Searchable text section of graphics shown above

[LOGO]

[GRAPHIC]

| Dealer Service Group |

| Automotive Finance Corporation |

| June 1, 2006 |

Cautionary Statement

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, including statements regarding anticipated financial results, the Company’s competitive position, anticipated industry developments and growth initiatives are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. The statements are based on assumptions about important factors including: general business conditions; market trends; competition; weather; vehicle production; trends in new and used vehicle sales; business development activities, including acquisitions; economic conditions, including exchange rate and interest rate fluctuations; litigation developments; and the other risk factors described in the Company’s Annual Report on Form 10-K, and other risks described from time to time in the Company’s filings with the Securities and Exchange Commission. Many of these risk factors are outside of the Company’s control, and as such, they involve risks which are not currently known to the Company that could cause actual results to differ materially from forecasted results. The forward-looking statements in this document are made as of the date hereof and the Company does not undertake to update its forward-looking statements.

2

Dealer Services Group

• Overview – Cam Hitchcock

• AFC Operations – Jeff Widholm

• Q & A

3

Early Observations/Questions

• Our dealer buyers and all consignors are not shy about communicating their needs. We are listening closely.

• We have a tremendous amount of “unmined” data at both the Auctions and DSG. We are investing to unearth and put the info to work.

• We are well positioned to grow both our traditional and non-traditional product lines. Stay tuned.

• We have no preconceived notion of what % of DSG’s revenue and earnings AFC will be 24-30 months out.

• When can one database be used to track dealers in all of our operating segments and feed our sales force?

4

Dealer Services Group

| | Dealer Services

Group | | |

| | | | |

Automotice

Financie

Corporation | | Finance Express

15% ownership | | Other Investments

To be determined |

5

Growth Opportunities – Dealer Services Group

Organic | | Strategic Focus |

| | |

• New Dealers | | • Ancillary Svcs. |

• Inactive Dealers | | • Leverage Footprint/Infrastructure |

• Improve Existing Customer Throughput | | • New Revenue Streams |

| | • Geographic Expansion |

6

Automotive Finance Corporation

| | President | | |

| | Cam Hitchcock | | |

| | | | |

Chief Operating

Officer

Jeff Widholm | VP of F & I

Services

Margot Hanulak | VP of Special

Projects

Gordon Rogers | Controller

Jim Money | VP of Legal/

Collections

Jack Cohen |

7

Experienced Management Team

Cam Hitchcock, President of Dealer Services Group (DSG)

• Previous global automotive industry experience

• VP-Treasurer and Six Sigma CFO at Lear Corp.

• Covered automotive industry as investment banker at Deutsche Morgan Grenfell

• International operations experience at Rockwell Intl.

• Joined ADESA as EVP and CFO in 2004

• Promoted to President of ADESA DSG effective June 1, 2006

Jeff Widholm, COO

• Overall 21 years experience in the finance/automotive industry

• 10 years as VP of commercial lending at Bank One

• 3 years as CFO at Budget Car Sales

• Joined AFC in 1998 as VP of the Northeast Division overseeing operations of 21 branches

• Promoted to COO in 2003 overseeing operations of AFC’s 85 branches

• The senior AFC team consists of 11 individuals with over 140 years of collective relative industry experience.

• 9 out of our 11 senior operating managers spent extensive time in the “field” before their current position.

• Margot Hanulak, VP of F&I Services oversees our efforts in the business development of Finance Express and F & I Services. Ms. Hanulak has 20 years experience in the F&I/automotive retail industry.

8

Dealer Services Group

• Overview – Cam Hitchcock

• AFC Operations – Jeff Widholm

• Q & A

9

Dealer Floorplanning Industry Overview

• Floorplanning –Short-term (typically 30 to 45 days) inventory financing of wholesale vehicles to independent dealers

• Each floorplan financed vehicle is treated as an individual loan

• Typically, a security interest and title of the vehicle is provided to lender

• The used car floorplanning market is a diverse and fragmented sector

• Market generally breaks down into two segments:

1. Franchise dealer financing

2. Independent dealer financing (where AFC focuses)

• Independent dealer market has two leading players:

• AFC (close to 13,000 active dealers last year) and

• Manheim Automotive Financial Services (MAFS) (over 9,100 estimated active dealers)

10

Dealer Floorplanning Industry Overview Continued

• Other competitors include specialty lenders, regional banks and other financial institutions

• New car floorplanning companies are not active in the independent market

• Independent dealer floorplanners primarily finance vehicles purchased at auto auctions

• Success in this sector requires the execution of well-defined processes and systems

11

AFC’s Competitive Advantages

• Functions as a non-captive floorplan company

• Specializes in floorplanning to the independent dealer

• Serving the industry since 1987, longer than any other direct competitor

• More branches than any other competitor

• Extensive level of controls to manage risk

12

AFC’s Competitive Advantages continued

• Diverse customer base with little concentration

• Low cost reliable funding

• Intense focus on training and development of personnel

• Nimble organization with service oriented culture

• Growing value added services for used vehicle dealers

13

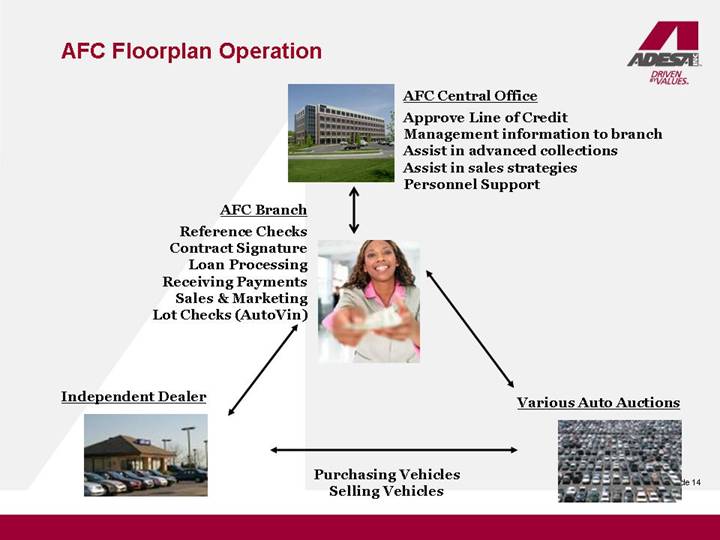

AFC Floorplan Operation

| [GRAPHIC] | AFC Central Office |

| Approve Line of Credit |

| Management information to branch |

| Assist in advanced collections |

| Assist in sales strategies |

| Personnel Support |

| | |

AFC Branch | | |

Reference Checks | | [GRAPHIC] | |

Contract Signature | |

Loan Processing | |

Receiving Payments | |

Sales & Marketing | |

Lot Checks (AutoVin) | |

| | |

Independent Dealer | | Various Auto Auctions |

| | |

[GRAPHIC] | | [GRAPHIC] |

| Purchasing Vehicles | |

| Selling Vehicles | |

14

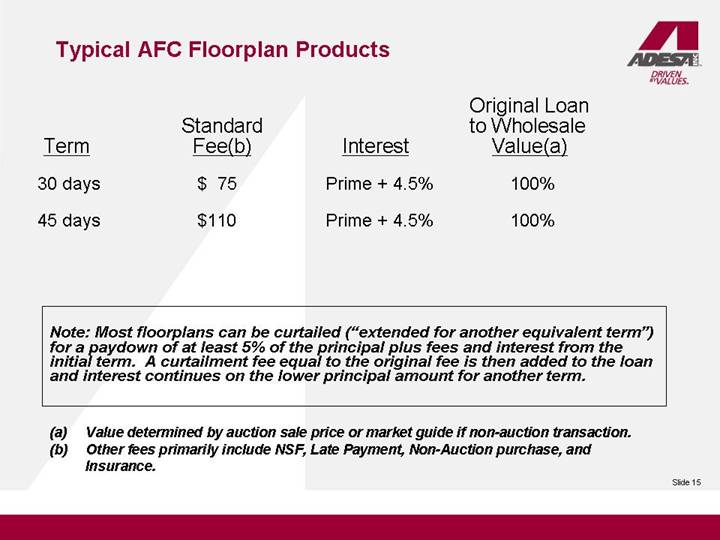

Typical AFC Floorplan Products

| | | | | | Original Loan | |

| | Standard | | | | to Wholesale | |

Term | | Fee(b) | | Interest | | Value(a) | |

| | | | | | | |

30 days | | $ | 75 | | Prime + 4.5% | | 100 | % |

| | | | | | | |

45 days | | $ | 110 | | Prime + 4.5% | | 100 | % |

Note: Most floorplans can be curtailed (“extended for another equivalent term”) for a paydown of at least 5% of the principal plus fees and interest from the initial term. A curtailment fee equal to the original fee is then added to the loan and interest continues on the lower principal amount for another term.

(a) Value determined by auction sale price or market guide if non-auction transaction.

(b) Other fees primarily include NSF, Late Payment, Non-Auction purchase, and Insurance.

15

Competitive Landscape

• The level of competition increased in 2005

• As shown by our 2005 results and the 2006 first quarter results, we have performed well despite our new competition

• Some reasons behind our ability to succeed in the face of competition include:

• The hiring of quality talent

• An increased emphasis on customer service and sales

• Our comprehensive training process of new personnel

• Maintaining customer loyalty by delivering exceptional customer service

• Our willingness to be flexible while mitigating risk

16

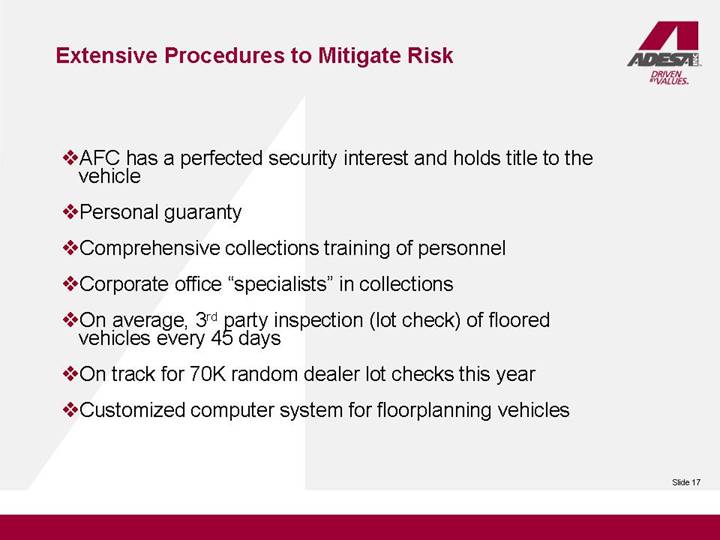

Extensive Procedures to Mitigate Risk

• AFC has a perfected security interest and holds title to the vehicle

• Personal guaranty

• Comprehensive collections training of personnel

• Corporate office “specialists” in collections

• On average, 3rd party inspection (lot check) of floored vehicles every 45 days

• On track for 70K random dealer lot checks this year

• Customized computer system for floorplanning vehicles

17

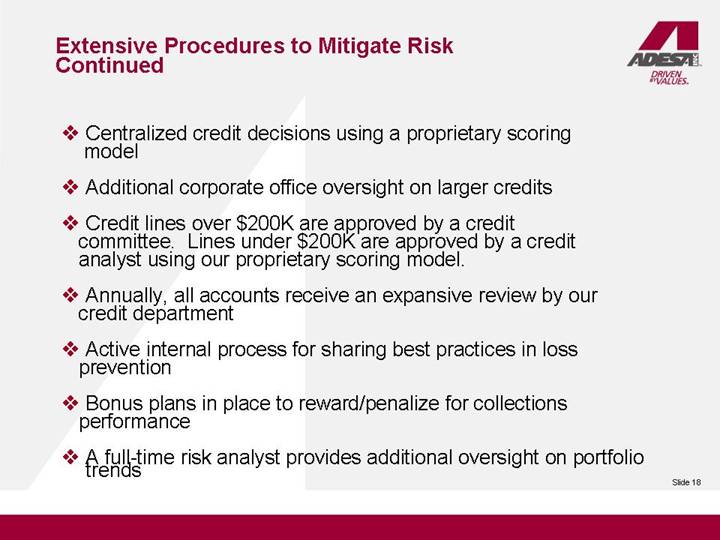

Extensive Procedures to Mitigate Risk Continued

• Centralized credit decisions using a proprietary scoring model

• Additional corporate office oversight on larger credits

• Credit lines over $200K are approved by a credit committee. Lines under $200K are approved by a credit analyst using our proprietary scoring model.

• Annually, all accounts receive an expansive review by our credit department

• Active internal process for sharing best practices in loss prevention

• Bonus plans in place to reward/penalize for collections performance

• A full-time risk analyst provides additional oversight on portfolio trends

18

…which results in a strong credit quality portfolio

• The percent current on the portfolio is in excess of 95% and has remained so over the past 5 years.

• Our loan loss provision has declined due to the quality of the portfolio.

• The calculation of our reserves is primarily formula driven and is reviewed quarterly by external accountants.

• Our securitization credit facility has been in place with the same provider since December 1996.

19

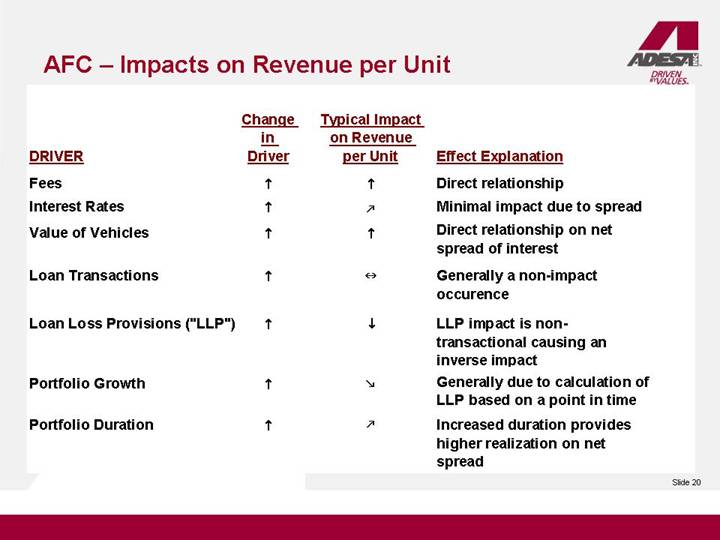

AFC – Impacts on Revenue per Unit

| | Change | | Typical Impact | | | |

| | in | | on Revenue | | | |

DRIVER | | Driver | | per Unit | | Effect Explanation | |

| | | | | | | |

Fees | |

| |

| | Direct relationship | |

| | | | | | | |

Interest Rates | |

| |

| | Minimal impact due to spread | |

| | | | | | | |

Value of Vehicles | |

| |

| | Direct relationship on net spread of interest | |

| | | | | | | |

Loan Transactions | |

| |

| | Generally a non-impact occurence | |

| | | | | | | |

Loan Loss Provisions (“LLP”) | |

| |

| | LLP impact is non-transactional causing an inverse impact | |

| | | | | | | |

Portfolio Growth | |

| |

| | Generally due to calculation of LLP based on a point in time | |

| | | | | | | |

Portfolio Duration | |

| |

| | Increased duration provides higher realization on net spread | |

20

AFC Securitization Structure

[GRAPHIC]

Low cost, reliable funding source

$550 million of credit line available with the ability to increase up to $600 million

21

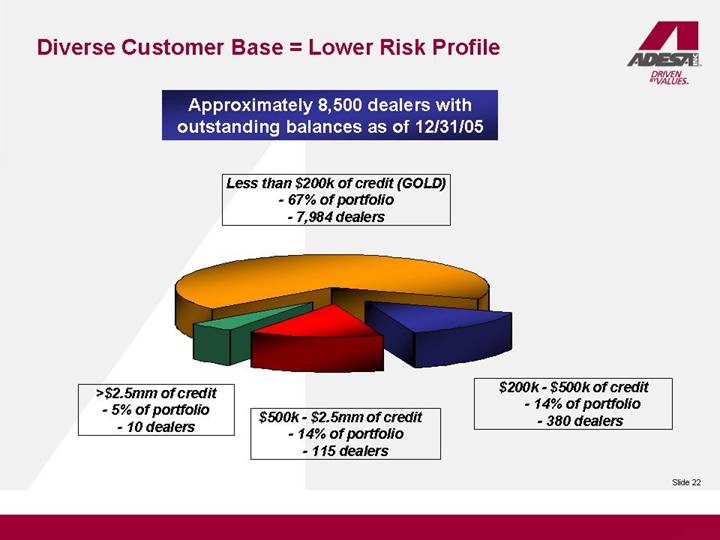

Diverse Customer Base = Lower Risk Profile

Approximately 8,500 dealers with outstanding balances as of 12/31/05

Less than $200k of credit (GOLD)

- -67% of portfolio

- -7,984 dealers

[CHART]

>$2.5mm of credit | | $200k -$500k of credit |

-5% of portfolio | | -14% of portfolio |

-10 dealers | $500k -$2.5mm of credit | -380 dealers |

| -14% of portfolio | |

| -115 dealers | |

22

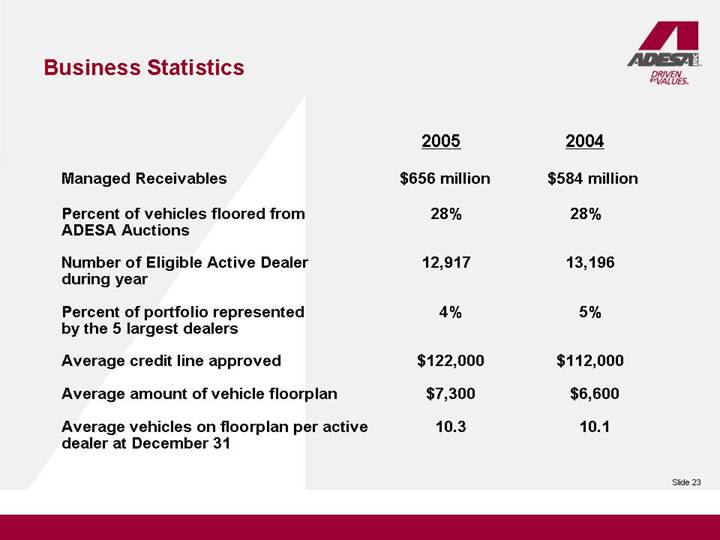

Business Statistics

| | 2005 | | 2004 | |

| | | | | |

Managed Receivables | | $ | 656 million | | $ | 584 million | |

| | | | | |

Percent of vehicles floored from ADESA Auctions | | 28 | % | 28 | % |

| | | | | |

Number of Eligible Active Dealer during year | | 12,917 | | 13,196 | |

| | | | | |

Percent of portfolio represented by the 5 largest dealers | | 4 | % | 5 | % |

| | | | | |

Average credit line approved | | $ | 122,000 | | $ | 112,000 | |

| | | | | |

Average amount of vehicle floorplan | | $ | 7,300 | | $ | 6,600 | |

| | | | | |

Average vehicles on floorplan per active dealer at December 31 | | 10.3 | | 10.1 | |

23

Consistent, Steady Growth with Solid Returns

Revenue | Loan Transactions |

| |

[CHART] | [CHART] |

| |

Revenue Per Loan Transaction | Income from Continuing Operations |

| |

[CHART] | [CHART] |

24

Finance Express

• Finance Express (FX) software is a complete web-based auto-financing solution that allows dealers to submit applications to lenders for approval, electronically, and receive automated responses in “real time”.

• Benefits to the independent dealer:

• Streamlines the retail financing process between consumer, dealer, and lender

• More availability of retail lenders to the independent dealer increases dealers' sales and profits

• “Lead generation” provides daily leads for dealer

• Benefits to AFC/ADESA Auctions/ADESA, Inc.:

• Providing multiple services creates customer loyalty

• More dealer retail sales should create more auction purchases and more floorings

• Provides a platform for AFC/ADESA to offer additional services such as vehicle service contracts, insurance, etc.

25

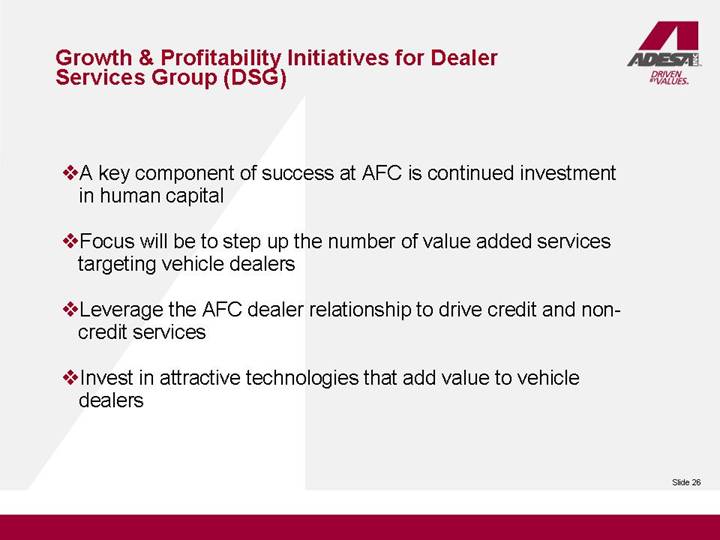

Growth & Profitability Initiatives for Dealer Services Group (DSG)

• A key component of success at AFC is continued investment in human capital

• Focus will be to step up the number of value added services targeting vehicle dealers

• Leverage the AFC dealer relationship to drive credit and non-credit services

• Invest in attractive technologies that add value to vehicle dealers

26

Dealer Services Group

• Overview – Cam Hitchcock

• AFC Operations – Jeff Widholm

• Q & A

27