Searchable text section of graphics shown above

[GRAPHIC]

[LOGO]

Auction Services Group

Salvage Operations

June 1, 2006

Cautionary Statement | | [LOGO] |

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements, including statements regarding the Company’s competitive position, anticipated industry developments and growth initiatives are subject to certain risks, trends, and uncertainties that could cause actual results to differ materially from those projected, expressed or implied by such forward-looking statements. The statements are based on assumptions about important factors including: general business conditions; market trends; competition; weather; vehicle production; trends in new and used vehicle sales; business development activities, including acquisitions; economic conditions, including exchange rate and interest rate fluctuations; litigation developments; and the other risk factors described in the Company’s Annual Report on Form 10-K, and other risks described from time to time in the Company’s filings with the Securities and Exchange Commission. Many of these risk factors are outside of the Company’s control, and as such, they involve risks which are not currently known to the Company that could cause actual results to differ materially from forecasted results. The forward-looking statements in this document are made as of the date hereof and the Company does not undertake to update its forward-looking statements.

2

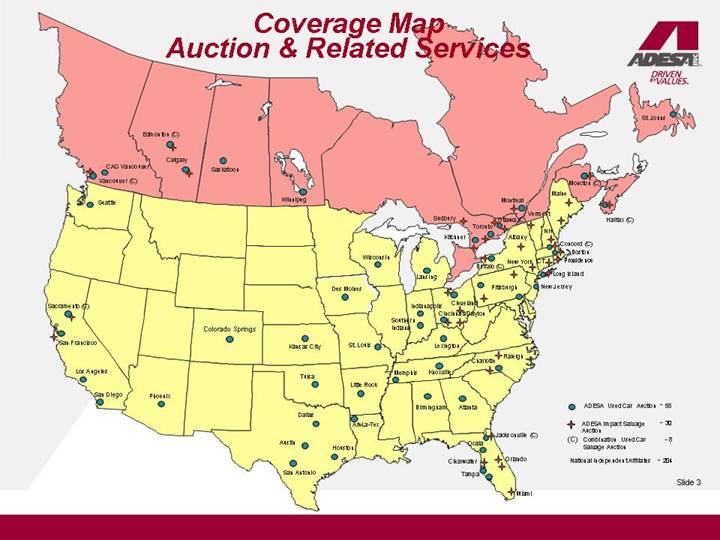

Coverage Map Auction & Related Services

[GRAPHIC]

3

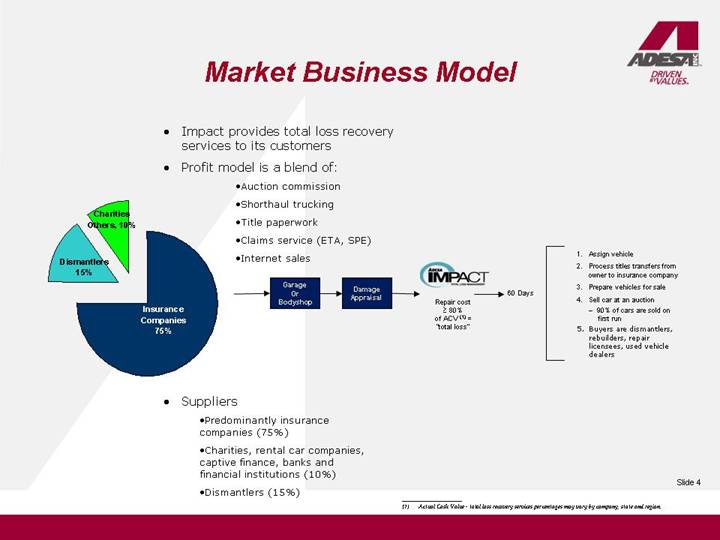

Market Business Model

• Impact provides total loss recovery services to its customers

• Profit model is a blend of:

• Auction commission

• Shorthaul trucking

• Title paperwork

• Claims service (ETA, SPE)

• Internet sales

[CHART]

• Suppliers

• Predominantly insurance companies (75%)

• Charities, rental car companies, captive finance, banks and financial institutions (10%)

• Dismantlers (15%)

(1) Actual Cash Value - total loss recovery services percentages may vary by company, state and region.

4

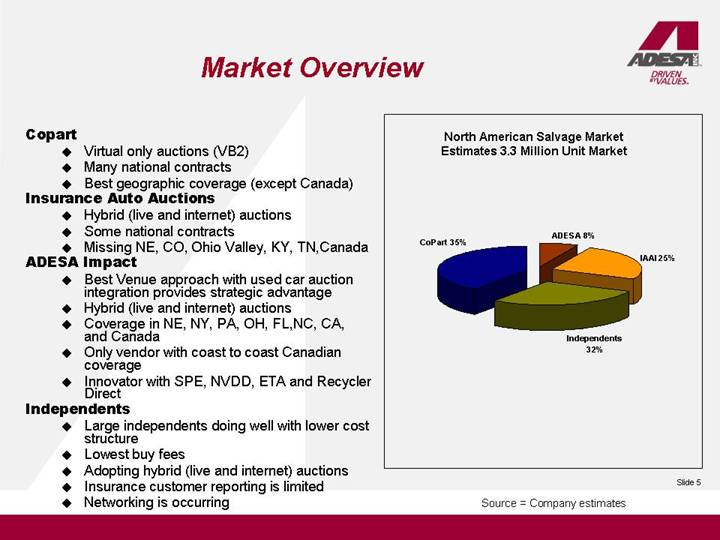

Market Overview

Copart

• Virtual only auctions (VB2)

• Many national contracts

• Best geographic coverage (except Canada)

Insurance Auto Auctions

• Hybrid (live and internet) auctions

• Some national contracts

• Missing NE, CO, Ohio Valley, KY, TN,Canada

ADESA Impact

• Best Venue approach with used car auction integration provides strategic advantage

• Hybrid (live and internet) auctions

• Coverage in NE, NY, PA, OH, FL,NC, CA, and Canada

• Only vendor with coast to coast Canadian coverage

• Innovator with SPE, NVDD, ETA and Recycler Direct

Independents

• Large independents doing well with lower cost structure

• Lowest buy fees

• Adopting hybrid (live and internet) auctions

• Insurance customer reporting is limited

• Networking is occurring

North American Salvage Market Estimates 3.3 Million Unit Market

[CHART]

Source = Company estimates

5

U.S. Total Losses by State

[GRAPHIC]

6

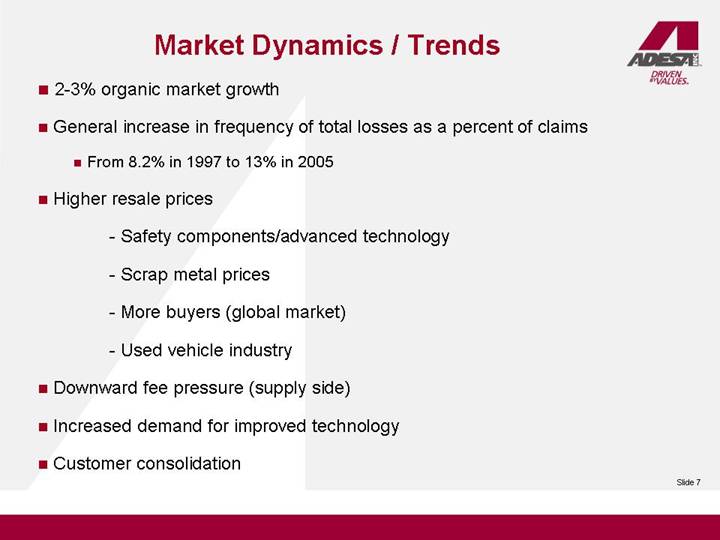

Market Dynamics / Trends

• 2-3% organic market growth

• General increase in frequency of total losses as a percent of claims

• From 8.2% in 1997 to 13% in 2005

• Higher resale prices

• Safety components/advanced technology

• Scrap metal prices

• More buyers (global market)

• Used vehicle industry

• Downward fee pressure (supply side)

• Increased demand for improved technology

• Customer consolidation

7

Salvage Volume Drivers

• Economy

• Fuel Prices

• Model Re-Tooling

• Legislation

• Property and Casualty Industry

• Weather

• Vehicle Complexity & Safety Features

• Parts Availability

• Cost of Repairs

[GRAPHIC]

8

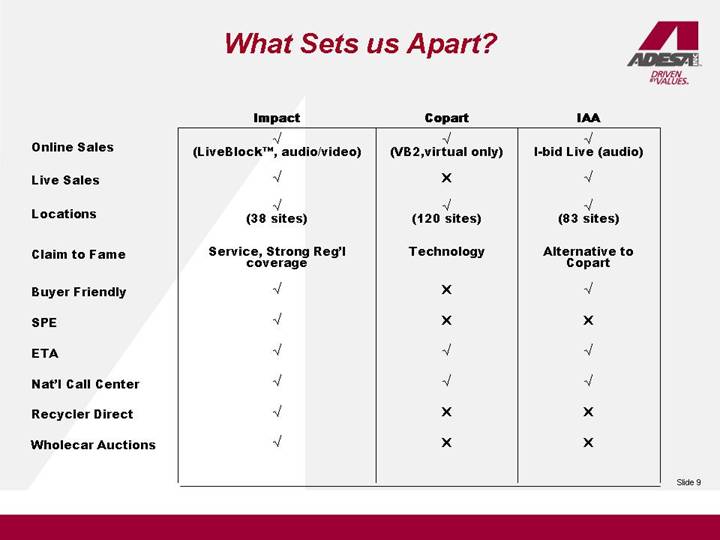

What Sets us Apart?

| | Impact | | Copart | | IAA | |

| | | | | | | |

Online Sales | | o

(LiveBlock™, audio/video) | | o

(VB2,virtual only) | | o

I-bid Live (audio) | |

| | | | | | | |

Live Sales | | o | | ý | | o | |

| | | | | | | |

Locations | | o

(38 sites) | | o

(120 sites) | | o

(83 sites) | |

| | | | | | | |

Claim to Fame | | Service, Strong Reg’l coverage | | Technology | | Alternative to Copart | |

| | | | | | | |

| | | | | | | |

Buyer Friendly | | o | | ý | | o | |

| | | | | | | |

SPE | | o | | ý | | ý | |

| | | | | | | |

ETA | | o | | o | | o | |

| | | | | | | |

Nat’l Call Center | | o | | o | | o | |

| | | | | | | |

Recycler Direct | | o | | ý | | ý | |

| | | | | | | |

Wholecar Auctions | | o | | ý | | ý | |

9

ADESA Impact

“Best Venue” Solutions

Vehicle Type | | Venue |

| | |

Scrap | | Recycler Direct |

| | |

Parts, Rebuildable, In-Op and | | Hybrid Auction |

Backline Used Vehicles | | (Live & LiveBlock™) |

| | |

Theft and Specialty | | Used Car Auction |

| | (LiveBlock™/ImpactDirect™) |

10

Customer Decision Drivers

• Recovered Dollars (Returns)

• Coverage Area

• Fees

• eBusiness Features

• Cycle-Time Performance

• Ease of Use

• Innovation

• Company Representatives and Reputation

11

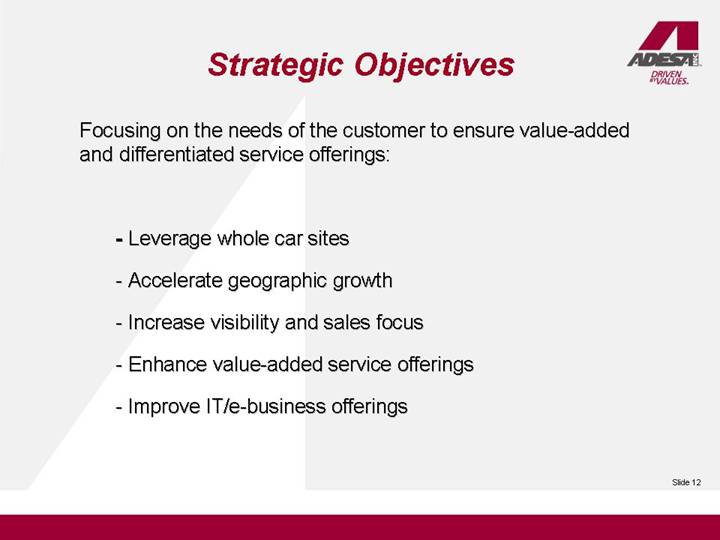

Strategic Objectives

Focusing on the needs of the customer to ensure value-added and differentiated service offerings:

• Leverage whole car sites

• Accelerate geographic growth

• Increase visibility and sales focus

• Enhance value-added service offerings

• Improve IT/e-business offerings

12

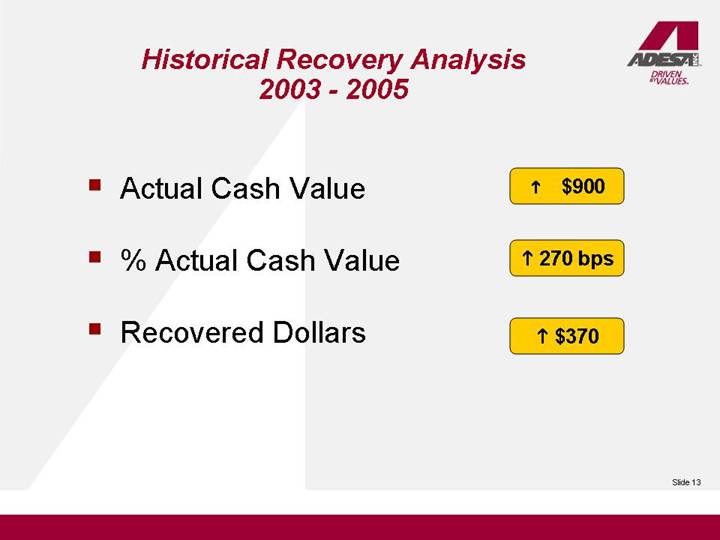

Historical Recovery Analysis

2003 - 2005

• Actual Cash Value | | á $900 | |

| | | |

• % Actual Cash Value | | á K270 bps | |

| | | |

• Recovered Dollars | | á K$370 | |

13

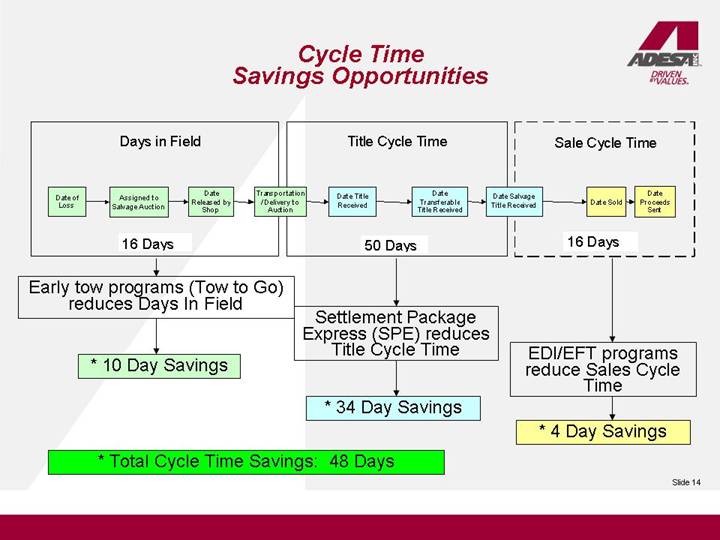

Cycle Time

Savings Opportunities

[CHART]

* Total Cycle Time Savings: 48 Days

14

2005 In Review

• LiveBlock™ launched throughout network ( 90% awarded to live buyer)

• New buyer registrations up double digits

• Upward pressure on services/ebusiness tools

• Higher operating costs (insurance, towing)

• Highest salvage recoveries in past 5 years (+$370/car since 2003)

• Strong out of state sales (30%)

[GRAPHIC]

15

2005 Growth Review

• Middletown, CT opened Q1

• Clearwater, FL opened Q1

• Orlando, FL (added additional site in Sanford, FL)

• Charlotte, NC acquired Q3

• Ohio (4 sites) acquired Q4

• Calgary, AB relocated to larger site

• Impact Direct™ for low end and high end units

• Settlement Package Express (SPE) automation

16

2006 Growth Initiatives

• SPE

• Best Venue solutions

• Combo sites

• Scranton, PA opened Q1

• South Pittsburgh opened Q2

• Sales focus - re-organization Q1/Q2 and marketing visibility

17

Salvage Summary

• Complementary to ADESA, Inc.’s strategic growth initiatives

• Growth expected through strategic, disciplined acquisitions and shared site opportunities

• Accelerated technology improvements

• Remarketing of non-traditional vehicles complementary to existing portfolio

• Commitment to development of employees at all levels of the organization

18

TOTAL Solutions...

[GRAPHIC]

For TOTAL Satisfaction

19