UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

———————————–

(Exact name of registrant as specified in charter)

1001 Nineteenth Street North

Arlington, VA 22209

————————————————

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 703.469.1040

William Ginivan

General Counsel

FBR Capital Markets Corp.

Potomac Tower

1001 Nineteenth Street North

Arlington, VA 22209

—————————————————————————

(Name and address of agent for service)

Date of fiscal year end: March 31, 2010

Date of reporting period: March 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

THE FBR FUNDS

FBR Balanced Fund

FBR Core Bond Fund

Annual Report

March 31, 2010

[THIS PAGE INTENTIONALLY LEFT BLANK]

The FBR Funds

Annual Letter to Shareholders

Dear Shareholder,

We are pleased to present the Annual Report for the FBR Balanced Fund and FBR Core Bond Fund for the fiscal year ended March 31, 2010.

To investors’ delight, the equity market staged one of the strongest advances in history over the past fiscal year. During the period, the equity market as measured by the S&P 500, a large company index, returned an impressive 49.77%. Since the market hit its low on March 9, 2009, the advance has been extraordinary with the S&P 500 advancing 56.89%. While short-term movements in either direction must be taken into perspective, the strong rebound has started to lift the confidence of investors. Money flow, dominated of late into the fixed income market, is starting to once again return to equities. Investors, who executed the flight to quality in late 2008 and early 2009, are no longer being rewarded with capital appreciation and income streams are difficult at best. During our current environment of historically low interest rates, the yield on fixed income securities, particularly short-term maturities, has been minimal. As of March 31, the yield on a two year Treasury note was only 1.02%. Money market fund returns have been even less with returns barely in positive territory primarily supported by management fee waivers.

As the American economy begins to rebound from one of the worst recessions in decades, the path to recovery may be more extended. High unemployment continues to persist, housing prices are just starting to firm after a period of substantial declines, deficits exist not only at the national level but at many state and local levels as well and tax burdens are rising. Globally, sovereign debt has become troublesome, with Greece, Spain and Portugal experiencing large deficits and downgrades. While the healing process is underway, many systemic issues need to be addressed and government intervention is becoming more commonplace. Rightfully so, many investors remain cautious and more conscious than ever of the trade-off between risk and return.

Against this backdrop, we believe the conservative investment philosophy employed at The FBR Funds bodes well for our shareholders. We strive to manage your money with the objective of protecting principal in declining markets while participating in rising ones. Our motto, Respecting Your Money®, guides all that we do. While short-term performance results can be extreme in both directions, as demonstrated over the past two years, our goal is to deliver out-performance over the long-term with less risk. By reducing volatility, we believe investors are well served. We are pleased to report that The FBR Funds continue to perform well on an absolute and relative basis. By focusing on an investment philosophy that emphasizes companies with strong balance sheets, low debt levels, quality management and sustainable financial results, shareholders of The FBR Funds have been rewarded over time. Each actively managed Fund continues to exceed the return of its benchmark since its inception and peer rankings have been impressive. In fact, 10 of the 11 FBR Funds were awarded a four or five star designation, the top two levels, as of March 31, 2010 by Morningstar, a leading independent mutual fund rating service*. Performance information on both Funds is included in this annual report. Comments and thoughts from each of our portfolio managers are found on the accompanying pages. We hope you find their insight to be informative.

We are pleased to report that the previously announced acquisition of the AFBA 5Star Funds has been completed. As a result, The FBR Funds have expanded in size and breadth. Two AFBA 5Star Funds were renamed and are now part of the FBR family of Funds. The two Funds include the FBR Balanced Fund, a portfolio that includes a blend of large company stocks and high-quality intermediate term fixed

2

income securities and the FBR Core Bond Fund, a high-quality fixed income offering. The equity portion of the FBR Balanced Fund is sub-advised by The London Company and the fixed income portion of the FBR Balanced Fund and FBR Core Bond Fund are sub-advised by Financial Counselors, Inc. We welcome the thousands of shareholders of the former AFBA 5Star Funds to The FBR Funds and look forward to serving your diversified investment needs.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. While none of us can predict the future direction and magnitude of the financial markets with any degree of certainty, you have our assurance that we will manage your money according to our time-tested, risk mitigating investment process. Please feel free to contact us at 888.200.4710 with your questions or comments. We also welcome you to visit www.fbrfunds.com for additional information on the Funds.

Sincerely,

David Ellison

President, Chief Investment Officer and Trustee

The FBR Funds

Past performance is no guarantee of future results. The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance quoted. To obtain performance data current to the most recent quarter-end please call 888.200.4710 or visit www.fbrfunds.com.

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Fund’s prospectus. To obtain a free prospectus, please call 888.200.4710 or visit www.fbrfunds.com. Please read the prospectus carefully before investing.

*The Overall Morningstar RatingTM for a fund is derived from a weighted average of the performance figures associated with its 3-, 5- and 10-yr (if applicable) Morningstar Rating metrics. Morningstar proprietary ratings reflect risk-adjusted performance as of the period stated above. For each fund with at least a 3-yr history, Morningstar calculates a Morningstar RatingTM based on a Morningstar risk-adjusted return measure that accounts for variation in a fund’s monthly performance placing more emphasis on downward variations and rewarding consistent performance. The top 10% of funds in each category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars and the bottom 10% receive 1 star.

3

The FBR Funds

FBR Balanced Fund*

Management Overview; Equity Portfolio

For the fiscal year ended March 31, 2010, the Investor Class of the FBR Balanced Fund returned 32.76% and the I Class returned 33.10%, lagging the S&P 500 Index, which returned 49.77% over the same time period.

Portfolio Manager: Stephen M. Goddard, CFA, Jonathan T. Moody, CFA, and J. Wade Stinnette, Jr., The London Company

Over the past 12 months, how did the equity sleeve of the Balanced Fund perform and what factors contributed to this performance?

The strong performance of our equity sleeve for the one-year period ended March 31st was in spite of the fact that the market’s positive performance was dominated by lower quality securities, an under-exposed area of our portfolio. The market had legitimate concerns about the viability of many over-leveraged companies at the bottom of the recent credit crisis and had accordingly priced many of these lower quality companies for bankruptcy. As the credit crisis passed, and concerns over the viability of these issues eased, the stocks of these companies reacted favorably.

We attribute the relative outperformance of the equity portfolio of the Fund to attractive stock selection during the period. Our investment horizon is three to five years, focusing on our best, undervalued, investment opportunities in higher quality, sustainable franchises. Our investment process is long-term oriented, with a goal of delivering excess, low risk returns over full market cycles.

In the first quarter of 2010, we sold or reduced our position in Altria Group, Berkshire Hathaway, Burlington Northern, IBM, Johnson and Johnson, Markel Preferred, Merck, Novartis, UDR, Inc. and Vulcan Materials. We added to or established positions in Brinks Company, Corrections Corporation of America, Hershey, Verizon,Wells Fargo, and White Mountains Insurance Group. The top five contributors to performance during the quarter were Berkshire Hathaway, Albemarle, Wells Fargo, Universal Corporation, and Intel. Conversely, the top five detractors to performance for the quarter were New Market, Vulcan Materials, Microsoft, Pfizer, and Coca Cola.

To give you a glimpse into the bottom-up selection process, we recently added to Hershey, a dominant, highly profitable franchise in the North American confectionary market. It has basically been forgotten by analysts, due to an ongoing feud between management and the Hershey Trust, hindering its flexibility to maximize shareholder value. It currently trades at a significant discount to its private market value and we believe the takeover probability has increased with the recent mergers of some of its main competitors. The company has had several premium offers over the past decade, and we would not be surprised if another offer surfaces over the next few years and is likely to be successful, due to the limited options remaining to fill the void in the company franchise international distribution.

Our focus on capital preservation and lower downside market participation benefitted overall performance. As a result of our more conservative approach, it is not unusual for the portfolio to lag somewhat during strong bull market moves, but outperform in down markets. Our goal is to outperform the index over the long-term, and importantly, to do that with less risk, as measured by the volatility of the portfolio’s returns.

4

The FBR Funds

FBR Balanced Fund*

Management Overview; Equity Portfolio (continued)

Portfolio managers comments on the Fund and the related investment outlook.

In July of last year, Mohamed El-Erian, co-Chief Executive Officer of Pacific Investment Management Co. (“PIMCO”), currently the largest bond fund manager in the world, compared the stock market rally to being on a “sugar high.” “It feels good for a while but is unsustainable,” El-Erian said. Less than six months later, PIMCO started a stock mutual fund that can also invest in bank loans, junk bonds and distressed securities. “PIMCO is a bond shop, but I think they have a view that bonds will under-perform stocks on a pretty regular basis in the future,” A. Michael Lipper, the head of Lipper Advisory Services Inc., said. We agree and reiterate our belief that stocks will outperform both bonds and cash.

Stocks have continued to outperform through the first quarter of 2010—but why? For starters, the long-term outlook for bonds is not strong. Interest rates are extremely low. For example, buyers of a 10-year U.S. Treasury bond today will receive an average annual return of less than 4% if the bond is held to maturity. Buyers of shorter-term Treasuries would receive even less: 2.7% for five years and less than 2% for three years. With the dividend yield on the S&P 500 Stock Index around 2%, it does not take much in the way of stock price appreciation for the total return of stocks to outperform government bonds. Furthermore, interest rates in our opinion are heading higher. High government fiscal deficits lead to higher debt issuance and ultimately higher interest rates. As rates rise, holders of existing bonds will see their prices decline and principal values erode.

Meanwhile, the ingredients are in place for stocks to continue to outperform. Real Gross Domestic Product, a measure of economic activity, expanded 5.6% in the final quarter of 2009. The largest advance since the third quarter of 2003, and the Index of Leading Economic Indicators continues to point toward sustained economic recovery. Temporary employment, usually a precursor to permanent hiring, has improved along with demand for products and services. Corporate profits rose 8% in the fourth quarter of 2009, and cash flows advanced 4.4%, the most in over a year. As we have stated in the past, many US companies have excess cash on the balance sheet and are in a position to use it to improve shareholder returns through dividend increases, stock repurchases, and M&A activity.

Investors are gradually returning to equities, but at a very cautious pace. Loose monetary policy, generous fiscal stimulus, and positive earnings trends have all contributed to a more stable financial environment and reduced stress in the stock market.

We view the current environment as one of broadening economic recovery marked by improved corporate earnings and accelerated consolidation. While additional short-term corrections cannot be ruled out, we believe the path of least resistance for stocks continues to be up. The prospect for higher returns plus lower volatility will cause investors to put more money in stocks.

5

The FBR Funds

FBR Balanced Fund*

Management Overview; Fixed Income Portfolio

Portfolio Manager: Gary Cloud, CFA and Peter Greig, CFA, Financial Counselors, Inc.

Over the past 12 months, how did the fixed income sleeve of the Balanced Fund perform and what factors contributed to this performance?

Our straightforward approach to fixed income investment management is focused on preserving principal and generating income. We are not managers who leverage client funds to amplify returns. We have a well-defined investment process that emphasizes fundamental credit analysis. We employ a risk-conscious approach that aims to identify attractive opportunities with prudent risk and return, rather than exposing the portfolio to the unpredictability of exotic trading strategies using currency bets and short sales. We seek to invest in high quality, intermediate-term, investment-grade securities that are generally transparent, liquid, and dollar-denominated. And despite our more conservative approach, our relative performance compares well against other managers who may utilize riskier tools to pursue greater yield. That is because, above all, protecting against downside risk is just as important as participating on the upside.

After enduring a difficult recessionary period, economic barometers are starting to show signs of recovery. Corporate America has strengthened its balance sheet, core inflation has been contained and domestic GDP posted 3-4% growth in the first quarter of 2010 and is likely to continue apace into the second quarter of this year. That said, we continue to believe that the economy will face headwinds in the second half of the year, but we do not anticipate anything worse than slowed growth. We believe consumer demand has been largely supported by the top 25% of wage earners, many of whom face the risk of rising tax levels next year and may find it increasingly difficult to sustain their current pace of consumption. State and local governments struggle with the challenge of falling tax revenues and higher expenditures, and the Federal budget picture continues to worsen. Our country’s employment picture is improving, but needs to strengthen further in order to offset the reduction in stimulus programs and the expiration of housing tax credit in order to support sustainable economic growth.

Late last year there was heightened concern for the impending impact that a cessation of the Federal Reserve’s quantitative easing would have on the market, but as it turns out, it was a non-event. Interest rates continue to be at historically low levels, though they cannot stay at these levels indefinitely. U.S. Treasury securities have traded in a tight band in 2010 and we expect the market to have a negative reaction when the Federal Reserve begins to tighten monetary policy. Given the backdrop of a potentially rising interest rate environment, we have found the greatest opportunity for appreciation in high quality, intermediate-term corporate bonds, and have been overweight in the 3-year and 5-year range. The fixed income portion of the Fund has roughly 70% of its holdings in high quality, corporate credit, which includes a slight 8% exposure in high yield exchange-traded funds and preferred securities. This yield-focused and generally high quality blended corporate mix provides additional interest income that can help supplement incremental return if rates begin to move higher.

Portfolio managers comments on the Fund and the related investment outlook.

A change in the forward-looking statement contained within the minutes of the Federal Open Market Committee may be the single biggest market driver to occur over the balance

6

The FBR Funds

FBR Balanced Fund*

Management Overview; Fixed Income Portfolio (continued)

of this year. U.S. Treasury securities have traded in a tight band year-to-date, and we expect the market to have a negative response when the Federal Reserve begins to tighten monetary policy.

European deficit problems have also ignited pressure on global fixed income markets and have served to drive our domestic market rates lower. The potential bailout of Greece by other members of the European Union and the International Monetary Fund was called into question, and fears of contagion rapidly spread. Riskier asset classes were sold off indiscriminately, and investors sought shelter in safer securities, such as U.S. dollar-denominated fixed-income instruments. This will likely help to keep market rates low in the near term, but within a broad trading range based on fears of contagion from the sovereign debt problems in Europe.

In the near-term, we will continue to pursue greater yield opportunities in high quality, intermediate-term corporate bonds. We anticipate maintaining this intermediate-term core strategy as it allows us to pursue attractive yield opportunities in high quality, investment-grade securities. This yield-focused and generally high quality blended corporate mix should also provide additional interest income that can help provide incremental return in a potentially rising rate environment.

* The FBR Balanced Fund is the successor to the AFBA 5Star Balanced Fund. On March 12, 2010, the FBR Balanced Fund acquired all of the assets and all of the liabilities of the AFBA 5Star Balanced Fund in a reorganization transaction that was approved by shareholders of the AFBA 5Star Balanced Fund. The performance presented for the FBR Balanced Fund for the period prior to March 12, 2010 reflects the performance of the applicable classes of shares of the AFBA 5Star Balanced Fund.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

7

The FBR Funds

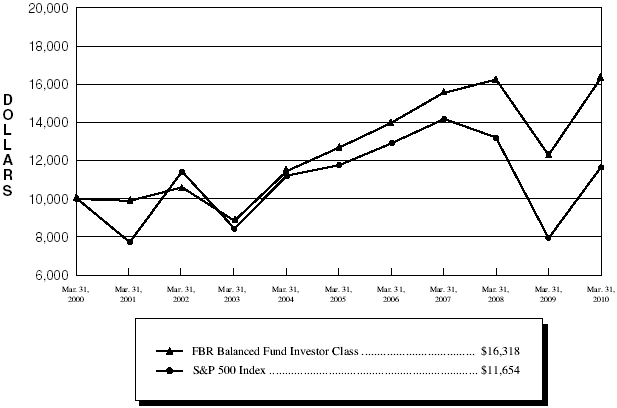

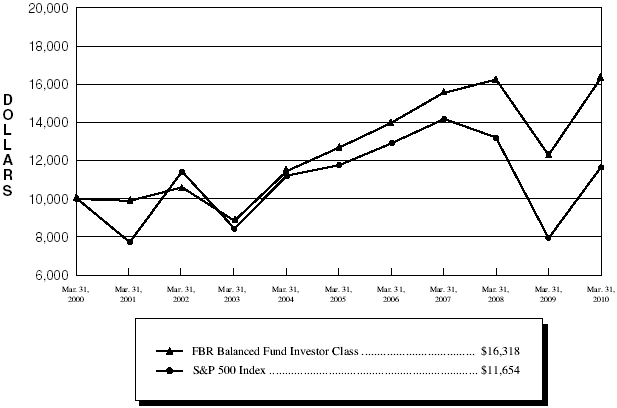

FBR Balanced Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2)(5) vs. S&P 500 Index(1)(3)

| Total Returns—For the Periods Ended March 31, 2010(4) |

| | | | | | | Annualized | | Annualized | |

| | | | One Year | | Five Year | | Ten Year | |

| | | |

| |

| |

| |

FBR Balanced Fund Investor Class(1)(2)(5) | | | 32.76 | % | | 5.17 | % | | 5.02 | % | |

FBR Balanced Fund I Class(2)(5) | | | 33.10 | % | | 5.42 | % | | 5.18 | % | |

S&P 500 Index(1)(3) | | | 49.77 | % | | 1.92 | % | | (0.65 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Investor Class shares of the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. and the Fund’s predecessor investment adviser each waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic ecomony through changes in aggregate market value of 500 stocks representing all major industries. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | The Fund is the investment successor to the AFBA 5Star Balanced Fund which commenced investment operations on June 3, 1997. On March 12, 2010, the AFBA 5Star Balanced Fund was reorganized into the Fund. The performance presented for the Investor Class of the Fund for the period prior to March 12, 2010 reflects the performance of the Advisor Class shares of the AFBA 5Star Balanced Fund and the performance presented for the I Class of the Fund for the period prior to March 12, 2010 reflects the performance of the Class I shares of the AFBA 5Star Balanced Fund. The performance of the Advisor Class shares of the AFBA 5Star Balanced Fund for the period prior to September 24, 2001 includes the performance of the Class I shares of the AFBA 5Star Balanced Fund. |

8

The FBR Funds

FBR Balanced Fund

Portfolio Summary

March 31, 2010

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Common Stocks | | 60.6 | % |

Consumer Non-Durables | 12.3 | % |

Finance | | 6.7 | % |

Health Technology | | 6.3 | % |

Process Industries | | 6.2 | % |

Technology Services | | 4.3 | % |

Energy Minerals | | 4.1 | % |

Retail Trade | | 4.0 | % |

Transportation | | 3.8 | % |

Utilities | | 3.7 | % |

Commercial Services | | 3.2 | % |

Electronic Technology | | 2.6 | % |

Miscellaneous | | 3.4 | % |

| Corporate Bonds | | 22.2 | % |

Finance | | 10.3 | % |

Communications | | 2.0 | % |

Consumer Non-Durables | 1.3 | % |

Electronic Technology | | 1.3 | % |

Producer Manufacturing | | 1.1 | % |

Non-Energy Minerals | | 0.8 | % |

Consumer Services | | 0.7 | % |

Miscellaneous | | 4.7 | % |

| U.S. Treasury Obligations | 6.8 | % |

| U.S. Government Agency Obligations | 4.6 | % |

| Exchange Traded Funds | 3.3 | % |

| Asset-Backed Securities | 1.4 | % |

| | | | |

| Cash | | 1.1 | % |

9

The FBR Funds

FBR Balanced Fund

Portfolio of Investments

March 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 60.4% | | | | |

| | | | Commercial Services — 3.2% | | | | |

| | 57,000 | | Corrections Corporation of America* | | $ | 1,132,020 | |

| | 57,000 | | The Brink’s Co. | | | 1,609,110 | |

| | | | | |

| |

| | | | | | | 2,741,130 | |

| | | | | |

| |

| | | | Communications — 2.2% | | | | |

| | 62,000 | | Verizon Communications, Inc. | | | 1,923,240 | |

| | | | | |

| |

| | | | | | | | |

| | | | Consumer Non-Durables — 12.2% | | | | |

| | 78,539 | | Altria Group, Inc. | | | 1,611,620 | |

| | 26,242 | | Brown-Forman Corp., Class B | | | 1,560,087 | |

| | 12,822 | | Lorillard, Inc. | | | 964,728 | |

| | 19,782 | | Philip Morris International, Inc. | | | 1,031,829 | |

| | 40,000 | | The Coca-Cola Co. | | | 2,200,000 | |

| | 35,000 | | The Hershey Co. | | | 1,498,350 | |

| | 30,893 | | Universal Corp. | | | 1,627,752 | |

| | | | | |

| |

| | | | | | | 10,494,366 | |

| | | | | |

| |

| | | | Electronic Technology — 2.6% | | | | |

| | 100,000 | | Intel Corp. | | | 2,226,000 | |

| | | | | |

| |

| | | | | | | | |

| | | | Energy Minerals — 4.1% | | | | |

| | 23,400 | | Chevron Corp. | | | 1,774,422 | |

| | 35,000 | | ConocoPhillips | | | 1,790,950 | |

| | | | | |

| |

| | | | | | | 3,565,372 | |

| | | | | |

| |

| | | | Finance — 6.6% | | | | |

| | 24,795 | | Berkshire Hathaway, Inc., Class B* | | | 2,015,090 | |

| | 83,500 | | Wells Fargo & Co. | | | 2,598,520 | |

| | 3,100 | | White Mountains Insurance Group Ltd. | | | 1,100,500 | |

| | | | | |

| |

| | | | | | | 5,714,110 | |

| | | | | |

| |

| | | | Health Technology — 6.3% | | | | |

| | 50,000 | | Bristol-Myers Squibb Co. | | | 1,335,000 | |

| | 24,700 | | Johnson & Johnson | | | 1,610,440 | |

| | 19,475 | | Novartis AG ADR | | | 1,053,597 | |

| | 83,000 | | Pfizer, Inc. | | | 1,423,450 | |

| | | | | |

| |

| | | | | | | 5,422,487 | |

| | | | | |

| |

10

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | | | | | | VALUE | |

| | SHARES | | | | | | | | | | | | (NOTE 2) | |

|

| | | | Process Industries — 6.2% | | | | | | | | | | | |

| | 61,500 | | Albemarle Corp. | | | | | | | | | $ | 2,621,745 | |

| | 26,070 | | NewMarket Corp. | | | | | | | | | | 2,684,949 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 5,306,694 | |

| | | | | | | | | | | | |

| |

| | | | Real Estate Investment Trust — 1.2% | | | | | | | | | | | |

| | 60,599 | | UDR, Inc. | | | | | | | | | | 1,068,966 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Retail Trade — 4.0% | | | | | | | | | | | |

| | 69,853 | | Lowe’s Companies, Inc. | | | | | | | | | | 1,693,237 | |

| | 31,838 | | Wal-Mart Stores, Inc. | | | | | | | | | | 1,770,193 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 3,463,430 | |

| | | | | | | | | | | | |

| |

| | | | Technology Services — 4.3% | | | | | | | | | | | |

| | 12,300 | | International Business Machines Corp. | | | | | | | | | | 1,577,475 | |

| | 72,248 | | Microsoft Corp. | | | | | | | | | | 2,114,699 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 3,692,174 | |

| | | | | | | | | | | | |

| |

| | | | Transportation — 3.8% | | | | | | | | | | | |

| | 53,500 | | Alexander & Baldwin, Inc. | | | | | | | | | | 1,768,175 | |

| | 16,000 | | FedEx Corp. | | | | | | | | | | 1,494,400 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 3,262,575 | |

| | | | | | | | | | | | |

| |

| | | | Utilities — 3.7% | | | | | | | | | | | |

| | 54,000 | | Dominion Resources, Inc. | | | | | | | | | | 2,219,940 | |

| | 60,315 | | Duke Energy Corp. | | | | | | | | | | 984,341 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 3,204,281 | |

| | | | | | | | | | | | |

| |

| | | | Total Common Stocks (Cost $45,996,802) | | | | | | | | | | 52,084,825 | |

| | | | | | | | | | | | |

| |

| | | | PREFERRED STOCK — N.M. | | | | | | | | | | | |

| | | | Finance — N.M. | | | | | | | | | | | |

| | 13,600 | | Federal National Mortgage Association, Perpetual, Series S, | | | | | | | | | | | |

| | | | 8.25%, due 12/31/10 (Cost $340,000)*(a) | | | | | | | | | | 17,272 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | | | | | | MATURITY | | | | | |

| | PAR | | | | RATE | | | DATE | | | | | |

| |

| | | |

| | |

| | | | | |

| | | | | | | | | | | | | | | |

| | | | ASSET-BACKED SECURITIES — 1.4% | | | | | | | | | | | |

| $ | 1,150,000 | | Chase Issuance Trust, Series 2007-A15, Class A | | 4.960 | % | | 9/17/12 | | | | 1,174,929 | |

| | 37,551 | | Capital Auto Receivables Asset Trust, Series 2006-2, | | | | | | | | | | | |

| | | | Class A3B(a) | | 0.290 | | | 5/15/11 | | | | 37,542 | |

| | | | | | | | | | | | |

| |

| | | | Total Asset-Backed Securities (Cost $1,169,097) | | | | | | | | | | 1,212,471 | |

| | | | | | | | | | | | |

| |

11

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | VALUE | |

| | PAR | | | | RATE | | | DATE | | (NOTE 2) | |

|

| | | | CORPORATE BONDS — 22.2% | | | | | | | | | | | |

| | | | Communications — 2.0% | | | | | | | | | | | |

| $ | 250,000 | | AT&T, Inc. | | 6.700 | % | | | 11/15/13 | | | $ | 285,504 | |

| | 225,000 | | AT&T, Inc. | | 4.950 | | | | 1/15/13 | | | | 241,851 | |

| | 300,000 | | Deutsche Telekom International Finance BV | | 5.875 | | | | 8/20/13 | | | | 327,415 | |

| | 150,000 | | Verizon Communications, Inc. | | 8.750 | | | | 11/1/18 | | | | 188,474 | |

| | 350,000 | | Verizon Communications, Inc. | | 5.250 | | | | 4/15/13 | | | | 382,643 | |

| | 275,000 | | Vodafone Group PLC | | 5.350 | | | | 2/27/12 | | | | 293,342 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,719,229 | |

| | | | | | | | | | | | |

| |

| | | | Consumer Durables — 0.4% | | | | | | | | | | | |

| | 300,000 | | Toyota Motor Credit Corp. | | 5.170 | | | | 1/11/12 | | | | 302,274 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Consumer Non-Durables — 1.3% | | | | | | | | | | | |

| | 150,000 | | Anheuser-Busch InBev Worldwide, Inc.(b) | | 7.750 | | | | 1/15/19 | | | | 178,701 | |

| | 350,000 | | Diageo Capital PLC | | 7.375 | | | | 1/15/14 | | | | 407,367 | |

| | 450,000 | | The Coca-Cola Co. | | 5.350 | | | | 11/15/17 | | | | 495,846 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,081,914 | |

| | | | | | | | | | | | |

| |

| | | | Consumer Services — 0.7% | | | | | | | | | | | |

| | 400,000 | | Comcast Corp. | | 5.500 | | | | 3/15/11 | | | | 416,251 | |

| | 150,000 | | Marriott International, Inc., Series J | | 5.625 | | | | 2/15/13 | | | | 159,700 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 575,951 | |

| | | | | | | | | | | | |

| |

| | | | Electronic Technology — 1.3% | | | | | | | | | | | |

| | 275,000 | | Corning, Inc. | | 6.050 | | | | 6/15/15 | | | | 276,501 | |

| | 350,000 | | Dell, Inc. | | 4.700 | | | | 4/15/13 | | | | 376,232 | |

| | 250,000 | | Hewlett-Packard Co. | | 4.500 | | | | 3/1/13 | | | | 267,858 | |

| | 220,000 | | The Boeing Co. | | 5.000 | | | | 3/15/14 | | | | 238,374 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,158,965 | |

| | | | | | | | | | | | |

| |

| | | | Energy Minerals — 0.4% | | | | | | | | | | | |

| | 200,000 | | Devon Energy Corp. | | 5.625 | | | | 1/15/14 | | | | 218,918 | |

| | 150,000 | | Husky Energy, Inc. | | 5.900 | | | | 6/15/14 | | | | 163,394 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 382,312 | |

| | | | | | | | | | | | |

| |

| | | | Finance — 10.3% | | | | | | | | | | | |

| | 250,000 | | Aflac, Inc. | | 8.500 | | | | 5/15/19 | | | | 301,509 | |

| | 60,000 | | American Express Credit Corp., Series C | | 7.300 | | | | 8/20/13 | | | | 67,396 | |

| | 275,000 | | American Express Travel Related Services | | | | | | | | | | | |

| | | | Company, Inc.(b) | | 5.250 | | | | 11/21/11 | | | | 287,516 | |

12

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | VALUE | |

| | PAR | | | | RATE | | | DATE | | (NOTE 2) | |

|

| | | | Finance — 10.3% (continued) | | | | | | | | | | | |

| $ | 300,000 | | Associates Corporation of North America | | 6.950 | % | | | 11/1/18 | | | $ | 316,665 | |

| | 250,000 | | Bank of America Corp. | | 5.375 | | | | 9/11/12 | | | | 265,673 | |

| | 300,000 | | Citigroup, Inc. | | 6.000 | | | | 2/21/12 | | | | 318,322 | |

| | 175,000 | | Citigroup, Inc. | | 6.125 | | | | 11/21/17 | | | | 180,290 | |

| | 375,000 | | CME Group, Inc. | | 5.750 | | | | 2/15/14 | | | | 412,040 | |

| | 225,000 | | Credit Suisse USA, Inc. | | 6.125 | | | | 11/15/11 | | | | 241,811 | |

| | 275,000 | | Credit Suisse USA, Inc. | | 5.125 | | | | 8/15/15 | | | | 294,848 | |

| | 250,000 | | Fifth Third Bancorp | | 6.250 | | | | 5/1/13 | | | | 269,049 | |

| | 160,000 | | Jefferies Group, Inc. | | 8.500 | | | | 7/15/19 | | | | 177,785 | |

| | 346,000 | | JPMorgan Chase & Co. | | 5.750 | | | | 1/2/13 | | | | 375,743 | |

| | 300,000 | | KeyCorp | | 6.500 | | | | 5/14/13 | | | | 320,598 | |

| | 325,000 | | Merrill Lynch & Company, Inc. | | 5.770 | | | | 7/25/11 | | | | 343,453 | |

| | 250,000 | | Merrill Lynch & Company, Inc., Series MTNC(a) | | 0.711 | | | | 1/15/15 | | | | 233,127 | |

| | 100,000 | | MetLife, Inc., Series A | | 6.817 | | | | 8/15/18 | | | | 111,109 | |

| | 222,000 | | MetLife, Inc. | | 6.125 | | | | 12/1/11 | | | | 237,603 | |

| | 250,000 | | Morgan Stanley | | 4.750 | | | | 4/1/14 | | | | 255,500 | |

| | 250,000 | | Nationwide Life Global Funding I(a)(b) | | 0.451 | | | | 5/19/10 | | | | 249,626 | |

| | 350,000 | | New York Life Global Funding(b) | | 5.250 | | | | 10/16/12 | | | | 377,851 | |

| | 285,000 | | Prudential Financial, Inc., Series MTNB | | 5.100 | | | | 9/20/14 | | | | 301,325 | |

| | 150,000 | | Regions Financial Corp. | | 7.750 | | | | 11/10/14 | | | | 157,973 | |

| | 375,000 | | SunTrust Banks, Inc. | | 5.250 | | | | 11/5/12 | | | | 395,754 | |

| | 250,000 | | SunTrust Banks, Inc. | | 6.000 | | | | 9/11/17 | | | | 253,603 | |

| | 150,000 | | Swiss Re Solutions Holding Corp. | | 7.000 | | | | 2/15/26 | | | | 152,396 | |

| | 350,000 | | The Allstate Corp. | | 5.000 | | | | 8/15/14 | | | | 374,377 | |

| | 125,000 | | The Goldman Sachs Group, Inc. | | 5.700 | | | | 9/1/12 | | | | 135,645 | |

| | 125,000 | | The Goldman Sachs Group, Inc. | | 6.600 | | | | 1/15/12 | | | | 135,688 | |

| | 300,000 | | The Hartford Financial Services Group, Inc. | | 5.375 | | | | 3/15/17 | | | | 300,653 | |

| | 250,000 | | The Progressive Corp. | | 6.375 | | | | 1/15/12 | | | | 270,377 | |

| | 300,000 | | Wachovia Corp. | | 5.250 | | | | 8/1/14 | | | | 315,420 | |

| | 400,000 | | Wells Fargo & Co. | | 5.250 | | | | 10/23/12 | | | | 431,202 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 8,861,927 | |

| | | | | | | | | | | | |

| |

| | | | Health Services — 0.5% | | | | | | | | | | | |

| | 150,000 | | CIGNA Corp. | | 8.500 | | | | 5/1/19 | | | | 182,137 | |

| | 250,000 | | UnitedHealth Group, Inc. | | 5.375 | | | | 3/15/16 | | | | 263,834 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 445,971 | |

| | | | | | | | | | | | |

| |

13

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | VALUE | |

| | PAR | | | | RATE | | | DATE | | (NOTE 2) | |

|

| | | | Health Technology — 0.7% | | | | | | | | | | | |

| $ | 325,000 | | GlaxoSmithKline Capital, Inc. | | 4.850 | % | | | 5/15/13 | | | $ | 352,524 | |

| | 220,000 | | Pfizer, Inc. | | 5.350 | | | | 3/15/15 | | | | 242,673 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 595,197 | |

| | | | | | | | | | | | |

| |

| | | | Non-Energy Minerals — 0.8% | | | | | | | | | | | |

| | 350,000 | | Barrick Gold Financeco LLC | | 6.125 | | | | 9/15/13 | | | | 390,227 | |

| | 250,000 | | BHP Billiton Finance USA Ltd. | | 6.750 | | | | 11/1/13 | | | | 282,372 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 672,599 | |

| | | | | | | | | | | | |

| |

| | | | Process Industries — 0.6% | | | | | | | | | | | |

| | 315,000 | | EI du Pont de Nemours & Co. | | 4.750 | | | | 3/15/15 | | | | 337,371 | |

| | 150,000 | | International Paper Co. | | 9.375 | | | | 5/15/19 | | | | 187,817 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 525,188 | |

| | | | | | | | | | | | |

| |

| | | | Producer Manufacturing — 1.1% | | | | | | | | | | | |

| | 325,000 | | Caterpillar Financial Services Corp. | | 4.900 | | | | 8/15/13 | | | | 351,245 | |

| | 250,000 | | General Electric Capital Corp. | | 5.500 | | | | 6/4/14 | | | | 270,323 | |

| | 125,000 | | General Electric Capital Corp. | | 4.800 | | | | 5/1/13 | | | | 132,936 | |

| | 150,000 | | Tyco International Finance SA | | 8.500 | | | | 1/15/19 | | | | 186,325 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 940,829 | |

| | | | | | | | | | | | |

| |

| | | | Real Estate Investment Trust — 0.4% | | | | | | | | | | | |

| | 325,000 | | Boston Properties LP | | 6.250 | | | | 1/15/13 | | | | 352,474 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Retail Trade — 0.6% | | | | | | | | | | | |

| | 300,000 | | Best Buy Company, Inc. | | 6.750 | | | | 7/15/13 | | | | 336,032 | |

| | 200,000 | | The Home Depot, Inc. | | 5.400 | | | | 3/1/16 | | | | 216,394 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 552,426 | |

| | | | | | | | | | | | |

| |

| | | | Technology Services — 0.3% | | | | | | | | | | | |

| | 250,000 | | International Business Machines Corp. | | 6.500 | | | | 10/15/13 | | | | 287,192 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Transportation — 0.4% | | | | | | | | | | | |

| | 300,000 | | FedEx Corp. | | 7.375 | | | | 1/15/14 | | | | 344,795 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Utilities — 0.4% | | | | | | | | | | | |

| | 275,000 | | Sempra Energy | | 6.500 | | | | 6/1/16 | | | | 307,620 | |

| | | | | | | | | | | | |

| |

| | | | Total Corporate Bonds (Cost $17,441,585) | | | | | | | | | | 19,106,863 | |

| | | | | | | | | | | | |

| |

14

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | | VALUE | |

| | PAR | | | | RATE | | | DATE | | | (NOTE 2) | |

|

| | | | U.S. GOVERNMENT AGENCY OBLIGATIONS — 4.6% | | | | | | | | | | | |

| $ | 449,327 | | Federal Home Loan Mortgage Corp. | | 5.000 | % | | | 5/1/20 | | | $ | 478,591 | |

| | 886,094 | | Federal Home Loan Mortgage Corp. | | 5.500 | | | | 4/1/37 | | | | 937,611 | |

| | 205,000 | | Federal National Mortgage Association | | 4.625 | | | | 10/15/14 | | | | 222,874 | |

| | 400,000 | | Federal National Mortgage Association*(c) | | 3.000 | | | | 12/28/16 | | | | 401,749 | |

| | 250,000 | | Federal National Mortgage Association | | 5.375 | | | | 6/12/17 | | | | 277,247 | |

| | 679,059 | | Federal National Mortgage Association | | 4.500 | | | | 8/1/20 | | | | 705,591 | |

| | 858,867 | | Federal National Mortgage Association | | 6.000 | | | | 10/1/37 | | | | 913,365 | |

| | | | | | | | | | | | |

| |

| | | | Total U.S. Government Agency Obligations (Cost $3,738,732) | | | | | | | | | | 3,937,028 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | U.S. TREASURY OBLIGATIONS — 6.8% | | | | | | | | | | | |

| | 1,620,000 | | U.S. Treasury Bond | | 5.000 | | | | 5/15/37 | | | | 1,706,317 | |

| | 300,000 | | U.S. Treasury Inflation Indexed Note(d) | | 2.500 | | | | 1/15/29 | | | | 320,755 | |

| | 1,150,000 | | U.S. Treasury Note | | 2.250 | | | | 1/31/15 | | | | 1,137,872 | |

| | 2,095,000 | | U.S. Treasury Note | | 4.750 | | | | 8/15/17 | | | | 2,292,225 | |

| | 400,000 | | U.S. Treasury Note | | 3.750 | | | | 11/15/18 | | | | 403,157 | |

| | | | | | | | | | | | |

| |

| | | | Total U.S. Treasury Obligations (Cost $5,891,068) | | | | | | | | | | 5,860,326 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | SHARES | | | | | | | | | | | | | |

| |

| | | | | | | | | | | | | |

| | | | EXCHANGE TRADED FUNDS — 3.2% | | | | | | | | | | | |

| | 13,625 | | iShares iBoxx $High Yield Corporate Bond Fund | | | | | | | | | | 1,204,041 | |

| | 11,050 | | iShares S&P U.S. Preferred Stock Index Fund | | | | | | | | | | 427,856 | |

| | 29,450 | | SPDR Barclays Capital High Yield Bond Fund | | | | | | | | | | 1,171,816 | |

| | | | | | | | | | | | |

| |

| | | | Total Exchange Traded Funds (Cost $2,721,943) | | | | | | | | | | 2,803,713 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | MONEY MARKET FUND — 1.1% | | | | | | | | | | | |

| | 937,937 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund | | | | | | | | | | | |

| | | | (Cost $937,937) | | | | | | | | | | 937,937 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Total Investments — 99.7% (Cost $78,237,164) | | | | | | | | | | 85,960,435 | |

| | | | | | | | | | | | | | | |

| | | | Other Assets Less Liabilities — 0.3% | | | | | | | | | | 251,352 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Net Assets — 100.0% | | | | | | | | | $ | 86,211,787 | |

| | | | | | | | | | | | |

| |

15

The FBR Funds

FBR Balanced Fund

Portfolio of Investments (continued)

March 31, 2010

|

| * | | Non-income producing security |

| (a) | | Variable/floating rate security |

| (b) | | This security is a restricted security under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2010, the total amount of 144A securities was $1,093,694, or 1.3% of total net assets. |

| (c) | | Stepped coupon bond - the rate shown is the rate in effect on March 31, 2010. |

| (d) | | Treasury Inflation Protected Security |

| | | |

| ADR | | American Depositary Receipts |

| LLC | | Limited Liability Company |

| LP | | Limited Partnership |

| N.M. | | Not meaningful |

| PLC | | Public Liability Company |

The accompanying notes are an integral part of the financial statements.

16

The FBR Funds

FBR Core Bond Fund*

Management Overview

Portfolio Manager: Gary Cloud, CFA and Peter Greig, CFA, Financial Counselors, Inc.

Over the past 12 months, how did the Core Bond Fund perform and what factors contributed to this performance?

For the fiscal year ended March 31, 2010, the Investor Class of the FBR Core Bond Fund returned 12.33% and the I Class returned 12.62%. This compares favorably to the Fund’s benchmark, the Barclays Capital Intermediate U.S. Government/Credit Index, which returned 6.92% over the same period.

Our straightforward approach to fixed income investment management is focused on preserving principal and generating income. We are not managers who leverage client funds to amplify returns. We have a well-defined investment process that emphasizes fundamental credit analysis. We employ a risk-conscious approach that aims to identify attractive opportunities with prudent risk and return, rather than exposing the portfolio to the unpredictability of exotic trading strategies using currency bets and short sales. We seek to invest in high quality, intermediate-term, investment-grade securities that are generally transparent, liquid, and dollar-denominated. And despite our more conservative approach, our relative performance compares well against other managers who may utilize riskier tools to pursue greater yield. That is because, above all, protecting against downside risk is just as important as participating on the upside.

After enduring a difficult recessionary period, economic barometers are starting to show signs of recovery. Corporate America has strengthened its balance sheet, core inflation has been contained and domestic GDP posted 3-4% growth in the first quarter of 2010 and is likely to continue apace into the second quarter of this year. That said, we continue to believe that the economy will face headwinds in the second half of the year, but we do not anticipate anything worse than slowed growth. We believe consumer demand has been largely supported by the top 25% of wage earners, many of whom face the risk of rising tax levels next year and may find it increasingly difficult to sustain their current pace of consumption. State and local governments struggle with the challenge of falling tax revenues and higher expenditures, and the Federal budget picture continues to worsen. Our country’s employment picture is improving, but needs to strengthen further in order to offset the reduction in stimulus programs and the expiration of housing tax credit in order to support sustainable economic growth.

Late last year there was heightened concern for the impending impact that a cessation of the Federal Reserve’s quantitative easing would have on the market, but as it turns out, it was a non-event. Interest rates continue to be at historically low levels, though they cannot stay at these levels indefinitely. U.S. Treasury securities have traded in a tight band in 2010 and we expect the market to have a negative reaction when the Federal Reserve begins to tighten monetary policy. Given the backdrop of a potentially rising rate environment, we have found the greatest opportunity for appreciation in high quality, intermediate-term corporate bonds, and have been overweight in the 3-year and 5-year range. The Fund has roughly 70% of its holdings in high quality, corporate credit, which includes a slight 8% exposure in high yield exchange-traded funds and preferred securities. This yield-focused

17

The FBR Funds

FBR Core Bond Fund*

Management Overview (continued)

and generally high quality blended corporate mix provides additional interest income that can help supplement incremental return if rates begin to move higher.

Portfolio managers comments on the Fund and the related investment outlook.

A change in the forward-looking statement contained within the minutes of the Federal Open Market Committee may be the single biggest market driver to occur over the balance of this year. U.S. Treasury securities have traded in a tight band year-to-date, and we expect the market to have a negative response when the Federal Reserve begins to tighten monetary policy.

European deficit problems have also ignited pressure on global fixed income markets and have served to drive our domestic market rates lower. The potential bailout of Greece by other members of the European Union and the International Monetary Fund was called into question, and fears of contagion rapidly spread. Riskier asset classes were sold off indiscriminately, and investors sought shelter in safer securities, such as U.S. dollar-denominated fixed-income instruments. This will likely help to keep market rates low in the near term, but within a broad trading range based on fears of contagion from the sovereign debt problems in Europe.

In the near-term, we will continue to pursue greater yield opportunities in high quality, intermediate-term corporate bonds. We anticipate maintaining this intermediate-term core strategy as it allows us to pursue attractive yield opportunities in high quality, investment-grade securities. This yield-focused and generally high quality blended corporate mix should also provide additional interest income that can help provide incremental return in a potentially rising rate environment.

* The FBR Core Bond Fund is the successor to the AFBA 5Star Total Return Bond Fund. On March 12, 2010, the FBR Core Bond Fund acquired all of the assets and all of the liabilities of the AFBA 5Star Total Return Bond Fund in a reorganization transaction that was approved by shareholders of the AFBA 5Star Total Return Bond Fund. The performance presented for the FBR Core Bond Fund for the period prior to March 12, 2010 reflects the performance of the applicable classes of shares of the AFBA 5Star Total Return Bond Fund.

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

18

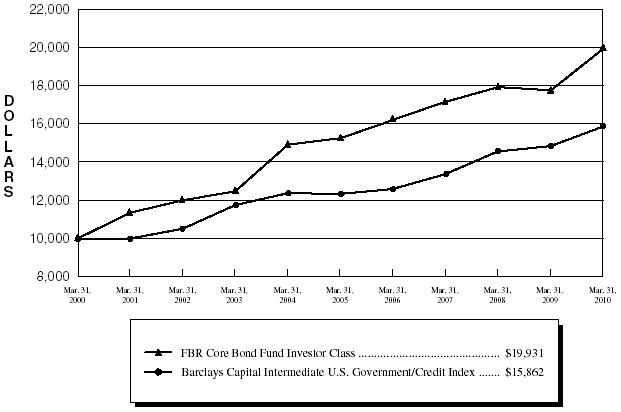

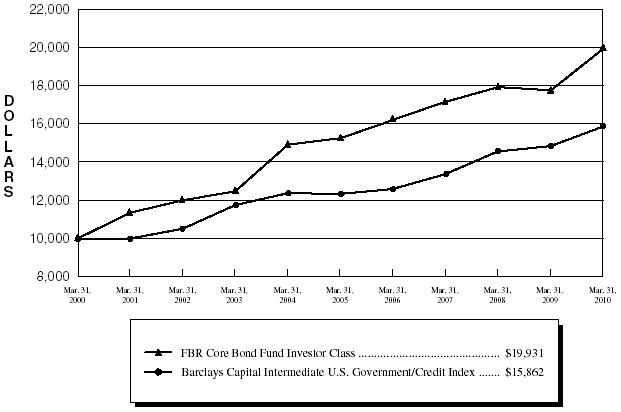

The FBR Funds

FBR Core Bond Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2)(5) vs. Barclays Capital Intermediate U.S. Government/Credit Index(1)(3)

| Total Returns—For the Periods Ended March 31, 2010(4) |

| | | | | | | Annualized | | Annualized | |

| | | | One Year | | Five Year | | Ten Year | |

| | | |

| |

| |

| |

FBR Core Bond Fund Investor Class(1)(2)(5) | | | 12.33 | % | | 5.51 | % | | 7.14 | % | |

FBR Core Bond Fund I Class(2)(5) | | | 12.62 | % | | 5.76 | % | | 7.18 | % | |

Barclays Capital Intermediate U.S. Government/Credit Index(1)(3) | | | 6.92 | % | | 5.16 | % | | 5.93 | % | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. If reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710 or visit www.fbrfunds.com.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Investor Class shares of the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. and the Fund’s predecessor investment adviser each waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Barclays Capital Intermediate U.S. Government/Credit Index measures the performance of U.S. dollar denominated U.S. Treasuries, government-related and investment grade U.S. corporate securities that have a remaining maturity of greater than or equal to 1 year and less than 10 years. Securities have $250 million or more of outstanding face value and must be fixed rate and non-convertible. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | The Fund is the investment successor to the AFBA 5Star Total Return Bond Fund which commenced investment operations on June 3, 1997. On March 12, 2010, the AFBA 5Star Total Return Bond Fund was reorganized into the Fund. The performance presented for the Investor Class of the Fund for the period prior to March 12, 2010 reflects the performance of the Advisor Class shares of the AFBA 5Star Total Return Bond Fund and the performance presented for the I Class of the Fund for the period prior to March 12, 2010 reflects the performance of the Class I shares of the AFBA 5Star Total Return Bond Fund. The performance of the Advisor Class shares of the AFBA 5Star Total Return Bond Fund for the period prior to September 24, 2001 includes the performance of the Class I shares of the AFBA 5Star Total Return Bond Fund. |

19

The FBR Funds

FBR Core Bond Fund

Portfolio Summary

March 31, 2010

The following provides a breakdown of the Fund by industry sector. The underlying securities represent a percentage of the portfolio investments.

| Industry Sectors | | % of Total Investments |

| |

|

| Corporate Bonds | | 57.6 | % |

Finance | | 25.3 | % |

Communications | | 4.5 | % |

Consumer Non-Durables | | 3.9 | % |

Electronic Technology | | 3.8 | % |

Retail Trade | | 3.6 | % |

Producer Manufacturing | | 3.5 | % |

Consumer Services | | 3.4 | % |

Health Technology | | 2.1 | % |

Process Industries | | 1.7 | % |

Energy Minerals | | 1.2 | % |

Miscellaneous | | 4.6 | % |

| U.S. Treasury Obligations | | 16.1 | % |

| U.S. Government Agency Obligations | | 12.7 | % |

| Exchange Traded Funds | | 8.2 | % |

| Asset-Backed Securities | | 3.8 | % |

| Convertible Preferred Stock | | 1.5 | % |

| Preferred Stock | | 0.1 | % |

20

The FBR Funds

FBR Core Bond Fund

Portfolio of Investments

March 31, 2010

|

| | | | | | | | | | | | | VALUE | |

| | SHARES | | | | | | | | | | | (NOTE 2) | |

|

| | | | CONVERTIBLE PREFERRED STOCK — 1.4% | | | | | | | | | | | |

| | | | Finance — 1.4% | | | | | | | | | | | |

| | 13,350 | | Boston Private Capital Trust I, 4.875%, due 10/1/3 (Cost $638,782) | | | | | | | | | $ | 409,678 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | PREFERRED STOCK — 0.1% | | | | | | | | | | | |

| | | | Finance — 0.1% | | | | | | | | | | | |

| | 10,400 | | Federal National Mortgage Association, Perpetual, Series S, 8.25%, due 12/31/10 | | | | | | | | | | | |

| | | | (Cost $260,000)*(a) | | | | | | | | | | 13,208 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | | | | | | MATURITY | | | | |

| | PAR | | | | RATE | | | DATE | | | | |

| |

| | | |

| | |

| | | | |

| | | | ASSET-BACKED SECURITIES — 3.7% | | | | | | | | | | | |

| $ | 1,000,000 | | Chase Issuance Trust, | | | | | | | | | | | |

| | | | Series 2007-A15, Class A | | 4.960 | % | | | 9/17/12 | | | | 1,021,541 | |

| | 33,796 | | Capital Auto Receivables Asset Trust, | | | | | | | | | | | |

| | | | Series 2006-2, Class A3B(a) | | 0.290 | | | | 5/15/11 | | | | 33,788 | |

| | | | | | | | | | | | |

| |

| | | | Total Asset-Backed Securities (Cost $1,018,133) | | | | | | | | | | 1,055,329 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | CORPORATE BONDS — 56.6% | | | | | | | | | | | |

| | | | Communications — 4.4% | | | | | | | | | | | |

| | 360,000 | | AT&T, Inc. | | 5.875 | | | | 8/15/12 | | | | 393,723 | |

| | 275,000 | | Deutsche Telekom International Finance BV | | 5.875 | | | | 8/20/13 | | | | 300,130 | |

| | 280,000 | | Rogers Communications, Inc. | | 7.500 | | | | 3/15/15 | | | | 327,160 | |

| | 212,000 | | Vodafone Group PLC | | 5.500 | | | | 6/15/11 | | | | 222,364 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,243,377 | |

| | | | | | | | | | | | |

| |

| | | | Consumer Durables — 1.0% | | | | | | | | | | | |

| | 275,000 | | Toyota Motor Credit Corp. | | 5.170 | | | | 1/11/12 | | | | 277,085 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Consumer Non-Durables — 3.8% | | | | | | | | | | | |

| | 125,000 | | Anheuser-Busch InBev Worldwide, Inc.(b) | | 7.750 | | | | 1/15/19 | | | | 148,918 | |

| | 250,000 | | Diageo Capital PLC | | 5.200 | | | | 1/30/13 | | | | 270,693 | |

| | 325,000 | | Phillips-Van Heusen Corp. | | 7.750 | | | | 11/15/23 | | | | 324,824 | |

| | 300,000 | | The Coca-Cola Co. | | 5.350 | | | | 11/15/17 | | | | 330,564 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,074,999 | |

| | | | | | | | | | | | |

| |

21

The FBR Funds

FBR Core Bond Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | VALUE | |

| | PAR | | | | RATE | | | DATE | | (NOTE 2) | |

|

| | | | Consumer Services — 3.3% | | | | | | | | | | | |

| $ | 250,000 | | Comcast Corp. | | 6.500 | % | | | 1/15/17 | | | $ | 278,313 | |

| | 150,000 | | Marriott International, Inc., Series J | | 5.625 | | | | 2/15/13 | | | | 159,700 | |

| | 575,000 | | Royal Caribbean Cruises Ltd. | | 7.500 | | | | 10/15/27 | | | | 510,312 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 948,325 | |

| | | | | | | | | | | | |

| |

| | | | Electronic Technology — 3.7% | | | | | | | | | | | |

| $ | 250,000 | | Corning, Inc. | | 6.050 | | | | 6/15/15 | | | | 251,365 | |

| | 300,000 | | Dell, Inc. | | 4.700 | | | | 4/15/13 | | | | 322,485 | |

| | 250,000 | | Hewlett-Packard Co. | | 4.500 | | | | 3/1/13 | | | | 267,857 | |

| | 200,000 | | The Boeing Co. | | 5.000 | | | | 3/15/14 | | | | 216,703 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,058,410 | |

| | | | | | | | | | | | |

| |

| | | | Energy Minerals — 1.1% | | | | | | | | | | | |

| | 175,000 | | Devon Energy Corp. | | 5.625 | | | | 1/15/14 | | | | 191,553 | |

| | 125,000 | | Husky Energy, Inc. | | 5.900 | | | | 6/15/14 | | | | 136,162 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 327,715 | |

| | | | | | | | | | | | |

| |

| | | | Finance — 24.8% | | | | | | | | | | | |

| | 250,000 | | Aflac, Inc. | | 8.500 | | | | 5/15/19 | | | | 301,510 | |

| | 60,000 | | American Express Credit Corp., Series C | | 7.300 | | | | 8/20/13 | | | | 67,396 | |

| | 140,000 | | American Express Travel Related Services | | | | | | | | | | | |

| | | | Company, Inc.(b) | | 5.250 | | | | 11/21/11 | | | | 146,372 | |

| | 250,000 | | Associates Corporation of North America | | 6.950 | | | | 11/1/18 | | | | 263,887 | |

| | 175,000 | | Bank of America Corp. | | 5.375 | | | | 9/11/12 | | | | 185,971 | |

| | 200,000 | | Capital One Financial Corp. | | 6.750 | | | | 9/15/17 | | | | 221,329 | |

| | 300,000 | | CME Group, Inc. | | 5.750 | | | | 2/15/14 | | | | 329,632 | |

| | 225,000 | | Credit Suisse USA, Inc. | | 6.125 | | | | 11/15/11 | | | | 241,811 | |

| | 225,000 | | Credit Suisse USA, Inc. | | 5.125 | | | | 8/15/15 | | | | 241,239 | |

| | 250,000 | | Fifth Third Bancorp | | 6.250 | | | | 5/1/13 | | | | 269,049 | |

| | 140,000 | | Jefferies Group, Inc. | | 8.500 | | | | 7/15/19 | | | | 155,562 | |

| | 235,000 | | JPMorgan Chase & Co. | | 5.375 | | | | 10/1/12 | | | | 254,446 | |

| | 300,000 | | KeyCorp | | 6.500 | | | | 5/14/13 | | | | 320,598 | |

| | 200,000 | | Merrill Lynch & Company, Inc., Series MTNC(a) | | 0.711 | | | | 1/15/15 | | | | 186,502 | |

| | 150,000 | | Merrill Lynch & Company, Inc. | | 5.770 | | | | 7/25/11 | | | | 158,517 | |

| | 275,000 | | MetLife, Inc., Series A | | 6.817 | | | | 8/15/18 | | | | 305,549 | |

| | 225,000 | | Nationwide Life Global Funding I(a)(b) | | 0.451 | | | | 5/19/10 | | | | 224,663 | |

22

The FBR Funds

FBR Core Bond Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | VALUE | |

| | PAR | | | | RATE | | | DATE | | (NOTE 2) | |

|

| | | | Finance — 24.8% (continued) | | | | | | | | | | | |

| $ | 275,000 | | New York Life Global Funding(b) | | 5.250 | % | | | 10/16/12 | | | $ | 296,883 | |

| | 250,000 | | Prudential Financial, Inc., Series MTNB | | 5.100 | | | | 9/20/14 | | | | 264,321 | |

| | 125,000 | | Regions Financial Corp. | | 7.750 | | | | 11/10/14 | | | | 131,644 | |

| | 300,000 | | SunTrust Banks, Inc. | | 6.000 | | | | 9/11/17 | | | | 304,324 | |

| | 215,000 | | SunTrust Banks, Inc. | | 5.250 | | | | 11/5/12 | | | | 226,899 | |

| | 125,000 | | Swiss Re Solutions Holding Corp. | | 7.000 | | | | 2/15/26 | | | | 126,997 | |

| | 270,000 | | The Allstate Corp. | | 5.000 | | | | 8/15/14 | | | | 288,805 | |

| | 125,000 | | The Goldman Sachs Group, Inc. | | 5.700 | | | | 9/1/12 | | | | 135,645 | |

| | 150,000 | | The Goldman Sachs Group, Inc. | | 6.600 | | | | 1/15/12 | | | | 162,826 | |

| | 300,000 | | The Hartford Financial Services Group, Inc. | | 5.375 | | | | 3/15/17 | | | | 300,652 | |

| | 240,000 | | The Progressive Corp. | | 6.375 | | | | 1/15/12 | | | | 259,562 | |

| | 166,000 | | Union Planters Corp. | | 4.375 | | | | 12/1/10 | | | | 166,860 | |

| | 200,000 | | Wachovia Corp. | | 5.250 | | | | 8/1/14 | | | | 210,280 | |

| | 300,000 | | Wells Fargo & Co. | | 5.250 | | | | 10/23/12 | | | | 323,401 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 7,073,132 | |

| | | | | | | | | | | | |

| |

| | | | Health Services — 0.5% | | | | | | | | | | | |

| | 125,000 | | CIGNA Corp. | | 8.500 | | | | 5/1/19 | | | | 151,781 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Health Technology — 2.0% | | | | | | | | | | | |

| | 325,000 | | GlaxoSmithKline Capital, Inc. | | 4.850 | | | | 5/15/13 | | | | 352,523 | |

| | 200,000 | | Pfizer, Inc. | | 5.350 | | | | 3/15/15 | | | | 220,612 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 573,135 | |

| | | | | | | | | | | | |

| |

| | | | Non-Energy Minerals — 1.2% | | | | | | | | | | | |

| | 300,000 | | Barrick Gold Financeco LLC | | 6.125 | | | | 9/15/13 | | | | 334,480 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Process Industries — 1.6% | | | | | | | | | | | |

| | 285,000 | | EI du Pont de Nemours & Co. | | 4.750 | | | | 3/15/15 | | | | 305,240 | |

| | 125,000 | | International Paper Co. | | 9.375 | | | | 5/15/19 | | | | 156,515 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 461,755 | |

| | | | | | | | | | | | |

| |

| | | | Producer Manufacturing — 3.5% | | | | | | | | | | | |

| | 50,000 | | American Railcar Industries, Inc. | | 7.500 | | | | 3/1/14 | | | | 48,000 | |

| | 325,000 | | Caterpillar Financial Services Corp. | | 4.900 | | | | 8/15/13 | | | | 351,245 | |

| | 281,000 | | General Electric Capital Corp. | | 5.000 | | | | 4/10/12 | | | | 298,141 | |

23

The FBR Funds

FBR Core Bond Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | | | MATURITY | | | VALUE | |

| | PAR | | | | RATE | | | DATE | | | (NOTE 2) | |

|

| | | | Producer Manufacturing — 3.5% (continued) | | | | | | | | | | | |

| $ | 125,000 | | General Electric Capital Corp. | | 4.800 | % | | | 5/1/13 | | | $ | 132,936 | |

| | 125,000 | | Tyco International Finance SA | | 8.500 | | | | 1/15/19 | | | | 155,272 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 985,594 | |

| | | | | | | | | | | | |

| |

| | | | Retail Trade — 3.6% | | | | | | | | | | | |

| | 275,000 | | Best Buy Company, Inc. | | 6.750 | | | | 7/15/13 | | | | 308,029 | |

| | 235,000 | | GameStop Corp. / GameStop, Inc. | | 8.000 | | | | 10/1/12 | | | | 244,988 | |

| | 300,000 | | Lowe’s Companies, Inc. | | 5.600 | | | | 9/15/12 | | | | 331,140 | |

| | 120,000 | | The Home Depot, Inc. | | 5.400 | | | | 3/1/16 | | | | 129,836 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | 1,013,993 | |

| | | | | | | | | | �� | | |

| |

| | | | Transportation — 1.1% | | | | | | | | | | | |

| | 275,000 | | FedEx Corp. | | 7.375 | | | | 1/15/14 | | | | 316,062 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | Utilities — 1.0% | | | | | | | | | | | |

| | 250,000 | | Sempra Energy | | 6.500 | | | | 6/1/16 | | | | 279,654 | |

| | | | | | | | | | | | |

| |

| | | | Total Corporate Bonds (Cost $14,758,025) | | | | | | | | | | 16,119,497 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | U.S. GOVERNMENT AGENCY OBLIGATIONS — 12.4% | | | | | | | | | | | |

| | 1,012,678 | | Federal Home Loan Mortgage Corp. | | 5.500 | | | | 4/1/37 | | | | 1,071,556 | |

| | 350,000 | | Federal National Mortgage Association*(c) | | 3.000 | | | | 12/28/16 | | | | 351,530 | |

| | 90,000 | | Federal National Mortgage Association | | 5.375 | | | | 6/12/17 | | | | 99,809 | |

| | 849,129 | | Federal National Mortgage Association | | 4.500 | | | | 8/1/20 | | | | 882,306 | |

| $ | 1,073,584 | | Federal National Mortgage Association | | 6.000 | | | | 10/1/37 | | | | 1,141,706 | |

| | | | | | | | | | | | |

| |

| | | | Total U.S. Government Agency Obligations (Cost $3,368,178) | | | | | | | | | | 3,546,907 | |

| | | | | | | | | | | | |

| |

| | | | | | | | | | | | | | | |

| | | | U.S. TREASURY OBLIGATIONS — 15.8% | | | | | | | | | | | |

| | 1,725,000 | | U.S. Treasury Bond | | 5.000 | | | | 5/15/37 | | | | 1,816,912 | |

| | 300,000 | | U.S. Treasury Inflation Indexed Note(d) | | 2.500 | | | | 1/15/29 | | | | 320,755 | |

| | 750,000 | | U.S. Treasury Note | | 2.250 | | | | 1/31/15 | | | | 742,090 | |

| | 885,000 | | U.S. Treasury Note | | 4.750 | | | | 8/15/17 | | | | 968,315 | |

| | 650,000 | | U.S. Treasury Note | | 3.750 | | | | 11/15/18 | | | | 655,129 | |

| | | | | | | | | | | | |

| |

| | | | Total U.S. Treasury Obligations (Cost $4,632,859) | | | | | | | | | | 4,503,201 | |

| | | | | | | | | | | | |

| |

24

The FBR Funds

FBR Core Bond Fund

Portfolio of Investments (continued)

March 31, 2010

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | EXCHANGE TRADED FUNDS — 8.1% | | | | |

| | 10,900 | | iShares iBoxx $ High Yield Corporate Bond Fund | | $ | 963,233 | |

| | 9,650 | | iShares S&P U.S. Preferred Stock Index Fund | | | 373,648 | |

| | 24,400 | | SPDR Barclays Capital High Yield Bond Fund | | | 970,876 | |

| | | | | |

| |

| | | | Total Exchange Traded Funds (Cost $2,244,775) | | | 2,307,757 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 98.1% (Cost $26,920,752) | | | 27,955,577 | |

| | | | | |

| |

| | | | | | | | |

| | | | Other Assets Less Liabilities — 1.9% | | | 544,512 | |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 28,500,089 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| (a) | | Variable/floating rate security |

| (b) | | This security is a restricted security under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. As of March 31, 2010, the total amount of 144A securities was $816,836, or 2.9% of total net assets. |

| (c) | | Stepped coupon bond - the rate shown is the rate in effect on March 31, 2010. |

| (d) | | Treasury Inflation Protected Security |

| | | |

| LLC | | Limited Liability Company |

| PLC | | Public Liability Company |

The accompanying notes are an integral part of the financial statements.

25

| The FBR Funds |

|

| Statements of Assets and Liabilities |

| March 31, 2010 |

| | | FBR | | FBR |

| | | Balanced Fund | | Core Bond Fund |

| | |

| |

|

| ASSETS | | | | | | | | | | |

Investment Securities at Cost | | | $ | 78,237,164 | | | | $ | 26,920,752 | |

| | | |

| | | |

| |

Investment Securities at Value (Note 2) | | | $ | 85,960,435 | | | | $ | 27,955,577 | |

Receivable for Capital Shares Sold | | | | 57,303 | | | | | 14,769 | |

Receivable for Investment Securities Sold | | | | 642,641 | | | | | 477,085 | |

Dividends and Interest Receivable | | | | 499,632 | | | | | 290,559 | |

Prepaid Expenses | | | | 13,467 | | | | | 11,925 | |

| | | |

| | | |

| |

Total Assets | | | | 87,173,478 | | | | | 28,749,915 | |

| | | |

| | | |

| |

| LIABILITIES | | | | | | | | | | |

Due to Custodian | | | | 736,927 | | | | | 158,163 | |

Payable for Capital Shares Redeemed | | | | 91,723 | | | | | 63 | |

Distribution Payable | | | | 18,025 | | | | | 40,353 | |

Investment Advisory Fee Payable (Note 4) | | | | 45,044 | | | | | 16,780 | |

Administration Fee Payable (Note 4) | | | | 9,410 | | | | | 3,093 | |

Distribution and Service Fees Payable (Note 4) | | | | 15,055 | | | | | 1,351 | |

Other Accrued Expenses | | | | 45,507 | | | | | 30,023 | |

| | | |

| | | |

| |

Total Liabilities | | | | 961,691 | | | | | 249,826 | |

| | | |

| | | |

| |

| NET ASSETS | | | $ | 86,211,787 | | | | $ | 28,500,089 | |

| | | |

| | | |

| |

| Net Assets Consist of: | | | | | | | | | | |

Paid-in capital | | | $ | 88,079,568 | | | | $ | 27,450,868 | |

Accumulated net investment income (loss) | | | | — | | | | | (89 | ) |

Accumulated net realized gain (loss) on investments | | | | (9,591,052 | ) | | | | 14,485 | |

Net unrealized appreciation on investments | | | | 7,723,271 | | | | | 1,034,825 | |

| | | |

| | | |

| |

| NET ASSETS | | | $ | 86,211,787 | | | | $ | 28,500,089 | |

| | | |

| | | |

| |

| Pricing of Investor Class Shares | | | | | | | | | | |

Net assets attributable to Investor Class shares | | | $ | 46,809,263 | | | | $ | 4,614,698 | |

Shares of Beneficial Interest Outstanding | | | | | | | | | | |

(unlimited number of shares authorized, no par value) | | | | 4,062,148 | | | | | 491,452 | |

| | | |

| | | |

| |

Net Asset Value Per Share | | | $ | 11.52 | | | | $ | 9.39 | |

| | | |

| | | |

| |

| Pricing of I Class Shares | | | | | | | | | | |

Net assets attributable to I Class shares | | | $ | 39,402,524 | | | | $ | 23,885,391 | |

Shares of Beneficial Interest Outstanding | | | | | | | | | | |

(unlimited number of shares authorized, no par value) | | | | 3,585,943 | | | | | 2,754,884 | |

| | | |

| | | |

| |

Net Asset Value Per Share | | | $ | 10.99 | | | | $ | 8.67 | |

| | | |

| | | |

| |

The accompanying notes are an integral part of the financial statements.

26

| The FBR Funds |

|

| Statements of Operations |

| For the Year Ended March 31, 2010 |

| | | FBR | | FBR |

| | | Balanced Fund | | Core Bond Fund |

| | |

| |

|

| Investment Income | | | | | | | | | | |

Dividends1 | | | $ | 1,497,826 | | | | $ | 42,104 | |

Interest | | | | 1,754,136 | | | | | 1,484,671 | |

| | | |

| | | |

| |

Total Investment Income | | | | 3,251,962 | | | | | 1,526,775 | |

| | | |

| | | |

| |

| Expenses | | | | | | | | | | |

Investment Advisory fees (Note 4) | | | | 649,450 | | | | | 225,182 | |

Administration fees (Note 4) | | | | 190,023 | | | | | 66,236 | |

Distribution and Service fees – Investor Class (Note 4) | | | | 65,401 | | | | | 7,616 | |

Distribution and Service fees – Class B2 (Note 4) | | | | 3,808 | | | | | 4,318 | |

Distribution and Service fees – Class C3 (Note 4) | | | | 181,800 | | | | | 13,190 | |

Transfer agent fees (Note 4) | | | | 122,110 | | | | | 27,746 | |

Transfer agent fees – Investor Class | | | | 1,044 | | | | | 192 | |

Transfer agent fees – I Class | | | | 1,002 | | | | | 327 | |

Professional fees | | | | 46,636 | | | | | 48,720 | |

Blue Sky fees | | | | 42,730 | | | | | 41,620 | |

Registration fees – Investor Class | | | | 97 | | | | | 97 | |

Registration fees – I Class | | | | 97 | | | | | 97 | |

Printing fees | | | | 23,993 | | | | | 9,440 | |

Reports to shareholders – Investor Class | | | | 618 | | | | | 173 | |

Reports to shareholders – I Class | | | | 607 | | | | | 293 | |

Trustees’ fees | | | | 15,453 | | | | | 15,453 | |

Custodian fees | | | | 11,145 | | | | | 7,442 | |

Accounting services fees | | | | 8,597 | | | | | 543 | |

Shareholder administrative fees – Investor Class | | | | 2,704 | | | | | 97 | |

Shareholder administrative fees – I Class | | | | 2,183 | | | | | 485 | |

Insurance fees | | | | 2,239 | | | | | 2,069 | |

Compliance fees | | | | 155 | | | | | 121 | |

Other expenses | | | | 39,520 | | | | | 29,833 | |

| | | |

| | | |

| |

Total expenses before waivers and related reimbursements | | | | 1,411,412 | | | | | 501,290 | |

Less waivers and related reimbursements (Note 4) | | | | (356,740 | ) | | | | (177,887 | ) |

| | | |

| | | |

| |

Total expenses after waivers and related reimbursements | | | | 1,054,672 | | | | | 323,403 | |

| | | |

| | | |

| |

Net Investment Income | | | | 2,197,290 | | | | | 1,203,372 | |

| | | |

| | | |

| |

| Net Realized and Unrealized Gain (Loss) on Investments | | | | | | | | | | |

Net Realized Gain (Loss) on Investment Transactions | | | | (628,466 | ) | | | | 176,611 | |

Change in Net Unrealized Appreciation/Depreciation of Investments | | | | 20,623,773 | | | | | 1,897,143 | |

| | | |

| | | |

| |