UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

(Exact name of registrant as specified in charter)

1001 Nineteenth Street North

Arlington, VA 22209

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 703.469.1040

William Ginivan

General Counsel

Friedman, Billings, Ramsey Group, Inc.

Potomac Tower

1001 Nineteenth Street North

Arlington, VA 22209

(Name and address of agent for service)Date of fiscal year end: October 31, 2008

Date of reporting period: October 31, 2008

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

THE FBR FUNDS

FBR Pegasus FundTM

FBR Pegasus Mid Cap FundTM

FBR Pegasus Small Cap FundTM

FBR Pegasus Small Cap Growth FundTM

FBR Focus Fund

FBR Large Cap Financial Fund

FBR Small Cap Financial Fund

FBR Technology Fund

FBR Gas Utility Index Fund

FBR Fund for Government Investors

Annual Report

October 31, 2008

[THIS PAGE INTENTIONALLY LEFT BLANK]

The FBR Funds

Annual Letter to Shareholders

Dear Shareholder,

Investor trust and confidence are key drivers of our financial markets and the economy. Over the trailing twelve months ended October 31, 2008, which constitutes The FBR Funds’ fiscal year, both have been severely impaired if not permanently altered by the global financial crisis. The failure, merger or conservatorship of several major U.S. financial institutions has completely transformed the financial landscape and the resulting collateral damage to date is incalculable.

The S&P 500 Index, which covers over 75% of the U.S. equity markets, finished the fiscal year down -36.10% as every sector of the capital markets recorded double digit losses led by Financial Services and Information Technology. No asset class (e.g. large, mid and small) or style of investing (e.g. value and growth) was left unscathed as all categories were down more than 30% over the course of the reporting period leaving investors with nowhere to hide.

The downward spiral in asset prices associated with the massive de-leveraging of the financial sector and the seizure of the credit markets prompted the U.S. Treasury and the Federal Reserve Board (the “Fed”) to orchestrate and lead a global response to what could prove to be the worst financial crisis in history. Through the Troubled Asset Relief Program (TARP) the Treasury will attempt to increase the liquidity and re-establish a market in mortgage-backed securities and whole loans with up to $800 billion in newly printed dollars. To this end the Treasury has purchased preferred equity stakes in several major U.S. financial institutions and could potentially extend its capital to thousands of smaller banks to stabilize capital and reserve positions and restore investor confidence. The Fed has aggressively expanded its balance sheet, reduced the Fed Funds rate to 1.0% and opened the discount window to both depository and non-depository institutions.

Despite the unprecedented government policy response to the credit crisis to restore investor confidence, selling in the equity markets did not discriminate relative to market capitalization, investment style, or sector, as all areas experienced significant redemptions of assets. According to Morningstar, in the month of September investors pulled an estimated $47.5 billion out of mutual funds, the largest surge of monthly net redemptions in the history of the mutual fund industry. The FBR Funds were not immune to the redemption activity. However, I am pleased to report that in the volatile month of September, four of our nine equity funds experienced positive net inflows which is a testament not only to the quality of our investment process but also to the enduring nature of the relationships we have established with our shareholders.

Broad market declines, especially of this magnitude, are disturbing and test the merits of every investing axiom. As you are aware, one of the hallmarks of our investment philosophy is to maintain a long-term orientation, and patience is a needed virtue in this environment. The 2008 fiscal year was without question the most volatile and challenging period in the Funds’ eleven year history. Since inception, our approach to balancing short-term risk against long-term potential has always focused on limiting downside participation through the selection of individual companies with superior balance sheet strength, defensive business models, and healthy profit margins able to be purchased at reasonable valuations.

Reporting negative short-term performance to shareholders is always disheartening. However, against this backdrop of volatility, chaos and complete dislocation in the capital markets, we are more encouraged and confident than ever before in the long-term merits and legitimacy of the fundamental investment philosophy and process that serves as a guide for all of our portfolios. For the 2008 fiscal year all nine of our equity funds, both traditional asset class and specialty, delivered on our objective of providing

2

investors with downside protection by outperforming each of their respective Morningstar peer group category averages. We firmly believe that on a relative and absolute basis, outperformance in difficult markets is a key factor of creating long-term wealth for our shareholders.

As we begin fiscal year 2009, I would like to bring to your attention the fact that the FBR Pegasus FundTM (FBRPX) received its first Morningstar RatingTM at the beginning of December. After three full years of investment performance, the Fund received five-stars, which is Morningstar’s highest rating. The five-star rating should provide investors with an additional layer of confidence that the Pegasus Fund is a high-quality large-cap core solution for any diversified portfolio.

The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-yr (if applicable) Morningstar Rating metrics. Morningstar proprietary ratings reflect risk-adjusted performance as of the period stated above. For each fund with at least a 3-yr history, Morningstar calculates a Morningstar RatingTM based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The FBR Pegasus FundTM received 5 stars for the 3-yrs ended 11/30/08 among 1738 large blend funds respectively.

Regardless of capitalization and industry sector, all of The FBR Funds are about respecting your money. Our goal is to achieve attractive returns that are balanced, focused on the long-term and ever mindful of the downside risks associated with equity investing. If you would like more timely updates, fbrfunds.com provides monthly performance data, and other important fund information.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. As always, we welcome your questions and comments. You can reach us via e-mail at fbrfundsinfo@fbr.com or toll free at 888.200.4710.

Sincerely,

David Ellison

President, Chief Investment Officer and Trustee

The FBR Funds

Past performance is no guarantee of future results. The performance data quoted represents past performance and the current performance may be lower or higher than the data quoted. Investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original value. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance quoted. To obtain performance data current to the most recent month-end call 888.888.0025.

3

The FBR Funds

FBR Pegasus FundTM

Management Overview

Portfolio Manager(s): Robert Barringer, CFA® and Ryan Kelley, CFA®

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2008, the Investor Class of the FBR Pegasus FundTM returned -32.37%. This compares to the S&P 500 Index and the Morningstar Large Blend Category average which returned -36.10% and -37.25% for the same period respectively.

What factors contributed to the Fund’s performance?

During this tumultuous year, the Fund outperformed its benchmark, the S&P 500 Index, by 373 (+3.73%) basis points and its peers, represented by the Morningstar Large Blend Category average, by 488 (+4.88%) basis points. While we are disappointed (along with many investors) with the overall negative returns, we are encouraged by our relative performance during an extremely difficult market. The FBR Funds are driven by a philosophy of outperforming when markets are falling, and we feel that this year provided solid proof that downside protection is extremely beneficial over the long-term.

Our performance was driven primarily by stock selection. Our disciplined stock selection process and long-term orientation provided better returns to our shareholders relative to the market and peers. Our analysis shows that the key drivers of the Fund’s outperformance relative to its benchmark during the fiscal year were our ability to choose and weight individual securities within each sector, regardless of a sector’s overall performance. Simply put, we strive to own the right companies with superior fundamental characteristics, regardless of its sector’s performance.

Sector selection, a description of a fund’s exposure to different industries relative to its benchmark, was the second major determinant of fund performance. While we as fund managers do not try to time market movements as a whole or within sectors, we do find valuable information in comparing our funds’ sector positions to their benchmarks. Relative to the S&P 500 Index, the Fund benefited from its underexposure to the industrial and financial sectors as well as its overexposure to the consumer staples and utilities sectors. Similar to last year, financials were the worst performing group of stocks, followed by industrial, material, and information technology stocks. Consumer staples and healthcare were the best performing sectors (although still negative) in the market.

Individual stock selection in the telecommunication services and materials sectors was the single largest detractor from the Fund’s performance relative to the benchmark. The Fund’s overweight to the information technology sector also negatively contributed to relative performance.

What is the outlook for the Fund?

We believe superior long-term investment performance is generated through individual stock selection. Our propensity to invest in industry leading companies with defensive business models, solid management teams and low levels of debt continues to drive our

4

The FBR Funds

FBR Pegasus FundTM

Management Overview (continued)

stock selection process. The Fund’s cash levels remain between 5% and 15%, well within our comfort range. We diligently seek opportunities to take advantage of the current dislocation in the capital markets to commit new capital in solid, long-term winners at distressed valuations.

As demonstrated above, our disciplined and consistent investment process and ability to under- or over-weight specific sectors of the market allow us to maintain our long-term orientation and construct a well-rounded and balanced portfolio. Our focus on stocks with sound business models, improving fundamentals and attractive valuations affords us the confidence to make investments within underperforming sectors, while preserving capital in declining markets. Overall, we are confident in our investment process as we head into 2009, despite uncertainties that exist in the market.

The opinions expressed in this commentary reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

5

The FBR Funds

FBR Pegasus FundTM

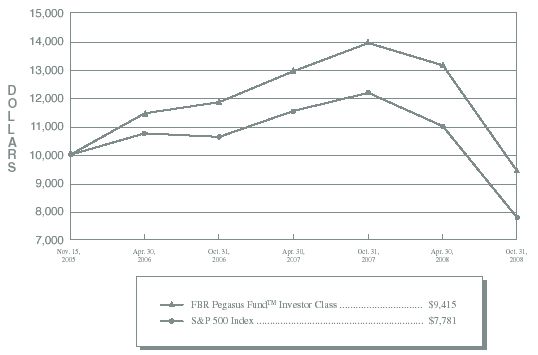

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. S&P 500 Index(1)(3)

| Total Returns—For the Periods Ended October 31, 2008(4) |

| | | | | | | | Annualized | | | | Cumulative | |

| | | | | | | | Since | | | | Since | |

| | | | One Year | | | | Inception(5) | | | | Inception(6) | |

| | | |

| | | |

| | | |

| |

| FBR Pegasus FundTM Investor Class(1)(2) | | | (32.37% | ) | | | (2.02% | ) | | | N/A | |

| FBR Pegasus FundTM I Class(2)(6) | | | N/A | | | | N/A | | | | (29.30% | ) |

| S&P 500 Index(1)(3) | | | (36.10% | ) | | | (8.12% | ) | | | (30.19% | ) |

| |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period November 15, 2005 (commencement of investment operations) through October 31, 2008. |

| (6) | | For the period May 30, 2008 (inception of share class) through October 31, 2008. |

6

The FBR Funds

FBR Pegasus FundTM

Portfolio Summary

October 31, 2008

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | | % of Total Investments |

| | |

|

| Information Technology | | | 16.2 | % |

| Health Care | | | | 15.7 | % |

| Financials | | | | 15.2 | % |

| Consumer Staples | | | 13.4 | % |

| Energy | | | | 8.8 | % |

| Consumer Discretionary | | | 8.0 | % |

| Industrials | | | | 6.4 | % |

| Utilities | | | 4.0 | % |

| Telecommunication Services | | | 1.2 | % |

| Materials | | | | 0.5 | % |

| Cash | | | | 10.6 | % |

7

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 90.8% | | | | |

| | | | Consumer Discretionary — 8.1% | | | | |

| | 1,150 | | Abercrombie & Fitch Co., Class A | | $ | 33,304 | |

| | 4,600 | | American Eagle Outfitters, Inc. | | | 51,152 | |

| | 650 | | Apollo Group, Inc., Class A* | | | 45,182 | |

| | 4,000 | | Lowe’s Companies, Inc. | | | 86,800 | |

| | 2,350 | | Target Corp. | | | 94,282 | |

| | 5,150 | | The Gap, Inc. | | | 66,641 | |

| | | | | |

| |

| | | | | | | 377,361 | |

| | | | | |

| |

| | | | Consumer Staples — 13.6% | | | | |

| | 1,950 | | Campbell Soup Co. | | | 74,003 | |

| | 1,475 | | Colgate-Palmolive Co. | | | 92,571 | |

| | 2,950 | | The Coca-Cola Co. | | | 129,976 | |

| | 1,200 | | The Hershey Co. | | | 44,688 | |

| | 1,575 | | The Procter & Gamble Co. | | | 101,651 | |

| | 3,800 | | Unilever PLC ADR | | | 85,728 | |

| | 1,850 | | Wal-Mart Stores, Inc. | | | 103,249 | |

| | | | | |

| |

| | | | | | | 631,866 | |

| | | | | |

| |

| | | | Energy — 8.9% | | | | |

| | 1,177 | | Apache Corp. | | | 96,902 | |

| | 1,750 | | ConocoPhillips | | | 91,035 | |

| | 1,600 | | Newfield Exploration Co.* | | | 36,768 | |

| | 1,885 | | Occidental Petroleum Corp. | | | 104,694 | |

| | 1,498 | | Royal Dutch Shell PLC, Class A ADR | | | 83,603 | |

| | | | | |

| |

| | | | | | | 413,002 | |

| | | | | |

| |

| | | | Financials — 15.5% | | | | |

| | 1,800 | | ACE Ltd. | | | 103,248 | |

| | 2,050 | | Ameriprise Financial, Inc. | | | 44,280 | |

| | 3,400 | | Bank of America Corp. | | | 82,178 | |

| | 1,600 | | Comerica, Inc. | | | 44,144 | |

| | 6,300 | | Hudson City Bancorp, Inc. | | | 118,503 | |

| | 400 | | IntercontinentalExchange, Inc.* | | | 34,224 | |

| | 1,600 | | JPMorgan Chase & Co. | | | 66,000 | |

| | 3,100 | | People’s United Financial, Inc. | | | 54,250 | |

| | 2,050 | | T. Rowe Price Group, Inc. | | | 81,057 | |

| | 2,700 | | Wells Fargo & Co. | | | 91,935 | |

| | | | | |

| |

| | | | | | | 719,819 | |

| | | | | |

| |

| | | | | | | | |

8

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Health Care — 15.9% | | | | |

| | 865 | | Abbott Laboratories | | $ | 47,705 | |

| | 275 | | Alcon, Inc. | | | 24,233 | |

| | 3,350 | | Applied Biosystems, Inc. | | | 103,281 | |

| | 1,325 | | Becton, Dickinson and Co. | | | 91,955 | |

| | 820 | | C.R. Bard, Inc. | | | 72,365 | |

| | 2,175 | | Eli Lilly and Co. | | | 73,559 | |

| | 1,850 | | Johnson & Johnson | | | 113,478 | |

| | 1,800 | | Novartis AG ADR | | | 91,782 | |

| | 2,270 | | Novo Nordisk A/S ADR | | | 121,467 | |

| | | | | |

| |

| | | | | | | 739,825 | |

| | | | | |

| |

| | | | Industrials — 6.5% | | | | |

| | 2,150 | | 3M Co. | | | 138,245 | |

| | 900 | | Burlington Northern Santa Fe Corp. | | | 80,154 | |

| | 1,600 | | Cummins, Inc. | | | 41,360 | |

| | 1,000 | | Fastenal Co. | | | 40,260 | |

| | | | | |

| |

| | | | | | | 300,019 | |

| | | | | |

| |

| | | | Information Technology — 16.5% | | | | |

| | 2,450 | | Accenture Ltd., Class A | | | 80,973 | |

| | 575 | | Apple, Inc.* | | | 61,864 | |

| | 1,700 | | Automatic Data Processing, Inc. | | | 59,415 | |

| | 1,700 | | Canon, Inc. ADR | | | 58,259 | |

| | 4,100 | | Cisco Systems, Inc.* | | | 72,857 | |

| | 80 | | Google, Inc., Class A* | | | 28,749 | |

| | 6,700 | | Intel Corp. | | | 107,199 | |

| | 560 | | Kyocera Corp. ADR | | | 33,734 | |

| | 4,850 | | Microsoft Corp. | | | 108,300 | |

| | 5,850 | | Oracle Corp.* | | | 106,997 | |

| | 3,500 | | Total System Services, Inc. | | | 48,090 | |

| | | | | |

| |

| | | | | | | 766,437 | |

| | | | | |

| |

| | | | Materials — 0.5% | | | | |

| | 750 | | Freeport-McMoRan Copper & Gold, Inc. | | | 21,825 | |

| | | | | |

| |

| | | | | | | | |

| | | | Telecommunication Services — 1.2% | | | | |

| | 1,850 | | America Movil S.A.B. de C.V., Series L ADR | | | 57,239 | |

| | | | | |

| |

9

The FBR Funds

FBR Pegasus FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Utilities — 4.1% | | | | |

| | 1,826 | | Edison International | | $ | 64,988 | |

| | 1,675 | | PG&E Corp. | | | 61,422 | |

| | 1,517 | | Sempra Energy | | | 64,609 | |

| | | | | |

| |

| | | | | | | 191,019 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $5,257,648) | | | 4,218,412 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 10.8% | | | | |

| | 500,803 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $500,803) | | | 500,803 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 101.6% (Cost $5,758,451) | | | 4,719,215 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (1.6%) | | | (74,342 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 4,644,873 | |

| | | | | |

| |

| * | | Non-income producing security |

| ADR | | American Depositary Receipt |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

| | | |

| The accompanying notes are an integral part of the financial statements. |

10

The FBR Funds

FBR Pegasus Mid Cap FundTM

Management Overview

Portfolio Manager: Ryan Kelley, CFA®

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2008, the Investor Class of the FBR Pegasus Mid Cap FundTM returned -26.71%. This compares to the Russell Midcap Index and the Morningstar Mid Blend Category average which returned -40.67% and -39.71% for the same period respectively.

What factors contributed to the Fund’s performance?

The Fund outperformed its benchmark, the Russell Midcap Index, by 1,394 basis points (+13.94%) and its peers, represented by the Morningstar Mid Blend Category, by 1,300 basis points (+13.00%). While we are disappointed with the overall negative returns, we are encouraged by our relative performance in a tumultuous market. The FBR Funds are driven by a philosophy of outperforming when markets are falling, and we feel that this year provided solid proof that downside protection is extremely beneficial over the long-term.

While we as fund managers do not try to time market movements as a whole or within sectors, we do find valuable information in comparing our funds’ relative positions to their benchmarks. Sector selection, a description of a fund’s relative exposure to different industries, is a major determinant of fund performance. Relative to the Russell Midcap Index, the FBR Pegasus Mid Cap FundTM benefited from its underexposure to the consumer discretionary, industrial and telecommunications services sectors as well as its overexposure to the healthcare sector. In the midcap space, telecommunications services, information technology, consumer discretionary, and industrials were the worst performing group of stocks, while consumer staples and healthcare performed best, although still negative.

Our outperformance was driven primarily by stock selection. Our disciplined stock selection process and investing for the long-term provided better returns to our shareholders relative to the market. Our analysis shows that the majority of our excess return above our benchmark was attributable to our ability to choose and weight individual securities within each sector, regardless of a sector’s overall performance. A prime example of this is Hudson City Bancorp (HCBK), a bank whose total return of 23% for the 12 months ended October 31, 2008 far outpaced the S&P 500 Financials’ total return of -49%. Simply put, we strive to own the right stocks, regardless of its sector’s performance.

Individual stock selection in the consumer discretionary and materials sectors was the single largest detractor from the Fund’s performance relative to the benchmark. The Fund’s overweight to the information technology sector also negatively contributed to relative performance.

11

The FBR Funds

FBR Pegasus Mid Cap FundTM

Management Overview (continued)

What is the outlook for the Fund?

We strive to provide solid long-term returns for our shareholders while protecting against the downside and exhibiting a lower level of volatility. Since its inception in February 2007, the Fund has managed to achieve this objective through the implementation of its disciplined investment process. Over its twenty months of existence, the Fund has consistently outperformed its benchmark and delivered top decile performance relative to its mid blend peers. It has managed to do so with 20% less volatility, as measured by standard deviation, than its benchmark which translates to a 73% downside capture ratio. Which means, when the benchmark is down 1% the Fund typically is down only 0.73%. We continue to aim for these types of metrics, which become integral parts of our stock selection process.

The Fund’s cash levels remain between 5% and 15%, well within our comfort range. We diligently seek opportunities to take advantage of the current dislocation in the capital markets to commit new capital in solid, long-term winners at distressed valuations. As demonstrated above, our disciplined and consistent investment process and ability to under- or over-weight specific sectors of the market allow us to maintain our long-term orientation and construct a well-rounded and balanced portfolio. Our focus on stocks with sound business models, improving fundamentals and attractive valuations affords us the confidence to make investments within underperforming sectors, while preserving capital in declining markets.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

12

The FBR Funds

FBR Pegasus Mid Cap FundTM

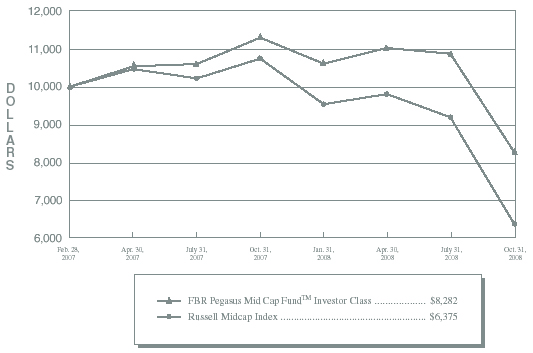

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell Midcap Index(1)(3)

| Total Returns—For the Periods Ended October 31, 2008(4) |

| | | | | | | | Annualized | | | Cumulative | |

| | | | | | | | Since | | | Since | |

| | | | | One Year | | | Inception(5) | | | Inception(6) | |

| | | | |

| | |

| | |

| |

| | FBR Pegasus Mid Cap FundTM Investor Class(1)(2) | | | (26.71% | ) | | (10.67% | ) | | N/A | |

| | FBR Pegasus Mid Cap FundTM I Class(2)(6) | | | N/A | | | N/A | | | (28.90% | ) |

| | Russell Midcap Index(1)(3) | | | (40.67% | ) | | (23.55% | ) | | (37.39% | ) |

| | | | | | | | | | | | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 31% of the total market-capitalization of the Russell 1000 Index. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of investment operations) through October 31, 2008. |

| (6) | | For the period May 30, 2008 (inception of share class) through October 31, 2008. |

13

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio Summary

October 31, 2008

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | | % of Total Investments |

| | |

|

| Financials | | | | 17.5 | % |

| Consumer Discretionary | | | 12.1 | % |

| Information Technology | | | 11.3 | % |

| Health Care | | | | 10.6 | % |

| Industrials | | | | 9.1 | % |

| Utilities | | | | 9.0 | % |

| Consumer Staples | | | 8.4 | % |

| Energy | | | | 4.9 | % |

| Materials | | | | 3.3 | % |

| Telecommunication Services | | | 1.0 | % |

| Cash | | | | 12.8 | % |

14

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 87.7% | | | | |

| | | | Consumer Discretionary — 12.2% | | | | |

| | 2,140 | | Abercrombie & Fitch Co., Class A | | $ | 61,974 | |

| | 6,725 | | American Eagle Outfitters, Inc. | | | 74,782 | |

| | 600 | | Apollo Group, Inc., Class A* | | | 41,706 | |

| | 425 | | ITT Educational Services, Inc.* | | | 37,251 | |

| | 1,945 | | Magna International, Inc., Class A | | | 65,760 | |

| | 5,575 | | Mattel, Inc. | | | 83,736 | |

| | 2,750 | | Tiffany & Co. | | | 75,488 | |

| | 1,225 | | VF Corp. | | | 67,498 | |

| | | | | |

| |

| | | | | | | 508,195 | |

| | | | | |

| |

| | | | Consumer Staples — 8.4% | | | | |

| | 1,350 | | Alberto-Culver Co. | | | 34,736 | |

| | 1,800 | | BJ’s Wholesale Club, Inc.* | | | 63,360 | |

| | 1,970 | | Bunge Ltd. | | | 75,668 | |

| | 4,525 | | Hansen Natural Corp.* | | | 114,572 | |

| | 7,275 | | Tyson Foods, Inc., Class A | | | 63,584 | |

| | | | | |

| |

| | | | | | | 351,920 | |

| | | | | |

| |

| | | | Energy — 4.9% | | | | |

| | 1,298 | | ENSCO International, Inc. | | | 49,337 | |

| | 1,045 | | Helmerich & Payne, Inc. | | | 35,854 | |

| | 1,900 | | Pioneer Natural Resources Co. | | | 52,876 | |

| | 370 | | SEACOR Holdings, Inc.* | | | 24,853 | |

| | 2,150 | | W&T Offshore, Inc. | | | 41,216 | |

| | | | | |

| |

| | | | | | | 204,136 | |

| | | | | |

| |

| | | | Financials — 17.6% | | | | |

| | 1,500 | | Annaly Capital Management, Inc. | | | 20,850 | |

| | 5,150 | | Astoria Financial Corp. | | | 97,953 | |

| | 1,325 | | Capitol Federal Financial | | | 61,626 | |

| | 7,475 | | Hudson City Bancorp, Inc. | | | 140,604 | |

| | 6,850 | | People’s United Financial, Inc. | | | 119,874 | |

| | 3,225 | | SEI Investments Co. | | | 57,018 | |

| | 2,840 | | T. Rowe Price Group, Inc. | | | 112,294 | |

| | 600 | | The Hanover Insurance Group, Inc. | | | 23,550 | |

| | 3,600 | | Unum Group | | | 56,700 | |

| | 2,550 | | Washington Federal, Inc. | | | 44,931 | |

| | | | | |

| |

| | | | | | | 735,400 | |

| | | | | |

| |

15

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Health Care — 10.6% | | | | |

| | 355 | | Bio-Rad Laboratories, Inc., Class A* | | $ | 30,310 | |

| | 1,220 | | C.R. Bard, Inc. | | | 107,664 | |

| | 2,138 | | Forest Laboratories, Inc.* | | | 49,666 | |

| | 3,350 | | Kinetic Concepts, Inc.* | | | 81,104 | |

| | 1,030 | | Lincare Holdings, Inc.* | | | 27,141 | |

| | 750 | | Techne Corp. | | | 51,765 | |

| | 2,125 | | Varian Medical Systems, Inc.* | | | 96,708 | |

| | | | | |

| |

| | | | | | | 444,358 | |

| | | | | |

| |

| | | | Industrials — 9.2% | | | | |

| | 2,325 | | Copart, Inc.* | | | 81,142 | |

| | 1,893 | | Cummins, Inc. | | | 48,934 | |

| | 725 | | Equifax, Inc. | | | 18,908 | |

| | 675 | | Fastenal Co. | | | 27,176 | |

| | 2,100 | | Graco, Inc. | | | 51,933 | |

| | 1,900 | | Kubota Corp. ADR | | | 47,063 | |

| | 1,325 | | Pall Corp. | | | 34,993 | |

| | 3,050 | | Ritchie Bros. Auctioneers, Inc. | | | 56,639 | |

| | 395 | | Roper Industries, Inc. | | | 17,913 | |

| | | | | |

| |

| | | | | | | 384,701 | |

| | | | | |

| |

| | | | Information Technology — 11.4% | | | | |

| | 6,200 | | Activision Blizzard, Inc.* | | | 77,252 | |

| | 4,700 | | Check Point Software Technologies Ltd.* | | | 95,033 | |

| | 1,620 | | FactSet Research Systems, Inc. | | | 62,840 | |

| | 1,125 | | Global Payments, Inc. | | | 45,574 | |

| | 1,300 | | Ingram Micro, Inc., Class A* | | | 17,329 | |

| | 2,350 | | Jack Henry & Associates, Inc. | | | 44,674 | |

| | 1,800 | | Paychex, Inc. | | | 51,372 | |

| | 3,250 | | QLogic Corp.* | | | 39,065 | |

| | 1,288 | | TDK Corp. ADR | | | 43,805 | |

| | | | | |

| |

| | | | | | | 476,944 | |

| | | | | |

| |

| | | | Materials — 3.3% | | | | |

| | 4,075 | | Compania de Minas Buenaventura S.A.A. ADR | | | 51,507 | |

| | 975 | | Ecolab, Inc. | | | 36,329 | |

| | 875 | | Sigma-Aldrich Corp. | | | 38,378 | |

| | 1,550 | | Ternium S.A. ADR | | | 13,656 | |

| | | | | |

| |

| | | | | | | 139,870 | |

| | | | | |

| |

16

The FBR Funds

FBR Pegasus Mid Cap FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Telecommunication Services — 1.0% | | | | |

| | 1,550 | | Telephone and Data Systems, Inc. | | $ | 41,618 | |

| | | | | |

| |

| | | | | | | | |

| | | | Utilities — 9.1% | | | | |

| | 2,890 | | Energen Corp. | | | 97,017 | |

| | 1,300 | | Pinnacle West Capital Corp. | | | 41,145 | |

| | 2,263 | | Questar Corp. | | | 77,983 | |

| | 1,400 | | SCANA Corp. | | | 46,074 | |

| | 1,150 | | Sempra Energy | | | 48,979 | |

| | 2,375 | | Westar Energy, Inc. | | | 46,289 | |

| | 1,250 | | Xcel Energy, Inc. | | | 21,775 | |

| | | | | |

| |

| | | | | | | 379,262 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $4,670,707) | | | 3,666,404 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 12.9% | | | | |

| | 536,964 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $536,964) | | | 536,964 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 100.6% (Cost $5,207,671) | | | 4,203,368 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (0.6%) | | | (24,647 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 4,178,721 | |

| | | | | |

| |

| * | | Non-income producing security |

| ADR | | American Depositary Receipt |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

17

The FBR Funds

FBR Pegasus Small Cap FundTM

Management Overview

Portfolio Manager: Robert Barringer, CFA®

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2008, the Investor Class of the FBR Pegasus Small Cap FundTM returned -28.49%. This compares to the Morningstar Small Growth Category Average and the Russell 2000 Index, which returned -41.90% and -34.16% for the same period respectively.

What factors contributed to the Fund’s performance?

Fiscal year 2008 was characterized by unprecedented volatility highlighted by the failure of several major U.S. financial institutions and monumental intervention and regulation by the U.S. government. Substantial short-term swings in the price of equities across the market capitalization spectrum forced investors to revaluate the fundamental notion of the equity risk premium as they indiscriminately reduced their exposure equities. During the period the average small cap mutual fund, regardless of investment style (e.g. value and growth) declined over -36%. Capital and liquidity were the most sought after items and the market severely punished companies that rely on short-term debt funding.

The Fund managed to outperform its benchmark index and peers through a combination of sector and individual stock selection. Stock selection made the consumer discretionary and industrials sectors leading contributors to relative performance. The Fund benefitted from a continued underweight to financials based on the thesis that the credit cycle was still in its early stages, non-performing assets would continue to rise and loan growth would be anemic. However, our investment process allowed us to identify three high quality and well-capitalized financial services companies that were top contributors to the Fund’s performance.

An overweight position in the information technology sector was the single largest detractor from the Fund’s performance relative to the benchmark. The Fund’s overweight to the materials sector and individual stock selection also negatively contributed to relative performance.

What is the outlook for the Fund?

The financial crisis is likely to continue and we expect the capital markets to remain volatile and unpredictable well into 2009. The outlook for the market is uncertain as the country continues to work its way through the recession that began near the end of 2007. Recovery takes time, yet we remain optimistic about the prospect for the portfolio and opportunistic in our efforts to take advantage of the current dislocation.

In uncertain economic times, investors tend to prefer fundamentally higher quality companies over lower quality. Our investment process is specifically designed to weather this kind of economic environment. Our focus will remain on companies whose business models and growth are funded from existing cash flow generation, not access to outside

18

The FBR Funds

FBR Pegasus Small Cap FundTM

Management Overview (continued)

capital. We seek to identify industry leading companies with strong balance sheets, low debt, high returns on equity, above market earnings growth and reasonable valuations. We believe a commitment to this type of investment approach, over time, can deliver the potential for upside participation with a degree of downside protection.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

19

The FBR Funds

FBR Pegasus Small Cap FundTM

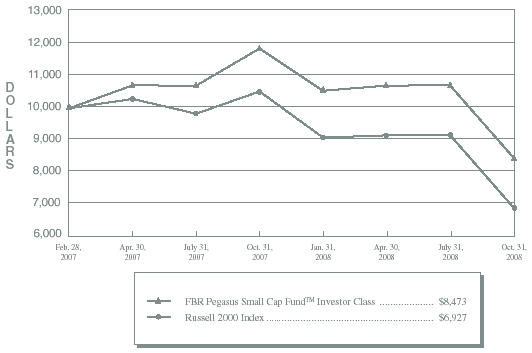

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

| Total Returns—For the Periods Ended October 31, 2008(4) |

| | | | | | | Annualized | | | Cumulative | |

| | | | | | | Since | | | Since | |

| | | | One Year | | | Inception(5) | | | Inception(6) | |

| | | |

| | |

| | |

| |

| | FBR Pegasus Small Cap FundTM Investor Class(1)(2) | | (28.49% | ) | | (9.44% | ) | | N/A | |

| | FBR Pegasus Small Cap FundTM I Class(2)(6) | | N/A | | | N/A | | | (23.80% | ) |

| | Russell 2000 Index(1)(3) | | (34.16% | ) | | (19.66% | ) | | (27.45% | ) |

| | | | | | | | | | | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market-capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period February 28, 2007 (commencement of investment operations) through October 31, 2008. |

| (6) | | For the period May 30, 2008 (inception of share class) through October 31, 2008. |

20

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio Summary

October 31, 2008

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | | % of Total Investments |

| | |

|

| Financials | | | | 24.4 | % |

| Industrials | | | | 20.3 | % |

| Health Care | | | | 11.3 | % |

| Information Technology | | | 10.1 | % |

| Consumer Discretionary | | | 8.9 | % |

| Consumer Staples | | | 5.8 | % |

| Energy | | | | 4.8 | % |

| Materials | | | | 3.3 | % |

| Utilities | | | | 2.8 | % |

| Telecommunication Services | | | 0.4 | % |

| Cash | | | | 7.9 | % |

21

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 96.1% | | | | |

| | | | Consumer Discretionary — 9.2% | | | | |

| | 1,500 | | Aéropostale, Inc.* | | $ | 36,315 | |

| | 6,800 | | Chico’s FAS, Inc.* | | | 23,120 | |

| | 2,050 | | Interactive Data Corp. | | | 48,338 | |

| | 1,200 | | Movado Group, Inc. | | | 18,252 | |

| | 65 | | NVR, Inc.* | | | 31,864 | |

| | 5,300 | | Pacific Sunwear of California, Inc.* | | | 18,126 | |

| | 1,450 | | Signet Jewelers Ltd. | | | 14,761 | |

| | 600 | | Snap-On, Inc. | | | 22,170 | |

| | 200 | | Strayer Education, Inc. | | | 45,254 | |

| | 750 | | The Buckle, Inc. | | | 19,755 | |

| | 825 | | The Gymboree Corp.* | | | 21,335 | |

| | 1,400 | | The Men’s Wearhouse, Inc. | | | 21,406 | |

| | 1,450 | | The Timberland Co., Class A* | | | 17,545 | |

| | 1,250 | | Williams-Sonoma, Inc. | | | 10,350 | |

| | 1,175 | | Wolverine World Wide, Inc. | | | 27,613 | |

| | | | | |

| |

| | | | | | | 376,204 | |

| | | | | |

| |

| | | | Consumer Staples — 6.0% | | | | |

| | 3,250 | | Alberto-Culver Co. | | | 83,623 | |

| | 1,150 | | BJ’s Wholesale Club, Inc.* | | | 40,480 | |

| | 1,400 | | Ingles Markets, Inc., Class A | | | 26,124 | |

| | 1,000 | | NBTY, Inc.* | | | 23,370 | |

| | 1,600 | | The J.M. Smucker Co. | | | 71,296 | |

| | | | | |

| |

| | | | | | | 244,893 | |

| | | | | |

| |

| | | | Energy — 5.0% | | | | |

| | 900 | | Concho Resources, Inc.* | | | 19,125 | |

| | 605 | | Dril-Quip, Inc.* | | | 14,944 | |

| | 1,150 | | Goodrich Petroleum Corp.* | | | 31,924 | |

| | 450 | | Massey Energy Co. | | | 10,391 | |

| | 1,350 | | Penn Virginia Corp. | | | 50,179 | |

| | 600 | | SEACOR Holdings, Inc.* | | | 40,301 | |

| | 1,950 | | W&T Offshore, Inc. | | | 37,382 | |

| | | | | |

| |

| | | | | | | 204,246 | |

| | | | | |

| |

| | | | Financials — 25.6% | | | | |

| | 1,700 | | 1st Source Corp. | | | 36,482 | |

| | 6,000 | | Abington Bancorp, Inc. | | | 62,099 | |

| | 2,300 | | American Financial Group, Inc. | | | 52,279 | |

22

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Financials — 25.6% (continued) | | | | |

| | 1,100 | | Astoria Financial Corp. | | $ | 20,922 | |

| | 3,400 | | Bank Mutual Corp. | | | 39,202 | |

| | 667 | | Bank of Marin Bancorp | | | 18,863 | |

| | 4,200 | | BankFinancial Corp. | | | 51,198 | |

| | 1,000 | | Cape Bancorp, Inc.* | | | 8,320 | |

| | 5,312 | | Cardinal Financial Corp. | | | 33,147 | |

| | 100 | | Chicopee Bancorp, Inc.* | | | 1,230 | |

| | 4,350 | | Chimera Investment Corp. | | | 12,528 | |

| | 1,000 | | Commerce Bancshares, Inc. | | | 47,280 | |

| | 450 | | Cullen/Frost Bankers, Inc. | | | 25,187 | |

| | 2,650 | | Danvers Bancorp, Inc. | | | 32,542 | |

| | 3,700 | | ESSA Bancorp, Inc. | | | 51,282 | |

| | 2,350 | | Federated Investors, Inc., Class B | | | 56,870 | |

| | 315 | | First Citizens BancShares, Inc., Class A | | | 48,170 | |

| | 5,150 | | Fox Chase Bancorp, Inc.* | | | 61,285 | |

| | 1,365 | | HCC Insurance Holdings, Inc. | | | 30,112 | |

| | 4,300 | | Home Federal Bancorp, Inc. | | | 49,837 | |

| | 1,550 | | Invesco Ltd. | | | 23,111 | |

| | 300 | | KBW, Inc.* | | | 8,784 | |

| | 1,400 | | National Health Investors, Inc. | | | 41,916 | |

| | 1,075 | | optionsXpress Holdings, Inc. | | | 19,092 | |

| | 575 | | ProAssurance Corp.* | | | 31,596 | |

| | 600 | | Raymond James Financial, Inc. | | | 13,974 | |

| | 500 | | StanCorp Financial Group, Inc. | | | 17,040 | |

| | 1,900 | | United Financial Bancorp, Inc. | | | 26,600 | |

| | 1,700 | | Validus Holdings Ltd. | | | 30,158 | |

| | 985 | | Waddell & Reed Financial, Inc., Class A | | | 14,302 | |

| | 3,100 | | Washington Federal, Inc. | | | 54,622 | |

| | 1,700 | | Westfield Financial, Inc. | | | 17,595 | |

| | | | | |

| |

| | | | | | | 1,037,625 | |

| | | | | |

| |

| | | | Health Care — 11.8% | | | | |

| | 750 | | Bio-Rad Laboratories, Inc., Class A* | | | 64,035 | |

| | 2,470 | | IDEXX Laboratories, Inc.* | | | 86,919 | |

| | 1,000 | | Kinetic Concepts, Inc.* | | | 24,210 | |

| | 2,350 | | King Pharmaceuticals, Inc.* | | | 20,657 | |

| | 2,300 | | Lincare Holdings, Inc.* | | | 60,605 | |

| | 750 | | National HealthCare Corp. | | | 30,758 | |

23

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Health Care — 11.8% (continued) | | | | |

| | 1,600 | | Techne Corp. | | $ | 110,431 | |

| | 1,700 | | VCA Antech, Inc.* | | | 30,770 | |

| | 2,300 | | ViroPharma, Inc.* | | | 28,842 | |

| | 1,000 | | WellCare Health Plans, Inc.* | | | 24,170 | |

| | | | | |

| |

| | | | | | | 481,397 | |

| | | | | |

| |

| | | | Industrials — 21.3% | | | | |

| | 1,160 | | Acuity Brands, Inc. | | | 40,554 | |

| | 850 | | Alexander & Baldwin, Inc. | | | 27,115 | |

| | 1,350 | | Arkansas Best Corp. | | | 39,407 | |

| | 1,350 | | Carlisle Companies, Inc. | | | 31,388 | |

| | 2,075 | | Ceradyne, Inc.* | | | 48,763 | |

| | 1,000 | | Cubic Corp. | | | 22,250 | |

| | 2,300 | | Genesee & Wyoming, Inc., Class A* | | | 76,704 | |

| | 1,630 | | Graco, Inc. | | | 40,310 | |

| | 700 | | Lincoln Electric Holdings, Inc. | | | 30,205 | |

| | 1,375 | | Mueller Industries, Inc. | | | 31,446 | |

| | 1,050 | | Nordson Corp. | | | 38,777 | |

| | 1,425 | | Ritchie Bros Auctioneers, Inc. | | | 26,462 | |

| | 1,250 | | Robbins & Myers, Inc. | | | 25,500 | |

| | 5,400 | | Rollins, Inc. | | | 94,877 | |

| | 20 | | Seaboard Corp. | | | 26,800 | |

| | 1,900 | | Simpson Manufacturing Company, Inc. | | | 43,776 | |

| | 700 | | SkyWest, Inc. | | | 10,787 | |

| | 500 | | Terex Corp.* | | | 8,345 | |

| | 1,125 | | The Toro Co. | | | 37,845 | |

| | 600 | | Valmont Industries, Inc. | | | 32,868 | |

| | 1,305 | | Watson Wyatt Worldwide, Inc., Class A | | | 55,423 | |

| | 2,500 | | Werner Enterprises, Inc. | | | 49,050 | |

| | 800 | | Woodward Governor Co. | | | 25,680 | |

| | | | | |

| |

| | | | | | | 864,332 | |

| | | | | |

| |

| | | | Information Technology — 10.5% | | | | |

| | 1,275 | | Cymer, Inc.* | | | 31,199 | |

| | 1,050 | | Diebold, Inc. | | | 31,206 | |

| | 750 | | FactSet Research Systems, Inc. | | | 29,093 | |

| | 2,250 | | Jack Henry & Associates, Inc. | | | 42,773 | |

| | 3,700 | | MICROS Systems, Inc.* | | | 63,010 | |

| | 1,500 | | NETGEAR, Inc.* | | | 16,575 | |

24

The FBR Funds

FBR Pegasus Small Cap FundTM

Portfolio of Investments (continued)

October 31, 2008

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Information Technology — 10.5% (continued) | | | | |

| | 2,600 | | Parametric Technology Corp.* | | $ | 33,774 | |

| | 1,500 | | SPSS, Inc.* | | | 35,040 | |

| | 2,350 | | Sybase, Inc.* | | | 62,580 | |

| | 2,450 | | Teradata Corp.* | | | 37,706 | |

| | 2,300 | | Total System Services, Inc. | | | 31,602 | |

| | 1,200 | | VeriFone Holdings, Inc.* | | | 13,632 | |

| | | | | |

| |

| | | | | | | 428,190 | |

| | | | | |

| |

| | | | Materials — 3.4% | | | | |

| | 1,500 | | H.B. Fuller Co. | | | 26,505 | |

| | 800 | | Kaiser Aluminum Corp. | | | 26,848 | |

| | 800 | | OM Group, Inc.* | | | 17,072 | |

| | 3,400 | | The Valspar Corp. | | | 69,530 | |

| | | | | |

| |

| | | | | | | 139,955 | |

| | | | | |

| |

| | | | Telecommunication Services — 0.4% | | | | |

| | 548 | | Telemig Celular Participacoes S.A. ADR | | | 17,333 | |

| | | | | |

| |

| | | | | | | | |

| | | | Utilities — 2.9% | | | | |

| | 1,700 | | El Paso Electric Co.* | | | 31,484 | |

| | 880 | | Energen Corp. | | | 29,542 | |

| | 1,850 | | The Empire District Electric Co. | | | 35,538 | |

| | 1,200 | | Westar Energy, Inc. | | | 23,388 | |

| | | | | |

| |

| | | | | | | 119,952 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $4,600,764) | | | 3,914,127 | |

| | | | | |

| |

| | | | | | | | |

| | | | MONEY MARKET FUND — 8.2% | | | | |

| | 334,597 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $334,597) | | | 334,597 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 104.3% (Cost $4,935,361) | | | 4,248,724 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (4.3%) | | | (174,268 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 4,074,456 | |

| | | | | |

| |

| * | | Non-income producing security |

| ADR | | American Depositary Receipt |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

25

The FBR Funds

FBR Pegasus Small Cap Growth FundTM

(Formerly known as the FBR Small Cap Technology Fund)

Management Overview

Portfolio Manager: Robert Barringer, CFA®

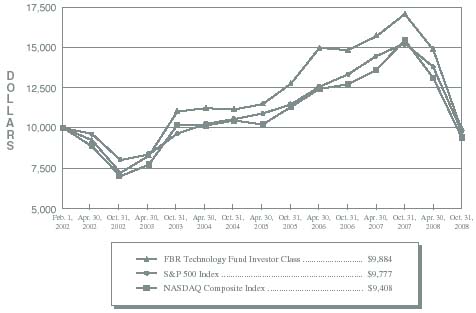

Over the recent fiscal year, how did the Fund perform?

For the one-year period ended October 31, 2008, the Investor Class of the FBR Pegasus Small Cap Growth FundTM returned -36.32%. This compares to the Morningstar Small Cap Growth Category average, the Russell 2000 Growth Index, the NASDAQ Composite Index and the Russell 2500 Technology Index, which returned -41.90%, -37.87%, -39.31% and -46.03% respectively.

What factors contributed to the Fund’s performance?

It is important to note that the first six months of the 2008 fiscal year the Fund was managed as a specialty technology portfolio and focused investments primarily in the technology sector. As such, the Fund’s performance was benchmarked against two technology oriented indices, the Russell 2500 Technology Index and the NASDAQ Composite Index.

In our continued effort to provide the highest quality equity solutions for investors, we successfully repositioned the Fund as a small-cap growth solution in early May 2008. As a result, we changed the Fund’s benchmark to the Russell 2000 Growth Index and rebalanced the portfolio to provide exposure to a wide variety of industry sectors. In November, the Fund was officially reclassified from the specialty technology category to the small cap growth category by Morningstar and retained its five-star rating relative to its new peer group.

The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-yr (if applicable) Morningstar Rating metrics. Morningstar proprietary ratings reflect risk-adjusted performance as of the period stated above. For each fund with at least a 3-yr history, Morningstar calculates a Morningstar RatingTM based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star. The FBR Pegasus Small Cap Growth FundTM received 5 stars for the 3-yrs ended 11/30/08 among 699 small growth funds respectively.

The Fund maintains the same disciplined bottom-up process that emphasizes superior stock selection that is now applied across all sectors and industries. On a relative basis, the Fund outperformed its former benchmarks as well as its new benchmark during the entire fiscal year. This is a direct testament to the quality of the factors and selection criteria we believe are important in driving stock returns.

The largest positive contributor to the Fund’s performance was its underweight to and individual stock selection in the consumer discretionary sector. The Fund also benefited from its underweight to financials and health care. The single largest detractor from

26

The FBR Funds

FBR Pegasus Small Cap Growth FundTM

Management Overview (continued)

performance was the Fund’s average overweight position in the information technology sector. This is directly attributable to the Fund’s mandate to invest primarily in the technology sector for the first half of the fiscal year which heavily skewed the average exposure to the sector.

What is the outlook for the Fund?

The financial crisis and economic malaise is likely to continue and we expect the capital markets to remain volatile and unpredictable well into 2009. The outlook for the market is uncertain as the country continues to work its way through the recession that began near the end of 2007. Recovery takes time, yet we remain optimistic about the prospects for the portfolio and opportunistic in our efforts to improve the risk reward profile by adding to our highest conviction names at attractive valuations and selling the names we feel are more at risk than others.

In uncertain economic times, investors tend to prefer fundamentally higher quality companies over lower quality. Our investment process is specifically designed to weather this kind of economic environment. Our focus will remain on companies whose business models and growth are sustainable and funded from existing cash flow generation, not access to outside capital. We seek to identify the fastest growing industry leading companies that are poised to benefit from improving secular or cyclical growth trends. These companies must meet our strict criteria for investment including (but not limited to) strong balance sheets, low debt, high returns on equity, robust business models and reasonable valuations. We believe a commitment to this type of investment approach, over time, can deliver the potential for upside participation with a degree of downside protection.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

27

The FBR Funds

FBR Pegasus Small Cap Growth FundTM

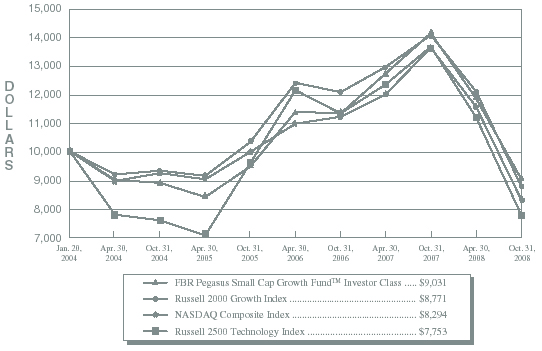

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Various Indices(1)(3)

| | Total Returns—For the Periods Ended October 31, 2008(4) |

| | | | | | | | | | Cumulative | |

| | | | | | | Since | | Since | |

| | | | One Year | | Inception(5) | | Inception(6) | |

| | | |

| |

| |

| |

| | FBR Pegasus Small Cap Growth FundTM Investor Class(1)(2) | | (36.32 | %) | | (2.11 | %) | | N/A | | |

| | FBR Pegasus Small Cap Growth FundTM I Class(2)(6) | | N/A | | | N/A | | | (28.10 | %) | |

| | FBR Pegasus Small Cap Growth FundTM R Class(2)(6) | | N/A | | | N/A | | | (28.30 | %) | |

| | Russell 2000 Growth Index(1)(3) | | (37.87 | %) | | (2.70 | %) | | (31.14 | %) | |

| | NASDAQ Composite Index(1)(3) | | (39.31 | %) | | (3.83 | %) | | (31.59 | %) | |

| | Russell 2500 Technology Index(1)(3) | | (43.43 | %) | | (5.18 | %) | | (35.91 | %) | |

| | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of redemption fees and if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | In April 2008, the Fund’s Board of Trustees approved the change of the primary benchmark to the Russell 2000 Growth Index. The Russell 2000 Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. The NASDAQ Composite Index is a broad-based capitalization-weighted index of all NASDAQ National Market and Small Cap stocks. The Russell 2500 Technology Index is a capitalization-weighted index of companies that serve the electronics and computer industries or that manufacture products based on the latest applied science. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period January 20, 2004 (commencement of investment operations) through October 31, 2008. |

| (6) | | For the period May 30, 2008 (inception of share class) through October 31, 2008. |

28

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio Summary |

| October 31, 2008 |

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | % of Total Investments |

|

|

| Software and Services | | 21.9 | % | |

| Health Care Equipment and Services | | 14.7 | % | |

| Energy | | 8.8 | % | |

| Consumer Services | | 7.8 | % | |

| Pharmaceuticals, Biotechnology and Life Sciences | | 6.1 | % | |

| Capital Goods | | 5.2 | % | |

| Diversified Financials | | 4.7 | % | |

| Transportation | | 3.8 | % | |

| Commercial and Professional Services | | 3.7 | % | |

| Technology Hardware and Equipment | | 3.3 | % | |

| Banks | | 3.0 | % | |

| Food, Beverage and Tobacco | | 2.7 | % | |

| Retailing | | 2.4 | % | |

| Consumer Durables and Apparel | | 2.3 | % | |

| Materials | | 1.5 | % | |

| Telecommunication Services | | 1.1 | % | |

| Semiconductors and Semiconductor Equipment | | 1.0 | % | |

| Insurance | | 0.5 | % | |

| Automobiles and Components | | 0.4 | % | |

| Cash | | 5.1 | % | |

29

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments |

| October 31, 2008 |

|

| | | | | VALUE |

| SHARES | | | | (NOTE 2) |

|

| | | COMMON STOCKS — 96.6% | | | | |

| | | Automobiles and Components — 0.4% | | | | |

| 1,300 | | Gentex Corp. | | $ | 12,467 | |

| | | | |

| |

| | | Banks — 3.0% | | | | |

| 2,900 | | Abington Bancorp, Inc. | | | 30,015 | |

| 200 | | First Citizens BancShares, Inc., Class A | | | 30,584 | |

| 2,500 | | Fox Chase Bancorp, Inc.* | | | 29,750 | |

| | | | |

| |

| | | | | | 90,349 | |

| | | | |

| |

| | | Capital Goods — 5.3% | | | | |

| 775 | | CLARCOR, Inc. | | | 27,427 | |

| 500 | | Crane Co. | | | 8,185 | |

| 800 | | Kaydon Corp. | | | 26,728 | |

| 1,550 | | KBR, Inc. | | | 23,002 | |

| 600 | | L.B. Foster Co.* | | | 16,500 | |

| 400 | | Valmont Industries, Inc. | | | 21,912 | |

| 1,025 | | Woodward Governor Co. | | | 32,903 | |

| | | | |

| |

| | | | | | 156,657 | |

| | | | |

| |

| | | Commercial and Professional Services — 3.8% | | | | |

| 850 | | Copart, Inc.* | | | 29,665 | |

| 1,200 | | Ritchie Bros. Auctioneers, Inc. | | | 22,284 | |

| 1,425 | | Watson Wyatt Worldwide, Inc., Class A | | | 60,520 | |

| | | | |

| |

| | | | | | 112,469 | |

| | | | |

| |

| | | Consumer Durables and Apparel — 2.4% | | | | |

| 220 | | Deckers Outdoor Corp.* | | | 18,669 | |

| 750 | | Fossil, Inc.* | | | 13,613 | |

| 1,205 | | lululemon athletica, inc.* | | | 17,075 | |

| 1,650 | | Volcom, Inc.* | | | 21,334 | |

| | | | |

| |

| | | | | | 70,691 | |

| | | | |

| |

| | | Consumer Services — 7.9% | | | | |

| 800 | | Capella Education Co.* | | | 37,920 | |

| 1,000 | | ITT Educational Services, Inc.* | | | 87,649 | |

| 2,025 | | Penn National Gaming, Inc.* | | | 39,002 | |

| 1,500 | | Sotheby’s | | | 13,965 | |

| 250 | | Strayer Education, Inc. | | | 56,568 | |

| | | | |

| |

| | | | | | 235,104 | |

| | | | |

| |

30

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

| October 31, 2008 |

|

| | | | | VALUE |

| SHARES | | | | (NOTE 2) |

|

| | | Diversified Financials — 4.8% | | | | |

| 645 | | Investment Technology Group, Inc.* | | $ | 13,164 | |

| 1,725 | | optionsXpress Holdings, Inc. | | | 30,636 | |

| 1,700 | | Stifel Financial Corp.* | | | 74,205 | |

| 1,625 | | Waddell & Reed Financial, Inc., Class A | | | 23,595 | |

| | | | |

| |

| | | | | | 141,600 | |

| | | | |

| |

| | | Energy — 9.0% | | | | |

| 2,250 | | Basic Energy Services, Inc.* | | | 30,780 | |

| 1,325 | | Berry Petroleum Co., Class A | | | 30,873 | |

| 3,900 | | Cal Dive International, Inc.* | | | 33,189 | |

| 750 | | Comstock Resources, Inc.* | | | 37,065 | |

| 750 | | Oceaneering International, Inc.* | | | 21,128 | |

| 600 | | Patriot Coal Corp.* | | | 9,498 | |

| 1,150 | | Stone Energy Corp.* | | | 34,891 | |

| 1,800 | | Superior Energy Services, Inc.* | | | 38,375 | |

| 950 | | Swift Energy Co.* | | | 30,476 | |

| | | | |

| |

| | | | | | 266,275 | |

| | | | |

| |

| | | Food, Beverage and Tobacco — 2.7% | | | | |

| 1,700 | | Flowers Foods, Inc. | | | 50,405 | |

| 1,200 | | Hansen Natural Corp.* | | | 30,384 | |

| | | | |

| |

| | | | | | 80,789 | |

| | | | |

| |

| | | Health Care Equipment and Services — 14.9% | | | | |

| 1,230 | | Cerner Corp.* | | | 45,793 | |

| 725 | | Gen-Probe, Inc.* | | | 34,119 | |

| 2,515 | | IDEXX Laboratories, Inc.* | | | 88,502 | |

| 1,950 | | Kinetic Concepts, Inc.* | | | 47,210 | |

| 2,475 | | Lincare Holdings, Inc.* | | | 65,215 | |

| 1,750 | | Patterson Companies, Inc.* | | | 44,328 | |

| 1,100 | | Pediatrix Medical Group, Inc.* | | | 42,515 | |

| 850 | | ResMed, Inc.* | | | 29,121 | |

| 1,900 | | VCA Antech, Inc.* | | | 34,390 | |

| 550 | | WellCare Health Plans, Inc.* | | | 13,294 | |

| | | | |

| |

| | | | | | 444,487 | |

| | | | |

| |

| | | Insurance — 0.5% | | | | |

| 1,500 | | Flagstone Reinsurance Holdings Ltd. | | | 15,885 | |

| | | | |

| |

31

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

| October 31, 2008 |

|

| | | | | VALUE |

| SHARES | | | | (NOTE 2) |

|

| | | Materials — 1.6% | | | | |

| 1,500 | | Balchem Corp. | | $ | 38,340 | |

| 300 | | Cytec Industries, Inc. | | | 8,496 | |

| | | | |

| |

| | | | | | 46,836 | |

| | | | |

| |

| | | Pharmaceuticals, Biotechnology and Life Sciences — 6.2% | | | | |

| 750 | | Bio-Rad Laboratories, Inc., Class A* | | | 64,035 | |

| 1,730 | | Techne Corp.* | | | 119,405 | |

| | | | |

| |

| | | | | | 183,440 | |

| | | | |

| |

| | | Retailing — 2.5% | | | | |

| 1,200 | | Aéropostale, Inc.* | | | 29,052 | |

| 1,025 | | J. Crew Group, Inc.* | | | 20,756 | |

| 300 | | PetMed Express, Inc.* | | | 5,298 | |

| 350 | | Priceline.com, Inc.* | | | 18,421 | |

| | | | |

| |

| | | | | | 73,527 | |

| | | | |

| |

| | | Semiconductors and Semiconductor Equipment — 1.0% | | | | |

| 950 | | Hittite Microwave Corp.* | | | 31,132 | |

| | | | |

| |

| | | Software and Services — 22.3% | | | | |

| 525 | | ANSYS, Inc.* | | | 15,031 | |

| 900 | | Blackbaud, Inc. | | | 13,680 | |

| 3,825 | | Compuware Corp.* | | | 24,404 | |

| 675 | | Concur Technologies, Inc.* | | | 17,030 | |

| 725 | | FactSet Research Systems, Inc. | | | 28,123 | |

| 1,400 | | Fidelity National Information Services, Inc. | | | 21,126 | |

| 1,000 | | Global Payments, Inc. | | | 40,510 | |

| 5,750 | | Informatica Corp.* | | | 80,787 | |

| 2,677 | | Jack Henry & Associates, Inc. | | | 50,889 | |

| 1,500 | | JDA Software Group, Inc.* | | | 21,420 | |

| 300 | | KONAMI Corp. ADR | | | 5,340 | |

| 1,900 | | Metavante Technologies, Inc.* | | | 31,863 | |

| 3,595 | | MICROS Systems, Inc.* | | | 61,222 | |

| 2,100 | | Parametric Technology Corp.* | | | 27,279 | |

| 2,200 | | Perot Systems Corp., Class A* | | | 31,658 | |

| 1,275 | | Quality Systems, Inc. | | | 49,075 | |

| 2,525 | | Quest Software, Inc.* | | | 33,456 | |

| 1,200 | | SPSS, Inc.* | | | 28,032 | |

| 1,400 | | Sybase, Inc.* | | | 37,282 | |

32

| The FBR Funds |

|

| FBR Pegasus Small Cap Growth FundTM |

| Portfolio of Investments (continued) |

| October 31, 2008 |

|

| | | | | VALUE |

| SHARES | | | | (NOTE 2) |

|

| | | Software and Services — 22.3% (continued) | | | | |

| 885 | | Syntel, Inc. | | $ | 22,010 | |

| 2,000 | | Take-Two Interactive Software, Inc.* | | | 23,720 | |

| | | | |

| |

| | | | | | 663,937 | |

| | | | |

| |

| | | Technology Hardware and Equipment — 3.4% | | | | |

| 1,990 | | CommScope, Inc.* | | | 29,273 | |

| 350 | | Mettler-Toledo International, Inc.* | | | 26,789 | |

| 1,125 | | Polycom, Inc.* | | | 23,636 | |

| 1,725 | | QLogic Corp.* | | | 20,735 | |

| | | | |

| |

| | | | | | 100,433 | |

| | | | |

| |

| | | Telecommunication Services — 1.1% | | | | |

| 1,550 | | SBA Communications Corp., Class A* | | | 32,535 | |

| | | | |

| |

| | | Transportation — 3.8% | | | | |

| 550 | | Con-Way, Inc. | | | 18,722 | |

| 1,375 | | Genessee & Wyoming, Inc.* | | | 45,856 | |

| 1,500 | | JetBlue Airways Corp.* | | | 8,325 | |

| 2,600 | | Knight Transportation, Inc. | | | 41,340 | |

| | | | |

| |

| | | | | | 114,243 | |

| | | | |

| |

| | | Total Common Stocks (Cost $3,593,782) | | | 2,872,856 | |

| | | | |

| |

| | | | | | | |

| | | MONEY MARKET FUND — 5.3% | | | | |

| 159,003 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $159,003) | | | 159,003 | |

| | | | |

| |

| | | Total Investments — 101.9% (Cost $3,752,785) | | | 3,031,859 | |

| | | | | | | |

| | | Liabilities Less Other Assets — (1.9%) | | | (57,608 | ) |

| | | | |

| |

| | | | | | | |

| | | Net Assets — 100.0% | | $ | 2,974,251 | |

| | | | |

| |

|

| * | Non-income producing security |

| ADR | American Depositary Receipts |

The accompanying notes are an integral part of the financial statements.

33

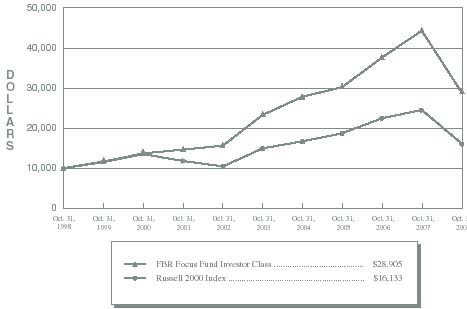

The FBR Funds

FBR Focus Fund

Management Overview

Investment Sub Adviser: Akre Capital Management, LLC

Portfolio Manager: Charles T. Akre, Jr.

As of mid November the S&P 500 Index has declined approximately 45% during the last twelve months. Years of prosperity have led to excesses in the economy, and for years many consumers and businesses alike have used easy credit to spend beyond their means. It is likely to take years for these excesses to be absorbed in our financial system, and as we have already experienced in the stock market, the process of reconciliation will continue to produce distress in many parts of the economy.

Our job as the manager of the Fund is to rise above the emotion of the marketplace, and to remain focused on basic investing principles. We are better able to accomplish this perhaps because we are grounded in certain fundamental truths related to investing. Importantly, we recognize that over long periods of time, the share prices of our holdings should grow at a pace driven by the economics of the underlying businesses. How then do we find businesses with economic characteristics allowing for growth, and more particularly, above average growth in intrinsic value?

Few businesses possess an “economic moat” formed by enduring competitive advantages. Our experience reinforces the fact that it is these moats which enable the businesses to earn higher returns on capital than average. Even fewer businesses have the opportunity to reinvest profits back into the business and earn a high rate of return on incremental invested capital. An even more select group of businesses have the aforementioned characteristics and are managed by honest, smart and shareholder oriented managers. When we identify this tri-fecta in a business and are able to obtain an attractive starting valuation, we may have located a “compounding machine.”

As we think about where we erred we question whether many companies were benefiting from unsustainable levels of demand. We admittedly did not appreciate how a large asset and credit bubble could affect businesses seemingly unrelated to the proximate causes of the bubbles. In some cases, we believe we got the business analysis right and the macroeconomic analysis wrong. Merely by being invested in the stock market we experienced a massive meltdown in value due to the seize-up of the entire financial system.