UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21488 |

|

Cohen & Steers Global Infrastructure Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Adam M. Derechin Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2008 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

August 8, 2008

To Our Shareholders:

We are pleased to submit to you our report for the six months ended June 30, 2008. The net asset values per share at that date were $15.24, $15.17, $15.18 and $15.27 for Class A, Class B, Class C and Class I shares, respectively. In addition, a distribution was declared for shareholders of record on June 27, 2008 and paid on June 30, 2008 to all four classes of shares. The distributions were as follows: Class A—$0.191 per share; Class B—$0.163 per share; Class C—$0.163 per share; and Class I—$0.203 per share.a

The total returns, including income and change in net asset value, for the fund and the comparative benchmarks were:

| | | Six Months Ended

June 30, 2008 | |

| Cohen & Steers Global Infrastructure Fund—Class A | | | –11.41 | % | |

| Cohen & Steers Global Infrastructure Fund—Class B | | | –11.72 | % | |

| Cohen & Steers Global Infrastructure Fund—Class C | | | –11.72 | % | |

| Cohen & Steers Global Infrastructure Fund—Class I | | | –11.30 | % | |

| UBS Global Infrastructure & Utilities 50/50 Indexb | | | –8.75 | % | |

| S&P 1500 Utilities Indexb | | | –2.52 | % | |

| Linked Benchmarkb | | | –11.01 | % | |

| S&P 500 Indexb | | | –11.91 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Total returns of the fund current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com. Performance quoted does not reflect the deduction of the maximum

a Please note that distributions paid by the fund to shareholders are subject to recharacterization for tax purposes. The final tax treatment of these distributions is reported to shareholders after the close of each fiscal year.

b The UBS Global Infrastructure & Utilities 50/50 Index tracks a 50% exposure to the global developed-market utilities sector and a 50% exposure to the global developed-market infrastructure sector. The S&P 1500 Utilities Index is an unmanaged market capitalization weighted index of 75 companies whose primary business involves the generation, transmission and/or distribution of electricity and/or natural gas. The linked benchmark is represented by the performance of the S&P 1500 Utilities Index from January 1, 2008 through March 31, 2008, the Macquarie Global Infrastructure Index from April 1, 2008 through May 31, 2008 and the UBS Global Infrastructure & Utilities 50/50 Index from June 1, 2008 through June 30, 2008. The Macquarie Global Infrastructure Index is a capitalization-weighted, global infrastructure index containing all publicly quoted infrastructure related stocks that are members of the FTSE G lobal Equity Index Series with market capitalization exceeding $250 million. The S&P 500 Index is an unmanaged index of common stocks that is frequently used as a general measure of stock market performance.

1

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

4.5% initial sales charge on Class A shares or the 5% and 1% maximum contingent deferred sales charge on Class B and Class C shares, respectively. If such charges were included, returns would have been lower.

Investment Review

A new objective and benchmark

Effective April 1, 2008, the fund changed its objective to invest according to a global infrastructure strategy. The fund's benchmark for April 1, 2008 through May 31, 2008 was the Macquarie Global Infrastructure Index (replacing the S&P 1500 Utilities Index), which is dominated by utilities. As we sought a heavier weighting in non-utility infrastructure securities, on June 1, 2008 we moved to the UBS Global Infrastructure & Utilities 50/50 Index, a recently created managed index that is equally weighted between utilities and non-utility infrastructure companies.

A challenging time for equities

The six-month period was a negative one for global equities of all descriptions, interrupted by a March-April "relief rally" after the U.S. Federal Reserve announced it would help JPMorgan Chase acquire Bear Stearns. Market conditions rapidly deteriorated late in the period. Surging oil prices contributed to fears of global stagflation—an unwelcome mix of inflation and slowing economic growth. This in turn reduced the probability that the world's central banks would lower interest rates.

Global infrastructure securities performed roughly in line with global equities, although performance varied by sector. In general, utility and energy infrastructure shares outperformed amid rising oil and fuel prices, while transportation infrastructure stocks underperformed as demand proved more sensitive to higher fuel costs.

Infrastructure privatizations continued

Six consortia, which include publicly listed toll road operators Atlantia, Cintra and Brisa, have qualified to bid for a 50/75 year leasing concession for Alligator Alley, a 78-mile stretch of the Everglades Parkway in Florida. The Florida Department of Transportation expects to select a winning bid by the end of this year. In another transaction, Public Service Enterprise Group (PSEG), a New Jersey electricity and natural gas utility, announced that it is selling its Chilean utility subsidiary to a private consortium composed of Morgan Stanley Infrastructure and Ontario Teachers' Pension Plan.

These developments underscore our belief that infrastructure assets have investment characteristics sought by private investors, and that they will increasingly find their way into listed markets (the global listed infrastructure market currently has a market capitalization of $2 trillion). Like commercial real estate, the asset class is associated with large projects with contractual cash flows that tend to be long-term, visible and relatively stable. The PSEG asset sale also highlights the interest large global infrastructure investors have in utilities.

Performance was in line with benchmark

The fund performed roughly in line with its linked benchmark in the period. Our underweight in transportation sectors, specifically toll roads and airports, helped relative performance. We were underweight transportation stocks based on their relatively higher sensitivity to economic factors and energy prices, compared with infrastructure stocks

2

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

in general. That aside, we believe all sectors of the infrastructure market are less cyclical and more defensive than the broad equity markets, and would generally expect them to outperform in a challenging market environment.

Stock selection in the electric and natural gas utility sectors also contributed positively to performance. Our overweight in the gas pipeline sector helped performance, although stock selection partly offset the beneficial weighting effect. Our stock selection and underweight in the telecommunications infrastructure sector detracted from relative performance.

Investment Outlook

Within a highly uncertain economic environment, we believe that infrastructure securities have the potential to outperform, as investors seek less cyclical sectors of the stock market.

We also believe that investors could find infrastructure securities appealing based on valuations and growth profiles. Global utilities currently trade at a price-to-earnings multiple of 14.5 times one-year forward earnings, in line with their historical average. However, they have a projected annual growth rate in the 9% to 11% range for the next three years, well above the historical average. In addition, at June 30, the three main transportation infrastructure sectors—toll roads, ports and airports—were trading at attractive valuations below their long-term cash-flow multiples.

| Sincerely, | |

|

| |  | |

|

| MARTIN COHEN | | ROBERT H. STEERS | |

|

| Co-chairman | | Co-chairman | |

|

| | |  | |

|

| | | ROBERT S. BECKER | |

|

| | | Portfolio Manager | |

|

The views and opinions in the preceding commentary are as of the date stated and are subject to change. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about any of our funds, visit cohenandsteers.com, where you will find daily net asset values, fund fact sheets and portfolio highlights. You can also access newsletters, education tools and market updates covering the global real estate, listed infrastructure, utilities, large cap value and preferred securities sectors.

In addition, our Web site contains comprehensive information about our firm, including our most recent press releases, profiles of our senior investment professionals and an overview of our investment approach.

3

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Performance Review (Unaudited)

Average Annual Total Returns—For the Periods Ended June 30, 2008

| | | Class A Shares | | Class B Shares | | Class C Shares | | Class I Shares | |

| 1 Year (with sales charge) | | | –7.38 | %a | | | –8.45 | %b | | | –4.59 | %d | | | — | | |

| 1 Year (without sales charge) | | | –3.01 | % | | | –3.63 | % | | | –3.62 | % | | | –2.68 | % | |

| Since Inceptione (with sales charge) | | | 13.99 | %a | | | 14.17 | %c | | | 14.69 | % | | | — | | |

| Since Inceptione (without sales charge) | | | 15.26 | % | | | 14.49 | % | | | 14.69 | % | | | 15.65 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate and shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance information current to the most recent month-end can be obtained by visiting our Web site at cohenandsteers.com. The performance table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

The annualized gross and net expense ratios, respectively, for each class of shares as disclosed in the April 1, 2008 prospectuses were as follows: Class A—1.64% and 1.50%; Class B—2.29% and 2.15%; Class C—2.28% and 2.15%; and Class I—1.31% and 1.15%. Through December 31, 2008, the advisor has contractually agreed to waive its fee and/or reimburse the fund for expenses incurred to the extent necessary to maintain the fund's annual operating expenses at 1.50% for Class A shares, 2.15% for both Class B and Class C shares and 1.15% for Class I shares.

a Reflects a 4.50% front-end sales charge.

b Reflects a contingent deferred sales charge of 5%.

c Reflects a contingent deferred sales charge of 3%.

d Reflects a contingent deferred sales charge of 1%.

e Inception date of May 3, 2004.

4

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)

As a shareholder of the fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption fees; and (2) ongoing costs including management fees; distribution and/or service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period January 1, 2008–June 30, 2008.

Actual Expenses

The first line of the table below provides information about actual account values and expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing cost of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) and redemption fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

5

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Expense Example (Unaudited)—(Continued)

| | | Beginning

Account Value

January 1, 2008 | | Ending

Account Value

June 30, 2008 | | Expenses Paid

During Period*

January 1, 2008–

June 30, 2008 | |

| Class A | |

| Actual (–11.41% return) | | $ | 1,000.00 | | | $ | 885.90 | | | $ | 7.03 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,017.40 | | | $ | 7.52 | | |

| Class B | |

| Actual (–11.72% return) | | $ | 1,000.00 | | | $ | 882.80 | | | $ | 10.06 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,014.17 | | | $ | 10.77 | | |

| Class C | |

| Actual (–11.72% return) | | $ | 1,000.00 | | | $ | 882.80 | | | $ | 10.06 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,014.17 | | | $ | 10.77 | | |

| Class I | |

| Actual (–11.30% return) | | $ | 1,000.00 | | | $ | 887.00 | | | $ | 5.40 | | |

| Hypothetical (5% annual return before expenses) | | $ | 1,000.00 | | | $ | 1,019.14 | | | $ | 5.77 | | |

* Expenses are equal to the fund's Class A, Class B, Class C and Class I annualized expense ratio of 1.50%, 2.15%, 2.15% and 1.15%, respectively, multiplied by the average account value over the period, multiplied by 182/366 (to reflect the one-half year period). If the fund had borne all of its expenses that were assumed by the advisor, the annualized expense ratios would have been 1.67%, 2.31%, 2.31% and 1.30%, respectively.

6

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

JUNE 30, 2008

Top Ten Long-Term Holdings

(Unaudited)

| Security | | Market

Value | | % of

Net

Assets | |

| E.ON AG (ADR) | | $ | 5,588,916 | | | | 5.5 | % | |

| American Tower Corp. | | | 5,453,334 | | | | 5.4 | | |

| Atlantia S.p.A. | | | 5,010,793 | | | | 4.9 | | |

| Suez SA | | | 4,220,914 | | | | 4.2 | | |

| Vinci SA | | | 3,315,794 | | | | 3.3 | | |

| Exelon Corp. | | | 3,241,709 | | | | 3.2 | | |

| Iberdrola SA | | | 2,934,289 | | | | 2.9 | | |

| Abertis Infraestructuras S.A. | | | 2,847,237 | | | | 2.8 | | |

| TransCanada Corp. | | | 2,304,845 | | | | 2.3 | | |

| Williams Cos. (The) | | | 2,294,768 | | | | 2.3 | | |

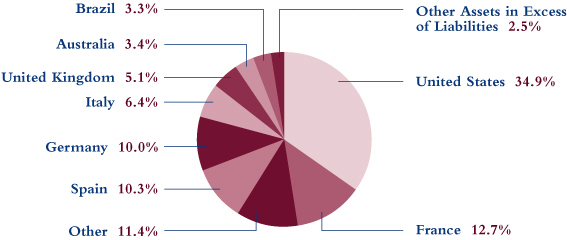

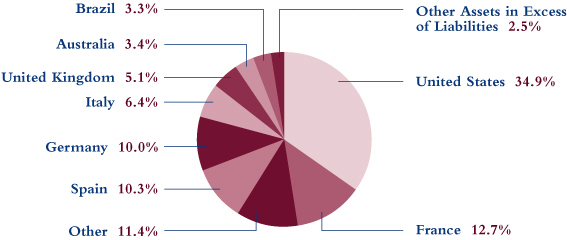

Country Breakdown

(Based on Net Assets)

(Unaudited)

7

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| COMMON STOCK | | | 97.5 | % | | | | | | | | | |

| AUSTRALIA | | | 3.4 | % | | | | | | | | | |

| INDUSTRIALS | | | | | | | | | | | | | |

| AIRPORT SERVICES | | | 0.8 | % | | | | | | | | | |

| Macquarie Airports | | | | | | | 385,700 | | | $ | 761,687 | | |

| HIGHWAYS & RAILTRACKS | | | 2.6 | % | | | | | | | | | |

| Macquarie Infrastructure Group | | | | | | | 737,500 | | | | 1,640,249 | | |

| Transurban Group | | | | | | | 251,500 | | | | 1,019,855 | | |

| | | | | | | | 2,660,104 | | |

| TOTAL AUSTRALIA | | | | | | | | | | | 3,421,791 | | |

| AUSTRIA | | | 0.5 | % | | | | | | | | | |

| UTILITIES—ELECTRIC UTILITIES | | | | | | | | | | | | | |

| Oesterreichische Elektrizitaetswirtschafts AG (Verbund) | | | | | | | 6,000 | | | | 537,707 | | |

| BRAZIL | | | 3.3 | % | | | | | | | | | |

| INDUSTRIALS | | | 0.5 | % | | | | | | | | | |

| HIGHWWAYS & RAILTRACKS | | | 0.2 | % | | | | | | | | | |

| Cia de Concessoes Rodoviarias | | | | | | | 12,000 | | | | 237,215 | | |

| MARINE PORTS & SERVICES | | | 0.3 | % | | | | | | | | | |

| Santos Brasil Participacoes SAa | | | | | | | 16,500 | | | | 237,758 | | |

| TOTAL INDUSTRIALS | | | | | | | | | | | 474,973 | | |

| UTILITIES | | | 2.8 | % | | | | | | | | | |

| ELECTRIC UTILITIES | | | 1.5 | % | | | | | | | | | |

| Cia de Transmissao de Energia Eletrica Paulista | | | | | | | 12,000 | | | | 395,609 | | |

| Cia Energetica de Minas Gerais | | | | | | | 11,000 | | | | 270,050 | | |

| EDP - Energias do Brasil SA | | | | | | | 47,000 | | | | 935,250 | | |

| | | | | | | | 1,600,909 | | |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS | | | 1.3 | % | | | | | | | | | |

| AES Tiete S.A. | | | | | | | 62,000 | | | | 653,609 | | |

| Tractebel Energia S.A. | | | | | | | 44,000 | | | | 655,979 | | |

| | | | | | | | 1,309,588 | | |

| TOTAL UTILITIES | | | | | | | | | | | 2,910,497 | | |

| TOTAL BRAZIL | | | | | | | | | | | 3,385,470 | | |

See accompanying notes to financial statements.

8

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| CANADA | | | 3.3 | % | | | | | | | | | |

| ENERGY—OIL & GAS STORAGE & TRANSPORTATION | | | | | | | | | | | | | |

| Enbridge | | | | | | | 23,700 | | | $ | 1,024,048 | | |

| TransCanada Corp. | | | | | | | 59,500 | | | | 2,304,845 | | |

| | | | | | | | 3,328,893 | | |

| CHILE | | | 0.2 | % | | | | | | | | | |

| UTILITIES—INDEPENDENT POWER PRODUCER & ENERGY TRADER | | | | | | | | | | | | | |

| Empresa Nacional de Electricidad S.A. | | | | | | | 5,000 | | | | 213,800 | | |

| CHINA | | | 0.8 | % | | | | | | | | | |

| INDUSTRIALS—HIGHWAYS & RAILTRACKS | | | | | | | | | | | | | |

| Jiangsu Expressway Co. | | | | | | | 340,000 | | | | 278,637 | | |

| Shenzhen Expressway Co. | | | | | | | 900,000 | | | | 526,339 | | |

| Zhejiang Expressway Co., Ltd. | | | | | | | 200 | | | | 154 | | |

| | | | | | | | 805,130 | | |

| FINLAND | | | 1.1 | % | | | | | | | | | |

| UTILITIES—ELECTRIC UTILITIES | | | | | | | | | | | | | |

| Fortum Oyj | | | | | | | 22,034 | | | | 1,119,146 | | |

| FRANCE | | | 12.7 | % | | | | | | | | | |

| INDUSTRIALS | | | 4.6 | % | | | | | | | | | |

| AIRPORT SERVICES | | | 1.3 | % | | | | | | | | | |

| ADP | | | | | | | 14,200 | | | | 1,328,912 | | |

| CONSTRUCTION & ENGINEERING | | | 3.3 | % | | | | | | | | | |

| Vinci SA | | | | | | | 54,000 | | | | 3,315,794 | | |

| TOTAL INDUSTRIALS | | | | | | | | | | | 4,644,706 | | |

| UTILITIES | | | 8.1 | % | | | | | | | | | |

| ELECTRIC UTILITIES | | | 1.6 | % | | | | | | | | | |

| Electricite de France | | | | | | | 17,289 | | | | 1,642,496 | | |

| GAS UTILITIES | | | 1.0 | % | | | | | | | | | |

| Gaz de France S.A. | | | | | | | 15,000 | | | | 964,036 | | |

See accompanying notes to financial statements.

9

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| MULTI UTILITIES | | | 5.5 | % | | | | | | | | | |

| Suez SA | | | | | | | 62,000 | | | $ | 4,220,915 | | |

| Veolia Environnement | | | | | | | 25,000 | | | | 1,402,442 | | |

| | | | | | | | 5,623,357 | | |

| TOTAL UTILITIES | | | | | | | | | | | 8,229,889 | | |

| TOTAL FRANCE | | | | | | | | | | | 12,874,595 | | |

| GERMANY | | | 10.0 | % | | | | | | | | | |

| INDUSTRIALS | | | 2.1 | % | | | | | | | | | |

| AIRPORT SERVICES | | | 1.6 | % | | | | | | | | | |

| Fraport AG | | | | | | | 24,200 | | | | 1,642,184 | | |

| MARINE PORTS & SERVICES | | | 0.5 | % | | | | | | | | | |

| Hamburger Hafen und Logistik AG | | | | | | | 6,000 | | | | 466,667 | | |

| TOTAL INDUSTRIALS | | | | | | | | | | | 2,108,851 | | |

| UTILITIES | | | 7.9 | % | | | | | | | | | |

| ELECTRIC UTILITIES | | | 6.4 | % | | | | | | | | | |

| CEZ AS | | | | | | | 9,442 | | | | 850,631 | | |

| E.ON AG (ADR) | | | | | | | 27,700 | | | | 5,588,916 | | |

| | | | | | | | 6,439,547 | | |

| MULTI UTILITIES | | | 1.5 | % | | | | | | | | | |

| RWE AG | | | | | | | 12,267 | | | | 1,549,545 | | |

| TOTAL UTILITIES | | | | | | | | | | | 7,989,092 | | |

| TOTAL GERMANY | | | | | | | | | | | 10,097,943 | | |

| HONG KONG | | | 1.3 | % | | | | | | | | | |

| UTILITIES | | | | | | | | | | | | | |

| ELECTRIC UTILITIES | | | 0.8 | % | | | | | | | | | |

| CLP Holdings Ltd. | | | | | | | 97,000 | | | | 831,011 | | |

| GAS UTILITIES | | | 0.5 | % | | | | | | | | | |

| Hong Kong and China Gas Co., Ltd. | | | | | | | 213,100 | | | | 506,701 | | |

| TOTAL HONG KONG | | | | | | | | | | | 1,337,712 | | |

See accompanying notes to financial statements.

10

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| ITALY | | | 6.4 | % | | | | | | | | | |

| INDUSTRIALS—HIGHWAYS & RAIL TRACKS | | | 4.9 | % | | | | | | | | | |

| Atlantia S.p.A. | | | | | | | 165,500 | | | $ | 5,010,793 | | |

| UTILITIES—ELECTRIC UTILITIES | | | 1.5 | % | | | | | | | | | |

| Enel S.p.A. | | | | | | | 158,800 | | | | 1,510,138 | | |

| TOTAL ITALY | | | | | | | | | | | 6,520,931 | | |

| JAPAN | | | 3.0 | % | | | | | | | | | |

| UTILITIES | | | | | | | | | | | | | |

| ELECTRIC UTILITIES | | | 2.4 | % | | | | | | | | | |

| Chubu Electric Power Co. | | | | | | | 10,000 | | | | 243,914 | | |

| Kansai Electric Power Co. (The) | | | | | | | 33,900 | | | | 793,346 | | |

| Tokyo Electric Power Co. (The) | | | | | | | 53,300 | | | | 1,370,335 | | |

| | | | | | | | 2,407,595 | | |

| GAS UTILITIES | | | 0.6 | % | | | | | | | | | |

| Osaka Gas Co. | | | | | | | 70,000 | | | | 256,440 | | |

| Tokyo Gas Co. | | | | | | | 90,000 | | | | 362,763 | | |

| | | | | | | | 619,203 | | |

| TOTAL JAPAN | | | | | | | | | | | 3,026,798 | | |

| KOREA | | | 0.3 | % | | | | | | | | | |

| UTILITIES—ELECTRIC UTILITIES | | | | | | | | | | | | | |

| Korea Electric Power Corp. | | | | | | | 20,200 | | | | 293,506 | | |

| MEXICO | | | 0.4 | % | | | | | | | | | |

| INDUSTRIALS—AIRPORT SERVICES | | | | | | | | | | | | | |

| Grupo Aeroportuario del Sureste SAB de CV | | | | | | | 78,000 | | | | 404,253 | | |

| NETHERLANDS | | | 0.3 | % | | | | | | | | | |

| INDUSTRIALS—MARINE PORTS & SERVICES | | | | | | | | | | | | | |

| Koninklijke Vopak NV | | | | | | | 4,000 | | | | 271,121 | | |

| SPAIN | | | 10.3 | % | | | | | | | | | |

| INDUSTRIALS | | | 5.5 | % | | | | | | | | | |

| CONSTRUCTION & ENGINEERING | | | 1.0 | % | | | | | | | | | |

| Grupo Ferrovial, S.A. | | | | | | | 16,500 | | | | 1,021,472 | | |

See accompanying notes to financial statements.

11

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| HIGHWAYS & RAILTRACKS | | | 4.5 | % | | | | | | | | | |

| Abertis Infraestructuras S.A. | | | | | | | 120,000 | | | $ | 2,847,237 | | |

| Cintra Concesiones de Infraestructuras de Transporte SA | | | | | | | 151,000 | | | | 1,692,724 | | |

| | | | | | | | 4,539,961 | | |

| TOTAL INDUSTRIALS | | | | | | | | | | | 5,561,433 | | |

| UTILITIES | | | 4.8 | % | | | | | | | | | |

| ELECTRIC UTILITIES | | | 3.4 | % | | | | | | | | | |

| Iberdrola SA | | | | | | | 219,000 | | | | 2,934,289 | | |

| Union Fenosa S.A. | | | | | | | 8,000 | | | | 466,289 | | |

| | | | | | | | 3,400,578 | | |

| GAS UTILITIES | | | 0.9 | % | | | | | | | | | |

| Enagas | | | | | | | 34,000 | | | | 963,564 | | |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS | | | 0.5 | % | | | | | | | | | |

| Iberdrola Renovables a | | | | | | | 66,000 | | | | 511,256 | | |

| TOTAL UTILITIES | | | | | | | | | | | 4,875,398 | | |

| TOTAL SPAIN | | | | | | | | | | | 10,436,831 | | |

| UNITED ARAB EMIRATES | | | 0.2 | % | | | | | | | | | |

| INDUSTRIALS—MARINE PORTS & SERVICES | | | | | | | | | | | | | |

| DP World | | | | | | | 271,000 | | | | 233,060 | | |

| UNITED KINGDOM | | | 5.1 | % | | | | | | | | | |

| UTILITIES | | | | | | | | | | | | | |

| ELECTRIC UTILITIES | | | 1.5 | % | | | | | | | | | |

| Scottish and Southern Energy PLC | | | | | | | 54,567 | | | | 1,524,910 | | |

| MULTI UTILITIES | | | 3.0 | % | | | | | | | | | |

| Centrica PLC | | | | | | | 134,800 | | | | 833,025 | | |

| National Grid PLC | | | | | | | 105,700 | | | | 1,390,607 | | |

| United Utilities PLC | | | | | | | 57,400 | | | | 784,890 | | |

| | | | | | | | 3,008,522 | | |

| WATER UTILITIES | | | 0.6 | % | | | | | | | | | |

| Severn Trent PLC | | | | | | | 26,000 | | | | 664,958 | | |

| TOTAL UNITED KINGDOM | | | | | | | | | | | 5,198,390 | | |

See accompanying notes to financial statements.

12

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| UNITED STATES | | | 34.9 | % | | | | | | | | | |

| ENERGY | | | 4.9 | % | | | | | | | | | |

| OIL & GAS STORAGE & TRANSPORTATION | | | | | | | | | | | | | |

| El Paso Corp. | | | | | | | 36,000 | | | $ | 782,640 | | |

| Energy Transfer Partners LP | | | | | | | 10,000 | | | | 434,700 | | |

| Kinder Morgan Energy Partners LP | | | | | | | 9,000 | | | | 501,570 | | |

| MarkWest Energy Partners LP | | | | | | | 11,579 | | | | 413,370 | | |

| Spectra Energy Corp. | | | | | | | 19,421 | | | | 558,160 | | |

| Williams Cos. (The) | | | | | | | 56,928 | | | | 2,294,768 | | |

| | | | | | | | 4,985,208 | | |

| TELECOMMUNICATION SERVICES—WIRELESS TELECOMMUNICATION SERVICES | | | 9.1 | % | | | | | | | | | |

| American Tower Corp.a | | | | | | | 129,073 | | | | 5,453,334 | | |

| Crown Castle International Corp.a | | | | | | | 50,500 | | | | 1,955,865 | | |

| SBA Communications Corp.a | | | | | | | 49,900 | | | | 1,796,899 | | |

| | | | | | | | 9,206,098 | | |

| UTILITIES | | | 20.9 | % | | | | | | | | | |

| ELECTRIC UTILITIES | | | 10.3 | % | | | | | | | | | |

| Allegheny Energy | | | | | | | 14,672 | | | | 735,214 | | |

| Entergy Corp. | | | | | | | 10,704 | | | | 1,289,618 | | |

| Exelon Corp. | | | | | | | 36,035 | | | | 3,241,709 | | |

| FirstEnergy Corp. | | | | | | | 20,054 | | | | 1,651,046 | | |

| FPL Group | | | | | | | 19,807 | | | | 1,298,943 | | |

| ITC Holdings Corp. | | | | | | | 9,000 | | | | 459,990 | | |

| Northeast Utilities | | | | | | | 39,845 | | | | 1,017,243 | | |

| PPL Corp. | | | | | | | 13,772 | | | | 719,862 | | |

| | | | | | | | 10,413,625 | | |

| GAS UTILITIES | | | 2.8 | % | | | | | | | | | |

| EnergySouth | | | | | | | 9,496 | | | | 465,874 | | |

| Equitable Resources | | | | | | | 13,586 | | | | 938,249 | | |

| Questar Corp. | | | | | | | 13,300 | | | | 944,832 | | |

| Southern Union Co. | | | | | | | 19,797 | | | | 534,915 | | |

| | | | | | | | 2,883,870 | | |

See accompanying notes to financial statements.

13

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

SCHEDULE OF INVESTMENTS—(Continued)

June 30, 2008 (Unaudited)

| | | | | Number

of Shares | | Value | |

| INDEPENDENT POWER PRODUCERS & ENERGY TRADERS | | | 2.3 | % | | | | | | | | | |

| AES Corp. (The)a | | | | | | | 27,755 | | | $ | 533,173 | | |

| Constellation Energy Group | | | | | | | 15,106 | | | | 1,240,203 | | |

| NRG Energya | | | | | | | 12,966 | | | | 556,241 | | |

| | | | | | | | 2,329,617 | | |

| MULTI UTILITIES | | | 5.5 | % | | | | | | | | | |

| Calpine Corp.a | | | | | | | 23,300 | | | | 525,648 | | |

| PG&E Corp. | | | | | | | 38,562 | | | | 1,530,526 | | |

| Public Service Enterprise Group | | | | | | | 19,330 | | | | 887,827 | | |

| Sempra Energy | | | | | | | 27,320 | | | | 1,542,214 | | |

| Wisconsin Energy Corp. | | | | | | | 24,628 | | | | 1,113,678 | | |

| | | | | | | | 5,599,893 | | |

| TOTAL UTILITIES | | | | | | | | | | | 21,227,005 | | |

| TOTAL UNITED STATES | | | | | | | | | | | 35,418,311 | | |

| TOTAL COMMON STOCK (Identified cost—$95,700,844) | | | | | | | | | | | 98,925,388 | | |

| | | | | Principal

Amount | | | |

| COMMERCIAL PAPER | | | 4.4 | % | | | | | | | | | |

Prudential Funding LLC, 1.05%, due 7/1/08

(Identified cost—$4,486,000) | | | | | | $ | 4,486,000 | | | | 4,486,000 | | |

| TOTAL INVESTMENTS (Identified cost—$100,186,844) | | | 101.9 | % | | | | | | | 103,411,388 | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS | | | (1.9 | )% | | | | | | | (1,919,459 | ) | |

| NET ASSETS | | | 100.0 | % | | | | | | $ | 101,491,929 | | |

Glossary of Portfolio Abbreviation

ADR American Depositary Receipt

Note: Percentages indicated are based on the net assets of the fund.

a Non-income producing security.

See accompanying notes to financial statements.

14

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES

June 30, 2008 (Unaudited)

| ASSETS: | |

| Investments in securities, at value (Identified cost—$100,186,844) | | $ | 103,411,388 | | |

| Foreign currency, at value (Identified cost—$545,944) | | | 546,326 | | |

| Receivable for fund shares sold | | | 1,270,396 | | |

| Receivable for investment securities sold | | | 1,050,094 | | |

| Dividends receivable | | | 374,376 | | |

| Other assets | | | 911 | | |

| Total Assets | | | 106,653,491 | | |

| LIABILITIES: | |

| Payable for investment securities purchased | | | 4,144,047 | | |

| Payable for dividends declared | | | 573,909 | | |

| Payable for fund shares redeemed | | | 334,164 | | |

| Payable for investment advisory fees | | | 17,241 | | |

| Payable for distribution fees | | | 5,223 | | |

| Payable for directors' fees | | | 4,531 | | |

| Payable for shareholder servicing fees | | | 1,834 | | |

| Payable for administration fees | | | 1,682 | | |

| Other liabilities | | | 78,931 | | |

| Total Liabilities | | | 5,161,562 | | |

| NET ASSETS | | $ | 101,491,929 | | |

| NET ASSETS consist of: | |

| Paid-in-capital | | $ | 91,736,558 | | |

| Dividends in excess of net investment income | | | (127,397 | ) | |

| Accumulated undistributed net realized gain | | | 6,655,308 | | |

| Net unrealized appreciation | | | 3,227,460 | | |

| | | $ | 101,491,929 | | |

See accompanying notes to financial statements.

15

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF ASSETS AND LIABILITIES—(Continued)

June 30, 2008 (Unaudited)

| CLASS A SHARES: | |

| NET ASSETS | | $ | 51,922,873 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 3,407,281 | | |

| Net asset value and redemption price per share | | $ | 15.24 | | |

| Maximum offering price per share ($15.24 ÷ 0.955)a | | $ | 15.96 | | |

| CLASS B SHARES: | |

| NET ASSETS | | $ | 10,500,078 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 692,283 | | |

| Net asset value and offering price per shareb | | $ | 15.17 | | |

| CLASS C SHARES: | |

| NET ASSETS | | $ | 36,613,854 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 2,411,757 | | |

| Net asset value and offering price per shareb | | $ | 15.18 | | |

| CLASS I SHARES: | |

| NET ASSETS | | $ | 2,455,124 | | |

| Shares issued and outstanding ($0.001 par value common stock outstanding) | | | 160,792 | | |

| Net asset value, offering and redemption price per share | | $ | 15.27 | | |

a On investments of $100,000 or more, the offering price is reduced.

b Redemption price per share is equal to the net asset value per share less any applicable deferred sales charge which varies with the length of time shares are held.

See accompanying notes to financial statements.

16

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF OPERATIONS

For the Six Months Ended June 30, 2008 (Unaudited)

| Investment Income: | |

| Dividend income (net of $183,587 of foreign withholding tax) | | $ | 2,032,399 | | |

| Interest income | | | 30,611 | | |

| Total Income | | | 2,063,010 | | |

| Expenses: | |

| Investment advisory fees | | | 367,927 | | |

| Distribution fees—Class A | | | 57,038 | | |

| Distribution fees—Class B | | | 42,411 | | |

| Distribution fees—Class C | | | 144,399 | | |

| Shareholder servicing fees—Class A | | | 22,815 | | |

| Shareholder servicing fees—Class B | | | 14,137 | | |

| Shareholder servicing fees—Class C | | | 48,133 | | |

| Professional fees | | | 66,522 | | |

| Administration fees | | | 49,993 | | |

| Registration and filing fees | | | 34,944 | | |

| Transfer agent fees and expenses | | | 33,822 | | |

| Shareholder reporting expenses | | | 30,518 | | |

| Directors' fees and expenses | | | 27,488 | | |

| Custodian fees and expenses | | | 26,054 | | |

| Line of credit fees | | | 1,109 | | |

| Miscellaneous | | | 6,929 | | |

| Total Expenses | | | 974,239 | | |

| Reduction of Expenses (See Note 2) | | | (81,064 | ) | |

| Net Expenses | | | 893,175 | | |

| Net Investment Income | | | 1,169,835 | | |

| Net Realized and Unrealized Gain: | |

| Net realized gain on: | |

| Investments | | | 6,782,328 | | |

| Foreign currency transactions | | | 167,961 | | |

| Net realized gain | | | 6,950,289 | | |

| Net change in unrealized appreciation on: | |

| Investments | | | (20,619,335 | ) | |

| Foreign currency translations | | | 2,558 | | |

| Net change in unrealized appreciation | | | (20,616,777 | ) | |

| Net realized and unrealized loss | | | (13,666,488 | ) | |

| Net Decrease in Net Assets Resulting from Operations | | $ | (12,496,653 | ) | |

See accompanying notes to financial statements.

17

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

STATEMENT OF CHANGES IN NET ASSETS (Unaudited)

| | | For the

Six Months Ended

June 30, 2008 | | For the

Year Ended

December 31, 2007 | |

| Change in Net Assets: | |

| From Operations: | |

| Net investment income | | $ | 1,169,835 | | | $ | 617,220 | | |

| Net realized gain | | | 6,950,289 | | | | 15,292,414 | | |

| Net change in unrealized appreciation | | | (20,616,777 | ) | | | 2,028,102 | | |

Net increase (decrease) in net assets resulting

from operations | | | (12,496,653 | ) | | | 17,937,736 | | |

| Dividends and Distributions to Shareholders from | |

| Net investment income: | |

| Class A | | | (767,772 | ) | | | (411,354 | ) | |

| Class B | | | (127,493 | ) | | | (32,228 | ) | |

| Class C | | | (431,960 | ) | | | (85,934 | ) | |

| Class I | | | (44,907 | ) | | | (39,241 | ) | |

| Net realized gain on investments: | |

| Class A | | | — | | | | (6,297,142 | ) | |

| Class B | | | — | | | | (1,765,116 | ) | |

| Class C | | | — | | | | (5,218,091 | ) | |

| Class I | | | — | | | | (224,806 | ) | |

| Total dividends and distributions to shareholders | | | (1,372,132 | ) | | | (14,073,912 | ) | |

| Capital Stock Transactions: | |

| Increase in net assets from fund share transactions | | | 21,825,110 | | | | 91,460 | | |

| Total increase in net assets | | | 7,956,325 | | | | 3,955,284 | | |

| Net Assets: | |

| Beginning of period | | | 93,535,604 | | | | 89,580,320 | | |

| End of perioda | | $ | 101,491,929 | | | $ | 93,535,604 | | |

a Includes dividends in excess of net investment income and undistributed net investment income of $127,397 and $74,900, respectively.

See accompanying notes to financial statements.

18

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)

The following table includes selected data for a share outstanding throughout each period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

| | | Class A | |

| | | For the

Six Months

Ended June 30, | | For the Years Ended December 31, | | For the Period

May 3, 2004a

through | |

| Per Share Operating Performance: | | 2008 | | 2007 | | 2006 | | 2005 | | December 31, 2004 | |

| Net asset value, beginning of period | | $ | 17.47 | | | $ | 16.60 | | | $ | 15.25 | | | $ | 13.78 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.22 | b | | | 0.18 | b | | | 0.39 | | | | 0.38 | b | | | 0.29 | b | |

Net realized and unrealized gain (loss) on

investments | | | (2.21 | ) | | | 3.75 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | (1.99 | ) | | | 3.93 | | | | 2.93 | | | | 1.83 | | | | 2.49 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.24 | ) | | | (0.17 | ) | | | (0.39 | ) | | | (0.34 | ) | | | (0.14 | ) | |

| Net realized gain on investments | | | — | | | | (2.90 | ) | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

Total dividends and distributions to

shareholders | | | (0.24 | ) | | | (3.07 | ) | | | (1.58 | ) | | | (0.36 | ) | | | (0.17 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.01 | | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase (decrease) in net asset value | | | (2.23 | ) | | | 0.87 | | | | 1.35 | | | | 1.47 | | | | 2.32 | | |

| Net asset value, end of period | | $ | 15.24 | | | $ | 17.47 | | | $ | 16.60 | | | $ | 15.25 | | | $ | 13.78 | | |

| Total investment returne | | | –11.41 | %d | | | 23.84 | % | | | 19.43 | % | | | 13.33 | % | | | 21.80 | %d | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 51.9 | | | $ | 43.4 | | | $ | 47.0 | | | $ | 114.5 | | | $ | 26.9 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.67 | %f | | | 1.64 | % | | | 1.54 | % | | | 1.58 | % | | | 3.55 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.50 | %f | | | 1.50 | % | | | 1.50 | % | | | 1.49 | % | | | 1.50 | %f | |

Ratio of net investment income to average daily net

assets (before expense reduction) | | | 2.58 | %f | | | 0.85 | % | | | 2.05 | % | | | 2.44 | % | | | 1.26 | %f | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 2.75 | %f | | | 0.99 | % | | | 2.08 | % | | | 2.53 | % | | | 3.31 | %f | |

| Portfolio turnover rate | | | 123 | %d | | | 102 | % | | | 56 | % | | | 45 | % | | | 16 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Not annualized.

e Does not reflect sales charges, which would reduce return.

f Annualized.

See accompanying notes to financial statements.

19

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class B | |

| | | For the

Six Months

Ended June 30, | | For the Years Ended December 31, | | For the Period

May 3, 2004a

through | |

| Per Share Operating Performance: | | 2008 | | 2007 | | 2006 | | 2005 | | December 31, 2004 | |

| Net asset value, beginning of period | | $ | 17.39 | | | $ | 16.54 | | | $ | 15.19 | | | $ | 13.74 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.16 | b | | | 0.06 | b | | | 0.28 | | | | 0.28 | b | | | 0.21 | b | |

Net realized and unrealized gain (loss) on

investments | | | (2.20 | ) | | | 3.74 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | (2.04 | ) | | | 3.80 | | | | 2.82 | | | | 1.73 | | | | 2.41 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.18 | ) | | | (0.06 | ) | | | (0.28 | ) | | | (0.26 | ) | | | (0.10 | ) | |

| Net realized gain on investments | | | — | | | | (2.90 | ) | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

Total dividends and distributions to

shareholders | | | (0.18 | ) | | | (2.96 | ) | | | (1.47 | ) | | | (0.28 | ) | | | (0.13 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.01 | | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase (decrease) in net asset value | | | (2.22 | ) | | | 0.85 | | | | 1.35 | | | | 1.45 | | | | 2.28 | | |

| Net asset value, end of period | | $ | 15.17 | | | $ | 17.39 | | | $ | 16.54 | | | $ | 15.19 | | | $ | 13.74 | | |

| Total investment returne | | | –11.72 | %d | | | 23.14 | % | | | 18.66 | % | | | 12.59 | % | | | 21.08 | %d | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 10.5 | | | $ | 12.0 | | | $ | 8.9 | | | $ | 7.7 | | | $ | 2.9 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.31 | %f | | | 2.29 | % | | | 2.14 | % | | | 2.23 | % | | | 4.66 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %f | | | 2.15 | % | | | 2.14 | % | | | 2.14 | % | | | 2.15 | %f | |

Ratio of net investment income (loss) to average daily

net assets (before expense reduction) | | | 1.88 | %f | | | 0.21 | % | | | 1.35 | % | | | 1.76 | % | | | (0.11 | )%f | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 2.04 | %f | | | 0.34 | % | | | 1.35 | % | | | 1.85 | % | | | 2.39 | %f | |

| Portfolio turnover rate | | | 123 | %d | | | 102 | % | | | 56 | % | | | 45 | % | | | 16 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Not annualized.

e Does not reflect sales charges, which would reduce return.

f Annualized.

See accompanying notes to financial statements.

20

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class C | |

| | | For the

Six Months

Ended June 30, | | For the Years Ended December 31, | | For the Period

May 3, 2004a

through | |

| Per Share Operating Performance: | | 2008 | | 2007 | | 2006 | | 2005 | | December 31, 2004 | |

| Net asset value, beginning of period | | $ | 17.40 | | | $ | 16.55 | | | $ | 15.20 | | | $ | 13.75 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.16 | b | | | 0.06 | b | | | 0.28 | | | | 0.28 | b | | | 0.22 | b | |

Net realized and unrealized gain (loss) on

investments | | | (2.20 | ) | | | 3.74 | | | | 2.54 | | | | 1.45 | | | | 2.20 | | |

| Total from investment operations | | | (2.04 | ) | | | 3.80 | | | | 2.82 | | | | 1.73 | | | | 2.42 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.18 | ) | | | (0.06 | ) | | | (0.28 | ) | | | (0.26 | ) | | | (0.10 | ) | |

| Net realized gain on investments | | | — | | | | (2.90 | ) | | | (1.19 | ) | | | (0.00 | )c | | | (0.02 | ) | |

| Tax return of capital | | | — | | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

Total dividends and distributions to

shareholders | | | (0.18 | ) | | | (2.96 | ) | | | (1.47 | ) | | | (0.28 | ) | | | (0.13 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.01 | | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase (decrease) in net asset value | | | (2.22 | ) | | | 0.85 | | | | 1.35 | | | | 1.45 | | | | 2.29 | | |

| Net asset value, end of period | | $ | 15.18 | | | $ | 17.40 | | | $ | 16.55 | | | $ | 15.20 | | | $ | 13.75 | | |

| Total investment returnd | | | –11.72 | %e | | | 23.04 | % | | | 18.70 | % | | | 12.58 | % | | | 21.17 | %e | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 36.6 | | | $ | 36.6 | | | $ | 30.8 | | | $ | 48.6 | | | $ | 14.6 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 2.31 | %f | | | 2.28 | % | | | 2.19 | % | | | 2.23 | % | | | 4.49 | %f | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 2.15 | %f | | | 2.15 | % | | | 2.15 | % | | | 2.14 | % | | | 2.15 | %f | |

Ratio of net investment income to average daily net

assets (before expense reduction) | | | 1.88 | %f | | | 0.20 | % | | | 1.35 | % | | | 1.79 | % | | | 0.15 | %f | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 2.04 | %f | | | 0.33 | % | | | 1.39 | % | | | 1.87 | % | | | 2.49 | %f | |

| Portfolio turnover rate | | | 123 | %e | | | 102 | % | | | 56 | % | | | 45 | % | | | 16 | %e | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Does not reflect sales charges, which would reduce return.

e Not annualized.

f Annualized.

See accompanying notes to financial statements.

21

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

FINANCIAL HIGHLIGHTS (Unaudited)—(Continued)

| | | Class I | |

| | | For the

Six Months

Ended June 30, | | For the Years Ended December 31, | | For the Period

May 3, 2004a

through | |

| Per Share Operating Performance: | | 2008 | | 2007 | | 2006 | | 2005 | | December 31, 2004 | |

| Net asset value, beginning of period | | $ | 17.51 | | | $ | 16.63 | | | $ | 15.26 | | | $ | 13.78 | | | $ | 11.46 | | |

| Income from investment operations: | |

| Net investment income | | | 0.20 | b | | | 0.25 | b | | | 0.43 | | | | 0.43 | b | | | 0.27 | b | |

Net realized and unrealized gain (loss) on

investments | | | (2.18 | ) | | | 3.76 | | | | 2.56 | | | | 1.45 | | | | 2.24 | | |

| Total from investment operations | | | (1.98 | ) | | | 4.01 | | | | 2.99 | | | | 1.88 | | | | 2.51 | | |

| Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.26 | ) | | | (0.24 | ) | | | (0.43 | ) | | | (0.38 | ) | | | (0.17 | ) | |

| Net realized gain on investments | | | — | | | | (2.90 | ) | | | (1.19 | ) | | | (0.00 | )c | | | (0.01 | ) | |

| Tax return of capital | | | — | | | | — | | | | (0.00 | )c | | | (0.02 | ) | | | (0.01 | ) | |

Total dividends and distributions to

shareholders | | | (0.26 | ) | | | (3.14 | ) | | | (1.62 | ) | | | (0.40 | ) | | | (0.19 | ) | |

| Redemption fees retained by the fund | | | 0.00 | c | | | 0.01 | | | | 0.00 | c | | | 0.00 | c | | | — | | |

| Net increase (decrease) in net asset value | | | (2.24 | ) | | | 0.88 | | | | 1.37 | | | | 1.48 | | | | 2.32 | | |

| Net asset value, end of period | | $ | 15.27 | | | $ | 17.51 | | | $ | 16.63 | | | $ | 15.26 | | | $ | 13.78 | | |

| Total investment return | | | –11.30 | %d | | | 24.36 | % | | | 19.81 | % | | | 13.73 | % | | | 21.98 | %d | |

| Ratios/Supplemental Data: | |

| Net assets, end of period (in millions) | | $ | 2.5 | | | $ | 1.5 | | | $ | 2.9 | | | $ | 2.7 | | | $ | 1.3 | | |

Ratio of expenses to average daily net assets

(before expense reduction) | | | 1.30 | %e | | | 1.31 | % | | | 1.14 | % | | | 1.24 | % | | | 9.33 | %e | |

Ratio of expenses to average daily net assets

(net of expense reduction) | | | 1.15 | %e | | | 1.15 | % | | | 1.14 | % | | | 1.14 | % | | | 1.15 | %e | |

Ratio of net investment income (loss) to average daily

net assets (before expense reduction) | | | 2.35 | %e | | | 1.20 | % | | | 2.36 | % | | | 2.80 | % | | | (4.92 | )%e | |

Ratio of net investment income to average daily net

assets (net of expense reduction) | | | 2.50 | %e | | | 1.36 | % | | | 2.36 | % | | | 2.89 | % | | | 3.26 | %e | |

| Portfolio turnover rate | | | 123 | %d | | | 102 | % | | | 56 | % | | | 45 | % | | | 16 | %d | |

a Commencement of operations.

b Calculation based on average shares outstanding.

c Amount is less than $0.005.

d Not annualized.

e Annualized.

See accompanying notes to financial statements.

22

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)

Note 1. Significant Accounting Policies

Cohen & Steers Global Infrastructure Fund, Inc. (the fund), formerly Cohen & Steers Utility Fund, Inc., was incorporated under the laws of the State of Maryland on January 13, 2004 and is registered under the Investment Company Act of 1940, as amended, as a nondiversified, open-end management investment company. On April 1, 2008, the fund's name change was effective. Additionally, the fund's investment objective was changed to total return through investment in U.S. and non-U.S. infrastructure companies. Prior to April 1, 2008 the fund's investment objective was total return through investment in utilities. The authorized shares of the fund are divided into four classes designated Class A, B, C, and I shares. Effective May 1, 2007, Class B shares are no longer offered except through dividend reinvestment and permitted exchanges by existing Class B shareholders. Each of the fund's shares has equal dividend, liquidation and voting righ ts (except for matters relating to distributions and shareholder servicing of such shares). Class B shares automatically convert to Class A shares at the end of the month which precedes the eighth anniversary of the purchase date.

The following is a summary of significant accounting policies consistently followed by the fund in the preparation of its financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the New York Stock Exchange are valued, except as indicated below, at the last sale price reflected at the close of the New York Stock Exchange on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day or, if no asked price is available, at the bid price.

Securities not listed on the New York Stock Exchange but listed on other domestic or foreign securities exchanges or admitted to trading on the National Association of Securities Dealers Automated Quotations, Inc. (Nasdaq) national market system are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price on the business day as of which such value is being determined as reflected on the tape at the close of the exchange representing the principal market for such securities.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by Cohen & Steers Capital Management, Inc. (the advisor) to be over-the-counter, but excluding securities admitted to trading on the Nasdaq National List, are valued at the official closing prices as reported by Nasdaq, the National Quotation Bureau, or such other comparable sources as the Board of Directors deem appropriate to reflect their fair market value. If there has been no sale on such day, the securities are valued at the mean of the closing bid and asked prices for the day, or if no asked price is available, at the bid price. However, certain fixed-income securities may be valued on the basis of prices provided by a pricing service when such prices

23

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

are believed by the Board of Directors to reflect the fair market value of such securities. Where securities are traded on more than one exchange and also over-the-counter, the securities will generally be valued using the quotations the Board of Directors believes most closely reflect the value of such securities.

Securities for which market prices are unavailable, or securities for which the advisor determines that bid and/or asked price does not reflect market value, will be valued at fair value pursuant to procedures approved by the fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include recent transactions in comparable securities, information relating to the specific security and developments in the markets.

The fund's use of fair value pricing may cause the net asset value of fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Short-term debt securities, which have a maturity date of 60 days or less, are valued at amortized cost, which approximates value.

The fund adopted Financial Accounting Standards Board Statement of Financial Accounting Standards No. 157, "Fair Value Measurements" ("FAS 157"), effective January 1, 2008. In accordance with FAS 157, fair value is defined as the price that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market the most advantageous market for the investment or liability. FAS 157 establishes a single definition of fair value, creates a three-tier hierarchy as a framework for measuring fair value based on inputs used to value the fund's investments, and requires additional disclosure about fair value. The hierarchy of inputs is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

• Level 3—significant unobservable inputs (including the fund's own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

24

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

The following is a summary of the inputs used as of June 30, 2008 in valuing the fund's investments carried at value:

| | | | | Fair Value Measurements at June 30, 2008 Using | |

| | | Total | | Quoted Prices In

Active Market for

Identical Assets

(Level 1) | | Significant

Other Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

| Investments in Securities | | $ | 103,411,388 | | | $ | 98,925,388 | | | $ | 4,486,000 | | | $ | — | | |

Security Transactions, Investment Income and Expense Allocations: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date except for certain dividends on foreign securities, which are recorded as soon as the fund is informed after the ex-dividend date. The fund records distributions received in excess of income from underlying investments as a reduction of cost of investments and/or realized gain. Such amounts are based on estimates if actual amounts are not available, and actual amounts of income, realized gain and return of capital may differ from the estimated amounts. The fund adjust s the estimated amounts of the components of distributions (and consequently its net investment income) as an increase to unrealized appreciation/(depreciation) and realized gain/(loss) on investments as necessary once the issuers provide information about the actual composition of the distributions. Expenses are allocated to each class of shares based on the relative net asset value on the day such expense is accrued except for distribution fees and shareholder service fees which are charged directly to the respective class.

Foreign Currency Translations: The books and records of the fund are maintained in U.S. dollars as follows: (1) the foreign currency market value of investment securities, other assets and liabilities and foreign currency contracts are translated at the exchange rates prevailing at the end of the period; and (2) purchases, sales, income and expenses are translated at the exchange rates prevailing on the respective dates of such transactions. The resultant exchange gains and losses are recorded as realized and unrealized gain/loss on foreign exchange transactions. Pursuant to U.S. federal income tax regulations, certain foreign exchange gains/losses included in realized and unrealized gain/loss are included in or are a reduction of ordinary income for federal income tax purposes. The fund does not isolate that portion of the results of operations arising as a resul t of changes in the foreign exchange rates from the changes in the market prices of the securities.

Foreign Securities: The fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many

25

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

foreign issuers and their markets may be less liquid and their prices more volatile than those of securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income are declared and paid semiannually. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex-dividend date and are automatically reinvested in full and fractional shares of the fund based on the net asset value per share at the close of business on the payable date unless the shareholder has elected to have them paid in cash.

Income Taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Accordingly, no provision for federal income or excise tax is necessary. The fund has adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainties in Income Taxes (FIN 48). FIN 48 clarifies the accounting for income taxes by prescribing the minimum recognition threshold a tax position must meet before being recognized in the financial statements. An assessment of the fund's tax positions has been made and it has been determined that there is no impact to the fund's financi al statements. Each of the fund's federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

Note 2. Investment Advisory and Administration Fees and Other Transactions with Affiliates

Investment Advisory Fees: The advisor serves as the fund's investment advisor pursuant to an investment advisory agreement (the advisory agreement). Under the terms of the advisory agreement, the advisor provides the fund with the day-to-day investment decisions and generally manages the fund's investments in accordance with the stated policies of the fund, subject to the supervision of the fund's Board of Directors. For the services provided to the fund, the advisor receives a fee, accrued daily and paid monthly, at the annual rate of 0.75% of the average daily net assets of the fund up to and including $1.5 billion and 0.65% of the average daily net asset above $1.5 billion.

For the six months ended June 30, 2008 and through December 31, 2008, the advisor has contractually agreed to waive its fee and/or reimburse the fund for expenses incurred to the extent necessary to maintain the fund's operating expenses at 1.50% for Class A shares, 2.15% for Class B shares and Class C shares and 1.15% for Class I shares.

Effective April 1, 2008, the advisor has entered into subadvisory agreements with Cohen & Steers Asia Limited, Cohen & Steers UK Limited and Cohen & Steers Europe S.A. (collectively the subadvisors), affiliates of the advisor. Under the agreements, the subadvisors are responsible for managing the fund's investments in certain non-U.S. securities. For

26

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

their services provided under the subadvisory agreements, the advisor (not the fund) pays the subadvisors 16.3%, 6.3% and 6.3%, respectively, of the advisory fee received by the advisor from the fund. For the period April 1, 2008 through June 30, 2008, the advisor paid the subadvisors $30,431, $11,762 and $11,762, respectively.

Administration Fees: The fund has entered into an administration agreement with the advisor under which the advisor performs certain administrative functions for the fund and receives a fee, accrued daily and paid monthly, at the annual rate of 0.02% of the fund's average daily net assets. For the six months ended June 30, 2008, the fund paid the advisor $9,811 in fees under this administration agreement. Additionally, the fund has retained State Street Bank and Trust Company as sub-administrator under a fund accounting and administration agreement.

Distribution Fees: Shares of the fund are distributed by Cohen & Steers Securities, LLC (the distributor), an affiliated entity of the advisor. The fund has adopted a distribution plan (the plan) pursuant to Rule 12b-1 under the Investment Company Act of 1940. The plan provides that the fund will pay the distributor a fee, accrued daily and paid monthly, at an annual rate of up to 0.25% of the average daily net assets attributable to the Class A shares and up to 0.75% of the average daily net assets attributable to the Class B and Class C shares.

For the six months ended June 30, 2008, the fund has been advised that the distributor received $27,337 in sales commissions from the sale of Class A shares and that the distributor also received $860, $4,630 and $13,609 of contingent deferred sales charges relating to redemptions of Class A, Class B and Class C shares, respectively. The distributor has advised the fund that proceeds from the contingent deferred sales charge on the Class A, Class B and C shares are paid to the distributor and are used by the distributor to defray its expenses related to providing distribution-related services to the fund in connection with the sale of these classes, including payments to dealers and other financial intermediaries for selling these classes and interest and other financing costs associated with these classes.

Shareholder Servicing Fees: The fund has adopted a shareholder services plan which provides that the fund may obtain the services of qualified financial institutions to act as shareholder servicing agents for their customers. For these services, the fund may pay the shareholder servicing agent a fee, accrued daily and paid monthly, at an annual rate of up to 0.10% of the average daily net asset value of the fund's Class A shares and up to 0.25% of the average daily net asset value of the fund's Class B and C shares.

Directors' and Officers' Fees: Certain directors and officers of the fund are also directors, officers, and/or employees of the advisor. The fund does not pay compensation to any affiliated directors and officers except for the Chief Compliance Officer, who received $624 from the fund for the six months ended June 30, 2008.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the six months ended June 30, 2008 totaled $145,793,384 and $117,445,555, respectively.

27

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 4. Income Tax Information

As of June 30, 2008, the federal tax cost and net unrealized appreciation on securities were as follows:

| Gross unrealized appreciation | | $ | 10,245,838 | | |

| Gross unrealized depreciation | | | (7,021,294 | ) | |

| Net unrealized appreciation | | $ | 3,224,544 | | |

| Cost for federal income tax purposes | | $ | 100,186,844 | | |

Note 5. Capital Stock

The fund is authorized to issue 200 million shares of capital stock, at a par value of $0.001 per share. The Board of Directors of the fund may increase or decrease the aggregate number of shares of common stock that the fund has authority to issue. Transactions in fund shares were as follows:

| | | For the

Six Months Ended

June 30, 2008 | | For the

Year Ended

December 31, 2007 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Class A: | |

| Sold | | | 1,549,119 | | | $ | 25,058,808 | | | | 1,084,044 | | | $ | 20,411,824 | | |

Issued as reinvestment of

dividends and distributions | | | 28,257 | | | | 430,113 | | | | 180,245 | | | | 3,160,703 | | |

| Redeemed | | | (654,058 | ) | | | (10,432,356 | ) | | | (1,612,463 | ) | | | (29,797,101 | ) | |

Redemption fees retained by

the funda | | | — | | | | 4,217 | | | | — | | | | 13,714 | | |

| Net increase (decrease) | | | 923,318 | | | $ | 15,060,782 | | | | (348,174 | ) | | $ | (6,210,860 | ) | |

28

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

| | | For the

Six Months Ended

June 30, 2008 | | For the

Year Ended

December 31, 2007 | |

| | | Shares | | Amount | | Shares | | Amount | |

| Class B: | |

| Sold | | | 77,254 | | | $ | 1,234,510 | | | | 244,636 | | | $ | 4,534,859 | | |

Issued as reinvestment of

dividends and distributions | | | 3,157 | | | | 48,312 | | | | 34,590 | | | | 602,034 | | |

| Redeemed | | | (81,351 | ) | | | (1,287,721 | ) | | | (121,802 | ) | | | (2,256,056 | ) | |

Redemption fees retained by

the funda | | | — | | | | 1,090 | | | | — | | | | 3,168 | | |

| Net increase (decrease) | | | (940 | ) | | $ | (3,809 | ) | | | 157,424 | | | $ | 2,884,005 | | |

| Class C: | |

| Sold | | | 936,171 | | | $ | 15,342,472 | | | | 1,114,970 | | | $ | 20,941,449 | | |

Issued as reinvestment of

dividends and distributions | | | 10,270 | | | | 155,414 | | | | 89,846 | | | | 1,564,607 | | |

| Redeemed | | | (635,667 | ) | | | (10,100,360 | ) | | | (963,264 | ) | | | (17,289,307 | ) | |

Redemption fees retained by

the funda | | | — | | | | 3,683 | | | | — | | | | 8,560 | | |

| Net increase | | | 310,774 | | | $ | 5,401,209 | | | | 241,552 | | | $ | 5,225,309 | | |

| Class I: | |

| Sold | | | 194,536 | | | $ | 3,300,201 | | | | 21,536 | | | $ | 407,626 | | |

Issued as reinvestment of

dividends and distributions | | | 2,933 | | | | 44,907 | | | | 13,925 | | | | 244,827 | | |

| Redeemed | | | (123,189 | ) | | | (1,978,459 | ) | | | (125,424 | ) | | | (2,460,547 | ) | |

Redemption fees retained by

the funda | | | — | | | | 279 | | | | — | | | | 1,100 | | |

| Net increase (decrease) | | | 74,280 | | | $ | 1,366,928 | | | | (89,963 | ) | | $ | (1,806,994 | ) | |

a The fund may charge a 2% redemption fee on shares sold within 60 days of the time of purchase. Redemption fees are paid directly to the fund. Prior to September 28, 2007, the redemption fee was charged at a rate of 1% on shares sold within six months of the time of purchase.

29

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

NOTES TO FINANCIAL STATEMENTS (Unaudited)—(Continued)

Note 6. Borrowings

The fund, in conjunction with other Cohen & Steers funds, is a party to a $200,000,000 syndicated credit agreement (the credit agreement) with State Street Bank and Trust Company, as administrative agent and operations agent, and the lenders identified in the credit agreement, which expires December 2008. The fund pays a commitment fee of 0.10% per annum on its proportionate share of the unused portion of the credit agreement.

During the six months ended June 30, 2008, the fund did not utilize the line of credit.

Note 7. Other

In the normal course of business, the fund enters into contracts that provide general indemnifications. The fund's maximum exposure under these arrangements is dependent on claims that may be made against the fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 8. New Accounting Pronouncement

In March 2008, the Financial Accounting Standards Board issued Statement of Financial Accounting Standards No. 161, Disclosures about Derivative Instruments and Hedging Activities ("FAS 161"), an amendment of FASB Statement No. 133. FAS 161 requires enhanced disclosures about (a) how and why an entity uses derivative instruments, (b) how derivative instruments and related hedged items are accounted for, and (c) how derivative instruments and related hedged items affect the fund's financial position, financial performance, and cash flows. Management is currently evaluating the impact the adoption of this pronouncement will have on the fund's financial statements. FAS 161 is effective for fiscal years beginning after November 15, 2008.

30

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

OTHER INFORMATION

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities is available (i) without charge, upon request, by calling 800-330-7348, (ii) on our Web site at cohenandsteers.com or (iii) on the Securities and Exchange Commission's Web site at http://www.sec.gov. In addition, the fund's proxy voting record for the most recent 12-month period ended June 30 is available (i) without charge, upon request, by calling 800-330-7348 or (ii) on the SEC's Web site at http://www.sec.gov.

The fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The fund's Forms N-Q are available (i) without charge, upon request by calling 800-330-7348, or (ii) on the SEC's Web site at http://www.sec.gov. In addition, the Forms N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 800-SEC-0330.

Please note that the distributions paid by the fund to shareholders are subject to recharacterization for tax purposes. The fund may also pay distributions in excess of the fund's net investment company taxable income and this excess would be a tax-free return of capital distributed from the fund's assets. The final tax treatment of all distributions is reported to shareholders on their 1099-DIV forms, which are mailed after the close of each calendar year.

31

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

Meet the Cohen & Steers family of open-end funds:

COHEN & STEERS

REALTY SHARES

• Designed for investors seeking total return, investing primarily in REITs

• Symbol: CSRSX

COHEN & STEERS

REALTY INCOME FUND

• Designed for investors seeking maximum total return, investing primarily in real estate securities with an emphasis on both income and capital appreciation

• Symbols: CSEIX, CSBIX, CSCIX, CSDIX

COHEN & STEERS

INTERNATIONAL REALTY FUND

• Designed for investors seeking total return, investing primarily in international real estate securities

• Symbols: IRFAX, IRFCX, IRFIX

COHEN & STEERS

DIVIDEND VALUE FUND

• Designed for investors seeking high current income and long-term growth of income and capital appreciation, investing primarily in dividend paying common stocks and preferred stocks

• Symbols: DVFAX, DVFCX, DVFIX

COHEN & STEERS

INSTITUTIONAL GLOBAL REALTY SHARES

• Designed for institutional investors seeking total return, investing primarily in global real estate securities

• Symbol: GRSIX

COHEN & STEERS

INSTITUTIONAL REALTY SHARES

• Designed for institutional investors seeking total return, investing primarily in REITs

• Symbol: CSRIX

COHEN & STEERS

GLOBAL REALTY SHARES

• Designed for investors seeking total return, investing primarily in global real estate equity securities

• Symbols: CSFAX, CSFBX, CSFCX, CSSPX

COHEN & STEERS

GLOBAL INFRASTRUCTURE FUND

• Designed for investors seeking total return, investing primarily in global infrastructure securities

• Symbols: CSUAX, CSUBX, CSUCX, CSUIX

COHEN & STEERS

ASIA PACIFIC REALTY SHARES

• Designed for investors seeking total return, investing primarily in real estate securities located in the Asia Pacific region

• Symbols: APFAX, APFCX, APFIX

COHEN & STEERS

EUROPEAN REALTY SHARES

• Designed for investors seeking total return, investing primarily in real estate securities located in Europe

• Symbols: EURAX, EURCX, EURIX

Please consider the investment objectives, risks, charges and expenses of the fund carefully before investing. A prospectus containing this and other information can be obtained by calling 800-330-7348 or by visiting cohenandsteers.com. Please read the prospectus carefully before investing.

Cohen & Steers Securities, LLC, Distributor

32

COHEN & STEERS GLOBAL INFRASTRUCTURE FUND, INC.

OFFICERS AND DIRECTORS