the years. | | | | | | |

7

|

PERFORMANCE SUMMARY (UNAUDITED) |

Average Annual Total Returns as of March 31, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

RBC Emerging Markets Equity Fund | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (10.03 | )%(e) | | | (0.08)% | (e) | | | 3.58% | | | | | | | | | |

-At Net Asset Value | | | (4.57 | )%(e) | | | 1.12% | | | | 4.25% | | | | 1.13% | | | | 1.68% | |

Class I | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (4.38 | )%(e) | | | 1.36% | | | | 4.49% | | | | 0.88% | | | | 0.99% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (4.36 | )%(e) | | | 1.38% | | | | 4.57% | | | | 0.88% | | | | 0.88% | |

MSCI Emerging Markets

Net Total Return

USD Index(f) | | | (10.70 | )%(e) | | | (0.91 | )%(e) | | | 2.43% | | | | | | | | | |

RBC Emerging Markets ex-China Equity Fund(d) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | N/A | | | | N/A | | | | (1.98)% | (e) | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.00% | | | | 1.13% | | | | 2.03% | |

Class I | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.10% | | | | 0.88% | | | | 1.66% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.10% | | | | 0.88% | | | | 1.83% | |

MSCI Emerging Markets ex-China | | | | | | | | | | | | | | | | | | | | |

Total Return Net Index(f) | | | N/A | | | | N/A | | | | 3.51% | | | | | | | | | |

RBC Emerging Markets Value Equity Fund | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (11.65 | )%(e) | | | (1.69)% | (e) | | | (1.28)% | (e) | | | | | | | | |

-At Net Asset Value | | | (6.24 | )%(e) | | | (0.52)% | (e) | | | (0.14)% | (e) | | | 1.20% | | | | 36.74% | |

Class I | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (6.10 | )%(e) | | | (0.30)% | (e) | | | 0.08% | | | | 0.95% | | | | 1.41% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (6.01 | )%(e) | | | (0.22)% | (e) | | | 0.15% | | | | 0.88% | | | | 1.33% | |

MSCI Emerging Markets

Net Total Return

USD Index(f) | | | (10.70 | )%(e) | | | (0.91 | )%(e) | | | (0.36 | )%(e) | | | | | | | | |

RBC Global Opportunities Fund | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (16.72 | )%(e) | | | 5.63% | | | | 8.04% | | | | | | | | | |

- At Net Asset Value | | | (11.66 | )%(e) | | | 6.90% | | | | 8.81% | | | | 1.00% | | | | 24.16% | |

Class I | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | (11.44 | )%(e) | | | 7.17% | | | | 9.01% | | | | 0.75% | | | | 0.81% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | (11.35 | )%(e) | | | 7.23% | | | | 9.06% | | | | 0.70% | | | | 0.72% | |

MSCI ACWI Net

Total Return USD Index(f) | | | (7.44 | )%(e) | | | 6.94% | | | | 7.14% | | | | | | | | | |

8

|

PERFORMANCE SUMMARY (UNAUDITED) |

Average Annual Total Returns as of March 31, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

RBC Global Equity Leaders Fund | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (14.91)% | (e) | | | N/A | | | | (18.48)% | (e) | | | | | | | | |

-At Net Asset Value | | | (9.73)% | (e) | | | N/A | | | | (14.65)% | (e) | | | 1.00% | | | | 2.26% | |

Class I | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (9.48)% | (e) | | | N/A | | | | (14.39)% | (e) | | | 0.75% | | | | 1.60% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (9.43)% | (e) | | | N/A | | | | (14.35)% | (e) | | | 0.70% | | | | 1.58% | |

MSCI ACWI Net Total Return USD Index(f) | | | (7.44)% | (e) | | | N/A | | | | (8.48)% | (e) | | | | | | | | |

RBC International Opportunities Fund | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (13.84)% | (e) | | | 1.73% | | | | 3.20% | | | | | | | | | |

-At Net Asset Value | | | (8.55)% | (e) | | | 2.95% | | | | 3.94% | | | | 1.05% | | | | 6.35% | |

Class I | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (8.33)% | (e) | | | 3.41% | | | | 4.28% | | | | 0.80% | | | | 0.98% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

-At Net Asset Value | | | (8.19)% | (e) | | | 3.49% | | | | 4.34% | | | | 0.75% | | | | 1.03% | |

MSCI ACWI ex US Index(f) | | | (5.07)% | (e) | | | 2.47% | | | | 3.75% | | | | | | | | | |

RBC International Equity Fund(d) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | N/A | | | | N/A | | | | (1.60)% | (e) | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.40% | | | | 1.04% | | | | 2.24% | |

Class I | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.50% | | | | 0.79% | | | | 1.71% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 4.50% | | | | 0.74% | | | | 1.68% | |

MSCI EAFE Total Return Net Index(f) | | | N/A | | | | N/A | | | | 7.54% | | | | | | | | | |

RBC International Small Cap Equity Fund(d) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | N/A | | | | N/A | | | | (3.39)% | (e) | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 2.50% | | | | 1.24% | | | | 2.47% | |

Class I | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 2.60% | | | | 0.99% | | | | 1.94% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | 2.60% | | | | 0.94% | | | | 1.91% | |

MSCI ACWI ex USA Small Cap Index(f) | | | N/A | | | | N/A | | | | 4.37% | | | | | | | | | |

9

|

PERFORMANCE SUMMARY (UNAUDITED) |

Average Annual Total Returns as of March 31, 2023 (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

RBC China Equity Fund(g) | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | N/A | | | | N/A | | | | (11.14 | )%(e) | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | (5.72 | )%(e) | | | 1.30% | | | | 3.47% | |

Class I | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | (5.44 | )%(e) | | | 1.05% | | | | 3.04% | |

Class R6 | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | N/A | | | | N/A | | | | (5.40 | )%(e) | | | 1.00% | | | | 3.06% | |

MSCI China Index(f) | | | N/A | | | | N/A | | | | (0.44 | )%(e) | | | | | | | | |

MSCI China All Shares Index(f) | | | N/A | | | | N/A | | | | (2.47 | )%(e) | | | | | | | | |

Parentheses indicate negative performance returns.

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. For performance data current to the most recent month-end go to www.rbcgam.com. Please see footnotes below.

| (a) | The since inception date (commencement of operations) is December 20, 2013 for RBC Emerging Markets Equity Fund for Class A and Class I shares and November 22, 2016 for Class R6 shares and February 9, 2018 for RBC Emerging Markets Value Equity Fund for Class I and Class R6 shares and April 19, 2022 for Class A shares and December 3, 2014 for RBC Global Opportunities Fund and RBC International Opportunities Fund for Class I shares, November 22, 2016 for Class R6 shares and January 28, 2020 for Class A Shares. The performance in the table for Class R6 shares prior to November 22, 2016 reflects the performance of the Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class R6 shares. The performance in the table for Class A shares of Global Opportunities Fund and International Opportunities Fund prior to January 28, 2020, reflects the performance of Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class A shares. |

| (b) | The Funds’ expenses are from the Funds’ most recent prospectus dated July 28, 2022, and reflect the fiscal year ended March 31, 2022. For Global Equity Leaders Fund, the expenses reflect the period from December 15, 2021 (commencement of operations) to March 31, 2022. For China Equity Fund, Emerging Markets ex-China Equity Fund, International Equity Fund and International Small Cap Equity Fund expenses are based on estimates for each Fund’s first fiscal year. |

| (c) | The Advisor has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels disclosed in the Funds’ prospectuses until July 31, 2024 (September 30, 2024 for RBC Emerging Markets Equity Fund). |

| (d) | The inception date for the RBC Emerging Markets ex-China Equity Fund is December 15, 2022. The inception date for the RBC International Equity Fund and RBC International Small Cap Equity Fund is December 14, 2022. Short-term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. |

| (e) | Parentheses indicate negative performance returns. |

10

|

PERFORMANCE SUMMARY (UNAUDITED) |

| (f) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but does not include sales fees or operating expenses. You cannot invest directly in indices. |

| (g) | The inception date for the RBC China Equity Fund is April 11, 2022. Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns. |

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax.

The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI EAFE Index is an equity index which captures large- and mid-capitalization representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI ACWI ex USA Small Cap Index captures small capitalization representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. The MSCI Emerging Markets ex-China Index captures large- and mid-capitalization representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. The MSCI China and MSCI China All Shares Indices capture large- and mid-capitalization representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (e.g., ADRs). The MSCI China Index covers about 85% of this China equity universe, and currently includes large- and mid-capitalization A shares represented at 20% of their free float-adjusted market capitalization. The MSCI China All Shares Index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen, and outside of China, and is based on the concept of the integrated MSCI China equity universe with China A shares included. The Net Indices are net of any foreign withholding tax.

You cannot invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible.

11

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC Emerging Markets Equity Fund |

| | | | | | | | |

| | | | |

Investment

Strategy | | | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities tied to emerging market countries that are considered by the Fund to have the potential to provide long-term capital growth. For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | | |

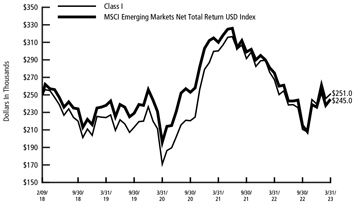

| Performance | | | | | | | | For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -4.38% (Class I). That compares to an annualized total return of -10.70% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | |

Factors That

Contributed to

Relative Returns | | | | | | | | • Performance of stocks within the Consumer Discretionary and Health Care sectors • Stock selection in India and China, as well as the Fund’s overweight exposure to Turkey |

| | | | |

Factors That

Detracted From

Relative Returns | | | | | | | | • Stock selection in South Korea |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | |

| | | | | | | | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. The Net Index are net of any foreign withholding tax. |

| | | | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | | | Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | | | | | Past performance is not a guarantee of future results. |

12

| | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | |

| MSCI Emerging Markets Net Total Return USD Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

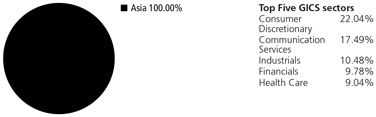

| | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 6.84% | | Tata Consultancy Services Ltd. | | 3.72% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

Tencent Holdings Ltd. | | | | 4.99% | | Fomento Economico Mexicano SAB de CV | | 3.40% | | | | |

SK Hynix, Inc. | | | | 4.48% | | Ping An Insurance Group Co. of China Ltd. | | 3.35% | | | | |

Antofagasta Plc | | | | 3.99% | | Unilever Plc | | 3.12% | | | | |

Housing Development Finance Corp. Ltd. Plc | | | | 3.90% | | Alibaba Group Holding Ltd. | | | | 2.97% | | | | |

*A listing of all portfolio holdings can be found beginning on page 33 | | | | | | |

| | | | | | | | | | | | | | | | | |

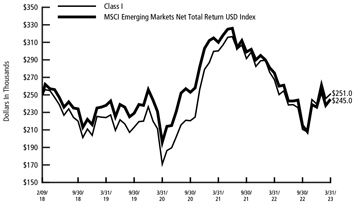

| | | | | | Growth of $250,000 Initial Investment Since Inception (12/20/13) |

| | | | | | |

| The graph reflects an initial hypothetical investment of $250,000 over the period from December 20, 2013 (commencement of operations) to March 31, 2023 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | | |

13

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Emerging Markets ex-China Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities economically tied to emerging market countries (excluding China). For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | |

| Performance | | | | | | For the period from December 15, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 4.10% (Class I). That compares to a total return of 3.51% for the MSCI Emerging Markets ex-China Total Return Net Index, the Fund’s primary benchmark, for the same period. |

| | | |

Factors That

Contributed to

Relative Returns | | | | | | • Performance of stocks within the Health Care and Industrials sectors. • Overweight exposure to Taiwan and Mexico, as well as strong stock selection in India. |

| | | |

Factors That

Detracted From

Relative Returns | | | | | | Performance of stocks within the Information Technology sector negatively impacted the Fund’s performance. |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund is new with no operating history or track record on which to base investment decisions. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | The MSCI Emerging Markets ex-China Total Return Net Index captures large and mid cap representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risks. |

| | | | | | Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | | | Past performance is not a guarantee of future results. |

14

| | | | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets ex-China Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets ex-China Net Total Return Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| *Includes U.S. dollar denominated cash equivalent investments and exchange-traded funds representing 2.81% and 8.03% of investments, respectively. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 9.62% | | | Antofagasta Plc | | 3.92% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

Samsung Electronics Co. Ltd. | | | 5.28% | | | Fomento Economico Mexicano

SAB de CV | | 3.77% | | | | |

HDFC Bank Ltd. | | | 4.53% | | | iShares India 50 ETF | | 3.68% | | | | |

Infosys Ltd. | | | 4.36% | | | Voltronic Power Technology Corp. | | 3.19% | | | | |

iShares MSCI India | | | 4.33% | | | Unilever Plc | | | | 3.10% | | | | |

*A listing of all portfolio holdings can be found beginning on page 36 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

15

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC Emerging Markets Value Equity Fund |

| | | | | | | | |

| | | | |

Investment Strategy | | | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities tied economically to emerging market countries that are considered to be undervalued in relation to earnings, dividends and/or assets. For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | | | | | | |

| | | | |

| Performance | | | | | | | | For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -6.10% (Class I). That compares to an annualized total return of -10.70% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | | | | | |

| | | | |

| Factors That Contributed to Relative Returns | | | | | | | | • Performance of stocks within the Financials and Information Technology sectors. • Stock selection in India and Taiwan |

| | | | | | | | |

| | | | |

Factors That Detracted From Relative Returns | | | | | | | | • An underweight exposure and stock selection within the Communication Services sector. • Stock selection in Vietnam. |

| | | | | | | | |

| | | | |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund invests in value stocks, which may not increase in price as anticipated by the Adviser if they fall out of favor with investors or the markets favor faster growing companies. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | | | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | | | Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | | | | | Past performance is not a guarantee of future results. |

16

| | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets Value Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | |

| MSCI Emerging Markets Net Total Return USD Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| *Includes U.S. dollar denominated cash equivalent investments representing 1.36% of investments. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 6.78% | | Antofagasta Plc | | 2.20% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

Alibaba Group Holding Ltd. | | 5.03% | | Ping An Bank Co. Ltd. | | 2.10% | | | | |

Samsung Electronics Co. Ltd. | | 4.68% | | Innodisk Corp. | | 1.86% | | | | |

Naspers Ltd. | | 2.96% | | Axis Bank Ltd. | | | | 1.84% | | | | |

Ping An Insurance Group Co. of China Ltd. | | 2.74% | | LG Corp. | | | | 1.83% | | | | |

*A listing of all portfolio holdings can be found beginning on page 39 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | Growth of $250,000 Initial Investment Since Inception (2/9/18) |

| | | | | | |

| The graph reflects an initial hypothetical investment of $250,000 over the period from February 9, 2018 (commencement of operations) to March 31, 2023 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | | |

| | | | | | | |

17

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC Global Opportunities Fund |

| | | | | | | | |

| | | | |

Investment Strategy | | | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets. Under normal circumstances, the Fund will typically invest at least the lesser of (i) 40% of its total assets in the securities of issuers located in countries other than the United States or (ii) an amount of its total assets equal to the approximate percentage of issuers located in countries other than the United States included in the MSCI ACWI Net Total Return USD Index, unless the Sub-Advisor determines, in its sole discretion, that conditions are not favorable. If the Sub-Advisor determines that conditions are not favorable, the Fund may invest under 40% of its total assets in the securities of issuers located outside of the United States, provided that the Fund will not invest less than 30% of its total assets in such securities except for temporary defensive purposes. The Fund will normally invest in equity securities of companies domiciled in at least three countries (one of which may be the United States). The Fund will invest in securities across all market capitalizations, although the Fund may invest a significant portion of its assets in companies of one particular market capitalization category. |

| | | | | | | | |

| | | | |

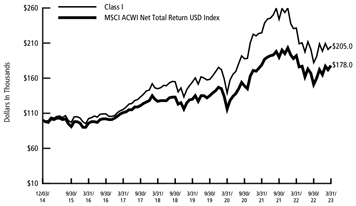

| Performance | | | | | | | | For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -11.44% (Class I). That compares to an annualized total return of -7.44% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | | | | | |

| | | | |

| Factors That Contributed to Relative Returns | | | | | | | | • Performance of stocks within the Consumer Staples, Consumer Discretionary and Information Technology sectors • At the stock level, Anheuser-Busch InBev, as the Belgium-based brewer delivered robust revenue growth aided by strong pricing power • Other individual stocks that made positive contributions to the Fund’s performance included AutoZone, T-Mobile and Fortive. |

| | | | | | | | |

| | | | |

Factors That Detracted From Relative Returns | | | | | | | | • Underperformance in the Financials, Health Care, and Energy sectors • Individual stocks that detracted from the Fund’s performance included First Republic Bank, SVB Financial and Alphabet. |

| | | | | | | | |

| | | | |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may focus its investments in a region or small group of countries. As a result, the Fund’s performance may be subject to greater volatility than a more geographically diversified fund.The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | | | The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

18

| | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | |

| | |

| RBC Global Opportunities Fund | | | | |

| | |

| Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. | | | | |

| | |

| Fund performance attribution data excludes Fund holdings that are fair-valued. | | | | |

| | |

| Past performance is not a guarantee of future results. | | | | |

19

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | |

| | | | | | | | | | RBC Global Opportunities Fund | |

Investment Objective | | | | | | | | | | The Fund seeks to provide long-term capital growth. | |

Benchmark | | | | | | | | | | MSCI ACWI Net Total Return USD Index | |

Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS

sectors (as of 3/31/23) (% of

Fund’s net assets) | | | | | | | |

| |

| | | |

| | | | | | | | | | * Includes U.S. dollar denominated cash equivalent investments representing 3.89% of investments. | |

| | | | | | |

Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) | | | | | | | | | | Microsoft Corp. | | | 6.15 | % | | Fortive Corp. | | | 3.69 | % |

| | Anheuser-Busch InBev NV | | | 5.66 | % | | Incyte Corp. | | | 3.48 | % |

| | UnitedHealth Group, Inc. | | | 4.68 | % | | EOG Resources, Inc. | | | 3.36 | % |

| | AIA Group Ltd. | | | 4.66 | % | | PepsiCo, Inc. | | | 3.34 | % |

| | T-Mobile US, Inc. | | | 4.60 | % | | | | | | |

| | | | | | | | | | Taiwan Semiconductor | | | 4.54 | % | | | | | | |

| | | | | | | | | | Manufacturing Co. Ltd. | | | | | | | | | | |

| | | | | | | | | | *A listing of all portfolio holdings can be found beginning on page 44 | |

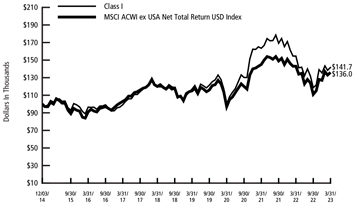

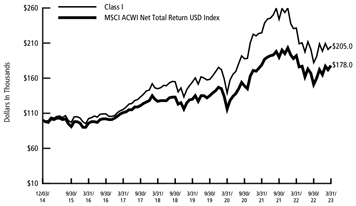

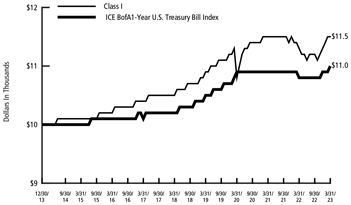

Growth of $100,000 Initial Investment Since Inception (12/3/14) | | | | | | | | | |

The graph reflects an initial hypothetical investment of $100,000 over the period from December 3, 2014 (commencement of operations) to March 31, 2023 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | |

| | | | | | | | | | | | | | | | | | | | |

20

This Page Intentionally Left Blank

21

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC Global Equity Leaders Fund |

| | | | | | | | |

| | | | |

Investment Strategy | | | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets. Under normal circumstances, the Fund aims to achieve its investment objective by investing at least 80% of the value of its net assets (plus any borrowings for investment purposes) in equity securities. The Fund also will, under normal market conditions: (1) invest at least 40% of its assets outside the United States, or if market conditions are not favorable, at least 30% of its assets outside the United States, and (2) hold securities of issuers located in at least three countries. |

| | | | |

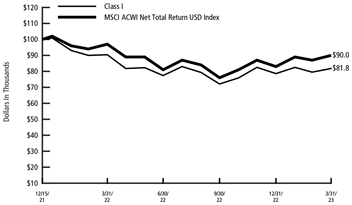

| Performance | | | | | | | | For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -9.48% (Class I). That compares to an annualized total return of -7.44% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | |

Factors That Contributed to Relative Returns | | | | | | | | • Performance of stocks within the Consumer Staples, Consumer Discretionary and Communication Services sectors • At the stock level, discount retailer TJX’s delivering robust sales growth • Other individual stocks that contributed to the Fund’s performance included T-Mobile, Anheuser-Busch InBev and PepsiCo. |

| | | | |

Factors That Detracted From Relative Returns | | | | | | | | • Underperformance in the Financials, Energy and Health Care sectors • Individual stocks that detracted from the Fund’s performance included Charles Schwab, Blackstone and Alphabet. |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund is non-diversified, which means it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual security volatility than a diversified fund. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | | | The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for complete lists of Fund holdings. Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | | | | | Past performance is not a guarantee of future results. |

22

| | | | | | | | | | | | | | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | | | | | | |

RBC Global Equity Leaders Fund | | | | | | | | | | | |

The Fund seeks to provide long-term capital growth. | | | | | | | | | | | Investment Objective |

MSCI ACWI Net Total Return USD Index | | | | | | | | | | | Benchmark |

| | | | | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 0.97% of investments. | | | | | | | | | | | |

| | | | | | | |

Microsoft Corp. | | 6.92% | | NVIDIA Corp. | | | 4.64 | % | | | | | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

UnitedHealth Group, Inc. | | 5.75% | | Anheuser-Busch InBev NV | | | 4.59 | % | | | | | | | | |

T-Mobile US, Inc. | | 5.73% | | Estee Lauder Cos, Inc. (The) | | | 4.33 | % | | | | | | | | |

Alphabet, Inc. | | 4.90% | | Roche Holding AG | | | 3.95 | % | | | | | | | | |

PepsiCo, Inc. | | 4.84% | | Deutsche Post AG | | | 3.94 | % | | | | | | | | |

* A listing of all portfolio holdings can be found beginning on page 47 | | | | | | | | | | | | |

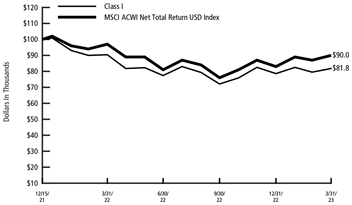

The graph reflects an initial hypothetical investment of $100,000 over the period from December 15, 2021 (commencement of operations) to March 31, 2023 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/15/2021) |

23

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC International Opportunities Fund |

| | | | | | | | |

| | | | |

Investment

Strategy | | | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets, excluding the U.S. The Fund will invest in securities across all market capitalizations, although the Fund may invest a significant portion of its assets in companies of one particular market capitalization category. |

| | | | |

| Performance | | | | | | | | For the 12-month period ended March 31, 2023, the Fund had an annualized total return of -8.33% (Class I). That compares to an annualized total return of -5.07% for the MSCI ACWI ex USA Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | |

Factors That

Contributed to

Relative Returns

Factors That

Detracted From

Relative Returns | | | | | | | | • Performance of stocks within the Real Estate and Information Technology sectors |

| | | | | | | | • Underperformance in the Health Care, Industrials and Utilities • Individual stocks that detracted from the Fund’s performance included Nidec, Roche and E.Sun Financial. |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may focus its investments in a region or small group of countries. As a result, the Fund’s performance may be subject to greater volatility than a more geographically diversified fund. The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | | | The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | |

| | | | | | | | Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | |

| | | | | | | | Past performance is not a guarantee of future results. |

24

| | | | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC International Opportunities Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | | | |

| | | |

| MSCI ACWI ex USA Net Total Return USD Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

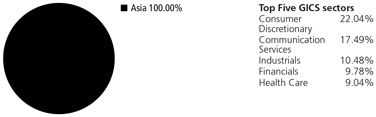

| | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| * Includes U.S. dollar denominated cash equivalent investments representing 0.06% of investments. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor

Manufacturing Co. Ltd. | | | 5.77% | | | DBS Group Holdings Ltd. | | 4.33% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

AIA Group Ltd. | | | 5.55% | | | Roche Holding AG | | 4.26% | | | | |

HDFC Bank Ltd. | | | 4.46% | | | E.Sun Financial Holding Co. Ltd. | | 3.93% | | | | |

Anheuser-Busch InBev NV | | | 4.44% | | | Oriental Land Co. Ltd | | 3.67% | | | | |

Essity AB | | | 4.36% | | | Kerry Group Plc | | | | 3.55% | | | | |

*A listing of all portfolio holdings can be found beginning on page 50 | | | | | | |

| | | | | | | | | | | | | | | | | | |

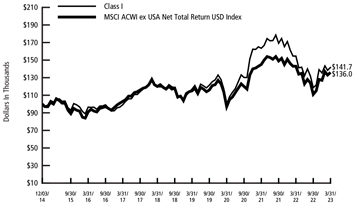

| | | | | | Growth of $100,000 Initial Investment Since Inception (12/3/14) |

| | | | | | |

The graph reflects an initial hypothetical investment of $100,000 over the period from December 3, 2014 (commencement of operations) to March 31, 2023 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | | |

25

| | | | | | | | |

| | | | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | | | RBC International Equity Fund |

| | | | | | | | |

| | | | |

Investment Strategy | | | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of companies located throughout the world, excluding the United States. |

| | | | | | | | |

| | | | |

| Performance | | | | | | | | For the period from December 14, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 4.50% (Class I). That compares to a total return of 7.54% for the MSCI EAFE Total Return Net Index, the Fund’s primary benchmark, for the same period. |

| | | | | | | | |

| | | | |

Factors That Contributed to Relative Returns | | | | | | | | • Performance of stocks within the Communications Services, Real Estate and Information Technology sectors • At the stock level, LVMH Moet Hennessy Luis Vuitton, Mitsubishi UFJ Financial and Novo Nordisk |

| | | | | | | | |

| | | | |

Factors That Detracted From Relative Returns | | | | | | | | • Underperformance in the Financials, Industrials and Energy sectors • Individual stocks that detracted from the Fund’s performance included Aker BP, Roche and Sampo. |

| | | | | | | | |

| | | | |

| | | | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund is new with no operating history or track record on which to base investment decisions. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | | | The MSCI EAFE Index is an equity index which captures large- and mid-capitalization representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. You cannot invest directly in an index. |

| | | | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | | | Fund performance attribution data excludes Fund holdings that are fair-valued. |

| | | | | | | | Past performance is not a guarantee of future results. |

26

| | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

| | | |

RBC International Equity Fund | | | | | | |

| | | | | | | | | | | | | | | |

| | | |

| The Fund seeks to provide long-term capital growth. | | | | | | Investment

Objective |

| | | | | | | | | | | | | |

| | | |

| MSCI EAFE Total Return Net Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/23 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/23) (% of Fund’s net assets) |

| *Includes U.S. dollar denominated cash equivalent investments representing 0.82% of investments. | | | | | | |

| | | | | | | |

| | | | | | | |

Novo Nordisk A/S | | 3.87% | | | | ASML Holding NV | | 2.90% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/23) (% of Fund’s net assets) |

Mitsubishi UFJ Financial Group, Inc. | | 3.80% | | | | London Stock Exchange Group Plc | | 2.89% | | | | |

LVMH Moet Hennessy Louis Vuitton SE | | 3.79% | | | | CSL Ltd. | | 2.73% | | | | |

Tokio Marine Holdings, Inc. | | 3.43% | | | | Diageo Plc | | 2.55% | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 3.19% | | | | EssilorLuxottica SA | | 2.41% | | | | |

*A listing of all portfolio holdings can be found beginning on page 54 | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

27

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC International Small Cap Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of small companies located throughout the world, excluding the United States. The Fund currently considers “small companies” to be those within the market capitalization range of the MSCI ACWI ex USA Small Cap Index at the time of inital purchase by the Fund. |

| | | |

| Performance | | | | | | For the period from December 14, 2022 (commencement of operations) through March 31, 2023, the Fund had a total return of 2.60% (Class I). That compares to a total return of 4.37% for the MSCI ACWI ex US Small Cap Total Return Net Index, the Fund’s primary benchmark. |

| | | |

Factors That Contributed to Relative Returns | | | | | | • Performance of stocks within the Real Estate, Financials and Consumer Discretionary sectors • At the stock level, Howden Joinery, MIPS and BayCurrent Consulting |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in the Information Technology, Materials and Energy sectors • Individual stocks that detracted from the Fund’s performance included Mineral Resources, Aker BP and Abcam. |

| | | |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund is new with no operating history or track record on which to base investment decisions. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | |

| | | | | | The MSCI ACWI ex USA Small Cap Index captures small capitalization representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | |