Cortina Funds, Inc. (the “Corporation”) is an open-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation was organized on April 27, 2004 as a Wisconsin corporation. The Corporation currently offers shares of common stock (“shares”) of the Cortina Small Cap Growth Fund and the Cortina Small Cap Value Fund (each a “Fund” and collectively, the “Funds”).

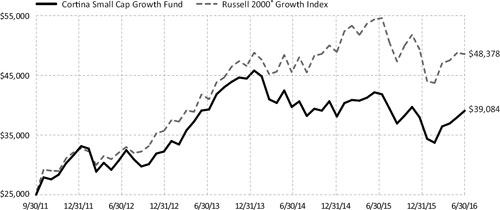

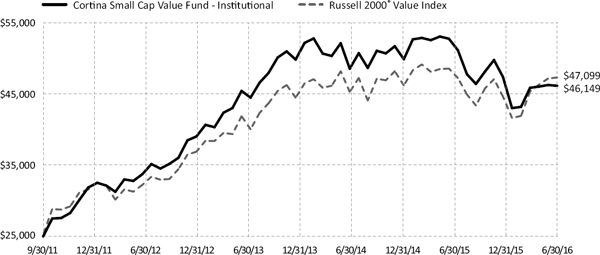

The Cortina Small Cap Growth Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011, is a diversified portfolio with an investment objective to seek growth of capital. The Cortina Small Cap Value Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011 and the sale of Investor Class Shares on April 30, 2014, is a diversified portfolio with an investment objective to seek long-term capital appreciation.

Shares of each Fund are designated as Institutional Shares or Investor Shares with an indefinite number of shares authorized at $0.01 par value. The Articles of Incorporation, as amended and restated, permit the Corporation’s Board of Directors (the “Board”) to create additional funds and share classes.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The Funds are considered investment companies for financial reporting purposes under GAAP.

Use of Estimates — The accompanying financial statements were prepared in accordance with GAAP, which require the use of estimates and assumptions made by management. These may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Valuation — Investment securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets. Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Funds’ Board. Securities with maturities of sixty (60) days or less are valued at amortized cost as Level 1 or 2 within the hierarchy. Money market funds, representing short-term investments, are valued at their daily net asset value.

Investment Transactions — Investment security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Investment Income — Interest income is accrued and recorded on a daily basis including amortization of premiums, accretions of discounts and income earned from money market funds. Interest is not accrued on securities that are in default. Dividend income is recorded on the ex-dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Fair Value Measurements — A three-tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

| Annual Report | June 30, 2016 | 19 |

| Notes to Financial Statements |

June 30, 2016

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 — | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| Level 2 — | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 — | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Funds to measure fair value during the year ended June 30, 2016 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Funds’ investments as of June 30, 2016:

Cortina Small Cap Growth Fund

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks* | | $ | 33,412,900 | | | $ | – | | | $ | – | | | $ | 33,412,900 | |

| Short Term Investment | | | 1,424,732 | | | | – | | | | – | | | | 1,424,732 | |

| Total | | $ | 34,837,632 | | | $ | – | | | $ | – | | | $ | 34,837,632 | |

Cortina Small Cap Value Fund

| | | Valuation Inputs | | | | |

| Investments in Securities at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks* | | $ | 62,453,233 | | | $ | – | | | $ | – | | | $ | 62,453,233 | |

| Short Term Investment | | | 2,778,795 | | | | – | | | | – | | | | 2,778,795 | |

| Total | | $ | 65,232,028 | | | $ | – | | | $ | – | | | $ | 65,232,028 | |

| * | See Schedule of Investments for sector classification. |

For the year ended June 30, 2016, there have been no significant changes to the Funds’ fair value methodologies. Additionally, there were no transfers into or out of Levels 1 and 2 during the year ended June 30, 2016. It is the Funds’ policy to recognize transfers at the end of the reporting period.

For the year ended June 30, 2016, the Funds did not have investments with significant unobservable inputs (Level 3) used in determining fair value.

Affiliated Companies — An affiliated company is a company that can have direct or indirect common ownership. The Funds did not hold any investments in affiliated companies as of and during the year ended June 30, 2016.

Expenses — The Funds bear expenses incurred specifically on each Fund’s respective behalf as well as a portion of general Corporation expenses, which may be allocated on the basis of relative net assets or the nature of the services performed relative to applicability to each Fund.

| 20 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2016

Expenses that are specific to a class of shares of the Funds are charged directly to the share class. The Funds’ realized and unrealized gains and losses, net investment income, and expenses other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

Distributions to Shareholders — Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex-dividend date.

Fees on Redemptions — The Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. The redemption fee is not a fee to finance sales or sales promotion expenses, but is paid to the Funds to defray the costs of liquidating an investor and discouraging short-term trading of the Funds’ shares. No redemption fee will be imposed on redemptions initiated by the Funds.

Federal Income Taxes — As of and during the year ended June 30, 2016, the Funds did not have a liability for any unrecognized tax benefits. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes. The Funds intend to distribute to shareholders all taxable investment income and realized gains, and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

3. ADVISORY FEES, FUND ACCOUNTING, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Investment Advisor

Cortina Asset Management, LLC, is the Funds’ investment adviser (the “Adviser”). The Adviser is subject to the general supervision of the Board and is responsible for the overall management of the Funds’ business affairs. The Adviser invests the assets of the Funds based on the Funds’ investment objectives and policies. The Adviser is entitled to an investment advisory fee, computed daily and payable monthly, of 1.00% of the average daily net assets for each Fund.

The Adviser has contractually agreed to waive fees with respect to each of the Funds so that the net annual operating expenses (excluding 12b-1 fee, taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) of the Funds’ shares will not exceed 1.10% of average daily net assets of each Fund for the period July 1, 2015 through August 16, 2015. Effective August 17, 2015, the Adviser has contractually agreed to waive fees with respect to each of the Funds so that the net annual operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) of the Funds’ shares will not exceed 1.10% and 1.35% of average daily net assets of each Fund’s Institutional and Investor Class shares, respectively, through October 31, 2016. The Adviser may request a reimbursement from the Funds to recapture any reduced management fees or reimbursed Fund expenses within three years following the fee reduction or expense reimbursement, but only to the extent the Funds’ total annual fund operating expenses including offering costs, plus any requested reimbursement amount, are less than the above limit at the time of the request. Any such reimbursement is subject to review by the Board.

As of June 30, 2016, reimbursements (including offering costs) that may potentially be made by the Fund to the Adviser total $582,615 for the Cortina Small Cap Growth Fund and $667,050 for the Cortina Small Cap Value Fund and expire as follows:

| Cortina Small Cap Growth Fund | | | |

| June 30, 2017 | | $ | 217,565 | |

| June 30, 2018 | | | 198,408 | |

| June 30, 2019 | | | 166,642 | |

| | | | 582,615 | |

| Cortina Small Cap Value Fund | | | |

| June 30, 2017 | | $ | 194,315 | |

| June 30, 2018 | | | 222,111 | |

| June 30, 2019 | | | 250,624 | |

| | | | 667,050 | |

Fund Accounting Fees and Expenses

ALPS Fund Services, Inc. (“ALPS” or the “Administrator”) provides administrative, fund accounting and other services to the Funds for a monthly administration fee based on the Funds’ average daily net assets.

The Administrator is also reimbursed by the Funds for certain out-of-pocket expenses.

| Annual Report | June 30, 2016 | 21 |

| Notes to Financial Statements |

June 30, 2016

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Funds (the “Transfer Agent”).

Compliance Services

ALPS provides services that assist the Corporation’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Corporation in conjunction with requirements under Rule 38a-1 under the 1940 Act. ALPS is compensated under the Administration Agreement.

Distributor

The Funds have entered into a Distribution Agreement with ALPS Distributors, Inc (“the Distributor”) to provide distribution services to the Funds. The Distributor serves as underwriter/distributor of shares of the Funds.

Distribution Plan

The Small Cap Value Fund has adopted a Distribution Plan in accordance with Rule 12b-1 (“Distribution Plan”) under the 1940 Act. The Distribution Plan provides that the Small Cap Value Fund may compensate or reimburse the Distributor for services rendered and expenses borne in connection with activities primarily intended to result in the sale of the Small Cap Value Fund’s shares. Sales charges may be paid to broker-dealers, banks and any other financial intermediary eligible to receive such fees for sales of Investor Shares of the Small Cap Value Fund and for services provided to shareholders.

The Small Cap Value Fund charges 12b-1 fees for Investor Shares. Pursuant to the Distribution Plan, the Small Cap Value Fund may annually pay the Distributor up to 0.25% of the average daily net assets of the Small Cap Value Fund’s Investor Shares. The expenses of the Distribution Plan are reflected in the Statements of Operations.

Certain Directors and Officers of the Funds are also officers of the Adviser.

4. PURCHASES AND SALES OF INVESTMENT SECURITIES

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short-term securities, are shown below for the year ended June 30, 2016.

| Fund Name | | Purchases | | | Sales | |

| Cortina Small Cap Growth Fund | | $ | 33,951,601 | | | $ | 42,527,042 | |

| Cortina Small Cap Value Fund | | | 87,971,497 | | | | 66,376,294 | |

There were no purchases or sales of long-term U.S. Government Obligations for either Fund during the year ended June 30, 2016.

5. TAX BASIS INFORMATION

For the year ended June 30, 2016 the following reclassifications, which had no impact on results of operations or net assets, were primarily attributed to differences in the treatment of passive foreign investment companies and the treatment of net investment loss. These were recorded to reflect tax character as follows:

| Fund | | Paid-in Capital | | | Accumulated Net Investment Income/(Loss) | | | Accumulated Net Realized Gain/(Loss) on Investments | |

| Cortina Small Cap Growth Fund* | | $ | (410,370 | ) | | $ | 410,370 | | | $ | – | |

| Cortina Small Cap Value Fund | | | (121 | ) | | | 760 | | | | (639 | ) |

| * | Includes Net Operating Loss (NOL) offset to Paid In Capital (PIC) in the amount of $410,370. |

Income and long-term capital gain distributions are determined in accordance with Federal income tax regulations, which differ from GAAP, and, therefore, may differ significantly in amount or character from net investment income and realized gains for financial reporting purposes.

| 22 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2016

The tax character of distributions paid during the year ended June 30, 2016, were as follows:

| Fund | | Ordinary Income | | | Long-Term Capital Gain | |

| Cortina Small Cap Growth Fund | | $ | – | | | $ | – | |

| Cortina Small Cap Value Fund | | | – | | | | – | |

The tax character of distributions paid during the year ended June 30, 2015, were as follows:

| Fund | | Ordinary Income | | | Long-Term Capital Gain | |

| Cortina Small Cap Growth Fund | | $ | 218,066 | | | $ | 1,615,118 | |

| Cortina Small Cap Value Fund | | | – | | | | 822,071 | |

As of June 30, 2016, the aggregate cost of investments, gross unrealized appreciation/(depreciation) and net unrealized appreciation/(depreciation) for Federal tax purposes was as follows:

| Fund | | Cost of Investments for Income Tax Purposes | | | Gross Appreciation (excess of value over tax cost) | | | Gross Depreciation (excess of tax cost over value) | | | Net Unrealized Appreciation | |

| Cortina Small Cap Growth Fund | | $ | 29,967,323 | | | $ | 6,444,454 | | | $ | (1,574,145 | ) | | $ | 4,870,309 | |

| Cortina Small Cap Value Fund | | | 60,460,806 | | | | 6,872,873 | | | | (2,101,651 | ) | | | 4,771,222 | |

The difference between book basis and tax basis net unrealized appreciation is attributable to the deferral of losses from wash sales.

At June 30, 2016, components of distributable earnings were as follows:

| Fund | Accumulated Net Investment Income/(Loss) | Accumulated Undistributed Net Realized Loss on Investments | Unrealized Appreciation on Investments | Other Cumulative Effect of Timing Differences | Total Distributable Earnings |

| Cortina Small Cap Growth Fund | $– | $(3,794,346) | $4,870,309 | $(168,486) | $907,477 |

| Cortina Small Cap Value Fund | 31,260 | (8,821,453) | 4,771,222 | – | (4,018,971) |

The Cortina Small Cap Growth Fund and the Cortina Small Cap Value Fund elected to defer to the year ending June 30, 2017, capital losses recognized during the period November 1, 2015 through June 30, 2016 in the amount of $1,812,149 and $6,445,230, respectively. The Cortina Small Cap Growth Fund elected to defer late year ordinary losses of $168,486 as having been incurred in the following fiscal year June 30, 2017.

At June 30, 2016, the following Funds had capital loss carryforwards which will reduce each Fund’s taxable income arising from future net realized gain on investments, if any, to the extent permitted by the Internal Revenue Code (the “Code”) and thus will reduce the amount of distributions to shareholders which would otherwise be necessary to relieve the Funds of any liability for federal income tax. Pursuant to the Code, such capital loss carry-forwards will accumulate as follows:

| Fund | | No Expiration Short-Term | | | No Expiration Long-Term | | | Total | |

| Cortina Small Cap Growth Fund | | $ | 1,315,308 | | | $ | 666,889 | | | $ | 1,982,197 | |

| Cortina Small Cap Value Fund | | | 2,223,680 | | | | 152,543 | | | | 2,376,223 | |

6. COMMITMENTS AND CONTINGENCIES

Under the Corporation’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, in the normal course of business, the Corporation entered into contracts with its service providers, on behalf of the Funds, and others that provide for general indemnifications. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds. The Funds expect risk of loss to be remote.

| Annual Report | June 30, 2016 | 23 |

| Report of Independent Registered

Public Accounting Firm |

To the Shareholders and Board of Directors of

Cortina Funds, Inc.

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of Cortina Funds, Inc., comprising Cortina Small Cap Growth Fund and Cortina Small Cap Value Fund (the “Funds”) as of June 30, 2016, and the related statements of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended. These financial statements and financial highlights are the responsibility of the Funds’ management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of June 30, 2016, by correspondence with the custodian and brokers, or by other appropriate auditing procedures where replies from brokers or counterparties were not received. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of each of the Funds constituting Cortina Funds, Inc. as of June 30, 2016, the results of their operations for the year then ended, the changes in their net assets for each of the two years in the period then ended, and the financial highlights for each of the five periods in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

COHEN FUND AUDIT SERVICES, LTD.

Cleveland, Ohio

August 26, 2016

| 24 | 1-855-612-3936 | www.cortinafunds.com |