Washington, D.C. 20549

825 N. Jefferson St., Suite 400

Item 1. Reports to Stockholders.

TABLE OF CONTENTS

| Cortina Small Cap Growth Fund | |

| Shareholder Letter | 1 |

| Portfolio Information | 3 |

| Cortina Small Cap Value Fund | |

| Shareholder Letter | 4 |

| Portfolio Information | 6 |

| Disclosure of Fund Expenses | 7 |

| Schedule of Investments | |

| Cortina Small Cap Growth Fund | 8 |

| Cortina Small Cap Value Fund | 11 |

| Statements of Assets and Liabilities | 13 |

| Statements of Operations | 14 |

| Statements of Changes in Net Assets | 15 |

| Financial Highlights | |

| Cortina Small Cap Growth Fund | 16 |

| Cortina Small Cap Value Fund - Institutional | 17 |

| Cortina Small Cap Value Fund - Investor | 18 |

| Notes to Financial Statements | 19 |

| Report of Independent Registered Public Accounting Firm | 25 |

| Additional Information | 26 |

| Board of Directors and Officers | 29 |

| Cortina Small Cap Growth Fund | June 30, 2017 (Unaudited) |

DEAR FELLOW SHAREHOLDERS:

Fiscal 2017 was another successful period for the Cortina Small Cap Growth Fund. Similar to fiscal 2016, the Fund outperformed both the Russell 2000 Growth benchmark index over the past three, six and twelve month periods. Unlike fiscal 2016, outperformance was defined as “making more” than the index as opposed to “losing less” than the index, making this a constructive period from both an absolute and relative

return standpoint.

The past six months have been a period of almost unprecedented calm on the surface of equity markets. The large cap S&P 500 index has yet to fall more than 3% from its highs thus far in 2017. Should that continue, it would be only the second time in thirty years that it didn’t pull back at least 5% at some point in the year. Volatility has been similarly muted in small caps. While the overall market has steadily grinded higher, sector and industry leadership has transitioned from month to month and quarter to quarter. Over the past six months, our portfolio has been on the right side of some sectors and industries, and the wrong side of others, but our overall security selection led to the slight outperformance. The same can be said for the fiscal year as a whole, though the outperformance was much more meaningful.

Starting with the good, we have been consistently overweight in the Technology sector in both prior periods and for the entire fiscal year. While it hasn’t been the best performing sector, it has steadily outperformed the benchmark as a whole, and our Technology stocks have steadily outperformed those in the benchmark. This has been driven by a combination of idiosyncratic ideas, as well as a preference for internet, software and semiconductor holdings while eschewing to a large degree the more commoditized hardware companies.

Our Health Care holdings have been our largest source of positive contribution, returning 51% for the full fiscal year and 21% over the past six months. It should be noted that the 21% calendar year-to-date return trailed the Health Care sector return of 24% in the Russell 2000 Growth benchmark. This was in large part due to our relatively slight exposure to the biotechnology industry which was up over 33%. While we continue to avoid clinical stage biotechnology companies, we have initiated a new investment theme we’re terming The Biotech REVENUE-tion. Contained within this theme are fully-funded businesses with vibrant revenue growth and importantly highly diversified value drivers. In addition to product sales tied to the manufacturing of biotherapeutics and pharmaceuticals, some holdings within the theme stand to earn milestone payments and royalties on the sales of other companies’ drugs without having to fund and assume the development risk. We have also become more active in investing in commercial stage pharmaceutical companies. This is a newer initiative for us, and it is being done on the heels of more than two years of underperformance for the industry. We believe past abuses of monopolistic pricing power and opaque reimbursement practices have resulted in a more disciplined industry that is focused on the creation of value through innovation, as opposed to the extraction of value through manipulation of the system.

Financials have also been a bright spot for the Fund over the past six and twelve month periods. While it is a small sector in the index, we have been consistently overweight, and our holdings have collectively performed well. Conversely, the Energy sector has been a meaningful detractor to Fund performance. While our exposure in the first half of the fiscal year was a positive, we maintained our positioning throughout the past six months and have paid a heavy price for it. Within the benchmark, the Energy sector has fallen 32%, and our holdings have fallen approximately 36% on average. To make matters worse, we have had an average sector weight of 5.4% versus just 1.2% for the benchmark.

OUTLOOK & PORTFOLIO POSITIONING

Predictions of stock market performance into the second half of the year are, at present, quite difficult. (Thankfully, short-term market calls are not a part of our investment process.) Most economic indicators reflect strength and growth, and as mentioned above, earnings estimates are set at what appears an achievable level. Frankly, the market and the economy are in our eyes currently healthy. Via policy, the Federal Reserve (Fed) is casually working on interest rates, having performed two increases to the Fed Funds rate this year following last December’s raise, in spite of very little evidence of inflation. More subtly, rhetoric out of a number of central banks including the Fed is increasingly hawkish, and yet the market climbs. Global rates are on the rise so the Fed may feel some pressure to keep interest rates in check as to prevent significant discrepancies in currencies. However, the market is not complying as the dollar is starting to fall relative to other currencies, particularly the Euro. This could help the U.S. exporters which may explain the recent strength in industrial stocks (as well as a turn up in fixed business investment). The strengthening Euro, in particular, may also be a byproduct of a stronger European economy, one year removed from the Brexit vote and now several years removed from discussions of austerity, populist demonstrations, bailouts and widespread concern over the downfall of the European Union. Could the election of Emmanuel Macron by the French suggest the citizens are interested in a stronger, more unified Europe with a brighter economic future? Should the global investment spotlight move to international markets, it is customary to expect global multinationals to exhibit more sales momentum than their domestic counterparts.

Of course, steady economic and corporate fundamentals have to be balanced against current market valuation. Today’s trading values cannot be described as cheap although valuations are not in extreme territories. In fact, it seems as if market participants and pundits alike are comfortable with these levels which basically have remained consistent for several years now. The forward earnings multiple of the S&P 500 has been pacing between 15-16 times since 2014. On its surface, this would suggest that the current valuation of 17 times is lofty, but not excessively so. Despite

| Annual Report | June 30, 2017 | 1 |

| Cortina Small Cap Growth Fund | June 30, 2017 (Unaudited) |

the stock market not being inexpensive, one prescription for the market going higher has to do with a rotation within it. While not classically narrow, without a doubt the market has been fueled by the strong performance of a number of bellwether technology stocks, including Amazon, Apple, Google and Facebook. The potential for the market to broaden is there, and it just might come from the Financials sector on the back of a more constructive interest rate environment and curve. In addition, Energy stocks have been such laggards the last six months that a bottoming there would also help the market broaden. What might be the biggest risk to valuation levels is a dramatic move in inflation expectations, which at present appears to be a low-probability event.

At present, overweight sectors include Technology, Energy, Health Care and Telecom Services. Our exposure to Industrials is underweight, and the level of underweight got slightly larger after the rebalance of the Russell indices. Consumer Discretionary is also sizably underweight. It should be noted that behind this allocation there is no commentary on the health of the consumer, rather due to the extreme disruption Amazon is having in that part of the economy, it is difficult to find companies with durable competitive positions and still-interesting valuations. We are slightly underexposed to Materials and Financials and have no positions in the Real Estate or Utility sectors. Finally, while the Strategy’s weighted average market cap is higher than in years past at $1.4 billion, it remains significantly smaller than the Russell 2000 Growth Index.

Investing involves risks, including loss of principal.

| 2 | 1-855-612-3936 | www.cortinafunds.com |

| Cortina Small Cap Growth Fund | June 30, 2017 (Unaudited) |

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to June 30, 2017.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Growth Fund (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Growth Index. It is important to note the Fund is a professionally managed mutual fund while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended June 30, 2017

| | 6 Months | 1 Year | 3 Years | 5 Years | Since Inception* | Gross

Expense Ratio** |

| Cortina Small Cap Growth Fund | 10.19% | 30.95% | 6.41% | 11.02% | 13.27% | 1.54% |

Russell 2000® Growth Index | 9.97% | 24.40% | 7.64% | 13.98% | 16.51% | |

| * | The Fund’s inception date is September 30, 2011. |

| ** | Cortina Asset Management, LLC (the “Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses and extraordinary expenses) to 1.10% of average daily net assets of the Fund. The agreement will continue in effect at least through October 31, 2017, subject thereafter to annual re-approval of the agreement by the Fund's Board of Directors. The current expense ratio for the Fund can be located in the Financial Highlights contained within this shareholder report. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Growth Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 companies with higher price-to-value ratios and higher forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

S&P 500 – The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

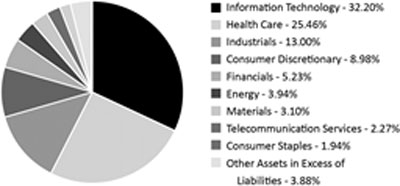

Sector Allocations***

| *** | Percentages are based on Net Assets as of June 30, 2017. Holdings are subject to change. |

| Annual Report | June 30, 2017 | 3 |

Cortina Small Cap Value Fund | June 30, 2017 (Unaudited) |

DEAR FELLOW SHAREHOLDERS:

The last twelve months have seen a solid return to positive results for the Cortina Small Cap Value Fund with a double-digit gain that slightly trailed the benchmark Russell 2000 Value Index. Rising equity markets occur for many reasons, but amidst the record highs for equity indexes, the volatility last year, and the seeming victory of the robots in the investing world, it is worth stepping back and looking at the big picture.

Sector allocation was the key contributor, particularly with the strategy's long-time overweight towards technology, which was the best performing sector in the index, and the portfolio's consistent underweight towards real estate, a sector that dramatically underperformed the benchmark. Selection was positive across most sectors, with the notable exception of Financials due to the explosive jump in that sector post-election that took many unremarkable companies to remarkable heights. The financials move was tied to excitement around rising interest rates, yet the critical 10-year Treasury yield peaked in March of 2017; as rate normalization euphoria faded, so has the relative performance of many of those companies since that point. Selection was positive in Consumer Discretionary, Energy, and Health Care. In particular, one long-term Health Care holding dramatically restructured its business to powerful effect, and in Consumer Discretionary and Industrials, the portfolio benefitted from strong rebounds in new and long-term holdings from the sell-off in early 2016. Utilities also benefitted the relative performance. The underweight towards the sector, which underperformed the Index was beneficial, as was selection where one of the portfolio's largest holdings, a non-traditional utility, posted strong absolute gains.

Across the style options, the equity class that has performed the best in recent years would probably surprise most people. The answer: all of them. Through June 30, 2017, the Russell 2000 Growth Index beat the Russell 2000 Value Index by approximately 9 percentage points. Yet on a one, three, and five year basis, the Russell 2000 Value, Core, and Growth returns are virtually identical to each other, and over a five year basis, all are close to the S&P 500’s return. This confluence reflects an economy that has been unable to forcefully assert itself one way or another and appears trapped in a steady but slow growth band.

“…the American response to economic adversity was to seek to restore comfort more than dynamism…”

Tyler Cowen, The Complacent Class, New York, St. Martin’s Press, 2017

Economist Tyler Cowen’s recent book, The Complacent Class, highlights the decline of risk-taking and that many perceptions about our nation are misplaced. Start-ups are declining, job movement is low, and while we read about the risk-takers, conformity is rising which may explain our current malaise – and the economic doldrums. We meet with strong firms with inclinations to invest more, but hesitate due to fear of failure or activist pressures for cash payouts. Weak firms continue to make mistakes, but access to capital beyond what previous cycles would allow enables leniency and lessens the need for hard decisions.

We believe this stasis is nearing its end. While for the moment the economy appears unlikely to lurch up or down, monetary policy is changing. Interest rates are increasing, quantitative easing is ending, and it may be surprisingly inflationary. If previous monetary tightenings were taking away the punch bowl, this one will be more akin to slowly draining the kitchen sink. We will find some shocks, but these will be cleansed and life moves on. Today the economy is on a positive trajectory, but at such a shallow slope it feels like a decline; early optimism about the new administration's economic policies is fading as reality (and investigations) set in; and the markets for Value equities are again stuck in a range that reflects an indeterminate near-term outlook.

We view this inert environment as short-lived as Federal Reserve tightening into a slow economy is a process that ultimately cuts the weakest players down. The political situation at the federal level is unhelpful and may depress activity on the margins, but we view this as a topic that gets more attention from investors than deserved. We expect a more definitive trend from the economy and markets later this year.

Many new businesses are addressing legitimate market needs and commercial opportunities, but are only currently viable because of an unusual subsidization from a surplus of investable capital. Monetary tightening could reverse that trend. This is not to say an epochal crash is coming, but it is to say that patience has its limits and all investment cycles come to an end when the returns fail to materialize.

Underappreciated in our view is that with a tightening bias at the Fed, this subsidized value destruction is probably nearing the end of its cycle. Unconventional monetary policy has enabled many commercial and financial enterprises undeservedly long lives that will soon end. Quantitative easing (QE) pushed an abundance of capital into the world, some of which found its way into funding new business ventures of varying success. In an older economy that was more commodity-based, QE may have resulted in massive inflation. Today QE may enable technological deflation. The perversity of unintended consequences is that a tighter monetary policy today could lead to inflation as irrational competitors are bankrupted. In a period of easy money, it is forgotten that eventually all firms must earn a return or their capital will dry up.

Just as investors chased the new titans of industry in both public and private markets, they also chase the newest products, be they passive indexation or products that seemingly assemble the best investment characteristics with the promise of low volatility. If a certain percentage of

| 4 | 1-855-612-3936 | www.cortinafunds.com |

Cortina Small Cap Value Fund | June 30, 2017 (Unaudited) |

new businesses are enabled by low-cost capital, a certain percentage of investment products probably are too. When the economy begins to take a more definitive trend, a development we expect in the next few quarters, the winners and losers will become more pronounced, the dispersion of returns will increase, and percentage points of absolute risk and return will begin to matter more than basis points of cost.

Today there is complacency to risks that are in some cases obvious. Capital markets will recognize that the financialization of volatility measures, such as the VIX index, have created artificial faith in downside protection. They are not so generous that investors can earn above average, or even average, returns with low volatility in perpetuity. That is fake news.

OUTLOOK & PORTFOLIO POSITIONING

Our broad view is for a stable economy punctuated by a few interesting moments. First, the economy should remain much the same with little acceleration or deceleration in trend for the very near-term. Second, the political environment will degrade, perhaps substantially, to the point that a US default, hopefully unlikely, will again be on the table as debt ceiling negotiations approach. Third, investment capital will become scarcer for developing companies and that will both dampen some growth at the same time it rescues able operators from improperly subsidized competitors. While the market as a whole may appear fairly benign, we expect some specific and narrow areas to post some very exciting divergences as we approach year-end.

The portfolio is positioned accordingly. Health Care and Technology remain overweights due to the more appealing growth trajectories and generally healthy cash flows and balance sheets. Financials, specifically banks, remain underweighted, but with the recent decline in most bank equities we are selectively adding to our exposure. Industrials are roughly evenly-weighted versus the benchmark, but with the unique attribute that many of our industrial companies are closer to growth companies than value companies; in many cases we see far more value in growing companies than in shrinking cheap ones. Energy, Utilities, and Materials are all close to evenly-weighted. Consumer Discretionary is becoming more interesting, with a few more names and now a very slight overweight versus underweight in previous reports. Real Estate Investment Trusts (REITs) remain an important part of the portfolio and the benchmark, but remain underweight as many appear both expensive on a valuation basis and vulnerable on a fundamental basis given industry trends.

We are hoping for a quiet summer, but we expect this hushed market to begin delivering a stronger message later this year as tightening monetary policy domestically and overseas begins to impact capital markets and the economy.

Investing involves risks, including loss of principal.

Quantitative Easing: Generally defined as an unconventional monetary policy in which a central bank purchases government securities or other securities from the market in order to lower interest rates and increase the money supply.

REIT – A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate.

VIX – The VIX Index is a measure of the implied volatility of S&P 500 Index options, calculated and published by the Chicago Board Options Exchange.

| Annual Report | June 30, 2017 | 5 |

Cortina Small Cap Value Fund | June 30, 2017 (Unaudited) |

Growth of $25,000 Investment (Unaudited)

For the period from September 30, 2011 (Inception) to June 30, 2017.

This graph assumes an initial $25,000 investment at September 30, 2011 (Inception Date). The Cortina Small Cap Value Fund Institutional share class (the “Fund”) will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. This graph depicts the performance of the Fund versus the Russell 2000® Value Index. It is important to note the Fund is a professionally managed mutual fund, while the index is not available for investment and is unmanaged. The comparison is shown for illustrative purposes only. Performance will vary from class to class based on differences in class-specific expenses.

This chart does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Performance Returns for the period ended June 30, 2017

| | 6 Months | 1 Year | 3 Years* | 5 Years* | Since Inception* | Gross Expense Ratio** |

| Cortina Small Cap Value Fund - Institutional | 2.60% | 24.65% | 3.34% | 11.76% | 15.59% | 1.51% |

| Cortina Small Cap Value Fund - Investor | 2.51% | 24.41% | 3.08% | 11.49% | 15.32% | 1.76% |

Russell 2000® Value Index | 0.54% | 24.86% | 7.02% | 13.39% | 16.04%*** | |

| * | The Fund’s Institutional shares inception date is September 30, 2011, Investor shares inception date is April 30, 2014. The performance shown for Investor shares for periods pre-dating the commencement of operations of that class reflects the performance of the Fund’s Institutional shares, the initial share class, calculated using the fees and expenses of Investor shares. If Investor shares of the Fund had been available during periods prior to April 30, 2014, the performance shown may have been different. |

| ** | Cortina Asset Management, LLC (the ”Adviser”) has contractually agreed to waive management fees and/or reimburse the Fund’s operating expenses in order to limit the Fund’s total annual fund operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) to 1.10% and 1.35% of average daily net assets of the Fund’s Institutional and Investor Class shares, respectively. The agreement will continue in effect at least through October 31, 2017, subject thereafter to annual re-approval of the agreement by the Fund’s Board of Directors. The current expense ratio for the Fund can be located in the Financial Highlights contained within this shareholder report. |

| *** | Represents the period from September 30, 2011 (date of original public offering of the Institutional shares) through June 30, 2017. |

Past performance does not guarantee future results. The performance data quoted represents past performance and current returns may be lower or higher. Total return figures include change in share price, reinvestment of dividends and capital gains. The investment return and principal value will fluctuate so that an investor's shares, when redeemed may be worth more or less than their original cost. To obtain performance information current to the most recent month end, call 1-855-612-3936.

Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values. All indices are unmanaged. It is not possible to invest directly in an index.

S&P 500 – The S&P 500 Index is the Standard & Poor’s composite index of 500 stocks, a widely recognized, unmanaged index of common stock prices.

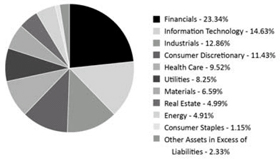

Sector Allocations****

| **** | Percentages are based on Net Assets as of June 30, 2017. Holdings are subject to change. |

| 6 | 1-855-612-3936 | www.cortinafunds.com |

| Disclosure of Fund Expenses |

| June 30, 2017 (Unaudited) |

As a shareholder of the Fund(s), you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period, as indicated below.

Actual Expenses – The first line of the table below provides information about the actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6) then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes – The second line of the table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not each Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds by comparing these 5% hypothetical examples with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any direct costs, such as wire fees or low balance fees. Therefore, the second line of the table is useful in comparing ongoing costs and will not help you determine the relative total costs of owning different funds. In addition, if these direct costs were included, your costs would be higher.

| | Beginning Account Value January 1, 2017 | Ending Account Value June 30, 2017 | Expenses Paid During Period(a) | Net Expense Ratios(b) |

| Cortina Small Cap Growth Fund ‐ Institutional | | | | |

| Actual Fund Return | $1,000.00 | $1,102.50 | $5.73 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.34 | $5.51 | 1.10% |

| Cortina Small Cap Value Fund ‐ Institutional | | | | |

| Actual Fund Return | $1,000.00 | $1,026.00 | $5.53 | 1.10% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,019.34 | $5.51 | 1.10% |

| Cortina Small Cap Value Fund ‐ Investor | | | | |

| Actual Fund Return | $1,000.00 | $1,025.10 | $6.78 | 1.35% |

| Hypothetical Fund Return (assuming a 5% return before expenses) | $1,000.00 | $1,018.10 | $6.76 | 1.35% |

(a) | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (181), divided by 365. |

(b) | Annualized, based on the Fund's most recent half-year expenses. |

| Annual Report | June 30, 2017 | 7 |

Cortina Small Cap Growth Fund | June 30, 2017 |

| | | Shares | | | Value | |

| COMMON STOCKS (96.12%) | | | | | | |

| Consumer Discretionary (8.98%) | | | | | | |

Duluth Holdings, Inc., Class B(a) | | | 10,294 | | | $ | 187,454 | |

Five Below, Inc.(a) | | | 6,607 | | | | 326,188 | |

IMAX Corp.(a) | | | 12,354 | | | | 271,788 | |

Malibu Boats, Inc., Class A(a) | | | 7,389 | | | | 191,153 | |

MarineMax, Inc.(a) | | | 12,608 | | | | 246,486 | |

Ollie's Bargain Outlet Holdings, Inc.(a) | | | 8,481 | | | | 361,291 | |

| Tile Shop Holdings, Inc. | | | 11,620 | | | | 239,953 | |

Universal Electronics, Inc.(a) | | | 3,667 | | | | 245,139 | |

| Wingstop, Inc. | | | 8,569 | | | | 264,782 | |

| | | | | | | | 2,334,234 | |

| Consumer Staples (1.94%) | | | | | | | | |

elf Beauty, Inc.(a) | | | 8,759 | | | | 238,333 | |

Primo Water Corp.(a) | | | 20,999 | | | | 266,687 | |

| | | | | | | | 505,020 | |

| Energy (3.94%) | | | | | | | | |

Abraxas Petroleum Corp.(a) | | | 81,559 | | | | 132,125 | |

Contango Oil & Gas Co.(a) | | | 11,901 | | | | 79,023 | |

Lonestar Resources US, Inc., Class A(a) | | | 24,189 | | | | 104,013 | |

Mammoth Energy Services, Inc.(a) | | | 9,576 | | | | 178,114 | |

Matador Resources Co.(a) | | | 7,047 | | | | 150,594 | |

Ring Energy, Inc.(a) | | | 19,303 | | | | 250,939 | |

SRC Energy, Inc.(a) | | | 19,399 | | | | 130,555 | |

| | | | | | | | 1,025,363 | |

| Financials (5.23%) | | | | | | | | |

| Financial Engines, Inc. | | | 7,722 | | | | 282,625 | |

Green Dot Corp., Class A(a) | | | 5,057 | | | | 194,846 | |

Health Insurance Innovations, Inc., Class A(a) | | | 10,775 | | | | 253,212 | |

| Independent Bank Group, Inc. | | | 3,543 | | | | 210,809 | |

LendingTree, Inc.(a) | | | 1,349 | | | | 232,298 | |

| Pinnacle Financial Partners, Inc. | | | 2,980 | | | | 187,144 | |

| | | | | | | | 1,360,934 | |

Health Care (25.46%)(b) | | | | | | | | |

AtriCure, Inc.(a) | | | 7,885 | | | | 191,211 | |

AxoGen, Inc.(a) | | | 17,766 | | | | 297,581 | |

BioTelemetry, Inc.(a) | | | 11,528 | | | | 385,612 | |

Bovie Medical Corp.(a) | | | 33,796 | | | | 83,476 | |

Cardiovascular Systems, Inc.(a) | | | 8,708 | | | | 280,659 | |

Cross Country Healthcare, Inc.(a) | | | 16,077 | | | | 207,554 | |

Diplomat Pharmacy, Inc.(a) | | | 8,963 | | | | 132,652 | |

Eagle Pharmaceuticals, Inc.(a) | | | 2,420 | | | | 190,914 | |

Entellus Medical, Inc.(a) | | | 13,265 | | | | 219,668 | |

Evolent Health, Inc., Class A(a) | | | 10,292 | | | | 260,902 | |

HealthEquity, Inc.(a) | | | 4,109 | | | | 204,752 | |

HealthStream, Inc.(a) | | | 5,097 | | | | 134,153 | |

Heska Corp.(a) | | | 2,543 | | | | 259,564 | |

HMS Holdings Corp.(a) | | | 14,080 | | | | 260,480 | |

K2M Group Holdings, Inc.(a) | | | 20,834 | | | | 507,516 | |

Ligand Pharmaceuticals, Inc.(a) | | | 2,371 | | | | 287,839 | |

Neogen Corp.(a) | | | 3,176 | | | | 219,493 | |

NeoGenomics, Inc.(a) | | | 37,561 | | | | 336,547 | |

NxStage Medical, Inc.(a) | | | 11,227 | | | | 281,461 | |

Oxford Immunotec Global PLC(a) | | | 18,058 | | | | 303,736 | |

Pacira Pharmaceuticals, Inc.(a) | | | 4,864 | | | | 232,013 | |

Repligen Corp.(a) | | | 6,031 | | | | 249,925 | |

See Notes to Financial Statements.

| 8 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | June 30, 2017 |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | |

| Health Care (continued) | | | | | | |

STAAR Surgical Co.(a) | | | 20,860 | | | $ | 225,288 | |

Teladoc, Inc.(a) | | | 5,769 | | | | 200,184 | |

Teligent, Inc.(a) | | | 22,546 | | | | 206,296 | |

Vanda Pharmaceuticals, Inc.(a) | | | 1,439 | | | | 23,456 | |

Veracyte, Inc.(a) | | | 26,891 | | | | 224,002 | |

Vocera Communications, Inc.(a) | | | 8,182 | | | | 216,168 | |

| | | | | | | | 6,623,102 | |

| Industrials (13.00%) | | | | | | | | |

Air Transport Services Group, Inc.(a) | | | 13,944 | | | | 303,700 | |

| Albany International Corp., Class A | | | 4,699 | | | | 250,927 | |

Axon Enterprise, Inc.(a) | | | 7,758 | | | | 195,036 | |

| Barnes Group, Inc. | | | 1,831 | | | | 107,168 | |

BMC Stock Holdings, Inc.(a) | | | 14,972 | | | | 327,138 | |

Covenant Transportation Group, Inc., Class A(a) | | | 12,819 | | | | 224,717 | |

Dycom Industries, Inc.(a) | | | 3,649 | | | | 326,658 | |

| Granite Construction, Inc. | | | 4,683 | | | | 225,908 | |

Kornit Digital, Ltd.(a) | | | 9,802 | | | | 189,669 | |

Kratos Defense & Security Solutions, Inc.(a) | | | 22,840 | | | | 271,111 | |

Manitex International, Inc.(a) | | | 23,696 | | | | 165,398 | |

Saia, Inc.(a) | | | 4,249 | | | | 217,974 | |

Spirit Airlines, Inc.(a) | | | 7,178 | | | | 370,744 | |

| Titan International, Inc. | | | 17,113 | | | | 205,527 | |

| | | | | | | | 3,381,675 | |

Information Technology (32.20%)(b) | | | | | | | | |

2U, Inc.(a) | | | 1,908 | | | | 89,523 | |

Amber Road, Inc.(a) | | | 26,560 | | | | 227,619 | |

Blackhawk Network Holdings, Inc.(a) | | | 7,080 | | | | 308,688 | |

Box, Inc., Class A(a) | | | 17,805 | | | | 324,763 | |

Brightcove, Inc.(a) | | | 30,404 | | | | 188,505 | |

BroadSoft, Inc.(a) | | | 5,571 | | | | 239,832 | |

CEVA, Inc.(a) | | | 3,964 | | | | 180,164 | |

ChannelAdvisor Corp.(a) | | | 18,293 | | | | 211,284 | |

Cirrus Logic, Inc.(a) | | | 3,548 | | | | 222,531 | |

Coherent, Inc.(a) | | | 1,384 | | | | 311,386 | |

CommVault Systems, Inc.(a) | | | 4,936 | | | | 278,637 | |

Cray, Inc.(a) | | | 13,399 | | | | 246,542 | |

| EMCORE Corp. | | | 22,785 | | | | 242,660 | |

Five9, Inc.(a) | | | 15,796 | | | | 339,930 | |

FormFactor, Inc.(a) | | | 24,397 | | | | 302,523 | |

Gogo, Inc.(a) | | | 13,723 | | | | 158,226 | |

Hortonworks, Inc.(a) | | | 11,629 | | | | 149,781 | |

Infinera Corp.(a) | | | 31,038 | | | | 331,175 | |

Inphi Corp.(a) | | | 6,337 | | | | 217,359 | |

Limelight Networks, Inc.(a) | | | 118,833 | | | | 343,427 | |

LivePerson, Inc.(a) | | | 7,708 | | | | 84,788 | |

MaxLinear, Inc., Class A(a) | | | 12,650 | | | | 352,808 | |

Mellanox Technologies, Ltd.(a) | | | 6,425 | | | | 278,202 | |

Mimecast, Ltd.(a) | | | 10,464 | | | | 280,226 | |

Nanometrics, Inc.(a) | | | 10,275 | | | | 259,855 | |

Oclaro, Inc.(a) | | | 18,647 | | | | 174,163 | |

Photronics, Inc.(a) | | | 24,234 | | | | 227,800 | |

Planet Payment, Inc.(a) | | | 49,383 | | | | 162,964 | |

Quantenna Communications, Inc.(a) | | | 12,981 | | | | 246,639 | |

RingCentral, Inc., Class A(a) | | | 7,600 | | | | 277,780 | |

ShoreTel, Inc.(a) | | | 33,827 | | | | 196,197 | |

Telenav, Inc.(a) | | | 18,350 | | | | 148,635 | |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2017 | 9 |

| Schedule of Investments |

| Cortina Small Cap Growth Fund | June 30, 2017 |

| | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | |

| Information Technology (continued) | | | | | | |

Truecar, Inc.(a) | | | 12,664 | | | $ | 252,394 | |

USA Technologies, Inc.(a) | | | 37,868 | | | | 196,914 | |

Varonis Systems, Inc.(a) | | | 8,652 | | | | 321,854 | |

| | | | | | | | 8,375,774 | |

| Materials (3.10%) | | | | | | | | |

Codexis, Inc.(a) | | | 47,728 | | | | 260,118 | |

LSB Industries, Inc.(a) | | | 24,730 | | | | 255,461 | |

Summit Materials, Inc., Class A(a) | | | 10,092 | | | | 291,356 | |

| | | | | | | | 806,935 | |

| Telecommunication Services (2.27%) | | | | | | | | |

Boingo Wireless, Inc.(a) | | | 22,539 | | | | 337,183 | |

ORBCOMM, Inc.(a) | | | 22,429 | | | | 253,448 | |

| | | | | | | | 590,631 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (COST $18,582,258) | | | | | | | 25,003,668 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (96.12%)(COST $18,582,258) | | | | | | | 25,003,668 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (3.88%) | | | | | | | 1,010,167 | |

| | | | | | | | | |

| NET ASSETS 100.00% | | | | | | $ | 26,013,835 | |

(a) | Non Income Producing Security. |

(b) | To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. When sector categorization is broken down by industry, no industry exceeds the 25% maximum specified in the Statement of Additional Information. |

| See Notes to Financial Statements. | |

| 10 | 1-855-612-3936 | www.cortinafunds.com |

| Schedule of Investments |

| Cortina Small Cap Value Fund | June 30, 2017 |

| | | Shares | | | Value | |

| COMMON STOCKS (97.67%) | | | | | | |

| Consumer Discretionary (11.43%) | | | | | | |

| Caleres, Inc. | | | 20,906 | | | $ | 580,769 | |

Eldorado Resorts, Inc.(a) | | | 36,262 | | | | 725,240 | |

Etsy, Inc.(a) | | | 21,819 | | | | 327,285 | |

Fox Factory Holding Corp.(a) | | | 15,169 | | | | 540,016 | |

Horizon Global Corp.(a) | | | 33,192 | | | | 476,637 | |

M/I Homes, Inc.(a) | | | 11,212 | | | | 320,103 | |

Red Robin Gourmet Burgers, Inc.(a) | | | 9,665 | | | | 630,641 | |

TRI Pointe Group, Inc.(a) | | | 33,174 | | | | 437,565 | |

| Winnebago Industries, Inc. | | | 23,514 | | | | 822,990 | |

| | | | | | | | 4,861,246 | |

| Consumer Staples (1.15%) | | | | | | | | |

| Andersons, Inc. | | | 14,272 | | | | 487,389 | |

| | | | | | | | | |

| Energy (4.91%) | | | | | | | | |

Eclipse Resources Corp.(a) | | | 183,291 | | | | 524,212 | |

Forum Energy Technologies, Inc.(a) | | | 21,741 | | | | 339,160 | |

Matador Resources Co.(a) | | | 19,164 | | | | 409,535 | |

Oil States International, Inc.(a) | | | 15,145 | | | | 411,187 | |

| Patterson‐UTI Energy, Inc. | | | 20,087 | | | | 405,556 | |

| | | | | | | | 2,089,650 | |

| Financials (23.34%) | | | | | | | | |

| BancorpSouth, Inc. | | | 29,149 | | | | 889,044 | |

| Banner Corp. | | | 14,654 | | | | 828,098 | |

| Capitol Federal Financial, Inc. | | | 39,491 | | | | 561,167 | |

| ConnectOne Bancorp, Inc. | | | 32,587 | | | | 734,837 | |

| Enterprise Financial Services Corp. | | | 20,012 | | | | 816,490 | |

| James River Group Holdings, Ltd. | | | 12,639 | | | | 502,147 | |

| MB Financial, Inc. | | | 17,381 | | | | 765,459 | |

| Meridian Bancorp, Inc. | | | 51,077 | | | | 863,201 | |

| Pinnacle Financial Partners, Inc. | | | 11,848 | | | | 744,035 | |

| ProAssurance Corp. | | | 8,332 | | | | 506,586 | |

TriState Capital Holdings, Inc.(a) | | | 19,771 | | | | 498,229 | |

| Waterstone Financial, Inc. | | | 36,816 | | | | 693,982 | |

Western Alliance Bancorp(a) | | | 13,238 | | | | 651,310 | |

| Wintrust Financial Corp. | | | 11,376 | | | | 869,581 | |

| | | | | | | | 9,924,166 | |

| Health Care (9.52%) | | | | | | | | |

Allscripts Healthcare Solutions, Inc.(a) | | | 81,584 | | | | 1,041,012 | |

Endologix, Inc.(a) | | | 84,316 | | | | 409,776 | |

Magellan Health, Inc.(a) | | | 11,576 | | | | 843,890 | |

| Owens & Minor, Inc. | | | 17,833 | | | | 574,044 | |

Pacira Pharmaceuticals, Inc.(a) | | | 12,338 | | | | 588,523 | |

Prestige Brands Holdings, Inc.(a) | | | 11,171 | | | | 589,940 | |

| | | | | | | | 4,047,185 | |

| Industrials (12.86%) | | | | | | | | |

Atkore International Group, Inc.(a) | | | 22,344 | | | | 503,857 | |

| AZZ, Inc. | | | 10,921 | | | | 609,392 | |

| Forward Air Corp. | | | 9,171 | | | | 488,631 | |

Generac Holdings, Inc.(a) | | | 16,549 | | | | 597,915 | |

Harsco Corp.(a) | | | 34,835 | | | | 560,844 | |

| Knoll, Inc. | | | 26,602 | | | | 533,370 | |

NCI Building Systems, Inc.(a) | | | 20,607 | | | | 344,137 | |

| REV Group, Inc. | | | 18,637 | | | | 515,872 | |

SPX Corp.(a) | | | 23,740 | | | | 597,298 | |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2017 | 11 |

| Schedule of Investments |

| Cortina Small Cap Value Fund | June 30, 2017 |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | | | | | | |

| Industrials (continued) | | | | | | |

| Student Transportation, Inc. | | | 79,959 | | | $ | 485,351 | |

| Wabash National Corp. | | | 10,552 | | | | 231,933 | |

| | | | | | | | 5,468,600 | |

| Information Technology (14.63%) | | | | | | | | |

Ambarella, Inc.(a) | | | 12,668 | | | | 615,031 | |

Barracuda Networks, Inc.(a) | | | 23,433 | | | | 540,365 | |

Benchmark Electronics, Inc.(a) | | | 18,322 | | | | 591,801 | |

BlackBerry, Ltd.(a) | | | 65,671 | | | | 656,053 | |

| Dolby Laboratories, Inc., Class A | | | 9,837 | | | | 481,619 | |

FARO Technologies, Inc.(a) | | | 16,177 | | | | 611,491 | |

OSI Systems, Inc.(a) | | | 9,119 | | | | 685,293 | |

Stratasys, Ltd.(a) | | | 22,315 | | | | 520,163 | |

Teradata Corp.(a) | | | 32,968 | | | | 972,226 | |

| Travelport Worldwide, Ltd. | | | 39,722 | | | | 546,575 | |

| | | | | | | | 6,220,617 | |

| Materials (6.59%) | | | | | | | | |

Cliffs Natural Resources, Inc.(a) | | | 86,227 | | | | 596,691 | |

| Commercial Metals Co. | | | 28,289 | | | | 549,655 | |

| Graphic Packaging Holding Co. | | | 50,201 | | | | 691,770 | |

Owens‐Illinois, Inc.(a) | | | 40,325 | | | | 964,574 | |

| | | | | | | | 2,802,690 | |

| Real Estate (4.99%) | | | | | | | | |

| Four Corners Property Trust, Inc., REIT | | | 31,801 | | | | 798,523 | |

| Gramercy Property Trust, Inc., REIT | | | 24,078 | | | | 715,358 | |

| Physicians Realty Trust, REIT | | | 30,150 | | | | 607,221 | |

| | | | | | | | 2,121,102 | |

| Utilities (8.25%) | | | | | | | | |

| Black Hills Corp. | | | 8,740 | | | | 589,688 | |

| Chesapeake Utilities Corp. | | | 9,226 | | | | 691,489 | |

| Middlesex Water Co. | | | 15,450 | | | | 611,820 | |

| Ormat Technologies, Inc. | | | 16,791 | | | | 985,296 | |

| PNM Resources, Inc. | | | 16,466 | | | | 629,824 | |

| | | | | | | | 3,508,117 | |

| | | | | | | | | |

| TOTAL COMMON STOCKS (COST $35,231,149) | | | | | | | 41,530,762 | |

| | | | | | | | | |

| | | | | | | | | |

| TOTAL INVESTMENTS (97.67%) (COST $35,231,149) | | | | | | | 41,530,762 | |

| | | | | | | | | |

| OTHER ASSETS IN EXCESS OF LIABILITIES (2.33%) | | | | | | | 991,038 | |

| | | | | | | | | |

| NET ASSETS 100.00% | | | | | | $ | 42,521,800 | |

(a) | Non Income Producing Security. |

| See Notes to Financial Statements. | |

| 12 | 1-855-612-3936 | www.cortinafunds.com |

| Statements of Assets and Liabilities |

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| ASSETS: | | | | | | |

| Investments, at value (Cost ‐ see below) | | $ | 25,003,668 | | | $ | 41,530,762 | |

| Cash | | | 896,409 | | | | 1,064,656 | |

| Receivable for investments sold | | | 559,662 | | | | 1,329,657 | |

| Receivable for fund shares subscribed | | | – | | | | 2,316 | |

| Dividends and interest receivable | | | 2,131 | | | | 47,540 | |

| Prepaid expenses and other assets | | | 3,424 | | | | 8,707 | |

| Total Assets | | | 26,465,294 | | | | 43,983,638 | |

| | | | | | | | | |

| LIABILITIES: | | | | | | | | |

| Payable for investments purchased | | | 390,170 | | | | 1,370,158 | |

| Payable for director fees | | | 5,000 | | | | 5,000 | |

| Payable for advisory fees | | | 9,973 | | | | 21,839 | |

| Payable for fund accounting and administration fees | | | 17,951 | | | | 25,999 | |

| Payable for distribution and service fees | | | – | | | | 458 | |

| Payable for audit and legal fees | | | 18,293 | | | | 20,921 | |

| Other accrued liabilities and expenses | | | 10,072 | | | | 17,463 | |

| Total Liabilities | | | 451,459 | | | | 1,461,838 | |

| Net Assets | | $ | 26,013,835 | | | $ | 42,521,800 | |

| | | | | | | | | |

| NET ASSETS CONSISTS OF: | | | | | | | | |

| Paid‐in capital | | $ | 16,482,078 | | | $ | 35,320,585 | |

| Accumulated net realized gain on investments | | | 3,110,347 | | | | 901,602 | |

| Net unrealized appreciation on investments | | | 6,421,410 | | | | 6,299,613 | |

| Net Assets | | $ | 26,013,835 | | | $ | 42,521,800 | |

| | | | | | | | | |

| Cost of Investments | | $ | 18,582,258 | | | $ | 35,231,149 | |

| | | | | | | | | |

| PRICING OF SHARES: | | | | | | | | |

| Institutional | | | | | | | | |

| Net Assets | | $ | 26,013,835 | | | $ | 41,491,636 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | 1,390,728 | | | | 2,057,765 | |

| Net Asset Value, offering and redemption price per share | | $ | 18.71 | | | $ | 20.16 | |

| Investor | | | | | | | | |

| Net Assets | | $ | – | | | $ | 1,030,164 | |

| Shares Outstanding ($0.01 par value, unlimited number of shares authorized) | | | – | | | | 51,411 | |

| Net Asset Value, offering and redemption price per share | | $ | – | | | $ | 20.04 | |

| See Notes to Financial Statements. |

| Annual Report | June 30, 2017 | 13 |

| For the Year Ended June 30, 2017 |

| |

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| INVESTMENT INCOME: | | | | | | |

| Dividends (net of foreign withholding taxes of $0 and $1,432, respectively) | | $ | 36,159 | | | $ | 525,342 | |

| Total Investment Income | | | 36,159 | | | | 525,342 | |

| | | | | | | | | |

| EXPENSES: | | | | | | | | |

| Advisory fees (Note 3) | | | 298,637 | | | | 465,884 | |

| Fund accounting and administration fees and expenses | | | 94,149 | | | | 139,836 | |

| Transfer agent fees | | | 31,148 | | | | 52,322 | |

| Distribution and service fees | | | | | | | | |

| Investor | | | – | | | | 1,986 | |

| Legal fees | | | 18,619 | | | | 30,437 | |

| Printing fees | | | 1,182 | | | | 8,712 | |

| Registration fees | | | 28,342 | | | | 43,742 | |

| Audit and tax fees | | | 15,025 | | | | 15,525 | |

| Custodian fees | | | 5,471 | | | | 6,458 | |

| Director fees and expenses | | | 20,000 | | | | 20,000 | |

| Other | | | 12,928 | | | | 16,938 | |

| Total Expenses Before Waivers | | | 525,501 | | | | 801,840 | |

| Less fees waived by Adviser (Note 3) | | | (197,268 | ) | | | (288,061 | ) |

| Total Net Expenses | | | 328,233 | | | | 513,779 | |

| Net Investment Income/(Loss) | | | (292,074 | ) | | | 11,563 | |

| | | | | | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | | | | | |

| Net realized gain on investments | | | 8,060,618 | | | | 10,540,771 | |

| Net change in unrealized appreciation on investments | | | 855,736 | | | | 744,058 | |

| Net Realized and Unrealized Gain on Investments | | | 8,916,354 | | | | 11,284,829 | |

| Net Increase in Net Assets Resulting from Operations | | $ | 8,624,280 | | | $ | 11,296,392 | |

| See Notes to Financial Statements. | |

| 14 | 1-855-612-3936 | www.cortinafunds.com |

| Statements of Changes in Net Assets |

| | | Cortina Small Cap Growth Fund | | | Cortina Small Cap Value Fund | |

| | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | |

| OPERATIONS: | | | | | | | | | | | | |

| Net investment income/(loss) | | $ | (292,074 | ) | | $ | (365,663 | ) | | $ | 11,563 | | | $ | 48,572 | |

| Net realized gain/(loss) on investments | | | 8,060,618 | | | | (1,159,675 | ) | | | 10,540,771 | | | | (9,000,915 | ) |

| Net change in unrealized appreciation/(depreciation) on investments | | | 855,736 | | | | (2,194,983 | ) | | | 744,058 | | | | 850,455 | |

| Net increase/(decrease) in net assets resulting from operations | | | 8,624,280 | | | | (3,720,321 | ) | | | 11,296,392 | | | | (8,101,888 | ) |

| | | | | | | | | | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | (76,127 | ) | | | – | |

| Investor | | | | | | | | | | | | | | | | |

| From net investment income | | | – | | | | – | | | | (79 | ) | | | – | |

| Total distributions | | | – | | | | – | | | | (76,206 | ) | | | – | |

| | | | | | | | | | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | 2,251,187 | | | | 2,334,148 | | | | 8,762,639 | | | | 45,242,703 | |

| Shares issued in reinvestment of distributions | | | – | | | | – | | | | 58,066 | | | | – | |

| Cost of shares redeemed | | | (19,682,697 | ) | | | (10,077,701 | ) | | | (42,973,360 | ) | | | (23,874,783 | ) |

| Redemption fees | | | – | | | | – | | | | 1,239 | | | | 561 | |

| Total | | | (17,431,510 | ) | | | (7,743,553 | ) | | | (34,151,416 | ) | | | 21,368,481 | |

| Investor | | | | | | | | | | | | | | | | |

| Proceeds from sale of shares | | | – | | | | – | | | | 585,238 | | | | 274,972 | |

| Shares issued in reinvestment of distributions | | | – | | | | – | | | | 76 | | | | – | |

| Cost of shares redeemed | | | – | | | | – | | | | (207,584 | ) | | | (80,147 | ) |

| Total | | | – | | | | – | | | | 377,730 | | | | 194,825 | |

| Net increase/(decrease) from capital shares transactions | | | (17,431,510 | ) | | | (7,743,553 | ) | | | (33,773,686 | ) | | | 21,563,306 | |

| | | | | | | | | | | | | | | | | |

| Net increase/(decrease) in net assets | | | (8,807,230 | ) | | | (11,463,874 | ) | | | (22,553,500 | ) | | | 13,461,418 | |

| | | | | | | | | | | | | | | | | |

| NET ASSETS: | | | | | | | | | | | | | | | | |

| Beginning of year | | | 34,821,065 | | | | 46,284,939 | | | | 65,075,300 | | | | 51,613,882 | |

| End of year | | $ | 26,013,835 | | | $ | 34,821,065 | | | $ | 42,521,800 | | | $ | 65,075,300 | |

| Including accumulated net investment income/(loss) of: | | $ | – | | | $ | (168,486 | ) | | $ | – | | | $ | 31,260 | |

| | | | | | | | | | | | | | | | | |

| OTHER INFORMATION: | | | | | | | | | | | | | | | | |

| Share Transactions: | | | | | | | | | | | | | | | | |

| Institutional | | | | | | | | | | | | | | | | |

| Beginning shares | | | 2,439,069 | | | | 3,003,898 | | | | 3,985,455 | | | | 2,768,059 | |

| Shares sold | | | 132,757 | | | | 170,048 | | | | 467,621 | | | | 2,708,555 | |

| Shares issued in reinvestment of dividends | | | – | | | | – | | | | 2,936 | | | | – | |

| Less shares redeemed | | | (1,181,098 | ) | | | (734,877 | ) | | | (2,398,247 | ) | | | (1,491,159 | ) |

| Ending shares | | | 1,390,728 | | | | 2,439,069 | | | | 2,057,765 | | | | 3,985,455 | |

| Investor | | | | | | | | | | | | | | | | |

| Beginning shares | | | – | | | | – | | | | 32,503 | | | | 19,513 | |

| Shares sold | | | – | | | | – | | | | 29,568 | | | | 18,003 | |

| Shares issued in reinvestment of dividends | | | – | | | | – | | | | 4 | | | | – | |

| Less shares redeemed | | | – | | | | – | | | | (10,664 | ) | | | (5,013 | ) |

| Ending shares | | | – | | | | – | | | | 51,411 | | | | 32,503 | |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2017 | 15 |

| Financial Highlights |

| Cortina Small Cap Growth Fund | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | | | Year Ended June 30, 2013 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 14.28 | | | $ | 15.41 | | | $ | 16.35 | | | $ | 14.46 | | | $ | 11.87 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment loss(a) | | | (0.16 | ) | | | (0.13 | ) | | | (0.14 | ) | | | (0.17 | ) | | | (0.13 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 4.59 | | | | (1.00 | ) | | | (0.02 | )(b) | | | 2.19 | | | | 2.81 | |

| Total from Investment Operations | | | 4.43 | | | | (1.13 | ) | | | (0.16 | ) | | | 2.02 | | | | 2.68 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | |

| From net realized gains on investments | | | – | | | | – | | | | (0.78 | ) | | | (0.13 | ) | | | (0.09 | ) |

| Total Dividends and Distributions to Shareholders | | | – | | | | – | | | | (0.78 | ) | | | (0.13 | ) | | | (0.09 | ) |

| Paid‐in Capital from Redemption Fees | | | – | | | | – | | | | 0.00 | (c) | | | 0.00 | (c) | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 4.43 | | | | (1.13 | ) | | | (0.94 | ) | | | 1.89 | | | | 2.59 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 18.71 | | | $ | 14.28 | | | $ | 15.41 | | | $ | 16.35 | | | $ | 14.46 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 30.95 | % | | | (7.33 | %) | | | (0.71 | %) | | | 13.99 | % | | | 22.79 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 26,014 | | | $ | 34,821 | | | $ | 46,285 | | | $ | 31,657 | | | $ | 18,245 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.76 | % | | | 1.54 | % | | | 1.57 | % | | | 1.86 | % | | | 3.85 | % |

| Operating expenses including waiver/reimbursement | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Net investment loss including waiver/reimbursement | | | (0.98 | )% | | | (0.97 | )% | | | (0.94 | )% | | | (1.02 | )% | | | (1.00 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 88 | % | | | 93 | % | | | 95 | % | | | 81 | % | | | 73 | % |

(a) | Calculated using average shares throughout the period. |

(b) | Realized and unrealized gains and losses per share in this caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statements of Operations due to the share transactions for the period. |

(c) | Less than $0.005 per share. |

| See Notes to Financial Statements. | |

| 16 | 1-855-612-3936 | www.cortinafunds.com |

| Financial Highlights |

| Cortina Small Cap Value Fund – Institutional | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | Year Ended June 30, 2014 | | | Year Ended June 30, 2013 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 16.20 | | | $ | 18.52 | | | $ | 18.67 | | | $ | 15.62 | | | $ | 12.54 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | | | | | |

Net investment income/(loss)(a) | | | 0.01 | | | | 0.01 | | | | (0.02 | ) | | | (0.01 | ) | | | 0.01 | |

| Net realized and unrealized gain/(loss) on investments | | | 3.98 | | | | (2.33 | ) | | | 0.24 | | | | 3.30 | | | | 3.68 | |

| Total from Investment Operations | | | 3.99 | | | | (2.32 | ) | | | 0.22 | | | | 3.29 | | | | 3.69 | |

| | | | | | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | |

| From net investment income | | | (0.03 | ) | | | – | | | | – | | | | (0.01 | ) | | | (0.07 | ) |

| From net realized gains on investments | | | – | | | | – | | | | (0.37 | ) | | | (0.23 | ) | | | (0.54 | ) |

| Total Dividends and Distributions to Shareholders | | | (0.03 | ) | | | – | | | | (0.37 | ) | | | (0.24 | ) | | | (0.61 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Paid‐in Capital from Redemption Fees | | | 0.00 | (b) | | | 0.00 | (b) | | | 0.00 | (b) | | | – | | | | – | |

| | | | | | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 3.96 | | | | (2.32 | ) | | | (0.15 | ) | | | 3.05 | | | | 3.08 | |

| | | | | | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 20.16 | | | $ | 16.20 | | | $ | 18.52 | | | $ | 18.67 | | | $ | 15.62 | |

| | | | | | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 24.65 | % | | | (12.53 | %) | | | 1.21 | % | | | 21.14 | % | | | 30.41 | % |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 41,492 | | | $ | 64,552 | | | $ | 51,254 | | | $ | 34,842 | | | $ | 4,344 | |

| | | | | | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 1.72 | % | | | 1.50 | % | | | 1.63 | % | | | 1.92 | % | | | 5.55 | % |

| Operating expenses including waiver/reimbursement | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % | | | 1.10 | % |

| Net investment income/(loss) including waiver/reimbursement | | | 0.03 | % | | | 0.08 | % | | | (0.13 | )% | | | (0.09 | )% | | | 0.10 | % |

| | | | | | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 89 | % | | | 109 | % | | | 102 | % | | | 78 | % | | | 81 | % |

(a) | Calculated using average shares throughout the period. |

(b) | Less than $0.005 per share. |

| See Notes to Financial Statements. | |

| Annual Report | June 30, 2017 | 17 |

| Financial Highlights |

| Cortina Small Cap Value Fund – Investor | For a share outstanding throughout the periods presented. |

| | | Year Ended June 30, 2017 | | | Year Ended June 30, 2016 | | | Year Ended June 30, 2015 | | | For the Period April 30, 2014 (Inception) to June 30, 2014 | |

| NET ASSET VALUE, BEGINNING OF PERIOD | | $ | 16.11 | | | $ | 18.47 | | | $ | 18.67 | | | $ | 18.15 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | | | | | |

Net investment loss(a) | | | (0.03 | )(b) | | | (0.02 | ) | | | (0.06 | ) | | | (0.01 | ) |

| Net realized and unrealized gain/(loss) on investments | | | 3.96 | | | | (2.34 | ) | | | 0.23 | | | | 0.53 | |

| Total from Investment Operations | | | 3.93 | | | | (2.36 | ) | | | 0.17 | | | | 0.52 | |

| | | | | | | | | | | | | | | | | |

| DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | | | | | | | | | |

| From net investment income | | | (0.00 | )(c) | | | – | | | | – | | | | – | |

| From net realized gains on investments | | | – | | | | – | | | | (0.37 | ) | | | – | |

| Total Dividends and Distributions to Shareholders | | | (0.00 | )(c) | | | – | | | | (0.37 | ) | | | – | |

| | | | | | | | | | | | | | | | | |

| Paid-in Capital from Redemption Fees | | | – | | | | – | | | | – | | | | – | |

| | | | | | | | | | | | | | | | | |

| NET INCREASE/(DECREASE) IN NET ASSET VALUE | | | 3.93 | | | | (2.36 | ) | | | (0.20 | ) | | | 0.52 | |

| | | | | | | | | | | | | | | | | |

| NET ASSET VALUE, END OF PERIOD | | $ | 20.04 | | | $ | 16.11 | | | $ | 18.47 | | | $ | 18.67 | |

| | | | | | | | | | | | | | | | | |

| TOTAL RETURN | | | 24.41 | % | | | (12.78 | %) | | | 0.94 | % | | | 2.87 | %(d) |

| | | | �� | | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000s) | | $ | 1,030 | | | $ | 524 | | | $ | 360 | | | $ | 103 | |

| | | | | | | | | | | | | | | | | |

| RATIOS TO AVERAGE NET ASSETS: | | | | | | | | | | | | | | | | |

| Operating expenses excluding waiver/reimbursement | | | 2.00 | % | | | 1.75 | % | | | 1.86 | % | | | 2.14 | %(e) |

| Operating expenses including waiver/reimbursement | | | 1.35 | % | | | 1.35 | % | | | 1.35 | % | | | 1.35 | %(e) |

| Net investment loss including waiver/reimbursement | | | (0.15 | )% | | | (0.13 | )% | | | (0.35 | )% | | | (0.20 | )%(e) |

| | | | | | | | | | | | | | | | | |

| PORTFOLIO TURNOVER RATE | | | 89 | % | | | 109 | % | | | 102 | % | | | 78 | %(f) |

(a) | Calculated using average shares throughout the period. |

(b) | The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and redemptions of Fund shares in relation to income earned and/or fluctuating market value of the investments of the Fund. |

(c) | Less than $0.005 per share. |

(f) | Portfolio turnover is calculated at the Fund level and represents the year ended June 30, 2014. |

| See Notes to Financial Statements. | |

| 18 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2017

1. ORGANIZATION

Cortina Funds, Inc. (the “Corporation”) is an open‐end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Corporation was organized on April 27, 2004 as a Wisconsin corporation. The Corporation currently offers shares of common stock (“shares”) of the Cortina Small Cap Growth Fund and the Cortina Small Cap Value Fund (each a “Fund” and collectively, the “Funds”).

The Cortina Small Cap Growth Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011, is a diversified portfolio with an investment objective to seek growth of capital. The Cortina Small Cap Value Fund, which commenced operations with the sale of Institutional Class Shares on September 30, 2011 and the sale of Investor Class Shares on April 30, 2014, is a diversified portfolio with an investment objective to seek long‐term capital appreciation.

Shares of each Fund are designated as Institutional Shares or Investor Shares with an indefinite number of shares authorized at $0.01 par value. The Articles of Incorporation, as amended and restated, permit the Corporation’s Board of Directors (the “Board”) to create additional funds and share classes.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies followed by the Funds. These policies are in conformity with U.S. generally accepted accounting principles (“GAAP”). The Funds are considered investment companies for financial reporting purposes under GAAP.

Use of Estimates — The accompanying financial statements were prepared in accordance with GAAP, which require the use of estimates and assumptions made by management. These may affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Investment Valuation — Investment securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over‐the‐counter markets. Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Funds’ Board. Securities with maturities of sixty (60) days or less are valued at amortized cost as Level 1 or 2 within the hierarchy.

Investment Transactions — Investment security transactions are accounted for on trade date. Gains and losses on securities sold are determined on a specific identification basis.

Investment Income — Interest income is accrued and recorded on a daily basis including amortization of premiums, accretions of discounts and income earned from money market funds. Interest is not accrued on securities that are in default. Dividend income is recorded on the ex‐dividend date. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

Fair Value Measurements — A three‐tier hierarchy has been established to classify fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs are inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available. In accordance with the authoritative guidance on fair value measurements and disclosure under GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure the fair value.

Cash — The Fund considers its investment in a FDIC insured interest bearing savings account to be cash. The Fund maintains cash balances, which, at times may exceed federally insured limits. The Fund maintains these balances with a high quality financial institution.

| Annual Report | June 30, 2017 | 19 |

| Notes to Financial Statements |

June 30, 2017

Various inputs are used in determining the value of each Fund’s investments as of the reporting period end. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 | | — | | Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| | | |

| Level 2 | | — | | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| | | |

| Level 3 | | — | | Significant unobservable prices or inputs (including a Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

An investment level within the fair value hierarchy is based on the lowest level input, individually or in the aggregate, that is significant to fair value measurement. The valuation techniques used by the Funds to measure fair value during the year ended June 30, 2017 maximized the use of observable inputs and minimized the use of unobservable inputs.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk or liquidity associated with investing in those securities. The following is a summary of the inputs used in valuing the Funds’ investments as of June 30, 2017:

Cortina Small Cap Growth Fund

| | | Valuation Inputs | | | |

| Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Common Stocks* | | $ | 25,003,668 | | $ | – | | $ | – | | $ | 25,003,668 | |

| Total | | $ | 25,003,668 | | $ | – | | $ | – | | $ | 25,003,668 | |

Cortina Small Cap Value Fund

| | | Valuation Inputs | | | |

| Investments in Securities at Value | | Level 1 | | Level 2 | | Level 3 | | Total | |

| Common Stocks* | | $ | 41,530,762 | | $ | – | | $ | – | | $ | 41,530,762 | |

| Total | | $ | 41,530,762 | | $ | – | | $ | – | | $ | 41,530,762 | |

| * | See Schedule of Investments for sector classification. |

For the year ended June 30, 2017, there have been no significant changes to the Funds’ fair value methodologies. Additionally, there were no transfers into or out of Levels 1 and 2 during the year ended June 30, 2017. It is the Funds’ policy to recognize transfers at the end of the reporting period.

For the year ended June 30, 2017, the Funds did not have investments with significant unobservable inputs (Level 3) used in determining fair value.

Affiliated Companies — An affiliated company is a company that can have direct or indirect common ownership. The Funds did not hold any investments in affiliated companies as of and during the year ended June 30, 2017.

Expenses — The Funds bear expenses incurred specifically on each Fund’s respective behalf as well as a portion of general Corporation expenses, which may be allocated on the basis of relative net assets or the nature of the services performed relative to applicability to each Fund.

Expenses that are specific to a class of shares of the Funds are charged directly to the share class. The Funds’ realized and unrealized gains and losses, net investment income, and expenses other than class specific expenses, are allocated daily to each class in proportion to its average daily net assets.

| 20 | 1-855-612-3936 | www.cortinafunds.com |

| Notes to Financial Statements |

June 30, 2017

Distributions to Shareholders — Dividends from net investment income and distributions of net realized capital gains, if any, will be declared and paid at least annually. Income and capital gains distributions are determined in accordance with income tax regulations, which may differ from GAAP. Distributions to shareholders are recorded on the ex‐dividend date.

Fees on Redemptions — The Funds will deduct a 2.00% redemption proceeds fee on Fund shares held 60 days or less. The redemption fee is not a fee to finance sales or sales promotion expenses, but is paid to the Funds to defray the costs of liquidating an investor and discouraging short‐term trading of the Funds’ shares. No redemption fee will be imposed on redemptions initiated by the Funds.

Federal Income Taxes — As of and during the year ended June 30, 2017, the Funds did not have a liability for any unrecognized tax benefits. The Funds file U.S. federal, state, and local tax returns as required. The Funds’ tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return for federal purposes and four years for most state returns. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes. The Funds intend to distribute to shareholders all taxable investment income and realized gains, and otherwise comply with Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies.

3. ADVISORY FEES, FUND ACCOUNTING FEES, ADMINISTRATION FEES, AND OTHER AGREEMENTS

Investment Adviser

Cortina Asset Management, LLC, is the Funds’ investment adviser (the “Adviser”). The Adviser is subject to the general supervision of the Board and is responsible for the overall management of the Funds’ business affairs. The Adviser invests the assets of the Funds based on the Funds’ investment objectives and policies. The Adviser is entitled to an investment advisory fee, computed daily and payable monthly, of 1.00% of the average daily net assets for each Fund.

The Adviser has contractually agreed to waive fees with respect to each of the Funds so that the net annual operating expenses (excluding taxes, leverage, interest, brokerage commissions, dividends or interest expenses on short positions, acquired fund fees and expenses, and extraordinary expenses) of the Funds’ shares will not exceed 1.10% and 1.35% of average daily net assets of each Fund’s Institutional and with respect to the Cortina Small Cap Value Fund Investor Class shares, respectively, through October 31, 2017. The Adviser may request a reimbursement from the Funds to recapture any reduced management fees or reimbursed Fund expenses within three years following the fee reduction or expense reimbursement, but only to the extent the Funds’ total annual fund operating expenses including any requested reimbursement amount, are less than the above limit at the time of the request. Any such reimbursement is subject to review by the Board.

As of June 30, 2017, reimbursements that may potentially be made by the Funds to the Adviser total $562,318 for the Cortina Small Cap Growth Fund and $760,796 for the Cortina Small Cap Value Fund and expire as follows:

| Cortina Small Cap Growth Fund | | | |

| June 30, 2018 | | $ | 198,408 | |

| June 30, 2019 | | | 166,642 | |

| June 30, 2020 | | | 197,268 | |

| | | $ | 562,318 | |

| | | | | |

| Cortina Small Cap Value Fund | | | | |

| June 30, 2018 | | $ | 222,111 | |

| June 30, 2019 | | | 250,624 | |

| June 30, 2020 | | | 288,061 | |

| | | $ | 760,796 | |

Fund Accounting Fees and Expenses

ALPS Fund Services, Inc. (“ALPS” or the “Administrator”) provides administrative, fund accounting and other services to the Funds for a monthly administration fee based on the Funds’ average daily net assets.

The Administrator is also reimbursed by the Funds for certain out‐of‐pocket expenses.

Transfer Agent

ALPS serves as transfer, dividend paying and shareholder servicing agent for the Funds (the “Transfer Agent”).

| Annual Report | June 30, 2017 | 21 |

| Notes to Financial Statements |

June 30, 2017

Compliance Services

ALPS provides services that assist the Corporation’s Chief Compliance Officer in monitoring and testing the policies and procedures of the Corporation in conjunction with requirements under Rule 38a‐1 under the 1940 Act. ALPS is compensated under the Administration Agreement.

Distributor

The Funds have entered into a Distribution Agreement with ALPS Distributors, Inc (“the Distributor”) to provide distribution services to the Funds. The Distributor serves as underwriter/distributor of shares of the Funds.

Distribution and Services Plan

The Small Cap Value Fund has adopted a Distribution and Services Plan in accordance with Rule 12b‐1 (“Distribution Plan”) under the 1940 Act. The Distribution Plan provides that the Cortina Small Cap Value Fund may compensate or reimburse the Distributor for services rendered and expenses borne in connection with activities primarily intended to result in the sale of the Cortina Small Cap Value Fund’s shares. Sales charges may be paid to broker‐dealers, banks and any other financial intermediary eligible to receive such fees for sales of Investor Shares of the Cortina Small Cap Value Fund and for services provided to shareholders.

The Cortina Small Cap Value Fund charges 12b‐1 fees for Investor Shares. Pursuant to the Distribution Plan, the Cortina Small Cap Value Fund may annually pay the Distributor up to 0.25% of the average daily net assets of the Cortina Small Cap Value Fund’s Investor Shares. The expenses of the Distribution Plan are reflected in the Statements of Operations.

Certain Directors and Officers of the Funds are also officers of the Adviser.

4. PURCHASES AND SALES OF INVESTMENT SECURITIES

The aggregate cost of purchases and proceeds from sales of investment securities, excluding short‐term securities, are shown below for the year ended June 30, 2017.

| Fund Name | | Purchases | | | Sales | |

| Cortina Small Cap Growth Fund | | $ | 25,557,366 | | | $ | 42,881,826 | |

| Cortina Small Cap Value Fund | | | 40,804,795 | | | | 72,909,313 | |

There were no purchases or sales of long‐term U.S. Government Obligations for either Fund during the year ended June 30, 2017.

5. TAX BASIS INFORMATION