UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-21494 |

Nuveen Floating Rate Income Fund

(Exact name of registrant as specified in charter)

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Address of principal executive offices) (Zip code)

Gifford R. Zimmerman

Nuveen Investments

333 West Wacker Drive

Chicago, IL 60606

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 917-7700

Date of fiscal year end: July 31

Date of reporting period: July 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

Closed-End Funds

31 July 2019

Nuveen

Closed-End Funds

| | |

| NSL | | Nuveen Senior Income Fund |

| JFR | | Nuveen Floating Rate Income Fund |

| JRO | | Nuveen Floating Rate Income Opportunity Fund |

| JSD | | Nuveen Short Duration Credit Opportunities Fund |

| JQC | | Nuveen Credit Strategies Income Fund |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ annual and semi-annual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Funds’ website (www.nuveen.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you have already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically anytime by contacting the financial intermediary (such as a broker-dealer or bank) through which you hold your Fund shares or, if you are a direct investor, by enrolling at www.nuveen.com/e-reports.

You may elect to receive all future shareholder reports in paper free of charge at any time by contacting your financial intermediary or, if you are a direct investor, (i) by calling 800-257-8787 and selecting option #2 or (ii) by logging into your Investor Center account at www.computershare.com/investor and clicking on “Communication Preferences.” Your election to receive reports in paper will apply to all funds held in your account with your financial intermediary or, if you are a direct investor, to all your directly held Nuveen Funds and any other directly held funds within the same group of related investment companies.

Annual Report

Life is Complex

Nuveen makes things e-simple.

It only takes a minute to sign up fore-Reports. Once enrolled, you’ll receive ane-mail as soon as your Nuveen Fund information is ready—no more waiting for delivery by regular mail. Just click on the link within thee-mail to see the report and save it on your computer if you wish.

Free e-Reports right to your email!

www.investordelivery.com

If you receive your Nuveen Fund dividends and statements from your financial advisor or brokerage account.

or

www.nuveen.com/client-access

If you receive your Nuveen Fund dividends and statements directly from Nuveen.

NOT FDIC INSURED MAY LOSE VALUE NO BANK GUARANTEE

Table of Contents

3

Chairman’s Letter to Shareholders

Dear Shareholders,

In recent months, economic pessimism has been rising. An unexpected escalation in U.S.- China trade tensions and an unpredictable Brexit outcome top the list of geopolitical concerns. Global macroeconomic data shows a further moderation in growth as a result of weaker export and manufacturing activity across the U.S., Europe and Asia. Notably, in the U.S., some of the more historically reliable leading economic indicators have turned bearish. Although these indicators do not predict the timing of an economic downturn, an inverted yield curve, which occurs when yields on long-term Treasury bonds fall below those of short-term Treasury bonds, and contracting manufacturing activity have preceded past U.S. recessions. U.S. economic growth forecasts and corporate earnings outlooks continue to be downgraded. In this environment, equity market volatility has increased while safe-haven assets, including government bonds and gold, have rallied strongly.

While these conditions have contributed to the market’s anxiety and certainly merit watching, it appears the likelihood of a near-term recession remains low. Consumer spending, buoyed by historically low unemployment and modest wage growth, has powered the economic recovery, even as business investment has been lackluster. Additionally, the sectors directly hit by trade, namely manufacturing and commodity-related businesses, represent a much smaller share of the overall economy than in the past. Central bank efforts to extend the economic cycle with lower interest rates encourages business and consumers to borrow at lower rates while markets have been encouraged by the expectation of easier financial conditions. Recession is not necessarily imminent if these factors can provide the economy with a measure of resilience, sustaining growth at a more subdued pace.

Outside the U.S., central banks and governments have been easing monetary conditions and rolling out fiscal spending programs to buffer slowing growth. The European Central Bank is widely expected to announce a stimulus plan at its September meeting, and China’s authorities remain committed to keeping economic growth rates steady with fiscal and monetary policy. Until there is more clarity on trade, however, the markets may experience bouts of risk-on, risk-off sentiment.

The opportunity set may be narrower, but there may still be scope for gains in this environment. Patience and maintaining perspective can help you weather periodic market volatility. We encourage you to work with your financial advisor to assess short-term market movements in the context of your time horizon, risk tolerance and investment goals. On behalf of the other members of the Nuveen Fund Board, we look forward to continuing to earn your trust in the months and years ahead.

Sincerely,

Terence J. Toth

Chairman of the Board

September 24, 2019

4

Portfolio Managers’ Comments

Nuveen Senior Income Fund (NSL)

Nuveen Floating Rate Income Fund (JFR)

Nuveen Floating Rate Income Opportunity Fund (JRO)

Nuveen Short Duration Credit Opportunities Fund (JSD)

Nuveen Credit Strategies Income Fund (JQC)

The Funds’ investment portfolios are managed by Symphony Asset Management, LLC (Symphony), an affiliate of Nuveen, LLC. During the reporting period, Scott Caraher and Jenny Rhee managed NSL, JFR JRO and JSD, while Scott Caraher, Jenny Rhee and Sutanto Widjaja managed JQC.

Effective September 3, 2019 (subsequent to the close of the reporting period), Bernard Wong, CFA, was added as portfolio manager to JQC and Sutanto Widjaja is no longer a portfolio manager to JQC.

Effective May 23, 2019, Scott Caraher and Jenny Rhee were added as portfolio managers to JQC. Jenny Rhee was also added as portfolio manager to NSL, JRO and JFR.

On October 1, 2018, Gunther Stein ceased serving as a portfolio manager for each of the Funds.

Here the team discusses economic and market conditions, their management strategies and the performance of the Funds for the twelve-month reporting period ended July 31, 2019.

What factors affected the U.S. economy and the markets during the twelve-month reporting period ended July 31, 2019?

The U.S. economy reached the tenth year of expansion since the previous recession ended in June 2009, marking the longest expansion in U.S. history. The Bureau of Economic Analysis “second” estimate of gross domestic product (GDP) growth came in at 2.0% (annualized) for the second quarter of 2019, a notable slowdown from 3.1% annualized growth in the first quarter of the year and below the 2.5% growth rate achieved in 2018. Strong consumer and government spending in the April to June 2019 quarter helped sustain the economy’s growth trend, despite weaker exports and reduced business investment.

Consumer spending, the largest driver of the economy, remained well supported by low unemployment, wage gains and tax cuts. As reported by the Bureau of Labor Statistics, the unemployment rate fell to 3.7% in July 2019 from 3.9%

This material is not intended to be a recommendation or investment advice, does not constitute a solicitation to buy, sell or hold a security or an investment strategy and is not provided in a fiduciary capacity. The information provided does not take into account the specific objectives or circumstances of any particular investor, or suggest any specific course of action. Investment decisions should be made based on an investor’s objectives and circumstances and in consultation with his or her advisors.

Certain statements in this report are forward-looking statements. Discussions of specific investments are for illustration only and are not intended as recommendations of individual investments. The forward-looking statements and other views expressed herein are those of the portfolio managers as of the date of this report. Actual future results or occurrences may differ significantly from those anticipated in any forward-looking statements and the views expressed herein are subject to change at any time, due to numerous market and other factors. The Funds disclaim any obligation to update publicly or revise any forward-looking statements or views expressed herein.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s (S&P), Moody’s Investors Service, Inc. (Moody’s) or Fitch, Inc. (Fitch). This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings, while BB, B, CCC, CC, C and D are below investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

5

Portfolio Managers’ Comments(continued)

in July 2018 and job gains averaged around 187,000 per month for the past twelve months. As the jobs market has tightened, average hourly earnings grew at an annualized rate of 3.2% in July 2019. However, falling energy prices dampened inflation over the past twelve months. The Bureau of Labor Statistics said the Consumer Price Index (CPI) increased 1.8% over the twelve-month reporting period ended July 31, 2019 before seasonal adjustment.

Low mortgage rates and low inventory drove home prices moderately higher in this reporting period, despite declining new home sales and housing starts. The S&P CoreLogic Case-Shiller U.S. National Home Price Index, which covers all nine U.S. census divisions, was up 3.1% year-over-year in June 2019 (most recent data available at the time this report was prepared). The10-City and20-City Composites reported year-over-year increases of 1.8% and 2.1%, respectively.

As data pointed to slower momentum in the overall economy, the Federal Reserve (Fed) notably shifted its stance. Although the Fed had indicated in December 2018 that there could be two more rate hikes in 2019, global growth concerns kept the central bank on the sidelines. As expected by the markets, the Fed left rates unchanged throughout the first half of 2019 while speculation increased that the Fed’s next move would be a rate cut. At the July 2019 policy committee meeting, the Fed announced a 0.25% cut to its main policy rate and that it will stop shrinking its bond portfolio sooner than scheduled. Markets initially registered disappointment with the Fed’s explanation that the rate cut was a“mid-cycle adjustment,” rather than a prolonged easing period.

During the twelve-month reporting period, geopolitical news remained a prominent market driver. Tariff and trade policy topped the list of concerns, most prominently the U.S.-China relations. After several rounds of talks and a series of tariff increases, President Trump and President Xi agreed to another temporary trade truce in late June 2019 that halted additional tariff increases. The July negotiations ended without an agreement, and President Trump announced a 10% tariff on the remaining $300 billion worth of Chinese imports effective in September. (Subsequent to the close of the reporting period, he said the tariffs would be postponed untilmid-December). Additionally, the U.S. administration walked back its ban on U.S. companies doing business with Chinese tech giant Huawei. The agreed-upon trade deal between the U.S., Mexico and Canada to replace the North American Free Trade Agreement has yet to be ratified by the national congresses, while President Trump rescinded the threat to impose tariffs on Mexico if the country didn’t take more action to curb illegal immigration. Meanwhile, as agreed in July 2018, the U.S. and the European Union continued to withhold further tariffs. Markets grew increasingly worried that trade conflicts would dampen already slowing global growth, as negative sentiment could inhibit business, consumer and investor confidence and spending.

In the U.K., Prime Minister Theresa May was unable to secure a Brexit deal before the original March 29, 2019 deadline. The European Union extended the deadline to October 31, 2019, and Prime Minister May resigned effective June 7, 2019. As widely expected, Brexit hardliner Boris Johnson was voted leader of the Conservative Party and assumed premiership. Europe also contended with Italy’s eurosceptic coalition government and its challenging fiscal condition, the “yellow vest” protests in France, immigration policy concerns, Russian sanctions and political risk in Turkey. (Subsequent to the close of the reporting period, Italy’s Prime Minister unexpectedly resigned amid a growing rift with the coalition government over key domestic and fiscal policies.)

Elections around the world also remained a source of uncertainty. Markets continued to closely monitor the new administrations in Brazil and Mexico, as well as Argentina’s upcoming presidential election. (After the close of the reporting period, President Macri, who is considered the market-friendly candidate, suffered a surprising defeat in Argentina’s August primary vote.) In the U.K., the possibility of ano-deal Brexit increased under new Prime Minister Boris Johnson. Europe’s traditional centrist parties lost seats in the Parliamentary elections and populist parties saw marginal gains. The ruling parties in India and South Africa maintained their majorities, where slower economic growth could complicate their respective reform mandates.

The twelve-month reporting period was generally a positive environment for U.S. corporate credit, although there were a few periods of market instability. In particular, the fourth quarter of 2018 saw heavy redemptions from retail mutual funds and exchange-traded funds (ETFs) that caused significant volatility for loans. This was particularly acute within

6

larger, more liquid and higher quality assets. Throughout much of 2019, this trend normalized with loans moving back closer to fair value. This was particularly the case for those assets most affected during thesell-off in the fourth quarter 2018 as these deeply discounted names had more upside. Throughout the reporting period, the market also saw heavy outflows from retail investors. However, loans continued to see strong and consistent demand from institutional investors in particular from the collateralized loan obligation (CLO) market. Meanwhile, high yield funds saw stronger demand during much of the latter part of the reporting period as interest rate risk became more benign amid a more dovish Fed monetary policy that benefits fixed rate high yield bonds.

What strategies were used to manage the Funds during the twelve-month reporting period ended July 31, 2019?

NSL seeks to achieve a high level of current income, consistent with capital preservation by investing primarily in adjustable rate U.S dollar-denominated secured senior loans. The Fund invests at least 80% of its managed assets in adjustable rate senior secured loans. Up to 20% may include U.S. dollar denominated senior loans ofnon-U.S. borrowers, senior loans that are not secured, other debt securities and equity securities and warrants. The Fund uses leverage.

JFR seeks to achieve a high level of current income by investing in adjustable rate secured and unsecured senior loans and other debt instruments. The Fund invests at least 80% of its managed assets in adjustable rate loans, primarily senior loans, though the loans may include unsecured senior loans and secured and unsecured subordinated loans. At least 65% the Fund’s managed assets must include adjustable rate senior loans that are secured by specific collateral. The Fund uses leverage.

JRO seeks to achieve a high level of current income. The Fund invests at least 80% of its managed assets in adjustable rate loans, primarily senior loans, though the loans may include unsecured senior loans and secured and unsecured subordinated loans. At least 65% of the Fund’s managed assets must include adjustable rate senior loans that are secured by specific collateral. The Fund uses leverage.

JSD seeks to provide current income and the potential for capital appreciation. The Fund invests at least 70% of its managed assets in adjustable rate corporate debt instruments, including senior secured loans, second lien loans and other adjustable rate corporate debt instruments, at least 80% of “assets,” at time of purchase, in loans or securities in the issuing company’s capital structure that are senior to its common equity, including but not limited to debt securities, preferred securities and up to 30% of the Fund’s assets may include other types of debt instruments or short positions consisting primarily of high yield debt. The Fund maintains a portfolio with an average duration that does not exceed two years. The Fund uses leverage.

JQC’s primary investment objective is high current income and its secondary objective is total return. The Fund invests at least 70% of its managed assets in adjustable rate senior secured and second lien loans, at least 80% of “assets,” at time of purchase, in loans or securities in the issuing company’s capital structure that are senior to its common equity, including but not limited to debt securities, preferred securities and up to 30% opportunistically in other types of securities across a company’s capital structure, primarily income-oriented securities such as high yield debt, convertible securities and other forms of corporate debt. The Fund uses leverage.

How did the Funds perform during this twelve-month reporting period ended July 31, 2019?

The tables in the Performance Overview and Holding Summaries section of this report provide total return performance for each Fund for theone-year, five-year,ten-year and/or since inception periods ended July 31, 2019. The Fund’s total returns at net asset value (NAV) are compared with the performance of a corresponding market index.

The Funds’ total returns at NAV for the reporting period are as follows: NSL 1.81%, JFR 2.03%, JRO 1.94%, JSD 1.30% and JQC 3.43%. Over the same period the Credit Suisse Leveraged Loan Index returned 4.10%.

7

Portfolio Managers’ Comments(continued)

What other Fund factors impacted Fund Performance?

The senior loan portion of the Funds is invested predominantly in first-lien, senior secured corporate loans. Symphony prefers to focus on issuers that have strong asset coverage, defensible businesses and loans of larger issuance size. These loans are generally referred to as broadly syndicated loans. At the beginning of the reporting period, Symphony generally believed that these larger loan issuances offered better risk/return dynamics as the liquidity premium, or spread, between larger loans and smaller loans remained tight. This was further exacerbated following a liquidity drivensell-off late in 2018 which had a more pronounced impact on larger, better quality issuances within the loan market. Throughout the latter half of the reporting period, Symphony continued to focus on these issuances as the market normalized, which benefited these names that were particularly hurt in the volatile period towards the end of 2018.

The Funds also invest in high yield corporate bonds. High yield bonds are typically invested in opportunistically as Symphony sees value in these assets. Many of the same issuers of high yield bonds also have senior loans outstanding and in some cases, Symphony believes that the bonds of these issuers offer a better risk-returntrade-off versus the loans. Oftentimes, Symphony will invest in both the loans and the bonds of the same issuer.

The major allocation and security selection performance factors were similar in NSL, JFR, JRO and JSD. During the reporting period, an overweight exposure to BBB rated loans contributed to performance as these higher quality assets outperformed the overall loan market as measured by the Credit Suisse Leveraged Loan Index. The media/telecom sector as well as security selection within the retail sector benefited performance. An underweight to metals and mining and energy sectors also contributed to performance as these cyclical sectors lagged the overall loan market. This was particularly the case for metals and mining names which were the most prominent underperformers within the loan market during the reporting period. The Funds also benefited from their high yield bond exposure, as high yield bonds outperformed loans during the reporting period. For comparison, the Credit Suisse Leveraged Loan Index returned 4.10% while the high yield bond market (as measured by the ICE BofAML High Yield Index) returned 6.94% over the same time period.

Individual securities that contributed to performance included Albertson’s LLC, the grocery store operator, whose loans have benefited from improved sales, reduced debt and a successful issuance of debt to refinance existing liabilities. In addition, the debt of Sprint Corporation was a top contributor as the company was given approval for a proposed merger with another telecom operator. Lastly, the loans of PetSmart benefited performance. PetSmart successfully brought its online business public during the reporting period, which improved the issuer’s fundamental profile.

Several factors contributed to the Funds’ underperformance, including security selection within the financials sector. In particular, the loan of mortgage service company, Walter Investment Management Corporation, detracted from performance. The distressed issuer filed for bankruptcy during the reporting period and has most recently been in the process of looking for buyers for the company. Also detracting from performance were the loans of Catalina Marketing. Catalina has historically been involved in the print coupon business. It is currently in the process of restructuring its business to changing market dynamics. Lastly, the post reorganization equity of Avaya, Inc. detracted from performance for all four of the Funds. The stock of the issuer has been volatile following the issuer’s emergence from bankruptcy. For JSD, the first and second lien loans of education software company Skillsoft Corporation detracted from performance. Skillsoft was downgraded amid high levels of leverage and pending debt maturities. We continue to hold all the positions.

JQC has a differentiated mandate relative to the other Funds. The core loan bucket for JQC is generally comprised of higher credit quality issues and the Fund is generally allocated more toward the high yield market on a relative basis. This relative overweight to high yield bonds benefited the Fund given their general outperformance versus loans during the reporting period. JQC is also less exposed to post reorganization equity positions, generally resulting in lower volatility. Due to these circumstances, it outperformed the other four Funds during the reporting period. Relative to the Credit Suisse Leveraged Loan Index, JQC’s overweight exposure to BBB rated loans contributed to performance during the reporting period as these higher quality assets outperformed the overall loan market.

8

From a sector perspective, JQC had strong issuer selection within media/telecom, health care, consumer durables and retail, which helped absolute and relative performance. Top issues benefiting the Fund’s return during the reporting period included PetSmart Inc., Revlon Consumer Products Corporation, and iHeart Communications Inc. PetSmart successfully brought its online business public during the reporting period, improving the issuer’s credit fundamental profile. The loans and bonds of Revlon rose on the announcement of good financial performance and a significant cost optimization program. Lastly, cash flows related to the successful restructuring of radio station operator iHeart Communications added to performance during the reporting period. We continue to hold PetSmart Inc., Revlon Consumer Products Corporation and iHeart Communications.

Detracting from performance was security selection predominantly within the financials sector. In particular, the loan of mortgage service company, Walter Investment Management Corporation, detracted from performance. The distressed issuer had filed for bankruptcy during the reporting period and has most recently been in the process of looking for buyers for the company. Also detracting from performance were the loans of Catalina Marketing. Catalina, which has historically been involved in the print coupon business, is in the process of restructuring its business to changing market dynamics. Also of note, the post reorganization equity of Avaya Holdings Corporation, Fieldwood Energy LLC and Harvey Gulf International Marine, Inc. detracted from performance. The stock of Fieldwood Energy LLC has been volatile following the issuer’s emergence from bankruptcy. Exposure to Harvey Gulf International Marine, Inc., which operates service vessels to the offshore drilling industry, detracted from performance amid volatility in the oil market. We continue to hold all of these positions.

9

Fund Leverage

IMPACT OF THE FUNDS’ LEVERAGE STRATEGIES ON PERFORMANCE

One important factor impacting the returns of the Funds’ common shares relative to their comparative benchmarks was the Funds’ use of leverage through bank borrowings, Term Preferred Shares (Term Preferred) for NSL, JFR, JRO and JSD and reverse repurchase agreements for JQC. The Funds use leverage because our research has shown that, over time, leveraging provides opportunities for additional income and total return, particularly in the recent market environment where short-term market rates are at or near historical lows, meaning that the short-term rates the Fund has been paying on its leveraging instruments in recent years have been much lower than the interest the Fund has been earning on its portfolio securities that it has bought with the proceeds of that leverage.

However, use of leverage can expose Fund common shares to additional price volatility. When a Fund uses leverage, the Fund common shares will experience a greater increase in their net asset value if the securities acquired through the use of leverage increase in value, but will also experience a correspondingly larger decline in their net asset value if the securities acquired through leverage decline in value, which will make the shares’ net asset value more volatile, and total return performance more variable, over time.

In addition, common share income in levered funds will typically decrease in comparison to unlevered funds when short-term interest rates increase and increase when short-term interest rates decrease. Over the last few quarters, short-term interest rates have indeed increased from their extended lows after the 2007-09 financial crisis. This increase has reduced common share net income, and also reduced potential for long-term total returns. Nevertheless, the ability to effectively borrow at current short-term rates is still resulting in enhanced common share income, and management believes that the advantages of continuation of leverage outweigh the associated increase in risk and volatility described above.

The Funds’ use of leverage had a positive impact on total return performance during this reporting period.

During the current fiscal period, NSL, JFR, JRO and JSD used cancellable interest rate swaps in which each Fund received payments based uponpre-determined fixed rates and paidone-month LIBOR plus a fixed spread. After anon-callable period, the swap counterparty owns the right on future monthly dates to terminate the swap at par. The purpose of the cancellable interest rate swap is to convert a fixed rate Term Preferred Share issuance to floating rate, and the cancellation dates of the swap correspond to dates on which the Funds can call the Term Preferred Share issue. Collectively, these interest rate swap contracts had a negligible impact on the Funds’ total return performance during the period.

As of July 31, 2019, the Funds’ percentages of leverage are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | NSL | | | JFR | | | JRO | | | JSD | | | JQC | |

Effective Leverage* | | | 38.15 | % | | | 37.66 | % | | | 37.20 | % | | | 38.56 | % | | | 37.57 | % |

Regulatory Leverage* | | | 38.15 | % | | | 37.66 | % | | | 37.20 | % | | | 38.56 | % | | | 29.42 | % |

| * | Effective leverage is a Fund’s effective economic leverage, and includes both regulatory leverage and the leverage effects of reverse repurchase agreements, certain derivatives and other investments in a Fund’s portfolio that increase the Fund’s investment exposure. Regulatory leverage consists of preferred shares issued or borrowings of a Fund. Both of these are part of a Fund’s capital structure. A Fund, however, may from time to time borrow on a typically transient basis in connection with its day-to-day operations, primarily in connection with the need to settle portfolio trades. Such incidental borrowings are excluded from the calculation of a Fund’s effective leverage ratio. Regulatory leverage is subject to asset coverage limits set forth in the Investment Company Act of 1940. |

10

THE FUNDS’ LEVERAGE

Bank Borrowings

As noted above, the Funds employ leverage through the use of bank borrowings. The Funds’ bank borrowing activities are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | August 1, 2018 | | | Draws | | | Paydowns | | | July 31, 2019 | | | Average Balance

Outstanding | | | | | | Draws | | | Paydowns | | | September 26, 2019 | |

NSL | | $ | 114,000,000 | | | $ | — | | | $ | — | | | $ | 114,000,000 | | | $ | 114,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 114,000,000 | |

JFR | | $ | 254,300,000 | | | $ | 10,200,000 | | | $ | — | | | $ | 264,500,000 | | | $ | 261,509,863 | | | | | | | $ | — | | | $ | — | | | $ | 264,500,000 | |

JRO | | $ | 178,800,000 | | | $ | — | | | $ | — | | | $ | 178,800,000 | | | $ | 178,800,000 | | | | | | | $ | — | | | $ | — | | | $ | 178,800,000 | |

JSD | | $ | 72,000,000 | | | $ | — | | | $ | — | | | $ | 72,000,000 | | | $ | 72,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 72,000,000 | |

JQC | | $ | 561,000,000 | | | $ | 25,000,000 | | | $ | (106,000,000 | ) | | $ | 480,000,000 | | | $ | 495,602,740 | | | | | | | $ | — | | | $ | (20,000,000 | ) | | $ | 460,000,000 | |

Refer to Notes to Financial Statements, Note 9 – Fund Leverage, Borrowings for further details.

Reverse Repurchase Agreements

As noted previously, in addition to bank borrowings, JQC also utilized reverse repurchase agreements, in which the Fund sells to a counterparty a security that it holds with a contemporaneous agreement to repurchase the same security at an agreed-upon price and date. The Fund’s transactions in reverse repurchase agreements are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| August 1, 2018 | | | Sales | | | Purchases | | | July 31, 2019 | | | Average Balance

Outstanding | | | | | | Sales | | | Purchases | | | September 26, 2019 | |

| | $145,000,000 | | | | $70,000,000 | | | | $(2,000,000) | | | | $213,000,000 | | | | $194,890,411 | | | | | | | | $ — | | | | $ — | | | | $213,000,000 | |

Refer to Notes to Financial Statements, Note 9 – Fund Leverage, Reverse Repurchase Agreements for further details.

Term Preferred Shares

As noted previously, in addition to bank borrowings, the following Funds also issued Term Preferred. The Funds' transactions in Term Preferred are as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Current Reporting Period | | | | | | Subsequent to the Close of

the Reporting Period | |

| Fund | | August 1, 2018 | | | Issuance | | | Redemptions | | | July 31, 2019 | | | Average Balance

Outstanding | | | | | | Issuance | | | Redemptions | | | September 26, 2019 | |

NSL | | $ | 43,000,000 | | | $ | — | | | $ | — | | | $ | 43,000,000 | | | $ | 43,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 43,000,000 | |

JFR | | $ | 125,200,000 | | | $ | — | | | $ | (10,200,000 | ) | | $ | 115,000,000 | | | $ | 118,129,863 | | | | | | | $ | — | | | $ | — | | | $ | 115,000,000 | |

JRO | | $ | 84,000,000 | | | $ | — | | | $ | — | | | $ | 84,000,000 | | | $ | 84,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 84,000,000 | |

JSD | | $ | 35,000,000 | | | $ | — | | | $ | — | | | $ | 35,000,000 | | | $ | 35,000,000 | | | | | | | $ | — | | | $ | — | | | $ | 35,000,000 | |

Refer to Notes to Financial Statements, Note 4 – Fund Shares, Preferred Shares for further details on Term Preferred.

11

Common Share Information

NSL, JFR, JRO and JSD COMMON SHARE DISTRIBUTION INFORMATION

The following information regarding NSL’s, JFR’s, JRO’s and JSD’s distributions is current as of July 31, 2019. Each Fund’s distribution levels may vary over time based on each Fund’s investment activity and portfolio investment value changes.

During the current reporting period, each Fund’s distributions to common shareholders were as shown in the accompanying table.

| | | | | | | | | | | | | | | | |

| | | Per Common Share Amounts | |

| Monthly Distribution(Ex-Dividend Date) | | NSL | | | JFR | | | JRO | | | JSD | |

August 2018 | | $ | 0.0335 | | | $ | 0.0575 | | | $ | 0.0580 | | | $ | 0.1005 | |

September | | | 0.0355 | | | | 0.0600 | | | | 0.0605 | | | | 0.1035 | |

October | | | 0.0355 | | | | 0.0600 | | | | 0.0605 | | | | 0.1035 | |

November | | | 0.0355 | | | | 0.0600 | | | | 0.0605 | | | | 0.1035 | |

December | | | 0.0355 | | | | 0.0600 | | | | 0.0605 | | | | 0.1035 | |

January | | | 0.0355 | | | | 0.0600 | | | | 0.0605 | | | | 0.1035 | |

February | | | 0.0365 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

March | | | 0.0375 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

April | | | 0.0375 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

May | | | 0.0375 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

June | | | 0.0375 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

July 2019 | | | 0.0375 | | | | 0.0615 | | | | 0.0625 | | | | 0.1035 | |

Total Distributions from Net Investment Income | | $ | 0.4350 | | | $ | 0.7265 | | | $ | 0.7355 | | | $ | 1.2390 | |

| | | | | | | | | | | | | | | | | |

Current Distribution Rate* | | | 7.63 | % | | | 7.56 | % | | | 7.73 | % | | | 8.09 | % |

| * | Current distribution rate is based on the Fund’s current annualized monthly distribution divided by the Fund’s current market price. The Fund’s monthly distributions to its shareholders may be comprised of ordinary income, net realized capital gains and, if at the end of the fiscal year the Fund’s cumulative net ordinary income and net realized gains are less than the amount of the Fund’s distributions, a return of capital for tax purposes. |

NSL, JFR, JRO and JSD seek to pay regular monthly dividends out of their net investment income at a rate that reflects their past and projected net income performance. To permit each Fund to maintain a more stable monthly dividend, the Fund may pay dividends at a rate that may be more or less than the amount of net income actually earned by the Fund during the period. Distributions to shareholders are determined on a tax basis, which may differ from amounts recorded in the accounting records. In instances where the monthly dividend exceeds the earned net investment income, the Fund would report a negative undistributed net ordinary income. Refer to Note 6 – Income Tax Information for additional information regarding the amounts of undistributed net ordinary income and undistributed net long-term capital gains and the character of the actual distributions paid by the Fund during the period.

All monthly dividends paid by NSL, JFR, JRO and JSD during the current reporting period were paid from net investment income. If a portion of the Fund’s monthly distributions is sourced or comprised of elements other than net investment income, including capital gains and/or a return of capital, shareholders will be notified of those sources. For financial reporting purposes, the per share amounts of each Fund’s distributions for the reporting period are presented in this report’s Financial Highlights. For income tax purposes, distribution information for each Fund as of its most recent tax year end is presented in Note 6 – Income Tax Information within the Notes to Financial Statements of this report.

12

JQC DISTRIBUTION INFORMATION

The following information regarding JQC’s distributions is current as of July 31, 2019.

Effective with JQC’s January 2019 distribution, the Fund has implemented a capital return plan where a supplemental amount is expected to be included in the Fund’s regular monthly distribution. Under this program, the Fund’s regular monthly distribution is expected to include net investment income, return of capital and potentially capital gains for tax purposes.

The figures in the table below provide the sources (for tax purposes) of the Fund’s distributions as of July 31, 2019. These sources include amounts attributable to realized gains and/or returns of capital. The Fund attributes thesenon-income sources equally to each regular distribution throughout the fiscal year. The information shown below is for the distributions paid on common shares for all months in the current fiscal year. These amounts should not be used for tax reporting purposes, and the distribution sources may differ for financial reporting than for tax reporting. The final determination of the tax characteristics of all distributions paid in 2019 will be made in early 2020 and reported to you on Form1099-DIV. More details about the tax characteristics of the Fund’s distributions are available on www.nuveen.com/CEFdistributions.

Data as of July 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Current Month

Percentage of Distributions | | | | | Calendar YTD

Per Share Amounts | |

Net

Investment

Income | | | Realized

Gains | | | Return of

Capital | | | | | Total

Distributions | | | Net

Investment

Income | | | Realized

Gains | | | Return of

Capital | |

| | 65.4% | | | | 0.0% | | | | 34.6% | | | | | | $0.9113 | | | | $0.5959 | | | | $0.000 | | | | $0.3154 | |

The following table provides information regarding Fund distributions and total return performance over various time periods. This information is intended to help you better understand whether Fund returns for the specified time periods were sufficient to meet Fund distributions.

Data as of July 31, 2019

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Annualized | | | | | Cumulative | |

Inception

Date | | Latest

Monthly

Per Share

Distribution | | | | | Current

Distribution on

NAV | | | 1-Year

Return on

NAV | | | 5-Year

Return on

NAV | | | | | Calendar YTD

Distributions on

NAV | | | Calendar

YTD Return

on NAV | |

| 6/25/2003 | | | $0.1035 | | | | | | 14.63% | | | | 3.43% | | | | 3.31% | | | | | | 7.29% | | | | 9.29% | |

CHANGE IN METHOD OF PUBLISHING NUVEENCLOSED-END FUND DISTRIBUTION AMOUNTS

Beginning on or about November 1, 2019, the NuveenClosed-End Funds will be discontinuing the practice of announcing Fund distribution amounts and timing via press release. Instead, information about the NuveenClosed-End Funds’ monthly and quarterly periodic distributions to shareholders will be posted and can be found on Nuveen’s enhancedclosed-end fund resource page, which is atwww.nuveen.com/closed-end-fund-distributions, along with other Nuveenclosed-end fund product updates. Shareholders can expect regular distribution information to be posted on www.nuveen.com on the first business day of each month. To ensure that our shareholders have timely access to the latest information, a subscribe function can be activated at this link here, or at this web page(www.nuveen.com/en-us/people/about-nuveen/for-the-media).

13

Common Share Information(continued)

COMMON SHARE EQUITY SHELF PROGRAMS

During the current reporting period, the following Funds were authorized by the Securities and Exchange Commission to issue additional common shares through an equity shelf program (“Shelf Offering”). Under these programs, the Funds, subject to market conditions, may raise additional capital from time to time in varying amounts and offering methods at a net price at or above each Fund’s NAV per common share. The total amount of common shares authorized under these Shelf Offerings are as shown in the accompanying table.

| | | | | | | | |

| | | JFR | | | JRO | |

Additional authorized common shares | | | 12,900,000 | * | | | 8,500,000 | * |

| * | Represents additional authorized common shares for the period August 1, 2018 through November 30, 2018. |

Refer to Notes to Financial Statements, Note 4 – Fund Shares, Common Shares Equity Shelf Programs and Offering Costs for further details of Shelf Offerings and each Fund’s respective transactions.

COMMON SHARE REPURCHASES

During August 2019 (subsequent to the close of this reporting period), the Funds’ Board of Trustees reauthorized an open-market share repurchase program, allowing each Fund to repurchase an aggregate of up to approximately 10% of its outstanding shares.

As of July 31, 2019, and since the inception of the Funds’ repurchase programs, the Funds have cumulatively repurchased and retired their outstanding common shares as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | NSL | | | JFR | | | JRO | | | JSD | | | JQC | |

Common shares cumulatively repurchased and retired | | | 15,400 | | | | 147,593 | | | | 39,400 | | | | — | | | | 5,473,400 | |

Common shares authorized for repurchase | | | 3,860,000 | | | | 5,690,000 | | | | 4,055,000 | | | | 1,010,000 | | | | 13,575,000 | |

During the current reporting period, the following Funds repurchased and retired their common shares at a weighted average price per share and a weighted average discount per share as shown in the following table.

| | | | | | | | | | | | |

| | | NSL | | | JRO | | | JQC | |

Common shares repurchased and retired | | | 10,400 | | | | 20,000 | | | | 157,700 | |

Weighted average price per common share repurchased and retired | | | $5.41 | | | | $8.82 | | | | $7.43 | |

Weighted average discount per common share repurchased and retired | | | 15.29 | % | | | 16.68 | % | | | 16.16 | % |

OTHER COMMON SHARE INFORMATION

As of July 31, 2019, and during the current reporting period, the Funds’ common share prices were trading at a premium/(discount) to their common share NAVs as shown in the accompanying table.

| | | | | | | | | | | | | | | | | | | | |

| | | NSL | | | JFR | | | JRO | | | JSD | | | JQC | |

Common share NAV | | | $6.59 | | | | $11.04 | | | | $10.94 | | | | $16.89 | | | | $8.49 | |

Common share price | | | $5.90 | | | | $9.76 | | | | $9.70 | | | | $15.36 | | | | $7.68 | |

Premium/(Discount) to NAV | | | (10.47 | )% | | | (11.59 | )% | | | (11.33 | )% | | | (9.06 | )% | | | (9.54 | )% |

12-month average premium/(discount) to NAV | | | (11.41 | )% | | | (11.19 | )% | | | (10.96 | )% | | | (8.12 | )% | | | (11.21 | )% |

14

Risk Considerations

Fund shares are not guaranteed or endorsed by any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation.

Nuveen Senior Income Fund (NSL)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such asinterest rate risk are described in more detail on the Fund’s web page atwww.nuveen.com/NSL.

Nuveen Floating Rate Income Fund (JFR)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such asinterest rate risk are described in more detail on the Fund’s web page atwww.nuveen.com/JFR.

Nuveen Floating Rate Income Opportunity Fund (JRO)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such asinterest rate risk are described in more detail on the Fund’s web page atwww.nuveen.com/JRO.

Nuveen Short Duration Credit Opportunities Fund (JSD)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset value.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such asinterest rate risk are described in more detail on the Fund’s web page atwww.nuveen.com/JSD.

Nuveen Credit Strategies Income Fund (JQC)

Investing in closed-end funds involves risk; principal loss is possible. There is no guarantee the Fund’s investment objectives will be achieved. Closed-end fund shares may frequently trade at a discount or premium to their net asset

15

Risk Considerations(continued)

value.Adjustable Rate Senior Loans may not be fully secured by collateral, generally do not trade on exchanges, and are typically issued by unrated or below-investment grade companies, and therefore are subject to greater liquidity and credit risk.Lower credit debt securities may be more likely to fail to make timely interest or principal payments.Common stock prices have often experienced significant volatility.Leverage increases return volatility and magnifies the Fund’s potential return and its risks; there is no guarantee a fund’s leverage strategy will be successful. These and other risk considerations such asinterest rate risk are described in more detail on the Fund’s web page atwww.nuveen.com/JQC.

16

THIS PAGE INTENTIONALLY LEFT BLANK

17

| | |

| NSL | | Nuveen Senior Income Fund Performance Overview and Holding Summaries as of July 31, 2019 |

Refer to Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of July 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

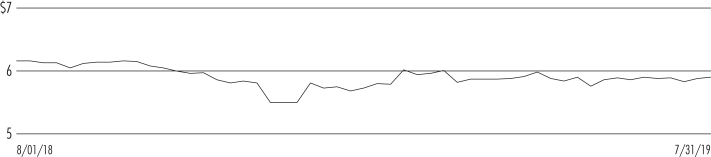

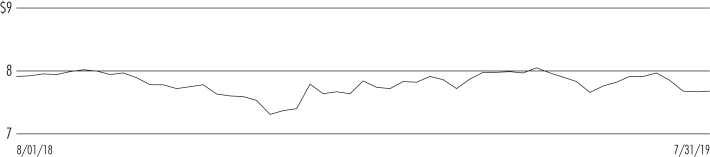

| NSL at Common Share NAV | | | 1.81% | | | | 3.84% | | | | 8.50% | |

| NSL at Common Share Price | | | 3.60% | | | | 3.63% | | | | 8.74% | |

| Credit Suisse Leveraged Loan Index | | | 4.10% | | | | 4.02% | | | | 5.94% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

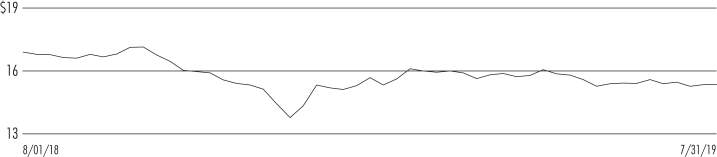

Common Share Price Performance —Weekly Closing Price

18

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Variable Rate Senior Loan Interests | | | 147.2% | |

| Corporate Bonds | | | 8.9% | |

| Common Stocks | | | 3.0% | |

| Common Stock Rights | | | 0.1% | |

| Convertible Bonds | | | 0.0% | |

| Warrants | | | 0.1% | |

| Short-Term Investment Companies | | | 5.3% | |

| Other Assets Less Liabilities | | | (3.1)% | |

| Net Assets Plus Borrowings and Term Preferred Shares, net of deferred offering costs | | | 161.5% | |

| Borrowings | | | (44.8)% | |

| Term Preferred Shares, net of deferred offering costs | | | (16.7)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term

investments)

| | | | |

| Albertson’s LLC | | | 2.7% | |

| Intelsat Jackson Holdings, S.A. | | | 2.7% | |

| Sprint Corporation | | | 2.0% | |

| Dell International LLC | | | 1.9% | |

| Micro Focus International PLC | | | 1.8% | |

Portfolio Composition

(% of total investments)

| | | | |

| Media | | | 10.9% | |

| Software | | | 10.1% | |

| Hotels, Restaurants & Leisure | | | 9.8% | |

| Health Care Providers & Services | | | 5.7% | |

| Diversified Telecommunication Services | | | 5.3% | |

| Communications Equipment | | | 4.5% | |

| Food & Staples Retailing | | | 4.0% | |

| Technology Hardware, Storage & Peripherals | | | 3.1% | |

| IT Services | | | 2.6% | |

| Commercial Services & Supplies | | | 2.5% | |

| Wireless Telecommunication Services | | | 2.3% | |

| Pharmaceuticals | | | 2.1% | |

| Oil, Gas & Consumable Fuels | | | 2.0% | |

| Aerospace & Defense | | | 1.9% | |

| Diversified Consumer Services | | | 1.8% | |

| Road & Rail | | | 1.8% | |

| Professional Services | | | 1.6% | |

| Specialty Retail | | | 1.6% | |

| Airlines | | | 1.4% | |

| Health Care Equipment & Supplies | | | 1.4% | |

| Insurance | | | 1.3% | |

| Other | | | 19.1% | |

| Short-Term Investment Companies | | | 3.2% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term fixed income investments)

| | | | |

| BBB | | | 12.2% | |

| BB or Lower | | | 87.7% | |

| N/R (not rated) | | | 0.1% | |

Total | | | 100% | |

19

| | |

| JFR | | Nuveen Floating Rate Income Fund Performance Overview and Holding Summaries as of July 31, 2019 |

Refer to Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of July 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

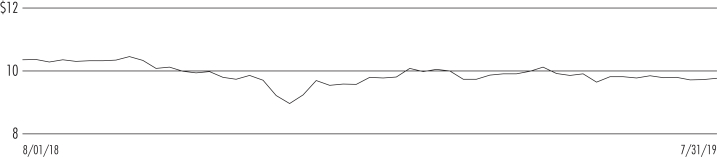

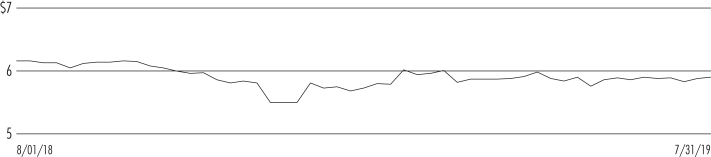

| JFR at Common Share NAV | | | 2.03% | | | | 3.91% | | | | 8.08% | |

| JFR at Common Share Price | | | 1.98% | | | | 3.35% | | | | 8.78% | |

| Credit Suisse Leveraged Loan Index | | | 4.10% | | | | 4.02% | | | | 5.94% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance —Weekly Closing Price

20

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Variable Rate Senior Loan Interests | | | 141.5% | |

| Corporate Bonds | | | 9.7% | |

| Common Stocks | | | 2.7% | |

| Long-Term Investment Companies | | | 1.7% | |

| Asset-Backed Securities | | | 1.0% | |

| Common Stock Rights | | | 0.1% | |

| Convertible Bonds | | | 0.0% | |

| Warrants | | | 0.1% | |

| Short-Term Investment Companies | | | 7.0% | |

| Other Assets Less Liabilities | | | (3.5)% | |

| Net Assets Plus Borrowings and Term Preferred Shares, net of deferred offering costs | | | 160.3% | |

| Borrowings | | | (42.1)% | |

| Term Preferred Shares, net of deferred offering costs | | | (18.2)% | |

Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term investments)

| | | | |

| Albertson’s LLC | | | 2.7% | |

| Burger King Corporation | | | 2.3% | |

| Intelsat Jackson Holdings, S.A. | | | 2.2% | |

| Dell International LLC | | | 2.0% | |

| Sprint Corporation | | | 1.8% | |

Portfolio Composition

(% of total investments)

| | | | |

| Hotels, Restaurants & Leisure | | | 10.9% | |

| Media | | | 10.8% | |

| Software | | | 9.1% | |

| Health Care Providers & Services | | | 5.8% | |

| Diversified Telecommunication Services | | | 5.2% | |

| Communications Equipment | | | 4.8% | |

| Food & Staples Retailing | | | 4.0% | |

| Technology Hardware, Storage & Peripherals | | | 2.8% | |

| IT Services | | | 2.6% | |

| Commercial Services & Supplies | | | 2.3% | |

| Wireless Telecommunication Services | | | 2.3% | |

| Pharmaceuticals | | | 2.0% | |

| Oil, Gas & Consumable Fuels | | | 1.6% | |

| Road & Rail | | | 1.6% | |

| Aerospace & Defense | | | 1.5% | |

| Specialty Retail | | | 1.5% | |

| Capital Markets | | | 1.4% | |

| Insurance | | | 1.4% | |

| Diversified Consumer Services | | | 1.4% | |

| Professional Services | | | 1.4% | |

| Other | | | 19.6% | |

| Long-Term Investment Companies | | | 1.1% | |

| Asset-Backed Securities | | | 0.6% | |

| Short-Term Investment Companies | | | 4.3% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term fixed income investments)

| | | | |

| BBB | | | 12.9% | |

| BB or Lower | | | 87.0% | |

| N/R (not rated) | | | 0.1% | |

Total | | | 100% | |

21

| | |

| JRO | | Nuveen Floating Rate Income Opportunity Fund Performance Overview and Holding Summaries as of July 31, 2019 |

Refer to Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of July 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

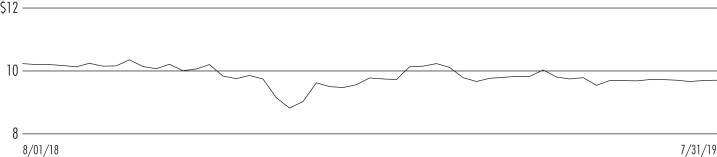

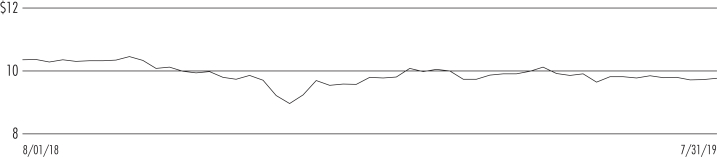

| JRO at Common Share NAV | | | 1.94% | | | | 3.85% | | | | 8.74% | |

| JRO at Common Share Price | | | 2.19% | | | | 2.33% | | | | 9.19% | |

| Credit Suisse Leveraged Loan Index | | | 4.10% | | | | 4.02% | | | | 5.94% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

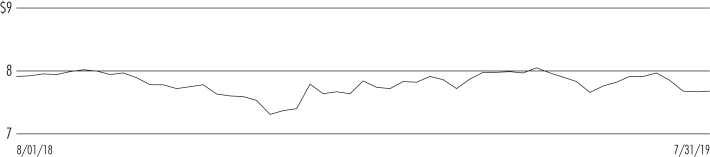

Common Share Price Performance —Weekly Closing Price

22

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Variable Rate Senior Loan Interests | | | 142.0% | |

| Corporate Bonds | | | 9.4% | |

| Common Stocks | | | 3.0% | |

| Asset-Backed Securities | | | 0.6% | |

| Common Stock Rights | | | 0.1% | |

| Convertible Bonds | | | 0.0% | |

| Warrants | | | 0.1% | |

| Short-Term Investment Companies | | | 8.2% | |

| Other Assets Less Liabilities | | | (4.4)% | |

| Net Assets Plus Borrowings and Term Preferred Shares, net of deferred offering costs | | | 159.0% | |

| Borrowings | | | (40.3)% | |

| Term Preferred Shares, net of deferred offering costs | | | (18.7)% | |

| Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term investments)

| | | | |

| Burger King Corporation | | | 2.5% | |

| Intelsat Jackson Holdings, S.A. | | | 2.4% | |

| Albertson’s LLC | | | 2.3% | |

| Dell International LLC | | | 2.0% | |

| Scientific Games Corp. | | | 1.6% | |

Portfolio Composition

(% of total investments)

| | | | |

| Media | | | 11.3% | |

| Hotels, Restaurants & Leisure | | | 11.2% | |

| Software | | | 9.6% | |

| Health Care Providers & Services | | | 5.9% | |

| Diversified Telecommunication Services | | | 5.1% | |

| Communications Equipment | | | 4.7% | |

| Food & Staples Retailing | | | 3.6% | |

| IT Services | | | 2.9% | |

| Technology Hardware, Storage & Peripherals | | | 2.8% | |

| Commercial Services & Supplies | | | 2.5% | |

| Wireless Telecommunication Services | | | 2.0% | |

| Pharmaceuticals | | | 2.0% | |

| Oil, Gas & Consumable Fuels | | | 1.8% | |

| Road & Rail | | | 1.7% | |

| Aerospace & Defense | | | 1.7% | |

| Diversified Consumer Services | | | 1.6% | |

| Capital Markets | | | 1.5% | |

| Building Products | | | 1.5% | |

| Specialty Retail | | | 1.4% | |

| Other | | | 19.8% | |

| Asset-Backed Securities | | | 0.4% | |

| Short-Term Investment Companies | | | 5.0% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term fixed income investments)

| | | | |

| BBB | | | 12.5% | |

| BB or Lower | | | 87.4% | |

| N/R (not rated) | | | 0.1% | |

Total | | | 100% | |

23

| | |

| JSD | | Nuveen Short Duration Credit Opportunities Fund Performance Overview and Holding Summaries as of July 31, 2019 |

Refer to the Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of July 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | Since

Inception | |

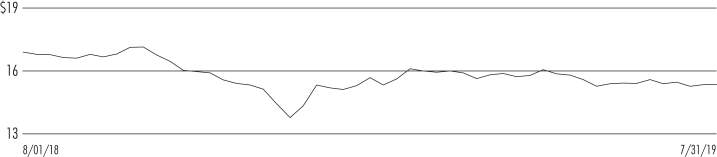

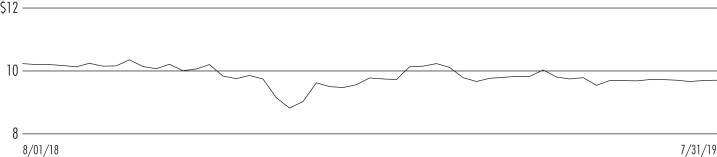

| JSD at Common Share NAV | | | 1.30% | | | | 4.15% | | | | 5.95% | |

| JSD at Common Share Price | | | (0.30)% | | | | 4.18% | | | | 4.59% | |

| Credit Suisse Leveraged Loan Index | | | 4.10% | | | | 4.02% | | | | 4.50% | |

Since inception returns are from May 25, 2011. Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance —Weekly Closing Price

24

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Variable Rate Senior Loan Interests | | | 146.8% | |

| Corporate Bonds | | | 9.3% | |

| Common Stocks | | | 2.9% | |

| Common Stock Rights | | | 0.2% | |

| Convertible Bonds | | | 0.0% | |

| Warrants | | | 0.1% | |

| Short-Term Investment Companies | | | 9.1% | |

| Other Assets Less Liabilities | | | (5.8)% | |

| Net Assets Plus Borrowings and Term Preferred Shares, net of deferred offering costs | | | 162.6% | |

| Borrowings | | | (42.2)% | |

| Term Preferred Shares, net of deferred offering costs | | | (20.4)% | |

Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term investments)

| | | | |

| Albertson’s LLC | | | 3.1% | |

| Intelsat Jackson Holdings, S.A. | | | 2.8% | |

| Scientific Games Corp. | | | 2.0% | |

| CenturyLink, Inc. | | | 1.8% | |

| Sprint Corporation | | | 1.7% | |

Portfolio Composition

(% of total investments)

| | | | |

| Media | | | 10.5% | |

| Software | | | 10.3% | |

| Hotels, Restaurants & Leisure | | | 9.1% | |

| Health Care Providers & Services | | | 6.8% | |

| Diversified Telecommunication Services | | | 4.9% | |

| Food & Staples Retailing | | | 3.8% | |

| Communications Equipment | | | 3.6% | |

| IT Services | | | 3.1% | |

| Oil, Gas & Consumable Fuels | | | 2.8% | |

| Technology Hardware, Storage & Peripherals | | | 2.7% | |

| Commercial Services & Supplies | | | 2.5% | |

| Aerospace & Defense | | | 1.9% | |

| Pharmaceuticals | | | 1.8% | |

| Wireless Telecommunication Services | | | 1.8% | |

| Health Care Equipment & Supplies | | | 1.7% | |

| Specialty Retail | | | 1.6% | |

| Road & Rail | | | 1.5% | |

| Professional Services | | | 1.5% | |

| Capital Markets | | | 1.5% | |

| Airlines | | | 1.4% | |

| Other | | | 19.8% | |

| Short-Term Investment Companies | | | 5.4% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term fixed income investments)

| | | | |

| BBB | | | 9.8% | |

| BB or Lower | | | 90.1% | |

| N/R (not rated) | | | 0.1% | |

Total | | | 100% | |

25

| | |

| JQC | | Nuveen Credit Strategies Income Fund Performance Overview and Holding Summaries as of July 31, 2019 |

Refer to Glossary of Terms Used in this Report for further definition of the terms used within this section.

Average Annual Total Returns as of July 31, 2019

| | | | | | | | | | | | |

| | | Average Annual | |

| | | 1-Year | | | 5-Year | | | 10-Year | |

| JQC at Common Share NAV | | | 3.43% | | | | 3.31% | | | | 8.50% | |

| JQC at Common Share Price | | | 9.33% | | | | 4.67% | | | | 10.60% | |

| Credit Suisse Leveraged Loan Index | | | 4.10% | | | | 4.02% | | | | 5.94% | |

Past performance is not predictive of future results. Current performance may be higher or lower than the data shown. Returns do not reflect the deduction of taxes that shareholders may have to pay on Fund distributions or upon the sale of Fund shares. Returns at NAV are net of Fund expenses, and assume reinvestment of distributions. Comparative index return information is provided for the Fund’s shares at NAV only. Indexes are not available for direct investment.

Common Share Price Performance —Weekly Closing Price

26

This data relates to the securities held in the Fund’s portfolio of investments as of the end of the reporting period. It should not be construed as a measure of performance for the Fund itself. Holdings are subject to change.

For financial reporting purposes, the ratings disclosed are the highest rating given by one of the following national rating agencies: Standard & Poor’s Group, Moody’s Investors Service, Inc. or Fitch, Inc. This treatment of split-rated securities may differ from that used for other purposes, such as for Fund investment policies. Credit ratings are subject to change. AAA, AA, A and BBB are investment grade ratings; BB, B, CCC, CC, C and D are below-investment grade ratings. Holdings designated N/R are not rated by these national rating agencies.

Fund Allocation

(% of net assets)

| | | | |

| Variable Rate Senior Loan Interests | | | 121.0% | |

| Corporate Bonds | | | 31.8% | |

| Convertible Bonds | | | 2.1% | |

| Common Stocks | | | 1.1% | |

| Common Stock Rights | | | 0.2% | |

| Warrants | | | 0.0% | |

| Short-Term Investment Companies | | | 9.1% | |

| Other Assets Less Liabilities | | | (5.1)% | |

| Net Assets Plus Borrowings and Reverse Repurchase Agreements | | | 160.2% | |

| Borrowings | | | (41.7)% | |

| Reverse Repurchase Agreements | | | (18.5)% | |

Net Assets | | | 100% | |

Top Five Issuers

(% of total long-term

investments)

| | | | |

| Acelity | | | 1.8% | |

| American Airlines, Inc. | | | 1.7% | |

| Dell International LLC | | | 1.6% | |

| Tribune Media Company | | | 1.4% | |

| Vistra Operation Co. | | | 1.4% | |

Portfolio Composition

(% of total investments)

| | | | |

| Hotels, Restaurants & Leisure | | | 10.3% | |

| Health Care Providers & Services | | | 10.2% | |

| Media | | | 9.5% | |

| Software | | | 8.9% | |

| Diversified Telecommunication Services | | | 3.7% | |

| Health Care Equipment & Supplies | | | 3.1% | |

| Commercial Services & Supplies | | | 2.6% | |

| Wireless Telecommunication Services | | | 2.6% | |

| IT Services | | | 2.5% | |

| Airlines | | | 2.4% | |

| Chemicals | | | 2.0% | |

| Technology Hardware, Storage & Peripherals | | | 2.0% | |

| Food Products | | | 1.8% | |

| Internet Software & Services | | | 1.8% | |

| Personal Products | | | 1.7% | |

| Pharmaceuticals | | | 1.7% | |

| Capital Markets | | | 1.7% | |

| Household Products | | | 1.5% | |

| Professional Services | | | 1.5% | |

| Consumer Finance | | | 1.4% | |

| Real Estate Management & Development | | | 1.3% | |

| Food & Staples Retailing | | | 1.3% | |

| Other | | | 19.0% | |

| Short-Term Investment Companies | | | 5.5% | |

Total | | | 100% | |

Portfolio Credit Quality

(% of total long-term fixed income investments)

| | | | |

| BBB | | | 14.7% | |

| BB or Lower | | | 84.1% | |

| N/R (not rated) | | | 1.2% | |

Total | | | 100% | |

27

Shareholder Meeting Report

The annual meeting of shareholders was held in the offices of Nuveen on April 10, 2019 for NSL, JFR, JRO, JSD and JQC; at this meeting the shareholders were asked to elect Board Members.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | NSL | | | JFR | | | JRO | | | JSD | | | JQC | |

| | | Common and

Preferred

shares voting

together

as a class | | | Preferred

Shares | | | Common and

Preferred

shares voting

together

as a class | | | Preferred

Shares | | | Common and

Preferred

shares voting

together

as a class | | | Preferred

Shares | | | Common and

Preferred

shares voting

together

as a class | | | Preferred

Shares | | | Common

Shares | |

Approval of the Board Members was reached as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Judith M. Stockdale | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For | | | 33,979,005 | | | | — | | | | 49,918,832 | | | | — | | | | 34,611,891 | | | | — | | | | 8,917,809 | | | | — | | | | 97,306,914 | |

Withhold | | | 1,418,487 | | | | — | | | | 1,578,969 | | | | — | | | | 2,299,754 | | | | — | | | | 275,138 | | | | — | | | | 24,629,925 | |

Total | | | 35,397,492 | | | | — | | | | 51,497,801 | | | | — | | | | 36,911,645 | | | | — | | | | 9,192,947 | | | | — | | | | 121,936,839 | |

Carole E. Stone | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For | | | 34,086,171 | | | | — | | | | 49,917,933 | | | | — | | | | 34,692,366 | | | | — | | | | 8,931,905 | | | | — | | | | 92,643,282 | |

Withhold | | | 1,311,321 | | | | — | | | | 1,579,868 | | | | — | | | | 2,219,279 | | | | — | | | | 261,042 | | | | — | | | | 29,293,557 | |

Total | | | 35,397,492 | | | | — | | | | 51,497,801 | | | | — | | | | 36,911,645 | | | | — | | | | 9,192,947 | | | | — | | | | 121,936,839 | |

Margaret L. Wolff | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For | | | 34,017,513 | | | | — | | | | 49,989,122 | | | | — | | | | 34,646,845 | | | | — | | | | 8,922,407 | | | | — | | | | 97,378,067 | |

Withhold | | | 1,379,979 | | | | — | | | | 1,508,679 | | | | — | | | | 2,264,800 | | | | — | | | | 270,540 | | | | — | | | | 24,558,772 | |

Total | | | 35,397,492 | | | | — | | | | 51,497,801 | | | | — | | | | 36,911,645 | | | | — | | | | 9,192,947 | | | | — | | | | 121,936,839 | |

William C. Hunter | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For | | | — | | | | 26,728 | | | | — | | | | 55,000 | | | | — | | | | 65,719 | | | | — | | | | 4,619 | | | | 92,613,820 | |

Withhold | | | — | | | | 50 | | | | — | | | | — | | | | — | | | | 1,254 | | | | — | | | | 18,482 | | | | 29,323,019 | |

Total | | | — | | | | 26,778 | | | | — | | | | 55,000 | | | | — | | | | 66,973 | | | | — | | | | 23,101 | | | | 121,936,839 | |

Albin F. Moschner | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

For | | | — | | | | 26,728 | | | | — | | | | 55,000 | | | | — | | | | 65,719 | | | | — | | | | 4,619 | | | | — | |

Withhold | | | — | | | | 50 | | | | — | | | | — | | | | — | | | | 1,254 | | | | — | | | | 18,482 | | | | — | |

Total | | | — | | | | 26,778 | | | | — | | | | 55,000 | | | | — | | | | 66,973 | | | | — | | | | 23,101 | | | | — | |

28

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Nuveen Senior Income Fund

Nuveen Floating Rate Income Fund

Nuveen Floating Rate Income Opportunity Fund

Nuveen Short Duration Credit Opportunities Fund

Nuveen Credit Strategies Income Fund:

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities of Nuveen Senior Income Fund, Nuveen Floating Rate Income Fund, Nuveen Floating Rate Income Opportunity Fund, Nuveen Short Duration Credit Opportunities Fund and Nuveen Credit Strategies Income Fund (the “Funds”), including the portfolios of investments, as of July 31, 2019, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets for each of the years in thetwo-year period then ended, and the related notes (collectively, the “financial statements”) and the financial highlights for each of the years in thefive-year period then ended. In our opinion, the financial statements and financial highlights present fairly, in all material respects, the financial position of the Funds as of July 31, 2019, the results of their operations and their cash flows for the year then ended, the changes in their net assets for each of the years in thetwo-year period then ended, and the financial highlights for each of the years in thefive-year period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.