UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21503

The FBR Funds

———————————–

(Exact name of registrant as specified in charter)

1001 Nineteenth Street North

Arlington, VA 22209

————————————————

(Address of principal executive offices) (Zip code)

Registrant’s telephone number, including area code: 703.469.1040

William Ginivan

General Counsel

FBR Capital Markets Corporation

Potomac Tower

1001 Nineteenth Street North

Arlington, VA 22209

—————————————————————————

(Name and address of agent for service)

Date of fiscal year end: October 31, 2010

Date of reporting period: October 31, 2010

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

ITEM 1. REPORT TO SHAREHOLDERS.

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 (17CRF 270.30e-1).

THE FBR FUNDS

FBR Large Cap Fund

FBR Mid Cap Fund

FBR Small Cap Fund

FBR Focus Fund

FBR Large Cap Financial Fund

FBR Small Cap Financial Fund

FBR Technology Fund

FBR Gas Utility Index Fund

Annual Report

October 31, 2010

[THIS PAGE INTENTIONALLY LEFT BLANK]

The FBR Funds

Annual Letter to Shareholders

Dear Shareholder:

We are pleased to present the FBR Funds’ Annual Report for the twelve-month period ended October 31, 2010.

The U.S. equity market extended its second-half of 2010 rally into October helping all market capitalization categories (large, mid, and small) deliver strong returns for the period. The S&P 500 Index rose 16.52% and the Dow Jones Industrial Average gained 17.6% during the period. Mid cap stocks lead the way generating the highest return of 27.71%1. Small cap stocks were close behind and returned 26.58%2. Growth stocks within each market cap segment significantly outperformed value stocks over the period.

All ten of the Global Industry Classification Standard (GICS) sectors represented in the S&P 500 Index posted positive returns for the period. Despite the historically high long-term unemployment rates, continued weakness in the housing market, and negative investor sentiment, the consumer discretionary sector lead the way outpacing the nine other sectors. Other top performing sectors included industrials, telecommunications and materials. The steady rise in commodity prices, especially precious metals, drove strong returns in material stocks. Not surprisingly, financials were the weakest performing sector as banks continue to struggle with numerous credit, regulatory and loan growth headwinds. Income-seeking investors, however, have been in a difficult place over the previous twelve-months with continuing low bond, bank CD and money market returns.

Overall, we believe the U.S. economy is healing and that better conditions for investing, employment and economic growth lie ahead. There is no doubt that this so called “great recession” has been very severe and will take time to heal. However, we see that companies are de-levering, de-risking and de-complicating their balance sheets and income statements. We see the consumer reducing debt and becoming more rational about the balance between spending and saving. We see governments and central banks globally looking to (or being forced to) be more efficient by reducing budget shortfalls and flooding the system with credit to ease liquidity issues. We see new products and services being invented or implemented that will create new industries and new jobs. We see well-run companies that are growing and improving profits despite the recession. We see companies in trouble that we believe will repair, recover and prosper. We see companies taking share from weakened competitors. In sum, we believe that attractive investment opportunities are available today despite the near-term “doom and gloom”. As stewards of your capital, we are working very hard to provide conservative exposure to these opportunities in accordance with our investment philosophy and process that drives all of our fund products.

During the year we accomplished two non-investment items that we believe make our products more efficient and easier to understand. First, during the fiscal year we merged the FBR Pegasus Small Cap Growth Fund into the FBR Small Cap Fund. The combined fund should provide a meaningful increase in assets which improves the cost efficiencies achieved by a larger shareholder base. More importantly, the merger allows Robert Barringer, portfolio manager of both small cap funds, to focus his time, attention and efforts on executing his investment process on a single small cap core strategy. We believe the FBR Small Cap Fund is a viable solution for any investor looking to gain diversified exposure to the small cap segment of the market. Second, we eliminated the “Pegasus” sub-brand from our product line

|

| 1 | 27.71% is the return for the Russell Mid Cap Index for the twelve month period ending October 31, 2010. |

| 2 | 26.58% is the return for the Russell 2000 Index for the twelve month period ending October 31, 2010. |

2

nomenclature. This was done to simplify and remove any confusion regarding the objective of each of our core equity products as they are increasingly being uncovered by professional and retail investors “screening” for strong performing funds.

As in prior years, what follows in this report is a discussion with each portfolio manager with respect to the performance of their fund(s) over the 2010 fiscal year. It also includes their thoughts on related industry or company conditions and their investment outlook. We believe the commentary from our fund managers is an important part of our communications to you. We encourage you to read them to gain a better understanding of the investment philosophy and process that drives our organization.

All of us at The FBR Funds want to thank you for your continued support, and we look forward to serving your investment needs in the years ahead. As always, we welcome your questions and comments. You can reach us via e-mail at fbrfundsinfo@fbr.com or toll free at 888.200.4710. If you would like more timely updates, www.fbrfunds.com provides quarterly performance data as well as other important information.

Sincerely,

David H. Ellison

President, Chief Investment Officer and Trustee

The FBR Funds

|

Past performance is no guarantee of future results. The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption fees. The Funds charge a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance quoted. To obtain performance data current to the most recent month-end please call 888.200.4710. |

| |

Investors should consider the investment objectives, risks, charges and expenses carefully before investing. This and other important information can be found in the Fund’s prospectus. To obtain a free prospectus, please call 888.200.4710 or visit www.fbrfunds.com. Please read the prospectus carefully before investing. The FBR Funds are distributed by FBR Investment Services, Inc., member FINRA/SIPC. |

3

The FBR Funds

FBR Large Cap Fund

Management Overview

Portfolio Managers: Robert Barringer, CFA® and Ryan Kelley, CFA®

Over the previous 12 months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2010, the Investor Class Shares of the FBR Large Cap Fund returned 12.43%. This compares to the S&P 500 Index and the Morningstar Large Blend Category Average which over the same time period returned 16.52% and 15.61%, respectively.

For each of the previous four fiscal years since inception, the FBR Large Cap Fund (previously the FBR Pegasus Fund™) outperformed both the S&P 500 Index and its peers, in most cases by a substantial amount. Regrettably, we did not fare as well for fiscal year 2010. While we are disappointed with our relative performance versus our peers, we believe that maintaining our disciplined investment process can mean underperformance during periods such as this when lower quality companies see more dramatic price appreciation than more stable ones. However, we also find that the Fund has outperformed in more difficult market environments as well as over a complete cycle.

We can attribute the majority of this fiscal year’s underperformance to two factors: first, carrying cash (albeit less than 5% average for the year) when the markets soared, and second, our relative exposure to different sectors relative to our benchmark. Specifically, we had very few investments in the telecommunications sector in a year in which those stocks saw significant appreciation, driven in part by increased usage and adoption of next generation smart phones, PDAs, and other telecommunications equipment. Conversely, our slight overweight in the financial sector also contributed to our relative underperformance, given financial stocks underperformed the broader market as large cap banks and other financial institutions continued to work through their asset quality, capital adequacy and earnings problems.

Throughout the life of the Fund (just over 5 years), our stock selection is what has driven our performance. This year, however, we saw mixed results as the Fund owned relatively outperforming stocks in the health care, technology, and energy sectors and relatively underperforming stocks in the consumer discretionary, consumer staples, and financial sectors.

Portfolio managers’ comments on the Fund and the related investment outlook.

The stock market performed exceptionally well for the second year in a row during our most recent fiscal year, after a dismal 2008. Specifically, the S&P 500 Index dropped 36% in fiscal year 2008, followed by a recovery of 10% in fiscal year 2009 and now close to a 17% return in fiscal year 2010. Overall, since October 31, 2007, the S&P 500 Index is down 18%, including dividends. Despite lagging the market in this most recent year, the FBR Large Cap Fund is down only half as much (-9%) as the benchmark during the same

4

The FBR Funds

FBR Large Cap Fund

Management Overview (continued)

time period. Our investment philosophy focuses on returns over longer time periods, and we are encouraged by our 3 and 5 year performance despite a tough fiscal year 2010.

Our investment process is designed to create a diversified portfolio of investments in companies with less leveraged balance sheets and historically strong business models trading at attractive valuations. Our philosophy tends to produce less volatile returns over a complete cycle, as is evidenced by our relative performance over the past three year and five year periods. We believe that the recent market volatility and tough economic times create opportunities to invest in companies that may do well over a longer time horizon.

|

The opinions expressed in this commentary reflect those of the Portfolio Managers as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

5

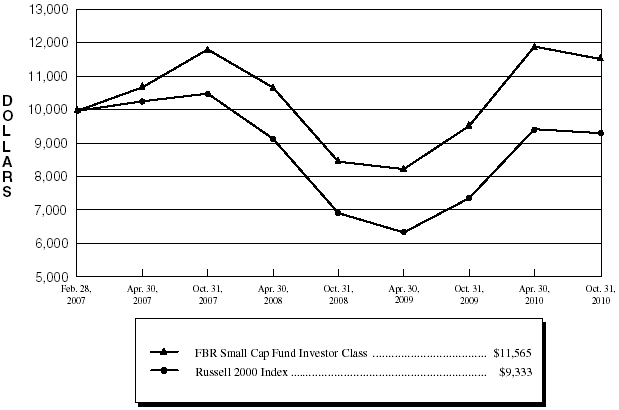

The FBR Funds

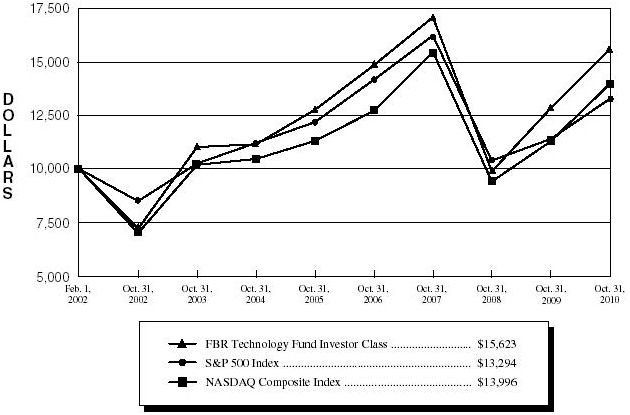

FBR Large Cap Fund

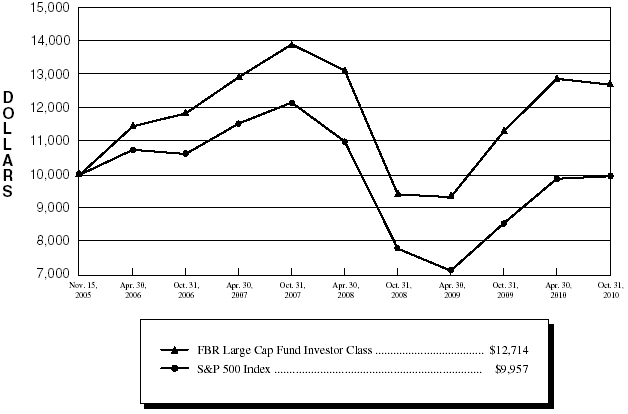

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. S&P 500 Index(1)(3)

Total Returns—For the Periods Ended October 31, 2010(4) | |

| | | | | | | Annualized | |

| | | | | | | Since | |

| | | One Year | | Inception(5) | |

| | |

| |

| |

FBR Large Cap Fund Investor Class(1)(2) | | | 12.43 | % | | | 4.96 | % | |

FBR Large Cap Fund I Class(2) | | | 12.71 | % | | | (1.76 | )% | |

S&P 500 Index(1)(3) | | | 16.52 | % | | | (0.09 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710.

|

(1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The S&P 500 Index is a capitalization-weighted index of 500 stocks. The index is designed to represent the broad domestic economy through changes in aggregate market value of 500 stocks representing all major industries. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | The inception date for the Investor Class is November 15, 2005 and the inception date for the I Class is May 30, 2008. The index return is for the period beginning November 15, 2005. |

6

The FBR Funds

FBR Large Cap Fund

Portfolio Summary

October 31, 2010

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

Industry Sector | | % of Total Investments |

| |

|

| Technology | | | 22.8 | % |

| Consumer, Non-cyclical | | | 21.4 | % |

| Financial | | | 15.9 | % |

| Consumer, Cyclical | | | 14.1 | % |

| Industrial | | | 10.5 | % |

| Energy | | | 6.5 | % |

| Communications | | | 4.1 | % |

| Basic Materials | | | 3.2 | % |

| | | | | |

| Cash | | | 1.5 | % |

7

The FBR Funds

FBR Large Cap Fund

Portfolio of Investments

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 98.5% | | | | |

| | | | Basic Materials — 3.2% | | | | |

| | 7,050 | | BHP Billiton Ltd. ADR | | $ | 582,259 | |

| | 7,000 | | Freeport-McMoRan Copper & Gold, Inc. | | | 662,760 | |

| | 5,600 | | United States Steel Corp. | | | 239,624 | |

| | | | | |

| |

| | | | | | | 1,484,643 | |

| | | | | |

| |

| | | | Communications — 4.1% | | | | |

| | 4,200 | | Akamai Technologies, Inc.* | | | 217,014 | |

| | 1,000 | | Amazon.com, Inc.* | | | 165,140 | |

| | 33,600 | | Cisco Systems, Inc.* | | | 767,088 | |

| | 1,275 | | Google, Inc., Class A* | | | 781,562 | |

| | | | | |

| |

| | | | | | | 1,930,804 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 14.1% | | | | |

| | 11,300 | | Coach, Inc. | | | 565,000 | |

| | 10,200 | | Fastenal Co. | | | 525,096 | |

| | 22,000 | | J. C. Penney Company, Inc. | | | 685,960 | |

| | 21,500 | | Lowe’s Companies, Inc. | | | 458,595 | |

| | 6,900 | | McDonald’s Corp. | | | 536,613 | |

| | 5,600 | | NIKE, Inc., Class B | | | 456,064 | |

| | 14,200 | | Target Corp. | | | 737,548 | |

| | 15,325 | | The Gap, Inc. | | | 291,328 | |

| | 13,100 | | The TJX Companies, Inc. | | | 601,159 | |

| | 4,800 | | V.F. Corp. | | | 399,552 | |

| | 12,700 | | Walgreen Co. | | | 430,276 | |

| | 17,150 | | Wal-Mart Stores, Inc. | | | 929,016 | |

| | | | | |

| |

| | | | | | | 6,616,207 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 21.4% | | | | |

| | 8,640 | | Abbott Laboratories | | | 443,405 | |

| | 15,500 | | Automatic Data Processing, Inc. | | | 688,510 | |

| | 8,475 | | Baxter International, Inc. | | | 431,378 | |

| | 9,200 | | Biogen Idec, Inc.* | | | 576,932 | |

| | 2,970 | | C.R. Bard, Inc. | | | 246,866 | |

| | 5,275 | | Colgate-Palmolive Co. | | | 406,808 | |

| | 12,400 | | Forest Laboratories, Inc.* | | | 409,820 | |

| | 8,000 | | General Mills, Inc. | | | 300,320 | |

8

The FBR Funds

FBR Large Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Non-cyclical — 21.4% (continued) | | | | |

| | 6,700 | | Gilead Sciences, Inc.* | | $ | 265,789 | |

| | 11,000 | | Johnson & Johnson | | | 700,370 | |

| | 18,800 | | Merck & Company, Inc. | | | 682,064 | |

| | 6,520 | | Novo Nordisk A/S ADR | | | 683,296 | |

| | 12,000 | | Paychex, Inc. | | | 332,400 | |

| | 6,800 | | PepsiCo, Inc. | | | 444,040 | |

| | 13,700 | | Stryker Corp. | | | 678,013 | |

| | 28,000 | | Sysco Corp. | | | 824,880 | |

| | 9,200 | | The Coca-Cola Co. | | | 564,144 | |

| | 25,450 | | Unilever PLC ADR | | | 738,559 | |

| | 4,600 | | Visa Inc., Class A | | | 359,582 | |

| | 5,400 | | Zimmer Holdings, Inc.* | | | 256,176 | |

| | | | | |

| |

| | | | | | | 10,033,352 | |

| | | | | |

| |

| | | | Energy — 6.5% | | | | |

| | 10,502 | | Apache Corp. | | | 1,060,912 | |

| | 22,900 | | BP PLC ADR | | | 935,007 | |

| | 17,200 | | ConocoPhillips | | | 1,021,680 | |

| | | | | |

| |

| | | | | | | 3,017,599 | |

| | | | | |

| |

| | | | Financial — 15.9% | | | | |

| | 61,300 | | Bank of America Corp. | | | 701,272 | |

| | 200,000 | | Citigroup Inc.* | | | 834,000 | |

| | 25,000 | | Discover Financial Services | | | 441,250 | |

| | 7,025 | | Franklin Resources, Inc. | | | 805,767 | |

| | 57,300 | | Hudson City Bancorp, Inc. | | | 667,545 | |

| | 23,525 | | JPMorgan Chase & Co. | | | 885,246 | |

| | 85,400 | | KeyCorp | | | 699,426 | |

| | 31,600 | | People’s United Financial, Inc. | | | 388,996 | |

| | 13,100 | | Prudential Financial, Inc. | | | 688,798 | |

| | 17,075 | | T. Rowe Price Group, Inc. | | | 943,735 | |

| | 2,425 | | The Goldman Sachs Group, Inc. | | | 390,304 | |

| | | | | |

| |

| | | | | | | 7,446,339 | |

| | | | | |

| |

| | | | Industrial — 10.5% | | | | |

| | 15,615 | | 3M Co. | | | 1,315,095 | |

| | 11,500 | | Canadian Pacific Railway Ltd. | | | 749,110 | |

9

The FBR Funds

FBR Large Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrial — 10.5% (continued) | | | | |

| | 59,300 | | General Electric Co. | | $ | 949,986 | |

| | 16,000 | | Norfolk Southern Corp. | | | 983,840 | |

| | 15,000 | | Spirit AeroSystems Holdings, Inc., Class A* | | | 324,600 | |

| | 6,950 | | Union Pacific Corp. | | | 609,376 | |

| | | | | |

| |

| | | | | | | 4,932,007 | |

| | | | | |

| |

| | | | Technology — 22.8% | | | | |

| | 4,900 | | Apple, Inc.* | | | 1,474,263 | |

| | 5,700 | | ARM Holdings PLC ADR | | | 100,776 | |

| | 9,000 | | Cerner Corp.* | | | 790,470 | |

| | 9,000 | | Check Point Software Technologies Ltd.* | | | 384,750 | |

| | 3,600 | | Citrix Systems, Inc.* | | | 230,652 | |

| | 46,800 | | Intel Corp. | | | 939,276 | |

| | 6,800 | | International Business Machines Corp. | | | 976,480 | |

| | 8,000 | | Lexmark International, Inc., Class A* | | | 304,240 | |

| | 33,050 | | Microsoft Corp. | | | 880,452 | |

| | 4,500 | | NetApp, Inc.* | | | 239,625 | |

| | 38,300 | | Oracle Corp. | | | 1,126,020 | |

| | 10,000 | | Research In Motion Ltd.* | | | 569,500 | |

| | 1,800 | | salesforce.com, Inc.* | | | 208,926 | |

| | 21,350 | | SAP AG ADR | | | 1,104,436 | |

| | 23,500 | | Teradata Corp.* | | | 924,960 | |

| | 13,400 | | Texas Instruments, Inc. | | | 396,238 | |

| | | | | |

| |

| | | | | | | 10,651,064 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $41,776,784) | | | 46,112,015 | |

| | | | | |

| |

10

The FBR Funds

FBR Large Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | SHORT-TERM INVESTMENT — 1.5% | | | | |

| | 706,944 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $706,944) | | $ | 706,944 | |

| | | | | |

| |

| | | | Total Investments — 100.0% (Cost $42,483,728) | | | 46,818,959 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — NM | | | (27,580 | ) |

| | | | | |

| |

| | | |

Net Assets — 100.0% | |

$ |

46,791,379 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| NM | | Not meaningful |

| PLC | | Public Liability Company |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

11

The FBR Funds

FBR Mid Cap Fund

Management Overview

Portfolio Manager: Ryan Kelley, CFA®

Over the previous 12 months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2010, the Investor Class of the FBR Mid Cap Fund returned 19.58%. This compares to the Russell Midcap Index and the Morningstar Mid Cap Blend Category Average which over the same time period returned 27.71% and 23.06%, respectively.

Despite a disappointing first half of this fiscal year, we are encouraged that our relative performance improved dramatically during the second half of the year. In fact, the Fund outperformed its peers during the second half while only underperforming the benchmark by approximately 1%. Past performance analysis shows that the Fund may lag the index and its peer group during strong market rallies where lesser quality securities can have more dramatic increases in value than more stable ones. While this was the case during the first half of this year, this same analysis shows the Fund has outperformed in more difficult market environments and over longer time periods.

We attribute the majority of this fiscal year’s underperformance to three factors: cash position, sector allocation and stock selection. First, carrying cash (albeit less than 5% average for the year) during certain time periods in which the markets soared led to relative underperformance. Second, our underexposure to consumer discretionary stocks and slight overexposure to financial stocks added to our underperformance. Third, we owned more conservative financial institutions and underperforming technology and consumer discretionary companies that all lagged the performance of their respective sectors.

Portfolio manager comments on the Fund and the related investment outlook.

During this fiscal year, mid-cap stocks and small-cap stocks performed significantly better when compared to large-cap stocks. While the Russell Midcap Index and the Russell 2000 Index (small-cap) returned 28% and 27%, respectively, the Russell Top 200 Index (large-cap) rose only 14%.

Mid cap stocks performed exceptionally well for the second year in a row, after a challenging 2008. Using our fiscal year end of October 31, the Russell Midcap Index had total returns of 19% and 28% in 2009 and 2010, respectively, after a dismal -41% in 2008. Overall, since October 31, 2007, the Russell Midcap Index is down 10%. Despite lagging in this most recent year, the FBR Mid Cap Fund is actually up 4% and is beating the benchmark by a significant amount since October 31, 2007.

Our goal is to provide better than average risk-adjusted returns over a complete market cycle. We strive to participate in the upside while protecting against the downside. While we are disappointed with the prior 12 month period’s return relative to the benchmark and our peers, we are encouraged by the more recent six month period and believe that the

12

The FBR Funds

FBR Mid Cap Fund

Management Overview (continued)

Fund is well positioned over the longer-term. Our investment philosophy, process and discipline remain intact, while we adapt to new opportunities and rapidly moving markets. We believe the Fund’s diversification, and quality stock investments will continue to provide solid returns for our shareholders with less volatility over a complete business cycle.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

13

The FBR Funds

FBR Mid Cap Fund

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell Midcap Index(1)(3)

Total Returns—For the Periods Ended October 31, 2010(4) |

| | | | | | | Annualized | |

| | | | | | | Since | |

| | | One Year | | Inception(5) | |

| | |

| |

| |

FBR Mid Cap Fund Investor Class(1)(2) | | | 19.58 | % | | | 4.46 | % | |

FBR Mid Cap Fund™ I Class(2) | | | 19.72 | % | | | 0.46 | % | |

Russell Midcap Index(1)(3) | | | 27.71 | % | | | (0.92 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell Midcap Index measures the performance of the 800 smallest companies in the Russell 1000 Index, which represents approximately 31% of the total market capitalization of the Russell 1000 Index. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | The inception date for the Investor Class is February 28, 2007 and the inception date for the I Class is May 30, 2008. The index return is for the period beginning February 28, 2007. |

14

The FBR Funds

FBR Mid Cap Fund

Portfolio Summary

October 31, 2010

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

Industry Sector | | % of Total Investments |

| |

|

| Consumer, Non-cyclical | | | 17.3 | % |

| Consumer, Cyclical | | | 17.2 | % |

| Industrial | | | 12.1 | % |

| Financial | | | 11.5 | % |

| Energy | | | 6.5 | % |

| Technology | | | 6.2 | % |

| Basic Materials | | | 5.9 | % |

| Utilities | | | 5.9 | % |

| Communications | | | 3.9 | % |

| | | | | |

| Cash | | | 13.5 | % |

15

The FBR Funds

FBR Mid Cap Fund

Portfolio of Investments

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 94.9% | | | | |

| | | | Basic Materials — 6.4% | | | | |

| | 8,500 | | Compania de Minas Buenaventura S.A.A. ADR | | $ | 450,840 | |

| | 6,075 | | Ecolab, Inc. | | | 299,619 | |

| | 8,000 | | Gold Fields Ltd. ADR | | | 126,160 | |

| | 4,934 | | Sigma-Aldrich Corp. | | | 312,914 | |

| | | | | |

| |

| | | | | | | 1,189,533 | |

| | | | | |

| |

| | | | Communications — 4.3% | | | | |

| | 6,250 | | Amdocs Ltd.* | | | 191,750 | |

| | 3,647 | | FactSet Research Systems, Inc. | | | 320,134 | |

| | 7,850 | | Telephone and Data Systems, Inc. | | | 273,415 | |

| | | | | |

| |

| | | | | | | 785,299 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 18.9% | | | | |

| | 8,915 | | Abercrombie & Fitch Co., Class A | | | 382,097 | |

| | 11,039 | | American Eagle Outfitters, Inc. | | | 176,734 | |

| | 12,080 | | Big Lots, Inc.* | | | 378,950 | |

| | 6,100 | | BJ’s Wholesale Club, Inc.* | | | 254,553 | |

| | 9,485 | | Copart, Inc.* | | | 321,162 | |

| | 16,325 | | Ingram Micro, Inc., Class A* | | | 288,300 | |

| | 4,865 | | Magna International, Inc. | | | 440,477 | |

| | 15,924 | | Mattel, Inc. | | | 371,507 | |

| | 7,535 | | Tiffany & Co. | | | 399,355 | |

| | 4,229 | | V.F. Corp. | | | 352,022 | |

| | 3,700 | | Williams-Sonoma, Inc. | | | 119,769 | |

| | | | | |

| |

| | | | | | | 3,484,926 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 19.0% | | | | |

| | 2,700 | | Brown-Forman Corp., Class B | | | 164,187 | |

| | 3,222 | | Bunge Ltd. | | | 193,546 | |

| | 3,196 | | C.R. Bard, Inc. | | | 265,652 | |

| | 9,050 | | Endo Pharmaceuticals Holdings, Inc.* | | | 332,497 | |

| | 6,850 | | Equifax, Inc. | | | 226,940 | |

| | 7,938 | | Forest Laboratories, Inc.* | | | 262,351 | |

| | 7,050 | | Hansen Natural Corp.* | | | 361,030 | |

| | 2,100 | | Humana, Inc.* | | | 122,409 | |

| | 6,995 | | Lincare Holdings, Inc. | | | 183,409 | |

16

The FBR Funds

FBR Mid Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Non-cyclical — 19.0% (continued) | | | | |

| | 7,275 | | Paychex, Inc. | | $ | 201,518 | |

| | 13,350 | | SEI Investments Co. | | | 295,702 | |

| | 4,785 | | Techne Corp. | | | 291,502 | |

| | 16,075 | | Tyson Foods, Inc., Class A | | | 249,966 | |

| | 5,644 | | Varian Medical Systems, Inc.* | | | 356,814 | |

| | | | | |

| |

| | | | | | | 3,507,523 | |

| | | | | |

| |

| | | | Energy — 7.1% | | | | |

| | 4,685 | | Ensco International PLC ADR | | | 217,103 | |

| | 4,540 | | Helmerich & Payne, Inc. | | | 194,221 | |

| | 7,800 | | Nabors Industries Ltd.* | | | 163,020 | |

| | 2,925 | | Newfield Exploration Co.* | | | 174,389 | |

| | 5,375 | | Pioneer Natural Resources Co. | | | 375,175 | |

| | 5,550 | | Rowan Companies, Inc.* | | | 182,595 | |

| | | | | |

| |

| | | | | | | 1,306,503 | |

| | | | | |

| |

| | | | Financial — 12.6% | | | | |

| | 5,520 | | Capitol Federal Financial | | | 129,168 | |

| | 7,725 | | Comerica, Inc. | | | 276,401 | |

| | 8,400 | | Hospitality Properties Trust | | | 191,604 | |

| | 21,825 | | Hudson City Bancorp, Inc. | | | 254,261 | |

| | 33,650 | | KeyCorp | | | 275,594 | |

| | 2,046 | | M&T Bank Corp. | | | 152,938 | |

| | 11,185 | | New York Community Bancorp, Inc. | | | 189,362 | |

| | 10,250 | | People’s United Financial, Inc. | | | 126,177 | |

| | 31,000 | | Regions Financial Corp. | | | 195,300 | |

| | 6,821 | | T. Rowe Price Group, Inc. | | | 376,997 | |

| | 5,800 | | W. R. Berkley Corp. | | | 159,616 | |

| | | | | |

| |

| | | | | | | 2,327,418 | |

| | | | | |

| |

| | | | Industrial — 13.3% | | | | |

| | 2,800 | | Alliant Techsystems, Inc.* | | | 213,472 | |

| | 4,153 | | Cummins, Inc. | | | 365,879 | |

| | 5,025 | | Dolby Laboratories, Inc., Class A* | | | 309,942 | |

| | 6,075 | | FLIR Systems, Inc.* | | | 169,128 | |

| | 3,050 | | Joy Global, Inc. | | | 216,397 | |

| | 3,700 | | Kansas City Southern* | | | 162,134 | |

17

The FBR Funds

FBR Mid Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Industrial — 13.3% (continued) | | | | |

| | 7,295 | | Pall Corp. | | $ | 311,278 | |

| | 5,392 | | Roper Industries, Inc. | | | 374,367 | |

| | 7,500 | | Spirit AeroSystems Holdings, Inc., Class A* | | | 162,300 | |

| | 3,500 | | Tidewater, Inc. | | | 161,455 | |

| | | | | |

| |

| | | | | | | 2,446,352 | |

| | | | | |

| |

| | | | Technology — 6.8% | | | | |

| | 40,068 | | Activision Blizzard, Inc. | | | 459,580 | |

| | 11,103 | | Check Point Software Technologies Ltd.* | | | 474,653 | |

| | 10,500 | | Seagate Technology PLC* | | | 153,825 | |

| | 6,200 | | Xilinx, Inc. | | | 166,222 | |

| | | | | |

| |

| | | | | | | 1,254,280 | |

| | | | | |

| |

| | | | Utilities — 6.5% | | | | |

| | 8,600 | | Ameren Corp. | | | 249,228 | |

| | 5,777 | | Energen Corp. | | | 257,885 | |

| | 8,100 | | NRG Energy, Inc.* | | | 161,271 | |

| | 10,650 | | Westar Energy, Inc. | | | 269,445 | |

| | 10,723 | | Xcel Energy, Inc. | | | 255,851 | |

| | | | | |

| |

| | | | | | | 1,193,680 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $15,848,259) | | | 17,495,514 | |

| | | | | |

| |

| | | | | | | | |

| | | | SHORT-TERM INVESTMENT — 14.8% | | | | |

| | 2,726,179 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $2,726,179) | | | 2,726,179 | |

| | | | | |

| |

| | | | Total Investments — 109.7% (Cost $18,574,438) | | | 20,221,693 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (9.7)% | | | (1,789,601 | ) |

| | | | | |

| |

| | | | Net Assets — 100.0% | |

$ |

18,432,092 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| ADR | | American Depositary Receipts |

| PLC | | Public Liability Company |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

18

The FBR Funds

FBR Small Cap Fund

Management Overview

Portfolio Manager: Robert Barringer, CFA®

Over the previous 12 months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2010, the Investor Class of the FBR Small Cap Fund returned 21.13%. This compares to the Russell 2000 Index and the Morningstar Small Growth Category, which returned 26.58% and 26.66% for the same period, respectively.

While the performance of the past year has been good, the Fund has lagged both its index and the peer group and this has been disappointing. Much of the discrepancy is attributed to specific stock selection, an area which has historically been a source of strength for us. Specific picks in the financial, technology, materials and energy sectors contributed to the shortfall.

The Fund tends to do less well when companies and sectors that are more cyclical or have more leverage are doing well, as has been the case during the past year. However, the Fund has continued to outperform its peers for the past three years.

Portfolio manager comments on the Fund and the related investment outlook.

The past year has been relatively volatile. The markets performed well until May, when the Greek debt crisis led to fears of a European and eventual global contagion. After moving up approximately 30% through the beginning of May from the end of October, 2009, the Russell 2000 Index then contracted 20% through August 2010 as global fears combined with U.S. data that was consistent with a sluggish and uneven recovery. Having said all of that, the U.S. markets have made an impressive recovery from the sell off through August, and are once again approaching their highs for the year.

With the dollar selling off, oil and other commodity prices rose, helping the earnings and those stocks of their producers, producing strong returns for energy and materials this year. Consumer discretionary stocks also had a good year as the earnings of those companies recovered in the face of skepticism on consumer spending. Lastly, technology companies performed well, with their earnings growing impressively, and their stocks accordingly. Importantly though, there were a large amount of takeovers in this sector as well as others, as larger companies and private equity buyers stepped up their investments.

As for the year ahead, we expect that we will continue to see volatility as the Euro zone attempts to work its way through the crises of its weaker members, potentially causing relative dollar strength. The Fed, through its quantitative easing, will attempt to keep interest rates low and keep the domestic economy in recovery mode.

19

The FBR Funds

FBR Small Cap Fund

Management Overview (continued)

As usual, we will attempt to select the stocks of above average companies with profitable margins, high returns on equity and low debt at reasonable prices. We find that these stocks provide the best risk adjusted returns over the long run, while at the same time being many times very attractive to a potential acquirer looking for a solid and growing franchise. With large companies holding large cash balances and in some cases, minimal growth prospects, and with private equity firms having access to low interest rate loans, we expect the flurry of mergers and acquisitions we have seen in the past year to continue.

|

The opinions expressed in this commentary reflect those of the Portfolio Manager as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change. |

20

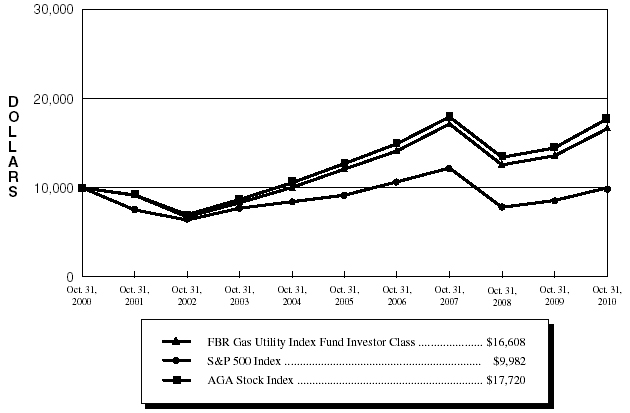

The FBR Funds

FBR Small Cap Fund

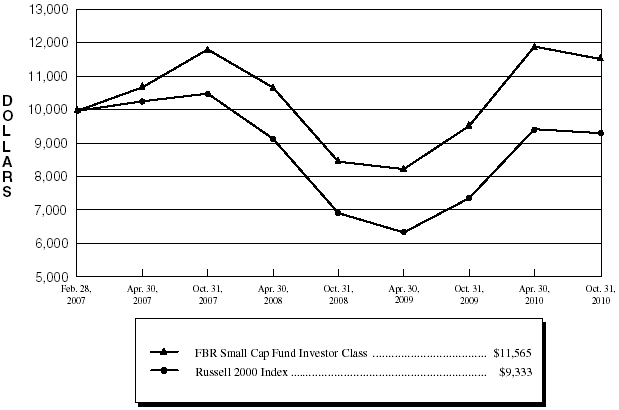

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

Total Returns—For the Periods Ended October 31, 2010(4) | |

| | | | | | | Annualized | |

| | | | | | | Since | |

| | | One Year | | Inception(5) | |

| | |

| |

| |

FBR Small Cap Fund Investor Class(1)(2) | | | 21.13 | % | | | 4.04 | % | |

FBR Small Cap Fund I Class(2) | | | 21.35 | % | | | 1.73 | % | |

Russell 2000 Index(1)(3) | | | 26.58 | % | | | (1.86 | )% | |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | The inception date for the Investor Class is February 28, 2007 and the inception date for the I Class is May 30, 2008. The index return is for the period beginning February 28, 2007. |

21

The FBR Funds

FBR Small Cap Fund

Portfolio Summary

October 31, 2010

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

Industry Sector | | % of Total Investments |

| |

|

| Technology | | | 22.0 | % |

| Consumer, Cyclical | | | 21.5 | % |

| Financial | | | 16.5 | % |

| Consumer, Non-cyclical | | | 13.9 | % |

| Industrial | | | 10.6 | % |

| Energy | | | 4.4 | % |

| Basic Materials | | | 4.3 | % |

| Communications | | | 3.3 | % |

| Utilities | | | 1.5 | % |

| Investment Company | | | 1.0 | % |

| | | | | |

| Cash | | | 1.0 | % |

22

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 97.7% | | | | |

| | | | Basic Materials — 4.2% | | | | |

| | 27,300 | | Harry Winston Diamond Corp.* | | $ | 348,894 | |

| | 24,000 | | Hecla Mining Co.* | | | 165,360 | |

| | 2,884 | | NewMarket Corp. | | | 341,812 | |

| | 7,750 | | Schnitzer Steel Industries, Inc., Class A | | | 400,597 | |

| | 8,000 | | The Valspar Corp. | | | 256,800 | |

| | | | | |

| |

| | | | | | | 1,513,463 | |

| | | | | |

| |

| | | | Communications — 3.3% | | | | |

| | 1,000 | | Acme Packet, Inc.* | | | 39,550 | |

| | 6,600 | | Blue Coat Systems, Inc.* | | | 178,002 | |

| | 8,000 | | SAVVIS, Inc.* | | | 191,920 | |

| | 7,600 | | Sourcefire, Inc.* | | | 179,284 | |

| | 29,900 | | TIBCO Software, Inc.* | | | 574,678 | |

| | | | | |

| |

| | | | | | | 1,163,434 | |

| | | | | |

| |

| | | | Consumer, Cyclical — 21.5% | | | | |

| | 19,800 | | Aèropostale, Inc.* | | | 482,724 | |

| | 34,000 | | American Eagle Outfitters, Inc. | | | 544,340 | |

| | 10,700 | | Bally Technologies, Inc.* | | | 386,056 | |

| | 12,100 | | BJ’s Wholesale Club, Inc.* | | | 504,933 | |

| | 10,000 | | Chico’s FAS, Inc. | | | 97,200 | |

| | 8,500 | | Deckers Outdoor Corp.* | | | 493,850 | |

| | 8,200 | | Foot Locker, Inc. | | | 130,626 | |

| | 6,300 | | Fossil, Inc.* | | | 371,637 | |

| | 8,060 | | J. Crew Group, Inc.* | | | 257,839 | |

| | 15,000 | | JetBlue Airways Corp.* | | | 104,700 | |

| | 2,375 | | Jos. A. Bank Clothiers, Inc.* | | | 103,550 | |

| | 2,000 | | Lululemon Athletica, Inc.* | | | 88,640 | |

| | 7,000 | | MSC Industrial Direct Company, Inc., Class A | | | 398,580 | |

| | 9,754 | | Owens & Minor, Inc. | | | 277,794 | |

| | 3,700 | | Panera Bread Co., Class A* | | | 331,187 | |

| | 19,200 | | Penn National Gaming, Inc.* | | | 638,592 | |

| | 6,200 | | Polaris Industries, Inc. | | | 440,758 | |

| | 10,000 | | Saks, Inc.* | | | 111,400 | |

| | 9,200 | | Signet Jewelers Ltd.* | | | 323,656 | |

| | 4,000 | | Steven Madden Ltd.* | | | 169,200 | |

23

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Consumer, Cyclical — 21.5% (continued) | | | | |

| | 8,700 | | The Buckle, Inc. | | $ | 253,083 | |

| | 3,000 | | The Children’s Place Retail Stores, Inc.* | | | 132,180 | |

| | 13,700 | | The Dress Barn, Inc.* | | | 314,278 | |

| | 3,600 | | The Men’s Wearhouse, Inc. | | | 87,984 | |

| | 7,600 | | The Toro Co. | | | 431,376 | |

| | 5,000 | | Wolverine World Wide, Inc. | | | 145,600 | |

| | | | | |

| |

| | | | | | | 7,621,763 | |

| | | | | |

| |

| | | | Consumer, Non-cyclical — 13.8% | | | | |

| | 19,100 | | BioMarin Pharmaceutical, Inc.* | | | 499,656 | |

| | 40,100 | | Bruker Corp.* | | | 601,099 | |

| | 4,500 | | Catalyst Health Solutions, Inc.* | | | 170,325 | |

| | 3,700 | | Emergency Medical Services Corp., Class A* | | | 201,206 | |

| | 6,200 | | Gen-Probe, Inc.* | | | 300,266 | |

| | 9,400 | | Immunogen, Inc.* | | | 77,268 | |

| | 12,800 | | Impax Laboratories, Inc.* | | | 241,152 | |

| | 5,750 | | Kinetic Concepts, Inc.* | | | 218,672 | |

| | 10,000 | | Par Pharmaceutical Cos., Inc.* | | | 325,100 | |

| | 12,800 | | Pharmaceutical Product Development, Inc. | | | 330,368 | |

| | 10,800 | | Rollins, Inc. | | | 281,340 | |

| | 20,000 | | Schiff Nutrition International, Inc. | | | 161,600 | |

| | 4,500 | | Seattle Genetics, Inc.* | | | 73,755 | |

| | 16,350 | | Sirona Dental Systems, Inc.* | | | 615,578 | |

| | 1,200 | | Sotheby’s | | | 52,608 | |

| | 2,700 | | SuccessFactors, Inc.* | | | 73,224 | |

| | 4,375 | | Techne Corp. | | | 266,525 | |

| | 4,285 | | Transcend Services, Inc.* | | | 74,645 | |

| | 9,110 | | Wright Express Corp.* | | | 343,538 | |

| | | | | |

| |

| | | | | | | 4,907,925 | |

| | | | | |

| |

| | | | Energy — 4.4% | | | | |

| | 14,400 | | Atlas Energy, Inc.* | | | 419,328 | |

| | 9,312 | | Atwood Oceanics, Inc.* | | | 302,733 | |

| | 24,600 | | Brigham Exploration Co.* | | | 518,814 | |

| | 21,000 | | EXCO Resources, Inc. | | | 311,430 | |

| | | | | |

| |

| | | | | | | 1,552,305 | |

| | | | | |

| |

24

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Financial — 16.5% | | | | |

| | 4,600 | | Affiliated Managers Group, Inc.* | | $ | 393,806 | |

| | 943 | | Alleghany Corp.* | | | 283,353 | |

| | 9,500 | | American Equity Investment Life Holding Co. | | | 103,075 | |

| | 4,435 | | American Financial Group, Inc. | | | 135,622 | |

| | 5,500 | | Arthur J. Gallagher & Co. | | | 154,880 | |

| | 2,700 | | Bancorp Rhode Island, Inc. | | | 78,543 | |

| | 57,000 | | Brookline Bancorp, Inc. | | | 555,180 | |

| | 19,100 | | Capitol Federal Financial | | | 446,940 | |

| | 58,500 | | CNO Financial Group, Inc.* | | | 318,240 | |

| | 36,700 | | Danvers Bancorp, Inc. | | | 551,601 | |

| | 15,800 | | East West Bancorp, Inc. | | | 278,554 | |

| | 8,170 | | Enterprise Bancorp, Inc. | | | 93,873 | |

| | 600 | | First Citizens BancShares, Inc., Class A | | | 112,068 | |

| | 14,000 | | First Horizon National Corp.* | | | 141,260 | |

| | 2,300 | | Hingham Institution for Savings | | | 92,000 | |

| | 3,407 | | Investors Title Co. | | | 110,353 | |

| | 16,000 | | Janus Capital Group, Inc. | | | 168,960 | |

| | 28,100 | | MGIC Investment Corp.* | | | 247,842 | |

| | 17,384 | | Montpelier Re Holdings Ltd. | | | 318,475 | |

| | 33,300 | | Sunstone Hotel Investors, Inc.* | | | 361,305 | |

| | 24,000 | | United Financial Bancorp, Inc. | | | 324,960 | |

| | 6,000 | | Waddell & Reed Financial, Inc., Class A | | | 174,420 | |

| | 9,000 | | Webster Financial Corp. | | | 154,080 | |

| | 827 | | White Mountains Insurance Group, Ltd. | | | 263,978 | |

| | | | | |

| |

| | | | | | | 5,863,368 | |

| | | | | |

| |

| | | | Industrial — 10.6% | | | | |

| | 9,625 | | A.O. Smith Corp. | | | 539,289 | |

| | 7,100 | | Armstrong World Industries, Inc.* | | | 296,425 | |

| | 3,000 | | Atlas Air Worldwide Holdings, Inc.* | | | 156,780 | |

| | 13,000 | | Dynamex, Inc.* | | | 274,820 | |

| | 9,800 | | Genesee & Wyoming, Inc., Class A* | | | 453,054 | |

| | 15,550 | | GrafTech International Ltd.* | | | 256,109 | |

| | 30,100 | | Heartland Express, Inc. | | | 448,791 | |

| | 15,150 | | Knight Transportation, Inc. | | | 270,730 | |

| | 3,000 | | Lennox International, Inc. | | | 123,030 | |

25

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | | VALUE | |

| | SHARES | | | | | (NOTE 2) | |

|

| | | | Industrial — 10.6% (continued) | | | | |

| | 8,000 | | Roadrunner Transportation Systems, Inc.* | | $ | 96,000 | |

| | 7,000 | | Simpson Manufacturing Company, Inc. | | | 186,060 | |

| | 3,600 | | Snap-On, Inc. | | | 183,600 | |

| | 22,250 | | Werner Enterprises, Inc. | | | 474,370 | |

| | | | | |

| |

| | | | | | | 3,759,058 | |

| | | | | |

| |

| | | | Technology — 21.9% | | | | |

| | 2,000 | | athenahealth, Inc.* | | | 79,940 | |

| | 67,100 | | Brocade Communications Systems, Inc.* | | | 424,072 | |

| | 19,200 | | CommVault Systems, Inc.* | | | 555,456 | |

| | 16,000 | | Compellent Technologies, Inc.* | | | 404,320 | |

| | 22,000 | | Compuware Corp.* | | | 220,220 | |

| | 1,500 | | Concur Technologies, Inc.* | | | 77,430 | |

| | 3,600 | | Ebix, Inc.* | | | 88,920 | |

| | 41,300 | | Emulex Corp.* | | | 470,820 | |

| | 7,200 | | Fortinet, Inc.* | | | 216,000 | |

| | 10,000 | | Isilon Systems, Inc.* | | | 284,700 | |

| | 24,377 | | Jack Henry & Associates, Inc. | | | 662,079 | |

| | 4,000 | | JDA Software Group, Inc.* | | | 101,200 | |

| | 7,900 | | Lexmark International, Inc., Class A* | | | 300,437 | |

| | 5,300 | | Medidata Solutions, Inc.* | | | 98,739 | |

| | 14,000 | | Mellanox Technologies Ltd.* | | | 322,280 | |

| | 8,015 | | MICROS Systems, Inc.* | | | 363,801 | |

| | 4,700 | | MicroStrategy, Inc., Class A* | | | 425,961 | |

| | 22,000 | | MIPS Technologies, Inc.* | | | 323,400 | |

| | 6,200 | | NetLogic Microsystems, Inc.* | | | 186,372 | |

| | 7,300 | | Netscout Systems, Inc.* | | | 171,331 | |

| | 8,000 | | NetSuite, Inc.* | | | 163,840 | |

| | 10,975 | | Open Text Corp.* | | | 485,424 | |

| | 24,575 | | QLogic Corp.* | | | 431,783 | |

| | 5,000 | | Quest Software, Inc.* | | | 130,850 | |

| | 4,500 | | RADWARE Ltd.* | | | 159,165 | |

| | 5,400 | | RightNow Technologies, Inc.* | | | 141,048 | |

| | 1,200 | | Riverbed Technology, Inc.* | | | 69,048 | |

| | 7,500 | | Solera Holdings, Inc. | | | 360,375 | |

| | 2,200 | | Taleo Corp., Class A* | | | 63,118 | |

| | | | | |

| |

| | | | | | | 7,782,129 | |

| | | | | |

| |

26

The FBR Funds

FBR Small Cap Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | Utilities — 1.5% | | | | |

| | 25,700 | | Portland General Electric Co. | | $ | 537,130 | |

| | | | | |

| |

| | | | Total Common Stocks (Cost $32,269,406) | | |

34,700,575 | |

| | | | | |

| |

| | | | INVESTMENT COMPANY — 1.0% | | | | |

| | 10,100 | | Materials Select Sector SPDR Fund (Cost $346,910) | | | 351,783 | |

| | | | | |

| |

| | | | SHORT-TERM INVESTMENT — 0.5% | | | | |

| | 177,473 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $177,473) | | | 177,473 | |

| | | | | |

| |

| | | | Total Investments — 99.2% (Cost $32,793,789) | | | 35,229,831 | |

| | | | | | | | |

| | | | Other Assets Less Liabilities — 0.8% | | | 266,124 | |

| | | | | |

| |

| | | | Net Assets — 100.0% | |

$ |

35,495,955 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

27

The FBR Funds

FBR Focus Fund

Management Overview

Portfolio Managers: David Rainey, CFA®, Brian Macauley, CFA® and Ira Rothberg, CFA®

Over the previous 12 months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2010, the Investor Class of the FBR Focus Fund returned 26.65% compared to 26.58% for the Russell 2000 Index, 25.94% for the Morningstar Mid Cap Growth Category Average and 16.52% for the S&P 500 Index.

On average, the Fund’s portfolio companies produced growing earnings and earnings power over the period, with some modest valuation expansion. While economic conditions remain difficult, there has been sufficient stability to allow the portfolio companies to increase their intrinsic value.

Major contributors to performance during the period included American Tower, CarMax, and O’Reilly Automotive.

| | • | | American Tower experienced growing rental income from its tower portfolio as wireless service providers (AT&T, Verizon, etc.) leased more space to meet the rapidly growing demand for data services. |

| | • | | CarMax benefited from a continued rebound in demand for used autos and an increase in the availability of auto financing from recessionary lows. Internal efficiency improvements enabled CarMax to set record earnings despite sales still well below pre-recession levels. |

| | • | | O’Reilly Automotive continued to make good progress integrating its acquisition of CSK Auto and extracting value from those formerly underperforming stores. We discuss O’Reilly in greater detail in the second section of this letter. |

The only major detractor from performance was Bally Technologies. Bally’s solid performance in casino information systems was overshadowed by disappointingly slow industry wide sales of slot machines. We expect capital budgets at casinos to improve over the next several years, freeing up cash to invest in new slot machines to Bally’s benefit.

We also had two portfolio companies accept buyout offers during the year: AmeriCredit and Dynamex. With modest valuations and interest rates at multi-decade lows, it is not surprising to see corporate and private equity buyout activity picking up.

We recycled some of the proceeds from the AmeriCredit buyout, along with selective pruning elsewhere in the portfolio, to add two new positions in the portfolio (Aon and Diamond Hill Investment Group) and to quadruple the size of our investment in Charles Schwab. We believe each of these companies has a strong franchise with a good growth opportunity at a very modest valuation.

28

The FBR Funds

FBR Focus Fund

Management Overview (continued)

We invest with a long-term time horizon and encourage Fund shareholders to do the same. Despite the discussion of one year results referenced above, we encourage investors to evaluate the Fund’s performance over three-, five-, and ten-year periods since shorter time frames can be influenced by many transitory issues unrelated to the intrinsic worth of the Fund’s holdings. Long-term performance metrics for the Fund can be found in the table below.

Portfolio managers’ comments on the Fund and the related investment outlook.

In the course of a generation, there has been a wholesale change in the nature of stock ownership in this country. Based on New York Stock Exchange data, from 1940 through the mid 1970s, the average holding period of a stock by U.S. investors fluctuated between four and ten years. Then, in 1975, the average holding period began a steady multi-decade march lower to its current level of about six months. The reasons for this change are numerous, but it is safe to say that the relationship between the typical U.S. investor and his investment in a public company has changed from “going-steady” to “speed dating”.

While we believe this short-term focus is pure folly, we do not protest too loudly. For it is this emphasis on the short-term by others that occasionally creates an opening for us to invest in exceptional businesses at discount prices.

Since inception, the Fund has had an average portfolio company holding period of about six years. While others spend their time trying to forecast share price movement over the next six months, we focus on building a deep understanding of a business and its long term value. We seek to identify well run, competitively advantaged companies that are likely to grow their per share intrinsic value at a mid teens or better rate per year over the next five or ten years. Our goal is to buy these high quality businesses at modest prices so that our long term investment return will approximate or exceed the growth in per share intrinsic value. Such gems are hard to find, especially with our disciplined valuation parameters. But occasionally the market loses sight of, or fails to appreciate the quality of a business and its growth prospects, giving us an investment opportunity. This concept is best illustrated with an example: O’Reilly Automotive.

O’Reilly Automotive is the second largest distributor and retailer of aftermarket auto parts in the U.S. with 3,535 locations across 38 states. The Company sells products ranging from spark plugs, windshield wipers, and motor oil, to alternators, transmissions, and cylinder heads.

The Fund first established a position in O’Reilly in January 2005 at $22 per share, or about 15x analysts’ expectations of 2005 earnings per share (a reasonable metric to track intrinsic value per share for this business). Additional large purchases were made opportunistically in early 2007 and early 2008 at lower valuations in comparison to earnings. Over the Fund’s nearly six year holding period, cash earnings per share have

29

The FBR Funds

FBR Focus Fund

Management Overview (continued)

grown 18% per annum, and the stock price has tracked closely behind, up 17% per annum. Today the shares at $61 still trade at about 15x analysts’ expectations of 2011 earnings per share.

During the same six year period, the S&P 500 grew operating earnings per share at just 2% per annum, so it was not a robust operating environment for businesses overall. The point we want to make is that occasionally you can find a needle in the haystack. There are businesses that can grow earnings at a rapid clip, available at conservative valuations that provide both downside protection and appreciation potential at least in line with mid teens growth in intrinsic value. The challenge is in identifying such opportunities.

In the case of O’Reilly, the company had a very successful history and had grown earnings per share at an 18% annual growth rate from 1999 to 2004 by acquiring competitors and gradually expanding its business from 571 stores in nine states to 1,249 stores in 19 states. So at the time of the Fund’s initial purchase in 2005, the obvious questions were why had the company been so successful in the past, and was this prosperity likely to continue in the future?

Since we typically hold an investment for many years, we conduct our research with an eye toward understanding the opportunity for a business over the course of the next decade. Most of our research is focused on evaluating those things that make a difference in the long term, i.e. the competitive structure of the industry, management quality, and the sustainability of pricing and margins.

To build this knowledge, we conduct industry standard research like reading annual reports, SEC filings, financial statements, attending presentations and meeting with senior management. But to really understand a business we find it is important to dig much deeper. So we often visit company facilities, meet with field level employees, talk to customers, interview former employees, attend industry trade shows, and speak with public and private competitors. While this is hard and time consuming work, we believe it gives us an edge over the more shallow practices common in the investment industry. It gives us an understanding of a company and its industry that often leads to unique investment insights.

As a product of our research, we learned that O’Reilly was advantaged versus its competition because its distribution model was configured to keep its inventory of auto parts closer to the end customer enabling better parts availability and faster delivery times. This was very important to commercial and heavy duty retail customers. Competitors had been unsuccessful replicating O’Reilly’s distribution model, so the company enjoyed a service advantage that had won market share in the past, and was likely to continue yielding benefits in the future.

Further, as one of the largest distributors in the industry, O’Reilly had substantial buying power compared to its many small competitors. So the company could secure parts inventory at a much better price than local and regional competitors enabling it to earn higher profit margins and good economic profits.

30

The FBR Funds

FBR Focus Fund

Management Overview (continued)

O’Reilly had a proven management team and a clear ambition to extend the company’s past regional success into a national franchise. Greg Henslee, CEO, and Ted Wise, COO, were best-in class operators with a combined 56 years experience at the company. And David O’Reilly, Chairman, was a skilled capital allocator who had successfully shepherded the company through a number of major acquisitions.

With a single digit market share in a huge industry and a number of sustainable competitive advantages, we believed O’Reilly had ample room to grow its business. Revenue growth would come from the same places in the future as it had in the past, namely buying and improving competing stores, building new stores in existing markets and expanding into new geographies. Profit growth would exceed revenue growth as O’Reilly harnessed its buying power and made better use of its existing distribution and store assets.

No single factor convinced us that O’Reilly had a high probability of future success. Rather, it was the combination of the favorable elements cited above, some obvious to anyone that studied the company’s history and public filings, others only revealed through diligent reading of industry trade publications and conversations with customers and regional competitors.

Of course not every investment we initiate performs as well as O’Reilly, but on balance the approach outlined above has worked well across the overall portfolio. We think it follows logically from the O’Reilly example that if the Fund’s portfolio companies are purchased at reasonable valuations, then our long-term investment outlook should be shaped by the prospects for growth in per share intrinsic value for each of the Fund’s individual holdings. We have a positive view on the long-term outlook for the Fund not because we expect a booming economic recovery or major bull, but rather because we have a favorable view of the fundamental outlook for each of the Fund’s individual portfolio companies.

We thank you for entrusting your capital to us. We take this responsibility very seriously, and we will do our best to protect and grow your investment.

The opinions expressed in this commentary reflect those of the Portfolio Manager(s) as of the date written. Any such opinions are subject to change based on market or other conditions. These opinions may not be relied upon as investment advice. Investment decisions for The FBR Funds are based on several factors, and may not be relied upon as an indication of trading intent on behalf of any FBR Fund. Security positions can and do change.

31

The FBR Funds

FBR Focus Fund

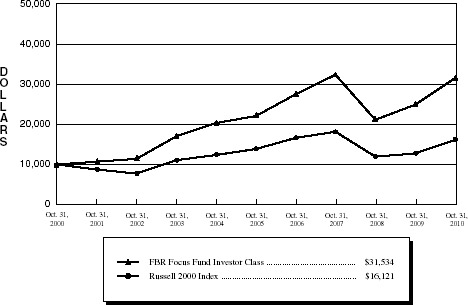

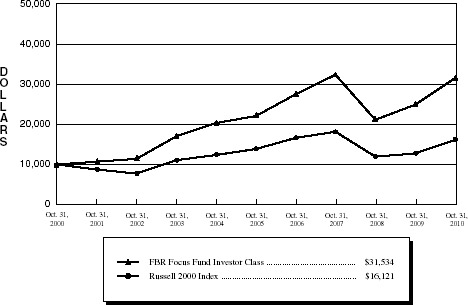

Comparison of Changes in Value of $10,000 Investment in

Investor Class Shares(1)(2) vs. Russell 2000 Index(1)(3)

| Total Returns—For the Periods Ended October 31, 2010(4) |

| | | | | | | | Annualized | | Annualized |

| | | | | One Year | | Five Year | | Ten Year |

| | | | |

| |

| |

|

| | FBR Focus Fund Investor Class(1)(2) | | | 26.65 | % | | 7.37 | % | | 12.17 | % |

| | FBR Focus Fund I Class(2)(5) | | | 27.32 | % | | N/A | | | N/A | |

| | Russell 2000 Index(1)(3) | | | 26.58 | % | | 3.07 | % | | 4.89 | % |

PAST PERFORMANCE IS NO GUARANTEE OF FUTURE RESULTS.

The performance data quoted represents past performance and the current performance may be lower or higher than the performance data quoted. The investment return and principal will fluctuate so that investors’ shares, when redeemed, may be worth more or less than their original cost. The performance data does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption fees. The Fund charges a redemption fee of 1.00% on shares redeemed or exchanged within 90 days; if reflected, the redemption fee would reduce the performance data quoted. To obtain performance data current to the most recent month-end, please call 888.200.4710.

|

| (1) | | The graph assumes a hypothetical $10,000 initial investment in the Fund and reflects the reinvestment of dividends and all Fund expenses. Investors should note that the Fund is a professionally managed mutual fund while the index is unmanaged, does not incur expenses and is not available for investment. The performance of the index includes reinvested dividends, and does not reflect sales charges or expenses. |

| (2) | | FBR Fund Advisers, Inc. waived a portion of its advisory fees and agreed to contractually reimburse a portion of the Fund’s operating expenses, as necessary, to maintain existing expense limitations, as set forth in the notes to the financial statements. Total returns shown include fee waivers and expense reimbursements, if any; total returns would have been lower had there been no waiver of fees and/or reimbursement of expenses in excess of expense limitations. |

| (3) | | The Russell 2000 Index is comprised of the smallest of the 2000 companies of the Russell 3000 Index, representing approximately 8% of the Russell 3000’s total market capitalization. |

| (4) | | The total returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| (5) | | For the period May 30, 2008 (inception of share class) through October 31, 2010, the I Class returned 3.76% and the Russell 2000 Index returned (0.93)%. |

32

The FBR Funds

FBR Focus Fund

Portfolio Summary

October 31, 2010

The following provides a breakdown of the Fund by industry sectors. The underlying securities represent a percentage of the portfolio investments.

| Industry Sector | | % of Total Investments |

| |

|

| Retail | | 31.4 | % |

| Entertainment | | 17.3 | % |

| Telecommunications | | 13.1 | % |

| Insurance | | 11.7 | % |

| Advertising | | 8.5 | % |

| Diversified Financial Services | | 5.9 | % |

| Building Materials | | 3.1 | % |

| Transportation | | 2.7 | % |

| Home Furnishings | | 1.7 | % |

| | | | |

| Cash | | 4.6 | % |

33

The FBR Funds

FBR Focus Fund

Portfolio of Investments

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | COMMON STOCKS — 95.6% | | | | |

| | | | Advertising — 8.5% | | | | |

| | 1,771,440 | | Lamar Advertising Co., Class A* | | $ | 60,211,246 | |

| | | | | |

| |

| | | | Building Materials — 3.1% | | | | |

| | 825,000 | | Simpson Manufacturing Company, Inc. | | | 21,928,500 | |

| | | | | |

| |

| | | | Diversified Financial Services — 5.9% | | | | |

| | 53,520 | | Diamond Hill Investment Group, Inc. | | | 4,098,561 | |

| | 668,256 | | Encore Capital Group, Inc.* | | | 13,578,962 | |

| | 125,000 | | T. Rowe Price Group, Inc. | | | 6,908,750 | |

| | 912,000 | | The Charles Schwab Corp. | | | 14,044,800 | |

| | 173,137 | | White River Capital, Inc. | | | 3,331,156 | |

| | | | | |

| |

| | | | | | | 41,962,229 | |

| | | | | |

| |

| | | | Entertainment — 17.3% | | | | |

| | 1,549,000 | | Bally Technologies, Inc.* | | | 55,887,920 | |

| | 2,009,070 | | Penn National Gaming, Inc.* | | | 66,821,668 | |

| | | | | |

| |

| | | | | | | 122,709,588 | |

| | | | | |

| |

| | | | Home Furnishings — 1.7% | | | | |

| | 680,160 | | American Woodmark Corp. | | | 12,038,832 | |

| | | | | |

| |

| | | | Insurance — 11.7% | | | | |

| | 508,700 | | AON Corp. | | | 20,220,825 | |

| | 187,000 | | Markel Corp.* | | | 62,648,740 | |

| | | | | |

| |

| | | | | | | 82,869,565 | |

| | | | | |

| |

| | | | Retail — 31.5% | | | | |

| | 3,810,235 | | 99 Cents Only Stores*† | | | 58,753,824 | |

| | 2,737,088 | | CarMax, Inc.* | | | 84,822,357 | |

| | 1,352,076 | | O’Reilly Automotive, Inc.* | | | 79,096,446 | |

| | | | | |

| |

| | | | | | | 222,672,627 | |

| | | | | |

| |

| | | | Telecommunications — 13.2% | | | | |

| | 1,804,500 | | American Tower Corp., Class A* | | | 93,130,245 | |

| | | | | |

| |

| | | | Transportation — 2.7% | | | | |

| | 901,315 | | Dynamex, Inc.*† | | | 19,053,799 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Common Stocks (Cost $373,033,504) | | | 676,576,631 | |

| | | | | |

| |

34

The FBR Funds

FBR Focus Fund

Portfolio of Investments (continued)

October 31, 2010

|

| | | | | | VALUE |

| | SHARES | | | | (NOTE 2) |

|

| | | | SHORT-TERM INVESTMENT — 4.6% | | | | |

| | 32,167,489 | | JPMorgan 100% U.S. Treasury Securities Money Market Fund (Cost $32,167,489) | | $ | 32,167,489 | |

| | | | | |

| |

| | | | | | | | |

| | | | Total Investments — 100.2% (Cost $405,200,993) | | | 708,744,120 | |

| | | | | | | | |

| | | | Liabilities Less Other Assets — (0.2)% | | | (1,093,576 | ) |

| | | | | |

| |

| | | | | | | | |

| | | | Net Assets — 100.0% | | $ | 707,650,544 | |

| | | | | |

| |

|

| * | | Non-income producing security |

| † | | Affiliated issuer as defined in the Investment Company Act of 1940 (ownership of at least 5% of the outstanding voting securities of an issuer) |

| Note: | | For presentation purposes, the Fund has grouped some of the industry categories. For purposes of categorizing securities for compliance with Section 8(b)(1) of the Investment Company Act of 1940, the Fund uses more specific industry classifications. |

The accompanying notes are an integral part of the financial statements.

35

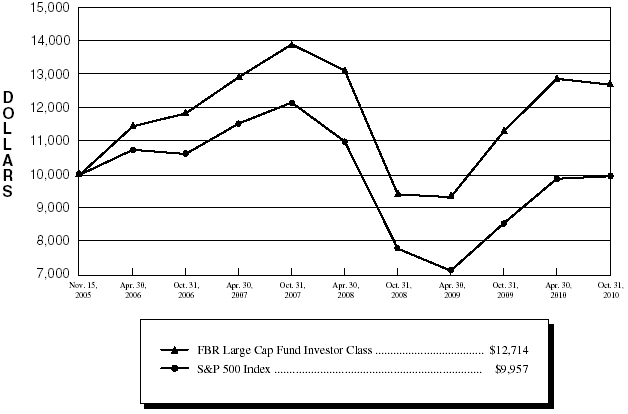

The FBR Funds

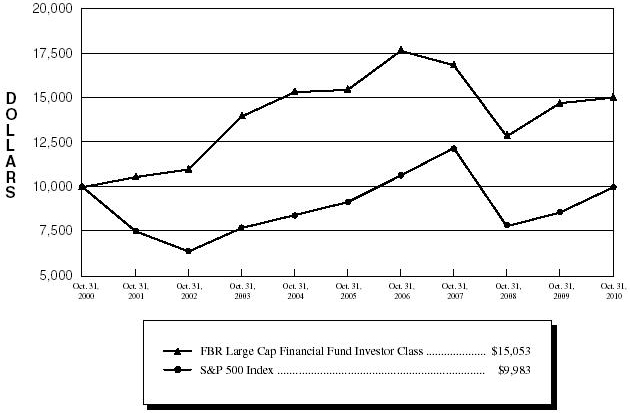

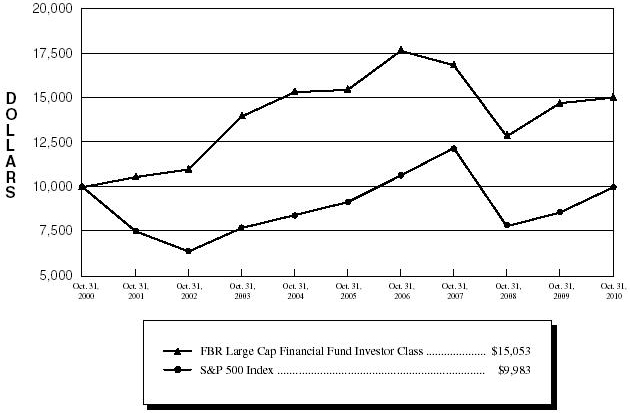

FBR Large Cap Financial Fund

Management Overview

Portfolio Manager: David Ellison

Over the previous 12 months, how did the Fund perform and what factors contributed to this performance?

For the twelve-month period ended October 31, 2010, the Investor Class of the FBR Large Cap Financial Fund returned 2.14%. This compares to the Philadelphia Bank Index, the S&P 500 Index and the Morningstar Financial Category Average, which returned 8.76%, 16.52% and 8.01% for the same period, respectively.

The Fund’s underperformance for the year was primarily due to conservative positioning in the second half of the year. In my last update to shareholders (April 2010) I was more constructive on the outlook for improved profits and stock performance. I have since become more conservative. The slowing recovery, continued rise in foreclosed homes, growing evidence of rising commercial delinquencies, a general lack of loan growth opportunities and cost impacts related to new regulatory mandates made me position the portfolio to protect gains achieved through mid year. What the Fund missed was the rally in late summer as aggressive Federal Reserve actions to promote recovery aided investor optimism.

The Fund remains concentrated in the large domestic depository franchises. I believe over the longer run these companies will benefit from a stable funding source (deposits), improved credit conditions and eventual return to loan growth. I expect cash balances will remain on the high side to take advantage of market opportunities and provide the Fund with cash to add new names as my conviction develops.

Portfolio manager comments on the Fund and the related investment outlook.