UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21475

RBC Funds Trust

(Exact name of registrant as specified in charter)

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Address of principal executive offices) (Zip code)

Tara Tilbury

50 South Sixth Street, Suite 2350

Minneapolis, MN 55402

(Name and address of agent for service)

Registrant’s telephone number, including area code: (612) 376-7132

Date of fiscal year end: March 31

Date of reporting period: March 31, 2024

| Item 1. | Reports to Stockholders. |

| | (a) | The Report to Shareholders is attached herewith. |

RBC Global Asset Management Annual Report For the year ended March 31, 2024 RBC Emerging Markets Equity Fund RBC Emerging Markets ex-China Equity Fund RBC Emerging Markets Value Equity Fund RBC Global Opportunities Fund RBC Global Equity Leaders Fund RBC International Opportunities Fund RBC International Equity Fund RBC International Small Cap Equity Fund RBC China Equity Fund

LETTER FROM THE PORTFOLIO MANAGERS

Dear Shareholder:

Market Review

2023 proved to be a more positive year for global equity markets than many anticipated. Entering the year, sentiment was very negative, with most economists assuming a global recession was inevitable as a significant tightening in monetary policy would act as a restraint on global activity. While some countries, most notably in Europe, experienced growth challenges, the U.S. economy remained remarkably resilient, propelled forward by steady consumer spending supported by a robust labor market. This relative economic strength coupled with excitement around artificial intelligence (“AI”) innovation caused the U.S. stock market to outperform many other developed markets. Having said that, gains were concentrated in a few mega capitalization technology and consumer companies dubbed the “Magnificent 7.”

China was a clear outlier to the global equity rebound in 2023. Despite positive posturing around reopening trade after China’s zero-COVID policy was lifted in late 2022, consumer and business confidence lagged, and the government was unable to suitably stimulate its property sector. Outside of China, emerging markets performed broadly in line with developed markets.

While inflation remained above target levels in many countries, the downward trajectory appeared sufficient for central bankers to signal that the upward interest rate cycle has likely ended and that market participants should expect the next interest rate move to be lower. Investors responded positively to this development, driving stocks higher into year-end. This enthusiasm has carried over to 2024 as a combination of declining interest rates against a backdrop of reasonable economic growth especially in the U.S. should be supportive for equity prices.

Portfolio Review – RBC Emerging Markets Equity Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 6.54% (Class I shares). That compares to an annualized total return of 8.15% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of the negative excess returns. Underperformance in financials was the primary drag on relative returns while the Fund had positive alpha from selection in the consumer staples and information technology sectors. Stock selection in China and India was negative, though selection in South Korea was positive.

Portfolio Review – RBC Global Opportunities Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 16.22% (Class I shares). That compares to an annualized total return of 23.22% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark

Stock selection was responsible for the majority of negative excess returns. Underperformance in financials, consumer staples, and health care holdings offset positive alpha derived from positions in information technology and consumer discretionary, and no exposure to real estate. At the stock level, relative returns were aided by NVIDIA, a leader in AI solutions. Other positive contributors included TSMC and Safran. Stocks that detracted from returns included AIA, MarketAxess, and Anheuser-Busch InBev.

Portfolio Review – RBC International Opportunities Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 0.69% (Class I shares). That compares to an annualized total return of 13.26% for the MSCI ACWI ex USA Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in financials, materials, and consumer staples holdings offset positive alpha derived from positions in communication services and information technology and not owning any real estate companies. At the stock level, stocks that aided relative returns included TSMC, InterContinental Hotels, and Safran. Stocks that detracted from returns included AIA, Astellas Pharma, and Adyen.

1

LETTER FROM THE PORTFOLIO MANAGERS

Portfolio Review – RBC Emerging Markets Value Equity Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 10.78% (Class I shares). That compares to an annualized total return of 8.15% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of the positive excess returns during the period. Positive alpha was derived from selection in the materials, financials, and information technology sectors.

Portfolio Review – RBC Global Equity Leaders Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 21.20% (Class I shares). That compares to an annualized total return of 23.22% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in financials, consumer staples, and industrials holdings offset positive alpha derived from positions in information technology and consumer discretionary and not owning any utilities stocks. At the stock level, relative returns were aided by NVIDIA and Safran and not owning Apple. Stocks that detracted from returns included Estee Lauder, AIA, and Anheuser-Busch InBev.

Portfolio Review – RBC China Equity Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of -13.69% (Class I shares). That compares to an annualized total return of -17.05% for the MSCI China Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was the primary driver of outperformance for the period. Positive alpha was derived from selection in the health care and consumer discretionary sectors.

Portfolio Review – RBC Emerging Markets ex-China Equity Fund

For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 19.07% (Class I shares). That compares to an annualized total return of 20.51% for the MSCI Emerging Markets ex-China Net Total Return USD Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of the negative excess returns. Outperformance in the consumer staples and information technology sectors was offset by negative alpha from selection in the financials and healthcare sectors. Positive alpha from selection in South Korea also contributed to outperformance.

Portfolio Review – RBC International Equity Fund

For the 12-month period ended March 31, 2024, the Fund had a total return of 16.62% (Class I shares). That compares to a total return of 15.32% for the MSCI EAFE Total Return Net Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of positive excess returns. Outperformance in industrials, health care, and materials holdings offset negative alpha derived from positions in consumer discretionary, consumer staples, and information technology. At the stock level, relative returns were aided by stocks including Tokio Marine Holdings, Mitsubishi UFJ, and Novo Nordisk. Stocks that detracted from returns included Budweiser Brewing, Toyota, and Tencent.

Portfolio Review – RBC International Small Cap Equity Fund

For the 12-month period ended March 31, 2024, the Fund had a total return of 8.77% (Class I shares). That compares to an total return of 12.80% for the MSCI ACWI ex USA Small Cap Total Return Net Index, the Fund’s primary benchmark.

Stock selection was responsible for the majority of negative excess returns. Underperformance in financials, information technology, and industrials holdings offset positive alpha derived from health care, consumer discretionary, and real estate positions. At the stock level, relative returns were aided by stocks including Laboratorius Farmaceuticas Rovi, M&A Research Institute, and Organu. Stocks that detracted from returns included Remy Cointreau, Keywords Studios, and BayCurrent Consulting.

2

LETTER FROM THE PORTFOLIO MANAGERS

Outlook

Global equity markets have rebounded significantly in recent months, primarily driven by valuation expansion rather than a significant earnings uplift. As such, stocks appear to be embedding a more positive outlook for corporate earnings, which may well be warranted given diminished macroeconomic uncertainty. However, given higher valuations observed in markets including the U.S., should the anticipated corporate earnings recovery disappoint relative to expectations, equity prices may experience some near-term volatility, which we believe will place extra emphasis on effective portfolio construction and disciplined risk management.

Our long-held belief in owning great businesses at attractive valuations remains unwavering. By investing in leading companies that enjoy strong competitive advantages, we remain optimistic that we can deliver attractive risk-adjusted returns for our investors.

Phil Langham

Senior Portfolio Manager and Head, Emerging Market Equities

RBC Global Asset Management (UK) Limited

Habib Subjally

Senior Portfolio Manager and Head, Global Equities

RBC Global Asset Management (UK) Limited

David Lambert

Senior Portfolio Manager and Head, European Equities

RBC Global Asset Management (UK) Limited

Past performance does not guarantee future results.

The information provided herein represents the opinions of the Funds’ Portfolio Managers and is not intended to be a forecast of future events, a guarantee of future results, or investment advice.

Mutual fund investing involves risk. Principal loss is possible. The Funds invest in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The RBC Global Equity Leaders Fund and the RBC China Equity Fund are non-diversified, which means they may concentrate their assets in fewer individual holdings than a diversified fund. Therefore, the Funds are more exposed to individual security volatility than a diversified fund. The RBC Emerging Markets Value Equity Fund invests in value stocks, which may not increase in price as anticipated by the Adviser if they fall out of favor with investors or the markets favor faster growing companies. Investing in securities economically tied to China may subject the RBC China Equity Fund to a higher degree of risk of loss than investing in other countries or groups of countries because of the risks associated with, among other things, adverse securities markets, negative foreign currency rate fluctuations and social, political, regulatory, economic, or environmental instabilities and natural disasters. The Funds may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. A Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus.

The “Magnificent 7” comprise Microsoft Corp., Amazon.com Inc., Meta Platforms Inc., Apple Inc., Alphabet Inc., Nvidia Corp., and Tesla Inc.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax.

3

LETTER FROM THE PORTFOLIO MANAGERS

Fund performance attribution data excludes Fund holdings that are fair-valued.

Excess return is the difference between the benchmark return and the portfolio return, which may be either positive or negative.

Alpha is a risk-adjusted performance measurement of a portfolio’s’ excess return relative to its benchmark after considering its risk relative to the benchmark.

Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for complete lists of Fund holdings.

The MSCI ACWI Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax.

The MSCI ACWI ex USA Index is a free float adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI China Index captures large- and mid-capitalization representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (e.g., ADRs). The MSCI China Index covers about 85% of this China equity universe, and currently includes large- and mid-capitalization A shares represented at 20% of their free float-adjusted market capitalization. The Net Index is net of any foreign withholding tax.

The MSCI Emerging Markets ex-China Index captures large- and mid-capitalization representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax.

The MSCI EAFE Index is an equity index which captures large- and mid-capitalization representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax.

The MSCI ACWI ex USA Small Cap Index captures small capitalization representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

You cannot invest directly in an index.

4

| | | | | | |

| | | | | | PORTFOLIO MANAGERS |

| | | | | | |

| | | |

| | | | | | RBC Global Asset Management (U.S.) Inc. (“RBC GAM-US”) serves as the investment advisor and RBC Global Asset Management (UK) Limited (“RBC GAM-UK”) serves as the investment sub-advisor to the Funds and is responsible for the overall management of the Funds’ portfolios. The individual primarily responsible for the day-to-day management of each Fund’s portfolio is set forth below. |

| | | | | | Philippe Langham Senior Portfolio Manager and Head of Emerging Market Equities Philippe Langham is Head of Emerging Market Equities at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Equity Fund and RBC Emerging Markets ex-China Equity Fund. Philippe joined RBC GAM-UK in November 2009 from Societe Generale Asset Management, where he was Head of Global Emerging Markets. He was previously Director and Head of Emerging Markets and Asia at Credit Suisse in Zurich. Prior to that, he managed Global Emerging Markets, Asian, Latin American and U.S. portfolios for nine years at the Kuwait Investment Office. Philippe holds a BSc in economics from the University of Manchester in England and is a Chartered Accountant. |

| | | | | | Laurence Bensafi Senior Portfolio Manager and Deputy Head of Emerging Markets Equity Laurence Bensafi is Deputy Head of Emerging Markets Equity at RBC GAM-UK and is responsible for portfolio management of RBC Emerging Markets Value Equity Fund. Prior to joining RBC GAM-UK in 2013, Laurence was the Head of Aviva Investors’ Emerging Markets team, where she was responsible for managing Global Emerging Markets income funds and for developing quantitative stock selection and analysis models. Laurence began her investment career as a Quantitative Analyst at Societe Generale Asset Management, supporting European and Global Equity portfolio management by developing quantitative models to assist in the portfolio construction and security selection process. In 1997, Laurence obtained a Magistere d’Economiste Statisticien & D.E.S.S. Statistique et Econometrie from Toulouse University in France. Laurence is a CFA charterholder. |

| | | | | | | Habib Subjally Senior Portfolio Manager and Head of Global Equities Habib Subjally is Head of Global Equities at RBC GAM-UK and is responsible for portfolio management of RBC Global Opportunities Fund, RBC International Opportunities Fund and RBC Global Equity Leaders Fund. Prior to joining RBC GAM-UK in 2014 Habib and his team spent eight years together at First State managing global equities. Previously he was Head of Small & Mid Cap Research at Credit Suisse and Head of the Global equities team at Invesco. Habib began his fund management career at Merrill Lynch Investment Managers, where he was Head of North American and Global equities research. He holds a BSc (Hons) from the London School of Economics and holds Chartered Accountant and Associate of the Society of Investment Professionals (ASIP) designations. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

5

| | | | | | |

PORTFOLIO MANAGERS | | | | | | |

| | | | | | | |

Siguo Chen Portfolio Manager Siguo Chen is a portfolio manager on the RBC Asian Equity team at RBC Global Asset Management and for RBC China Equity Fund. She is the lead manager for the team’s China strategy and is also the team’s healthcare specialist. Prior to joining RBC in 2017, Siguo was a sell-side equity analyst with a multinational investment bank where she specialized in China and Hong Kong consumer sectors and Hong Kong Equity strategy. | | | | | | |

Mayur Nallamala Head of Asian Equity, Senior Portfolio Manager Mayur Nallamala is a senior portfolio manager on the RBC Asian Equity team at RBC Global Asset Management and for RBC China Equity Fund. Prior to joining the firm in 2013, he was a portfolio manager at a global asset management firm, responsible for Asia Pacific ex-Japan mandates, managing assets on behalf of sovereign wealth, institutional and retail clients around the world. Mayur had earlier worked at major brokerage firms in London and Hong Kong, working in derivatives and equity research. He began his career in the investment industry in 1998. | | | | | | |

David Lambert Senior Portfolio Manager and Head of European Equities David Lambert is Senior Portfolio Manager and Head of the European Equity Team at RBC GAM-UK and is responsible for portfolio management of RBC International Equity Fund and RBC International Small Cap Equity Fund. He joined the organization directly from university in 1999, originally as a quantitative analyst. During his time at RBC GAM-UK, David has completed the UK Institute of Investment Management and Research (now UKSIP) examinations. He has managed a number of UK and European portfolios for the firm over the years. | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

6

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | 10 Year | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

Average Annual Total Returns as of March 31, 2024 (Unaudited) | | | | | | | | | | | | | | | |

| | | | | |

RBC Emerging Markets Equity Fund | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 0.12% | | | | 1.53% | | | 3.74% | | | 3.83% | | | | | | | | | |

- At Net Asset Value | | | 6.29% | | | | 2.74% | | | 4.35% | | | 4.44% | | | | 1.13% | | | | 1.82% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 6.54% | | | | 3.01% | | | 4.60% | | | 4.69% | | | | 0.88% | | | | 1.03% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 6.59% | | | | 3.00% | | | 4.66% | | | 4.76% | | | | 0.88% | | | | 0.90% | |

| | | | | | |

MSCI Emerging Markets | | | | | | | | | | | | | | | | | | | | | | |

Net Total Return | | | | | | | | | | | | | | | | | | | | | | |

USD Index(e) | | | 8.15% | | | | 2.22% | | | 2.95% | | | 2.95% | | | | | | | | | |

RBC Emerging Markets ex-China Equity Fund(d) | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 12.04% | | | | N/A | | | N/A | | | 12.55% | | | | | | | | | |

- At Net Asset Value | | | 18.73% | | | | N/A | | | N/A | | | 17.83% | | | | 1.15% | | | | 4.29% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 19.07% | | | | N/A | | | N/A | | | 18.10% | | | | 0.90% | | | | 2.24% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 18.99% | | | | N/A | | | N/A | | | 18.12% | | | | 0.90% | | | | 3.12% | |

| | | | | | |

MSCI Emerging Markets ex-China | | | | | | | | | | | | | | | | | | | | | | |

Total Return Net Index(e) | | | 20.51% | | | | N/A | | | N/A | | | 16.93% | | | | | | | | | |

RBC Emerging Markets Value Equity Fund | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 4.13% | | | | 2.95% | | | N/A | | | 0.54% | | | | | | | | | |

- At Net Asset Value | | | 10.47% | | | | 4.17% | | | N/A | | | 1.52% | | | | 1.20% | | | | 19.67% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 10.78% | | | | 4.41% | | | N/A | | | 1.75% | | | | 0.95% | | | | 1.57% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 11.00% | | | | 4.52% | | | N/A | | | 1.84% | | | | 0.88% | | | | 1.62% | |

| | | | | | |

MSCI Emerging Markets | | | | | | | | | | | | | | | | | | | | | | |

Net Total Return | | | | | | | | | | | | | | | | | | | | | | |

USD Index(e) | | | 8.15% | | | | 2.22% | | | N/A | | | 0.98% | | | | | | | | | |

RBC Global Opportunities Fund | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 9.20% | | | | 7.49% | | | N/A | | | 8.85% | | | | | | | | | |

- At Net Asset Value | | | 15.88% | | | | 8.78% | | | N/A | | | 9.54% | | | | 1.00% | | | | 20.49% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 16.22% | | | | 9.06% | | | N/A | | | 9.76% | | | | 0.75% | | | | 0.84% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 16.23% | | | | 9.11% | | | N/A | | | 9.81% | | | | 0.70% | | | | 0.73% | |

| | | | | | |

MSCI ACWI Net | | | | | | | | | | | | | | | | | | | | | | |

Total Return USD Index(e) | | | 23.22% | | | | 10.92% | | | N/A | | | 8.76% | | | | | | | | | |

7

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | 10 Year | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

Average Annual Total Returns as of March 31, 2024 (Unaudited) | | | | | | | | | | | | | | | |

| | | | | |

RBC Global Equity Leaders Fund(f) | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 14.03% | | | | N/A | | | N/A | | | (3.16)% | | | | | | | | | |

- At Net Asset Value | | | 20.93% | | | | N/A | | | N/A | | | (0.63)% | | | | 1.00% | | | | 7.76% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 21.20% | | | | N/A | | | N/A | | | (0.36)% | | | | 0.75% | | | | 7.24% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 21.25% | | | | N/A | | | N/A | | | (0.31)% | | | | 0.70% | | | | 7.51% | |

| | | | | | |

MSCI ACWI Net Total Return USD Index(e) | | | 23.22% | | | | N/A | | | N/A | | | 4.20% | | | | | | | | | |

RBC International Opportunities Fund | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (5.26)% | | | | 2.39% | | | N/A | | | 2.91% | | | | | | | | | |

- At Net Asset Value | | | 0.49% | | | | 3.61% | | | N/A | | | 3.56% | | | | 1.05% | | | | 4.98% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 0.69% | | | | 4.06% | | | N/A | | | 3.89% | | | | 0.80% | | | | 1.07% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 0.58% | | | | 4.09% | | | N/A | | | 3.93% | | | | 0.75% | | | | 1.00% | |

| | | | | | |

MSCI ACWI ex USA Net Total Return USD Index(e) | | | 13.26% | | | | 5.97% | | | N/A | | | 4.73% | | | | | | | | | |

RBC International Equity Fund(d) | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 9.64% | | | | N/A | | | N/A | | | 11.04% | | | | | | | | | |

- At Net Asset Value | | | 16.36% | | | | N/A | | | N/A | | | 16.24% | | | | 1.04% | | | | 3.74% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 16.62% | | | | N/A | | | N/A | | | 16.52% | | | | 0.79% | | | | 2.64% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 16.77% | | | | N/A | | | N/A | | | 16.64% | | | | 0.74% | | | | 3.19% | |

| | | | | | |

MSCI EAFE Total Return Net Index(e) | | | 15.32% | | | | N/A | | | N/A | | | 15.72% | | | | | | | | | |

RBC International Small Cap Equity Fund(d) | | | | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | 2.23% | | | | N/A | | | N/A | | | 3.72% | | | | | | | | | |

- At Net Asset Value | | | 8.51% | | | | N/A | | | N/A | | | 8.57% | | | | 1.24% | | | | 10.81% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.77% | | | | N/A | | | N/A | | | 8.86% | | | | 0.99% | | | | 9.00% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | 8.82% | | | | N/A | | | N/A | | | 8.90% | | | | 0.94% | | | | 9.65% | |

| | | | | | |

MSCI ACWI ex USA Small Cap Index(e) | | | 12.80% | | | | N/A | | | N/A | | | 11.79% | | | | | | | | | |

8

|

PERFORMANCE SUMMARY (UNAUDITED) |

| | | | | | | | | | | | | | | | | | | | | | |

| | | 1

Year | | | 5

Year | | | 10 Year | | Since

Inception(a) | | | Net

Expense

Ratio(b)(c) | | | Gross

Expense

Ratio(b)(c) | |

Average Annual Total Returns as of March 31, 2024 (Unaudited) | | | | | | | | | | | | | | | |

| | | | | |

RBC China Equity Fund(g) | | | | | | | | | | | | | | | | | | | |

Class A | | | | | | | | | | | | | | | | | | | | | | |

- Including Max Sales Charge of 5.75% | | | (18.79)% | | | | N/A | | | N/A | | | (12.68)% | | | | | | | | | |

- At Net Asset Value | | | (13.84)% | | | | N/A | | | N/A | | | (10.01)% | | | | 1.30% | | | | 8.66% | |

Class I | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | (13.69)% | | | | N/A | | | N/A | | | (9.80)% | | | | 1.05% | | | | 7.48% | |

Class R6 | | | | | | | | | | | | | | | | | | | | | | |

- At Net Asset Value | | | (13.64)% | | | | N/A | | | N/A | | | (9.76)% | | | | 1.00% | | | | 7.87% | |

| | | | | | |

MSCI China Index(e) | | | (17.05)% | | | | N/A | | | N/A | | | (9.25)% | | | | | | | | | |

MSCI China All Shares Index(e) | | | (16.63)% | | | | N/A | | | N/A | | | (9.97)% | | | | | | | | | |

Parentheses indicate negative performance returns.

Performance data quoted represents past performance. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Performance shown reflects contractual fee waivers, without such fee waivers total returns would be reduced. For performance data current to the most recent month-end go to www.rbcgam.com. Please see footnotes below.

| (a) | The since inception date (commencement of operations) is December 20, 2013 for RBC Emerging Markets Equity Fund for Class A and Class I shares and November 22, 2016 for Class R6 shares and February 9, 2018 for RBC Emerging Markets Value Equity Fund for Class I and Class R6 shares and April 19, 2022 for Class A shares and December 3, 2014 for RBC Global Opportunities Fund and RBC International Opportunities Fund for Class I shares, November 22, 2016 for Class R6 shares and January 28, 2020 for Class A Shares. The performance in the table for Class R6 shares prior to November 22, 2016 reflects the performance of the Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class R6 shares. The performance in the table for Class A shares of Global Opportunities Fund and International Opportunities Fund prior to January 28, 2020, reflects the performance of Class I shares since the Fund’s inception, adjusted to reflect the fees and expenses of Class A shares. |

| (b) | The Funds’ expenses are from the Funds’ most recent prospectus dated July 26, 2023, and reflect the fiscal year ended March 31, 2023. For International Equity Fund and International Small Cap Equity Fund, the expenses reflect the period from December 14, 2022 (commencement of operations) through March 31, 2023. For Emerging Markets ex-China Equity Fund, the expenses reflect the period from December 15, 2022 (commencement of operations) through March 31, 2023. |

| (c) | The Advisor has contractually agreed to waive fees and/or make payments in order to keep total operating expenses of the Fund to the levels disclosed in the Funds’ prospectuses until July 31, 2025 (September 30, 2025 for RBC Emerging Markets Equity Fund). |

| (d) | The inception date for the RBC Emerging Markets ex-China Equity Fund is December 15, 2022. The inception date for the RBC International Equity Fund and RBC International Small Cap Equity Fund is December 14, 2022. |

9

|

PERFORMANCE SUMMARY (UNAUDITED) |

| (e) | Each of the comparative indices is a widely recognized market value weighted measure of the return of securities, but does not include sales fees or operating expenses. You cannot invest directly in indices. |

| (f) | The inception date for the RBC Global Equity Leaders Fund is December 15, 2021. |

| (g) | The inception date for the RBC China Equity Fund is April 11, 2022. |

The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax.

The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI EAFE Index is an equity index which captures large- and mid-capitalization representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI ACWI ex USA Small Cap Index captures small capitalization representation across 22 of 23 Developed Markets (DM) countries (excluding the U.S.) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax.

The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax.

The MSCI Emerging Markets ex-China Index captures large- and mid-capitalization representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax.

The MSCI China and MSCI China All Shares Indices capture large- and mid-capitalization representation across China A shares, H shares, B shares, Red chips, P chips, and foreign listings (e.g., ADRs). The MSCI China Index covers about 85% of this China equity universe, and currently includes large- and mid-capitalization A shares represented at 20% of their free float-adjusted market capitalization. The MSCI China All Shares Index aims to reflect the opportunity set of China share classes listed in Hong Kong, Shanghai, Shenzhen, and outside of China, and is based on the concept of the integrated MSCI China equity universe with China A shares included. The Net Indices are net of any foreign withholding tax.

You cannot invest directly in an index.

Mutual fund investing involves risk. Principal loss is possible.

10

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Emerging Markets Equity Fund |

| | | | | | |

| | | |

| Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities tied to emerging market countries that are considered by the Fund to have the potential to provide long-term capital growth. For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 6.54% (Class I). That compares to an annualized total return of 8.15% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark. |

| | | |

| Factors that Contributed to Relative Returns | | | | | | • Stock selection within the Consumer Staples and Information Technology sectors • Stock selection in South Korea |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in Financials sector • Stock selection in China and India |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

11

| | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | |

| MSCI Emerging Markets Net Total Return USD Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| *Includes U.S. dollar denominated cash equivalent investments representing 0.73% of investments. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 8.44% | | SK Hynix, Inc. | | 3.69% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

HDFC Bank Ltd. | | | | 4.79% | | Mahindra & Mahindra Ltd. | | 3.46% |

Antofagasta Plc | | | | 4.64% | | Samsung Electronics Co. Ltd., 2.23% | | 3.08% |

Tencent Holdings Ltd. | | | | 4.64% | | Unilever Plc | | 2.80% |

Tata Consultancy Services Ltd. | | | | 4.17% | | | | | | |

Fomento Economico Mexicano SAB de CV | | 4.01% | | | | | | |

*A listing of all portfolio holdings can be found beginning on page 32 | | |

| | | | | | | | | | | | | | | | | |

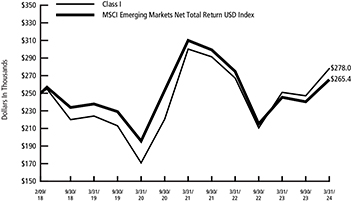

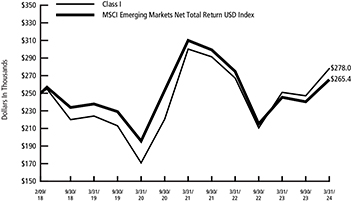

| | | | | | Growth of $250,000 Initial Investment Over 10 Years |

| | | | | | |

| The graph reflects an initial hypothetical investment of $250,000 over 10 year period through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

12

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Emerging Markets ex-China Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities economically tied to emerging market countries (excluding China). For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had a total return of 19.07% (Class I). That compares to a total return of 20.51% for the MSCI Emerging Markets ex-China Total Return Net Index, the Fund’s primary benchmark. |

Factors that Contributed to Relative Returns | | | | | | • Performance of stocks within the Consumer Staples and Information Technology sectors • Stock selection within South Korea |

Factors That Detracted From Relative Returns | | | | | | • Stock selection within the Financials and Healthcare sectors |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | The MSCI Emerging Markets ex-China Index captures large and mid cap representation across 23 of the 24 Emerging Markets (EM) countries excluding China. With 663 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

13

| | | | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets ex-China Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | | | |

| MSCI Emerging Markets ex-China Net Total Return Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

*Includes U.S. dollar denominated cash equivalent investments representing 0.22% of investments. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 9.50% | | | Phoenix Mills Ltd. (The) | | 3.38% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

Antofagasta Plc | | | 4.43% | | | Samsung Electronics Co. Ltd. | | 3.16% | | | | |

SK Hynix, Inc. | | | 3.88% | | | Mahindra & Mahindra Ltd. | | 3.07% | | | | |

Fomento Economico Mexicano SAB de CV | | | 3.72% | | | Samsung Electronics Co. Ltd., 2.23% | | 3.05% | | | | |

Tata Consultancy Services Ltd. | | | 3.59% | | | Raia Drogasil SA | | | | 2.89% | | | | |

*A listing of all portfolio holdings can be found beginning on page 36 | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | Growth of $250,000 Initial Investment Since Inception (12/15/22) |

| | | | | | | |

| The graph reflects an initial hypothetical investment of $250,000 over the period from December 15, 2022 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

14

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Emerging Markets Value Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities tied economically to emerging market countries that are considered to be undervalued in relation to earnings, dividends and/or assets. For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. |

| | | | | | |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 10.78% (Class I). That compares to an annualized total return of 8.15% for the MSCI Emerging Markets Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | | | |

| | | |

| Factors that Contributed to Relative Returns | | | | | | • Stock selection in the Materials, Financials and Information Technology sectors |

| | | | | | |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Stock selection in Communication Services and Brazil |

| | | | | | |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund invests in value stocks, which may not increase in price as anticipated by the Adviser if they fall out of favor with investors or the markets favor faster growing companies. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. It captures large- and mid-capitalization representation across emerging markets countries and covers approximately 85% of the free float-adjusted market capitalization in each country. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. |

| | | | | | Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

15

| | | | | | | | | | | | | | | | |

| | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

RBC Emerging Markets Value Equity Fund | | | | | | |

| | | | | | | |

| | | | |

| The Fund seeks to provide long-term capital growth. | | | | | | | | Investment Objective |

| | | | | | | | | | | | | | | |

MSCI Emerging Markets Net Total Return USD Index | | | | | | Benchmark |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| *Includes U.S. dollar denominated cash equivalent investments representing 0.01% of investments. | | | | | | |

| | | | | | | |

| | | | | | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 8.62% | | Axis Bank Ltd. | | 2.09% | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

Samsung Electronics Co. Ltd. | | 5.37% | | Hindalco Industries Ltd. | | 1.99% | | | | |

Alibaba Group Holding Ltd. | | 3.84% | | China Merchants Bank Co. Ltd. | | 1.95% | | | | |

Naspers Ltd. | | 2.79% | | Shriram Finance Ltd. | | | | 1.92% | | | | |

Antofagasta Plc | | 2.76% | | Redington Ltd. | | | | 1.90% | | | | |

*A listing of all portfolio holdings can be found beginning on page 40 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | Growth of $250,000 Initial Investment Since Inception (2/9/18) |

| | | | | | |

| The graph reflects an initial hypothetical investment of $250,000 over the period from February 9, 2018 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

16

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Global Opportunities Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets. Under normal circumstances, the Fund will typically invest at least the lesser of (i) 40% of its total assets in the securities of issuers located in countries other than the United States or (ii) an amount of its total assets equal to the approximate percentage of issuers located in countries other than the United States included in the MSCI ACWI Net Total Return USD Index, unless the Sub-Advisor determines, in its sole discretion, that conditions are not favorable. If the Sub-Advisor determines that conditions are not favorable, the Fund may invest under 40% of its total assets in the securities of issuers located outside of the United States, provided that the Fund will not invest less than 30% of its total assets in such securities except for temporary defensive purposes. The Fund will normally invest in equity securities of companies domiciled in at least three countries (one of which may be the United States). |

| | | | | | |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 16.22% (Class I). That compares to an annualized total return of 23.22% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark. |

| | | | | | |

| Factors that Contributed to Relative Returns | | | | | | • Stock selection within the Information Technology and Consumer Discretionary sectors • Lack of exposure to the Real Estate sector • Performance of NVIDIA Corp., Taiwan Semiconductor Manufacturing Company and Safran SA |

| | | | | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance of stocks in the Financials, Consumer Staples and Healthcare sectors • Performance of AIA Group Ltd, MarketAxess Holdings and Anheuser-Busch InBev |

| | | | | | |

| | | |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may focus its investments in a region or small group of countries. As a result, the Fund’s performance may be subject to greater volatility than a more geographically diversified fund. The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | |

17

| | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | |

| | | |

| RBC Global Opportunities Fund | | | | | | |

| | | |

| The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. | | | | | | |

| | | |

| Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. | | | | | | |

| | | |

| Past performance is not a guarantee of future results. | | | | | | |

| | | |

| | | | | | |

18

| | | | | | | | | | | | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | |

| | | | | | RBC Global Opportunities Fund | |

| Investment Objective | | | | | | The Fund seeks to provide long-term capital growth. | |

| Benchmark | | | | | | MSCI ACWI Net Total Return USD Index | |

Asset Allocation

as of 3/31/24 (%

of Fund’s

investments) &

Top Five GICS

sectors (as of

3/31/24) (% of

Fund’s net assets) | | | | | |

| |

| | | |

| | | | | | *Includes U.S. dollar denominated cash equivalent investments representing 2.51% of investments. | |

| | | | | | |

Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) | | | | | | Microsoft Corp. | | | 6.01 | % | | AutoZone, Inc. | | | 3.76 | % |

| | NVIDIA Corp. | | | 4.22 | % | | Visa, Inc. | | | 3.67 | % |

| | UnitedHealth Group, Inc. | | | 4.19 | % | | Fortive Corp. | | | 3.51 | % |

| | Safran SA | | | 4.13 | % | | Anheuser-Busch InBev NV | | | 3.50 | % |

| | Alphabet, Inc. | | | 4.07 | % | | | | | | |

| | | | | | Taiwan Semiconductor | | | 4.04 | % | | | | | | |

| | | | | | Manufacturing Co. Ltd. | | | | | | | | | | |

| | | | | | *A listing of all portfolio holdings can be found beginning on page 45 | |

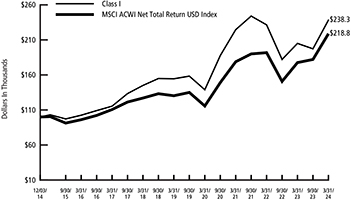

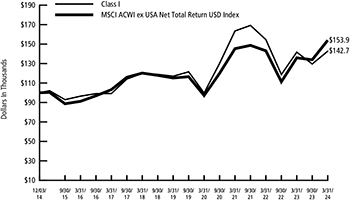

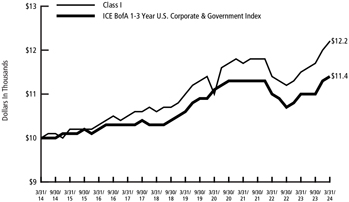

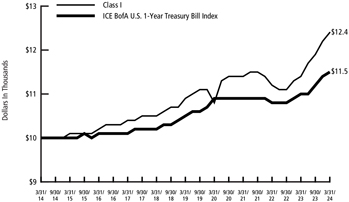

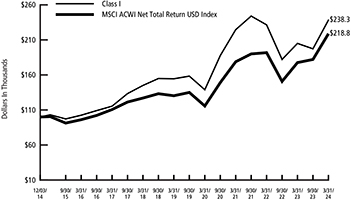

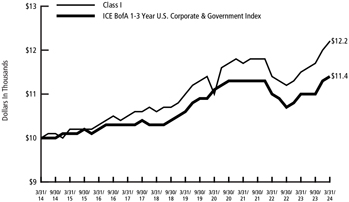

Growth of $100,000 Initial Investment Since Inception (12/3/14) | | | | | |

The graph reflects an initial hypothetical investment of $100,000 over the period from December 3, 2014 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | |

| | | | | | |

| | | | | | | | | | | | | | | | |

19

This Page Intentionally Left Blank

20

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC Global Equity Leaders Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets. Under normal circumstances, the Fund aims to achieve its investment objective by investing at least 80% of the value of its net assets (plus any borrowings for investment purposes) in equity securities. The Fund also will, under normal market conditions: (1) invest at least 40% of its assets outside the United States, or if market conditions are not favorable, at least 30% of its assets outside the United States, and (2) hold securities of issuers located in at least three countries. |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 21.20% (Class I). That compares to an annualized total return of 23.22% for the MSCI ACWI Net Total Return USD Index, the Fund’s primary benchmark. |

| | | |

Factors that Contributed to Relative Returns | | | | | | • Underperformance in the Financials, Consumer Staples and Industrials sectors • At the stock level, relative returns were aided performance of NVIDIA Corp. and Safran SA and not holding stock in Apple |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in the Information Technology and Consumer Discretionary • Lack of exposure to the Utilities sector • Underperformance of Estee Lauder Cos., AIA Group and Anheuser-Busch InBev |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund is non-diversified, which means it may concentrate its assets in fewer individual holdings than a diversified fund. Therefore, the Fund is more exposed to individual security volatility than a diversified fund. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. It captures large- and mid-capitalization representation across developed markets and emerging markets countries and covers approximately 85% of the global investable equity opportunity set. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

21

| | | | | | | | | | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | | |

RBC Global Equity Leaders Fund | | | | | | | |

The Fund seeks to provide long-term capital growth. | | | | | | | Investment Objective |

MSCI ACWI Net Total Return USD Index | | | | | | | Benchmark |

| | | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 1.59% of investments. | | | | | | | |

| | | | | | | |

Microsoft Corp. | | 5.82% | | NVIDIA Corp. | | | 4.56 | % | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

Novo Nordisk A/S | | 5.25% | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 4.41 | % | | | | |

Alphabet, Inc. | | 5.21% | | Visa, Inc. | | | 4.27 | % | | | | |

Amazon.com, Inc. | | 5.18% | | Procter & Gamble Co. (The) | | | 3.93 | % | | | | |

Safran SA | | 5.02% | | | | | | | | | | |

UnitedHealth Group, Inc. | | 4.96% | | | | | | | | | | |

* A listing of all portfolio holdings can be found beginning on page 48 | | | | | | | | | | |

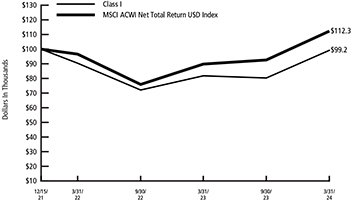

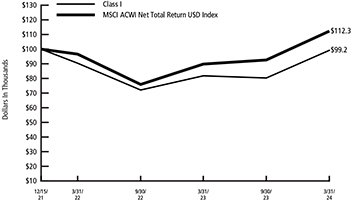

The graph reflects an initial hypothetical investment of $100,000 over the period from December 15, 2021 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/15/2021) |

22

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC International Opportunities Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by primarily investing in equity securities of issuers located throughout the world, including both developed and emerging markets, excluding the U.S. The Fund will invest in securities across all market capitalizations, although the Fund may invest a significant portion of its assets in companies of one particular market capitalization category. |

| | | |

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had an annualized total return of 0.69% (Class I). That compares to an annualized total return of 13.26% for the MSCI ACWI ex USA Net Total Return USD Index, the Fund’s primary benchmark. |

| | | |

Factors that Contributed to Relative Returns | | | | | | • Performance of stocks within the Communication Services and information Technology sectors • Lack of exposure to Real Estate sector • Performance of Taiwan Semiconductor Manufacturing Co., InterContinental Hotels Group Plc, and Safran SA |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in the Financials, Materials and Consumer Staples sectors • Underperformance of AIA Group Ltd., Astellas Pharma and Adyen NV |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund may focus its investments in a region or small group of countries. As a result, the Fund’s performance may be subject to greater volatility than a more geographically diversified fund. The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund may be subject to the risk that a particular investment may be difficult to purchase or sell and that the Fund may be unable to sell illiquid securities at an advantageous time or price. These risks are described more fully in the prospectus. |

| | | | | | The MSCI ACWI ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the U.S. It captures large- and mid-capitalization representation across developed markets and emerging markets countries excluding the U.S. and covers approximately 85% of the global investable equity opportunity set outside the U.S. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

23

| | | | | | | | | | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | | |

RBC International Opportunities Fund | | | | | | | |

The Fund seeks to provide long-term capital growth. | | | | | | | Investment Objective |

MSCI ACWI ex USA Net Total Return USD Index | | | | | | | Benchmark |

| | | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 1.53% of investments. | | | | | | | |

| | | | | | | |

Novo Nordisk A/S | | 6.93% | | Deutsche Post AG | | | 4.52 | % | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

Taiwan Semiconductor Manufacturing Co. Ltd. | | 5.91% | | ICICI Bank Ltd. | | | 4.41 | % | | | | |

Safran SA | | 5.02% | | AIA Group Ltd. | | | 4.31 | % | | | | |

InterContinental Hotels Group Plc | | 4.82% | | Naspers Ltd. | | | 3.74 | % | | | | |

DBS Group Holdings Ltd. | | 4.74% | | Anheuser-Busch InBev NV | | | 3.61 | % | | | | |

* A listing of all portfolio holdings can be found beginning on page 51 | | | | | | | | |

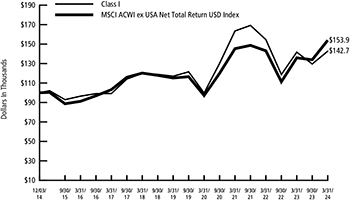

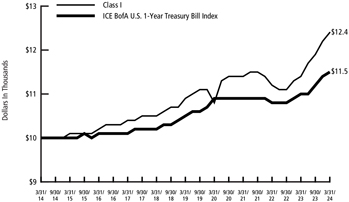

The graph reflects an initial hypothetical investment of $100,000 over the period from December 3, 2014 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/3/14) |

24

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC International Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of companies located throughout the world, excluding the United States. |

| | | |

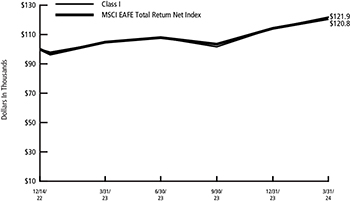

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had a total return of 16.62% (Class I). That compares to a total return of 15.32% for the MSCI EAFE Total Return Net Index, the Fund’s primary benchmark. |

| | | |

Factors that Contributed to Relative Returns | | | | | | • Performance of stocks within the Industrials, Health Care and Materials sectors • Performance of Tokio Marine Holdings, Mitsubishi UFJ Financial Group and Novo Nordisk |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in the Consumer Discretionary, Consumer Staples and Information Technology sectors • Performance of Budweiser Brewing Co. and Tencent Holdings • Lack of exposure to Toyota Motor Corp. |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | The MSCI EAFE Index is an equity index which captures large and mid cap representation across 21 Developed Markets countries around the world, excluding the U.S. and Canada. With 796 constituents, the index covers approximately 85% of the free float adjusted market capitalization in each country. You cannot invest directly in an index. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

25

| | | | | | | | | | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | | |

RBC International Equity Fund | | | | | | | |

The Fund seeks to provide long-term capital growth. | | | | | | | Investment Objective |

MSCI EAFE Total Return Net Index | | | | | | | Benchmark |

| | | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| | | |

*Includes U.S. dollar denominated cash equivalent investments representing 2.11% of investments. | | | | | | | |

| | | | | | | |

Novo Nordisk A/S | | 4.77% | | Mitsubishi Corp. | | | 3.04 | % | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

ASML Holding NV | | 3.71% | | Taiwan Semiconductor Manufacturing Co. Ltd. | | | 2.95 | % | | | | |

Tokio Marine Holdings, Inc. | | 3.19% | | EssilorLuxottica SA | | | 2.89 | % | | | | |

LVMH Moet Hennessy Louis Vuitton SE | | 3.13% | | Hitachi Ltd. | | | 2.88 | % | | | | |

Mitsubishi UFJ Financial Group, Inc. | | 3.07% | | ING Groep NV | | | 2.53 | % | | | | |

* A listing of all portfolio holdings can be found beginning on page 54 | | | | | | | | |

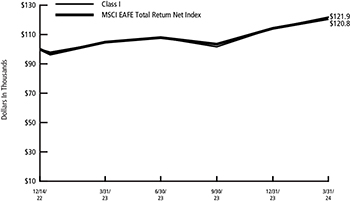

The graph reflects an initial hypothetical investment of $100,000 over the period from December 14, 2022 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/14/22) |

26

| | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | | | | RBC International Small Cap Equity Fund |

| | | | | | |

| | | |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity securities of small companies located throughout the world, excluding the United States. The Fund currently considers “small companies” to be those within the market capitalization range of the MSCI ACWI ex USA Small Cap Index at the time of initial purchase by the Fund. |

| | | |

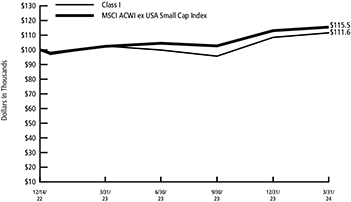

| Performance | | | | | | For the 12-month period ending March 31, 2024, the Fund had a total return of 8.77% (Class I). That compares to a total return of 12.80% for the MSCI ACWI ex US Small Cap Total Return Net Index, the Fund’s primary benchmark. |

| | | |

Factors that Contributed to Relative Returns | | | | | | • Performance of stocks within the Health Care, Consumer Discretionary and Real Estate sectors • At the stock level, relative returns were aided by performance of Laboratorios Farmaceruticos Rovi, M&A Research Institute Holdings and Organo Corp. |

| | | |

Factors That Detracted From Relative Returns | | | | | | • Underperformance in the Financials, Information Technology and Industrials sectors • Individual stocks that detracted from the fund’s performance included Remy Cointreau, Keywords Studios and BayCurrent Consulting |

| | | | | | Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic, and currency risks, and differences in accounting methods. These risks may be greater in emerging markets. The Fund’s investments in smaller companies subject it to greater levels of credit, market and issuer risk. The Fund’s consideration of ESG factors could cause it to perform differently compared to funds that do not take ESG factors into account. These risks are described more fully in the prospectus. |

| | | | | | The MSCI ACWI ex US Small Cap Index captures small cap representation across 22 of 23 Developed Markets (DM) countries (excluding the US) and 23 Emerging Markets (EM) countries. With 4,330 constituents, the index covers approximately 14% of the global equity opportunity set outside the US. The Net Index is net of any foreign withholding tax. You cannot invest directly in an index. Fund holdings and/or sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. Please refer to the Schedule of Investments in this report for a complete list of Fund holdings. |

| | | | | | Past performance is not a guarantee of future results. |

27

| | | | | | | | | | | | | | | | |

MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) | | | | | | | |

RBC International Small Cap Equity Fund | | | | | | | | | | |

The Fund seeks to provide long-term capital growth. | | | | | | | Investment Objective |

MSCI ACWI ex USA Small Cap Index | | | | | | | Benchmark |

*Includes U.S. dollar denominated cash equivalent investments representing 1.88% of investments. | | | | | | | Asset Allocation as of 3/31/24 (% of Fund’s investments) & Top Five GICS sectors (as of 3/31/24) (% of Fund’s net assets) |

| | | | | | |

SpareBank 1 SMN | | | 2.86% | | | Isetan Mitsukoshi Holdings Ltd. | | | 2.39% | | | | | | | Top Ten Holdings (excluding investment companies) (as of 3/31/24) (% of Fund’s net assets) |

Voltronic Power Technology Corp. | | | 2.57% | | | Howden Joinery Group Plc | | | 2.32% | | | | | |

Gaztransport Et Technigaz SA | | | 2.51% | | | M&A Research Institute Holdings, Inc. | | | 2.32% | | | | | |

Laboratorios Farmaceuticos Rovi SA | | | 2.51% | | | Cranswick Plc | | | 2.27% | | | | | |

International Container Terminal Services, Inc. | | | 2.45% | | | Sanrio Co. Ltd. | | | 2.23% | | | | | |

*A listing of all portfolio holdings can be found beginning on page 58 | | | | | | | | | | | |

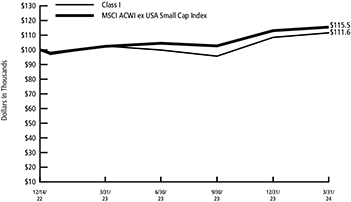

The graph reflects an initial hypothetical investment of $100,000 over the period from December 14, 2022 (commencement of operations) through March 31, 2024 and is based on Class I shares. The Fund’s total return includes reinvested dividends and capital gains. The Fund’s total return also includes operating expenses that reduce return while the total return of the index does not. The graph does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. Performance of other classes will vary due to differences in fee structures. This chart does not imply any future performance. | | | | | | | Growth of $100,000 Initial Investment Since Inception (12/14/22) |

| | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

28

| | | | | | | | |

| | | | | | MANAGEMENT DISCUSSION AND ANALYSIS (UNAUDITED) |

| | | |

| | | | | | RBC China Equity Fund |

Investment Strategy | | | | | | The Fund seeks to achieve its investment objective by investing, under normal circumstances, at least 80% of its assets in equity investments in issuers economically tied to China. For purposes of this policy, the term “assets” means net assets plus the amount of borrowings for investment purposes. For purposes of the 80% investment policy, China includes Mainland China, Hong Kong, and Macau. |

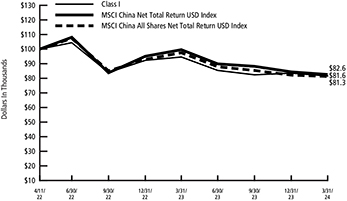

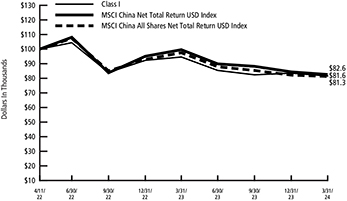

| Performance | | | | | | For the 12-month period ended March 31, 2024, the Fund had a return of -13.69% (Class I). That compares to an annualized total return of -17.05% for the MSCI China Net Total Return USD Index, the Fund’s primary benchmark and -16.63% for the MSCI China All Shares Net Total Return USD Index. |

Factors that Contributed to Relative Returns | | | | | | • Individual stock selection within the Health Care and Consumer Discretionary sectors was better than the benchmark |