UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-09997

Baird Funds, Inc.

(Exact name of Registrant as specified in charter)

777 East Wisconsin Avenue

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Andrew D. Ketter

Robert W. Baird & Co. Incorporated

777 East Wisconsin Avenue

Milwaukee, WI 53202

(Name and address of agent for service)

1-866-442-2473

Registrant's telephone number, including area code

Date of fiscal year end: December 31, 2016

Date of reporting period: December 31, 2016

Item 1. Reports to Stockholders.

Annual Report –

Baird Funds

December 31, 2016

Taxable Bond Funds

Baird Ultra Short Bond Fund

Baird Short-Term Bond Fund

Baird Intermediate Bond Fund

Baird Aggregate Bond Fund

Baird Core Plus Bond Fund

Municipal Bond Funds

Baird Short-Term Municipal Bond Fund

Baird Quality Intermediate Municipal Bond Fund

Baird Core Intermediate Municipal Bond Fund

| Go Green. |  | Go Paperless. |

Sign up to receive your Baird Funds’ prospectuses and reports online.

Table of Contents

| Letter to Shareholders | 1 |

| 2016 Bond Market Overview | 2 |

| Baird Ultra Short Bond Fund | 7 |

| Baird Short-Term Bond Fund | 17 |

| Baird Intermediate Bond Fund | 27 |

| Baird Aggregate Bond Fund | 37 |

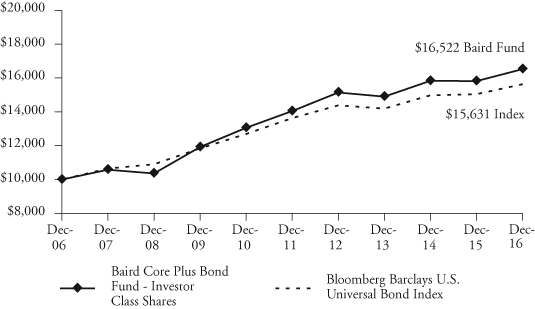

| Baird Core Plus Bond Fund | 46 |

| 2016 Municipal Bond Market Overview | 56 |

| Baird Short-Term Municipal Bond Fund | 61 |

| Baird Quality Intermediate Municipal Bond Fund | 74 |

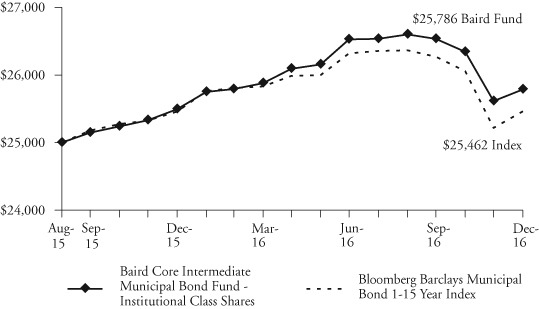

| Baird Core Intermediate Municipal Bond Fund | 86 |

| Additional Information on Fund Expenses | 99 |

| Statements of Assets and Liabilities | 101 |

| Statements of Operations | 104 |

| Statements of Changes in Net Assets | 107 |

| Financial Highlights | 115 |

| Notes to the Financial Statements | 131 |

| Report of Independent Registered Public Accounting Firm | 145 |

| Directors and Officers | 146 |

| Disclosure Regarding the Board of Directors’ Approval | |

| of the Investment Advisory Agreement for Baird Bond Funds | 149 |

| Additional Information | 152 |

| Privacy Notice | A-1 |

This report has been prepared for shareholders and may be distributed to others only if preceded or accompanied by a current prospectus.

Cautionary Note on Analyses, Opinions and Outlooks: In this report we offer analyses and opinions on the performance of individual securities, companies, industries, sectors, markets, interest rates and governmental policies, including predictions, forecasts and outlooks regarding possible future events. These can generally be identified as such because the context of the statements may include such words as “believe,” “should,” “will,” “expects,” “anticipates,” “hopes” and words of similar effect. These statements reflect the portfolio managers’ good faith beliefs and judgments and involve risks and uncertainties, including the risk that the portfolio managers’ analyses, opinions and outlooks are or will prove to be inaccurate. It is inherently difficult to correctly assess and explain the performance of particular securities, sectors, markets, interest rate movements, governmental actions or general economic trends and conditions, and many unforeseen factors contribute to the performance of Baird Funds. Investors are, therefore, cautioned not to place undue reliance on subjective judgments contained in this report.

Baird Funds

1-866-442-2473

www.bairdfunds.com

February 27, 2017

Dear Shareholder,

2016 proved to be a year of significant volatility driven by changing U.S. and global growth expectations, shifting global central bank policies, and political surprises both in the U.S and abroad. Through this volatility, the Baird Bond Funds generated consistent and attractive results for the year. Our all-weather strategy produced these results for our Fund investors in a year with a lot of weather, reinforcing our belief that our bottom-up investment approach, focused on risk control, remains a prudent path.

Baird Advisors is a strategically sized investment manager possessing a unique combination of experience and expertise which gives us distinctive competitive advantages within the industry. These include:

| | • | A seasoned, knowledgeable and stable investment team with uncommon longevity together |

| | • | Our consistency of approach and exacting adherence to a duration neutral, risk-controlled investment philosophy |

| | • | A firm ownership structure and team-based, collaborative culture focused on generating competitive returns for our investors |

| | • | A high-touch service approach lead by the senior investment team |

| | • | Competitive expense ratios |

Our commitment to these long-term principles combined with strong alignment with the interests of our investors, helped drive assets under management in the Baird Bond Funds to $31.2 billion at year end.

We are mindful that we continue to operate in an elevated risk environment and are committed to judicious management of your assets. We never lose sight of the fact that our success rests on the trust you have placed in us to be effective stewards of your assets and we want to thank you for your continued investment in the Baird Bond Funds.

Sincerely,

Mary Ellen Stanek, CFA

President

Baird Funds

2016 Bond Market Overview

Treasury Yields Fall in 1H, Rise in 2H on Shifting Economic Data, Central Bank, Political Landscape

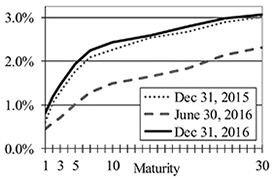

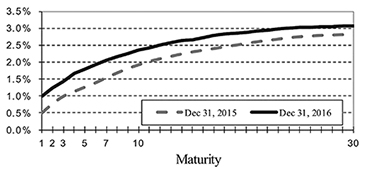

The Treasury market experienced significant volatility in 2016, driven by changing U.S. and global growth expectations, shifting global central bank policies, and political surprises both in the U.S and abroad. After a sharp dip in the 1st half and rebound in the 2nd half, the Treasury yield curve ended 2016 higher – the 10yr traded in a 123 bps range throughout the year before ending the year 17 bps higher at 2.44%. Early in 2016 global growth concerns focused on China shook global equity and credit markets as oil prices hit the lowest levels since 2003. By the end of March, however, volatility subsided and markets rebounded as global central banks took actions to abate market concerns – the European Central Bank announced an expanded bond-buying program, the Bank of Japan set a 0% target for its 10yr sovereign debt, and the Fed signaled it too would keep rates lower for longer as Fed Chair Janet Yellen noted “caution was especially warranted” in removing monetary stimulus. The Fed had started 2016 with a much more optimistic forecast than the market, projecting four rate hikes in the year, but ultimately only made one 25 bps hike at its December meeting, setting the Fed funds target range at 0.50%-0.75%. Britain’s unexpected “Brexit” vote on June 23rd to leave the European Union triggered a drop in global bond yields and the 10yr and 30yr U.S. Treasury yields hit all-time lows. Treasury yields began moving higher two weeks after the surprise “Brexit” vote as the market’s negative reaction was short-lived, allowing investors to focus on the policy shift that was taking place globally that would emphasize fiscal stimulus and move away from a sole reliance on central bank monetary stimulus. The U.S. economy also showed signs of improving growth in the second half of the year as annualized 3Q GDP rose +3.5%, bouncing back from a weak first half of +1.1% annualized growth. Treasury yields rose sharply in response to the surprising U.S. election results in November as Donald Trump won the presidency while the Republican Party held on to a majority of seats in the House and Senate. The 10yr Treasury rose from 1.86% on Election Day to 2.44% on 12/31/2016 in anticipation of higher growth and inflation if President Trump delivers on his promises of fiscal stimulus through tax cuts and infrastructure spending.

Treasury Yields

| | | | | 3 Mo | 1 Year |

Maturity | 12/31/15 | 9/30/16 | 12/31/16 | Change | Change |

| 1 | 0.60% | 0.58% | 0.81% | 0.23% | 0.21% |

| 2 | 1.05% | 0.76% | 1.19% | 0.43% | 0.14% |

| 3 | 1.31% | 0.87% | 1.45% | 0.58% | 0.14% |

| 5 | 1.76% | 1.15% | 1.93% | 0.78% | 0.17% |

| 7 | 2.09% | 1.43% | 2.25% | 0.82% | 0.16% |

| 10 | 2.27% | 1.60% | 2.44% | 0.84% | 0.17% |

| 30 | 3.02% | 2.33% | 3.07% | 0.74% | 0.05% |

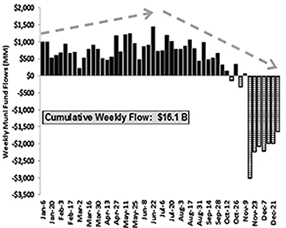

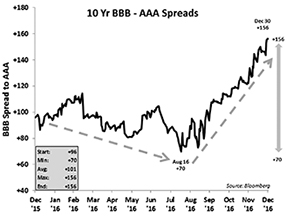

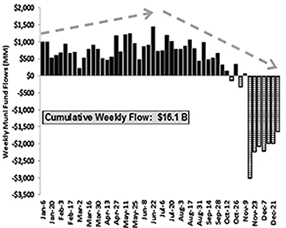

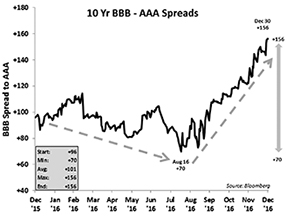

Volatile Credit Spreads End 2016 Tighter as Heavy Issuance Absorbed by Strong Global Demand and Fund Inflows

Spreads experienced significant volatility in 2016 – after hitting a wide of 214 bps on 2/11/16, investment grade corporate spreads ended the year 42 bps tighter at 123 bps. While corporate leverage increased in 2016, the increase in debt levels has been concentrated in higher quality issuers such as Apple and Microsoft that have cash-rich balance sheets. Foreign net buying of corporate bonds, which had been close to zero and even negative from 2010-2012, grew as foreign direct net purchases of U.S. corporates was on pace to exceed $290 billion for

2016 Bond Market Overview

2016 (see graph below). In addition to strong demand from foreign direct buying, robust net flows into fixed-income mutual funds and ETFs ended the year just under $190 billion according to ICI estimates. High Yield corporates also benefitted from flows, tightening an impressive 251 bps to end the year at 409 bps.

Option-Adjusted Spreads (in bps)

| | | | | 3 Mo | 12 Mo |

| | 12/31/15 | 9/30/16 | 12/31/16 | Chg | Chg |

| U.S. Aggregate Index | 56 | 47 | 43 | -4 | -13 |

| U.S. Agency (non-mortgage) | 21 | 21 | 21 | 0 | 0 |

| Mortgage and ABS Sectors | | | | | |

| U.S. Agency Pass-throughs 24 | 14 | 15 | 1 | -9 | |

| Asset-Backed Securities | 72 | 55 | 59 | 4 | -13 |

| CMBS | 121 | 84 | 75 | -9 | -46 |

| Corporate Sectors | | | | | |

| U.S. Investment Grade | 165 | 138 | 123 | -15 | -42 |

| Industrial | 183 | 140 | 125 | -15 | -58 |

| Utility | 150 | 132 | 117 | -15 | -33 |

| Financial Institutions | 134 | 137 | 120 | -17 | -14 |

| U.S. High Yield | 660 | 480 | 409 | -71 | -251 |

Sources: Bloomberg Barclays Indices

Credit:Gross/Net Supply, Foreign Demand

| | *2016 Foreign Net Buying is YTD annualized rate through 3Q16 | |

| | Sources: Federal Reserve, Barclays | |

Volatile Interest Rate Moves Create Bumpy Ride for Agency Mortgage-Backed Securities

The volatile interest rate moves of 2016 had a profound impact on Agency Mortgage-Backed Securities (“MBS”). Record low Treasury yields midyear helped push 30-year mortgage rates down nearly 60bps to a 3.32% low, spurring borrowers to pay off their existing mortgages by refinancing into new mortgages with lower rates. As shown in the table (right), heightened prepayments shortened the duration of the MBS index from 4.49 yrs at the end of 2015 to 2.45 yrs by the end of June. However with the sharp rise in rates post-election, the refinancing opportunity quickly receded. As refinancing activity slowed, the MBS Index duration extended all the way to 4.61 yrs by year end and pushed the duration of the Aggregate index (of which 28% is MBS) to 5.89 yrs. This adverse duration drift (i.e. negative convexity) made MBS one of the worst performing index sectors in 2016 as tight spreads weren’t enough to compensate investors for this risk.

| Mortgage – Adverse Duration Drift |

| | 12/31/2015 | 6/30/2016 | 12/31/2016 |

| 30yr Mortgage | | | |

| Rate (Bankrate) | 3.90% | 3.53% | 4.06% |

| U.S. MBS | | | |

| Index Duration | 4.49 | 2.45 | 4.61 |

| U.S. Aggregate | | | |

| Index Duration | 5.68 | 5.47 | 5.89 |

| Source: Bankrate, Bloomberg Barclays Indices | | | |

2016 Bond Market Overview

Investment-Grade Returns Negative in 4Q, Positive for the Year

Rising Treasury yields led to negative returns for the 4th quarter, although returns stayed positive for the year. Treasuries and Tax-exempt municipal bonds were particularly hard-hit (-3.84% and -3.62%, respectively) due to the post-election rise in yields and the prospect of lower marginal tax rates in 2017. For the year, strong demand for yield drove outperformance for non-government sectors. Investment grade corporates posted strong annual returns (+6.11%) buoyed by tighter spreads. High yield corporates posted equity-like returns for the year (+17.13%) after dropping early in 2016 as fundamentals became worrisome in commodity-sensitive sectors. The sector recovered sharply as growth concerns abated, commodities recovered, and demand from yield-starved investors remained strong. MBS returns (+1.39%) lagged due to rate volatility and heightened prepayment concerns. In contrast, high quality mortgage and asset-backed sectors with more cashflow timing certainty such as CMBS and ABS outperformed for the year (+3.32% and +2.03%, respectively).

Total Returns of Selected Barclays Indices and Subsectors

Barclays Index/Sector | December | 4th Quarter | 2016 |

| U.S. Aggregate Index | 0.14% | -2.98% | 2.65% |

| U.S. Gov’t/Credit Index | 0.21% | -3.39% | 3.05% |

| U.S. Intermediate Gov’t/Credit Index | 0.07% | -2.07% | 2.08% |

| U.S. 1-3 Yr. Gov’t/Credit Index | 0.06% | -0.39% | 1.28% |

| U.S. Treasury | -0.11% | -3.84% | 1.04% |

| U.S. Agency | -0.13% | -1.96% | 1.39% |

| MBS (Mortgage Backed Securities) | 0.00% | -1.97% | 1.67% |

| CMBS (Commercial Mortgage Backed Securities) | -0.41% | -3.03% | 3.32% |

| ABS (Asset Backed Securities) | -0.15% | -0.70% | 2.03% |

| U.S. Corporate – Investment Grade | 0.67% | -2.83% | 6.11% |

| Corporate High Yield | 1.85% | 1.75% | 17.13% |

| Municipal Bond Index | 1.17% | -3.62% | 0.25% |

| TIPS (Treasury Inflation Protected Securities) | -0.10% | -2.41% | 4.68% |

Outlook

We expect the U.S. economy to continue to grow at a moderate pace in 2017 with better near-term prospects post-election given Trump’s pro-growth agenda, though headwinds remain. Consumer inflation is likely to move modestly higher and reach the Fed’s 2% target with wage inflation continuing its slow uptick. That being our base-case forecast, we believe the range of possible outcomes over the next 1-2 years is as wide as we have ever seen for a couple reasons. First, a global policy shift is underway from exhausted unconventional central bank easing toward fiscal stimulus that clearly presents “execution risk”. Second, while the immediate implications of a growing trend toward populism point to the potential for anti-free trade and anti-immigration policies, the ramifications of a broader resurgence of nationalism and less global cooperation remain to be seen. We believe these uncertainties should keep the risk environment quite elevated for some time. The pace of additional Fed moves will likely accelerate but be limited by the lower potential growth rate for the U.S. economy which continues to be impacted by secular trends including aging populations and stubbornly low productivity growth. Additionally, low interest rates abroad will continue to hold down yields in the U.S. as foreign capital flows into U.S. markets; however, the magnitude of such flows may be smaller than in previous years. We see potential for modest additional spread tightening in 2017 and anticipate non-government sectors, including investment grade corporates, will outperform modestly by earning their yield advantage over time. We remain cautious on agency MBS as the Fed will likely discontinue MBS reinvestment once policy normalization is “well underway” and anticipate wider spreads may be required in this sector to absorb any material increase in supply. We see better relative value in the mortgage and asset-backed sectors in securities with more certain cashflow timing, including senior CMBS structures with superior credit enhancement and select short-duration asset-backed sectors (e.g., cards, autos, equipment). Non-agency RMBS continue to offer attractive relative value as new issuance is very limited and housing fundamentals

2016 Bond Market Overview

continue to improve. We remain cautious of high yield corporates, finding value only selectively as spreads have compressed significantly. Municipal market valuations have become more compelling this year and will likely continue to offer select pockets of opportunity from both taxable and tax-free issuers.

Disclosures

This is not a complete analysis of every material fact regarding any company, industry or security. The information has been obtained from sources we consider to be reliable, but we cannot guarantee the accuracy.

Fixed income is generally considered to be a more conservative investment than stocks, but bonds and other fixed income investments still carry a variety of risks such as interest rate risk, credit risk, inflation risk, and liquidity risk. In a rising interest rate environment, the value of fixed-income securities generally decline and conversely, in a falling interest rate environment, the value of fixed-income securities generally increase. High yield securities may be subject to heightened market, interest rate or credit risk and should not be purchased solely because of the stated yield.

Indices are unmanaged, and are not available for direct investment. Past performance is not a guarantee of future results.

The Bloomberg Barclays Aggregate Bond Index is an index comprised of approximately 6000 publicly traded bonds including U.S. Government, mortgage-backed, corporate, and Yankee bonds with an average maturity of approximately 10 years.

The Bloomberg Barclays Government/Credit Index is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt.

The Bloomberg Barclays Intermediate Government/Credit Index is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt with maturities between one and ten years.

The Bloomberg Barclays Government/Credit Intermediate Index (1 – 3 yr.) is a combination of the Government Index which measures government-bond general and Treasury funds, and the Credit Bond Index, which is a market value-weighted index which tracks the returns of all publicly issued, fixed-rate, nonconvertible, dollar-denominated, SEC registered, investment grade Corporate Debt with maturities between zero and three years.

The Bloomberg Barclays U.S. Treasury Index includes public obligations of the U.S. Treasury. Treasury bills are excluded by the maturity constraint of at least one year but are part of a separate Short Treasury Index. In addition, certain special issues, such as state and local government series bonds (SLGs), as well as U.S. Treasury TIPS, are excluded. STRIPS are excluded from the index because their inclusion would result in double-counting. Securities in the Index roll up to the U.S. Aggregate, U.S. Universal, and Global Aggregate Indices. The U.S. Treasury Index was launched on January 1, 1973.

U.S. Agency: This index is the U.S. Agency component of the U.S. Government/Credit index. Publicly issued debt of U.S. Government agencies, quasi-federal corporations, and corporate or foreign debt guaranteed by the U.S. Government (such as USAID securities). The largest issues are Fannie Mae, Freddie Mac, and the Federal Home Loan Bank System (FHLB). The index includes both callable and non-callable agency securities.

U.S Corporate – Investment Grade: This index is the Corporate component of the U.S. Credit index. It includes publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements. To qualify, bonds must be SEC-registered.

CMBS (Commercial Mortgage-Backed Securities): This index is the CMBS component of the U.S. Aggregate index. The Bloomberg Barclays CMBS ERISA-Eligible Index is the ERISA-eligible component of the Bloomberg Barclays CMBS Index. This index, which includes investment grade securities that are ERISA eligible under the underwriter’s exemption, is the only CMBS sector that is included in the U.S. Aggregate Index.

MBS (Mortgage-Backed Securities): This index is the U.S. MBS component of the U.S. Aggregate index. The MBS Index covers the mortgage-backed pass-through securities of Ginnie Mae (GNMA), Fannie Mae (FNMA), and

2016 Bond Market Overview

Freddie Mac (FHLMC). The MBS Index is formed by grouping the universe of over 600,000 individual fixed rate MBS pools into approximately 3,500 generic aggregates.

ABS (Asset-Backed Securities): This index is the ABS component of the U.S. Aggregate index. The ABS index has three subsectors: credit and charge cards, autos, and utility. The index includes pass-through, bullet, and controlled amortization structures. The ABS Index includes only the senior class of each ABS issue and the ERISA-eligible B and C tranche. The Manufactured Housing sector was removed as of January 1, 2008, and the Home Equity Loan sector was removed as of October 1, 2009.

Corporate High Yield: The Bloomberg Barclays U.S. High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. Original issue zeroes, step-up coupon structures, 144-As and pay-in-kind bonds (PIKs, as of October 1, 2009) are also included.

The Bloomberg Barclays Municipal Bond Index is a broad-based, total-return index. The bonds are all investment-grade, tax-exempt, and fixed-rate securities with long-term maturities (greater than 2 years). They are selected from issues larger than $50 million.

The Bloomberg Barclays TIPS Index consists of Treasury Inflation Protected Securities (TIPS). TIPS are securities whose principal is tied to the Consumer Price Index. TIPS pay interest semi-annually, based on the fixed rate applied to the adjusted principal.

Ratings are measured on a scale that ranges from AAA or Aaa (highest) to D or C (lowest). Investment grade investments are those rated from highest down to BBB- or Baa3.

Baird Ultra Short Bond Fund

December 31, 2016

The Baird Ultra Short Bond Fund seeks current income consistent with preservation of capital. The Fund’s primary benchmark index against which it measures performance is the Bloomberg Barclays U.S. Short-Term Government/Corporate Index. The Bloomberg Barclays U.S. Short-Term Government/Corporate Index is an unmanaged, market value weighted index of investment grade fixed debt, including government and corporate securities, with maturities of less than one year.

During a very volatile 2016, the Fund generated strong absolute returns and outperformed its benchmark. The year can be considered a tale of two halves with the bond market experiencing significant volatility, driven by changing U.S. and global growth expectations, shifting global central bank policies, and political surprises both in the U.S and abroad. Our long-term commitment and strict adherence to a risk-controlled, duration neutral approach overseen by a seasoned team of investment professionals with uncommon longevity working together through multiple market cycles once again proved to be a prudent strategy during this period of heightened volatility.

The primary factors contributing to the Fund’s strong absolute and relative performance in 2016 are described below.

Positive contributors to the Fund’s performance during the year:

| | • | Overweight to investment grade credit |

| | | º | Overweight to BBB-rated credit |

| | | º | Exposure to commodity sensitive industrial sectors (energy and metals and mining) as spreads were significantly tighter in the year |

| | • | Security selection particularly within the Credit sector |

| | • | Exposure to high-quality Non Agency Residential Mortgage Backed Securities (RMBS) and other Asset Backed Securities (ABS) |

Our base case outlook for 2017 is a continuation of moderate economic growth and inflation with better near-term economic growth prospects post-election given President Trump’s pro-growth agenda—though headwinds remain. However, we also acknowledge that a wide range of possible outcomes exists. If policy measures are passed that provide fiscal stimulus to the economy, they are likely to be met by tighter monetary policy from the Fed, limiting improvement in near-term economic growth. Additionally, low interest rates abroad will likely continue to limit the upside for U.S. interest rates. As a reminder, the Fund only purchases U.S. dollar denominated securities in the cash bond market (no derivatives). We believe the Fund is well positioned to add value relative to its benchmark.

Baird Ultra Short Bond Fund

December 31, 2016 (Unaudited)

Portfolio Characteristics

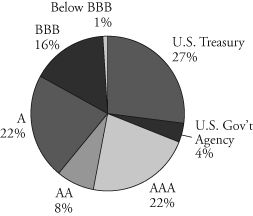

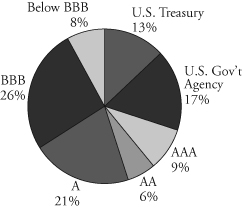

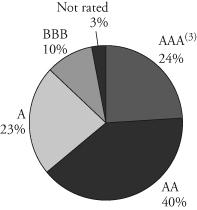

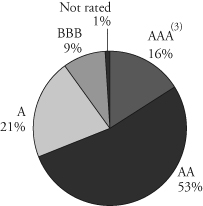

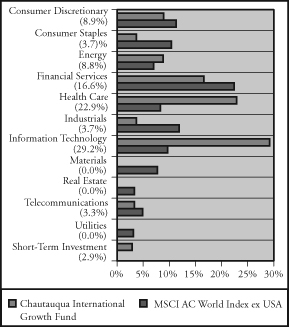

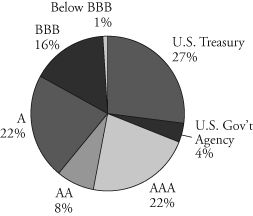

Quality Distribution(1)(2)

| | | | | | |

| | Net Assets | $392,504,874 | | |

| | | | | |

| | SEC 30-Day | | | |

| | Yield(3) | | | |

| | Institutional Class | | | |

| | (Subsidized) | 1.15% | | |

| | Institutional Class | | | |

| | (Unsubsidized) | 1.00% | | |

| | Investor Class | | | |

| | (Subsidized) | 0.90% | | |

| | Investor Class | | | |

| | (Unsubsidized) | 0.75% | | |

| | | | | |

| | Average | | | |

| | Effective | | | |

| | Duration | 0.46 years | | |

| | | | | | |

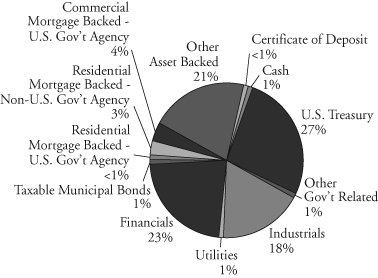

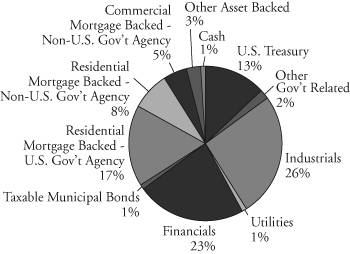

Sector Weightings(1) | | Average | | | |

| | | Effective | | | |

| | Maturity | 0.47 years | | |

| | | | | |

| | Annualized | | | |

| | Expense Ratio(4) | | | |

| | Gross | | | |

| | Institutional Class | 0.30% | | |

| | Investor Class | 0.55% | (5) | |

| | | | | |

| | Net | | | |

| | Institutional Class | 0.15% | | |

| | Investor Class | 0.40% | (5) | |

| | | | | |

| | Portfolio | | | |

| | Turnover Rate | 96.9% | | |

| | | | | |

| | Number of | | | |

| | Holdings | 249 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | |

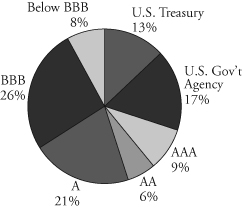

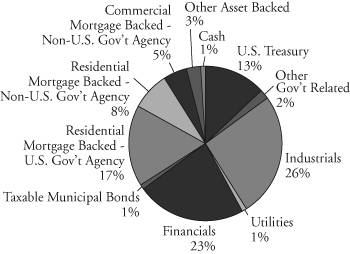

(1) | Percentages shown are based on the Fund’s total investments. |

(2) | The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

(3) | SEC yields are based on SEC guidelines and are calculated for the 30 days ended December 31, 2016. |

(4) | Reflects expense ratios as stated in the Fund’s current prospectus. The Advisor has contractually agreed to waive management fees in an amount equal to an annual rate of 0.15% of average daily net assets for the Fund, at least through April 30, 2018. The agreement may only be terminated prior to the end of this term by or with the consent of the Board of Directors of Baird Funds, Inc. |

(5) | Includes 0.25% 12b-1 fee. |

Baird Ultra Short Bond Fund

December 31, 2016 (Unaudited)

Institutional Class

Value of a $25,000 Investment

Growth of a hypothetical investment of $25,000 made on the Fund’s inception date (12/31/13), assuming reinvestment of all distributions.

Investor Class

Value of a $10,000 Investment

Growth of a hypothetical investment of $10,000 made on the Fund’s inception date (12/31/13), assuming reinvestment of all distributions.

Baird Ultra Short Bond Fund

December 31, 2016 (Unaudited)

Total Returns

| | | Average Annual |

| | One | Three | Since |

| For the Periods Ended December 31, 2016 | Year | Years | Inception(1) |

| Institutional Class Shares | 1.56% | 1.02% | 1.02% |

| Investor Class Shares | 1.32% | 0.78% | 0.78% |

| Bloomberg Barclays U.S. Short-Term | | | |

Government/Corporate Index(2) | 0.80% | 0.41% | 0.41% |

| (1) | For the period from December 31, 2013 (inception date) through December 31, 2016. |

| (2) | The Bloomberg Barclays U.S. Short-Term Government/Corporate Index is an unmanaged, market value weighted index of investment grade, fixed debt including government and corporate securities with maturities less than one year. This Index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible. |

The line graph on the previous page and the returns shown in the table above reflect reinvestment of dividends and/or capital gains distributions in additional shares. The returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund’s gross expense ratio for each Class, as reflected in the Fund’s current prospectus, is set forth under “Portfolio Characteristics”.

The Fund may invest up to 10% of its net assets in non-investment grade debt securities (commonly referred to as “high yield” bonds). While these types of securities typically offer higher yields than investment grade securities, they also include greater risks including increased credit risk and the increased risk of default or bankruptcy. The Fund may also invest in U.S. dollar denominated foreign securities which involve additional risks such as political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund may also invest in mortgage- and asset-backed securities, which include interest rate and prepayment risks more pronounced than those of other fixed income securities.

Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

For information about the performance of the Fund as of the most recent month-end, please call 1-866-44BAIRD or visit www.bairdfunds.com. Mutual fund performance changes over time and current performance may be lower or higher than that stated.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

This schedule summarizes the Fund’s holdings by asset type. Details are reported for each of the Fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the Fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The Fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter end. For the second and fourth fiscal quarters, the complete listing of the Fund’s holdings is available electronically in the Fund’s Form N-CSR at http://www.bairdassetmanagement.com/baird-funds/funds-and-performance#Literature and on the Securities and Exchange Commission’s website (www.sec.gov) or you can have it mailed to you without charge by calling 1-866-44BAIRD. For the first and third fiscal quarters, the Fund files the lists with the SEC on Form N-Q. Shareholders can look up the Fund’s Forms N-CSR and N-Q on the SEC’s website (www.sec.gov).

Long-Term Investments

| | | Principal | | | % of | | | | |

| | | Amount | | | Value | | | Net Assets | |

| U.S. Treasury Securities | | | | | | | | | |

| U.S. Treasury Notes: | | | | | | | | | |

| 2.375%, 07/31/2017 | | $ | 45,700,000 | | | $ | 46,139,132 | | | | 11.8 | % |

| 1.000%, 09/15/2017 | | | 46,100,000 | | | | 46,172,008 | | | | 11.8 | % |

| 0.875%, 01/15/2018 | | | 12,000,000 | | | | 11,994,372 | | | | 3.0 | % |

| Total U.S. Treasury Securities | | | | | | | | | | | | |

| (Cost $104,315,597) | | | | | | | 104,305,512 | | | | 26.6 | % |

| Other Government Related Securities | | | | | | | | | | | | |

Other Government Related Securities#~ | | | | | | | 3,267,226 | | | | 0.8 | % |

| Total Other Government Related Securities | | | | | | | | | | | | |

| (Cost $3,268,774) | | | | | | | 3,267,226 | | | | 0.8 | % |

| Corporate Bonds | | | | | | | | | | | | |

| Industrials | | | | | | | | | | | | |

| Bunge Limited Finance Corp., | | | | | | | | | | | | |

| 3.200%, 06/15/2017 | | | 2,000,000 | | | | 2,015,058 | | | | 0.5 | % |

| Enterprise Products Operating LLC, | | | | | | | | | | | | |

| Class L, 6.300%, 09/15/2017 | | | 2,000,000 | | | | 2,062,718 | | | | 0.5 | % |

| General Motors Financial Co., Inc., | | | | | | | | | | | | |

2.337%, 05/09/2019∞ | | | 2,000,000 | | | | 2,019,734 | | | | 0.5 | % |

| Hyundai Capital Services, Inc., | | | | | | | | | | | | |

| 1.793%, 03/18/2017 (Acquired 01/13/2015 through | | | | | | | | | | | | |

08/24/2016, Cost $2,450,546)∞ * f | | | 2,450,000 | | | | 2,450,691 | | | | 0.6 | % |

| Ingredion, Inc., | | | | | | | | | | | | |

| 1.800%, 09/25/2017 | | | 2,500,000 | | | | 2,503,162 | | | | 0.6 | % |

| Pentair Finance SA, | | | | | | | | | | | | |

1.875%, 09/15/2017 f | | | 2,000,000 | | | | 2,002,984 | | | | 0.5 | % |

| Pernod Ricard SA, | | | | | | | | | | | | |

| 2.950%, 01/15/2017 (Acquired 08/18/2016, | | | | | | | | | | | �� | |

Cost $2,001,394)* f | | | 2,000,000 | | | | 2,001,078 | | | | 0.5 | % |

| Rohm and Haas Co., | | | | | | | | | | | | |

| 6.000%, 09/15/2017 | | | 2,095,000 | | | | 2,160,364 | | | | 0.5 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Time Warner Cable LLC, | | | | | | | | | |

| 5.850%, 05/01/2017 | | $ | 2,000,000 | | | $ | 2,028,382 | | | | 0.5 | % |

Other Industrials#~ | | | | | | | 49,483,088 | | | | 12.8 | % |

| Total Industrials | | | | | | | | | | | | |

| (Cost $68,663,289) | | | | | | | 68,727,259 | | | | 17.5 | % |

| Utilities | | | | | | | | | | | | |

| NextEra Energy Capital Holdings, Inc., | | | | | | | | | | | | |

| Class F, 2.056%, 09/01/2017 | | | 2,500,000 | | | | 2,511,012 | | | | 0.6 | % |

Other Utilities#~ | | | | | | | 1,803,237 | | | | 0.5 | % |

| Total Utilities | | | | | | | | | | | | |

| (Cost $4,320,251) | | | | | | | 4,314,249 | | | | 1.1 | % |

| Financials | | | | | | | | | | | | |

| ABN AMRO Bank NV, | | | | | | | | | | | | |

| 4.250%, 02/02/2017 (Acquired 11/16/2015 through | | | | | | | | | | | | |

08/16/2016, Cost $2,203,859)* f | | | 2,198,000 | | | | 2,202,743 | | | | 0.6 | % |

| Aetna, Inc., | | | | | | | | | | | | |

1.601%, 12/08/2017∞ | | | 2,000,000 | | | | 2,006,896 | | | | 0.5 | % |

| American Express Bank FSB, | | | | | | | | | | | | |

| 6.000%, 09/13/2017 | | | 2,000,000 | | | | 2,061,828 | | | | 0.5 | % |

| Bank of America NA, | | | | | | | | | | | | |

| 5.300%, 03/15/2017 | | | 2,000,000 | | | | 2,015,490 | | | | 0.5 | % |

| Capital One NA/Mclean VA, | | | | | | | | | | | | |

| 1.500%, 09/05/2017 | | | 2,000,000 | | | | 1,997,514 | | | | 0.5 | % |

| Compass Bank, | | | | | | | | | | | | |

| 1.850%, 09/29/2017 | | | 3,015,000 | | | | 3,008,156 | | | | 0.8 | % |

| Royal Bank of Canada, | | | | | | | | | | | | |

1.138%, 10/13/2017∞ f | | | 3,000,000 | | | | 2,998,983 | | | | 0.8 | % |

| SunTrust Banks, Inc., | | | | | | | | | | | | |

| 6.000%, 09/11/2017 | | | 2,143,000 | | | | 2,207,149 | | | | 0.6 | % |

| Swedbank AB, | | | | | | | | | | | | |

| 2.125%, 09/29/2017 | | | | | | | | | | | | |

(Acquired 08/30/2016, Cost $2,012,656)* f | | | 2,000,000 | | | | 2,009,596 | | | | 0.5 | % |

Other Financials#~ | | | | | | | 66,718,051 | | | | 16.9 | % |

| Total Financials | | | | | | | | | | | | |

| (Cost $87,204,081) | | | | | | | 87,226,406 | | | | 22.2 | % |

| Total Corporate Bonds | | | | | | | | | | | | |

| (Cost $160,187,621) | | | | | | | 160,267,914 | | | | 40.8 | % |

| Taxable Municipal Bonds | | | | | | | | | | | | |

| Montana Board of Investments, | | | | | | | | | | | | |

0.520%, 03/01/2032 (Callable 03/01/2017)∞ | | | 2,000,000 | | | | 1,997,760 | | | | 0.5 | % |

| Other Taxable Municipal Bonds# | | | | | | | 3,742,770 | | | | 1.0 | % |

| Total Taxable Municipal Bonds | | | | | | | | | | | | |

| (Cost $5,737,622) | | | | | | | 5,740,530 | | | | 1.5 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Residential Mortgage-Backed Securities | | | | | | | | | |

| U.S. Government Agency Issues | | | | | | | | | |

| Other U.S. Government Agency Issues# | | | | | $ | 1,630,178 | | | | 0.4 | % |

| Total U.S. Government Agency Issues | | | | | | | | | | | |

| (Cost $1,619,227) | | | | | | 1,630,178 | | | | 0.4 | % |

| Non-U.S. Government Agency Issues | | | | | | | | | | | |

| Other Non-U.S. Government Agency Issues# | | | | | | 11,839,521 | | | | 3.0 | % |

| Total Non-U.S. Government Agency Issues | | | | | | | | | | | |

| (Cost $11,783,697) | | | | | | 11,839,521 | | | | 3.0 | % |

| Commercial Mortgage-Backed Securities | | | | | | | | | | | |

| U.S. Government Agency Issues | | | | | | | | | | | |

| Fannie Mae REMIC Trust: | | | | | | | | | | | |

| Series 2012-M9, Class ASQ2, 1.513%, 12/25/2017 | | $ | 2,991,716 | | | | 2,996,029 | | | | 0.8 | % |

| Series 2015-M1, Class ASQ2, 1.626%, 02/25/2018 | | | 1,539,018 | | | | 1,542,675 | | | | 0.4 | % |

| Freddie Mac Multifamily | | | | | | | | | | | | |

| Structured Pass Through Certificates: | | | | | | | | | | | | |

Series K701, Class A2, 3.882%, 11/25/2017∞ | | | 2,045,000 | | | | 2,080,145 | | | | 0.5 | % |

| Series K702, Class A2, 3.154%, 02/25/2018 | | | 2,031,037 | | | | 2,061,234 | | | | 0.5 | % |

| Series K008, Class A1, 2.746%, 12/25/2019 | | | 1,986,201 | | | | 2,006,315 | | | | 0.5 | % |

| Series K009, Class A1, 2.757%, 05/25/2020 | | | 2,132,019 | | | | 2,150,930 | | | | 0.6 | % |

| 1.426%-2.699%, 08/25/2017-05/25/2018 | | | 1,542,694 | | | | 1,558,116 | | | | 0.4 | % |

| Total U.S. Government Agency Issues | | | | | | | | | | | | |

| (Cost $14,387,453) | | | | | | | 14,395,444 | | | | 3.7 | % |

| Other Asset Backed Securities | | | | | | | | | | | | |

| Ally Auto Receivables Trust, | | | | | | | | | | | | |

| Series 2014-2, Class A3, 1.250%, 04/15/2019 | | | 2,034,304 | | | | 2,035,101 | | | | 0.5 | % |

| American Express Credit Account Master Trust, | | | | | | | | | | | | |

| Series 2014-2, Class A, 1.260%, 01/15/2020 | | | 4,630,000 | | | | 4,632,929 | | | | 1.2 | % |

| BMW Vehicle Lease Trust, | | | | | | | | | | | | |

| Series 2015-1, Class A4, 1.340%, 06/20/2018 | | | 1,925,000 | | | | 1,926,631 | | | | 0.5 | % |

| California Republic Auto Receivables Trust, | | | | | | | | | | | | |

| Series 2015-3, Class A3, 1.620%, 11/15/2019 | | | 3,160,000 | | | | 3,165,254 | | | | 0.8 | % |

| Capital One Multi-Asset Execution Trust: | | | | | | | | | | | | |

| Series 2014-A2, Class A2, 1.260%, 01/15/2020 | | | 3,280,000 | | | | 3,281,822 | | | | 0.8 | % |

| Series 2007-A7, Class A7, 5.750%, 07/15/2020 | | | 3,000,000 | | | | 3,096,200 | | | | 0.8 | % |

| Carmax Auto Owner Trust, | | | | | | | | | | | | |

| Series 2014-3, 1.160%, 06/17/2019 | | | 2,007,432 | | | | 2,006,454 | | | | 0.5 | % |

| Chase Issuance Trust: | | | | | | | | | | | | |

| Series 2014-A1, Class A1, 1.150%, 01/15/2019 | | | 2,593,000 | | | | 2,593,008 | | | | 0.7 | % |

| Series 2014-A6, Class A6, 1.260%, 07/15/2019 | | | 2,100,000 | | | | 2,101,287 | | | | 0.5 | % |

| Citibank Credit Card Issuance Trust: | | | | | | | | | | | | |

| Series 2014-A2, Class A2, 1.020%, 02/22/2019 | | | 2,984,000 | | | | 2,983,885 | | | | 0.8 | % |

| Series 2014-A4, Class A4, 1.230%, 04/24/2019 | | | 2,000,000 | | | | 2,000,800 | | | | 0.5 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Discover Card Execution Note Trust, | | | | | | | | | |

| Series 2014-A3, Class A3, 1.220%, 10/15/2019 | | $ | 3,000,000 | | | $ | 3,001,010 | | | | 0.8 | % |

| Enterprise Fleet Financing LLC, | | | | | | | | | | | | |

| Series 2015-2, Class A2, 1.590%, 2/22/2021 | | | | | | | | | | | | |

| (Acquired 08/23/2016 through 12/19/2016, | | | | | | | | | | | | |

| Cost $2,802,871)* | | | 2,802,274 | | | | 2,800,718 | | | | 0.7 | % |

| Ford Credit Auto Lease Trust, | | | | | | | | | | | | |

| Series 2015-A, Class A4, 1.310%, 08/15/2018 | | | 2,450,000 | | | | 2,451,068 | | | | 0.6 | % |

| Ford Credit Floorplan Master Owner Trust | | | | | | | | | | | | |

| Series 2014-1, Class A1, 1.200%, 02/15/2019 | | | 2,500,000 | | | | 2,500,118 | | | | 0.6 | % |

| Golden Credit Card Trust, | | | | | | | | | | | | |

| Series 2012-2A, Class A1, 1.770%, 01/15/2019 | | | | | | | | | | | | |

| (Acquired 09/26/2016 through 09/30/2016, | | | | | | | | | | | | |

| Cost $4,001,306)* | | | 4,000,000 | | | | 4,001,128 | | | | 1.0 | % |

| Hyundai Auto Lease Securitization Trust, | | | | | | | | | | | | |

| Series 2015-A, Class A3, 1.420%, 09/17/2018 | | | | | | | | | | | | |

| (Acquired 09/26/2016 through 11/04/2016, | | | | | | | | | | | | |

| Cost $2,046,396)* | | | 2,043,137 | | | | 2,045,940 | | | | 0.5 | % |

| Mercedes Benz Auto Lease Trust, | | | | | | | | | | | | |

| Series 2015-A, Class A4, 1.210%, 10/15/2020 | | | 2,000,000 | | | | 2,000,129 | | | | 0.5 | % |

| MMAF Equipment Finance LLC: | | | | | | | | | | | | |

| Series 2016-AA, Class A2, 1.390%, 12/17/2018 | | | | | | | | | | | | |

| (Acquired 10/26/2016 through 11/14/2016, | | | | | | | | | | | | |

| Cost $3,302,311)* | | | 3,300,000 | | | | 3,301,181 | | | | 0.9 | % |

| Series 2011-AA, Class A5, 3.040%, 08/15/2028 | | | | | | | | | | | | |

| (Acquired 09/22/2016 through 12/30/2016, | | | | | | | | | | | | |

| Cost $2,446,093)* | | | 2,429,077 | | | | 2,443,641 | | | | 0.6 | % |

| Synchrony Credit Card Master Note Trust: | | | | | | | | | | | | |

| Series 2012-6, Class A, 1.360%, 08/17/2020 | | | 3,150,000 | | | | 3,151,757 | | | | 0.8 | % |

Series 2012-3, Class A, 1.154%, 03/15/2020∞ | | | 1,025,000 | | | | 1,025,278 | | | | 0.3 | % |

| Toyota Auto Receivables Owner Trust, | | | | | | | | | | | | |

| Series 2016-B, Class A2A, 1.020%, 10/15/2018 | | | 2,000,000 | | | | 1,998,825 | | | | 0.5 | % |

| Other Asset Backed Securities#~ | | | | | | | 19,210,029 | | | | 4.9 | % |

| Total Other Asset Backed Securities | | | | | | | | | | | | |

| (Cost $79,769,642) | | | | | | | 79,754,193 | | | | 20.3 | % |

| Total Long-Term Investments | | | | | | | | | | | | |

| (Cost $381,069,633) | | | | | | | 381,200,518 | | | | 97.1 | % |

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

Short-Term Investments

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Certificate of Deposit | | | | | | | | | |

| Federal Home Loan Bank Discount Notes | | $ | 845,000 | | | $ | 844,390 | | | | 0.2 | % |

| Total Certificate of Deposit | | | | | | | | | | | | |

| (Cost $845,000) | | | | | | | 844,390 | | | | 0.2 | % |

| | | Shares | | | | | | | | | |

| Money Market Mutual Fund | | | | | | | | | | | | |

| Fidelity Institutional Money Market Fund – | | | | | | | | | | | | |

| Government Portfolio, Institutional Class, 0.43%« | | | 4,876,398 | | | | 4,876,398 | | | | 1.3 | % |

| Total Short-Term Investments | | | | | | | | | | | | |

| (Cost $5,720,775) | | | | | | | 5,720,788 | | | | 1.5 | % |

| Total Investments | | | | | | | | | | | | |

| (Cost $386,790,408) | | | | | | | 386,921,306 | | | | 98.6 | % |

| Other Assets in Excess of Liabilities | | | | | | | 5,583,568 | | | | 1.4 | % |

| TOTAL NET ASSETS | | | | | | $ | 392,504,874 | | | | 100.0 | % |

Notes to Summary Schedule of Investments

| ∞ | Variable or floating rate security. Floating rate securities are securities whose yields vary with a designated index rate. These securities’ rates are as of December 31, 2016. |

| * | Restricted security as defined in Rule 144(a) under the Securities Act of 1933 and determined to be liquid. Purchased in a private placement transaction; resale to the public may require registration or may extend only to qualified institutional buyers. At December 31, 2016, the value of these securities total $23,256,716, which represents 5.93% of total net assets. |

| f | Foreign Security |

| # | Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets. |

| ~ | Groupings contain, in aggregate, restricted securities totaling $36,318,368, representing 9.25% of net assets. |

| « | 7-Day Yield |

Summary of Fair Value Exposure at December 31, 2016

The Fund has adopted authoritative fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion on changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized into three broad levels and described below:

The accompanying notes are an integral part of these financial statements.

Baird Ultra Short Bond Fund

Summary Schedule of Investments, December 31, 2016

Summary of Fair Value Exposure at December 31, 2016 (cont.)

Level 1 – | Unadjusted quoted prices in active markets for identical unrestricted securities. |

Level 2 – | Other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets, dealer indications, interest rates, yield curves, prepayment speeds, credit risk, default rates, inputs corroborated by observable market data, etc.). |

Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about the factors that market participants would use in valuing the security) based on the best information available. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2016:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments | | | | | | | | | | | | |

| U.S. Treasury Securities | | $ | — | | | $ | 104,305,512 | | | $ | — | | | $ | 104,305,512 | |

| Other Government Related Securities | | | — | | | | 3,267,226 | | | | — | | | | 3,267,226 | |

| Corporate Bonds | | | — | | | | 160,267,914 | | | | — | | | | 160,267,914 | |

| Taxable Municipal Bonds | | | — | | | | 5,740,530 | | | | — | | | | 5,740,530 | |

| Residential Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | — | | | | 1,630,178 | | | | — | | | | 1,630,178 | |

| Residential Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| Non-U.S. Government Agency Issues | | | — | | | | 11,839,521 | | | | — | | | | 11,839,521 | |

| Commercial Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | — | | | | 14,395,444 | | | | — | | | | 14,395,444 | |

| Other Asset Backed Securities | | | — | | | | 79,754,193 | | | | — | | | | 79,754,193 | |

| Total Long-Term Investments | | | — | | | | 381,200,518 | | | | — | | | | 381,200,518 | |

| Short-Term Investments | | | | | | | | | | | | | | | | |

| Certificate of Deposit | | | — | | | | 844,390 | | | | — | | | | 844,390 | |

| Money Market Mutual Fund | | | 4,876,398 | | | | — | | | | — | | | | 4,876,398 | |

| Total Short-Term Investments | | | 4,876,398 | | | | 844,390 | | | | — | | | | 5,720,788 | |

| Total Investments | | $ | 4,876,398 | | | $ | 382,044,908 | | | $ | — | | | $ | 386,921,306 | |

Changes in valuation techniques may result in transfers into or out of assigned levels within the fair value hierarchy. There were no transfers between Level 1, Level 2 and Level 3 fair value measurements during the reporting period. See the Fund’s valuation policy in Note 2a to the financial statements.

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

December 31, 2016

The Baird Short-Term Bond Fund seeks an annual rate of total return, before Fund expenses, greater than the annual rate of total return of the Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index. The Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index is an unmanaged, market value weighted index of investment grade, fixed rate debt issues, including government and credit securities, with maturities between one and three years.

During a very volatile 2016, the Fund generated strong absolute returns and outperformed its benchmark. The year can be considered a tale of two halves with the bond market experiencing significant volatility, driven by changing U.S. and global growth expectations, shifting global central bank policies, and political surprises both in the U.S and abroad. Our long-term commitment and strict adherence to a risk-controlled, duration neutral approach overseen by a seasoned team of investment professionals with uncommon longevity working together through multiple market cycles once again proved to be a prudent strategy during this period of heightened volatility.

The primary factors contributing to the Fund’s strong absolute and relative performance in 2016 are described below.

Positive contributors to the Fund’s performance during the year:

| | • | Overweight to investment grade credit |

| | | º | Overweight to BBB-rated credit |

| | | º | Exposure to commodity sensitive industrial sectors (energy and metals and mining) as spreads were significantly tighter in the year |

| | • | Security selection particularly within the Credit sector |

| | • | Exposure to high-quality Commercial Mortgage Backed Securities (CMBS), Non Agency Residential Mortgage Backed Securities (RMBS) and other Asset Backed Securities (ABS) |

Our base case outlook for 2017 is a continuation of moderate economic growth and inflation with better near-term economic growth prospects post-election given President Trump’s pro-growth agenda—though headwinds remain. However, we also acknowledge that a wide range of possible outcomes exists. If policy measures are passed that provide fiscal stimulus to the economy, they are likely to be met by tighter monetary policy from the Fed, limiting improvement in near-term economic growth. Additionally, low interest rates abroad will likely continue to limit the upside for U.S. interest rates. As a reminder, the Fund only purchases investment grade, U.S. dollar denominated securities in the cash bond market (no derivatives). The Fund remains duration neutral to its benchmark and we believe it is well positioned to add value relative to its benchmark.

Baird Short-Term Bond Fund

December 31, 2016 (Unaudited)

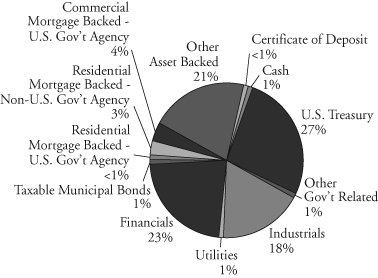

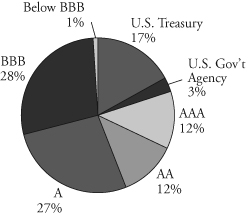

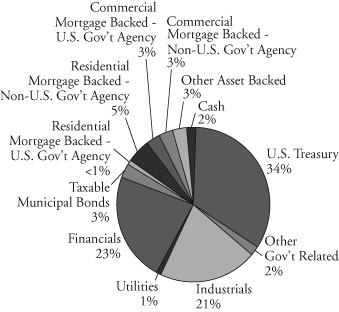

Portfolio Characteristics

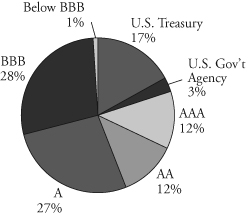

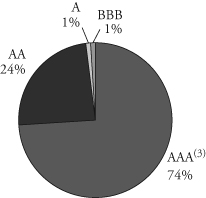

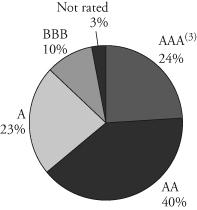

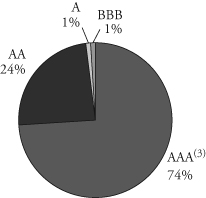

Quality Distribution(1)(2)

| | | | | | |

| | | Net Assets | $3,874,189,461 | | |

| | | | | |

| | SEC 30-Day | | | |

| | Yield(3) | | | |

| | Institutional Class | 1.71% | | |

| | Investor Class | 1.47% | | |

| | | | | |

| | Average | | | |

| | Effective | | | |

| | Duration | 1.92 years | | |

| | | | | |

| | Average | | | |

| | Effective | | | |

| | Maturity | 2.00 years | | |

| | | | | |

| | Annualized | | | |

| | | Expense | | | |

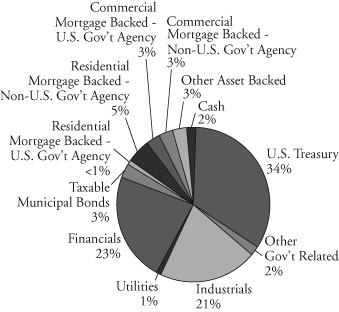

Sector Weightings(1) | | Ratio(4) | | | |

| | | Institutional Class | 0.30% | | |

| | Investor Class | 0.55% | (5) | |

| | | | | |

| | Portfolio | | | |

| | Turnover Rate | 44.0% | | |

| | | | | |

| | Number of | | | |

| | Holdings | 586 | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | | |

(1) | Percentages shown are based on the Fund’s total investments. |

(2) | The quality profile is calculated on a market value-weighted basis using the highest credit quality rating for each security held by the Fund given by S&P, Moody’s or Fitch, each of which is a Nationally Recognized Statistical Rating Organization (NRSRO). NRSROs rate the credit quality of securities using a scale that generally ranges from AAA (highest) to D (lowest). |

(3) | SEC yields are based on SEC guidelines and are calculated for the 30 days ended December 31, 2016. |

(4) | Reflects expense ratios as stated in the Fund’s current prospectus. |

(5) | Includes 0.25% 12b-1 fee. |

Baird Short-Term Bond Fund

December 31, 2016 (Unaudited)

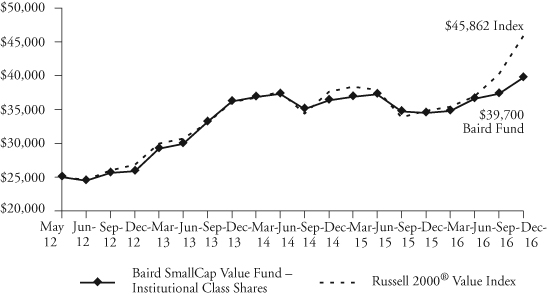

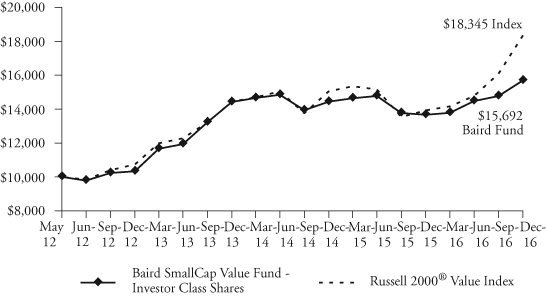

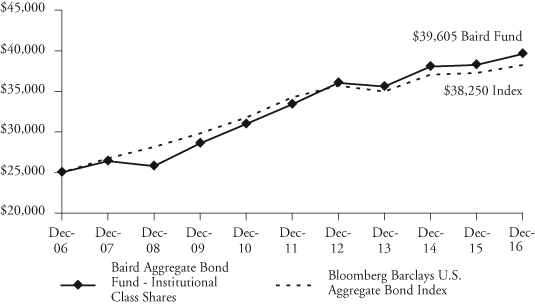

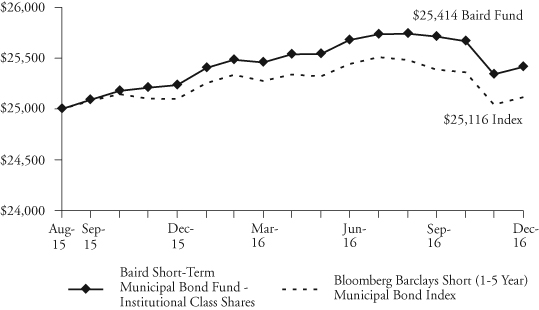

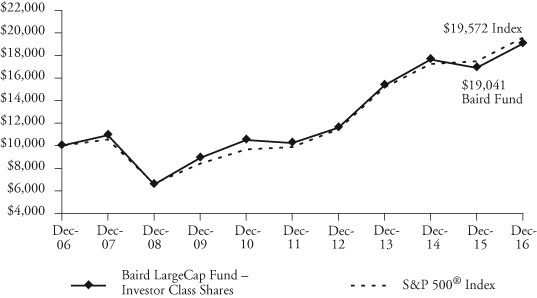

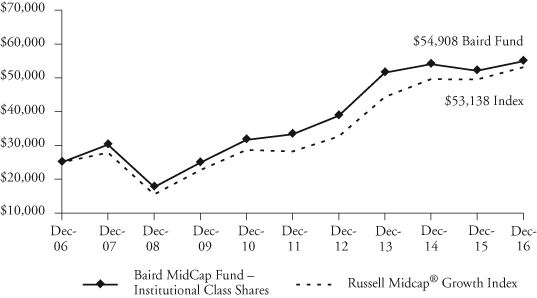

Institutional Class

Value of a $25,000 Investment

Growth of a hypothetical investment of $25,000 made on 12/31/06, assuming reinvestment of all distributions.

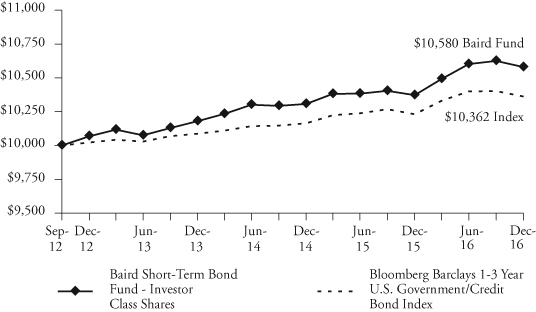

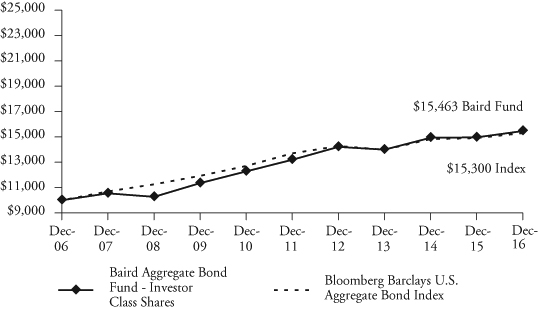

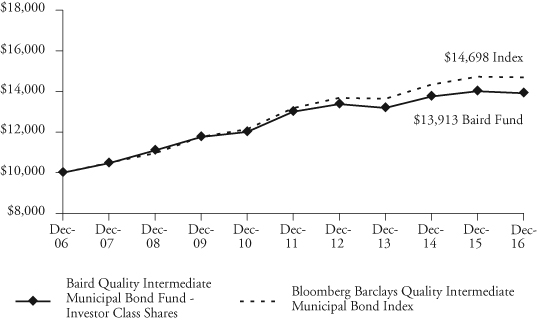

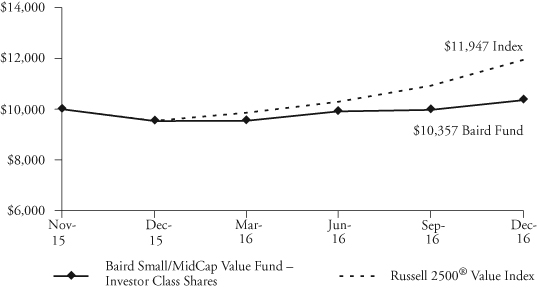

Investor Class

Value of a $10,000 Investment

Growth of a hypothetical investment of $10,000 made on 12/31/06, assuming reinvestment of all distributions.

Baird Short-Term Bond Fund

December 31, 2016 (Unaudited)

Total Returns

| | | Average Annual |

| | | | | Since | Since |

| | One | Five | Ten | Inception | Inception |

| For the Periods Ended December 31, 2016 | Year | Years | Years | (8/31/04) | (9/19/12) |

| Institutional Class Shares | 2.25% | 2.02% | 2.87% | 2.86% | N/A |

| Investor Class Shares | 2.00% | N/A | N/A | N/A | 1.33% |

| Bloomberg Barclays 1-3 Year U.S. | | | | | |

Government/Credit Bond Index(1) | 1.28% | 0.92% | 2.44% | 2.47% | 0.83% |

| (1) | The Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index is an unmanaged, market value weighted index of investment grade, fixed-rate debt issues, including government and corporate securities, with maturities between one and three years. This Index does not reflect any deduction for fees, expenses or taxes. A direct investment in an index is not possible. |

The line graph on the previous page and the returns shown in the table above reflect reinvestment of dividends and/or capital gains distributions in additional shares. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The returns reflect the actual performance for each period and do not include the impact of trades executed on the last business day of the period that were recorded on the first business day of the next period.

The Fund’s gross expense ratio for each Class, as reflected in the Fund’s current prospectus, is set forth under “Portfolio Characteristics”.

The Fund may invest in U.S. dollar denominated foreign securities which involve additional risks such as political and economic instability, and different and sometimes less strict financial reporting standards and regulation. The Fund may also invest in mortgage- and asset-backed securities, which include interest rate and prepayment risks more pronounced than those of other fixed income securities.

Past performance does not guarantee future results. Investment returns and principal value will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

For information about the performance of the Fund as of the most recent month-end, please call 1-866-44BAIRD or visit www.bairdfunds.com. Mutual fund performance changes over time and current performance may be lower or higher than that stated.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

This schedule summarizes the Fund’s holdings by asset type. Details are reported for each of the Fund’s 50 largest individual holdings and for investments that, in total for any issuer, represent more than 1% of the Fund’s net assets. The total value of smaller holdings is reported as a single amount within each category.

The Fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter end. For the second and fourth fiscal quarters, the complete listing of the Fund’s holdings is available electronically in the Fund’s Form N-CSR at http://www.bairdassetmanagement.com/baird-funds/funds-and-performance#Literature and on the Securities and Exchange Commission’s website (www.sec.gov) or you can have it mailed to you without charge by calling 1-866-44BAIRD. For the first and third fiscal quarters, the Fund files the lists with the SEC on Form N-Q. Shareholders can look up the Fund’s Forms N-CSR and N-Q on the SEC’s website (www.sec.gov).

Long-Term Investments

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| U.S. Treasury Securities | | | | | | | | | |

| U.S. Treasury Bonds: | | | | | | | | | |

| 2.625%, 08/15/2020 | | $ | 258,775,000 | | | $ | 267,569,210 | | | | 6.9 | % |

| 1.375%, 08/31/2020 | | | 330,000,000 | | | | 326,570,970 | | | | 8.4 | % |

| 2.000%, 08/31/2021 | | | 67,000,000 | | | | 67,266,928 | | | | 1.8 | % |

| Total U.S. Treasury Securities | | | | | | | | | | | | |

| (Cost $669,144,141) | | | | | | | 661,407,108 | | | | 17.1 | % |

| Other Government Related Securities | | | | | | | | | | | | |

| Other Government Related Securities#~ | | | | | | | 72,690,299 | | | | 1.9 | % |

| Total Other Government Related Securities | | | | | | | | | | | | |

| (Cost $72,557,753) | | | | | | | 72,690,299 | | | | 1.9 | % |

| Corporate Bonds | | | | | | | | | | | | |

| Industrials | | | | | | | | | | | | |

| Abbott Laboratories, | | | | | | | | | | | | |

| 2.350%, 11/22/2019 | | | 14,125,000 | | | | 14,141,653 | | | | 0.4 | % |

| Boardwalk Pipelines LP, | | | | | | | | | | | | |

| 5.500%, 02/01/2017 | | | 17,884,000 | | | | 17,931,643 | | | | 0.5 | % |

| CF Industries, Inc., | | | | | | | | | | | | |

| 6.875%, 05/01/2018 | | | 19,412,000 | | | | 20,433,848 | | | | 0.5 | % |

| Diamond 1 Finance Corp. / Diamond 2 Finance Corp., | | | | | | | | | | | | |

| 3.480%, 06/01/2019 (Acquired 05/17/2016 | | | | | | | | | | | | |

| through 10/07/2016, Cost $18,556,894)* | | | 18,535,000 | | | | 18,920,639 | | | | 0.5 | % |

| Dollar General Corp., | | | | | | | | | | | | |

| 4.125%, 07/15/2017 | | | 17,321,000 | | | | 17,572,328 | | | | 0.5 | % |

| Ecolab, Inc., | | | | | | | | | | | | |

| 2.000%, 01/14/2019 | | | 14,250,000 | | | | 14,260,944 | | | | 0.4 | % |

| ERAC USA Finance LLC, | | | | | | | | | | | | |

| 2.350%, 10/15/2019 (Acquired 01/21/2015 | | | | | | | | | | | | |

| through 10/26/2016, Cost $19,143,622)* | | | 19,000,000 | | | | 18,983,128 | | | | 0.5 | % |

| Keysight Technologies, Inc., | | | | | | | | | | | | |

| 3.300%, 10/30/2019 | | | 18,125,000 | | | | 18,405,140 | | | | 0.5 | % |

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Marathon Petroleum Corp., | | | | | | | | | |

| 2.700%, 12/14/2018 | | $ | 14,100,000 | | | $ | 14,287,713 | | | | 0.4 | % |

| Mylan NV, | | | | | | | | | | | | |

| 3.000%, 12/15/2018 (Acquired 08/18/2016 | | | | | | | | | | | | |

through 10/31/2016, Cost $14,431,764)* f | | | 14,095,000 | | | | 14,196,935 | | | | 0.4 | % |

| Pentair Finance SA, | | | | | | | | | | | | |

2.900%, 09/15/2018 f | | | 13,075,000 | | | | 13,226,108 | | | | 0.3 | % |

| Potash Corp of Saskatchewan, Inc., | | | | | | | | | | | | |

6.500%, 05/15/2019 f | | | 11,500,000 | | | | 12,561,462 | | | | 0.3 | % |

| The Dow Chemical Co., | | | | | | | | | | | | |

| 8.550%, 05/15/2019 | | | 14,777,000 | | | | 16,935,639 | | | | 0.4 | % |

| Thermo Fisher Scientific, Inc., | | | | | | | | | | | | |

| 1.850%, 01/15/2018 | | | 13,000,000 | | | | 13,018,603 | | | | 0.3 | % |

| TSMC Global Ltd., | | | | | | | | | | | | |

| 1.625%, 04/03/2018 (Acquired 08/05/2014 | | | | | | | | | | | | |

through 06/07/2016, Cost $15,840,544)* f | | | 15,919,000 | | | | 15,858,126 | | | | 0.4 | % |

| Verizon Communications, Inc., | | | | | | | | | | | | |

| 3.650%, 09/14/2018 | | | 14,000,000 | | | | 14,462,238 | | | | 0.4 | % |

| Other Industrials#~ | | | | | | | 935,907,155 | | | | 24.0 | % |

| Total Industrials | | | | | | | | | | | | |

| (Cost $1,188,927,398) | | | | | | | 1,191,103,302 | | | | 30.7 | % |

| Utilities | | | | | | | | | | | | |

| Other Utilities#~ | | | | | | | 85,441,646 | | | | 2.2 | % |

| Total Utilities | | | | | | | | | | | | |

| (Cost $85,347,613) | | | | | | | 85,441,646 | | | | 2.2 | % |

| Financials | | | | | | | | | | | | |

| Banque Federative du Credit Mutuel SA, | | | | | | | | | | | | |

| 2.000%, 04/12/2019 (Acquired 04/06/2016 | | | | | | | | | | | | |

through 10/21/2016, Cost $18,599,065)* f | | | 18,600,000 | | | | 18,524,186 | | | | 0.5 | % |

| Branch Banking & Trust Co., | | | | | | | | | | | | |

1.220%, 05/23/2017∞ | | | 12,895,000 | | | | 12,894,033 | | | | 0.3 | % |

| Canadian Imperial Bank of Commerce/Canada, | | | | | | | | | | | | |

1.600%, 09/06/2019 f | | | 20,000,000 | | | | 19,809,640 | | | | 0.5 | % |

| Citizens Bank NA/Providence RI, | | | | | | | | | | | | |

| 1.600%, 12/04/2017 | | | 14,300,000 | | | | 14,284,985 | | | | 0.3 | % |

| CNA Financial Corp., | | | | | | | | | | | | |

| 7.350%, 11/15/2019 | | | 14,915,000 | | | | 16,915,445 | | | | 0.4 | % |

| Commonwealth Bank of Australia/New York NY, | | | | | | | | | | | | |

1.750%, 11/02/2018 f | | | 15,000,000 | | | | 14,962,860 | | | | 0.4 | % |

| First Tennessee Bank NA, | | | | | | | | | | | | |

| 2.950%, 12/01/2019 | | | 15,286,000 | | | | 15,323,909 | | | | 0.4 | % |

| KEB Hana Bank, | | | | | | | | | | | | |

| 1.750%, 10/18/2019 (Acquired 10/11/2016, | | | | | | | | | | | | |

Cost $17,942,040)* f | | | 18,000,000 | | | | 17,797,338 | | | | 0.5 | % |

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| LeasePlan Corp. NV, | | | | | | | | | |

| 2.500%, 05/16/2018 (Acquired 05/07/2013 | | | | | | | | | |

through 02/25/2016, Cost $16,360,141)* f | | $ | 16,435,000 | | | $ | 16,458,896 | | | | 0.4 | % |

| Protective Life Global Funding, | | | | | | | | | | | | |

| 1.555%, 09/13/2019 (Acquired 09/07/2016, | | | | | | | | | | | | |

| Cost $18,000,000)* | | | 18,000,000 | | | | 17,725,050 | | | | 0.5 | % |

| Reliance Standard Life Global Funding II, | | | | | | | | | | | | |

| 2.150%, 10/15/2018 (Acquired 10/13/2015 | | | | | | | | | | | | |

| through 06/09/2016, Cost $13,020,388)* | | | 13,000,000 | | | | 13,064,584 | | | | 0.3 | % |

| Synchrony Financial, | | | | | | | | | | | | |

| 3.000%, 08/15/2019 | | | 13,350,000 | | | | 13,523,002 | | | | 0.3 | % |

| The Huntington National Bank, | | | | | | | | | | | | |

| 2.000%, 06/30/2018 | | | 12,990,000 | | | | 12,995,612 | | | | 0.3 | % |

| Voya Financial, Inc., | | | | | | | | | | | | |

| 2.900%, 02/15/2018 | | | 17,494,000 | | | | 17,710,681 | | | | 0.5 | % |

| Other Financials#~ | | | | | | | 761,889,686 | | | | 19.8 | % |

| Total Financials | | | | | | | | | | | | |

| (Cost $984,946,330) | | | | | | | 983,879,907 | | | | 25.4 | % |

| Total Corporate Bonds | | | | | | | | | | | | |

| (Cost $2,259,221,341) | | | | | | | 2,260,424,855 | | | | 58.3 | % |

| Taxable Municipal Bonds | | | | | | | | | | | | |

| Other Taxable Municipal Bonds# | | | | | | | 113,213,350 | | | | 2.9 | % |

| Total Taxable Municipal Bonds | | | | | | | | | | | | |

| (Cost $113,697,097) | | | | | | | 113,213,350 | | | | 2.9 | % |

| Residential Mortgage-Backed Securities | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | | | | | | | | | | |

| Other U.S. Government Agency Issues# | | | | | | | 8,582 | | | | 0.0 | % |

| Total U.S. Government Agency Issues | | | | | | | | | | | | |

| (Cost $8,447) | | | | | | | 8,582 | | | | 0.0 | % |

| Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| Other Non-U.S. Government Agency Issues#~ | | | | | | | 227,514,434 | | | | 5.9 | % |

| Total Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| (Cost $227,308,316) | | | | | | | 227,514,434 | | | | 5.9 | % |

| Commercial Mortgage-Backed Securities | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | | | | | | | | | | |

| Fannie Mae REMIC Trust: | | | | | | | | | | | | |

| Series 2012-M9, Class ASQ2, 1.513%, 12/25/2017 | | | 24,270,826 | | | | 24,305,813 | | | | 0.6 | % |

| Series 2015-M1, Class ASQ2, 1.626%, 02/25/2018 | | | 24,170,737 | | | | 24,228,161 | | | | 0.6 | % |

| Series 2016-M6, Class ASQ2, 1.785%, 06/25/2019 | | | 13,650,000 | | | | 13,681,435 | | | | 0.4 | % |

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Freddie Mac Multifamily | | | | | | | | | |

| Structured Pass Through Certificates: | | | | | | | | | |

| Series K006, Class A2, 4.251%, 01/25/2020 | | $ | 15,000,000 | | | $ | 15,878,226 | | | | 0.4 | % |

1.426%-3.882%, 08/25/2017-09/25/2018∞ | | | 26,243,388 | | | | 26,522,193 | | | | 0.7 | % |

| Total U.S. Government Agency Issues | | | | | | | | | | | | |

| (Cost $104,739,546) | | | | | | | 104,615,828 | | | | 2.7 | % |

| Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| J.P. Morgan Chase Commercial Mortgage Securities Trust, | | | | | | | | | | | | |

| Series 2012-C8, Class ASB, 2.379%, 10/15/2045 | | | 16,100,000 | | | | 16,174,965 | | | | 0.4 | % |

| Other Non-U.S. Government Agency Issues# | | | | | | | 13,691,953 | | | | 0.4 | % |

| Total Non-U.S. Government Agency Issues | | | | | | | | | | | | |

| (Cost $30,074,294) | | | | | | | 29,866,918 | | | | 0.8 | % |

| Other Asset Backed Securities | | | | | | | | | | | | |

| California Republic Auto Receivables Trust, | | | | | | | | | | | | |

| Series 2015-3, Class A3, 1.620%, 11/15/2019 | | | 20,500,000 | | | | 20,534,083 | | | | 0.5 | % |

| Chase Issuance Trust, | | | | | | | | | | | | |

| Series 2015-A5, Class A5, 1.360%, 04/15/2020 | | | 13,750,000 | | | | 13,741,914 | | | | 0.4 | % |

| Discover Card Execution Note Trust, | | | | | | | | | | | | |

| Series 2016-A4, Class A4, 1.390%, 03/15/2022 | | | 19,075,000 | | | | 18,857,270 | | | | 0.5 | % |

| Ford Credit Auto Owner Trust: | | | | | | | | | | | | |

| Series 2014-1, Class A, 2.260%, 11/15/2025 | | | | | | | | | | | | |

| (Acquired 05/06/2014 through 11/18/2014, | | | | | | | | | | | | |

| Cost $17,933,705)* | | | 17,894,000 | | | | 18,046,743 | | | | 0.5 | % |

| Series 2014-2, Class A, 2.310%, 04/15/2026 | | | | | | | | | | | | |

| (Acquired 01/06/2016 through 09/02/2016, | | | | | | | | | | | | |

| Cost $15,050,289)* | | | 14,892,000 | | | | 15,016,546 | | | | 0.4 | % |

| Series 2015-1, Class A, 2.120%, 07/15/2026 | | | | | | | | | | | | |

| (Acquired 01/13/2015 through 03/14/2016, | | | | | | | | | | | | |

| Cost $12,566,749)* | | | 12,592,000 | | | | 12,616,795 | | | | 0.3 | % |

| GMF Floorplan Owner Revolving Trust, | | | | | | | | | | | | |

| Series 2015-1, Class A1, 1.650%, 05/15/2020 | | | | | | | | | | | | |

| (Acquired 05/13/2015, Cost $14,699,441)* | | | 14,700,000 | | | | 14,688,346 | | | | 0.4 | % |

| Honda Auto Receivables Owner Trust, | | | | | | | | | | | | |

| Series 2016-1, Class A3, 1.220%, 12/18/2019 | | | 13,000,000 | | | | 12,970,031 | | | | 0.3 | % |

| Kubota Credit Owner Trust, | | | | | | | | | | | | |

| Series 2015-1A, Class A3, 1.540%, 03/15/2019 | | | | | | | | | | | | |

| (Acquired 01/22/2015 through 07/21/2016, | | | | | | | | | | | | |

| Cost $20,226,877)* | | | 20,225,000 | | | | 20,252,002 | | | | 0.5 | % |

| Mercedes-Benz Auto Lease Trust, | | | | | | | | | | | | |

| Series 2016-B, Class A3, 1.350%, 08/15/2019 | | | 18,800,000 | | | | 18,748,845 | | | | 0.5 | % |

| Verizon Owner Trust: | | | | | | | | | | | | |

| Series 2016-1A, Class A, 1.420%, 01/20/2021 | | | | | | | | | | | | |

| (Acquired 07/12/2016, Cost $16,247,263)* | | | 16,250,000 | | | | 16,136,908 | | | | 0.4 | % |

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

Long-Term Investments (cont.)

| | | Principal | | | | | | % of | |

| | | Amount | | | Value | | | Net Assets | |

| Series 2016-2A, Class A, 1.680%, 05/20/2021 | | | | | | | | | |

| (Acquired 11/16/2016, Cost $12,748,678)* | | $ | 12,750,000 | | | $ | 12,698,634 | | | | 0.3 | % |

| Other Asset Backed Securities#~ | | | | | | | 119,436,680 | | | | 3.1 | % |

| Total Other Asset Backed Securities | | | | | | | | | | | | |

| (Cost $314,028,455) | | | | | | | 313,744,797 | | | | 8.1 | % |

| Total Long-Term Investments | | | | | | | | | | | | |

| (Cost $3,790,779,390) | | | | | | | 3,783,486,171 | | | | 97.7 | % |

| Short-Term Investment | | | | | | | | | | | | |

| | | Shares | | | | | | | | | |

| Money Market Mutual Fund | | | | | | | | | | | | |

| Fidelity Institutional Money Market Fund – | | | | | | | | | | | | |

| Government Portfolio, Institutional Class, 0.43%« | | | 116,128,236 | | | | 116,128,236 | | | | 3.0 | % |

| Total Short-Term Investment | | | | | | | | | | | | |

| (Cost $116,128,236) | | | | | | | 116,128,236 | | | | 3.0 | % |

| Total Investments | | | | | | | | | | | | |

| (Cost $3,906,907,626) | | | | | | | 3,899,614,407 | | | | 100.7 | % |

| Liabilities in Excess of Other Assets | | | | | | | (25,424,946 | ) | | | (0.7 | )% |

| TOTAL NET ASSETS | | | | | | $ | 3,874,189,461 | | | | 100.0 | % |

Notes to Summary Schedule of Investments

| ∞ | Variable or Floating rate security. Floating rate securities are securities whose yields vary with a designated index rate. These securities’ rates are as of December 31, 2016. |

| * | Restricted security as defined in Rule 144(a) under the Securities Act of 1933 and determined to be liquid. Purchased in a private placement transaction; resale to the public may require registration or may extend only to qualified institutional buyers. At December 31, 2016, the value of these securities total $260,984,856, which represents 6.74% of total net assets. |

| f | Foreign Security |

| # | Represents the aggregate value, by category, of securities that are not among the 50 largest holdings and, in total for any issuer, represent 1% or less of net assets. |

| ~ | Groupings contain, in aggregate, restricted securities totaling $552,150,012, representing 14.25% of net assets. |

| « | 7-Day Yield |

Summary of Fair Value Exposure at December 31, 2016

The Fund has adopted authoritative fair valuation accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion on changes in valuation techniques and related inputs during the period. These standards define fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

The accompanying notes are an integral part of these financial statements.

Baird Short-Term Bond Fund

Summary Schedule of Investments, December 31, 2016

Summary of Fair Value Exposure at December 31, 2016 (cont.)

The fair value hierarchy is organized into three levels based upon the assumptions (referred to as “inputs”) used in pricing the asset or liability. These standards state that “observable inputs” reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from independent sources and “unobservable inputs” reflect an entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability. These inputs are summarized into three broad levels and described below:

Level 1 – | Unadjusted quoted prices in active markets for identical unrestricted securities. |

Level 2 – | Other significant observable inputs (including quoted prices for similar securities, quoted prices in inactive markets, dealer indications, interest rates, yield curves, prepayment speeds, credit risk, default rates, inputs corroborated by observable market data, etc.). |

Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions about the factors that market participants would use in valuing the security) based on the best information available. |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used to value the Fund’s investments as of December 31, 2016:

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Long-Term Investments | | | | | | | | | | | | |

| U.S. Treasury Securities | | $ | — | | | $ | 661,407,108 | | | $ | — | | | $ | 661,407,108 | |

| Other Government Related Securities | | | — | | | | 72,690,299 | | | | — | | | | 72,690,299 | |

| Corporate Bonds | | | — | | | | 2,260,424,855 | | | | — | | | | 2,260,424,855 | |

| Taxable Municipal Bonds | | | — | | | | 113,213,350 | | | | — | | | | 113,213,350 | |

| Residential Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | — | | | | 8,582 | | | | — | | | | 8,582 | |

| Residential Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| Non-U.S. Government Agency Issues | | | — | | | | 227,514,434 | | | | — | | | | 227,514,434 | |

| Commercial Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| U.S. Government Agency Issues | | | — | | | | 104,615,828 | | | | — | | | | 104,615,828 | |

| Commercial Mortgage-Backed Securities – | | | | | | | | | | | | | | | | |

| Non-U.S. Government Agency Issues | | | — | | | | 29,866,918 | | | | — | | | | 29,866,918 | |

| Other Asset Backed Securities | | | — | | | | 313,744,797 | | | | — | | | | 313,744,797 | |

| Total Long-Term Investments | | | — | | | | 3,783,486,171 | | | | — | | | | 3,783,486,171 | |

| Short-Term Investment | | | | | | | | | | | | | | | | |

| Money Market Mutual Fund | | | 116,128,236 | | | | — | | | | — | | | | 116,128,236 | |

| Total Short-Term Investment | | | 116,128,236 | | | | — | | | | — | | | | 116,128,236 | |

| Total Investments | | $ | 116,128,236 | | | $ | 3,783,486,171 | | | $ | — | | | $ | 3,899,614,407 | |