UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21488 |

|

Cohen & Steers Utility Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Adam M. Derechin Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2007 | |

| | | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS UTILITY FUND, INC.

August 9, 2007

To Our Shareholders:

We are pleased to submit to you our report for the six months ended June 30, 2007. The net asset values per share at that date were $18.66, $18.60, $18.61 and $18.70 for Class A, Class B, Class C and Class I shares, respectively. In addition, a dividend was declared for shareholders of record on June 28, 2007 and paid on June 29, 2007 to all four classes of shares. The distribution was as follows: Class A—$0.068 per share, Class B—$0.034 per share, Class C—$0.034 per share and Class I—$0.085 per share.a

The total return, including income and change in net asset value for, Cohen & Steers Utility Fund and the comparative benchmarks were:

| | | Six Months Ended

June 30, 2007 | |

| Cohen & Steers Utility Fund—Class A | | | 13.11 | % | |

| Cohen & Steers Utility Fund—Class B | | | 12.79 | % | |

| Cohen & Steers Utility Fund—Class C | | | 12.71 | % | |

| Cohen & Steers Utility Fund—Class I | | | 13.35 | % | |

| S&P 1500 Utilities Indexb | | | 7.50 | % | |

| S&P 500 Indexb | | | 6.96 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the fund current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com. Performance quoted does not reflect the deduction of the maximum 4.5% initial sales charge on Class A shares or the 5% and 1% maximum sales contingent deferred sales charge on Class B and Class C shares, respectively. If such charges were included, returns would have been lower.

a Please note that distributions paid by the fund to shareholders are subject to recharacterization for tax purposes. The final tax treatment of these distributions is reported to shareholders after the close of each fiscal year.

b S&P 1500 Utilities Index is an unmanaged market capitalization weighted index of 78 companies whose primary business involves the generation, transmission and/or distribution of electricity and/or natural gas. The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance.

1

COHEN & STEERS UTILITY FUND, INC.

Investment Review

Following strong absolute and relative performance in 2006, utilities performed well in the first half of 2007, despite a late-period decline amid rising bond yields. Utility stocks generally continued to benefit from a confluence of positive factors: economic and market uncertainty, which led investors to favor the group for its relatively high dividends and perceived defensive nature; strong fundamentals for long-term energy prices, with steady demand and limited supply growth; upward revisions in valuations for power generation assets; and earnings growth projections that remained well above utilities' historical average.

We believe that utilities are also increasingly benefiting from recognition of the growth potential of the competitive wholesale power market. This was highlighted in February, when a KKR-led consortium announced plans to purchase TXU Corp. at a 16% premium to the stock's previous closing day price (while there is some risk the deal may not be completed, we believe this development underscores the attractiveness of power generation). TXU is a Texas-based energy provider with a focus on unregulated power generation and supply. At the time, the $45 billion transaction was the largest announced LBO in history.

The fund outperformed its benchmark in the period, with the strongest returns coming from its integrated electric and independent power producer holdings. Stock selection in the telecommunications services sector was favorable as well. The fund's holdings in the oil and gas storage and transportation sector modestly underperformed.

Investment Outlook

Our outlook for utility fundamentals is generally favorable. We believe that the group should continue to benefit from improving fundamentals, in part due to rising replacement costs and environmental concerns that are driving resistance to the construction of new power generation facilities. If demand continues to outstrip supply, many utilities with unregulated generation should grow earnings as they re-price below-market contracts at higher levels. We further believe that significant restrictions on carbon dioxide emissions will be introduced over time, which could potentially increase the value of carbon-free energy sources such as unregulated nuclear and wind power. Our holdings include companies that are among the largest owners of such assets.

We also note the emergence of formal, structured capacity markets in several regions of the country. Capacity markets are designed to encourage new power plant construction by compensating plant owners solely for having the physical plant available to produce power. This earnings stream is separate from, and is designed to supplement, the earnings that companies make from selling the actual electricity produced. Successful capacity markets should support the economics of new power plant construction and eventually lead to more plants being built.

There remain risks of course, including potential for volatility during periods of rising interest rates (as occurred in early June) as well as political risks, due to utilities' quasi-regulated nature. But given increasing energy prices, strong potential earnings and stock valuations that are not excessive in historical terms, we believe utilities continue to have potential for attractive total returns. We will continue to invest in companies that we believe have attractive valuations and strong earnings and dividend growth potential.

2

COHEN & STEERS UTILITY FUND, INC.

Sincerely,

| |  | |

|

| MARTIN COHEN | | ROBERT H. STEERS | |

|

| Co-chairman | | Co-chairman | |

|

| | |  | |

|

| | | ROBERT S. BECKER | |

|

| | | Portfolio Manager | |

|

The views and opinions in the preceding commentary are as of the date stated and are subject to change. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about any of our funds, visit cohenandsteers.com, where you'll find daily net asset values, fund fact sheets and portfolio highlights. You can also access newsletters, education tools and market updates covering REIT, utility and preferred securities sectors.

In addition, our Web site contains comprehensive information about our firm, including our most recent press releases, profiles of our senior investment professionals, and an overview or our investment approach.

3

COHEN & STEERS UTILITY FUND, INC.

Performance Review (Unaudited)

Average Annual Total Returns for Periods Ended June 30, 2007

| | | Class A Shares | | Class B Shares | | Class C Shares | | Class I Shares | |

| 1 Year (with sales charge) | | | 25.05 | %a | | | 25.05 | %b | | | 29.01 | %d | | | — | | |

| 1 Year (without sales charge) | | | 30.94 | % | | | 30.05 | % | | | 30.01 | % | | | 31.38 | % | |

Since Inceptione

(with sales charge) | | | 19.99 | %a | | | 20.27 | %c | | | 21.20 | % | | | — | | |

Since Inceptione

(without sales charge) | | | 21.75 | % | | | 20.92 | % | | | 21.20 | % | | | 22.15 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com. The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

Through December 31, 2007, the fund's advisor has contractually agreed to waive certain fees and/or reimburse the fund for expenses. Absent such arrangements, returns would have been lower.

a Reflects a 4.50% front-end sales charge.

b Reflects a contingent deferred sales charge of 5%.

c Reflects a contingent deferred sales charge of 3%.

d Reflects a contingent deferred sales charge of 1%.

e Inception date of May 3, 2004.

4

COHEN & STEERS UTILITY FUND, INC.

Expense Example (Unaudited)

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period 01/01/07–06/30/07.

Actual Expenses

The first line of the table below provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

COHEN & STEERS UTILITY FUND, INC.

Expense Example (Unaudited)—(Continued)

| | | Beginning

Account Value

January 1, 2007 | | Ending

Account Value

June 30, 2007 | | Expenses Paid

During Period*

January 1, 2007–

June 30, 2007 | |

| Class A | |

| Actual (13.11% return) | | $ | 1,000.00 | | | $ | 1,131.10 | | | $ | 7.93 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,017.36 | | | $ | 7.50 | | |

| Class B | |

| Actual (12.79% return) | | $ | 1,000.00 | | | $ | 1,127.90 | | | $ | 11.34 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,014.13 | | | $ | 10.74 | | |

| Class C | |

| Actual (12.71% return) | | $ | 1,000.00 | | | $ | 1,127.10 | | | $ | 11.34 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,014.13 | | | $ | 10.74 | | |

| Class I | |

| Actual (13.35% return) | | $ | 1,000.00 | | | $ | 1,133.50 | | | $ | 6.08 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,019.09 | | | $ | 5.76 | | |

* Expenses are equal to the fund's Class A, Class B, Class C and Class I annualized expense ratio of 1.50%, 2.15%, 2.15% and 1.15%, respectively, multiplied by the average account value over the period, multiplied by 181/365 (to reflect the one-half year period). If the fund had borne all of its expenses that were assumed by the advisor, the annualized expense ratios would have been 1.62%, 2.27%, 2.28% and 1.27%, respectively.

6

COHEN & STEERS UTILITY FUND, INC.

JUNE 30, 2007

Top Ten Holdings

(Unaudited)

| Security | | Market

Value | | % of

Net

Assets | |

| Exelon Corp. | | $ | 5,265,896 | | | | 6.1 | % | |

| Entergy Corp. | | | 4,493,027 | | | | 5.2 | | |

| FirstEnergy Corp. | | | 4,029,766 | | | | 4.7 | | |

| Constellation Energy Group | | | 3,835,480 | | | | 4.5 | | |

| FPL Group | | | 3,579,670 | | | | 4.2 | | |

| Public Service Enterprise Group | | | 3,435,972 | | | | 4.0 | | |

| PPL Corp. | | | 3,278,950 | | | | 3.8 | | |

| Allegheny Energy | | | 3,156,140 | | | | 3.7 | | |

| PG&E Corp. | | | 3,058,067 | | | | 3.6 | | |

| AT&T | | | 2,780,500 | | | | 3.2 | | |

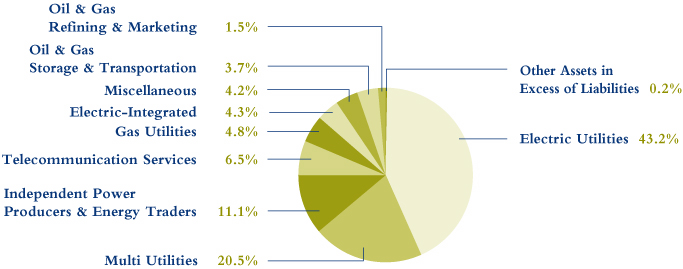

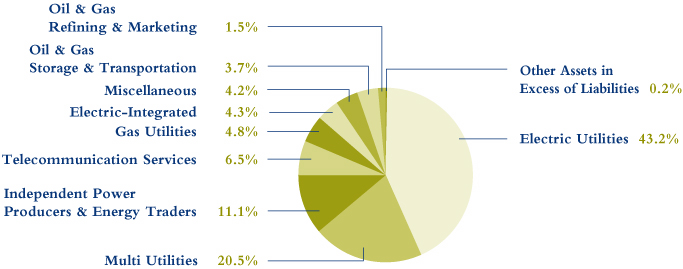

Sector Breakdown

(Based on Net Assets)

(Unaudited)

7

COHEN & STEERS UTILITY FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2007 (Unaudited)

| | | | | Number

of Shares | | Value | |

| COMMON STOCK | | | 99.8 | % | | | | | | | | | |

| Energy | | | 8.5 | % | | | | | | | | | |

| DISTRIBUTION | | | 1.2 | % | | | | | | | | | |

| Spectra Energy Corp. | | | | | | | 39,926 | | | $ | 1,036,479 | | |

| GAS—DISTRIBUTION | | | 1.4 | % | | | | | | | | | |

| EnergySouth | | | | | | | 10,000 | | | | 510,000 | | |

| South Jersey Industries | | | | | | | 19,000 | | | | 672,220 | | |

| | | | | | | | 1,182,220 | | |

| INTEGRATED OIL & GAS | | | 0.2 | % | | | |

| Targa Resources Partners LP | | | | | | | 6,000 | | | | 201,000 | | |

| OIL & GAS EQUIPMENT & SERVICES | | | 0.5 | % | | | |

| Universal Compression Partners LP | | | | | | | 12,500 | | | | 457,375 | | |

| OIL & GAS REFINING & MARKETING | | | 1.5 | % | | | |

| Williams Partners LP | | | | | | | 26,500 | | | | 1,279,420 | | |

| OIL & GAS STORAGE & TRANSPORTATION | | | 3.7 | % | | | |

| DCP Midstream Partners LP | | | | | | | 13,600 | | | | 634,032 | | |

| Teekay Offshore Partners LP | | | | | | | 6,300 | | | | 214,830 | | |

| Williams Cos. (The) | | | | | | | 72,300 | | | | 2,286,126 | | |

| | | | | | | | 3,134,988 | | |

| TOTAL ENERGY | | | | | | | | | | | 7,291,482 | | |

| TELECOMMUNICATIONS SERVICES | | | 6.5 | % | | | |

| America Movil SAB de CV (ADR) (Mexico) | | | | | | | 5,000 | | | | 309,650 | | |

| AT&T | | | | | | | 67,000 | | | | 2,780,500 | | |

| Citizens Communications Co. | | | | | | | 15,000 | | | | 229,050 | | |

| Verizon Communications | | | | | | | 42,940 | | | | 1,767,840 | | |

| Windstream Corp. | | | | | | | 32,000 | | | | 472,320 | | |

| | | | | | | | 5,559,360 | | |

| UTILITIES | | | 84.8 | % | | | |

| ELECTRIC UTILITIES | | | 43.2 | % | | | |

| Allegheny Energya | | | | | | | 61,000 | | | | 3,156,140 | | |

| Cleco Corp. | | | | | | | 31,300 | | | | 766,850 | | |

| DPL | | | | | | | 36,900 | | | | 1,045,746 | | |

See accompanying notes to financial statements.

8

COHEN & STEERS UTILITY FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2007 (Unaudited)

| | | | | Number

of Shares | | Value | |

| Duke Energy Corp. | | | | | | | 59,852 | | | $ | 1,095,291 | | |

| E.ON AG (ADR) (Germany) | | | | | | | 48,226 | | | | 2,683,295 | | |

| Edison International | | | | | | | 23,240 | | | | 1,304,229 | | |

| Entergy Corp. | | | | | | | 41,854 | | | | 4,493,027 | | |

| Exelon Corp. | | | | | | | 72,533 | | | | 5,265,896 | | |

| FirstEnergy Corp. | | | | | | | 62,255 | | | | 4,029,766 | | |

| FPL Group | | | | | | | 63,089 | | | | 3,579,670 | | |

| ITC Holdings Corp. | | | | | | | 31,800 | | | | 1,292,034 | | |

| Mirant Corp.a | | | | | | | 17,000 | | | | 725,050 | | |

| Northeast Utilities | | | | | | | 32,800 | | | | 930,208 | | |

| Pepco Holdings | | | | | | | 13,000 | | | | 366,600 | | |

| PPL Corp. | | | | | | | 70,078 | | | | 3,278,950 | | |

| Scottish and Southern Energy PLC (United Kingdom) | | | | | | | 31,879 | | | | 927,595 | | |

| Sierra Pacific Resourcesa | | | | | | | 63,100 | | | | 1,108,036 | | |

| Southern Co. | | | | | | | 31,624 | | | | 1,084,387 | | |

| | | | | | | | 37,132,770 | | |

| ELECTRIC—DISTRIBUTION | | | 0.9 | % | | | | | | | | | |

| EnerNOCa | | | | | | | 20,000 | | | | 762,600 | | |

| ELECTRIC—INTEGRATED | | | 4.3 | % | | | | | | | | | |

| American Electric Power Co. | | | | | | | 10,000 | | | | 450,400 | | |

| Comvergea | | | | | | | 15,900 | | | | 493,059 | | |

| Electricite de France (France) | | | | | | | 17,700 | | | | 1,923,192 | | |

| Enel S.p.A. (Italy) | | | | | | | 7,600 | | | | 408,120 | | |

| Fortum Oyj (Finland)a | | | | | | | 14,000 | | | | 439,411 | | |

| | | | | | | | 3,714,182 | | |

| GAS UTILITIES | | | 4.8 | % | | | | | | | | | |

| Equitable Resources | | | | | | | 50,720 | | | | 2,513,683 | | |

| Questar Corp. | | | | | | | 11,278 | | | | 596,042 | | |

| Southern Union Co. | | | | | | | 30,300 | | | | 987,477 | | |

| | | | | | | | 4,097,202 | | |

See accompanying notes to financial statements.

9

COHEN & STEERS UTILITY FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2007 (Unaudited)

| | | | | Number

of Shares | | Value | |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS | | | 11.1 | % | | | | | | | | | |

| AES Corp. (The)a | | | | | | | 93,700 | | | $ | 2,050,156 | | |

| Constellation Energy Group | | | | | | | 44,000 | | | | 3,835,480 | | |

| NRG Energya | | | | | | | 52,000 | | | | 2,161,640 | | |

| TXU Corp. | | | | | | | 22,280 | | | | 1,499,444 | | |

| | | | | | | | 9,546,720 | | |

| MULTI UTILITIES | | | 20.5 | % | | | | | | | | | |

| Alliant Energy Corp. | | | | | | | 8,000 | | | | 310,800 | | |

| Ameren Corp. | | | | | | | 24,000 | | | | 1,176,240 | | |

| CEZ AS (Germany) | | | | | | | 24,721 | | | | 1,276,112 | | |

| CMS Energy Corp. | | | | | | | 115,600 | | | | 1,988,320 | | |

| Dominion Resources | | | | | | | 26,500 | | | | 2,287,215 | | |

| PG&E Corp. | | | | | | | 67,507 | | | | 3,058,067 | | |

| Public Service Enterprise Group | | | | | | | 39,143 | | | | 3,435,972 | | |

| Sempra Energy | | | | | | | 13,468 | | | | 797,710 | | |

| TECO Energy | | | | | | | 13,000 | | | | 223,340 | | |

| Wisconsin Energy Corp. | | | | | | | 49,000 | | | | 2,167,270 | | |

| Xcel Energy | | | | | | | 41,903 | | | | 857,754 | | |

| | | | | | | | 17,578,800 | | |

| TOTAL UTILITIES | | | | | | | | | | | 72,832,274 | | |

| TOTAL INVESTMENTS (Identified cost—$64,700,288) | | | 99.8 | % | | | | | | | 85,683,116 | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES | | | 0.2 | % | | | | | | | 161,316 | | |

| NET ASSETS | | | 100.0 | % | | | | | | $ | 85,844,432 | | |

Glossary of Portfolio Abbreviation

ADR American Depositary Receipt

Note: Percentages indicated are based on the net assets of the fund.

a Non-income producing security.

See accompanying notes to financial statements.

10

COHEN & STEERS UTILITY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2007 (Unaudited)

| ASSETS: | |

| Investments in securities, at value (Identified cost—$64,700,288) | | $ | 85,683,116 | | |

| Receivable for investment securities sold | | | 3,132,520 | | |

| Receivable for fund shares sold | | | 236,204 | | |

| Dividends receivable | | | 149,810 | | |

| Other assets | | | 895 | | |

| Total Assets | | | 89,202,545 | | |

| LIABILITIES: | |

| Due to custodian | | | 1,768,749 | | |

| Payable for investment securities purchased | | | 936,559 | | |

| Payable for fund shares redeemed | | | 260,710 | | |

| Payable for dividends declared | | | 136,928 | | |

| Payable for investment advisory fees | | | 83,747 | | |

| Payable for distribution fees | | | 3,172 | | |

| Payable for administration fees | | | 1,470 | | |

| Payable for shareholder servicing fees | | | 1,120 | | |

| Other liabilities | | | 165,658 | | |

| Total Liabilities | | | 3,358,113 | | |

| NET ASSETS | | $ | 85,844,432 | | |

| NET ASSETS consist of: | |

| Paid-in-capital | | $ | 54,609,052 | | |

| Dividends in excess of net investment income | | | (2,724 | ) | |

| Accumulated undistributed net realized gain on investments | | | 10,255,785 | | |

| Net unrealized appreciation | | | 20,982,319 | | |

| | | $ | 85,844,432 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS UTILITY FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

June 30, 2007 (Unaudited)

| CLASS A SHARES: | |

| NET ASSETS | | $ | 46,008,160 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 2,464,965 | | |

| Net asset value and redemption price per share | | $ | 18.66 | | |

| Maximum offering price per share ($18.66 ÷ 0.955)a | | $ | 19.54 | | |

| CLASS B SHARES: | |

| NET ASSETS | | $ | 9,774,133 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 525,517 | | |

| Net asset value and offering price per shareb | | $ | 18.60 | | |

| CLASS C SHARES: | |

| NET ASSETS | | $ | 26,495,674 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 1,423,681 | | |

| Net asset value and offering price per shareb | | $ | 18.61 | | |

| CLASS I SHARES: | |

| NET ASSETS | | $ | 3,566,465 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 190,757 | | |

| Net asset value, offering, and redemption price per share | | $ | 18.70 | | |

a On investments of $100,000 or more, the offering price is reduced.

b Redemption price per share is equal to the net asset value per share less any applicable deferred sales charge which varies with the length of time shares are held.

See accompanying notes to financial statements.

12

COHEN & STEERS UTILITY FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2007 (Unaudited)

| Investment Income: | |

| Dividend income (net of $18,035 of foreign withholding tax) | | $ | 1,112,159 | | |

| Expenses: | |

| Investment advisory fees | | | 321,986 | | |

| Distribution fees— Class A | | | 56,512 | | |

| Distribution fees—Class B | | | 34,533 | | |

| Distribution fees—Class C | | | 105,652 | | |

| Shareholder servicing fees—Class A | | | 22,605 | | |

| Shareholder servicing fees—Class B | | | 11,511 | | |

| Shareholder servicing fees—Class C | | | 35,217 | | |

| Administration fees | | | 59,736 | | |

| Transfer agent fees and expenses | | | 36,130 | | |

| Directors' fees and expenses | | | 33,975 | | |

| Custodian fees and expenses | | | 29,224 | | |

| Registration and filing fees | | | 24,639 | | |

| Professional fees | | | 21,370 | | |

| Shareholder reporting expenses | | | 14,752 | | |

| Miscellaneous | | | 4,258 | | |

| Total Expenses | | | 812,100 | | |

| Reduction of Expenses | | | (52,358 | ) | |

| Net Expenses | | | 759,742 | | |

| Net Investment Income | | | 352,417 | | |

| Net Realized and Unrealized Gain (Loss) on Investments: | |

Net realized gain (loss) on:

Investments | | | 10,592,514 | | |

| Foreign currency transactions | | | (18,143 | ) | |

| Net realized gain | | | 10,574,371 | | |

| Net change in unrealized appreciation on: | |

| Investments | | | (837,350 | ) | |

| Foreign currency translations | | | 3,534 | | |

| Net change in unrealized appreciation | | | (833,816 | ) | |

| Total net realized and unrealized gain on investments | | | 9,740,555 | | |

| Net Increase in Net Assets Resulting from Operations | | $ | 10,092,972 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS UTILITY FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | |

| Change in Net Assets: | |

| From Operations: | |

| Net investment income | | $ | 352,417 | | | $ | 2,162,858 | | |

| Net realized gain on investments | | | 10,574,371 | | | | 6,033,151 | | |

| Net change in unrealized appreciation on investments | | | (833,816 | ) | | | 8,386,818 | | |

| Net increase in net assets resulting from operations | | | 10,092,972 | | | | 16,582,827 | | |

| Dividends and Distributions to Shareholders from: | |

| Net investment income: | |

| Class A | | | (257,375 | ) | | | (1,357,458 | ) | |

| Class B | | | (22,977 | ) | | | (142,804 | ) | |

| Class C | | | (62,382 | ) | | | (574,207 | ) | |

| Class I | | | (25,543 | ) | | | (72,709 | ) | |

| Net realized gain on investments: | |

| Class A | | | — | | | | (3,260,776 | ) | |

| Class B | | | — | | | | (601,799 | ) | |

| Class C | | | — | | | | (2,072,739 | ) | |

| Class I | | | — | | | | (197,703 | ) | |

| Tax return of capital: | |

| Class A | | | — | | | | (7,602 | ) | |

| Class B | | | — | | | | (1,403 | ) | |

| Class C | | | — | | | | (4,832 | ) | |

| Class I | | | — | | | | (461 | ) | |

| Total dividends and distributions to shareholders | | | (368,277 | ) | | | (8,294,493 | ) | |

| Capital Stock Transactions: | |

| Decrease in net assets from fund share transactions | | | (13,460,583 | ) | | | (92,241,640 | ) | |

| Total decrease in net assets | | | (3,735,888 | ) | | | (83,953,306 | ) | |

| Net Assets: | |

| Beginning of period | | | 89,580,320 | | | | 173,533,626 | | |

| End of perioda | | $ | 85,844,432 | | | $ | 89,580,320 | | |

a Includes dividends in excess of net investment income and undistributed net investment income of $2,724 and $13,136, respectively.

See accompanying notes to financial statements.

14

COHEN & STEERS UTILITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | Class A | |

| Per Share Operating Performance: | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | | For the

Year Ended

December 31, 2005 | | For the Period

May 3, 2004a

through

December 31, 2004 | |

| Net asset value, beginning of period | | $ | 16.60 | | | $ | 15.25 | | | $ | 13.78 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.10 | b | | | 0.39 | | | | 0.38 | b | | | 0.29 | b | |

| Net realized and unrealized gain on investments | | | 2.07 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | 2.17 | | | | 2.93 | | | | 1.83 | | | | 2.49 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.11 | ) | | | (0.39 | ) | | | (0.34 | ) | | | (0.14 | ) | |

| Net realized gain on investments | | | — | | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | 0.00 | c | | | (0.02 | ) | | | (0.01 | ) | |

| Total dividends and distributions to shareholders | | | (0.11 | ) | | | (1.58 | ) | | | (0.36 | ) | | | (0.17 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase in net asset value | | | 2.06 | | | | 1.35 | | | | 1.47 | | | | 2.32 | | |

| Net asset value, end of period | | $ | 18.66 | | | $ | 16.60 | | | $ | 15.25 | | | $ | 13.78 | | |

| Total investment returnf | | | 13.11 | %e | | | 19.43 | % | | | 13.33 | % | | | 21.80 | %e | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 46.0 | | | $ | 47.0 | | | $ | 114.5 | | | $ | 26.9 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.62 | %d | | | 1.54 | % | | | 1.58 | % | | | 3.55 | %d | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.50 | %d | | | 1.50 | % | | | 1.49 | % | | | 1.50 | %d | |

Ratio of net investment income to average

daily net assets (before expense reduction) | | | 0.98 | %d | | | 2.05 | % | | | 2.44 | % | | | 1.26 | %d | |

Ratio of net investment income to average

daily net assets (net of expense reduction) | | | 1.10 | %d | | | 2.08 | % | | | 2.53 | % | | | 3.31 | %d | |

| Portfolio turnover rate | | | 57 | %e | | | 56 | % | | | 45 | % | | | 16 | %e | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Annualized.

e Not annualized.

f Does not reflect sales charges, which would reduce return.

See accompanying notes to financial statements.

15

COHEN & STEERS UTILITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class B | |

| Per Share Operating Performance: | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | | For the

Year Ended

December 31, 2005 | | For the Period

May 3, 2004a

through

December 31, 2004 | |

| Net asset value, beginning of period | | $ | 16.54 | | | $ | 15.19 | | | $ | 13.74 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.04 | b | | | 0.28 | | | | 0.28 | b | | | 0.21 | b | |

| Net realized and unrealized gain on investments | | | 2.06 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | 2.10 | | | | 2.82 | | | | 1.73 | | | | 2.41 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.04 | ) | | | (0.28 | ) | | | (0.26 | ) | | | (0.10 | ) | |

| Net realized gain on investments | | | — | | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

| Total dividends and distributions to shareholders | | | (0.04 | ) | | | (1.47 | ) | | | (0.28 | ) | | | (0.13 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase in net asset value | | | 2.06 | | | | 1.35 | | | | 1.45 | | | | 2.28 | | |

| Net asset value, end of period | | $ | 18.60 | | | $ | 16.54 | | | $ | 15.19 | | | $ | 13.74 | | |

| Total investment returnf | | | 12.79 | %e | | | 18.66 | % | | | 12.59 | % | | | 21.08 | %e | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 9.8 | | | $ | 8.9 | | | $ | 7.7 | | | $ | 2.9 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.27 | %d | | | 2.14 | % | | | 2.23 | % | | | 4.66 | %d | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %d | | | 2.14 | % | | | 2.14 | % | | | 2.15 | %d | |

Ratio of net investment income (loss) to average daily net

assets (before expense reduction) | | | 0.33 | %d | | | 1.35 | % | | | 1.76 | % | | | (0.11 | )%d | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 0.46 | %d | | | 1.35 | % | | | 1.85 | % | | | 2.39 | %d | |

| Portfolio turnover rate | | | 57 | %e | | | 56 | % | | | 45 | % | | | 16 | %e | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Annualized.

e Not annualized.

f Does not reflect sales charges, which would reduce return.

See accompanying notes to financial statements.

16

COHEN & STEERS UTILITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class C | |

| Per Share Operating Performance: | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | | For the

Year Ended

December 31, 2005 | | For the Period

May 3, 2004a

through

December 31, 2004 | |

| Net asset value, beginning of period | | $ | 16.55 | | | $ | 15.20 | | | $ | 13.75 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.04 | b | | | 0.28 | | | | 0.28 | b | | | 0.22 | b | |

| Net realized and unrealized gain on investments | | | 2.06 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | 2.10 | | | | 2.82 | | | | 1.73 | | | | 2.42 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.04 | ) | | | (0.28 | ) | | | (0.26 | ) | | | (0.10 | ) | |

| Net realized gain on investments | | | — | | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

| Total dividends and distributions to shareholders | | | (0.04 | ) | | | (1.47 | ) | | | (0.28 | ) | | | (0.13 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase in net asset value | | | 2.06 | | | | 1.35 | | | | 1.45 | | | | 2.29 | | |

| Net asset value, end of period | | $ | 18.61 | | | $ | 16.55 | | | $ | 15.20 | | | $ | 13.75 | | |

| Total investment returnf | | | 12.71 | %e | | | 18.70 | % | | | 12.58 | % | | | 21.17 | %e | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 26.5 | | | $ | 30.8 | | | $ | 48.6 | | | $ | 14.6 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.28 | %d | | | 2.19 | % | | | 2.23 | % | | | 4.49 | %d | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %d | | | 2.15 | % | | | 2.14 | % | | | 2.15 | %d | |

Ratio of net investment income to average daily net

assets (before expense reduction) | | | 0.29 | %d | | | 1.35 | % | | | 1.79 | % | | | 0.15 | %d | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 0.42 | %d | | | 1.39 | % | | | 1.87 | % | | | 2.49 | %d | |

| Portfolio turnover rate | | | 57 | %e | | | 56 | % | | | 45 | % | | | 16 | %e | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Annualized.

e Not annualized.

f Does not reflect sales charges, which would reduce return.

See accompanying notes to financial statements.

17

COHEN & STEERS UTILITY FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class I | |

| Per Share Operating Performance: | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | | For the

Year Ended

December 31, 2005 | | For the Period

May 3, 2004a

through

December 31, 2004 | |

| Net asset value, beginning of period | | $ | 16.63 | | | $ | 15.26 | | | $ | 13.78 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.13 | b | | | 0.43 | | | | 0.43 | b | | | 0.27 | b | |

| Net realized and unrealized gain on investments | | | 2.08 | | | | 2.56 | | | | 1.45 | | | | 2.24 | | |

| Total from investment operations | | | 2.21 | | | | 2.99 | | | | 1.88 | | | | 2.51 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.14 | ) | | | (0.43 | ) | | | (0.38 | ) | | | (0.17 | ) | |

| Net realized gain on investments | | | — | | | | (1.19 | ) | | | (0.00 | )c | | | (0.01 | ) | |

| Tax return of capital | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

| Total dividends and distributions to shareholders | | | (0.14 | ) | | | (1.62 | ) | | | (0.40 | ) | | | (0.19 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase in net asset value | | | 2.07 | | | | 1.37 | | | | 1.48 | | | | 2.32 | | |

| Net asset value, end of period | | $ | 18.70 | | | $ | 16.63 | | | $ | 15.26 | | | $ | 13.78 | | |

| Total investment return | | | 13.35 | %d | | | 19.81 | % | | | 13.73 | % | | | 21.98 | %d | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 3.6 | | | $ | 2.9 | | | $ | 2.7 | | | $ | 1.3 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.27 | %e | | | 1.14 | % | | | 1.24 | % | | | 9.33 | %e | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.15 | %e | | | 1.14 | % | | | 1.14 | % | | | 1.15 | %e | |

Ratio of net investment income (loss) to average daily net

assets (before expense reduction) | | | 1.37 | %e | | | 2.36 | % | | | 2.80 | % | | | (4.92 | )%e | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 1.48 | %e | | | 2.36 | % | | | 2.89 | % | | | 3.26 | %e | |

| Portfolio turnover rate | | | 57 | %d | | | 56 | % | | | 45 | % | | | 16 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Not annualized.

e Annualized.

See accompanying notes to financial statements.

18

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Significant Accounting Policies

Cohen & Steers Utility Fund, Inc. (the fund) was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940, as amended, as a nondiversified, open-end management investment company. The fund's investment objective is total return. The authorized shares of the fund are divided into four classes designated Class A, B, C, and I shares. Effective May 1, 2007, Class B shares are no longer offered except through dividend reinvestment and permitted exchanges by existing Class B shareholders. Each of the fund's shares has equal dividend, liquidation and voting rights (except for matters relating to distributions and shareholder servicing of such shares). Class B shares automatically convert to Class A shares at the end of the month which precedes the eighth anniversary of the purchase date.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange are valued, except as indicated below, at the last sale price reflected at the close of the New York Stock Exchange on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day or, if no asked price is available, at the bid price.

Securities not listed on the New York Stock Exchange but listed on other domestic or foreign securities exchanges or admitted to trading on the National Association of Securities Dealers Automated Quotations, Inc. (Nasdaq) national market system are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the tape at the close of the exchange representing the principal market for such securities.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the advisor) to be over-the-counter, but excluding securities admitted to trading on the Nasdaq National List, are valued at the official closing prices as reported by Nasdaq, the National Quotation Bureau, or such other comparable sources as the Board of Directors deem appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. However, certain fixed-income securities may be valued on the basis of prices provided by a pricing service when such prices are believed by the Board of Directors to reflect the fair market value of such securities. Where securities are traded on more than one exchange and also over-the-counter, the securities will generally be valued using the quotations the Board of Directors believes most closely reflect the value of such securities.

19

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Securities for which market prices are unavailable, or securities for which the advisor determines that bid and/or asked price does not reflect market value, will be valued at fair value pursuant to procedures approved by the fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The fund's use of fair value pricing may cause the net asset value of fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Short-term debt securities, which have a maturity date of 60 days or less, are valued at amortized cost, which approximates value.

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the fund is informed after the ex-dividend date. The fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available, and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The fund adjusts the estimated amoun ts of the components of distributions (and consequently its net investment income) as an increase to unrealized appreciation/ (depreciation) and realized gain/(loss) on investments as necessary once the issuers provide information about the actual composition of the distributions. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

Foreign Currency Translation and Forward Foreign Currency Contracts: The books and records of the fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, other assets and liabilities and forward foreign currency contracts (forward contracts) are translated at the exchange rates prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the exchange rates prevailing on the respective dates of such transactions. The resultant exchange gains and losses are recorded as realized and unrealized gain/loss on foreign exchange transactions. Pursuant to U.S. federal income tax regulations, certain foreign exchange gains/losses included in realized and unrealized gain/loss are included in

20

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

or are a reduction of ordinary income for federal income tax purposes. The fund does not isolate that portion of the results of operations arising as a result of changes in the foreign exchange rates from the changes in the market prices of the securities. Forward contracts are valued daily at the appropriate exchange rates. The resultant unrealized exchange gains and losses are recorded as unrealized foreign currency gain or loss. The fund records realized gains or losses on delivery of the currency or at the time the forward contract is extinguished (compensated) by entering into a closing transaction prior to delivery.

Foreign Securities: The fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income are declared and paid quarterly. Net realized capital gains, unless offset by any available capital loss carryforward, are distributed to shareholders annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the fund based on the net asset value per share at the close of business on the ex-dividend date unless the shareholder has elected to have them paid in cash.

Federal Income Taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Accordingly, no provision for federal income or excise tax is necessary.

Note 2. Investment Advisory and Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The advisor serves as the fund's investment advisor pursuant to an investment advisory agreement (the advisory agreement). Under the terms of the advisory agreement, the advisor provides the fund with the day-to-day investment decisions and generally manages the fund's investments in accordance with the stated policies of the fund, subject to the supervision of the fund's Board of Directors. For the services provided to the fund, the advisor receives a fee, accrued daily and paid monthly, at the annual rate of 0.75% of the average daily net assets of the fund up to and including $1.5 billion and 0.65% of the average daily net asset above $1.5 billion.

For the six months ended June 30, 2007 and through December 31, 2007, the advisor has contractually agreed to waive its fee and/or reimburse the fund for expenses incurred to the extent necessary to maintain the

21

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

fund's operating expenses at 1.50% for Class A shares, 2.15% for Class B shares and Class C shares and 1.15% for Class I shares.

Administration Fees: The fund has entered into an administration agreement with the advisor under which the advisor performs certain administrative functions for the fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the fund's average daily net assets. For the six months ended June 30, 2007, the fund paid the advisor $8,586 in fees under this administration agreement. Additionally, the fund has retained State Street Bank and Trust Company as sub-administrator under a fund accounting and administration agreement.

Distribution Fees: Shares of the fund are distributed by Cohen & Steers Securities, LLC (the distributor), an affiliated entity of the advisor. The fund has adopted a distribution plan (the plan) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The plan provides that the fund will pay the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.25% of the average daily net assets attributable to the Class A shares and up to 0.75% of the average daily net assets attributable to the Class B and Class C shares.

For the six months ended June 30, 2007, the fund has been advised that the distributor received $7,647 in sales commissions from the sale of Class A shares and that the distributor also received $51, $13,047 and $8,724 of contingent deferred sales charges relating to redemptions of Class A, Class B and Class C shares, respectively. The distributor has advised the fund that proceeds from the contingent deferred sales charge on the Class B and C shares are paid to the distributor and are used by the distributor to defray its expenses related to providing distribution-related services to the fund in connection with the sale of the Class B and C shares, including payments to dealers and other financial intermediaries for selling Class B and C shares and interest and other financing costs associated with Class B and C shares.

Shareholder Servicing Fees: The fund has adopted a shareholder services plan which provides that the fund may obtain the services of qualified financial institutions to act as shareholder servicing agents for their customers. For these services, the fund may pay the shareholder servicing agent a fee, accrued daily and paid monthly, at an annual rate of up to 0.10% of the average daily net asset value of the fund's Class A shares and up to 0.25% of the average daily net asset value of the fund's Class B and C shares.

Directors' and Officers' Fees: Certain directors and officers of the fund are also directors, officers, and/or employees of the advisor. The fund does not pay compensation to any affiliated directors and officers except for the Chief Compliance Officer, who received $440 from the fund for the six months ended June 30, 2007.

Other: At June 30, 2007, the advisor owned 97,597 Class I shares or 2.1% of the fund.

22

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended June 30, 2007 totaled $49,405,910 and $62,351,326 respectively.

Note 4. Income Tax Information

As of June 30, 2007, the federal tax cost and net unrealized appreciation were as follows:

| Cost for federal income tax purposes | | $ | 64,700,288 | | |

| Gross unrealized appreciation | | $ | 21,294,561 | | |

| Gross unrealized depreciation | | | (311,733 | ) | |

| Net unrealized appreciation | | $ | 20,982,828 | | |

Note 5. Capital Stock

The fund is authorized to issue 200 million shares of capital stock, at a par value of $0.001 per share. The Board of Directors of the fund may increase or decrease the aggregate number of shares of common stock that the fund has authority to issue. Transactions in fund shares were as follows:

| | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Class A: | |

| Sold | | | 448,935 | | | $ | 8,218,745 | | | | 1,013,824 | | | $ | 16,825,056 | | |

Issued as reinvestment of

dividends and distributions | | | 7,407 | | | | 136,802 | | | | 137,608 | | | | 2,262,794 | | |

| Redeemed | | | (823,514 | ) | | | (14,444,459 | ) | | | (5,830,011 | ) | | | (90,891,934 | ) | |

Redemption fees retained by

the funda | | | — | | | | 5,326 | | | | — | | | | 15,767 | | |

| Net decrease | | | (367,172 | ) | | $ | (6,083,586 | ) | | | (4,678,579 | ) | | $ | (71,788,317 | ) | |

23

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

| | | For the

Six Months Ended

June 30, 2007 | | For the

Year Ended

December 31, 2006 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Class B: | |

| Sold | | | 45,588 | | | $ | 841,396 | | | | 108,507 | | | $ | 1,723,726 | | |

Issued as reinvestment of

dividends and distributions | | | 266 | | | | 4,924 | | | | 7,963 | | | | 130,747 | | |

| Redeemed | | | (56,136 | ) | | | (996,635 | ) | | | (89,675 | ) | | | (1,443,829 | ) | |

Redemption fees retained by

the funda ......... | | | — | | | | 1,084 | | | | — | | | | 1,185 | | |

| Net increase (decrease). | | | (10,282 | ) | | $ | (149,231 | ) | | | 26,795 | | | $ | 411,829 | | |

| Class C: | |

| Sold | | | 264,963 | | | $ | 4,824,882 | | | | 355,567 | | | $ | 5,727,955 | | |

Issued as reinvestment of

dividends and distributions | | | 721 | | | | 13,343 | | | | 23,272 | | | | 382,648 | | |

| Redeemed | | | (701,434 | ) | | | (12,338,329 | ) | | | (1,717,155 | ) | | | (27,011,666 | ) | |

Redemption fees retained by

the funda ................ . | | | — | | | | 3,201 | | | | — | | | | 7,018 | | |

| Net decrease | | | (435,750 | ) | | $ | (7,496,903 | ) | | | (1,338,316 | ) | | $ | (20,894,045 | ) | |

| Class I: | |

| Sold | | | 16,885 | | | $ | 314,738 | | | | 7,171 | | | $ | 111,881 | | |

Issued as reinvestment of

dividends and distributions | | | 658 | | | | 12,177 | | | | 14,059 | | | | 231,985 | | |

| Redeemed | | | (3,261 | ) | | | (58,173 | ) | | | (19,995 | ) | | | (315,375 | ) | |

Redemption fees retained by

the funda ................ | | | — | | | | 395 | | | | — | | | | 402 | | |

| Net increase | | | 14,282 | | | $ | 269,137 | | | | 1,235 | | | $ | 28,893 | | |

a The fund may charge a 1% redemption fee on shares sold within six months of the time of purchase.

24

COHEN & STEERS UTILITY FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 6. Borrowings

The fund, in conjunction with other Cohen & Steers funds, is a party to a $150,000,000 syndicated credit agreement (the credit agreement) with State Street Bank and Trust Company, as administrative agent and operations agent, and the lenders identified in the credit agreement, which expires December 2007. The fund pays a commitment fee of 0.10% per annum on its proportionate share of the unused portion of the credit agreement.

During the six months ended June 30, 2007, the fund did not utilize the line of credit.

Note 7. Other

In the normal course of business, the fund enters into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is dependent on claims that may be made against the fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. New Accounting Pronouncements

In July 2006, the Financial Accounting Standards Board (FASB) issued Interpretation 48, Accounting for Uncertainty in Income Taxes—an interpretation of FASB Statement 109 (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. FIN 48 is effective for fiscal years beginning after December 15, 2006. An assessment of the fund's tax positions has been made and it has been determined that there is no impact to the fund's financial statements.

In September 2006, Statement of Financial Accounting Standards No. 157, Fair Value Measurements (SFAS 157), was issued and is effective for fiscal years beginning after November 15, 2007. SFAS 157 defines fair value, establishes a framework for measuring fair value and expands disclosures about fair value measurements. Management is currently evaluating the impact the adoption of SFAS 157 will have on the fund's financial statements.

Note 9. Subsequent Event

Effective September 28, 2007, the redemption fee charged by the fund will be 2% on shares redeemed or exchanged within 60 days of the time of purchase.

25

COHEN & STEERS UTILITY FUND, INC.

OTHER INFORMATION

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 800-330-7348, (ii) on our Web site at cohenandsteers.com or (iii) on the Securities and Exchange Commission's Web site at http://www.sec.gov. In addition, the fund's proxy voting record for the most recent 12-month period ended June 30 is available (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC's Web site at http://www.sec.gov.

The fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund's Forms N-Q are available (i) without charge, upon request by calling 800-330-7348, or (ii) on the SEC's Web site at http://www.sec.gov. In addition, the Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Please note that the distributions paid by the fund to shareholders are subject to recharacterization for tax purposes. The fund may also pay distributions in excess of the fund's net investment company taxable income and this excess would be a tax-free return of capital distributed from the fund's assets. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year.

26

COHEN & STEERS UTILITY FUND, INC.

Meet the Cohen & Steers family of open-end funds:

COHEN & STEERS

REALTY SHARES

• Designed for investors seeking maximum total return, investing primarily in REITs

• Symbol: CSRSX

COHEN & STEERS

REALTY INCOME FUND

• Designed for investors seeking high current income, investing primarily in REITs

• Symbols: CSEIX, CSBIX, CSCIX, CSDIX

COHEN & STEERS

INTERNATIONAL REALTY FUND

• Designed for investors seeking maximum total return, investing primarily in international real estate securities

• Symbols: IRFAX, IRFCX, IRFIX

COHEN & STEERS

DIVIDEND VALUE FUND

• Designed for investors seeking high current income and long-term growth of income and capital appreciation, investing primarily in dividend paying common stocks and preferred stocks

• Symbols: DVFAX, DVFCX, DVFIX

COHEN & STEERS

INSTITUTIONAL GLOBAL REALTY SHARES

• Designed for investors seeking maximum total return, investing primarily in global real estate securities

• Symbol: GRSIX

COHEN & STEERS

INSTITUTIONAL REALTY SHARES

• Designed for institutional investors seeking maximum total return, investing primarily in REITs

• Symbol: CSRIX

COHEN & STEERS

REALTY FOCUS FUND

• Designed for investors seeking maximum capital appreciation, investing in a limited number of REITs and other real estate securities

• Symbols: CSFAX, CSFBX, CSFCX, CSSPX

COHEN & STEERS

UTILITY FUND

• Designed for investors seeking maximum total return, investing primarily in utilities

• Symbols: CSUAX, CSUBX, CSUCX, CSUIX

COHEN & STEERS

ASIA PACIFIC REALTY SHARES

• Designed for investors seeking maximum total return, investing primarily in real estate securities located in the Asia Pacific region

• Symbols: APFAX, APFCX, APFIX

COHEN & STEERS

EUROPEAN REALTY SHARES

• Designed for investors seeking maximum total return, investing primarily in real estate securities located in Europe

• Symbols: EURAX, EURCX, EURIX

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. A prospectus containing this and other information can be obtained by calling 800-330-7348 or by visiting cohenandsteers.com. Please read the prospectus carefully before investing.

Cohen & Steers Securities, LLC, Distributor

27

COHEN & STEERS UTILITY FUND, INC.

OFFICERS AND DIRECTORS

Robert H. Steers

Director and co-chairman

Martin Cohen

Director and co-chairman

Bonnie Cohen

Director

George Grossman

Director

Richard E. Kroon

Director

Richard J. Norman

Director

Frank K. Ross

Director

Willard H. Smith Jr.

Director

C. Edward Ward, Jr.

Director

Adam M. Derechin

President and chief executive officer

Joseph M. Harvey

Vice president

Robert S. Becker

Vice president

William F. Scapell

Vice president

John E. McLean

Secretary

James Giallanza

Treasurer and chief financial officer

Lisa D. Phelan

Chief compliance Officer

KEY INFORMATION

Investment Advisor

Cohen & Steers Capital Management, Inc.

280 Park Avenue

New York, NY 10017

(212) 832-3232

Subadministrator and Custodian

State Street Bank and Trust Company

One Lincoln Street

Boston, MA 02111

Transfer Agent

Boston Financial Data Services, Inc.

2 Heritage Drive

North Quincy, MA 02171

(800) 437-9912

Legal Counsel

Stroock & Stroock & Lavan LLP

180 Maiden Lane

New York, NY 10038

Distributor

Cohen & Steers Securities, LLC

280 Park Avenue

New York, NY 10017

Nasdaq Symbol: Class A—CSUAX

Class B—CSUBX

Class C—CSUCX

Class I— CSUIX

Web site: cohenandsteers.com

This report is authorized for delivery only to shareholders of Cohen & Steers Utility Fund, Inc. unless accompanied or preceded by the delivery of a currently effective prospectus setting forth details of the fund. Past performance is of course no guarantee of future results and your investment may be worth more or less at the time you sell.

28

COHEN & STEERS

UTILITY FUND

280 PARK AVENUE

NEW YORK, NY 10017

SEMIANNUAL REPORT

JUNE 30, 2007

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Schedule of Investments.

Included in Item 1 above.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable.

Item 10. Submission of Matters to a Vote of Security Holders.

None.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have concluded, based upon their evaluation of the registrant’s disclosure controls and procedures as conducted within 90 days of the filing date of this report, that these disclosure controls and procedures provide reasonable assurance that material information required to be disclosed by the registrant in the report it files or submits on Form N-CSR is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms

and that such material information is accumulated and communicated to the registrant’s management, including its principal executive officer and principal financial officer, as appropriate, in order to allow timely decisions regarding required disclosure.

(b) There were no changes in the registrant’s internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a) (2) Certifications of principal executive officer and principal financial officer as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certifications of principal exe cutive officer and principal financial officer as required by Rule 30a- 2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

COHEN & STEERS UTILITY FUND, INC. | |

| |

| |

| By: | /s/ Adam M. Derechin | |

| | Name: Adam M. Derechin | |

| | Title: President and Chief Executive Officer | |

| | | |

| Date: August 29, 2007 | |

| | | | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| |

| By: | /s/ Adam M. Derechin | |

| | Name: | Adam M. Derechin | |

| | Title: | President and Chief Executive Officer | |

| | (principal executive officer) | |

| | |

| By: | /s/ James Giallanza | |

| | Name: | James Giallanza | |

| | Title: | Treasurer | |

| | | (principal financial officer) | |

| | | |

| | | |

| Date: August 29, 2007 | |

| | | | | |