Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

Industry Overview

June 1, 2006

| | ADESA Analytical Services Reports | | [LOGO] |

GVR Global Vehicle Remarketing

A Service Industry Positioned for Growth 2005/2006

[GRAPHIC]

Pulse

Latest Economic Indicators

2005 Mid-Year

[GRAPHIC]

Plus monthly postings on:

www.adesa.com/kontoskorner

Contact Tom Kontos

tkontos@adesa.com

317/249-4235

2

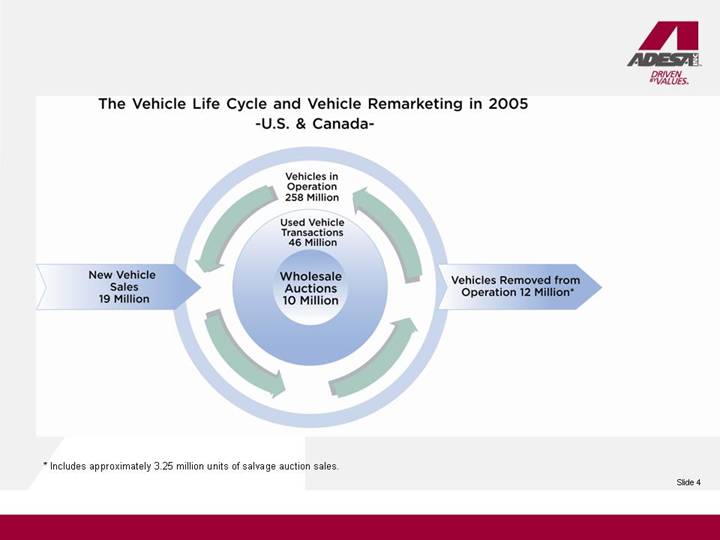

The Vehicle Life Cycle and Vehicle Remarketing in 2005

- -U.S. & Canada-

[GRAPHIC]

* Includes approximately 3.25 million units of salvage auction sales.

4

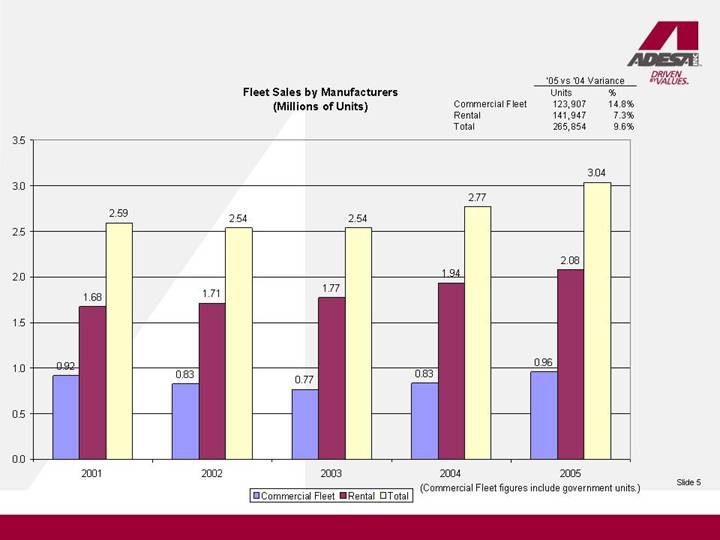

Fleet Sales by Manufacturers

(Millions of Units)

| | ’05 vs ’04 Variance | |

| | Units | | % | |

Commercial Fleet | | 123,907 | | 14.8 | % |

Rental | | 141,947 | | 7.3 | % |

Total | | 265,854 | | 9.6 | % |

[CHART]

5

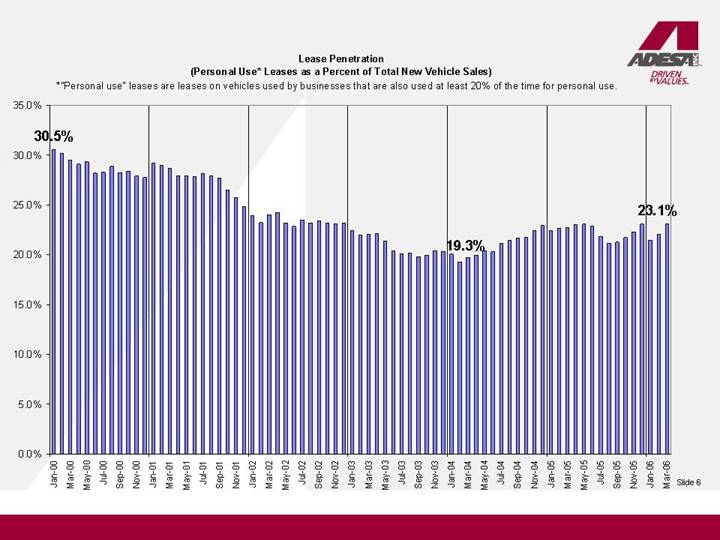

Lease Penetration

(Personal Use* Leases as a Percent of Total New Vehicle Sales)

*“Personal use” leases are leases on vehicles used by businesses that are also used at least 20% of the time for personal use.

[CHART]

6

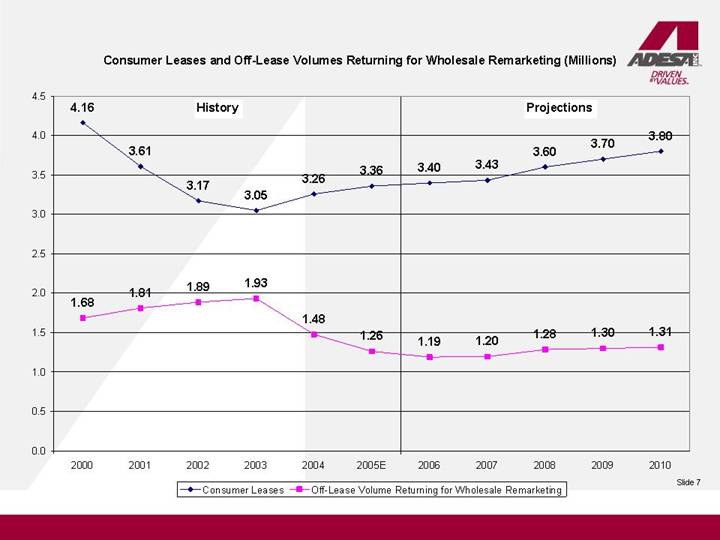

Consumer Leases and Off-Lease Volumes Returning for Wholesale Remarketing (Millions)

[CHART]

7

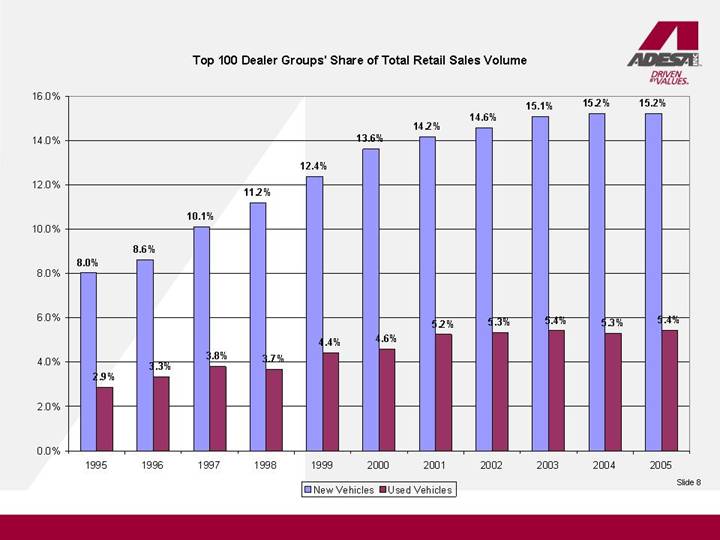

Top 100 Dealer Groups’ Share of Total Retail Sales Volume

[CHART]

8

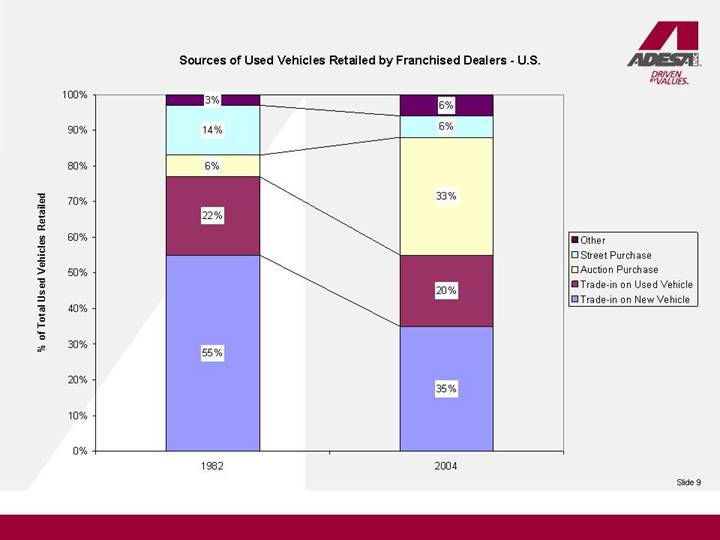

Sources of Used Vehicles Retailed by Franchised Dealers - U.S.

[CHART]

9

Current Market Conditions

10

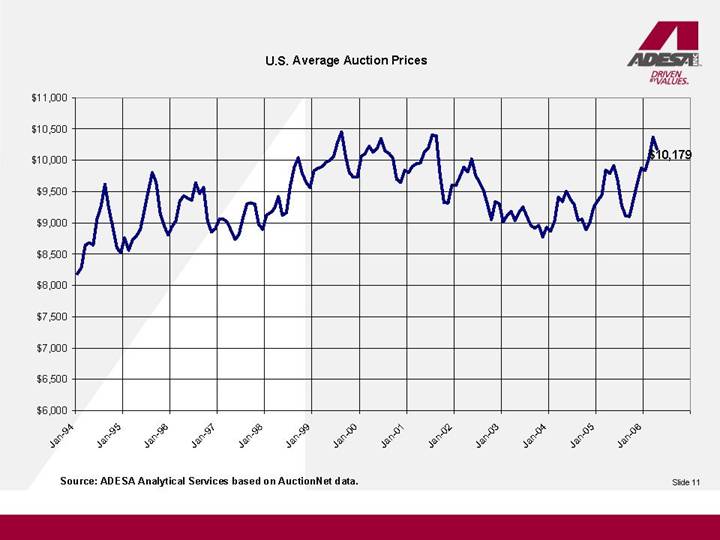

U.S. Average Auction Prices

[CHART]

Source: ADESA Analytical Services based on AuctionNet data.

11

Year-on-Year % Change in Average AuctionNet Price by Model Class - April 2006

[CHART]

12

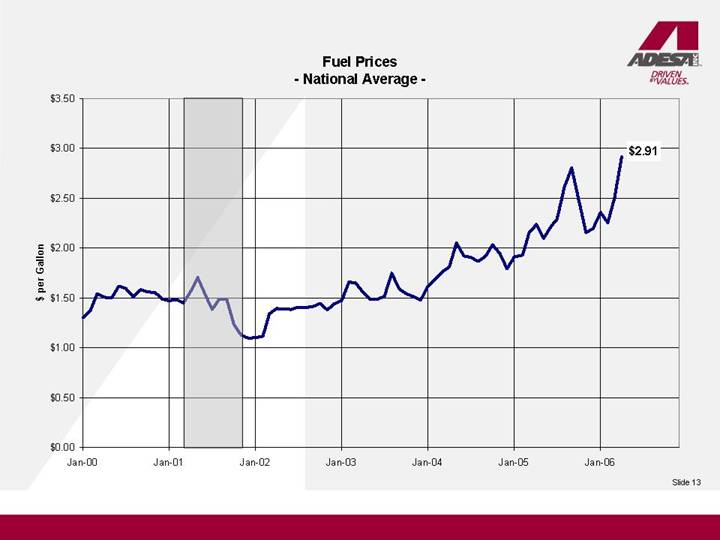

Fuel Prices

- National Average -

[CHART]

13

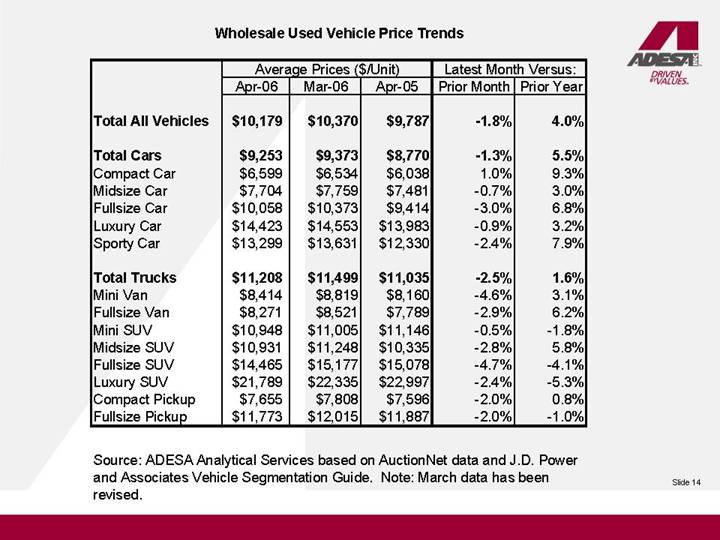

Wholesale Used Vehicle Price Trends

| | Average Prices ($/Unit) | | Latest Month Versus: | |

| | Apr-06 | | Mar-06 | | Apr-05 | | Prior Month | | Prior Year | |

| | | | | | | | | | | |

Total All Vehicles | | $ | 10,179 | | $ | 10,370 | | $ | 9,787 | | -1.8 | % | 4.0 | % |

| | | | | | | | | | | |

Total Cars | | $ | 9,253 | | $ | 9,373 | | $ | 8,770 | | -1.3 | % | 5.5 | % |

Compact Car | | $ | 6,599 | | $ | 6,534 | | $ | 6,038 | | 1.0 | % | 9.3 | % |

Midsize Car | | $ | 7,704 | | $ | 7,759 | | $ | 7,481 | | -0.7 | % | 3.0 | % |

Fullsize Car | | $ | 10,058 | | $ | 10,373 | | $ | 9,414 | | -3.0 | % | 6.8 | % |

Luxury Car | | $ | 14,423 | | $ | 14,553 | | $ | 13,983 | | -0.9 | % | 3.2 | % |

Sporty Car | | $ | 13,299 | | $ | 13,631 | | $ | 12,330 | | -2.4 | % | 7.9 | % |

| | | | | | | | | | | |

Total Trucks | | $ | 11,208 | | $ | 11,499 | | $ | 11,035 | | -2.5 | % | 1.6 | % |

Mini Van | | $ | 8,414 | | $ | 8,819 | | $ | 8,160 | | -4.6 | % | 3.1 | % |

Fullsize Van | | $ | 8,271 | | $ | 8,521 | | $ | 7,789 | | -2.9 | % | 6.2 | % |

Mini SUV | | $ | 10,948 | | $ | 11,005 | | $ | 11,146 | | -0.5 | % | -1.8 | % |

Midsize SUV | | $ | 10,931 | | $ | 11,248 | | $ | 10,335 | | -2.8 | % | 5.8 | % |

Fullsize SUV | | $ | 14,465 | | $ | 15,177 | | $ | 15,078 | | -4.7 | % | -4.1 | % |

Luxury SUV | | $ | 21,789 | | $ | 22,335 | | $ | 22,997 | | -2.4 | % | -5.3 | % |

Compact Pickup | | $ | 7,655 | | $ | 7,808 | | $ | 7,596 | | -2.0 | % | 0.8 | % |

Fullsize Pickup | | $ | 11,773 | | $ | 12,015 | | $ | 11,887 | | -2.0 | % | -1.0 | % |

Source: ADESA Analytical Services based on AuctionNet data and J.D. Power and Associates Vehicle Segmentation Guide. Note: March data has been revised.

14

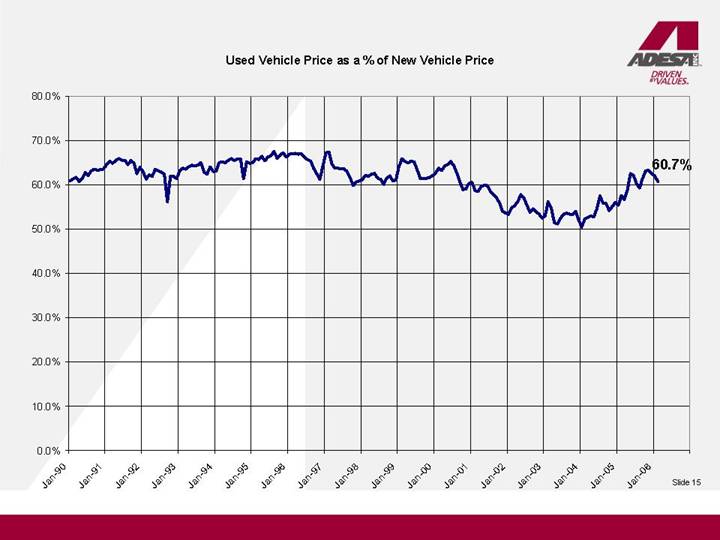

Used Vehicle Price as a % of New Vehicle Price

[CHART]

15

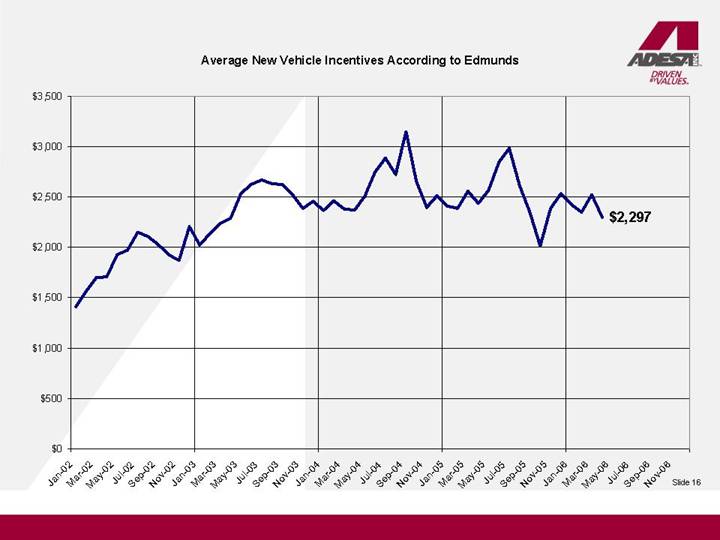

Average New Vehicle Incentives According to Edmunds

[CHART]

16

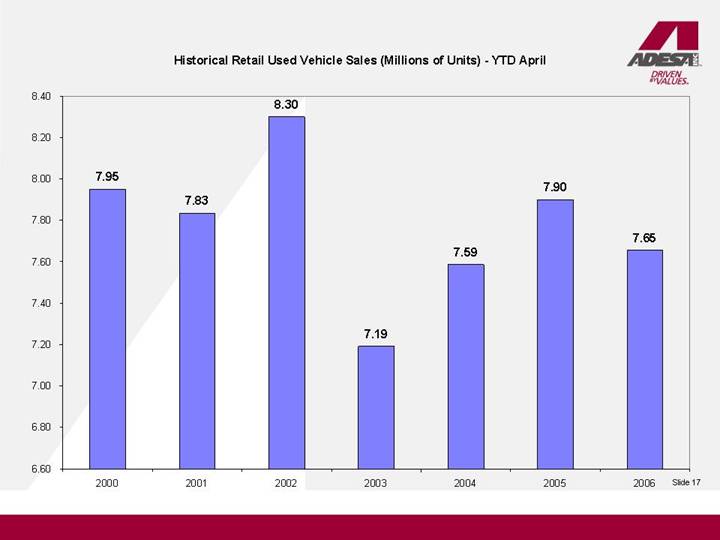

Historical Retail Used Vehicle Sales (Millions of Units) - YTD April

[CHART]

17

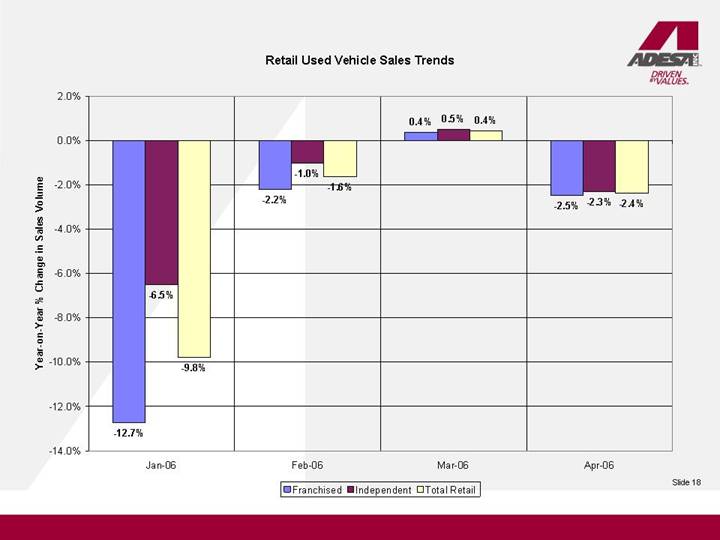

Retail Used Vehicle Sales Trends

[CHART]

18

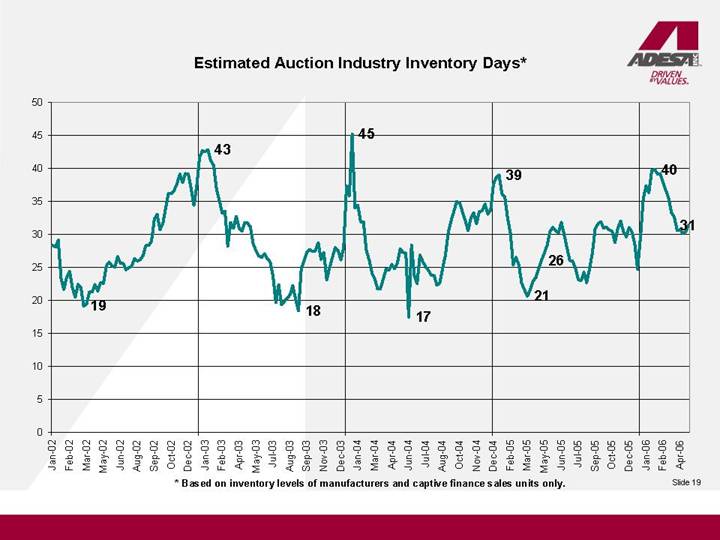

Estimated Auction Industry Inventory Days*

[CHART]

* Based on inventory levels of manufacturers and captive finance sales units only.

19

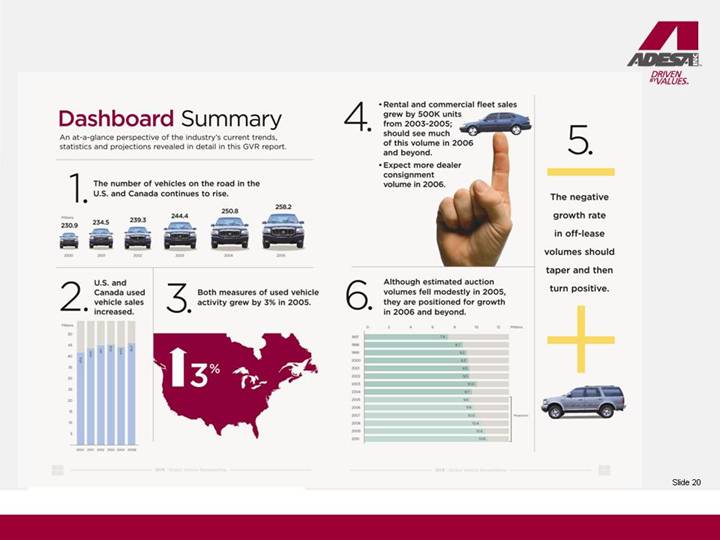

Dashboard Summary

An at-a-glance perspective of the industry’s current trends, statistics and projections revealed in detail in this GVR report.

1. | | The number of vehicles on the road in the U.S. and Canada continues to rise. | | 4. | | • Rental and commercial fleet sales grew by 500k units from 2003-2005; should see much of this volume in 2006 and beyond. • Expect more dealer consignment volume in 2006. | | 5. The negative growth rate in off-lease volumes should taper and then turn positive |

| | | | | | | | |

| | [GRAPHIC] | | | | [GRAPHIC] | | [GRAPHIC] |

| | | | | | | | |

2. | | U.S. and Canada used vehicle sales increased. | | 3. | | Both measures of used vehicle activity grew by 3% in 2005. | | 6. | | Although estimated auction volumes fell modestly in 2005, they are positioned for growth in 2006 and beyond. | | |

| | | | | | | | | | | | |

| | [CHART] | | | | [GRAPHIC] | | | | [CHART] | | |

20

In Summary:

[GRAPHIC]

• VIO, off-fleet, off-lease, and dealer consignment trends appear positive for future auction volumes.

• Retail market started the year soft, but VIO churn and hurricane replacement should support solid retail sales for remainder of 2006.

• Prices should stabilize, around typical seasonal fluctuations.

21