UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21580

CORTINA FUNDS, INC.

(Exact name of registrant as specified in charter)

825 N. Jefferson St., Suite 400, Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

(414) 225-7365

Registrant’s telephone number, including area code

Lori Hoch

825 N. Jefferson St., Suite 400

Milwaukee, WI 53202

(Name and address of agent for service)

Date of fiscal year end: June 30

Date of reporting period: July 1, 2017 - June 30, 2018

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Cortina Small Cap Growth Fund | |

| Shareholder Letter | 1 |

| Portfolio Information | 3 |

| Cortina Small Cap Value Fund | |

| Shareholder Letter | 4 |

| Portfolio Information | 6 |

| Disclosure of Fund Expenses | 7 |

| Schedule of Investments | |

| Cortina Small Cap Growth Fund | 8 |

| Cortina Small Cap Value Fund | 11 |

| Statements of Assets and Liabilities | 13 |

| Statements of Operations | 14 |

| Statements of Changes in Net Assets | 15 |

| Financial Highlights | |

| Cortina Small Cap Growth Fund | 16 |

| Cortina Small Cap Value Fund - Institutional | 17 |

| Cortina Small Cap Value Fund - Investor | 18 |

| Notes to Financial Statements | 19 |

| Report of Independent Registered Public Accounting Firm | 24 |

| Additional Information | 25 |

| Board of Directors and Officers | 28 |

| Shareholder Letter |

| Cortina Small Cap Growth Fund | June 30, 2018 (Unaudited) |

DEAR FELLOW SHAREHOLDERS:

The Cortina Small Cap Growth Fund had a stellar second half of fiscal 2018 leading to our third fiscal year in a row of positive performance versus the Russell 2000 Growth Index. Over the past six months, the Fund returned 22.36% compared to the benchmark return of just 9.70%. Second half performance was strong enough to overcome a lagging first half of the fiscal year (i.e. July through December of 2017). There were many contributors to the Fund’s strong absolute and relative performance including stylistic tailwinds and sector allocation but positive security selection was the biggest factor.

The past six months have been a much different market environment than was experienced in the preceding calendar year. The euphoria of tax cuts and the implications they would have on economic growth and earnings per share drove strong returns to start the year. That was quickly followed by tariff threats which sparked the first 5% pullback in the S&P 500 since 2016. Normalized levels of volatility returning to equity markets was a welcome development for active managers such as ourselves. A healthy amount of volatility provides opportunity to more effectively trade around core positions and add high quality growth names off our watch list as they hit our desired entry points.

Trade war fears also helped spark a market preference for small caps over large caps as small companies are more domestically focused and in theory less exposed to trade wars. Further fueling the preference for small caps over large caps was the belief that smaller companies would disproportionately benefit from domestic tax cuts. This provided the first stylistic tailwind for our Fund, with small caps meaningfully outperforming large caps. In fact, the Russell 2000 Small Cap Index returned 7.66% compared to just a 2.65% return for the S&P 500. Our Fund tends to skew smaller than the benchmark which provided an added benefit for us.

Rising interest rates also contributed to market volatility and we believe provided a second tailwind to our investment style. Following three rate hikes in 2017, the Federal Open Market Committee again raised the Fed Funds Rate in both March and June of this year. Rates, while still historically low, have now reached a point where investors seeking current income can achieve that in bonds with the 2 Year U.S. Treasury Yield exceeding the S&P 500 Dividend Yield for the first time since the Great Recession. Dividends became less important and stocks without dividends significantly outperformed their counterparts. In addition, companies with low debt levels shined as the prospect of refinancing at higher rates pressured more highly leveled companies. Consistent with our mantra of being early investors to innovative growth companies, we shun companies who fund nascent growth with debt and we do not seek mature, dividend-paying companies.

From a sector standpoint, the two best performing sectors within the index were the Technology (up 17.86%) and Health Care (up 17.06%) sectors in the first half of 2018. These two sectors were our two most heavily weighted sectors and averaged a combined 57% of Fund assets on average over the last six months versus 50% of the Russell 2000 Growth Index. Fund returns of 24.04% and 41.18% within the Technology and Health Care sectors respectively, however, were much more impactful than our sector allocations. We also had strong security selection in all but the Materials and Telecom Services sectors which were negligibly negative. We attribute a portion of the strong security selection to the stylistic tailwinds discussed above. We also attribute a large portion to very strong sales and earnings results. Based on our calculations, 82% of our holdings reported better than expected fourth quarter 2017 revenue estimates and 79% exceeded earnings estimates. First quarter 2018 results were nearly as good with 80% and 74% of holdings exceeding sales and earnings estimates respectively.

OUTLOOK AND POSITIONING

For the first time in ten quarters, the Information Technology sector does not start the quarter as the Fund’s largest absolute weight. Technology’s influence on businesses across the economy has been the single greatest driver of innovation and efficiency for some time and our enthusiasm for discovering technology companies has not waned. We have been, however, in the process of methodically reducing our aggregate exposure to emerging risks within the sector. The first is valuations which have reached lofty levels reminiscent of 2013. Along the same lines, the group is reaching extreme popularity with investors as it is difficult to find an institutional investor who is not already overweight the sector. While not the current focus of trade rhetoric and tariffs, technology companies sell to the industries that are at the center of it and are vulnerable to purchase delays stemming from uncertainty. Finally, some tech companies, namely those in the semiconductor and semiconductor food chain, rely heavily on sales to Chinese customers. China consumes roughly 60% of the world’s semiconductors. As China is the sparring partner in the most contentious trade negotiations, hardball between the two nations could cause domestic company sales to get caught in the crossfire.

With the Information Technology sector no longer our largest sector, the Health Care sector has taken the helm. Here too, some valuations are rich following tremendous returns and we have been proactively trimming and eliminating holdings that we feel are vulnerable. To that end, we reduced exposure to or completely eliminated more than a third of our Health Care holdings in the June quarter and initiated six new positions where we felt the risk reward was more attractive. We continue to have a large absolute and relative weight in the sector, however, as sector fundamentals remain strong and innovation abounds.

We expect overall market volatility to persist in the ensuing months. Trade is likely to continue to dominate business headlines and that could continue to benefit small caps. How trade policy ultimately shakes out remains unknowable, but two things are certain: 1) the Trump Administration is looking to make definitive gains in terms with trading partners across the globe; and 2) negotiations with trade partners will occur in the clear eye of the public. Investors will have to numb (if they have not already done so) to the news / Tweet of the day regarding policy proposals, threats and ultimatums and focus on actual policy. This may become even harder to do was we approach the midterm election season. The stakes are always high entering midterms and this year is no different as Republican control of the House is vulnerable and control of the Senate is not guaranteed. Markets often retreat heading into midterms and we would not be entirely surprised to see that happen this year.

| Annual Report | June 30, 2018 | 1 |

| Shareholder Letter |

| Cortina Small Cap Growth Fund | June 30, 2018 (Unaudited) |

Looking beyond the immediate future, our outlook remains bright. U.S. economic growth, small business optimism, consumer confidence and other metrics continue to impress. While valuations are extended in certain pockets of the market, stocks remain attractive versus bonds and overall valuations are far from the bubble levels in March of 2000. Should trade and election uncertainty lead to further volatility, we will eagerly seek to identify and try to take advantage of dislocations in the market.

Dividend yield is a dividend expressed as a percentage of a current share price.

U.S. Treasury yield is the return on investment, expressed as a percentage, on the U.S. government’s debt obligations. These debt obligations can be for varying lengths of time.

Cortina Funds are subject to risks, including loss of principal.

Investing in small or micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

S&P 500 – The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

| 2 | 1-855-612-3936 | www.cortinafunds.com |

| Portfolio Information |

| Cortina Small Cap Growth Fund | June 30, 2018 (Unaudited) |

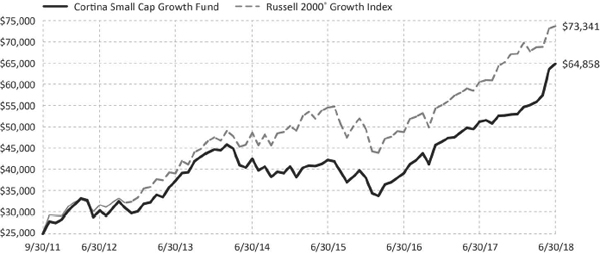

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to June 30, 2018.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Growth Fund (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Growth Index. It is important to note the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended June 30, 2018

| | 6 Months | 1 Year | 3 Years | 5 Years | Since Inception* | Gross

Expense Ratio** |

| Cortina Small Cap Growth Fund | 22.36% | 26.72% | 15.42% | 11.72% | 15.17% | 1.76% |

| Russell 2000® Growth Index | 9.70% | 21.86% | 10.60% | 13.65% | 17.28% | |

| * | The Fund’s inception date is September 30, 2011. |

| ** | Cortina Asset Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses and extraordinary expenses) to 1.10% of average daily net assets of the Fund. The agreement will continue in effect at least through October 31, 2018, subject thereafter to annual re-approval of the agreement by the Fund’s Board of Directors. The current expense ratio for the Fund can be located in the Financial Highlights contained within this shareholder report. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

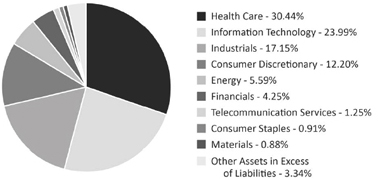

Sector Allocations***

| *** | Percentages are based on Net Assets as of June 30, 2018. Holdings are subject to change. |

| Annual Report | June 30, 2018 | 3 |

| Shareholder Letter |

| Cortina Small Cap Value Fund | June 30, 2018 (Unaudited) |

DEAR FELLOW SHAREHOLDERS:

Over the past twelve months the Cortina Small Cap Value Fund rose nearly 8% versus the Russell 2000 Value’s 13.10% gain. Equity markets have posted solid returns as positive economic momentum has continued. Much of the Fund’s lag in the last twelve months occurred in calendar 2018, and mostly in the quarter ended June. Value equities continue to struggle to gain investors’ attention in an environment of rapid technological enablement of new business ideas, regardless of their long-term viability.

Allocation across sectors was positive, but equity selection was negative. By a wide margin, health care was the biggest negative for the Fund, entirely due to selection. Specific weakness in two pharmaceutical companies has been a material drag on performance yet both companies remain in the Fund as progress continues on their development of new products, one of which is an opioid substitute that has gained expanded FDA-approvals and is growing at a double-digit rate, and while the market has been slow to give it credit, recent results are encouraging. Simultaneously, biotech, a sub-sector the Fund has no exposure to, posted amongst the best returns of any sub-sector in the market including a single-security sub-sector (beverages). The Fund’s lack of exposure to biotech cost nearly 100 basis points of relative performance. Biotech companies may have wonderful futures, but considering the lack of profitability, high risk outcomes, and incompatibility with any valuation discipline, it is difficult to make a case for investment that includes any margin of safety.

Energy and Materials were also drags on performance, while Consumer Discretionary, Consumer Staples, Information Technology, and Real Estate were all positive contributors to relative performance.

As 2018 has progressed, economic data has exhibited some indications of topping out, which has led to a reduction in our cyclical exposure. Conversely, an early 2018 rise in interest rates created opportunities in REITs and Utilities. Given the Fund’s relatively defensive posture, some degree of underperformance makes sense, and we remain comfortable with our positioning. It is probably indicative of an important financial market juncture that, according to Jefferies Financial Group, nearly 90% of small cap value managers underperformed the benchmark in the most recent quarter. As we look at the numbers, valuation was the most striking contributor. Within the benchmark, the top valuation quintile (expensive) outperformed the bottom valuation quintile (inexpensive) by 770 basis points. Non-earners, of which the Fund holds only three expected to post net income losses this year, contributed the highest absolute performance and nearly 200 basis points of the index’s return. On a factor basis, Value was at the bottom. Within the Fund the same dynamic occurred, with the top quintile of valuation outperforming the bottom. At the same time, many of the Fund companies that reported solid earnings were fairly ignored by the market. Which is to say price was a more important factor versus results. This hurts the Fund which earns its best returns in equities where we find consensus estimates too low.

We strive to be both intelligent investors and fiduciaries simultaneously, but the concepts at times seem to conflict as to which is more prudent, the avoidance of a speculative loss versus the absence of an irrational gain. In the present environment, we do have two views that guide our current positioning:

| ● | First, we expect adherents to a strictly low-valuation-based investment strategy will continue to underperform because low cost does not necessarily equate with high value. Low valuation is often an appropriate reflection of elevated risk, not opportunity. It is a particularly flawed strategy today as it assumes the past is worth something. |

Reversion to the mean, historical valuation levels, peak and trough margins are all less and less relevant by the day. In the 1950s, the average lifespan of a company in the S&P 500 was sixty years. Today it is less than twenty; maybe two business cycles with shorter lifespans likely in years to come. The massive disruption occurring in the economy is understated. As a vast generalization, many so-called Value Stocks today are correctly expected to shuffle off this mortal coil and are priced as such, and some of the loss makers that did well this quarter may quickly reverse when realistic outlooks reassert themselves.

| ● | Second, chasing growth without discipline remains high risk. New champions are expected to live forever and also priced as such until proven otherwise. As we suspected last quarter, a negative view on Netflix has been woefully wrong; the stock has risen another 20% since a prominent analyst said its valuation was extreme in March. Rapidly growing Netflix trading at 9x revenues is possibly just as an appropriate valuation as the rapidly shrinking GE trading at 1x revenues is. However, when the straight line of growth on an expensive equity breaks, downside is often savage and immediate and a 9x revenue multiple can decline precipitously. Thus value managers chasing momentum might be correct for a period, but it is with far greater peril when not. The sugar high of a few months riding a hot stock does not make up for the rapid crash. |

| 4 | 1-855-612-3936 | www.cortinafunds.com |

| Shareholder Letter |

| Cortina Small Cap Value Fund | June 30, 2018 (Unaudited) |

In our process, valuation is a tool for risk control, not an invitation to make a purchase. Value investing should be thought of as investing in companies that create value versus those that are priced at low multiples. We investigate dozens of companies before buying one, and we retain our belief in evolution: change for the better creates value. And evolution takes time to both occur and be recognized. Functionally, when we make an initial investment in an equity it is with two basic beliefs:

| ● | Company earnings / outcomes will be above then current expectations |

| ● | The valuation of the security is low enough that if we are wrong or early our downside should be limited |

The largest overweight in the Fund is currently Consumer Discretionary, followed by modest overweights in Health Care and Consumer Staples. Financials are the largest underweight, followed by Energy and modest underweights in Real Estate and Technology. Our view remains that economic momentum appears to have peaked, and while at a healthy level we expect the next indications to be towards less robust growth. As interest rates spiked early in 2018, we took advantage of weakness in REITs to increase our weighting to the sector. We added very selectively to existing Industrials positions but remain generally pessimistic towards more cyclical companies even as their nominal valuations continue to decline and believe other areas offer greater potential.

In sum, we see growing opportunities for value capture as crowded positions are extrapolating yesterday’s trends when it is clear that much of what we take for granted is under grave threat, from companies to politics to foreign relations. Risks today are quite elevated but so are opportunities.

Peak-to-trough – The stage of the business or market cycle from the end of a period of growth (peak) into declining activity and contraction until it hits its ultimate cyclical bottom (trough).

Margin refers to the difference between revenue and expenses, where businesses typically track their gross profit margins, operating margins and net profit margins.

Cortina Funds are subject to risks, including loss of principal.

Investing in small or micro cap funds will be more volatile and loss of principal could be greater than investing in large cap or more diversified funds.

S&P 500 – The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

Basis Point – Basis Point refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in a financial instrument.

| Annual Report | June 30, 2018 | 5 |

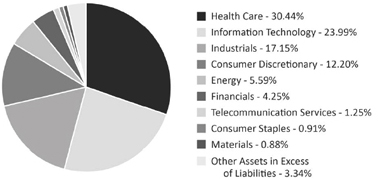

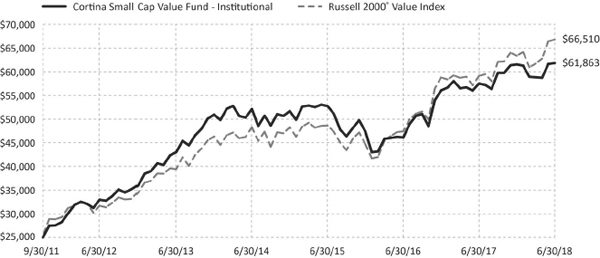

| Portfolio Information |

| Cortina Small Cap Value Fund | June 30, 2018 (Unaudited) |

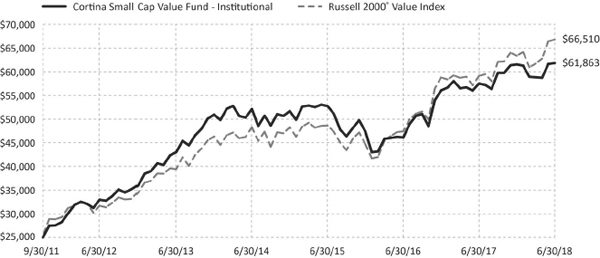

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to June 30, 2018.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Value Fund Institutional share class (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Value Index. It is important to note the Fund is a professionally managed mutual fund, while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. Performance will vary from class to class based on differences in class-specific expenses.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended June 30, 2018

| | 6 Months | 1 Year | 3 Years | 5 Years* | Since Inception* | Gross Expense Ratio** |

| Cortina Small Cap Value Fund - Institutional | 0.49% | 7.54% | 5.45% | 7.53% | 14.36% | 1.72% |

| Cortina Small Cap Value Fund - Investor | 0.34% | 7.23% | 5.18% | 7.26% | 14.08% | 1.97% |

| Russell 2000® Value Index | 5.44% | 13.10% | 11.22% | 11.18% | 15.60%*** | |

| * | The Fund’s Institutional shares inception date is September 30, 2011, Investor shares inception date is April 30, 2014. The performance shown for Investor shares for periods pre-dating the commencement of operations of that class reflects the performance of the Fund’s Institutional shares, the initial share class, calculated using the fees and expenses of Investor shares. If Investor shares of the Fund had been available during periods prior to April 30, 2014, the performance shown may have been different. |

| ** | Cortina Asset Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) to 1.10% and 1.35% of average daily net assets of the Fund’s Institutional and Investor Class shares, respectively. The agreement will continue in effect at least through October 31, 2018, subject thereafter to annual re-approval of the agreement by the Fund’s Board of Directors. The current expense ratio for the Fund can be located in the Financial Highlights contained within this shareholder report. |

| *** | Represents the period from September 30, 2011 (date of original public offering of the Institutional shares) through June 30, 2018. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor’s shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

Sector Allocations****

| **** | Percentages are based on Net Assets as of June 30, 2018. Holdings are subject to change. |

| 6 | 1-855-612-3936 | www.cortinafunds.com |

| Disclosure of Fund Expenses |

June 30, 2018 (Unaudited)

As a shareholder of the Fund(s), you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, as indicated below.

Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds by comparing these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | Beginning

Account Value

January 1, 2018 | Ending

Account Value

June 30, 2018 | Expenses Paid

During Period(a) | Net

Expense

Ratios(b) |

| Cortina Small Cap Growth Fund - Institutional | | | | |

| Actual Fund Return | $1,000.00 | $1,223.60 | $6.06 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.34 | $5.51 | 1.10% |

| Cortina Small Cap Value Fund - Institutional | | | | |

| Actual Fund Return | $1,000.00 | $1,004.90 | $5.47 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.34 | $5.51 | 1.10% |

| Cortina Small Cap Value Fund - Investor | | | | |

| Actual Fund Return | $1,000.00 | $1,003.90 | $6.71 | 1.35% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,018.10 | $6.76 | 1.35% |

| (a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

| (b) | Annualized, based on the Fund’s most recent half-year expenses. |

| Annual Report | June 30, 2018 | 7 |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | June 30, 2018 |

| | | Shares | | | Value | |

| COMMON STOCKS (96.66%) | | | | | | | | |

| Consumer Discretionary (12.20%) | | | | | | | | |

| Camping World Holdings, Inc., Class A | | | 11,624 | | | $ | 290,368 | |

| Cavco Industries, Inc.(a) | | | 1,931 | | | | 400,972 | |

| Chegg, Inc.(a) | | | 14,270 | | | | 396,563 | |

| Chuy’s Holdings, Inc.(a) | | | 10,334 | | | | 317,254 | |

| Cooper-Standard Holding, Inc.(a) | | | 3,070 | | | | 401,157 | |

| Duluth Holdings, Inc., Class B(a) | | | 4,301 | | | | 102,321 | |

| Five Below, Inc.(a) | | | 3,380 | | | | 330,260 | |

| IMAX Corp.(a) | | | 9,471 | | | | 209,783 | |

| Installed Building Products, Inc.(a) | | | 4,045 | | | | 228,745 | |

| MarineMax, Inc.(a) | | | 14,553 | | | | 275,779 | |

| Ollie’s Bargain Outlet Holdings, Inc.(a) | | | 6,731 | | | | 487,997 | |

| Skyline Champion Corp. | | | 6,326 | | | | 221,663 | |

| Wingstop, Inc. | | | 7,043 | | | | 367,081 | |

| | | | | | | | 4,029,943 | |

| Consumer Staples (0.91%) | | | | | | | | |

| Limoneira Co. | | | 12,192 | | | | 300,045 | |

| | | | | | | | | |

| Energy (5.59%) | | | | | | | | |

| Abraxas Petroleum Corp.(a) | | | 99,260 | | | | 286,861 | |

| Extraction Oil & Gas, Inc.(a) | | | 16,206 | | | | 238,066 | |

| Mammoth Energy Services, Inc.(a) | | | 7,825 | | | | 265,737 | |

| Matador Resources Co.(a) | | | 9,366 | | | | 281,448 | |

| Penn Virginia Corp(a) | | | 4,781 | | | | 405,859 | |

| Profire Energy, Inc.(a) | | | 35,867 | | | | 121,231 | |

| ProPetro Holding Corp.(a) | | | 15,851 | | | | 248,544 | |

| | | | | | | | 1,847,746 | |

| Financials (4.25%) | | | | | | | | |

| Green Dot Corp., Class A(a) | | | 5,116 | | | | 375,463 | |

| Independent Bank Group, Inc. | | | 3,983 | | | | 266,065 | |

| Pinnacle Financial Partners, Inc. | | | 3,611 | | | | 221,535 | |

| Seacoast Banking Corp. of Florida(a) | | | 12,220 | | | | 385,908 | |

| Sterling Bancorp, Inc. | | | 11,598 | | | | 154,949 | |

| | | | | | | | 1,403,920 | |

| Health Care (30.44%)(b) | | | | | | | | |

| Amphastar Pharmaceuticals, Inc.(a) | | | 16,634 | | | | 253,835 | |

| ANI Pharmaceuticals, Inc.(a) | | | 3,539 | | | | 236,405 | |

| Apollo Endosurgery, Inc.(a) | | | 18,493 | | | | 129,081 | |

| AtriCure, Inc.(a) | | | 17,668 | | | | 477,919 | |

| BioDelivery Sciences International, Inc.(a) | | | 82,863 | | | | 244,446 | |

| BioTelemetry, Inc.(a) | | | 8,273 | | | | 372,285 | |

| Bovie Medical Corp.(a) | | | 28,552 | | | | 124,201 | |

| Cardiovascular Systems, Inc.(a) | | | 12,106 | | | | 391,508 | |

| Castlight Health, Inc., Class B(a) | | | 89,591 | | | | 380,762 | |

| Chembio Diagnostics, Inc.(a) | | | 28,242 | | | | 313,486 | |

| Codexis, Inc.(a) | | | 17,158 | | | | 247,075 | |

| Collegium Pharmaceutical, Inc.(a) | | | 15,880 | | | | 378,738 | |

| Cutera, Inc.(a) | | | 11,453 | | | | 461,556 | |

| Diplomat Pharmacy, Inc.(a) | | | 15,704 | | | | 401,394 | |

| Evolent Health, Inc., Class A(a) | | | 19,114 | | | | 402,350 | |

| Glaukos Corp.(a) | | | 7,752 | | | | 315,041 | |

| HealthEquity, Inc.(a) | | | 3,428 | | | | 257,443 | |

| K2M Group Holdings, Inc.(a) | | | 14,877 | | | | 334,733 | |

| Ligand Pharmaceuticals, Inc.(a) | | | 1,495 | | | | 309,719 | |

| Neogen Corp.(a) | | | 4,205 | | | | 337,199 | |

| NeoGenomics, Inc.(a) | | | 30,722 | | | | 402,766 | |

See Notes to Financial Statements.

| 8 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | June 30, 2018 |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | | | |

| Health Care (continued) | | | | | | | | |

| Neuronetics, Inc.(a) | | | 10,432 | | | $ | 277,596 | |

| Nevro Corp.(a) | | | 3,132 | | | | 250,090 | |

| Novocure, Ltd.(a) | | | 13,034 | | | | 407,964 | |

| OrthoPediatrics Corp.(a) | | | 6,717 | | | | 178,941 | |

| Oxford Immunotec Global PLC(a) | | | 21,790 | | | | 280,873 | |

| Pacira Pharmaceuticals, Inc.(a) | | | 10,806 | | | | 346,332 | |

| Repligen Corp.(a) | | | 5,569 | | | | 261,966 | |

| Sientra, Inc.(a) | | | 14,473 | | | | 282,368 | |

| STAAR Surgical Co.(a) | | | 8,663 | | | | 268,553 | |

| Tactile Systems Technology, Inc.(a) | | | 8,315 | | | | 432,380 | |

| Tandem Diabetes Care, Inc.(a) | | | 13,500 | | | | 297,270 | |

| | | | | | | | 10,056,275 | |

| Industrials (17.15%) | | | | | | | | |

| AAR Corp. | | | 5,665 | | | | 263,366 | |

| Air Transport Services Group, Inc.(a) | | | 16,878 | | | | 381,274 | |

| Astec Industries, Inc. | | | 6,628 | | | | 396,355 | |

| Atlas Air Worldwide Holdings, Inc.(a) | | | 4,878 | | | | 349,753 | |

| Axon Enterprise, Inc.(a) | | | 6,745 | | | | 426,149 | |

| Chart Industries, Inc.(a) | | | 6,138 | | | | 378,592 | |

| Dycom Industries, Inc.(a) | | | 3,062 | | | | 289,390 | |

| Granite Construction, Inc. | | | 4,420 | | | | 246,017 | |

| Kratos Defense & Security Solutions, Inc.(a) | | | 24,202 | | | | 278,565 | |

| Manitex International, Inc.(a) | | | 25,034 | | | | 312,424 | |

| Meritor, Inc.(a) | | | 11,709 | | | | 240,854 | |

| Saia, Inc.(a) | | | 4,219 | | | | 341,106 | |

| Spartan Motors, Inc. | | | 22,593 | | | | 341,154 | |

| Spirit Airlines, Inc.(a) | | | 7,549 | | | | 274,406 | |

| Titan International, Inc. | | | 18,705 | | | | 200,705 | |

| TPI Composites, Inc.(a) | | | 13,689 | | | | 400,266 | |

| Werner Enterprises, Inc. | | | 8,884 | | | | 333,594 | |

| Westport Fuel Systems, Inc.(a) | | | 83,576 | | | | 211,447 | |

| | | | | | | | 5,665,417 | |

| Information Technology (23.99%) | | | | | | | | |

| 2U, Inc.(a) | | | 2,414 | | | | 201,714 | |

| Amber Road, Inc.(a) | | | 24,031 | | | | 226,132 | |

| Appian Corp.(a) | | | 6,456 | | | | 233,449 | |

| Asure Software, Inc.(a) | | | 13,779 | | | | 219,775 | |

| Blackline, Inc.(a) | | | 3,565 | | | | 154,828 | |

| Bottomline Technologies de, Inc.(a) | | | 5,817 | | | | 289,861 | |

| Box, Inc., Class A(a) | | | 12,718 | | | | 317,823 | |

| ChannelAdvisor Corp.(a) | | | 9,877 | | | | 138,772 | |

| Cray, Inc.(a) | | | 16,684 | | | | 410,426 | |

| Envestnet, Inc.(a) | | | 3,006 | | | | 165,180 | |

| FARO Technologies, Inc.(a) | | | 4,506 | | | | 244,901 | |

| Five9, Inc.(a) | | | 7,805 | | | | 269,819 | |

| FormFactor, Inc.(a) | | | 19,177 | | | | 255,054 | |

| Inphi Corp.(a) | | | 7,597 | | | | 247,738 | |

| Internap Corp.(a) | | | 15,223 | | | | 158,624 | |

| Limelight Networks, Inc.(a) | | | 71,593 | | | | 320,021 | |

| LivePerson, Inc.(a) | | | 23,786 | | | | 501,884 | |

| Mellanox Technologies, Ltd.(a) | | | 4,627 | | | | 390,056 | |

| Mimecast, Ltd.(a) | | | 6,339 | | | | 261,230 | |

| Model N, Inc.(a) | | | 13,632 | | | | 253,555 | |

| Photronics, Inc.(a) | | | 28,036 | | | | 223,587 | |

| Quantenna Communications, Inc.(a) | | | 23,613 | | | | 366,946 | |

| Rapid7, Inc.(a) | | | 10,555 | | | | 297,862 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2018 | 9 |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | June 30, 2018 |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | | | |

| Information Technology (continued) | | | | | | | | |

| RingCentral, Inc., Class A(a) | | | 3,320 | | | $ | 233,562 | |

| Sailpoint Technologies Holding(a) | | | 12,206 | | | | 299,535 | |

| Silicon Motion Technology Corp., ADR | | | 4,955 | | | | 262,070 | |

| Twilio, Inc., Class A(a) | | | 4,730 | | | | 264,975 | |

| USA Technologies, Inc.(a) | | | 27,499 | | | | 384,986 | |

| Varonis Systems, Inc.(a) | | | 4,418 | | | | 329,141 | |

| | | | | | | | 7,923,506 | |

| Materials (0.88%) | | | | | | | | |

| Summit Materials, Inc., Class A(a) | | | 11,049 | | | | 290,036 | |

| | | | | | | | | |

| Telecommunication Services (1.25%) | | | | | | | | |

| Boingo Wireless, Inc.(a) | | | 18,204 | | | | 411,228 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (COST $23,250,371) | | | | | | | 31,928,116 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (96.66%) | | | | | | | | |

| (COST $23,250,371) | | | | | | | 31,928,116 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (3.34%) | | | | | | | 1,103,633 | |

| | | | | | | | | |

| NET ASSETS 100.00% | | | | | | $ | 33,031,749 | |

| (a) | Non Income Producing Security. |

| (b) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. When sector categorization is broken down by industry, no industry exceeds the 25% maximum specified in the Statement of Additional Information. |

See Notes to Financial Statements.

| 10 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Value Fund | June 30, 2018 |

| | | Shares | | | Value | |

| COMMON STOCKS (97.39%) | | | | | | | | |

| Consumer Discretionary (18.76%) | | | | | | | | |

| Abercrombie & Fitch Co., Class A | | | 20,698 | | | $ | 506,687 | |

| Adtalem Global Education, Inc.(a) | | | 13,455 | | | | 647,186 | |

| Bojangles’, Inc.(a) | | | 30,463 | | | | 438,667 | |

| Buckle, Inc. | | | 17,689 | | | | 475,834 | |

| Caleres, Inc. | | | 12,649 | | | | 434,999 | |

| Career Education Corp.(a) | | | 37,445 | | | | 605,486 | |

| Eldorado Resorts, Inc.(a) | | | 13,739 | | | | 537,195 | |

| Express, Inc.(a) | | | 43,789 | | | | 400,669 | |

| M/I Homes, Inc.(a) | | | 9,421 | | | | 249,468 | |

| New Home Co., Inc.(a) | | | 15,889 | | | | 158,413 | |

| Tailored Brands, Inc. | | | 13,086 | | | | 333,955 | |

| TRI Pointe Group, Inc.(a) | | | 13,863 | | | | 226,799 | |

| Williams-Sonoma, Inc. | | | 10,211 | | | | 626,751 | |

| | | | | | | | 5,642,109 | |

| Consumer Staples (4.23%) | | | | | | | | |

| Andersons, Inc. | | | 12,519 | | | | 428,150 | |

| TreeHouse Foods, Inc.(a) | | | 16,087 | | | | 844,728 | |

| | | | | | | | 1,272,878 | |

| Energy (5.23%) | | | | | | | | |

| Carrizo Oil & Gas, Inc.(a) | | | 17,159 | | | | 477,878 | |

| Eclipse Resources Corp.(a) | | | 67,022 | | | | 107,235 | |

| Matador Resources Co.(a) | | | 12,711 | | | | 381,966 | |

| Oil States International, Inc.(a) | | | 11,735 | | | | 376,693 | |

| Patterson-UTI Energy, Inc. | | | 12,762 | | | | 229,716 | |

| | | | | | | | 1,573,488 | |

| Financials (22.85%) | | | | | | | | |

| BancorpSouth, Inc. | | | 16,137 | | | | 531,714 | |

| Capitol Federal Financial, Inc. | | | 22,787 | | | | 299,877 | |

| CBTX, Inc. | | | 12,638 | | | | 417,686 | |

| ConnectOne Bancorp, Inc. | | | 12,182 | | | | 303,332 | |

| Enterprise Financial Services Corp. | | | 10,555 | | | | 569,442 | |

| James River Group Holdings, Ltd. | | | 7,789 | | | | 306,030 | |

| Live Oak Bancshares, Inc. | | | 24,294 | | | | 744,611 | |

| Meridian Bancorp, Inc. | | | 28,070 | | | | 537,540 | |

| Pinnacle Financial Partners, Inc. | | | 9,466 | | | | 580,739 | |

| Provident Financial Services, Inc. | | | 15,929 | | | | 438,525 | |

| TriState Capital Holdings, Inc.(a) | | | 24,119 | | | | 629,506 | |

| Waterstone Financial, Inc. | | | 25,575 | | | | 436,054 | |

| Western Alliance Bancorp(a) | | | 9,900 | | | | 560,439 | |

| Wintrust Financial Corp. | | | 5,955 | | | | 518,383 | |

| | | | | | | | 6,873,878 | |

| Health Care (6.49%) | | | | | | | | |

| Allscripts Healthcare Solutions, Inc.(a) | | | 41,159 | | | | 493,908 | |

| Endologix, Inc.(a) | | | 59,430 | | | | 336,374 | |

| Invacare Corp. | | | 20,997 | | | | 390,544 | |

| Pacira Pharmaceuticals, Inc.(a) | | | 15,703 | | | | 503,281 | |

| Prestige Brands Holdings, Inc.(a) | | | 5,901 | | | | 226,481 | |

| | | | | | | | 1,950,588 | |

| Industrials (11.83%) | | | | | | | | |

| Astronics Corp.(a) | | | 10,476 | | | | 376,822 | |

| Atkore International Group, Inc.(a) | | | 35,312 | | | | 733,430 | |

| Forward Air Corp. | | | 6,711 | | | | 396,486 | |

| Generac Holdings, Inc.(a) | | | 12,327 | | | | 637,676 | |

| Harsco Corp.(a) | | | 23,368 | | | | 516,433 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2018 | 11 |

| Schedule of Investments |

| Cortina Small Cap Value Fund | June 30, 2018 |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | | | |

| Industrials (continued) | | | | | | | | |

| Knoll, Inc. | | | 24,181 | | | $ | 503,207 | |

| REV Group, Inc. | | | 13,460 | | | | 228,954 | |

| Safe Bulkers, Inc.(a) | | | 48,463 | | | | 164,774 | |

| | | | | | | | 3,557,782 | |

| Information Technology (9.20%) | | | | | | | | |

| ACI Worldwide, Inc.(a) | | | 24,237 | | | | 597,927 | |

| Ambarella, Inc.(a) | | | 5,069 | | | | 195,714 | |

| BlackBerry, Ltd.(a) | | | 30,937 | | | | 298,542 | |

| Dolby Laboratories, Inc., Class A | | | 7,219 | | | | 445,340 | |

| Etsy, Inc.(a) | | | 13,614 | | | | 574,375 | |

| Teradata Corp.(a) | | | 16,341 | | | | 656,091 | |

| | | | | | | | 2,767,989 | |

| Materials (4.36%) | | | | | | | | |

| AdvanSix, Inc.(a) | | | 12,559 | | | | 460,036 | |

| Commercial Metals Co. | | | 18,768 | | | | 396,192 | |

| Graphic Packaging Holding Co. | | | 31,417 | | | | 455,861 | |

| | | | | | | | 1,312,089 | |

| Real Estate (9.53%) | | | | | | | | |

| Americold Realty Trust, REIT | | | 30,638 | | | | 674,649 | |

| Brixmor Property Group, Inc., REIT | | | 23,774 | | | | 414,381 | |

| Essential Properties Realty Trust, Inc., REIT(a) | | | 31,569 | | | | 427,444 | |

| Four Corners Property Trust, Inc., REIT | | | 23,046 | | | | 567,623 | |

| Physicians Realty Trust, REIT | | | 9,596 | | | | 152,960 | |

| Taubman Centers, Inc., REIT | | | 2,467 | | | | 144,961 | |

| Washington Prime Group, Inc., REIT | | | 59,690 | | | | 484,086 | |

| | | | | | | | 2,866,104 | |

| Utilities (4.91%) | | | | | | | | |

| Chesapeake Utilities Corp. | | | 7,033 | | | | 562,288 | |

| Connecticut Water Service, Inc. | | | 2,630 | | | | 171,791 | |

| Middlesex Water Co. | | | 8,139 | | | | 343,222 | |

| Portland General Electric Co. | | | 9,330 | | | | 398,951 | |

| | | | | | | | 1,476,252 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS | | | | | | | | |

| (COST $23,519,312) | | | | | | | 29,293,157 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (97.39%) | | | | | | | | |

| (COST $23,519,312) | | | | | | | 29,293,157 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (2.61%) | | | | | | | 785,612 | |

| | | | | | | | | |

| NET ASSETS 100.00% | | | | | | $ | 30,078,769 | |

| (a) | Non Income Producing Security. |

See Notes to Financial Statements.

| 12 | 1-855-612-3936 | www.cortinafunds.com |

| Statements of Assets and Liabilities |

June 30, 2018

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| ASSETS: | | | | | | |

| Investments, at value (Cost - see below) | | $ | 31,928,116 | | | $ | 29,293,157 | |

| Cash | | | 1,278,731 | | | | 1,054,902 | |

| Receivable for investments sold | | | 284,223 | | | | – | |

| Receivable for fund shares subscribed | | | 39,025 | | | | – | |

| Dividends and interest receivable | | | 1,848 | | | | 34,551 | |

| Prepaid expenses and other assets | | | 3,689 | | | | 9,137 | |

| Total Assets | | | 33,535,632 | | | | 30,391,747 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for investments purchased | | | 428,829 | | | | 216,616 | |

| Payable for fund shares redeemed | | | – | | | | 13,558 | |

| Payable for director fees | | | 5,000 | | | | 5,000 | |

| Payable for advisory fees | | | 16,535 | | | | 11,861 | |

| Payable for fund accounting and administration fees | | | 22,734 | | | | 23,001 | |

| Payable for distribution and service fees | | | – | | | | 274 | |

| Payable for audit, tax and legal fees | | | 20,213 | | | | 23,717 | |

| Other accrued liabilities and expenses | | | 10,572 | | | | 18,951 | |

| Total Liabilities | | | 503,883 | | | | 312,978 | |

| Net Assets | | $ | 33,031,749 | | | $ | 30,078,769 | |

| | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | |

| Paid-in capital | | $ | 21,203,948 | | | $ | 22,585,577 | |

| Accumulated net realized gain on investments | | | 3,150,056 | | | | 1,719,347 | |

| Net unrealized appreciation on investments | | | 8,677,745 | | | | 5,773,845 | |

| Net Assets | | $ | 33,031,749 | | | $ | 30,078,769 | |

| | | | | | | | | |

| Cost of Investments | | $ | 23,250,371 | | | $ | 23,519,312 | |

| | | | | | | | | |

| PRICING OF SHARES: | | | | | | | | |

| Institutional | | | | | | | | |

| Net Assets | | $ | 33,031,749 | | | $ | 29,419,485 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | 1,658,226 | | | | 1,431,227 | |

| Net Asset Value, offering and redemption price per share | | $ | 19.92 | | | $ | 20.56 | |

| Investor | | | | | | | | |

| Net Assets | | $ | – | | | $ | 659,284 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | – | | | | 32,367 | |

| Net Asset Value, offering and redemption price per share | | $ | – | | | $ | 20.37 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2018 | 13 |

| Statements of Operations |

For the Year Ended June 30, 2018

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| INVESTMENT INCOME: | | | | | | | | |

| Dividends (net of foreign withholding taxes of $24 and $3,332, respectively) | | $ | 36,778 | | | $ | 458,053 | |

| Total Investment Income | | | 36,778 | | | | 458,053 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Advisory fees (Note 3) | | | 272,011 | | | | 429,311 | |

| Fund accounting and administration fees and expenses | | | 97,079 | | | | 144,118 | |

| Transfer agent fees | | | 32,361 | | | | 51,578 | |

| Distribution and service fees | | | | | | | | |

| Investor | | | – | | | | 1,780 | |

| Legal fees | | | 15,449 | | | | 25,959 | |

| Printing fees | | | 1,179 | | | | 7,728 | |

| Registration fees | | | 22,937 | | | | 34,593 | |

| Audit and tax fees | | | 15,775 | | | | 16,275 | |

| Custodian fees | | | 4,853 | | | | 6,005 | |

| Director fees and expenses | | | 20,000 | | | | 20,000 | |

| Other | | | 11,753 | | | | 16,965 | |

| Total Expenses Before Waivers | | | 493,397 | | | | 754,312 | |

| Less fees waived by Adviser (Note 3) | | | (193,974 | ) | | | (280,662 | ) |

| Total Net Expenses | | | 299,423 | | | | 473,650 | |

| Net Investment Loss | | | (262,645 | ) | | | (15,597 | ) |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain on investments | | | 4,491,713 | | | | 3,156,765 | |

| Net change in unrealized appreciation/depreciation on investments | | | 2,256,335 | | | | (525,768 | ) |

| Net Realized and Unrealized Gain on Investments | | | 6,748,048 | | | | 2,630,997 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 6,485,403 | | | $ | 2,615,400 | |

See Notes to Financial Statements.

| 14 | 1-855-612-3936 | www.cortinafunds.com |

| Statements of Changes in Net Assets |

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| | | Year Ended

June 30, 2018 | | | Year Ended

June 30, 2017 | | | Year Ended

June 30, 2018 | | | Year Ended

June 30, 2017 | |

| OPERATIONS: | | | | | | | | | | | | | | | | |

| Net investment income/(loss) | | $ | (262,645 | ) | | $ | (292,074 | ) | | $ | (15,597 | ) | | $ | 11,563 | |

| Net realized gain on investments | | | 4,491,713 | | | | 8,060,618 | | | | 3,156,765 | | | | 10,540,771 | |

| Net change in unrealized appreciation/ depreciation on investments | | | 2,256,335 | | | | 855,736 | | | | (525,768 | ) | | | 744,058 | |

| Net increase in net assets resulting from operations | | | 6,485,403 | | | | 8,624,280 | | | | 2,615,400 | | | | 11,296,392 | |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | – | | | | (76,127 | ) |

| From net realized gains on investments | | | (4,189,359 | ) | | | – | | | | (2,288,431 | ) | | | – | |

| Investor | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | – | | | | (79 | ) |

| From net realized gains on investments | | | – | | | | – | | | | (34,992 | ) | | | – | |

| Total distributions | | | (4,189,359 | ) | | | – | | | | (2,323,423 | ) | | | (76,206 | ) |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | 5,542,873 | | | | 2,251,187 | | | | 14,918,148 | | | | 8,762,639 | |

| Shares issued in reinvestment of distributions | | | 4,159,270 | | | | – | | | | 1,673,166 | | | | 58,066 | |

| Cost of shares redeemed | | | (4,980,273 | ) | | | (19,682,697 | ) | | | (28,948,315 | ) | | | (42,973,360 | ) |

| Redemption fees | | | – | | | | – | | | | 4 | | | | 1,239 | |

| Total | | | 4,721,870 | | | | (17,431,510 | ) | | | (12,356,997 | ) | | | (34,151,416 | ) |

| Investor | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | – | | | | – | | | | 37,009 | | | | 585,238 | |

| Shares issued in reinvestment of distributions | | | – | | | | – | | | | 30,671 | | | | 76 | |

| Cost of shares redeemed | | | – | | | | – | | | | (445,691 | ) | | | (207,584 | ) |

| Total | | | – | | | | – | | | | (378,011 | ) | | | 377,730 | |

| Net increase/(decrease) from capital shares transactions | | | 4,721,870 | | | | (17,431,510 | ) | | | (12,735,008 | ) | | | (33,773,686 | ) |

| | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in net assets | | | 7,017,914 | | | | (8,807,230 | ) | | | (12,443,031 | ) | | | (22,553,500 | ) |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of year | | | 26,013,835 | | | | 34,821,065 | | | | 42,521,800 | | | | 65,075,300 | |

| End of year | | $ | 33,031,749 | | | $ | 26,013,835 | | | $ | 30,078,769 | | | $ | 42,521,800 | |

| Including accumulated net investment income of: | | $ | – | | | $ | – | | | $ | – | | | $ | – | |

| | | | | | | | | | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| Beginning shares | | | 1,390,728 | | | | 2,439,069 | | | | 2,057,765 | | | | 3,985,455 | |

| Shares sold | | | 280,309 | | | | 132,757 | | | | 741,753 | | | | 467,621 | |

| Shares issued in reinvestment of dividends | | | 260,769 | | | | – | | | | 83,868 | | | | 2,936 | |

| Less shares redeemed | | | (273,580 | ) | | | (1,181,098 | ) | | | (1,452,159 | ) | | | (2,398,247 | ) |

| Ending shares | | | 1,658,226 | | | | 1,390,728 | | | | 1,431,227 | | | | 2,057,765 | |

| Investor | | | | | | | | | | | | | | | | |

| Beginning shares | | | – | | | | – | | | | 51,411 | | | | 32,503 | |

| Shares sold | | | – | | | | – | | | | 1,820 | | | | 29,568 | |

| Shares issued in reinvestment of dividends | | | – | | | | – | | | | 1,549 | | | | 4 | |

| Less shares redeemed | | | – | | | | – | | | | (22,413 | ) | | | (10,664 | ) |

| Ending shares | | | – | | | | – | | | | 32,367 | | | | 51,411 | |

See Notes to Financial Statements.

| Annual Report | June 30, 2018 | 15 |

| Financial Highlights |

| Cortina Small Cap Growth Fund | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2018 | | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 18.71 | | | $ | 14.28 | | | $ | 15.41 | | | $ | 16.35 | | | $ | 14.46 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.18 | ) | | | (0.16 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.17 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 4.41 | | | | 4.59 | | | | (1.00 | ) | | | (0.02 | )(b) | | | 2.19 | |

| Total from Investment Operations | | | 4.23 | | | | 4.43 | | | | (1.13 | ) | | | (0.16 | ) | | | 2.02 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | |

| From net realized gains on investments | | | (3.02 | ) | | | – | | | | – | | | | (0.78 | ) | | | (0.13 | ) |

| Total Dividends and Distributions to Shareholders | | | (3.02 | ) | | | – | | | | – | | | | (0.78 | ) | | | (0.13 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | – | | | | – | | | | – | | | | 0.00 | (c) | | | 0.00 | (c) |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 1.21 | | | | 4.43 | | | | (1.13 | ) | | | (0.94 | ) | | | 1.89 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 19.92 | | | $ | 18.71 | | | $ | 14.28 | | | $ | 15.41 | | | $ | 16.35 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 26.72 | % | | | 30.95 | % | | | (7.33 | %) | | | (0.71 | %) | | | 13.99 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 33,032 | | | $ | 26,014 | | | $ | 34,821 | | | $ | 46,285 | | | $ | 31,657 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.81 | % | | | 1.76 | % | | | 1.54 | % | | | 1.57 | % | | | 1.86 | % |

| Operating expenses including waiver/reimbursement | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Net investment loss including waiver/reimbursement | | | (0.96 | )% | | | (0.98 | )% | | | (0.97 | )% | | | (0.94 | )% | | | (1.02 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 96 | % | | | 88 | % | | | 93 | % | | | 95 | % | | | 81 | % |

| (a) | Calculated using average shares throughout the period. |

| (b) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to the share transactions for the period. |

| (c) | Less than $0.005 per share. |

See Notes to Financial Statements.

| 16 | 1-855-612-3936 | www.cortinafunds.com |

| Financial Highlights |

| Cortina Small Cap Value Fund – Institutional | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2018 | | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 20.16 | | | $ | 16.20 | | | $ | 18.52 | | | $ | 18.67 | | | $ | 15.62 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss)(a) | | | (0.01 | ) | | | 0.01 | | | | 0.01 | | | | (0.02 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 1.50 | | | | 3.98 | | | | (2.33 | ) | | | 0.24 | | | | 3.30 | |

| Total from Investment Operations | | | 1.49 | | | | 3.99 | | | | (2.32 | ) | | | 0.22 | | | | 3.29 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.03 | ) | | | – | | | | – | | | | (0.01 | ) |

| From net realized gains on investments | | | (1.09 | ) | | | – | | | | – | | | | (0.37 | ) | | | (0.23 | ) |

| Total Dividends and Distributions to Shareholders | | | (1.09 | ) | | | (0.03 | ) | | | – | | | | (0.37 | ) | | | (0.24 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | 0.00 | (b) | | | 0.00 | (b) | | | 0.00 | (b) | | | 0.00 | (b) | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 0.40 | | | | 3.96 | | | | (2.32 | ) | | | (0.15 | ) | | | 3.05 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 20.56 | | | $ | 20.16 | | | $ | 16.20 | | | $ | 18.52 | | | $ | 18.67 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 7.54 | % | | | 24.65 | % | | | (12.53 | %) | | | 1.21 | % | | | 21.14 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 29,419 | | | $ | 41,492 | | | $ | 64,552 | | | $ | 51,254 | | | $ | 34,842 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.75 | % | | | 1.72 | % | | | 1.50 | % | | | 1.63 | % | | | 1.92 | % |

| Operating expenses including waiver/reimbursement | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Net investment income/(loss) including waiver/reimbursement | | | (0.03 | )% | | | 0.03 | % | | | 0.08 | % | | | (0.13 | )% | | | (0.09 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 95 | % | | | 89 | % | | | 109 | % | | | 102 | % | | | 78 | % |

| (a) | Calculated using average shares throughout the period. |

| (b) | Less than $0.005 per share. |

See Notes to Financial Statements.

| Annual Report | June 30, 2018 | 17 |

| Financial Highlights |

| Cortina Small Cap Value Fund – Investor | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2018 | | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | For the Period April 30, 2014 (Inception) to June 30, 2014 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 20.04 | | | $ | 16.11 | | | $ | 18.47 | | | $ | 18.67 | | | $ | 18.15 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.06 | ) | | | (0.03 | )(b) | | | (0.02 | ) | | | (0.06 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 1.48 | | | | 3.96 | | | | (2.34 | ) | | | 0.23 | | | | 0.53 | |

| Total from Investment Operations | | | 1.42 | | | | 3.93 | | | | (2.36 | ) | | | 0.17 | | | | 0.52 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | (0.00 | )(c) | | | – | | | | – | | | | – | |

| From net realized gains on investments | | | (1.09 | ) | | | – | | | | – | | | | (0.37 | ) | | | – | |

| Total Dividends and Distributions to Shareholders | | | (1.09 | ) | | | (0.00 | )(c) | | | – | | | | (0.37 | ) | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 0.33 | | | | 3.93 | | | | (2.36 | ) | | | (0.20 | ) | | | 0.52 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 20.37 | | | $ | 20.04 | | | $ | 16.11 | | | $ | 18.47 | | | $ | 18.67 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 7.23 | % | | | 24.41 | % | | | (12.78 | %) | | | 0.94 | % | | | 2.87 | %(d) |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 659 | | | $ | 1,030 | | | $ | 524 | | | $ | 360 | | | $ | 103 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 2.01 | % | | | 2.00 | % | | | 1.75 | % | | | 1.86 | % | | | 2.14 | %(e) |

| Operating expenses including waiver/reimbursement | | | 1.35 | % | | | 1.35 | % | | | 1.35 | % | | | 1.35 | % | | | 1.35 | %(e) |

| Net investment loss including waiver/reimbursement | | | (0.28 | )% | | | (0.15 | )% | | | (0.13 | )% | | | (0.35 | )% | | | (0.20 | )%(e) |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 95 | % | | | 89 | % | | | 109 | % | | | 102 | % | | | 78 | %(f) |

| (a) | Calculated using average shares throughout the period. |

| (b) | The amount shown for a share outstanding throughout the period may not correlate with the Statements of Operations for the period due to the timing of sales and redemptions of Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. |

| (c) | Less than $0.005 per share. |

| (f) | Portfolio turnover is calculated at the Fund level and represents the year ended June 30, 2014. |

See Notes to Financial Statements.

| 18 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2018

1. ORGANIZATION

Cortina Funds, Inc. (the “Corporation”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation was organized on April 27, 2004 as a Wisconsin corporation. The Corporation currently offers shares of common stock (“shares”) of the Cortina Small Cap Growth Fund and the Cortina Small Cap Value Fund (each a “Fund” and collectively, the “Funds”).

The Cortina Small Cap Growth Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011, is a diversified portfolio with an investment objective to seek growth of capital. The Cortina Small Cap Value Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011 and the sale of Investor Class Shares on April 30, 2014, is a diversified portfolio with an investment objective to seek long-term capital appreciation.

Shares of each Fund are designated as Institutional Shares or Investor Shares with an indefinite number of shares authorized at $0.01 par value. The Articles of Incorporation, as amended and restated, permit the Corporation’s Board of Directors (the “Board”) to create additional funds and share classes.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). Each Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard Codification Topic 946 Financial Services – Investment Companies.

Use of Estimates — The accompanying financial statements were prepared in accordance with GAAP, which require the use of estimates and assumptions made by management. These may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Valuation — Investment securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets. Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Funds’ Board. Securities with maturities of sixty (60) days or less are valued at amortized cost as Level 1 or 2 within the hierarchy.

Investment Transactions — Investment security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Investment Income — Interest income is accrued and recorded on a daily basis including amortization of premiums, accretions of discounts and income earned from money market funds. Interest is not accrued on securities that are in default. Dividend income is recorded on the exdividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Fair Value Measurements — A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Cash — Each Fund considers its investment in a FDIC insured interest bearing savings account to be cash. Each Fund maintains cash balances, which, at times may exceed federally insured limits. Each Fund maintains these balances with a high quality financial institution.

| Annual Report | June 30, 2018 | 19 |

| Notes to Financial Statements |

June 30, 2018

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| Level 2 — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 — | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Funds to measure fair value during the year ended June 30, 2018 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Funds’ investments as of June 30, 2018:

Cortina Small Cap Growth Fund

| | | Valuation Inputs | | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks* | | $ | 31,928,116 | | | $ | – | | | $ | – | | | $ | 31,928,116 | |

| Total | | $ | 31,928,116 | | | $ | – | | | $ | – | | | $ | 31,928,116 | |

Cortina Small Cap Value Fund

| | | Valuation Inputs | | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks* | | $ | 29,293,157 | | | $ | – | | | $ | – | | | $ | 29,293,157 | |

| Total | | $ | 29,293,157 | | | $ | – | | | $ | – | | | $ | 29,293,157 | |

| * | See Schedule of Investments for sector classification. |

For the year ended June 30, 2018, there have been no significant changes to the Funds’ fair value methodologies. Additionally, there were no transfers into or out of Levels 1 and 2 during the year ended June 30, 2018. It is the Funds’ policy to recognize transfers at the end of the reporting period.

For the year ended June 30, 2018, the Funds did not have investments with significant unobservable inputs (Level 3) used in determining fair value.

Affiliated Companies — An affiliated company is a company that can have direct or indirect common ownership. The Funds did not hold any investments in affiliated companies as of and during the year ended June 30, 2018.

Expenses — The Funds bear expenses incurred specifically on each Fund’s respective behalf as well as a portion of general Corporation expenses, which may be allocated on the basis of relative net assets or the nature of the services performed relative to applicability to each Fund.

Expenses that are specific to a class of shares of the Funds are charged directly to the share class. The Funds’ realized and unrealized gains and losses, net investment income, and expenses other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

| 20 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2018

Distributions to Shareholders — Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex-dividend date.

Fees on Redemptions — The Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. The redemption fee is not a fee to finance sales or sales promotion expenses, but is paid to the Funds to defray the costs of liquidating an investor and discouraging short-term trading of the Funds’ shares. No redemption fee will be imposed on redemptions initiated by the Funds.

Federal Income Taxes — As of and during the year ended June 30, 2018, the Funds did not have a liability for any unrecognized tax benefits. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes. The Funds intend to distribute to shareholders all taxable investment income and realized gains, and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

3. ADVISORY FEES, FUND ACCOUNTING FEES, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Investment Adviser

Cortina Asset Management, LLC, is the Funds’ investment adviser (the “Adviser”). The Adviser is subject to the general supervision of the Board and is responsible for the overall management of the Funds’ business affairs. The Adviser invests the assets of the Funds based on the Funds’ investment objectives and policies. The Adviser is entitled to an investment advisory fee, computed daily and payable monthly, of 1.00% of the average daily net assets for each Fund.

The Adviser has contractually agreed to waive fees with respect to each of the Funds so that the net annual operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) of the Funds’ shares will not exceed 1.10% and 1.35% of average daily net assets of each Fund’s Institutional and with respect to the Cortina Small Cap Value Fund Investor Class shares, respectively, through October 31, 2018. The Adviser may request a reimbursement from the Funds to recapture any reduced management fees or reimbursed Fund expenses within three years following the fee reduction or expense reimbursement, but only to the extent the Funds’ total annual fund operating expenses including any requested reimbursement amount, are less than the above limit at the time of the request. Any such reimbursement is subject to review by the Board.

As of June 30, 2018, reimbursements that may potentially be made by the Funds to the Adviser total $557,884 for the Cortina Small Cap Growth Fund and $819,347 for the Cortina Small Cap Value Fund and expire as follows:

| Cortina Small Cap Growth Fund | | | |

| June 30, 2019 | | $ | 166,642 | |

| June 30, 2020 | | | 197,268 | |

| June 30, 2021 | | | 193,974 | |

| | | $ | 557,884 | |

| Cortina Small Cap Value Fund | | | | |

| June 30, 2019 | | $ | 250,624 | |

| June 30, 2020 | | | 288,061 | |

| June 30, 2021 | | | 280,662 | |

| | | $ | 819,347 | |

Fund Accounting Fees and Expenses

ALPS Fund Services, Inc. (“ALPS” or the “Administrator”) provides administrative, fund accounting and other services to the Funds for a monthly administration fee based on the Funds’ average daily net assets under the Administration, Bookkeeping and Pricing Services Agreement (the “Administration Agreement”).

The Administrator is also reimbursed by the Funds for certain out-of-pocket expenses.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Funds (the “Transfer Agent”).

Compliance Services

ALPS provides services that assist the Corporation’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Corporation in conjunction with requirements under Rule 38a-1 under the 1940 Act. ALPS is compensated under the Administration Agreement.

| Annual Report | June 30, 2018 | 21 |

| Notes to Financial Statements |

June 30, 2018

Distributor

The Funds have entered into a Distribution Agreement with ALPS Distributors, Inc. (the “Distributor”) to provide distribution services to the Funds. The Distributor serves as underwriter/distributor of shares of the Funds.

Distribution and Services Plan

The Small Cap Value Fund has adopted a Distribution and Services Plan in accordance with Rule 12b-1 (“Distribution Plan”) under the 1940 Act. The Distribution Plan provides that the Cortina Small Cap Value Fund may compensate or reimburse the Distributor for services rendered and expenses borne in connection with activities primarily intended to result in the sale of the Cortina Small Cap Value Fund’s shares. Sales charges may be paid to broker-dealers, banks and any other financial intermediary eligible to receive such fees for sales of Investor Shares of the Cortina Small Cap Value Fund and for services provided to shareholders.

The Cortina Small Cap Value Fund charges 12b-1 fees for Investor Shares. Pursuant to the Distribution Plan, the Cortina Small Cap Value Fund may annually pay the Distributor up to 0.25% of the average daily net assets of the Cortina Small Cap Value Fund’s Investor Shares. The expenses of the Distribution Plan are reflected in the Statements of Operations.

Certain Directors and Officers of the Funds are also officers of the Adviser.